Ticker Symbol: MAV |

| 2 | |

| 8 | |

| 11 | |

| 12 | |

| 13 | |

| 22 | |

| 28 | |

| 42 | |

| 44 | |

| 47 | |

| 75 | |

| 77 |

Q |

How did the Fund perform during the 12-month period ended March 31, 2024? |

A |

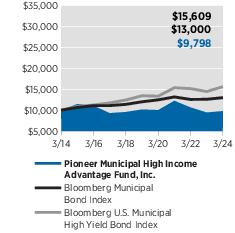

Pioneer Municipal High Income Advantage Fund, Inc. returned 2.49% at net asset value (NAV) and 3.59% at market price during the 12-month period ended March 31, 2024. During the same 12-month period, the Fund’s benchmarks, the Bloomberg US Municipal High Yield Bond Index and the Bloomberg Municipal Bond Index, returned 7.19% and 3.13% at NAV, respectively. The Bloomberg US Municipal High Yield Bond Index is an unmanaged measure of the performance of lower rated municipal bonds, while the Bloomberg Municipal Bond Index is an unmanaged measure of the performance of investment-grade municipal bonds. Unlike the Fund, the two indices do not use leverage. While the use of leverage increases investment opportunity, it also increases investment risk. |

| During the same 12-month period, the average return at NAV of the 24 closed end funds in Morningstar’s Closed End High Yield Municipal category (which may or may not be leveraged) was 1.84%, and the average return at market price of the closed-end funds within the same Morningstar category was 3.60%. | |

| The shares of the Fund were selling at a 11.41% discount to NAV on March 31, 2024. Comparatively, the shares of the Fund were selling at a 12.35% discount to NAV on March 31, 2023. On March 31, 2024, the standardized 30-day SEC yield of the Fund’s shares was 3.31%.** |

| * | Mr. van Roden and Mr. Vadlamani became portfolio managers of the Fund effective February 28, 2024. |

| ** | The 30-day SEC yield is a standardized formula that is based on the hypothetical annualized earning power (investment income only) of the Fund’s portfolio securities during the period indicated. |

Q |

Which investment strategies detracted from the Fund’s benchmark-relative performance results during the 12-month period ended March 31, 2024? |

A |

The use of leverage, which tends to augment income but also amplifies the effect of price movements, was a key detractor from the Fund’s benchmark-relative performance over the 12-month period, as the high-yield municipal bond market experienced a downturn. Unlike the Fund, the two benchmark indices do not use leverage. With respect to sector positioning, overweight allocations to hospitals and housing municipal bonds detracted from relative performance during the 12-month period. From a rating perspective, an overweight allocation to the highest rated municipal bonds, AAA, combined with an underweight to AA rated municipal bonds, also detracted from the Fund's benchmark-relative performance during the 12-month period. |

Q |

Which of the Fund's investment strategies contributed positively to the Fund’s benchmark-relative performance during the period? |

A |

With respect to ratings categories, the Fund’s exposure to lower quality issues within high-yield municipal bonds benefited benchmark relative results during the 12-month period, as non-rated issues provided positive relative returns to the portfolio. In sector terms, the Fund's positioning in the education sector contributed positively to the Fund’s relative returns during the 12-month period. Longer duration positions within hospitals, water and sewer and tobacco bonds were additive to the Fund's performance during the 12-month period. |

Q |

Did the Fund’s distributions*** to stockholders change during the 12-month period ended March 31, 2024? |

A |

The Fund’s monthly distribution rate decreased from $0.03450 per share in March 2023, to $0.03100 per share in March 2024. The decrease in the Fund’s distribution rate was due to an increase in the cost of leverage incurred by the Fund, which reduced the amount of funds available for distribution. |

| *** | Distributions are not guaranteed. |

Q |

Did the level of leverage in the Fund change during the 12-month period March 31, 2024? |

A |

On March 31, 2024, 18.5% of the Fund’s total managed assets were financed by leverage obtained through the issuance of Variable Rate MuniFund Term Preferred Shares, compared with 38.4% of the Fund’s total managed assets financed by leverage at the start of the period on April 1, 2023. During the 12-month period, the Fund decreased the amount of leverage by a total of $90 million, to $50 million as of March 31, 2024. The reduction in the amount of fund leverage during the period was due to increased borrowing costs and a decrease in the value of the Fund's total assets. The interest rate on the Fund's leverage increased by 60 basis points from March 31, 2023 to March 31, 2024. |

Q |

Did the Fund have any exposure to derivatives during the 12- month period ended March 31, 2024? |

A |

Yes, we invested the Fund’s portfolio in futures contracts during the period, which had a slight positive effect on benchmark-relative performance. |

Q |

What is your investment outlook, and how is the Fund positioned heading into its new fiscal year? |

A |

We have continued to prefer investments in hospital-related issues, since the sector has historically had very low default rates. The revenue received by hospitals has remained diverse, coming from a combination of Medicare, Medicaid, private insurers, and self-payors. The Fund is also overweight to tobacco Master Settlement Agreement (MSA) bonds, due in part to the fact that the sector has never experienced a default. Tobacco bond revenues have provided substantial funding for the advancement of public health and other similar programs to state and local governments that signed the tobacco MSA. |

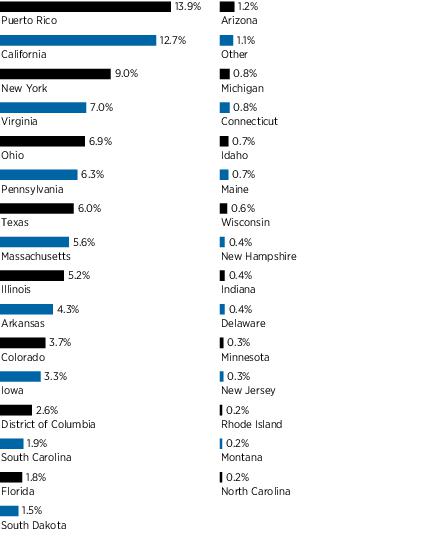

| In addition, the Fund is slightly underweight relative to the benchmark to bonds issued by the Commonwealth of Puerto Rico. The territory’s geographic position makes it vulnerable to hurricane risks, and the local economy’s dependence on tourism means Puerto Rico bonds are potentially more susceptible to a global economic slowdown than bonds of other issuers. |

| The Fund is also underweight to state general obligation issues, which have tended to be sensitive to political considerations, as certain state governments may have lower flexibility to raise taxes due to constituents’ preferences, thus limiting their ability to increase revenues. Likewise, healthcare and labor costs could apply additional pressure. | |

| We anticipate that the shifting interest-rate outlook will continue to impact near-term market performance, given the data dependent nature of US Federal Reserve System (Fed) policy. However, slowing consumer spending and decelerating activity in the housing market may indicate that the Fed is moving closer to the point at which it can conclude its monetary tightening cycle. If this turns out to be the case, we believe investors may turn their attention to the positive fundamental traits of the high-yield municipal market, including its current low default rate and the continued decline in new-issue supply. We are also encouraged by the opportunities afforded by the compelling yields in the investment-grade municipal bond space. | |

| As is always the case, headline news events have had a minimal effect on our day-to-day approach to managing the portfolio. Our goal is to invest the Fund in what we believe are fundamentally sound credits representing relative value opportunities, while maintaining an appropriate level of risk management. We also seek to avoid experiencing defaults in the Fund through our emphasis on fundamental research. We believe this steady, long-term approach remains the most effective way to identify opportunities and to help minimize the risk associated with investing in the high-yield municipal market. |

| (As a percentage of total investments)* | ||

| 1. | Puerto Rico Commonwealth Aqueduct & Sewer Authority, Series A, 5.00%, 7/1/47 (144A) | 5.85% |

| 2. | Buckeye Tobacco Settlement Financing Authority, Senior Class 2, Series B-2, 5.00%, 6/1/55 | 5.64 |

| 3. | California County Tobacco Securitization Agency, Capital Appreciation, Stanislaus County, Subordinated, Series A, 6/1/46 | 3.92 |

| 4. | Massachusetts Development Finance Agency, WGBH Educational Foundation, Series A, 5.75%, 1/1/42 (AMBAC Insured) | 3.84 |

| 5. | Arkansas Development Finance Authority, Green Bond, 5.45%, 9/1/52 | 3.80 |

| 6. | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-1, 5.00%, 7/1/58 | 3.12 |

| 7. | District of Columbia Tobacco Settlement Financing Corp., Asset-Backed, 6.75%, 5/15/40 | 2.58 |

| 8. | Iowa Finance Authority, Alcoa Inc. Projects, 4.75%, 8/1/42 | 2.53 |

| 9. | City of Houston Airport System Revenue, 4.00%, 7/15/41 | 2.47 |

| 10. | Commonwealth of Puerto Rico, Restructured Series A-1, 4.00%, 7/1/46 | 2.34 |

3/31/24 |

3/31/23 | |

| Market Value | $ |

$ |

| Discount | ( |

( |

3/31/24 |

3/31/23 | |

| Net Asset Value | $ |

$ |

Net Investment Income |

Short-Term Capital Gains |

Long-Term Capital Gains | |

| 4/1/23 – 3/31/24 | $0.3480 | $— | $— |

3/31/24 |

3/31/23 | |

| 30-Day SEC Yield | 3.31% | 3.28% |

Principal Amount USD ($) |

Value | |||||

UNAFFILIATED ISSUERS — 120.8% |

||||||

Municipal Bonds — 119.5% of Net Assets(a) |

||||||

Arizona — 1.4% |

||||||

| 1,325,000 | Arizona Industrial Development Authority, Doral Academy Nevada Fire Mesa, Series A, 5.00%, 7/15/39 | $ 1,330,618 | ||||

| 1,965,000 | Industrial Development Authority of the City of Phoenix, 3rd & Indian School Assisted Living Project, 5.40%, 10/1/36 | 1,777,991 | ||||

Total Arizona |

$3,108,609 | |||||

Arkansas — 5.3% |

||||||

| 1,500,000 | Arkansas Development Finance Authority, Big River Steel Project, 4.75%, 9/1/49 (144A) | $ 1,476,390 | ||||

| 10,000,000 | Arkansas Development Finance Authority, Green Bond, 5.45%, 9/1/52 | 10,094,300 | ||||

Total Arkansas |

$11,570,690 | |||||

California — 15.3% |

||||||

| 38,610,000(b) | California County Tobacco Securitization Agency, Capital Appreciation, Stanislaus County, Subordinated, Series A, 6/1/46 | $ 10,417,364 | ||||

| 5,000,000 | California Health Facilities Financing Authority, Cedars-Sinai Health System, Series A, 3.00%, 8/15/51 | 4,000,250 | ||||

| 1,500,000 | California Municipal Finance Authority, Series A, 5.25%, 11/1/52 (AGM Insured) | 1,667,220 | ||||

| 1,875,000 | California Statewide Communities Development Authority, Lancer Plaza Project, 5.875%, 11/1/43 | 1,878,525 | ||||

| 2,000,000 | California Statewide Communities Development Authority, Loma Linda University Medical Center, 5.50%, 12/1/58 (144A) | 2,054,620 | ||||

| 5,915,000 | California Statewide Communities Development Authority, Loma Linda University Medical Center, Series A, 5.00%, 12/1/46 (144A) | 5,937,655 | ||||

| 5,500,000 | City of Oroville, Oroville Hospital, 5.25%, 4/1/49 | 3,539,855 | ||||

| 4,000,000 | San Diego County Regional Airport Authority, Private Activity, Series B, 5.25%, 7/1/58 | 4,268,280 | ||||

Total California |

$33,763,769 | |||||

Colorado — 4.5% |

||||||

| 1,000,000 | Aerotropolis Regional Transportation Authority, 4.375%, 12/1/52 | $ 850,370 | ||||

| 1,148,000(c) | Cottonwood Highlands Metropolitan District No. 1, Series A, 5.00%, 12/1/49 | 1,084,229 | ||||

Principal Amount USD ($) |

Value | |||||

Colorado — (continued) |

||||||

| 5,450,000 | Dominion Water & Sanitation District, 5.875%, 12/1/52 | $ 5,434,685 | ||||

| 2,500,000 | Nine Mile Metropolitan District, 5.125%, 12/1/40 | 2,477,525 | ||||

Total Colorado |

$9,846,809 | |||||

Connecticut — 0.9% |

||||||

| 2,035,000 | Mohegan Tribal Finance Authority, 7.00%, 2/1/45 (144A) | $ 2,039,396 | ||||

Total Connecticut |

$2,039,396 | |||||

Delaware — 0.4% |

||||||

| 450,000 | Delaware State Economic Development Authority, Aspira of Delaware Charter, 3.00%, 6/1/32 | $ 381,847 | ||||

| 700,000 | Delaware State Economic Development Authority, Aspira of Delaware Charter, 4.00%, 6/1/42 | 571,067 | ||||

Total Delaware |

$952,914 | |||||

District of Columbia — 3.1% |

||||||

| 6,630,000 | District of Columbia Tobacco Settlement Financing Corp., Asset-Backed, 6.75%, 5/15/40 | $ 6,867,354 | ||||

Total District of Columbia |

$6,867,354 | |||||

Florida — 2.1% |

||||||

| 550,000 | County of Lake, Imagine South Lake, Charter School Project, 5.00%, 1/15/39 (144A) | $ 533,120 | ||||

| 825,000 | County of Lake, Imagine South Lake, Charter School Project, 5.00%, 1/15/49 (144A) | 751,039 | ||||

| 4,300,000 | State of Florida Department of Transportation Turnpike System Revenue, Series B, 2.00%, 7/1/37 | 3,390,206 | ||||

Total Florida |

$4,674,365 | |||||

Idaho — 0.9% |

||||||

| 2,000,000 | Power County Industrial Development Corp., FMC Corp. Project, 6.45%, 8/1/32 | $ 2,006,320 | ||||

Total Idaho |

$2,006,320 | |||||

Illinois — 6.3% |

||||||

| 3,760,000(c) | Chicago Board of Education, Series A, 5.00%, 12/1/47 | $ 3,840,765 | ||||

| 1,000,000(c) | Chicago Board of Education, Series A, 7.00%, 12/1/46 (144A) | 1,075,880 | ||||

| 1,200,000(c) | Chicago Board of Education, Series D, 5.00%, 12/1/46 | 1,205,664 | ||||

| 2,000,000(c) | Chicago Board of Education, Series H, 5.00%, 12/1/46 | 2,007,900 | ||||

| 2,000,000(c) | City of Chicago, Series B-R, 5.50%, 1/1/34 | 2,016,520 | ||||

| 140,903(b)(d) | Illinois Finance Authority, Cabs Clare Oaks Project, Series B-1, 11/15/52 | 8,454 | ||||

Principal Amount USD ($) |

Value | |||||

Illinois — (continued) |

||||||

| 223,202(d)(e) | Illinois Finance Authority, Clare Oaks Project, Series A-3, 4.00%, 11/15/52 | $ 145,081 | ||||

| 3,000,000 | Metropolitan Pier & Exposition Authority, McCormick Place Expansion, 4.00%, 6/15/50 | 2,764,260 | ||||

| 1,015,000(d) | Southwestern Illinois Development Authority, Village of Sauget Project, 5.625%, 11/1/26 | 761,250 | ||||

Total Illinois |

$13,825,774 | |||||

Indiana — 0.5% |

||||||

| 1,000,000 | Indiana Finance Authority, Multipurpose Educational Facilities, Avondale Meadows Academy Project, 5.125%, 7/1/37 | $ 1,008,390 | ||||

Total Indiana |

$1,008,390 | |||||

Iowa — 3.9% |

||||||

| 6,900,000 | Iowa Finance Authority, Alcoa Inc. Projects, 4.75%, 8/1/42 | $ 6,721,773 | ||||

| 2,055,000 | Iowa Tobacco Settlement Authority, Series A-2, 4.00%, 6/1/49 | 1,939,160 | ||||

Total Iowa |

$8,660,933 | |||||

Maine — 0.9% |

||||||

| 2,000,000 | Maine Health & Higher Educational Facilities Authority, Series A, 4.00%, 7/1/50 | $ 1,899,740 | ||||

Total Maine |

$1,899,740 | |||||

Massachusetts — 6.8% |

||||||

| 3,500,000 | Massachusetts Development Finance Agency, Lowell General Hospital, Series G, 5.00%, 7/1/44 | $ 3,408,895 | ||||

| 8,000,000 | Massachusetts Development Finance Agency, WGBH Educational Foundation, Series A, 5.75%, 1/1/42 (AMBAC Insured) | 10,220,640 | ||||

| 1,315,000 | Massachusetts Housing Finance Agency, Series A-1, 4.20%, 12/1/52 | 1,231,563 | ||||

Total Massachusetts |

$14,861,098 | |||||

Michigan — 0.9% |

||||||

| 1,985,000 | David Ellis Academy-West, 5.25%, 6/1/45 | $ 1,846,447 | ||||

| 205,000 | Michigan Public Educational Facilities Authority, Crescent Academy, 7.00%, 10/1/36 | 205,668 | ||||

Total Michigan |

$2,052,115 | |||||

Minnesota — 0.4% |

||||||

| 1,000,000 | City of Ham Lake, DaVinci Academy, Series A, 5.00%, 7/1/47 | $ 931,220 | ||||

Total Minnesota |

$931,220 | |||||

Principal Amount USD ($) |

Value | |||||

Montana — 0.2% |

||||||

| 2,445,000(d)(e) | City of Hardin, Tax Allocation, Rocky Mountain Power, Inc., Project, 6.25%, 9/1/31 | $ 489,000 | ||||

| 1,000,000(d) | Two Rivers Authority, 7.375%, 11/1/27 | 40,000 | ||||

Total Montana |

$529,000 | |||||

New Hampshire — 0.5% |

||||||

| 1,375,000 | New Hampshire Health and Education Facilities Authority Act, Catholic Medical Centre, 3.75%, 7/1/40 | $ 1,063,067 | ||||

Total New Hampshire |

$1,063,067 | |||||

New Jersey — 0.4% |

||||||

| 1,000,000 | New Jersey Economic Development Authority, Marion P. Thomas Charter School, Inc., Project, Series A, 5.375%, 10/1/50 (144A) | $ 919,020 | ||||

Total New Jersey |

$919,020 | |||||

New York — 10.9% |

||||||

| 3,000,000 | Erie Tobacco Asset Securitization Corp., Asset-Backed, Series A, 5.00%, 6/1/45 | $ 2,891,850 | ||||

| 2,000,000 | Metropolitan Transportation Authority, Green Bond, Series C-1, 5.25%, 11/15/55 | 2,099,560 | ||||

| 5,000,000 | Metropolitan Transportation Authority, Green Bond, Series D-2, 4.00%, 11/15/48 | 4,625,800 | ||||

| 2,530,000 | New York Counties Tobacco Trust IV, Settlement pass through, Series A, 5.00%, 6/1/45 | 2,361,300 | ||||

| 3,240,000 | New York Counties Tobacco Trust VI, Series 2B, 5.00%, 6/1/45 | 3,119,504 | ||||

| 4,685,000 | New York State Housing Finance Agency, Sustainability Bond, Series G, 2.73%, 11/1/51 (SONYMA Insured) | 3,260,807 | ||||

| 1,750,000 | New York Transportation Development Corp., Green Bond, 5.375%, 6/30/60 | 1,849,505 | ||||

| 2,000,000 | TSASC, Inc., Series B, 5.00%, 6/1/48 | 1,824,600 | ||||

| 1,168,828 | Westchester County Healthcare Corp., Series A, 5.00%, 11/1/44 | 1,150,092 | ||||

| 1,000,000 | Westchester County Local Development Corp., Purchase Senior Learning Community, Inc. Project, 4.50%, 7/1/56 (144A) | 855,420 | ||||

Total New York |

$24,038,438 | |||||

North Carolina — 0.2% |

||||||

| 500,000 | City of Charlotte Airport Revenue, Series A, 5.00%, 7/1/42 | $ 519,940 | ||||

Total North Carolina |

$519,940 | |||||

Principal Amount USD ($) |

Value | |||||

Ohio — 8.4% |

||||||

| 15,855,000 | Buckeye Tobacco Settlement Financing Authority, Senior Class 2, Series B-2, 5.00%, 6/1/55 | $ 14,993,598 | ||||

| 1,500,000 | County of Muskingum, Genesis Healthcare System Project , 5.00%, 2/15/44 | 1,383,090 | ||||

| 2,000,000 | State of Ohio, 5.00%, 12/31/39 | 2,011,960 | ||||

Total Ohio |

$18,388,648 | |||||

Pennsylvania — 7.7% |

||||||

| 1,000,000 | Chester County Industrial Development Authority, Collegium Charter School, Series A, 5.25%, 10/15/47 | $ 915,440 | ||||

| 6,665,000 | Montgomery County Higher Education and Health Authority, Thomas Jefferson University, 4.00%, 9/1/49 | 6,125,402 | ||||

| 6,000,000 | Pennsylvania Higher Educational Facilities Authority, University of Pennsylvania, 4.00%, 8/15/49 | 5,706,360 | ||||

| 2,500,000(e) | Philadelphia Authority for Industrial Development, 5.125%, 12/15/44 (144A) | 2,312,575 | ||||

| 500,000 | Philadelphia Authority for Industrial Development, 5.50%, 6/1/49 (144A) | 467,530 | ||||

| 1,000,000 | Philadelphia Authority for Industrial Development, Global Leadership Academy Charter School Project, Series A, 5.00%, 11/15/50 | 899,290 | ||||

| 470,000 | Philadelphia Authority for Industrial Development, Greater Philadelphia Health Action, Inc., Project, Series A, 6.625%, 6/1/50 | 455,068 | ||||

Total Pennsylvania |

$16,881,665 | |||||

Puerto Rico — 16.8% |

||||||

| 2,375,679(c) | Commonwealth of Puerto Rico, Restructured Series A-1, 4.00%, 7/1/37 | $ 2,259,105 | ||||

| 5,021,480(c) | Commonwealth of Puerto Rico, Restructured Series A-1, 4.00%, 7/1/41 | 4,410,667 | ||||

| 6,810,000(c) | Commonwealth of Puerto Rico, Restructured Series A-1, 4.00%, 7/1/46 | 6,226,315 | ||||

| 15,250,000 | Puerto Rico Commonwealth Aqueduct & Sewer Authority, Series A, 5.00%, 7/1/47 (144A) | 15,555,610 | ||||

| 1,000,000(d) | Puerto Rico Electric Power Authority, Series AAA, 5.25%, 7/1/24 | 260,000 | ||||

| 8,255,000 | Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, Restructured Series A-1, 5.00%, 7/1/58 | 8,285,626 | ||||

Total Puerto Rico |

$36,997,323 | |||||

Rhode Island — 0.3% |

||||||

| 1,355,000(d) | Central Falls Detention Facility Corp., 7.25%, 7/15/35 | $ 542,000 | ||||

Total Rhode Island |

$542,000 | |||||

Principal Amount USD ($) |

Value | |||||

South Carolina — 2.3% |

||||||

| 4,400,000(f) | Tobacco Settlement Revenue Management Authority, Series B, 6.375%, 5/15/30 | $ 5,013,800 | ||||

Total South Carolina |

$5,013,800 | |||||

South Dakota — 1.8% |

||||||

| 4,000,000 | South Dakota Health & Educational Facilities Authority, Sanford Health, Series B, 4.00%, 11/1/44 | $ 3,877,040 | ||||

Total South Dakota |

$3,877,040 | |||||

Texas — 7.2% |

||||||

| 500,000 | Arlington Higher Education Finance Corp., 5.45%, 3/1/49 (144A) | $ 525,125 | ||||

| 1,000,000 | Arlington Higher Education Finance Corp., Universal Academy, Series A, 7.00%, 3/1/34 | 1,001,750 | ||||

| 1,500,000 | Arlington Higher Education Finance Corp., Universal Academy, Series A, 7.125%, 3/1/44 | 1,500,180 | ||||

| 7,345,000 | City of Houston Airport System Revenue, 4.00%, 7/15/41 | 6,576,419 | ||||

| 1,000,000 | City of Houston Airport System Revenue, Series A, 4.00%, 7/1/41 | 874,640 | ||||

| 1,545,000(c) | Denton Independent School District, 5.00%, 8/15/53 (PSF-GTD Insured) | 1,674,749 | ||||

| 5,000,000(d)(e) | Greater Texas Cultural Education Facilities Finance Corp., 8.00%, 2/1/50 (144A) | 3,050,000 | ||||

| 6,960,000(d) | Sanger Industrial Development Corp., Texas Pellets Project, Series B, 8.00%, 7/1/38 | 696 | ||||

| 1,000,000(e) | Texas Midwest Public Facility Corp., Secure Treatment Facility Project, Restructured, 12/1/30 | 693,670 | ||||

Total Texas |

$15,897,229 | |||||

Virginia — 8.4% |

||||||

| 2,035,000 | Lynchburg Economic Development Authority, 3.00%, 1/1/51 | $ 1,445,827 | ||||

| 50,000 | Tobacco Settlement Financing Corp., Series B-1, 5.00%, 6/1/47 | 48,987 | ||||

| 2,000,000 | Virginia College Building Authority, Public Higher Education Financing Program, Series C, 3.00%, 9/1/51 (ST INTERCEPT Insured) | 1,522,800 | ||||

| 10,000(g) | Virginia Public Building Authority, Series A, 4.00%, 8/1/40 | 10,758 | ||||

| 990,000 | Virginia Public Building Authority, Series A, 4.00%, 8/1/40 | 1,010,879 | ||||

| 1,000,000 | Virginia Small Business Financing Authority, Senior Lien, 5.00%, 12/31/47 | 1,001,170 | ||||

| 1,000,000 | Virginia Small Business Financing Authority, Senior Lien 95 Express Lanes LLC Project, 4.00%, 1/1/48 | 903,470 | ||||

Principal Amount USD ($) |

Value | |||||

Virginia — (continued) |

||||||

| 5,500,000 | Virginia Small Business Financing Authority, Transform 66-P3 Project, 5.00%, 12/31/49 | $ 5,483,775 | ||||

| 2,500,000 | Virginia Small Business Financing Authority, Transform 66-P3 Project, 5.00%, 12/31/52 | 2,479,400 | ||||

| 4,600,000 | Virginia Small Business Financing Authority, Transform 66-P3 Project, 5.00%, 12/31/56 | 4,615,272 | ||||

Total Virginia |

$18,522,338 | |||||

Wisconsin — 0.8% |

||||||

| 750,000 | Public Finance Authority, Roseman University Health Sciences Project, 5.875%, 4/1/45 | $ 758,985 | ||||

| 1,000,000 | Public Finance Authority, SearStone CCRC Project, Series A, 5.00%, 6/1/37 (144A) | 951,840 | ||||

Total Wisconsin |

$1,710,825 | |||||

Total Municipal Bonds (Cost $266,559,308) |

$262,969,829 | |||||

U.S. Government and Agency Obligations — 1.3% of Net Assets |

||||||

| 3,000,000(b) | U.S. Treasury Bills, 4/23/24 | $ 2,990,338 | ||||

Total U.S. Government and Agency Obligations (Cost $2,990,348) |

$ 2,990,338 | |||||

TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 120.8% (Cost $269,549,656) |

$265,960,167 | |||||

OTHER ASSETS AND LIABILITIES — (20.8)% |

$(45,883,077) | |||||

net assets applicable to common stockholders — 100.0% |

$220,077,090 | |||||

| AGM | Assured Guaranty Municipal Corp. |

| AMBAC | Ambac Assurance Corporation. |

| PSF-GTD | Permanent School Fund Guaranteed. |

| SONYMA | State of New York Mortgage Agency. |

| ST INTERCEPT | State Aid Intercept. |

| (144A) | The resale of such security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers. At March 31, 2024, the value of these securities amounted to $38,505,220, or 17.5% of net assets applicable to common stockholders. |

| (a) | Consists of Revenue Bonds unless otherwise indicated. |

| (b) | Security issued with a zero coupon. Income is recognized through accretion of discount. |

| (c) | Represents a General Obligation Bond. |

| (d) | Security is in default. |

| (e) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at March 31, 2024. |

| (f) | Escrow to maturity. |

| (g) | Pre-refunded bonds have been collateralized by U.S. Treasury or U.S. Government Agency securities which are held in escrow to pay interest and principal on the tax exempt issue and to retire the bonds in full at the earliest refunding date. |

Revenue Bonds: |

|

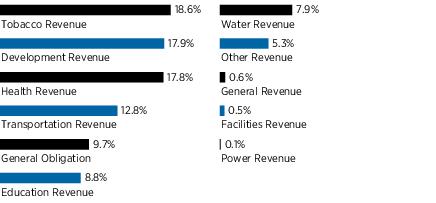

| Tobacco Revenue | 18.6% |

| Development Revenue | 17.9 |

| Health Revenue | 17.8 |

| Transportation Revenue | 12.8 |

| Education Revenue | 8.8 |

| Water Revenue | 7.9 |

| Other Revenue | 5.3 |

| General Revenue | 0.6 |

| Facilities Revenue | 0.5 |

| Power Revenue | 0.1 |

| 90.3% | |

General Obligation Bonds: |

9.7% |

| 100.0% |

FIXED INCOME INDEX FUTURES CONTRACTS

Number of Contracts Long |

Description |

Expiration Date |

Notional Amount |

Market Value |

Unrealized Appreciation |

| 135 | U.S. Long Bond (CBT) | 6/18/24 | $16,067,466 | $16,259,062 | $191,596 |

TOTAL FUTURES CONTRACTS |

$16,067,466 |

$16,259,062 |

$191,596 | ||

| Aggregate gross unrealized appreciation for all investments in which there is an excess of value over tax cost | $16,819,217 |

| Aggregate gross unrealized depreciation for all investments in which there is an excess of tax cost over value | (19,350,014) |

| Net unrealized depreciation | $(2,530,797) |

| Level 1 | – | unadjusted quoted prices in active markets for identical securities. |

| Level 2 | – | other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A. |

| Level 3 | – | significant unobservable inputs (including the Adviser’s own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A. |

Level 1 |

Level 2 |

Level 3 |

Total | |

| Municipal Bonds | $— | $262,969,829 | $— | $262,969,829 |

| U.S. Government and Agency Obligations | — | 2,990,338 | — | 2,990,338 |

Total Investments in Securities |

$— |

$265,960,167 |

$— |

$265,960,167 |

Other Financial Instruments |

||||

| Variable Rate MuniFund Term Preferred Shares (a) |

$— | $(50,000,000) | $— | $(50,000,000) |

| Net unrealized appreciation on futures contracts | 191,596 | — | — | 191,596 |

Total Other Financial Instruments |

$191,596 |

$(50,000,000) |

$— |

$(49,808,404) |

| (a) | The Fund may hold liabilities in which the fair value approximates the carrying amount for financial statement purposes. |

ASSETS: |

|

| Investments in unaffiliated issuers, at value (cost $269,549,656) | $265,960,167 |

| Cash | 125,590 |

| Futures collateral | 847,852 |

| Variation margin for futures contracts | 33,750 |

| Distribution paid in advance | 741,348 |

| Receivables — | |

| Interest | 3,414,040 |

| Other assets | 100 |

Total assets |

$271,122,847 |

LIABILITIES: |

|

| Variable Rate MuniFund Term Preferred Shares* | $50,000,000 |

| Due to broker for futures | 33,750 |

| Payables — | |

| Distributions | 741,348 |

| Directors’ fees | 1,507 |

| Management fees | 26,556 |

| Administrative expenses | 26,920 |

| Accrued expenses | 215,676 |

Total liabilities |

$51,045,757 |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS: |

|

| Paid-in capital | $284,214,601 |

| Distributable earnings (loss) | (64,137,511) |

Net assets |

$220,077,090 |

NET ASSET VALUE PER COMMON SHARE: |

|

| No par value | |

| Based on $220,077,090/23,914,439 common shares | $9.20 |

INVESTMENT INCOME: |

||

| Interest from unaffiliated issuers | $19,571,094 | |

| Total Investment Income | $19,571,094 | |

EXPENSES: |

||

| Management fees | $2,087,327 | |

| Administrative expenses | 85,111 | |

| Transfer agent fees | 17,146 | |

| Stockholder communications expense | 68,097 | |

| Custodian fees | 3,320 | |

| Professional fees | 404,625 | |

| Printing expense | 15,066 | |

| Officers’ and Directors’ fees | 17,783 | |

| Insurance expense | 7,501 | |

| Interest expense | 7,469,215 | |

| Miscellaneous | 87,192 | |

| Total expenses | $10,262,383 | |

| Net investment income | $9,308,711 | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: |

||

| Net realized gain (loss) on: | ||

| Reimbursement by the Adviser | $78,397 | |

| Investments in unaffiliated issuers | (17,365,022) | |

| Futures contracts | (1,221,950) | $(18,508,575) |

| Change in net unrealized appreciation (depreciation) on: | ||

| Investments in unaffiliated issuers | $12,862,793 | |

| Futures contracts | 191,596 | $13,054,389 |

| Net realized and unrealized gain (loss) on investments | $(5,454,186) | |

| Net increase in net assets resulting from operations | $3,854,525 |

Year Ended 3/31/24 |

Year Ended 3/31/23 | |

FROM OPERATIONS: |

||

| Net investment income (loss) | $9,308,711 | $9,793,580 |

| Net realized gain (loss) on investments | (18,508,575) | (17,881,409) |

| Change in net unrealized appreciation (depreciation) on investments | 13,054,389 | (12,624,865) |

| Net increase (decrease) in net assets resulting from operations | $3,854,525 |

$(20,712,694) |

DISTRIBUTIONS TO COMMON STOCKHOLDERS: |

||

| ($0.35 and $0.42 per share, respectively) | $(8,322,225) | $(10,115,452) |

Tax Return Of Capital To Common Stockholders: |

||

| ($— and $0.07 per share, respectively) | $— | $(1,674,366) |

| Total distributions to common stockholders | $(8,322,225) | $(11,789,818) |

Net decrease in net assets applicable to common stockholders |

$(4,467,700) |

$(32,502,512) |

NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS: |

||

| Beginning of year | $224,544,790 | $257,047,302 |

| End of year | $220,077,090 |

$224,544,790 |

Year Ended 3/31/24 Common Shares |

Year Ended 3/31/24 Amount |

Year Ended 3/31/23 Common Shares |

Year Ended 3/31/23 Amount | |

FUND SHARE TRANSACTIONS |

||||

| Common Shares sold | — | $— | — | $— |

| Reinvestment of distributions | — | — | — | — |

| Less Common Shares repurchased | — | — | — | — |

| Net increase | — | $— | — | $— |

Cash Flows From Operating Activities |

|

| Net increase in net assets resulting from operations | $3,854,525 |

Adjustments to reconcile net decrease in net assets resulting from operations to net cash and restricted cash from operating activities: |

|

| Purchases of investment securities | $(53,770,763) |

| Proceeds from disposition and maturity of investment securities | 146,652,353 |

| Net purchases of short term investments | (2,598,302) |

| Net accretion and amortization of discount/premium on investment securities | (1,435,958) |

| Reimbursement by the Adviser | (78,397) |

| Net realized loss on investments in unaffiliated issuers | 17,365,022 |

| Change in unrealized appreciation on investments in unaffiliated issuers | (12,862,793) |

| Decrease in interest receivable | 1,823,227 |

| Decrease in distributions paid in advance | 83,700 |

| Decrease in other assets | 37 |

| Increase in variation margin for futures contracts | (33,750) |

| Increase in management fees payable | 8,642 |

| Increase in directors’ fees payable | 1,469 |

| Increase in due to broker for futures | 33,750 |

| Decrease in administrative expenses payable | (2,023) |

| Increase in accrued expenses payable | 47,197 |

| Net cash and restricted cash from operating activities | $99,087,936 |

Cash Flows Used In Financing Activities: |

|

| Borrowings repaid | (90,000,000) |

| Distributions to stockholders | (8,405,925) |

| Net cash flows used in financing activities | $(98,405,925) |

NET INCREASE (DECREASE) IN CASH AND RESTRICTED CASH |

$682,011 |

Cash and Restricted Cash: |

|

| Beginning of year* | $291,431 |

| End of year* | $973,442 |

Cash Flow Information: |

|

| Cash paid for interest | $7,469,215 |

| * | The following table provides a reconciliation of cash and restricted cash reported within the Statement of Assets and Liabilities that sum to the total of the same such amounts shown in the Statement of Cash Flows: |

Year Ended 3/31/24 |

Year Ended 3/31/23 | |

| Cash | $125,590 | $291,431 |

| Restricted cash | 847,852 | — |

Total cash and restricted cash shown in the Statement of Cash Flows |

$973,442 |

$291,431 |

Year Ended 3/31/24 |

Year Ended 3/31/23 |

Year Ended 3/31/22 |

Year Ended 3/31/21 |

Year Ended 3/31/20 | |

Per Share Operating Performance |

|||||

| Net asset value, beginning of period | $9.39 | $10.75 | $12.16 | $11.77 | $11.68 |

| Increase (decrease) from investment operations:(a) | |||||

| Net investment income (loss)(b) | $0.39 | $0.41 | $0.49 | $0.53 | $0.49 |

| Net realized and unrealized gain (loss) on investments | (0.23) | (1.28) | (1.38) | 0.42 | 0.06 |

Net increase (decrease) from investment operations |

$0.16 |

$(0.87) |

$(0.89) |

$0.95 |

$0.55 |

| Distributions to stockholders: | |||||

| Net investment income and previously undistributed net investment income | $(0.35) | $(0.42)* | $(0.52)* | $(0.56)* | $(0.46) |

| Tax return of capital | — | (0.07) | — | — | — |

Total distributions |

$(0.35) |

$(0.49) |

$(0.52) |

$(0.56) |

$(0.46) |

Net increase (decrease) in net asset value |

$(0.19) |

$(1.36) |

$(1.41) |

$0.39 |

$0.09 |

| Net asset value, end of period | $9.20 | $9.39 | $10.75 | $12.16 | $11.77 |

| Market value end of period | $8.15 | $8.23 | $9.83 | $11.82 | $10.18 |

Total return at net asset value(c) |

2.49%(d) |

(7.42)% |

(7.54)% |

8.60% |

5.12% |

Total return at market value(c) |

3.59% |

(11.26)% |

(13.03)% |

22.05% |

(1.30)% |

| Ratios to average net assets of stockholders: | |||||

| Total expenses plus interest expense(e)(f) | 4.76% | 3.40% | 1.86% | 1.82% | 2.61% |

| Net investment income | 4.32% | 4.29% | 4.02% | 4.33% | 4.14% |

| Portfolio turnover rate | 16% | 63% | 11% | 12% | 11% |

| Net assets of common stockholders, end of period (in thousands) | $ 220,077 |

$ 224,545 |

$ 257,047 |

$ 290,614 |

$ 281,372 |

| Preferred shares outstanding (in thousands)(g)(h)(i)(j) | $ |

$ |

$ |

$ |

$ |

| Asset coverage per preferred share, end of period | $ |

$ |

$ |

$ |

$ |

| Average market value per preferred share(k) | $ |

$ |

$ |

$ |

$ |

| Liquidation value, including interest expense payable, per preferred share | $ |

$ |

$ |

$ |

$ |

| * | The amount of distributions made to shareowners during the period was in excess of the net investment income earned by the Fund during the period. The Fund has accumulated undistributed net investment income which is part of the Fund’s NAV. A portion of this accumulated net investment income was distributed to shareowners during the period. A decrease in distributions may have a negative effect on the market value of the Fund’s shares. |

| (a) | The per common share data presented above is based upon the average common shares outstanding for the periods presented. |

| (b) | Beginning March 31, 2020, distribution payments to preferred shareowners are included as a component of net investment income. |

| (c) | Total investment return is calculated assuming a purchase of common shares at the current net asset value or market value on the first day and a sale at the current net asset value or market value on the last day of the periods reported. Dividends and distributions, if any, are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions. Past performance is not a guarantee of future results. |

| (d) | For the year ended March 31, 2024, the Fund’s total return includes a reimbursement by the Adviser (see Notes to the Financial Statements-Note 1B). The impact on total return was less than 0.005%. |

| (e) | Includes interest expense of 3.47%, 2.09%, 0.56%, 0.64% and 1.50%, respectively. |

| (f) | Prior to March 31, 2020, the expense ratios do not reflect the effect of distribution payments to preferred shareowners. |

| (g) | The Fund redeemed 900 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on February 29, 2024. |

| (h) | The Fund redeemed 200 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on November 14, 2022. |

| (i) | The Fund redeemed 200 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on September 29, 2022. |

| (j) | The Fund issued 200 Variable Rate MuniFund Term Preferred Shares, with a liquidation preference of $100,000 per share, on February 16, 2021. |

| (k) | Market value is redemption value without an active market. |

A. |

Security Valuation |

| The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE. | |

| Fixed income securities are valued by using prices supplied by independent pricing services, which consider such factors as market prices, market events, quotations from one or more brokers, Treasury spreads, yields, maturities and ratings, or may use a pricing matrix or other fair value methods or techniques to provide an estimated value of the security or instrument. A pricing matrix is a means of valuing a debt security on the basis of current market prices for other debt securities, historical trading patterns in the market for fixed income securities and/or other factors. Non-U.S. debt securities that are listed on an exchange will be valued at the bid price obtained from an independent third party pricing service. When independent third party pricing services are unable to supply prices, or when prices or market quotations are considered to be unreliable, the value of that security may be determined using quotations from one or more broker-dealers. | |

| Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser. The Adviser is designated as the valuation designee for the Fund pursuant to Rule 2a-5 under the 1940 Act. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued securities. | |

| Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Adviser may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Fund’s net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Fund’s securities may differ significantly from exchange prices, and such differences could be material. |

| Futures contracts are generally valued at the closing settlement price established by the exchange on which they are traded. | |

B. |

Investment Income and Transactions |

| Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities. | |

| Discounts and premiums on purchase prices of debt securities are accreted or amortized, respectively, daily, into interest income on an effective yield to maturity basis with a corresponding increase or decrease in the cost basis of the security. Premiums and discounts related to certain mortgage backed securities are amortized or accreted in proportion to the monthly paydowns. | |

| Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively. | |

| Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes. | |

| During the year ended March 31, 2024, the Fund realized a loss of $78,397 due to an operational error. The Adviser voluntarily reimbursed the Fund for this loss, which is reflected on the Statement of Operations as Reimbursement by the Adviser. | |

C. |

Federal Income Taxes |

| It is the Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to its stockholders. Therefore, no provision for federal income taxes is required. As of March 31, 2024, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities. | |

| The amount and character of income and capital gain distributions to stockholders are determined in accordance with federal income tax rules, which may differ from U.S. GAAP. Distributions in excess of net investment income or net realized gains are temporary over distributions for financial statement purposes resulting from differences in the |

| recognition or classification of income or distributions for financial statement and tax purposes. Capital accounts within the financial statements are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences. | |

| At March 31, 2024, the Fund was permitted to carry forward indefinitely $2,848,872 of short-term losses and $58,692,841 of long-term losses. | |

| The tax character of distributions paid during the years ended March 31, 2024 and March 31, 2023, was as follows: |

2024 |

2023 | |

Distributions paid from: |

||

| Tax-exempt income | $15,807,773 | $14,529,823 |

| Ordinary income | 67,364 | 361,454 |

| Tax return of capital | — | 1,674,366 |

Total |

$15,875,137 |

$16,565,643 |

2024 | |

Distributable earnings/(losses): |

|

| Undistributed ordinary income | $461,587 |

| Undistributed tax-exempt income | 214,763 |

| Capital loss carryforward | (61,541,713) |

| Other book/tax temporary differences | (741,351) |

| Net unrealized depreciation | (2,530,797) |

Total |

$(64,137,511) |

D. |

Automatic Dividend Reinvestment Plan |

| All stockholders whose shares are registered in their own names automatically participate in the Automatic Dividend Reinvestment Plan (the “Plan”), under which participants receive all dividends and capital gain distributions (collectively, dividends) in full and fractional shares of the Fund in lieu of cash. Stockholders may elect not to participate in the Plan. Stockholders not participating in the Plan receive all dividends and capital gain distributions in cash. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notifying Equiniti Trust Company, the agent for stockholders in administering the Plan (the “Plan Agent”), in writing prior to any |

| dividend record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. | |

| If a stockholder’s shares are held in the name of a brokerage firm, bank or other nominee, the stockholder can ask the firm or nominee to participate in the Plan on the stockholder’s behalf. If the firm or nominee does not offer the Plan, dividends will be paid in cash to the stockholder of record. A firm or nominee may reinvest a stockholder’s cash dividends in shares of the Fund on terms that differ from the terms of the Plan. | |

| Whenever the Fund declares a dividend on shares payable in cash, participants in the Plan will receive the equivalent in shares acquired by the Plan Agent either (i) through receipt of additional unissued but authorized shares from the Fund or (ii) by purchase of outstanding shares on the New York Stock Exchange or elsewhere. If, on the payment date for any dividend, the net asset value per share is equal to or less than the market price per share plus estimated brokerage trading fees (market premium), the Plan Agent will invest the dividend amount in newly issued shares. The number of newly issued shares to be credited to each account will be determined by dividing the dollar amount of the dividend by the net asset value per share on the date the shares are issued, provided that the maximum discount from the then current market price per share on the date of issuance does not exceed 5%. If, on the payment date for any dividend, the net asset value per share is greater than the market value (market discount), the Plan Agent will invest the dividend amount in shares acquired in open-market purchases. There are no brokerage charges with respect to newly issued shares. However, each participant will pay a pro rata share of brokerage trading fees incurred with respect to the Plan Agent’s open-market purchases. Participating in the Plan does not relieve stockholders from any federal, state or local taxes which may be due on dividends paid in any taxable year. Stockholders holding Plan shares in a brokerage account may be able to transfer the shares to another broker and continue to participate in the Plan. | |

E. |

Risks |

| The value of securities held by the Fund may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, recessions, the spread of infectious illness or other public health issues, inflation, changes in interest rates, armed conflict such as between Russia and Ukraine or in the Middle East, sanctions against Russia, |

| other nations or individuals or companies and possible countermeasures, lack of liquidity in the bond markets or adverse investor sentiment. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread. Inflation and interest rates have increased and may rise further. These circumstances could adversely affect the value and liquidity of the Fund’s investments and negatively impact the Fund’s performance. | |

| The long-term impact of the COVID-19 pandemic and its subsequent variants on economies, markets, industries and individual issuers, are not known. Some sectors of the economy and individual issuers have experienced or may experience particularly large losses. Periods of extreme volatility in the financial markets, reduced liquidity of many instruments, increased government debt, inflation, and disruptions to supply chains, consumer demand and employee availability, may continue for some time. Following Russia’s invasion of Ukraine, Russian securities lost all, or nearly all, their market value. Other securities or markets could be similarly affected by past or future political, geopolitical or other events or conditions. | |

| Governments and central banks, including the U.S. Federal Reserve, have taken extraordinary and unprecedented actions to support local and global economies and the financial markets. These actions have resulted in significant expansion of public debt, including in the U.S. The consequences of high public debt, including its future impact on the economy and securities markets, may not be known for some time. | |

| The U.S. and other countries are periodically involved in disputes over trade and other matters, which may result in tariffs, investment restrictions and adverse impacts on affected companies and securities. For example, the U.S. has imposed tariffs and other trade barriers on Chinese exports, has restricted sales of certain categories of goods to China, and has established barriers to investments in China. Trade disputes may adversely affect the economies of the U.S. and its trading partners, as well as companies directly or indirectly affected and financial markets generally. If the political climate between the U.S. and China does not improve or continues to deteriorate, if China were to attempt unification of Taiwan by force, or if other geopolitical conflicts develop or get worse, economies, markets and individual securities may be severely affected both regionally and globally, and the value of the Fund’s assets may go down. |

| At times, the Fund’s investments may represent industries or industry sectors that are interrelated or have common risks, making the Fund more susceptible to any economic, political, or regulatory developments or other risks affecting those industries and sectors. | |

| Under normal circumstances, the Fund will invest substantially all of its assets in municipal securities. The municipal bond market can be susceptible to unusual volatility, particularly for lower-rated and unrated securities. Liquidity can be reduced unpredictably in response to overall economic conditions or credit tightening. Municipal issuers may be adversely affected by rising health care costs, increasing unfunded pension liabilities, and by the phasing out of federal programs providing financial support. Unfavorable conditions and developments relating to projects financed with municipal securities can result in lower revenues to issuers of municipal securities, potentially resulting in defaults. Issuers often depend on revenues from these projects to make principal and interest payments. The value of municipal securities can also be adversely affected by changes in the financial condition of one or more individual municipal issuers or insurers of municipal issuers, regulatory and political developments, tax law changes or other legislative actions, and by uncertainties and public perceptions concerning these and other factors. Municipal securities may be more susceptible to down-grades or defaults during recessions or similar periods of economic stress. Financial difficulties of municipal issuers may continue or get worse, particularly in the event of economic or market turmoil or a recession. To the extent the Fund invests significantly in a single state (including California and Massachusetts), city, territory (including Puerto Rico), or region, or in securities the payments on which are dependent upon a single project or source of revenues, or that relate to a sector or industry, including health care facilities, education, transportation, special revenues and pollution control, the Fund will be more susceptible to associated risks and developments. | |

| The Fund invests in below investment grade (high yield) municipal securities. Debt securities rated below investment grade are commonly referred to as “junk bonds” and are considered speculative with respect to the issuer's capacity to pay interest and repay principal. These securities involve greater risk of loss, are subject to greater price volatility, and may be less liquid and more difficult to value, especially during periods of economic uncertainty or change, than higher rated debt securities. | |

| The market prices of the Fund’s fixed income securities may fluctuate significantly when interest rates change. The value of your investment will generally go down when interest rates rise. A rise in rates tends to |

| have a greater impact on the prices of longer term or duration securities. For example, if interest rates increase by 1%, the value of a Fund’s portfolio with a portfolio duration of ten years would be expected to decrease by 10%, all other things being equal. In recent years interest rates and credit spreads in the U.S. have been at historic lows. The U.S. Federal Reserve has raised certain interest rates, and interest rates may continue to go up. A general rise in interest rates could adversely affect the price and liquidity of fixed income securities. The maturity of a security may be significantly longer than its effective duration. A security’s maturity and other features may be more relevant than its effective duration in determining the security’s sensitivity to other factors affecting the issuer or markets generally, such as changes in credit quality or in the yield premium that the market may establish for certain types of securities (sometimes called “credit spread”). In general, the longer its maturity the more a security may be susceptible to these factors. When the credit spread for a fixed income security goes up, or “widens”, the value of the security will generally go down. | |

| If an issuer or guarantor of a security held by the Fund or a counterparty to a financial contract with the Fund defaults on its obligation to pay principal and/or interest, has its credit rating downgraded or is perceived to be less creditworthy, or the credit quality or value of any underlying assets declines, the value of your investment will typically decline. Changes in actual or perceived creditworthiness may occur quickly. The Fund could be delayed or hindered in its enforcement of rights against an issuer, guarantor or counterparty. | |

| With the increased use of technologies such as the Internet to conduct business, the Fund is susceptible to operational, information security and related risks. While the Fund’s Adviser has established business continuity plans in the event of, and risk management systems to prevent, limit or mitigate, such cyber-attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified. Furthermore, the Fund cannot control the cybersecurity plans and systems put in place by service providers to the Fund such as the Fund’s custodian and accounting agent, and the Fund’s transfer agent. In addition, many beneficial owners of Fund shares hold them through accounts at broker-dealers, retirement platforms and other financial market participants over which neither the Fund nor the Adviser exercises control. Each of these may in turn rely on service providers to them, which are also subject to the risk of cyber-attacks. Cybersecurity failures or breaches at the Adviser or the Fund’s service providers or intermediaries have the ability to cause disruptions and impact business operations, potentially resulting in |

| financial losses, interference with the Fund’s ability to calculate its net asset value, impediments to trading, the inability of Fund stockholders to effect share purchases or sales or receive distributions, loss of or unauthorized access to private stockholder information and violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, or additional compliance costs. Such costs and losses may not be covered under any insurance. In addition, maintaining vigilance against cyber-attacks may involve substantial costs over time, and system enhancements may themselves be subject to cyber-attacks. | |

F. |

Statement of Cash Flows |

| Information on financial transactions which have been settled through the receipt or disbursement of cash or restricted cash is presented in the Statement of Cash Flows. Cash as presented in the Fund's Statement of Assets and Liabilities includes cash on hand at the Fund's custodian bank and does not include any short-term investments. As of and for the year ended March 31, 2024, the Fund had restricted cash in the form of futures collateral on the Statement of Assets and Liabilities. | |

G. |

Futures Contracts |

| The Fund may enter into futures transactions in order to attempt to hedge against changes in interest rates, securities prices and currency exchange rates or to seek to increase total return. Futures contracts are types of derivatives. | |

| All futures contracts entered into by the Fund are traded on a futures exchange. Upon entering into a futures contract, the Fund is required to deposit with a broker an amount of cash or securities equal to the minimum "initial margin" requirements of the associated futures exchange. The amount of cash deposited with the broker as collateral at March 31, 2024 is recorded as "Futures collateral" on the Statement of Assets and Liabilities. | |

| Subsequent payments for futures contracts ("variation margin") are paid or received by the Fund, depending on the daily fluctuation in the value of the contracts, and are recorded by the Fund as unrealized appreciation or depreciation. Cash received from or paid to the broker related to previous margin movement is held in a segregated account at the broker and is recorded as either "Due from broker for futures" or "Due to broker for futures" on the Statement of Assets and Liabilities. When the contract is closed, the Fund realizes a gain or loss equal to the difference between the opening and closing value of the contract as well as any fluctuation in foreign currency exchange rates where applicable. Futures contracts are subject to market risk, interest rate risk and currency |

| exchange rate risk. Changes in value of the contracts may not directly correlate to the changes in value of the underlying securities. With futures, there is reduced counterparty credit risk to the Fund since futures are exchange-traded and the exchange's clearinghouse, as counterparty to all exchange-traded futures, guarantees the futures against default. | |

| The average notional value of futures contracts long position during the year ended March 31, 2024 was $3,213,493. Open futures contracts outstanding at March 31, 2024 are listed in the Schedule of Investments. |

Statement of Assets and Liabilities |

Interest Rate Risk |

Credit Risk |

Foreign Exchange Rate Risk |

Equity Risk |

Commodity Risk |

Assets |

|||||

| Net unrealized appreciation on futures contracts* | $191,596 | $— | $— | $— | $— |

Total Value |

$191,596 |

$— |

$— |

$— |

$— |

| * | Includes cumulative unrealized appreciation (depreciation) of futures contracts as reported in the Schedule of Investments. Only net variation margin is reported within the assets and/or liabilities on the Statement of Assets and Liabilities. |

Statement of Operations |

Interest Rate Risk |

Credit Risk |

Foreign Exchange Rate Risk |

Equity Risk |

Commodity Risk |

Net Realized Gain (Loss) on |

|||||

| Futures contracts | $(1,221,950) | $— | $— | $— | $— |

Total Value |

$(1,221,950) |

$— |

$— |

$— |

$— |

Change in Net Unrealized Appreciation (Depreciation) on |

|||||

| Futures contracts | $191,596 | $— | $— | $— | $— |

Total Value |

$191,596 |

$— |

$— |

$— |

$— |

3/31/24 |

3/31/23 | |

| Shares outstanding at beginning of year | 23,914,439 | 23,914,439 |

Shares outstanding at end of year |

prior reporting periods were as follows:

Year Ended 3/31/24 |

Year Ended 3/31/23 | |||

Shares |

Amount |

Shares |

Amount | |

| VMTP Shares issued | — | $— | — | $— |

| VMTP Shares redeemed | (900) | (90,000,000) | (400) | (40,000,000) |

| Net decrease | (900) | $(90,000,000) | (400) | $(40,000,000) |

May 29, 2024

| • | In an attempt to hedge against adverse changes in the market prices of securities, interest rates or currency exchange rates |

| • | As a substitute for purchasing or selling securities |

| • | To attempt to increase the Fund’s return as a non-hedging strategy that may be considered speculative |

| • | To manage portfolio characteristics (for example, the duration or credit quality of the Fund’s portfolio) |

| • | As a cash flow management technique |

| Preferred shares as a percentage of total managed assets (including assets attributable to preferred shares) | 18.51% |

| Annual effective dividend rate payable by Fund on preferred shares | |

| Annual return Fund portfolio must experience (net of expenses) to cover dividend rate on preferred shares | |

| Common share total return for (10.00)% assumed portfolio total return | ( |

| Common share total return for (5.00)% assumed portfolio total return | ( |

| Common share total return for 0.00% assumed portfolio total return | ( |

| Common share total return for 5.00% assumed portfolio total return | |

| Common share total return for 10.00% assumed portfolio total return |

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Director During At Least The Past Five Years |

Thomas J. Perna (73) Chairman of the Board and Director |

Class III Director since 2006. Term expires in 2024. |

Private investor (2004 – 2008 and 2013 – present); Chairman (2008 – 2013) and Chief Executive Officer (2008 – 2012), Quadriserv, Inc. (technology products for securities lending industry); and Senior Executive Vice President, The Bank of New York (financial and securities services) (1986 – 2004) | Director, Broadridge Financial Solutions, Inc. (investor communications and securities processing provider for financial services industry) (2009 – present); Director, Quadriserv, Inc. (2005 – 2013); and Commissioner, New Jersey State Civil Service Commission (2011 – 2015) |

John E. Baumgardner, Jr. (73)* Director |

Class I Director since 2019. Term expires in 2025. |

Of Counsel (2019 – present), Partner (1983-2018), Sullivan & Cromwell LLP (law firm). | Chairman, The Lakeville Journal Company, LLC, (privately-held community newspaper group) (2015-present) |

Diane Durnin (67) Director |

Class II Director since 2020. Term expires in 2026. |

Managing Director - Head of Product Strategy and Development, BNY Mellon Investment Management (investment management firm) (2012-2018); Vice Chairman – The Dreyfus Corporation (2005 – 2018): Executive Vice President Head of Product, BNY Mellon Investment Management (2007-2012); Executive Director- Product Strategy, Mellon Asset Management (2005-2007); Executive Vice President Head of Products, Marketing and Client Service, Dreyfus Corporation (investment management firm) (2000-2005); Senior Vice President Strategic Product and Business Development, Dreyfus Corporation (1994-2000) | None |

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Director During At Least The Past Five Years |

Benjamin M. Friedman (79) Director |

Class II Director since 2008. Term expires in 2026. |

William Joseph Maier Professor of Political Economy, Harvard University (1972 – present) | Trustee, Mellon Institutional Funds Investment Trust and Mellon Institutional Funds Master Portfolio (oversaw 17 portfolios in fund complex) (1989 - 2008) |

Craig C. MacKay (61) Director |

Class III Director since 2021. Term expires in 2024. |

Partner, England & Company, LLC (advisory firm) (2012 – present); Group Head – Leveraged Finance Distribution, Oppenheimer & Company (investment bank) (2006 – 2012); Group Head – Private Finance & High Yield Capital Markets Origination, SunTrust Robinson Humphrey (investment bank) (2003 – 2006); and Founder and Chief Executive Officer, HNY Associates, LLC (investment bank) (1996 – 2003) | Director, Equitable Holdings, Inc. (financial services holding company) (2022 – present); Board Member of Carver Bancorp, Inc. (holding company) and Carver Federal Savings Bank, NA (2017 – present); Advisory Council Member, MasterShares ETF (2016 – 2017); Advisory Council Member, The Deal (financial market information publisher) (2015 – 2016); Board Co-Chairman and Chief Executive Officer, Danis Transportation Company (privately-owned commercial carrier) (2000 – 2003); Board Member and Chief Financial Officer, Customer Access Resources (privately-owned teleservices company) (1998 – 2000); Board Member, Federation of Protestant Welfare Agencies (human services agency) (1993 – present); and Board Treasurer, Harlem Dowling Westside Center (foster care agency) (1999 – 2018) |

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Director During At Least The Past Five Years |

Lorraine H. Monchak (67) Director |

Class I Director since 2015. Term expires in 2025. |

Chief Investment Officer, 1199 SEIU Funds (healthcare workers union pension funds) (2001 – present); Vice President – International Investments Group, American International Group, Inc. (insurance company) (1993 – 2001); Vice President – Corporate Finance and Treasury Group, Citibank, N.A. (1980 – 1986 and 1990 – 1993); Vice President – Asset/Liability Management Group, Federal Farm Funding Corporation (government-sponsored issuer of debt securities) (1988 – 1990); Mortgage Strategies Group, Shearson Lehman Hutton, Inc. (investment bank) (1987 – 1988); Mortgage Strategies Group, Drexel Burnham Lambert, Ltd. (investment bank) (1986 – 1987) | None |

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Director During At Least The Past Five Years |

Fred J. Ricciardi (77) Director |

Class III Director since 2014. Term expires in 2024. |

Private investor (2020 – present); Consultant (investment company services) (2012 – 2020); Executive Vice President, BNY Mellon (financial and investment company services) (1969 – 2012); Director, BNY International Financing Corp. (financial services) (2002 – 2012); Director, Mellon Overseas Investment Corp. (financial services) (2009 – 2012); Director, Financial Models (technology) (2005-2007); Director, BNY Hamilton Funds, Ireland (offshore investment companies) (2004-2007); Chairman/Director, AIB/BNY Securities Services, Ltd., Ireland (financial services) (1999-2006); Chairman, BNY Alternative Investment Services, Inc. (financial services) (2005-2007) | None |

| * Mr. Baumgardner is Of Counsel to Sullivan & Cromwell LLP, which acts as counsel to the Independent Directors of each Pioneer Fund. | |||

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Director During At Least The Past Five Years |

Lisa M. Jones (62)** Director, President and Chief Executive Officer |

Class I Director since 2014. Term expires in 2025. |

Director, CEO and President of Amundi US, Inc. (investment management firm) (since September 2014); Director, CEO and President of Amundi Asset Management US, Inc. (since September 2014); Director, CEO and President of Amundi Distributor US, Inc. (since September 2014); Director, CEO and President of Amundi Asset Management US, Inc. (since September 2014); Chair, Amundi US, Inc., Amundi Distributor US, Inc. and Amundi Asset Management US, Inc. (September 2014 – 2018); Managing Director, Morgan Stanley Investment Management (investment management firm) (2010 – 2013); Director of Institutional Business, CEO of International, Eaton Vance Management (investment management firm) (2005 – 2010); Director of Amundi Holdings US, Inc. (since 2017) | Director of Clearwater Analytics (provider of web-based investment accounting software for reporting and reconciliation services) (September 2022 – present) |

Marco Pirondini (57)** Director, Executive Vice President |

Class II Director since January 2024. Term expires in 2026. |

Executive Vice President and Chief Investment Officer of Amundi Asset Management US, Inc. since January 2024; Senior Managing Director and Head of Equities U.S. of Amundi US from 2010 to December 2023 | None |

| ** Ms. Jones and Mr. Pirondini are Interested Directors because they are officers or directors of the Fund’s investment adviser and certain of its affiliates. | |||

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Director During At Least The Past Five Years |

Marguerite A. Piret (75)*** Advisory Director |

Advisory Director since January 2024 (Class III Director from 2003 to January 2024). |

Chief Financial Officer, American Ag Energy, Inc. (technology for the environment, energy and agriculture) (2019 – present); Chief Operating Officer, North Country Growers LLC (controlled environment agriculture company) (2020 – present); Chief Executive Officer, Green Heat LLC (biofuels company) (2022 – present); President and Chief Executive Officer, Newbury Piret Company (investment banking firm) (1981 – 2019) | Director of New America High Income Fund, Inc. (closed-end investment company) (2004 – present); and Member, Board of Governors, Investment Company Institute (2000 – 2006) |

| *** Ms. Piret became a non-voting Advisory Director effective January 22, 2024. | |||

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Officer During At Least The Past Five Years |

Christopher J. Kelley (59) Secretary and Chief Legal Officer |

Since 2003. Serves at the discretion of the Board |

Senior Vice President and Deputy General Counsel of Amundi US since March 2024; Vice President and Associate General Counsel of Amundi US from January 2008 to March 2024; Secretary and Chief Legal Officer of all of the Pioneer Funds since June 2010; Assistant Secretary of all of the Pioneer Funds from September 2003 to May 2010; Vice President and Senior Counsel of Amundi US from July 2002 to December 2007 | None |

Thomas Reyes (61) Assistant Secretary |

Since 2010. Serves at the discretion of the Board |

Assistant General Counsel of Amundi US since May 2013 and Assistant Secretary of all the Pioneer Funds since June 2010; Counsel of Amundi US from June 2007 to May 2013 | None |

Heather L. Melito-Dezan (47) Assistant Secretary |

Since 2022. Serves at the discretion of the Board |

Director - Trustee and Board Relationships of Amundi US since September 2019; Private practice from 2017 – 2019. | None |

Anthony J. Koenig, Jr. (60) Treasurer and Chief Financial and Accounting Officer |

Since 2021. Serves at the discretion of the Board |

Managing Director, Chief Operations Officer and Fund Treasurer of Amundi US since May 2021; Treasurer of all of the Pioneer Funds since May 2021; Assistant Treasurer of all of the Pioneer Funds from January 2021 to May 2021; and Chief of Staff, US Investment Management of Amundi US from May 2008 to January 2021 | None |

Luis I. Presutti (58) Assistant Treasurer |

Since 2003. Serves at the discretion of the Board |

Director – Fund Treasury of Amundi US since 1999; and Assistant Treasurer of all of the Pioneer Funds since 1999 | None |

Gary Sullivan (65) Assistant Treasurer |

Since 2003. Serves at the discretion of the Board |

Senior Manager – Fund Treasury of Amundi US since 2012; and Assistant Treasurer of all of the Pioneer Funds since 2002 | None |

Antonio Furtado (41) Assistant Treasurer |

Since 2020. Serves at the discretion of the Board |

Fund Oversight Manager – Fund Treasury of Amundi US since 2020; Assistant Treasurer of all of the Pioneer Funds since 2020; and Senior Fund Treasury Analyst from 2012 - 2020 | None |

Name, Age and Position Held With the Fund |

Term of Office and Length of Service |

Principal Occupation(s) During At Least The Past Five Years |

Other Directorships Held by Officer During At Least The Past Five Years |

Michael Melnick (53) Assistant Treasurer |

Since 2021. Serves at the discretion of the Board |

Vice President - Deputy Fund Treasurer of Amundi US since May 2021; Assistant Treasurer of all of the Pioneer Funds since July 2021; Director of Regulatory Reporting of Amundi US from 2001 – 2021; and Director of Tax of Amundi US from 2000 - 2001 | None |

John Malone (53) Chief Compliance Officer |

Since 2018. Serves at the discretion of the Board |

Managing Director, Chief Compliance Officer of Amundi US Asset Management; Amundi Asset Management US, Inc.; and the Pioneer Funds since September 2018; Chief Compliance Officer of Amundi Distributor US, Inc. since January 2014. | None |

Brandon Austin (52) Anti-Money Laundering Officer |

Since 2022. Serves at the discretion of the Board |

Director, Financial Security – Amundi Asset Management; Anti-Money Laundering Officer of all the Pioneer Funds since March 2022: Director of Financial Security of Amundi US since July 2021; Vice President, Head of BSA, AML and OFAC, Deputy Compliance Manager, Crédit Agricole Indosuez Wealth Management (investment management firm) (2013 – 2021) | None |

change of address, lost stock certificates,Company, LLC

stock transferOperations Center

6201 15th Ave.

Brooklyn, NY 11219

Company, LLC

Wall Street Station

P.O. Box 922

New York, NY 10269-0560

60 State Street

Boston, MA 02109

ITEM 2. CODE OF ETHICS.

(a) Disclose whether, as of the end of the period covered by the report, the registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party. If the registrant has not adopted such a code of ethics, explain why it has not done so.

The registrant has adopted, as of the end of the period covered by this report, a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer and controller.

(b) For purposes of this Item, the term “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

(1) Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

(2) Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant;

(3) Compliance with applicable governmental laws, rules, and regulations;

(4) The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and

(5) Accountability for adherence to the code.