July 16, 2010

Via EDGAR Correspondence

Securities and Exchange Commission

Division of Corporation Finance

Attn: Jonathan E. Gottlieb, Esq.

100 F Street, N.E.

Washington, D.C. 20549

|

Re:

|

Nelnet, Inc.

|

|

Form 10-K for the year ended December 31, 2009, filed March 3, 2010

|

|

|

Form 10-Q for the quarterly period ended March 31, 2010, filed May 10, 2010

|

|

|

Schedule 14A, filed April 15, 2010

|

|

|

Amendment to Schedule 14A, filed April 15, 2010

|

|

|

File No. 001-31924

|

Dear Mr. Gottlieb:

On behalf of Nelnet, Inc. (the “Company”), submitted below are the Company’s responses to the comments of the Staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) set forth in the letter by Michael R. Clampitt dated June 14, 2010 (which letter was received by the Company on June 28, 2010) in connection with the above-referenced filings. For your convenience, the responses set forth below have been placed in the order in which the Staff presented the Comments and the text of each Comment is presented in bold italics before each response.

Form 10-K for the Fiscal Year ended December 31, 2009

Operating Results-Revenue Diversification, page 4

|

1.

|

Please provide to us and undertake to include in your future filings, consistent with Item 101(b) of Regulation S-K, discussion of the amount of profit or loss and total assets for each of your segments for each of your last three fiscal years. In addition, please reconcile the disclosure in the pie chart relating to 2009 with the table disclosing percent of revenues as reported by segment.

|

Pursuant to the cross referencing provisions of Item 101(b) of Regulation S-K, there was a sentence immediately before this subsection that stated that the Company includes separate financial information about its operating segments in note 22 of the notes to the consolidated financial statements. Note 22, Segment Reporting, of the notes to the consolidated financial statements, included in our 2009 Form 10-K provided the amount of revenues, net income or loss, and total assets for each of our segments for each of our last three fiscal years. We presented duplicative revenue information in this subsection in order to provide a quantitative sense of the relative revenue contribution of each segment over the last three fiscal years in connection with the accompanying narrative discussion of our expansion of products and services generated from businesses that are not dependent on the Federal Family Education Loan Program (the “FFEL Program” or “FFELP”).

Securities and Exchange Commission

July 16, 2010

Page 2

We will revise in applicable future filings the cross-reference sentence to clarify the segment information included in the financial statements, and such sentence will read substantially as follows:

The Company includes separate financial information about its operating segments, including revenues, net income or loss, and total assets for each of the Company’s segments for the last three fiscal years, in note 22 of the notes to the consolidated financial statements included in this Report.

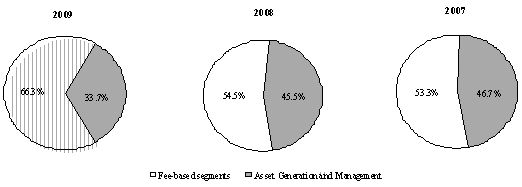

As indicated in this subsection, the pie charts showing the contribution of revenue from our fee-based businesses as compared to the revenue from the Asset Generation and Management operating segment exclude Corporate Activity and Overhead and fixed rate floor income. The pie charts exclude these items in order to provide better comparability of revenue recognized from our external customers and to reflect the fact that fixed rate floor income is a component of Asset Generation and Management segment revenue over which we have limited control and which has been significantly affected by the recent historically low interest rates. Attached hereto as Appendix A is a proposed revised disclosure for this subsection, which includes a reconciliation of the disclosure in the pie charts with the table disclosing the percentage of revenues as reported by segment. We hereby undertake to include this revised subsection in future filings.

Risk Factors, page 14

|

2.

|

Please provide to us and undertake to include in your future filings, revision of each risk factor to comply with the following requirements:

|

|

·

|

Item 503(c) of Regulation S-K which requires you to “[e]xplain how the risk affects the issuer;”

|

|

·

|

Securities Act Release No. 33-7497 which requires that you “place any risk factor in context so investors can understand the specific risk as it applies to your company and its operations;”

|

|

·

|

sample comment 34 to Staff Legal Bulletin No. 7, which directs that you provide the information investors need to “assess the magnitude” of each risk and “explain why” each risk may result in a material adverse effect on you; and

|

|

·

|

sample comment 38 to Staff Legal Bulletin No. 7, which directs that you include “specific disclosure of how your [operations] [financial condition] [business] would be affected” by each risk.

|

Many of your risk factors merely state you “may be” or “could be” adversely affected without explaining why or how you may be affected and without differentiating the magnitude of one risk from another. Please identify the specific impact and quantify each risk to the extent possible. For instance, your first risk factor merely states you are “exposed to interest rate risk” without addressing specific current market conditions that heighten the risk and without attempting to assess the potential magnitude of the risk. For instance, your third risk factor relating to auction rate securities does not quantify the potential losses from your inability to sell these securities.

Securities and Exchange Commission

July 16, 2010

Page 3

Attached hereto as Appendix B is a proposed revised and substantially reorganized set of risk factors, which proposed revised set of risk factors is intended to address this comment. We hereby undertake to include these revised risk factors in applicable future filings.

|

3.

|

We note that you list thirty one risk factors. Please provide to us and undertake to include in your future filings, revision of this section to comply with Item 503(c) of Regulation S-K which requires that you disclose in this section “the most significant factors that make the offering speculative or risky.” Item 503(c) explicitly directs “Do not present risks that could apply to any issuer or any offering.” Please review all forty one [sic] of your risk factors, delete those that do not comply with this directive or revise to explain how these risks apply to you including, but not limited to, the following:

|

|

·

|

the costs and effects of litigation (page 17);

|

|

·

|

changes in accounting policies (page 18);

|

|

·

|

security and privacy breaches (page 19);

|

|

·

|

federal and state regulations (page 20);

|

|

·

|

manage operations and growth (page 21);

|

|

·

|

information technology systems and infrastructure (page 21);

|

|

·

|

ratings of the Company (page 23);

|

|

·

|

retain necessary technical personnel, skilled management and qualified subcontractors (page 26);

|

|

·

|

reliance on vendors (page 26); and

|

|

·

|

markets highly competitive (page 27).

|

The proposed revised and substantially reorganized set of risk factors attached hereto as Appendix B as indicated in our response to comment 2 above is intended to address this comment. We hereby undertake to include these revised risk factors in applicable future filings. To address Item 503(c) of Regulation S-K, which requires that we disclose in this section “the most significant factors that make the offering speculative or risky” and explicitly directs “do not present risks that could apply to any issuer or any offering,” we deleted the items outlined below from our risk factors previously included in our 2009 Form 10-K. In addition, other risk factors were combined and/or revised to further explain how these risks apply to us as required by Item 503(c) of Regulation S-K. A summary of risk factors that were combined and revised is also provided below.

Securities and Exchange Commission

July 16, 2010

Page 4

Deleted Risk Factors

|

·

|

Exposure related to certain tax issues could decrease the Company’s net income.

|

|

·

|

Changes in accounting policies or accounting standards, changes in how accounting standards are interpreted or applied, and incorrect estimates and assumptions by management in connection with the preparation of the Company’s consolidated financial statements could materially affect the reported amounts of asset and liabilities, the reported amounts of income and expenses, and related disclosures.

|

|

·

|

Federal and state regulations can restrict the Company’s business and noncompliance with these regulations could result in penalties, litigation, and reputation damage.

|

|

·

|

A failure to properly manage operations and growth could have a material adverse effect on the Company’s ability to retain existing customers and attract new business opportunities.

|

|

·

|

The ratings of the Company or of any securities issued by the Company may change, which may increase the Company’s costs of capital and may reduce the liquidity of the Company’s securities.

|

|

·

|

There are risks inherent in owning the Company’s common stock.

|

|

·

|

Changes in industry structure and market conditions could lead to charges related to discontinuances of certain products or businesses and asset impairment, including goodwill.

|

|

·

|

The Company is subject to foreign currency exchange risk and such risk could lead to increased costs.

|

|

·

|

A failure to attract and retain necessary technical personnel, skilled management, and qualified subcontractors may have an adverse impact on the Company’s future growth.

|

|

·

|

The markets in which the Company competes are highly competitive, which could affect revenue and profit margins.

|

|

·

|

Negative publicity could damage the Company’s reputation and adversely affect its operating segments and their financial results.

|

|

·

|

A continued economic recession could reduce demand for Company products and services and lead to lower revenue and earnings.

|

Securities and Exchange Commission

July 16, 2010

Page 5

|

·

|

The Company may not be able to successfully protect its intellectual property and may be subject to infringement claims.

|

Combined and Revised Risk Factors

The risk factors identified below were combined and revised to form a new risk factor as follows: “Our student loan portfolio is subject to certain risks related to interest rates, our ability to manage the risks related to interest rates, prepayment, and credit risk, each of which could reduce the expected cash flows and earnings on our portfolio.”

|

·

|

The Company is exposed to interest rate risk in the form of basis risk and repricing risk because the interest rate characteristics of the Company’s assets do not match the interest rate characteristics of the funding for the assets.

|

|

·

|

The Company is exposed to interest rate risk because of the interest rate characteristics of certain of its assets and the interest rate characteristics of the related funding of such assets.

|

|

·

|

Characteristics unique to certain asset-backed securitizations, namely auction rate securities and variable rate demand notes, may negatively affect the Company’s earnings.

|

|

·

|

The Company’s derivative instruments may not be successful in managing interest and foreign currency exchange rate risks, which may negatively impact the Company’s operations.

|

|

·

|

Higher rates of prepayments of student loans, including consolidations by third parties or the Department of Education through the Direct Loan Program, could reduce the Company’s profits.

|

|

·

|

The Company faces counterparty risk.

|

|

·

|

Future losses due to defaults on loans held by the Company, or loans sold to third parties which the Company is obligated to repurchase in the event of certain delinquencies, present credit risk which could adversely affect the Company’s earnings.

|

The risk factors identified below were combined and revised to form a new risk factor as follows: “A failure of our information technology systems or infrastructure, or those of our third-party vendors, could result in security and privacy breaches and damage client relations and our reputation.”

|

·

|

Security and privacy breaches in systems or system failures may damage client relations and the Company’s reputation.

|

Securities and Exchange Commission

July 16, 2010

Page 6

|

·

|

The Company and its operating segments are highly dependent upon information technology systems and infrastructure.

|

|

·

|

Managing assets for third parties has inherent risks that, if not properly managed, could negatively affect the Company’s business.

|

|

·

|

The Company may face operational and security risks from its reliance on vendors to complete specific business operations.

|

Revised Risk Factors

The risk factor identified below was revised as follows: “Effective July 1, 2010, the Reconciliation Act of 2010 prohibits new loan originations under the Federal Family Education Loan Program (“FFELP”) and requires that all new federal loan originations be made through the Federal Direct Loan Program (the “Direct Loan Program”). As a result of this legislation, net interest income on our existing FFELP loan portfolio, as well as fee-based revenue from guarantee and third-party FFELP servicing and education loan software licensing and consulting fees, will decline over time as our and our customers’ FFELP loan portfolios are paid down.”

|

·

|

Changes in student lending legislation and regulations or the elimination of the FFEL Program by the Federal Government could have a negative impact upon the Company’s business and may affect its earnings and operations.

|

The risk factor identified below was revised as follows: “If our loan servicing contract with the Department of Education expiring in 2014 is not renewed, our loan servicing revenues will be significantly reduced and we will need to restructure our loan servicing operations.”

|

·

|

The Company’s government contracts are subject to termination rights, audits, and investigations, and, if terminated, could negatively impact the Company’s reputation and reduce its ability to compete for new contracts.

|

The risk factor identified below was revised as follows: “We have entered into contractual arrangements with Union Bank. Union Bank is controlled by Farmers & Merchants Investment, Inc. (“F&M”) which owns 81.4% of Union Bank’s common stock and 15.4% of Union Bank’s non-voting preferred stock. Michael S. Dunlap, a significant shareholder of us as well as our Chief Executive Officer, Chairman, and a member of our Board of Directors, owns or controls 40.2% of the stock of F&M, while Mr. Dunlap’s sister, Angela L. Muhleisen, owns or controls 38.55% of F&M stock. The transactions with Union Bank present conflicts of interest and pose risks to our shareholders that the terms may not be as favorable to us as we could receive from unrelated third-parties.”

|

·

|

Transactions with affiliates and potential conflicts of interest of certain of the Company’s officers and directors, including the Company’s Chief Executive Officer, pose risks to the Company’s shareholders that the Company may not enter into transactions on the same terms that the Company could receive from unrelated third-parties.

|

Securities and Exchange Commission

July 16, 2010

Page 7

The risk factor identified below was revised as follows: “Our Chairman and Chief Executive Officer beneficially owns over 67% of the voting rights of our shareholders and has day to day control over all matters at our Company.”

|

·

|

The Company’s Chairman and Chief Executive Officer owns a substantial percentage of the Company’s Class A and Class B common stock and is able to control all matters subject to a shareholder vote.

|

|

4.

|

Please provide to us and undertake to include in your future filings, revision of the caption and text of the twenty seventh risk (which is on page 27) relating to transactions with related parties to provide more detail including, but not limited to, the following:

|

|

·

|

revise the second sentence to quantify in the aggregate the “significant portion of the company’s business” which you conduct with related parties;

|

|

·

|

revise the third sentence and the caption to replace your description that circumstances “may present potential” conflicts of interest with dislcousre [sic] to reflect the fact that there are actual conflicts of interest since you conduct business with other companies that your Chairman and CEO and his sister Ms. Muhleisen beneficially own a substantial percentage of the outstanding stock and serve on the boards and in management;

|

|

·

|

revise the fourth sentence to replace your reference to Mr. Dunlap having “an indirect interest” in Union Bank and Trust Company to quantify his beneficial ownership in Union Bank and Trust Company and that of his sister and to disclose the position that he and his sister hold on the board and management of Farmers and Merchants and Union Bank and Trust Company;

|

|

·

|

briefly explain the “substantial benefits” of your business with Union Bank and Trust Company and other related parties and explain whether these benefits could be obtained from unrelated third parties;

|

|

·

|

disclose whether or not these contracts with related parties were offered to unrelated parties and/or subject to competitive bids; and

|

|

·

|

clarify in the last sentence that the risk is that you have and/or will enter into contracts and business transactions with related parties that benefit Mr. Dunlap and his sister and other related parties and that do not benefit the company and/or minority shareholders.

|

The proposed revised set of risk factors attached hereto as Appendix B as indicated in our response to comment 2 above is intended to address this comment. We hereby undertake to include this revised risk factor in applicable future filings.

Securities and Exchange Commission

July 16, 2010

Page 8

|

5.

|

Please provide to us and undertake to include in your future filings, revision of the caption and text of the twenty eighth risk factor (which is on page 27) relating to Mr. Dunlap’s control over your company to provide more detail including, but not limited to, the following:

|

|

·

|

revise the first sentence and the caption to replace your references to your Chairman and CEO owing “a substantial percentage” of your stock to disclose that he beneficially owns stock that has over sixty seven percent of the voting rights of your shareholders;

|

|

·

|

revise the third sentence to replace your references to Mr. Dunlap controlling “matters subject to a shareholder vote” with disclosure that Mr. Dunlap as Chairman, CEO and controlling stockholder has day to day control over all matters at your company;

|

|

·

|

disclose that each member of the Board and each member of management have been appointed by Mr. Dunlap and can be removed by Mr. Dunlap because he beneficially owns stock that has over sixty seven percent of the voting rights of your shareholders and he is the Chief Executive Officer;

|

|

·

|

revise the last sentence to disclose that your [sic] Mr. Dunlap, his sister (Ms. Muhleisen) and your Vice Chairman (Mr. Butterfield) beneficially own stock that in the aggregate has over eighty one percent of the voting rights of your shareholders; and

|

|

·

|

clarify that the risk is that Mr. Dunlap has the ability to take actions that benefit him and his sister but do not benefit other shareholders who hold only nineteen percent of the voting rights.

|

The proposed revised set of risk factors attached hereto as Appendix B as indicated in our response to comment 2 above is intended to address this comment. We hereby undertake to include this revised risk factor in applicable future filings.

Form 10-Q for the Quarterly Period ended March 31, 2010

Recent Developments, page 26

|

6.

|

Please provide to us and undertake to include in your future filings, more detail regarding the impact of the Reconciliation Act of 2010 on your revenues and net income including but not limited to the following:

|

|

·

|

provide more detail regarding the amount of the loss in net interest income and fee-based revenue from the termination of the Federal Family Education Loan Program briefly discussed in the last sentence of the second paragraph;

|

|

·

|

disclose, when known, the amount of loans that the Department of Education has allocated to you to service;

|

Securities and Exchange Commission

July 16, 2010

Page 9

|

·

|

provide the basis for your claim, in the last sentence of the third paragraph, that revenue from servicing loans and from fee based services “will partially offset” the losses in revenues from the termination of the program.

|

In addition, please file as an exhibit your student loan servicing contract with the U.S. Department of Education. Please revise your disclosure including your risk factors to reflect the fact that you will cease to originate these loans.

We will include in applicable future filings, beginning with the Form 10-Q for the quarterly period ended June 30, 2010, revised disclosure regarding the impact of the Reconciliation Act of 2010 which will read substantially as shown below. We will also disclose, when known, the amount of loans the Department of Education will allocate to us to service. As of the filing of this letter, we do not know the allocation of direct loan servicing volume.

We will file the student loan servicing contract with the U.S. Department of Education as an exhibit to our Form 10-Q for the quarterly period ended June 30, 2010.

The proposed revised set of risk factors attached hereto as Appendix B as indicated in our response to comment 2 above includes disclosure reflecting the impact of us no longer originating FFELP loans as a result of the Reconciliation Act of 2010.

Recent Developments

Legislation

On March 30, 2010, President Obama signed into law the Health Care and Education Reconciliation Act of 2010 (the “Reconciliation Act of 2010”). Effective July 1, 2010, this law prohibits new loan originations under the Federal Family Education Loan Program (“FFELP”) and requires that all new federal loan originations be made through the Federal Direct Loan Program (the “Direct Loan Program”). If a first disbursement has been made on a FFELP loan prior to July 1, 2010, subsequent disbursements of that loan may still be made under the FFELP. The new law does not alter or affect the terms and conditions of existing FFELP loans.

Securities and Exchange Commission

July 16, 2010

Page 10

As a result of the Reconciliation Act of 2010, the Company will no longer originate new (first disbursement) FFELP loans after June 30, 2010. As such, subsequent to 2010, the Company will no longer recognize a gain from originating and subsequently selling FFELP loans to the Department of Education (the “Department”) under the Department’s Loan Purchase Commitment Program (the “Purchase Program”). During 2009, the Company recognized a gain of $36.6 million from selling $2.1 billion of 2008-2009 academic year loans to the Department under the Purchase Program. The Company continues to use the Department’s Participation Program to fund loans originated for the 2009-2010 academic year. Based on the number of 2009-2010 academic year loans held by the Company that are eligible for this program ($2.0 billion as of June 30, 2010), the Company estimates that it will recognize a gain during the fourth quarter of 2010 of approximately $31 million to $33 million when it sells these loans under this program. This amount does not include loans acquired after June 30, 2010 which would increase the gain recognized by the Company. In addition, as a result of the Reconciliation Act of 2010, net interest income on the Company’s existing FFELP loan portfolio, as well as fee-based revenue from guarantee and third-party FFELP servicing and education loan software licensing and consulting fees, will decline over time as the Company and its customers’ FFELP loan portfolios are paid down. During the six month period ended June 30, 2010 and year ended December 31, 2009, the Company recognized approximately $187 million and $247 million, respectively, of net interest income on its FFELP loan portfolio, $61 million and $100 million, respectively, in guarantee and third-party FFELP servicing revenue, and approximately $5 million and $12 million, respectively, in education loan software licensing and consulting fees related to the FFEL Program.

Due to the legislative changes in the student loan industry, the Company believes there will be opportunities to purchase FFELP loan portfolios and/or expand its current level of guarantee and third-party FFELP servicing volume on behalf of current FFELP participants looking to modify their involvement in FFELP and/or exit that business.

Direct Loan Servicing Contract

In June 2009, the Company was one of four private sector companies awarded a student loan servicing contract by the Department. As of June 30, 2010, the Company was servicing approximately $13 billion of loans for 1.5 million borrowers under this contract. The Department has estimated $116 billion of new student loan originations will be funded through the Direct Loan Program for the 2010-2011 academic year (July 1, 2010 – June 30, 2011). This volume will be allocated by the Department to the four servicers based on performance factors such as customer satisfaction levels and default rates. For the six-month period ended June 30, 2010, the Company earned $9.7 million in revenue under this contract.

Schedule 14A and Amendment to Schedule 14A

Board Composition and Independence, page 8

|

7.

|

Please provide to us and undertake to include in your future filings, a revised first paragraph to disclose that each member of the Board has been elected by Mr. Dunlap and can be defeated by Mr. Dunlap because he beneficially owns stock that has over sixty seven percent of the voting rights.

|

Securities and Exchange Commission

July 16, 2010

Page 11

We will include in applicable future filings a revised paragraph which reads substantially as follows:

The Board of Directors is composed of a majority of independent directors as defined by the rules of the New York Stock Exchange. A director does not qualify as an independent director unless the Board has determined, pursuant to applicable legal and regulatory requirements, that such director has no material relationship with the Company (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company). The Nominating and Corporate Governance Committee reviews compliance with the definition of “independent” director annually. Mr. Dunlap beneficially owns shares representing over 67% of the combined voting power of our shareholders. Because of his beneficial ownership, Mr. Dunlap can effectively elect each member of the Board of Directors and has the power to defeat or remove each member of the Board of Directors.

Risk Management, page 16

|

8.

|

Please provide to us and undertake to include in your future filings, revised disclosure that complies with the requirements of Item 402(s).

|

We concluded that disclosure in response to Item 402(s) of Regulation S-K was not necessary due to our determination that risks arising from our compensation policies and practices for our employees are not reasonably likely to have a material adverse effect on us, and pursuant to guidance included in the Commission’s adopting release for Item 402(s) of Regulation S-K [Release No. 33-9089] indicating that Item 402(s) does not require a company to make an affirmative statement that it has determined that the risks arising from its compensation policies and practices are not reasonably likely to have a material adverse effect on the company.

The process that we undertook to reach that conclusion involved a review and evaluation by our internal compensation committee, Enterprise Risk Management team, and Compensation Committee of our Board of Directors, which all met and evaluated our compensation policies and practices for all employees to determine whether and to what extent, if any, our policies and practices of compensating our employees could result in risk taking incentives, and whether risks arising from our compensation policies and practices for our employees are reasonably likely to have a material adverse effect on us In their review and evaluation, the internal compensation committee, Enterprise Risk Management team, and Compensation Committee of our Board of Directors considered, among other factors, whether there were situations that may require disclosure, such as potential material risk-incentivizing compensation policies and practices:

|

·

|

at a business unit of the company that carries a significant portion of the company’s risk profile;

|

|

·

|

at a business unit with compensation structured significantly differently than other units within the company;

|

Securities and Exchange Commission

July 16, 2010

Page 12

|

·

|

at a business unit that is significantly more profitable than others within the company;

|

|

·

|

at a business unit where compensation expense is a significant percentage of the unit’s revenues; and

|

|

·

|

that vary significantly from the overall risk and reward structure of the company, such as when bonuses are awarded upon accomplishment of a task, while the income and risk to the company from the task extend over a significantly longer period of time.

|

Based upon their review and evaluation of our compensation policies and practices, the internal compensation committee, Enterprise Risk Management team, and Compensation Committee of the Board of Directors determined that our compensation policies are not reasonably likely to have a material adverse effect on us.

Industry Comparison of Compensation, page 16

|

9.

|

Please provide to us and undertake to include in your future filings, revised disclosure that complies with the requirements of Item 407(e)(3)(iii) regarding the role of compensation consultants.

|

We note that Item 407(e)(3)(iii) of Regulation S-K requires a narrative description of any role of compensation consultants in determining or recommending the amount or form of executive and director compensation during the registrant’s last fiscal year, and that we (including our Compensation Committee of the Board of Directors and management) did not utilize any compensation consultants during or with respect to our last fiscal year ended December 31, 2009. As indicated in our disclosure, we utilized compensation consultants in 2007 and will do so in 2010. We hereby undertake to include in applicable future filings disclosure that complies with the requirements of Item 407(e)(3)(iii) of Regulation S-K regarding the role of compensation consultants.

Certain Relationships and Related Transactions, page 28

|

10.

|

Please provide to us and undertake to include in your future filings, revised disclosure consistent with Item 404 (including Item 404(a)(6)) to provide more detail including, but not limited to, the following:

|

|

·

|

revise the first paragraph to describe the standards to be applied by the Board and revise the second paragraph to describe the standards to be applied by management in reviewing transactions between you and related persons, such as Mr. Dunlap and his sister, as required by Item 404(b)(1)(ii) and to disclose that each member of the Board has been elected by Mr. Dunlap and can be removed or defeated by Mr. Dunlap because he beneficially owns stock that has over sixty seven percent of the voting rights;

|

Securities and Exchange Commission

July 16, 2010

Page 13

|

·

|

revise the second paragraph to describe the standards to be applied by executive management in reviewing transactions between you and related persons, such as Mr. Dunlap and his sister, as required by Item 404(b)(1)(ii) and to disclose that each member of the Company’ [sic] executive management has been hired by and are supervised by Mr. Dunlap and can be fired by him or otherwise penalized by him because he is the Chief Executive Officer;

|

|

·

|

revise the third paragraph to revise your disclosure of “some of the Company’s directors and members of management” to disclose, as required by Item 404, the identities [sic] all related parties (including beneficial owners under Item 404(b)(i) and immediate family members pursuant to Item 404(b)(ii)) and to disclose all related parties rather than only two;

|

|

·

|

revise your disclosure of each transaction to disclose the aggregate amount of profit or loss to you and to Union Bank and Trust Company and Union Financial Services of each transactions [sic] with Mr. Dunlap or another related person, as required by Item 404(a)(3); and

|

|

·

|

revise your disclosure of each transaction (on pages 28-31) to disclose whether or not the fees and terms of each transaction are substantially the same terms as those prevailing at the time for transactions with person [sic] that do not have any relationship to you pursuant to Item 404(a)(6) and the approximate dollar value of each related persons interest in each transaction as required by Item 404(a)(4).

|

We will include in applicable future filings revised disclosure describing the standards to be applied by the Company’s Board of Directors and executive management in reviewing transactions between us and related persons which reads substantially as shown below.

As required by Item 404(a)(3) of Regulation S-K, the approximate dollar value of the amount involved in related party transactions should be disclosed. Upon review of our disclosure, management believes we have met that requirement.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Policies and Procedures on Transactions with Related Persons

The Company has adopted written policies and procedures for the Nominating and Corporate Governance Committee’s review of any transaction, arrangement, or relationship (including any indebtedness or guarantee of indebtedness) or series of similar transactions, arrangements, or relationships in which (i) the Company is a participant, (ii) the aggregate amount involved will or may be expected to exceed $120,000, and (iii) a related person has or will have a direct or indirect material interest. For purposes of this policy, a “related person” means (i) any of our directors, executive officers, or nominees for director, (ii) any stockholder that beneficially owns more than five percent of the Company’s outstanding shares of common stock, and (iii) any immediate family member of the foregoing. The Nominating and Corporate Governance Committee approves or ratifies only those transactions that it determines in good faith are in, or are not inconsistent with, the best interests of the Company and its stockholders. The Nominating and Corporate Governance Committee may, in its discretion, submit certain transactions to the full Board of Directors for approval where it deems appropriate.

Securities and Exchange Commission

July 16, 2010

Page 14

In determining whether to approve or ratify a transaction, the Nominating and Corporate Governance Committee takes into account the factors it deems appropriate, which may include, among others, the benefits to the Company, the availability of other sources for comparable products or services, the impact on a director’s independence in the event the related person is a director, and the extent of the related person’s interest in the transaction. The policy also provides for the delegation of its authority to the Chairman of the Nominating and Corporate Governance Committee for any related person transaction requiring pre-approval or ratification between meetings of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee reviews and assesses ongoing relationships with a related person on at least an annual basis to see that they are in compliance with the policy and remain appropriate.

All approved related party transactions are communicated to the full Board of Directors by the Chairman of the Nominating and Corporate Governance Committee, or his designee. Mr. Dunlap beneficially owns shares representing over 67% of the combined voting power of our shareholders. Because of his beneficial ownership, Mr. Dunlap can effectively elect each member of the Board of Directors, including all members of the Nominating and Corporate Governance Committee, and has the power to defeat or remove each member.

Although there is no formal requirement for executive management of the Company to approve related party transactions, executive management reviews all related party transactions. Upon reviewing related party transactions, executive management takes into account the factors it deems appropriate, which may include, among others, the benefits to the Company, the availability of other sources for comparable products or services, the impact on a director’s independence in the event the related person is a director, and the extent of the related person’s interest in the transaction.

Each member of the Company’s executive management has been hired by and is supervised by Mr. Dunlap and can be fired by him or otherwise penalized by him because he is the Chief Executive Officer.

Securities and Exchange Commission

July 16, 2010

Page 15

During 2009, the Company entered into certain transactions and had business arrangements with Union Bank and Trust Company and Union Financial Services. These transactions were reviewed and approved by the Nominating and Corporate Governance Committee and reviewed by executive management. Union Bank and Trust Company and Union Financial Services are related persons as discussed below. We cannot affirm whether or not the fees and terms of each transaction are substantially the same terms as those prevailing at the time for transactions with persons that do not have a relationship with the company (either directly or as a partner, shareholder, or officer of an organization that has a relationship with the Company). However, all related party transactions are based on available market information for comparable assets, products, and services and are extensively negotiated.

* * * * *

On behalf of the Company, the undersigned acknowledges that:

|

|

•

|

the Company is responsible for the adequacy and accuracy of the disclosures in our filings;

|

|

|

•

|

Staff comments or changes to disclosures in response to Staff comments do not foreclose the Commission from taking any actions with respect to our filings; and

|

|

|

•

|

the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

|

We believe that the foregoing is responsive to the Comments. If you need further information, you may contact the undersigned at 402.458.2370.

Sincerely,

/S/ TERRY J. HEIMES

Terry J. Heimes

Chief Financial Officer

Appendix A

Operating Results - Revenue Diversification

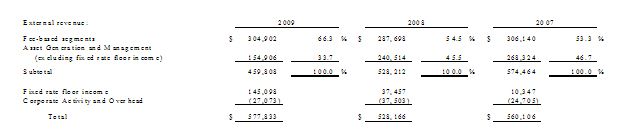

The Company ranks among the nation’s leaders in terms of total student loan assets originated, held, and serviced, principally consisting of loans originated under the FFEL Program (a detailed description of the FFEL Program is included in Appendix A to this Report). In recent years, the Company has expanded products and services generated from businesses that are not dependent upon the FFEL Program (as shown below), thereby reducing legislative and political risk related to the education lending industry. Revenues from these businesses are primarily generated from products and services offered in the Company’s Tuition Payment Processing and Campus Commerce and Enrollment Services operating segments. The following chart summarizes the percent of external revenue earned by the Company’s operating segments when excluding Corporate Activity and Overhead and fixed rate floor income included in the Asset Generation and Management operating segment. Excluding Corporate Activity and Overhead and fixed rate floor income provides better comparability of revenue recognized from the Company’s operating segments’ external customers during the years presented. The majority of external revenue included in Corporate Activity and Overhead is interest expense on unsecured corporate debt. Fixed rate floor income is subject to changes in interest rates, which is a factor beyond the Company’s control. The amount of fixed rate floor income increased during both 2009 and 2008 due to a decrease in interest rates to historical lows. (See Part II, Item 7A, “Quantitative and Qualitative Disclosures about Market Risk – Interest Rate Risk” for further detail related to the Company’s fixed rate floor income.) The following chart shows the increased contribution of revenue from fee-based segments and includes a reconciliation to total external revenue by operating segment as presented on the following page.

A-1

The following tables summarize the Company’s revenues by operating segment (dollars in thousands):

A-2

Appendix B

ITEM 1A. RISK FACTORS

We operate our business in a highly competitive and regulated environment. We are subject to business risks including, but not limited to, operating in markets that are highly competitive, negative publicity and reputation damage, and the impact of a sustained economic downturn. This risk factors section highlights specific risks that could affect us. Although this section attempts to highlight key risk factors, other risks may emerge at any time and we cannot predict all risks or estimate the extent to which they may affect our financial performance. These risk factors should be read in conjunction with the other information included in this Report.

Student Loan Portfolio.

Our student loan portfolio is subject to certain risks related to interest rates, our ability to manage the risks related to interest rates, prepayment, and credit risk, each of which could reduce the expected cash flows and earnings on our portfolio.

Interest rate risk – basis and repricing risk:

We are exposed to interest rate risk in the form of basis risk and repricing risk because the interest rate characteristics of our student loan assets do not match the interest rate characteristics of the funding for those assets.

We fund the majority of our student loan assets with 3-month LIBOR indexed floating rate securities. In addition, the interest rates on some of our debt are set via a “dutch auction” or through a periodic remarketing. Meanwhile, the margins on our student loan assets are indexed to treasury bill and commercial paper rates. The different interest rate characteristics of our loan assets and liabilities funding these assets results in basis risk. We also face repricing risk due to the timing of the interest rate resets on our liabilities, which may occur as infrequently as every quarter, in contrast to the timing of the interest rate resets on our assets, which generally occur daily. In a declining interest rate environment, this may cause our student loan spread to compress, while in a rising interest rate environment, it may cause the spread to increase.

As of December 31, 2009, we had $22.4 billion of FFELP loans indexed to the fiscal quarter average rate of daily financial commercial paper rates and $1.0 billion indexed to the fiscal quarter average rate of 13-week Treasury Bill auctions, and $20.2 billion of debt to fund such loans indexed to three-month LIBOR in which the rate resets discretely in advance. While these indices are all short term in nature with rate movements that are highly correlated over a longer period of time, there have been points in recent history where volatility has been high and correlation has been reduced. There can be no assurance that the indices’ historically high level of correlation will not be disrupted in the future due to capital market dislocations or other factors not within our control. In such circumstances, our earnings could be adversely affected, possibly to a material extent. See Part II, Item 7A, “Quantitative and Qualitative Disclosures About Market Risk – Interest Rate Risk.”

B-1

Interest rate risk – loss of floor income:

We are exposed to interest rate risk because of the interest rate characteristics of certain of our student loan assets and the interest rate characteristics of the related funding of those assets.

FFELP loans originated prior to April 1, 2006 generally earn interest at the higher of a floating rate based on the Special Allowance Payment or SAP formula set by the Department and the borrower rate, which is fixed over a period of time. We generally finance our student loan portfolio with variable rate debt. In low and/or declining interest rate environments, when the fixed borrower rate is higher than the rate produced by the SAP formula, our student loans earn at a fixed rate while the interest on the variable rate debt typically continues to decline. In these interest rate environments, we may earn additional spread income that we refer to as floor income.

Depending on the type of loan and when it was originated, the borrower rate is either fixed to term or is reset to an annual rate each July 1. As a result, for loans where the borrower rate is fixed to term, we may earn floor income for an extended period of time, which we refer to as fixed rate floor income, and for those loans where the borrower rate is reset annually on July 1, we may earn floor income to the next reset date, which we refer to as variable rate floor income.

For the year ended December 31, 2009, we earned $145.1 million of fixed rate floor income and $7.5 million of variable rate floor income. Absent the use of derivative instruments and apart from potential repricing benefits associated with the mismatch between the interest reset of the loan assets and debt securities, a rise in interest rates will reduce the amount of floor income received and this will have an impact on earnings due to interest margin compression caused by increased financing costs, until such time as the federally insured loans earn interest at a variable rate in accordance with their SAP formulas. In higher interest rate environments, where the interest rate rises above the borrower rate and fixed rate loans effectively convert to variable rate loans, the impact of the rate fluctuations is reduced. See Part II, Item 7A, “Quantitative and Qualitative Disclosures About Market Risk – Interest Rate Risk.”

Interest rate risk – use of derivatives:

We utilize derivative instruments to manage interest rate sensitivity. Our derivative instruments are intended as economic hedges but do not qualify for hedge accounting; consequently, the change in fair value, called the “mark-to-market”, of these derivative instruments is included in our operating results. Changes or shifts in the forward yield curve can and have significantly impacted the valuation of our derivatives. Accordingly, changes or shifts in the forward yield curve will impact our financial position, results of operations, and cash flows.

Developing an effective strategy for dealing with movements in interest rates is complex, and no strategy can completely insulate us from risks associated with such fluctuations. Although we believe our derivative instruments are highly effective, because many of our derivatives are not balance guaranteed to a particular pool of student loans, we are subject to prepayment risk that could result in our being under or over hedged, which could result in material losses. In addition, our interest rate risk management activities could expose us to substantial mark-to-market losses if interest rates move in a materially different way than was expected based on the environment when the derivatives were entered into. As a result, we cannot offer any assurance that our economic hedging activities will effectively manage our interest rate sensitivity, or have the desired beneficial impact on our results of operations or financial condition.

B-2

By using derivative instruments, we are exposed to market risk and counterparty credit risk.

When the mark-to-market value of a derivative instrument is negative, we owe the counterparty, and therefore have no immediate counterparty risk. Additionally, if the negative mark-to-market value of derivatives with a counterparty exceeds a specified threshold, we may be required to maintain a collateral deposit with the counterparty. The threshold at which we post collateral may depend on our unsecured credit rating. If interest rates move materially, we could be required to deposit a significant amount of collateral with our derivative instrument counterparties. The collateral deposits, if significant, could negatively impact our capital resources. As of December 31, 2009, the negative mark-to-market value of derivatives with counterparties was $2.5 million. As of December 31, 2009, we were not required to post any collateral.

When the fair value of a derivative contract is positive, this generally indicates that the counterparty owes us if the contract would be terminated. If the counterparty fails to perform, credit risk with such counterparty is equal to the extent of the fair value gain in the derivative less any collateral held by us. As of December 31, 2009, the fair value of our derivatives which had a positive fair value in our favor was $193.4 million, of which $169.8 million related to the value of our cross-currency interest rate swaps. As of December 31, 2009, our trustee held $329 million of collateral from the counterparty on the cross-currency interest rate swaps.

We attempt to manage market and credit risks associated with our derivative instruments by establishing and monitoring limits as to the types and degree of risk that may be undertaken, and by entering into transactions with high-quality counterparties that are reviewed periodically by our risk committee.

Prepayment risk:

Higher rates of prepayments of student loans, including consolidation by the Department through the Direct Loan Program, would reduce our net interest income.

Pursuant to the Higher Education Act, borrowers may prepay loans made under the FFEL Program at any time without penalty. Prepayments may result from consolidation of student loans by the Department as part of the Direct Loan Program, which historically tends to occur more frequently in low interest rate environments, from borrower defaults, which will result in the receipt of a guaranty payment, and from voluntary full or partial prepayments, among other things.

The rate of prepayments of student loans may be influenced by a variety of economic, social, and other factors affecting borrowers, including interest rates and the availability of alternative financing. Our profits could be adversely affected by higher prepayments, which reduces the balance of loans outstanding and therefore the amount of net interest income we receive.

B-3

Credit risk:

Future losses due to defaults on loans held by us, or loans sold to unaffiliated third parties which we are obligated to repurchase in the event of certain delinquencies, present credit risk which could adversely affect our earnings.

Over 99% of our student loan portfolio is federally guaranteed. The allowance for loan losses from the federally insured loan portfolio is based on periodic evaluations of our loan portfolios considering past experience, trends in student loan claims rejected for payment by guarantors, changes to federal student loan programs, current economic conditions, and other relevant factors. The federal government currently guarantees 97% of the principal and interest on federally insured student loans disbursed on and after July 1, 2006 (and 98% for those loans disbursed prior to July 1, 2006), which limits our loss exposure on the outstanding balance of our federally insured portfolio. Student loans disbursed prior to October 1, 1993 are fully insured for both principal and interest.

Our non-federally insured loans are unsecured, with neither a government nor a private insurance guarantee. Accordingly, we bear the full risk of loss on these loans if the borrower and co-borrower, if applicable, default. In determining the adequacy of the allowance for loan losses on the non-federally insured loans, we consider several factors, including: loans in repayment versus those in a nonpaying status, delinquency status, loan program type, and trends in defaults in the portfolio based on company and industry data. We place a non-federally insured loan on nonaccrual status when the collection of principal and interest is 30 days past due and charge off the loan when the collection of principal and interest is 120 days past due.

The evaluation of the allowance for loan losses is inherently subjective, as it requires material estimates that may be subject to significant changes. As of December 31, 2009, our allowance for loan losses was $50.9 million. During the year ended December 31, 2009, we recognized a provision for loan losses of $29.0 million. The provision for loan losses reflects the activity for the applicable period and provides an allowance at a level that management believes is adequate to cover probable losses inherent in the loan portfolio. However, future defaults can be higher than anticipated due to a variety of factors such as downturns in the economy, regulatory or operational changes, debt management operational effectiveness, and other unforeseen future trends. If actual performance is worse than estimated, it would materially affect our estimate of the allowance for loan losses and the related provision for loan losses in our statement of operations.

We have participated interests in non-federally insured loans to unaffiliated third parties. Loans participated under these agreements have been accounted for as loan sales. Accordingly, the participation interests sold are not included on our consolidated balance sheet. Under the terms of the servicing agreements, our servicing operations are obligated to repurchase loans subject to the participation interests when such loans become 60 or 90 days delinquent. As of December 31, 2009, we had a reserve related to this obligation of $10.6 million included in other liabilities on the consolidated balance sheet. The evaluation of the reserve related to these participated loans is inherently subjective, as it requires estimates that may be subject to changes. If actual performance is worse than estimated, it would negatively affect our results of operations.

B-4

Liquidity and Funding.

We face liquidity and funding risk to meet our financial obligations.

We have three primary liquidity and funding needs:

|

·

|

Satisfy unsecured debt obligations, specifically our unsecured line of credit

|

|

·

|

Satisfy debt obligations secured by student loan assets and related collateral

|

|

·

|

Fund 2009-2010 academic year FFELP Stafford and PLUS loan originations and FFELP student loan acquisitions from third parties

|

Satisfy unsecured debt obligations, specifically our unsecured line of credit:

We have a $750.0 million unsecured line of credit that terminates in May 2012. As of December 31, 2009, $691.5 million was outstanding under this facility. Upon termination in 2012, there can be no assurance that we will be able to maintain this line of credit, find alternative funding, or increase the amount outstanding under the line, if necessary. The line of credit agreement contains certain financial covenants that, if not met, lead to an event of default under the agreement. The covenants include maintaining a minimum consolidated net worth, minimum adjusted EBITDA to corporate debt interest (over the last four rolling quarters), limitation on subsidiary indebtedness, and limitation on the percentage of non-guaranteed loans in our portfolio.

Satisfy debt obligations secured by student loan assets and related collateral:

The majority of our portfolio of student loans is funded with asset-backed securitizations that are structured to substantially match the maturity of the funded assets and there are minimal liquidity issues related to these facilities. We also have student loans funded in a FFELP warehouse facility and a Department of Education conduit program. The current maturities of these facilities do not match the maturity of the related funded assets. Therefore, we will need to modify and/or find alternative funding related to the student loan collateral in these facilities prior to their expiration.

On August 3, 2009, we entered into a FFELP warehouse facility (the “2009 FFELP Warehouse Facility”). The 2009 FFELP Warehouse Facility has a maximum financing amount of $500.0 million, with a revolving financing structure supported by 364-day liquidity provisions, which expire on August 2, 2010. The final maturity date of the facility is August 3, 2012. In the event that we are unable to renew the liquidity provisions by August 2, 2010, the facility would become a term facility at a stepped-up cost, with no additional student loans being eligible for financing, and we would be required to refinance the existing loans in the facility by August 3, 2012. The 2009 FFELP Warehouse Facility provides for formula based advance rates depending on FFELP loan type, up to a maximum of 92 percent to 98 percent of the principal and interest of loans financed. The advance rates for collateral may increase or decrease based on market conditions. The facility contains financial covenants relating to levels of our consolidated net worth, ratio of adjusted EBITDA to corporate debt interest, and unencumbered cash. Any violation of these covenants could result in a requirement for the immediate repayment of any outstanding borrowings under the facility. As of December 31, 2009, $305.7 million was outstanding under this facility and we had $14.2 million of operating cash advanced in the facility.

B-5

In January 2009, the Department published summary terms for its program under which it will finance eligible FFELP Stafford and PLUS loans in a conduit vehicle established to provide funding for student lenders (the “Conduit Program”). Loans eligible for the Conduit Program had to be first disbursed on or after October 1, 2003, but not later than June 30, 2009, and fully disbursed before September 30, 2009, and meet certain other requirements. The Conduit Program was launched on May 11, 2009. Funding for the Conduit Program is provided by the capital markets at a cost based on market rates, in which we are advanced 97 percent of the student loan face amount. Excess amounts needed to fund the remaining 3 percent of the student loan balances are contributed by us. The Conduit Program has a term of five years and expires on May 8, 2014. The Student Loan Short-Term Notes (“Student Loan Notes”) issued by the Conduit Program are supported by a combination of (i) notes backed by FFELP loans, (ii) a liquidity agreement with the Federal Financing Bank, and (iii) a put agreement provided by the Department. If the conduit does not have sufficient funds to pay all Student Loan Notes, then those Student Loan Notes will be repaid with funds from the Federal Financing Bank. The Federal Financing Bank will hold the notes for a short period of time and, if at the end of that time, the Student Loan Notes still cannot be paid off, the underlying FFELP loans that serve as collateral to the Conduit Program will be sold to the Department through the Put Agreement at a price of 97 percent of the face amount of the loans. As of December 31, 2009, $1.1 billion was outstanding under this facility and we had $66.8 million of operating cash advanced in the facility.

If we are unable to obtain cost-effective funding alternatives for the loans in the 2009 FFELP Warehouse Facility or the Conduit Program prior to the facilities’ maturities, our cost of funds could increase, adversely affecting our results of operations. If we cannot find any funding alternatives, we would lose our collateral, including the student loan assets and cash advances, related to these facilities.

Fund 2009-2010 academic year FFELP Stafford and PLUS loan originations and FFELP student loan acquisitions from third parties

Our principal sources of liquidity for new FFELP Stafford and PLUS loan originations for the 2009-2010 academic year are the Department’s Participation and Purchase Programs. In addition, we maintain an agreement with Union Bank, as trustee for various grantor trusts, under which Union Bank has agreed to purchase from us participation interests in student loans, and in August 2009, we entered into a FFELP warehouse facility with a revolving financing structure. We plan to fund all 2009-2010 academic year loans using the Participation Program, the agreement with Union Bank, and the FFELP warehouse facility, and we plan to fund FFELP student loan acquisitions from third parties using the agreement with Union Bank, the FFELP warehouse facility, and, if loans are eligible, the Department’s Conduit Program. If we are unable to maintain these facilities or find cost-effective alternatives, our ability to originate and acquire student loans would be limited or could be eliminated.

B-6

Operations.

Risks associated with our operations, as further discussed below, include those related to our information technology systems and security and privacy breaches, our ability to manage performance related to regulatory requirements, and the importance of maintaining scale by retaining existing customers and attracting new business opportunities.

A failure of our information technology systems or infrastructure, or those of our third-party vendors, could result in security and privacy breaches and damage client relations and our reputation.

We must continually and cost-effectively maintain and improve our information technology systems and infrastructure in order to successfully deliver products and services to our customers. The widespread adoption of new technologies and market demands could require substantial expenditures to enhance system infrastructure and existing products and services. If we fail to enhance our system infrastructure or products and services, our operating segments may lose their competitive advantage and this could adversely affect financial and operating results.

Additionally, we face the risk of business disruption if failures in our information systems occur as a result of changes in infrastructure, relocation of infrastructure, or failure to perform required services, which could have a material impact upon our business and operations. Although we regularly back up our data and maintain detailed disaster recovery plans, a major physical disaster or other calamity that causes significant damage to or the loss of our information systems for a sustained period of time could adversely affect our business and cash flows if we are unable to process transactions and/or provide services to customers.

We rely on outside vendors to provide some of the key components of business operations. Several of these key vendors are provided access to our customer data to complete the operations required by their contracts, such as banking services, electronic and paper correspondence, credit reporting, skip tracing, and secure storage of proprietary and customer information. Our vendors must comply with our defined servicing levels, security policies, and applicable industry regulations. However, disruptions in vendor services, changes in servicing contracts, security, or non-compliance with industry regulations could hinder our ability to meet customer obligations, service levels, or lead to financial or reputation damage. Financial or operational difficulties of an outside vendor could also hurt operations if those difficulties interfere with the vendor’s services.

The secure confidentiality of customer information contained in our systems is critical to our business. A compromise of security surrounding our student loan portfolio and cash management processes or mismanagement of customer assets could lead to litigation, fraud, reputation damage, and unanticipated operating costs that could affect our overall business. Although we believe that the applications we use are proven and designed for data security and integrity to process electronic transactions, there can be no assurance that these applications will be sufficient to counter all current and emerging technology threats designed to interrupt service or breach systems in order to gain access to confidential client information or intellectual property or assurance that these applications will be sufficient to address the security and privacy concerns of existing and potential customers.

B-7

We must satisfy certain requirements necessary to maintain the federal guarantees of our federally insured loans, and we may incur penalties or lose our guarantees if we fail to meet these requirements.

We must meet various requirements in order to maintain the federal guaranty on our federally insured loans. The federal guaranty on our federally insured loans is conditional based on our compliance with origination, servicing, and collection policies set by the Department and guaranty agencies. Federally insured loans that are not originated, disbursed, or serviced in accordance with the Department’s and guaranty agency regulations may risk partial or complete loss of the guaranty. If we experience a high rate of servicing deficiencies (including any deficiencies resulting from the conversion of loans from one servicing platform to another, errors in the loan origination process, establishment of the borrower’s repayment status, and due diligence or claim filing processes), it could result in the loan guarantee being revoked or denied. In most cases we have the opportunity to cure these deficiencies by following a prescribed cure process which usually involves obtaining the borrower’s reaffirmation of the debt. The lender becomes ineligible for special allowance interest benefits from the time of the first error leading to the loan rejection through the date that the loan is cured.

We are allowed three years from the date of the loan rejection to cure most loan rejections. If a cure cannot be achieved during this three year period, insurance is permanently revoked, although we maintain our right to collect the loan proceeds from the borrower.

A guaranty agency may also assess an interest penalty upon claim payment if the error(s) does not result in a loan rejection. These interest penalties are not subject to cure provisions, and are typically related to isolated instances of due diligence deficiencies.

Failure to comply with Federal and guarantor regulations may result in loss of insurance or assessment of interest penalties at the time of claim reimbursement by us. A future increase in either the loans claim rejections and/or interest penalties could become material to our fiscal operations.

As of December 31, 2009, the Company serviced $31.1 billion of FFELP loans that maintained a federal guarantee, of which $23.1 billion and $8.0 billion were owned by the Company and third party entities, respectively.

If our loan servicing contract with the Department of Education expiring in 2014 is not renewed, our loan servicing revenues will be significantly reduced and we will need to restructure our loan servicing operations.

B-8

In June 2009, the Department named us as one of four private sector companies awarded a servicing contract to service all federally-owned student loans. Our servicing contract with the Department spans five years and the Department can renew the contract for one, five-year period. During the year ended December 31, 2009, we recognized $1.7 million of revenue on this contract. We expect total loans serviced and revenue from this contract to grow each year of the contract. Upon the expiration of this contract, any renewal to provide loan servicing to the Department could be subject to a bidding process in which we may not be successful. Not obtaining a renewal of a loan servicing contract upon its expiration would result in a significant reduction in revenue and we would have to make significant changes to our operations which may result in the recording of special charges, such as workforce reduction costs, charges relating to consolidating excess facilities, and impairments of assets.

Legal and Regulatory.

Federal and state regulations can restrict, impact, or eliminate the Company’s business, and noncompliance with these regulations could result in penalties, litigation, and reputation damage.

Effective July 1, 2010, the Reconciliation Act of 2010 prohibits new loan originations under the Federal Family Education Loan Program (“FFELP”) and requires that all new federal loan originations be made through the Federal Direct Loan Program (the “Direct Loan Program”). As a result of this legislation, net interest income on our existing FFELP loan portfolio, as well as fee-based revenue from guarantee and third-party FFELP servicing and education loan software licensing and consulting fees, will decline over time as our and our customers’ FFELP loan portfolios are paid down.

On March 30, 2010, President Obama signed into law the Health Care and Education Reconciliation Act of 2010 (the “Reconciliation Act of 2010”). Effective July 1, 2010, this law prohibits new loan originations under the Federal Family Education Loan Program (“FFELP”) and requires that all new federal loan originations be made through the Federal Direct Loan Program (the “Direct Loan Program”). If a first disbursement has been made on a FFELP loan prior to July 1, 2010, subsequent disbursements of that loan may still be made under the FFELP. The new law does not alter or affect the terms and conditions of existing FFELP loans.

As a result of the Reconciliation Act of 2010, the Company will no longer originate new (first disbursement) FFELP loans after June 30, 2010. As such, subsequent to 2010, the Company will no longer recognize a gain from originating and subsequently selling FFELP loans to the Department of Education (the “Department”) under the Department’s Loan Purchase Commitment Program (the “Purchase Program”). During 2009, the Company recognized a gain of $36.6 million from selling $2.1 billion of 2008-2009 academic year loans to the Department under the Purchase Program. The Company continues to use the Department’s Participation Program to fund loans originated for the 2009-2010 academic year. Based on the number of 2009-2010 academic year loans held by the Company that are eligible for this program ($2.0 billion as of June 30, 2010), the Company estimates that it will recognize a gain during the fourth quarter of 2010 of approximately $31 million to $33 million when it sells these loans under this program. This amount does not include loans acquired after June 30, 2010 which would increase the gain recognized by the Company. In addition, as a result of the Reconciliation Act of 2010, net interest income on the Company’s existing FFELP loan portfolio, as well as fee-based revenue from guarantee and third-party FFELP servicing and education loan software licensing and consulting fees, will decline over time as the Company and its customers’ FFELP loan portfolios are paid down. During the six month period ended June 30, 2010 and year ended December 31, 2009, the Company recognized approximately $187 million and $247 million, respectively, of net interest income on its FFELP loan portfolio, $61 million and $100 million, respectively, in guarantee and third-party FFELP servicing revenue, and approximately $5 million and $12 million, respectively, in education loan software licensing and consulting fees related to the FFEL Program.

B-9

The costs and effects of litigation, investigations, or similar matters, or adverse facts and developments related thereto, could materially affect our financial position, results of operations, and cash flows.

We may be involved from time to time in a variety of lawsuits, investigations, or similar matters arising out of our business operations. Our insurance may not cover all claims that may be asserted against us, and any claims asserted against us, regardless of merit or eventual outcome, may harm our reputation. If the ultimate judgments or settlements in any litigation or investigation significantly exceed our insurance coverage, they could have a material adverse effect on our financial position, results of operations, and cash flows for any particular period. For a discussion of material pending legal proceedings and other similar matters that may involve these risks, see Part I, Item 3 “Legal Proceedings.”

Principal Shareholder and Related Party Transactions.

Our Chairman and Chief Executive Officer beneficially owns over 67% of the voting rights of our shareholders and has day to day control over all matters at our Company.

Michael S. Dunlap, our Chairman, Chief Executive Officer, and a principal shareholder, beneficially owns over 67% of the voting rights of our shareholders. In addition, Mr. Dunlap, Stephen F. Butterfield, our Vice Chairman, and Angela L. Muhleisen, Mr. Dunlap’s sister, beneficially own stock that in the aggregate has over 81% of the voting rights of our shareholders. Accordingly, each member of the Board of Directors and each member of management has been elected or effectively appointed by Mr. Dunlap and can be removed by Mr. Dunlap. As a result, Mr. Dunlap, as Chairman, Chief Executive Officer, and controlling shareholder, has day to day control over all matters at our Company and has the ability to take actions that benefit him and Ms. Muhleisen but may not benefit other minority shareholders, and may otherwise exercise his control in a manner with which other minority shareholders may not agree or which they may not consider to be in their best interests.

We have entered into contractual arrangements with Union Bank. Union Bank is controlled by Farmers & Merchants Investment, Inc. (“F&M”) which owns 81.4% of Union Bank’s common stock and 15.4% of Union Bank’s non-voting preferred stock. Michael S. Dunlap, a significant shareholder of us as well as our Chief Executive Officer, Chairman, and a member of our Board of Directors, owns or controls 40.2% of the stock of F&M, while Mr. Dunlap’s sister, Angela L. Muhleisen, owns or controls 38.55% of F&M stock. The transactions with Union Bank present conflicts of interest and pose risks to our shareholders that the terms may not be as favorable to us as we could receive from unrelated third-parties.

B-10

Union Bank is controlled by Farmers & Merchants Investment, Inc. (“F&M”) which owns 81.4% of Union Bank’s common stock and 15.4% of Union Bank’s non-voting preferred stock. Michael S. Dunlap, a significant shareholder of us as well as our Chief Executive Officer, Chairman, and a member of our Board of Directors, owns or controls 40.2% of the stock of F&M, while Mr. Dunlap’s sister, Angela L. Muhleisen, owns or controls 38.55% of F&M stock. Mr. Dunlap serves as a Director and Co-President of F&M. Ms. Muhleisen serves as Director and Co-President of F&M and as a Director, Chairperson, President, and Chief Executive Officer of Union Bank. Union Bank is deemed to have beneficial ownership of various shares of Nelnet because it serves in a capacity of trustee and has sole voting and/or investment power. As of February 26, 2010, Union Bank was deemed to beneficially own 12.8% of the voting rights of our common stock. As of February 26, 2010, Mr. Dunlap and Ms. Muhleisen beneficially owned 67.2% and 14.9%, respectively, of the voting rights of our outstanding common stock.

We have entered into certain contractual arrangements with Union Bank. These transactions include:

|

·

|