For Release: May 7, 2020

Investor Contact: Phil Morgan, 402.458.3038

Nelnet, Inc. supplemental financial information for the first quarter 2020

(All dollars are in thousands, except per share amounts, unless otherwise noted)

The following information should be read in connection with Nelnet, Inc.'s (the “Company's”) press release for first quarter 2020 earnings, dated May 7, 2020, and the Company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2020.

Forward-looking and cautionary statements

This report contains forward-looking statements and information that are based on management's current expectations as of the date of this document. Statements that are not historical facts, including statements about the Company's plans and expectations for future financial condition, results of operations or economic performance, or that address management's plans and objectives for future operations, and statements that assume or are dependent upon future events, are forward-looking statements. The words “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “scheduled,” “should,” “will,” “would,” and similar expressions, as well as statements in future tense, are intended to identify forward-looking statements.

The forward-looking statements are based on assumptions and analyses made by management in light of management's experience and its perception of historical trends, current conditions, expected future developments, and other factors that management believes are appropriate under the circumstances. These statements are subject to known and unknown risks, uncertainties, assumptions, and other factors that may cause the actual results and performance to be materially different from any future results or performance expressed or implied by such forward-looking statements. These factors include, among others, the risks and uncertainties set forth in the “Risk Factors” section of the Company's Annual Report on Form 10-K for the year ended December 31, 2019 (the "2019 Annual Report") and the Company's Quarterly Report on Form 10-Q for the three months ended March 31, 2020, and include such risks and uncertainties as:

•risks and uncertainties related to the severity, magnitude, and duration of the COVID-19 pandemic, including changes in the macroeconomic environment and consumer behavior, restrictions on business, individual, or travel activities intended to slow the spread of the pandemic, and volatility in market conditions resulting from the pandemic, including interest rates, the value of equities, and other financial assets;

•the ability to successfully maintain and increase allocated volumes of student loans serviced under existing and any future servicing contracts with the U.S. Department of Education (the "Department"), which current contracts accounted for 30 percent of the Company's revenue in 2019, risks to the Company related to the Department's initiatives to procure new contracts for federal student loan servicing, including the pending and uncertain nature of the Department's procurement process, the uncertain timing and nature of the outcome of the Company's protest of the reported decision by the Department as to the Company's proposal for the transitional information technology component of the Department's procurement, the possibility that awards or other evaluations of proposals may be challenged by various interested parties and may not be finalized within the currently anticipated time frame or at all, risks that the Company may not be successful in obtaining any of such potential new contracts, and risks related to the Company's ability to comply with agreements with third-party customers for the servicing of Federal Direct Loan Program, Federal Family Education Loan Program (the "FFEL Program" or "FFELP"), and private education and consumer loans;

•loan portfolio risks such as interest rate basis and repricing risk resulting from the fact that the interest rate characteristics of the student loan assets do not match the interest rate characteristics of the funding for those assets, the risk of loss of floor income on certain student loans originated under the FFEL Program, risks related to the use of derivatives to manage exposure to interest rate fluctuations, uncertainties regarding the expected benefits from purchased securitized and unsecuritized FFELP, private education, and consumer loans and initiatives to purchase additional FFELP, private education, and consumer loans, and risks from changes in levels of loan prepayment or default rates;

•financing and liquidity risks, including risks of changes in the general interest rate environment, including the availability of any relevant money market index rate such as LIBOR or the relationship between the relevant money market index rate and the rate at which the Company's assets and liabilities are priced, and in the securitization and other financing markets for loans, including adverse changes resulting from unanticipated repayment trends on student loans in FFELP securitization trusts that could accelerate or delay repayment of the associated bonds, which may increase the costs or limit the availability of financings necessary to purchase, refinance, or continue to hold student loans;

•risks from changes in the terms of education loans and in the educational credit and services markets resulting from changes in applicable laws, regulations, and government programs and budgets, such as the expected decline over time in FFELP loan interest income and fee-based revenues due to the discontinuation of new FFELP loan originations in 2010 and potential government initiatives or legislative proposals to consolidate existing FFELP loans to the Federal Direct Loan Program or otherwise allow FFELP loans to be refinanced with Federal Direct Loan Program loans;

•risks related to a breach of or failure in the Company's operational or information systems or infrastructure, or those of third-party vendors, including cybersecurity risks related to the potential disclosure of confidential student loan borrower and other customer information, the potential disruption of the Company's systems or those of third-party vendors or customers, and/or the potential damage to the Company's reputation resulting from cyber-breaches;

•uncertainties inherent in forecasting future cash flows from student loan assets and related asset-backed securitizations;

•risks and uncertainties related to the ability of ALLO Communications LLC to successfully expand its fiber network and market share in existing service areas and additional communities and manage related construction risks;

•risks that the conditions to the reported approval of federal deposit insurance and an industrial bank charter for Nelnet Bank may not be satisfied within a reasonable timeframe or at all, thus delaying or preventing Nelnet Bank from commencing operations, and the uncertain nature of the expected benefits from obtaining an industrial bank charter, including the ability to successfully launch banking operations and achieve expected market penetration;

•risks related to investments in solar projects, including risks of not being able to realize tax credits which remain subject to recapture by taxing authorities;

•risks and uncertainties related to other initiatives to pursue additional strategic investments, acquisitions, and other activities, including activities that are intended to diversify the Company both within and outside of its historical core education-related businesses; and

•risks and uncertainties associated with litigation matters and with maintaining compliance with the extensive regulatory requirements applicable to the Company's businesses, reputational and other risks, including the risk of increased regulatory costs, resulting from the politicization of student loan servicing, and uncertainties inherent in the estimates and assumptions about future events that management is required to make in the preparation of the Company's consolidated financial statements.

All forward-looking statements contained in this report are qualified by these cautionary statements and are made only as of the date of this document. Although the Company may from time to time voluntarily update or revise its prior forward-looking statements to reflect actual results or changes in the Company's expectations, the Company disclaims any commitment to do so except as required by securities laws.

1

Consolidated Statements of Operations

(Dollars in thousands, except share data)

(unaudited)

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Interest income: | |||||||||||||||||

| Loan interest | $ | 181,793 | 204,638 | 242,333 | |||||||||||||

| Investment interest | 7,398 | 7,720 | 8,253 | ||||||||||||||

| Total interest income | 189,191 | 212,358 | 250,586 | ||||||||||||||

| Interest expense: | |||||||||||||||||

| Interest on bonds and notes payable | 134,118 | 148,106 | 191,770 | ||||||||||||||

| Net interest income | 55,073 | 64,252 | 58,816 | ||||||||||||||

| Less provision for loan losses | 76,299 | 13,000 | 7,000 | ||||||||||||||

Net interest income after provision for loan losses | (21,226) | 51,252 | 51,816 | ||||||||||||||

| Other income/expense: | |||||||||||||||||

| Loan servicing and systems revenue | 112,735 | 113,086 | 114,898 | ||||||||||||||

Education technology, services, and payment processing revenue | 83,675 | 63,578 | 79,159 | ||||||||||||||

| Communications revenue | 18,181 | 17,499 | 14,543 | ||||||||||||||

| Gain on sale of loans | 18,206 | 15,549 | — | ||||||||||||||

| Other income | 8,281 | 10,973 | 9,067 | ||||||||||||||

| Impairment expense | (34,087) | — | — | ||||||||||||||

| Derivative settlements, net | 4,237 | 6,100 | 19,035 | ||||||||||||||

Derivative market value adjustments, net | (20,602) | (2,930) | (30,574) | ||||||||||||||

| Total other income/expense | 190,626 | 223,855 | 206,128 | ||||||||||||||

| Cost of services: | |||||||||||||||||

Cost to provide education technology, services, and payment processing services | 22,806 | 19,002 | 21,059 | ||||||||||||||

| Cost to provide communications services | 5,582 | 5,327 | 4,759 | ||||||||||||||

Total cost of services | 28,388 | 24,329 | 25,818 | ||||||||||||||

| Operating expenses: | |||||||||||||||||

| Salaries and benefits | 119,878 | 124,561 | 111,059 | ||||||||||||||

| Depreciation and amortization | 27,648 | 28,651 | 24,213 | ||||||||||||||

| Other expenses | 43,384 | 46,710 | 43,816 | ||||||||||||||

| Total operating expenses | 190,910 | 199,922 | 179,088 | ||||||||||||||

| (Loss) income before income taxes | (49,898) | 50,856 | 53,038 | ||||||||||||||

| Income tax benefit (expense) | 10,133 | (9,022) | (11,391) | ||||||||||||||

| Net (loss) income | (39,765) | 41,834 | 41,647 | ||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (767) | 546 | (56) | ||||||||||||||

| Net (loss) income attributable to Nelnet, Inc. | $ | (40,532) | 42,380 | 41,591 | |||||||||||||

| Earnings per common share: | |||||||||||||||||

| Net (loss) income attributable to Nelnet, Inc. shareholders - basic and diluted | (1.01) | 1.06 | 1.03 | ||||||||||||||

| Weighted average common shares outstanding - basic and diluted | 39,955,514 | 39,896,232 | 40,373,295 | ||||||||||||||

2

Condensed Consolidated Balance Sheets

(Dollars in thousands)

(unaudited)

| As of | As of | As of | |||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Assets: | |||||||||||||||||

| Loans and accrued interest receivable, net | $ | 21,158,208 | 21,402,868 | 22,661,505 | |||||||||||||

Cash, cash equivalents, and investments | 458,783 | 381,005 | 305,879 | ||||||||||||||

| Restricted cash | 895,494 | 1,088,695 | 976,744 | ||||||||||||||

| Goodwill and intangible assets, net | 231,039 | 238,444 | 262,707 | ||||||||||||||

| Other assets | 537,104 | 597,958 | 515,092 | ||||||||||||||

| Total assets | $ | 23,280,628 | 23,708,970 | 24,721,927 | |||||||||||||

| Liabilities: | |||||||||||||||||

| Bonds and notes payable | $ | 20,466,730 | 20,529,054 | 21,835,723 | |||||||||||||

| Other liabilities | 488,098 | 788,822 | 555,910 | ||||||||||||||

| Total liabilities | 20,954,828 | 21,317,876 | 22,391,633 | ||||||||||||||

| Equity: | |||||||||||||||||

| Total Nelnet, Inc. shareholders' equity | 2,320,680 | 2,386,712 | 2,325,996 | ||||||||||||||

| Noncontrolling interests | 5,120 | 4,382 | 4,298 | ||||||||||||||

| Total equity | 2,325,800 | 2,391,094 | 2,330,294 | ||||||||||||||

| Total liabilities and equity | $ | 23,280,628 | 23,708,970 | 24,721,927 | |||||||||||||

3

Overview

The Company is a diverse company with a purpose to serve others and a vision to make customers' dreams possible by delivering customer focused products and services. The largest operating businesses engage in loan servicing; education technology, services, and payment processing; and communications. A significant portion of the Company's revenue is net interest income earned on a portfolio of federally insured student loans. The Company also makes investments to further diversify both within and outside of its historical core education-related businesses, including, but not limited to, investments in real estate, early-stage and emerging growth companies, and renewable energy.

GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments

The Company prepares its financial statements and presents its financial results in accordance with U.S. GAAP. However, it also provides additional non-GAAP financial information related to specific items management believes to be important in the evaluation of its operating results and performance. A reconciliation of the Company's GAAP net (loss) income to net (loss) income, excluding derivative market value adjustments, and a discussion of why the Company believes providing this additional information is useful to investors, is provided below.

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| GAAP net (loss) income attributable to Nelnet, Inc. | $ | (40,532) | 42,380 | 41,591 | |||||||||||||

Realized and unrealized derivative market value adjustments | 20,602 | 2,930 | 30,574 | ||||||||||||||

Tax effect (a) | (4,944) | (703) | (7,338) | ||||||||||||||

Net (loss) income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | (24,874) | 44,607 | 64,827 | |||||||||||||

| Earnings per share: | |||||||||||||||||

| GAAP net (loss) income attributable to Nelnet, Inc. | $ | (1.01) | 1.06 | 1.03 | |||||||||||||

Realized and unrealized derivative market value adjustments | 0.52 | 0.07 | 0.76 | ||||||||||||||

Tax effect (a) | (0.13) | (0.01) | (0.18) | ||||||||||||||

Net (loss) income attributable to Nelnet, Inc., excluding derivative market value adjustments (b) | $ | (0.62) | 1.12 | 1.61 | |||||||||||||

(a) The tax effects are calculated by multiplying the realized and unrealized derivative market value adjustments by the applicable statutory income tax rate.

(b) "Derivative market value adjustments" includes both the realized portion of gains and losses (corresponding to variation margin received or paid on derivative instruments that are settled daily at a central clearinghouse) and the unrealized portion of gains and losses that are caused by changes in fair values of derivatives which do not qualify for "hedge treatment" under GAAP. "Derivative market value adjustments" does not include "derivative settlements" that represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms.

The accounting for derivatives requires that changes in the fair value of derivative instruments be recognized currently in earnings, with no fair value adjustment of the hedged item, unless specific hedge accounting criteria is met. Management has structured all of the Company’s derivative transactions with the intent that each is economically effective; however, the Company’s derivative instruments do not qualify for hedge accounting. As a result, the change in fair value of derivative instruments is reported in current period earnings with no consideration for the corresponding change in fair value of the hedged item. Under GAAP, the cumulative net realized and unrealized gain or loss caused by changes in fair values of derivatives in which the Company plans to hold to maturity will equal zero over the life of the contract. However, the net realized and unrealized gain or loss during any given reporting period fluctuates significantly from period to period.

The Company believes these point-in-time estimates of asset and liability values related to its derivative instruments that are subject to interest rate fluctuations are subject to volatility mostly due to timing and market factors beyond the control of management, and affect the period-to-period comparability of the results of operations. Accordingly, the Company’s management utilizes operating results excluding these items for comparability purposes when making decisions regarding the Company’s performance and in presentations with credit rating agencies, lenders, and investors. Consequently, the Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance.

Operating Results

The Company earns net interest income on its loan portfolio, consisting primarily of FFELP loans, in its Asset Generation and Management ("AGM") operating segment. This segment is expected to generate a stable net interest margin and significant amounts of cash as the FFELP portfolio amortizes. As of March 31, 2020, the Company had a $20.6 billion loan portfolio that management anticipates will amortize over the next approximately 20 years and has a weighted average remaining life of 9.8 years. The

4

Company actively works to maximize the amount and timing of cash flows generated by its FFELP portfolio and seeks to acquire additional loan assets to leverage its servicing scale and expertise to generate incremental earnings and cash flow. However, due to the continued amortization of the Company’s FFELP loan portfolio, over time, the Company's net income generated by the AGM segment will continue to decrease. The Company currently believes that in the short-term it will most likely not be able to invest the excess cash generated from the FFELP loan portfolio into assets that immediately generate the rates of return historically realized from that portfolio.

In addition, the Company earns fee-based revenue through the following reportable operating segments:

•Loan Servicing and Systems ("LSS") - referred to as Nelnet Diversified Solutions ("NDS")

•Education Technology, Services, and Payment Processing ("ETS&PP") - referred to as Nelnet Business Solutions ("NBS")

•Communications - referred to as ALLO Communications ("ALLO")

Other business activities and operating segments that are not reportable are combined and included in Corporate and Other Activities ("Corporate"). Corporate and Other Activities also includes income earned on certain investments and interest expense incurred on unsecured debt transactions.

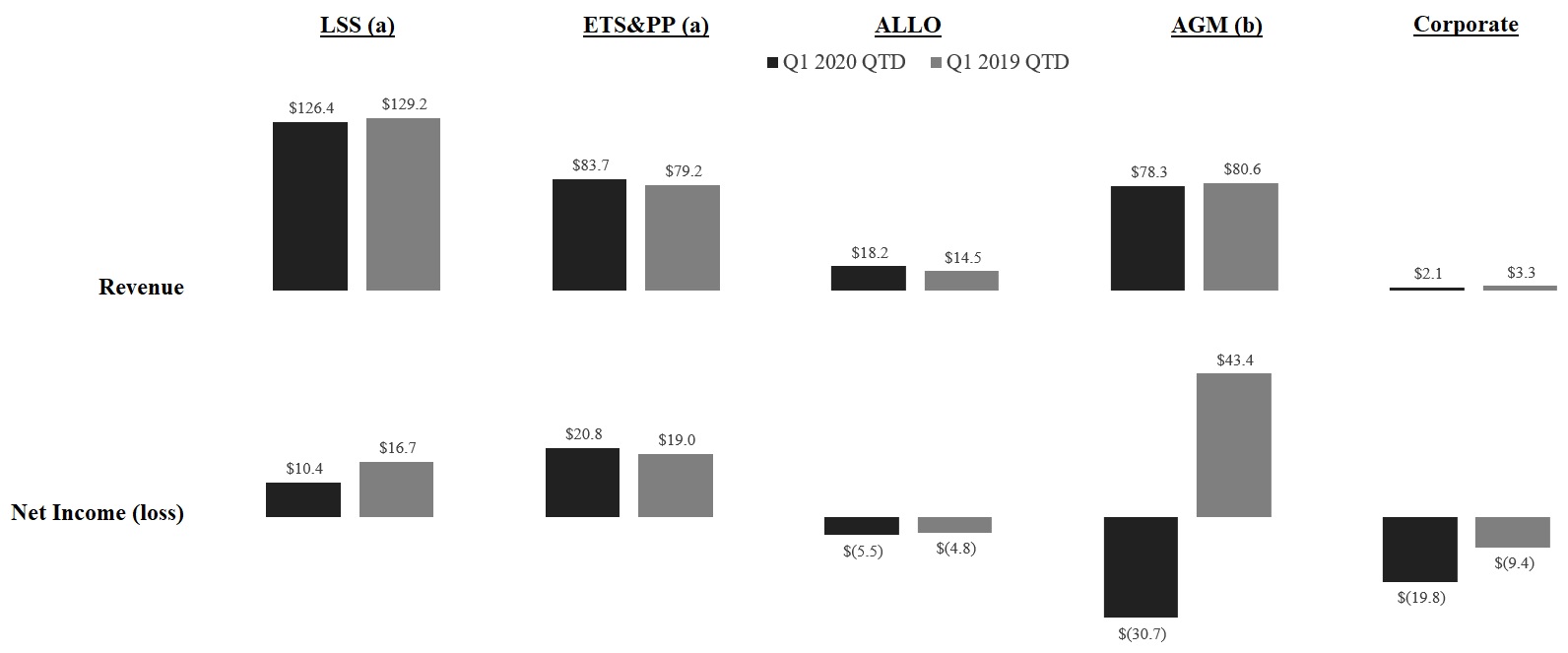

The information below provides the operating results for each reportable operating segment and Corporate and Other Activities for the three months ended March 31, 2020 and 2019 (dollars in millions).

(a) Revenue includes intersegment revenue.

(b) Total revenue includes "net interest income" and "total other income/expense" from the Company's segment statements of operations, excluding a COVID-19 related impairment expense in 2020 of $26.3 million and the impact from changes in fair values of derivatives. Net income excludes changes in fair values of derivatives, net of tax. For information regarding the exclusion of the impact from changes in fair values of derivatives, see "GAAP Net Income and Non-GAAP Net Income, Excluding Adjustments" above.

Certain events and transactions from 2020, which have impacted, will impact, of could impact the operating results of the Company, are discussed below.

Impacts of COVID-19 Pandemic

The rapid outbreak of the respiratory disease caused by a novel strain of coronavirus, coronavirus 2019 or COVID-19 (“COVID-19”), was declared a global pandemic by the World Health Organization on March 11, 2020 and a national emergency by the President on March 13, 2020. Beginning on March 15, 2020, many businesses and schools closed or reduced hours throughout the U.S. to combat the spread of COVID-19, and states and local jurisdictions implemented various containment efforts, including lockdowns on non-essential business, stay-at-home orders, and shelter-in-place orders. The COVID-19 pandemic has caused significant disruption to the U.S. and world economies, including significantly higher unemployment and underemployment, significantly lower interest rates and equity market valuations, and extreme volatility in the U.S. and world markets. As a result of the COVID-19 outbreak and federal, state, and local government responses to COVID-19, we have and may in the future experience

5

various disruptions and impacts to our businesses and results of operations. The following provides a summary of how COVID-19 has and may impact our business and operating results.

Corporate

The Company has implemented adjustments to its operations designed to keep employees safe and comply with federal, state, and local guidelines, including those regarding social distancing. As of March 25, 2020, the majority of our 6,600 associates were working and continue to work from home. Substantially all Company associates working from home are able to connect to their work environment virtually and continue to serve our customers.

The Company has investments in real estate, early-stage and emerging growth companies (venture capital investments), and renewable energy (solar). During March 2020, the Company identified several venture capital investments that were negatively impacted by the distressed economic conditions resulting from the COVID-19 pandemic and recognized an impairment charge on such investments of $7.8 million (pre-tax).

Loan Servicing and Systems

The Coronavirus Aid, Relief, and Economic Security Act (the "CARES Act"), which was signed into law on March 27, 2020, among other things, provides broad relief for federal student loan borrowers. Under the CARES Act, federal student loan payments and interest accruals were suspended until September 30, 2020 for all borrowers that have loans owned by the Department. The Department instructed servicers to apply the benefits of the law retroactively to March 13, 2020, when the President declared a state of emergency related to COVID-19. As a part of the payment suspension, student loan servicers are required to report suspended payments to credit bureaus as if the customer made their payment on-time, rather than a forbearance, which would negatively affect a customer's credit report. Although the Company will receive less revenue per borrower through September 30, 2020 based on borrower status, the Company currently anticipates more borrowers being in a current status subsequent to September 30, 2020, at which time the Company's revenue per borrower will increase. Currently, the Company anticipates no adverse impact to the total amount of revenue earned for the remainder of 2020 under the Department servicing contracts as a result of the CARES Act. However, the revenue recognized in the second and third quarters is expected to be lower and revenue in the fourth quarter is expected to be higher, than in corresponding prior periods. While federal student loan payments are suspended, the Company anticipates a decrease in operating expenses due to a significant reduction of borrower statement printing and postage costs.

The Company anticipates a decrease in FFELP, private education, and consumer loan servicing revenue in future periods that are impacted by the COVID-19 pandemic due to reduced or eliminated delinquency outreach to borrowers, holds on claim filings, and reduced or eliminated late fees processing.

Due to decreased servicing and transaction activity as a result of suspended payments under the CARES Act as discussed above, the Company has been able to transition associates to help government entities process unemployment claims and conduct certain health tracing support activities. These contracts were awarded to the Company as a result of the Company's technology, security, compliance, and other capabilities needed to conduct such activities.

Education Technology, Services, and Payment Processing

This segment has been and will continue to be impacted by COVID-19 through lower interest rate levels, which reduce earnings for this business compared to recent historical results as the tuition funds held in custody for schools produce less interest earnings. If interest rates remain at current levels, the Company anticipates this segment will earn minimal interest income in future periods. Another potential impact relates to school enrollments. As a result of COVID-19, enrollments in higher education, beginning with the summer 2020 term, and for K-12 schools, beginning with the fall 2020 academic term, could be negatively impacted. A decrease in enrollment at schools served by the Company would negatively impact schools' demand for certain of the Company's products and services, which would negatively impact the Company's revenue in future periods.

Communications

As a result of COVID-19, ALLO has experienced increased demand from new and existing residential customers to support connectivity needs primarily for work and learn from home applications. Along with offering 60 days free for eligible customers, ALLO has partnered with school districts to provide more connectivity to students, often at discounted rates. ALLO has signed the FCC Keep Americans Connected Pledge and will not suspend customers for non-payment, will not charge late fees, and will not apply suspension fees during the period March 15, 2020 to May 15, 2020, which may be extended.

A prolonged economic downturn as a result of the COVID-19 pandemic could adversely impact customers’ ability to pay for ALLO services. However, to date the impact has been minimal as the services ALLO provides are viewed as critical by both residential and

6

business customers. Due to losses from COVID-19, in the future some businesses may not be able to re-open, which would adversely impact ALLO’s results of operations and cash flow.

In view of the importance of ALLO's technicians being able to connect new customers while maintaining social distance and protecting community and associate health and safety, ALLO has adjusted operational procedures by implementing associate health checks, following CDC and local health official safety protocols, facilitating customer screening, and adjusting the installation process to limit the time in the home or business as much as possible.

Asset Generation and Management

AGM's results were adversely impacted during the first quarter of 2020 as a result of COVID-19 due to:

•A decrease in variable loan spread due to a widening of the basis between the asset and debt indices in which the Company earns interest on its loans and funds such loans. The significant widening during the first quarter of 2020 was the result of a significant decrease in interest rates during the quarter as a result of COVID-19. In a declining interest rate environment, student loan spread is compressed, due to the timing of interest rate resets on the Company's assets occurring daily in contrast to the timing of the interest resets on the Company's debt that occurs either monthly or quarterly. As the Company's debt resets at lower interest rates during the second quarter of 2020, the Company expects variable loan spread will increase from current levels. In addition, the Company anticipates receiving increased levels of gross fixed rate floor income on its federal insured student loan portfolio in future periods as a result of the significant drop in interest rates in March 2020. This increase will be partially offset by a decrease in net settlements received on derivatives used to hedge these loans.

•A $26.3 million (pre-tax) impairment charge recognized during the quarter on the Company's beneficial interest in consumer loan securitizations. As of March 31, 2020, the Company's estimate of future cash flows from the beneficial interest in consumer loan securitizations was lower than previously anticipated due to the expectation of increased consumer loan defaults within such securitizations due to the distressed economic conditions resulting from the COVID-19 pandemic.

•An incremental increase in the provision for loan losses of $63.0 million (pre-tax) resulting from an increase in expected defaults due to the COVID-19 pandemic.

The CARES Act, among other things, provides broad relief, effective March 13, 2020, for borrowers that have student loans owned by the Department of Education. This relief package excluded FFELP, private education, and consumer loans. Although the Company’s loans are excluded from the provisions of the CARES Act, the Company is providing relief for its borrowers.

For the Company’s federally insured loans, the Company is proactively applying a 90 day, non-capping natural disaster forbearance to any loan that is 31-269 days past due, and to any current loan upon request. For the Company’s private education loans, the Company is proactively applying a 90 day non-capping natural disaster forbearance to any loan that is 80 days past due, and to any other loan upon request. Federally insured loans in forbearance increased to $2.1 billion, or 10.6% of the portfolio at March 31, 2020, compared to $1.3 billion, or 6.6% of the portfolio, as of December 31, 2019. Private education loans in forbearance increased to $11.4 million, or 4.2% of the portfolio, at March 31, 2020, compared to $3.1 million, or 1.3% of the portfolio, at December 31, 2019. Federally insured and private education loans in forbearance continued to increase in April 2020 to $5.2 billion, or 26.1% of the portfolio, and $35.7 million, or 13.3% of the portfolio, as of April 30, 2020, respectively. The Company anticipates that loans in forbearance will continue to increase, but at a much slower rate than in March and April 2020. The Company currently expects this trend to reverse in June and July 2020, absent any intervening policy change, when borrowers are currently scheduled to exit forbearance. Despite the COVID-19 pandemic, most borrowers continue to make payments according to their payment plans.

For private education loans, the Company is delaying final demand letters and default activity, while replacing collection calls with borrower outreach on relief options. For both federally insured and private education loans, all borrower late fees are being waived and borrower payments made after March 13, 2020 are refunded upon a borrower’s request. All borrower relief activity was implemented in late March and April 2020, using an effective date of March 13, 2020. The borrower relief activity will continue until July 1, 2020, at which time the Company will review whether such policies should continue. No negative borrower reporting will be sent to credit bureaus during this time.

For the majority of the Company’s consumer loans, borrowers are generally being offered, upon request, a two-month deferral of payments, with an option of additional deferrals if the COVID-19 crisis continues. In addition, all fees (non-sufficient funds, late charges, check fees) and credit bureau reporting are currently suspended. The specific relief terms on the Company’s consumer loan portfolio vary depending on the loan program and servicer of such loans.

7

The Company is not contractually committed to acquire private education or consumer loans, so the Company has been and will continue to be selective as to which, if any, loans it purchases during the current period of economic uncertainty. As a result of the economic uncertainty, the Company has identified certain opportunities to deploy capital. In March and April 2020, the Company purchased residual interest in certain FFELP securitizations for $3.1 million and $24.0 million, respectively.

Liquidity

The Company currently believes its cash and anticipated cash generated from operations will be sufficient to fund its operating expenses and business activities for the foreseeable future. In addition, the Company does not currently believe the COVID-19 pandemic will have any impact regarding compliance with covenants on any of the Company's debt facilities, including its unsecured line of credit.

See further discussion regarding the Company’s strong liquidity position below.

Other Risks and Uncertainties

The COVID-19 crisis is unprecedented and continues to evolve. The extent to which COVID-19 may impact our businesses depends on future developments, which are highly uncertain, subject to various risks, and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the outbreak, travel restrictions, stay-at-home or other similar orders and social distancing in the United States and other countries, business and/or school closures and disruptions, and the effectiveness of actions taken in the United States and other countries to contain and treat the virus.

Adoption of New Accounting Standard for Credit Losses

On January 1, 2020, the Company adopted ASU No. 2016-13, Financial Instruments – Credit Losses (“ASC 326”), which replaces the incurred loss methodology with an expected loss methodology that is referred to as the current expected credit loss (“CECL”) methodology.

The CECL methodology utilizes a lifetime “expected credit loss” measurement objective for the recognition of credit losses for financial assets measured at amortized cost at the time the financial asset is originated or acquired. The expected credit losses are adjusted each period for changes in expected lifetime credit losses.

The new guidance primarily impacted the allowance for loan losses related to the Company’s loan portfolio. Upon adoption, the Company recorded an increase to the allowance for loan losses of $91.0 million, which included a reclassification of the non-accretable discount balance and premiums related to loans purchased with evidence of credit deterioration, and decreased retained earnings, net of tax, by $18.9 million. Results for reporting periods beginning after January 1, 2020 are presented under ASC 326 (recognizing estimated credit losses expected to occur over the asset's remaining life) while prior period amounts continue to be reported in accordance with previously applicable GAAP (recognizing estimated credit losses using an incurred loss model); therefore, the comparative information for 2019 is not comparable to the information presented for 2020.

Department of Education NextGen Procurement

Nelnet Servicing, LLC ("Nelnet Servicing"), a subsidiary of the Company, earns loan servicing revenue from a servicing contract with the Department of Education (the "Department"). Revenue earned by Nelnet Servicing related to this contract was $38.7 million and $39.6 million for the three months ended March 31, 2020 and 2019, respectively.

In addition, Great Lakes Educational Loan Services, Inc. ("Great Lakes"), which was acquired by the Company on February 7, 2018, also earns loan servicing revenue from a similar servicing contract with the Department. Revenue earned by Great Lakes related to this contract was $46.4 million and $47.1 million for the three months ended March 31, 2020 and 2019, respectively.

Nelnet Servicing and Great Lakes' servicing contracts with the Department previously provided for expiration on June 16, 2019. Nelnet Servicing and Great Lakes each received extensions from the Department on their contracts through December 14, 2020. The most current contract extensions also provide the potential for two additional six-month extensions at the Department's discretion through December 14, 2021.

The Department is conducting a contract procurement process entitled Next Generation Financial Services Environment (“NextGen”) for a new framework for the servicing of all student loans owned by the Department. On January 15, 2019, FSA issued solicitations for three NextGen components:

•NextGen Enhanced Processing Solution ("EPS")

•NextGen Business Process Operations ("BPO")

•NextGen Optimal Processing Solution ("OPS")

8

On April 1, 2019 and October 4, 2019, the Company responded to the EPS solicitation component. On January 16, 2020, the Department released an amendment to the EPS solicitation component and the Company responded on February 3, 2020. In addition, on August 1, 2019, the Company responded to the BPO solicitation component. On January 10, 2020, the Department released an amendment to the BPO solicitation component and the Company responded on January 30, 2020. EPS is the transitional technology system and certain processing functions the Department planned to use under NextGen to service the Department's student loan customers for a period of time before eventually moving to OPS in the future. However, on April 3, 2020, the Department cancelled the OPS solicitation component. BPO is the back office and call center operational functions for servicing the Department's student loan customers.

On March 30, 2020, the Company received a letter from the Department notifying the Company that the Company's proposal in response to the EPS component has been determined to be outside of the competitive range and will receive no further consideration for an award. On April 13, 2020, the Company filed a protest with the Government Accountability Office ("GAO") challenging the Department's decision to cancel the OPS solicitation component without amending the EPS solicitation component. In addition, on April 27, 2020, the Company filed a supplemental protest challenging on a number of bases the Department's competitive range exclusion of the Company's proposal from the EPS solicitation component and requesting that the GAO restore the Company's ability to participate in the EPS solicitation. The Department has not yet awarded a contract for the EPS component. Under applicable law, as of the date of the Company's initial protest filing, the Department is subject to a stay from awarding a contract until all protests are resolved. The Company cannot predict the timing or nature of the outcome of its protests.

The Department has not yet made an award on the BPO component and the Company cannot predict the timing, nature, or outcome of the BPO solicitation. If the Department's NextGen EPS decision stands, Nelnet Servicing and Great Lakes will eventually be required to migrate their portfolios onto another provider's system after an award is made, and the Company would ultimately need to restructure the Company's loan servicing segment for long-term success. If the Company is awarded a BPO contract for operational services, it would partially mitigate the impact of not being awarded the EPS component.

Nelnet Bank

On March 18, 2020, the Company announced that it received notification of approval from the Federal Deposit Insurance Corporation (“FDIC”) Board of Directors for federal deposit insurance and the Utah Department of Financial Institutions (“UDFI”) in connection with the establishment of Nelnet Bank as a Utah-chartered industrial bank. Nelnet Bank would operate as an internet bank franchise focused on the private education loan marketplace, with a home office in Salt Lake City.

The approval from the FDIC and UDFI is subject to a number of conditions, including a Capital Adequacy and Liquidity Management Agreement and a Parent Company Agreement with the FDIC and compliance with the terms of the orders from the FDIC and UDFI, respectively. Nelnet Bank will have to meet a readiness review by the FDIC and UDFI before commencing operations. Nelnet Bank is also awaiting approval of its Community Reinvestment Act Plan. A timeline has not been established for these next steps in the process.

Nelnet Bank will be funded with an initial capital commitment of $100.0 million from the Company. Nelnet Bank will operate as a separate subsidiary of the Company, and the industrial bank charter will allow the Company to maintain its other diversified business offerings.

Liquidity

•As of March 31, 2020, the Company had cash and cash equivalents of $204.8 million. In addition, the Company had a portfolio of available-for-sale investments, consisting primarily of student loan asset-backed securities, with a fair value of $57.1 million as of March 31, 2020.

•The Company has a $455.0 million unsecured line of credit with a maturity date of December 16, 2024. As of March 31, 2020, the unsecured line of credit had $100.0 million outstanding and $355.0 million was available for future use. The line of credit provides that the Company may increase the aggregate financing commitments, through the existing lenders and/or through new lenders, up to a total of $550.0 million, subject to certain conditions.

•The majority of the Company’s portfolio of student loans is funded in asset-backed securitizations that will generate significant earnings and cash flow over the life of these transactions. As of March 31, 2020, the Company currently expects future undiscounted cash flows from its securitization portfolio to be approximately $2.27 billion, of which approximately $1.57 billion will be generated over the next six years.

•During the first three months of 2020, the Company completed three FFELP asset-backed securitizations totaling $1.1 billion.

9

•As of March 31, 2020, the Company had $767.5 million, $114.5 million, and $132.9 million of capacity under its FFELP, private education, and consumer loan warehouse facilities, respectively, to purchase additional loans.

•The Company has a stock repurchase program to purchase up to a total of five million shares of the Company’s Class A common stock during the three-year period ending May 7, 2022. Year to date, through May 7, 2020, the Company has repurchased 791,104 shares of stock for $35.4 million ($44.73 per share). As of May 7, 2020, 4.0 million shares remained authorized for repurchase under the Company's stock repurchase program.

•The Company paid a first quarter 2020 cash dividend on the Company's Class A and Class B common stock of $0.20 per share. In addition, the Company's Board of Directors has declared a second quarter 2020 cash dividend on the Company's outstanding shares of Class A and Class B common stock of $0.20 per share. The second quarter cash dividend will be paid on June 15, 2020 to shareholders of record at the close of business on June 1, 2020.

The Company intends to use its strong liquidity position to capitalize on market opportunities, including FFELP, private education, and consumer loan acquisitions; strategic acquisitions and investments; expansion of ALLO’s telecommunications network; and capital management initiatives, including stock repurchases, debt repurchases, and dividend distributions. The timing and size of these opportunities will vary and will have a direct impact on the Company’s cash and investment balances.

10

Segment Reporting

The following tables include the results of each of the Company's reportable operating segments reconciled to the consolidated financial statements.

| Three months ended March 31, 2020 | |||||||||||||||||||||||||||||||||||||||||

| Loan Servicing and Systems | Education Technology, Services, and Payment Processing | Communications | Asset Generation and Management | Corporate and Other Activities | Eliminations | Total | |||||||||||||||||||||||||||||||||||

| Total interest income | $ | 317 | 1,991 | — | 185,926 | 1,555 | (598) | 189,191 | |||||||||||||||||||||||||||||||||

| Interest expense | 44 | 17 | — | 133,249 | 1,407 | (598) | 134,118 | ||||||||||||||||||||||||||||||||||

| Net interest income (expense) | 273 | 1,974 | — | 52,677 | 148 | — | 55,073 | ||||||||||||||||||||||||||||||||||

| Less provision for loan losses | — | — | — | 76,299 | — | — | 76,299 | ||||||||||||||||||||||||||||||||||

Net interest income after provision for loan losses | 273 | 1,974 | — | (23,622) | 148 | — | (21,226) | ||||||||||||||||||||||||||||||||||

| Other income/expense: | |||||||||||||||||||||||||||||||||||||||||

Loan servicing and systems revenue | 112,735 | — | — | — | — | — | 112,735 | ||||||||||||||||||||||||||||||||||

Intersegment revenue | 11,054 | 11 | — | — | — | (11,065) | — | ||||||||||||||||||||||||||||||||||

Education technology, services, and payment processing revenue | — | 83,675 | — | — | — | — | 83,675 | ||||||||||||||||||||||||||||||||||

| Communications revenue | — | — | 18,181 | — | — | — | 18,181 | ||||||||||||||||||||||||||||||||||

| Gain on sale of loans | — | — | — | 18,206 | — | — | 18,206 | ||||||||||||||||||||||||||||||||||

| Other income | 2,630 | — | 353 | 3,215 | 2,083 | — | 8,281 | ||||||||||||||||||||||||||||||||||

| Impairment expense | — | — | — | (26,303) | (7,783) | — | (34,087) | ||||||||||||||||||||||||||||||||||

Derivative settlements, net | — | — | — | 4,237 | — | — | 4,237 | ||||||||||||||||||||||||||||||||||

Derivative market value adjustments, net | — | — | — | (20,602) | — | — | (20,602) | ||||||||||||||||||||||||||||||||||

| Total other income/expense | 126,419 | 83,686 | 18,534 | (21,247) | (5,700) | (11,065) | 190,626 | ||||||||||||||||||||||||||||||||||

| Cost of services: | |||||||||||||||||||||||||||||||||||||||||

Cost to provide education technology, services, and payment processing services | — | 22,806 | — | — | — | — | 22,806 | ||||||||||||||||||||||||||||||||||

| Cost to provide communications services | — | — | 5,582 | — | — | — | 5,582 | ||||||||||||||||||||||||||||||||||

| Total cost of services | — | 22,806 | 5,582 | — | — | — | 28,388 | ||||||||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | 70,493 | 23,696 | 5,416 | 443 | 19,830 | — | 119,878 | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 8,848 | 2,387 | 10,507 | — | 5,907 | — | 27,648 | ||||||||||||||||||||||||||||||||||

| Other expenses | 17,489 | 6,092 | 3,689 | 3,717 | 12,398 | — | 43,384 | ||||||||||||||||||||||||||||||||||

| Intersegment expenses, net | 16,239 | 3,327 | 624 | 11,916 | (21,041) | (11,065) | — | ||||||||||||||||||||||||||||||||||

| Total operating expenses | 113,069 | 35,502 | 20,236 | 16,076 | 17,094 | (11,065) | 190,910 | ||||||||||||||||||||||||||||||||||

Income (loss) before income taxes | 13,623 | 27,352 | (7,284) | (60,945) | (22,646) | — | (49,898) | ||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit | (3,269) | (6,565) | 1,748 | 14,627 | 3,592 | — | 10,133 | ||||||||||||||||||||||||||||||||||

| Net income (loss) | 10,354 | 20,787 | (5,536) | (46,318) | (19,054) | — | (39,765) | ||||||||||||||||||||||||||||||||||

Net income attributable to noncontrolling interests | — | — | — | — | (767) | — | (767) | ||||||||||||||||||||||||||||||||||

Net income (loss) attributable to Nelnet, Inc. | $ | 10,354 | 20,787 | (5,536) | (46,318) | (19,821) | — | (40,532) | |||||||||||||||||||||||||||||||||

11

| Three months ended December 31, 2019 | |||||||||||||||||||||||||||||||||||||||||

| Loan Servicing and Systems | Education Technology, Services, and Payment Processing | Communications | Asset Generation and Management | Corporate and Other Activities | Eliminations | Total | |||||||||||||||||||||||||||||||||||

| Total interest income | $ | 452 | 2,069 | — | 208,576 | 2,062 | (801) | 212,358 | |||||||||||||||||||||||||||||||||

| Interest expense | 46 | 14 | — | 149,056 | (208) | (801) | 148,106 | ||||||||||||||||||||||||||||||||||

| Net interest income (expense) | 406 | 2,055 | — | 59,520 | 2,270 | — | 64,252 | ||||||||||||||||||||||||||||||||||

| Less provision for loan losses | — | — | — | 13,000 | — | — | 13,000 | ||||||||||||||||||||||||||||||||||

Net interest income after provision for loan losses | 406 | 2,055 | — | 46,520 | 2,270 | — | 51,252 | ||||||||||||||||||||||||||||||||||

| Other income/expense: | |||||||||||||||||||||||||||||||||||||||||

Loan servicing and systems revenue | 113,086 | — | — | — | — | — | 113,086 | ||||||||||||||||||||||||||||||||||

Intersegment revenue | 11,325 | — | — | — | — | (11,325) | — | ||||||||||||||||||||||||||||||||||

Education technology, services, and payment processing revenue | — | 63,578 | — | — | — | — | 63,578 | ||||||||||||||||||||||||||||||||||

| Communications revenue | — | — | 17,499 | — | — | — | 17,499 | ||||||||||||||||||||||||||||||||||

| Gain on sale of loans | — | — | — | 15,549 | — | — | 15,549 | ||||||||||||||||||||||||||||||||||

| Other income | 3,094 | 259 | 490 | 3,004 | 4,127 | — | 10,973 | ||||||||||||||||||||||||||||||||||

| Impairment expense | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Derivative settlements, net | — | — | — | 6,100 | — | — | 6,100 | ||||||||||||||||||||||||||||||||||

Derivative market value adjustments, net | — | — | — | (2,930) | — | — | (2,930) | ||||||||||||||||||||||||||||||||||

| Total other income/expense | 127,505 | 63,837 | 17,989 | 21,723 | 4,127 | (11,325) | 223,855 | ||||||||||||||||||||||||||||||||||

| Cost of services: | |||||||||||||||||||||||||||||||||||||||||

Cost to provide education technology, services, and payment processing services | — | 19,002 | — | — | — | — | 19,002 | ||||||||||||||||||||||||||||||||||

| Cost to provide communications services | — | — | 5,327 | — | — | — | 5,327 | ||||||||||||||||||||||||||||||||||

| Total cost of services | — | 19,002 | 5,327 | — | — | — | 24,329 | ||||||||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | 74,212 | 25,010 | 5,312 | 392 | 19,635 | — | 124,561 | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 8,519 | 2,988 | 11,148 | — | 5,995 | — | 28,651 | ||||||||||||||||||||||||||||||||||

| Other expenses | 18,332 | 5,587 | 3,981 | 5,346 | 13,464 | — | 46,710 | ||||||||||||||||||||||||||||||||||

| Intersegment expenses, net | 14,008 | 3,763 | 881 | 11,732 | (19,059) | (11,325) | — | ||||||||||||||||||||||||||||||||||

| Total operating expenses | 115,071 | 37,348 | 21,322 | 17,470 | 20,035 | (11,325) | 199,922 | ||||||||||||||||||||||||||||||||||

Income (loss) before income taxes | 12,840 | 9,542 | (8,660) | 50,773 | (13,638) | — | 50,856 | ||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit | (3,082) | (2,290) | 2,079 | (12,186) | 6,457 | — | (9,022) | ||||||||||||||||||||||||||||||||||

| Net income (loss) | 9,758 | 7,252 | (6,581) | 38,587 | (7,181) | — | 41,834 | ||||||||||||||||||||||||||||||||||

| Net loss attributable to noncontrolling interests | — | — | — | — | 546 | — | 546 | ||||||||||||||||||||||||||||||||||

Net income (loss) attributable to Nelnet, Inc. | $ | 9,758 | 7,252 | (6,581) | 38,587 | (6,635) | — | 42,380 | |||||||||||||||||||||||||||||||||

12

| Three months ended March 31, 2019 | |||||||||||||||||||||||||||||||||||||||||

| Loan Servicing and Systems | Education Technology, Services, and Payment Processing | Communications | Asset Generation and Management | Corporate and Other Activities | Eliminations | Total | |||||||||||||||||||||||||||||||||||

| Total interest income | $ | 497 | 2,017 | 2 | 246,867 | 2,053 | (851) | 250,586 | |||||||||||||||||||||||||||||||||

| Interest expense | — | 8 | — | 188,799 | 3,814 | (851) | 191,770 | ||||||||||||||||||||||||||||||||||

| Net interest income (expense) | 497 | 2,009 | 2 | 58,068 | (1,761) | — | 58,816 | ||||||||||||||||||||||||||||||||||

| Less provision for loan losses | — | — | — | 7,000 | — | — | 7,000 | ||||||||||||||||||||||||||||||||||

Net interest income after provision for loan losses | 497 | 2,009 | 2 | 51,068 | (1,761) | — | 51,816 | ||||||||||||||||||||||||||||||||||

| Other income/expense: | |||||||||||||||||||||||||||||||||||||||||

Loan servicing and systems revenue | 114,898 | — | — | — | — | — | 114,898 | ||||||||||||||||||||||||||||||||||

| Intersegment revenue | 12,217 | — | — | — | — | (12,217) | — | ||||||||||||||||||||||||||||||||||

Education technology, services, and payment processing revenue | — | 79,159 | — | — | — | — | 79,159 | ||||||||||||||||||||||||||||||||||

| Communications revenue | — | — | 14,543 | — | — | — | 14,543 | ||||||||||||||||||||||||||||||||||

| Gain on sale of loans | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

| Other income | 2,074 | — | 125 | 3,525 | 3,344 | — | 9,067 | ||||||||||||||||||||||||||||||||||

| Impairment expense | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||

Derivative settlements, net | — | — | — | 19,035 | — | — | 19,035 | ||||||||||||||||||||||||||||||||||

Derivative market value adjustments, net | — | — | — | (30,574) | — | — | (30,574) | ||||||||||||||||||||||||||||||||||

| Total other income/expense | 129,189 | 79,159 | 14,668 | (8,014) | 3,344 | (12,217) | 206,128 | ||||||||||||||||||||||||||||||||||

| Cost of services: | |||||||||||||||||||||||||||||||||||||||||

Cost to provide education technology, services, and payment processing services | — | 21,059 | — | — | — | — | 21,059 | ||||||||||||||||||||||||||||||||||

| Cost to provide communications services | — | — | 4,759 | — | — | — | 4,759 | ||||||||||||||||||||||||||||||||||

| Total cost of services | — | 21,059 | 4,759 | — | — | — | 25,818 | ||||||||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||||||||

| Salaries and benefits | 66,220 | 23,008 | 4,737 | 378 | 16,716 | — | 111,059 | ||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 8,871 | 3,510 | 7,362 | — | 4,469 | — | 24,213 | ||||||||||||||||||||||||||||||||||

| Other expenses | 18,928 | 5,311 | 3,477 | 3,837 | 12,262 | — | 43,816 | ||||||||||||||||||||||||||||||||||

| Intersegment expenses, net | 13,758 | 3,299 | 664 | 12,287 | (17,791) | (12,217) | — | ||||||||||||||||||||||||||||||||||

| Total operating expenses | 107,777 | 35,128 | 16,240 | 16,502 | 15,656 | (12,217) | 179,088 | ||||||||||||||||||||||||||||||||||

Income (loss) before income taxes | 21,909 | 24,981 | (6,329) | 26,552 | (14,073) | — | 53,038 | ||||||||||||||||||||||||||||||||||

| Income tax (expense) benefit | (5,258) | (5,995) | 1,519 | (6,372) | 4,716 | — | (11,391) | ||||||||||||||||||||||||||||||||||

| Net income (loss) | 16,651 | 18,986 | (4,810) | 20,180 | (9,357) | — | 41,647 | ||||||||||||||||||||||||||||||||||

Net income attributable to noncontrolling interests | — | — | — | — | (56) | — | (56) | ||||||||||||||||||||||||||||||||||

Net income (loss) attributable to Nelnet, Inc. | $ | 16,651 | 18,986 | (4,810) | 20,180 | (9,413) | — | 41,591 | |||||||||||||||||||||||||||||||||

13

Net Interest Income, Net of Settlements on Derivatives

The following table summarizes the components of “net interest income” and “derivative settlements, net.”

Derivative settlements represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms. Derivative accounting requires that net settlements with respect to derivatives that do not qualify for "hedge treatment" under GAAP be recorded in a separate income statement line item below net interest income. The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. As such, management believes derivative settlements for each applicable period should be evaluated with the Company’s net interest income as presented in the table below. Net interest income (net of settlements on derivatives) is a non-GAAP financial measure, and the Company reports this non-GAAP information because the Company believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance. See "Derivative Settlements" included in this supplement for the net settlement activity recognized by the Company for each type of derivative for the periods presented in the table below.

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

Variable loan interest margin | $ | 30,367 | 40,643 | 43,951 | |||||||||||||

Settlements on associated derivatives (a) | 2,112 | 1,839 | 2,334 | ||||||||||||||

Variable loan interest margin, net of settlements on derivatives | 32,479 | 42,482 | 46,285 | ||||||||||||||

Fixed rate floor income | 18,758 | 15,727 | 10,425 | ||||||||||||||

Settlements on associated derivatives (b) | 2,125 | 4,261 | 16,701 | ||||||||||||||

Fixed rate floor income, net of settlements on derivatives | 20,883 | 19,988 | 27,126 | ||||||||||||||

| Investment interest | 7,398 | 7,720 | 8,253 | ||||||||||||||

| Corporate debt interest expense | (1,450) | 162 | (3,813) | ||||||||||||||

Net interest income (net of settlements on derivatives) | $ | 59,310 | 70,352 | 77,851 | |||||||||||||

(a) Includes the net settlements received related to the Company’s 1:3 basis swaps.

(b) Includes the net settlements received related to the Company’s floor income interest rate swaps.

14

Loan Servicing and Systems Revenue

The following table provides disaggregated revenue by service offering for the Loan Servicing and Systems operating segment.

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Government servicing - Nelnet | $ | 38,650 | 39,247 | 39,640 | |||||||||||||

| Government servicing - Great Lakes | 46,446 | 46,371 | 47,077 | ||||||||||||||

| Private education and consumer loan servicing | 8,609 | 8,762 | 9,480 | ||||||||||||||

FFELP servicing | 5,614 | 5,835 | 6,695 | ||||||||||||||

| Software services | 11,318 | 10,822 | 9,741 | ||||||||||||||

Outsourced services and other | 2,098 | 2,049 | 2,265 | ||||||||||||||

Loan servicing and systems revenue | $ | 112,735 | 113,086 | 114,898 | |||||||||||||

Loan Servicing Volumes

| As of | |||||||||||||||||||||||||||||||||||

| December 31, 2018 | March 31, 2019 | June 30, 2019 | September 30, 2019 | December 31, 2019 | March 31, 2020 | ||||||||||||||||||||||||||||||

| Servicing volume (dollars in millions): | |||||||||||||||||||||||||||||||||||

| Nelnet | |||||||||||||||||||||||||||||||||||

| Government | $ | 179,507 | 183,093 | 181,682 | 184,399 | 183,790 | 185,477 | ||||||||||||||||||||||||||||

| FFELP | 36,748 | 35,917 | 35,003 | 33,981 | 33,185 | 32,326 | |||||||||||||||||||||||||||||

| Private and consumer | 15,666 | 16,065 | 16,025 | 16,286 | 16,033 | 16,364 | |||||||||||||||||||||||||||||

| Great Lakes | |||||||||||||||||||||||||||||||||||

| Government | 232,694 | 237,050 | 236,500 | 240,268 | 239,980 | 243,205 | |||||||||||||||||||||||||||||

| Total | $ | 464,615 | 472,125 | 469,210 | 474,934 | 472,988 | 477,372 | ||||||||||||||||||||||||||||

| Number of servicing borrowers: | |||||||||||||||||||||||||||||||||||

| Nelnet | |||||||||||||||||||||||||||||||||||

| Government | 5,771,923 | 5,708,582 | 5,592,989 | 5,635,653 | 5,574,001 | 5,498,872 | |||||||||||||||||||||||||||||

| FFELP | 1,709,853 | 1,650,785 | 1,588,530 | 1,529,392 | 1,478,703 | 1,423,286 | |||||||||||||||||||||||||||||

| Private and consumer | 696,933 | 699,768 | 693,410 | 701,299 | 682,836 | 670,702 | |||||||||||||||||||||||||||||

| Great Lakes | |||||||||||||||||||||||||||||||||||

| Government | 7,458,684 | 7,385,284 | 7,300,691 | 7,430,165 | 7,396,657 | 7,344,509 | |||||||||||||||||||||||||||||

| Total | 15,637,393 | 15,444,419 | 15,175,620 | 15,296,509 | 15,132,197 | 14,937,369 | |||||||||||||||||||||||||||||

| Number of remote hosted borrowers: | 6,393,151 | 6,332,261 | 6,211,132 | 6,457,296 | 6,433,324 | 6,354,158 | |||||||||||||||||||||||||||||

15

Education Technology, Services, and Payment Processing

The following table provides disaggregated revenue by servicing offering for the Education Technology, Services, and Payment Processing operating segment.

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Tuition payment plan services | $ | 31,587 | 26,093 | 30,173 | |||||||||||||

Payment processing | 31,742 | 25,420 | 28,979 | ||||||||||||||

Education technology and services | 20,054 | 11,706 | 19,709 | ||||||||||||||

Other | 292 | 359 | 298 | ||||||||||||||

Education technology, services, and payment processing revenue | $ | 83,675 | 63,578 | 79,159 | |||||||||||||

Communications Financial and Operating Data

Certain financial and operating data for ALLO is summarized in the tables below.

| Three months ended | |||||||||||||||||||||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||||||||||||||||||||

| Residential revenue | $ | 13,559 | 74.6 | % | $ | 12,993 | 74.3 | % | $ | 11,065 | 76.1 | % | |||||||||||||||||||||||

| Business revenue | 4,471 | 24.6 | 4,433 | 25.3 | 3,414 | 23.5 | |||||||||||||||||||||||||||||

| Other revenue | 151 | 0.8 | 73 | 0.4 | 64 | 0.4 | |||||||||||||||||||||||||||||

| Communications revenue | $ | 18,181 | 100.0 | % | $ | 17,499 | 100.0 | % | $ | 14,543 | 100.0 | % | |||||||||||||||||||||||

| Revenue contribution: | |||||||||||||||||||||||||||||||||||

| Internet | $ | 11,199 | 61.6 | % | $ | 10,598 | 60.5 | % | $ | 8,449 | 58.1 | % | |||||||||||||||||||||||

| Television | 4,236 | 23.3 | 4,176 | 23.9 | 3,898 | 26.8 | |||||||||||||||||||||||||||||

| Telephone | 2,691 | 14.8 | 2,643 | 15.1 | 2,167 | 14.9 | |||||||||||||||||||||||||||||

| Other | 55 | 0.3 | 82 | 0.5 | 29 | 0.2 | |||||||||||||||||||||||||||||

| Communications revenue | $ | 18,181 | 100.0 | % | $ | 17,499 | 100.0 | % | $ | 14,543 | 100.0 | % | |||||||||||||||||||||||

| Net loss | $ | (5,536) | (6,581) | (4,810) | |||||||||||||||||||||||||||||||

| EBITDA (a) | 3,223 | 2,488 | 1,031 | ||||||||||||||||||||||||||||||||

| Capital expenditures | 7,163 | 7,803 | 11,958 | ||||||||||||||||||||||||||||||||

| As of March 31, 2020 | As of December 31, 2019 | As of September 30, 2019 | As of June 30, 2019 | As of March 31, 2019 | As of December 31, 2018 | ||||||||||||||||||||||||||||||

| Residential customer information: | |||||||||||||||||||||||||||||||||||

| Households served | 49,684 | 47,744 | 45,228 | 42,760 | 40,338 | 37,351 | |||||||||||||||||||||||||||||

| Households passed (b) | 143,505 | 140,986 | 137,269 | 132,984 | 127,253 | 122,396 | |||||||||||||||||||||||||||||

| Households served/passed | 34.6 | % | 33.9 | % | 32.9 | % | 32.2 | % | 31.7 | % | 30.5 | % | |||||||||||||||||||||||

| Total households in current markets and new markets announced (c) | 171,121 | 160,884 | 159,974 | 159,974 | 152,840 | 152,840 | |||||||||||||||||||||||||||||

(a) Earnings before interest, income taxes, depreciation, and amortization ("EBITDA") is a supplemental non-GAAP performance measure that is frequently used in capital-intensive industries such as telecommunications. ALLO's management uses EBITDA to compare ALLO's performance to that of its competitors and to eliminate certain non-cash and non-operating items in order to consistently measure performance from period to period. EBITDA excludes interest and income taxes because these items are associated with a company's particular capitalization and tax structures. EBITDA also excludes depreciation and amortization expense because these non-cash expenses primarily reflect the impact of historical capital investments, as opposed to the cash impacts of capital expenditures made in recent periods, which may be evaluated through cash flow measures. The Company reports EBITDA for ALLO because the Company believes that it provides useful additional information for investors regarding a key metric used by management to assess ALLO's performance. There are limitations to using EBITDA as a performance measure, including the difficulty associated with comparing companies that use similar performance measures whose calculations may differ from ALLO's calculations. In addition, EBITDA should not be considered a substitute for other measures of financial performance, such as net income or any other performance measures derived in accordance with GAAP. A reconciliation of EBITDA from ALLO's net loss under GAAP is presented below:

16

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

Net loss | $ | (5,536) | (6,581) | (4,810) | |||||||||||||

Net interest (income) expense | — | — | (2) | ||||||||||||||

Income tax benefit | (1,748) | (2,079) | (1,519) | ||||||||||||||

Depreciation and amortization | 10,507 | 11,148 | 7,362 | ||||||||||||||

Earnings before interest, income taxes, depreciation, and amortization (EBITDA) | $ | 3,223 | 2,488 | 1,031 | |||||||||||||

(b) Represents the number of single residence homes, apartments, and condominiums that ALLO already serves and those in which ALLO has the capacity to connect to its network distribution system without further material extensions to the transmission lines, but have not been connected.

(c) During the second quarter of 2019, ALLO announced plans to expand its network to make services available in Breckenridge, Colorado. During the fourth quarter of 2019, ALLO announced plans to expand its network to make services available in Imperial, Nebraska. During the first quarter of 2020, ALLO announced plans to expand its network to make services available in Norfolk, Nebraska. ALLO is now in twelve communities, including ten in Nebraska and two in Colorado.

Other Income

The following table summarizes the components of "other income."

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Borrower late fee income | $ | 3,188 | 3,014 | 3,512 | |||||||||||||

| Investment advisory services | 2,802 | 747 | 711 | ||||||||||||||

| Management fee revenue | 2,243 | 2,831 | 1,872 | ||||||||||||||

| Gain (loss) on investments, net | (3,864) | 3,680 | (427) | ||||||||||||||

| Other | 3,912 | 701 | 3,399 | ||||||||||||||

| Other income | $ | 8,281 | 10,973 | 9,067 | |||||||||||||

Derivative Settlements

The following table summarizes the components of "derivative settlements, net" included in the attached consolidated statements of operations.

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| 1:3 basis swaps | $ | 2,112 | 1,839 | 2,334 | |||||||||||||

Interest rate swaps - floor income hedges | 2,125 | 4,261 | 16,701 | ||||||||||||||

Total derivative settlements - income (expense) | $ | 4,237 | 6,100 | 19,035 | |||||||||||||

17

Loans and Accrued Interest Receivable, net

Loans and accrued interest receivable, net consisted of the following:

| As of | As of | As of | |||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Federally insured student loans: | |||||||||||||||||

| Stafford and other | $ | 4,645,574 | 4,684,314 | 4,901,934 | |||||||||||||

| Consolidation | 15,539,478 | 15,644,229 | 16,778,679 | ||||||||||||||

| Total | 20,185,052 | 20,328,543 | 21,680,613 | ||||||||||||||

| Private education loans | 274,210 | 244,258 | 211,029 | ||||||||||||||

| Consumer loans | 145,803 | 225,918 | 191,001 | ||||||||||||||

| 20,605,065 | 20,798,719 | 22,082,643 | |||||||||||||||

| Accrued interest receivable | 766,773 | 733,497 | 715,352 | ||||||||||||||

Loan discount, net of unamortized loan premiums and deferred origination costs | (4,762) | (35,036) | (43,602) | ||||||||||||||

| Non-accretable discount | — | (32,398) | (31,110) | ||||||||||||||

| Allowance for loan losses: | |||||||||||||||||

| Federally insured loans | (146,759) | (36,763) | (40,934) | ||||||||||||||

| Private education loans | (23,056) | (9,597) | (10,587) | ||||||||||||||

| Consumer loans | (39,053) | (15,554) | (10,257) | ||||||||||||||

| $ | 21,158,208 | 21,402,868 | 22,661,505 | ||||||||||||||

Loan Activity

The following table sets forth the activity of loans:

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Beginning balance | $ | 20,798,719 | 21,206,948 | 22,520,498 | |||||||||||||

| Loan acquisitions: | |||||||||||||||||

| Federally insured student loans | 349,061 | 441,645 | 270,015 | ||||||||||||||

| Private education loans | 47,605 | 67,739 | — | ||||||||||||||

| Consumer loans | 62,831 | 107,634 | 70,121 | ||||||||||||||

| Total loan acquisitions | 459,497 | 617,018 | 340,136 | ||||||||||||||

Repayments, claims, capitalized interest, and other | (312,579) | (635,693) | (504,720) | ||||||||||||||

| Consolidation loans lost to external parties | (216,327) | (210,253) | (273,271) | ||||||||||||||

| Consumer loans sold | (124,245) | (179,301) | — | ||||||||||||||

| Ending balance | $ | 20,605,065 | 20,798,719 | 22,082,643 | |||||||||||||

18

Loan Spread Analysis

The following table analyzes the loan spread on the Company’s portfolio of loans, which represents the spread between the yield earned on loan assets and the costs of the liabilities and derivative instruments used to fund the assets.

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Variable loan yield, gross | 3.98 | % | 4.36 | % | 5.04 | % | |||||||||||

| Consolidation rebate fees | (0.83) | (0.83) | (0.84) | ||||||||||||||

Discount accretion, net of premium and deferred origination costs amortization | 0.01 | 0.02 | 0.03 | ||||||||||||||

| Variable loan yield, net | 3.16 | 3.55 | 4.23 | ||||||||||||||

| Loan cost of funds - interest expense | (2.58) | (2.83) | (3.47) | ||||||||||||||

| Loan cost of funds - derivative settlements (a) (b) | 0.04 | 0.04 | 0.04 | ||||||||||||||

| Variable loan spread | 0.62 | 0.76 | 0.80 | ||||||||||||||

Fixed rate floor income, gross | 0.36 | 0.30 | 0.19 | ||||||||||||||

Fixed rate floor income - derivative settlements (a) (c) | 0.04 | 0.08 | 0.31 | ||||||||||||||

Fixed rate floor income, net of settlements on derivatives | 0.40 | 0.38 | 0.50 | ||||||||||||||

| Core loan spread (d) | 1.02 | % | 1.14 | % | 1.30 | % | |||||||||||

| Average balance of loans | $ | 20,793,758 | 21,040,484 | 22,313,270 | |||||||||||||

| Average balance of debt outstanding | 20,616,771 | 20,850,214 | 21,989,065 | ||||||||||||||

(a) Derivative settlements represent the cash paid or received during the current period to settle with derivative instrument counterparties the economic effect of the Company's derivative instruments based on their contractual terms. Derivative accounting requires that net settlements with respect to derivatives that do not qualify for "hedge treatment" under GAAP be recorded in a separate income statement line item below net interest income. The Company maintains an overall risk management strategy that incorporates the use of derivative instruments to reduce the economic effect of interest rate volatility. As such, management believes derivative settlements for each applicable period should be evaluated with the Company’s net interest income (loan spread) as presented in this table. The Company reports this non-GAAP information because it believes that it provides additional information regarding operational and performance indicators that are closely assessed by management. There is no comprehensive, authoritative guidance for the presentation of such non-GAAP information, which is only meant to supplement GAAP results by providing additional information that management utilizes to assess performance. See "Derivative Settlements" included in this supplement for additional information on the Company's derivative instruments, including the net settlement activity recognized by the Company for each type of derivative for the periods presented in the table.

A reconciliation of core loan spread, which includes the impact of derivative settlements on loan spread, to loan spread without

derivative settlements follows.

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Core loan spread | 1.02 | % | 1.14 | % | 1.30 | % | |||||||||||

| Derivative settlements (1:3 basis swaps) | (0.04) | (0.04) | (0.04) | ||||||||||||||

| Derivative settlements (fixed rate floor income) | (0.04) | (0.08) | (0.31) | ||||||||||||||

| Loan spread | 0.94 | % | 1.02 | % | 0.95 | % | |||||||||||

(b) Derivative settlements consist of net settlements received related to the Company’s 1:3 basis swaps.

(c) Derivative settlements consist of net settlements received related to the Company’s floor income interest rate swaps.

(d) Core loan spread, excluding consumer loans, would have been 0.97%, 1.05%, and 1.22% for the three months ended March 31, 2020, December 31, 2019, and March 31, 2019, respectively.

19

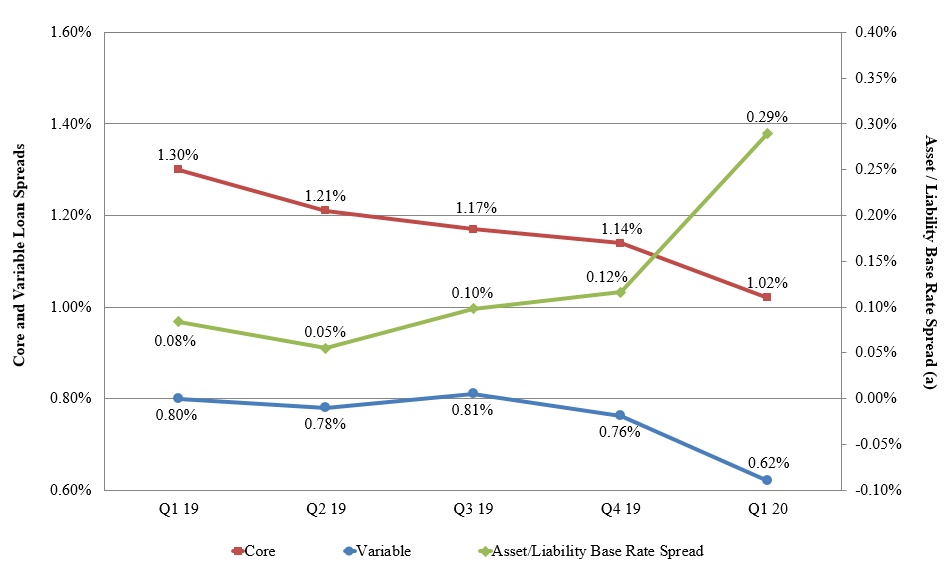

A trend analysis of the Company's core and variable student loan spreads is summarized below.

(a) The interest earned on a large portion of the Company's FFELP student loan assets is indexed to the one-month LIBOR rate. The Company funds a portion of its assets with three-month LIBOR indexed floating rate securities. The relationship between the indices in which the Company earns interest on its loans and funds such loans has a significant impact on loan spread. This table (the right axis) shows the difference between the Company's liability base rate and the one-month LIBOR rate by quarter.

The difference between variable loan spread and core loan spread is fixed rate floor income earned on a portion of the Company's federally insured student loan portfolio. A summary of fixed rate floor income and its contribution to core loan spread follows:

| Three months ended | |||||||||||||||||

| March 31, 2020 | December 31, 2019 | March 31, 2019 | |||||||||||||||

| Fixed rate floor income, gross | $ | 18,758 | 15,727 | 10,425 | |||||||||||||

| Derivative settlements (a) | 2,125 | 4,261 | 16,701 | ||||||||||||||

| Fixed rate floor income, net | $ | 20,883 | 19,988 | 27,126 | |||||||||||||

Fixed rate floor income contribution to spread, net | 0.40 | % | 0.38 | % | 0.50 | % | |||||||||||

(a) Includes settlement payments on derivatives used to hedge student loans earning fixed rate floor income.

20

Fixed Rate Floor Income

The following table shows the Company’s federally insured student loan assets that were earning fixed rate floor income as of March 31, 2020.

| Fixed interest rate range | Borrower/lender weighted average yield | Estimated variable conversion rate (a) | Loan balance | |||||||||||||||||

| 4.0 - 4.49% | 4.24% | 1.60% | $ | 872,708 | ||||||||||||||||

| 4.5 - 4.99% | 4.71% | 2.07% | 703,949 | |||||||||||||||||

| 5.0 - 5.49% | 5.22% | 2.58% | 461,229 | |||||||||||||||||

| 5.5 - 5.99% | 5.67% | 3.03% | 312,875 | |||||||||||||||||

| 6.0 - 6.49% | 6.19% | 3.55% | 361,038 | |||||||||||||||||

| 6.5 - 6.99% | 6.70% | 4.06% | 352,930 | |||||||||||||||||

| 7.0 - 7.49% | 7.17% | 4.53% | 125,752 | |||||||||||||||||

| 7.5 - 7.99% | 7.71% | 5.07% | 227,095 | |||||||||||||||||

| 8.0 - 8.99% | 8.18% | 5.54% | 532,903 | |||||||||||||||||

| > 9.0% | 9.05% | 6.41% | 202,149 | |||||||||||||||||

| $ | 4,152,628 | |||||||||||||||||||

(a) The estimated variable conversion rate is the estimated short-term interest rate at which loans would convert to a variable rate. As of March 31, 2020, the weighted average estimated variable conversion rate was 3.29% and the short-term interest rate was 144 basis points.

The following table summarizes the outstanding derivative instruments as of March 31, 2020 used by the Company to economically hedge loans earning fixed rate floor income.

| Maturity | Notional amount | Weighted average fixed rate paid by the Company (a) | ||||||||||||

| 2020 | $ | 1,000,000 | 1.00 | % | ||||||||||

| 2021 | 600,000 | 2.15 | ||||||||||||

| 2022 (b) | 250,000 | 1.65 | ||||||||||||

| 2023 | 150,000 | 2.25 | ||||||||||||

| $ | 2,000,000 | 1.52 | % | |||||||||||

(a) For all interest rate derivatives, the Company receives discrete three-month LIBOR.