| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-262701-02 | ||

FREE WRITING PROSPECTUS

PRELIMINARY COLLATERAL TERM SHEET

STRICTLY CONFIDENTIAL

| FOR DISTRIBUTION TO QUALIFIED INSTITUTIONAL BUYERS (RULE 144A), INSTITUTIONAL ACCREDITED INVESTORS (IAIs) AND REGULATION S BUYERS ONLY |

YL

Subordinate Loan

Bank of Montreal Citi

Real Estate Funding Inc.

As Originators and Loan Sellers

April 18, 2022

|

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-262701) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., BMO Capital Markets Corp. or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

This Collateral Term Sheet (this “Term Sheet”) is a confidential document. Any reproduction or distribution of this Term Sheet, in whole or in part, and any disclosure of its contents or use of any information herein for any purpose other than considering an investment in all or a portion of the YL Mortgage Loan (or any certificates representing an interest therein) described in this Term Sheet is strictly prohibited.

Nothing in this Term Sheet constitutes an offer of securities for sale in the United States or any other jurisdiction. Neither this Term Sheet nor anything contained in this Term Sheet forms the basis of any contract or commitment whatsoever. This Term Sheet has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any of the assets described in this Term Sheet. The information contained in this Term Sheet is preliminary as of the date of this Term Sheet, supersedes any previous version of such information delivered to you and will be superseded by any such information subsequently delivered. This Term Sheet is subject to change, completion, supplement and amendment from time to time.

This Term Sheet contains certain tables and other statistical analyses (the “Computational Materials”). Numerous assumptions were used in preparing the Computational Materials, which may or may not be stated in this Term Sheet. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. These Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountants and other advisors as to the legal, tax, business, financial and related aspects of a purchase of the assets described in this Term Sheet. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the YL Mortgage Loan, including the YL Subordinate Loan, will occur at rates higher or lower than the rates shown in the Computational Materials.

Certain information in this Term Sheet is based on information set forth in third-party reports or other third-party sources or has been provided by the Borrower and/or its affiliates. Appraisals, market studies, environmental, accounting engineering, financial and other reports, studies or surveys prepared or produced by third party appraisal firms and/or other firms or information provided by the Borrower or its affiliates to the extent included in this Term Sheet, are for informational purposes only and should not be relied upon as indicators of the value or the future performance of the YL Mortgage Loan (including the YL Subordinate Loan) or the Property or for any other purpose. None of the Originators or Loan Sellers have participated in the preparation of any of these materials, nor have the Originators or Loan Sellers independently verified the information contained therein. You may not rely upon the conclusions or other data set forth in any such underwriting, financial, appraisal or other reports, studies or surveys. None of the Originators or Loan Sellers or any of their respective affiliates makes any representation as to the accuracy or completeness thereof or the reasonableness of any assumptions or other statements set forth therein.

This Term Sheet contains forward-looking statements. These forward looking statements are found in this Term Sheet, including certain of the tables. Forward-looking statements are also found elsewhere in this Term Sheet and include words like “expects”, “intends”, “anticipates”, “estimates” and other similar words. These statements intend to convey our projections or expectations as of the date of this Term Sheet. These statements are subject to certain risks and uncertainties that could cause the success of collections and the actual cash flow generated to differ materially from the information set forth in this Term Sheet. While such information reflects projections prepared in good faith based upon methods and data that are believed to be reasonable and accurate as of the dates thereof, the Depositor undertakes no obligation to revise these forward-looking statements to reflect subsequent events or circumstances. Individuals should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecasted periods, which reflect the Depositor's view only as of the date of this Term Sheet.

Capitalized terms used herein may be defined below or above in this Term Sheet. Capitalized terms used in this Term Sheet but not separately defined herein have the meanings assigned to them in the Mortgage Loan Documents.

Notwithstanding anything to the contrary in this Term Sheet, as of the date of this Term Sheet, the YL Mortgage Loan has not been originated. Therefore, the description of the terms of the YL Mortgage Loan in this Term Sheet is based on their respective expected terms if and when the YL Mortgage Loan is originated by the Originators. As a result, the terms of the YL Mortgage Loan and the descriptions thereof in this Term Sheet are subject to revision. None of the Originators, any of their affiliates, or any other person is obligated to make the YL Mortgage Loan and there can be no assurance that the YL Mortgage Loan will be made.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

2

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

3

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

4

| Table of Contents |

| Section 1: | Executive Summary |

| Section 2: | Summary of Mortgage Loan Terms |

| Section 3: | Property Overview |

| Section 4: | Market Overview |

| Section 5: | Property Historical and Underwritten Cash Flows |

| Section 6: | Sponsorship Overview |

| Section 7: | Contacts |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

5

| Section 1: Executive Summary |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

6

| Executive Summary | YL Subordinate Loan |

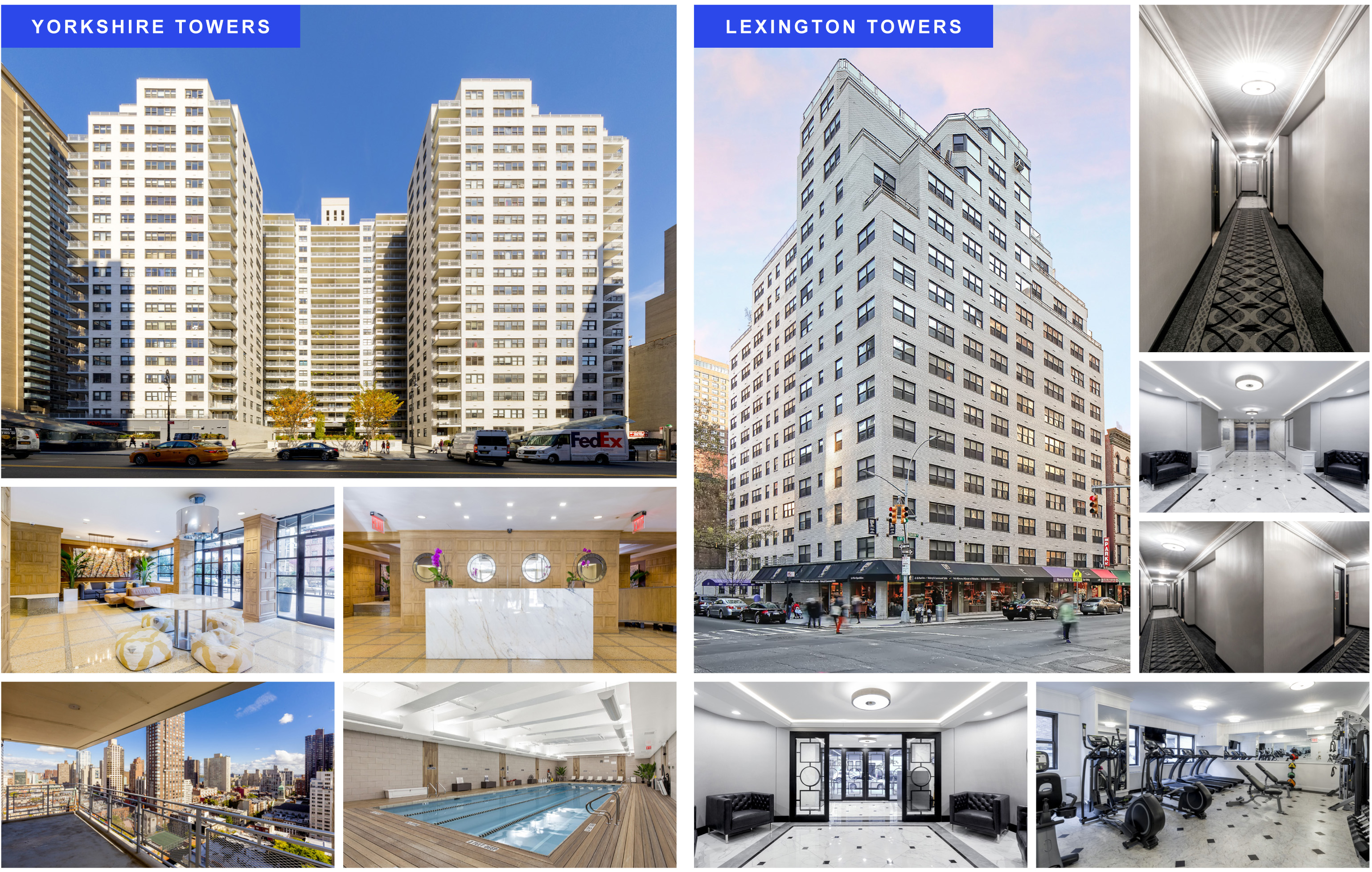

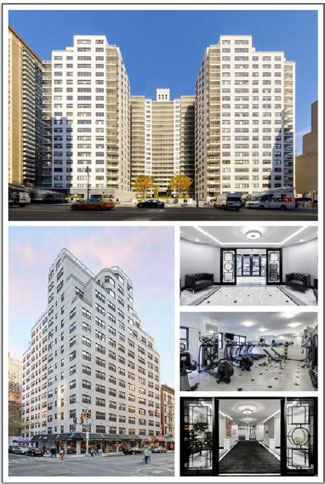

The YL Subordinate Loan is a 5-year interest-only fixed rate subordinate mortgage loan with an initial principal balance of $237,100,000 (the “YL Subordinate Loan”). The YL Subordinate Loan is part of a whole mortgage loan structure with an aggregate initial principal balance of $539,500,000 (the “YL Mortgage Loan” or the “Mortgage Loan”) consisting of the YL Subordinate Loan and one or more YL Senior Loans (as defined below). The YL Mortgage Loan will be primarily secured by, among other things, a first priority mortgage on the Borrowers’ fee simple interests in a single property comprised of two multifamily residential buildings containing an aggregate of 808 multifamily units and 12 commercial and retail units located in New York, New York, known as Yorkshire & Lexington Towers (the “Property”).

| ● | The YL Mortgage Loan is expected to be originated on or about April [_], 2022 (the “Origination Date”) as follows, (i) Bank of Montreal (“BMO”) and Citi Real Estate Funding Inc. (“CREFI”) are expected to originate the YL Subordinate Loan, and (ii) BMO, CREFI and Starwood Mortgage Capital LLC (“SMC” and together with BMO and CREFI, the “Originators” and, together with their respective successors and assigns, the “Mortgage Lender”) are expected to originate the YL Senior Loans, each in favor of certain affiliates of Meyer Chetrit and Laurence Gluck (collectively, the “Sponsor” or the “Borrower Sponsor”). The Borrowers (as defined herein) consist of multiple special purpose entities that own the Property as tenants in common (see “SUMMARY OF MORTGAGE LOAN TERMS—The Borrowers” in this Term Sheet). In addition, multiple mezzanine loans with an aggregate original principal balance of $174,500,000 (collectively, the “Mezzanine Loans”, and together with the Mortgage Loan, the “Total Debt”) are expected to be originated by a third party, which will be secured by the equity interests in the Borrower. Proceeds of the Total Debt are expected to be used to refinance existing debt on the Property, fund upfront reserves, pay closing costs and return equity to the Borrower Sponsor. |

| ● | The YL Subordinate Loan will be part of the YL Mortgage Loan (in the aggregate initial principal amount of $539,500,000), which will be comprised of: (i) the YL Subordinate Loan, which is evidenced by two pari passu junior notes in the aggregate initial principal amount of $237,100,000 (the “Junior Notes”), and (ii) multiple senior loans in the aggregate principal amount of $302,400,000 (the “YL Senior Loans”), which are evidenced by multiple senior pari passu promissory notes in the aggregate initial principal amount of $302,400,000 (the “Senior Notes”). The respective rights and obligations of the holder(s) of the YL Subordinate Loan and the holder(s) of the YL Senior Loans are governed by the terms and provisions of a co-lender agreement entered into in April 2022 (the “Co-Lender Agreement”). The Junior Notes are generally subordinate in right of payment to the Senior Notes. The Mortgage Loan will be secured by, among other things, a first lien mortgage on the Borrowers’ fee simple interests in the Property. |

| ● | The Junior Notes, which are pari passu in right of payment with each other, will be evidenced by Note B-1 in the initial principal amount of $158,066,667 in favor of BMO and Note B-2 in the initial principal amount of $79,033,333 in favor of CREFI. The Senior Notes, which are pari passu in right of payment with each other, will consist of multiple separate promissory notes in favor of BMO, CREFI and SMC, respectively. |

| ● | The holder(s) of the YL Subordinate Loan and the YL Senior Loans are expected to into an agreement between noteholders (the “Co-Lender Agreement”), that governs the relative rights and obligations of the holders of, and the allocation of payments to, the YL Senior Loans and the YL Subordinate Loan. The Co-Lender Agreement will generally provide, among other things, that: (i) the entire Mortgage Loan will be serviced and administered pursuant to the terms of a lead pooling and servicing Agreement, but subject to the terms of the Co-Lender Agreement; (ii) the Junior Notes are generally subordinate in right of payment to the Senior Notes and expenses and losses relating to the Mortgage Loan and the Property will be allocated first to the Junior Notes prior to being allocated to the Senior Notes, and will be allocated among the Senior Notes on a pro rata and pari passu basis; and (iii) the Controlling Note Holder will be the holder of Note B-1. |

| ● | Notwithstanding anything to the contrary in this Term Sheet, as of the date of this Term Sheet, the YL Mortgage Loan has not been originated. Therefore, the description of the terms of the YL Mortgage Loan in this Term Sheet is based on their respective expected terms if and when the YL Mortgage Loan is originated by the Originators. As a result, the terms of the YL Mortgage Loan and the descriptions thereof in this Term Sheet are subject to revision. None of the Originators, any of their affiliates, or any other person is obligated to make the YL Mortgage Loan and there can be no assurance that the YL Mortgage Loan will be made. |

Experienced Sponsorship

| ● | Meyer Chetrit is one of the controllers of The Chetrit Group. The Chetrit Group is an experienced, privately held New York City real estate development firm controlled by two brothers: Joseph and Meyer Chetrit. The ownership interests in the Borrower are indirectly 50% owned by Meyer Chetrit and 50% owned by Joseph Chetrit, who jointly control the Borrower. The Chetrit Group, which is headquartered in Manhattan, has ownership interests in over 14 million square feet (“SF”) of commercial and residential real estate across the United States, including New York, Chicago, Miami, and Los Angeles, as well as internationally. |

| ● | Laurence Gluck is the founder of Stellar Management, a real estate development and management firm founded in 1985. Based in New York City, Stellar Management owns and manages a portfolio of over 13,000 apartments in 100 buildings located across New York City and over three million SF of office space. Prior to founding Stellar Management, Laurence Gluck served as a real estate attorney at Proskauer, Rose, Goetz & d and later as a partner at Dreyer & Traub. Laurence Gluck is also a member of the Board of Governors of the Real Estate Board of New York. |

| ● | The Borrower is indirectly controlled and managed by non-member managers, CFSM E 86 Manager LLC and CFSM E 88 Manager LLC, respectively, each of which is directly controlled and managed (acting unanimously as managers) by Jacob Chetrit and the Amended and Restated 2013 LG Revocable Trust. |

| ● | Meyer Chetrit & the Gluck Family Trust (collectively, the “Guarantors”) will provide a non-recourse carveout guaranty and a carry guaranty, subject to the terms and conditions set forth in the Mortgage Loan Agreement. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

7

| Executive Summary | YL Subordinate Loan |

Sponsor’s Renovation Plan

| ● | The Sponsor is currently renovating the residential units at the Property. Renovations will consist of major renovation units and light renovation units. The Sponsor has executed the major renovation strategy on 41 units to date, which have been combined into a total of 23 units. The Sponsor is projecting an average cost of $36,923 per unit for the remaining 26 major renovation units, which will be combined into 12 total units. 16 of the 26 units projected to receive major renovations are rent stabilized units, all of which are vacant. The remaining 10 units that are projected to receive major renovations are market rate units. The Sponsor has executed the light renovation strategy on 16 units to date. The Sponsor is projecting an average cost of $19,375 per unit for the remaining 284 light renovation units. All units that are projected to receive light renovations are market rate units. |

Loan Structure

| ● | The Mortgage Loan is structured with upfront Unit Upgrade Reserves of $6.5 million to help facilitate the Sponsor’s renovation plan for the Property. |

| ● | The Mortgage Loan is structured with upfront Supplemental Income Reserves of $5.9 million to enhance debt service coverage during the renovation of the Property, until the Property has achieved stabilization. In addition, the Guarantors are required to provide a carry guaranty acceptable to Lender until a Debt Yield (without taking into account any disbursement of Supplemental Income Reserve funds) of at least 5.0% for the Loan, as the case may be, has been achieved for one calendar quarter. |

Property Overview

| ● | Yorkshire & Lexington Towers (the “Property”) consists of two buildings comprised of 808 residential units totaling 730,829 SF, 204 parking spaces totaling 41,886 SF, six commercial and retail units totaling 29,451 SF at the Yorkshire building, and six commercial and retail units totaling 9,998 SF at the Lexington Towers building. The commercial tenants at the Property have a remaining weighted average lease term (“WALT”) based on underwritten gross rent (“UW Gross Rent”) of 7.9 years. The Property is located in the Upper East Side neighborhood and is well positioned, located approximately 200 feet from the Lexington Avenue/East 86th Street subway station with access to the 4, 5, and 6 subway lines. |

| ● | The Property was built between 1963 and 1964 and the residential portion of the Property features a range of studio, 1 bedroom, 2 bedrooms, 3 bedrooms, and 4 bedrooms. Of the 808 residential units, 305 of the units are rent stabilized. The Property’s residential units all feature hardwood flooring, full kitchen appliances, and many units include a private balcony. Bathrooms feature marble flooring in the renovated units and vinyl tile in the unrenovated units. Renovated units feature marble countertop kitchens, stainless steel appliances including a refrigerator, dishwasher, microwave, and gas-fired stove and oven, and washer and dryer. Community spaces include 24-hour attended lobby lounge, health club and fitness center, children’s playroom, and outdoor seating area. |

Mortgage Loan Metrics

| ● | The Mortgage Loan has an original principal balance of $539,500,000 ($664 per SF) and exhibits the following credit metrics: |

| – | Based on the as-is appraised value of $954,000,000 (the “Property As-Is Appraised Value”), prepared by Cushman & Wakefield, Inc. (the “Appraiser”) as of January 20, 2022, the Mortgage Loan represents a 56.6% as-is LTV. Based on the as-stabilized appraised value as of February 1, 2025 for the Yorkshire building and February 1, 2024 for the Lexington Towers building, of $1,057,000,000 (the “Property As-Stabilized Appraised Value”), which assumes that the $6.5 million renovation of the Property has been completed, the Mortgage Loan represents a 51.0% as-stabilized LTV. |

| – | Based on the as-is underwritten net operating income (“Property As-Is UW NOI”) of approximately $35.4 million (which includes the related upfront Supplement Income Reserve of $5.9 million), the Mortgage Loan represents a 6.6% debt yield . The debt yield for the Mortgage Loan based on Property As-Is UW NOI excluding such $5.9 million reserve is 5.5% . Based on the as-stabilized underwritten net operating income (“Property As-Stabilized UW NOI”) of approximately $35.4 million, the Mortgage Loan represents a 6.6% debt yield a |

| – | Based on the as-is underwritten net cash flow (“Property As-Is UW NCF”) of approximately $35.4 million (which includes the related upfront Supplement Income Reserve of $5.9 million), the Mortgage Loan represents a 2.13x DSCR. The DSCR for the Mortgage Loan based on Property As-Is UW NCF excluding such $5.9 million reserve is 1.77x. Based on the as-stabilized underwritten net cash flow (“Property As-Stabilized UW NCF”) of approximately $35.4 million, the Mortgage Loan represents a 2.13x DSCR. |

Total Debt Metrics

| ● | The Total Debt has an original principal balance of $714,000,000 ($879 per SF) and exhibits the following credit metrics: |

| – | Based on the Property As-Is Appraised Value of $954,000,000, the Total Debt represents a 74.8% as-is LTV. Based on the Property As-Stabilized Appraised Value of $1,057,000,000, the Total Debt represents a 67.5% as-stabilized LTV. |

| – | Based on the Property As-Is UW NOI of approximately $35.4 million (which includes the upfront Supplement Income Reserve of $5.9 million), the Total Debt represents a 5.0% debt yield. The debt yield for the Total Debt based on Property As-Is UW NOI excluding such $5.9 million reserve is 4.1%. Based on the As-Stabilized Property UW NOI of approximately $35.4 million the Total Debt represents a 5.0% debt yield. |

| – | Based on the Property As-Is UW NCF of approximately $35.4 million (which includes the upfront Supplement Income Reserve of $5.9 million), the Total Debt represents a 1.20x DSCR. The DSCR for the Total Debt based on Property As-Is UW NCF excluding such $5.9 million reserve is 1.00x. Based on the Property As-Stabilized UW NCF of approximately $35.4 million, the Total Debt represents a 1.20x DSCR. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

8

| Executive Summary | YL Subordinate Loan |

Leasing Activity and COVID-19 Rent Collections

| ● | As of January 31, 2022, the residential portion of the Property was 96.4% occupied and the parking, commercial, and retail portions of the Property were 98.9% occupied based on SF. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

9

| Sources and Uses | YL Subordinate Loan |

| ● | Proceeds of the Mortgage Loan and the Mezzanine Loan are expected to be used to refinance existing debt on the Property, fund upfront reserves, pay closing costs and return equity to the Sponsor. The estimated sources and uses for the Total Debt are detailed below. |

| Total Debt Sources and Uses | ||||||

| Sources | $ Amount | % of Sources | Uses | $ Amount | % of Uses | |

| Mortgage Loan Amount | $539,500,000 | 75.6% | Repayment of Existing Debt | $550,000,000 | 77.0% | |

| Mezzanine Loan Amount | $174,500,000 | 24.4% | Defeasance Cost | $3,887,160 | 0.5% | |

| Closing Costs | $21,885,000 | 3.1% | ||||

| Origination Fee | $5,355,000 | 0.8% | ||||

| Rate Buydown | $38,917,035 | 5.5% | ||||

| Supplemental Income Reserve | $5,900,000 | 0.8% | ||||

| Unit Upgrade Reserve | $6,500,000 | 0.9% | ||||

| Upfront Rollover Reserve | $1,000,000 | 0.1% | ||||

| Upfront Replacement Reserve | $1,100,000 | 0.2% | ||||

| Return of Equity | $131,332,840 | 18.4% | ||||

| Total Sources | $714,000,000 | 100.0% | Total Uses | $714,000,000 | 100.0% | |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

10

| Capital Structure | YL Subordinate Loan |

| ● | Based on a Total Debt amount of $714.0 million, the LTV, UW NOI Debt Yield and UW NCF DSCR as of the Origination Date are set forth below. |

| As-Is | As-Stabilized | |||||||

| Tranche | % of Total Debt(1) | Cumulative Basis PSF(2) | Cumulative LTV based on the Appraised Value(3) | Cumulative UW NOI Debt Yield(4) |

Cumulative UW NCF DSCR(5) | Cumulative LTV based on the Appraised Value(3) | Cumulative UW NOI Debt Yield(4) |

Cumulative UW NCF DSCR(5) |

Senior Notes (YL Senior Loans) $302,400,000 |

42.4% | $372 | 31.7% | 11.7% | 3.73x | 28.6% | 11.7% | 3.73x |

Junior Notes (YL Subordinate Loan)(1) $237,100,000 |

33.2% | $664 | 56.6% | 6.6% | 2.13x | 51.0% | 6.6% | 2.13x |

Mezzanine Loan A(1) $80,000,000 |

11.2% | $763 | 64.9% | 5.7% | 1.66x | 58.6% | 5.7% | 1.66x |

Mezzanine Loan B(1) $23,100,000 |

3.2% | $791 | 67.4% | 5.5% | 1.54x | 60.8% | 5.5% | 1.54x |

Mezzanine Loan C(1) $71,400,000 |

10.0% | $891 | 74.8% | 5.0% | 1.20x | 67.5% | 5.0% | 1.20x |

| $207,500,000 Implied Equity(3) |

NAP | NAP | NAP | NAP | NAP | NAP | NAP | NAP |

| Note: Information in the chart above is based on the indicated level of debt together with all debt pari passu with, or senior to, such level of debt. | |

| (1) | The Mortgage Loan is evidenced by the Senior Notes and the Junior Notes. The Junior Notes evidence the YL Subordinate Loan. The Senior Notes evidence the YL Senior Loans. The Senior Notes are, collectively, senior in right of payment to the Junior Notes (to the extent described in this Term Sheet and the Co-Lender Agreement). |

| (2) | Based on 812,164 SF of the residential and commercial space. |

| (3) | “As-Is” is based on the Property As-Is Appraised Value of $954,000,000. “As-Stabilized” is based on the Property As-Stabilized Appraised Value of $1,057,000,000. |

| (4) | “As-Is” is based on the Property As-Is UW NOI of $35,372,797, which includes credit for the upfront Supplemental Income Reserve. “As-Stabilized” is based on the Property As-Stabilized UW NOI of $35,372,797. The Mortgage Loan As-Is Cumulative UW NOI Debt Yield and Total Debt As-Is Cumulative UW NOI Debt Yield excluding credit for the upfront Supplemental Income Reserve are 5.5% and 4.1%, respectively. |

| (5) | “As-Is” based on the Property As-Is UW NCF of $35,372,797 which includes credit for the upfront Supplemental Income Reserve. “As-Stabilized” based on the Property As-Stabilized UW NCF of $35,372,797. The Mortgage Loan As-Is Cumulative UW NCF DSCR and Total Debt As-Is Cumulative UW NCF DSCR excluding credit for the upfront Supplemental Income Reserve are 1.77x and 1.00x, respectively. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

11

| Section 3: Summary of Mortgage Loan Terms |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

12

| Summary of Mortgage Loan Terms | YL Subordinate Loan |

| Notwithstanding anything to the contrary in this Term Sheet, as of the date of this Term Sheet, the YL Mortgage Loan has not been originated. Therefore, the description of the terms of the YL Mortgage Loan (including the YL Subordinate Loan) in this Term Sheet is based on their respective expected terms if and when the YL Mortgage Loan is originated by the Originators. As a result, the terms of the YL Mortgage Loan (including the YL Subordinate Loan) and the descriptions thereof in this Term Sheet are subject to revision. None of the Originators, any of their affiliates, or any other person is obligated to make the YL Mortgage Loan and there can be no assurance that the YL Mortgage Loan will be made. | |

| Original Mortgage Loan Balance: | $539,500,000 |

| Mortgage Loan: | The Mortgage Loan is evidenced by [twelve] pari passu promissory notes, in the aggregate principal amount of $539,500,000 |

| Mortgage Loan Structure: | The Mortgage Loan is expected to be part of the split loan structure that is comprised of (i) the YL Subordinate Loan and (ii) the YL Senior Loans. |

| Mortgage Loan Collateral: | The Mortgage Loan is secured by, among other things, a first priority mortgage on the Borrower’s fee simple interests in two multifamily buildings containing 808 multifamily units and 12 commercial and retail units located in New York, New York. |

| Mortgage Loan Term: | 5 years. |

| Payment Date: | The 6th day of each calendar month, provided, that if such day is not a Business Day, then amounts due on such date will be due on the immediately preceding Business Day (each, a “Payment Date”). |

| Interest Accrual Period: | The period commencing on and including the sixth (6th) day of the calendar month prior to such Payment Date and ending on and including the fifth (5th) day of the calendar month in which such Payment Date occurs (the “Interest Accrual Period”). |

| Interest Accrual Method: | Actual/360 |

| Maturity Date: | April 6th, 2027 (the “Maturity Date”). |

| Interest Rate: | A fixed rate of [_____]% per annum. |

| Amortization: | Interest Only. |

| Borrowers: | CF E 88 LLC, SM E 88 LLC, CF E 86 LLC, SM E 86 LLC and LSG E 86 LLC, as tenants in common, each of which is a Delaware limited liability company. |

| Non-Recourse Carveout Guarantors: | Meyer Chetrit & the Gluck Family Trust. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

13

| Summary of Mortgage Loan Terms | YL Subordinate Loan |

| Upfront Reserves: |

The following reserves were funded at the origination of the Mortgage Loan:

● Required Repairs: $8,030 representing 110% of the estimated costs for required repairs to the Property.

● Real Estate Taxes: An estimated $2,589,753 for real estate taxes coming due in the next 12 months.

● Insurance: An estimated $116,560 for insurance premiums coming due in the next 12 months.

● Replacement Reserve: $1,100,000 representing approximately five years’ collection of $250 per unit.

● Rollover Reserve: $1,000,000 representing five years’ collection of $1.00 PSF on the 81,335 square feet of Commercial Space.

● Unit Upgrade: $6,500,000 representing the estimated costs to complete the Borrower’s renovation plan at the Property.

● Supplemental Income Reserve: $5,900,000 for the projected shortfall between the underwritten net cash flow and the cash flow required to achieve a 5.00% debt yield.

|

| Ongoing Reserves: |

The following reserves will be funded on a monthly (or other) basis as indicated below:

● Real Estate Tax Reserve: On each Payment Date, the Borrower is required to deposit 1/12th of the Taxes that Lender estimates will be payable during the next ensuing twelve (12) months in order to accumulate with Lender sufficient funds to pay all such Taxes at least thirty (30) days prior to their respective due dates.

● Insurance Reserve: On each Payment Date, the Borrower is required to deposit 1/12th of an amount which would be sufficient to pay insurance premiums for the next ensuing 12 months, provided that such monthly deposit will be waived so long as the Borrower maintains a blanket or umbrella policy approved by Lender in its sole discretion and provides Lender with evidence of renewal of such policy and evidence of payment of the insurance premiums.

● Supplemental Income Reserve: Guarantors are required to provide a carry guaranty acceptable to Lender until a Debt Yield of at least 5.00% has been achieved (without taking into account any disbursement of Supplemental Income Reserve funds) for one calendar quarter, provided no Event of Default then exists (the “Stabilization Event”). On a quarterly basis after year one of the Loan term, if Lender, in its reasonable discretion, determines that additional deposits to the Supplemental Income Reserve are required to achieve a Debt Yield of 5.00% for the following (12) months, Borrower will be required to make such additional deposits to the Supplemental Income Reserve within fifteen (15) business days’ notice, which obligation will be guaranteed by Guarantors pursuant to the Carry Guaranty (“Supplemental Income Reserve True Up”). Notwithstanding the foregoing, such Carry Guaranty will be limited to an amount that results in the difference between (x) the Stabilized NOI that results in a 5.00% Debt Yield and (y) the Actual Net Operating Income (based on Trailing 3 Month Annualized Income) |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

14

| Summary of Mortgage Loan Terms | YL Subordinate Loan |

| Excess Cash Flow: On each Payment Date during the continuance of a Cash Trap Period (as defined below), Mortgage Lender is required to reserve any excess cash flow after payment of other Mortgage Loan obligations (as described in the Mortgage Loan documents). | |

| Prepayment: | From the end of the Lock Out Period through the beginning of the Open Period, Borrower may defease the Loan in whole, upon 30 days written notice to Lender, by (a) depositing an amount sufficient to purchase U.S. Treasury securities whose cash flows are equal to and occur on or before the successive remaining scheduled interest and principal payment dates required under the Loan through the Lock Out Date, including the balloon payment due on the Maturity Date; (b) granting Lender a perfected first priority security interest in the securities with an opinion of counsel to such effect; and (c) paying all direct, customary costs incurred in such transfer...During the last 4 months of Loan term (the “Open Period”), prepayment, in whole, is permitted without premium.

During the last 4 months of Loan term (the “Open Period”), prepayment, in whole, is permitted without premium.

|

| Cash Management: | The Mortgage Loan is subject to a soft/hard lockbox with in-place cash management. The Borrower is required to deposit all rent into the Soft Lockbox (the “Restricted Account”) within 3 business days of receipt. All commercial tenants deposit rents directly into the Soft Lockbox. All amounts on deposit in the Restricted Account will be transferred to an account designated by Lender (the “Cash Management Account”), which amounts will be disbursed as follows (y) the monthly Loan payments required under the Loan Documents (including, but not limited to, mortgage debt service payments, reserve payments, and mezzanine loan payments) will be made from the Cash Management Account, and (z) (i) absent the existence of a Cash Trap Period, any remaining amounts on deposit in the Cash Management Account (the “Excess Cash Flow”) will be transferred to an account designated by Borrower and (ii) during the continuance of a Cash Trap Period , all Excess Cash Flow will be retained in an account controlled by Lender (the “Excess Cash Flow Reserve”) as additional collateral for the Loan, until such time as the Cash Trap Period has been terminated. |

Cash Trap Period:

|

A period (a) commencing upon: (i) the occurrence of any Event of Default; (ii) any bankruptcy action by or against Borrower, Principal, Guarantor or Manager has occurred; (iii) the failure by Borrower, after Stabilization, to maintain a Debt Yield of at least 4.25%; or (iv) a Mezzanine Loan Default shall have occurred and (b) have terminated, if ever: (i) in the case of the foregoing clause (a)(i), Lender accepts a cure of the Event of Default giving rise to such Cash Trap Period and no other Event of Default has occurred which is continuing (provided that no other Cash Trap Period is then continuing); (ii) in the case of a bankruptcy action by or against Manager only, if Borrower replaces the Manager with a Qualified Manager under a Replacement Management Agreement (and no other Cash Trap Period is then continuing); (iii) in the case of the foregoing clause (a)(iii), for one (1) calendar quarter since the commencement of the existing Cash Trap Period, the Debt Yield is equal to or greater than [__]% (tested as of the last day of each such calendar quarter) (and no other Cash Trap Period is then continuing), or (iv) as in the case of clause (a)(iv) above, Mezzanine Lender accepts a cure of the Mezzanine Loan Default giving rise to such Cash Trap Period (and no other Cash Trap Period is then continuing). |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

15

| Summary of Mortgage Loan Terms | YL Subordinate Loan |

Permitted Transfers and Assumptions:

|

Without the prior written consent of the Mortgage Lender, neither the Borrower nor any other Restricted Party may (i) sell, convey, mortgage, grant, bargain, encumber, pledge, assign, grant options with respect to, or otherwise transfer or dispose of the Property or any part thereof, or any interest therein, (ii) permit a sale or pledge of any interest in a Restricted Party, (iii) enter into or subject the Property to a PACE Loan or (iv) transfer any interest in the Tenant in Common Agreement (any of the actions in the foregoing clauses (i), (ii), (iii) or (iv), a “Transfer”), other than Permitted Transfers and certain transfers in connection with the Mezzanine Loan, as more fully described in the Mortgage Loan Documents. In addition, subject to the terms and conditions of the Mortgage Loan Agreement, the certain equity transfers are permitted without the Mortgage Lender’s consent, including, without limitation: (i) direct or indirect interests in the Borrower among the Sponsor and any Sponsor Controlled Parties; (ii) not more than 49% of the direct or indirect stock, general partnership interests, the limited partnership interest, the managing member interests or non-managing member interest in the Borrower; (iii) the sale, transfer or issuance of stock in any Restricted Party so long as such stock is listed on the New York Stock Exchange or another nationally recognized stock exchange; (iv) direct or indirect interests in the Borrower for estate planning purposes by any Sponsor to the spouse, child, parent, grandparent, grandchild, niece, nephew, aunt or uncle of such Sponsor, or to a trust for the benefit of such Sponsor or for the benefit of the spouse, child, parent, grandparent, grandchild, niece, nephew, aunt or uncle of such Sponsor; or (v) not more than 75% of the direct or indirect stock, general partnership interests, the limited partnership interest, the managing member interests or non-managing member interest in the Stellar Borrower.

“Restricted Party” means, collectively (a) Borrower, Principal, Guarantor and any Affiliated Manager, and (b) any shareholder, partner, member, non-member manager, direct or indirect legal or beneficial owner, agent or employee of, Borrower, Principal, Guarantor, any Affiliated Manager or any non-member manager, provided that “Restricted Party” shall not include any of the foregoing Persons or any Person if such Person is a publicly traded company. For avoidance of doubt, for the purposes of this definition Restricted Party, “Borrower” means any tenant in common entity comprising Borrower.

“Sponsor(s)” means [_________, an individual].

“Sponsor Controlled Party” means an entity Controlled by the Sponsor(s).

“Stellar Borrower” means [___________________].

|

Subordinate Debt:

|

Subordinate financing is not permitted. Notwithstanding the foregoing, the Borrower is permitted to incur unsecured trade and operational debt in the ordinary course of owning and operating the Property under certain conditions and limitations to be set forth in the Mortgage Loan Documents, including, without limitation, that the same not exceed, in the aggregate, 2.0% of the outstanding principal amount of the Mortgage Loan. |

| Mezzanine Debt: | Two mezzanine loans with an aggregate original principal amount of $174,500,000 will be originated by one or more third parties concurrently with the Mortgage Loan. The mezzanine loans will be secured by the mezzanine borrower’s equity interest in the Borrowers. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

16

Section 5: Property Overview

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

17

| Property Overview | YL Subordinate Loan |

The Mortgage Loan is secured by the Borrowers’ fee simple interests in a single Property comprised of two residential buildings totaling 808 units located in the Upper East Side of New York.

| ● | The Property consists of two buildings comprised of 808 residential units totaling 730,829 SF, 204 parking spaces totaling 41,886 SF, six commercial and retail units totaling 29,451 SF at the Yorkshire building, and six commercial and retail units totaling 9,998 SF at the Lexington Towers building. The commercial tenants at the Property have a remaining weighted average lease term (“WALT”) of 7.9 years. The Property is located in the Upper East Side neighborhood and is well positioned, located approximately 200 feet from the Lexington Avenue/East 86th Street subway station with access to the 4, 5, and 6 subway lines. |

| ● | The Property was built between 1963 and 1964 and the residential portion of the Property features a range of studio, 1 bedroom, 2 bedrooms, 3 bedrooms, and 4 bedrooms. Of the 808 residential units, 305 of the units are rent stabilized. The Property’s residential units all feature hardwood flooring, full kitchen appliances, and many units include a private balcony. Bathrooms feature marble flooring in the renovated units and vinyl tile in the unrenovated units. Renovated units feature marble countertop kitchens, stainless steel appliances including a refrigerator, dishwasher, microwave, and gas-fired stove and oven, and washer and dryer. Community spaces include 24-hour attended lobby lounge, health club and fitness center, children’s playroom, and outdoor seating area. |

| ● | The Property has exhibited strong occupancy over the past five years, with an average occupancy of 92% since 2017. The following table shows the historical occupancy of the Property: |

| 2017(1) | 2018(1) | 2019(2) | 2020(2) | 2021(2) | |

| Property | 87% | 94% | 90% | 90% | 95% |

| (1) | Source: Trepp. |

| (2) | Source: Borrower’s Occupancy Report |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

18

| Property Overview | YL Subordinate Loan |

| Yorkshire & Lexington Property(1) | |||

| Property Name | Yorkshire & Lexington Towers | No. of Units | 808(2) |

| Address | 160 East 88th Street & 305 East 86th Street | Unit of Measure | Units |

| City | New York | No. of Properties | 1 |

| State | NY | No. of Buildings | 2 |

| Zip | 10028 | No. of Stories | Yorkshire: 21; Lexington: 15 |

| General Property Type | Multifamily | No. of Parking Spaces | Yorkshire: 168; Lexington: 36 |

| Specific Property Type | High-Rise | Year Built | Yorkshire: 1964; Lexington: 1963 |

| Zoning Classification | Yorkshire: R8B, C2-8, and C2-8A; Lexington: C1-8X and R8B | Year Renovated | NAP |

| Type of Ownership | Fee Simple | Occupancy | 96.4%(3) |

| Ground Lease Maturity | NAP | Occupancy Date | 1/31/2022(3) |

| (1) | Source: Appraisal unless otherwise noted. |

| (2) | The Property consists of two buildings, 808 residential units, 204 parking spaces (totaling 41,886 SF), six commercial and retail units at Yorkshire (totaling 29,451 SF), and six commercial and retail units at Lexington Towers (totaling 9,998 SF). |

| (3) | Source: Underwritten rent roll dated January 31, 2022. Based on the residential units only. |

The following table shows the residential unit mix for the Property:

| Unit Type | # of Units | Occupancy | Total SF | Average SF Per Unit | Average UW Monthly Rent per Unit | Average UW Monthly Rent per SF |

| Studio | 123 | 94.3% | 70,070 | 570 | $2,653 | $4.66 |

| 1 Bedroom | 424 | 96.9% | 333,074 | 786 | $3,508 | $4.46 |

| 2 Bedroom | 183 | 97.3% | 217,201 | 1,187 | $4,541 | $3.82 |

| 3 Bedroom | 70 | 97.1% | 94,933 | 1,356 | $7,249 | $5.38 |

| 4 Bedroom | 8 | 75.0% | 15,551 | 1,944 | $12,561 | $6.59 |

| Total/Wtd. Average | 808 | 96.4% | 730,829 | 904 | $4,013 | $4.44 |

Source: Underwritten rent roll dated as of January 31, 2022.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

19

| Property Overview | YL Subordinate Loan |

The following table shows the residential unit mix breakdown of market rate units and rent stabilized units for the Property:

| Unit Type | # of Market Rate Units | Market Rate Units Occupancy | Total Market Rate Unit SF | Average Market Unit SF Per Unit | Average UW Monthly Rent per Market Rate Rent Unit | # of Rent Stabilized Units | Rent Stabilized Units Occupancy | Total Stabilized Unit SF | Average Stabilized Unit SF Per Unit | Average UW Monthly Rent per Stabilized Unit |

| Studio | 73 | 98.6% | 40,627 | 557 | $3,098 | 50 | 88.0% | 29,443 | 589 | $1,925 |

| 1 Bedroom | 277 | 98.9% | 215,460 | 778 | $4,270 | 147 | 93.2% | 117,614 | 800 | $1,984 |

| 2 Bedroom | 91 | 96.7% | 103,762 | 1,140 | $6,121 | 92 | 97.8% | 113,439 | 1,233 | $2,996 |

| 3 Bedroom | 59 | 100.0% | 77,221 | 1,309 | $7,798 | 11 | 81.8% | 17,712 | 1,610 | $3,649 |

| 4 Bedroom | 3 | 100.0% | 5,865 | 1,955 | $12,955 | 5 | 60.0% | 9,686 | 1,937 | $12,167 |

| Total/Wtd. Average | 503 | 98.6% | 442,935 | 881 | $4,900 | 305 | 92.8% | 287,894 | 944 | $2,458 |

Source: Underwritten rent roll dated as of January 31, 2022.

The following table shows the monthly and annual rent allocation for the residential units at the Property:

| # of Units | % of Total Units | UW Monthly Rent | UW Annual Rent | % of Total UW Annual Rent | |

| Occupied Units | 779 | 96.4% | $3,126,108 | $37,513,299 | 95.8% |

| Vacant Units | 29 | 3.6% | $137,548 | $1,650,577 | 4.2% |

| Total | 808 | 100.0% | $3,263,656 | $39,163,876 | 100.0% |

Source: Underwritten rent roll dated as of January 31, 2022.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

20

| Property Overview | YL Subordinate Loan |

Sponsor’s Renovation Plan:

The information set forth below (including the information in the tables on the following page) reflects forward-looking statements and certain projections provided by the Sponsor, assuming, among other things, that the Borrower will complete certain projected renovations by December 1, 2024 and that all of the newly renovated and currently unoccupied units will be leased at current market rate rent and all of the currently occupied units will continue to be leased at the current contractual rent. We cannot assure you that such assumptions and projections provided by the Sponsor will materialize in the future.

| ● | The Sponsor is currently renovating the residential units at the Property. Renovations will consist of major renovation units and light renovation units. Major renovations will feature either the combination of 2 or 3 units or a significant floor plan alteration, and is expected to take approximately four to six months to complete. The Sponsor has executed the major renovation strategy on 41 units to date, which have been combined into a total of 23 units. The Sponsor is projecting an average cost of $36,923 per unit for the remaining 26 major renovation units, which will be combined into 12 total units. 16 of the 26 units projected to receive major renovations are rent stabilized units, all of which are currently vacant. The remaining 10 units that are projected to receive major renovations are market rate units. |

| ● | Light renovations will feature aesthetic and systems upgrades such as new appliances, countertops, removal of carpeting, and lighting upgrades, among other updates. The Sponsor has executed the light renovation strategy on 16 units to date. The Sponsor is projecting an average cost of $19,375 per unit for the remaining 284 light renovation units. All units that are projected to receive light renovations are market rate units. |

The following table shows the projected residential unit mix of the Property as of the projected renovation completion date of December 1, 2024 based on the assumptions set forth above:

| Unit Type | # of Units | Total SF | Average SF | Average Projected Monthly Rent per Unit | Average Projected Monthly Rent per SF | # of Market Rate Units | # of Rent Stabilized Units |

| Studio | 117 | 66,773 | 571 | 2,943 | $5.16 | 71 | 46 |

| 1 Bedroom | 410 | 322,109 | 786 | 4,085 | $5.20 | 273 | 137 |

| 2 Bedroom | 183 | 218,555 | 1,194 | 5,443 | $4.56 | 87 | 96 |

| 3 Bedroom | 74 | 102,582 | 1,386 | 8,355 | $6.03 | 59 | 15 |

| 4 Bedroom | 10 | 20,810 | 2,081 | 14,098 | $6.77 | 3 | 7 |

| Total/Wtd. Average | 794 | 730,829 | 920 | 4,754 | $5.16 | 493 | 301 |

Source: Underwritten rent roll dated January 31, 2022.

The following table shows the projected monthly and annual rent allocation for the residential units at the Property as of December 1, 2024 based on the assumptions set forth above:

| # of Units | % of Total Units | Total Projected Monthly Rent | Total Projected Annual Rent | % of Total Projected Annual Rent | |

| Total | 794 | 100.0% | $3,774,412 | $45,292,944 | 100.0% |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

21

| Property Overview | YL Subordinate Loan |

The following table shows the projected major renovation and light renovation plans for the Property prepared by the Borrower:

Historical Renovation Information vs. Projected Renovation Budget

MAJOR RENOVATIONS / UNIT COMBINATIONS

| HISTORICAL | Rent PSF | PROJECTED | Rent PSF | |||||||||||||

| Property | #

of Units Pre-Reno |

#

of Units In-Place |

Total Reno Cost |

Avg.

Reno Cost/Unit |

Pre-

Renovation |

In-Place | Property | #

of Units In-Place |

#

of Units Post-Reno |

Total Reserve |

Per Unit |

In-Place | Post-

Renovation | |||

| Yorkshire | 21 | 13 | $1,410,975 | $67,189 | $31.84 | $73.59 | Yorkshire | 26 | 12 | $960,000 | $36,923 | $53.28 | $82.50 | |||

| Lexington Towers | 20 | 10 | $1,004,000 | $50,200 | $34.21 | $77.47 | Lexington | 0 | 0 | $0 | - | - | - | |||

| TOTAL / WTD. AVG. | 41 | 23 | $2,414,975 | $58,902 | $32.93 | $75.37 | TOTAL / WTD. AVG. | 26 | 12 | $960,000 | $36,923 | $53.28 | $82.50 | |||

LIGHT RENOVATION

| HISTORICAL | Rent PSF | PROJECTED | Rent PSF | |||||||||||||

| Property | #

of Units Pre-Reno |

#

of Units In-Place |

Total Reno Cost |

Avg.

Reno Cost/Unit |

Pre- Renovation |

In-Place | Property | #

of Units In-Place |

#

of Units Post-Reno |

Total Reserve |

Per Unit |

In-Place | Post- Renovation | |||

| Yorkshire | 10 | 10 | $187,500 | $18,750 | $53.55 | $81.62 | Yorkshire | 247 | 247 | $4,822,500 | $19,524 | $61.25 | $82.50 | |||

| Lexington Towers | 6 | 6 | $110,000 | $18,333 | $43.95 | $82.89 | Lexington | 37 | 37 | $680,000 | $18,378 | $63.59 | $85.00 | |||

| TOTAL / WTD. AVG. | 16 | 16 | $297,500 | $18,594 | $50.33 | $82.04 | TOTAL / WTD. AVG. | 284 | 284 | $5,502,500 | $19,375 | $61.53 | $82.80 | |||

TOTAL RENOVATION INFORMATION

| HISTORICAL | Rent PSF | PROJECTED | Rent PSF | |||||||||||||

| Property | #

of Units Pre-Reno |

#

of Units In-Place |

Total Reno Cost |

Avg.

Reno Cost/Unit |

Pre- Renovation |

In-Place | Property | #

of Units In-Place |

#

of Units Post-Reno |

Total Reserve |

Per Unit |

In-Place | Post- Renovation | |||

| Yorkshire | 31 | 23 | $1,598,475 | $51,564 | $38.65 | $76.10 | Yorkshire | 273 | 259 | $5,782,500 | $21,181 | $60.57 | $82.50 | |||

| Lexington Towers | 26 | 16 | $1,114,000 | $42,846 | $36.30 | $78.63 | Lexington | 37 | 37 | $680,000 | $18,378 | $63.59 | $85.00 | |||

| TOTAL / WTD. AVG. | 57 | 39 | $2,712,475 | $47,587 | $37.65 | $77.18 | TOTAL / WTD. AVG. | 310 | 296 | $6,462,500 | $20,847 | $60.90 | $82.78 | |||

Source: Underwritten rent roll dated January 31, 2022.

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

22

| Property Overview | YL Subordinate Loan |

Commercial Tenant Summary by Net Rentable Area

| Commercial Tenant Summary(1)(2) | |||||||||

| Tenant Name | Property | Ratings (Moody’s/S&P/Fitch)(3) |

Net Rentable Area (SF) |

% of Net Rentable Area | UW Base Rent PSF | % of UW Base Rent | UW Gross Rent PSF | % of UW Gross Rent | Lease Expiration |

| City Parking | Yorkshire & Lexington Towers | NR/NR/NR | 41,886 | 51.5% | $32.23 | 20.9% | $32.05 | 19.6% | 12/31/2026 |

| CVS Pharmacy | Yorkshire & Lexington Towers | Baa2/BBB/BBB | 15,813 | 19.4% | $230.82 | 56.6% | $252.37 | 58.1% | 1/31/2033 |

| SwimJim Swimming Lessons | Yorkshire & Lexington Towers | NR/NR/NR | 7,804 | 9.6% | $32.68 | 4.0% | $35.37 | 4.0% | 1/12/2023 |

| Hi Rise Laundry | Yorkshire & Lexington Towers | NR/NR/NR | 3,812 | 4.7% | $66.58 | 3.9% | $66.58 | 3.7% | 7/31/2027 |

| Le Pain Quotidien | Yorkshire & Lexington Towers | NR/NR/NR | 3,454 | 4.2% | $94.09 | 5.0% | $94.09 | 4.7% | 1/31/2024 |

| Smiles+Grins Pediatric Dentistry | Yorkshire & Lexington Towers | NR/NR/NR | 1,952 | 2.4% | $75.00 | 2.3% | $75.00 | 2.1% | 5/31/2029 |

| Dr. Alan Jaslove Dentistry | Yorkshire & Lexington Towers | NR/NR/NR | 1,320 | 1.6% | $65.13 | 1.3% | $84.98 | 1.6% | 12/31/2023 |

| Dr. Terry Robinson, DPM | Yorkshire & Lexington Towers | NR/NR/NR | 1,276 | 1.6% | $99.92 | 2.0% | $115.84 | 2.2% | 5/31/2027 |

| Bloom Nails & Spa | Yorkshire & Lexington Towers | NR/NR/NR | 1,220 | 1.5% | $93.44 | 1.8% | $96.25 | 1.7% | 5/31/2026 |

| Dr. Michael Brunetti, DPM | Yorkshire & Lexington Towers | NR/NR/NR | 1,123 | 1.4% | $87.62 | 1.5% | $98.62 | 1.6% | 2/28/2023 |

| Subtotal / Wtd. Avg. | 79,660 | 97.9% | $80.42 | 99.3% | $85.65 | 99.4% | |||

| Other Tenants | 762 | 0.9% | $55.12 | 0.7% | $55.12 | 0.6% | |||

| Total / Wtd. Avg. Occupied | 80,422 | 98.9% | $80.18 | 100.0% | $85.36 | 100.0% | |||

| Vacant | 913 | 1.1% | |||||||

| Total | 81,335 | 100.0% | |||||||

| (1) | Based on underwritten rent roll dated January 31, 2022. |

| (2) | Based on the commercial and retail rentable area at the Property and the UW Base Rent and UW Gross Rent attributable to the commercial and retail rentable area at the Property. |

| (3) | Ratings of tenants used in this Term Sheet may reflect ratings of the parent company whether or not the parent guarantees the lease. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

23

| Property Overview | YL Subordinate Loan |

Commercial Tenant Rollover

| ● | The Property’s rollover is heavily weighted towards the end of the Mortgage Loan extended term, with approximately 33.9% of the Property UW Gross Rent, of the current tenants rolling during the term of the Mortgage Loan. The Property’s remaining WALT with respect to the commercial and retail leases is 7.9 years. |

| ● | The following chart outlines the lease rollover at the Property: |

| Commercial Rollover Schedule(1)(2)(3) | |||||||||

| Year | Total SF Expiring | % NRA | Cumulative SF Expiring | % Cumulative Expiring SF | UW Gross Rent | UW Gross Rent PSF | % of UW Gross Expiring Rent Rolling | Cumulative UW Gross Rent | % of Cumulative UW Gross Rent Expiring |

| MTM | 0 | 0.0% | 0 | 0.0% | $0 | $0.00 | 0.0% | $0 | 0.0% |

| 2022 | 0 | 0.0% | 0 | 0.0% | $0 | $0.00 | 0.0% | $0 | 0.0% |

| 2023 | 11,009 | 13.5% | 11,009 | 13.5% | $540,944 | $49.14 | 7.9% | $540,944 | 7.9% |

| 2024 | 3,454 | 4.2% | 14,463 | 17.8% | $325,000 | $94.09 | 4.7% | $865,944 | 12.6% |

| 2025 | 0 | 0.0% | 14,463 | 17.8% | $0 | $0.00 | 0.0% | $865,944 | 12.6% |

| 2026 | 43,106 | 53.0% | 57,569 | 70.8% | $1,460,025 | $33.87 | 21.3% | $2,325,969 | 33.9% |

| 2027 | 5,088 | 6.3% | 62,657 | 77.0% | $401,607 | $78.93 | 5.9% | $2,727,577 | 39.7% |

| Thereafter | 17,765 | 21.8% | 80,422 | 98.9% | $4,137,067 | $232.88 | 60.3% | $6,864,643 | 100.0% |

| Vacant | 913 | 1.1% | 81,335 | 100.0% | $0 | $0.00 | 0.0% | ||

| Total / Wtd. Avg. | 81,335 | 100.0% | $6,864,643 | $85.36 | 100.0% | ||||

| (1) | Based on the underwritten rent roll dated January 31, 2022. |

| (2) | Certain tenants may have termination options that may be exercisable prior to their stated lease expiration date. |

| (3) | Based on the commercial and retail rentable area at the Property and the UW Gross Rent attributable to the commercial and retail rentable area at the Property. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

24

Section 7: Market Overview

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

25

| Market Overview | YL Subordinate Loan |

The Property is located in the Upper East Side neighborhood of New York, NY and is situated in the Upper East Side – Multifamily submarket.

| ■ | Location: The Property is located in the Upper East Side neighborhood of New York, NY. |

| ■ | Submarket: The Property is situated in the Upper East Side – Multifamily submarket. According to CoStar, as of February 2022, the Upper East Side – Multifamily submarket had an overall vacancy rate of 2.0%, with net absorption totaling 17 units. The vacancy rate decreased 2.2% over the past 12 months. Rental rates increased in the first quarter 2022 by 3.1% for the past 12 months and ended at $4,096 per unit per month. A total of 46 units are still under construction at the end of the quarter. |

The following table represents a summary of the Property’s market statistics related to the residential units:

| Market Overview | ||||||

Submarket(1) |

Rent | |||||

Submarket |

Inventory (Units) |

Vacancy |

Submarket Rent (Unit)(2) | UW Base Rent (Unit)(3) | ||

| Upper East Side – Multifamily | 58,573 | 2.0% | $4,096 | $4,013 | ||

| (1) | Source: CoStar |

| (2) | Source: Appraisal. |

| (3) | Based on underwritten rent roll dated January 31, 2022. |

The following table represents historical submarket statistics:

| Upper East Side Multifamily Submarket(1) | |||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 Q1 | |

| Existing Inventory (Units) | 58,492 | 58,450 | 58,423 | 58,368 | 58,485 | 58,384 | 58,667 | 58,644 | 58,585 | 58,582 | 58,582 | 58,573 | 58,573 |

| Vacancy % | 3.8% | 3.8% | 3.5% | 3.2% | 3.4% | 3.3% | 2.5% | 2.3% | 2.1% | 2.9% | 4.4% | 2.0% | 2.0% |

| Net Absorption (Units) | 119 | (40) | 104 | 147 | (32) | (9) | 756 | 72 | 86 | (497) | (892) | 1,400 | 17 |

| Net Completions (Units) | (5) | (42) | (27) | (55) | 117 | (101) | 283 | (23) | (59) | (3) | 0 | (9) | 0 |

| Under Const. (Units) | 0 | 8 | 216 | 226 | 321 | 382 | 66 | 56 | 196 | 140 | 21 | 46 | 46 |

| Quoted Rates ($/Unit/Month) | $3,517 | $3,553 | $3,597 | $3,683 | $3,734 | $3,829 | $3,868 | $3,909 | $3,980 | $4,020 | $3,964 | $4,091 | $4,096 |

| (1) | Source: CoStar |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

26

| Market Overview | YL Subordinate Loan |

The following table represents the appraisal’s market rent conclusions as compared to the Property’s residential UW Base Rents:

| Market Rent | ||||||

| Unit Type | # of Units(1) | SF(1) | Market Rent Conclusion(2) |

UW Base Rent Minimum(1) |

UW Base Rent Maximum(1) |

UW Base Rent Average(1) |

| Studio | 123 | 70,070 | $3,156 | $1,047 | $3,999 | $2,653 |

| 1 Bedroom | 424 | 333,074 | $4,314 | $1,183 | $5,520 | $3,508 |

| 2 Bedroom | 183 | 217,201 | $6,347 | $1,369 | $11,000 | $4,541 |

| 3 Bedroom | 70 | 94,933 | $7,892 | $2,550 | $10,050 | $7,249 |

| 4 Bedroom | 8 | 15,551 | $12,965 | $11,000 | $13,500 | $12,561 |

| Total / Wtd. Avg. | 808 | 730,829 | $4,988 | NAP | NAP | $4,013 |

| (1) | Based on the underwritten rent roll dated January 31, 2022. |

| (2) | Source: Appraisal. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

27

| Market Overview | YL Subordinate Loan |

The following table reflects a competitive set for the residential units at the Property:

| Competitive Set(1) | ||||||||||

| Rent | ||||||||||

| Property | Distance to Subject | Property Type | Built | Number of Units | Occupancy | Studio | 1 Bedroom | 2 Bedroom | 3 Bedroom | 4 Bedroom |

|

Yorkshire & Lexington Towers 160 East 88th Street & 305 East 86th Street |

-- | High-Rise | 1963 & 1964 | 808(2) | 96.4%(2) | $2,653(2) | $3,508(2) | $4,541(2) | $7,249(2) | $12,561(2) |

|

The Serrano 1735 York Avenue New York, NY |

0.5 miles | High-Rise | 1986 | 263 | 92.6% | NAP | $4,501 | $7,201 | $8,878 | NAP |

|

Ventura 240 East 86th Street New York, NY |

0.1 miles | High-Rise | 1999 | 246 | 98.4% | $3,734 | $4,652 | $6,380 | $8,921 | NAP |

|

The Lucerne 350 East 79th Street New York, NY |

0.6 miles | High-Rise | 1989 | 219 | 98.6% | NAP | $4,617 | $7,134 | $11,878 | $17,975 |

|

The Colorado 201 East 86th Street New York, NY |

0.2 miles | High-Rise | 1987 | 173 | 99.6% | $3,953 | $4,595 | $6,675 | $9,938 | $15,473 |

|

The Strathmore 400 East 84th Street New York, NY |

0.3 miles | High-Rise | 1996 | 179 | 99.2% | NAP | $4,168 | $6,926 | $11,217 | $17,520 |

|

One Carnegie Hill 215 East 96th Street New York, NY |

0.8 miles | High-Rise | 2005 | 455 | 99.6% | $3,355 | $4,141 | $6,248 | $8,318 | $10,625 |

|

CONVIVIUM 515 East 86th Street New York, NY |

0.3 miles | High-Rise | 2020 | 140 | 98.6% | $4,300 | $5,474 | $7,523 | $9,750 | NAP |

| (1) | Source: Appraisal unless otherwise noted. |

| (2) | Based on the underwritten rent roll dated January 31, 2022. |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

28

| Section 8: Property Historical and Underwritten Cash Flows |

THE INFORMATION IN THIS TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. CAPITALIZED TERMS USED HEREIN MAY BE DEFINED BELOW OR ABOVE IN THIS TERM SHEET. CAPITALIZED TERMS USED BUT NOT OTHERWISE DEFINED IN THIS TERM SHEET HAVE THE MEANINGS ASCRIBED TO THEM IN THE OFFERING CIRCULAR OR, IF NOT DEFINED THEREIN, IN THE MORTGAGE LOAN DOCUMENTS.

29

| Property Historical and Underwritten Cash Flows | YL Subordinate Loan |

| Yorkshire & Lexington | 2019 | 2020 | T-12 | |||

| Cash Flow Analysis | Actual | $/sf | Actual | $/sf | Actual | $/sf |

| GPR/Unit/Month | $3,551 | $3,394 | $3,369 | |||

| Gross Potential Rent - Resi | $34,429,262 | $42.4 | $32,908,021 | $40.5 | $32,667,236 | $40.2 |

| Multifamily Vacancy | ($99,272) | -0.3% | ($35,705) | -0.1% | $0 | 0.0% |

| Total Multifamily Vacancy | ($99,272) | -0.3% | ($35,705) | -0.1% | $0 | 0.0% |

| Net Multifamily Income | $34,329,990 | $42.3 | $32,872,316 | $40.5 | $32,667,236 | $40.2 |

| Commercial Rent | $6,197,568 | $7.6 | $5,981,339 | $7.4 | $5,734,068 | $7.1 |

| Commercial Recoveries | $297,713 | $0.4 | $410,419 | $0.5 | $285,837 | $0.4 |

| Total Commercial Income | $6,495,281 | $8.0 | $6,391,757 | $7.9 | $6,019,905 | $7.4 |

| Commercial Vacancy | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% |

| Total Commercial Vacancy | $0 | 0.0% | $0 | 0.0% | $0 | 0.0% |

| Net Commercial Income | $6,495,281 | $8.0 | $6,391,757 | $7.9 | $6,019,905 | $7.4 |

| Other Income | $702,657 | $0.9 | $863,978 | $1.1 | $647,883 | $0.8 |

| Supplemental Income Reserve | $0 | $0.0 | $0 | $0.0 | $0 | $0.0 |

| Effective Gross Income | $41,527,928 | $51.1 | $40,128,052 | $49.4 | $39,335,024 | $48.4 |

| Real Estate Taxes | $8,345,869 | $10.3 | $9,104,352 | $11.2 | $9,722,823 | $12.0 |

| Insurance | $368,159 | $0.5 | $430,452 | $0.5 | $466,238 | $0.6 |

| Management Fee | $830,559 | 2.0% | $802,561 | 2.0% | $787,616 | 2.0% |

| Utilities | $2,106,544 | $2.6 | $1,712,437 | $2.1 | $2,056,268 | $2.5 |

| Repairs & Maintenance | $628,742 | $0.8 | $524,663 | $0.6 | $520,048 | $0.6 |

| General & Administrative | $135,803 | $0.2 | $100,798 | $0.1 | $92,737 | $0.1 |

| Payroll & Benefits | $1,768,438 | $2.2 | $1,834,839 | $2.3 | $1,820,235 | $2.2 |

| Total Expenses | $14,184,113 | $17.5 | $14,510,102 | $17.9 | $15,465,965 | $19.0 |

| Expense Ratio | ||||||

| Net Operating Income | $27,343,815 | $33.7 | $25,617,949 | $31.5 | $23,869,059 | $29.4 |

| Commercial TILC Reserves | $0 | $0.0 | $0 | $0.0 | $0 | $0.0 |

| Commercial CapEx Reserves | $0 | $0.0 | $0 | $0.0 | $0 | $0.0 |

| MF Replacement Reserves | $0 | $0.0 | $0 | $0.0 | $0 | $0.0 |

| Total Reserves | $0 | $0.0 | $0 | $0.0 | $0 | $0.0 |

| Net Cash Flow | $27,343,815 | $33.7 | $25,617,949 | $31.5 | $23,869,059 | $29.4 |