| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-262701-02 | ||

May 31, 2022

Free Writing Prospectus

Structural and Collateral Term Sheet

$633,273,980

(Approximate Initial Mortgage Pool Balance)

$524,152,000

(Offered Certificates)

Citigroup Commercial Mortgage Trust 2022-GC48

As Issuing Entity

Citigroup Commercial Mortgage Securities Inc.

As Depositor

Commercial Mortgage Pass-Through Certificates, Series 2022-GC48

Citi Real Estate Funding Inc.

Goldman Sachs Mortgage Company

Starwood Mortgage Capital LLC

Bank of Montreal

As Sponsors and Mortgage Loan Sellers

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Citigroup | BMO Capital Markets | Goldman Sachs & Co. LLC |

| Co-Lead Managers and Joint Bookrunners | ||

| Academy Securities | Siebert Williams Shank | |

| Co-Manager | Co-Manager | |

| CERTIFICATE SUMMARY |

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus, dated on or about May 31, 2022, included as part of our registration statement (SEC File No. 333-262701) (the “Preliminary Prospectus”). The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including, without limitation, a summary of risks associated with an investment in the offered securities under the heading “Summary of Risk Factors” and a detailed discussion of such risks under the heading “Risk Factors”). The Preliminary Prospectus is available upon request from Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc. or Siebert Williams Shank & Co., LLC. This Term Sheet is subject to change.

For information regarding certain risks associated with an investment in this transaction, refer to “Summary of Risk Factors” and “Risk Factors” in the Preliminary Prospectus. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the headings “Summary of Risk Factors” and “Risk Factors” in the Preliminary Prospectus, the yield to maturity of, the aggregate amount and timing of distributions on and the market value of the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

The securities offered by these materials are being offered when, as and if issued. This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc. or Siebert Williams Shank & Co., LLC provides accounting, tax or legal advice.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

2

| CERTIFICATE SUMMARY |

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—General Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity and Other Aspects of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

3

| CERTIFICATE SUMMARY |

| OFFERED CERTIFICATES | ||||||||

Offered Classes |

Expected

Ratings |

Approximate Initial Certificate Balance or Notional Amount(2) |

Approximate Initial Credit Support(3) |

Initial

Pass- |

Pass-Through Rate Description |

Expected |

Expected Principal Window(5) | |

| Class A-1 | Aaa(sf)/AAAsf/AAA(sf) | $3,961,000 | 30.000% | % | (6) | 2.46 | 07/22 – 02/27 | |

| Class A-2 | Aaa(sf)/AAAsf/AAA(sf) | $93,366,000 | 30.000% | % | (6) | 4.93 | 02/27 – 06/27 | |

| Class A-4 | Aaa(sf)/AAAsf/AAA(sf) | (7) | 30.000% | % | (6) | (7) | (7) | |

| Class A-5 | Aaa(sf)/AAAsf/AAA(sf) | (7) | 30.000% | % | (6) | (7) | (7) | |

| Class A-SB | Aaa(sf)/AAAsf/AAA(sf) | $5,942,000 | 30.000% | % | (6) | 7.42 | 06/27 – 02/32 | |

| Class X-A | Aa1(sf)/AAAsf/AAA(sf) | $463,239,000(8) | N/A | % | Variable IO(9) | N/A | N/A | |

| Class A-S | Aa2(sf)/AAAsf/AAA(sf) | $42,112,000 | 23.000% | % | (6) | 9.90 | 05/32 – 05/32 | |

| Class B | NR/AA-sf/AA(sf) | $30,833,000 | 17.875% | % | (6) | 9.96 | 05/32 – 06/32 | |

| Class C | NR/A-sf/A-(sf) | $30,080,000 | 12.875% | % | (6) | 9.98 | 06/32 – 06/32 | |

| NON-OFFERED CERTIFICATES(10) | ||||||||

Non-Offered Classes |

Expected

Ratings |

Approximate Initial Certificate Balance or Notional Amount(2) |

Approximate Initial Credit Support(3) |

Initial

Pass- |

Pass-Through Rate Description |

Expected |

Expected Principal Window(5) | |

| Class X-B | NR/A-sf/AAA(sf) | $60,913,000(8) | N/A | % | Variable IO(9) | N/A | N/A | |

| Class X-D | NR/BBB-sf /BBB-(sf) | $33,841,000(8) | N/A | % | Variable IO(9) | N/A | N/A | |

| Class X-F | NR/BB-sf/BB-(sf) | $15,040,000(8) | N/A | % | Variable IO(9) | N/A | N/A | |

| Class X-G | NR/B-sf /B-(sf) | $6,768,000(8) | N/A | % | Variable IO(9) | N/A | N/A | |

| Class X-H | NR/NR/NR | $21,809,280(8) | N/A | % | Variable IO(9) | N/A | N/A | |

| Class D | NR/BBBsf/BBB+(sf) | $18,801,000 | 9.750% | % | (6) | 9.98 | 06/32 – 06/32 | |

| Class E | NR/BBB-sf/BBB-(sf) | $15,040,000 | 7.250% | % | (6) | 9.98 | 06/32 – 06/32 | |

| Class F | NR/BB-sf/BB-(sf) | $15,040,000 | 4.750% | % | (6) | 9.98 | 06/32 – 06/32 | |

| Class G | NR/B-sf/B-(sf) | $6,768,000 | 3.625% | % | (6) | 9.98 | 06/32 – 06/32 | |

| Class H | NR/NR/NR | $21,809,280 | 0.000% | % | (6) | 9.98 | 06/32 – 06/32 | |

| Class S(11) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |

| Class R(11) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |

| NON-OFFERED VERTICAL RISK RETENTION INTEREST(10) | ||||||||

Non-Offered Eligible Vertical Interest |

Expected

Ratings |

Approximate Initial Combined VRR Interest Balance(2) |

Approximate Initial Credit Support(3) |

Initial Effective Interest Rate(4) |

Effective Interest Rate Description |

Expected |

Expected Principal Window(5) | |

| Combined VRR Interest(12) | NR / NR / NR | $31,663,699(13) | N/A(14) | %(15) | (15) | 9.05 | 07/22 – 06/32 | |

| NON-OFFERED LOAN-SPECIFIC CERTIFICATES(16) | ||||||||

| (1) | It is a condition of issuance that the offered certificates and certain classes of non-offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, LLC (“KBRA”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders thereof of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest-only certificates, the ultimate receipt by holders thereof of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. Moody’s, Fitch and KBRA have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5% and further subject to any additional variances described in the footnotes below. In addition, the notional amounts of the Class X-A, Class X-B, Class X-D, Class X-F, Class X-G and Class X-H certificates (collectively, the “Class X Certificates”) may vary depending upon the final pricing of the classes of Principal Balance Certificates (as defined in footnote (14) below) whose certificate balances comprise such notional amounts, and, if as a result of such pricing (a) the pass-through rate of any class of Class X Certificates would be equal to zero at all times, such class of Class X Certificates will not be issued on the closing date of this securitization (the “Closing Date”) or (b) the pass-through rate of any class of Principal Balance Certificates whose certificate balance comprises such notional amount is at all times equal to the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time (the “WAC Rate”), the certificate balance of such class of Principal Balance Certificates may not be part of, and there would be a corresponding reduction in, such notional amount of the related class of Class X Certificates. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

4

| CERTIFICATE SUMMARY |

| (3) | “Approximate Initial Credit Support” means, with respect to any class of Non-Vertically Retained Principal Balance Certificates (as defined in footnote (6) below), the quotient, expressed as a percentage, of (i) the aggregate of the initial certificate balances of all classes of Non-Vertically Retained Principal Balance Certificates, if any, junior to such class of Non-Vertically Retained Principal Balance Certificates, divided by (ii) the aggregate of the initial certificate balances of all classes of Non-Vertically Retained Principal Balance Certificates. The approximate initial credit support percentages set forth for the Class A-1, Class A-2, Class A-4, Class A-5 and Class A-SB certificates are represented in the aggregate. The approximate initial credit support percentages shown in the table above do not take into account the Combined VRR Interest (as defined in footnote (12) below) or the trust subordinate companion loan (as defined in footnote (16) below). |

| (4) | Approximate per annum rate as of the Closing Date. |

| (5) | Determined assuming no prepayments prior to the maturity date or any anticipated repayment date, as applicable, for any mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Preliminary Prospectus. |

| (6) | For any distribution date, the pass-through rate for each class of the Class A-1, Class A-2, Class A-4, Class A-5, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H certificates (collectively, the “Non-Vertically Retained Principal Balance Certificates”, and collectively with the Class X, Class S and Class R certificates, the “Non-Vertically Retained Certificates”, and the Non-Vertically Retained Certificates, collectively with the Class VRR certificates, the “Certificates”) will generally be equal to one of (i) a fixed per annum rate, (ii) the WAC Rate, (iii) a rate equal to the lesser of a specified per annum rate and the WAC Rate, or (iv) the WAC Rate less a specified percentage, but no less than 0.000%. The trust subordinate companion loan will not be taken into account in determining the pass-through rates on the Non-Vertically Retained Principal Balance Certificates or the WAC Rate. The Non-Vertically Retained Certificates, other than the Class S and Class R certificates, are collectively referred to in this term sheet as the “Non-Vertically Retained Regular Certificates”. See “Description of the Certificates—Distributions—Pass-Through Rates” in the Preliminary Prospectus. |

| (7) | The exact initial certificate balances of the Class A-4 and Class A-5 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, weighted average lives and principal windows of the Class A-4 and Class A-5 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-4 and Class A-5 certificates is expected to be approximately $317,858,000, subject to a variance of plus or minus 5%. |

Class of Certificates |

Expected Range of Initial Certificate Balances |

Expected Range of Weighted Avg. Lives (Yrs) |

Expected Range of Principal Windows |

| Class A-4 | $0 – $145,000,000 | N/A – 9.78 | N/A / 01/32 – 05/32 |

| Class A-5 | $172,858,000 – $317,858,000 | 9.90 – 9.85 | 05/32 – 05/32 / 01/32 – 05/32 |

| (8) | The Class X Certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each class of Class X Certificates at the related pass-through rate based upon the related notional amount. The notional amount of each class of the Class X Certificates will be equal to the certificate balance or the aggregate of the certificate balances, as applicable, from time to time of the class or classes of the Non-Vertically Retained Principal Balance Certificates identified in the same row as such class of Class X Certificates in the chart below (as to such class of Class X Certificates, the “Corresponding Principal Balance Certificates”): |

| Class of Class X Certificates | Class(es)

of Corresponding Principal Balance Certificates |

| Class X-A | Class A-1, Class A-2, Class A-4, Class A-5, Class A-SB and Class A-S |

| Class X-B | Class B and Class C |

| Class X-D | Class D and Class E |

| Class X-F | Class F |

| Class X-G | Class G |

| Class X-H | Class H |

| (9) | The pass-through rate for each class of Class X Certificates will generally be a per annum rate equal to the excess, if any, of (i) the WAC Rate over (ii) the pass-through rate (or, if applicable, the weighted average of the pass-through rates) of the class or classes of Corresponding Principal Balance Certificates as in effect from time to time, as described in the Preliminary Prospectus. See “Description of the Certificates—Distributions—Pass-Through Rates” in the Preliminary Prospectus. |

| (10) | The classes of Certificates set forth below “Non-Offered Certificates” and “Non-Offered Vertical Risk Retention Interest” in the table and the Loan-Specific Certificates (as defined in footnote (16) below) are not offered by this Term Sheet. |

| (11) | Neither the Class S certificates nor the Class R certificates will have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. A specified portion of the “excess interest” accruing after the related anticipated repayment date on any mortgage loan with an anticipated repayment date will, to the extent collected, be allocated to the Class S certificates as set forth in “Description of the Certificates—Distributions—Excess Interest” in the Preliminary Prospectus. The Class R certificates will represent the residual interests in each of three separate REMICs, as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

| (12) | In satisfaction of the risk retention obligations of Citi Real Estate Funding Inc. (“CREFI”) as retaining sponsor for this securitization transaction, CREFI is expected to acquire (or cause one or more other retaining parties to acquire) from the depositor, on the Closing Date, portions of an “eligible vertical interest” in the form of a “single vertical security” with an initial principal balance of approximately $31,663,699 (the “Combined VRR Interest”), which is expected to represent at least 5% of the aggregate principal balance of all the “ABS interests” (i.e. the sum of the aggregate initial certificate balance of all of the Certificates (other than the Class R certificates) and the initial principal balance of the Uncertificated VRR Interest) issued by the issuing entity on the Closing Date. The Combined VRR Interest will consist of the “Uncertificated VRR Interest” and the “Class VRR Certificates” (each as defined under “Credit Risk Retention” in the Preliminary Prospectus). The Combined VRR Interest will be retained by certain retaining parties in accordance with the credit risk retention rules applicable to this securitization transaction. “Eligible vertical interest”, “single vertical security” and “ABS interests” have the meanings given to such terms in Regulation RR. See “Credit Risk Retention” in the Preliminary Prospectus. The Combined VRR Interest is not offered hereby. |

| (13) | Constitutes the Combined VRR Interest Balance (as defined in footnote (14) below), which consists of the aggregate certificate balance of the Class VRR certificates and the principal balance of the Uncertificated VRR Interest. |

| (14) | Although the approximate initial credit support percentages shown in the table above with respect to the Non-Vertically Retained Principal Balance Certificates do not take into account the Combined VRR Interest, losses incurred on the mortgage loans will be allocated between the Combined VRR Interest, on the one hand, and the Non-Vertically Retained Principal Balance Certificates, on the other hand, pro rata in accordance with the principal balance of the Combined VRR Interest (the “Combined VRR Interest Balance”) and the aggregate outstanding certificate balance of the Non-Vertically Retained Principal Balance Certificates, respectively. See “Credit Risk Retention” and “Description of the Certificates” in the Preliminary Prospectus. The Class VRR Certificates and the Non-Vertically Retained Principal Balance Certificates are collectively referred to in this Term Sheet as the “Principal Balance Certificates”. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

5

| CERTIFICATE SUMMARY |

| (15) | Although it does not have a specified pass-through rate (other than for tax reporting purposes), the effective interest rate for the Combined VRR Interest will be the WAC Rate. |

| (16) | Certain additional classes of commercial mortgage pass-through certificates (collectively, the “Loan-Specific Certificates”) will be issued by the issuing entity, which additional classes will only be entitled to receive distributions from, and will only incur losses with respect to, two junior promissory notes secured by the Yorkshire & Lexington Towers mortgaged property (such junior promissory notes, collectively, the “trust subordinate companion loan”). The trust subordinate companion loan will be included as an asset of the issuing entity but will not constitute a “mortgage loan” and will not be part of the mortgage pool backing the classes of Certificates identified in the Certificate Summary table above. The Loan-Specific Certificates are not “Certificates” for purposes of this Term Sheet, and the issuance of the Loan-Specific Certificates should be considered a separate securitization. No class of Certificates will have any interest in the trust subordinate companion loan. See “Description of the Mortgage Pool—The Trust Subordinate Companion Loans” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

6

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics(1) | |

| Initial Pool Balance(2) | $633,273,980 |

| Number of Mortgage Loans | 32 |

| Number of Mortgaged Properties | 88 |

| Average Cut-off Date Balance | $19,789,812 |

| Weighted Average Mortgage Rate | 4.89429% |

| Weighted Average Remaining Term to Maturity/ARD (months)(3) | 110 |

| Weighted Average Remaining Amortization Term (months)(4) | 359 |

| Weighted Average Cut-off Date LTV Ratio(5) | 53.4% |

| Weighted Average Maturity Date/ARD LTV Ratio(3)(5) | 52.3% |

| Weighted Average UW NCF DSCR(6) | 2.29x |

| Weighted Average Debt Yield on Underwritten NOI(7) | 11.7% |

| % of Initial Pool Balance of Mortgage Loans that are Amortizing Balloon | 9.3% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only then Amortizing Balloon | 1.9% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only | 85.1% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only – ARD | 3.7% |

| % of Initial Pool Balance of Mortgaged Properties with Single Tenants | 14.1% |

| % of Initial Pool Balance of Mortgage Loans with Mezzanine Debt | 9.5% |

| % of Initial Pool Balance of Mortgage Loans with Subordinate Debt | 12.0% |

| (1) | The Cut-off Date LTV Ratio, Maturity Date/ARD LTV Ratio, UW NCF DSCR, Debt Yield on Underwritten NOI and Cut-off Date Balance Per SF / Unit / Room / Pad information for each mortgage loan is presented in this Term Sheet (i) if such mortgage loan is part of a whole loan (as defined under “Collateral Overview—Whole Loan Summary” below), are based on both that mortgage loan and any related pari passu companion loan(s) but, unless otherwise specifically indicated, without regard to any related subordinate companion loan(s), and (ii) unless otherwise specifically indicated, are calculated without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | Unless otherwise indicated, mortgage loans with anticipated repayment dates are presented as if they were to mature on the anticipated repayment date. |

| (4) | Excludes mortgage loans that are interest-only for the entire term. |

| (5) | The Cut-off Date LTV Ratios and Maturity Date/ARD LTV Ratios presented in this Term Sheet are generally based on the “as-is” appraised values of the related mortgaged properties (as set forth on Annex A to the Preliminary Prospectus), provided that such LTV ratios may be calculated based on (i) “as-stabilized” or similar values in certain cases where the completion of certain hypothetical conditions or other events at the property are assumed and/or where reserves have been established at origination to satisfy the applicable condition or event that is expected to occur, or (ii) the Cut-off Date Balance or Balloon Balance, as applicable, net of a related earnout or holdback reserve, or (iii) the “as-is” appraised value for a portfolio of mortgaged properties that includes a premium relating to the valuation of the portfolio of mortgaged properties as a whole rather than as the sum of individually valued mortgaged properties, in each case as further described in the definitions of “Appraised Value”, “Cut-off Date LTV Ratio” and “Maturity Date/ARD LTV Ratio” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (6) | The UW NCF DSCR for each mortgage loan is generally calculated by dividing the Underwritten NCF for the related mortgaged property or mortgaged properties by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment due. |

| (7) | The Debt Yield on Underwritten NOI for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of such mortgage loan, and the Debt Yield on Underwritten NCF for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of such mortgage loan. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

7

| KEY FEATURES OF THE CERTIFICATES |

| Co-Lead Managers and Joint Bookrunners: | Citigroup Global Markets Inc. Goldman Sachs & Co. LLC BMO Capital Markets Corp. |

Co-Managers:

|

Academy Securities, Inc. Siebert Williams Shank & Co., LLC |

| Depositor: | Citigroup Commercial Mortgage Securities Inc. |

| Initial Pool Balance: | $633,273,980 |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Special Servicers: | Greystone Servicing Company LLC (with respect to all serviced loans other than the Yorkshire & Lexington Towers whole loan) Rialto Capital Advisors, LLC (with respect to the Yorkshire & Lexington Towers whole loan) |

| Certificate Administrator: | ComputerShare Trust Company, National Association |

| Trustee: | Wilmington Trust, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| Risk Retention Consultation Parties: | Citi Real Estate Funding Inc. and Goldman Sachs Mortgage Company |

| Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements are being satisfied by Citi Real Estate Funding Inc., as retaining sponsor for this securitization transaction, see “Credit Risk Retention” in the Preliminary Prospectus. Note that this securitization transaction is not structured to satisfy European or United Kingdom risk retention and due diligence requirements. |

| Closing Date: | On or about June 21, 2022 |

| Cut-off Date: | With respect to each mortgage loan, the due date in June 2022 for that mortgage loan (or, in the case of any mortgage loan that has its first due date subsequent to June 2022, the date that would have been its due date in June 2022 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) |

| Determination Date: | The 11th day of each month or next business day, commencing in July 2022 |

| Distribution Date: | The 4th business day after the Determination Date, commencing in July 2022 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible, subject to the exemption conditions described in the Preliminary Prospectus |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | May 2054 |

| Cleanup Call: | 1.0% |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

8

| KEY FEATURES OF THE CERTIFICATES |

| Minimum Denominations: | $10,000 minimum for the offered certificates (other than the Class X-A certificates); $1,000,000 minimum for the Class X-A certificates; and integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | Book-entry through DTC |

| Bond Information: | Cash flows are expected to be modeled by TREPP, INTEX, BLOOMBERG and Moody’s Analytics |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

9

| TRANSACTION HIGHLIGHTS |

| ■ | $524,152,000 (Approximate) New-Issue Multi-Borrower CMBS: |

| — | Overview: The mortgage pool consists of 32 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $633,273,980 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $19,789,812 and are secured by 88 mortgaged properties located throughout 24 states and Washington D.C. |

| — | LTV: 53.4% weighted average Cut-off Date LTV Ratio |

| — | DSCR: 2.29x weighted average Underwritten NCF Debt Service Coverage Ratio |

| — | Debt Yield: 11.7% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-4/ A-5 / A-SB |

| ■ | Loan Structural Features: |

| — | Amortization: 11.2% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| – | 9.3% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| – | 1.9% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| — | Hard Lockboxes: 48.3% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 100.0% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than (i) a 1.15x coverage or (ii) a 4.25% debt yield, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| – | Real Estate Taxes: 26 mortgage loans representing 86.8% of the Initial Pool Balance |

| – | Insurance: 18 mortgage loans representing 48.9% of the Initial Pool Balance |

| – | Replacement Reserves (Including FF&E Reserves): 27 mortgage loans representing 86.5% of the Initial Pool Balance |

| – | Tenant Improvements / Leasing Commissions: 19 mortgage loans representing 87.7% of the portion of the Initial Pool Balance that is secured by office, industrial, retail, self storage (with commercial tenants), mixed use and multifamily (with commercial tenants) properties |

| — | Predominantly Defeasance Mortgage Loans: 76.9% of the mortgage loans by Initial Pool Balance permit defeasance only after an initial lockout period |

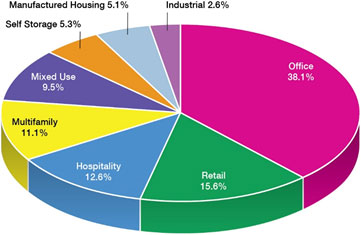

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| — | Office: 38.1% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| — | Retail: 15.6% of the mortgaged properties by allocated Initial Pool Balance are retail properties |

| — | Hospitality: 12.6% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| — | Multifamily: 11.1% of the mortgaged properties by allocated Initial Pool Balance are multifamily properties |

| — | Mixed Use: 9.5% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| — | Self Storage: 5.3% of the mortgaged properties by allocated Initial Pool Balance are self storage properties |

| — | Manufactured Housing: 5.1% of the mortgaged properties by allocated Initial Pool Balance are manufactured housing properties |

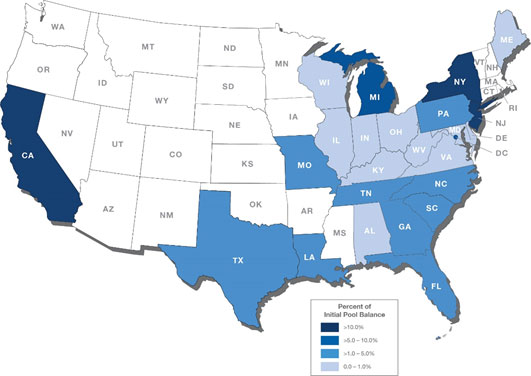

| ■ | Geographic Diversity: The 88 mortgaged properties are located throughout 24 states and Washington D.C., with only three states having 10% or greater of the allocated Initial Pool Balance: New York (24.3%), California (22.2%), and New Jersey (10.8%). |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

10

| COLLATERAL OVERVIEW |

Mortgage Loans by Loan Seller

Mortgage Loan Seller |

Mortgage Loans |

Mortgaged Properties |

Aggregate Cut-off Date Balance |

% of Initial Pool Balance |

| Citi Real Estate Funding Inc. | 9 | 46 | $194,950,691 | 30.8% |

| Goldman Sachs Mortgage Company | 5 | 12 | 145,422,000 | 23.0% |

| Starwood Mortgage Capital LLC | 10 | 21 | 131,181,289 | 20.7% |

| Bank of Montreal | 6 | 6 | 61,720,000 | 9.7% |

| Bank of Montreal, Starwood Mortgage Capital LLC, Citi Real Estate Funding Inc.(1) | 1 | 2 | 60,000,000 | 9.5% |

| Citi Real Estate Funding Inc., Bank of Montreal(2) | 1 | 1 | 40,000,000 | 6.3% |

| Total | 32 | 88 | $633,273,980 | 100.0% |

| (1) | The Yorkshire & Lexington Towers mortgage loan (9.5%) is comprised of separate notes that are being sold by Bank of Montreal, Starwood Mortgage Capital LLC and Citi Real Estate Funding Inc. The Yorkshire & Lexington Towers mortgage loan is part of a “whole loan” that was co-originated by Bank of Montreal, Starwood Mortgage Capital LLC, and Citi Real Estate Funding Inc. The Yorkshire & Lexington Towers mortgage loan is evidenced by three promissory notes: (i) note A-4, with an outstanding principal balance of $20,000,000 as of the cut-off date, as to which Bank of Montreal is acting as mortgage loan seller; (ii) note A-9, with an outstanding principal balance of $20,000,000 as of the cut-off date, as to which Citi Real Estate Funding Inc. is acting as mortgage loan seller and (iii) note A-11, with an outstanding principal balance of $20,000,000 as of the cut-off date, as to which Starwood Mortgage Capital LLC is acting as mortgage loan seller. |

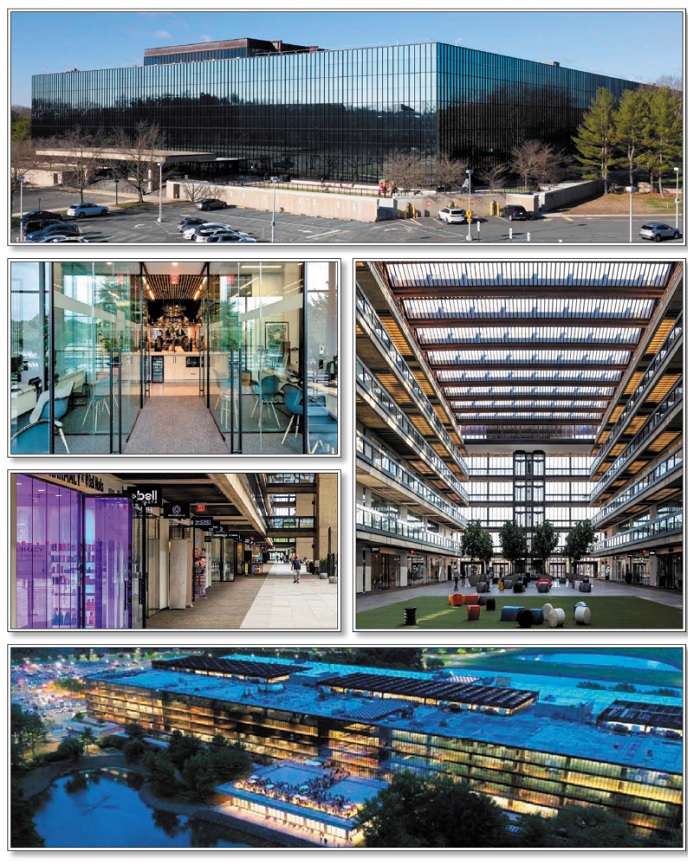

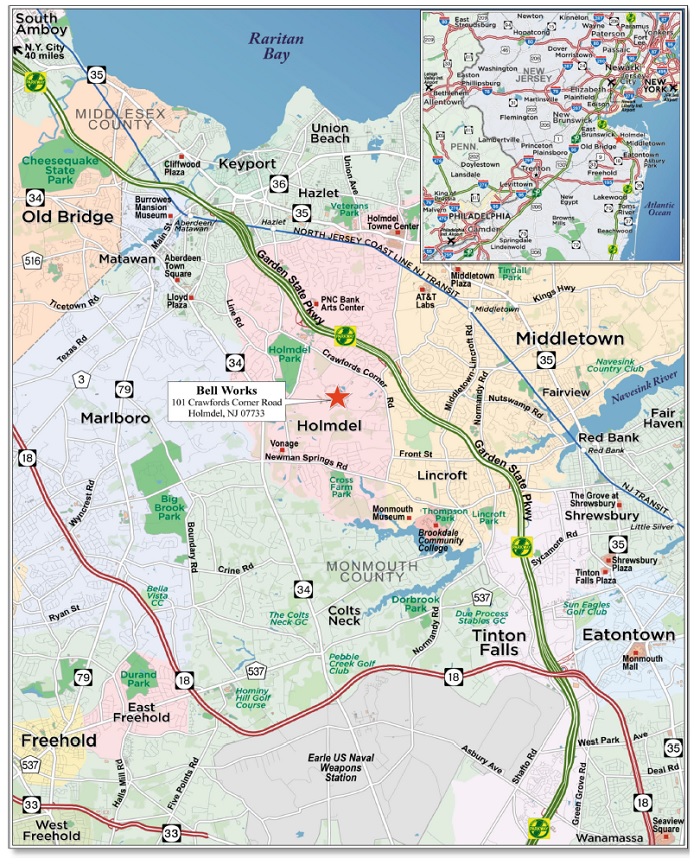

| (2) | The Bell Works mortgage loan (6.3%) is comprised of separate notes that are being sold by Citi Real Estate Funding Inc. and Bank of Montreal. The Bell Works mortgage loan is part of a “whole loan” that was co-originated by Citi Real Estate Funding Inc., Bank of Montreal and Barclays Capital Real Estate Inc. The Bell Works mortgage loan is evidenced by two promissory notes: (i) note A-2-1, with an aggregate outstanding principal balance of $20,000,000 as of the cut-off date, as to which Citi Real Estate Funding Inc. is acting as mortgage loan seller and (ii) note A-4, with an aggregate outstanding principal balance of $20,000,000 as of the cut-off date, as to which Bank of Montreal is acting as mortgage loan seller. |

Ten Largest Mortgage Loans(1)(2)

# |

Mortgage Loan Name |

Cut-off Date Balance |

% of Initial Pool Balance |

Property Type |

Property

Size |

Cut-off Date Balance Per SF/Unit/Room |

UW

NCF |

UW |

Cut-off Date LTV Ratio(3) |

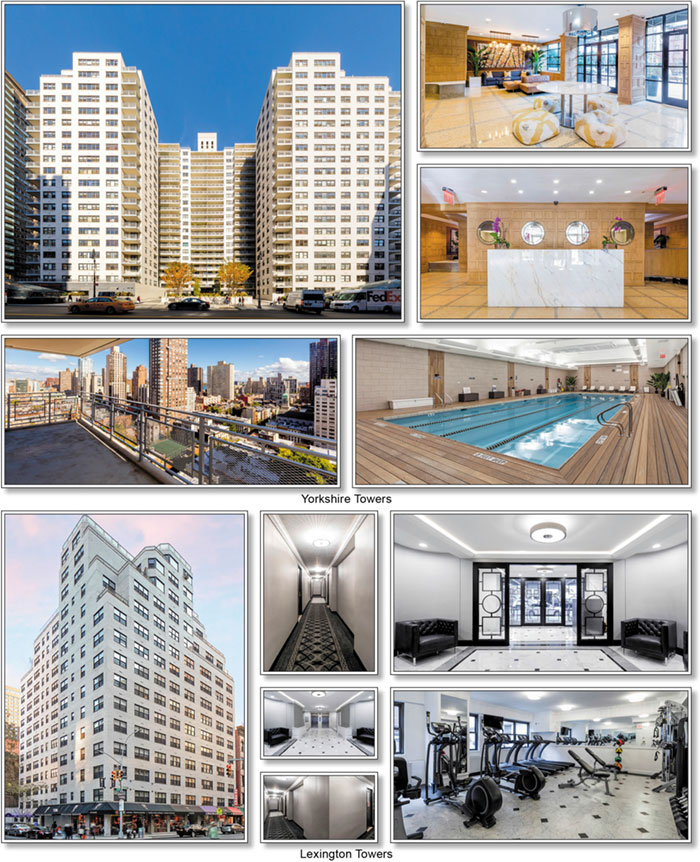

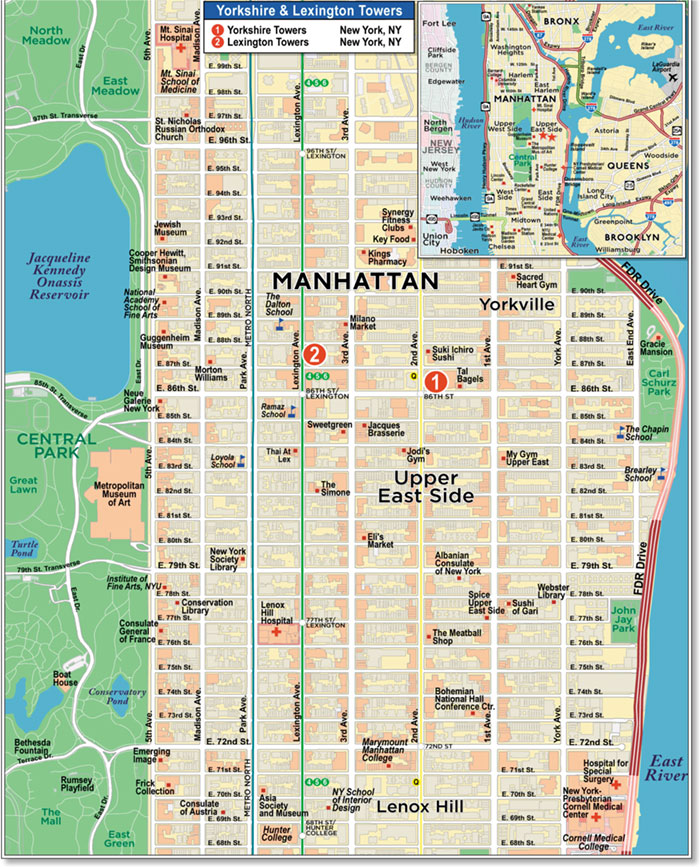

| 1 | Yorkshire & Lexington Towers | $60,000,000 | 9.5% | Multifamily | 808 | $393,564 | 3.61x | 11.1% | 33.3% |

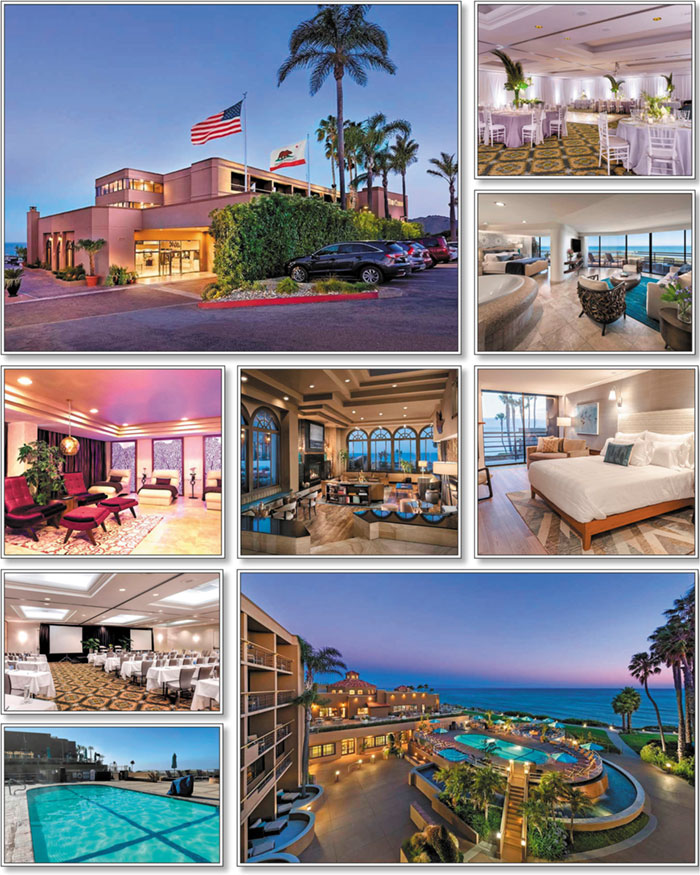

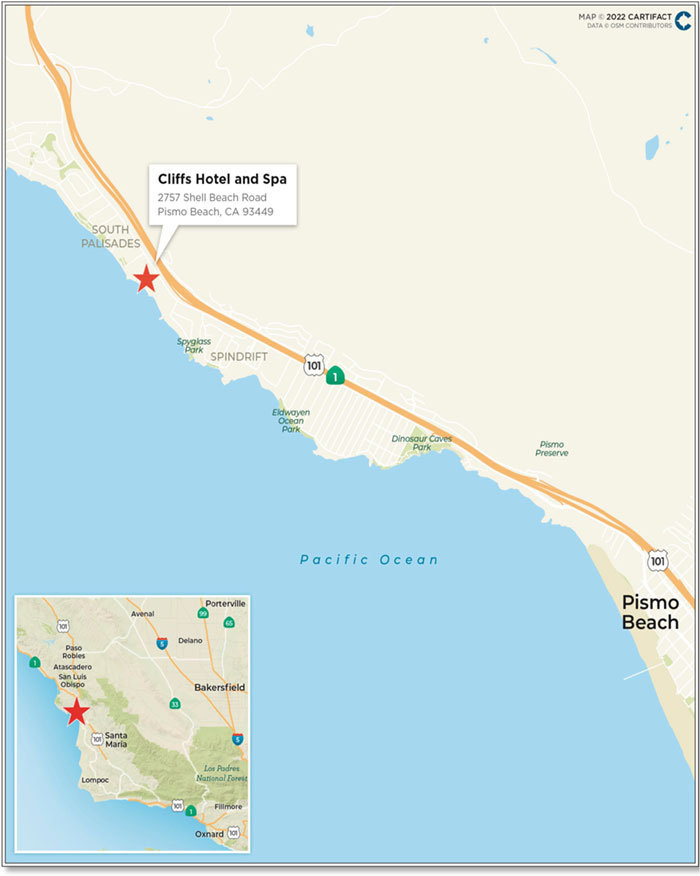

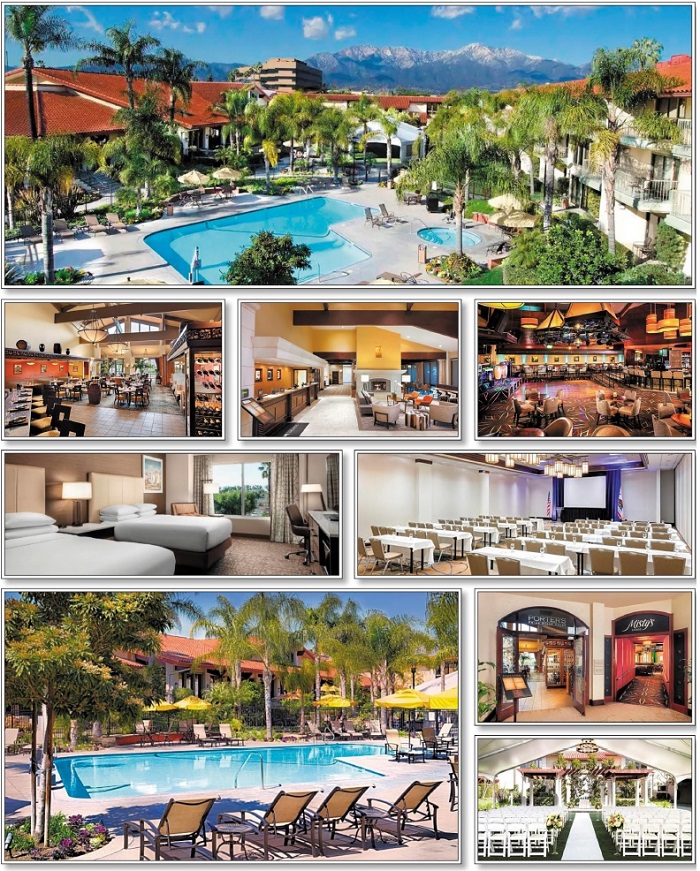

| 2 | Cliffs Hotel and Spa | 50,000,000 | 7.9 | Hospitality | 162 | $308,642 | 3.15x | 17.2% | 47.6% |

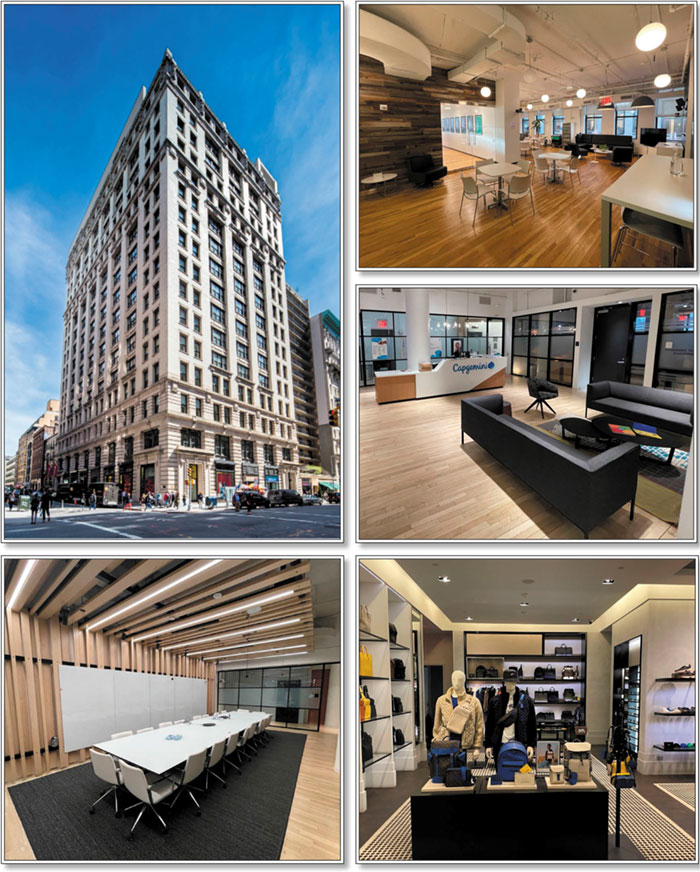

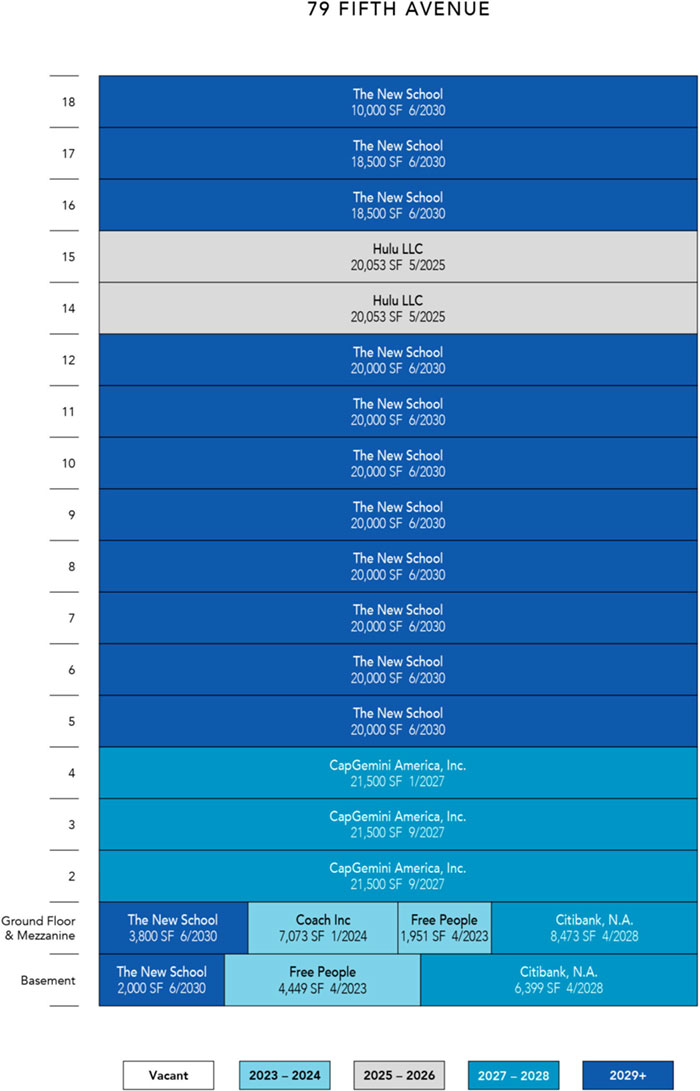

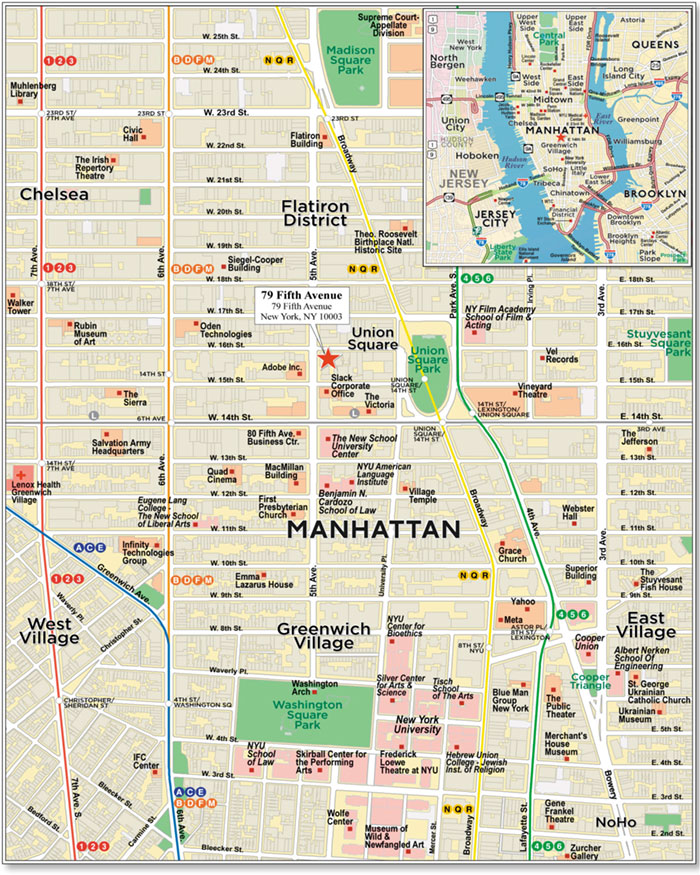

| 3 | 79 Fifth Avenue | 50,000,000 | 7.9 | Office | 345,751 | $694 | 1.61x | 8.4% | 60.8% |

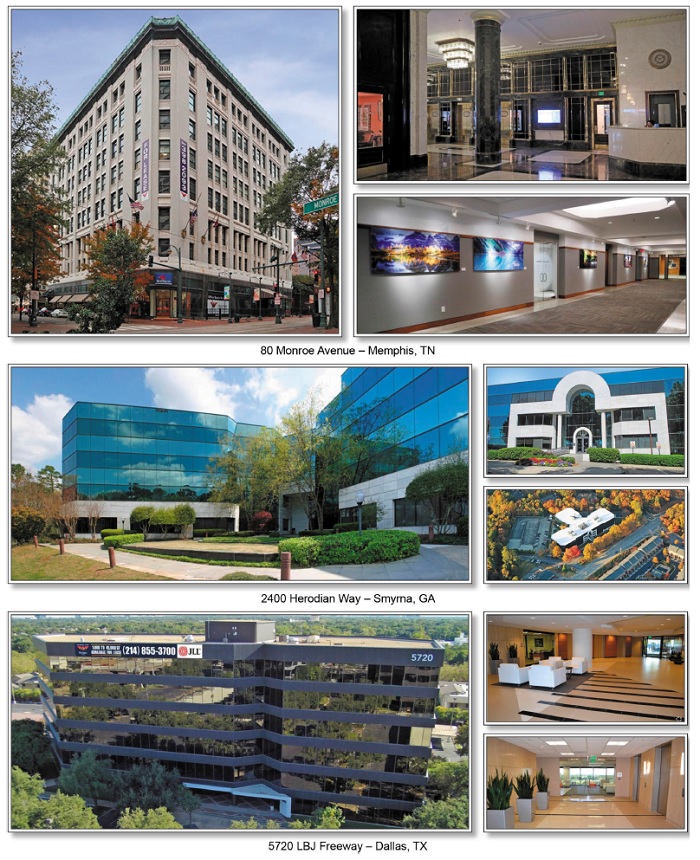

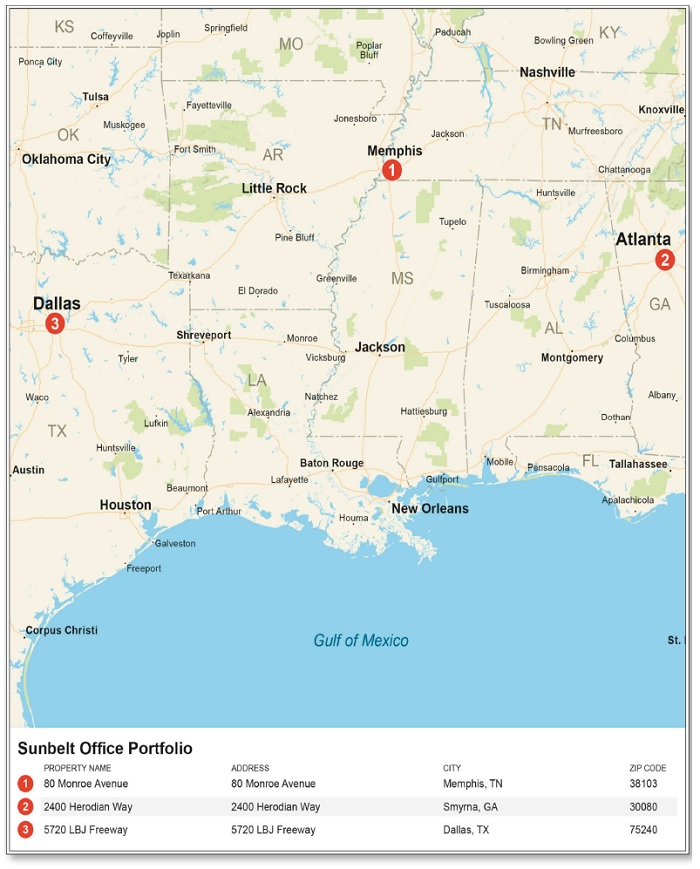

| 4 | Sunbelt Office Portfolio | 42,955,691 | 6.8 | Office | 485,687 | $88 | 1.51x | 11.0% | 65.6% |

| 5 | Brighton Towne Square | 40,000,000 | 6.3 | Mixed Use | 247,031 | $162 | 1.54x | 9.8% | 61.2% |

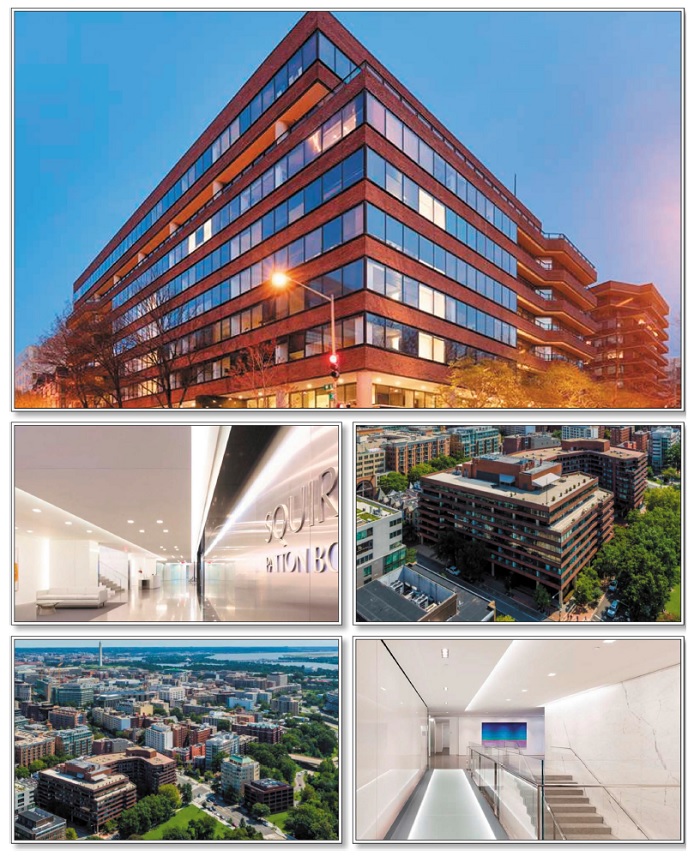

| 6 | 2550 M Street | 40,000,000 | 6.3 | Office | 207,081 | $419 | 1.87x | 8.8% | 65.5% |

| 7 | Bell Works | 40,000,000 | 6.3 | Office | 1,371,470 | $153 | 1.68x | 9.4% | 62.6% |

| 8 | DoubleTree Ontario | 30,000,000 | 4.7 | Hospitality | 482 | $62,241 | 4.72x | 30.1% | 22.6% |

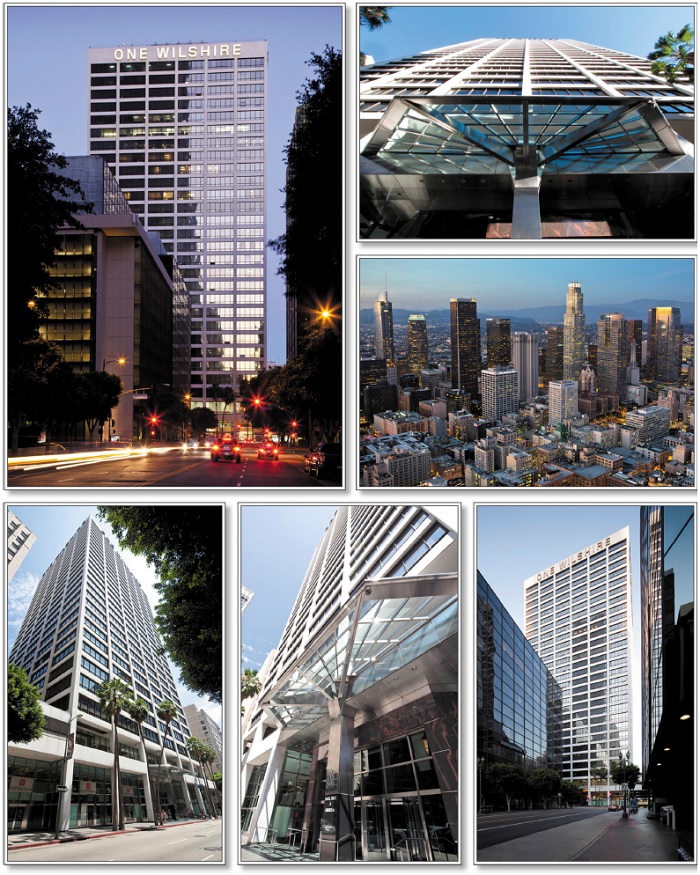

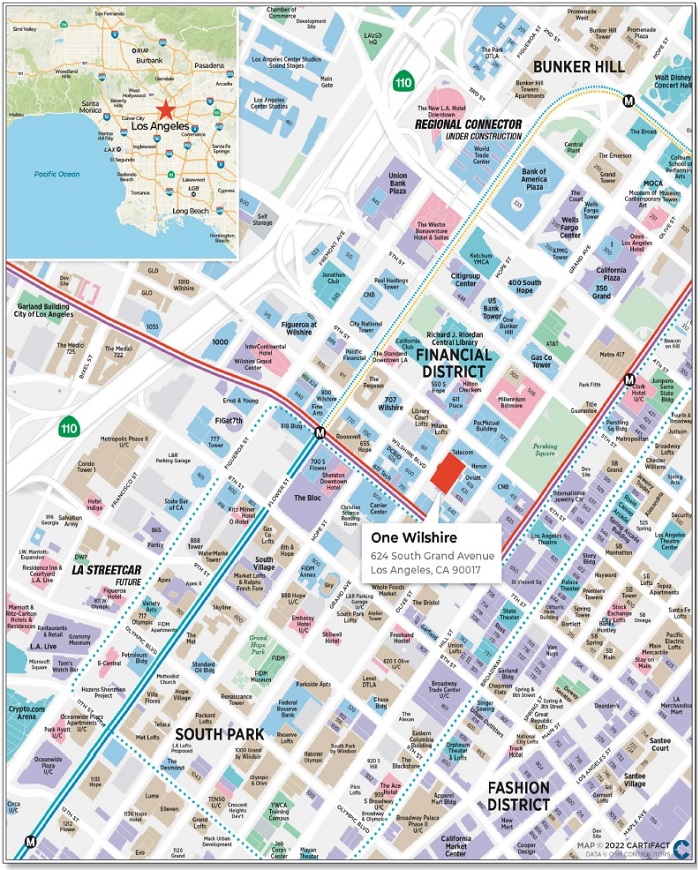

| 9 | One Wilshire | 23,250,000 | 3.7 | Office | 661,553 | $588 | 3.37x | 9.6% | 42.6% |

| 10 | ExchangeRight Net Leased Portfolio #55 | 22,340,000 |

3.5 |

Retail | 747,953 | $139 | 2.03x |

9.6% |

53.1% |

| Top 10 Total / Wtd. Avg. | $398,545,691 | 62.9% | 2.48x | 12.2% | 51.8% | ||||

| Remaining Total / Wtd. Avg. | 234,728,289 |

37.1 |

1.97x |

10.9% |

56.0% | ||||

| Total / Wtd. Avg. | $633,273,980 | 100.0% | 2.29x | 11.7% | 53.4% |

| (1) | See footnotes to table entitled “Mortgage Pool Characteristics” above. |

| (2) | With respect to each mortgage loan that is part of a whole loan (as identified under “Collateral Overview—Whole Loan Summary” below), the Cut-off Date Balance Per SF/Unit/Room, UW NCF DSCR, UW NOI Debt Yield and Cut-off Date LTV Ratio are calculated based on both that mortgage loan and any related pari passu companion loan(s), but without regard to any related subordinate companion loan(s) or other indebtedness. |

| (3) | With respect to certain of the mortgage loans identified above, the Cut-off Date LTV Ratios have been calculated using “as-stabilized”, “portfolio premium” or similar hypothetical values. Such mortgage loans are identified under the definition of “Appraised Value” set forth under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

11

| COLLATERAL OVERVIEW (continued) |

Whole Loan Summary

Mortgage Loan Name(1) |

Mortgage Loan Cut-off Date Balance |

Mortgage Loan as Approx. % of Initial Pool Balance |

Aggregate Pari Passu Companion Loan Cut-off Date Balance |

Aggregate Subordinate Companion Loan Cut-off Date Balance |

Whole Loan Cut-off Date Balance |

Controlling Pooling/Trust and Servicing Agreement (“Controlling PSA”)(2) |

Master Servicer/ Outside Servicer |

Special Servicer/ Outside Special Servicer |

| Yorkshire & Lexington Towers | $60,000,000 |

9.5% | $258,000,000 | $221,500,000 | $539,500,000 | CGCMT 2022-GC48 | Midland | Rialto |

| 79 Fifth Avenue | $50,000,000 | 7.9% | $190,000,000 | - | $240,000,000 | CGCMT 2022-GC48 | Midland | Greystone |

| 2550 M Street | $40,000,000 | 6.3% | $46,800,000 | - | $86,800,000 | Benchmark 2022-B35 | KeyBank | KeyBank |

| Bell Works | $40,000,000 | 6.3% | $170,000,000 | - | $210,000,000 | Benchmark 2022-B35 | KeyBank | KeyBank |

| One Wilshire | $23,250,000 | 3.7% | $366,000,000 | - | $389,250,000 | Benchmark 2022-B32 | Midland | KeyBank |

| ExchangeRight Net Leased Portfolio #55 | $22,340,000 | 3.5% | $81,560,000 | - | $103,900,000 | Benchmark 2022-B35 | KeyBank | KeyBank |

| Stockton Self Storage Portfolio | $13,985,622 | 2.2% | $24,974,325 | - | $38,959,947 | (3) | (3) | (3) |

| 360 Rosemary | $8,000,000 | 1.3% | $77,000,000 | $125,000,000 | $210,000,000 | BMO 2022-C1 | KeyBank | CWCapital |

| 111 River Street | $8,000,000 | 1.3% | $69,500,000 | $76,250,000 | $153,750,000 | BMO 2022-C1 | KeyBank | CWCapital |

| 2 Riverfront Plaza | $7,500,000 | 1.2% | $102,500,000 | - | $110,000,000 | BBCMS 2022-C15 | Midland | Rialto |

| (1) | Each of the mortgage loans included in the issuing entity that is secured by a mortgaged property or portfolio of mortgaged properties identified in the table above, together with the related companion loan(s) (none of which is included in the issuing entity), is referred to in this Term Sheet as a “whole loan”. See “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus. |

| (2) | Each whole loan will be serviced under the related Controlling PSA and, in the event the Controlling Note is included in the related securitization transaction, the controlling class representative (or an equivalent entity) under such Controlling PSA will generally be entitled to exercise the rights of the controlling note holder for the subject whole loan. See, however, the chart entitled “Whole Loan Controlling Notes and Non-Controlling Notes” below and “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus for information regarding the party that will be entitled to exercise such rights in the event the Controlling Note is held or deemed to be held by a third party or included in a separate securitization transaction. |

| (3) | It is expected that (i) the Stockton Self Storage Portfolio mortgage loan will initially be serviced and administered under CGCMT 2022-GC48 pooling and servicing agreement, and (ii) upon the inclusion of the related controlling pari passu companion loan in a future commercial mortgage securitization transaction, will be serviced and administered pursuant to the servicing agreement governing that future commercial mortgage securitization transaction. |

Mortgage Loans with Existing Mezzanine Debt or Subordinate Debt(1)

Mortgage Loan Name |

Mortgage Loan Cut-off Date Balance |

Aggregate Pari Passu Companion Loan Cut-off Date Balance |

Aggregate Mezzanine Debt Cut-off Date Balance |

Aggregate Subordinate Companion Loan Cut-off Date Balance |

Cut-off Date Total Debt Balance(2) |

Wtd. Avg Cut-off Date Total Debt Interest Rate(2) |

Cut-off Date Mortgage Loan LTV(3) |

Cut-off Date Total Debt LTV(2) |

Cut-off Date Mortgage Loan UW NCF DSCR(3) |

Cut-off Date Total Debt UW NCF DSCR(2) |

Cut-off Date Mortgage Loan UW NOI Debt Yield(3) |

Cut-off Date Total Debt UW NOI Debt Yield(2) |

| Yorkshire & Lexington Towers | $60,000,000 | $258,000,000 | $174,500,000 | $221,500,000 | $714,000,000 | 4.07289075641457% | 33.3% | 74.8% | 3.61x | 1.20x | 11.1% | 5.0% |

| 360 Rosemary | $8,000,000 | $77,000,000 | - | $125,000,000 | $210,000,000 | 3.95000% | 26.6% | 65.8% | 4.35x | 1.76x | 17.8% | 7.2% |

| 111 River Street | $8,000,000 | $69,500,000 | - | $76,250,000 | $153,750,000 | 3.28000% | 31.8% | 63.0% | 5.08x | 2.56x | 16.9% | 8.5% |

| (1) | See footnotes to table entitled “Mortgage Pool Characteristics” above. |

| (2) | All “Total Debt” calculations set forth in the table above include any related pari passu companion loan(s), any related subordinate companion loan(s) and any related mezzanine debt. |

| (3) | “Cut-off Date Mortgage Loan LTV”, “Cut-off Date Mortgage Loan UW NCF DSCR” and “Cut-off Date Mortgage Loan UW NOI Debt Yield” calculations include any related pari passu companion loan(s) and exclude any related subordinate companion loan(s). |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

12

| COLLATERAL OVERVIEW (continued) |

Whole Loan Controlling Notes and Non-Controlling Notes(1)(2)

| Mortgaged Property Name | Servicing of Whole Loan | Note Detail | Controlling Note | Current

Holder of Unsecuritized Note(3)(4)(5) |

Current

or Anticipated Holder of Securitized Note(5) |

Aggregate

Cut-off Date Balance |

| Yorkshire & Lexington Towers(6) | Serviced | Notes A-1, A-7, A-10, A-13, A-16 | No | BMO | Not Identified | $87,000,000 |

| Notes A-2, A-5, A-8 | No | Starwood Mortgage Funding II LLC | Not Identified | $65,000,000 | ||

| Notes A-3, A-6, A-12, A-15, A-18 | No | CREFI | Not Identified | $86,000,000 | ||

| Notes A-4, A-9, A-11 | No | — | CGCMT 2022-GC48 | $60,000,000 | ||

| Notes A-14, A-17 | No | Starwood Mortgage Funding II LLC | Not Identified | $20,000,000 | ||

| Notes B-1, B-2 | Yes | — | CGCMT 2022-GC48 (Loan Specific) | $221,500,000 | ||

| 79 Fifth Avenue | Serviced | Note A-1-1 | Yes | — | CGCMT 2022-GC48 | $50,000,000 |

| Notes A-1-2, A-1-3 | No | CREFI | Not Identified | $46,000,000 | ||

| Notes A-2-1, A-2-3-2 | No | — | BANK 2022-BNK42 | $71,000,000 | ||

| Notes A-2-2, A-2-3-1 | No | WFB | Not Identified | $25,000,000 | ||

| Notes A-3-1, A-3-2, A-3-3 | No | JPMCB | Not Identified | $48,000,000 | ||

| 2550 M Street | Outside Serviced | Note A-1 | Yes | — | Benchmark 2022-B35 | $46,800,000 |

| Note A-2 | No | — | CGCMT 2022-GC48 | $40,000,000 | ||

| Bell Works | Outside Serviced | Note A-1 | Yes | — | Benchmark 2022-B35 | $50,000,000 |

| Notes A-2-1, A-4 | No | — | CGCMT 2022-GC48 | $40,000,000 | ||

| Notes A-2-2, A-3 | No | CREFI | Not Identified | $30,000,000 | ||

| Notes A-5, A-6, A-7, A-8 | No | BMO | Not Identified | $50,000,000 | ||

| Notes A-9, A-10, A-11 | No | BCREI | Not Identified | $40,000,000 | ||

| One Wilshire | Outside Serviced | Note A-1 | Yes | — | Benchmark 2022-B32 | $90,000,000 |

| Note A-2 | No | — | Benchmark 2022-B33 | $80,000,000 | ||

| Note A-3 | No | — | Benchmark 2022-B34 | $85,000,000 | ||

| Note A-4 | No | — | Benchmark 2022-B35 | $111,000,000 | ||

| Note A-5 | No | — | CGCMT 2022-GC48 | $23,250,000 | ||

| ExchangeRight Net Leased Portfolio #55 | Outside Serviced | Note A-1-A | Yes | — | Benchmark 2022-B35 | $40,000,000 |

| Note A-1-B | No | — | CGCMT 2022-GC48 | $22,340,000 | ||

| Note A-2 | No | BCREI | Not Identified | $41,560,000 | ||

| Stockton Self Storage Portfolio | Outside Serviced | Note A-1 | Yes | Starwood Mortgage Funding III LLC | Not Identified | $24,974,325 |

| Note A-2 | No | — | CGCMT 2022-GC48 | $13,985,622 | ||

| 360 Rosemary(6) | Outside Serviced | Notes A-1, A-2 | No | — | BMO 2022-C1 | $45,000,000 |

| Notes A-3, A-4 | No | BMO | Not Identified | $32,000,000 | ||

| Note A-5 | No | — | CGCMT 2022-GC48 | $8,000,000 | ||

| Note B-1 | No | — | BMO 2022-C1 (Loan Specific) | $100,802,000 | ||

| Note C-1 | Yes | Third Party | Not Identified | $24,198,000 | ||

| 111 River Street(6) | Outside Serviced | Note A-1 | No | — | BMO 2022-C1 | $37,500,000 |

| Notes A-2, A-3, A-5 | No | BMO | Not Identified | $32,000,000 | ||

| Note A-4 | No | — | CGCMT 2022-GC48 | $8,000,000 | ||

| Note B | Yes | — | BMO 2022-C1 (Loan Specific) | $76,250,000 | ||

| 2 Riverfront Plaza | Outside Serviced | Note A-1 | No | — | BMO 2022-C1 | $37,500,000 |

| Note A-2, A-5 | Yes | — | BBCMS 2022-C15 | $50,000,000 | ||

| Note A-3 | No | BMO | Not Identified | $15,000,000 | ||

| Note A-4 | No | — | CGCMT 2022-GC48 | $7,500,000 | ||

| (1) | The holder(s) of one or more specified controlling notes (collectively, the “Controlling Note”) will be the “controlling note holder(s)” (collectively, the “Controlling Note Holder”) entitled (directly or through a representative) to (a) approve or, in some cases, direct material servicing decisions involving the related whole loan(while the remaining such holder(s) generally are only entitled to non-binding consultation rights in such regard), and (b) in some cases, replace the applicable special servicer with respect to such whole loan with or without cause. See “Description of the Mortgage Pool—The Whole Loans” and “The Pooling and Servicing Agreement—Directing Holder” in the Preliminary Prospectus. |

| (2) | The holder(s) of the note(s) other than the Controlling Note (each, a “Non-Controlling Note”) will be the “non-controlling note holder(s)” generally entitled (directly or through a representative) to certain non-binding consultation rights with respect to any decisions as to which the holder of the Controlling Note has consent rights involving the related whole loan, subject to certain exceptions, including that in certain cases where the related Controlling Note is a B-note, C-note or other subordinate note, such consultation rights will not be afforded to the holder(s) of the Non-Controlling Notes until after a control trigger event has occurred with respect to either such Controlling Note(s) or certain certificates backed thereby, in each case as set forth in the related co-lender agreement. See “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus. |

| (3) | Unless otherwise specified, with respect to each whole loan, any related unsecuritized Controlling Note and/or Non-Controlling Note may be further split, modified, combined and/or reissued (prior to its inclusion in a securitization transaction) as one or multiple Controlling Notes or Non-Controlling Notes, as the case may be, subject to the terms of the related co-lender agreement (including that the aggregate principal balance, weighted average interest rate and certain other material terms cannot be changed). In connection with the foregoing, any such split, modified, combined or re-issued Controlling Note or Non-Controlling Note, as the case may be, may be transferred to one or multiple parties (not identified in the table above) prior to its inclusion in a future commercial mortgage securitization transaction. |

| (4) | Unless otherwise specified, with respect to each whole loan, each related unsecuritized pari passu companion loan (whether controlling or non-controlling) is expected to be contributed to one or more future commercial mortgage securitization transactions. Under the column “Current or Anticipated Holder of Securitized Note”, (i) the identification of a securitization trust means we have identified an outside securitization (a) that has closed or (b) as to which a preliminary prospectus or final prospectus has been filed with the SEC or (c) as to which a preliminary offering circular or final offering circular has been printed, that, in each such case, has included or is expected to include the subject Controlling Note or Non-Controlling Note, as the case may be, (ii) “Not Identified” means the subject Controlling Note or Non-Controlling Note, as the case may be, has not been securitized and no preliminary prospectus or final prospectus has been filed with the SEC nor has any preliminary offering circular or final offering circular been printed that identifies any future outside securitization that is expected to include the subject Controlling Note or Non-Controlling Note, and (iii) “Not Applicable” means the subject Controlling Note or Non-Controlling Note is not intended to be contributed to a future commercial mortgage securitization transaction. In the case of an outside securitization that has not closed, there is no assurance that such securitization will close. Under the column “Current Holder of Unsecuritized Note”, “—” means the subject Controlling Note or Non-Controlling Note is not an unsecuritized note and is currently held (or is expected to be held) by the securitization trust referenced under the “Current or Anticipated Holder of Securitized Note” column. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

13

| COLLATERAL OVERVIEW (continued) |

| (5) | Entity names have been abbreviated for presentation. |

”BCREI” means Barclays Capital Real Estate Inc.

”BMO” means Bank of Montreal.

“CREFI” means Citi Real Estate Funding Inc.

“GSBI” means Goldman Sachs Bank USA.

“GSMC” means Goldman Sachs Mortgage Company.

“JPMCB“ means JPMorgan Chase Bank, National Association.

“WFB” means Wells Fargo Bank, National Association.

| (6) | The subject whole loan is an AB whole loan or a Pari Passu-AB whole loan, and the Controlling Note as of the date hereof (as identified in the chart above) is a related subordinate note. Upon the occurrence of certain trigger events specified in the related Co-Lender Agreement, however, control will generally shift to a more senior note (or, if applicable, first to one more senior note and, following certain additional trigger events, to another more senior note) in the subject whole loan (each identified in the chart above as a “Control Shift Note”), which more senior note will thereafter be the Controlling Note. See “Description of the Mortgage Pool—The Whole Loans—The Yorkshire & Lexington Towers Pari Passu AB Whole Loan”, “—The 111 River Street Pari Passu-AB Whole Loan” and “—The 360 Rosemary Pari Passu-AB Whole Loan” in the Preliminary Prospectus for more information regarding the manner in which control shifts under each such whole loan. |

Previously Securitized Mortgaged Properties(1)

Mortgaged Property Name |

Mortgage Loan Seller |

City |

State |

Property Type |

Cut-off Date Balance / Allocated Cut-off Date Balance |

% of Initial Pool Balance |

Previous Securitization |

| Yorkshire Towers | BMO, SMC, CREFI | New York | New York | Multifamily | $51,635,220 | 8.2% | CSAIL 2017-CX10, UBSCM 2017-C5, UBSCM 2017-C6, CCUBS 2017-C1, UBSCM 2018-C8 |

| Cliffs Hotel and Spa | GSMC | Pismo Beach | California | Hospitality | $50,000,000 | 7.9% | MSBAM 2012-C6 |

| Brighton Towne Square | SMC | Brighton | Michigan | Mixed Use | $40,000,000 | 6.3% | COMM 2013-CR10 |

| One Wilshire | GSMC | Los Angeles | California | Office | $23,250,000 | 3.7% | COMM 2013-CR10 |

| League City Storage | SMC | League City | Texas | Self Storage | $18,725,000 | 3.0% | BANK 2019-BN20 |

| Lexington Towers | BMO, SMC, CREFI | New York | New York | Multifamily | $8,364,780 | 1.3% | CSAIL 2017-CX10, UBSCM 2017-C5, UBSCM 2017-C6, CCUBS 2017-C1, UBSCM 2018-C8 |

| 2 Riverfront Plaza | BMO | Newark | New Jersey | Office | $7,500,000 | 1.2% | LCCM 2017-LC26 |

| Creekside Plaza | GSMC | Shelby | North Carolina | Retail | $6,975,485 | 1.1% | GSMS 2013-GC13 |

| Southside Commons | GSMC | Florence | South Carolina | Retail | $5,164,542 | 0.8% | GSMS 2013-GC13 |

| Airport Road Self Storage | SMC | Rio Vista | California | Self Storage | $5,128,061 | 0.8% | JPMBB 2015-C28 |

| White Horse Commons | GSMC | Greenville | South Carolina | Retail | $4,741,991 | 0.7% | GSMS 2013-GC13 |

| Hillview Plaza | GSMC | Greer | South Carolina | Retail | $4,741,991 | 0.7% | GSMS 2013-GC13 |

| Southtowne Commons | GSMC | Salisbury | Maryland | Retail | $4,359,679 | 0.7% | WFRBS 2011-C2 |

| Piedmont Plaza | GSMC | Gaffney | South Carolina | Retail | $4,359,678 | 0.7% | WFRBS 2013-C11 |

| Tidewater Plaza | GSMC | Southport | North Carolina | Retail | $4,215,103 | 0.7% | WFRBS 2013-C11 |

| Boiling Springs Centre | GSMC | Boiling Springs | South Carolina | Retail | $4,017,521 | 0.6% | WFRBS 2013-C11 |

| Garber’s Crossing | GSMC | Harrisonburg | Virginia | Retail | $3,596,010 | 0.6% | WFRBS 2013-C11 |

| Morada Self Storage | SMC | Stockton | California | Self Storage | $2,725,403 | 0.4% | JPMBB 2015-C28 |

| Highway 88 Self Storage | SMC | Lockeford | California | Self Storage | $1,828,889 | 0.3% | JPMBB 2015-C28 |

| Beckman Road Industrial | SMC | Lodi | California | Industrial | $1,793,028 | 0.3% | JPMBB 2015-C28 |

| Highway 99 Self Storage | SMC | Galt | California | Self Storage | $1,506,144 | 0.2% | JPMBB 2015-C28 |

| Eight Mile Road Self Storage | SMC | Lodi | California | Self Storage | $1,004,096 | 0.2% | JPMBB 2015-C28 |

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged properties was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

14

| COLLATERAL OVERVIEW (continued) |

Property Types

| Property Type / Detail | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Wtd. Avg. Underwritten NCF DSCR(2)(3) | Wtd. Avg. Cut-off Date LTV Ratio(2)(3) | Wtd. Avg. Debt Yield on Underwritten NOI(2)(3) | |||||||||||

| Office | 12 | $241,555,691 | 38.1 | % | 2.06 | x | 58.1 | % | 10.1 | % | |||||||

| CBD | 6 | 135,976,815 | 21.5 | 2.06 | x | 59.2 | % | 10.1 | % | ||||||||

| Suburban | 4 | 71,328,876 | 11.3 | 1.68 | x | 62.3 | % | 10.2 | % | ||||||||

| CBD/Data Center | 1 | 23,250,000 | 3.7 | 3.37 | x | 42.6 | % | 9.6 | % | ||||||||

| Medical | 1 | 11,000,000 | 1.7 | 1.82 | x | 50.2 | % | 9.9 | % | ||||||||

| Retail | 48 | $99,082,667 | 15.6 | % | 1.89 | x | 57.6 | % | 10.7 | % | |||||||

| Shadow Anchored | 10 | 48,201,470 | 7.6 | 1.84 | x | 62.3 | % | 10.9 | % | ||||||||

| Single Tenant | 36 | 40,210,667 | 6.3 | 1.77 | x | 54.3 | % | 9.5 | % | ||||||||

| Anchored | 1 | 7,070,530 | 1.1 | 2.85 | x | 43.4 | % | 16.1 | % | ||||||||

| Unanchored | 1 | 3,600,000 | 0.6 | 1.91 | x | 59.0 | % | 10.8 | % | ||||||||

| Hospitality | 2 | $80,000,000 | 12.6 | % | 3.74 | x | 38.2 | % | 22.0 | % | |||||||

| Full Service | 2 | 80,000,000 | 12.6 | 3.74 | x | 38.2 | % | 22.0 | % | ||||||||

| Multifamily | 3 | $70,000,000 | 11.1 | % | 3.32 | x | 37.6 | % | 10.6 | % | |||||||

| High Rise | 2 | 60,000,000 | 9.5 | 3.61 | x | 33.3 | % | 11.1 | % | ||||||||

| Mid Rise | 1 | 10,000,000 | 1.6 | 1.58 | x | 63.3 | % | 7.6 | % | ||||||||

| Mixed Use | 4 | $60,450,000 | 9.5 | % | 1.67 | x | 59.5 | % | 10.0 | % | |||||||

| Office/Retail | 1 | 40,000,000 | 6.3 | 1.54 | x | 61.2 | % | 9.8 | % | ||||||||

| Office/Multifamily | 1 | 13,200,000 | 2.1 | 2.10 | x | 54.1 | % | 10.7 | % | ||||||||

| Multifamily/Retail | 2 | 7,250,000 | 1.1 | 1.59 | x | 59.7 | % | 9.5 | % | ||||||||

| Self Storage | 7 | $33,647,593 | 5.3 | % | 1.66 | x | 57.2 | % | 9.7 | % | |||||||

| Manufactured Housing | 9 | $32,000,000 | 5.1 | % | 1.60 | x | 57.0 | % | 9.9 | % | |||||||

| Industrial | 3 | $16,538,028 | 2.6 | % | 1.61 | x | 62.7 | % | 11.6 | % | |||||||

| Warehouse/Distribution | 1 | 9,170,000 | 1.4 | 1.58 | x | 70.0 | % | 12.7 | % | ||||||||

| Flex | 1 | 5,575,000 | 0.9 | 1.67 | x | 55.2 | % | 10.2 | % | ||||||||

| Manufacturing | 1 | 1,793,028 | 0.3 | 1.60 | x | 49.1 | % | 10.7 | % | ||||||||

| Total / Wtd. Avg. | 88 | $633,273,980 | 100.0 | % | 2.29 | x | 53.4 | % | 11.7 | % | |||||||

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (3) | See footnotes to the table entitled “Mortgage Pool Characteristics” above. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

15

| COLLATERAL OVERVIEW (continued) |

Geographic Distribution

Property Location | Number of Mortgaged Properties | Aggregate Cut-off Date Balance(1) | % of Initial Pool Balance(1) | Aggregate

| %

of Total | Underwritten

| %

of Total | ||||||||||||||

| New York | 8 | $154,100,000 | 24.3 | % | $1,427,650,000 | 32.0 | % | $59,520,917 | 27.1 | % | |||||||||||

| California | 11 | 140,585,622 | 22.2 | 1,271,750,000 | 28.5 | 61,719,969 | 28.1 | ||||||||||||||

| New Jersey | 5 | 68,600,000 | 10.8 | 791,600,000 | 17.8 | 45,282,613 | 20.6 | ||||||||||||||

| Michigan | 3 | 40,605,051 | 6.4 | 70,385,000 | 1.6 | 4,227,053 | 1.9 | ||||||||||||||

| District of Columbia | 1 | 40,000,000 | 6.3 | 132,500,000 | 3.0 | 7,630,397 | 3.5 | ||||||||||||||

| Texas | 6 | 31,340,016 | 4.9 | 57,690,000 | 1.3 | 2,982,395 | 1.4 | ||||||||||||||

| Georgia | 2 | 25,187,635 | 4.0 | 41,400,000 | 0.9 | 2,776,623 | 1.3 | ||||||||||||||

| South Carolina | 5 | 23,025,723 | 3.6 | 34,700,000 | 0.8 | 2,394,080 | 1.1 | ||||||||||||||

| Tennessee | 2 | 22,832,019 | 3.6 | 35,000,000 | 0.8 | 2,836,773 | 1.3 | ||||||||||||||

| Louisiana | 11 | 18,132,461 | 2.9 | 102,510,000 | 2.3 | 5,079,453 | 2.3 | ||||||||||||||

| Florida | 2 | 13,575,000 | 2.1 | 329,100,000 | 7.4 | 15,735,778 | 7.2 | ||||||||||||||

| Missouri | 2 | 11,900,000 | 1.9 | 17,120,000 | 0.4 | 1,413,988 | 0.6 | ||||||||||||||

| North Carolina | 2 | 11,190,588 | 1.8 | 16,800,000 | 0.4 | 1,131,964 | 0.5 | ||||||||||||||

| Pennsylvania | 3 | 10,250,000 | 1.6 | 17,180,000 | 0.4 | 1,057,671 | 0.5 | ||||||||||||||

| Illinois | 10 | 5,287,635 | 0.8 | 43,360,000 | 1.0 | 2,361,712 | 1.1 | ||||||||||||||

| Maryland | 1 | 4,359,679 | 0.7 | 6,500,000 | 0.1 | 368,995 | 0.2 | ||||||||||||||

| Virginia | 2 | 3,791,888 | 0.6 | 7,060,000 | 0.2 | 469,990 | 0.2 | ||||||||||||||

| Ohio | 3 | 2,573,899 | 0.4 | 7,675,000 | 0.2 | 403,533 | 0.2 | ||||||||||||||

| Wisconsin | 2 | 2,463,635 | 0.4 | 20,200,000 | 0.5 | 1,042,124 | 0.5 | ||||||||||||||

| Alabama | 2 | 2,112,517 | 0.3 | 17,530,000 | 0.4 | 877,336 | 0.4 | ||||||||||||||

| West Virginia | 1 | 552,372 | 0.1 | 4,550,000 | 0.1 | 236,431 | 0.1 | ||||||||||||||

| Kentucky | 1 | 296,505 | 0.0 | 2,480,000 | 0.1 | 112,645 | 0.1 | ||||||||||||||

| Maine | 1 | 234,796 | 0.0 | 1,900,000 | 0.0 | 100,079 | 0.0 | ||||||||||||||

| Indiana | 1 | 152,875 | 0.0 | 1,220,000 | 0.0 | 66,364 | 0.0 | ||||||||||||||

| Delaware | 1 | 124,063 | 0.0 | 1,060,000 | 0.0 | 59,523 | 0.0 | ||||||||||||||

| Total | 88 | $633,273,980 | 100.0 | % | $4,458,920,000 | 100.0 | % | $219,888,404 | 100.0 | % | |||||||||||

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values without any reduction for the pari passu companion loan(s). |

| (3) | For multi-property loans that do not have underwritten cash flow information reported on a property level basis, Underwritten NOI is allocated based on each respective property’s allocated loan amount. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, BMO Capital Markets Corp., Academy Securities, Inc., Siebert Williams Shank & Co., LLC or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

16

| COLLATERAL OVERVIEW (continued) |

| Distribution of Cut-off Date Balances | ||||

Range

of Cut-off |

Number

of |

Cut-off

Date |

%

of Initial | |

| 2,020,667 - 9,999,999 | 10 | $63,095,667 | 10.0 | % |

| 10,000,000 - 19,999,999 | 10 | 129,460,622 | 20.4 | |

| 20,000,000 - 29,999,999 | 4 | 87,762,000 | 13.9 | |

| 30,000,000 - 39,999,999 | 1 | 30,000,000 | 4.7 | |

| 40,000,000 - 49,999,999 | 4 | 162,955,691 | 25.7 | |

| 50,000,000 - 60,000,000 | 3 |

160,000,000 |

25.3 |

|

| Total | 32 | $633,273,980 | 100.0 | % |

| Distribution of UW NCF DSCRs(1) | ||||

Range of UW NCF DSCR (x) |

Number

of |

Cut-off

Date |

%

of Initial | |

| 1.31 - 1.49 | 4 | $33,100,667 | 5.2 | % |

| 1.50 - 1.99 | 17 | 353,933,313 | 55.9 | |

| 2.00 - 2.49 | 4 | 53,890,000 | 8.5 | |

| 2.50 - 2.99 | 1 | 13,100,000 | 2.1 | |

| 3.00 - 5.08 | 6 |

179,250,000 |

28.3 |

|

| Total | 32 | $633,273,980 | 100.0 | % |

| (1) See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” above. | ||||

| Distribution of Amortization Types(1)(2) | ||||

Amortization Type |

Number

of |

Cut-off