| FILED PURSUANT TO RULE 424(b)(5) | ||

| REGISTRATION FILE NO.: 333-189017-11 | ||

Prospectus Supplement supplementing the Prospectus dated January 16, 2015

$879,413,000 (Approximate)

Citigroup Commercial Mortgage Trust 2015-GC33

as Issuing Entity

Citigroup Commercial Mortgage Securities Inc.

as Depositor

Citigroup Global Markets Realty Corp.

Goldman Sachs Mortgage Company

Rialto Mortgage Finance, LLC

KGS-Alpha Real Estate Capital Markets, LLC

RAIT Funding, LLC

as Sponsors

Commercial Mortgage Pass-Through Certificates, Series 2015-GC33

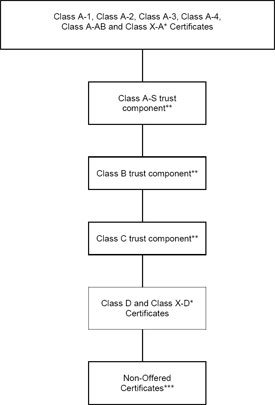

The Commercial Mortgage Pass-Through Certificates, Series 2015-GC33 will consist of multiple classes of certificates, including those identified on the table below which are offered pursuant to this prospectus supplement. The Series 2015-GC33 certificates will represent the beneficial ownership interests in the issuing entity, which will be Citigroup Commercial Mortgage Trust 2015-GC33. The issuing entity’s main assets will be a pool of 64 fixed rate mortgage loans secured by first liens on various types of commercial and multifamily properties.

Classes of Offered Certificates |

Initial

Certificate Principal |

Initial

Pass- |

Pass-Through

Rate |

Rated

Final | |||||

| Class A-1 | $ 31,785,000 | 1.643% | Fixed | September 2058 | |||||

| Class A-2 | $ 15,217,000 | 2.946% | Fixed | September 2058 | |||||

| Class A-3 | $ 220,000,000 | 3.515% | Fixed | September 2058 | |||||

| Class A-4 | $ 331,456,000 | 3.778% | Fixed | September 2058 | |||||

| Class A-AB | $ 72,484,000 | 3.522% | Fixed | September 2058 | |||||

| Class X-A | $718,866,000 | (5) | 0.989% | Variable IO(6) | September 2058 | ||||

| Class A-S(7) | $ 47,924,000 | (8) | 4.114% | Fixed | September 2058 | ||||

| Class B(7) | $ 62,302,000 | (8) | 4.571% | WAC(9) | September 2058 | ||||

| Class PEZ(7) | $152,160,000 | (8) | (11) | (11) | September 2058 | ||||

| Class C(7) | $ 41,934,000 | (8) | 4.571% | WAC(9) | September 2058 | ||||

| Class D | $ 56,311,000 | 3.172% | Fixed | September 2058 | |||||

| Class X-D | $ 56,311,000 | (5) | 1.399% | Variable IO(6) | September 2058 | ||||

(Footnotes to table begin on page S-13)

You should carefully consider the risk factors beginning on page S-65 of this prospectus supplement and page 19 of the accompanying prospectus.

Neither the Series 2015-GC33 certificates nor the underlying mortgage loans are insured or guaranteed by any governmental agency or instrumentality or any other person or entity.

The Series 2015-GC33 certificates will represent interests in and obligations of the issuing entity and will not represent the obligations of the depositor, the sponsors or any of their affiliates. |

THE SECURITIES AND EXCHANGE COMMISSION AND STATE SECURITIES REGULATORS HAVE NOT APPROVED OR DISAPPROVED OF THE OFFERED CERTIFICATES OR DETERMINED IF THIS PROSPECTUS SUPPLEMENT OR THE ACCOMPANYING PROSPECTUS ARE TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. THE DEPOSITOR WILL NOT LIST THE OFFERED CERTIFICATES ON ANY SECURITIES EXCHANGE OR ANY AUTOMATED QUOTATION SYSTEM OF ANY NATIONAL SECURITIES ASSOCIATION.

Distributions to holders of the certificates of amounts to which they are entitled will be made monthly, commencing in October 2015. Credit enhancement will be provided by certain classes of subordinate certificates that will be subordinate to certain classes of senior certificates as described under “Description of the Offered Certificates—Subordination” in this prospectus supplement. |

The offered certificates will be offered by Citigroup Global Markets Inc., Goldman, Sachs & Co. and Drexel Hamilton, LLC when, as and if issued by the issuing entity, delivered to and accepted by the underwriters and subject to each underwriter’s right to reject orders in whole or in part. The underwriters will offer the offered certificates to prospective investors from time to time in negotiated transactions or otherwise at varying prices determined at the time of sale, plus, in certain cases, accrued interest, determined at the time of sale. The underwriters expect to deliver the offered certificates to purchasers in book-entry form only through the facilities of The Depository Trust Company in the United States and Clearstream Banking, société anonyme and Euroclear Bank SA/NV, as operator of the Euroclear System, in Europe against payment in New York, New York on or about September 29, 2015. Citigroup Commercial Mortgage Securities Inc. expects to receive from this offering approximately 106.8% of the aggregate principal balance of the offered certificates, plus accrued interest from September 1, 2015, before deducting expenses payable by the depositor.

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act“), contained in Section 3(c)(5) of the Investment Company Act or Rule 3a-7 under the Investment Company Act, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in “Risk Factors—Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates” in this prospectus supplement). See also “Legal Investment” in this prospectus supplement.

| Citigroup | Goldman, Sachs & Co. |

Co-Lead Managers and Joint Bookrunners

Drexel Hamilton

Co-Manager

September 14, 2015

TABLE OF CONTENTS

| CERTIFICATE SUMMARY | S-13 | |

| SUMMARY | S-15 | |

| RISK FACTORS | S-65 | |

| The Offered Certificates May Not Be a Suitable Investment for You | S-65 | |

| The Offered Certificates Are Limited Obligations | S-65 | |

| The Volatile Economy, Credit Crisis and Downturn in the Real Estate Market Have Adversely Affected and May Continue to Adversely Affect the Value of CMBS | S-65 | |

| External Factors May Adversely Affect the Value and Liquidity of Your Investment | S-66 | |

| The Certificates May Have Limited Liquidity and the Market Value of the Certificates May Decline | S-67 | |

| The Exchangeable Certificates Are Subject to Additional Risks | S-68 | |

| Subordination of Exchangeable Certificates | S-68 | |

| Limited Information Causes Uncertainty | S-69 | |

| Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates | S-69 | |

| Your Yield May Be Affected by Defaults,Prepayments and Other Factors | S-71 | |

| Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded | S-74 | |

| Commercial and Multifamily Lending Is Dependent on Net Operating Income | S-75 | |

| Design Center and Showroom Building Properties Have Special Risks | S-76 | |

| Underwritten Net Cash Flow Could Be Based on Incorrect or Failed Assumptions | S-77 | |

| The Mortgage Loans Have Not Been Reunderwritten by Us; Some Mortgage Loans May Not Have Complied with Another Originator’s Underwriting Criteria | S-77 | |

| Static Pool Data Would Not Be Indicative of the Performance of This Pool | S-77 | |

| Appraisals May Not Reflect Current or Future Market Value of Each Property | S-78 |

| Performance of the Certificates Will Be Highly Dependent on the Performance of Tenants and Tenant Leases | S-79 | |

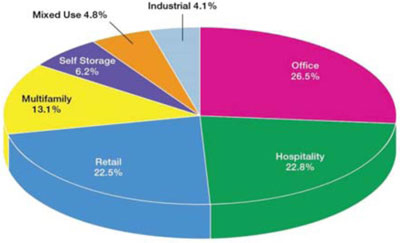

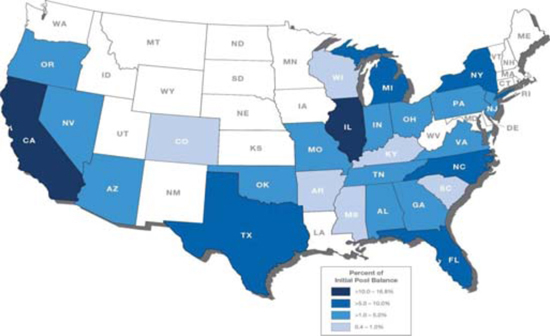

| Concentrations Based on Property Type, Geography, Related Borrowers and Other Factors May Disproportionately Increase Losses | S-81 | |

| Risks Relating to Enforceability of Cross-Collateralization | S-82 | |

| The Performance of a Mortgage Loan and Its Related Mortgaged Property Depends in Part on Who Controls the Borrower and Mortgaged Property | S-83 | |

| The Borrower’s Form of Entity May Cause Special Risks | S-83 | |

| A Bankruptcy Proceeding May Result in Losses and Delays in Realizing on the Mortgage Loans | S-84 | |

| Mortgage Loans Are Non-Recourse and Are Not Insured or Guaranteed | S-85 | |

| Adverse Environmental Conditions at or Near Mortgaged Properties May Result in Losses | S-85 | |

| Risks Related to Redevelopment, Expansion and Renovation at Mortgaged Properties | S-85 | |

| Risks Relating to Costs of Compliance with Applicable Laws and Regulations | S-86 | |

| Litigation Regarding the Mortgaged Properties or Borrowers May Impair Your Distributions | S-86 | |

| Other Financings or Ability to Incur Other Financings Entails Risk | S-87 | |

| A Borrower May Be Unable to Repay Its Remaining Principal Balance on the Maturity Date or Anticipated Repayment Date; Longer Amortization Schedules and Interest-Only Provisions Increase Risk | S-88 | |

| Risks Relating to Interest on Advances and Special Servicing Compensation | S-89 | |

| Increases in Real Estate Taxes May Reduce Available Funds | S-89 | |

| Some Mortgaged Properties May Not Be Readily Convertible to Alternative Uses | S-90 | |

| Risks Related to Zoning Non-Compliance and Use Restrictions | S-91 | |

| Risks Relating to Inspections of Properties | S-91 | |

| Earthquake, Flood and Other Insurance May Not Be Available or Adequate | S-91 | |

| Terrorism Insurance May Not Be Available for All Mortgaged Properties | S-92 | |

| Risks Associated with Blanket Insurance Policies or Self-Insurance | S-93 |

| S-3 |

| State and Local Mortgage Recording Taxes May Apply Upon a Foreclosure or Deed-in-Lieu of Foreclosure and Reduce Net Proceeds | S-94 | |

| The Mortgage Loan Sellers, the Sponsors and the Depositor Are Subject to Bankruptcy or Insolvency Laws That May Affect the Issuing Entity’s Ownership of the Mortgage Loans | S-94 | |

| Interests and Incentives of the Originators, the Sponsors and Their Affiliates May Not Be Aligned with Your Interests | S-95 | |

| Interests and Incentives of the Underwriter Entities May Not Be Aligned with Your Interests | S-96 | |

| Potential Conflicts of Interest of the Master Servicer, the Special Servicer, the Trustee, any Outside Servicer and any Outside Special Servicer | S-98 | |

| Potential Conflicts of Interest of the Operating Advisor | S-99 | |

| Potential Conflicts of Interest of a Directing Holder, any Outside Controlling Class Representative and any Companion Loan Holder | S-100 | |

| Potential Conflicts of Interest in the Selection of the Underlying Mortgage Loans | S-101 | |

| Conflicts of Interest May Occur as a Result of the Rights of the Controlling Class Representative, an Outside Controlling Class Representative or a Controlling Note Holder to Terminate the Special Servicer of the Related Loan Combination | S-102 | |

| Other Potential Conflicts of Interest May Affect Your Investment | S-102 | |

| Your Lack of Control Over the Issuing Entity and Servicing of the Mortgage Loans Can Create Risks | S-103 | |

| Rights of the Directing Holder and the Operating Advisor Could Adversely Affect Your Investment | S-104 | |

| Loan Combinations Pose Special Risks | S-105 | |

| Sponsors May Not Be Able to Make Required Repurchases or Substitutions of Defective Mortgage Loans | S-107 | |

| Any Loss of Value Payment Made by a Sponsor May Prove to Be Insufficient to Cover All Losses on a Defective Mortgage Loan | S-108 | |

| Book-Entry Registration Will Mean You Will Not Be Recognized as a Holder of Record | S-108 | |

| Tax Matters and Changes in Tax Law May Adversely Impact the Mortgage Loans or Your Investment | S-108 |

| Combination or “Layering” of Multiple Risks May Significantly Increase Risk of Loss | S-109 | |

| DESCRIPTION OF THE MORTGAGE POOL | S-110 | |

| General | S-110 | |

| Certain Calculations and Definitions | S-112 | |

| Statistical Characteristics of the Mortgage Loans | S-120 | |

| Environmental Considerations | S-133 | |

| Litigation Considerations | S-136 | |

| Redevelopment, Expansion and Renovation | S-138 | |

| Default History, Bankruptcy Issues and Other Proceedings | S-139 | |

| Tenant Issues | S-140 | |

| Insurance Considerations | S-150 | |

| Zoning and Use Restrictions | S-151 | |

| Appraised Value | S-152 | |

| Non-Recourse Carveout Limitations | S-152 | |

| Real Estate and Other Tax Considerations | S-152 | |

| Certain Terms of the Mortgage Loans | S-153 | |

| The Loan Combinations | S-161 | |

| Significant Obligor | S-179 | |

| Representations and Warranties | S-179 | |

| Sale of Mortgage Loans; Mortgage File Delivery | S-180 | |

| Cures, Repurchases and Substitutions | S-181 | |

| Additional Information | S-184 | |

| TRANSACTION PARTIES | S-185 | |

| The Sponsors | S-185 | |

| Compensation of the Sponsors | S-198 | |

| The Depositor | S-198 | |

| The Originators | S-199 | |

| The Issuing Entity | S-217 | |

| The Trustee | S-218 | |

| The Certificate Administrator | S-220 | |

| Trustee and Certificate Administrator Fee | S-223 | |

| The Operating Advisor | S-223 | |

| Servicers | S-224 | |

| Servicing Compensation, Operating Advisor Compensation and Payment of Expenses | S-231 | |

| Certain Affiliations and Certain Relationships | S-240 | |

| DESCRIPTION OF THE OFFERED CERTIFICATES | S-244 | |

| General | S-244 | |

| Exchangeable Certificates | S-247 | |

| Distributions | S-248 | |

| Subordination | S-262 | |

| Appraisal Reduction Amounts | S-263 | |

| Voting Rights | S-266 | |

| Delivery, Form, Transfer and Denomination | S-268 | |

| Certificateholder Communication | S-271 | |

| YIELD, PREPAYMENT AND MATURITY CONSIDERATIONS | S-271 | |

| Yield | S-271 |

| S-4 |

| Yield on the Class X-A and Class X-D Certificates | S-274 | |

| Weighted Average Life of the Offered Certificates | S-275 | |

| Price/Yield Tables | S-280 | |

| THE POOLING AND SERVICING AGREEMENT | S-285 | |

| General | S-285 | |

| Certain Considerations Regarding the Outside Serviced Loan Combinations | S-285 | |

| Assignment of the Mortgage Loans | S-286 | |

| Servicing of the Mortgage Loans | S-286 | |

| Advances | S-291 | |

| Accounts | S-295 | |

| Application of Penalty Charges and Modification Fees | S-297 | |

| Withdrawals from the Collection Account | S-297 | |

| Enforcement of “Due-On-Sale” and “Due-On-Encumbrance” Clauses | S-298 | |

| Inspections | S-300 | |

| Evidence as to Compliance | S-300 | |

| Certain Matters Regarding the Depositor, the Master Servicer, the Special Servicer and the Operating Advisor | S-301 | |

| Servicer Termination Events | S-303 | |

| Rights Upon Servicer Termination Event | S-305 | |

| Waivers of Servicer Termination Events | S-306 | |

| Termination of the Special Servicer | S-306 | |

| Amendment | S-309 | |

| Realization Upon Mortgage Loans | S-311 | |

| Directing Holder | S-320 | |

| Operating Advisor | S-326 | |

| Asset Status Reports | S-331 | |

| Rating Agency Confirmations | S-333 | |

| Termination; Retirement of Certificates | S-334 | |

| Optional Termination; Optional Mortgage Loan Purchase | S-335 | |

| Reports to Certificateholders; Available Information | S-335 | |

| Servicing of the Outside Serviced Mortgage Loans | S-342 | |

| USE OF PROCEEDS | S-347 | |

| MATERIAL FEDERAL INCOME TAX CONSEQUENCES | S-348 |

| General | S-348 | |

| Tax Status of Offered Certificates | S-348 | |

| Taxation of the Offered Regular Certificates and the Trust Components | S-349 | |

| Taxation of the Exchangeable Certificates | S-351 | |

| Further Information | S-351 | |

| STATE AND OTHER TAX CONSIDERATIONS | S-351 | |

| ERISA CONSIDERATIONS | S-352 | |

| Exempt Plans | S-355 | |

| Further Warnings | S-355 | |

| LEGAL INVESTMENT | S-356 | |

| CERTAIN LEGAL ASPECTS OF THE MORTGAGE LOANS | S-357 | |

| RATINGS | S-358 | |

| PLAN OF DISTRIBUTION (UNDERWRITER CONFLICTS OF INTEREST) | S-360 | |

| LEGAL MATTERS | S-361 | |

| INDEX OF CERTAIN DEFINED TERMS | S-362 | |

| ANNEX A – STATISTICAL CHARACTERISTICS OF THE MORTGAGE LOANS | A-1 | |

| ANNEX B – STRUCTURAL AND COLLATERAL TERM SHEET | B-1 | |

| ANNEX C – MORTGAGE POOL INFORMATION | C-1 | |

| ANNEX D – FORM OF DISTRIBUTION DATE STATEMENT | D-1 | |

| ANNEX E-1 – SPONSOR REPRESENTATIONS AND WARRANTIES | E-1-1 | |

| ANNEX E-2 – EXCEPTIONS TO SPONSOR REPRESENTATIONS AND WARRANTIES | E-2-1 | |

| ANNEX F – CLASS A-AB SCHEDULED PRINCIPAL BALANCE SCHEDULE | F-1 | |

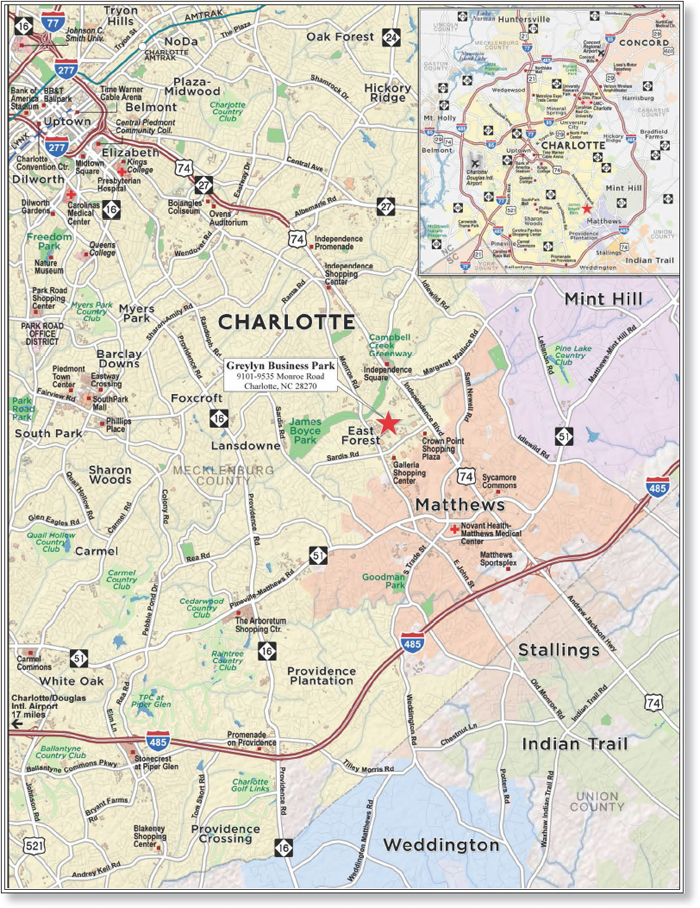

| ANNEX G – GREYLYN BUSINESS PARK MORTGAGE LOAN AMORTIZATION SCHEDULE | G-1 |

| S-5 |

IMPORTANT NOTICE ABOUT INFORMATION PRESENTED IN THIS

PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

Information about the offered certificates is contained in two separate documents that progressively provide more detail: (a) the accompanying prospectus, which provides general information, some of which may not apply to the offered certificates; and (b) this prospectus supplement, which describes the specific terms of the offered certificates. The terms of the offered certificates contained in this prospectus supplement, including the annexes to this prospectus supplement, are intended to supplement the terms contained in the accompanying prospectus.

We have filed with the Securities and Exchange Commission a registration statement under the Securities Act of 1933, as amended, with respect to the offered certificates. This prospectus supplement does not contain all of the information contained in our registration statement, nor does it contain all information that is required to be included in a prospectus required to be filed as part of a registration statement. For further information regarding the documents referred to in this prospectus supplement, you should refer to our registration statement and the exhibits to it. Any materials we file with the Securities and Exchange Commission will be available for website viewing and printing at the Securities and Exchange Commission’s Public Reference Room, 100 F Street, N.E., Washington, D.C. 20549, on official business days between the hours of 10:00 a.m. and 3:00 p.m. You may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-SEC-0330. The Securities and Exchange Commission maintains an internet website (http://www.sec.gov) that contains information we file and other information regarding issuers that file electronically with the Securities and Exchange Commission.

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone to provide you with information that is different from that contained in this prospectus supplement and the prospectus. The information contained in this prospectus supplement is accurate only as of the date of this prospectus supplement.

■ This prospectus supplement begins with two introductory sections describing the Series 2015-GC33 certificates and the issuing entity in abbreviated form:

| · | the “Certificate Summary“ commencing on page S-13 of this prospectus supplement, which sets forth important statistical information relating to the Series 2015-GC33 certificates; and |

| · | the “Summary“ commencing on page S-15 of this prospectus supplement, which gives a brief introduction to the key features of the Series 2015-GC33 certificates and a description of the underlying mortgage loans. |

Additionally, “Risk Factors“ commencing on page S-65 of this prospectus supplement, describes the material risks that apply to the Series 2015-GC33 certificates which are in addition to those described in the prospectus with respect to the securities issued by the issuing entity generally.

This prospectus supplement includes cross-references to other sections in this prospectus supplement and to sections in the accompanying prospectus where you can find further related discussions. The Table of Contents in this prospectus supplement and the prospectus identify the pages where these sections are located.

Certain capitalized terms are defined and used in this prospectus supplement and the accompanying prospectus to assist you in understanding the terms of the offered certificates and this offering. The capitalized terms used in this prospectus supplement are defined on the pages indicated under the caption “Index of Certain Defined Terms” commencing on page S-362 of this prospectus supplement. The capitalized terms used in the prospectus are defined on the pages indicated under the caption “Glossary” commencing on page 200 of the prospectus.

■ In this prospectus supplement:

| · | the terms “depositor,” “we,” “us” and “our” refer to Citigroup Commercial Mortgage Securities Inc. |

| · | references to “lender” with respect to the mortgage loans generally should be construed to mean, from and after the date of initial issuance of the offered certificates, the trustee on behalf of the issuing entity as the holder of record title to the mortgage loans or the master servicer or the special |

| S-6 |

| servicer, as applicable, with respect to the obligations and rights of the lender as described under “The Pooling and Servicing Agreement” in this prospectus supplement. |

The Annexes attached to this prospectus supplement are incorporated into and made a part of this prospectus supplement.

THERE IS CURRENTLY NO SECONDARY MARKET FOR THE OFFERED CERTIFICATES. WE CANNOT ASSURE YOU THAT A SECONDARY MARKET WILL DEVELOP OR, IF A SECONDARY MARKET DOES DEVELOP, THAT IT WILL PROVIDE HOLDERS OF THE OFFERED CERTIFICATES WITH LIQUIDITY OF INVESTMENT OR THAT IT WILL CONTINUE FOR THE TERM OF THE OFFERED CERTIFICATES. THE UNDERWRITERS CURRENTLY INTEND TO MAKE A MARKET IN THE OFFERED CERTIFICATES, BUT ARE UNDER NO OBLIGATION TO DO SO. ACCORDINGLY, PURCHASERS MUST BE PREPARED TO BEAR THE RISKS OF THEIR INVESTMENTS FOR AN INDEFINITE PERIOD. SEE “RISK FACTORS—THE CERTIFICATES MAY HAVE LIMITED LIQUIDITY AND THE MARKET VALUE OF THE CERTIFICATES MAY DECLINE” IN THIS PROSPECTUS SUPPLEMENT.

THIS PROSPECTUS SUPPLEMENT IS NOT AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY STATE OR OTHER JURISDICTION WHERE SUCH OFFER, SOLICITATION OR SALE IS NOT PERMITTED.

THE OFFERED CERTIFICATES DO NOT REPRESENT AN INTEREST IN OR OBLIGATION OF THE DEPOSITOR, THE SPONSORS, THE ORIGINATORS, THE MASTER SERVICER, THE SPECIAL SERVICER, THE TRUSTEE, THE CERTIFICATE ADMINISTRATOR, THE OPERATING ADVISOR, THE CONTROLLING CLASS REPRESENTATIVE, THE COMPANION LOAN HOLDERS (OR THEIR REPRESENTATIVES), THE UNDERWRITERS OR ANY OF THEIR RESPECTIVE AFFILIATES. NEITHER THE OFFERED CERTIFICATES NOR THE MORTGAGE LOANS ARE INSURED OR GUARANTEED BY ANY GOVERNMENTAL AGENCY OR INSTRUMENTALITY OR PRIVATE INSURER.

THE YIELD TO MATURITY ON THE CLASS X-A CERTIFICATES WILL BE ESPECIALLY SENSITIVE TO THE RATE AND TIMING OF REDUCTIONS MADE TO THE CERTIFICATE PRINCIPAL AMOUNTS OF THE CLASS A-1, CLASS A-2, CLASS A-3, CLASS A-4 AND CLASS A-AB CERTIFICATES AND THE CLASS A-S TRUST COMPONENT, INCLUDING BY REASON OF DELINQUENCIES AND LOSSES ON THE MORTGAGE LOANS DUE TO LIQUIDATIONS, PRINCIPAL PAYMENTS (INCLUDING BOTH VOLUNTARY AND INVOLUNTARY PREPAYMENTS, DELINQUENCIES, DEFAULTS AND LIQUIDATIONS) ON THE MORTGAGE LOANS AND PAYMENTS WITH RESPECT TO PURCHASES AND REPURCHASES THEREOF, WHICH MAY FLUCTUATE SIGNIFICANTLY FROM TIME TO TIME. A RATE OF PRINCIPAL PAYMENTS AND LIQUIDATIONS ON THE MORTGAGE LOANS THAT IS MORE RAPID THAN EXPECTED BY INVESTORS MAY HAVE A MATERIAL ADVERSE EFFECT ON THE YIELD TO MATURITY OF THE CLASS X-A CERTIFICATES AND MAY RESULT IN HOLDERS NOT FULLY RECOUPING THEIR INITIAL INVESTMENTS. THE YIELD TO MATURITY OF THE CLASS X-A CERTIFICATES MAY BE ADVERSELY AFFECTED BY THE PREPAYMENT OF MORTGAGE LOANS WITH HIGHER NET MORTGAGE LOAN RATES. THE YIELD TO MATURITY ON THE CLASS X-D CERTIFICATES WILL BE ESPECIALLY SENSITIVE TO THE RATE AND TIMING OF REDUCTIONS MADE TO THE CERTIFICATE PRINCIPAL AMOUNT OF THE CLASS D CERTIFICATES, INCLUDING BY REASON OF DELINQUENCIES AND LOSSES ON THE MORTGAGE LOANS DUE TO LIQUIDATIONS, PRINCIPAL PAYMENTS (INCLUDING BOTH VOLUNTARY AND INVOLUNTARY PREPAYMENTS, DELINQUENCIES, DEFAULTS AND LIQUIDATIONS) ON THE MORTGAGE LOANS AND PAYMENTS WITH RESPECT TO PURCHASES AND REPURCHASES THEREOF, WHICH MAY FLUCTUATE SIGNIFICANTLY FROM TIME TO TIME. A RATE OF PRINCIPAL PAYMENTS AND LIQUIDATIONS ON THE MORTGAGE LOANS THAT IS MORE RAPID THAN EXPECTED BY INVESTORS MAY HAVE A MATERIAL ADVERSE EFFECT ON THE YIELD TO MATURITY OF THE CLASS X-D CERTIFICATES AND MAY RESULT IN HOLDERS NOT FULLY RECOUPING THEIR INITIAL INVESTMENTS. THE YIELD TO MATURITY OF THE CLASS X-D CERTIFICATES MAY BE ADVERSELY AFFECTED BY THE PREPAYMENT OF MORTGAGE LOANS WITH HIGHER NET MORTGAGE LOAN RATES. SEE “YIELD, PREPAYMENT AND MATURITY CONSIDERATIONS—YIELD ON THE CLASS X-A AND CLASS X-D CERTIFICATES” IN THIS PROSPECTUS SUPPLEMENT.

| S-7 |

UNITED KINGDOM

EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT:

(A) IN THE UNITED KINGDOM, IT HAS ONLY COMMUNICATED OR CAUSED TO BE COMMUNICATED AND WILL ONLY COMMUNICATE OR CAUSE TO BE COMMUNICATED AN INVITATION OR INDUCEMENT TO ENGAGE IN INVESTMENT ACTIVITY (WITHIN THE MEANING OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (THE “FSMA“)) RECEIVED BY IT IN CONNECTION WITH THE ISSUE OR SALE OF THE OFFERED CERTIFICATES IN CIRCUMSTANCES IN WHICH SECTION 21(1) OF THE FSMA DOES NOT APPLY TO THE DEPOSITOR OR THE ISSUING ENTITY; AND

(B) IT HAS COMPLIED AND WILL COMPLY WITH ALL APPLICABLE PROVISIONS OF THE FSMA WITH RESPECT TO ANYTHING DONE BY IT IN RELATION TO THE OFFERED CERTIFICATES IN, FROM OR OTHERWISE INVOLVING THE UNITED KINGDOM.

NOTICE TO UNITED KINGDOM INVESTORS

THE ISSUING ENTITY MAY CONSTITUTE A “COLLECTIVE INVESTMENT SCHEME“ AS DEFINED BY SECTION 235 OF THE FSMA THAT IS NOT A “RECOGNIZED COLLECTIVE INVESTMENT SCHEME“ FOR THE PURPOSES OF THE FSMA AND THAT HAS NOT BEEN AUTHORIZED, REGULATED OR OTHERWISE RECOGNIZED OR APPROVED. AS AN UNREGULATED SCHEME, THE OFFERED CERTIFICATES CANNOT BE MARKETED IN THE UNITED KINGDOM TO THE GENERAL PUBLIC, EXCEPT IN ACCORDANCE WITH THE FSMA.

THE DISTRIBUTION OF THIS PROSPECTUS SUPPLEMENT (A) IF MADE BY A PERSON WHO IS NOT AN AUTHORIZED PERSON UNDER THE FSMA, IS BEING MADE ONLY TO, OR DIRECTED ONLY AT, PERSONS WHO (I) ARE OUTSIDE THE UNITED KINGDOM, OR (II) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFY AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (THE “FINANCIAL PROMOTION ORDER“), OR (III) ARE PERSONS FALLING WITHIN ARTICLE 49(2)(A) THROUGH (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.“) OF THE FINANCIAL PROMOTION ORDER (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “FPO PERSONS“); AND (B) IF MADE BY A PERSON WHO IS AN AUTHORIZED PERSON UNDER THE FSMA, IS BEING MADE ONLY TO, OR DIRECTED ONLY AT, PERSONS WHO (I) ARE OUTSIDE THE UNITED KINGDOM, OR (II) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFY AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 14(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (PROMOTION OF COLLECTIVE INVESTMENT SCHEMES) (EXEMPTIONS) ORDER 2001 (THE “PROMOTION OF COLLECTIVE INVESTMENT SCHEMES EXEMPTIONS ORDER“), OR (III) ARE PERSONS FALLING WITHIN ARTICLE 22(2)(A) THROUGH (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.“) OF THE PROMOTION OF COLLECTIVE INVESTMENT SCHEMES EXEMPTIONS ORDER, OR (IV) PERSONS TO WHOM THE ISSUING ENTITY MAY LAWFULLY BE PROMOTED IN ACCORDANCE WITH RULE 4.12 OF THE UK FINANCIAL CONDUCT AUTHORITY’S CONDUCT OF BUSINESS SOURCEBOOK (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “PCIS PERSONS“ AND, TOGETHER WITH THE FPO PERSONS, THE “RELEVANT PERSONS“).

THIS PROSPECTUS SUPPLEMENT MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS PROSPECTUS SUPPLEMENT RELATES, INCLUDING THE OFFERED CERTIFICATES, IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. ANY PERSONS OTHER THAN RELEVANT PERSONS SHOULD NOT ACT OR RELY ON THIS PROSPECTUS SUPPLEMENT.

POTENTIAL INVESTORS IN THE UNITED KINGDOM ARE ADVISED THAT ALL, OR MOST, OF THE PROTECTIONS AFFORDED BY THE UNITED KINGDOM REGULATORY SYSTEM WILL NOT APPLY TO AN INVESTMENT IN THE OFFERED CERTIFICATES AND THAT COMPENSATION WILL NOT BE AVAILABLE UNDER THE UNITED KINGDOM FINANCIAL SERVICES COMPENSATION SCHEME.

| S-8 |

EUROPEAN ECONOMIC AREA

THIS PROSPECTUS SUPPLEMENT HAS BEEN PREPARED ON THE BASIS THAT ANY OFFER OF OFFERED CERTIFICATES IN ANY MEMBER STATE OF THE EUROPEAN ECONOMIC AREA WHICH HAS IMPLEMENTED THE PROSPECTUS DIRECTIVE (EACH, A “RELEVANT MEMBER STATE“) WILL BE MADE PURSUANT TO AN EXEMPTION UNDER THE PROSPECTUS DIRECTIVE (AS DEFINED BELOW) FROM THE REQUIREMENT TO PUBLISH A PROSPECTUS FOR OFFERS OF CERTIFICATES. ACCORDINGLY ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN THAT RELEVANT MEMBER STATE OF CERTIFICATES WHICH ARE THE SUBJECT OF AN OFFERING CONTEMPLATED IN THIS PROSPECTUS SUPPLEMENT AS COMPLETED BY FINAL TERMS IN RELATION TO THE OFFER OF THOSE OFFERED CERTIFICATES MAY ONLY DO SO IN CIRCUMSTANCES IN WHICH NO OBLIGATION ARISES FOR THE ISSUING ENTITY, THE DEPOSITOR OR AN UNDERWRITER TO PUBLISH A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE IN RELATION TO SUCH OFFER.

NONE OF THE ISSUING ENTITY, THE DEPOSITOR OR ANY OF THE UNDERWRITERS HAS AUTHORIZED, NOR DOES ANY OF THEM AUTHORIZE, THE MAKING OF ANY OFFER OF OFFERED CERTIFICATES IN CIRCUMSTANCES IN WHICH AN OBLIGATION ARISES FOR THE ISSUING ENTITY, THE DEPOSITOR OR AN UNDERWRITER TO PUBLISH OR SUPPLEMENT A PROSPECTUS FOR SUCH OFFER.

FOR THE PURPOSES OF THIS PROVISION AND THE PROVISION IMMEDIATELY BELOW, THE EXPRESSION “PROSPECTUS DIRECTIVE” MEANS DIRECTIVE 2003/71/EC (AND AMENDMENTS THERETO, INCLUDING THE 2010 PD AMENDING DIRECTIVE, TO THE EXTENT IMPLEMENTED IN THE RELEVANT MEMBER STATE), AND INCLUDES ANY RELEVANT IMPLEMENTING MEASURE IN THE RELEVANT MEMBER STATE, AND THE EXPRESSION “2010 PD AMENDING DIRECTIVE“ MEANS DIRECTIVE 2010/73/EU.

EUROPEAN ECONOMIC AREA SELLING RESTRICTIONS

IN RELATION TO EACH RELEVANT MEMBER STATE, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT, WITH EFFECT FROM AND INCLUDING THE DATE ON WHICH THE PROSPECTUS DIRECTIVE IS IMPLEMENTED IN THAT RELEVANT MEMBER STATE, IT HAS NOT MADE AND WILL NOT MAKE AN OFFER OF THE CERTIFICATES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED BY THIS PROSPECTUS SUPPLEMENT TO THE PUBLIC IN THAT RELEVANT MEMBER STATE OTHER THAN:

(A) TO ANY LEGAL ENTITY WHICH IS A “QUALIFIED INVESTOR” AS DEFINED IN THE PROSPECTUS DIRECTIVE;

(B) TO FEWER THAN 150 NATURAL OR LEGAL PERSONS (OTHER THAN “QUALIFIED INVESTORS“ AS DEFINED IN THE PROSPECTUS DIRECTIVE) SUBJECT TO OBTAINING THE PRIOR CONSENT OF THE RELEVANT UNDERWRITER OR UNDERWRITERS NOMINATED BY THE ISSUING ENTITY FOR ANY SUCH OFFER; OR

(C) IN ANY OTHER CIRCUMSTANCES FALLING WITHIN ARTICLE 3(2) OF THE PROSPECTUS DIRECTIVE;

PROVIDED THAT NO SUCH OFFER OF THE OFFERED CERTIFICATES REFERRED TO IN CLAUSES (A), (B) AND (C) ABOVE SHALL REQUIRE THE DEPOSITOR, THE ISSUING ENTITY OR ANY UNDERWRITER TO PUBLISH A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE.

FOR THE PURPOSES OF THE PRIOR PARAGRAPH, THE EXPRESSION AN “OFFER OF THE CERTIFICATES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED BY THIS PROSPECTUS SUPPLEMENT TO THE PUBLIC” IN RELATION TO ANY CERTIFICATE THAT IS OFFERED IN ANY RELEVANT MEMBER STATE MEANS THE COMMUNICATION IN ANY FORM AND BY ANY MEANS OF SUFFICIENT INFORMATION ON THE TERMS OF THE OFFER AND THE CERTIFICATES TO BE OFFERED SO AS TO ENABLE AN INVESTOR TO DECIDE TO PURCHASE OR SUBSCRIBE TO THE OFFERED CERTIFICATES, AS THE SAME MAY BE VARIED IN THAT RELEVANT MEMBER STATE BY ANY MEASURE IMPLEMENTING THE PROSPECTUS DIRECTIVE IN THAT RELEVANT MEMBER STATE.

| S-9 |

HONG KONG

NO PERSON HAS ISSUED OR HAD IN ITS POSSESSION FOR THE PURPOSES OF ISSUE, OR WILL ISSUE OR HAVE IN ITS POSSESSION FOR THE PURPOSES OF ISSUE, WHETHER IN HONG KONG OR ELSEWHERE, ANY ADVERTISEMENT, INVITATION OR DOCUMENT RELATING TO THE OFFERED CERTIFICATES, WHICH IS DIRECTED AT, OR THE CONTENTS OF WHICH ARE LIKELY TO BE ACCESSED OR READ BY, THE PUBLIC OF HONG KONG (EXCEPT IF PERMITTED TO DO SO UNDER THE LAWS OF HONG KONG) OTHER THAN WITH RESPECT TO OFFERED CERTIFICATES WHICH ARE OR ARE INTENDED TO BE DISPOSED OF ONLY TO PERSONS OUTSIDE HONG KONG OR ONLY TO “PROFESSIONAL INVESTORS“ WITHIN THE MEANING OF THE SECURITIES AND FUTURES ORDINANCE (CAP. 571 OF THE LAWS OF HONG KONG) AND ANY RULES OR REGULATIONS MADE UNDER THAT ORDINANCE.

THE OFFERED CERTIFICATES (IF THEY ARE NOT A “STRUCTURED PRODUCT“ AS DEFINED IN THE SECURITIES AND FUTURES ORDINANCE (CAP. 571 OF THE LAWS OF HONG KONG) HAVE NOT BEEN OFFERED OR SOLD AND WILL NOT BE OFFERED OR SOLD, BY MEANS OF ANY DOCUMENT, OTHER THAN (A) TO “PROFESSIONAL INVESTORS” AS DEFINED IN THE SECURITIES AND FUTURES ORDINANCE (CAP. 571 OF THE LAWS OF HONG KONG) AND ANY RULES OR REGULATIONS MADE UNDER THAT ORDINANCE, OR (B) IN OTHER CIRCUMSTANCES WHICH DO NOT RESULT IN THE DOCUMENT CONSTITUTING A “PROSPECTUS“ AS DEFINED IN THE COMPANIES (WINDING UP AND MISCELLANEOUS PROVISIONS) ORDINANCE (CAP. 32 OF THE LAWS OF HONG KONG) OR WHICH DO NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE MEANING OF THE COMPANIES ORDINANCE (CAP. 622 OF THE LAWS OF HONG KONG). FURTHER, THE CONTENTS OF THIS PROSPECTUS SUPPLEMENT HAVE NOT BEEN REVIEWED OR APPROVED BY THE SECURITIES AND FUTURES COMMISSION OF HONG KONG OR ANY OTHER REGULATORY AUTHORITY IN HONG KONG. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE OFFERING CONTEMPLATED IN THIS PROSPECTUS SUPPLEMENT. IF YOU ARE IN ANY DOUBT ABOUT ANY OF THE CONTENTS OF THIS PROSPECTUS SUPPLEMENT, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

SINGAPORE

NEITHER THIS PROSPECTUS SUPPLEMENT NOR ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH ANY OFFER OF THE OFFERED CERTIFICATES HAS BEEN REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE (“MAS“) UNDER THE SECURITIES AND FUTURES ACT (CAP. 289) OF SINGAPORE (THE “SFA“). ACCORDINGLY, MAS ASSUMES NO RESPONSIBILITY FOR THE CONTENTS OF THIS PROSPECTUS SUPPLEMENT. THIS PROSPECTUS SUPPLEMENT IS NOT A PROSPECTUS AS DEFINED IN THE SFA AND STATUTORY LIABILITY UNDER THE SFA IN RELATION TO THE CONTENTS OF PROSPECTUSES WOULD NOT APPLY. THE PROSPECTIVE INVESTORS SHOULD CONSIDER CAREFULLY WHETHER THE INVESTMENT IS SUITABLE FOR IT.

THIS PROSPECTUS SUPPLEMENT AND ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF THE OFFERED CERTIFICATES MAY NOT BE CIRCULATED OR DISTRIBUTED, NOR MAY THE OFFERED CERTIFICATES BE OFFERED OR SOLD, OR BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN (I) TO AN INSTITUTIONAL INVESTOR (AS DEFINED IN SECTION 4A OF THE SFA (“INSTITUTIONAL INVESTOR“)) UNDER SECTION 274 OF THE SFA, (II) TO A RELEVANT PERSON (AS DEFINED IN SECTION 275(2) OF THE SFA (“RELEVANT PERSON“)) PURSUANT TO SECTION 275(2) OF THE SFA, AND IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA; (III) TO ANY PERSON PURSUANT TO SECTION 275(1A) OF THE SFA, IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SFA; OR (IV) OTHERWISE PURSUANT TO, AND IN ACCORDANCE WITH THE CONDITIONS OF, ANY OTHER APPLICABLE PROVISION OF THE SFA.

UNLESS ANY OFFER OF SUCH OFFERED CERTIFICATES WAS PREVIOUSLY MADE IN OR ACCOMPANIED BY A PROSPECTUS AND WHICH ARE OF THE SAME CLASS AS OTHER OFFERED CERTIFICATES OF A CORPORATION LISTED ON FOR QUOTATION ON A SECURITIES EXCHANGE, ANY SUBSEQUENT OFFERS IN SINGAPORE OF OFFERED CERTIFICATES ACQUIRED PURSUANT TO AN INITIAL OFFER MADE IN RELIANCE ON AN EXEMPTION UNDER SECTION 274 OF THE SFA OR SECTION 275 OF THE SFA MAY ONLY BE MADE, PURSUANT TO THE REQUIREMENTS OF SECTION 276 OF THE SFA, FOR THE INITIAL SIX MONTH PERIOD AFTER SUCH ACQUISITION, TO PERSONS WHO ARE

| S-10 |

INSTITUTIONAL INVESTORS OR TO ACCREDITED INVESTORS (AS DEFINED IN SECTION 4A OF THE SFA (“ACCREDITED INVESTOR“)) OR RELEVANT PERSONS OR TO SUCH PERSONS PURSUANT TO AN OFFER REFERRED TO UNDER SECTION 275(1A) OF THE SFA. ANY TRANSFER AFTER SUCH INITIAL SIX MONTH PERIOD IN SINGAPORE SHALL BE MADE, PURSUANT TO THE REQUIREMENTS OF SECTION 257 OF THE SFA, IN RELIANCE ON ANY APPLICABLE EXEMPTION UNDER SUBDIVISION (4) OF DIVISION 1 OF PART XIII OF THE SFA (OTHER THAN SECTION 280 OF THE SFA).

IN ADDITION TO THE ABOVE, WHERE THE OFFERED CERTIFICATES ARE SUBSCRIBED OR PURCHASED UNDER SECTION 275 OF THE SFA BY A RELEVANT PERSON WHICH IS:

| (A) | A CORPORATION (WHICH IS NOT AN ACCREDITED INVESTOR THE SOLE BUSINESS OF WHICH IS TO HOLD INVESTMENTS AND THE ENTIRE SHARE CAPITAL OF WHICH IS OWNED BY ONE OR MORE INDIVIDUALS, EACH OF WHOM IS AN ACCREDITED INVESTOR; OR |

| (B) | A TRUST (WHERE THE TRUSTEE IS NOT AN ACCREDITED INVESTOR) WHOSE SOLE PURPOSE IS TO HOLD INVESTMENTS AND EACH BENEFICIARY IS AN ACCREDITED INVESTOR, |

SECURITIES (AS DEFINED IN SECTION 239(1) OF THE SFA) OF THAT CORPORATION OR THE BENEFICIARIES’ RIGHTS AND INTEREST (HOWSOEVER DESCRIBED) IN THAT TRUST SHALL NOT BE TRANSFERABLE FOR SIX MONTHS AFTER THAT CORPORATION OR THAT TRUST HAS ACQUIRED THE OFFERED CERTIFICATES UNDER SECTION 275 OF THE SFA EXCEPT:

| (1) | TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 OF THE SFA OR TO A RELEVANT PERSON, OR TO ANY PERSON ARISING FROM AN OFFER REFERRED TO IN SECTION 275(1A) OR SECTION 276(4)(i)(B) OF THE SFA; |

| (2) | WHERE NO CONSIDERATION IS GIVEN FOR THE TRANSFER; OR |

| (3) | WHERE THE TRANSFER IS BY OPERATION OF LAW. |

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL“), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS SUPPLEMENT MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR RE-OFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN.

| S-11 |

FORWARD-LOOKING STATEMENTS

In this prospectus supplement and the prospectus, we use certain forward-looking statements. These forward-looking statements are found in the material, including each of the tables, set forth under “Risk Factors” and “Yield, Prepayment and Maturity Considerations” in this prospectus supplement. Forward-looking statements are also found elsewhere in this prospectus supplement and in the prospectus and include words like “expects,” “intends,” “anticipates,” “estimates” and other similar words. These statements are intended to convey our projections or expectations as of the date of this prospectus supplement. These statements are inherently subject to a variety of risks and uncertainties. Actual results could differ materially from those we anticipate due to changes in, among other things:

| · | economic conditions and industry competition, |

| · | political and/or social conditions, and |

| · | the law and government regulatory initiatives. |

We will not update or revise any forward-looking statement to reflect changes in our expectations or changes in the conditions or circumstances on which these statements were originally based.

| S-12 |

CERTIFICATE SUMMARY

Set forth below are the indicated characteristics of the respective classes of the Series 2015-GC33 certificates.

Classes of Certificates |

Initial

Certificate Principal

Amount or |

Approximate |

Initial |

Pass-Through Rate Description |

Expected |

Expected

Principal | |||||||

| Offered Certificates | |||||||||||||

| Class A-1 | $ 31,785,000 | 30.000%(4) | 1.643% | Fixed | 2.83 | 10/15 – 8/20 | |||||||

| Class A-2 | $ 15,217,000 | 30.000%(4) | 2.946% | Fixed | 4.86 | 8/20 – 8/20 | |||||||

| Class A-3 | $220,000,000 | 30.000%(4) | 3.515% | Fixed | 9.83 | 7/25 – 8/25 | |||||||

| Class A-4 | $331,456,000 | 30.000%(4) | 3.778% | Fixed | 9.87 | 8/25 – 9/25 | |||||||

| Class A-AB | $ 72,484,000 | 30.000%(4) | 3.522% | Fixed | 7.44 | 8/20 – 7/25 | |||||||

| Class X-A | $718,866,000 | (5) | N/A | 0.989% | Variable IO(6) | N/A | N/A | ||||||

| Class A-S(7) | $ 47,924,000 | (8) | 25.000% | 4.114% | Fixed | 9.95 | 9/25 – 9/25 | ||||||

| Class B(7) | $ 62,302,000 | (8) | 18.500% | 4.571% | WAC(9) | 9.95 | 9/25 – 9/25 | ||||||

| Class PEZ(7) | $152,160,000 | (8) | 14.125%(10) | (11) | (11) | 9.95 | 9/25 – 9/25 | ||||||

| Class C(7) | $ 41,934,000 | (8) | 14.125%(10) | 4.571% | WAC(9) | 9.95 | 9/25 – 9/25 | ||||||

| Class D | $ 56,311,000 | 8.250% | 3.172% | Fixed | 9.95 | 9/25 – 9/25 | |||||||

| Class X-D | $ 56,311,000 | (5) | N/A | 1.399% | Variable IO(6) | N/A | N/A | ||||||

| Non-Offered Certificates | |||||||||||||

| Class E | $ 23,963,000 | 5.750% | 4.571% | WAC(9) | 10.07 | 9/25 – 5/26 | |||||||

| Class F | $ 9,584,000 | 4.750% | 4.571% | WAC(9) | 10.61 | 5/26 – 5/26 | |||||||

| Class G | $ 11,129,000 | 3.589% | 4.571% | WAC(9) | 10.61 | 5/26 – 5/26 | |||||||

| Class H | $ 34,400,233 | 0.000% | 4.571% | WAC(9) | 10.61 | 5/26 – 5/26 | |||||||

| Class R(12) | N/A | N/A | N/A | N/A | N/A | N/A | |||||||

| (1) | Approximate, subject to a variance of plus or minus 5%. |

| (2) | Approximate per annum rate as of the closing date. |

| (3) | Determined assuming no prepayments prior to the maturity date or any anticipated repayment date, as applicable, for each mortgage loan and based on the modeling assumptions described under “Yield, Prepayment and Maturity Considerations” in this prospectus supplement. |

| (4) | The credit support percentages set forth for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates are represented in the aggregate. |

| (5) | The Class X-A and Class X-D certificates will not have certificate principal amounts and will not be entitled to receive distributions of principal. Interest will accrue on the Class X-A and Class X-D certificates at their respective pass-through rates based upon their respective notional amounts. The notional amount of the Class X-A certificates will be equal to the aggregate of the certificate principal amounts of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component from time to time. The notional amount of the Class X-D certificates will be equal to the certificate principal amount of the Class D certificates from time to time. |

| (6) | The pass-through rate on the Class X-A certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the weighted average of the pass-through rates of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-AB certificates and the Class A-S trust component, as described in this prospectus supplement. The pass-through rate on the Class X-D certificates will generally be a per annum rate equal to the excess, if any, of (i) the weighted average of the net interest rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (ii) the pass-through rate of the Class D certificates, as described in this prospectus supplement. |

| (7) | The Class A-S, Class B and Class C certificates, in the applicable proportions, may be exchanged for Class PEZ certificates, and Class PEZ certificates may be exchanged for the applicable proportions of Class A-S, Class B and Class C certificates. The Class A-S, Class B, Class PEZ and Class C certificates are collectively referred to in this prospectus supplement as “exchangeable certificates.” |

| (8) | On the closing date, the issuing entity will issue the Class A-S, Class B and Class C trust components, which will have initial outstanding principal balances, subject to a variance of plus or minus 5%, of $47,924,000, $62,302,000 and $41,934,000, respectively. The exchangeable certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold such trust components. Each class of the exchangeable certificates will, at all times, represent a beneficial interest in a percentage of the outstanding principal balance of the Class A-S, Class B and/or Class C trust components. Following any exchange of Class A-S, Class B and Class C certificates for Class PEZ certificates or any exchange of Class PEZ certificates for Class A-S, Class B and Class C certificates, the percentage interest of the outstanding principal balances of the Class A-S, Class B and Class C trust components that is represented by the Class A-S, Class B, Class PEZ and Class C certificates will be increased or decreased accordingly. The initial certificate principal amount of each class of the Class A-S, Class B and Class C certificates shown in the table on the cover page of this prospectus supplement, in the table above and on the back cover of this prospectus supplement represents the maximum certificate principal amount of such class without giving effect to any issuance of Class PEZ certificates. The initial certificate principal amount of the Class PEZ certificates shown in the table on the cover page of this prospectus supplement, in the table above and on the back cover of this prospectus supplement is equal to the aggregate of the maximum initial certificate principal amounts of the Class A-S, Class B and Class C certificates, representing the maximum certificate principal amount of the Class PEZ certificates that could be issued in an exchange. The actual certificate principal amount of any class of exchangeable certificates issued on the closing date may be less than the maximum certificate principal amount of that class and may be zero. The certificate principal amounts of the Class A-S, Class B and Class C certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal amount of the Class PEZ certificates issued on the closing date. The aggregate certificate principal amount of the offered certificates shown on the cover page and back page of this prospectus supplement includes the maximum certificate principal amount of exchangeable certificates that could be outstanding on the closing date, equal to $152,160,000 (subject to a variance of plus or minus 5%). |

| (9) | For any distribution date, the pass-through rate on each class of the Class B, Class C, Class E, Class F, Class G and Class H certificates will be equal to the weighted average of the net interest rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis |

| S-13 |

| of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs. |

| (10) | The initial subordination levels for the Class C and Class PEZ certificates are equal to the subordination level of the underlying Class C trust component. |

| (11) | The Class PEZ certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, Class B and Class C trust components represented by the Class PEZ certificates. The pass-through rates on the Class A-S, Class B and Class C trust components will at all times be the same as the pass-through rates on the Class A-S, Class B and Class C certificates, respectively. |

| (12) | The Class R certificates will not have a certificate principal amount, notional amount, pass-through rate, rating or rated final distribution date. The Class R certificates will represent the residual interests in each of two separate REMICs, as further described in this prospectus supplement. The Class R certificates will not be entitled to distributions of principal or interest. |

The Class E, Class F, Class G, Class H and Class R certificates are not offered by this prospectus supplement.

| S-14 |

Summary

The following is only a summary. Detailed information appears elsewhere in this prospectus supplement and in the accompanying prospectus. That information includes, among other things, detailed mortgage loan information and calculations of cash flows on the offered certificates. To understand all of the terms of the offered certificates, read carefully this entire document and the accompanying prospectus. See “Index of Certain Defined Terms” in this prospectus supplement and “Glossary” in the prospectus for definitions of capitalized terms.

General

| Title of the Certificates | The certificates to be issued are known as the Citigroup Commercial Mortgage Trust 2015-GC33, Commercial Mortgage Pass-Through Certificates, Series 2015-GC33. | |

| Mortgage Loans | The certificates will be backed by 64 fixed rate mortgage loans with an aggregate outstanding principal balance as of the cut-off date of $958,489,233. The mortgage loans are secured by first liens on various types of commercial and multifamily properties. | |

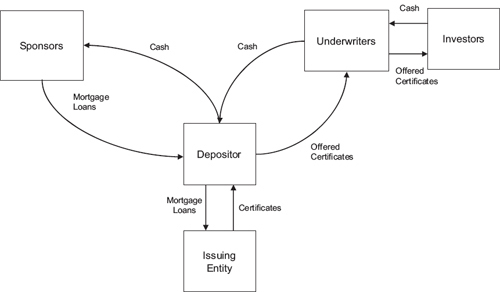

| Transaction Overview | On the closing date, each sponsor will sell its respective mortgage loans to the depositor, which will in turn deposit them into a common law trust created on the closing date. That common law trust, which will be the issuing entity, will be formed pursuant to a pooling and servicing agreement, to be dated as of September 1, 2015, among the depositor, the master servicer, the special servicer, the operating advisor, the certificate administrator and the trustee. Subject to the discussion under “—Transaction Parties—Companion Loan Holders and Other Parties Related to Loan Combinations” below, the master servicer and, if and when necessary, the special servicer will each service the mortgage loans for which it is responsible in accordance with the pooling and servicing agreement and provide information to the certificate administrator as necessary for the certificate administrator to calculate distributions and other information regarding the certificates. | |

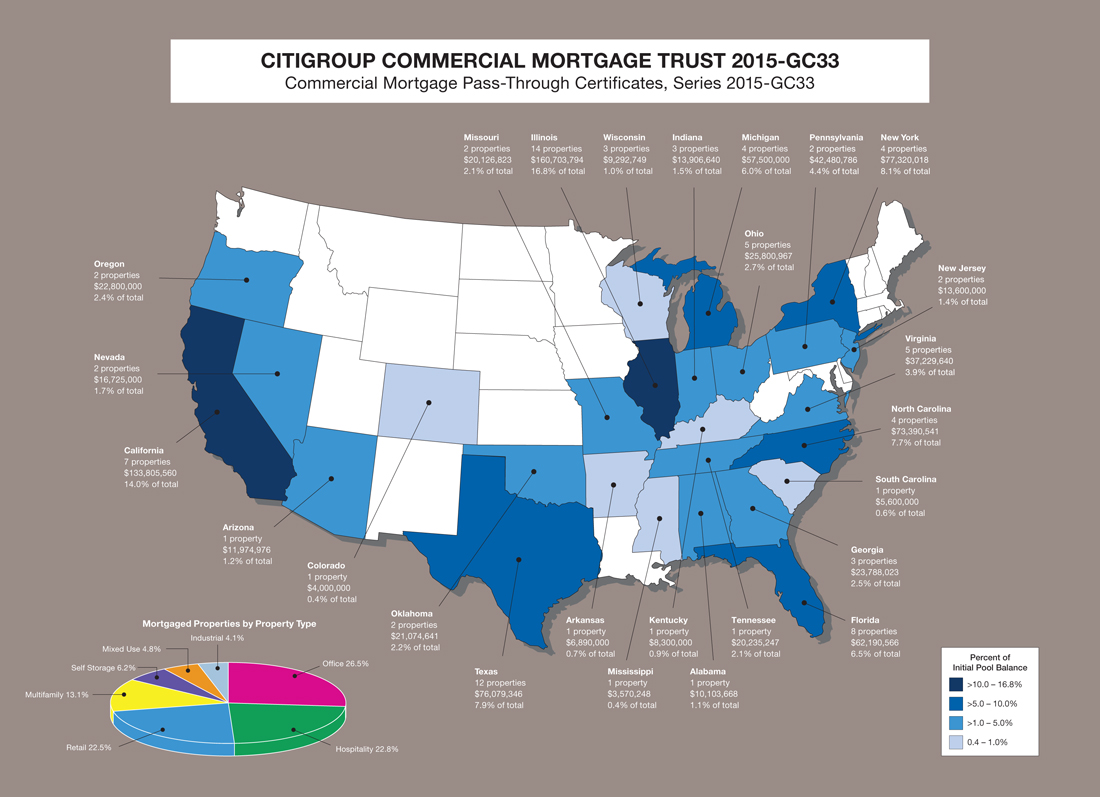

| The transfers of the mortgage loans from the sponsors to the depositor in exchange for cash and from the depositor to the issuing entity in exchange for the certificates, as well as the sales of the offered certificates by the depositor to the underwriters and by the underwriters to investors that purchase from them, are illustrated below: | ||

| ||

| S-15 |

| Transaction Parties | |||

| Issuing Entity | Citigroup Commercial Mortgage Trust 2015-GC33, a New York common law trust to be established on the closing date of this securitization transaction under the pooling and servicing agreement, dated as of September 1, 2015, between the depositor, the master servicer, the special servicer, the trustee, the certificate administrator and the operating advisor. See “Transaction Parties—The Issuing Entity” in this prospectus supplement. | ||

| Depositor | Citigroup Commercial Mortgage Securities Inc., a Delaware corporation. As depositor, Citigroup Commercial Mortgage Securities Inc. will acquire the mortgage loans from the sponsors and transfer them to the issuing entity. The depositor’s address is 388 Greenwich Street, New York, New York 10013 and its telephone number is (212) 816-6000. See “Transaction Parties—The Depositor” in this prospectus supplement and “Transaction Participants—The Depositor” in the prospectus. | ||

| Sponsors | The mortgage loans will be sold to the depositor by the following sponsors, which have organized and initiated the transaction in which the certificates will be issued: | ||

| · | Citigroup Global Markets Realty Corp., a New York corporation (40.1% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date); | ||

| · | Goldman Sachs Mortgage Company, a New York limited partnership (34.4% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date); | ||

| · | Rialto Mortgage Finance, LLC, a Delaware limited liability company (19.3% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date); | ||

| · | KGS-Alpha Real Estate Capital Markets, LLC, a Delaware limited liability company (3.3% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date); and | ||

| · | RAIT Funding, LLC, a Delaware limited liability company (2.9% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date). | ||

| See “Transaction Parties—The Sponsors” in this prospectus supplement. | |||

| S-16 |

| Originators | The mortgage loans were originated by the entities set forth in the following chart: | ||

| Originator | Sponsor | Number of Mortgage Loans |

% of Initial Pool Balance |

||||||||

| Citigroup Global Markets Realty Corp. | Citigroup Global Markets Realty Corp. | 22 | 40.1 | % | |||||||

| Goldman Sachs Mortgage Company | Goldman Sachs Mortgage Company | 11 | 30.9 | ||||||||

| Rialto Mortgage Finance, LLC | Rialto Mortgage Finance, LLC | 18 | 19.3 | ||||||||

| GS Commercial Real Estate LP | Goldman Sachs Mortgage Company | 5 | 3.5 | ||||||||

| KGS-Alpha Real Estate Capital Markets, LLC | KGS-Alpha Real Estate Capital Markets, LLC | 5 | 3.3 | ||||||||

| RAIT Funding, LLC | RAIT Funding, LLC | 3 | 2.9 | ||||||||

| Total | 64 | 100.0 | % | ||||||||

| See “Transaction Parties—The Originators” in this prospectus supplement. | |||

| Companion Loan Holders and Other | |||

| Parties Related to Loan | |||

| Combinations | As described under “The Trust Fund—Mortgage Loans—Loan Combinations” in the accompanying prospectus, any of the mortgage loans held by the issuing entity may be part of a split loan structure referred to in this prospectus supplement as a “loan combination”. A loan combination consists of the particular mortgage loan to be included in the issuing entity (a “split mortgage loan”) and one or more “companion loans” that will be held outside the issuing entity. Any holder of a related companion loan would constitute a “companion loan holder”. The subject mortgage loan and its related companion loan(s) comprising any particular loan combination are: (i) each evidenced by one or more separate promissory notes; (ii) obligations of the same borrower(s); (iii) cross-defaulted; and (iv) collectively secured by the same mortgage(s) and/or deed(s) of trust encumbering the related mortgaged property or portfolio of mortgaged properties. | ||

| A companion loan may be pari passu in right of payment with, or subordinate in right of payment to, the related split mortgage loan. In connection therewith: | |||

| · | If a companion loan is pari passu in right of payment with the related split mortgage loan, then such companion loan would constitute a “pari passu companion loan” and the related loan combination would constitute a “pari passu loan combination”. | ||

| · | If a companion loan is subordinate in right of payment to the related split mortgage loan, then such companion loan would constitute a “subordinate companion loan” and the related loan combination would constitute an “AB loan combination”. | ||

| · | If a loan combination includes both a pari passu companion loan and a subordinate companion loan, the discussions in this prospectus supplement regarding both pari passu loan combinations and AB loan combinations will apply to such loan combination. | ||

| S-17 |

| In the case of any loan combination, the allocation of payments to the subject mortgage loan and its related companion loan(s), whether on a senior/subordinated or a pari passu basis (or some combination thereof), is generally effected through a co-lender agreement, intercreditor agreement, agreement among noteholders or comparable agreement to which the respective holders of the subject promissory notes are parties (any such agreement being referred to in this prospectus supplement as a “co-lender agreement”). That co-lender agreement will govern the relative rights and obligations of such holders and, in connection therewith, will provide that one of those holders will be the “controlling note holder” entitled (directly or through a representative) to (i) approve or direct material servicing decisions involving the related loan combination (while the remaining such holder(s) generally are only entitled to non-binding consultation rights in such regard) and (ii) in some cases, replace the special servicer with respect to the related loan combination with or without cause. In addition, that co-lender agreement will designate whether servicing of the related loan combination is to be governed by the pooling and servicing agreement for this securitization or the pooling and servicing agreement, trust and servicing agreement or other comparable agreement for a securitization involving a related companion loan or portion thereof. In connection therewith: | |||

| · | If a loan combination is serviced under the pooling and servicing agreement, trust and servicing agreement or other comparable agreement for a securitization involving a related companion loan or portion thereof (such agreement, an “outside servicing agreement”), then such loan combination would constitute an “outside serviced loan combination”, the related mortgage loan would constitute an “outside serviced mortgage loan” and any related companion loan would constitute an “outside serviced companion loan”. | ||

| · | If a pari passu loan combination is serviced under the pooling and servicing agreement for this securitization transaction, then such pari passu loan combination would constitute a “serviced loan combination” or a “serviced pari passu loan combination”, any related pari passu companion loan would constitute a “serviced companion loan” or a “serviced pari passu companion loan” and any holder of a related pari passu companion loan would constitute a “serviced companion loan holder” or a “serviced pari passu companion loan holder”. | ||

| · | If an AB loan combination is serviced under the pooling and servicing agreement for this securitization transaction, then such AB loan combination would constitute a “serviced loan combination” or a “serviced AB loan combination”, the related subordinate companion loan would constitute a “serviced companion loan” or a “serviced subordinate companion loan” and any holder of the related subordinate companion loan would constitute a “serviced companion loan holder” or a “serviced subordinate companion loan holder”. | ||

| · | If and for so long as the “controlling note” with respect to any serviced loan combination (regardless of whether such note evidences a pari passu companion loan or a subordinate companion loan) is not included in this securitization transaction, then such serviced loan combination would constitute a “serviced outside controlled loan combination”, the related mortgage loan would constitute a “serviced outside controlled mortgage loan” and the related serviced companion loan would constitute a “serviced outside controlled companion loan”. However, a serviced outside controlled | ||

| S-18 |

| loan combination may cease to be such if, by virtue of any trigger event contemplated by the related co-lender agreement, the promissory note evidencing the related split mortgage loan becomes the controlling note for such loan combination, in which case the discussion in this prospectus supplement regarding “serviced outside controlled loan combinations” will thereafter cease to apply to the subject loan combination. | |||

| With respect to any loan combination that is, and only for so long as such loan combination is, a serviced outside controlled loan combination, the “outside controlling note holder” will at any time be the holder of the related controlling note (regardless of whether such note evidences a pari passu companion loan or a subordinate companion loan) or such holder’s designated representative. If, with respect to any serviced outside controlled loan combination, the related controlling note is included in a securitization trust, the pooling and servicing agreement, trust and servicing agreement or other comparable agreement for the relevant securitization will likely designate a particular party associated with that securitization, which may be, among others, a “controlling class representative” (or equivalent party), the majority holder of a particular class, a servicer or another service provider, to exercise the rights associated with the related controlling note, although the right of any such designated party to exercise some or all of such rights may terminate or shift to another designated party upon the occurrence of certain trigger events. | |||

| Each of the following mortgage loans to be held by the issuing entity is part of a loan combination: | |||

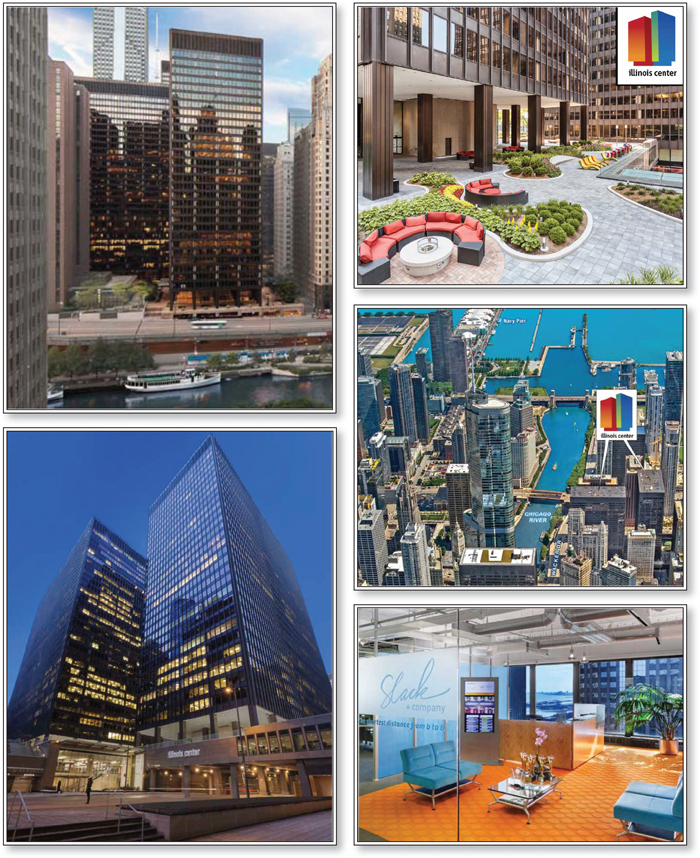

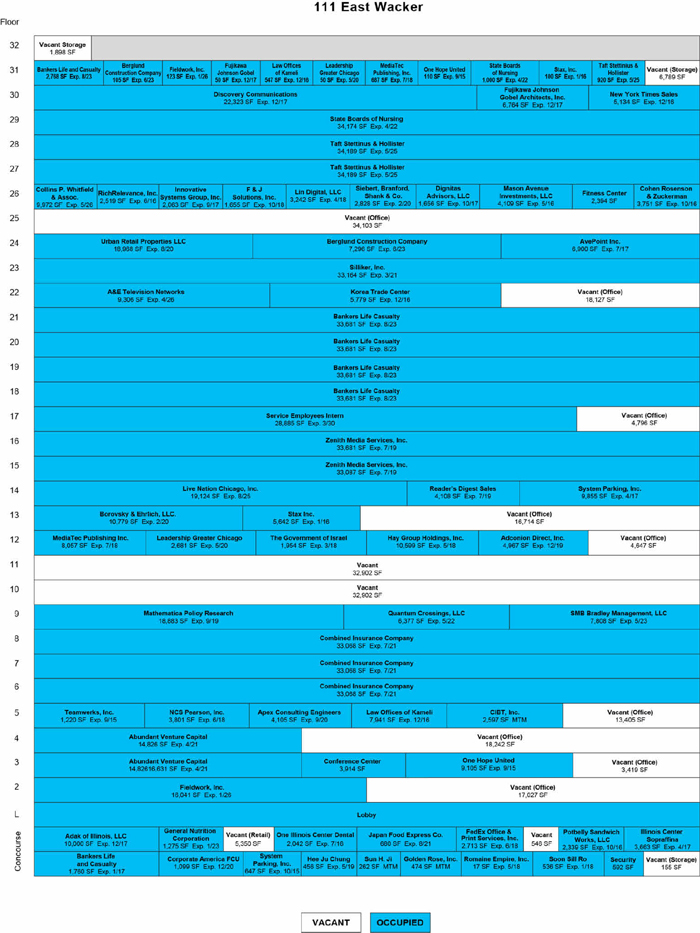

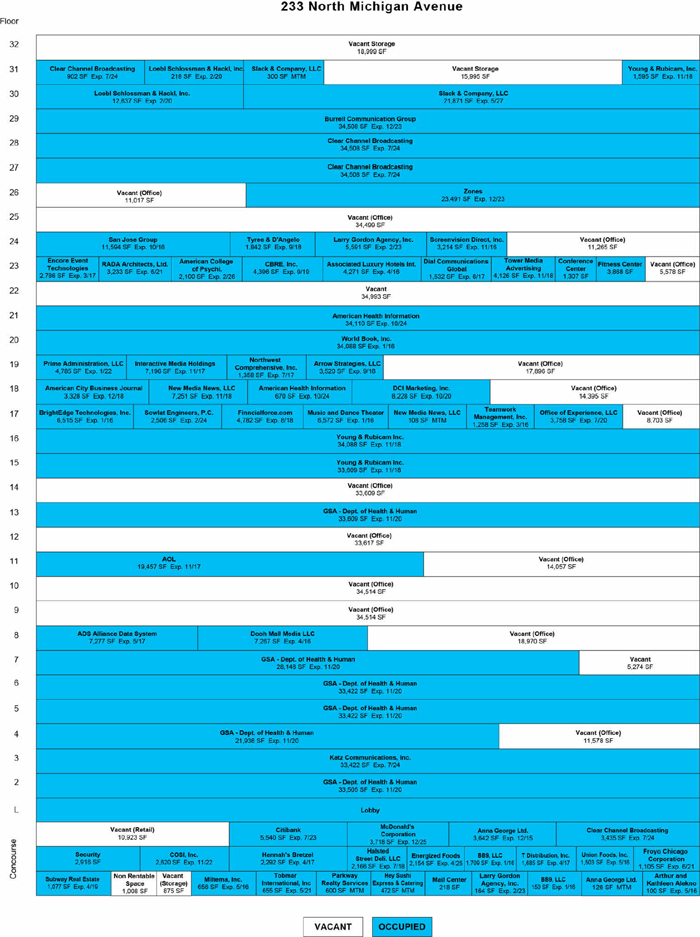

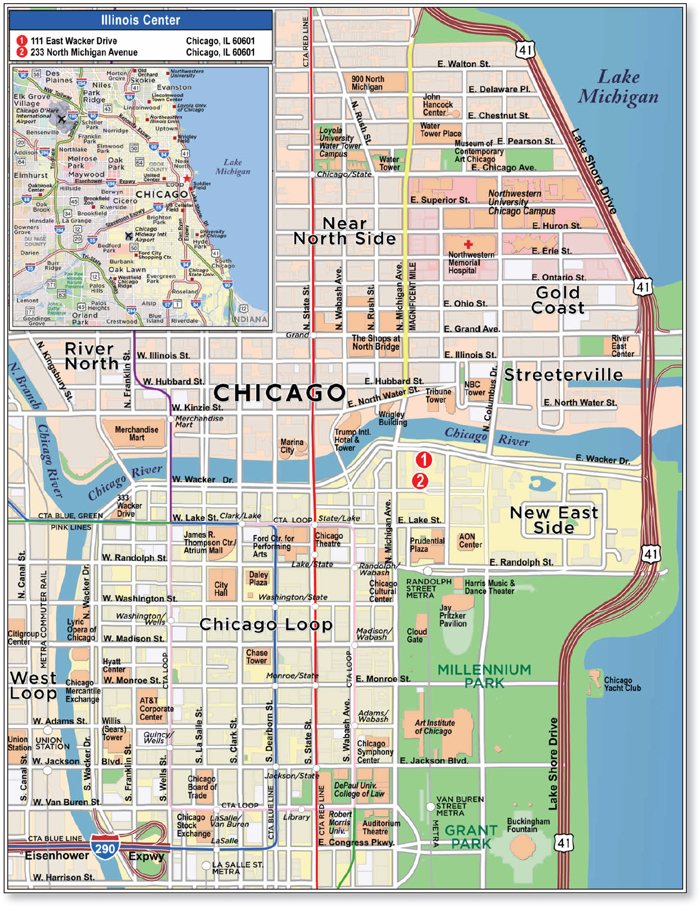

| · | the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A to this prospectus supplement as Illinois Center, which mortgage loan represents approximately 10.4% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date (the “Illinois Center mortgage loan”); | ||

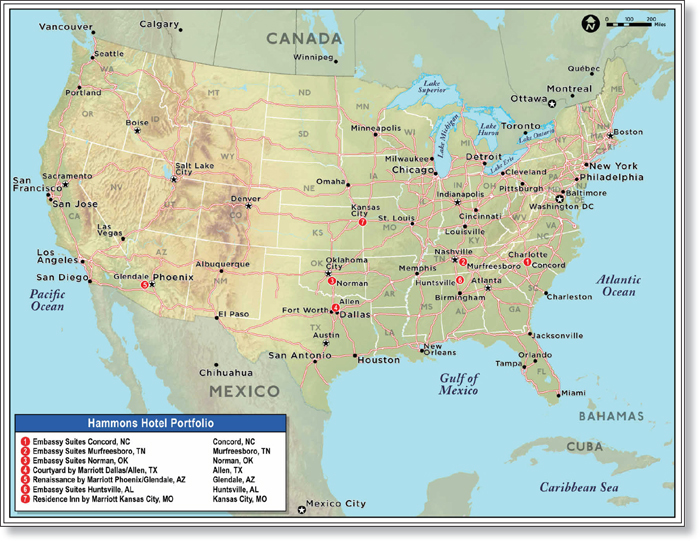

| · | the mortgage loan secured by the portfolio of mortgaged properties identified on Annex A to this prospectus supplement as Hammons Hotel Portfolio, which mortgage loan represents approximately 10.4% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date (the “Hammons Hotel Portfolio mortgage loan”); | ||

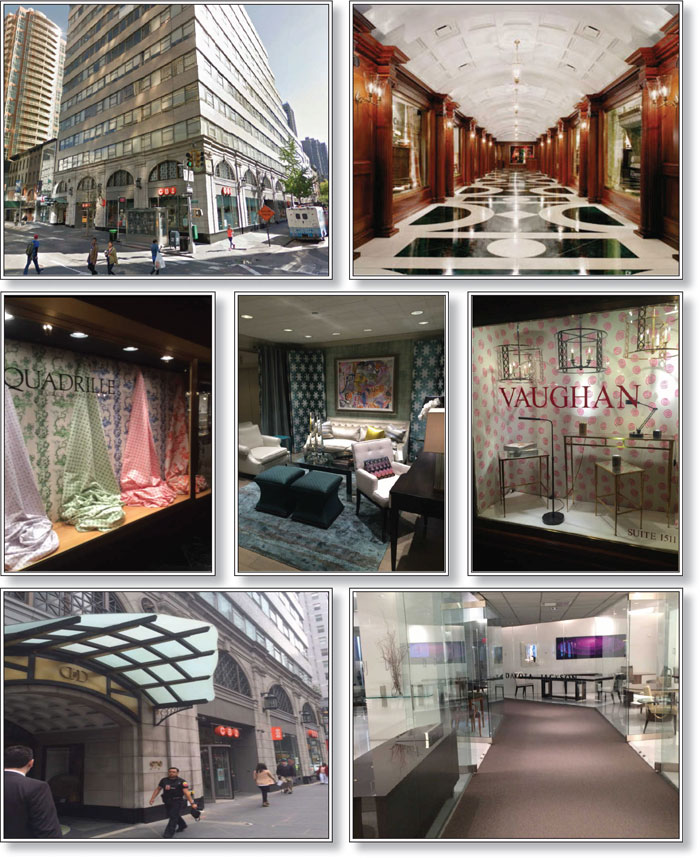

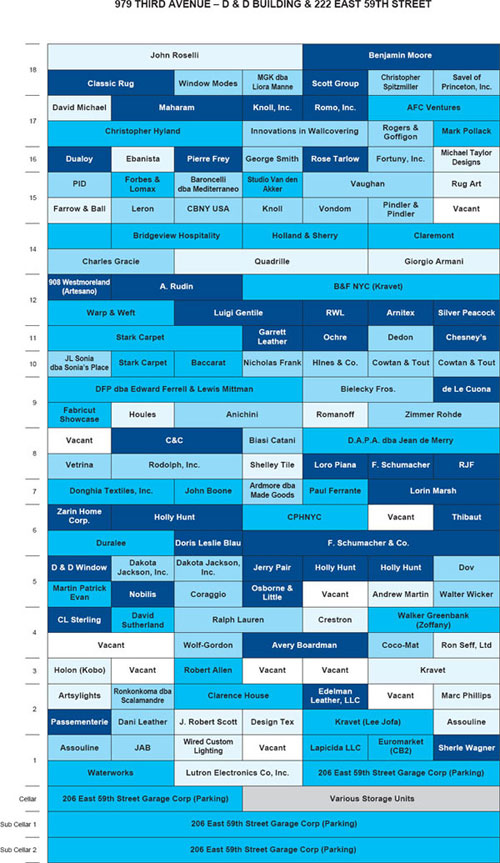

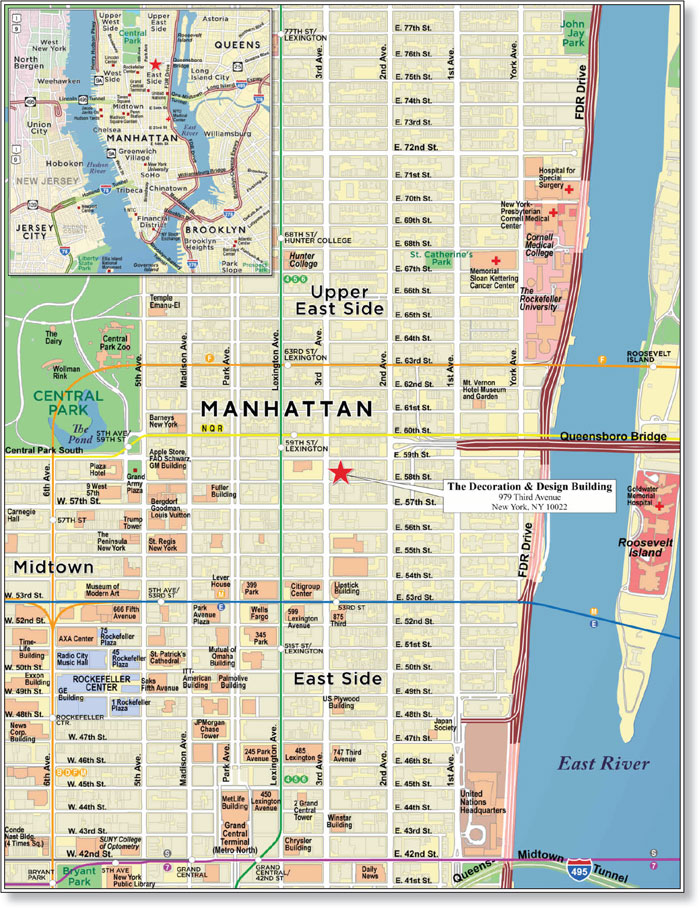

| · | the mortgage loan secured by the mortgaged property identified on Annex A to this prospectus supplement as The Decoration & Design Building, which mortgage loan represents approximately 6.8% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date (“The Decoration & Design Building mortgage loan”); and | ||

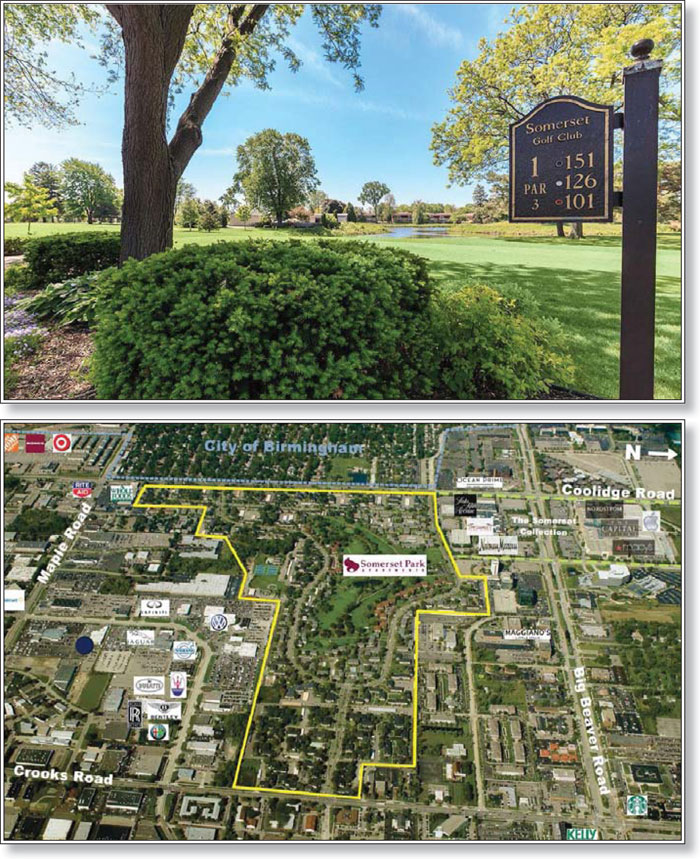

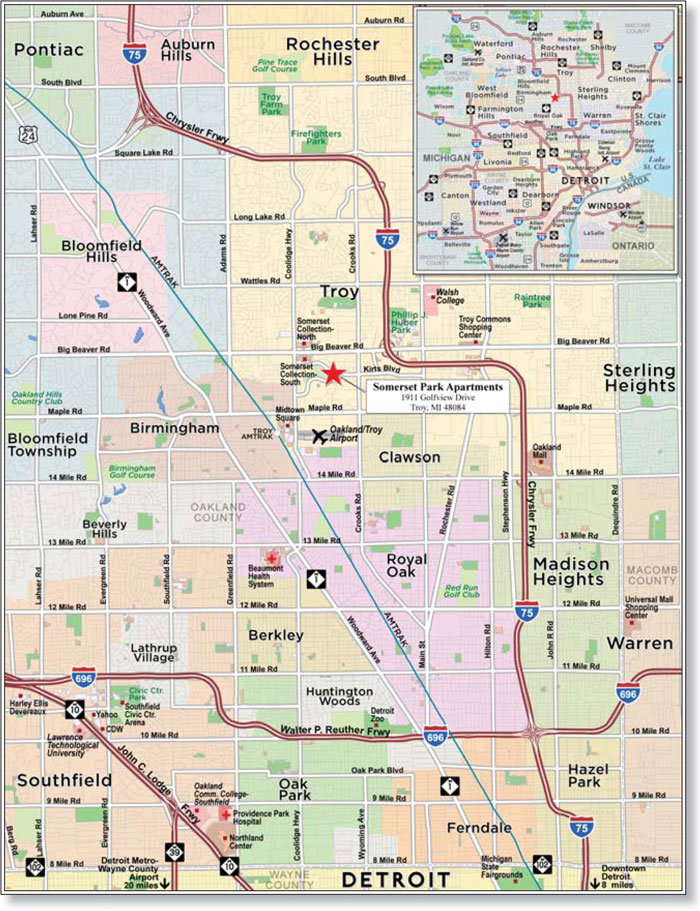

| · | the mortgage loan secured by the mortgaged property identified on Annex A to this prospectus supplement as Somerset Park Apartments, which mortgage loan represents approximately 3.8% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date (the “Somerset Park Apartments mortgage loan”). | ||

| S-19 |

| The following characteristics apply to the Illinois Center loan combination: | |||

| · | The Illinois Center loan combination includes two (2) companion loans (each an “Illinois Center pari passu companion loan” and, collectively, the “Illinois Center pari passu companion loans”), which are pari passu in right of payment with the Illinois Center mortgage loan. | ||

| · | The Illinois Center pari passu companion loans, which are evidenced by the non-controlling notes A-2 and A-3, are currently held by Citigroup Global Markets Realty Corp. and are expected to be contributed to one or more future commercial mortgage securitization transactions. | ||

| · | The Illinois Center loan combination is a serviced loan combination that will be serviced under the pooling and servicing agreement for this securitization transaction. | ||

| · | The controlling note holder for the Illinois Center loan combination (which is the holder of the controlling note A-1 included in this securitization transaction) will be the trustee on behalf of the holders of the Series 2015-GC33 certificates and, in accordance with the pooling and servicing agreement, such rights of the trustee will be exercised by the controlling class representative until a Control Termination Event shall have occurred and be continuing. | ||

| See “Description of the Mortgage Pool—The Loan Combinations—The Illinois Center Loan Combination” in this prospectus supplement. | |||

| The following characteristics apply to the Hammons Hotel Portfolio loan combination: | |||

| · | The Hammons Hotel Portfolio loan combination includes three (3) companion loans (each a “Hammons Hotel Portfolio pari passu companion loan” and, collectively, the “Hammons Hotel Portfolio pari passu companion loans”), which are pari passu in right of payment with the Hammons Hotel Portfolio mortgage loan. | ||

| · | The Hammons Hotel Portfolio pari passu companion loans, which are evidenced by the non-controlling notes A-2, A-3 and A-4, are currently held by Goldman Sachs Mortgage Company and are expected to be contributed to one or more future commercial mortgage securitization transactions. | ||

| · | The Hammons Hotel Portfolio loan combination is a serviced loan combination that will be serviced under the pooling and servicing agreement for this securitization transaction. | ||

| · | The controlling note holder for the Hammons Hotel Portfolio loan combination (which is the holder of the controlling note A-1 included in this securitization transaction) will be the trustee on behalf of the holders of the Series 2015-GC33 certificates and, in accordance with the pooling and servicing agreement, such rights of the trustee will be exercised by the controlling class representative until a Control Termination Event (as described under “—Significant Dates, Events and Periods” below) shall have occurred and be continuing. | ||

| S-20 |

| See “Description of the Mortgage Pool—The Loan Combinations—The Hammons Hotel Portfolio Loan Combination” in this prospectus supplement. | |||

| The following characteristics apply to The Decoration & Design loan combination: | |||

| · | The Decoration & Design Building loan combination includes one (1) companion loan (“The Decoration & Design Building pari passu companion loan”), which is pari passu in right of payment with The Decoration & Design Building mortgage loan. | ||

| · | The Decoration & Design Building pari passu companion loan, which is evidenced by the controlling note A-1, was contributed by Citigroup Global Markets Realty Corp. to the commercial mortgage securitization transaction (the “CGCMT 2015-P1 securitization”) involving the issuance of the Citigroup Commercial Mortgage Trust 2015-P1, Commercial Mortgage Pass-Through Certificates, Series 2015-P1 (the “CGCMT 2015-P1 certificates”). | ||

| · | The Decoration & Design Building loan combination is an outside serviced loan combination that is being serviced under the pooling and servicing agreement for the CGCMT 2015-P1 securitization (the “CGCMT 2015-P1 pooling and servicing agreement” and also an “outside servicing agreement”) by the master servicer for the CGCMT 2015-P1 securitization and, if and to the extent necessary, will be specially serviced by the special servicer for the CGCMT 2015-P1 securitization. | ||

| · | The controlling note holder for The Decoration & Design Building loan combination (which is the holder of the controlling note A-1 included in the CGCMT 2015-P1 securitization) will be the trustee for the CGCMT 2015-P1 securitization on behalf of the holders of the CGCMT 2015-P1 certificates. In accordance with the CGCMT 2015-P1 pooling and servicing agreement, the rights of the holder of such companion loan will be exercised by the controlling class representative for the CGCMT 2015-P1 securitization (the “CGCMT 2015-P1 controlling class representative” and also an “outside controlling class representative”) or another party designated under the CGCMT 2015-P1 pooling and servicing agreement. | ||

| See “—CGCMT 2015-P1 Servicer, Special Servicer, Trustee and Custodian” below and “Description of the Mortgage Pool—The Loan Combinations—The Decoration & Design Building Loan Combination” in this prospectus supplement. | |||

| The following characteristics apply to the Somerset Park Apartments loan combination: | |||

| · | The Somerset Park Apartments loan combination includes four (4) companion loans (each a “Somerset Park Apartments pari passu companion loan” and, collectively, the “Somerset Park Apartments pari passu companion loans”), which are pari passu in right of payment with the Somerset Park Apartments mortgage loan (which is comprised of two (2) non-controlling notes designated as notes A-1-3 and A-2-3). | ||

| S-21 |

| · | The Somerset Park Apartments pari passu companion loans evidenced by the controlling notes A-1-1 and A-2-1 were contributed by Rialto Mortgage Finance, LLC to the commercial mortgage securitization transaction (the “WFCM 2015-C30 securitization”) involving the issuance of the Wells Fargo Commercial Mortgage Trust 2015-C30, Commercial Mortgage Pass-Through Certificates, Series 2015-C30 (the “WFCM 2015-C30 certificates”). | ||

| · | The Somerset Park Apartments pari passu companion loans evidenced by the non-controlling notes A-1-2 and A-2-2 are currently held by Rialto Mortgage Finance, LLC and are expected to be included in one or more future commercial mortgage securitization transactions. | ||

| · | The Somerset Park Apartments loan combination is an outside serviced loan combination that is being serviced under the pooling and servicing agreement for the WFCM 2015-C30 securitization (the “WFCM 2015-C30 pooling and servicing agreement” and also an “outside servicing agreement”) by the master servicer for the WFCM 2015-C30 securitization and, if and to the extent necessary, will be specially serviced by the special servicer for the WFCM 2015-C30 securitization. | ||

| · | The controlling note holder for Somerset Park Apartments loan combination (which is the holder of the controlling notes A-1-1 and A-2-1 included in the WFCM 2015-C30 securitization) is the trustee for the WFCM 2015-C30 securitization on behalf of the holders of the WFCM 2015-C30 certificates. In accordance with the WFCM 2015-C30 pooling and servicing agreement, the rights of the holder of such companion loan will be exercised by the controlling class representative for the WFCM 2015-C30 securitization (the “WFCM 2015-C30 controlling class representative” and also an “outside controlling class representative”) or another party designated under the WFCM 2015-C30 pooling and servicing agreement. | ||

| See “—WFCM 2015-C30 Servicer, Special Servicer, Trustee and Custodian” below and “Description of the Mortgage Pool—The Loan Combinations—The Somerset Park Apartments Loan Combination” in this prospectus supplement. | |||

| There are no serviced outside controlled loan combinations, subordinate companion loans or AB loan combinations related to this securitization transaction and, therefore, all references in this prospectus supplement to “serviced outside controlled loan combinations”, “subordinate companion loans”, “AB loan combinations” or any related terms should be disregarded. | |||

| Each outside controlling class representative and each holder of a companion loan may have interests in conflict with those of the holders of the offered certificates. See “Risk Factors—Potential Conflicts of Interest of a Directing Holder, any Outside Controlling Class Representative and any Companion Loan Holder” and “—Loan Combinations Pose Special Risks” in this prospectus supplement. | |||

| S-22 |

| Trustee and Custodian | Deutsche Bank Trust Company Americas, a New York banking corporation. The corporate trust offices of Deutsche Bank Trust Company Americas are located at 1761 East St. Andrew Place, Santa Ana, California 92705-4934, Attention: Trust Administration-CGCMT Commercial Mortgage Trust 2015-GC33. Following the transfer of the underlying mortgage loans into the issuing entity, the trustee, on behalf of the issuing entity, will become the mortgagee of record with respect to each of the mortgage loans (other than any outside serviced mortgage loan) transferred to the issuing entity. In addition, subject to the terms of the pooling and servicing agreement, the trustee will be primarily responsible for back-up advancing. See “Transaction Parties—The Trustee” in this prospectus supplement. | |

| As described under “—CGCMT 2015-P1 Servicer, Special Servicer, Trustee and Custodian” below, Deutsche Bank Trust Company Americas is the trustee for the securitization of the controlling The Decoration & Design Building pari passu companion loan and, accordingly, the mortgagee of record for The Decoration & Design Building loan combination. | ||

| As described under “—WFCM 2015-C30 Servicer, Special Servicer, Trustee and Custodian” below, Wilmington Trust, National Association is the trustee for the securitization of the controlling Somerset Park Apartments pari passu companion loan and, accordingly, the mortgagee of record for the Somerset Park Apartments loan combination. | ||

| Certificate Administrator | Citibank, N.A., a national banking association organized under the laws of the United States. The corporate trust office of the Certificate Administrator responsible for: (i) administration of the issuing entity is located at 388 Greenwich Street, 14th Floor, New York, New York 10013, Attention: Global Transaction Services – CGCMT Commercial Mortgage Trust 2015-GC33; and (ii) certificate transfer services and the presentment of Certificates for final payment thereon is located at 480 Washington Boulevard, 30th Floor, Jersey City, New Jersey 07310, Attention: Global Transaction Services – CGCMT Commercial Mortgage Trust 2015-GC33. See “Transaction Parties—The Certificate Administrator” in this prospectus supplement. | |

| Operating Advisor | Situs Holdings, LLC, a Delaware limited liability company. At any time that a Control Termination Event has occurred and is continuing, the operating advisor will generally review the special servicer’s operational practices in respect of the applicable specially serviced mortgage loan(s) to formulate an opinion as to whether or not those operational practices generally satisfy the servicing standard with respect to the resolution and/or liquidation of such specially serviced mortgage loan(s). In addition, at any time after the occurrence and during the continuance of a Control Termination Event, the operating advisor will consult on a non-binding basis with the special servicer with regard to certain major decisions with respect to the applicable serviced mortgage loan(s) to the extent described in this prospectus supplement and as provided in the pooling and servicing agreement. | |

| At any time after the occurrence and during the continuance of a Control Termination Event, the operating advisor will be required to review certain operational activities related to the applicable specially serviced mortgage loan(s) in general on a platform-level basis. Based on the operating advisor’s review of certain information described in this prospectus supplement, the operating advisor will be required (if any applicable mortgage loan(s) were specially serviced under the pooling | ||

| S-23 |

| and servicing agreement for this securitization transaction during the prior calendar year) to prepare an annual report to be provided to the depositor, the rule 17g-5 information provider, the trustee and the certificate administrator (and made available through the certificate administrator’s website) setting forth its assessment of the special servicer’s performance of its duties under the pooling and servicing agreement on a platform-level basis with respect to the resolution and liquidation of the applicable specially serviced mortgage loan(s). No annual report will be required from the operating advisor with respect to the special servicer if during the prior calendar year no asset status report was prepared by the special servicer in connection with a specially serviced loan or REO property. | ||

| At any time that a Consultation Termination Event (as described under “—Significant Dates, Events and Periods” below) has occurred and is continuing, the operating advisor may recommend the replacement of the special servicer with respect to the mortgage loans and any companion loan(s) serviced under the pooling and servicing agreement for this securitization transaction (but not the related outside special servicer with respect to any outside serviced mortgage loan) if the operating advisor determines that the special servicer is not performing its duties as required under the pooling and servicing agreement or is otherwise not acting in accordance with the servicing standard, as described under “The Pooling and Servicing Agreement—Termination of the Special Servicer” in this prospectus supplement. | ||