PART I-DISCLOSURE DOCUMENT

S&P MANAGED FUTURES INDEX FUND, LP

549,252 Class 1 Units of Limited Partnership Interest

86,839 Class 2 Units of Limited Partnership Interest

The Fund

S&P Managed Futures Index Fund, LP is a Delaware limited partnership designed to seek investment returns that substantially track the S&P Managed Futures Index, before expenses of the Fund. The general partner of the Fund pursues the Fund's investment objective by allocating substantially all of the Fund's assets to SPhinX(TM) Managed Futures Fund SPC, which is designed to track the S&P Managed Futures Index pursuant to a license granted by Standard & Poor's.

An investment in the Fund may provide valuable diversification to a traditional portfolio of stocks and bonds.

The General Partner

RefcoFund Holdings, LLC, a registered commodity pool operator and commodity trading advisor, is the general partner of the Fund.

The Index

The S&P Managed Futures Index is designed to offer an investable benchmark that is representative of the managed futures segment of hedge fund investing. The S&P Managed Futures Index focuses on systematic, trend-following trading methodologies that constitute a majority of managed futures investment strategies.

The Offering

The Fund's units are offered in two classes - Class 1 and Class 2. With respect to the Class 1 Units, a 2% service fee per annum will be payable by the Fund to the selling agent. The Class 2 Units are offered only by qualified broker-dealers as part of a wrap fee program and also by certain fee-only registered investment advisers. The term "wrap fee program" is used to describe a number of investment services that are bundled together and covered by a single fee. The Class 2 Units are not subject to the initial or ongoing service fees, so the total fees charged by the general partner for the Class 2 Units is accordingly lower. Refco Securities, LLC and additional selling agents are offering both classes of the units of the Fund as of the 1st and 16th day of each month (if either day is not a business day, then, the next business day) at the current net asset value per unit of the particular class.

The units are being offered on a continuous basis. There is no scheduled termination date for the offering of the units. The selling agents will use their best efforts to sell the units offered.

The units available as set forth above are stated as of May 31, 2005. As of May 31, 2005, the net asset value per Class 1 Unit was $795.74, and the net asset value per Class 2 Unit was $813.06.

| Minimum Initial Investment | $ | 10,000 | |||||

| Minimum Initial Investment for IRAs | $ | 3,000 | |||||

|

Minimum Additional Investment for Existing Investors |

$ | 2,500 | |||||

The Risks

These are speculative securities. Read this entire prospectus before you decide to invest. See "The Risks You Face" beginning on page 8.

• The Fund is speculative and its performance is expected to be volatile.

• You may lose all or substantially all of your investment in the Fund.

• Past performance is not necessarily indicative of future results.

• You will be taxed on your share of the Fund's income, even though the Fund does not intend to make any distributions.

• The Fund is subject to substantial charges. You will sustain losses if the Fund is unable to generate sufficient trading profits to offset its fees and expenses.

• The Fund must generate trading profits equal to 3.70% for the Class 1 Units and 1.70% for the Class 2 Units per annum to cover its expenses and break-even.

• There is no secondary market for the units and none is expected to develop. You may only redeem units you own as of the 15th day and the last day of each month (provided such day is a business day). A redemption fee of up to 2% of the net asset value of the Class 1 Units applies if you redeem Class 1 Units within 12 months of their original purchase. There are substantial restrictions on the ability of the Fund to make withdrawals from the SPhinX(TM) Managed Futures Fund SPC that further reduces the Fund's liquidity.

• The Fund is subject to conflicts of interest.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED UPON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

|

Refco Securities, LLC Selling Agent |

RefcoFund Holdings, LLC General Partner |

||||||

The date of this prospectus is July 1, 2005.

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGES 35 TO 39 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE 5.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGES 8 TO 15.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

PART ONE

DISCLOSURE DOCUMENT

Table of Contents

| SUMMARY | 1 | ||||||

| THE RISKS YOU FACE | 8 | ||||||

| You Could Lose Your Entire Investment in the Fund | 8 | ||||||

| The Fund Has a Limited Operating History; Past Performance Is Not Indicative of Future Performance | 8 | ||||||

| The Fund Is Subject to Substantial Fees and Expenses | 8 | ||||||

|

The Break-Even Table Does Not Include Expenses Inherent to the S&P Managed Futures Index |

8 | ||||||

| An Investment in the Fund Is Not Liquid | 8 | ||||||

| The Fund Will Not Precisely Track the S&P Managed Futures Index | 9 | ||||||

| Risks Related to Managed Futures Trading | 9 | ||||||

| The General Partner Does Not Currently Operate Any Other Public Funds | 11 | ||||||

| The Fund Is Dependent Upon Third Parties | 11 | ||||||

|

The Fund Has Limited Access to Information Regarding the SPhinX(TM) Managed Futures Fund and the Portfolio Managers |

12 | ||||||

|

The SPhinX(TM) Managed Futures Fund May Not Be Able to Access All Portfolio Managers |

12 | ||||||

|

The Fund Must Rely on the SPhinX(TM) Managed Futures Fund When Calculating Net Asset Value |

12 | ||||||

| The Fund May Lose the Standard & Poor's License | 12 | ||||||

| Incentive-Based Compensation May Affect Portfolio Managers' Trading | 13 | ||||||

| The Fund Does Not Anticipate Making Distributions | 13 | ||||||

|

Possible Effect of Redemptions on the Value of the Units |

13 | ||||||

| Special Notice in Event of 50% Decline in Net Assets; Limitation on Redemption Payments | 13 | ||||||

| The General Partner Has the Ability to Suspend Redemption Rights Which Will Impact Your Ability to Redeem Your Units | 13 | ||||||

| The Fund's Status As a Partnership | 14 | ||||||

| You Will Be Taxed Each Year On Your Share of Fund Profits | 14 | ||||||

|

You Will Be Taxed On the Fund's Interest Income Even If the Fund Suffers Trading Losses |

14 | ||||||

|

Limitations On the Deductibility of Investment Advisory Fees |

14 | ||||||

| The IRS Could Audit Both the Fund, the SPhinX(TM) Managed Futures Fund, and the Individual Limited Partners | 14 | ||||||

| The Fund Does Not Have Some Statutory Registrations | 15 | ||||||

| INVESTMENT FACTORS | 15 | ||||||

| PERFORMANCE OF THE FUND-CLASS 1 UNITS | 17 | ||||||

| PERFORMANCE OF THE FUND-CLASS 2 UNITS | 18 | ||||||

|

SELECTED FINANCIAL DATA AND SELECTED QUARTERLY FINANCIAL DATA |

19 | ||||||

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

20 | ||||||

| QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK | 22 | ||||||

| THE GENERAL PARTNER | 26 | ||||||

| THE SUB-INVESTMENT MANAGER | 30 | ||||||

| INVESTMENT PROGRAM | 31 | ||||||

| USE OF PROCEEDS | 35 | ||||||

| CHARGES | 35 | ||||||

| REDEMPTIONS; NET ASSET VALUE | 39 | ||||||

| CONFLICTS OF INTEREST | 41 | ||||||

| THE FUND'S AMENDED AND RESTATED LIMITED PARTNERSHIP AGREEMENT | 43 | ||||||

| FEDERAL INCOME TAX ASPECTS | 45 | ||||||

| PURCHASES BY EMPLOYEE BENEFIT PLANS | 50 | ||||||

| PLAN OF DISTRIBUTION | 51 | ||||||

| PRIVACY POLICY | 53 | ||||||

| EXPERTS | 55 | ||||||

| WHERE YOU CAN FIND MORE INFORMATION | 55 | ||||||

| REPORTS | 55 | ||||||

|

PART TWO STATEMENT OF ADDITIONAL INFORMATION |

|||||||

| THE FUTURES AND FORWARD MARKETS | 57 | ||||||

| GLOSSARY | 67 | ||||||

| FINANCIAL STATEMENTS | F-1 | ||||||

| AMENDED AND RESTATED LIMITED PARTNERSHIP AGREEMENT | A-1 | ||||||

| SUBSCRIPTION REQUIREMENTS | B-1 | ||||||

| SUBSCRIPTION INSTRUCTIONS | C-1 | ||||||

| NOTICE OF SUBSCRIPTION FOR ADDITIONAL UNITS | D-1 | ||||||

| REQUEST FOR REDEMPTION | E-1 | ||||||

[This Page Intentionally Left Blank]

The date of this prospectus is July 1, 2005.

SUMMARY

This summary highlights certain information contained elsewhere in this prospectus. Before you decide to invest in the Fund, you should read the entire prospectus, the statement of additional information and the exhibits.

The Fund and the General Partner

S&P Managed Futures Index Fund, LP, referred to throughout this prospectus as the Fund, is a futures investment fund designed to seek returns that substantially track the S&P Managed Futures Index, before expenses of the Fund. An investment in the Fund can provide valuable diversification to a traditional portfolio of stocks and bonds, as the Fund's performance is not expected to be correlated to the performance of stocks and bonds. Investing in the Fund poses risks to investors. See "The Risks You Face" beginning on page 8.

RefcoFund Holdings, LLC serves as the Fund's general partner. The Fund is a Delaware limited partnership which was formed on May 13, 2003. The Fund's main office is located at the office of the general partner-One World Financial Center, 200 Liberty Street-Tower A, New York, New York 10281, telephone: (212) 693-7000.

The general partner has been registered with the Commodity Futures Trading Commission as a commodity pool operator since October 14, 1981, as a commodity trading advisor since September 21, 1993, and is a member of the National Futures Association. As of May 31, 2005, the general partner was managing approximately $90 million in client assets.

The S&P Managed Futures Index

Standard & Poor's has long been recognized as a global provider of equity indices. In January 2003, Standard & Poor's launched the S&P Managed Futures Index. The S&P Managed Futures Index is designed to offer an investable benchmark (a standard for performance comparison that is available to investors as an investment itself) comprised of programs traded by commodity trading advisors selected by Standard & Poor's as broadly representative of systematic trading strategies. A majority of managed futures trading strategies are systematic, with only a limited number following a discretionary approach. Standard & Poor's has selected only systematic strategies for the S&P Managed Futures Index (although certain of these strategies may have minor discretionary elements incorporated into their systematic strategy). Systematic strategies are likely to take positions based on computer-generated models to identify trades, determine the size of positions and time trades. Unlike discretionary strategies, systematic strategies do not take into account factors external to the market itself. For purposes of the description of the S&P Managed Futures Index in this prospectus, the commodity trading advisors and their programs selected for the S&P Managed Futures Index are referred to as "constituents" or "portfolio managers."

The general partner pursues the Fund's investment objective by allocating substantially all of the Fund's assets to SPhinX(TM) Managed Futures Fund SPC, which is a Cayman Islands segregated portfolio company. The SPhinX(TM) Managed Futures Fund allocates its assets to portfolio managers that generally employ a broad range of systematic trading strategies in the futures markets. Other markets, such as the interbank foreign exchange market, may be used as well. Standard & Poor's has granted a license to PlusFunds Group, Inc. to utilize the S&P Managed Futures Index in connection with the SPhinX(TM) Managed Futures Fund. Standard & Poor's intends to disclose in advance on its website any additions to or deletions of the constituent managers of the S&P Managed Futures Index. Generally, this will be done with sufficient notice to provide PlusFunds Group, Inc. with the opportunity to make corresponding adjustments to the SPhinX(TM) Managed Futures Fund. In certain circumstances there may be a period in which the portfolio managers in the SPhinX(TM) Managed Futures Fund differ from those in the S&P Managed Futures Index.

The SPhinX(TM) Managed Futures Fund is designed to track the S&P Managed Futures Index and thus provide its investors with exposure to a broad cross-section of systematic managed futures strategies through a single investment. As a limited partner, you will have access to a variety of managed futures strategies that ordinarily would not be available without satisfying high minimum investment requirements. The Fund

1

provides you with access to professionally selected managers who are considered to be representative of systematic managed futures strategies.

The portfolio managers that are included in the S&P Managed Futures Index are selected by the S&P Managed Futures Index Committee, based on, among other things, an analysis of:

• the portfolio manager's trading strategy;

• risk/return characteristics;

• volatility levels;

• performance during various time periods and market cycles; and

• the structure of the portfolio manager's portfolio and the types of instruments held.

The Standard & Poor's Index Committee oversees and monitors the S&P Managed Futures Index. The S&P Managed Futures Index Committee is responsible for the S&P Managed Futures Index's composition, computation methodology, maintenance and operations. All constituent additions and deletions as well as other major analytic policy decisions are made directly by the S&P Managed Futures Index Committee. The S&P Managed Futures Index Committee does not manage the S&P Managed Futures Index in an effort to achieve specific investment returns or with regard to the interests of investors of index-based investment vehicles. The S&P Managed Futures Index Committee has monthly meetings, and may have interim discussions should the need arise. The S&P Managed Futures Index Committee's membership, subject to change from time to time, is composed primarily of Standard & Poor's employees, and is currently chaired by the individual who chairs the S&P 500 Index Committee.

Standard & Poor's is responsible for calculating the S&P Managed Futures Index and publishes its value on the Standard & Poor's website in the S&P indices section, located at: www.standardandpoors.com. The S&P Managed Futures Index is rebalanced annually in January and as otherwise determined from time to time by Standard & Poor's.

Major Risks of the Fund

• The Fund is speculative and its performance is expected to be volatile.

• You may lose all or substantially all of your investment in the Fund.

• Past performance is not necessarily indicative of future results.

• The Fund is subject to substantial charges. You will sustain losses if the Fund is unable to generate sufficient trading profits to offset its fees and expenses.

• The units are not a liquid investment. No secondary market exists for the units and one is not expected to develop. You may redeem the units you own only as of the 15th and the last day of each month by submitting a completed Request for Redemption Form. If either day is not a business day, the redemption date will be as of the immediately prior business day. A redemption fee equal to up to 2% of a Class 1 Unit's net asset value applies if you redeem Class 1 Units within 12 months of their original purchase. There are substantial restrictions on the ability of the Fund to make withdrawals from the SPhinX(TM) Managed Futures Fund that further reduces the Fund's liquidity.

Although the Fund's investment in the SPhinX(TM) Managed Futures Fund seeks to track the performance of the S&P Managed Futures Index, certain factors, including expenses, will cause a deviation between the Fund's performance and the S&P Managed Futures Index's performance.

The operation of the Fund is subject to various conflicts of interest as further described in this prospectus, including those related to the following: (1) the general partner, the selling agent and the clearing broker for the SPhinX(TM) Managed Futures Fund are affiliates; and (2) your selling agent will receive upfront and ongoing compensation in connection with your purchase of Class 1 Units.

The market prices of commodity interest contracts fluctuate rapidly. In addition, commodity interest contracts are typically traded on margin. This means that a small amount of capital can be used to invest in contracts of much greater total value. The resulting leverage magnifies the impact of both profit and loss.

See pages 8 through 15 for a complete description of the risks of an investment in the Fund.

2

The Offering

The Fund is offering Class 1 Units and Class 2 Units. Both classes of units are offered on a continuous basis. With respect to the Class 1 Units, a 2% initial service fee per annum will be immediately paid to the selling agent by the general partner and reimbursed by the Fund monthly over the following 12-month period. After an investor holds Class 1 Units for 12 months, a 2% ongoing service fee per annum will be paid by the Fund to the selling agent on a monthly basis. The Class 2 Units are offered only by qualified broker-dealers that offer a wrap fee program and also by fee-only registered investment advisers. The term "wrap fee program" is used to describe a number of investment services that are bundled together and covered by a single fee. The Class 2 Units are not subject to the initial or ongoing service fee, so the fees for the Class 2 Units are accordingly lower.

You may buy units at the net asset value per unit of the relevant class as of the 1st and 16th day (if the day is not a business day then on the next business day) of each calendar month in which they are offered. Interest earned on subscriptions submitted prior to the 1st or 16th day of the calendar month will be treated as interest earned by the Fund. The net asset value per unit is determined by dividing a class' net assets (its assets minus its liabilities) by the number of outstanding units of that class on the date the calculation is being performed.

The minimum investment is $10,000 for new investors, although the minimum initial investment for an individual retirement account is $3,000. Existing investors subscribing for additional units may do so with a $2,500 minimum investment. In order for an individual retirement account to purchase units, the assets of the account must be held by a third-party custodian, such as your broker. Units will be sold in fractions calculated to four decimal places.

To subscribe, you must complete and sign the Subscription Agreement and Power of Attorney Signature Page that accompanies this prospectus and deliver it to your selling agent. You must submit these documents at least 6 business days before the 1st or 16th day of the calendar month in which you wish to subscribe, along with cleared funds to purchase the units at least 3 business days in advance.

Use of Proceeds

The Fund expects that all of the proceeds from the sale of the units, net of amounts the Fund retains to cover ongoing operating and offering expenses, will be invested in the SPhinX(TM) Managed Futures Fund as soon as practicable after receipt.

Is the Fund a Suitable Investment for You?

You should consider investing in the Fund if you are interested in its potential to produce returns that are generally unrelated to those of stocks and bonds and you are prepared to risk the loss of all or a significant portion of your investment.

The Fund is a diversification opportunity for an investment portfolio and is not intended to be a complete investment program.

You should consider an investment in the Fund to be a three-to five-year commitment.

Financial Suitability

To invest, you must, at a minimum, have either: (1) a net worth of at least $150,000, exclusive of home, furnishings and automobiles, or (2) a net worth, similarly calculated, of at least $45,000 and an annual gross income of at least $45,000. A number of states in which the units are offered impose higher suitability standards. These standards are regulatory minimums only, and just because you meet the minimum standard does not necessarily mean the units are a suitable investment for you.

You should not invest more than 10% of your net worth (exclusive of home, furnishings and automobiles) in the Fund.

3

You should read this prospectus carefully and discuss with your selling agent any questions you have about the Fund before making an investment.

Redemptions

You may redeem your units as of the 15th day and the last day of any calendar month. If either day is not a business day, the redemption date will be as of the immediately prior business day. You must submit your written redemption request at least 10 business days prior to the redemption date. You may withdraw a redemption request you have submitted up to the 6th business day prior to the redemption date by contacting your selling agent or the Fund's administrator, BISYS-RK Alternative Investment Services Inc. Redemption requests that remain outstanding on the 6th business day prior to the redemption date may not be withdrawn. For Class 1 Units purchased as of the date of this prospectus, a redemption fee of up to 2% of net asset value per Class 1 Unit applies if you redeem Class 1 Units within 12 months of their original purchase. The amount of the redemption fee will be reduced by 1/24th of 2%, or 0.08333%, on the 15th day of the month and the last business day of each month following the date you purchased the applicable units. Thus, once you have held the units for more than 12 months those units will no longer be subject to a redemption fee. The Class 2 Units are not subject to a redemption fee. There are substantial restrictions on the ability of the Fund to make withdrawals from the SPhinX(TM) Managed Futures Fund that further reduces the Fund's liquidity. As a result, the general partner may not be able to satisfy a timely redemption request until it is permitted to liquidate a portion of the Fund's investment in the SPhinX(TM) Managed Futures Fund.

Fees and Expenses of the Fund

The Fund pays substantial fees and expenses that must be offset by trading gains in order to avoid depletion of the Fund's assets.

| Fee | Description | ||||||

| Management Fees | The general partner receives a monthly management fee equal to 0.104167% per month (1.25% annually) of the net assets of the Class 1 Units and the Class 2 Units, subject to waiver under certain circumstances as described in this prospectus. The management fee is payable regardless of whether or not the Fund's investment in the SPhinX(TM) Managed Futures Fund is profitable. Until further notice, the management fee payable to the general partner and the operating and administrative expenses of the Fund have been limited to an aggregate of 0.14167% per month (1.70% annually) with respect to the Class 1 Units and Class 2 Units. To the extent that the monthly management fee and the operating and administrative expenses of the Fund exceed such limits, the general partner has agreed to waive a portion of its management fee. If, after the deduction of the waived management fee, the operating and administrative expenses of the Fund remain above 0.0375% per month (0.45% annually) for either of the Class 1 Units or the Class 2 Units, the general partner will reimburse the Fund for such expenses to bring them within the foregoing limits. | ||||||

| Redemption Fees | You will pay the general partner a redemption fee equal to 2% of net asset value of Class 1 Units redeemed if your redeemed units were purchased within 12 months of the date of their original purchase. The redemption fee will be reduced by 1/24th of 2%, or 0.08333%, on the 15th day of the month and the last business day of each month following the date you purchased the applicable units. Thus, once you have held the units for more than 12 months those units will no longer be subject to a redemption fee. No redemption fee applies to the Class 2 Units. | ||||||

4

| Fee | Description | ||||||

| Service Fee | With respect to Class 1 Units, a 2% initial service fee per annum will be immediately paid to the selling agent by the general partner and reimbursed to the general partner by the Fund monthly over the following 12-month period. A 2% ongoing service fee per annum will be paid by the Fund to the selling agent on a monthly basis. The Class 2 units are not subject to the initial or ongoing service fee. | ||||||

|

Pro rata portion of the expenses of the Index SPC |

The Fund is required to pay its pro rata portion of the expenses of the SPhinX(TM) Managed Futures Fund, including advisory fees, brokerage commissions and transaction expenses, administrative expenses and operating expenses. | ||||||

|

Operating and Administrative Expenses |

The Fund pays its own administrative expenses, legal and audit expenses, and other operating and ongoing offering expenses. These are estimated at a monthly rate of 0.0375% (0.45% annually) of the Fund's net asset value. | ||||||

Break-Even Table

The Break-Even Table below indicates the approximate percentage and dollar returns required for an initial $10,000 investment in the Class 1 Units and the Class 2 Units to equal the amount originally invested 12 months after issuance. The "Break-Even Table," as presented, is an approximation only. Redemption fees are not payable after the 12th month. Accordingly, redemption fees are not included in the Break-Even Table. There are no redemption fees applicable to Class 2 Units.

BREAK-EVEN TABLE

| Class 1 Units | Class 2 Units | ||||||||||||||||||

|

Percentage Return |

Dollar Return Required |

Percentage Return |

Dollar Return Required |

||||||||||||||||

| Expenses (1) | |||||||||||||||||||

| Management Fee (2) | 1.25 | % | $ | 125 | 1.25 | % | $ | 125 | |||||||||||

| Operating Expenses (3) | 0.45 | % | $ | 45 | 0.45 | % | $ | 45 | |||||||||||

| Service Fee (4) | 2.00 | % | $ | 200 | 0.00 | % | $ | 0 | |||||||||||

|

Return required for "Break-Even" on the first anniversary of purchase |

3.70 | % | $ | 370 | 1.70 | % | $ | 170 | |||||||||||

(1) The break-even analysis assumes that the units have a constant month-end net asset value. See "Charges" at page 35 of this prospectus for an explanation of the expenses included in the "Break-Even Table."

(2) The Fund pays the general partner a monthly management fee equal to 1.25% per annum of the net assets of the Class 1 Units and Class 2 Units. From this amount the general partner pays the sub-investment manager certain fees. Until further notice, the management fee payable to the general partner and the operating and administrative expenses of each class have been limited to an aggregate of 1.70% per annum of the net assets of the Class 1 Units and the Class 2 Units. To the extent that the monthly management fee payable to the general partner and operating and administrative expenses of either class exceeds the above mentioned limits, the general partner will waive a portion of its management fee. If, after the deduction of the waived management fee, the operating and administrative expenses of either class remain above 0.45% for either of the Class 1 Units or the Class 2 Units, the general partner will reimburse the Fund for such expenses to bring them within the foregoing limits.

(3) Operating and administrative expenses are paid as incurred. For this Break-Even Table such amounts have been estimated. These expenses include the legal, audit, administrative and other operating and ongoing offering expenses of the Fund. See note (2) above regarding the possible waiver of a portion of the management fee.

5

(4) For all Class 1 Units purchased as of the date of this prospectus, an initial service fee of 2% will be immediately paid to the selling agent by the general partner. The general partner will be reimbursed by the Fund monthly over the following 12-month period in arrears for the initial service fee. Beginning in the 13th month after the purchase of the Class 1 Units and for the entire time that you hold the units, the Fund will pay the selling agent an ongoing service fee of 0.1666% monthly (2% annually) of the net asset value per unit. There is no service fee charged with respect to the Class 2 Units.

The objective of the Fund is to seek investment returns that track the S&P Managed Futures Index, before expenses of the Fund. The only fees, which the Fund is subject to, but the S&P Managed Futures Index is not, are reflected above. However, you should be aware that in order for the Fund to make a positive rate of return, its investment in the SPhinX(TM) Managed Futures Fund must make a positive rate of return. In order for the SPhinX(TM) Managed Futures Fund to make a positive rate of return, the SPhinX(TM) Managed Futures Fund must first pay all of the expenses inherent to the S&P Managed Futures Index. These expenses include (1) management fees and incentive fees, if any, paid to the portfolio managers; (2) administration fees and expenses; (3) brokerage commissions and other transaction-related expenses; and (4) organizational expenses, accounting, audit and legal expenses, custodial fees and any extraordinary expenses. The management fees paid to the portfolio managers generally are expected to range from 1% to 2.50% per annum of the assets allocated to the portfolio manager. The incentive fees are generally expected to range from 15% to 25% of net trading profits. These expenses are reflected in the net asset value of the shares of the SPhinX(TM) Managed Futures Fund held by the Fund. Because these expenses are costs of the S&P Managed Futures Index, and as such are reflected in the performance of the SPhinX(TM) Managed Futures Fund, they are not included in the break-even estimate set forth above. The aggregate of the expenses discussed in (1) and (2) above and the management fees and other asset based fees charged by the Fund will not exceed 10% per year of the average net asset value of the units and the weighted average of the incentive fees paid to the portfolio managers will not exceed 25% of net trading profits.

Federal Income Tax Aspects

The Fund will be treated as a partnership for federal income tax purposes. You will be taxed each year on the Fund's income whether or not you redeem any of your units or receive distributions from the Fund. The general partner does not intend to make any distributions. Accordingly, unless you redeem units, you may not have a source of income from the Fund to pay your taxes on your allocated portion of the Fund's income.

40% of any trading profits on U.S. exchange-traded contracts are taxed as short-term capital gains at ordinary income rates, while 60% of any trading profits are taxed as long-term capital gains at a 15% maximum rate for individuals for sales and exchanges occurring after May 5, 2003, and prior to January 1, 2009 (and 20% for sales or exchanges occurring thereafter). The Fund's trading gains from other contracts will be primarily short-term capital gains. This tax treatment applies regardless of how long a limited partner holds units. Interest income is taxed at ordinary income rates.

Losses on the units may be deducted against capital gains. However, capital losses in excess of capital gains may only be deducted against ordinary income to the extent of $3,000 per year. Consequently, you could pay tax on the Fund's interest income even though you have lost money on your units.

The Futures and Forward Markets; Spot and Swap Contracts

Futures contracts are generally traded on exchanges and call for the future delivery of various commodities or cash settlement of certain financial instruments.

Forward currency contracts are traded off-exchange through banks or dealers.

Futures and forward trading is a "zero-sum" risk transfer economic activity. For every gain realized by a futures and forward trader, there is an equal and offsetting loss suffered by another.

Spot contracts are cash market transactions in which the buyer and seller agree to the immediate purchase and sale of a specific commodity, usually with a short settlement period. Swap contracts generally involve an exchange of a stream of payments between contracting parties. Neither spot nor swap contracts are exchange-traded.

6

S&P MANAGED FUTURES INDEX FUND, LP

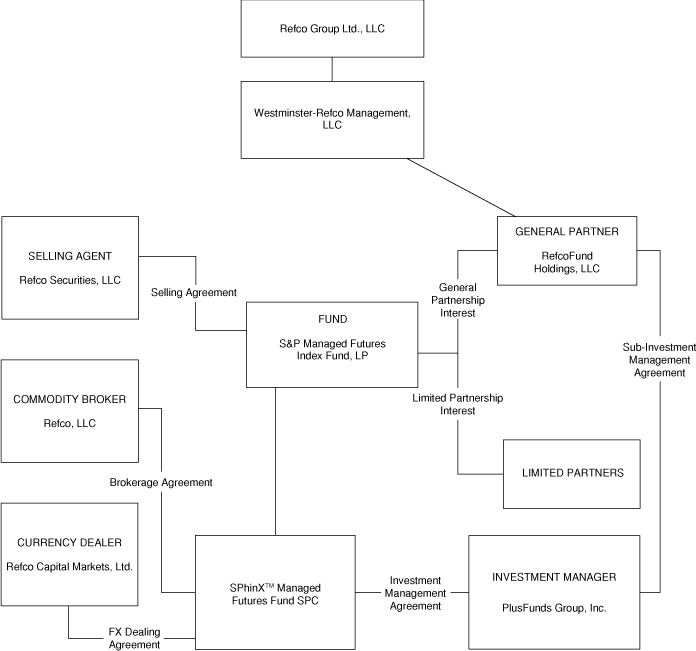

ORGANIZATIONAL CHART

The following is an organizational chart that shows the relationships among the various parties involved with this offering. All of the parties are affiliates of Refco Group Ltd., LLC except for PlusFunds Group, Inc. and SPhinX(TM) Managed Futures Fund.

Where You Can Find More Information

The Fund filed its registration statement relating to the units registered with the SEC. This prospectus is part of the registration statement, but the registration statement includes additional information. You may read any of the registration statements, or obtain copies by paying prescribed charges, at the SEC's public reference rooms located at 100 F Street, N.E., Room 1580, Washington DC 20549; 233 Broadway, New York, New York 10279; and Citicorp Center, 500 West Madison Street, Suite 1400, Chicago, Illinois 60661-2511. For further information on the public reference rooms, please call the SEC at 1-800-SEC-0330. The registration statement is also available to the public from the SEC's web site at "http://www.sec.gov."

7

THE RISKS YOU FACE

This section includes the principal risks that you will face with an investment in the Fund. You should consider these risks when making your investment decision. You should not invest in the units unless you can afford to lose all of your investment.

You Could Lose Your Entire Investment in the Fund

The Fund pursues its investment objective by investing in the SPhinX(TM) Managed Futures Fund, which allocates its assets among the portfolio managers. The SPhinX(TM) Managed Futures Fund is subject to all of the risks associated with the investment and trading by the portfolio managers. There are some general market conditions in which any given investment strategy is unlikely to be profitable. Neither the Fund, the SPhinX(TM) Managed Futures Fund nor the portfolio managers have any ability to control or predict these market conditions. The investment approach utilized on behalf of the Fund and the SPhinX(TM) Managed Futures Fund may not be successful, and there is no guarantee that the strategies employed by the portfolio managers on behalf of the SPhinX(TM) Managed Futures Fund (and, indirectly, the Fund) will be successful. You could lose all or substantially all of your investment in the Fund.

The Fund Has a Limited Operating History; Past Performance Is Not Indicative of Future Performance

The Fund was formed in May 2003 and has a very limited performance history. The past performance of the Fund and the SPhinX(TM) Managed Futures Fund are not necessarily indicative of future results. The portfolio managers will be selected based in part on their performance history and implementation of a strategy deemed by Standard & Poor's to be representative of managed futures programs in general. The experience of some portfolio managers may be limited. Furthermore, each portfolio manager is free to alter its managed futures strategy as it deems appropriate from time to time. Significant changes in strategy would require a review by Standard & Poor's. Market conditions and trading approaches are continually changing, and a portfolio manager's past successful performance may be largely irrelevant to its prospects for future profitability.

The Fund is Subject to Substantial Fees and Expenses

The Fund is subject to significant fees and expenses. In order for the Fund to be profitable and for the investors to realize any profits, the investment profits realized by the Fund must exceed these fees and expenses. The Fund will pay monthly management fees to the general partner in an amount equal to an annual rate of 1.25% of the net assets of the units, a 2% initial service fee per annum, a 2% ongoing service fee per annum, operating and administrative expenses estimated at an annual rate of 0.45% of the Fund's net asset value and the Fund's pro rata share of the fees and expenses of the SPhinX(TM) Managed Futures Fund regardless of the overall profitability of the Fund. Some of the strategies and techniques employed by the portfolio managers may require frequent trades to take place and, as a consequence, portfolio turnover and brokerage commissions may be greater than for other investment entities of similar size. You will sustain losses if the Fund is unable to generate sufficient trading profits to offset its fees and expenses. Please see "Summary-Break-Even Table" and "Charges" for a more complete discussion of the fees to be charged the Fund, on pages 5 and 35 respectively.

The Break-Even Table Does Not Include Expenses Inherent to the S&P Managed Futures Index

The break-even table presented on page 5 only includes the expenses to which the Fund will directly be subject and charged. The expenses that are inherent to the S&P Managed Futures Index are not included in the break-even table. These expenses are reflected in the net asset value of the shares of the SPhinX(TM) Managed Futures Fund held by the Fund and thus in the value of the units.

An Investment in the Fund Is Not Liquid

The units are not a liquid investment. There is no secondary market for the units. You may redeem your units only as of the 15th and last day of each calendar month (if either day is not a business day, you may redeem your units on the prior business day), and you must give the Fund at least 10 business days prior written notice of your intent to redeem. A redemption fee will apply if you redeem your Class 1 Units within 12 months after their original purchase. There are also substantial restrictions on the ability of the Fund to

8

make withdrawals from the SPhinX(TM) Managed Futures Fund that further reduce the Fund's liquidity. Please see "Redemptions-Redemption Procedure" and "Redemptions-Limits on Redemption" beginning on page 39 for a more complete discussion of the redemption terms of the units.

The Fund Will Not Precisely Track the S&P Managed Futures Index

Although the Fund seeks to track the performance of the S&P Managed Futures Index, various factors will cause a deviation between the performance of the Fund and the performance of the S&P Managed Futures Index. These factors include (1) the expenses of the Fund and the SPhinX(TM) Managed Futures Fund, (2) limitations on the Fund's investments resulting from the need to comply with the Fund's investment restrictions or with regulatory or tax law requirements and (3) the need to maintain a portion of the Fund's assets in cash or short-term investments to maintain liquidity to effect redemptions and to pay expenses. The performance of the Fund will not correspond precisely to the performance of the S&P Managed Futures Index. Please see "Investment Program" on page 31 for a more complete discussion of the S&P Managed Futures Index.

Risks Related to Managed Futures Trading

The SPhinX(TM) Managed Futures Fund Is Subject to Market Fluctuations. Managed futures trading involves trading in various commodity interests and financial instruments. The market prices of futures contracts fluctuate rapidly. Prices of futures contracts traded by the portfolio managers are affected generally, among other things, by (1) changing supply and demand relationships, (2) agricultural, trade, fiscal, monetary and exchange control programs and (3) policies of governments, and national and international political and economic events. The profitability of the SPhinX(TM) Managed Futures Fund depends entirely on capitalizing on fluctuations in market prices.

As a Result of Leverage, Small Changes in the Price of the Portfolio Managers' Positions May Result in Substantial Losses. Commodity interest contracts are typically traded on margin. This means that a small amount of capital can be used to invest in contracts of much greater total value. The resulting leverage means that a relatively small change in the market price of a contract can produce a substantial loss. Like other leveraged investments, any purchase or sale of a contract may result in losses in excess of the amount invested in that contract. The portfolio managers may lose more than their initial margin deposits on a trade.

The Portfolio Managers' Trading Is Subject to Execution Risks. Market conditions may make it impossible for the portfolio managers to execute a buy or sell order at the desired price, or to close out an open position. Daily price fluctuation limits are established by the exchanges and approved by the CFTC. When the market price of a contract reaches its daily price fluctuation limit, no trades can be executed at prices outside the limit. The holder of a contract may therefore be locked into an adverse price movement for several days or more and lose considerably more than the initial margin put up to establish the position. Thinly traded or illiquid markets also can make it difficult or impossible to execute trades.

The SPhinX(TM) Managed Futures Fund Is Subject to Counterparty Risks. If the SPhinX(TM) Managed Futures Fund's clearing brokers become bankrupt or insolvent, or otherwise default on their obligations to the SPhinX(TM) Managed Futures Fund, the SPhinX(TM) Managed Futures Fund may not receive all amounts owed to it in respect to its trading, despite the clearinghouse fully discharging all of its obligations. Furthermore, in the event of the bankruptcy of one of the clearing brokers, the SPhinX(TM) Managed Futures Fund could be limited to recovering only a pro rata share of all available funds segregated on behalf of the clearing broker's combined customer accounts, even though property specifically traceable to the SPhinX(TM) Managed Futures Fund (for example, Treasury bills deposited by the SPhinX(TM) Managed Futures Fund with the clearing broker as margin) was held by the clearing broker. In addition, some of the instruments which the SPhinX(TM) Managed Futures Fund may trade are traded in markets such as foreign exchanges or forward contract markets in which performance is the responsibility only of the individual counterparty with whom the trader has entered into a contract and not of an exchange or clearing corporation. The SPhinX(TM) Managed Futures Fund is subject to the risk of the inability or refusal to perform on the part of the counterparties with whom those types of contracts are traded. There are no limitations on the amount of allocated assets a portfolio manager can trade on foreign exchanges or in forward contracts.

9

The SPhinX(TM) Managed Futures Fund's Positions Are Subject to Speculative Limits. The CFTC and domestic exchanges have established speculative position limits on the maximum futures position which any person, or group of persons acting in concert, may hold or control in particular futures contracts or options on futures contracts traded on U.S. commodity exchanges. Under current regulations, other accounts of the portfolio managers are combined with the positions held by the SPhinX(TM) Managed Futures Fund for position limit purposes. This trading could preclude additional trading in these commodities by the portfolio manager for the account of the SPhinX(TM) Managed Futures Fund.

There are No Limits on the Amount of Leverage a Portfolio Manager May Use. There are no limits on the amount of leverage a portfolio manager may use in connection with its trading strategies. However, in determining the constituents of the S&P Managed Futures Index, the S&P Managed Futures Index Committee selects portfolio managers it considers to be representative of managed futures trading strategies. It is estimated that the margin to equity ratio employed by portfolio managers will range from 4:1 to 40:1, although it may at times be higher or lower. If a portfolio manager were to increase its leverage to a higher level than the S&P Managed Futures Index Committee considers to be representative, the S&P Managed Futures Index Committee may elect to remove the portfolio manager from the S&P Managed Futures Index. The removal of a portfolio manager from the S&P Managed Futures Index will result in a termination of such portfolio manager at the SPhinX(TM) Managed Futures Fund level, as well.

Trading On Foreign Exchanges Presents Greater Risk Than Trading On U.S. Exchanges. The portfolio managers may trade contracts on non-U.S. exchanges. Non-U.S. trading often involves risks-including exchange-rate exposure, excessive taxation, possible governmental regulation and lack of regulation-which U.S. trading does not. Some non-U.S. markets, in contrast to U.S. exchanges, are "principals' markets" where performance is the responsibility only of the individual member with whom the trader has entered into a contract and not of any exchange or clearing corporation. In addition, the SPhinX(TM) Managed Futures Fund's rights if a non-U.S. exchange or clearinghouse defaults or declares bankruptcy are likely to be more limited than if a U.S. exchange does the same. There are no limitations on the amount of allocated assets a portfolio manager can trade on foreign exchanges.

The Portfolio Managers May Trade Forward Contracts. Forward contracts are not traded on exchanges and the SPhinX(TM) Managed Futures Fund will not receive the regulatory protections of the exchanges or the CFTC in connection with such trading. As a result, the SPhinX(TM) Managed Futures Fund may incur substantial losses if the banks and dealers acting as principals on forward contracts are unable to perform. In addition, there are no limitations on daily price movements in forward contracts, and speculative position limits do not apply to forward contract trading. Further, there have been periods when participants in forward markets have refused to quote prices for forward contracts or have quoted prices with an unusually wide spread between the price at which they will buy and that at which they will sell. There are no limitations on the amount of allocated assets a portfolio manager can trade in forward contracts.

The Portfolio Managers May Enter into Swap and Similar Transactions. Swap contracts are not traded on exchanges and are not subject to the same type of government regulation as exchange markets. As a result, many of the protections afforded to participants on organized exchanges and in a regulated environment are not available in connection with these transactions. The swap markets are "principals' markets," in which performance with respect to a swap contract is the responsibility only of the counterparty to the contract, and not of any exchange or clearinghouse. As a result, the SPhinX(TM) Managed Futures Fund is subject to the risk of the inability or refusal to perform with respect to swap contracts on the part of the counterparties with which the portfolio managers trade. There are no limitations on daily price movements in swap transactions. Speculative position limits are not applicable to swap transactions, although the counterparties with which the portfolio managers trade may limit the size or duration of positions available to the portfolios managers as a consequence of credit considerations. Participants in the swap markets are not required to make continuous markets in the swap contracts they trade. Participants could refuse to quote prices for swap contracts or quote prices with an unusually wide spread between the price at which they are prepared to buy and the price at which they are prepared to sell.

The Portfolio Managers May Engage in Exchanges of Futures for Physicals. An exchange of futures for physicals is a transaction permitted under the rules of many futures exchanges in which two parties holding futures positions may close out their positions without making an open, competitive trade on the exchange. Generally, the holder of a short futures position buys the physical commodity, while the holder of a long

10

futures position sells the physical commodity. The prices at which these transactions are executed are negotiated between the parties. Regulatory changes, such as limitations on price or types of underlying interests subject to an exchange of futures for physicals, may in the future prevent the portfolio managers from exchanging futures for physicals, which could adversely affect the performance of the SPhinX(TM) Managed Futures Fund.

The SPhinX(TM) Managed Futures Fund May Trade Security Futures Products. The portfolio managers may purchase and sell single stock futures contracts and other security futures products. A single stock future obligates the seller to deliver (and the purchaser to take delivery of) a specified equity security to settle the futures transaction. Other security futures products include "narrow-based" stock index futures contracts (in general, contracts based on the value of 9 or fewer securities in a specific market or industry sector, such as energy, health care or banking) and futures contracts based on exchange-traded funds, or ETFs, that are designed to track the value of broader stock market indices (such as the S&P 500 or the NASDAQ 100 Index). Single stock futures and other security futures products are relatively illiquid and trade on a limited number of exchanges. The margin required with respect to single stock futures (usually at least 20% of the face value of the contract) generally is higher than the margin required with respect to other types of futures contracts (in some cases as low as 2% of the face value of the contract). The resulting lower level of leverage available to the portfolio managers with respect to security futures products may adversely affect the SPhinX(TM) Managed Futures Fund's performance. Security futures products are typically traded on electronic trading platforms and are subject to risks related to system access, varying response time, security and system or component failure. In addition, although the SPhinX(TM) Managed Futures Fund's broker will be required to segregate the SPhinX(TM) Managed Futures Fund's trades, positions and funds from those of the broker itself as required by CFTC regulations, the insurance provided to securities customers by the Securities Investor Protection Corporation, or SIPC, may not be applicable to the SPhinX(TM) Managed Futures Fund's security futures positions.

Systematic Strategies Do Not Consider Fundamental Types of Data and Do Not Have the Benefit of Discretionary Decision Making. Most of the SPhinX(TM) Managed Futures Fund's assets will be allocated to portfolio managers that rely on technical, systematic strategies that do not take into account factors external to the market itself (although certain of these strategies may have minor discretionary elements incorporated into their systematic strategy). The widespread use of technical trading systems frequently results in numerous managers attempting to execute similar trades at or about the same time, altering trading patterns and affecting market liquidity. Furthermore, the profit potential of trend-following systems may be diminished by the changing character of the markets, which may make historical price data (on which technical programs are based) only marginally relevant to future market patterns. Systematic strategies are developed on the basis of a statistical analysis of market prices. Consequently, any factor external to the market itself that dominates prices that a discretionary decision maker may take into account may cause major losses for a systematic strategy. For example, a pending political or economic event may be very likely to cause a major price movement, but a systematic strategy may continue to maintain positions indicated by its trading method that might incur major losses if the event proved to be adverse.

Increased Competition Among Trend-Following Traders Could Reduce the SPhinX(TM) Managed Futures Fund's Profitability. A substantial number of commodity trading advisors use technical trading systems, particularly trend-following systems, like some of the portfolio managers' systems. As the amount of money under the management of such systems increases, competition for the same positions increases, making the positions more costly and more difficult to acquire.

The General Partner Does Not Currently Operate Any Other Public Funds

While the general partner currently operates a private fund and has in the past operated public funds, the general partner does not currently operate any public funds other than the Fund.

The Fund Is Dependent Upon Third Parties

The Fund does not control the SPhinX(TM) Managed Futures Fund, PlusFunds Group, Inc. or any portfolio manager, and has no role in the choice of portfolio managers, any portfolio manager's choice of investments or any other investment decisions of the SPhinX(TM) Managed Futures Fund. The Fund is dependent upon the expertise and abilities of the portfolio managers who have investment discretion over assets allocated to

11

them. There can be no assurance that the services of PlusFunds Group, Inc. or of a portfolio manager will be available for any length of time, or that the SPhinX(TM) Managed Futures Fund will remain available for investment by the Fund.

The Fund Has Limited Access to Information Regarding the SPhinX(TM) Managed Futures Fund and the Portfolio Managers

The Fund is dependent on PlusFunds Group, Inc. and the SPhinX(TM) Managed Futures Fund's independent administrator to provide it with periodic reports and other information. The Fund may not be provided with detailed information regarding the precise investments made by a portfolio manager because some of this information may be considered proprietary or otherwise confidential. This lack of access to information may make it more difficult for the Fund to evaluate the SPhinX(TM) Managed Futures Fund and the portfolio managers and to value the assets of the Fund.

The SPhinX(TM) Managed Futures Fund May Not Be Able to Access All Portfolio Managers

The Fund's ability to track the S&P Managed Futures Index is dependent upon the SPhinX(TM) Managed Futures Fund's ability to make the requisite allocations to all of the portfolio managers that are included in the S&P Managed Futures Index. To the extent the SPhinX(TM) Managed Futures Fund is not able to make an allocation to a portfolio manager, the performance of the Fund will not track the performance of the S&P Managed Futures Index, before fees and expenses of the Fund.

The Fund Must Rely on the SPhinX(TM) Managed Futures Fund When Calculating Net Asset Value

The net asset values received by the Fund as determined by the SPhinX(TM) Managed Futures Fund may be subject to revision through monthly financial reports of the SPhinX(TM) Managed Futures Fund. As a result, revisions to the Fund's gain and loss calculations may occur. Any revisions not deemed material in the sole discretion of the general partner will not result in an adjustment to prior subscription or redemption prices for the Fund. Moreover, in some cases, the Fund will have little ability to assess the accuracy of the valuations of its investment in the SPhinX(TM) Managed Futures Fund that are received from PlusFunds Group, Inc. or from the SPhinX(TM) Managed Futures Fund or its administrator. There are no market quotations available to use in valuing the Fund's investments in the SPhinX(TM) Managed Futures Fund. As a result, these investments will be valued at their fair values as determined in accordance with procedures adopted in good faith by the general partner. These valuations may not in all cases accurately reflect the values of the Fund's investments in the SPhinX(TM) Managed Futures Fund. These inaccuracies may adversely affect the Fund or investors who purchase or redeem units.

The Fund May Lose the Standard & Poor's License

Standard & Poor's has granted a license to PlusFunds Group, Inc. to use various trademarks, and also discloses the weightings and constituents represented in the S&P Managed Futures Index to PlusFunds Group, Inc. PlusFunds Group, Inc. has sublicensed some of these rights to Refco Group Ltd., LLC and its affiliates, referred to in this prospectus as the Refco Group. Upon the occurrence of certain events, the license agreement between PlusFunds Group, Inc. and Standard & Poor's or the sublicense agreement between PlusFunds Group, Inc. and the Refco Group may be terminated. In the event of a termination, the Fund may be unable to continue to utilize the trademarks and continued operation of the Fund may become impractical or impossible because we will not be able to replicate the weightings and constituents of the S&P Managed Futures Index.

The sublicense agreement will be terminated if the Fund ceases to invest in the SPhinX(TM) Managed Futures Fund or the license agreement between Standard & Poor's and PlusFunds Group, Inc. is terminated. In addition, both the sublicense agreement and the license agreement may be terminated in the event of: (i) a material breach by either party; (ii) Standard & Poor's ceasing to publish the S&P Managed Futures Index; (iii) material damage to the reputation of a party as a result of continued performance under the agreement; (iv) legislative or regulatory changes that negatively affect Standard & Poor's ability to license its trade names or trademarks or the licensee's ability to promote its products; (v) material litigation or regulatory proceedings regarding the Fund, the SPhinX(TM) Managed Futures Fund or the S&P Managed Futures Index is threatened or commenced; and (vi) certain changes in control of the licensee.

12

Incentive-Based Compensation May Affect Portfolio Managers' Trading

The portfolio managers are entitled to compensation based upon net trading gain in the value of the assets they manage. Incentive-based arrangements may give them incentives to engage in transactions that are more risky or speculative than they might otherwise make because speculative investments might result in higher profits in which the portfolio manager would participate, resulting in higher incentive fees to them. On the other hand, such investments might result in larger losses to the SPhinX(TM) Managed Futures Fund. The portfolio managers will not return an incentive fee for a period in which there is net trading gain if, in a subsequent period, the investments under their management suffer a net trading loss. In addition, because the incentive fee for each portfolio manager is based solely on its performance, and not the overall performance of the SPhinX(TM) Managed Futures Fund, the Fund may indirectly pay an incentive fee to one or more portfolio managers during periods when the SPhinX(TM) Managed Futures Fund, and thus the Fund, are not profitable on an overall basis.

The Fund Does Not Anticipate Making Distributions

The general partner does not intend to make distributions to the limited partners but intends to re-invest substantially all of the Fund's income and gains for the foreseeable future. You will be liable to pay taxes on your allocable share of the Fund's taxable income. You may need to pay this tax liability out of your other resources or redemptions from the Fund.

Possible Effect of Redemptions on the Value of the Units

Substantial redemptions of units could require the Fund and the SPhinX(TM) Managed Futures Fund to liquidate investments more rapidly than otherwise desirable in order to raise the necessary cash to fund the redemptions and, at the same time, achieve a market position appropriately reflecting a smaller equity base. This could make it more difficult to recover losses or generate profits. Illiquidity in the markets could make it difficult to liquidate positions on favorable terms, and may result in losses.

Special Notice in Event of 50% Decline in Net Assets; Limitation on Redemption Payments

The general partner will send notice to limited partners whenever the Fund experiences a decline in net asset value per unit of either the Class 1 Units or the Class 2 Units as of the close of business on any business day to less than 50% of the net asset value per unit on the last redemption date. The right of a limited partner to receive a redemption payment, including in connection with this special notice, depends on the Fund's ability to obtain the necessary funds by redeeming its investment in the SPhinX(TM) Managed Futures Fund. Redemptions of interests in the SPhinX(TM) Managed Futures Fund by the Fund as of any particular redemption date cannot exceed 20% of the Fund's investment in the SPhinX(TM) Managed Futures Fund as of that date unless the SPhinX(TM) Managed Futures Fund has received at least 15 business days' notice prior to a redemption date. It is unlikely that the Fund would be capable of providing sufficient prior notice to the SPhinX(TM) Managed Futures Fund in connection with a redemption date immediately following a 50% decline in net assets. As a result, to the extent any redemptions on a redemption date exceed 20% of the Fund's investment in the SPhinX(TM) Managed Futures Fund, the Fund's ability to make redemption payments may be delayed. The Fund will make redemption payments to redeeming limited partners on a pro rata basis in the event the Fund's ability to make redemption payments is delayed. In addition, the net asset value per unit of either class of the Fund may decline further in the event that the SPhinX(TM) Managed Futures Fund is not able to liquidate positions on favorable terms. Please see "Redemptions; Net Asset Value-Redemption Procedure" and "Redemptions; Net Asset Value-Limits on Redemption" beginning on page 40 for a more complete discussion of the redemption terms of the units.

The General Partner Has the Ability to Suspend Redemption Rights which Will Impact Your Ability to Redeem Your Units

Under certain circumstances, the general partner may suspend your right to redeem all or some of your units. This may occur if the general partner determines that a market disruption makes it impossible or impracticable to value the units or liquidate Fund assets or if the SPhinX(TM) Managed Futures Fund has suspended redemptions. If redemption rights are suspended, the units subject to the redemption request will not be redeemed and will continue to be subject to market and other risks. The SPhinX(TM) Managed Futures Fund may suspend the Fund's redemption rights for similar reasons with similar consequences. Please see

13

"Redemptions; Net Asset Value-Redemption Procedure" and "Redemptions; Net Asset Value-Limits on Redemption" beginning on page 39 respectively for a more complete discussion of the redemption terms of the units.

The Fund's Status As a Partnership

The general partner has been advised by its counsel that under current federal income tax laws and regulations the Fund will be classified as a partnership and not as an association taxable as a corporation. In addition, the general partner has been advised by its counsel that under current federal income tax laws the Fund will not be classified as a so-called publicly traded partnership. This advice is not binding upon the IRS. If the Fund were taxed as a corporation for federal income tax purposes, income or loss of the Fund would not be passed through to the limited partners, and the Fund would be subject to tax on its income at the rates of tax applicable to corporations without any deductions for distributions to the investors. In addition, all or a portion of distributions made to limited partners could be taxable to the limited partners as dividends. Please see "Federal Income Tax Aspects-The Fund's Partnership Tax Status" on page 46 for more information regarding the Fund's tax status.

You Will Be Taxed Each Year On Your Share of Fund Profits

You will be taxed on your share of Fund income or gain each year, whether or not you redeem units or receive distributions from the Fund. Because a substantial portion of the SPhinX(TM) Managed Futures Fund's open positions are "marked-to-market" at the end of each year, some of your tax liability will be based on unrealized gains which the Fund may, in fact, never realize. 40% of any trading profits on U.S. exchange-traded contracts are taxed as short-term capital gains at ordinary income rates, while 60% of any trading profits are taxed as long-term capital gains at a 15% maximum rate for individuals. These rates apply regardless of how long the SPhinX(TM) Managed Futures Fund holds a contract, or an investor holds his or her units.

Over time, the compounding effects of the annual taxation of the Fund's income are material to the economic consequences of investing in the Fund. For example, a 10% compound annual rate of return over five years would result in an initial $10,000 investment compounding to $16,105. However, after factoring in a 30% tax rate each year, the result would be $14,025. Please see "Federal Income Tax Aspects-Taxation of Limited Partners on Profits and Losses of the Fund," "Federal Income Tax Aspects-Gain or Loss on Section 1256 Contracts and Non-Section 1256 Contracts" and "Federal Income Tax Aspects-Tax on Capital Gains and Losses" beginning on page 45 for more information.

You Will Be Taxed On the Fund's Interest Income Even If the Fund Suffers Trading Losses

Losses on the Fund's trading are almost exclusively capital losses. Non-corporate investors may use net capital losses to offset up to $3,000 of ordinary income each year. So, for example, if your share of the Fund's trading loss was $10,000 in a given fiscal year and your share of interest income was $5,000, you would incur a net loss in the net asset value of your units equal to $5,000, but would nevertheless recognize taxable income of $2,000. Please see "Federal Income Tax Aspects-Tax on Capital Gains and Losses" on page 47 for more information.

Limitations On the Deductibility of Investment Advisory Fees

The general partner does not intend to treat the operating expenses of the Fund as "investment advisory fees" for federal income tax purposes. The general partner believes that this is the position adopted by virtually all United States futures fund sponsors. However, were the operating expenses of the Fund characterized as investment advisory fees, non-corporate taxpayers would be subject to substantial restrictions on the deductibility of those expenses, would pay increased taxes in respect of an investment in the Fund and may actually recognize taxable income despite having incurred a financial loss. Please see "Federal Income Tax Aspects-Limited Deduction for Certain Expenses" on page 48 for more information.

The IRS Could Audit the Fund, the SPhinX(TM) Managed Futures Fund and the Individual Limited Partners

The IRS could audit the Fund's tax returns and the tax returns of the SPhinX(TM) Managed Futures Fund portfolios. If either audit resulted in an adjustment, all limited partners may be required to pay additional

14

taxes, interest, and penalties. Please see "Federal Income Tax Aspects-IRS Audits of the Fund and its Limited Partners" on page 48 for more information.

The Fund Does Not Have Some Statutory Registrations

Pursuant to an exemption from registration, the Fund has not registered as an investment company or a "mutual fund," which would subject the Fund to extensive regulation by the SEC, under the Investment Company Act of 1940, as amended. Therefore, you do not have the protection provided by such legislation, which, among other things, (1) requires that an investment company's board of directors, including a majority of disinterested directors, approve certain of its activities and contractual relationships and (2) prohibits an investment company from engaging in some transactions with its affiliates. Further, to the extent registration under or compliance with these laws is required, the Fund may incur significant burdens and expenses in connection therewith.

The general partner is not registered as an investment adviser under the Investment Advisers Act of 1940 or any similar state law. However, the general partner is registered as a commodity pool operator and a commodity trading advisor and is subject to regulation as such by the CFTC and the NFA.

INVESTMENT FACTORS

Although there can be no assurance that the portfolio managers will trade successfully on behalf of the SPhinX(TM) Managed Futures Fund or that the Fund will avoid substantial losses, if the Fund is successful, an investment in the Fund offers investors the following potential advantages.

The General Partner

The general partner has experience and familiarity with the managed futures industry, which provides the general partner with a basis to monitor the SPhinX(TM) Managed Futures Fund as well as administer the Fund. The general partner's principals have over 100 years of combined experience in the investment field. As of May 31, 2005, the general partner had approximately $90 million in client assets under management.

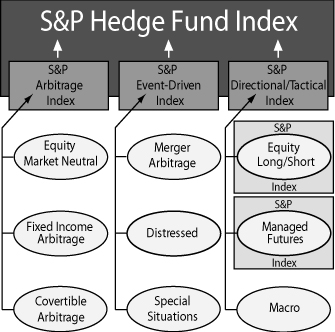

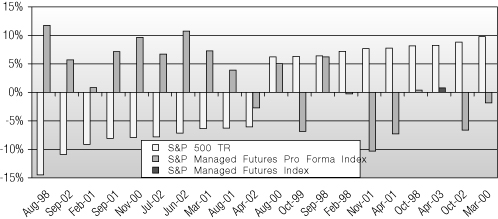

The S&P Managed Futures Index

The S&P Managed Futures Index is designed to offer an investable benchmark comprising programs traded by commodity trading advisors selected by Standard & Poor's as broadly representative of systematic trading strategies. An investable benchmark refers to a standard for performance comparison that is available to investors as an investment itself. By investing in the Fund, you will have access to a broad cross-section of systematic managed futures strategies through a single investment.

Investment Diversification

If you are not prepared to spend substantial time trading in the futures and forward markets, you may nevertheless participate in these markets through investing in the Fund. In connection with an investment in the Fund, however, you should read and understand this prospectus completely, monitor the net asset value of any units you purchase and review any reports provided to you by the Fund. An investment in the Fund can provide valuable diversification to a traditional portfolio of stocks and bonds. The general partner believes that the profit potential of the Fund does not depend upon favorable general economic conditions and that the Fund is just as likely to be profitable or unprofitable during periods of declining stock and bond markets as at any other time.

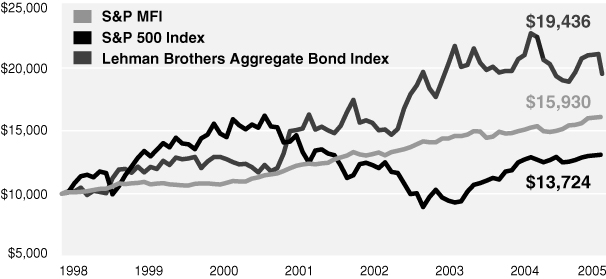

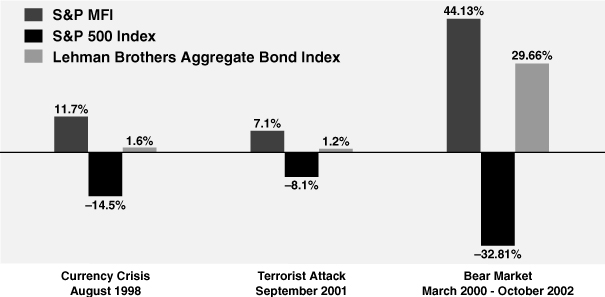

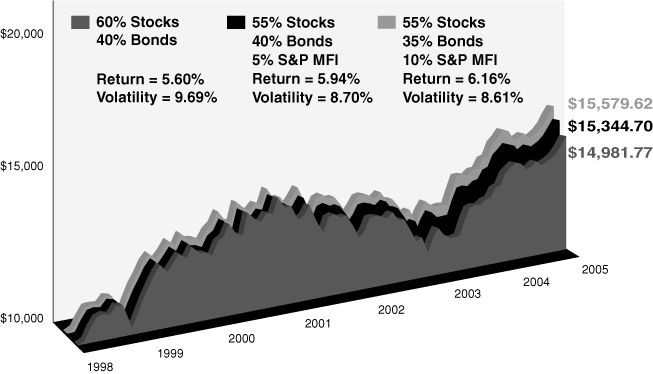

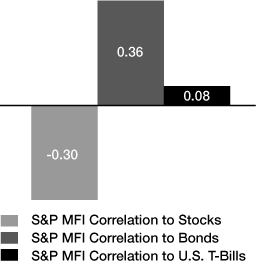

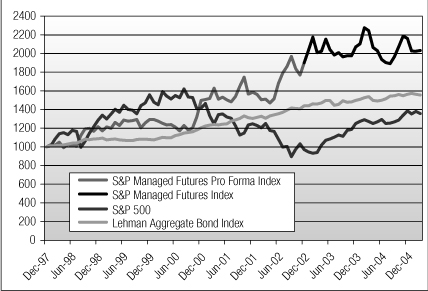

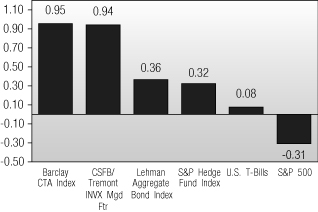

Allocating a small portion of your investment portfolio to a managed futures investment, such as the Fund, can potentially enhance the overall performance of your portfolio. Modern portfolio theory suggests that a diverse portfolio with positively performing assets that have little or no correlation with each other should have higher returns and lower risk, as measured by variability of returns, than a less diversified portfolio.

Historically, managed futures investments have had very little correlation to the stock and bond markets, which means that the performance of managed futures likely has no relationship to the performance of stocks and bonds.

15

Market Diversification

The SPhinX(TM) Managed Futures Fund will trade in 40 to 60 or more markets, though not necessarily in all markets at all times.

Diversification of an investor's assets in the SPhinX(TM) Managed Futures Fund permits investors to participate in markets that would otherwise not be included in their portfolios, thereby both potentially diversifying risk and increasing profit opportunities.

The markets that the SPhinX(TM) Managed Futures Fund trades in may change from time to time.

Opportunity to Profit in Rising as well as in Declining Markets

The Fund may realize positive or negative returns in both rising and declining markets as futures positions may be established on either the long or the short side of a market. Unlike short selling in the securities markets, selling short in futures in anticipation of a drop in price can be accomplished without additional restrictions or special margin requirements. However, leverage may be used in selling short in futures contracts, and the magnitude of gain or loss may not be less than selling short in the securities markets.

It is potentially advantageous for investors to own investments that can appreciate during a period of generally declining prices, financial disruption or economic instability. Investors must realize, however, that the Fund is not specifically designed to appreciate in declining markets. Rather, it is designed to substantially track the S&P Managed Futures Index, before expenses of the Fund. The Fund will only increase in value if the portfolio managers' trading systems identify market trends and are able to trade those trends profitably.

Small Minimum Investment; Smaller Minimum Additional Investment

The portfolio managers typically manage individual accounts only of substantial size-$1,000,000 or more. You may gain access to the portfolio managers for a minimum investment of $10,000 ($3,000 for an individual retirement account). As an existing investor, you may make additional investments in the units with a minimum investment of $2,500.

Limited Liability

If you open an individual futures account, you will be generally liable for all losses incurred in the account, and may lose substantially more than you committed to the account. However, as an investor in the Fund, you cannot lose more than your investment plus undistributed profits.

Administrative Convenience

The general partner is responsible for all aspects of the Fund's operation. You will receive monthly unaudited statements and annual audited financial reports as well as information necessary for you to complete your federal income tax returns. The approximate daily net asset value per unit will be available on the Refco website (http://www.refco.com/rai) as well as other Internet sites or by calling representatives of the general partner at 866-822-4373.

16

PERFORMANCE OF THE FUND-CLASS 1 UNITS

S&P MANAGED FUTURES INDEX FUND, LP

CLASS 1 UNITS

March 15, 2004 through May 31, 2005

Name of Pool: S&P Managed Futures Index Fund, LP

Type of Pool: Publicly Offered

Inception of Trading: March 15, 2004

Aggregate Class 1 Gross Subscriptions: $43,715,718

Current Class 1 Net Asset Value: $38,915,642 (as of May 31, 2005)

Largest Class 1 Monthly Draw-down*: (8.72)% (in April 2004)

Worst Class 1 Peak-to-Valley Draw-down**: (19.69)% (from March 15, 2004 through August 2004)

|

Class 1 Units Rates of Return (Computed on a Compounded Monthly Basis) |

|||||||||||

| Month | 2004 | 2005 | |||||||||

| January | - | (6.75 | )% | ||||||||

| February | - | (0.44 | )% | ||||||||

| March | (1.90 | )% | (0.13 | )% | |||||||

| April | (8.72 | )% | (6.91 | )% | |||||||

| May | (2.24 | )% | 2.02 | % | |||||||

| June | (5.28 | )% | |||||||||

| July | (2.14 | )% | |||||||||

| August | (1.03 | )% | |||||||||

| September | 3.57 | % | |||||||||

| October | 5.12 | % | |||||||||

| November | 4.96 | % | |||||||||

| December | (1.54 | )% | |||||||||

| Compound Period Rate Return | (9.64 | )% | (11.94 | )% | |||||||

| (10 months) | (5 months) | ||||||||||

*"Largest Monthly Drawdown" is the largest negative monthly rate of return experienced by a pool.

**"Worst Peak-to-Valley Drawdown" is the greatest percentage decline in net asset value of a pool experienced by the pool without such net asset value being subsequently equaled or exceeded. For example, if the value of a pool unit dropped by 1% in each of January and February, rose 1% in March and dropped again by 2% in April, a "Peak-to-Valley Drawdown" would still be continuing at the end of April in the amount of approximately (3)%, whereas if the value of the pool unit had risen by approximately 2% or more in March, the drawdown would have ended as of the end of February at the (2)% level.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

17

PERFORMANCE OF THE FUND-CLASS 2 UNITS