Table of Contents

Exhibit 99.1

NOTICE OF SPECIAL MEETING

OF SHAREHOLDERS

AND

MANAGEMENT INFORMATION CIRCULAR / PROXY STATEMENT

IN RESPECT OF THE

SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON THURSDAY, NOVEMBER 15, 2012

OCTOBER 11, 2012

Table of Contents

October 11, 2012

Dear Shareholders:

On behalf of our Board of Directors and management, I am pleased to invite you to a special meeting (the “Meeting”) of the holders (“Shareholders”) of common shares (“Granite Common Shares”) of Granite Real Estate Inc. (“Granite”, or the “Company”) to be held at the Metro Toronto Convention Centre, 255 Front Street West, Meeting Room 206F, Toronto, Ontario, Canada, at 10:00 a.m. (Toronto time) on Thursday, November 15, 2012. The Meeting has been called to consider and, if thought fit, approve, among other things, a special resolution, the full text of which is set out in Appendix “A” of the accompanying management information circular/proxy statement (the “Circular”), approving a plan of arrangement (the “Arrangement”) under the Business Corporations Act (Québec) providing for the conversion of the Company from a corporate structure to a “stapled unit” real estate investment trust (“REIT”) structure.

As discussed in the Circular, upon completion of the Arrangement (a) Shareholders will become the holders of stapled units, each of which will consist of a unit of a new REIT, Granite Real Estate Investment Trust (“Granite REIT”), and a common share of a new corporation, Granite REIT Inc. (“Granite GP”), and (b) Granite REIT and Granite GP will acquire, directly or indirectly, all of the Granite Common Shares and will carry on indirectly all of the business and activities currently carried on by the Company.

The proposal to convert the Company from a corporate structure to a stapled unit REIT structure is the result of a review conducted by the Board of Directors of the Company’s business model and strategic options and extensive work by management, together with legal, financial and other professional advisors, to develop and settle a structure for the conversion of the Company to a REIT. In making its determinations and recommendation regarding the Arrangement, the Board of Directors considered the following benefits that are expected to be realized as a result of the conversion to a stapled unit REIT structure:

| • | the proposed REIT structure is expected to allow the resulting Granite organization to reduce its liability for cash taxes, thereby increasing Granite REIT’s adjusted funds from operations and the amount of cash available for distribution; |

| • | the stapled units are expected to be generally valued on a price-to-adjusted funds from operations basis, which may result in more favourable market trading levels for the stapled units compared to the pre-Arrangement trading levels for the Granite Common Shares due to the increase in the adjusted funds from operations, primarily as a result of the reduced cash taxes payable, following conversion to the proposed REIT structure; and |

| • | the stapled units are expected to provide an enhanced ability for Granite REIT to access the Canadian equity capital markets, given that most publicly traded real estate entities in Canada are REIT structures or high yielding corporate structures with minimal cash tax leakage. |

The Board of Directors also retained RBC Dominion Securities Inc., a member of RBC Capital Markets (“RBC”), to advise the Board of Directors with respect to the Arrangement and to provide its opinion as to the fairness, from a financial point of view, of the consideration to be received by Shareholders pursuant to the Arrangement. RBC has provided a fairness opinion to the Board of Directors which states that, on the basis of the assumptions, qualifications and limitations summarized therein, in the opinion of RBC, as of September 28, 2012, the consideration to be received by Shareholders pursuant to the Arrangement is fair, from a financial point of view, to Shareholders. The fairness opinion is subject to the assumptions, qualifications and limitations contained therein and should be read in its entirety, and is attached as Appendix “D” to the Circular.

Table of Contents

For these reasons, among others, the Board of Directors has unanimously concluded that, in its opinion, the Arrangement is in the best interests of Granite and is fair and reasonable to Granite and Shareholders. The Board of Directors recommends that Shareholders vote in favour of the approval of the Arrangement.

Shareholders will also be asked at the Meeting to consider and, if thought fit, ratify a new general by-law of Granite which was adopted by the Board of Directors on September 28, 2012. The new general by-law was adopted to reflect the provisions of the Business Corporations Act (Québec) following the continuance of the Company under that Act on September 25, 2012 and, pursuant to that Act, is required to be ratified by Shareholders at the Meeting in order to continue in effect following the Meeting. The new general by-law is attached as Appendix “B” to the Circular. The Board of Directors recommends that Shareholders vote in favour of the approval of the new general by-law of Granite.

I hope you can attend the Meeting, but in any case, your vote is important, and your Granite Common Shares should be represented at the Meeting. If you are unable to attend, please complete, date and sign the enclosed proxy form, and return it in accordance with the instructions set out in the proxy form. Even if you plan to attend the Meeting, you may find it convenient to express your views in advance by completing and returning the proxy form.

If you have questions between now and the Meeting, I encourage you to visit the “REIT Conversion Frequently Asked Questions” section of our website at www.graniterealestate.com or contact us at ir@graniterealestate.com or (647) 925-7550 for assistance.

I look forward to seeing you at the Meeting on November 15, 2012.

Yours truly,

Thomas Heslip

Chief Executive Officer

Table of Contents

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE is hereby given that a special meeting (the “Meeting”) of the holders (“Shareholders”) of common shares (“Granite Common Shares”) of Granite Real Estate Inc. (“Granite” or the “Company”) will be held at the Metro Toronto Convention Centre, 255 Front Street West, Meeting Room 206F, Toronto, Ontario, Canada, on Thursday, November 15, 2012, commencing at 10:00 a.m. (Toronto time) for the following purposes:

| (a) | to consider and, if thought fit, approve a special resolution (the “Arrangement Resolution”), the full text of which is set out in Appendix “A” of the accompanying Management Information Circular/Proxy Statement (the “Circular”), approving a plan of arrangement under the Business Corporations Act (Québec) (the “QBCA”) providing for the conversion of the Company from a corporate structure to a “stapled unit” real estate investment trust (“REIT”) structure; |

| (b) | to consider and, if thought fit, approve an ordinary resolution to ratify By-law 2012 of the Company under the QBCA, a copy of which is attached as Appendix “B” to the Circular; and |

| (c) | to transact such further and other business or matters as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. |

Only Shareholders of record at the close of business on Thursday, October 11, 2012 will be entitled to notice of, to attend and to vote at the Meeting or any adjournment(s) or postponement(s) thereof.

The Circular and a form of proxy are enclosed with this Notice of Special Meeting of Shareholders. The Circular provides additional information concerning the matters to be dealt with at the Meeting. If you are unable to be present at the Meeting in person, please complete, date and sign the enclosed proxy and return it in the enclosed envelope provided for that purpose in accordance with the instructions set out in the section of the Circular entitled “Appointment and Revocation of Proxies”. To be effective, proxies must be received by 10:00 a.m. (Toronto time) on Tuesday, November 13, 2012, or not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time any adjourned Meeting is reconvened or any postponed Meeting is convened, at one of the following locations: (a) Computershare Investor Services Inc., the Company’s registrar and transfer agent, at 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1, addressed to the Proxy Department; or (b) the principal executive offices of the Company at 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion Centre, Toronto, Ontario M5K 1H1, addressed to the General Counsel of the Company. Shareholders may elect to vote by use of the telephone or via the Internet in accordance with the instructions on the accompanying form of proxy.

Only registered Shareholders and persons appointed as proxyholders are permitted to attend and vote at the Meeting. If you are a non-registered Shareholder, you should follow the instructions received from the intermediary through which your Granite Common Shares are held. See “Appointment and Revocation of Proxies – Non-Registered Holders” in the Circular for additional information.

Pursuant to the Interim Order (as defined in the Circular) and Chapter XIV of the QBCA (and as modified by the Interim Order), registered Shareholders have the right to dissent in respect of the Arrangement Resolution and to have their Granite Common Shares repurchased by Granite in return for an amount equal to the fair value of their Granite Common Shares. This right of dissent is described in the Circular. Failure to strictly comply with the dissent procedures set out in the Circular may result in the loss or unavailability of any right to dissent. See the section entitled “Rights of Dissenting Shareholders” in the Circular and Appendix “L” to the Circular. Beneficial owners of Granite Common Shares registered in the name of a broker, trustee, financial institution or other nominee who wish to dissent should be aware that only registered owners of Granite Common Shares are entitled to dissent.

By order of the Board of Directors.

| October 11, 2012 Toronto, Ontario |

JENNIFER TINDALE Executive Vice-President, General Counsel | |

-i-

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 13 | ||||

| 16 | ||||

| 29 | ||||

| 45 | ||||

| 45 | ||||

| 49 | ||||

| 63 | ||||

| 64 | ||||

| 82 | ||||

| 87 | ||||

| Interests of Certain Persons in the Matters to be Considered at the Meeting |

87 | |||

| 87 | ||||

| 87 | ||||

| Interests of Certain Persons or Companies in Matters to be Acted Upon |

88 | |||

| 88 | ||||

| 89 | ||||

| 92 | ||||

| 93 | ||||

| A-1 | ||||

| B-1 | ||||

| Appendix “C” Impact of Change in Reporting Currency on 2011 and 2010 Annual Financial Statements |

C-1 | |||

| D-1 | ||||

| E-1 | ||||

| F-1 | ||||

| G-1 | ||||

| H-1 | ||||

| Appendix “I” Unaudited Pro Forma Combined Financial Statements of Granite REIT and Granite GP |

I-1 | |||

| J-1 | ||||

| K-1 | ||||

| L-1 | ||||

Table of Contents

MANAGEMENT INFORMATION CIRCULAR / PROXY STATEMENT

This Management Information Circular / Proxy Statement dated October 11, 2012 (this “Circular”), accompanying Notice of Special Meeting of Shareholders (the “Notice”), form of proxy and all attachments thereto (collectively the “Meeting Materials”) are furnished to holders (“Shareholders”) of common shares (“Granite Common Shares”) of Granite Real Estate Inc. (the “Company” or “Granite”) in connection with the solicitation by and on behalf of the management of the Company of proxies to be used at a special meeting of Shareholders (the “Meeting”) to be held at the Metro Toronto Convention Centre, 255 Front Street West, Meeting Room 206F, Toronto, Ontario, Canada, on Thursday, November 15, 2012, commencing at 10:00 a.m. (Toronto time), and at any adjournment(s) or postponement(s) thereof, for the purposes set forth in the Notice.

The Meeting Materials are being mailed on or about October 17, 2012 to Shareholders of record as of the close of business on Thursday, October 11, 2012. The Company will bear all costs associated with the preparation and mailing of the Meeting Materials, as well as the cost of the solicitation of proxies. The solicitation will be primarily by mail; however, officers and regular employees of the Company may also directly solicit proxies (but not for additional compensation) personally, by telephone, by facsimile or by other means of electronic transmission. Banks, brokerage houses and other custodians and nominees or fiduciaries will be requested to forward proxy solicitation materials to their principals and to obtain authorizations for the execution of proxies and will be reimbursed for their reasonable expenses in doing so.

Certain capitalized terms not otherwise defined herein have the meanings ascribed to them in the section entitled “Glossary of Terms”. Unless the context otherwise requires, references in the Circular to the business, operations and activities to be carried on by Granite REIT refer to the business, operations and activities to be carried on by Granite REIT and Granite GP indirectly through Granite LP and its subsidiaries. Unless otherwise noted, all monetary amounts referred to in this Circular are presented in Canadian dollars and all information contained herein is given as at October 11, 2012.

This Circular contains statements that, to the extent they are not recitations of historical fact, constitute “forward-looking statements” within the meaning of applicable securities legislation, including the 1933 Act and the 1934 Act. Forward-looking statements may include, among others, statements regarding the Company’s future plans, goals, strategies, intentions, beliefs, estimates, costs, objectives, capital structure, cost of capital, tenant base, tax consequences, economic performance or expectations, or the assumptions underlying any of the foregoing. In particular, this Circular contains forward-looking statements regarding the Arrangement and the Company’s expectations with respect to the Arrangement. Words such as “may”, “would”, “could”, “will”, “likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “forecast”, “project”, “estimate”, “seek” and similar expressions are used to identify forward-looking statements. Forward-looking statements should not be read as guarantees of future events, performance or results and will not necessarily be accurate indications of whether or the times at or by which such future performance will be achieved. Undue reliance should not be placed on such statements. In particular, Granite cautions that the timing or completion of the Arrangement, and the effect or results of the Arrangement, cannot be predicted with certainty, and there can be no assurance at this time that all required or desirable approvals and consents to effect the Arrangement will be obtained in a timely manner or at all. Forward-looking statements are based on information available at the time and/or management’s good faith assumptions and analyses made in light of our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances, and are subject to known and unknown risks, uncertainties and other unpredictable factors, many of which are beyond the Company’s control, that could cause actual events or results to differ materially from such forward-looking statements. Important factors that could cause such differences include, but are not limited to: the risk of changes to tax or other laws that may adversely affect the Arrangement; the inability of Granite to implement a suitable structure for the Arrangement; the inability to obtain all required or desirable consents and approvals for the Arrangement; the risks set forth in the Risk Factors section in the Company’s Annual Information Form

1

Table of Contents

for 2011, filed on SEDAR at www.sedar.com and attached as Exhibit 1 to the Company’s Annual Report on Form 40-F for the year ended December 31, 2011; and the risks set forth in the section of this Circular entitled “Risk Factors”, all of which investors are strongly advised to review. The “Risk Factors” section also contains information about the material factors or assumptions underlying such forward-looking statements. Forward-looking statements speak only as of the date the statements were made and unless otherwise required by applicable securities laws, the Company expressly disclaims any intention and undertakes no obligation to update or revise any forward-looking statements contained in this Circular to reflect subsequent information, events or circumstances or otherwise.

INFORMATION FOR UNITED STATES SHAREHOLDERS

None of the Stapled Units to be issued to Shareholders in exchange for Granite Common Shares under the Arrangement have been or will be registered under the 1933 Act, and such securities are being issued to Shareholders in reliance on the exemption from registration set forth in Section 3(a)(10) of the 1933 Act. The solicitation of proxies for the Meeting is not subject to the proxy requirements of Section 14(a) of the 1934 Act. Accordingly, the solicitations and transactions contemplated in this Circular are made in the United States for securities of a Canadian issuer in accordance with Canadian corporate and securities laws, and, unless otherwise indicated, this Circular has been prepared solely in accordance with disclosure requirements applicable in Canada. Shareholders in the United States should be aware that such requirements are different from those of the United States applicable to registration statements under the 1933 Act and proxy statements under the 1934 Act.

Information contained or incorporated by reference herein has been prepared in accordance with Canadian disclosure standards, which are not comparable in all respects to United States disclosure standards.

Shareholders should be aware that the acquisition of the Stapled Units as a result of the implementation of the Arrangement may have tax consequences both in the United States and in Canada. See “Certain Canadian Federal Income Tax Considerations” and “Certain United States Federal Income Tax Considerations.” Shareholders should consult their own tax advisors with respect to their own particular circumstances.

The enforcement by investors of civil liabilities under the United States securities laws may be affected adversely by the fact that the Company is organized under the laws of the Province of Québec, Granite REIT is organized under the laws of the Province of Ontario and Granite GP is organized under the laws of the Province of British Columbia, that certain of their respective officers, directors and trustees are or may be residents of countries other than the United States, that certain of the experts named in this Circular are residents of countries other than the United States, and that all or substantial portions of the assets of the Company, Granite GP and Granite REIT and such other persons are, or will be, located outside of the United States. As a result, it may be difficult or impossible for Shareholders in the United States to effect service of process within the United States upon the Company, Granite GP and Granite REIT and such other persons, against them, upon judgments of courts of the United States predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the United States. In addition, Shareholders in the United States should not assume that the courts of Canada: (a) would enforce judgments of United States courts obtained in actions against such persons predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the United States; or (b) would enforce, in original actions, liabilities against such persons predicated upon civil liabilities under the federal securities laws of the United States or “blue sky” laws of any state within the United States.

The 1933 Act imposes restrictions on the resale of securities received pursuant to the Plan of Arrangement by persons who will be “affiliates” of Granite GP or Granite REIT after the Effective Date. See “The Arrangement – Securities Law Matters – United States Securities Law Matters” in this Circular.

2

Table of Contents

NONE OF THE STAPLED UNITS TO BE ISSUED PURSUANT TO THE ARRANGEMENT HAVE BEEN APPROVED OR DISAPPROVED BY THE U.S. SECURITIES AND EXCHANGE COMMISSION OR SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED STATES, NOR HAS THE U.S. SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES REGULATORY AUTHORITY OF ANY STATE OF THE UNITED STATES PASSED ON THE ADEQUACY OR ACCURACY OF THIS INFORMATION CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents, filed with the applicable securities commissions or similar securities regulatory authorities in each of the provinces and territories of Canada, are specifically incorporated by reference into and form an integral part of this Circular:

| • | the annual information form of the Company dated March 12, 2012; |

| • | the management information circular of the Company dated May 9, 2012 in respect of the Company’s annual general and special meeting held on June 13, 2012 (the “May 2012 Circular”); |

| • | the annual audited consolidated financial statements of the Company for the years ended December 31, 2011 and 2010, together with management’s discussion and analysis thereof; and |

| • | the unaudited consolidated interim financial statements of the Company for the three and six months ended June 30, 2012 and 2011, together with management’s discussion and analysis thereof. |

The Company changed its reporting currency effective January 1, 2012 from U.S. dollars to Canadian dollars. With the change in reporting currency all comparative financial information has been recast. The impact of the change in reporting currency on the annual audited consolidated financial statements for the year ended December 31, 2011 and 2010 is described in Appendix “C” to this Circular.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded, for purposes of this Circular, to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such prior statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded thereafter shall not constitute a part of this Circular, except as so modified or superseded.

Shareholders may obtain copies of the documents incorporated herein by reference on request without charge from the General Counsel of the Company as described under “Additional Information” in this Circular and those documents are also available electronically at www.sedar.com.

3

Table of Contents

The following is a summary of certain information contained elsewhere in this Circular. This summary is not intended to be complete and is provided for convenience only. The information contained in this summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information and statements contained elsewhere in this Circular, including the appendices hereto, all of which is important and should be reviewed carefully. Certain capitalized terms not otherwise defined have the meanings ascribed to them in the section entitled “Glossary of Terms” or elsewhere in this Circular. Unless otherwise noted, all monetary amounts referred to in this Circular are presented in Canadian dollars and all information contained herein is given as at October 11, 2012.

THE MEETING

The Meeting will be held at the Metro Toronto Convention Centre, 255 Front Street West, Meeting Room 206F, Toronto, Ontario, Canada, on Thursday, November 15, 2012, commencing at 10:00 a.m. (Toronto time). The record date for determining the shareholders entitled to receive notice of and to vote at the Meeting is October 11, 2012.

At the Meeting, Shareholders will be asked to consider and, if thought fit, approve (i) the Arrangement Resolution providing for the conversion of the Company from a corporate structure to a stapled unit REIT structure; and (ii) an ordinary resolution ratifying a new general by-law of Granite which was adopted by the Board of Directors on September 28, 2012.

THE ARRANGEMENT

Effect on Granite and Shareholders

The purpose of the Arrangement is to convert the Company from a corporate structure to a “stapled unit” REIT structure. The Arrangement will involve Shareholders becoming, upon implementation of the Arrangement, holders of Stapled Units, each of which will consist of a unit of a new REIT, Granite REIT, and a common share of a new corporation, Granite GP. Together, Granite REIT and Granite GP will hold all the partnership interests in a new limited partnership, Granite LP, which will own directly and indirectly the subsidiaries and assets currently owned directly and indirectly by Granite. Following completion of the Arrangement, Granite REIT and Granite GP, through Granite LP and its subsidiaries, will continue to carry on all the business and activities currently carried on, directly and indirectly, by Granite.

The trustees of Granite REIT and the board of directors of Granite GP will initially be comprised of the seven individuals who currently comprise the Board of Directors. The senior management of Granite GP and Granite REIT will be comprised of the current members of the Company’s senior management team, who will be employed by Granite LP.

Following completion of the Arrangement, each Granite REIT Unit will be stapled to a Granite GP Common Share to form a Stapled Unit and the two securities will, subject to listing approval, trade together as a Stapled Unit on the TSX and the NYSE. The Granite REIT Units and the Granite GP Common Shares will only become unstapled if an Event of Uncoupling occurs.

See “The Arrangement – Effect of the Arrangement”.

Recommendation of the Board of Directors

The Board of Directors has reviewed the terms of the Arrangement. The Board of Directors has determined that the Arrangement is in the best interests of the Company and is fair and reasonable to the Company and the Shareholders, and unanimously recommends that Shareholders vote FOR the Arrangement Resolution.

4

Table of Contents

The following is a summary of the principal benefits of the Arrangement that the Board of Directors considered in making its determinations and recommendation:

| • | Granite is currently cash taxable. It is expected that the proposed REIT structure will allow the resulting Granite organization to reduce its liability for cash taxes, thereby increasing Granite REIT’s adjusted funds from operations and the amount of cash available for distribution. For more information, see the Pro Forma Combined Financial Statements (as defined below) attached to this Circular as Appendix “I”; |

| • | the Stapled Units are expected to be generally valued on a price-to-adjusted funds from operations basis, which may result in more favourable market trading levels for the Stapled Units compared to the pre-Arrangement trading levels for the Granite Common Shares due to the increase in the adjusted funds from operations, primarily as a result of the reduced cash tax payable, following conversion to the proposed REIT structure; and |

| • | the Stapled Units are expected to provide an enhanced ability for Granite REIT to access the Canadian equity capital markets, given that most publicly traded real estate entities in Canada are REIT structures or high yielding corporate structures with minimal cash tax leakage. |

See “The Arrangement – Background to and Reasons for the Arrangement”.

Fairness Opinion

The Board of Directors retained RBC to advise the Board of Directors with respect to the Arrangement and to provide its opinion as to the fairness, from a financial point of view, of the consideration to be received by Shareholders pursuant to the Arrangement. RBC has provided the Board of Directors with the Fairness Opinion which states that, on the basis of the assumptions, qualifications and limitations summarized therein, in the opinion of RBC, as of September 28, 2012 the consideration to be received by Shareholders pursuant to the Arrangement is fair, from a financial point of view, to Shareholders. A copy of the Fairness Opinion is attached to this Circular as Appendix “D”.

See “The Arrangement – Fairness Opinion”.

Background to the Arrangement

On June 30, 2011, the Company completed a court-approved plan of arrangement under the Business Corporations Act (Ontario). Immediately following the completion of that plan of arrangement, the board of directors was replaced by the current Board of Directors and new senior management was appointed. The Board of Directors undertook a review of Granite’s business model and strategic options to determine the best alternatives to enhance shareholder value.

The Board of Directors, in conjunction with various professional advisors and senior management, conducted its review of the Company’s business and alternatives and unanimously approved a strategic plan that included the conversion of Granite from a Canadian corporation to a Canadian REIT structure.

Through the remainder of 2011 and to date in 2012, management worked with legal, financial and other professional advisors to further develop and settle the structure for the conversion of the Company to a REIT. It was determined to be desirable to utilize a “stapled unit” structure so as to not have an acquisition of control of Granite for Canadian income tax purposes and thereby preserve significant capital loss carry-forwards.

5

Table of Contents

In making its determinations and recommendation, the Board of Directors relied upon legal, tax, financial, and other advice and information received during the course of its deliberations, as described below. The following is a summary of certain factors, among others, that the Board of Directors considered in making its determinations and recommendation:

| • | the expected benefits of converting the Company from a corporate structure to a REIT structure, as described above; |

| • | that the conversion to a REIT structure is not expected to materially affect the Company’s business strategy or management team; |

| • | the Fairness Opinion; |

| • | that the Arrangement Resolution must receive the approval of at least two-thirds of the votes cast by holders of the Granite Common Shares, voting in person or by proxy at the Meeting; |

| • | that the Arrangement is subject to Court approval, which will consider, among other things, the fairness and reasonableness of the Arrangement to Shareholders; |

| • | that the Arrangement is expected to trigger capital gains for certain of the Company’s shareholders; |

| • | the complexity of the Company’s proposed capital structure and the costs of maintaining the same; |

| • | the withholding tax complexities that may impact both Canadian and non-resident unitholders depending on the jurisdiction of the source of the income being distributed; and |

| • | that Shareholders will be afforded a right to dissent and to demand repurchase of their Granite Common Shares for fair value through the exercise of Dissent Rights in the event that the Arrangement is approved and consummated. |

See “The Arrangement – Background to and Reasons for the Arrangement” and “The Arrangement – Recommendation of the Board of Directors”.

Effect on Distributions

Granite currently intends to continue to pay a quarterly dividend of $0.50 per Granite Common Share for the remainder of 2012, subject to declaration by the Board of Directors.

If the Plan of Arrangement is approved at the Meeting and the Effective Date occurs on or about December 31, 2012, as currently anticipated, it is anticipated that the distribution policy of Granite GP and Granite REIT will initially provide for a monthly distribution of $0.175 per Stapled Unit, with the first post-Arrangement distribution to be declared in respect of the month ending January 31, 2013 and paid on or about February 15, 2013.

In determining the anticipated level of the initial monthly distribution of $0.175 per Stapled Unit, the Board of Directors considered, among other factors, estimated 2013 adjusted funds from operations and capital requirements, its current and targeted payout ratios and the alignment of the distribution policy with Granite REIT’s strategic objectives.

Although we have stated this anticipated level of initial distributions, distributions will always be subject to the discretion of the Trustees (in the case of distributions by Granite REIT) (except to the extent the Granite REIT Declaration of Trust provides otherwise) and the board of directors of Granite GP (in the case of dividends by Granite GP). The distribution policy and the declaration of distributions may vary depending on, among other things, earnings, financial requirements, the satisfaction of solvency tests imposed by the BCBCA for the declaration of dividends by Granite GP and other relevant factors.

See “The Arrangement – Effect of the Arrangement – Effect on Distributions”.

6

Table of Contents

Post-Arrangement Structure

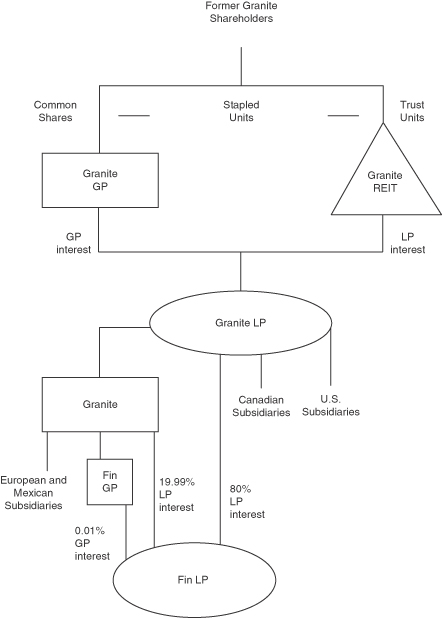

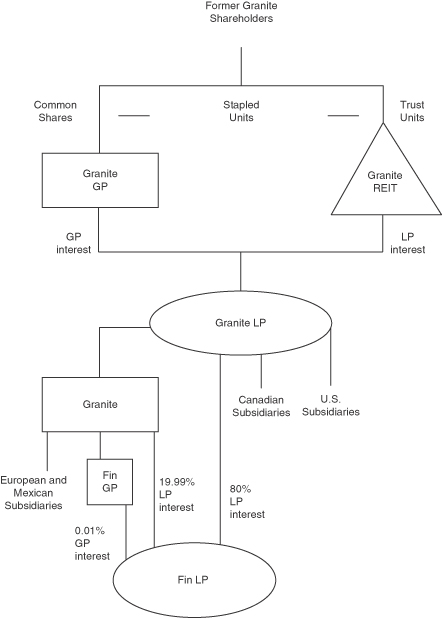

A diagram showing the post-Arrangement structure of Granite REIT, Granite GP, Granite LP and the Company is set out below.

Immediately upon completion of the Arrangement, it is expected that (a) the only material assets of Granite REIT will be the limited partnership interests in Granite LP, (b) the only significant asset of Granite GP will be its relatively nominal general partner interest in Granite LP, and (c) Granite REIT will not own any equity securities of Granite GP and Granite GP will not own any equity securities of Granite REIT.

See “The Arrangement – Details of the Arrangement”.

7

Table of Contents

Shareholder and Court Approvals

Under the Interim Order and the QBCA, the number of votes required to approve the Arrangement Resolution is at least two-thirds of the votes cast by holders of Granite Common Shares, either in person or by proxy, at the Meeting.

On October 9, 2012, the Court granted the Interim Order facilitating the holding of the Meeting and certain procedures relating to sending of Meeting materials and the conduct of the Meeting and other matters. The application for the Final Order approving the Arrangement is expected to be made on November 20, 2012 at 9:15 a.m. Eastern time, or as soon thereafter as counsel may be heard.

See “The Arrangement – Approvals”.

Timing of Completion of the Arrangement

If the Meeting is held as scheduled and the application for the Final Order is granted, Granite’s current objective is to have the Effective Date be December 31, 2012.

See “The Arrangement – Timing of Completion of the Arrangement”.

Procedure for Exchange of Granite Common Shares

A Letter of Transmittal is enclosed with this Circular for use by registered Shareholders for the purpose of the surrender of the certificates representing their Granite Common Shares.

In order to exchange certificates representing Granite Common Shares for certificates representing Stapled Units on the completion of the Arrangement, registered Shareholders must deposit with the Depositary (at the address specified in the Letter of Transmittal) a duly completed Letter of Transmittal together with the certificates representing the holder’s Granite Common Shares in accordance with the instructions contained in the Letter of Transmittal. Registered Shareholders may request additional copies of the Letter of Transmittal by contacting the Depositary. The Letter of Transmittal will also be available on the Computershare website at www.computershare.com.

If your Granite Common Shares are held through a broker, dealer, bank, trust company or other registered nominee that administers your account, you should contact your account administrator for information about how the exchange of your Granite Common Shares will be effected.

See “The Arrangement – Procedure for Exchange of Granite Common Shares”.

Stock Exchange Listings

It is a condition to completion of the Plan of Arrangement that the TSX shall have conditionally approved the listing of the Stapled Units and the NYSE shall have approved the listing of Stapled Units, subject to official notice of issuance. The TSX has conditionally approved the substitutional listing of the Stapled Units, subject to the Company fulfilling all the requirements of the TSX no later than the business day after the completion of the Arrangement. Granite REIT and Granite GP intend to apply to list the Stapled Units on the NYSE. The Stapled Units are expected to be listed on the TSX under the trading symbol “GRT.UN” and on the NYSE under the trading symbol “GRP.U”.

See “The Arrangement – Stock Exchange Listings”.

INFORMATION CONCERNING GRANITE REIT

Granite REIT is an unincorporated, open-ended, limited purpose trust established under and governed by the laws of the Province of Ontario and created pursuant to a declaration of trust which

8

Table of Contents

will be amended and restated in connection with the Arrangement. Although it is intended that Granite REIT qualify as a “mutual fund trust” pursuant to the Tax Act, Granite REIT will not be a mutual fund under applicable securities laws.

Following completion of the Arrangement, Granite REIT will engage principally in the ownership and management of income-producing properties in Canada, the United States, Mexico and Europe. In the conduct of Granite REIT’s operations and affairs, the Trustees will be subject to the investment guidelines and operating policies set out in the Granite REIT Declaration of Trust.

The objectives of Granite REIT will be to:

| (a) | provide Granite REIT Unitholders with stable and growing cash flow available for distribution generated by revenue it derives from the ownership of and investment in income-producing real estate properties; and |

| (b) | maximize Granite REIT’s long term unit value through ongoing active management of its portfolio, acquisition of additional income-producing properties and the development and construction of projects and properties which enhance the quality, diversification and value of the portfolio. |

The beneficial interests in Granite REIT are represented and constituted by a single class of “trust units”. Until an Event of Uncoupling, Granite REIT Units will trade together with Granite GP Common Shares as Stapled Units.

Each Granite REIT Unit represents an equal undivided beneficial interest in any distributions by Granite REIT, whether of net income, net realized capital gains or other amounts and, in the event of termination of Granite REIT, in the net assets of Granite REIT remaining after satisfaction of all liabilities, and no Granite REIT Unit has any preference over any other. Granite REIT Unitholders may attend and vote at all meetings of Granite REIT Unitholders, either in person or by proxy, and each Granite REIT Unit is entitled to one vote at all such meetings or in respect of any written resolution of Granite REIT Unitholders.

See “Information Concerning Granite REIT”.

Limitations on Non-Resident Ownership of Granite REIT Units

At no time may more than 49% (on either a basic or fully-diluted basis) of the Granite REIT Units be held for the benefit of Non-Resident Beneficiaries. The Trustees may require declarations as to the jurisdictions in which beneficial owners of Granite REIT Units are resident or declarations from holders of Granite REIT Units as to whether such Granite REIT Units are held for the benefit of Non-Resident Beneficiaries. If the Trustees become aware that more than 49% (on either a basic or fully-diluted basis) of the Granite REIT Units then outstanding are, or may be, held for the benefit of Non-Resident Beneficiaries or that such a situation is imminent, the Trustees may cause Granite REIT to make a public announcement thereof and shall not accept a subscription for Granite REIT Units from or issue or register a transfer of Granite REIT Units to a person unless the person provides a declaration that the person is not a Non-Resident (or, in the discretion of the Trustees, that the person is not a Non-Resident Beneficiary) and does not hold its Granite REIT Units for a Non-Resident Beneficiary. If, notwithstanding the foregoing, the Trustees determine that more than 49% of the Granite REIT Units (on either a basic or fully-diluted basis) are held for the benefit of Non-Resident Beneficiaries, the Trustees may cause Granite REIT to send a notice to Non-Resident holders of Granite REIT Units, chosen in inverse order to the order of acquisition or registration or in such manner as the Trustees may consider equitable and practicable, requiring them to sell their Granite REIT Units or a portion thereof within a specified period of not more than 60 days. If the Granite REIT Unitholders receiving such notice have not sold the specified number of Granite REIT Units or provided the Trustees with

9

Table of Contents

satisfactory evidence that they are not Non-Residents and do not hold their Granite REIT Units for the benefit of Non-Resident Beneficiaries within such period, the Trustees may cause Granite REIT to sell such Granite REIT Units on behalf of such Granite REIT Unitholders and, in the interim, the voting and distribution rights attached to such Granite REIT Units shall be suspended. Upon such sale the affected holders shall cease to be holders of Granite REIT Units and their rights shall be limited to receiving the net proceeds from such sale.

INFORMATION CONCERNING GRANITE GP

Granite GP was incorporated on September 28, 2012 under the BCBCA for the sole purpose of participating in the Arrangement.

Granite GP’s authorized share capital after completion of the Arrangement will consist of an unlimited number of Granite GP Common Shares without par value. Until an Event of Uncoupling, Granite GP Common Shares will trade together with Granite REIT Units as Stapled Units.

Holders of Granite GP Common Shares are entitled to: (a) one vote per share at all meetings of shareholders (except for meetings of holders of another specified class or series of Granite GP shares); (b) receive pari passu with other holders of Granite GP Common Shares, any dividends as and when declared by the directors of Granite GP; and (c) receive pari passu with other holders of Granite GP Common Shares the remaining assets of Granite GP available for distribution to Granite GP shareholders in the event of the liquidation, dissolution or winding-up of Granite GP.

See “Information Concerning Granite GP”.

RIGHTS OF DISSENTING SHAREHOLDERS

Shareholders who wish to dissent should take note that strict compliance with the requirements for exercising Dissent Rights is required.

The Interim Order, which is attached to this Circular as Appendix “F”, expressly provides Registered Shareholders with the Dissent Rights in respect of the Arrangement on substantially the same terms and conditions as set out in Chapter XIV—Right to Demand Repurchase of Granite Common Shares (sections 372 to 397) of the QBCA, the text of which is reproduced in Appendix “L” to this Circular, with modifications to the provisions of such sections 372 to 397 in accordance with the Interim Order and Article 5 of the Plan of Arrangement.

Persons who are Non-Registered Holders of Granite Common Shares registered in the name of an intermediary, custodian or nominee who wish to exercise Dissent Rights should be aware that only the Registered Shareholder as of the Record Date is entitled to exercise Dissent Rights. A Non-Registered Holder may give instructions to the Registered Shareholder in whose name the Granite Common Shares in which it has a beneficial interest are registered as to the exercise of Dissent Rights attaching to its Granite Common Shares.

The procedures for exercising Dissent Rights are technical and complex. It is suggested that any Shareholder wishing to avail itself of Dissent Rights seek its own legal advice, as failure to comply strictly with the applicable provisions of the QBCA, the Interim Order and the Plan of Arrangement may prejudice the availability of Dissent Rights.

See “Rights of Dissenting Shareholders”.

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

Consequences of the proposed Plan of Arrangement to certain Shareholders are described in this Circular under “Certain Canadian Federal Income Tax Considerations.” In very general terms, the participation of such Shareholders in the Plan of Arrangement will not occur on a tax deferred basis for

10

Table of Contents

Canadian federal income tax purposes, so that such Shareholders may recognize a capital gain under the Plan of Arrangement if they are resident in Canada. Such Shareholders who instead are not resident in Canada will not be subject to Canadian federal income tax on any capital gain realized by them under the Plan of Arrangement, provided that they do not hold their Granite Common Shares, and certain other securities acquired under the Plan of Arrangement, as taxable Canadian property.

CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

Consequences of the proposed Plan of Arrangement to Shareholders are described in this Circular under “Certain United States Federal Income Tax Considerations.” Generally, U.S. Shareholders will be subject to U.S. federal income tax upon receipt of their Stapled Units as a result of the Arrangement, but Non-U.S. Shareholders generally will not be subject to U.S. federal income tax. Consequences of holding and disposing of Stapled Units are also addressed in this Circular under “Certain United States Federal Income Tax Considerations.” Granite REIT will elect to be treated as a partnership for U.S. federal income tax purposes, and as a result, each Granite REIT Unitholder will be required to take into account its allocable share of items of income, gain, loss and deduction of Granite REIT in computing its U.S. federal income tax liability, regardless of whether cash distributions are made to Granite REIT Unitholders. Shareholders are encouraged to consult their tax advisors regarding the tax consequences of the Arrangement and the ownership of Stapled Units.

RISK FACTORS

Risk factors related to the business of the Company will continue to apply to Granite REIT, Granite GP and Granite LP after the Effective Date. Certain risk factors relating to the activities of the Company are contained in the Company’s annual information form for the year ended December 31, 2011, which is incorporated by reference in this Circular and filed on SEDAR at www.sedar.com and attached as Exhibit 1 to the Company’s Annual Report on form 40-F. Shareholders should consider the risk factors set out therein together with the information set out in this Circular. Additional risks and uncertainties, including those currently unknown to, or considered immaterial by, the Company may also adversely affect the business of the Company, Granite REIT, Granite GP and Granite LP. In particular, the Plan of Arrangement is subject to certain risks, including risks relating to the following:

| • | the completion of the Arrangement is subject to a number of conditions precedent and requires regulatory and third-party approvals; |

| • | cash distributions are not guaranteed and will fluctuate with the performance of the business of Granite REIT; |

| • | structural subordination of the Granite REIT Units; |

| • | limitation on non-resident ownership; |

| • | dependence on Granite LP; |

| • | mutual fund trust status of Granite REIT; |

| • | REIT status of Granite REIT; |

| • | potential capital gains tax liability of Granite; |

| • | uncertainty regarding withholding tax rate for U.S. residents; |

| • | Granite REIT Unitholders may recognize taxable income without receiving corresponding cash distributions; and |

| • | Granite America’s status as a U.S. REIT. |

For more information about the foregoing and a discussion of additional risk factors in connection with the Plan of Arrangement, see “Risk Factors”.

11

Table of Contents

RATIFICATION OF BY-LAW

On September 28, 2012, following the continuance of the Company from the OBCA to the QBCA as previously approved by Shareholders, the Board passed a resolution approving By-law 2012 as the general by-law for the continued Company. The full text of By-law 2012 is attached to this Circular as Appendix “B”.

Under the provisions of the QBCA, By-law 2012 must be ratified by Shareholders at the Meeting in order for it to continue in effect following the Meeting. Accordingly, Shareholders will be asked at the Meeting to consider and, if thought fit, to approve the ordinary resolution to ratify By-law 2012 as the general by-law of the Company.

The Board of Directors unanimously recommends that Shareholders vote FOR the ordinary resolution ratifying By-law 2012.

12

Table of Contents

APPOINTMENT AND REVOCATION OF PROXIES

REGISTERED HOLDERS

The persons named in the accompanying form of proxy are nominees of management of Granite and are officers of the Company. A Shareholder has the right to appoint a person or a company (who need not be a Shareholder) as nominee to attend and act for and on behalf of such Shareholder at the Meeting other than the management nominees named in the accompanying form of proxy. This right may be exercised by inserting in the blank space the name of the person the Shareholder wishes to appoint as proxyholder, or by completing, signing and submitting another proper form of proxy naming such person as proxyholder.

Shareholders desiring to be represented at the Meeting by proxy must deposit their forms of proxy at one of the following locations:

| (a) | the offices of Computershare Investor Services Inc., the registrar and transfer agent of the Company, at 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1, addressed to the Proxy Department; or |

| (b) | the principal executive offices of the Company at 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion Centre, Toronto, Ontario M5K 1H1, addressed to the General Counsel of the Company, |

by 10:00 a.m. (Toronto time) on Tuesday, November 13, 2012 or not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time any adjourned Meeting is reconvened or any postponed Meeting is convened. If a Shareholder who has completed a proxy attends the Meeting in person, any votes cast by such Shareholder on a poll will be counted and the proxy will be disregarded.

Rather than returning the proxy by mail or hand delivery, registered Shareholders may also elect to vote by telephone or via the Internet. Those registered holders electing to vote by telephone require a touch-tone telephone to transmit their voting preferences. Registered Shareholders electing to vote by telephone or via the Internet must follow the instructions included in the accompanying form of proxy.

NON-REGISTERED HOLDERS

Only registered Shareholders and persons appointed as proxyholders are permitted to attend and vote at the Meeting. However, in many cases, Granite Common Shares beneficially owned by a Shareholder (a “Non-Registered Holder”) are registered either:

| (a) | in the name of an intermediary that the Non-Registered Holder deals with in respect of the Granite Common Shares, such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of registered plans; or |

| (b) | in the name of a clearing agency (such as The Canadian Depository for Securities Limited and, in the United States, The Depository Trust Company) of which the intermediary is a participant. |

The Meeting Materials are being sent to both registered and non-registered owners of Granite Common Shares. In accordance with National Instrument 54-101 – Communication with Beneficial Owners of Securities of Reporting Issuers, Granite is delivering the Meeting Materials directly to depositories and other intermediaries for onward distribution to Non-Registered Holders. Typically, intermediaries will use a service company to forward the Meeting Materials to, and to obtain voting instructions from, beneficial owners.

If you are a Non-Registered Holder, you should follow the instructions received from the intermediary through which your Granite Common Shares are held. Generally, Non-Registered Holders will receive either:

| (a) | a voting instruction form (a “VIF”), which must be completed and signed by the Non-Registered Holder in accordance with the directions set out on the VIF (which may, in some cases, allow for voting by telephone or Internet); or |

13

Table of Contents

| (b) | less typically, a proxy that has already been signed by the intermediary (usually by way of a facsimile, stamped signature), that is restricted as to the number of Granite Common Shares beneficially owned by the Non-Registered Holder, but that is otherwise not fully completed. In this case, the Non-Registered Holder who wishes to submit the proxy should otherwise properly complete and deposit it with Computershare Investor Services Inc., as described above. |

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Granite Common Shares they beneficially own. Non-Registered Holders that wish to vote in person at the Meeting must insert their name in the space provided on the form of proxy or VIF and adhere to the signing and return instructions provided on the form. If you are a Non-Registered Holder, you should follow the instructions on the document you receive and contact your intermediary promptly if you need assistance.

REVOCATION

A proxy may be revoked at any time by the person giving it to the extent it has not yet been exercised. A proxy may be revoked by:

| (a) | completing and signing a proxy bearing a later date and depositing it with Computershare Investor Services Inc. at 100 University Avenue, 9th Floor, Toronto, Ontario, Canada M5J 2Y1, addressed to the Proxy Department; |

| (b) | depositing an instrument in writing executed by the Shareholder or by the Shareholder’s attorney authorized in writing at the principal executive offices of the Company at 77 King Street West, Suite 4010, P.O. Box 159, Toronto-Dominion Centre, Toronto, Ontario M5K 1H1 addressed to the General Counsel of the Company at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of the Meeting, or with the Chairman of the Meeting on the day of the Meeting or any adjournment thereof; or |

| (c) | in any other manner permitted by law. |

A Non-Registered Holder who wishes to revoke his or her proxy or VIF must make appropriate arrangements with the intermediary through which his or her Granite Common Shares are held.

SIGNATURE OF PROXY

A form of proxy must be executed by the Shareholder depositing the proxy or by his or her attorney authorized in writing, or if the Shareholder is a corporation, the form of proxy should be signed in its corporate name by an authorized officer. A proxy signed by a person acting as attorney or in some other representative capacity should reflect such person’s capacity following his or her signature and should be accompanied by the appropriate instrument evidencing qualification and authority to act (unless such instrument has been previously filed with Granite).

VOTING OF PROXIES

The persons named in the accompanying form of proxy will vote the Granite Common Shares in respect of which they are appointed in accordance with the direction of the Shareholder appointing them. Where a choice for such matter is not specified, Granite Common Shares will be voted as the proxyholder sees fit. Unless contrary instructions are provided, Granite Common Shares represented by proxies received by management will be voted FOR the Arrangement Resolution and FOR the ordinary resolution ratifying By-law 2012 as the general by-law of the Company.

EXERCISE OF DISCRETION OF PROXY

The accompanying form of proxy confers discretionary authority upon the persons named therein with respect to any amendments or variations to matters identified in the Notice of Meeting and with respect to such other business or matters which may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. As of the date of this Circular, the Company is not aware of any such amendments or variations or any other matters to be addressed at the Meeting.

14

Table of Contents

RECORD DATE

The Board has fixed Thursday, October 11, 2012 (the “Record Date”) as the record date for the Meeting. Only holders of record of Granite Common Shares at the close of business on the Record Date are entitled to receive notice of and to vote at the Meeting.

15

Table of Contents

BACKGROUND TO AND REASONS FOR THE ARRANGEMENT

Background

On June 30, 2011, the Company completed a court-approved plan of arrangement under the Business Corporations Act (Ontario) which eliminated the Company’s dual class share capital structure through which certain securityholders and their family controlled the Company. Immediately following the completion of that plan of arrangement, a new board of directors (the “Board of Directors”) commenced its term of office, and new senior management was appointed. The Board of Directors undertook a review of Granite’s business model and strategic options to determine the best alternatives to enhance shareholder value.

From July 2011 until October 2011 the Board of Directors, in conjunction with various professional advisors and senior management, conducted its review of the Company’s business and alternatives. On October 25, 2011, the Company announced that it had completed its strategic review process and that the Board of Directors had unanimously approved a strategic plan that included, among other things, the conversion of Granite from a Canadian corporation to a Canadian real estate investment trust (“REIT”) structure.

Through the remainder of 2011 and to date in 2012, management worked with legal, financial and other professional advisors to further develop and settle the structure for the conversion of the Company to a REIT. Among other things, it was determined to be desirable to utilize a “stapled unit” structure so as to not have an acquisition of control of Granite for Canadian income tax purposes and thereby preserve significant capital loss carry-forwards.

It was also determined to be desirable that the Company be continued as a corporation under the QBCA to facilitate the creation, in connection with the Arrangement, of hypothecs to be governed by Quebec law. Such continuance was approved by Shareholders on June 13, 2012 and completed on September 25, 2012.

The Board of Directors received updates on the development of the proposed REIT structure during the course of this time. The Board of Directors received and reviewed the recommended structure and the related detailed information about the proposed conversion in connection with its meeting held on September 28, 2012, at which it approved the proposed Plan of Arrangement and the contents and sending of this Circular, and determined to recommend that Shareholders vote FOR the Arrangement.

As described in more detail below, the “stapled unit” REIT structure will involve Shareholders becoming, upon implementation of the Arrangement, holders of Stapled Units, each of which will consist of a unit of a new REIT, Granite REIT, and a common share of a new corporation, Granite GP. Together, Granite REIT and Granite GP will hold all the partnership interests in a new limited partnership, Granite LP, which will own directly and indirectly the subsidiaries and assets currently owned directly and indirectly by Granite. The Trustees of Granite REIT and the board of directors of Granite GP will initially be comprised of the seven individuals who comprise the Board of Directors. The senior management of Granite GP and Granite REIT will be comprised of the current members of the Company’s senior management team, who will be employed by Granite LP. See “– Effect of the Arrangement” and “– Details of the Arrangement”.

Reasons for the Arrangement

In making its determinations and recommendation, the Board of Directors relied upon legal, tax and other advice and information received in connection with its deliberations. The following is a summary of the principal benefits of the Arrangement that the Board of Directors considered in making its determinations and recommendation:

| • | Granite is currently cash taxable. It is expected that the proposed REIT structure will allow the resulting Granite organization to reduce its liability for cash taxes, thereby increasing Granite REIT’s adjusted funds from operations and the amount of cash available for distribution; |

16

Table of Contents

| • | the Stapled Units are expected to be generally valued on a price-to-adjusted funds from operations basis, which may result in more favourable market trading levels for the Stapled Units compared to the pre-Arrangement trading levels for the Granite Common Shares due to the increase in the adjusted funds from operations, primarily as a result of the reduced cash tax payable, following conversion to the proposed REIT structure; and |

| • | the Stapled Units are expected to provide an enhanced ability for Granite REIT to access the Canadian equity capital markets, given that most publicly traded real estate entities in Canada are REIT structures or high yielding corporate structures with minimal cash tax leakage. |

FAIRNESS OPINION

The Board of Directors retained RBC to advise the Board of Directors with respect to the Arrangement and to provide its opinion as to the fairness, from a financial point of view, of the consideration to be received by Shareholders pursuant to the Arrangement. Management met with RBC and legal counsel to review the proposed Arrangement. At these meetings, RBC provided management with a preliminary view regarding fairness and management and legal counsel provided RBC with various financial, tax and other information.

RBC has provided the Board of Directors with the Fairness Opinion. The Fairness Opinion states that, on the basis of the assumptions, qualifications and limitations summarized therein, in the opinion of RBC, as of September 28, 2012 the consideration to be received by Shareholders pursuant to the Arrangement is fair, from a financial point of view, to Shareholders. The Fairness Opinion is subject to the assumptions, qualifications and limitations contained therein and should be read in its entirety, and is attached as Appendix “D” to this Circular.

RECOMMENDATION OF THE BOARD OF DIRECTORS

The Board of Directors has reviewed the terms of the Arrangement. The Board of Directors has determined that the Arrangement is in the best interests of the Company and is fair and reasonable to the Company and the Shareholders, and unanimously recommends that Shareholders vote FOR the Arrangement Resolution.

In making its determinations and recommendation, the Board of Directors relied upon legal, tax, financial, and other advice and information received during the course of its deliberations, as described below. The following is a summary of the factors, among others, that the Board of Directors considered in making its determinations and recommendation:

| • | the expected benefits of converting the Company from a corporate structure to a REIT structure, as described in “– Background to and Reasons for the Arrangement”; |

| • | that the conversion to a REIT structure is not expected to materially affect the Company’s business strategy or management team; |

| • | the Fairness Opinion; |

| • | that the Arrangement Resolution must receive the approval of at least two-thirds of the votes cast by holders of the Granite Common Shares, voting in person or by proxy at the Meeting; |

| • | that the Arrangement is subject to Court approval, which will consider, among other things, the fairness and reasonableness of the Arrangement to Shareholders; |

| • | that the Arrangement is expected to trigger capital gains for certain of the Company’s shareholders; |

| • | the complexity of the Company’s proposed capital structure and the costs of maintaining the same; |

| • | the withholding tax complexities that may impact both Canadian and non-resident unitholders depending on the jurisdiction of the source of the income being distributed; and |

17

Table of Contents

| • | that Shareholders will be afforded a right to dissent and to demand repurchase of their Granite Common Shares for fair value through the exercise of Dissent Rights in the event that the Arrangement is approved and consummated. |

The foregoing discussion of the information and factors considered by the Board of Directors is not intended to be exhaustive. In reaching the determination to approve and recommend the Arrangement Resolution, the Board of Directors did not expressly assign any relative or specific weight to the factors that were considered, and individual directors may have given different weight to each factor. There are risks associated with the Arrangement, including that some of the potential benefits set forth in this Circular may not be realized or that there may be significant costs associated with realizing such benefits. See “Risk Factors”.

EFFECT OF THE ARRANGEMENT

General

If approved and implemented, the Arrangement will result in the conversion of Granite’s corporate structure into a “stapled unit” REIT structure. Under the Arrangement, if implemented, Shareholders will become the sole holders of Stapled Units immediately following completion of the Arrangement and Granite REIT and Granite GP, through Granite LP, will acquire, directly or indirectly, all of the Granite Common Shares. See “– Details of the Arrangement”.

Following completion of the Arrangement, Granite REIT and Granite GP, through Granite LP and its subsidiaries, will continue to carry on all of the business and activities currently carried on, directly and indirectly, by Granite. The senior management of Granite GP and Granite REIT will be comprised of the current members of the Company’s senior management.

The Trustees of Granite REIT and the board of directors of Granite GP will initially be comprised of the seven individuals who comprise the Board of Directors. It is anticipated that the Trustees of Granite REIT and/or the board of Granite GP will establish an audit committee, a compensation committee, and a corporate governance and nominating committee, and will generally adopt structures and procedures currently utilized by the Company to ensure that effective corporate governance practices are followed and that the Board of Directors functions independently of management. For more information regarding Granite’s current governance structures and procedures, including committees of the Board of Directors and the charter of the Board of Directors, please see the May 2012 Circular, which is incorporated herein by reference.

Effect on Shareholders

Under the Arrangement, Shareholders will, through a series of steps, acquire Stapled Units in exchange for their Granite Common Shares on the basis of one Stapled Unit for each Granite Common Share.

Effect on Distributions

Granite currently intends to continue to pay a quarterly dividend of $0.50 per Granite Common Share for the remainder of 2012, subject to declaration by the Board of Directors.

If the Plan of Arrangement is approved at the Meeting and the Effective Date occurs on or about December 31, 2012, as currently anticipated, it is anticipated that the distribution policy of Granite GP and Granite REIT will initially provide for a monthly distribution of $0.175 per Stapled Unit, with the first post-Arrangement distribution to be declared in respect of the month ending January 31, 2013 and paid on or about February 15, 2013.

In determining the anticipated level of the initial monthly distribution of $0.175 per Stapled Unit, the Board of Directors considered, among other factors, estimated 2013 adjusted funds from operations and capital requirements, its current and targeted payout ratios and the alignment of the distribution policy with Granite REIT’s strategic objectives.

18

Table of Contents

Although we have stated this anticipated level of initial distributions, distributions will always be subject to the discretion of the Trustees of Granite REIT (in the case of distributions by Granite REIT) (except to the extent the Granite REIT Declaration of Trust provides otherwise) and the board of directors of Granite GP (in the case of dividends by Granite GP). The distribution policy and the declaration of distributions may vary depending on, among other things, earnings, financial requirements, the satisfaction of solvency tests imposed by the BCBCA for the declaration of dividends by Granite GP and other relevant factors. See “Risk Factors”.

Effect on Existing Equity-Based Compensation Plans

Granite intends to amend its equity-based compensation plans to reflect the new REIT structure.

Executive Share Unit Plan

Granite has an executive share unit plan (the “Executive Share Unit Plan”) under which certain executive officers have been granted share units which permit the holders to receive Granite Common Shares or the value thereof subject to satisfying vesting requirements established by Granite at the time the share units are granted. The Granite Common Shares provided to holders of share units issued under the Executive Share Unit Plan may be newly issued or purchased on the open market. It is intended that, in connection with the Arrangement, in accordance with the terms of the Executive Share Unit Plan, a right under outstanding units to acquire Stapled Units or receive a payment based on the fair market value of the Stapled Units will be substituted for the holders’ rights to acquire Granite Common Shares or a payment based on the value of such shares. In addition, it is intended that the Executive Share Unit Plan will be amended to provide that, following the completion of the Arrangement, the securities provided to holders of share units issued under the Executive Share Unit Plan in the future will be Stapled Units rather than Granite Common Shares, and to make other changes required to conform to the new REIT structure.

Stock Option Plan

Granite has a legacy employee stock option plan (the “Stock Option Plan”) that was in place prior to the time Granite completed its plan of arrangement on June 30, 2011 (see “– Background to and Reasons for the Arrangement”) and remained in existence thereafter with respect to those persons who had outstanding options at such time. It is intended that, as part of the Arrangement, the optionholders will exchange their existing options to acquire Granite Common Shares for options to acquire Stapled Units on a one for one basis. It is also intended that the Stock Option Plan will be amended in connection with the Arrangement to make other changes required to conform to the new REIT structure. No options have been granted since the Company completed its plan of arrangement on June 30, 2011. See “– Background to and Reasons for the Arrangement”.

Non-Employee Share-Based Plan

Granite maintains a deferred share unit plan (the “Non-Employee Share-Based Plan”) for directors who are not employed by Granite. Under the Non-Employee Share-Based Plan, directors are required to receive a portion of their annual retainer as deferred share units (“Deferred Share Units”), which are rights to receive a payment based on the fair market value of a Granite Common Share. Under the Non-Employee Share-Based Plan, directors may also elect to receive up to 100% of their annual remuneration that would, absent their election, be payable in cash, as Deferred Share Units. Upon a director’s termination, resignation or other event resulting in the director ceasing to be eligible to continue to hold Deferred Share Units under the Non-Employee Share-Based Plan, the director’s Deferred Share Units are paid to him or her in cash based on the then fair market value of a Granite Common Share. It is intended that the Non-Employee Share-Based Plan will be amended in connection with the Arrangement to provide that, following completion of the Arrangement, each Deferred Share Unit outstanding at the Effective Time will entitle the holder thereof to receive a payment based on the fair market value of a preferred share of the Company that will be equal in value to a Stapled Unit.

It is intended that a new deferred share unit plan will be established by Granite GP following the completion of the Arrangement for directors who are not employed by Granite. Under the new plan, directors

19

Table of Contents

of Granite GP will be entitled to receive a portion of their annual retainer (and to elect to receive up to 100% of their annual remuneration that would otherwise be paid in cash) as deferred share units, which will entitle them to receive a payment based on the fair market value of a preferred share of the Company that will be equal in value to a Stapled Unit.

Certain Transactions Affecting Granite’s Debentures in Connection with the Arrangement

Granite is the issuer of $265 million outstanding principal amount of 6.05% senior unsecured debentures, series 1 (the “Debentures”) issued under an indenture dated as of December 22, 2004 (as amended, supplemented or otherwise modified from time to time, the “Indenture”). The completion of the Arrangement is permitted under the terms of the Indenture and does not require approval by any holders of Debentures.

As one of the anticipated steps in the Arrangement, as described below under “– Details of the Arrangement,” it is anticipated that Granite will transfer substantially all of its assets to Granite LP and Fin LP. As required by the Indenture, in connection with such asset transfer, Granite LP and Fin LP will agree to be bound by the terms of the Indenture and of the Debentures as co-principal debtors, in place of Granite, with Granite guaranteeing all amounts payable under the Debentures. Concurrently with the foregoing, (a) Granite intends to enter into a supplemental indenture (the “Co-Issuer Supplemental Indenture”) to the Indenture pursuant to which it will covenant that, notwithstanding that the Indenture would release Granite as primary debtor, as described above, Granite will continue to remain bound as co-principal debtor under the Debentures and the Indenture so that it will not be so released, and (b) Granite REIT and Granite GP, the direct parent entities of Granite LP on completion of the Arrangement, will guarantee all amounts payable under the Debentures. The transactions described in this paragraph are permitted under the terms of the Indenture, and none of them requires approval by any holders of Debentures.

DETAILS OF THE ARRANGEMENT

Pre-Arrangement Steps

Prior to and in preparation for implementing the Arrangement, it is anticipated that a number of events and transactions will be completed by Granite, Granite REIT, Granite GP and other Granite subsidiaries, including the following:

| (a) | if the Arrangement is approved by the Shareholders, Granite will apply for and obtain the Final Order, as described below under “– Approvals – Court Approvals”; |

| (b) | inter-company transactions will be undertaken to create, transfer or consolidate inter-company indebtedness to be transferred and secured under the Arrangement; and |

| (c) | Granite’s U.S. and Canadian subsidiaries will be reorganized to facilitate the Arrangement and the creation of, after completion of the Arrangement, a U.S. private REIT structure for Granite’s U.S. business operations. |

The Arrangement

The detailed steps of the Arrangement are set forth in the Plan of Arrangement, which is Schedule A to the Arrangement Agreement attached to this Circular as Appendix “E”. The following is a summary of the anticipated principal steps and results of the Arrangement, but is not complete and is qualified entirely by reference to the full text of the Arrangement Agreement and Plan of Arrangement:

| (a) | the Granite Common Shares held by Dissenting Shareholders who have validly exercised Dissent Rights will be repurchased by Granite and cancelled, and such Dissenting Shareholders will not have any further rights other than the right to be paid the fair value of their Granite Common Shares in accordance with the Plan of Arrangement and the Interim Order; |

| (b) | Granite will transfer the equity of its Canadian and United States subsidiaries, and indebtedness owed to it by certain U.S. subsidiaries, to Granite LP and will transfer indebtedness owed to it by certain European subsidiaries to a newly created limited partnership that will be controlled indirectly |

20

Table of Contents