Item 1. |

Reports to Shareholders. |

| Page | ||||||||

| 2 | ||||||||

| 21 | ||||||||

| 22 | ||||||||

| 28 | ||||||||

| 29 | ||||||||

| 30 | ||||||||

| 32 | ||||||||

| 92 | ||||||||

| 124 | ||||||||

| 125 | ||||||||

| 126 | ||||||||

| 127 | ||||||||

| 128 | ||||||||

| 130 | ||||||||

| 131 | ||||||||

| 132 | ||||||||

| 134 | ||||||||

| 135 | ||||||||

| 156 | ||||||||

| 189 | ||||||||

| 190 | ||||||||

| 191 | ||||||||

| 196 | ||||||||

| 200 | ||||||||

| 206 | ||||||||

| Fund | Fund Summary |

Schedule of Investments |

||||||

| 6 | 33 | |||||||

| 9 | 47 | |||||||

| 12 | 59 | |||||||

| 15 | 70 | |||||||

| 18 | 81 | |||||||

Important Information About the Funds |

2 |

PIMCO CLOSED-END FUNDS |

ANNUAL REPORT |

| | JUNE 30, 2024 | 3 |

Important Information About the Funds |

(Cont.) |

Fund Name |

Inception Date |

Diversification Status |

||||||||||

PIMCO Corporate & Income Opportunity Fund |

12/27/02 |

Diversified |

||||||||||

PIMCO Corporate & Income Strategy Fund |

12/21/01 |

Diversified |

||||||||||

PIMCO High Income Fund |

04/30/03 |

Diversified |

||||||||||

PIMCO Income Strategy Fund |

08/29/03 |

Diversified |

||||||||||

PIMCO Income Strategy Fund II |

10/29/04 |

Diversified |

||||||||||

4 |

PIMCO CLOSED-END FUNDS |

ANNUAL REPORT |

| | JUNE 30, 2024 | 5 |

Corporate Bonds & Notes |

32.5% |

|||

Loan Participations and Assignments |

28.9% |

|||

Non-Agency Mortgage-Backed Securities |

10.1% |

|||

Short-Term Instruments ‡ |

7.3% |

|||

Common Stocks |

6.5% |

|||

Asset-Backed Securities |

6.5% |

|||

Sovereign Issues |

4.1% |

|||

Municipal Bonds & Notes |

1.9% |

|||

U.S. Government Agencies |

1.0% |

|||

Other |

1.2% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

‡ |

Includes Central Funds Used for Cash Management Purposes. |

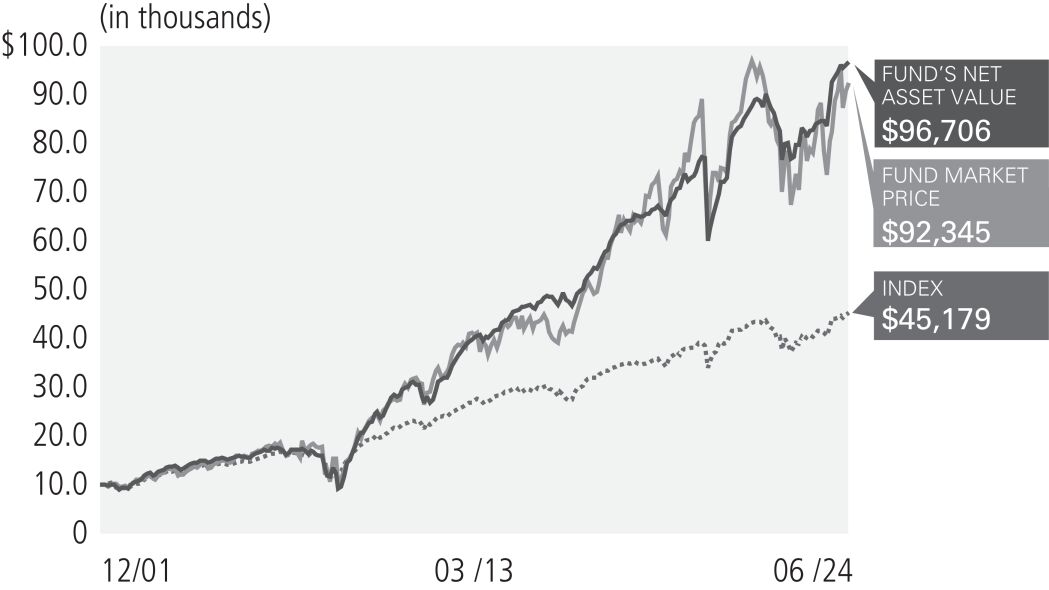

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||

1 Year |

5 Year |

10 Year |

Commencement of Operations (12/27/02) |

|||||||||||||||

|

Market Price |

13.77% |

5.79% |

8.52% |

12.32% |

|||||||||||||

|

NAV |

17.24% |

7.03% |

9.18% |

12.47% |

|||||||||||||

|

ICE BofA US High Yield Index |

10.44% |

3.73% |

4.21% |

7.36% |

¨ | ||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Market Price |

$14.31 | |||

NAV |

$11.17 | |||

Premium/(Discount) to NAV |

28.11% | |||

Market Price Distribution Rate (2) |

9.96% | |||

NAV Distribution Rate (2) |

12.76% | |||

Total Effective Leverage (3) |

18.75% | |||

| » | Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to absolute performance, as select securities posted positive returns. |

| » | Exposure to corporate credit, notably bank loans and high yield, contributed to absolute performance, as the asset classes posted positive returns. |

| » | At-the-market |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Holdings related to emerging market special situation investments detracted from absolute performance, as select securities posted negative returns. |

| » | Interest rate swaps detracted from performance, as interest rates rose. |

6 |

PIMCO CLOSED-END FUNDS |

Market and Net Asset Value Information |

Common share market price (1) |

Common share net asset value |

Premium (discount) as a % of net asset value |

||||||||||||||||||||||

Quarter |

High |

Low |

High |

Low |

High |

Low |

||||||||||||||||||

| Quarter ended June 30, 2024 | $ | 15.05 | $ | 13.49 | $ | 11.37 | $ | 11.07 | 32.60% | 21.42% | ||||||||||||||

| Quarter ended March 31, 2024 | $ | 14.87 | $ | 13.24 | $ | 11.39 | $ | 11.11 | 30.93% | 17.58% | ||||||||||||||

| Quarter ended December 31, 2023 | $ | 14.10 | $ | 12.13 | $ | 11.26 | $ | 10.24 | 29.76% | 17.05% | ||||||||||||||

| Quarter ended September 30, 2023 | $ | 14.83 | $ | 13.03 | $ | 10.85 | $ | 10.56 | 37.06% | 23.04% | ||||||||||||||

| Quarter ended June 30, 2023 | $ | 14.00 | $ | 12.40 | $ | 10.99 | $ | 10.75 | 29.03% | 14.68% | ||||||||||||||

| Quarter ended March 31, 2023 | $ | 14.37 | $ | 12.01 | $ | 11.55 | $ | 10.83 | 25.28% | 9.98% | ||||||||||||||

| Quarter ended December 31, 2022 | $ | 13.34 | $ | 11.73 | $ | 11.29 | $ | 10.72 | 19.32% | 8.86% | ||||||||||||||

| Quarter ended September 30, 2022 | $ | 14.42 | $ | 11.50 | $ | 11.83 | $ | 10.89 | 22.72% | 4.93% | ||||||||||||||

(1) |

Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

ANNUAL REPORT |

| | JUNE 30, 2024 | 7 |

Sales load (as a percentage of offering price) (1) |

[ ]% |

|||||||

Offering Expenses Borne by Common Shareholders (as a percentage of offering price) (2) |

[ ]% |

|||||||

Dividend Reinvestment Plan Fees (3) |

None |

|||||||

1 |

In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

2 |

The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price. |

3 |

You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Percentage of Net Assets Attributable to Common Shares (reflecting leverage attributable to ARPS and reverse repurchase agreements) |

||||||||

Management Fees (1) |

0.69% |

|||||||

Dividend Cost on Preferred Shares (2) |

0.03% |

|||||||

Interest Payments on Borrowed Funds (3) |

1.59% |

|||||||

Other Expenses (4) |

0.05% |

|||||||

Total Annual Fund Operating Expenses (5) |

2.36% |

|||||||

1. |

Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all-in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.65% based on the Fund’s average daily net assets (including daily net assets attributable to any Preferred Shares of the Fund that may be outstanding). The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the |

management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

2. |

Reflects the Fund’s outstanding Preferred Shares averaged over the fiscal year ended June 30, 2024, which represented 0.22% of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to reverse repurchase agreements), at an estimated annual dividend rate to the Fund of 6.82% (based on the weighted average Preferred Share dividend rate during the fiscal year ended June 30, 2024) and assumes the Fund will continue to pay Preferred Share dividends at the “maximum applicable rate” called for under the Fund’s Bylaws due to the ongoing failure of auctions for the ARPS. The actual dividend rate paid on the ARPS will vary over time in accordance with variations in market interest rates. |

3. |

Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the fiscal year ended June 30, 2024, which represented 17.05% of the Fund’s total average managed assets (including assets attributable to reverse repurchase agreements), at an annual interest rate cost to the Fund of 5.73%, which is the weighted average interest rate cost during the fiscal year ended June 30, 2024. The actual amount of borrowing expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls/buybacks and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Fund Operating Expenses table above, but would be reflected in the Fund’s performance results. |

4. |

Other expenses are estimated for the Fund’s current fiscal year ending June 30, 2025. |

5. |

“Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 0.74%. Excluding only distributions on Preferred Shares of 0.03%, Total Annual Fund Operating Expenses are 2.33%. |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||

Total Expenses Incurred |

$ |

24 |

$ |

74 |

$ |

126 |

$ |

270 |

||||||||||||

(1) |

The example above should not be considered a representation of future expenses. |

8 |

PIMCO CLOSED-END FUNDS |

Symbol on NYSE - PCN |

Corporate Bonds & Notes |

31.9% |

|||

Loan Participations and Assignments |

26.2% |

|||

Short-Term Instruments ‡ |

9.6% |

|||

Non-Agency Mortgage-Backed Securities |

8.4% |

|||

Asset-Backed Securities |

7.9% |

|||

Common Stocks |

7.3% |

|||

Sovereign Issues |

3.8% |

|||

Municipal Bonds & Notes |

2.1% |

|||

U.S. Government Agencies |

1.3% |

|||

Other |

1.5% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

‡ |

Includes Central Funds Used for Cash Management Purposes. |

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||

1 Year |

5 Year |

10 Year |

Commencement of Operations (12/21/01) |

|||||||||||||||

|

Market Price |

12.39% |

4.69% |

7.66% |

10.37% |

|||||||||||||

|

NAV |

15.07% |

5.79% |

7.79% |

10.60% |

|||||||||||||

|

ICE BofA US High Yield Index |

10.44% |

3.73% |

4.21% |

6.93% |

¨ | ||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Market Price |

$13.21 | |||

NAV |

$11.40 | |||

Premium/(Discount) to NAV |

15.88% | |||

Market Price Distribution Rate (2) |

10.22% | |||

NAV Distribution Rate (2) |

11.84% | |||

Total Effective Leverage (3) |

14.02% | |||

| » | Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition contributed to absolute performance, as select securities posted positive returns. |

| » | Exposure to corporate credit, notably bank loans and high yield, contributed to performance, as the asset classes posted positive returns. |

| » | At-the-market |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Interest rate swaps detracted from performance, as interest rates rose. |

| » | Holdings related to emerging market special situation investments detracted from absolute performance, as select securities posted negative returns. |

ANNUAL REPORT |

| | JUNE 30, 2024 | 9 |

Market and Net Asset Value Information |

Common share market price (1) |

Common share net asset value |

Premium (discount) as a % of net asset value |

||||||||||||||||||||||

Quarter |

High |

Low |

High |

Low |

High |

Low |

||||||||||||||||||

| Quarter ended June 30, 2024 | $ | 14.21 | $ | 12.46 | $ | 11.66 | $ | 11.35 | 22.08% | 8.82% | ||||||||||||||

| Quarter ended March 31, 2024 | $ | 13.97 | $ | 12.37 | $ | 11.68 | $ | 11.41 | 19.81% | 7.19% | ||||||||||||||

| Quarter ended December 31, 2023 | $ | 12.66 | $ | 10.75 | $ | 11.58 | $ | 10.58 | 14.93% | 1.32% | ||||||||||||||

| Quarter ended September 30, 2023 | $ | 14.24 | $ | 12.17 | $ | 11.15 | $ | 10.83 | 29.00% | 11.55% | ||||||||||||||

| Quarter ended June 30, 2023 | $ | 13.11 | $ | 12.47 | $ | 11.26 | $ | 11.03 | 17.37% | 11.84% | ||||||||||||||

| Quarter ended March 31, 2023 | $ | 14.00 | $ | 11.85 | $ | 11.75 | $ | 11.06 | 20.65% | 5.33% | ||||||||||||||

| Quarter ended December 31, 2022 | $ | 12.94 | $ | 11.51 | $ | 11.58 | $ | 11.15 | 12.25% | 2.49% | ||||||||||||||

| Quarter ended September 30, 2022 | $ | 14.52 | $ | 11.79 | $ | 12.20 | $ | 11.30 | 19.80% | 3.31% | ||||||||||||||

(1) |

Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

10 |

PIMCO CLOSED-END FUNDS |

Sales load (as a percentage of offering price) (1) |

[ ]% |

|||||||

Offering Expenses Borne by Common Shareholders (as a percentage of offering price) (2) |

[ ]% |

|||||||

Dividend Reinvestment Plan Fees (3) |

None |

|||||||

1 |

In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

2 |

The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price. |

3 |

You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Percentage of Net Assets Attributable to Common Shares (reflecting leverage attributable to ARPS and reverse repurchase agreements) |

||||||||

Management Fees (1) |

0.83% |

|||||||

Dividend Cost on Preferred Shares (2) |

0.01% |

|||||||

Interest Payments on Borrowed Funds (3) |

1.44% |

|||||||

Other Expenses (4) |

0.04% |

|||||||

Total Annual Fund Operating Expenses (5) |

2.32% |

|||||||

1. |

Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all-in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.81% of the Fund’s average daily net assets (including daily net assets attributable to any Preferred Shares of the Fund that may be outstanding). The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the |

management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

2. |

Reflects the Fund’s outstanding Preferred Shares averaged over the fiscal year ended June 30, 2024, which represented 0.15% of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to reverse repurchase agreements), at an estimated annual dividend rate to the Fund of 4.27% (based on the weighted average Preferred Share dividend rate during the fiscal year ended June 30, 2024) and assumes the Fund will continue to pay Preferred Share dividends at the “maximum applicable rate” called for under the Fund’s Bylaws due to the ongoing failure of auctions for the ARPS. The actual dividend rate paid on the ARPS will vary over time in accordance with variations in market interest rates. |

3. |

Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the fiscal year ended June 30, 2024, which represented 15.15% of the Fund’s total average managed assets (including assets attributable to reverse repurchase agreements), at an annual interest rate cost to the Fund of 5.92%, which is the weighted average interest rate cost during the fiscal year ended June 30, 2024. The actual amount of borrowing expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls/buybacks and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Fund Operating Expenses table above, but would be reflected in the Fund’s performance results. |

4. |

Other expenses are estimated for the Fund’s current fiscal year ending June 30, 2025. |

5. |

“Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 0.87%. Excluding only distributions on Preferred Shares of 0.01%, Total Annual Fund Operating Expenses are 2.31%. |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||

Total Expenses Incurred |

$ |

24 |

$ |

72 |

$ |

124 |

$ |

266 |

||||||||||||

(1) |

The example above should not be considered a representation of future expenses. |

ANNUAL REPORT |

| | JUNE 30, 2024 | 11 |

Symbol on NYSE - PHK |

Corporate Bonds & Notes |

31.0% |

|||

Loan Participations and Assignments |

18.6% |

|||

Short-Term Instruments ‡ |

12.0% |

|||

Non-Agency Mortgage-Backed Securities |

10.2% |

|||

Common Stocks |

8.6% |

|||

Asset-Backed Securities |

6.3% |

|||

Municipal Bonds & Notes |

4.6% |

|||

Sovereign Issues |

3.2% |

|||

Preferred Securities |

3.1% |

|||

U.S. Government Agencies |

1.6% |

|||

Other |

0.8% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

‡ |

Includes Central Funds Used for Cash Management Purposes. |

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||

1 Year |

5 Year |

10 Year |

Commencement of Operations (04/30/03) |

|||||||||||||||

|

Market Price |

9.17% |

1.27% |

1.70% |

7.70% |

|||||||||||||

|

NAV |

14.34% |

5.19% |

8.07% |

10.31% |

|||||||||||||

|

ICE BofA US High Yield Index |

10.44% |

3.73% |

4.21% |

6.84% |

|||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Market Price |

$4.82 | |||

NAV |

$4.56 | |||

Premium/(Discount) to NAV |

5.70% | |||

Market Price Distribution Rate (2) |

11.95% | |||

NAV Distribution Rate (2) |

12.63% | |||

Total Effective Leverage (3) |

15.27% | |||

| » | Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to absolute performance, as the securities posted positive returns. |

| » | Exposure to corporate credit, notably bank loans and high yield credit, contributed to absolute performance, as the asset classes posted positive returns. |

| » | Exposure to emerging market debt contributed to absolute performance, as the sector posted positive performance. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Holdings related to emerging market special situation investments detracted from absolute performance, as select securities posted negative returns. |

| » | Interest rate swaps detracted from performance, as interest rates rose. |

12 |

PIMCO CLOSED-END FUNDS |

Market and Net Asset Value Information |

Common share market price (1) |

Common share net asset value |

Premium (discount) as a % of net asset value |

||||||||||||||||||||||

Quarter |

High |

Low |

High |

Low |

High |

Low |

||||||||||||||||||

| Quarter ended June 30, 2024 | $ | 5.00 | $ | 4.63 | $ | 4.66 | $ | 4.55 | 7.53% | 1.54% | ||||||||||||||

| Quarter ended March 31, 2024 | $ | 5.01 | $ | 4.79 | $ | 4.68 | $ | 4.58 | 8.24% | 4.59% | ||||||||||||||

| Quarter ended December 31, 2023 | $ | 4.99 | $ | 4.16 | $ | 4.65 | $ | 4.26 | 7.54% | (2.35)% | ||||||||||||||

| Quarter ended September 30, 2023 | $ | 5.13 | $ | 4.42 | $ | 4.52 | $ | 4.38 | 14.51% | 0.91% | ||||||||||||||

| Quarter ended June 30, 2023 | $ | 5.00 | $ | 4.64 | $ | 4.59 | $ | 4.49 | 10.38% | 3.11% | ||||||||||||||

| Quarter ended March 31, 2023 | $ | 5.35 | $ | 4.71 | $ | 4.81 | $ | 4.54 | 12.53% | 1.94% | ||||||||||||||

| Quarter ended December 31, 2022 | $ | 5.05 | $ | 4.58 | $ | 4.71 | $ | 4.55 | 7.91% | 0.44% | ||||||||||||||

| Quarter ended September 30, 2022 | $ | 5.37 | $ | 4.64 | $ | 4.96 | $ | 4.63 | 9.40% | (0.22)% | ||||||||||||||

(1) |

Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

ANNUAL REPORT |

| | JUNE 30, 2024 | 13 |

Sales load (a s a percentage of offering price )(1) |

[ ]% |

|||||||

Offering Expenses Borne by Common Shareholders (as a percentage of offering price) (2) |

[ ]% |

|||||||

Dividend Reinvestment Plan Fees (3) |

None |

|||||||

1 |

In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

2 |

The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price. |

3 |

You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Percentage of Net Assets Attributable to Common Shares (reflecting leverage attributable to ARPS and reverse repurchase agreements) |

||||||||

Management Fees (1) |

0.80% |

|||||||

Dividend Cost on Preferred Shares (2) |

0.01% |

|||||||

Interest Payments on Borrowed Funds (3) |

2.06% |

|||||||

Other Expenses (4) |

0.05% |

|||||||

Total Annual Fund Operating Expenses (5) |

2.92% |

|||||||

1. |

Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all-in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.76% of the Fund’s average daily net assets (including daily net assets attributable to any Preferred Shares of the Fund that may be outstanding). The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the |

management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

2. |

Reflects the Fund’s outstanding Preferred Shares averaged over the fiscal year ended June 30, 2024, which represented 0.21% of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to reverse repurchase agreements), at an estimated annual dividend rate to the Fund of 4.26% (based on the weighted average Preferred Share dividend rate during the fiscal year ended June 30, 2024) and assumes the Fund will continue to pay Preferred Share dividends at the “maximum applicable rate” called for under the Fund’s Bylaws due to the ongoing failure of auctions for the ARPS. The actual dividend rate paid on the ARPS will vary over time in accordance with variations in market interest rates. |

3. |

Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the fiscal year ended June 30, 2024, which represented 14.59% of the Fund’s total average managed assets (including assets attributable to reverse repurchase agreements), at an annual interest rate cost to the Fund of 5.80%, which is the weighted average interest rate cost during the fiscal year ended June 30, 2024. The actual amount of borrowing expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls/buybacks and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Fund Operating Expenses table above, but would be reflected in the Fund’s performance results. |

4. |

Other expenses are estimated for the Fund’s current fiscal year ending June 30, 2025. |

5. |

“Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 0.85%. Excluding only distributions on Preferred Shares of 0.01%, Total Annual Fund Operating Expenses are 2.91%. |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||

Total Expenses Incurred |

$ |

30 |

$ |

90 |

$ |

154 |

$ |

324 |

||||||||||||

(1) |

The example above should not be considered a representation of future expenses. |

14 |

PIMCO CLOSED-END FUNDS |

Symbol on NYSE - PFL |

Corporate Bonds & Notes |

31.5% |

|||

Loan Participations and Assignments |

28.5% |

|||

Non-Agency Mortgage-Backed Securities |

9.5% |

|||

Common Stocks |

8.8% |

|||

Short-Term Instruments ‡ |

8.5% |

|||

Asset-Backed Securities |

5.7% |

|||

Sovereign Issues |

2.8% |

|||

Municipal Bonds & Notes |

2.3% |

|||

U.S. Government Agencies |

1.3% |

|||

Other |

1.1% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

‡ |

Includes Central Funds Used for Cash Management Purposes. |

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||

1 Year |

5 Year |

10 Year |

Commencement of Operations (08/29/03) |

|||||||||||||||

|

Market Price |

12.60% |

3.55% |

6.55% |

6.38% |

|||||||||||||

|

NAV |

14.02% |

4.48% |

6.28% |

6.54% |

|||||||||||||

|

ICE BofA US High Yield Index |

10.44% |

3.73% |

4.21% |

6.76% ¨ |

|||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Market Price |

$ |

|||

NAV |

$ |

|||

Premium/(Discount) to NAV |

||||

Market Price Distribution Rate (2) |

11.99% | |||

NAV Distribution Rate (2) |

12.46% | |||

Total Effective Leverage (3) |

17.66% | |||

| » | Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to absolute performance, as the securities posted positive returns. |

| » | Exposure to corporate credit, notably bank loans and high yield, contributed to absolute performance, as the asset classes posted positive returns. |

| » | Exposure to emerging market debt contributed to absolute performance, as the sector posted positive performance. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Interest Rate swaps detracted from performance, as interest rates rose. |

| » | Holdings related to emerging market special situation investments detracted from absolute performance, as select securities posted negative returns. |

ANNUAL REPORT |

| | JUNE 30, 2024 | 15 |

Market and Net Asset Value Information |

Common share market price (1) |

Common share net asset value |

Premium (discount) as a % of net asset value |

||||||||||||||||||||||

Quarter |

High |

Low |

High |

Low |

High |

Low |

||||||||||||||||||

| Quarter ended June 30, 2024 | $ | $ | $ | $ | ||||||||||||||||||||

| Quarter ended March 31, 2024 | $ | $ | $ | $ | ||||||||||||||||||||

| Quarter ended December 31, 2023 | $ | $ | $ | $ | ( |

|||||||||||||||||||

| Quarter ended September 30, 2023 | $ | $ | $ | $ | ( |

|||||||||||||||||||

| Quarter ended June 30, 2023 | $ | $ | $ | $ | ||||||||||||||||||||

| Quarter ended March 31, 2023 | $ | $ | $ | $ | ||||||||||||||||||||

| Quarter ended December 31, 2022 | $ | $ | $ | $ | ( |

|||||||||||||||||||

| Quarter ended September 30, 2022 | $ | |

$ | |

$ | |

$ | |

( |

|||||||||||||||

(1) |

mark-up, mark-down or commission and may not represent actual transactions. |

16 |

PIMCO CLOSED-END FUNDS |

Sales load ( (1) |

||||||||

Offering Expenses Borne by Common Shareholders ( (2) |

||||||||

Dividend Reinvestment Plan Fees (3) |

||||||||

1 |

In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

2 |

3 |

You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Percentage of Net Assets Attributable to Common Shares (reflecting leverage attributable to ARPS and reverse repurchase agreements) |

||||||||

Management Fees (1) |

||||||||

Dividend Cost on Preferred Shares (2) |

||||||||

Interest Payments on Borrowed Funds (3) |

||||||||

Other Expenses (4) |

||||||||

Total Annual Fund Operating Expenses (5) |

||||||||

1. |

Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all-in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.86% of the Fund’s average weekly total managed assets. “Total managed assets” includes the total assets of the Fund (including any assets attributable to any Preferred Shares or other forms of leverage that may be outstanding) minus accrued liabilities (other than liabilities representing leverage). |

The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

2. |

Reflects the Fund’s outstanding Preferred Shares averaged over the fiscal year ended June 30, 2024, which represented 0.25% of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to reverse repurchase agreements), at an estimated annual dividend rate to the Fund of 4.28% (based on the weighted average Preferred Share dividend rate during the fiscal year ended June 30, 2024) and assumes the Fund will continue to pay Preferred Share dividends at the “maximum applicable rate” called for under the Fund’s Bylaws due to the ongoing failure of auctions for the ARPS. The actual dividend rate paid on the ARPS will vary over time in accordance with variations in market interest rates. |

3. |

Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the fiscal year ended June 30, 2024, which represented 16.73% of the Fund’s total average managed assets (including assets attributable to reverse repurchase agreements), at an annual interest rate cost to the Fund of 5.73%, which is the weighted average interest rate cost during the fiscal year ended June 30, 2024. The actual amount of borrowing expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls/buybacks and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Fund Operating Expenses table above, but would be reflected in the Fund’s performance results. |

4. |

5. |

“Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 1.18%. Excluding only distributions on Preferred Shares of 0.01%, Total Annual Fund Operating Expenses are 3.34%. |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||

Total Expenses Incurred |

$ |

$ |

$ |

$ |

||||||||||||||||

(1) |

The example above should not be considered a representation of future expenses. |

ANNUAL REPORT |

| | JUNE 30, 2024 | 17 |

Symbol on NYSE - PFN |

Loan Participations and Assignments |

28.3% |

|||

Corporate Bonds & Notes |

28.0% |

|||

Non-Agency Mortgage-Backed Securities |

11.2% |

|||

Short-Term Instruments ‡ |

10.4% |

|||

Common Stocks |

9.4% |

|||

Asset-Backed Securities |

4.8% |

|||

Sovereign Issues |

2.9% |

|||

Municipal Bonds & Notes |

2.3% |

|||

U.S. Government Agencies |

1.4% |

|||

Other |

1.3% |

|||

† |

% of Investments, at value. |

§ |

Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

‡ |

Includes Central Funds Used for Cash Management Purposes. |

Average Annual Total Return (1) for the period ended June 30, 2024 |

||||||||||||||||||

1 Year |

5 Year |

10 Year |

Commencement of Operations (10/29/04) |

|||||||||||||||

|

Market Price |

12.55% |

3.23% |

6.53% |

5.71% |

|||||||||||||

|

NAV |

14.13% |

3.99% |

6.22% |

5.81% |

|||||||||||||

|

ICE BofA US High Yield Index |

10.44% |

3.73% |

4.21% |

6.30% ¨ |

|||||||||||||

(1) |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. Total return, market price, NAV, market price distribution rate, and NAV distribution rate will fluctuate with changes in market conditions. The NAV presented may differ from the NAV reported for the same period in other Fund materials. Performance current to the most recent month-end is available at www.pimco.com or via (844) 33-PIMCO. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect any brokerage commissions in connection with the purchase or sale of Fund shares. |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance. Please see Additional Information Regarding the Funds for a description of the Fund’s principal investment strategies. |

(2) |

Distribution rates are not performance and are calculated by annualizing the most recent distribution per share and dividing by the NAV or market price, as applicable, as of the reported date. Distributions may be comprised of ordinary income, net capital gains, and/or a return of capital (‘‘ROC’’) of your investment in the Fund. Because the distribution rate may include a ROC, it should not be confused with yield or income. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income in accordance with its policies and good accounting practices, the Fund will notify shareholders of the estimated composition of such distribution through a Section 19 Notice. Please refer to the most recent Section 19 Notice, if applicable, for additional information regarding the estimated composition of distributions. Please visit www.pimco.com for most recent Section 19 Notice, if applicable. Final determination of a distribution’s tax character will be made on Form 1099 DIV sent to shareholders each January. |

(3) |

Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Market Price |

$7.17 | |||

NAV |

$6.92 | |||

Premium/(Discount) to NAV |

3.61% | |||

Market Price Distribution Rate (2) |

12.02% | |||

NAV Distribution Rate (2) |

12.45% | |||

Total Effective Leverage (3) |

16.19% | |||

| » | Holdings related to corporate special situation investments, which include companies undergoing stress, distress, challenges or significant transition, contributed to absolute performance, as the securities posted positive returns. |

| » | Exposure to corporate credit, notably bank loans and high yield credit, contributed to absolute performance, as the asset classes posted positive returns. |

| » | Exposure to emerging market debt contributed to absolute performance, as the sector posted positive performance. |

| » | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | Active interest rate positioning detracted from performance, as interest rates rose. |

| » | Holdings related to emerging market special situation investments detracted from absolute performance, as select securities posted negative returns. |

18 |

PIMCO CLOSED-END FUNDS |

Market and Net Asset Value Information |

Common share market price (1) |

Common share net asset value |

Premium (discount) as a % of net asset value |

||||||||||||||||||||||

Quarter |

High |

Low |

High |

Low |

High |

Low |

||||||||||||||||||

Quarter ended June 30, 2024 |

$ |

7.53 |

$ |

7.01 |

$ |

7.14 |

$ |

6.92 |

6.01% |

0.57% |

||||||||||||||

Quarter ended March 31, 2024 |

$ |

7.54 |

$ |

7.21 |

$ |

7.17 |

$ |

7.01 |

7.26% |

1.69% |

||||||||||||||

Quarter ended December 31, 2023 |

$ |

7.23 |

$ |

6.02 |

$ |

7.12 |

$ |

6.46 |

3.18% |

(7.24)% |

||||||||||||||

Quarter ended September 30, 2023 |

$ |

7.27 |

$ |

6.51 |

$ |

6.85 |

$ |

6.66 |

6.94% |

(2.54)% |

||||||||||||||

Quarter ended June 30, 2023 |

$ |

7.25 |

$ |

6.84 |

$ |

6.96 |

$ |

6.81 |

5.25% |

0.00% |

||||||||||||||

Quarter ended March 31, 2023 |

$ |

8.00 |

$ |

6.94 |

$ |

7.41 |

$ |

6.86 |

8.47% |

(0.28)% |

||||||||||||||

Quarter ended December 31, 2022 |

$ |

7.70 |

$ |

6.77 |

$ |

7.22 |

$ |

6.94 |

6.80% |

(2.73)% |

||||||||||||||

Quarter ended September 30, 2022 |

$ |

8.39 |

$ |

6.91 |

$ |

7.69 |

$ |

7.06 |

9.87% |

(3.35)% |

||||||||||||||

(1) |

Such prices reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. |

ANNUAL REPORT |

| | JUNE 30, 2024 | 19 |

Sales load (as a percentage of offering price) (1) |

[ ]% |

|||||||

Offering Expenses Borne by Common Shareholders (as a percentage of offering price) (2) |

[ ]% |

|||||||

Dividend Reinvestment Plan Fees (3) |

None |

|||||||

1 |

In the event that the Common Shares to which this relates are sold to or through underwriters or dealer managers, a corresponding supplement will disclose the applicable sale load and/or commission. |

2 |

The related supplement will disclose the estimated amount of offering expense, the offering price and the offering expenses borne by the Fund and indirectly by all of its Common Shareholders as a percentage of the offering price. |

3 |

You will pay broker chargers if you direct your broker or the plan agent to sell your Common Shares that you acquired pursuant to a dividend reinvestment plan. You may also pay a pro rata share of brokerage commissions incurred in connection with open market purchase pursuant to the Fund’s Dividend Reinvestment Plan. |

Percentage of Net Assets Attributable to Common Shares (reflecting leverage attributable to ARPS and reverse repurchase agreements) |

||||||||

Management Fees (1) |

1.06% |

|||||||

Dividend Cost on Preferred Shares (2) |

0.06% |

|||||||

Interest Payments on Borrowed Funds (3) |

1.96% |

|||||||

Other Expenses (4) |

0.07% |

|||||||

Total Annual Fund Operating Expenses (5) |

3.15% |

|||||||

1. |

Management fees include fees payable to the Investment Manager for advisory services and for supervisory, administrative and other services. The Fund pays for the advisory, supervisory and administrative services it requires under what is essentially an all-in fee structure. Pursuant to an investment management agreement, PIMCO is paid a Management Fee of 0.83% of the Fund’s average weekly total managed assets. “Total managed assets” includes the total assets of the Fund (including any assets attributable to any Preferred Shares or other forms of leverage that may be outstanding) minus accrued liabilities (other than liabilities representing leverage). |

The Fund (and not PIMCO) will be responsible for certain fees and expenses which are, reflected in the table above, that are not covered by the management fee under the investment management agreement. Please see Note 9, Fees and Expenses in the Notes to Financial Statements for an explanation of the management fee. |

2. |

Reflects the Fund’s outstanding Preferred Shares averaged over the fiscal year ended June 30, 2024, which represented 0.46% of the Fund’s total average managed assets (including the liquidation preference of outstanding Preferred Shares and assets attributable to reverse repurchase agreements), at an estimated annual dividend rate to the Fund of 6.87% (based on the weighted average Preferred Share dividend rate during the fiscal year ended June 30, 2024) and assumes the Fund will continue to pay Preferred Share dividends at the “maximum applicable rate” called for under the Fund’s Bylaws due to the ongoing failure of auctions for the ARPS. The actual dividend rate paid on the ARPS will vary over time in accordance with variations in market interest rates. |

3. |

Reflects the Fund’s use of leverage in the form of reverse repurchase agreements averaged over the fiscal year ended June 30, 2024, which represented 16.68% of the Fund’s total average managed assets (including assets attributable to reverse repurchase agreements), at an annual interest rate cost to the Fund of 5.75%, which is the weighted average interest rate cost during the fiscal year ended June 30, 2024. The actual amount of borrowing expense borne by the Fund will vary over time in accordance with the level of the Fund’s use of reverse repurchase agreements, dollar rolls/buybacks and/or borrowings and variations in market interest rates. Borrowing expense is required to be treated as an expense of the Fund for accounting purposes. Any associated income or gains (or losses) realized from leverage obtained through such instruments is not reflected in the Annual Fund Operating Expenses table above, but would be reflected in the Fund’s performance results. |

4. |

Other expenses are estimated for the Fund’s current fiscal year ending June 30, 2025. |

5. |

“Dividend Cost on Preferred Shares”, including distributions on Preferred Shares, and “Interest Payments on Borrowed Funds” are borne by the Fund separately from management fees paid to PIMCO. Excluding these expenses, Total Annual Fund Operating Expenses are 1.13%. Excluding only distributions on Preferred Shares of 0.06%, Total Annual Fund Operating Expenses are 3.09%. |

1 Year |

3 Years |

5 Years |

10 Years |

|||||||||||||||||

Total Expenses Incurred |

$ |

32 |

$ |

97 |

$ |

165 |

$ |

346 |

||||||||||||

(1) |

The example above should not be considered a representation of future expenses. |

20 |

PIMCO CLOSED-END FUNDS |

Index Descriptions |

Index |

Index Description | |

| ICE BofA US High Yield Index | ICE BofA US High Yield Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. Qualifying bonds must have at least one year remaining term to maturity, a fixed coupon schedule and a minimum amount outstanding of USD 100 million. Bonds must be rated below investment grade based on a composite of Moody’s and S&P. | |

ANNUAL REPORT |

| | JUNE 30, 2024 | 21 |

Financial Highlights |

Investment Operations |

Less Distributions to ARPS (c) |

Less Distributions to Common Shareholders (d) |

||||||||||||||||||||||||||||||||||||||

| Selected Per Share Data for the Year or Period Ended^: | Net Asset Value Beginning of Year or Period (a) |

Net Investment Income (Loss) (b) |

Net Realized/ Unrealized Gain (Loss) |

From Net Investment Income |

From Net Realized Capital Gains |

Net Increase (Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations |

From Net Investment Income |

From Net Realized Capital Gains |

Tax Basis Return of Capital |

Total |

||||||||||||||||||||||||||||||

PIMCO Corporate & Income Opportunity Fund |

||||||||||||||||||||||||||||||||||||||||

06/30/2024 |

$ | 10.83 | $ | 1.11 | $ | 0.33 | $ | (0.07 | ) | $ | 0.00 | $ | 1.37 | $ | (0.95 | ) | $ | 0.00 | $ | (0.48 | ) | $ | (1.43 | ) | ||||||||||||||||

06/30/2023 |

11.21 | 1.32 | (0.25 | ) | (0.12 | ) | 0.00 | 0.95 | (1.58 | ) | 0.00 | 0.00 | (1.58 | ) | ||||||||||||||||||||||||||

08/01/2021 - 06/30/2022 (i) |

14.40 | 1.21 | (3.22 | ) | (0.01 | ) | 0.00 | (2.02 | ) | (1.32 | ) | 0.00 | 0.00 | (1.32 | ) (j) | |||||||||||||||||||||||||

07/31/2021 |

12.44 | 1.32 | 1.78 | 0.00 | 0.00 | 3.10 | (1.22 | ) | 0.00 | (0.34 | ) | (1.56 | ) | |||||||||||||||||||||||||||

07/31/2020 |

14.66 | 1.36 | (2.41 | ) | (0.05 | ) | 0.00 | (1.10 | ) | (1.59 | ) | 0.00 | 0.00 | (1.59 | ) | |||||||||||||||||||||||||

07/31/2019 |

14.80 | (h) |

1.36 | 0.09 | (0.13 | ) | 0.00 | 1.32 | (1.63 | ) | 0.00 | 0.00 | (1.63 | ) | ||||||||||||||||||||||||||

07/31/2018 |

14.87 | 1.30 | 0.16 | (0.09 | ) | 0.00 | 1.37 | (1.56 | ) | 0.00 | 0.00 | (1.56 | ) | |||||||||||||||||||||||||||

07/31/2017 |

13.27 | 1.21 | 2.06 | (0.04 | ) | 0.00 | 3.23 | (1.59 | ) | 0.00 | (0.14 | ) | (1.73 | ) | ||||||||||||||||||||||||||

07/31/2016 |

14.23 | 1.30 | (0.65 | ) | (0.02 | ) | 0.00 | 0.63 | (1.59 | ) | 0.00 | 0.00 | (1.59 | ) | ||||||||||||||||||||||||||

12/01/2014 - 07/31/2015 (k) |

15.41 | 0.68 | (0.33 | ) | (0.00 | ) | 0.00 | 0.35 | (1.69 | ) | 0.00 | 0.00 | (1.69 | ) (l) | ||||||||||||||||||||||||||

11/30/2014 |

16.62 | 1.14 | 1.06 | (0.00 | ) | (0.01 | ) | 2.19 | (1.56 | ) | (1.84 | ) | 0.00 | (3.40 | ) | |||||||||||||||||||||||||

11/30/2013 |

17.58 | 1.43 | 0.19 | (0.00 | ) | (0.00 | ) | 1.62 | (1.82 | ) | (0.76 | ) | 0.00 | (2.58 | ) | |||||||||||||||||||||||||

PIMCO Corporate & Income Strategy Fund |

||||||||||||||||||||||||||||||||||||||||

06/30/2024 |

$ | 11.14 | $ | 1.01 | $ | 0.37 | $ | (0.02 | ) | $ | 0.00 | $ | 1.36 | $ | (1.00 | ) | $ | 0.00 | $ | (0.35 | ) | $ | (1.35 | ) | ||||||||||||||||

06/30/2023 |

11.60 | 1.19 | (0.27 | ) | (0.03 | ) | 0.00 | 0.89 | (1.50 | ) | 0.00 | 0.00 | (1.50 | ) | ||||||||||||||||||||||||||

08/01/2021 - 06/30/2022 (i) |

14.54 | 1.11 | (2.93 | ) | 0.00 | 0.00 | (1.82 | ) | (1.24 | ) | 0.00 | 0.00 | (1.24 | ) (j) | ||||||||||||||||||||||||||

07/31/2021 |

12.76 | 1.24 | 1.77 | 0.00 | 0.00 | 3.01 | (1.35 | ) | 0.00 | 0.00 | (1.35 | ) | ||||||||||||||||||||||||||||

07/31/2020 |

14.94 | 1.31 | (2.07 | ) | (0.01 | ) | 0.00 | (0.77 | ) | (1.41 | ) | 0.00 | 0.00 | (1.41 | ) | |||||||||||||||||||||||||

07/31/2019 |

14.90 | (h) |

1.22 | 0.20 | (0.05 | ) | 0.00 | 1.37 | (1.43 | ) | 0.00 | 0.00 | (1.43 | ) | ||||||||||||||||||||||||||

07/31/2018 |

15.32 | 1.20 | (0.24 | ) | (0.03 | ) | 0.00 | 0.93 | (1.35 | ) | 0.00 | 0.00 | (1.35 | ) | ||||||||||||||||||||||||||

07/31/2017 |

14.28 | 1.12 | 1.70 | (0.01 | ) | 0.00 | 2.81 | (1.75 | ) | 0.00 | (0.02 | ) | (1.77 | ) | ||||||||||||||||||||||||||

07/31/2016 |

14.75 | 1.24 | (0.84 | ) | (0.01 | ) | 0.00 | 0.39 | (1.37 | ) | 0.00 | 0.00 | (1.37 | ) | ||||||||||||||||||||||||||

11/01/2014 - 07/31/2015 (m) |

15.60 | 0.73 | (0.21 | ) | (0.00 | ) | 0.00 | 0.52 | (1.37 | ) | 0.00 | 0.00 | (1.37 | ) (l) | ||||||||||||||||||||||||||

10/31/2014 |

16.04 | 0.99 | 0.87 | (0.00 | ) | (0.00 | ) | 1.86 | (1.35 | ) | (0.95 | ) | 0.00 | (2.30 | ) | |||||||||||||||||||||||||

10/31/2013 |

15.90 | 1.28 | 0.44 | (0.01 | ) | 0.00 | 1.71 | (1.57 | ) | 0.00 | 0.00 | (1.57 | ) | |||||||||||||||||||||||||||

PIMCO High Income Fund |

||||||||||||||||||||||||||||||||||||||||

06/30/2024 |

$ | 4.51 | $ | 0.40 | $ | 0.22 | $ | (0.02 | ) | $ | 0.00 | $ | 0.60 | $ | (0.48 | ) | $ | 0.00 | $ | (0.10 | ) | $ | (0.58 | ) | ||||||||||||||||

06/30/2023 |

4.72 | 0.48 | (0.10 | ) | (0.03 | ) | 0.00 | 0.35 | (0.58 | ) | 0.00 | 0.00 | (0.58 | ) | ||||||||||||||||||||||||||

08/01/2021 - 06/30/2022 (i) |

5.92 | 0.47 | (1.14 | ) | 0.00 | 0.00 | (0.67 | ) | (0.53 | ) | 0.00 | 0.00 | (0.53 | ) (j) | ||||||||||||||||||||||||||

07/31/2021 |

5.01 | 0.56 | 0.93 | 0.00 | 0.00 | 1.49 | (0.44 | ) | 0.00 | (0.14 | ) | (0.58 | ) | |||||||||||||||||||||||||||

07/31/2020 |

6.38 | 0.65 | (1.30 | ) | (0.01 | ) | 0.00 | (0.66 | ) | (0.68 | ) | 0.00 | (0.03 | ) | (0.71 | ) | ||||||||||||||||||||||||

07/31/2019 |

6.54 | (h) |

0.61 | 0.11 | (0.03 | ) | 0.00 | 0.69 | (0.73 | ) | 0.00 | (0.16 | ) | (0.89 | ) | |||||||||||||||||||||||||

07/31/2018 |

6.90 | 0.62 | 0.01 | (0.02 | ) | 0.00 | 0.61 | (0.84 | ) | 0.00 | (0.13 | ) | (0.97 | ) | ||||||||||||||||||||||||||

07/31/2017 |

6.63 | 0.67 | 0.71 | (0.01 | ) | 0.00 | 1.37 | (0.91 | ) | 0.00 | (0.19 | ) | (1.10 | ) | ||||||||||||||||||||||||||

07/31/2016 |

7.37 | 0.74 | (0.48 | ) | (0.00 | ) | 0.00 | 0.26 | (1.18 | ) | 0.00 | (0.08 | ) | (1.26 | ) | |||||||||||||||||||||||||

04/01/2015 - 07/31/2015 (n) |

7.59 | 0.21 | 0.06 | (0.00 | ) | 0.00 | 0.27 | (0.33 | ) | 0.00 | (0.16 | ) | (0.49 | ) (l) | ||||||||||||||||||||||||||

03/31/2015 |

8.23 | 0.94 | (0.12 | ) | (0.00 | ) | 0.00 | 0.82 | (1.46 | ) | 0.00 | 0.00 | (1.46 | ) | ||||||||||||||||||||||||||

03/31/2014 |

8.65 | 0.84 | 0.20 | (0.00 | ) | 0.00 | 1.04 | (1.35 | ) | 0.00 | (0.11 | ) | (1.46 | ) | ||||||||||||||||||||||||||

PIMCO Income Strategy Fund |

||||||||||||||||||||||||||||||||||||||||

06/30/2024 |

$ | 7.77 | $ | 0.74 | $ | 0.27 | $ | (0.04 | ) | $ | 0.00 | $ | 0.97 | $ | (0.64 | ) | $ | 0.00 | $ | (0.34 | ) | $ | (0.98 | ) | ||||||||||||||||

06/30/2023 |

8.39 | 0.86 | (0.44 | ) | (0.09 | ) | 0.00 | 0.33 | (0.98 | ) | 0.00 | 0.00 | (0.98 | ) | ||||||||||||||||||||||||||

08/01/2021 - 06/30/2022 (i) |

10.66 | 0.75 | (2.11 | ) | (0.02 | ) | 0.00 | (1.38 | ) | (0.90 | ) | 0.00 | 0.00 | (0.90 | ) (j) | |||||||||||||||||||||||||

07/31/2021 |

9.46 | 0.91 | 1.32 | (0.02 | ) | 0.00 | 2.21 | (0.84 | ) | 0.00 | (0.24 | ) | (1.08 | ) | ||||||||||||||||||||||||||

07/31/2020 |

11.00 | 1.01 | (1.52 | ) | (0.04 | ) | 0.00 | (0.55 | ) | (0.97 | ) | 0.00 | (0.11 | ) | (1.08 | ) | ||||||||||||||||||||||||

07/31/2019 |

11.14 | (h) |

0.90 | 0.02 | (0.07 | ) | 0.00 | 0.85 | (0.99 | ) | 0.00 | (0.09 | ) | (1.08 | ) | |||||||||||||||||||||||||

07/31/2018 |

11.60 | 0.87 | (0.19 | ) | (0.06 | ) | 0.00 | 0.62 | (1.07 | ) | 0.00 | (0.01 | ) | (1.08 | ) | |||||||||||||||||||||||||

07/31/2017 |

10.53 | 0.88 | 1.31 | (0.04 | ) | 0.00 | 2.15 | (1.08 | ) | 0.00 | 0.00 | (1.08 | ) | |||||||||||||||||||||||||||

07/31/2016 |

11.46 | 0.88 | (0.70 | ) | (0.03 | ) | 0.00 | 0.15 | (1.08 | ) | 0.00 | 0.00 | (1.08 | ) | ||||||||||||||||||||||||||

07/31/2015 |

12.15 | 0.79 | (0.34 | ) | (0.03 | ) | 0.00 | 0.42 | (1.22 | ) | 0.00 | 0.00 | (1.22 | ) | ||||||||||||||||||||||||||

07/31/2014 |

11.70 | 0.79 | 0.78 | (0.04 | ) | 0.00 | 1.53 | (1.08 | ) | 0.00 | 0.00 | (1.08 | ) | |||||||||||||||||||||||||||

22 |

PIMCO CLOSED-END FUNDS |

See Accompanying Notes |

Common Share |

Ratios/Supplemental Data |

|||||||||||||||||||||||||||||||||||||||||||||||||

Ratios to Average Net Assets (f)(o) |

||||||||||||||||||||||||||||||||||||||||||||||||||

Increase resulting from Common Share offering |

Offering Cost Charged to Paid in Capital |

Increase Resulting from Tender of ARPS (c) |

Net Asset Value End of Year or Period (a) |

Market Price End of Year or Period |

Total Investment Return (e) |

Net Assets Applicable to Common Shareholders End of Year or Period (000s) |

Expenses (g) |

Expenses Excluding Waivers (g) |

Expenses Excluding Interest Expense |

Expenses Excluding Interest Expense and Waivers |

Net Investment Income (Loss) |

Portfolio Turnover Rate |

||||||||||||||||||||||||||||||||||||||

| |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

| $ | 0.35 | $ | 0.00 | $ | 0.05 | $ | 11.17 | $ | 14.31 | 13.77 | % | $ | 1,817,343 | 2.33 | % | 2.33 | % | 0.74 | % | 0.74 | % | 10.07 | % | 31 | % | |||||||||||||||||||||||||

| 0.25 | 0.00 | 0.00 | 10.83 | 14.00 | 27.06 | 1,532,891 | 2.23 | 2.23 | 0.78 | 0.78 | 11.80 | 35 | ||||||||||||||||||||||||||||||||||||||

| 0.15 | 0.00 | 0.00 | 11.21 | 12.51 | (33.71 | ) | 1,361,439 | 1.13 | * | 1.13 | * | 0.77 | * | 0.77 | * | 9.86 | * | 58 | ||||||||||||||||||||||||||||||||

| 0.42 | 0.00 | 0.00 | 14.40 | 20.56 | 46.75 | 1,643,538 | 1.06 | 1.06 | 0.76 | 0.76 | 9.60 | 58 | ||||||||||||||||||||||||||||||||||||||

| 0.47 | (0.00 | ) | 0.00 | 12.44 | 15.34 | (8.77 | ) | 1,248,837 | 1.30 | 1.30 | 0.82 | 0.82 | 10.20 | 34 | ||||||||||||||||||||||||||||||||||||

| 0.15 | 0.00 | 0.02 | 14.66 | 18.60 | 14.48 | 1,291,233 | 1.35 | 1.35 | 0.80 | 0.80 | 9.44 | 22 | ||||||||||||||||||||||||||||||||||||||

| 0.12 | 0.00 | 0.00 | 14.80 | (h) |

17.95 | 16.78 | 1,219,515 | 1.26 | 1.26 | 0.81 | 0.81 | 8.73 | 19 | |||||||||||||||||||||||||||||||||||||

| 0.10 | 0.00 | 0.00 | 14.87 | 16.92 | 29.18 | 1,140,768 | 1.08 | 1.08 | 0.83 | 0.83 | 8.68 | 39 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 13.27 | 14.75 | 16.09 | 946,843 | 0.89 | 0.89 | 0.85 | 0.85 | 9.93 | 45 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.16 | 14.23 | 14.31 | (13.61 | ) | 1,006,484 | 0.91 | * | 0.91 | * | 0.90 | * | 0.90 | * | 7.01 | * | 34 | ||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 15.41 | 18.50 | 26.04 | 1,082,000 | 0.91 | 0.91 | 0.91 | 0.91 | 7.36 | 44 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 16.62 | 17.75 | (0.15 | ) | 1,149,779 | 0.91 | 0.91 | 0.91 | 0.91 | 8.49 | 118 | |||||||||||||||||||||||||||||||||||||

| $ | 0.22 | $ | 0.00 | $ | 0.03 | $ | 11.40 | $ | 13.21 | 12.39 | % | $ | 657,867 | 2.31 | % | 2.31 | % | 0.87 | % | 0.87 | % | 8.96 | % | 28 | % | |||||||||||||||||||||||||

| 0.15 | 0.00 | 0.00 | 11.14 | 13.11 | 17.15 | 551,441 | 2.40 | 2.40 | 0.89 | 0.89 | 10.38 | 29 | ||||||||||||||||||||||||||||||||||||||

| 0.12 | 0.00 | 0.00 | 11.60 | 12.65 | (27.59 | ) | 509,542 | 1.22 | * | 1.22 | * | 0.88 | * | 0.88 | * | 8.89 | * | 47 | ||||||||||||||||||||||||||||||||

| 0.12 | (0.00 | ) | 0.00 | 14.54 | 18.93 | 34.41 | 605,830 | 1.15 | 1.15 | 0.87 | 0.87 | 8.95 | 48 | |||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 12.76 | 15.29 | (7.72 | ) | 509,488 | 1.57 | 1.57 | 0.87 | 0.87 | 9.57 | 31 | |||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.10 | 14.94 | 18.08 | 9.20 | 591931 | 1.60 | 1.60 | 0.94 | 0.94 | 8.39 | 18 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 14.90 | (h) |

18.09 | 9.61 | 586,592 | 1.36 | 1.36 | 0.94 | 0.94 | 7.97 | 20 | |||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 15.32 | 17.92 | 30.63 | 599,266 | 1.17 | 1.17 | 0.93 | 0.93 | 7.65 | 38 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.51 | 14.28 | 15.43 | 24.21 | 553,569 | 1.10 | 1.10 | 1.02 | 1.02 | 8.91 | 43 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 14.75 | 13.71 | (7.12 | ) | 570,122 | 1.07 | * | 1.07 | * | 1.07 | * | 1.07 | * | 6.51 | * | 40 | ||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 15.60 | 16.18 | 8.84 | 599,980 | 1.09 | 1.09 | 1.09 | 1.09 | 6.32 | 48 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 16.04 | 17.15 | 3.48 | 612,225 | 1.10 | 1.10 | 1.09 | 1.09 | 7.91 | 108 | ||||||||||||||||||||||||||||||||||||||

| $ | 0.01 | $ | 0.00 | $ | 0.02 | $ | 4.56 | $ | 4.82 | 9.17 | % | $ | 720,939 | 2.91 | % | 2.91 | % | 0.85 | % | 0.85 | % | 8.95 | % | 29 | % | |||||||||||||||||||||||||

| 0.02 | 0.00 | 0.00 | 4.51 | 5.00 | 9.20 | 667,041 | 2.70 | 2.70 | 0.92 | 0.92 | 10.14 | 27 | ||||||||||||||||||||||||||||||||||||||

| 0.00 | 0.00 | 0.00 | 4.72 | 5.17 | (18.39 | ) | 640,448 | 1.18 | * | 1.18 | * | 0.86 | * | 0.86 | * | 9.30 | * | 37 | ||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 5.92 | 6.95 | 47.82 | 792,773 | 1.14 | 1.14 | 0.86 | 0.86 | 9.96 | 60 | ||||||||||||||||||||||||||||||||||||||

| N/A | N/A | 0.00 | 5.01 | 5.18 | (27.55 | ) | 664,144 | 1.73 | 1.73 | 0.86 | 0.86 | 11.42 | 40 | |||||||||||||||||||||||||||||||||||||