| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-207132-09 | ||

November 29, 2016

Free Writing Prospectus

Structural and Collateral Term Sheet

$913,408,704

(Approximate Initial Mortgage Pool Balance)

$778,680,000

(Offered Certificates)

Citigroup Commercial Mortgage Trust 2016-P6

As Issuing Entity

Citigroup Commercial Mortgage Securities Inc.

As Depositor

Commercial Mortgage Pass-Through Certificates

Series 2016-P6

Citigroup Global Markets Realty Corp.

Barclays Bank PLC

Starwood Mortgage Funding V LLC

Principal Commercial Capital

Société Générale

As Sponsors and Mortgage Loan Sellers

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation being made that these materials are accurate or complete and that these materials may not be updated or (3) these materials possibly being confidential, are, in each case, not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Citigroup | Barclays | Société Générale |

| Co-Lead Managers and Joint Bookrunners | ||

| Drexel Hamilton | ||

| Co-Manager | ||

The securities offered by this structural and collateral term sheet (this “Term Sheet”) are described in greater detail in the preliminary prospectus, dated on or about November 29, 2016, included as part of our registration statement (SEC File No. 333-207132) (the “Preliminary Prospectus”). The Preliminary Prospectus contains material information that is not contained in this Term Sheet (including, without limitation, a detailed discussion of risks associated with an investment in the offered securities under the heading “Risk Factors” in the Preliminary Prospectus). The Preliminary Prospectus is available upon request from Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC or Drexel Hamilton, LLC. This Term Sheet is subject to change.

For information regarding certain risks associated with an investment in this transaction, refer to “Risk Factors” in the Preliminary Prospectus. Capitalized terms used but not otherwise defined in this Term Sheet have the respective meanings assigned to those terms in the Preliminary Prospectus.

The Securities May Not Be a Suitable Investment for You

The securities offered by this Term Sheet are not suitable investments for all investors. In particular, you should not purchase any class of securities unless you understand and are able to bear the prepayment, credit, liquidity and market risks associated with that class of securities. For those reasons and for the reasons set forth under the heading “Risk Factors” in the Preliminary Prospectus, the yield to maturity of, the aggregate amount and timing of distributions on and the market value of the offered securities are subject to material variability from period to period and give rise to the potential for significant loss over the life of those securities. The interaction of these factors and their effects are impossible to predict and are likely to change from time to time. As a result, an investment in the offered securities involves substantial risks and uncertainties and should be considered only by sophisticated institutional investors with substantial investment experience with similar types of securities and who have conducted appropriate due diligence on the mortgage loans and the securities. Potential investors are advised and encouraged to review the Preliminary Prospectus in full and to consult with their legal, tax, accounting and other advisors prior to making any investment in the offered securities described in this Term Sheet.

The securities offered by these materials are being offered when, as and if issued. This Term Sheet is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. The information contained in this Term Sheet may not pertain to any securities that will actually be sold. The information contained in this Term Sheet may be based on assumptions regarding market conditions and other matters as reflected in this Term Sheet. We make no representations regarding the reasonableness of such assumptions or the likelihood that any of such assumptions will coincide with actual market conditions or events, and this Term Sheet should not be relied upon for such purposes. We and our affiliates, officers, directors, partners and employees, including persons involved in the preparation or issuance of this Term Sheet may, from time to time, have long or short positions in, and buy or sell, the securities mentioned in this Term Sheet or derivatives thereof (including options). Information contained in this Term Sheet is current as of the date appearing on this Term Sheet only. Information in this Term Sheet regarding the securities and the mortgage loans backing any securities discussed in this Term Sheet supersedes all prior information regarding such securities and mortgage loans. None of Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC or Drexel Hamilton, LLC provides accounting, tax or legal advice.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

2

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in the Preliminary Prospectus). See also “Legal Investment” in the Preliminary Prospectus.

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

3

| CERTIFICATE SUMMARY |

| OFFERED CERTIFICATES | ||||||||||||||

Offered Classes |

Expected

Ratings |

Initial Certificate Balance or Notional Amount(2) |

Approximate Initial Credit Support |

Initial

Pass- |

Pass-Through Rate Description |

Expected |

Expected Principal Window(4) | |||||||

| Class A-1 | Aaa(sf) / AAAsf / AAA(sf) | $29,657,000 | 30.000%(5) | [ ]% | (6) | 2.57 | 1/17 - 7/21 | |||||||

| Class A-2 | Aaa(sf) / AAAsf / AAA(sf) | $126,447,000 | 30.000%(5) | [ ]% | (6) | 4.83 | 7/21 - 12/21 | |||||||

| Class A-3 | Aaa(sf) / AAAsf / AAA(sf) | $16,600,000 | 30.000%(5) | [ ]% | (6) | 6.90 | 11/23 - 11/23 | |||||||

| Class A-4 | Aaa(sf) / AAAsf / AAA(sf) | $195,000,000 | 30.000%(5) | [ ]% | (6) | 9.82 | 8/26 - 11/26 | |||||||

| Class A-5 | Aaa(sf) / AAAsf / AAA(sf) | $228,776,000 | 30.000%(5) | [ ]% | (6) | 9.90 | 11/26 - 11/26 | |||||||

| Class A-AB | Aaa(sf) / AAAsf / AAA(sf) | $42,906,000 | 30.000%(5) | [ ]% | (6) | 7.38 | 12/21 - 8/26 | |||||||

| Class X-A | Aa1(sf) / AAAsf / AAA(sf) | $685,056,000(7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class X-B | A1(sf) / AA-sf / AAA(sf) | $44,529,000(7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class A-S | Aa2(sf) / AAAsf / AAA(sf) | $45,670,000 | 25.000% | [ ]% | (6) | 9.90 | 11/26 - 11/26 | |||||||

| Class B | A1(sf) / AA-sf / AA+(sf) | $44,529,000 | 20.125% | [ ]% | (6) | 9.91 | 11/26 - 12/26 | |||||||

| Class C | NR / A-sf / A+(sf) | $49,095,000 | 14.750% | [ ]% | (6) | 9.99 | 12/26 - 12/26 | |||||||

| NON-OFFERED CERTIFICATES | ||||||||||||||

Non-Offered Classes |

Expected

Ratings |

Initial Certificate Balance or Notional Amount(2) |

Approximate Initial Credit Support |

Initial Pass-Through Rate(3) |

Pass-Through Rate Description |

Expected |

Expected Principal Window(4) | |||||||

| Class D | NR / BBB-sf / BBB(sf) | $57,088,000 | 8.500% | [ ]% | (6) | 9.99 | 12/26 - 12/26 | |||||||

| Class X-D | NR / BBB-sf / BBB(sf) | $57,088,000 (7) | N/A | [ ]% | Variable IO(8) | N/A | N/A | |||||||

| Class E | NR / BB-sf / BB+(sf) | $26,261,000 | 5.625% | [ ]% | (6) | 9.99 | 12/26 - 12/26 | |||||||

| Class F | NR / B-sf / BB-(sf) | $11,418,000 | 4.375% | [ ]% | (6) | 10.05 | 12/26 - 1/27 | |||||||

| Class G | NR / NR / B-(sf) | $10,275,000 | 3.250% |

[ ]% | (6) | 10.07 | 1/27 - 1/27 | |||||||

| Class H | NR / NR / NR | $29,686,704 | 0.000% | [ ]% | (6) | 10.07 | 1/27 - 1/27 | |||||||

| Class S(9) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |||||||

| Class R(9) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |||||||

| (1) | It is a condition of issuance that the offered certificates receive the ratings set forth above. The anticipated ratings shown are those of Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and Kroll Bond Rating Agency, Inc. (“KBRA”). Subject to the discussion under “Ratings” in the Preliminary Prospectus, the ratings on the certificates address the likelihood of the timely receipt by holders of all payments of interest to which they are entitled on each distribution date and, except in the case of the interest only certificates, the ultimate receipt by holders of all payments of principal to which they are entitled on or before the applicable rated final distribution date. Certain nationally recognized statistical rating organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended, that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended, or otherwise to rate the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign. See “Risk Factors—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” in the Preliminary Prospectus. Moody’s, Fitch and KBRA have informed us that the “sf” designation in the ratings represents an identifier of structured finance product ratings. For additional information about this identifier, prospective investors can go to the related rating agency’s website. The depositor and the underwriters have not verified, do not adopt and do not accept responsibility for any statements made by the rating agencies on those websites. Credit ratings referenced throughout this Term Sheet are forward-looking opinions about credit risk and express a rating agency’s opinion about the willingness and ability of an issuer of securities to meet its financial obligations in full and on time. Ratings are not indications of investment merit and are not buy, sell or hold recommendations, a measure of asset value or an indication of the suitability of an investment. |

| (2) | Approximate, subject to a variance of plus or minus 5%. |

| (3) | Approximate per annum rate as of the Closing Date. |

| (4) | Determined assuming no prepayments prior to the maturity date or any anticipated repayment date, as applicable, for any mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Preliminary Prospectus. |

| (5) | The approximate initial credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5 and Class A-AB certificates are represented in the aggregate. |

| (6) | The pass-through rate on each class of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-AB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H certificates (collectively, the “principal balance certificates”) will generally be equal to one of (i) a fixed per annum rate, (ii) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, (iii) a rate equal to the lesser of a specified per annum rate and the weighted average rate described in clause (ii), or (iv) the weighted average rate described in clause (ii) less a specified percentage, but no less than 0.000%, as described under “Description of the Certificates—Distributions—Pass Through Rates” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

4

| CERTIFICATE SUMMARY (continued) |

| (7) | The Class X-A, Class X-B and Class X-D certificates (collectively, the “Class X certificates”) will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A, Class X-B and Class X-D certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate of the certificate balances of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-5, Class A-AB and Class A-S certificates from time to time. The notional amount of the Class X-B certificates will be equal to the certificate balance of the Class B certificates from time to time. The notional amount of the Class X-D certificates will be equal to the certificate balance of the Class D certificates from time to time. |

| (8) | The pass-through rate on each class of Class X certificates will generally be equal to a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as in effect from time to time, over (ii) the pass-through rate (or the weighted average of the pass-through rates, as applicable) on the class (or classes, as applicable) of principal balance certificates with the certificate balance(s) upon which the notional amount of such class of Class X certificates is based, as described in the Preliminary Prospectus. |

| (9) | Neither the Class S certificates nor the Class R certificates will have a certificate balance, notional amount, pass-through rate, rating or rated final distribution date. The Class S certificates will be entitled to receive certain excess interest accruing after the related anticipated repayment date on any mortgage loan with an anticipated repayment date. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loans” in the Preliminary Prospectus. The Class R certificates will represent the residual interests in each of two separate REMICs, as further described in the Preliminary Prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

5

| MORTGAGE POOL CHARACTERISTICS |

| Mortgage Pool Characteristics(1) | |

| Initial Pool Balance(2) | $913,408,704 |

| Number of Mortgage Loans | 54 |

| Number of Mortgaged Properties | 94 |

| Average Cut-off Date Balance | $16,914,976 |

| Weighted Average Mortgage Rate | 4.30583% |

| Weighted Average Remaining Term to Maturity/ARD (months)(3) | 110 |

| Weighted Average Remaining Amortization Term (months)(4) | 354 |

| Weighted Average Cut-off Date LTV Ratio(5) | 59.4% |

| Weighted Average Maturity Date/ARD LTV Ratio(3)(5) | 53.8% |

| Weighted Average UW NCF DSCR(6) | 1.94x |

| Weighted Average Debt Yield on Underwritten NOI(7) | 10.1% |

| % of Initial Pool Balance of Mortgage Loans that are Amortizing Balloon | 29.4% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only then Amortizing Balloon | 28.4% |

| % of Initial Pool Balance of Mortgage Loans that are Interest Only | 42.3% |

| % of Initial Pool Balance of Mortgaged Properties with Single Tenants | 19.7% |

| % of Initial Pool Balance of Mortgage Loans with Mezzanine or Subordinate Debt | 6.4% |

| (1) | With respect to each mortgage loan that is part of a loan combination (as identified under “Collateral Overview—Loan Combination Summary” below), the Cut-off Date LTV Ratio, Maturity Date/ARD LTV Ratio, UW NCF DSCR, Debt Yield on Underwritten NOI and Cut-off Date Balance Per SF / Rooms / Pads / Units are calculated based on both that mortgage loan and any related pari passu companion loan(s), but without regard to any related subordinate companion loan(s), unless otherwise indicated. Other than as specifically noted, the Cut-off Date LTV Ratio, Maturity Date/ARD LTV Ratio, UW NCF DSCR, Debt Yield on Underwritten NOI and Cut-off Date Balance Per SF / Rooms / Pads / Units information for each mortgage loan is presented in this Term Sheet without regard to any other indebtedness (whether or not secured by the related mortgaged property, ownership interests in the related borrower or otherwise) that currently exists or that may be incurred by the related borrower or its owners in the future. |

| (2) | Subject to a permitted variance of plus or minus 5%. |

| (3) | Unless otherwise indicated, mortgage loans with anticipated repayment dates are presented as if they were to mature on the anticipated repayment date. |

| (4) | Excludes mortgage loans that are interest-only for the entire term. |

| (5) | The Cut-off Date LTV Ratios and Maturity Date/ARD LTV Ratios presented in this Term Sheet are generally based on the “as-is” appraised values of the related mortgaged properties (as set forth on Annex A to the Preliminary Prospectus), provided, that such LTV ratios may be (i) based on “as-complete”, “as-stabilized” or similar values in certain cases where the completion of certain hypothetical conditions or other events at the property are assumed and/or where reserves have been established at origination to satisfy the applicable condition or event that is expected to occur, or (ii) calculated based on the Cut-off Date Balance or Balloon Balance, as applicable, net of a related earnout or holdback reserve, in each case as further described in the definitions of “Appraised Value”, “Cut-off Date LTV Ratio” and “Maturity Date/ARD LTV Ratio” under “Certain Definitions” in this Term Sheet and under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (6) | The UW NCF DSCR for each mortgage loan is generally calculated by dividing the UW NCF for the related mortgaged property or mortgaged properties by the annual debt service for such mortgage loan, as adjusted in the case of mortgage loans with a partial interest only period by using the first 12 amortizing payments due instead of the actual interest only payment due. See the definition of “UW NCF DSCR” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

| (7) | The Debt Yield on Underwritten NOI for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NOI divided by the Cut-off Date Balance of such mortgage loan, and the Debt Yield on Underwritten NCF for each mortgage loan is generally calculated as the related mortgaged property’s Underwritten NCF divided by the Cut-off Date Balance of such mortgage loan; provided, that such Debt Yields may be calculated based on the Cut-off Date Balance net of a related earnout or holdback reserve, as further described in the definitions of “Debt Yield on Underwritten NOI” and “Debt Yield on Underwritten NCF” under “Description of the Mortgage Pool—Certain Calculations and Definitions” in the Preliminary Prospectus. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

6

| KEY FEATURES OF THE CERTIFICATES |

| Co-Lead Managers and Joint Bookrunners: | Citigroup Global Markets Inc. Barclays Capital Inc. SG Americas Securities, LLC |

| Co-Manager: | Drexel Hamilton, LLC |

| Depositor: | Citigroup Commercial Mortgage Securities Inc. |

| Initial Pool Balance: | $913,408,704 |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association |

| Special Servicer: | CWCapital Asset Management LLC |

| Certificate Administrator: | Citibank, N.A. |

| Trustee: | Deutsche Bank Trust Company Americas |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| Closing Date: | On or about December 15, 2016 |

| Cut-off Date: | With respect to each mortgage loan, the due date in December 2016 for that mortgage loan (or, in the case of any mortgage loan that has its first due date subsequent to December 2016, the date that would have been its due date in December 2016 under the terms of that mortgage loan if a monthly payment were scheduled to be due in that month) |

| Determination Date: | The

6th day of each month or next business day, commencing in January 2017 |

| Distribution Date: | The

4th business day after the Determination Date, commencing in January 2017 |

| Interest Accrual: | Preceding calendar month |

| ERISA Eligible: | The offered certificates are expected to be ERISA eligible, subject to the exemption conditions described in the Preliminary Prospectus |

| SMMEA Eligible: | No |

| Payment Structure: | Sequential

Pay |

| Day Count: | 30/360 |

| Tax Structure: | REMIC |

| Rated Final Distribution Date: | December

2049 |

| Cleanup Call: | 1.0% |

| Minimum Denominations: | $10,000 minimum for the offered certificates (except with respect to the Class X-A and Class X-B certificates: $1,000,000 minimum); integral multiples of $1 thereafter for all the offered certificates |

| Delivery: | Book-entry

through DTC |

| Bond Information: | Cash

flows are expected to be modeled by TREPP, INTEX and BLOOMBERG |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

7

| TRANSACTION HIGHLIGHTS |

| ■ | $913,408,704 (Approximate) New-Issue Multi-Borrower CMBS: |

| — | Overview: The mortgage pool consists of 54 fixed-rate commercial mortgage loans that have an aggregate Cut-off Date Balance of $913,408,704 (the “Initial Pool Balance”), have an average mortgage loan Cut-off Date Balance of $16,914,976 and are secured by 94 mortgaged properties located throughout 28 states and the District of Columbia. |

| — | LTV: 59.4% weighted average Cut-off Date LTV Ratio |

| — | DSCR: 1.94x weighted average Underwritten Debt Service Coverage Ratio |

| — | Debt Yield: 10.1% weighted average Debt Yield on Underwritten NOI |

| — | Credit Support: 30.000% credit support to Class A-1 / A-2 / A-3 / A-4 / A-5 / A-AB |

| ■ | Loan Structural Features: |

| — | Amortization: 57.7% of the mortgage loans by Initial Pool Balance have scheduled amortization: |

| – | 29.4% of the mortgage loans by Initial Pool Balance have amortization for the entire term with a balloon payment due at maturity |

| – | 28.4% of the mortgage loans by Initial Pool Balance have scheduled amortization following a partial interest only period with a balloon payment due at maturity |

| — | Hard Lockboxes: 54.8% of the mortgage loans by Initial Pool Balance have a Hard Lockbox in place |

| — | Cash Traps: 81.4% of the mortgage loans by Initial Pool Balance have cash traps triggered by certain declines in cash flow, all at levels equal to or greater than a 1.10x coverage, that fund an excess cash flow reserve |

| — | Reserves: The mortgage loans require amounts to be escrowed for reserves as follows: |

| – | Real Estate Taxes: 41 mortgage loans representing 70.0% of the Initial Pool Balance |

| – | Insurance: 27 mortgage loans representing 42.1% of the Initial Pool Balance |

| – | Replacement Reserves (Including FF&E Reserves): 45 mortgage loans representing 75.5% of the Initial Pool Balance |

| – | Tenant Improvements / Leasing Commissions: 19 mortgage loans representing 37.4% of the portion of the Initial Pool Balance that is secured by retail, office and mixed use properties |

| — | Predominantly Defeasance Mortgage Loans: 73.6% of the mortgage loans by Initial Pool Balance permit defeasance only after an initial lockout period |

| ■ | Multiple-Asset Types > 5.0% of the Initial Pool Balance: |

| — | Retail: 33.6% of the mortgaged properties by allocated Initial Pool Balance are retail properties (18.1% are anchored retail properties) |

| — | Mixed Use: 26.8% of the mortgaged properties by allocated Initial Pool Balance are mixed use properties |

| — | Office: 18.9% of the mortgaged properties by allocated Initial Pool Balance are office properties |

| — | Hospitality: 9.1% of the mortgaged properties by allocated Initial Pool Balance are hospitality properties |

| — | Self Storage: 6.1% of the mortgaged properties by allocated Initial Pool Balance are self storage properties |

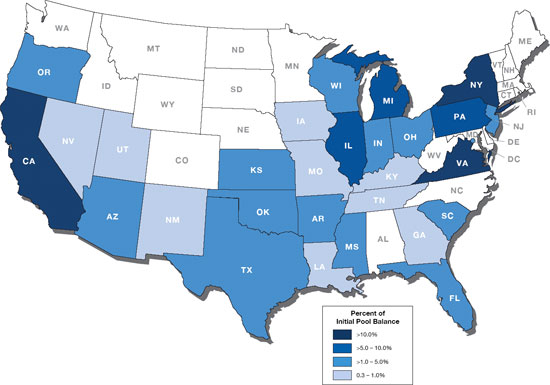

| ■ | Geographic Diversity: The 94 mortgaged properties are located throughout 28 states and the District of Columbia, with only three states having greater than 10.0% of the allocated Initial Pool Balance: California (16.6%), New York (14.5%) and Virginia (10.1%) |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

8

| COLLATERAL OVERVIEW |

| Mortgage Loans by Loan Seller |

| Mortgage Loan Seller | Mortgage Loans | Mortgaged Properties | Aggregate

Cut-off Date Balance |

% of Initial Pool Balance | ||||||||

| Citigroup Global Markets Realty Corp. | 17 | 39 | $335,076,678 | 36.7 | % | |||||||

| Barclays Bank PLC | 15 | 15 | 252,245,856 | 27.6 | ||||||||

| Starwood Mortgage Funding V LLC | 11 | 29 | 148,194,970 | 16.2 | ||||||||

| Principal Commercial Capital(1) | 6 | 6 | 97,976,416 | 10.7 | ||||||||

| Société Générale | 5 | 5 | 79,914,784 | 8.7 | ||||||||

| Total | 54 | 94 | $913,408,704 | 100.0 | % | |||||||

| (1) | As used herein, “Principal Commercial Capital” refers to Macquarie US Trading LLC d/b/a Principal Commercial Capital. Macquarie US Trading LLC and Principal Real Estate Investors, LLC jointly formed a lending platform to originate and securitize commercial mortgage loans. The mortgage loans to be sold by Macquarie US Trading LLC d/b/a Principal Commercial Capital were initially originated either by (i) Macquarie Investments US Inc. d/b/a Principal Commercial Capital, which will transfer such mortgage loans to Macquarie US Trading LLC d/b/a Principal Commercial Capital on or prior to the closing date, or (ii) Macquarie US Trading LLC d/b/a Principal Commercial Capital. |

Ten Largest Mortgage Loans(1)

# | Mortgage Loan Name | Cut-off Date Balance | % of Initial Pool Balance | Property Type | Property

Size | Cut-off Date Balance Per SF / Rooms |

UW

NCF | UW | Cut-off Date LTV Ratio | |||||||||||||

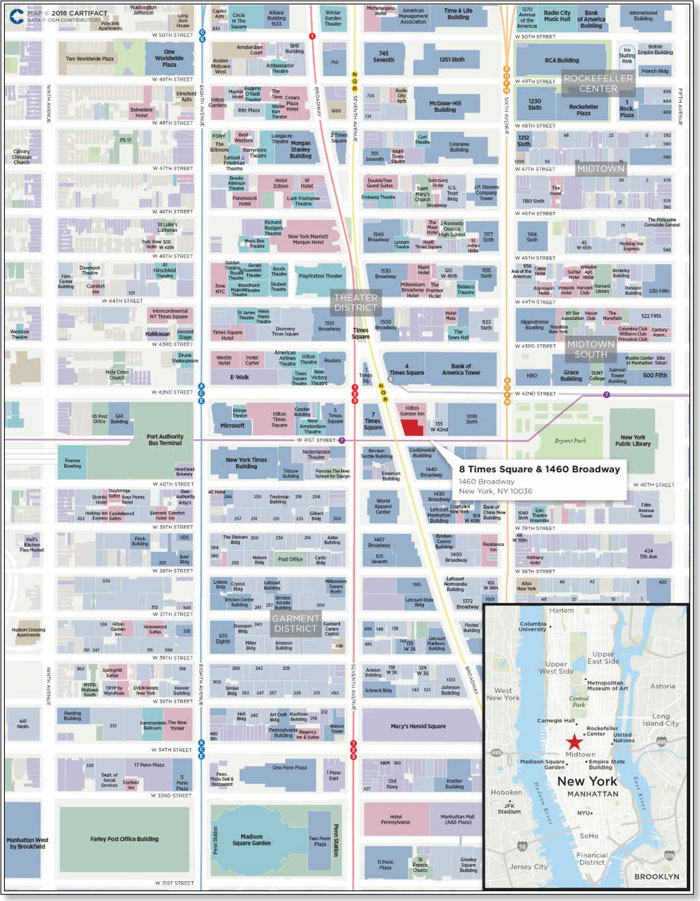

| 1 | 8 Times Square & 1460 Broadway | $75,000,000 | 8.2% | Mixed Use | 214,341 | $933 | 1.71x | 7.4% | 55.6% | |||||||||||||

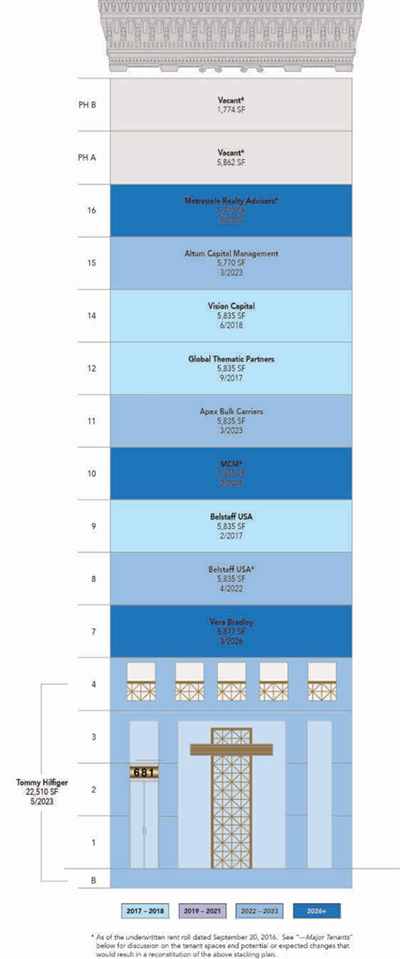

| 2 | 681 Fifth Avenue | 57,500,000 | 6.3 | Mixed Use | 82,573 | $2,604 | 1.67x | 7.3% | 48.9% | |||||||||||||

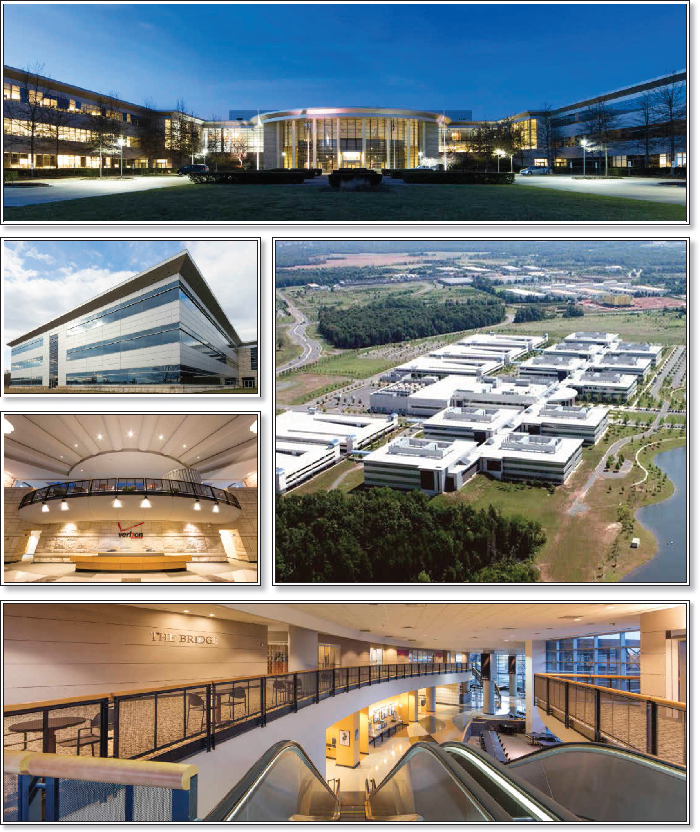

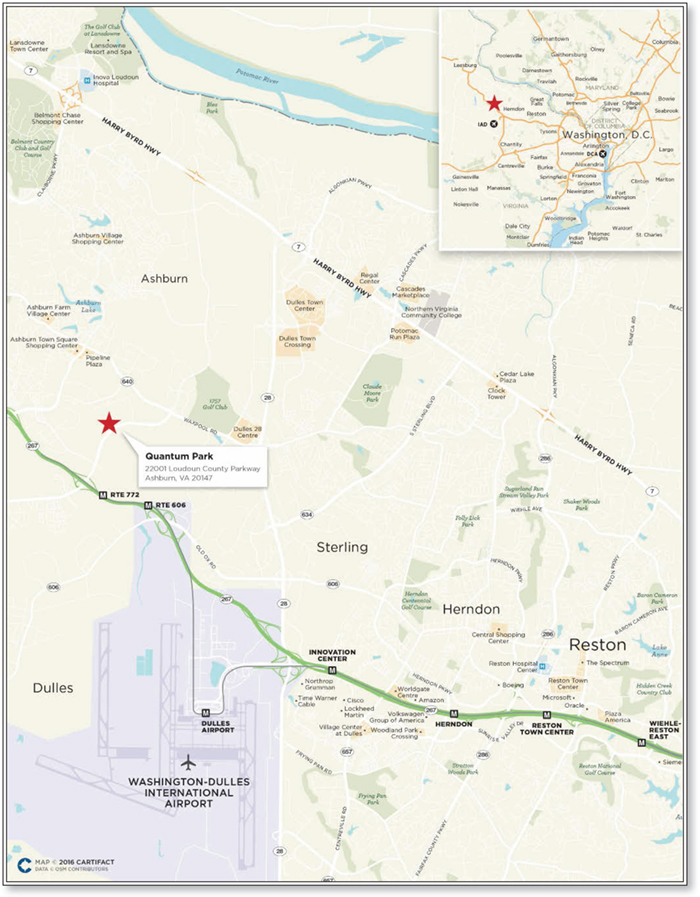

| 3 | Quantum Park | 50,000,000 | 5.5 | Office | 942,843 | $140 | 3.00x | 11.4% | 66.0% | |||||||||||||

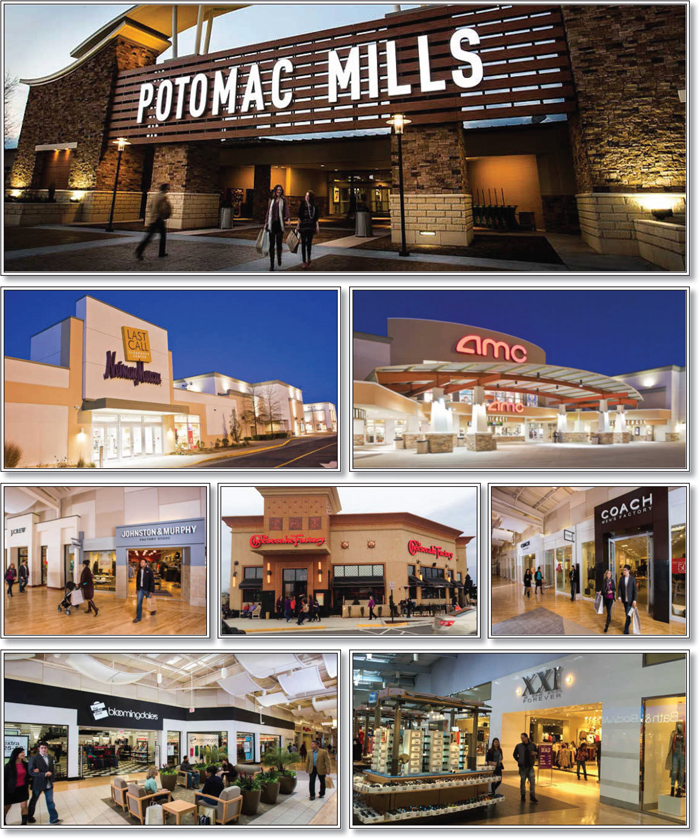

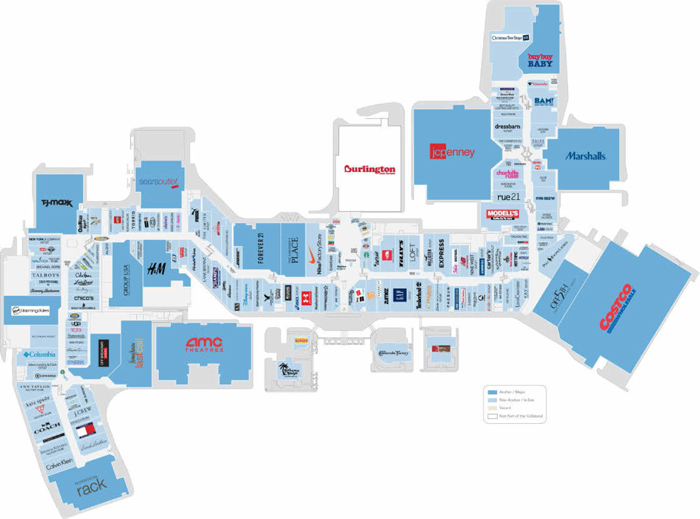

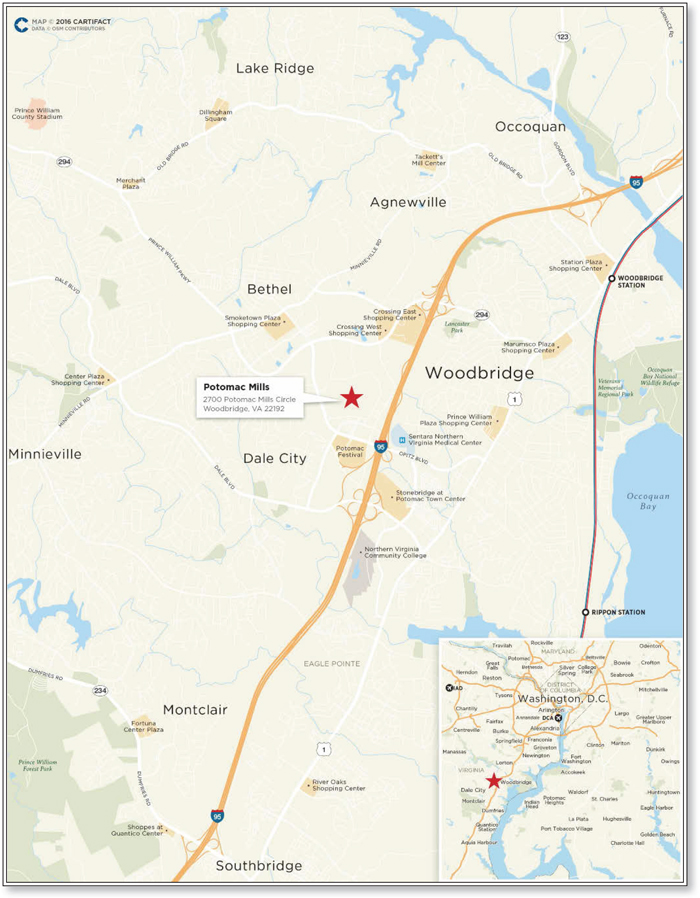

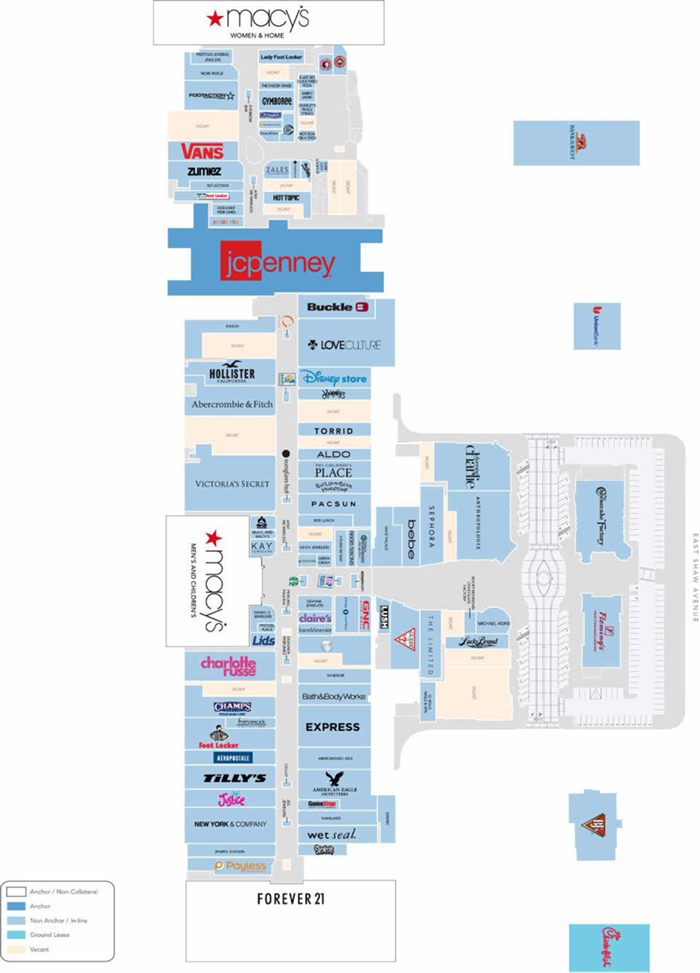

| 4 | Potomac Mills | 36,375,000 | 4.0 | Retail | 1,459,997 | $199 | 4.39x | 13.9% | 38.0% | |||||||||||||

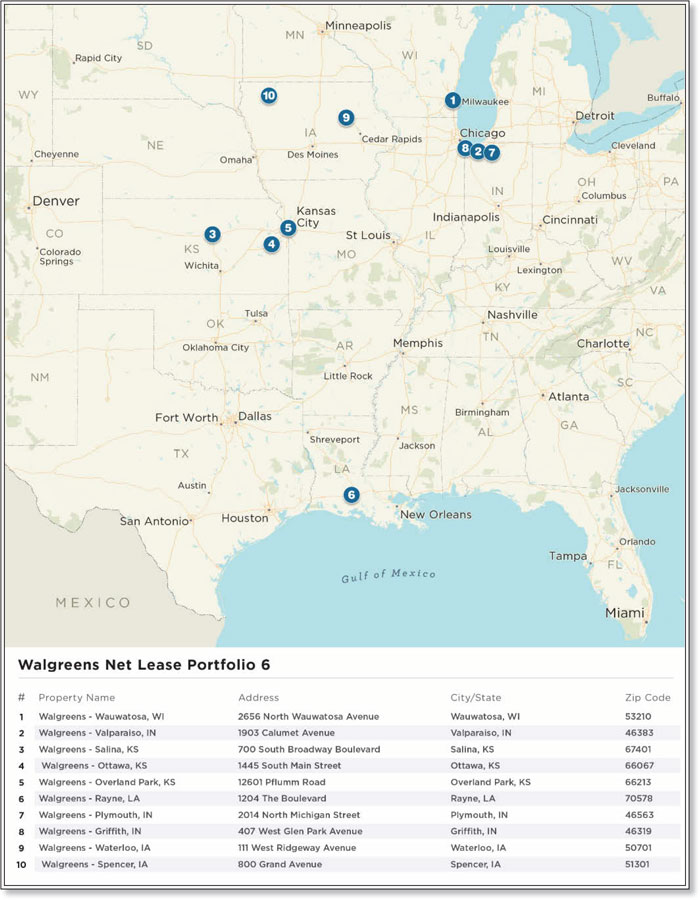

| 5 | Walgreens Net Lease Portfolio 6 | 35,048,994 | 3.8 | Retail | 158,399 | $221 | 2.01x | 9.5% | 56.3% | |||||||||||||

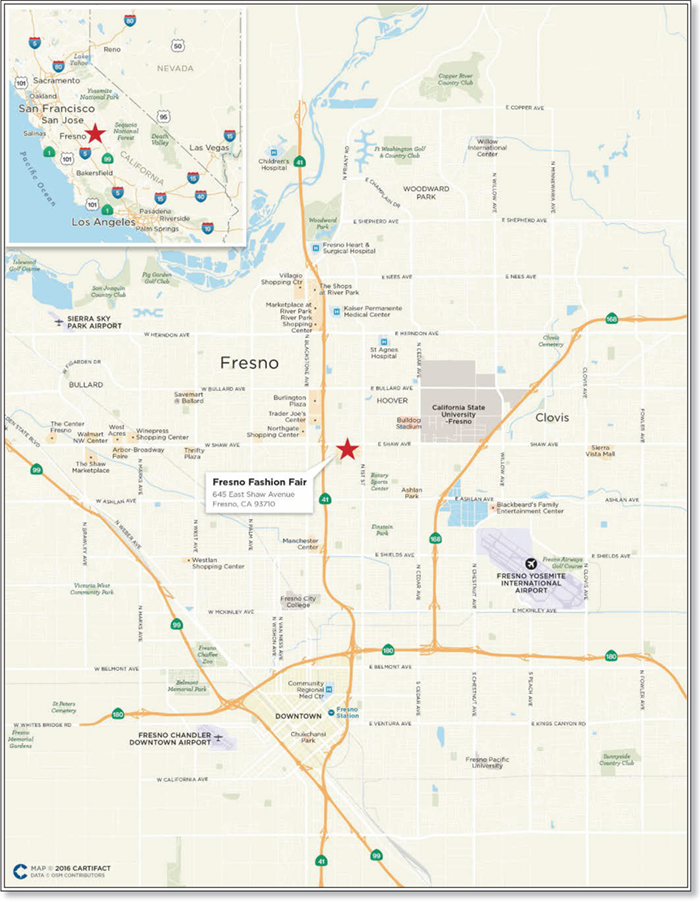

| 6 | Fresno Fashion Fair | 35,000,000 | 3.8 | Retail | 536,093 | $606 | 2.14x | 8.1% | 57.5% | |||||||||||||

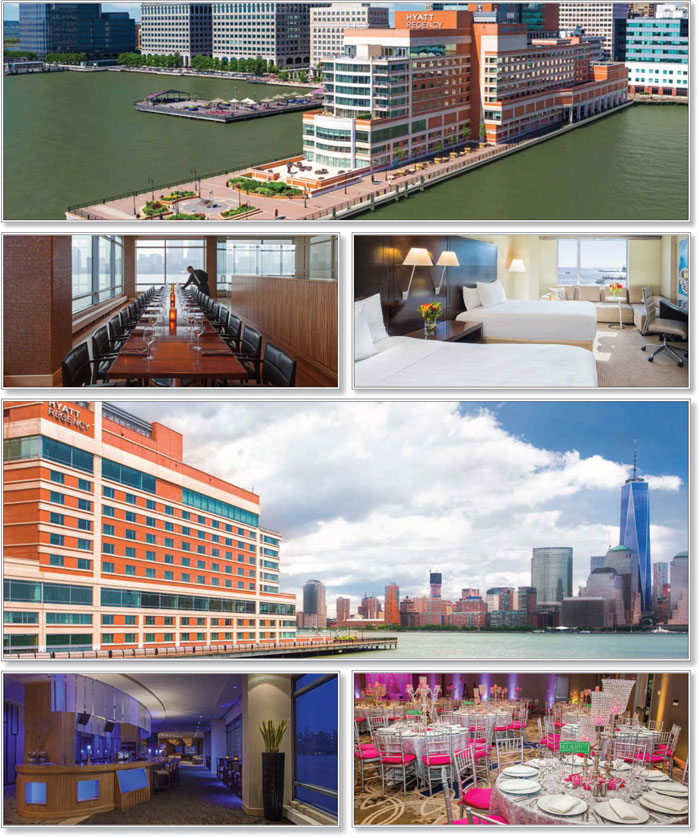

| 7 | Hyatt Regency Jersey City | 35,000,000 | 3.8 | Hospitality | 351 | $284,900 | 3.55x | 15.4% | 52.4% | |||||||||||||

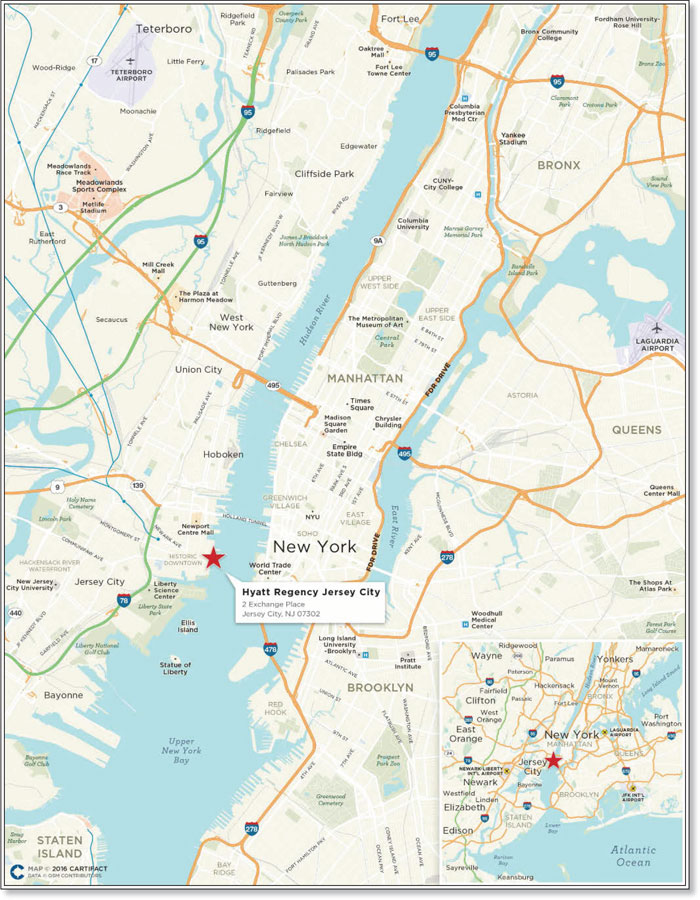

| 8 | 925 La Brea Avenue | 29,400,000 | 3.2 | Mixed Use | 63,331 | $464 | 1.40x | 8.6% | 63.1% | |||||||||||||

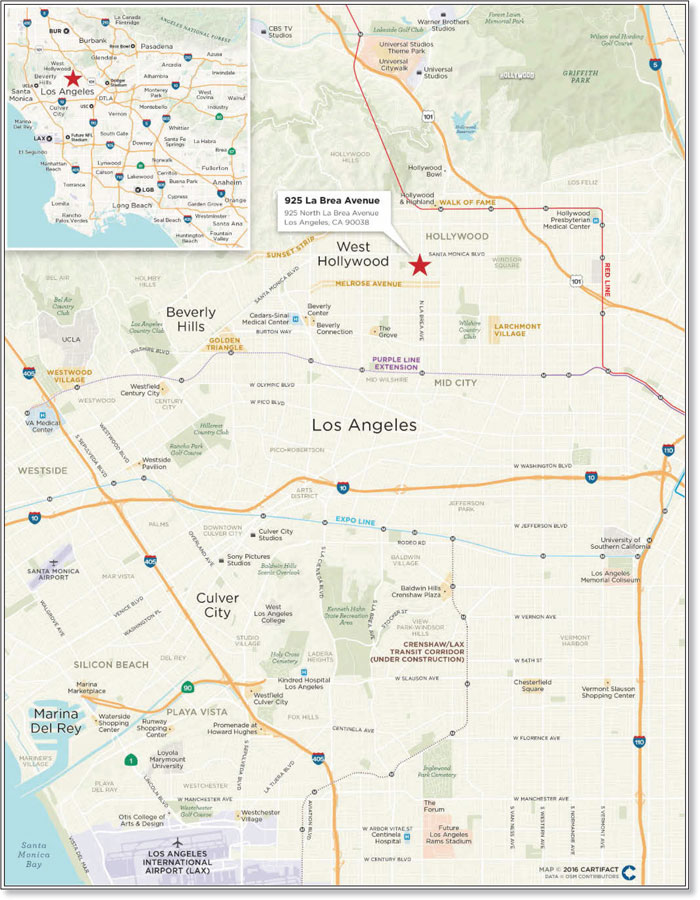

| 9 | Veva 16 & 18 | 28,837,003 | 3.2 | Office | 192,979 | $149 | 1.45x | 9.5% | 70.0% | |||||||||||||

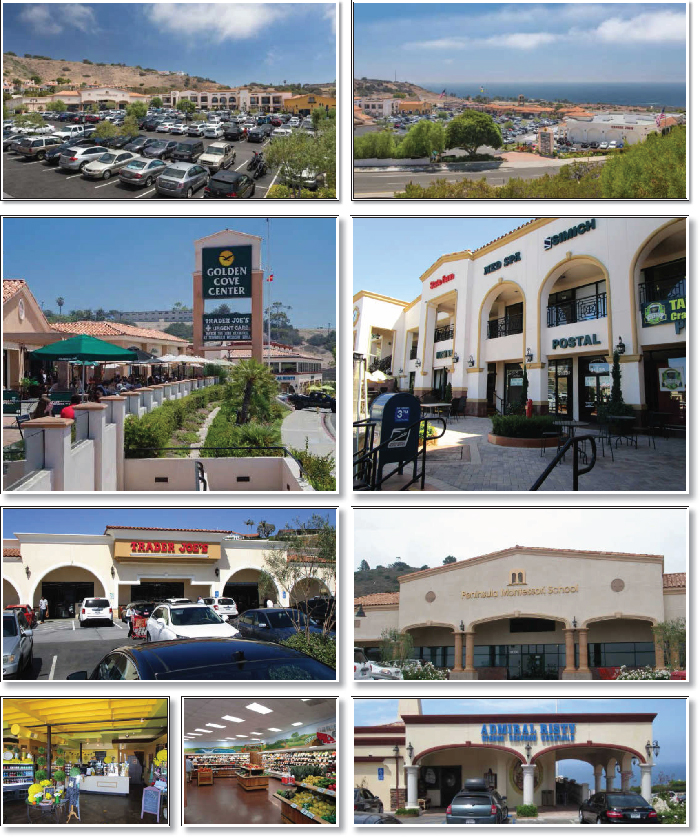

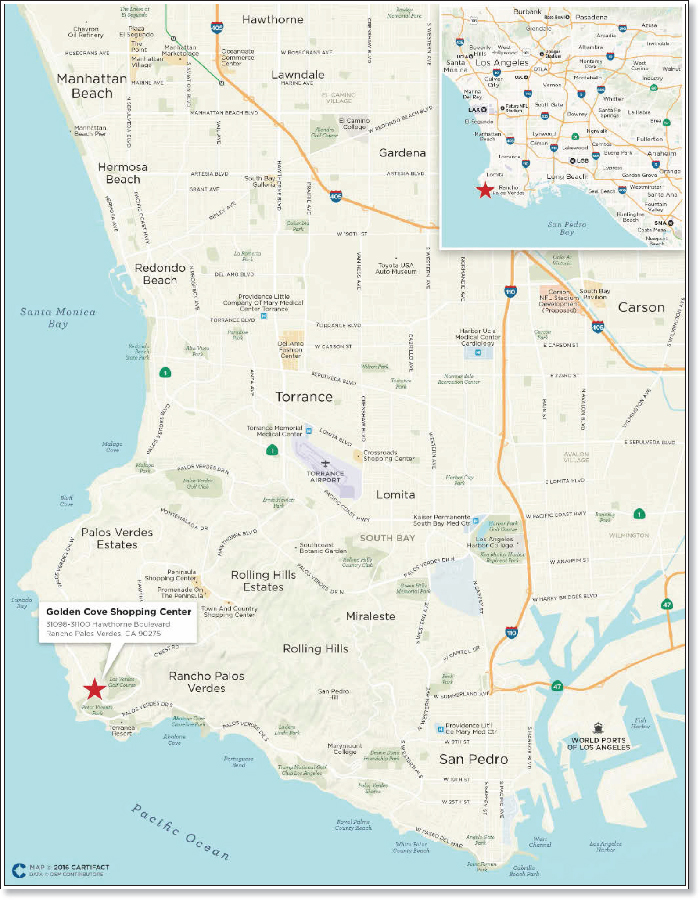

| 10 | Golden Cove Shopping Center | 28,050,000 | 3.1 |

Mixed Use | 91,102 | $308 | 1.30x | 8.4% |

59.1% | |||||||||||||

| Top 10 Total / Wtd. Avg. | $410,210,997 | 44.9% | 2.25x | 9.7% | 56.1% | |||||||||||||||||

| Remaining Total / Wtd. Avg. | 503,197,708 | 55.1 |

1.68x | 10.5% |

62.0% | |||||||||||||||||

| Total / Wtd. Avg. | $913,408,704 | 100.0% | 1.94x | 10.1% | 59.4% | |||||||||||||||||

| (1) | See footnotes to table entitled “Mortgage Pool Characteristics” above. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

9

| COLLATERAL OVERVIEW (continued) |

| Loan Combination Summary |

Mortgaged Property Name(1) |

Mortgage Loan Cut-off Date Balance |

Mortgage Loan as Approx. % of Initial Pool Balance |

Aggregate Pari Passu Companion Loan Cut-off Date Balance |

Aggregate Subordinate Companion Loan Cut-off Date Balance |

Loan Combination Cut-off Date Balance |

Controlling Pooling and Servicing Agreement (“Controlling PSA”)(2) |

Master Servicer / Outside Servicer |

Special Servicer / Outside Special Servicer |

| 8 Times Square & 1460 Broadway | $75,000,000 | 8.2% | $125,000,000 | — | $200,000,000 | CD 2016-CD2(3) | Wells Fargo(3) | KeyBank(3) |

| 681 Fifth Avenue | $57,500,000 | 6.3% | $157,500,000 | — | $215,000,000 | MSC 2016-UBS12(4) | Midland(4) | Rialto(4) |

| Quantum Park | $50,000,000 | 5.5% | $82,000,000 | — | $132,000,000 | CGCMT 2016-C3(5) | Midland(5) | Rialto(5) |

| Potomac Mills | $36,375,000 | 4.0% | $254,625,000 | $125,000,000 | $416,000,000 | CFCRE 2016-C6(6) | Wells Fargo | AEGON USA Realty Advisors |

| Fresno Fashion Fair | $35,000,000 | 3.8% | $290,000,000 | — | $325,000,000 | JPMDB 2016-C4 | Wells Fargo | Midland |

| Hyatt Regency Jersey City | $35,000,000 | 3.8% | $65,000,000 | — | $100,000,000 | CGCMT 2016-P5 | Midland | LNR |

| Easton Town Center | $22,500,000 | 2.5% | $315,000,000 | $362,500,000 | $700,000,000 | BBCMS 2016-ETC | Wells Fargo | AEGON USA Realty Advisors |

| (1) | Each of the mortgage loans included in the issuing entity that is secured by a mortgaged property or portfolio of mortgaged properties identified in the table above, together with the related companion loan(s) (each of which is not included in the issuing entity), is referred to in this Term Sheet as a “loan combination”. See “Description of the Mortgage Pool—The Loan Combinations” in the Preliminary Prospectus. |

| (2) | Each loan combination will be serviced under the related Controlling PSA, and the controlling class representative (or an equivalent entity) under the related Controlling PSA (or such other party as is designated under the related Controlling PSA) will be entitled to exercise the rights of controlling note holder for the subject loan combination, except as otherwise discussed in footnotes (5) and (6) below. |

| (3) | The 8 Times Square & 1460 Broadway controlling pari passu companion loan is currently held by Citigroup Global Markets Realty Corp., but is expected to be contributed to the CD 2016-CD2 securitization transaction. Although the CD 2016-CD2 securitization transaction has not yet closed, the 8 Times Square & 1460 Broadway loan combination is presented throughout this Term Sheet as an outside serviced loan combination (given that, based on a publicly available preliminary prospectus for the CD 2016-CD2 securitization transaction, the anticipated closing date for the CD 2016-CD2 securitization transaction is prior to the anticipated closing date for this securitization transaction). Accordingly, the 8 Times Square & 1460 Broadway loan combination is expected to be (and information presented in the foregoing table is based on the assumption that the 8 Times Square & 1460 Broadway loan combination will be) serviced and administered pursuant to the CD 2016-CD2 pooling and servicing agreement. |

| (4) | The 681 Fifth Avenue controlling pari passu companion loan is currently held by UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG, New York Branch”), but is expected to be contributed to the MSC 2016-UBS12 securitization transaction. Although the MSC 2016-UBS12 securitization transaction has not yet closed, the 681 Fifth Avenue loan combination is presented throughout this Term Sheet as an outside serviced loan combination (given that, based on a publicly available preliminary prospectus for the MSC 2016-UBS12 securitization transaction, the anticipated closing date for the MSC 2016-UBS12 securitization transaction is prior to the anticipated closing date for this securitization transaction). Accordingly, the 681 Fifth Avenue loan combination is expected to be (and information presented in the foregoing table is based on the assumption that the 681 Fifth Avenue loan combination will be) serviced and administered pursuant to the MSC 2016-UBS12 pooling and servicing agreement. |

| (5) | The Quantum Park loan combination is being serviced pursuant to the CGCMT 2016-C3 pooling and servicing agreement (which will be the initial Controlling PSA for such loan combination), by the outside servicer and outside special servicer set forth in the table above. Notwithstanding the foregoing, upon the inclusion of the related controlling pari passu companion loan in a future securitization transaction, such loan combination will be serviced under the pooling and servicing agreement entered into in connection with that future securitization, which will then be the applicable Controlling PSA for such loan combination. Although the CGCMT 2016-C3 pooling and servicing agreement will initially be the Controlling PSA for the Quantum Park loan combination, the holder of the related controlling pari passu companion loan for such loan combination will be the directing holder for such loan combination while it is serviced under the CGCMT 2016-C3 pooling and servicing agreement and, solely as to such loan combination, will exercise all rights normally exercised by the CGCMT 2016-C3 controlling class representative with respect to most other mortgage loans serviced under the CGCMT 2016-C3 pooling and servicing agreement. |

| (6) | With respect to the Potomac Mills loan combination, the control rights are held by the holder(s) of greater than 50% of the aggregate principal balance of the subordinate companion loans (Teachers Insurance and Annuity Association of America) so long as no AB control appraisal period is in effect (and, accordingly, there is currently no “initial outside controlling class representative” (or equivalent entity) exercising such rights). If an AB control appraisal period under the related co-lender agreement is in effect, then note A-1 will be the controlling note and the controlling class representative under the CFCRE 2016-C6 securitization will be the outside controlling class representative with respect to the Potomac Mills mortgage loan. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

10

| COLLATERAL OVERVIEW (continued) |

| Loan Combination Controlling Notes and Non-Controlling Notes |

Mortgaged Property Name / Note Detail |

Controlling

|

Current

Holder of |

Current

or Anticipated |

Cut-off

Date |

| 8 Times Square & 1460 Broadway | ||||

| Note A-1 | Yes | CGMRC | CD 2016-CD2 | $100,000,000 |

| Note A-2-1 | No | CGMRC | CGCMT 2016-P6 | $75,000,000 |

| Note A-2-2 | No | CGMRC | Not Identified | $25,000,000 |

| 681 Fifth Avenue | ||||

| Note A-1 | Yes | UBS AG, New York Branch | MSC 2016-UBS12 | $80,000,000 |

| Note A-2 | No | UBS AG, New York Branch | Not Identified | $15,000,000 |

| Note A-3 | No | UBS AG, New York Branch | Not Identified | $15,000,000 |

| Note A-4 | No | UBS AG, New York Branch | Not Identified | $19,000,000 |

| Note A-5 | No | CGMRC | CGCMT 2016-P6 | $57,500,000 |

| Note A-6 | No | CGMRC | Not Identified | $28,500,000 |

| Quantum Park | ||||

| Note A-1 | No | — | CGCMT 2016-C3 | $30,000,000 |

| Note A-2 | No | Barclays | CGCMT 2016-P6 | $50,000,000 |

| Note A-3 | Yes | Barclays | Not Identified | $52,000,000 |

| Potomac Mills | ||||

| Note A-1 | (5) | — | CFCRE 2016-C6 | $40,000,000 |

| Note A-2 | No | Société Générale | Not Identified | $20,000,000 |

| Note A-3 | No | Société Générale | Not Identified | $12,750,000 |

| Note A-4 | No | Bank of America, N.A. | Not Identified | $52,000,000 |

| Note A-5 | No | Bank of America, N.A. | Not Identified | $20,750,000 |

| Note A-6 | No | — | CFCRE 2016-C6 | $30,000,000 |

| Note A-7 | No | — | CGCMT 2016-C3 | $35,000,000 |

| Note A-8 | No | Cantor Commercial Real Estate Lending, L.P. | Not Identified | $7,750,000 |

| Note A-9 | No | Barclays | CGCMT 2016-P6 | $36,375,000 |

| Note A-10 | No | Barclays | Not Identified | $36,375,000 |

| Notes B-1, B-2, B-3, B-4, B-5, B-6, B-7, B-8, B-9 and B-10 | (5) | Teachers Insurance and Annuity Association of America | Not Applicable | $125,000,000 (aggregate) |

| Fresno Fashion Fair | ||||

| Note A-1-A | Yes | — | JPMDB 2016-C4 | $60,000,000 |

| Note A-1-B | No | JPMorgan Chase Bank, National Association | Not Identified | $80,000,000 |

| Note A-1-C | No | JPMorgan Chase Bank, National Association | Not Identified | $69,000,000 |

| Note A-2-A | No | — | CFCRE 2016-C6 | $40,000,000 |

| Note A-2-B | No | Société Générale | Not Identified | $36,000,000 |

| Note A-2-C | No | Société Générale | CGCMT 2016-P6 | $35,000,000 |

| Note A-2-D | No | Société Générale | Not Identified | $5,000,000 |

| Hyatt Regency Jersey City | ||||

| Note A-1 | Yes | — | CGCMT 2016-P5 | $65,000,000 |

| Note A-2 | No | Barclays | CGCMT 2016-P6 | $35,000,000 |

| Easton Town Center | ||||

| Note A-1-A | Yes | — | BBCMS 2016-ETC | $90,000,000 |

| Note A-2-A | No | — | BBCMS 2016-ETC | $60,000,000 |

| Note A-1-B-1 | No | — | CGCMT 2016-P5 | $45,000,000 |

| Note A-1-B-2 | No | — | WFCM 2016-C36 | $45,000,000 |

| Note A-1-B-3 | No | Barclays | CGCMT 2016-P6 | $22,500,000 |

| Note A-2-B | No | — | MSBAM 2016-C30 | $75,000,000 |

| Note B-1 | No | — | BBCMS 2016-ETC | $217,500,000 |

| Note B-2 | No | — | BBCMS 2016-ETC | $145,000,000 |

| (1) | The holder(s) of the Controlling Note will be entitled (directly or through a representative) to (a) approve or, in some cases, direct material servicing decisions involving the related loan combination (while the remaining such holder(s) generally are only entitled to non-binding consultation rights in such regard), and (b) in some cases, replace the applicable special servicer with respect to such loan combination with or without cause. See “Description of the Mortgage Pool—The Loan Combinations” and “The Pooling and Servicing Agreement—Directing Holder” in the Preliminary Prospectus. |

| (2) | The holder(s) of the Non-Controlling Note(s) will generally be entitled (directly or through a representative) to certain non-binding consultation rights with respect to any decisions as to which the holder of the Controlling Note has consent rights involving the related loan combination, subject to certain exceptions, including that in certain cases such consultation rights will not be afforded to the holder(s) of the Non-Controlling Notes until after a control trigger event has occurred with respect to either the Control Note or certain certificates backed thereby, in each case as set forth the related co-lender agreement. See “Description of the Mortgage Pool—The Loan Combinations” in the Preliminary Prospectus. |

| (3) | Unless otherwise specified, with respect to each loan combination, any related unsecuritized Controlling Note and/or Non-Controlling Note may be further split, modified, combined and/or reissued (prior to its inclusion in a securitization transaction) as one or multiple Controlling Notes or Non-Controlling Notes, as the case may be, subject to the terms of the related co-lender agreement (including that the aggregate principal balance, weighted average interest rate and certain other material terms cannot be changed). In connection with the foregoing, any such split, modified or combined Controlling Note or Non-Controlling Note, as the case may be, may be transferred to one or multiple parties (not identified in the table above) prior to its inclusion in a securitization transaction. |

| (4) | Unless otherwise specified, with respect to each loan combination, each related unsecuritized pari passu Companion Note (both controlling and non-controlling) is expected to be contributed to one or more future commercial mortgage securitization transactions. Under the column “Current or Anticipated Holder of Securitized Note”, (i) the identification of a securitization trust means we have identified an outside securitization that has closed or as to which a preliminary prospectus or final prospectus has printed that has or is expected to include the subject Controlling Note or Non-Controlling Note, as the case may be, (ii) “Not identified” means no preliminary or final prospectus has printed that identifies the future outside securitization that is expected to include the subject Controlling Note or Non-Controlling Note, and (iii) “Not applicable” means the subject Controlling Note or Non-Controlling Note is not intended to be contributed to a commercial mortgage securitization transaction. Under the column “Current Holder of Unsecuritized Note”, “—” means the subject Controlling Note or Non-Controlling Note is not an unsecuritized note and is currently held by the securitization trust referenced under the “Current or Anticipated Holder of Securitized Note” column. |

| (5) | Pursuant to the related co-lender agreement, (i) the Controlling Note Holder (except if an AB control appraisal period is in effect) is the holder of greater than 50% of the aggregate outstanding principal balance of such subordinate companion loans, and (ii) if an AB control appraisal period under the related co-lender agreement is in effect, then note A-1 will be the Controlling Note and the controlling class representative under the CFCRE 2016-C6 securitization will be the outside controlling class representative with respect to the Potomac Mills mortgage loan. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

11

| COLLATERAL OVERVIEW (continued) |

| Previously Securitized Mortgaged Properties(1) |

Mortgaged Property Name |

Mortgage Loan Seller |

City |

State |

Property Type |

Cut-off Date Balance / Allocated Cut-off Date Balance(2) |

% of Initial Pool Balance |

Previous Securitization |

| 681 Fifth Avenue | CGMRC | New York | New York | Mixed Use | $57,500,000 | 6.3% | DBUBS 2011-LC1A |

| Hyatt Regency Jersey City | Barclays | Jersey City | New Jersey | Hospitality | $35,000,000 | 3.8% | BSCMS 2004-BBA3 |

| Golden Cove Shopping Center | PCC | Rancho Palos Verdes | California | Mixed Use | $28,050,000 | 3.1% | CSMC 2007-C1 |

| Easton Town Center | Barclays | Columbus | Ohio | Retail | $22,500,000 | 2.5% | MSC 2007-IQ16; BSCMS 2007-T28 |

| Walgreens Pool 1(3) | SMF V | Various | Various | Retail | $20,973,238 | 2.3% | BACM 2006-5 |

| Walgreens Pool 2(4) | SMF V | Various | Various | Retail | $19,515,099 | 2.1% | BACM 2006-5 |

| Walgreens Pool 4(5) | SMF V | Various | Various | Retail | $19,262,421 | 2.1% | BACM 2006-5 |

| Seven Mile Crossing | CGMRC | Livonia | Michigan | Office | $17,550,000 | 1.9% | MLMT 2002-MW1 |

| Ontario City Centre | SG | Chicago | Illinois | Mixed Use | $15,700,000 | 1.7% | BSCMSI 2006-PW14 |

| Horn Lake Storage - Goodman Road | CGMRC | Horn Lake | Mississippi | Self Storage | $7,200,000 | 0.8% | WFRBS 2014-LC14 |

| Springbrook Shopping Center | CGMRC | Bloomingdale | Illinois | Retail | $15,000,000 | 1.6% | JPMCC 2006-LDP9 |

| Villanueva Portfolio(6) | SMF V | Various | Various | Various | $13,033,623 | 1.4% | LBUBS 2006-C7 |

| Boulevard Apartments | SG | Auburn Hills | Michigan | Multifamily | $13,000,000 | 1.4% | JPMCC 2006-CB17 |

| Summit Center Marketplace | PCC | Oconomowoc | Wisconsin | Mixed Use | $11,834,081 | 1.3% | CSMC 2006-C5 |

| Sand Creek Business Center | SG | Brentwood | California | Office | $8,250,000 | 0.9% | MSC 2007-HQ11 |

| All Storage Granbury | SG | Fort Worth | Texas | Self Storage | $7,964,784 | 0.9% | JPMCC 2006-CB17 |

| Venture Plaza | SMF V | Troy | Michigan | Office | $5,900,00 | 0.6% | COMM 2007-C9 |

| Judiciary Place | PCC | Manassas | Virginia | Office | $5,792,334 | 0.6% | BSCMS 2006-PW13 |

| Palm West | SMF V | Avondale | Arizona | Manufactured Housing Community | $4,238,876 | 0.5% | MSC 2007-HQ11 |

| (1) | The table above includes mortgaged properties securing mortgage loans for which the most recent prior financing of all or a significant portion of such mortgaged property was included in a securitization. Information under “Previous Securitization” represents the most recent such securitization with respect to each of those mortgaged properties. The information in the above table is based solely on information provided by the related borrower or obtained through searches of a third-party database, and has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | Reflects the allocated loan amount in cases where the applicable mortgaged property is one of a portfolio of mortgaged properties securing a particular mortgage loan. |

| (3) | All six of the Walgreens Pool 1 mortgaged properties secured one or more prior loans that were included in the BACM 2006-5 transaction. |

| (4) | All six of the Walgreens Pool 2 mortgaged properties secured one or more prior loans that were included in the BACM 2006-5 transaction. |

| (5) | All six of the Walgreens Pool 4 mortgaged properties secured one or more prior loans that were included in the BACM 2006-5 transaction. |

| (6) | All four of the Villanueva Portfolio mortgaged properties secured one or more prior loans that were included in the LBUBS 2006-C7 transaction. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

12

(THIS PAGE INTENTIONALLY LEFT BLANK)

13

| COLLATERAL OVERVIEW (continued) |

| Property Types |

Property Type / Detail |

Number of Mortgaged Properties |

Aggregate Cut-off Date Balance(1) |

% of Initial Pool Balance(1) |

Wtd. Avg. Underwritten NCF DSCR(2) |

Wtd. Avg. Cut-off Date LTV Ratio(2) |

Wtd. Avg. Debt Yield on Underwritten NOI(2) | |

| Retail | 49 | $307,324,204 | 33.6% | 2.15x | 57.0% | 10.0% | |

| Single Tenant | 37 | 125,287,437 | 13.7 | 1.62x | 61.5% | 8.7% | |

| Super Regional Mall | 2 | 71,375,000 | 7.8 | 3.29x | 47.6% | 11.1% | |

| Anchored | 5 | 71,300,000 | 7.8 | 1.51x | 65.5% | 9.5% | |

| Urban Streetscape Retail Center | 1 | 22,500,000 | 2.5 | 4.02x | 28.5% | 15.4% | |

| Unanchored | 2 | 10,310,000 | 1.1 | 1.45x | 67.8% | 9.3% | |

| Shadow Anchored | 2 | 6,551,768 | 0.7 | 1.48x | 64.2% | 10.1% | |

| Mixed Use | 7 | $244,484,081 | 26.8% | 1.57x | 56.9% | 8.2% | |

| Office/Retail | 6 | 228,784,081 | 25.0 | 1.56x | 57.2% | 7.9% | |

| Retail/Hospitality | 1 | 15,700,000 | 1.7 | 1.71x | 52.0% | 11.3% | |

| Office | 13 | $172,661,207 | 18.9% | 2.06x | 65.7% | 11.3% | |

| Suburban | 9 | 149,601,065 | 16.4 | 2.12x | 66.5% | 11.3% | |

| Medical Office | 3 | 20,463,712 | 2.2 | 1.71x | 61.9% | 11.3% | |

| CBD | 1 | 2,596,430 | 0.3 | 1.41x | 50.9% | 9.8% | |

| Hospitality | 5 | $83,381,482 | 9.1% | 2.50x | 55.0% | 15.1% | |

| Full Service | 2 | 52,956,162 | 5.8 | 2.92x | 52.3% | 15.8% | |

| Limited Service | 2 | 17,941,124 | 2.0 | 1.87x | 61.0% | 13.9% | |

| Select Service | 1 | 12,484,195 | 1.4 | 1.66x | 57.7% | 14.3% | |

| Self Storage | 12 | $55,809,784 | 6.1% | 1.34x | 67.1% | 8.8% | |

| Multifamily (Garden) | 7 | $45,509,068 | 5.0% | 1.71x | 62.0% | 9.8% | |

| Manufactured Housing Community | 1 |

|

$4,238,876 |

0.5% |

1.62x |

74.4% |

9.8% |

| Total | 94 | $913,408,704 | 100% | 1.94x | 59.4% | 10.1% | |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Weighted average based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

14

| COLLATERAL OVERVIEW (continued) |

| Geographic Distribution |

Property Location |

Number of Mortgaged Properties |

Aggregate Cut-off Date Balance(1) |

% of Initial Pool Balance(1) |

Aggregate |

% of Total Appraised Value |

Underwritten NOI(2) |

% of Total Underwritten NOI | |||||||

| California | 12 | $152,002,226 | 16.6% | $752,470,000 | 16.1% | $36,496,321 | 15.2% | |||||||

| New York | 2 | 132,500,000 | 14.5 | 800,000,000 | 17.2 | 30,404,500 | 12.7 | |||||||

| Virginia | 3 | 92,167,334 | 10.1 | 973,400,000 | 20.9 | 55,940,440 | 23.4 | |||||||

| Michigan | 6 | 57,359,720 | 6.3 | 101,080,000 | 2.2 | 7,127,826 | 3.0 | |||||||

| Pennsylvania | 3 | 51,401,519 | 5.6 | 72,600,000 | 1.6 | 5,352,580 | 2.2 | |||||||

| Illinois | 6 | 51,050,241 | 5.6 | 83,450,000 | 1.8 | 4,885,359 | 2.0 | |||||||

| New Jersey | 2 | 42,500,000 | 4.7 | 201,050,000 | 4.3 | 16,335,421 | 6.8 | |||||||

| Ohio | 4 | 41,505,752 | 4.5 | 1,214,720,000 | 26.0 | 54,079,867 | 22.6 | |||||||

| Texas | 10 | 39,007,677 | 4.3 | 60,310,000 | 1.3 | 3,604,561 | 1.5 | |||||||

| Florida | 2 | 33,375,000 | 3.7 | 53,500,000 | 1.1 | 3,172,018 | 1.3 | |||||||

| Wisconsin | 3 | 27,855,812 | 3.0 | 42,590,000 | 0.9 | 3,006,450 | 1.3 | |||||||

| District of Columbia | 1 | 27,000,000 | 3.0 | 41,000,000 | 0.9 | 2,457,993 | 1.0 | |||||||

| Arkansas | 7 | 24,327,496 | 2.7 | 37,900,000 | 0.8 | 2,086,324 | 0.9 | |||||||

| Oregon | 1 | 17,956,162 | 2.0 | 34,500,000 | 0.7 | 2,958,268 | 1.2 | |||||||

| Mississippi | 3 | 15,020,439 | 1.6 | 22,000,000 | 0.5 | 1,247,623 | 0.5 | |||||||

| Arizona | 4 | 14,424,879 | 1.6 | 21,500,000 | 0.5 | 1,220,080 | 0.5 | |||||||

| South Carolina | 2 | 14,100,000 | 1.5 | 18,960,000 | 0.4 | 1,234,559 | 0.5 | |||||||

| Indiana | 4 | 13,489,008 | 1.5 | 23,180,000 | 0.5 | 1,223,933 | 0.5 | |||||||

| Kansas | 4 | 12,800,488 | 1.4 | 22,200,000 | 0.5 | 1,179,561 | 0.5 | |||||||

| Oklahoma | 4 | 12,148,147 | 1.3 | 19,700,000 | 0.4 | 1,105,327 | 0.5 | |||||||

| Nevada | 1 | 7,381,124 | 0.8 | 11,900,000 | 0.3 | 1,092,776 | 0.5 | |||||||

| New Mexico | 2 | 7,351,619 | 0.8 | 11,350,000 | 0.2 | 580,002 | 0.2 | |||||||

| Iowa | 2 | 6,065,105 | 0.7 | 10,770,000 | 0.2 | 576,892 | 0.2 | |||||||

| Missouri | 1 | 4,192,500 | 0.5 | 6,450,000 | 0.1 | 411,956 | 0.2 | |||||||

| Tennessee | 1 | 4,100,000 | 0.4 | 5,500,000 | 0.1 | 343,821 | 0.1 | |||||||

| Georgia | 1 | 4,000,000 | 0.4 | 7,700,000 | 0.2 | 600,469 | 0.3 | |||||||

| Louisiana | 1 | 3,221,021 | 0.4 | 5,720,000 | 0.1 | 288,024 | 0.1 | |||||||

| Kentucky | 1 | 2,795,433 | 0.3 | 4,325,000 | 0.1 | 220,581 | 0.1 | |||||||

| Utah | 1 |

2,310,000 |

0.3 |

3,300,000 |

0.1 |

201,955 |

0.1 | |||||||

| Total | 94 | $913,408,704 | 100.0% | $4,663,125,000 | 100.0% | $239,435,486 | 100.0% |

| (1) | Calculated based on the mortgaged property’s allocated loan amount for mortgage loans secured by more than one mortgaged property. |

| (2) | Aggregate Appraised Values and Underwritten NOI reflect the aggregate values without any reduction for the pari passu companion loan(s). |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

15

COLLATERAL OVERVIEW (continued)

| Distribution of Cut-off Date Balances | |||||||||||

| Range

of Cut-off Date Balances ($) |

Number of Mortgage Loans |

Cut-off

Date Balance |

%

of Initial Pool Balance |

||||||||

| 2,310,000- 4,999,999 | 10 | $37,285,605 | 4.1 | % | |||||||

| 5,000,000 - 9,999,999 | 11 | 81,716,241 | 8.9 | ||||||||

| 10,000,000 - 14,999,999 | 9 | 110,843,757 | 12.1 | ||||||||

| 15,000,000 - 19,999,999 | 9 | 153,383,683 | 16.8 | ||||||||

| 20,000,000 - 24,999,999 | 3 | 65,968,422 | 7.2 | ||||||||

| 25,000,000 - 29,999,999 | 5 | 140,287,003 | 15.4 | ||||||||

| 30,000,000 - 39,999,999 | 4 | 141,423,994 | 15.5 | ||||||||

| 40,000,000 - 75,000,000 | 3 | 182,500,000 | 20.0 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

| Distribution of UW NCF DSCRs(1) | |||||||||||

| Range of UW DSCR (x) | Number

of Mortgage Loans |

Cut-off

Date Balance |

%

of Initial Pool Balance |

||||||||

| 1.20 - 1.35 | 11 | $150,005,759 | 16.4 | % | |||||||

| 1.36 - 1.50 | 18 | 228,081,933 | 25.0 | ||||||||

| 1.51 - 1.65 | 4 | 20,123,711 | 2.2 | ||||||||

| 1.66 - 1.80 | 6 | 186,021,482 | 20.4 | ||||||||

| 1.81 - 2.00 | 4 | 50,241,857 | 5.5 | ||||||||

| 2.01 - 4.39 | 11 | 278,933,962 | 30.5 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

| (1) See footnotes (1) and (6) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Amortization Types(1) | |||||||||||

| Amortization Type | Number

of Mortgage Loans |

Cut-off

Date Balance |

%

of Initial Pool Balance |

||||||||

| Interest Only | 8 | $278,375,000 | 30.5 | % | |||||||

| Interest Only, Then Amortizing(2) | 19 | 259,022,500 | 28.4 | ||||||||

| Amortizing (30 Years) | 22 | 243,129,739 | 26.6 | ||||||||

| Interest Only — ARD | 3 | 107,544,178 | 11.8 | ||||||||

| Amortizing (20 Years) | 2 | 25,337,287 | 2.8 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

| (1) All of the mortgage loans will have balloon payments at maturity date or anticipated repayment date. | |||||||||||

| (2) Original partial interest only periods range from 12 to 60 months. | |||||||||||

| Distribution of Lockboxes | |||||||||||

| Lockbox Type | Number of Mortgage Loans |

Cut-off Date Balance | % of Initial Pool Balance |

||||||||

| Hard | 18 | $500,366,538 | 54.8 | % | |||||||

| Springing | 33 | 354,742,166 | 38.8 | ||||||||

| Soft Springing | 2 | 45,300,000 | 5.0 | ||||||||

| None | 1 | 13,000,000 | 1.4 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

| Distribution of Cut-off Date LTV Ratios(1) | |||||||||||

| Range

of Cut-off Date LTV (%) |

Number

of Mortgage Loans |

Cut-off Date Balance | %

of Initial Pool Balance |

||||||||

| 28.5 - 54.9 | 9 | $209,177,593 | 22.9 | % | |||||||

| 55.0 - 59.9 | 9 | 233,177,474 | 25.5 | ||||||||

| 60.0 - 64.9 | 13 | 172,556,303 | 18.9 | ||||||||

| 65.0 - 69.9 | 14 | 202,861,456 | 22.2 | ||||||||

| 70.0 - 74.6 | 9 | 95,635,879 | 10.5 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

| (1) See footnotes (1) and (5) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Maturity Date/ARD LTV Ratios(1) | |||||||||||

| Range

of Maturity Date/ARD LTV (%) |

Number

of Mortgage Loans |

Cut-off Date Balance | %

of Initial Pool Balance |

||||||||

| 28.5 - 49.9 | 14 | $254,160,139 | 27.8 | % | |||||||

| 50.0 - 54.9 | 13 | 177,179,592 | 19.4 | ||||||||

| 55.0 - 59.9 | 16 | 308,681,970 | 33.8 | ||||||||

| 60.0 - 64.9 | 4 | 58,237,003 | 6.4 | ||||||||

| 65.0 - 68.8 | 7 | 115,150,000 | 12.6 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

| (1) See footnotes (1), (3) and (5) to the table entitled “Mortgage Pool Characteristics” above. | |||||||||||

| Distribution of Loan Purpose | |||||||||||

| Loan Purpose | Number

of Mortgage Loans |

Cut-off Date Balance | %

of Initial Pool Balance |

||||||||

| Refinance | 39 | $667,195,298 | 73.0 | % | |||||||

| Acquisition | 14 | 211,213,406 | 23.1 | ||||||||

| Recapitalization | 1 | 35,000,000 | 3.8 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

| Distribution of Mortgage Rates | |||||||||||

| Range

of Mortgage Rates (%) |

Number

of Mortgage Loans |

Cut-off Date Balance | %

of Initial Pool Balance |

||||||||

| 2.988 - 4.000 | 8 | $219,389,784 | 24.0 | % | |||||||

| 4.001 - 4.500 | 20 | 329,755,790 | 36.1 | ||||||||

| 4.501 - 5.000 | 19 | 277,021,127 | 30.3 | ||||||||

| 5.001 - 5.370 | 7 | 87,242,003 | 9.6 | ||||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||||

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

16

| COLLATERAL OVERVIEW (continued) |

Distribution of Debt Yield on Underwritten NOI(1)

| Range of | Number of | % of Initial | |||||||

| Debt Yields on | Mortgage | Cut-off Date | Pool | ||||||

| Underwritten NOI (%) | Loans | Balance | Balance | ||||||

| 7.3 - 7.9 | 5 | $192,250,759 | 21.0 | % | |||||

| 8.0 - 8.9 | 16 | 197,839,068 | 21.7 | ||||||

| 9.0 - 9.9 | 14 | 208,439,796 | 22.8 | ||||||

| 10.0 - 10.9 | 2 | 18,825,958 | 2.1 | ||||||

| 11.0 - 11.9 | 6 | 111,746,641 | 12.2 | ||||||

| 12.0 - 12.9 | 2 | 20,500,000 | 2.2 | ||||||

| 13.0 - 16.5 | 9 | 163,806,482 | 17.9 | ||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||

| (1) | See footnotes (1) and (7) to the table entitled “Mortgage Pool Characteristics” above. |

| Distribution of Debt Yield on Underwritten NCF(1) |

| Range of | Number of | % of Initial | |||||||

| Debt Yields on | Mortgage | Cut-off Date | Pool | ||||||

| Underwritten NCF (%) | Loans | Balance | Balance | ||||||

| 7.0 - 7.9 | 6 | $227,250,759 | 24.9 | % | |||||

| 8.0 - 8.9 | 22 | 262,091,307 | 28.7 | ||||||

| 9.0 - 9.9 | 10 | 133,913,515 | 14.7 | ||||||

| 10.0 - 10.9 | 2 | 33,900,000 | 3.7 | ||||||

| 11.0 - 11.9 | 6 | 103,006,641 | 11.3 | ||||||

| 12.0 - 12.9 | 2 | 30,034,195 | 3.3 | ||||||

| 13.0 - 14.7 | 6 | 123,212,287 | 13.5 | ||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||

| (1) | See footnotes (1) and (7) to the table entitled “Mortgage Pool Characteristics” above. |

| Mortgage Loans with Original Partial Interest Only Periods |

| Original Partial | Number of | % of Initial | ||||||||

| Interest Only Period | Mortgage | Cut-off Date | Pool | |||||||

| (months) | Loans | Balance | Balance | |||||||

| 12 | 2 | $33,375,000 | 3.7 | % | ||||||

| 18 | 4 | $47,845,000 | 5.2 | % | ||||||

| 24 | 4 | $70,760,000 | 7.7 | % | ||||||

| 36 | 4 | $30,492,500 | 3.3 | % | ||||||

| 48 | 1 | $5,900,000 | 0.6 | % | ||||||

| 60 | 4 | $70,650,000 | 7.7 | % | ||||||

| Distribution of Original Terms to Maturity/ARD(1) |

| Number of | % of Initial | |||||||||

| Original Term to | Mortgage | Cut-off Date | Pool | |||||||

| Maturity/ARD (months) | Loans | Balance | Balance | |||||||

| 60 | 6 | $126,682,003 | 13.9 | % | ||||||

| 84 | 1 | 18,200,000 | 2.0 | |||||||

| 120 | 44 | 708,775,943 | 77.6 | |||||||

| 122 | 3 | 59,750,759 | 6.5 | |||||||

| Total | 54 | $913,408,704 | 100.0 | % | ||||||

| (1) | See footnote (3) to the table entitled “Mortgage Pool Characteristics” above. |

Distribution of Remaining Terms to Maturity/ARD(1)

| Range of Remaining | Number of | % of Initial | ||||||||

| Terms to Maturity/ARD | Mortgage | Cut-off Date | Pool | |||||||

| (months) | Loans | Balance | Balance | |||||||

| 55 - 60 | 6 | $126,682,003 | 13.9 | % | ||||||

| 83 | 1 | 18,200,000 | 2.0 | |||||||

| 116 - 120 | 44 | 708,775,943 | 77.6 | |||||||

| 121 | 3 | 59,750,759 | 6.5 | |||||||

| Total | 54 | $913,408,704 | 100.0 | % | ||||||

| (1) | See footnote (3) to the table entitled “Mortgage Pool Characteristics” above. |

| Distribution of Original Amortization Terms(1) |

| % of | ||||||||||

| Number of | Initial | |||||||||

| Original Amortization | Mortgage | Cut-off Date | Pool | |||||||

| Term (months) | Loans | Balance | Balance | |||||||

| Interest Only | 11 | $385,919,178 | 42.3 | % | ||||||

| 240 | 2 | 25,337,287 | 2.8 | |||||||

| 360 | 41 | 502,152,239 | 55.0 | |||||||

| Total | 54 | $913,408,704 | 100.0 | % | ||||||

| (1) | All of the mortgage loans will have balloon payments at maturity or have an anticipated repayment date. |

Distribution of Remaining Amortization Terms(1)

| % of | |||||||||

| Range of Remaining | Number of | Initial | |||||||

| Amortization Terms | Mortgage | Cut-off Date | Pool | ||||||

| (months) | Loans | Balance | Balance | ||||||

| Interest Only | 11 | $385,919,178 | 42.3 | % | |||||

| 239 - 240 | 2 | 25,337,287 | 2.8 | ||||||

| 355 - 360 | 41 | 502,152,239 | 55.0 | ||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||

| (1) | All of the mortgage loans will have balloon payments at maturity or have an anticipated repayment date. |

| Distribution of Prepayment Provisions |

| % of | |||||||||

| Number of | Initial | ||||||||

| Mortgage | Cut-off Date | Pool | |||||||

| Prepayment Provision | Loans | Balance | Balance | ||||||

| Defeasance | 44 | $672,321,911 | 73.6 | % | |||||

| Yield Maintenance | 5 | 123,836,035 | 13.6 | ||||||

| Defeasance or Yield Maintenance | 5 | 117,250,759 | 12.8 | ||||||

| Total | 54 | $913,408,704 | 100.0 | % | |||||

Distribution of Escrow Types

| % of | |||||||||

| Number of | Initial | ||||||||

| Mortgage | Cut-off Date | Pool | |||||||

| Escrow Type | Loans | Balance | Balance | ||||||

| Replacement Reserves(1) | 45 | $689,238,767 | 75.5 | % | |||||

| Real Estate Tax | 41 | $639,386,267 | 70.0 | % | |||||

| Insurance | 27 | $384,165,104 | 42.1 | % | |||||

| TI/LC(2) | 19 | $270,950,626 | 37.4 | % | |||||

| (1) | Includes mortgage loans with FF&E reserves. |

| (2) | Percentage of the portion of the Initial Pool Balance secured by retail, office, industrial and mixed use properties. |

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-207132) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Citigroup Global Markets Inc., Barclays Capital Inc., SG Americas Securities, LLC, Drexel Hamilton, LLC, or any other underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by calling toll-free 1-800-831-9146.

17

| SHORT TERM CERTIFICATE PRINCIPAL PAY DOWN SCHEDULE |

Class A-2 Principal Pay Down(1)

| Mortgage Loan Name | Property Type | Cut-off

Date Balance |

%

of Initial Pool Balance |

Remaining

Loan Term |

Underwritten NCF DSCR |

Debt

Yield on Underwritten NOI |

Cut-off

Date LTV Ratio | |||||||

| Quantum Park | Office | $50,000,000 | 5.5% | 58 | 3.00x | 11.4% | 66.0% | |||||||

| Veva 16 & 18 | Office | $28,837,003 | 3.2% | 55 | 1.45x | 9.5% | 70.0% | |||||||

| Bentonville Self Storage Portfolio | Self Storage | $15,200,000 | 1.7% | 60 | 1.23x | 8.4% | 68.5% | |||||||

| Texas Self Storage Portfolio | Self Storage | $14,550,000 | 1.6% | 60 | 1.20x | 8.1% | 72.4% | |||||||

| Sun Belt Self Storage Portfolio | Self Storage | $11,100,000 | 1.2% | 60 | 1.22x | 8.4% | 67.3% | |||||||

| Razorback Self Storage Portfolio | Self Storage | $6,995,000 | 0.8% | 60 | 1.23x | 8.6% | 63.0% |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the certificate balance of the Class A-2 certificates assuming a 0% CPR and applying the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in the Preliminary Prospectus, including the assumptions that (i) no mortgage loan in the pool experiences prepayments prior to its stated maturity date or anticipated repayment date, as applicable, or defaults or losses; (ii) there are no extensions of the maturity date of any mortgage loan in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date or, if applicable, anticipated repayment date. Each class of certificates, including the Class A-2 certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A to the Preliminary Prospectus. See the footnotes to the table entitled “Mortgage Pool Characteristics” above. |

Class A-3 Principal Pay Down(1)

| Mortgage Loan Name | Property |

Cut-off

Date |

%

of Initial |

Remaining |

Underwritten |

Debt

Yield on |

Cut-off

Date | |||||||

| Arbor Ridge Office | Office | $18,200,000 | 2.0% | 83 | 1.83x | 11.9% | 74.0% |