ecdc_s1-080911.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EAST COAST DIVERISIFIED CORPORATION

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

5810

|

|

55-0840109

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

120 Interstate North Parkway, Suite 445

Atlanta, Georgia 20853

(770) 953-4184

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

National Registered Agents, Inc. of NV

1000 East William Street, Suite 204,

Carson City, NV 89701

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Joseph M. Lucosky, Esq.

Lucosky Brookman LLP

33 Wood Avenue South, 6th Floor

Iselin, New Jersey 08830

(732) 395-4400

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

| |

|

|

|

|

Non-accelerated filer

|

¨

|

Smaller reporting company

|

x

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class Of

Securities to be Registered

|

|

Amount to be

Registered (1)

|

|

Proposed

Maximum

Aggregate

Offering Price

per share

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration

fee

|

|

| |

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value per share, issuable pursuant to the Equity Credit Agreement

|

|

|

28,000,000

|

|

|

$

|

0.016 (2)

|

|

|

$

|

448,000 (3)

|

|

|

$

|

52.01

|

|

|

(1)

|

We are registering 28,000,000 shares of our common stock (the “Put Shares”) that we will put to Southridge Partners II, LP (“Southridge”), pursuant to an equity credit agreement (the “Equity Credit Agreement”) between the Southridge and the registrant, effective on July 1, 2011. In the event of stock splits, stock dividends, or similar transactions involving the common stock, the number of common shares registered shall, unless otherwise expressly provided, automatically be deemed to cover the additional securities to be offered or issued pursuant to Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”). In the event that adjustment provisions of the Equity Credit Agreement require the registrant to issue more shares than are being registered in this registration statement, for reasons other than those stated in Rule 416 of the Securities Act, the registrant will file a new registration statement to register those additional shares.

|

|

(2)

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c) of the Securities Act on the basis of the closing bid price of common stock of the registrant as reported on the Over-the-Counter Bulletin Board (the “OTCBB”) on August 15, 2011.

|

|

(3)

|

This amount represents the maximum aggregate value of common stock which may be put to Southridge by the registrant pursuant to the terms and conditions of the Equity Credit Agreement between Southridge and the registrant.

|

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED AUGUST 19, 2011

EAST COAST DIVERSIFIED CORPORATION

28,000,000 Shares of Common Stock

This prospectus relates to the resale of up to 28,000,000 shares of our common stock, par value $0.001 per share, by the selling security holder (the “Selling Security Holder”), which are Put Shares that we will put to Southridge pursuant to the Equity Credit Agreement.

The Equity Credit Agreement with Southridge provides that Southridge is committed to purchase up to $10,000,000 of our common stock. We may draw on the facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Equity Credit Agreement.

Southridge is an “underwriter” within the meaning of the Securities Act in connection with the resale of our common stock under the Equity Credit Agreement. No other underwriter or person has been engaged to facilitate the sale of shares of our common stock in this offering. This offering will terminate twenty four (24) months after the registration statement to which this prospectus is made a part is declared effective by the U.S. Securities and Exchange Commission (the “SEC”). Southridge will pay us 92% of the average of the lowest closing bid price of our common stock reported by Bloomberg, LP in any two trading days of the five consecutive trading day period commencing the date a put notice is delivered.

We will not receive any proceeds from the sale of these shares of common stock offered by the Selling Security Holder. However, we will receive proceeds from the sale of our Put Shares under the Equity Credit Agreement. The proceeds will be used for working capital or general corporate purposes. We will bear all costs associated with this registration.

Our common stock is quoted on the OTCBB under the symbol “ECDC.OB.” The shares of our common stock registered hereunder are being offered for sale by the Selling Security Holder at prices established on the OTCBB during the term of this offering. On August 15, 2011, the closing bid price of our common stock was $0.016 per share. These prices will fluctuate based on the demand for our common stock.

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on page 7.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011

|

|

|

Page

|

|

PROSPECTUS SUMMARY

|

|

1

|

|

THE OFFERING

|

|

4

|

|

SUMMARY FINANCIAL INFORMATION

|

|

6

|

|

RISK FACTORS

|

|

7

|

|

FORWARD LOOKING STATEMENTS

|

|

15

|

|

USE OF PROCEEDS

|

|

15

|

|

DETERMINATION OF OFFERING PRICE

|

|

15

|

|

MARKET FOR OUR COMMON STOCK

|

|

15

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

|

|

16

|

|

DESCRIPTION OF BUSINESS

|

|

21

|

|

DESCRIPTION OF PROPERTY

|

|

25

|

|

LEGAL PROCEEDINGS

|

|

25

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

|

26

|

|

EXECUTIVE COMPENSATION

|

|

27

|

|

DIRECTOR COMPENSATION

|

|

28

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

29

|

|

CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

|

29

|

|

DESCRIPTION OF SECURITIES

|

|

30

|

|

SELLING SECURITY HOLDERS

|

|

31

|

|

PLAN OF DISTRIBUTION

|

|

33

|

|

LEGAL MATTERS

|

|

35

|

|

EXPERTS

|

|

35

|

|

AVAILABLE INFORMATION

|

|

35

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

|

35

|

|

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. This prospectus may be used only where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities. This prospectus contains important information about us that you should read and consider carefully before you decide whether to invest in our common stock. If you have any questions regarding the information in this prospectus, please contact Kayode A. Aladesuyi, our President and Chief Executive Officer, at: East Coast Diversified Corporation, 120 Interstate North Parkway Suite 445, Atlanta, Georgia 20853 or by phone at (770) 953-4184.

All dealers that effect transactions in these securities whether or not participating in this offering may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that a person should consider before investing in the Company’s securities. A potential investor should carefully read the entire Prospectus, including “Risk Factors” and the Consolidated Financial Statements, before making an investment decision.

In this prospectus, “ECDC,” the “Company,” “we,” “us” and “our” refers to East Coast Diversified Corporation.

The Company

Background

East Coast Diversified Corporation (the “Company”, “East Coast”, “ECDC”, “we”, “us” or “our”), through its majority owned subsidiary, EarthSearch Communications International, Inc. (“EarthSearch”), offers a portfolio of Global Positioning System (“GPS”) devices, Radio Frequency Identification (“RFID”) interrogators, integrated GPS/RFID technologies and tag designs. These solutions help businesses worldwide to increase asset management, provide safety and security, increase productivity and deliver real-time visibility of the supply chain through automation. EarthSearch is an international provider of GPS and telemetric devices, applications and solutions for both consumer and commercial markets. EarthSearch developed and created devices which feature the world’s first wireless communication between RFID and GPS technologies. These devices provide real-time visibility of assets and goods in transit as well providing specialized security applications for sea ports, shipyards, and power and energy plants.

The principal business offices of the Company are located at 120 Interstate North Parkway Suite 445, Atlanta, Georgia, 20853, and their telephone number at that address is (770) 953-4184. We currently lease approximately 4,500 square feet of generic office space for $4,796 per month. This lease expired on June 30, 2011 and was immediately renewed for a six month extension. The Company will consider renewing the prior lease or seek a new office location at the beginning of the 2012 fiscal year.

Recent Developments

Effective as of March 7, 2011, the Company replaced KBL LLP (the “Former Accounting Firm”) as its independent registered public accounting firm and engaged Randall N. Drake, CPA PA, 1981 Promenade Way, Clearwater, FL 33760 (the “New Accounting Firm”) as its new independent registered public accounting firm as of and for the year ended December 31, 2010. The change in independent registered public accounting firm was not the result of any disagreement with the Former Accounting Firm.

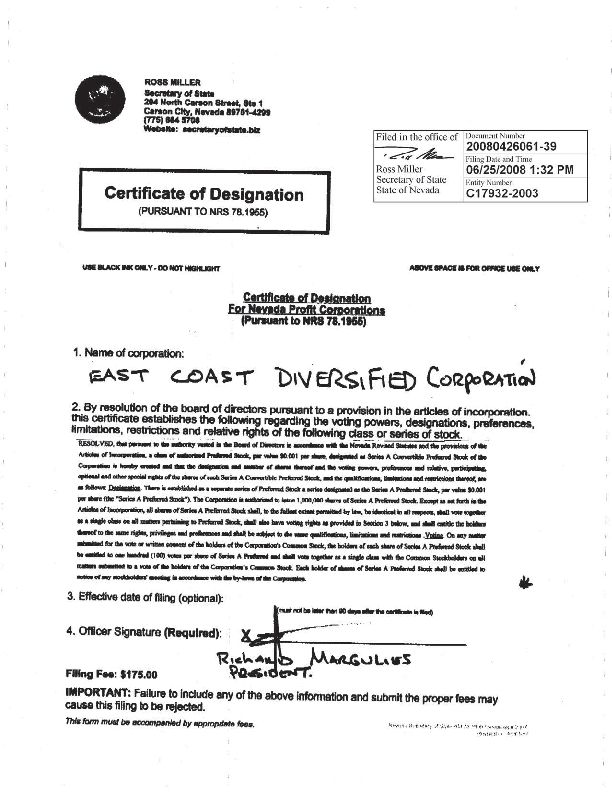

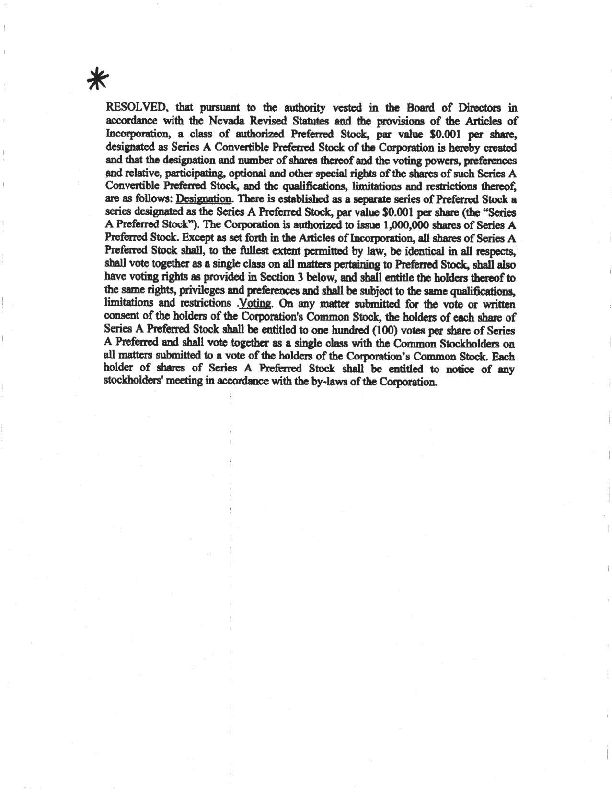

On June 3, 2011, the Company filed a certificate of amendment to the Company’s Articles of Incorporation (the “Amendment”) with the Secretary of State of Nevada to increase the Company’s authorized capital stock to 500,000,000 shares, par value $0.001 per share, including (i) 480,000,000 shares of common stock, par value $0.001 per share and (ii) 20,000,000 shares of preferred stock, par value $0.001 per share. The effective date of the Amendment is June 1, 2011.

History

The Company was incorporated under the laws of the State of Florida on May 27, 1994, under the name Plantastic Corp., to engage in the business of purchasing and operating a tree farm and nursery. The Company was unsuccessful in this venture and in March 1997, the Company amended its articles of incorporation, reorganized its capital structure and changed its name to Viva Golf, USA Corp. The Company then acquired the assets of Viva Golf, USA Corp., a Delaware corporation, which consisted of a golf equipment marketing plan and other related assets. The Company unsuccessfully engaged in the business of golf club manufacturing and marketing and ceased those operations in 1998.

The Company acquired 100% of the issued and outstanding shares of common stock of Lifekeepers International, Inc. in exchange for 1,000,000 of its newly issued shares under an Agreement and Plan of Reorganization on October 22, 1998. In connection with this acquisition, the Company changed its name to Lifekeepers International, Inc. On May 29, 2003, the Company changed its name to East Coast Diversified Corporation and changed its domicile to Nevada. During 2001, the Company discontinued its operations, and remained inoperative until April 26, 2006.

On April 26, 2006, the Company entered into a definitive Share Exchange Agreement (the “Agreement”) to acquire 100% of the issued and outstanding shares of Miami Renaissance Group, Inc. (“MRG”), a privately-owned Florida corporation, in exchange for the issuance of 4,635,000 restricted shares of the Company’s common stock and 167,650 preferred stock designated as Series A Convertible Preferred Stock (the “Preferred Stock”). The Company’s officers and directors, who did not own any shares of common stock of the Company prior to this Agreement, were also the majority shareholders of MRG. The Agreement was adopted by the unanimous consent of the Company’s Board of Directors (the “Board”) and written consent of the majority shareholders of the Company. Further, it was approved by unanimous consent of MRG’s Board of Directors and by written consent of the majority shareholders of MRG.

Pursuant to the Agreement, the Company issued a total of 4,635,000 shares of common stock and 167,650 shares of Preferred Stock to the shareholders of the MRG in exchange for 20,500,000 shares of MRG, which represented 100% of the issued and outstanding shares of MRG. Following the closing of the Agreement, the shareholders of MRG owned approximately 63.75% of the Company’s issued and outstanding shares of common stock.

On February 20, 2008, the Company entered into a Stock Sale Agreement (the “Stock Sale Agreement”), pursuant to which the Company agreed to sell and MRG Acquisition Corp. (a Delaware corporation formed for the purpose of acquiring MRG, hereinafter “MRGA”) agreed to acquire 100% of the capital stock of MRG (“MRG Shares”), representing substantially all of the assets of the Company, in consideration for the forgiveness of liabilities in the amount of $1,051,471 owed by the Company to certain affiliated persons.

On April 6, 2009, the Board unanimously adopted and the consenting stockholders approved a resolution to effectuate a one-for-one hundred (1:100) reverse stock split (the “Reverse Split”) of the Company’s common stock. On June 29, 2009, the Company was notified by NASDAQ that has it had received the necessary documentation to process the Reverse Split and issue a new symbol (ECDC). The Reverse Split became effective on June 30, 2009.

EarthSearch Transactions

On December 18, 2009, the Company’s former principal stockholders, Frank Rovito, Aaron Goldstein and Green Energy Partners, LLC (collectively, the “Sellers”), entered into a Securities Purchase Agreement (the “Purchase Agreement”) with Kayode Aladesuyi (the “Buyer”), pursuant to which the Sellers, beneficial owners of an aggregate of 6,997,150 shares of the Company’s common stock (the “Sellers’ Shares”), agreed to sell and transfer the Sellers’ Shares to the Buyer for total consideration of Three Hundred Thousand Dollars ($300,000.00). The Purchase Agreement also provided that the Company would enter into a share exchange agreement with EarthSearch.

On January 15, 2010, the Company entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with EarthSearch Communications International, Inc. (“EarthSearch”), pursuant to which the Company agreed to issue 35,000,000 shares of the Company’s restricted common stock to the shareholders of EarthSearch. On April 2, 2010, EarthSearch consummated all obligations under the Share Exchange Agreement. In accordance with the terms and provisions of the Share Exchange Agreement, the Company acquired 93.49% of the issued and outstanding common stock of EarthSearch. As a result of the execution and closing of the Purchase Agreement and Share Exchange Agreement, our principal business became the business of EarthSearch (the “Share Exchange”). The Board passed a resolution electing the new Board members and appointing new management of the Company and effectively resigning as their last order of business.

The Share Exchange is being accounted for as an acquisition and recapitalization. EarthSearch is the acquirer for accounting purposes and, consequently, the assets and liabilities and the historical operations that are reflected in the consolidated financial statements herein are those of EarthSearch. The accumulated deficit of EarthSearch was also carried forward after the acquisition.

EarthSearch was founded in November 2003 as a Georgia corporation. The company subsequently re-incorporated in Delaware on July 8, 2005. The operations of its former wholly-owned subsidiary, EarthSearch Localizacao de Veiculos, Ltda in Brazil, were discontinued during 2007.

On December 31, 2010, the Company acquired 1,800,000 additional shares of EarthSearch from a non-controlling shareholder in exchange for 439,024 shares of the Company’s common stock. As of August 15, 2011, the Company owns 94.66% of the issued and outstanding stock of EarthSearch.

Business Summary

The Company, through its majority owned subsidiary, EarthSearch, offers a portfolio of GPS devices, RFID interrogators, integrated GPS/RFID technologies and Tag designs. These solutions help businesses worldwide to increase asset management, provide safety and security, increase productivity, and deliver real-time visibility of the supply chain through automation. EarthSearch is an international provider of GPS and telemetric devices, applications and solutions for both consumer and commercial markets. EarthSearch developed and created devices which feature the world’s first wireless communication between RFID and GPS technologies. These devices provide real-time visibility of assets and goods in transit as well providing specialized security applications for sea ports, shipyards, and power and energy plants.

THE OFFERING

|

Common stock offered by selling security holders

|

|

28,000,000 shares of common stock.

|

| |

|

|

|

Common stock outstanding before the offering

|

|

180,861,766 shares of common stock outstanding as of August 15, 2011.

|

| |

|

|

|

Common stock outstanding after the offering

|

|

208,861,766 shares of common stock.

|

| |

|

|

|

Terms of the Offering

|

|

The selling security holders will determine when and how they will sell the common stock offered in this prospectus.

|

| |

|

|

|

Termination of the Offering

|

|

This offering will terminate twenty (24) months after the registration statement to which this prospectus is made a part is declared effective by the SEC pursuant to the Equity Credit Agreement.

|

| |

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of the shares of common stock offered by the Selling Security Holders. However, we will receive proceeds from sale of our common stock under the Equity Credit Agreement. The proceeds from the offering will be used for working capital and general corporate purposes. See “Use of Proceeds.”

|

| |

|

|

|

Risk Factors

|

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 7.

|

| |

|

|

|

OTC Bulletin Board Symbol

|

|

ECDC

|

This offering relates to the resale of up to 28,000,000 shares of our common stock, par value $0.001 per share, by the Selling Security Holder, which are the Put Shares that we will put to Southridge pursuant to the Equity Credit Agreement. Assuming the resale of all of the shares being registered in this Registration Statement, such shares would constitute approximately 13.4% of the Company’s outstanding common stock.

On July 1, 2011, the Company and Southridge entered into the Equity Credit Agreement pursuant to which, we have the opportunity, for a two year period, commencing on the date on which the SEC first declares effective this registration statement to which this prospectus is made a part registering the resale of our common shares by Southridge, to resell shares of our common stock purchased under the Equity Credit Agreement. For each share of our common stock purchased under the Equity Credit Agreement, Southridge will pay ninety-two percent (92%) of the average of two lowest closing bid price (the “Bid Price”) of any two applicable trading days during the five (5) trading day period (the “Valuation Period”) commencing the date a put notice (the “Put Notice”) is delivered to Southridge (the “Put Date”) in a manner provided by the Equity Credit Agreement. Subject to the limitations outlined below, the Company may, at its sole discretion, issue a Put Notice to Southridge and Southridge will then be irrevocably bound to acquire such shares.

Subject to the terms and conditions of the Equity Credit Agreement, at any time or from time to time after the effectiveness of this registration statement, we can notify Southridge in writing of the existence of a potential material event based upon the good faith determination of our board of directors (the “Blackout Notice”), and Southridge shall not offer or sell any of our securities acquired under the Equity Credit Agreement from the time the Blackout Notice was provided to Southridge until Southridge receives our written notice that such potential material event has either been disclosed to the public or no longer constitutes a potential material event. If we deliver a Blackout Notice within fifteen trading days commencing the sixth day following a Put Date (the “Closing Date”), and the Bid Price immediately preceding the applicable Blackout Period (the “Old Bid Price”) is greater than the Bid price on the first trading day immediately following such Blackout Period (the “New Bid Price”), then we are obligated to issue to the Investor a number of additional common shares (the “Blackout Shares”) equal to the difference between (i) the product of (X) the shares that were issued to the Investor on the most recent Closing Date and held by the Investor immediately prior to the Blackout Period (the “Remaining Put Shares”), multiplied by (Y) the Old Bid Price, and divided by (Z) the New Bid Price, and (ii) the Remaining Put Shares.

In connection with the Equity Credit Agreement, we paid Southridge (i) a due diligence fee of $10,000 and (ii) 600,000 shares of the Company’s restricted common stock as additional consideration.

We are relying on an exemption from the registration requirements of the Securities Act and/or Rule 506 of Regulation D promulgated thereunder. The transaction does involve a private offering, Southridge is an “accredited investor” and/or qualified institutional buyer and Southridge has access to information about us and its investment.

At the assumed offering price of $0.016 per share, we will be able to receive up to $412,160 in gross proceeds, assuming the sale of the entire 28,000,000 shares being registered hereunder pursuant to the Equity Credit Agreement. Neither the Equity Credit Agreement nor any rights or obligations of the parties under the Equity Credit Agreement may be assigned by either party to any other person.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the Equity Credit Agreement. These risks include dilution of stockholders, significant decline in our stock price and our inability to draw sufficient funds when needed.

Southridge will periodically purchase our common stock under the Equity Credit Agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to Southridge to raise the same amount of funds, as our stock price declines.

SUMMARY FINANCIAL INFORMATION

The following selected financial information is derived from the Company’s financial statements appearing elsewhere in this Prospectus and should be read in conjunction with the Company’s financial statements, including the notes thereto, appearing elsewhere in this Prospectus.

Summary of Operations

For the Years Ended December 31,

| |

|

2010

|

|

|

2009

|

|

|

Total Revenue

|

|

$

|

129,248

|

|

|

$

|

147,193

|

|

|

Loss from operations

|

|

$

|

(2,357,129

|

)

|

|

$

|

(1,411,018

|

)

|

|

Net loss

|

|

$

|

(2,496,892

|

)

|

|

$

|

(1,473,225

|

)

|

|

Net loss per common share (basic and diluted)

|

|

$

|

(0.03

|

)

|

|

$

|

(0.01

|

)

|

|

Weighted average common shares outstanding

|

|

|

77,118,976

|

|

|

|

98,358,696

|

|

For the Six Months Ended June 30,

| |

|

2011

|

|

|

2010

|

|

|

Total Revenue

|

|

$

|

370,092

|

|

|

$

|

22,574

|

|

|

Loss from operations

|

|

$

|

(451,139)

|

|

|

$

|

(1,105,623)

|

|

|

Net loss

|

|

$

|

(478,199)

|

|

|

$

|

(1,130,491)

|

|

|

Net loss per common share (basic and diluted)

|

|

$

|

(0.00)

|

|

|

$

|

(0.00)

|

|

|

Weighted average common shares outstanding

|

|

$

|

157,651,502

|

|

|

$

|

95,616,829

|

|

Statement of Financial Position

As of the Years Ended December 31,

| |

|

2010

|

|

|

2009

|

|

|

Cash and cash equivalents

|

|

$

|

1,278

|

|

|

$

|

766

|

|

|

Total assets

|

|

$

|

239,861

|

|

|

$

|

471,604

|

|

|

Working Capital

|

|

$

|

(3,863,418

|

)

|

|

$

|

(3,025,646

|

)

|

|

Long term debt

|

|

$

|

3,965,668

|

|

|

$

|

3,063,247

|

|

|

Stockholders’ equity ( deficit )

|

|

$

|

(3,725,807)

|

|

|

$

|

(3,063,247

|

)

|

As of June 30,

| |

|

2011

|

|

|

2010

|

|

|

Cash and cash equivalents

|

|

$

|

592

|

|

|

$

|

2,113

|

|

|

Total assets

|

|

$

|

316,436

|

|

|

$

|

279,547

|

|

|

Working Capital

|

|

$

|

(3,666,845

|

) |

|

$

|

(3,515,291

|

) |

|

Long term debt

|

|

$

|

3,933,515

|

|

|

$

|

3,576,052

|

|

|

Stockholders’ equity ( deficit )

|

|

$

|

(3,368,808

|

) |

|

$

|

(3,296,505)

|

|

RISK FACTORS

The shares of our common stock being offered for resale by the Selling Security Holders are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested therein. Before purchasing any of these securities, you should carefully consider the following factors relating to our business and prospects. If any of the following risks actually occurs, our business, financial condition or operating results could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related To Our Business

THERE IS SUBSTANTIAL DOUBT ABOUT THE COMPANY’S ABILITY TO CONTINUE AS A GOING CONCERN.

Our auditor’s report in our 2010 consolidated financial statements expresses an opinion that substantial doubt exists as to whether we can continue as an ongoing concern. Because obtaining investment capital in not certain, or that our officers and directors may be unable or unwilling to loan or advance any additional capital to the Company, we may not have the funds necessary to continue our operations. Currently, our liabilities are greater than our assets. Our ability to meet our operating needs depends in large part on our ability to secure third party financing. We cannot provide any assurances that we will be able to obtain financing. See “December 31, 2010 Audited Consolidated Financial Statements.”

WE HAVE SUSTAINED RECURRING LOSSES SINCE INCEPTION AND EXPECT TO INCUR ADDITIONAL LOSSES IN THE FORESEEABLE FUTURE.

Our main operating subsidiary was formed in November 2003 and has reported annual net losses since inception. For our fiscal years ended December 31, 2010 and 2009, we experienced losses of $2,496,892 and $1,473,225, respectively. As of December 31, 2010, we had an accumulated deficit of $10,781,919. In addition, we expect to incur additional losses in the foreseeable future, and there can be no assurance that we will ever achieve profitability. Our future viability, profitability and growth depend upon our ability to successfully operate, expand our operations and obtain additional capital. There can be no assurance that any of our efforts will prove successful or that we will not continue to incur operating losses in the future.

WE DO NOT HAVE SUBSTANTIAL CASH RESOURCES AND IF WE CANNOT RAISE ADDITIONAL FUNDS OR GENERATE MORE REVENUES, WE WILL NOT BE ABLE TO PAY OUR VENDORS AND WILL PROBABLY NOT BE ABLE TO CONTINUE AS A GOING CONCERN.

At December 31, 2010, our available cash balance was $1,278. We will need to raise additional funds to pay outstanding vendor invoices and execute our business plan. Our future cash flows depend on our ability to enter into, and be paid under, contracts with merchants to provide our products to their customers. There can be no assurance that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us.

We may be required to pursue sources of additional capital through various means, including joint venture projects and debt or equity financings. Future financings through equity investments will be dilutive to existing stockholders. Also, the terms of securities we may issue in future capital transactions may be more favorable for our new investors. Newly issued securities may include preferences, superior voting rights, the issuance of warrants or other convertible securities, which will have additional dilutive effects. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees, accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations.

Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets and the fact that we have not been profitable, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, even to the extent that we reduce our operations accordingly, we may be required to cease operations.

THE LIMITED HISTORY OF OUR BUSINESS MAKES IT DIFFICULT TO EVALUATE AN INVESTMENT IN OUR COMPANY.

Due to the early stage of our development, limited financial and other historical data is available for investors to evaluate whether we will be able to fulfill our business strategy and plans, including whether we will be able to achieve sales growth or meet our sales objectives. Further, financial and other limitations may force us to modify, alter, or significantly delay the implementation of such plans. Our anticipated investments include, but are not limited to, information systems, sales and marketing, research and development, distribution and fulfillment, customer support and administrative infrastructure. We may incur substantial losses in the future, making it extremely difficult to implement our business plans and strategies and sustain our then current level of operations. Furthermore, no assurances can be given that our strategy will result in an improvement in operating results or that our operations will become profitable.

OUR BUSINESS MODEL IS UNPROVEN AND MAY ULTIMATELY PROVE TO BE COMMERCIALLY UNVIABLE.

Because of our limited history of operations, we are unable to predict whether our business model will prove to be viable, whether the actual demand we anticipate for our products and services will materialize, whether demand for our products and services will materialize at the prices we expect to charge, or whether current or future revenue streams and/or pricing levels will be sustainable. There can be no assurances we will be able to achieve or sustain such revenue streams and/or pricing levels, the results of which could have a material, adverse effect on our business, financial condition and results of operations. Our ability to generate future revenues will depend on a number of factors, many of which are beyond our control, including, among other things, the risks described herein. Our likelihood of success must be considered in light of the problems, expenses, complications, delays, and disruptions typically encountered in forming a new management team, hiring and training new employees, expanding into new markets, application of GPS, telematics and wireless technology still in its infancy and the competitive environment in which we intend to operate.

WE WILL REQUIRE SIGNIFICANT ADDITIONAL CAPITAL TO FULFILL OUR BUSINESS PLAN, AND OUR FAILURE TO RAISE ADDITIONAL CAPITAL WILL HAVE A MATERIAL, ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The development of our sales and marketing capabilities, product and service offerings, and business in general requires significant capital. The amount of our future capital requirements depends primarily on the rate of client growth, the rate and extent of our current expansion plans, and results of operations. There can be no assurances that unexpected circumstances (including failure to achieve anticipated cash flow) will not arise, requiring us to delay or abandon our development plans or seek additional financing. There can also be no assurance that additional financing will be available when needed or, that it will be available on commercially acceptable terms. If we are not able to obtain additional capital on acceptable terms, there is a risk that investors could lose their entire investment. Moreover, additional equity financing, if obtained, could result in substantial dilution to investors in our common stock, and the terms of such additional equity financing may include liquidation and dividend preferences over the common stock, as well as superior voting rights and other advantages in comparison to the holders of and investors in our common stock.

COMPETITION MAY INCREASE IN THE GPS DEVICE MARKET.

We may in the future compete for potential customers with companies not yet offering GPS devices. Competition in the GPS related industry may increase in the future, partly due to the potentially rebounding economic situation in the United States and internationally. Increased competition could result in price reductions, reduced margins or loss of market share and greater competition for major merchants.

WE ARE DEPENDENT ON KAYODE ALADESUYI. OUR FAILURE TO RETAIN MR. ALADESUYI AND/OR ATTRACT NEW HIGHLY QUALIFIED MEMBERS TO OUR COMPANY’S MANAGEMENT TEAM WOULD ADVERSELY AFFECT OUR ABILITY TO EITHER REMAIN IN OPERATION OR CONTINUE TO GROW.

Our success to date has largely been attributable to the skills and efforts of Kayode Aladesuyi, our Chief Executive Officer, President and Treasurer. Our continued growth and profitability will depend on our ability to strengthen our leadership infrastructure by recruiting and retaining qualified, experienced executive personnel. Competition in our industry for executive-level personnel is fierce, and there can be no assurance that we will be able to hire and retain other highly skilled executive employees, or that we can do so on economically feasible or desirable terms. The loss of Mr. Aladesuyi or our inability to hire and retain other such executives would have a material adverse effect on our business, financial condition and results of operations. In addition, the other members of our management team do not have substantial, if any, experience in the telematics industry.

IF WE ARE UNABLE TO ATTRACT, TRAIN AND RETAIN HIGHLY QUALIFIED PERSONNEL, THE QUALITY OF OUR SERVICES MAY DECLINE AND WE MAY NOT SUCCESSFULLY EXECUTE OUR INTERNAL GROWTH STRATEGIES.

Our success depends in large part upon our ability to continue to attract, train, motivate and retain highly skilled and experienced employees, including technical personnel. Qualified technical employees periodically are in great demand and may be unavailable in the time frame required to satisfy our customers’ requirements. While we currently have available technical expertise sufficient for the requirements of our business, expansion of our business could require us to employ additional highly skilled technical personnel.

There can be no assurance that we will be able to attract and retain sufficient numbers of highly skilled technical employees in the future. The loss of personnel or our inability to hire or retain sufficient personnel at competitive rates of compensation could impair our ability to secure and complete customer engagements and could harm our business.

WE ARE EXPOSED TO RISKS ASSOCIATED WITH THE ONGOING FINANCIAL CRISIS AND WEAKENING GLOBAL ECONOMY, WHICH INCREASE THE UNCERTAINTY OF CONSUMERS PURCHASING PRODUCTS AND/OR SERVICES.

The recent severe tightening of the credit markets, turmoil in the financial markets, and weakening global economy are contributing to a decrease in spending by consumers. If these economic conditions are prolonged or deteriorate further, the market for our products will decrease accordingly.

IF WE ARE NOT SUCCESSFUL IN THE CONTINUED DEVELOPMENT, INTRODUCTION, OR TIMELY MANUFACTURE OF NEW PRODUCTS, DEMAND FOR OUR PRODUCTS AND SERVICES COULD DECREASE SUBSTANTIALLY.

We expect that a significant portion of our future revenue will be derived from sales of newly introduced products and services. The market for our products and services is characterized by rapidly changing technology, evolving industry standards, and changes in customer needs. Specifically, the GPS, telematics, and wireless industries are experiencing significant technological change and advancement, and the industry in which we operate may coalesce in support of one or more particular advanced technologies that our company does not possess. If we fail to modify or improve our products and services in response to changes in technology, industry standards or customer needs, our products and services could rapidly become less competitive or obsolete. We must continue to make significant investments in research and development in order to continue to develop new products, enhance existing products and achieve market acceptance for such products. However, there can be no assurance that development stage products will be successfully completed or, if developed, will achieve significant customer acceptance.

If we are unable to successfully develop and introduce competitive new products and services, and enhance our existing products and services, our future results of operations would be adversely affected. Our pursuit of necessary technology may require substantial time and expense, and we may need to license new technologies to respond to technological change. These licenses may not be available, desirable or contain acceptable terms. Development and manufacturing schedules for technology products are difficult to predict, and there can be no assurance that we will achieve timely initial customer shipments of new products. The timely availability of these products in volume and their acceptance by customers are important to our future success. We may experience delays in shipping certain of our products and, whether due to manufacturing delays, lack of market acceptance, delays in regulatory approval, or otherwise, they could have a material adverse effect on our business, financial condition and results of operations.

WE WILL DERIVE A SIGNIFICANT PORTION OF OUR REVENUES FROM SALES OUTSIDE THE UNITED STATES, AND NUMEROUS FACTORS RELATED TO INTERNATIONAL BUSINESS ACTIVITIES WILL SUBJECT US TO RISKS THAT COULD, AMONG OTHER THINGS, AFFECT THE DEMAND FOR OUR PRODUCTS, NEGATIVELY AFFECTING OUR BUSINESS, FINANCIAL CONDITION OR RESULTS OF OPERATIONS.

Part of our strategy will involve the pursuit of growth opportunities in a number of foreign markets. If we are not able to maintain or increase international market demand for our products, services and technologies, then we may not be able to achieve our financial goals.

In many foreign markets, barriers to entry are created by long-standing relationships between potential customers and their local providers and protective regulations, including local content and service requirements. In addition, the pursuit of international growth opportunities requires significant efforts for an extended period before substantial revenues from these markets are realized. Our business could be adversely affected by a variety of uncontrollable and changing factors, including:

| |

● |

Unexpected changes in legal or regulatory requirements;

|

| |

|

|

| |

● |

Difficulty in protecting our intellectual property rights in a particular foreign jurisdiction;

|

| |

|

|

| |

● |

Cultural differences in the conduct of business;

|

| |

|

|

| |

● |

Difficulty in attracting qualified personnel and managing foreign activities;

|

| |

|

|

| |

● |

Recessions in foreign economies;

|

| |

|

|

| |

● |

Longer payment cycles for and greater difficulties collecting accounts receivable;

|

| |

|

|

| |

● |

Export controls, tariffs, and other trade protection measures;

|

| |

|

|

| |

● |

Fluctuations in currency exchange rates;

|

| |

|

|

| |

● |

Nationalization, expropriation, and limitations on repatriation of cash;

|

| |

|

|

| |

● |

Social, economic, and political instability;

|

| |

|

|

| |

● |

Natural disasters, acts of terrorism, and war;

|

| |

|

|

| |

● |

Taxation; and

|

| |

|

|

| |

● |

Changes in laws and policies affecting trade, foreign investment, and loans.

|

WE RELY ON THIRD-PARTY RFID DEVICES WE INTEGRATED WITH OUR PRODUCT. THE LOSS OR INABILITY TO MAINTAIN LICENSES WITH SUCH THIRD-PARTIES COULD MATERIALLY, NEGATIVELY IMPACT OUR BUSINESS.

We currently rely upon certain software licensed from third-parties, including software that is integrated with our internally developed software and used to perform key functions. Certain of these licenses, including our license with Google, are for limited terms and can be renewed only by mutual consent. In addition, these licenses may be terminated if we breach the terms of the license and fail to cure the breach within a specified period of time. There can be no assurance that such licenses will be available to us on commercially reasonable terms, if at all. The loss of or inability to maintain or obtain licenses on such third-party software could result in the discontinuation of, or delays or reductions in, product shipments unless and until equivalent technology is identified, licensed, and integrated with our software. Any such discontinuation, delay, or reduction would harm our business, results of operations, and financial condition.

In addition, the third-party licenses that we may need to acquire in the future may not be exclusive, and there can be no assurance that our competitors will not obtain similar licenses and utilize such technology in competition with us. There can be no assurance that the vendors of certain technology that we may need to utilize in our products, will be able to provide such technology in the form we require, nor can there be any assurance that we will be able to modify our own products to adapt to changes in such technology. In addition, there can be no assurance that financial or other difficulties that may be experienced by such third-party vendors will not have a material adverse effect upon the technologies that may be incorporated into our products, or that, if such technologies become unavailable, we will be able to find suitable alternatives if we in fact need them. The loss of, or inability to maintain or obtain, any such software licenses could potentially result in shipment delays or reductions until equivalent software can be developed, identified, licensed and integrated, and could harm our business, operating results, and financial condition if we ultimately need to rely on such software.

IF WE DO NOT CORRECTLY ANTICIPATE DEMAND FOR OUR PRODUCTS, WE MAY NOT BE ABLE TO SECURE SUFFICIENT QUANTITIES OR COST-EFFECTIVE PRODUCTION OF OUR PRODUCTS, OR WE COULD HAVE COSTLY EXCESS PRODUCTION OR INVENTORIES.

We expect that it will become more difficult to forecast demand as we introduce and support multiple products and as competition in the market for our products intensifies. Significant unanticipated fluctuations in demand could cause the following problems in our operations:

| |

● |

If demand increases beyond what we forecast, we would have to rapidly increase production. We would depend on suppliers to provide additional volumes of components, and those suppliers might not be able to increase production rapidly enough to meet unexpected demand.

|

| |

|

|

| |

● |

Rapid increases in production levels to meet unanticipated demand could result in higher costs for manufacturing and supply of components and other expenses. These higher costs could lower our profit margins. Further, if production is increased rapidly, manufacturing quality could decline, which may also lower our profit margins.

|

| |

|

|

| |

● |

If forecasted demand does not develop, we could have excess production resulting in higher inventories of finished products and components, which would use cash and could lead to write-offs of some or all of the excess inventories. Lower than forecasted demand could also result in excess manufacturing capacity at our facilities, which could result in lower margins.

|

OUR SALES AND GROSS MARGINS FOR OUR PRODUCTS MAY FLUCTUATE OR ERODE.

Our sales and gross margins for our products may fluctuate from quarter to quarter due to a number of factors, including product mix, competition, and unit volumes. In particular, the average selling prices of a specific product tend to decrease over that product’s life. To offset such decreases, we intend to rely primarily on obtaining yield improvements and corresponding cost reductions in the manufacture of existing products and on introducing new products that incorporate advanced features and, therefore, can be sold at higher average selling prices. However, there can be no assurance that we will be able to obtain any such yield improvements, or cost reductions, or introduce any such new products in the future. To the extent that such cost reductions and new product introductions do not occur in a timely manner or our products do not achieve market acceptance, our business, financial condition, and results of operations could be materially, adversely affected.

WE MAY NOT BE ABLE TO PROTECT OUR INTELLECTUAL PROPERTY RIGHTS AGAINST PIRACY OR THE INFRINGEMENT OF THE PATENTS THAT WE USE BY THIRD-PARTIES DUE TO THE DECLINING LEGAL PROTECTION GIVEN TO INTELLECTUAL PROPERTY.

Preventing unauthorized use or infringement of intellectual property rights that we use is difficult. Piracy of our software represents a potential loss of significant revenue. While this would adversely affect our revenue from the United States market, the impact on revenue from abroad is more significant, particularly in countries where laws are less protective of intellectual property rights. Similarly, the absence of harmonized patent laws makes it more difficult to ensure consistent respect for patent rights. Moreover, future legal changes could make defending our intellectual property rights even more challenging. Continued enforcement efforts of our intellectual property rights may not affect revenue positively, and revenue could be adversely affected by reductions in the legal protection for intellectual property rights for software developers or by compliance with additional legal obligations impacting the intellectual property rights of software developers.

THE LOSS OF ANY MEMBER OF OUR SENIOR MANAGEMENT TEAM OR A SIGNIFICANT NUMBER OF OUR MANAGERS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR ABILITY TO MANAGE OUR BUSINESS.

Our operations depend heavily on the skills and efforts of our senior management team, our President and Chief Executive Officer. We will rely substantially on the experience of the management of our subsidiaries with regard to day-to-day operations. We face intense competition for qualified personnel, and many of our competitors have greater resources than we have to hire qualified personnel. The loss of any member of our senior management team or a significant number of managers could have a material adverse effect on our ability to manage our business.

LIMITED LIABILITY OF DIRECTORS AND OFFICERS.

The Company has adopted provisions to its Articles of Incorporation and Bylaws which limit the liability of its Officers and Directors, and provide for indemnification by the Company of its Officers and Directors to the full extent permitted by Nevada corporate law, which generally provides that its officers and directors shall have no personal liability to the Company or its stockholders for monetary damages for breaches of their fiduciary duties as directors, except for breaches of their duties of loyalty, acts or omissions not in good faith or which involve intentional misconduct or knowing violation of law, acts involving unlawful payment of dividends or unlawful stock purchases or redemptions, or any transaction from which a director derives an improper personal benefit. Such provisions substantially limit the shareholder’s ability to hold officers and directors liable for breaches of fiduciary duty, and may require the Company to indemnify its officers and directors.

IF WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION AND ADVERSELY IMPACT THE TRADING PRICE OF OUR COMMON STOCK.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance personnel in order to develop and implement appropriate internal controls and reporting procedures. Effective internal control is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. In addition, if we are unable to comply with the internal controls requirements of the Sarbanes-Oxley Act, then we may not be able to obtain the independent accountant certifications required by such act, which may preclude us from keeping our filings with the SEC current and may adversely affect any market for, and the liquidity of, our common stock.

PUBLIC COMPANY COMPLIANCE MAY MAKE IT MORE DIFFICULT FOR US TO ATTRACT AND RETAIN OFFICERS AND DIRECTORS.

The Sarbanes-Oxley Act and new rules subsequently implemented by the SEC have required changes in corporate governance practices of public companies. As a public company, we expect these new rules and regulations to increase our compliance costs and to make certain activities more time consuming and costly. As a public company, we also expect that these new rules and regulations may make it more difficult and expensive for us to obtain director and officer liability insurance in the future and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified persons to serve on our board of directors or as executive officers.

Risks Related to Our Common Stock

THERE IS ONLY A VOLATILE LIMITED MARKET FOR OUR COMMON STOCK.

Recent history relating to the market prices of public companies indicates that, from time to time, there may be periods of extreme volatility in the market price of the Company’s securities due to factors unrelated to the operating performance of the Company, or announcements concerning the condition of the Company, especially for stock quoted on the OTCBB. In the last 52 week period, the common stock was quoted on the OTCBB from a high closing price of $0.068 to a low closing price of $0.005 per share. See “Market for Common Equity, Related Stockholder Matter and Issuer Purchases of Equity Securities.” General market price declines, market volatility, especially for low priced securities, or factors related to the general economy or specifically to the Company in the future could adversely affect the price of the common stock. With the low price of the common stock, securities placement by the Company could be very dilutive to existing stockholders, thereby limiting the nature of future equity placements.

WE HAVE NEVER PAID DIVIDENDS AND WE DO NOT ANTICIPATE PAYING DIVIDENDS IN THE FUTURE.

We do not believe that we will pay any cash dividends on our common stock in the future. We have never declared any cash dividends on our common stock, and if we were to become profitable, it would be expected that all of such earnings would be retained to support our business. Since we have no plan to pay cash dividends, an investor would only realize income from his investment in our shares if there is a rise in the market price of our common stock, which is uncertain and unpredictable.

WE ARE SUBJECT TO PENNY STOCK REGULATIONS AND RESTRICTIONS.

The SEC has adopted regulations that generally define penny stocks to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. As a penny stock, our common stock may become subject to Rule 15g-9 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), or the “Penny Stock Rule.” This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is required to be made regarding sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be provided disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

Our common stock might not qualify for exemption from the penny stock restrictions. In any event, even if our common stock were exempt from the penny stock restrictions, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

AS AN ISSUER OF “PENNY STOCK,” THE PROTECTION PROVIDED BY THE FEDERAL SECURITIES LAWS RELATING TO FORWARD LOOKING STATEMENTS DOES NOT APPLY TO US.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, the Company will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by the Company contained a material misstatement of fact or was misleading in any material respect because of the Company’s failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

ADDITIONAL SHARES OF OUR AUTHORIZED CAPITAL STOCK WHICH ARE ISSUED IN THE FUTURE WILL DECREASE EQUITY OWNERSHIP PERCENTAGES OF EXISTING SHAREHOLDERS, COULD ALSO BE DILUTIVE TO EXISTING SHAREHOLDERS, AND COULD DELAY OR PREVENT A CHANGE OF CONTROL OF OUR COMPANY.

We are authorized to issue up to 480,000,000 shares of common stock, and our board of directors has the sole authority to issue unissued authorized stock without further shareholder approval. To the extent that additional common shares are issued in the future, they will decrease existing shareholders’ percentage equity ownership and, depending upon the prices at which they are issued, could be dilutive to existing shareholders.

YOUR OWNERSHIP INTEREST MAY BE DILUTED AND THE VALUE OF OUR COMMON STOCK MAY DECLINE BY EXERCISING THE PUT RIGHT PURSUANT TO OUR EQUITY CREDIT AGREEMENT.

Effective July 1, 2011, we entered into a $10,000,000 Equity Credit Agreement with Southridge Partners II, LP. Pursuant to the Equity Credit Agreement, when we deem it necessary, we may raise capital through the private sale of our common stock to Southridge at a price equal to 92% of the average of the lowest closing bid price of our common stock of any two trading days, consecutive or inconsecutive, during the five (5) trading day period immediately following the date our put notice is delivered. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest will be diluted.

WE ARE REGISTERING AN AGGREGATE OF 28,000,000 SHARES OF COMMON STOCK TO BE ISSUED UNDER THE EQUITY CREDIT AGREEMENT. THE SALE OF SUCH SHARES COULD DEPRESS THE MARKET PRICE OF OUR COMMON STOCK.

We are registering an aggregate of 28,000,000 shares of common stock under the registration statement of which this prospectus forms a part for issuance pursuant to the Equity Credit Agreement. The 28,000,000 shares of our common stock will represent approximately 13.4% of our shares outstanding immediately after our exercise of the put right. The sale of these shares into the public market by Southridge could depress the market price of our common stock.

SOUTHRIDGE WILL PAY LESS THAN THE THEN-PREVAILING MARKET PRICE FOR OUR COMMON STOCK.

The common stock to be issued to Southridge pursuant to the Equity Credit Agreement will be purchased at a 8% discount to the average of the lowest closing price of the common stock of any two trading days, consecutive or inconsecutive, during the five consecutive trading days immediately following the date of our notice to Southridge of our election to put shares pursuant to the Equity Credit Agreement. Southridge has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If Southridge sells the shares, the price of our common stock could decrease. If our stock price decreases, Southridge may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

FORWARD LOOKING STATEMENTS

Information included or incorporated by reference in this Prospectus may contain forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology.

This Prospectus contains forward-looking statements, including statements regarding, among other things, (a) our projected sales and profitability, (b) our technology, (c) our manufacturing, (d) the regulations to which we are subject, (e) anticipated trends in our industry and (f) our needs for working capital. These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Business,” as well as in this Prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Prospectus will in fact occur.

USE OF PROCEEDS

The Selling Security Holder is selling all of the shares of our common stock covered by this prospectus for their own account. Accordingly, we will not receive any proceeds from the resale of the common stock. However, we will receive proceeds from any sale of the common stock under the Equity Credit Agreement to Southridge. We intend to use the net proceeds received for working capital or general corporate needs.

DETERMINATION OF OFFERING PRICE

Our common stock is currently quoted on the OTCBB under the symbol “ECDC.OB.” The proposed offering price of the Put Shares is $0.016, which is the closing bid price of our common stock on August 15, 2011, as reported by the OTCBB. The selling security holder may sell shares in any manner at the current market price.

MARKET FOR OUR COMMON STOCK

(a) Market Information

Our common stock is currently quoted on the OTCBB under the symbol “ECDC.OB.” The Company’s shares commenced trading on or about August 6, 2003. The following chart is indicative of the fluctuations in the stock prices:

|

Quarter ended

|

|

Low Price

|

|

|

High Price

|

|

| |

|

|

|

|

|

|

|

March 31, 2009

|

|

$

|

0.0500

|

|

|

$

|

0.8000

|

|

|

June 30, 2009

|

|

$

|

0.0700

|

|

|

$

|

0.5000

|

|

|

September 30, 2009

|

|

$

|

0.0700

|

|

|

$

|

0.5100

|

|

|

December 31, 2009

|

|

$

|

0.0700

|

|

|

$

|

0.2000

|

|

|

March 31, 2010

|

|

$

|

0.1000

|

|

|

$

|

1.7500

|

|

|

June 30, 2010

|

|

$

|

0.0610

|

|

|

$

|

2.2500

|

|

|

September 30, 2010

|

|

$

|

0.0110

|

|

|

$

|

0.2000

|

|

|

December 31, 2010

|

|

$

|

0.0044

|

|

|

$

|

0.0450

|

|

|

March 31, 2011

|

|

$

|

0.0055

|

|

|

$

|

0.0680

|

|

|

June 30, 2011

|

|

$

|

0.0098

|

|

|

$

|

0.0570

|

|

(b) Holders

As of August 15, 2011, the Company had approximately 469 stockholders of record. This figure does not include those shareholders whose certificates are held in the name of brokers-dealers, “street name” or other nominees.

(c) Dividend Policy

We have never declared dividends or paid cash dividends on our common stock. We intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends on the common stock in the foreseeable future. The declaration of dividends will be at the discretion of the board of directors and will depend upon the Company’s earnings, financial position, general economic conditions and other pertinent factors.

(d) Securities authorized for issuance under equity compensation plans.

Not applicable.

MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATION

Forward Looking Statements

The Company is including the following cautionary statement in this Registration Statement for any forward-looking statements made by, or on behalf of, the Company. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements which are other than statements of historical facts. Certain statements contained herein are forward-looking statements and accordingly involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. Our expectations, beliefs and projections are expressed in good faith and are believed by us to have a reasonable basis, including without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties, but there can be no assurance that management’s expectation, beliefs or projections will result or be achieved or accomplished. In addition to other factors and matters discussed elsewhere herein, the following are important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements: technological advances by our competitors, changes in health care reform, including reimbursement programs, changes to regulatory requirements relating to environmental approvals for the treatment of infectious medical waste, capital needs to fund any delays or extensions of development programs, delays in the manufacture of new and existing products by us or third party contractors, market acceptance of our products, the loss of any key employees, delays in obtaining federal, state or local regulatory clearance for new installations and operations, changes in governmental regulations, availability of capital on terms satisfactory to us. We are also subject to numerous Risk Factors relating to manufacturing, regulatory, financial resources and personnel as described in “Risk Factors.” We disclaim any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

Plan of Operation

EarthSearch, based in Atlanta, Georgia, has created the world’s first integration of RFID and GPS technology. EarthSearch is an international provider of supply chain management solutions offering real-time visibility in the supply chain with integrated RFID/GPS and other telemetry products. These solutions help businesses worldwide to increase asset management, provide safety and security, increase productivity, and deliver real-time visibility of the supply chain through automation.

We experienced a sudden reversal of our revenue growth in the 4th quarter of 2008 as the real estate market and global economy came to a halt. A significant number of our customers declared bankruptcy or defaulted on their account. New business opportunities ceased and our sales plummeted. These events forced us to take dramatic steps and business decisions that resulted in substantial reductions of revenue for the years 2009 and 2010.

Based on our internal research, the board and management made the decision to change the business focus and product portfolio. We concluded that simply offering GPS devices, which we believed would become a commodity, exposed the company and its shareholders to potential failure. We accelerated R&D operations and began the development of wireless communication between GPS and RFID devices. We shut down most of our commercial operations due to the economic conditions and expanded R&D.

Our internal research showed GPS solutions will become inadequate for business needs and the market would demand or require more sophisticated solutions for asset management, workforce optimization and security. RFID technology was growing at significant rate and a combination of both technologies was inevitable. Management seized the opportunity of the slow economy to develop the world’s first solution for continuous visibility of assets and become a global leader in offering such an integrated solution. We are also continuing to utilize the technology to provide other applications such as oil pipeline monitoring

We completed our product development in the first quarter of 2010, and began commercial beta tests in the summer of 2010. We officially launched our new business and product portfolio in 4th quarter of 2010. We immediately saw revenue growth as 60% of our 2010 revenue came in the 4th quarter of 2010. We outperformed our entire 2010 revenue levels in the 1st quarter of 2011 and we expect to continue to see significant increases in revenue throughout 2011. We are currently engaged in numerous pilot projects with several major organizations. We have also expanded our product offering into military logistics

As part of our growth strategy, we launched an aggressive sales network development program in the summer of 2010. As of the end of the 2nd quarter 2011 we have more than 15 distribution partners in 5 geographic regions (Southeast, Asia, Africa, South and North America). We launched a new web site reflecting our new business, products and solutions. We launched our first commercial ecommerce site (www.shop.earthsearch.us) in the 2nd quarter of 2011.

Part of our strategy is to implement a merger and acquisition plan as a part of the 2011 growth strategy. We will focus on targeting those GPS firms with a concentration of clients with advanced supply chain solution needs. We will also seek joint venture opportunities where our technology will have significant impact on the success of the opportunities.

Results of Operations

For the Three Months Ended June 30, 2011 and 2010

Revenues

For the three months ended June 30, 2011, our revenue was $206,014, compared to $13,471 for the same period in 2010, representing an increase of 1,429%. This increase in revenue was directly attributable to the Company’s decision to change its business focus and product portfolio in 2010 from simply marketing GPS devices to developing full-fledged supply chain solutions which include RFID technologies, other supply chain and warehouse solutions, as well as the expansion of marketing activities to develop a global distribution network for its new product portfolios. Management believes these changes will result in greater stability and long term growth for the Company.

Revenues are generated from three separate but related offerings, RFID/GPS product sales, consulting services, and user fees for GATIS – our advanced web based asset management platform. We generated revenues from product sales of $76,732 and $7,783 for the three months ended June 30, 2011 and 2010, respectively. Revenues for consulting services were $116,000 for the three months ended June 30, 2011 compared to $600 for the three months ended June 30, 2010. User fees were $13,281 and $5,088 for the three months ended June 30, 2011 and 2010, respectively.

Gross Profit