SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

INFORMATION ABOUT THE MANAGED DURATION

INVESTMENT GRADE MUNICIPAL FUND

|

·

|

Daily, weekly and monthly data on share prices, distributions and more

|

|

·

|

Portfolio overviews and performance analyses

|

|

·

|

Announcements, press releases and special notices and tax characteristics

|

|

(Unaudited)

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 3

|

DEAR SHAREHOLDER (Unaudited) continued

|

July 31, 2016

|

Chief Executive Officer and President

Managed Duration Investment Grade Municipal Fund

August 31, 2016

4 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited)

|

July 31, 2016

|

Senior Portfolio Manager

Head of U.S. Fixed Income

Senior Portfolio Manager

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 5

|

QUESTIONS & ANSWERS (Unaudited) continued

|

July 31, 2016

|

6 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 7

|

QUESTIONS & ANSWERS (Unaudited) continued

|

July 31, 2016

|

8 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 9

|

QUESTIONS & ANSWERS (Unaudited) continued

|

July 31, 2016

|

10 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 11

|

FUND SUMMARY (Unaudited)

|

July 31, 2016

|

|

|

|

|

Fund Statistics

|

|

|

Symbol on New York Stock Exchange

|

MZF

|

|

Initial Offering Date

|

August 27, 2003

|

|

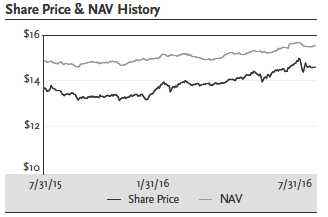

Share Price

|

$14.62

|

|

Net Asset Value

|

$15.54

|

|

Yield on Closing Market Price

|

4.39%

|

|

Taxable Equivalent Yield on Closing Market Price1

|

7.76%

|

|

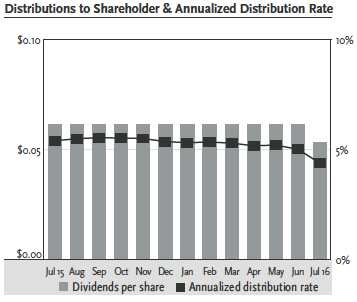

Monthly Distribution Per Common Share2

|

$0.0535

|

|

Leverage3

|

39%

|

|

Percentage of total investments subject to alternative minimum tax

|

11.2%

|

2 Monthly distribution is subject to change.

3 As a percentage of total investments.

FOR THE PERIOD ENDED JULY 31, 2016

|

|

One

|

Three

|

Five

|

Ten

|

Since

|

|

|

Year

|

Year

|

Year

|

Year

|

Inception

|

|

Managed Duration

|

|

|

|

|

|

|

Investment Grade

|

|

|

|

|

|

|

Municipal Fund

|

|

|

|

|

|

|

NAV

|

9.68%

|

10.19%

|

8.12%

|

6.84%

|

6.38%

|

|

Market

|

12.79%

|

11.76%

|

8.00%

|

8.23%

|

5.92%

|

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/mzf. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

12 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

FUND SUMMARY (Unaudited) continued

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 13

|

PORTFOLIO OF INVESTMENTS

|

|

July 31, 2016

|

|

|

||

|

|

||

|

|

Shares

|

Value

|

|

SHORT TERM INVESTMENTS† – 2.2%

|

|

|

|

JPMorgan Tax Free Money Market, 0.01%1

|

2,346,989

|

$ 2,346,989

|

|

Total Short Term Investments

|

|

|

|

(Cost $2,346,989)

|

|

2,346,989

|

|

|

||

|

|

Face

|

|

|

|

Amount

|

Value

|

|

MUNICIPAL BONDS†† – 168.2%

|

|

|

|

California – 23.9%

|

|

|

|

Hartnell Community College District General Obligation Unlimited

|

|

|

|

0.00% due 08/01/422

|

$12,640,000

|

$ 4,416,289

|

|

Northern California Gas Authority No. 1 Revenue Bonds

|

|

|

|

1.15% due 07/01/273

|

3,760,000

|

3,415,809

|

|

Sacramento County Sanitation Districts Financing Authority, (AGC-ICC FGIC)

|

|

|

|

0.98% due 12/01/353

|

3,500,000

|

3,255,629

|

|

Los Angeles Unified School District

|

|

|

|

5.00% due 01/01/34

|

2,525,000

|

2,811,739

|

|

California Statewide Communities Development Authority

|

|

|

|

1.21% due 04/01/363

|

2,500,000

|

2,151,525

|

|

Bay Area Toll Authority

|

|

|

|

1.69% due 04/01/363

|

2,000,000

|

2,034,640

|

|

California Health Facilities Financing Authority

|

|

|

|

5.88% due 08/15/31

|

1,500,000

|

1,791,645

|

|

San Bernardino City Unified School District, (AGM)

|

|

|

|

5.00% due 08/01/28

|

1,000,000

|

1,196,350

|

|

California Pollution Control Financing Authority, AMT

|

|

|

|

5.00% due 07/01/304

|

1,000,000

|

1,147,810

|

|

San Diego Unified School District General Obligation Unlimited

|

|

|

|

0.00% due 07/01/382

|

3,145,000

|

1,146,384

|

|

Los Angeles County Public Works Financing Authority

|

|

|

|

4.00% due 08/01/42

|

1,000,000

|

1,083,600

|

|

Desert Community College District General Obligation Unlimited, (AGM)

|

|

|

|

0.00% due 08/01/462

|

3,750,000

|

764,888

|

|

Total California

|

|

25,216,308

|

|

Texas – 17.2%

|

|

|

|

North Texas Tollway Authority Revenue Bonds

|

|

|

|

5.00% due 01/01/45

|

2,500,000

|

2,956,850

|

|

5.63% due 01/01/185

|

1,775,000

|

1,900,138

|

|

5.00% due 01/01/24

|

500,000

|

621,115

|

|

5.63% due 01/01/33

|

225,000

|

239,675

|

|

Tarrant County Cultural Education Facilities Finance Corp. Revenue Bonds

|

|

|

|

5.00% due 10/01/43

|

2,000,000

|

2,294,820

|

|

5.00% due 11/15/52

|

940,000

|

1,095,222

|

|

Matagorda County Navigation District No. 1, AMT, (AMBAC)

|

|

|

|

5.13% due 11/01/28

|

2,515,000

|

3,213,667

|

14 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

|

|

Face

|

|

|

|

Amount

|

Value

|

|

MUNICIPAL BONDS†† – 168.2% (continued)

|

|

|

|

Texas – 17.2% (continued)

|

|

|

|

Lower Colorado River Authority Revenue Bonds

|

|

|

|

6.25% due 05/15/185

|

$ 2,000,000

|

$ 2,201,255

|

|

San Leanna Educational Facilities Corp.

|

|

|

|

5.13% due 06/01/175

|

2,100,000

|

2,179,233

|

|

Fort Bend County Industrial Development Corp.

|

|

|

|

4.75% due 11/01/42

|

1,000,000

|

1,109,150

|

|

Tarrant County Cultural Education Facilities Finance Corp. Revenue Bonds, (AGC)

|

|

|

|

5.75% due 07/01/18

|

335,000

|

356,685

|

|

Total Texas

|

|

18,167,810

|

|

Florida – 10.3%

|

|

|

|

Miami-Dade County Educational Facilities Authority

|

|

|

|

5.00% due 04/01/42

|

2,000,000

|

2,324,960

|

|

School Board of Miami-Dade County Certificate Of Participation, (AGC)

|

|

|

|

5.38% due 02/01/195

|

1,500,000

|

1,675,875

|

|

JEA Water & Sewer System Revenue

|

|

|

|

4.00% due 10/01/41

|

1,500,000

|

1,542,105

|

|

Town of Davie FL

|

|

|

|

6.00% due 04/01/42

|

1,000,000

|

1,246,150

|

|

Tampa-Hillsborough County Expressway Authority Revenue Bonds

|

|

|

|

5.00% due 07/01/42

|

1,000,000

|

1,152,590

|

|

County of Broward FL, AMT, (AGM)

|

|

|

|

5.00% due 04/01/38

|

1,000,000

|

1,142,600

|

|

Seminole Indian Tribe of Florida

|

|

|

|

5.25% due 10/01/274

|

1,000,000

|

1,038,500

|

|

Mid-Bay Bridge Authority Revenue Bonds

|

|

|

|

5.00% due 10/01/40

|

625,000

|

747,681

|

|

Total Florida

|

|

10,870,461

|

|

Louisiana – 9.1%

|

|

|

|

Louisiana Local Government Environmental Facilities & Community Development Authority

|

|

|

|

6.75% due 11/01/32

|

3,000,000

|

3,212,370

|

|

State of Louisiana Gasoline & Fuels Tax Revenue

|

|

|

|

5.00% due 05/01/43

|

1,600,000

|

1,871,680

|

|

Louisiana Public Facilities Authority Revenue Bonds

|

|

|

|

3.50% due 06/01/30

|

1,200,000

|

1,260,372

|

|

Lafayette Consolidated Government Revenue Bonds, (AGM)

|

|

|

|

5.00% due 11/01/31

|

1,000,000

|

1,205,170

|

|

Louisiana Public Facilities Authority, Hospital Revenue

|

|

|

|

5.25% due 11/01/30

|

1,000,000

|

1,132,900

|

|

Louisiana Public Facilities Authority Revenue Bonds, (AGM)

|

|

|

|

5.00% due 06/01/42

|

800,000

|

942,952

|

|

Total Louisiana

|

|

9,625,444

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 15

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

|

|

Face

|

|

|

|

Amount

|

Value

|

|

MUNICIPAL BONDS†† – 168.2% (continued)

|

|

|

|

Illinois – 9.0%

|

|

|

|

Metropolitan Pier & Exposition Authority

|

|

|

|

5.00% due 06/15/42

|

$ 2,000,000

|

$ 2,202,340

|

|

City of Chicago IL O'Hare International Airport Revenue

|

|

|

|

5.50% due 01/01/31

|

1,750,000

|

2,047,675

|

|

Illinois Finance Authority, Roosevelt University Revenue

|

|

|

|

5.50% due 04/01/37

|

2,000,000

|

2,022,540

|

|

Railsplitter Tobacco Settlement Authority

|

|

|

|

6.00% due 06/01/28

|

1,000,000

|

1,195,390

|

|

Illinois Finance Authority, Rush University Medical Center Revenue

|

|

|

|

6.38% due 05/01/195

|

1,000,000

|

1,156,950

|

|

Chicago O'Hare International Airport Revenue Bonds, AMT

|

|

|

|

5.00% due 01/01/35

|

750,000

|

871,650

|

|

Total Illinois

|

|

9,496,545

|

|

Pennsylvania – 8.9%

|

|

|

|

Pennsylvania Higher Educational Facilities Authority

|

|

|

|

6.00% due 08/15/185

|

1,000,000

|

1,109,180

|

|

5.00% due 05/01/37

|

1,000,000

|

1,036,280

|

|

Delaware River Port Authority

|

|

|

|

5.00% due 01/01/27

|

1,500,000

|

1,715,100

|

|

County of Allegheny Pennsylvania General Obligation Unlimited, (AGM)

|

|

|

|

1.06% due 11/01/263

|

1,750,000

|

1,698,078

|

|

City of Philadelphia PA, General Obligation, (AGC)

|

|

|

|

5.38% due 08/01/30

|

1,110,000

|

1,247,307

|

|

County of Lehigh PA

|

|

|

|

4.00% due 07/01/43

|

1,000,000

|

1,059,340

|

|

City of Philadelphia PA, General Obligation

|

|

|

|

5.88% due 08/01/165

|

1,000,000

|

1,000,000

|

|

State Public School Building Authority Revenue Bonds

|

|

|

|

5.00% due 04/01/32

|

500,000

|

538,460

|

|

Total Pennsylvania

|

|

9,403,745

|

|

Massachusetts – 7.7%

|

|

|

|

Massachusetts Bay Transportation Authority Revenue Bonds

|

|

|

|

0.00% due 07/01/322

|

4,000,000

|

2,659,120

|

|

Massachusetts Educational Financing Authority, AMT

|

|

|

|

4.70% due 07/01/26

|

905,000

|

973,889

|

|

5.38% due 07/01/25

|

665,000

|

748,571

|

|

Commonwealth of Massachusetts, General Obligation (BHAC-CR FGIC)

|

|

|

|

1.08% due 05/01/373

|

1,800,000

|

1,688,796

|

|

Massachusetts Health & Educational Facilities Authority

|

|

|

|

6.25% due 07/01/30

|

1,000,000

|

1,151,500

|

|

Massachusetts Housing Finance Agency Revenue Bonds, AMT

|

|

|

|

5.10% due 12/01/27

|

950,000

|

972,173

|

|

Total Massachusetts

|

|

8,194,049

|

16 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

|

|

Face

|

|

|

|

Amount

|

Value

|

|

MUNICIPAL BONDS†† – 168.2% (continued)

|

|

|

|

New York – 7.6%

|

|

|

|

Metropolitan Transportation Authority

|

|

|

|

5.00% due 11/15/43

|

$ 2,000,000

|

$ 2,379,340

|

|

Triborough Bridge & Tunnel Authority Revenue Bonds

|

|

|

|

0.00% due 11/15/312

|

2,750,000

|

1,828,008

|

|

New York State Dormitory Authority

|

|

|

|

5.00% due 07/01/32

|

1,000,000

|

1,138,330

|

|

5.25% due 07/01/175

|

400,000

|

417,136

|

|

Troy Industrial Development Authority

|

|

|

|

5.00% due 09/01/31

|

1,000,000

|

1,155,660

|

|

New York City Water & Sewer System Revenue Bonds

|

|

|

|

5.00% due 06/15/45

|

930,000

|

1,100,078

|

|

Total New York

|

|

8,018,552

|

|

Arizona – 7.5%

|

|

|

|

Arizona Health Facilities Authority Revenue Bonds

|

|

|

|

1.24% due 01/01/373

|

3,500,000

|

3,195,745

|

|

Arizona Health Facilities Authority

|

|

|

|

2.29% due 02/01/483

|

2,000,000

|

2,037,160

|

|

Glendale Municipal Property Corp.

|

|

|

|

5.00% due 07/01/33

|

1,250,000

|

1,471,275

|

|

Phoenix Industrial Development Authority

|

|

|

|

5.25% due 06/01/34

|

1,000,000

|

1,181,540

|

|

Total Arizona

|

|

7,885,720

|

|

Michigan – 6.8%

|

|

|

|

Michigan State Building Authority Revenue Bonds

|

|

|

|

5.00% due 04/15/36

|

2,500,000

|

3,061,775

|

|

Michigan Finance Authority Revenue Bonds

|

|

|

|

5.00% due 11/01/44

|

1,000,000

|

1,188,810

|

|

5.00% due 07/01/44

|

1,030,000

|

1,177,208

|

|

Michigan Finance Authority, Revenue

|

|

|

|

5.00% due 12/01/31

|

1,000,000

|

1,175,750

|

|

Detroit Wayne County Stadium Authority Revenue Bonds, (AGM)

|

|

|

|

5.00% due 10/01/26

|

500,000

|

569,115

|

|

Total Michigan

|

|

7,172,658

|

|

New Jersey – 6.5%

|

|

|

|

New Jersey Economic Development Authority

|

|

|

|

2.04% due 03/01/283

|

3,000,000

|

2,704,350

|

|

5.00% due 07/01/32

|

500,000

|

489,245

|

|

New Jersey Transportation Trust Fund Authority

|

|

|

|

5.00% due 06/15/42

|

1,750,000

|

1,915,253

|

|

New Jersey Health Care Facilities Financing Authority

|

|

|

|

5.75% due 07/01/195

|

1,500,000

|

1,714,620

|

|

Total New Jersey

|

|

6,823,468

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 17

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

|

|

Face

|

|

|

|

Amount

|

Value

|

|

MUNICIPAL BONDS†† – 168.2% (continued)

|

|

|

|

Iowa – 4.6%

|

|

|

|

Iowa Tobacco Settlement Authority

|

|

|

|

5.60% due 06/01/34

|

$ 2,000,000

|

$ 2,017,860

|

|

Iowa Higher Education Loan Authority

|

|

|

|

5.50% due 09/01/25

|

1,500,000

|

1,635,660

|

|

Iowa Finance Authority

|

|

|

|

5.00% due 08/15/29

|

1,090,000

|

1,260,879

|

|

Total Iowa

|

|

4,914,399

|

|

Tennessee – 4.5%

|

|

|

|

Knox County Health Educational & Housing Facility Board

|

|

|

|

5.25% due 04/01/27

|

2,500,000

|

2,568,625

|

|

Metropolitan Nashville Airport Authority Revenue Bonds, AMT

|

|

|

|

5.00% due 07/01/43

|

1,310,000

|

1,541,516

|

|

Metropolitan Nashville Airport Authority

|

|

|

|

5.20% due 07/01/26

|

560,000

|

604,055

|

|

Total Tennessee

|

|

4,714,196

|

|

Connecticut – 4.3%

|

|

|

|

City of Bridgeport Connecticut General Obligation Unlimited, (AGM)

|

|

|

|

5.00% due 10/01/25

|

2,535,000

|

3,119,977

|

|

Connecticut State Health & Educational Facility Authority Revenue Bonds

|

|

|

|

5.00% due 07/01/45

|

1,250,000

|

1,474,150

|

|

Total Connecticut

|

|

4,594,127

|

|

Wyoming – 3.8%

|

|

|

|

County of Sweetwater WY, AMT

|

|

|

|

5.60% due 12/01/35

|

4,000,000

|

4,014,039

|

|

Washington – 3.3%

|

|

|

|

Spokane Public Facilities District

|

|

|

|

5.00% due 12/01/38

|

1,000,000

|

1,162,130

|

|

Washington Higher Education Facilities Authority

|

|

|

|

5.25% due 04/01/43

|

1,000,000

|

1,155,790

|

|

Tes Properties

|

|

|

|

5.63% due 06/01/195

|

1,000,000

|

1,137,350

|

|

Total Washington

|

|

3,455,270

|

|

Ohio – 3.2%

|

|

|

|

American Municipal Power, Inc.

|

|

|

|

5.00% due 02/15/42

|

2,000,000

|

2,332,180

|

|

Ohio Air Quality Development Authority

|

|

|

|

5.63% due 06/01/18

|

1,000,000

|

1,041,770

|

|

Total Ohio

|

|

3,373,950

|

|

Vermont – 2.8%

|

|

|

|

Vermont Student Assistance Corp., AMT

|

|

|

|

3.76% due 12/03/353

|

2,800,000

|

3,003,196

|

18 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

|

|

Face

|

|

|

|

Amount

|

Value

|

|

MUNICIPAL BONDS†† – 168.2% (continued)

|

|

|

|

Mississippi – 2.7%

|

|

|

|

State of Mississippi Revenue Bonds

|

|

|

|

5.00% due 10/15/35

|

$ 1,500,000

|

$ 1,780,680

|

|

County of Warren MS

|

|

|

|

6.50% due 09/01/32

|

1,000,000

|

1,110,620

|

|

Total Mississippi

|

|

2,891,300

|

|

Wisconsin – 2.3%

|

|

|

|

Wisconsin Health & Educational Facilities Authority

|

|

|

|

5.00% due 11/15/165

|

1,250,000

|

1,266,225

|

|

WPPI Energy Revenue Bonds

|

|

|

|

5.00% due 07/01/37

|

1,000,000

|

1,172,990

|

|

Total Wisconsin

|

|

2,439,215

|

|

Alabama – 2.2%

|

|

|

|

Alabama Special Care Facilities Financing Authority-Birmingham Alabama

|

|

|

|

Revenue Bonds

|

|

|

|

5.00% due 06/01/32

|

2,000,000

|

2,374,640

|

|

Colorado – 2.2%

|

|

|

|

City & County of Denver CO Airport System Revenue

|

|

|

|

5.00% due 11/15/43

|

1,000,000

|

1,177,870

|

|

Colorado Health Facilities Authority

|

|

|

|

5.25% due 01/01/45

|

1,000,000

|

1,146,000

|

|

Total Colorado

|

|

2,323,870

|

|

Kentucky – 2.1%

|

|

|

|

County of Owen KY, Waterworks System Revenue

|

|

|

|

5.63% due 09/01/39

|

1,000,000

|

1,101,370

|

|

Kentucky Economic Development Finance Authority

|

|

|

|

5.63% due 08/15/27

|

1,000,000

|

1,087,560

|

|

Total Kentucky

|

|

2,188,930

|

|

District of Columbia – 1.9%

|

|

|

|

District of Columbia Housing Finance Agency, AMT, (FHA)

|

|

|

|

5.10% due 06/01/37

|

1,970,000

|

2,014,601

|

|

Delaware – 1.6%

|

|

|

|

Delaware State Economic Development Authority

|

|

|

|

5.40% due 02/01/31

|

1,500,000

|

1,715,955

|

|

Nevada – 1.6%

|

|

|

|

Las Vegas Valley Water District

|

|

|

|

5.00% due 06/01/31

|

1,435,000

|

1,677,515

|

|

Rhode Island – 1.4%

|

|

|

|

Rhode Island Convention Center Authority, (Assured Gty) (AGC)

|

|

|

|

5.50% due 05/15/27

|

1,300,000

|

1,464,762

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 19

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

|

|

Face

|

|

|

|

Amount

|

Value

|

|

MUNICIPAL BONDS†† – 168.2% (continued)

|

|

|

|

Virginia – 1.3%

|

|

|

|

Washington County Industrial Development Authority

|

|

|

|

7.50% due 07/01/29

|

$ 1,250,000

|

$ 1,417,350

|

|

Arkansas – 1.3%

|

|

|

|

Arkansas Development Finance Authority Revenue Bonds

|

|

|

|

1.99% due 09/01/443

|

1,400,000

|

1,399,244

|

|

Alaska – 1.1%

|

|

|

|

City of Anchorage Alaska Electric Revenue Revenue Bonds

|

|

|

|

5.00% due 12/01/41

|

1,000,000

|

1,191,840

|

|

South Carolina – 1.1%

|

|

|

|

South Carolina Public Service Authority Revenue Bonds

|

|

|

|

5.00% due 12/01/48

|

1,000,000

|

1,169,330

|

|

Hawaii – 1.1%

|

|

|

|

Hawaii Pacific Health

|

|

|

|

5.63% due 07/01/30

|

1,000,000

|

1,161,900

|

|

New Hampshire – 1.1%

|

|

|

|

New Hampshire Health & Education Facilities Authority

|

|

|

|

5.00% due 01/01/34

|

1,000,000

|

1,158,120

|

|

Oklahoma – 1.1%

|

|

|

|

Oklahoma Development Finance Authority

|

|

|

|

5.00% due 02/15/34

|

1,000,000

|

1,144,000

|

|

West Virginia – 0.6%

|

|

|

|

West Virginia Economic Development Authority Revenue Bonds, AMT

|

|

|

|

2.88% due 12/15/26

|

600,000

|

603,516

|

|

Maryland – 0.5%

|

|

|

|

Maryland Economic Development Corp.

|

|

|

|

5.75% due 09/01/25

|

500,000

|

488,590

|

|

Total Municipal Bonds

|

|

|

|

(Cost $162,028,535)

|

|

177,768,615

|

|

Total Investments – 170.4%

|

|

|

|

(Cost $164,375,524)

|

|

$180,115,604

|

|

Preferred Shares – (65.7)%

|

|

(69,450,000)

|

|

Other Assets & Liabilities, net – (4.7)%

|

|

(4,983,533)

|

|

Total Net Assets – 100.0%

|

|

$105,682,071

|

20 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

|

†

|

Value determined based on Level 1 inputs — See Note 2.

|

|

††

|

Value determined based on Level 2 inputs — See Note 2.

|

|

1

|

Rate indicated is the 7-day yield as of July 31, 2016.

|

|

2

|

Zero coupon rate security.

|

|

3

|

Variable rate security. Rate indicated is rate effective at July 31, 2016.

|

|

4

|

Security is a 144A or Section 4(a)(2) security. The total market value of 144A or Section 4(a)(2)

|

|

|

securities is $2,186,310 (cost $2,030,693), or 2.1% of total net assets. These securities have been

|

|

|

determined to be liquid under guidelines established by the Board of Trustees.

|

|

5

|

The bond is prerefunded. U.S. government or U.S. government agency securities, held in escrow, are

|

|

|

used to pay interest on this security, as well as to retire the bond in full at the date and price indicated

|

|

|

under the Optional Call Provisions.

|

|

AGC

|

Insured by Assured Guaranty Corporation

|

|

AGM

|

Insured by Assured Guaranty Municipal Corporation

|

|

AMBAC

|

Insured by Ambac Assurance Corporation

|

|

AMT

|

Income from this security is a preference item under the Alternative Minimum Tax

|

|

FGIC

|

Insured by Financial Guaranty Insurance Company

|

|

FHA

|

Guaranteed by Federal Housing Administration

|

|

|

Level 2

|

Level 3

|

||||||||||||||

|

|

Level 1

|

Significant

|

Significant

|

|||||||||||||

|

|

Quoted

|

Observable

|

Unobservable

|

|||||||||||||

|

|

Prices

|

Inputs

|

Inputs

|

Total

|

||||||||||||

|

Assets:

|

||||||||||||||||

|

Municipal Bonds

|

$

|

–

|

$

|

177,768,615

|

$

|

–

|

$

|

177,768,615

|

||||||||

|

Short Term Investments

|

2,346,989

|

–

|

–

|

2,346,989

|

||||||||||||

|

Total

|

$

|

2,346,989

|

$

|

177,768,615

|

$

|

–

|

$

|

180,115,604

|

||||||||

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 21

|

PORTFOLIO OF INVESTMENTS continued

|

July 31, 2016

|

22 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

STATEMENT OF ASSETS AND LIABILITIES

|

July 31, 2016

|

|

ASSETS:

|

||||

|

Investments, at value

|

$

|

180,115,604

|

||

|

Receivables:

|

||||

|

Interest

|

1,536,294

|

|||

|

Cash

|

55,000

|

|||

|

Other assets

|

9,969

|

|||

|

Total assets

|

181,716,867

|

|||

|

LIABILITIES:

|

||||

|

Payable for:

|

||||

|

Investments purchased

|

6,290,245

|

|||

|

Professional fees

|

73,140

|

|||

|

Distributions – preferred shareholders

|

54,506

|

|||

|

Investment advisory fees

|

44,601

|

|||

|

Listing fees

|

36,609

|

|||

|

Servicing agent fees

|

29,694

|

|||

|

Fund accounting fees

|

19,232

|

|||

|

Printing fees

|

18,262

|

|||

|

Administration fees

|

3,698

|

|||

|

Trustees’ fees and expenses*

|

3,408

|

|||

|

Transfer agent fees

|

1,789

|

|||

|

Custodian fees

|

1,690

|

|||

|

Other liabilities

|

7,922

|

|||

|

Total liabilities

|

6,584,796

|

|||

|

PREFERRED SHARES, at redemption value:

|

||||

|

$0.001 par value per share; 2,778 Auction Market Preferred Shares

|

||||

|

authorized, issued and outstanding at $25,000 per share

|

||||

|

liquidated preference

|

69,450,000

|

|||

|

NET ASSETS

|

$

|

105,682,071

|

||

|

NET ASSETS CONSIST OF:

|

||||

|

Common shares, $0.001 par value per share; unlimited shares of shares

|

||||

|

authorized, 6,800,476 shares issued and outstanding

|

$

|

6,800

|

||

|

Additional paid-in capital

|

95,057,477

|

|||

|

Distributions in excess of net investment income

|

(106,011

|

)

|

||

|

Accumulated net realized loss on investments

|

(5,016,275

|

)

|

||

|

Net unrealized appreciation on investments

|

15,740,080

|

|||

|

NET ASSETS

|

$

|

105,682,071

|

||

|

Shares outstanding ($0.01 par value with unlimited amount authorized)

|

6,800,476

|

|||

|

Net asset value, offering price and repurchase price per share

|

$

|

15.54

|

||

|

Investments in securities, at cost

|

164,375,524

|

|||

See notes to financial statements.

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 23

|

STATEMENT OF OPERATIONS

|

July 31, 2016

|

|||

|

For the Year Ended July 31, 2016

|

||||

|

INVESTMENT INCOME:

|

||||

|

Interest

|

$

|

7,077,849

|

||

|

EXPENSES:

|

||||

|

Investment advisory fees

|

670,532

|

|||

|

Servicing fees

|

447,022

|

|||

|

Professional fees

|

120,161

|

|||

|

Auction agent fees – preferred shares

|

119,553

|

|||

|

Fund accounting fees

|

65,965

|

|||

|

Trustees' fees and expenses*

|

54,802

|

|||

|

Administration fees

|

47,281

|

|||

|

Printing fees

|

31,513

|

|||

|

Listing fees

|

23,790

|

|||

|

Transfer agent fees

|

20,487

|

|||

|

Custodian fees

|

9,627

|

|||

|

Insurance

|

9,083

|

|||

|

Other expenses

|

6,378

|

|||

|

Total expenses

|

1,626,194

|

|||

|

Investment advisory fees waived

|

(154,738

|

)

|

||

|

Servicing fees waived

|

(103,159

|

)

|

||

|

Net expenses

|

1,368,297

|

|||

|

Net investment income

|

5,709,552

|

|||

|

NET REALIZED AND UNREALIZED GAIN (LOSS):

|

||||

|

Net realized loss on:

|

||||

|

Investments

|

(124,994

|

)

|

||

|

Net change in unrealized appreciation (depreciation) on:

|

||||

|

Investments

|

5,062,442

|

|||

|

Net realized and unrealized gain

|

4,937,448

|

|||

|

Distributions to Auction Market Preferred Shareholders from

|

||||

|

Net Investment Income

|

(1,097,271

|

)

|

||

|

Net increase in net assets applicable to common shareholders

|

||||

|

resulting from operations

|

$

|

9,549,729

|

||

See notes to financial statements.

24 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

STATEMENTS OF CHANGES IN NET ASSETS

|

July 31, 2016

|

|

|

Year Ended

|

Year Ended

|

||||||

|

|

July 31, 2016

|

July 31, 2015

|

||||||

|

INCREASE IN NET ASSETS FROM OPERATIONS:

|

||||||||

|

Net investment income

|

$

|

5,709,552

|

$

|

5,999,448

|

||||

|

Net realized gain (loss) on investments

|

(124,994

|

)

|

29,630

|

|||||

|

Net change in unrealized appreciation

|

||||||||

|

on investments

|

5,062,442

|

1,054,933

|

||||||

|

Net increase in net assets resulting from operations

|

10,647,000

|

7,084,011

|

||||||

|

DISTRIBUTIONS TO PREFERRED SHAREHOLDERS FROM:

|

||||||||

|

Net investment income

|

(1,097,271

|

)

|

(962,743

|

)

|

||||

|

Net increase in net assets applicable to common shareholders

|

||||||||

|

resulting from operations

|

9,549,729

|

6,121,268

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM:

|

||||||||

|

Net investment income

|

(4,761,281

|

)

|

(5,142,520

|

)

|

||||

|

Return of capital

|

(210,547

|

)

|

–

|

|||||

|

Total distributions

|

(4,971,828

|

)

|

(5,142,520

|

)

|

||||

|

Net increase in net assets

|

4,577,901

|

978,748

|

||||||

|

NET ASSETS:

|

||||||||

|

Beginning of period

|

101,104,170

|

100,125,422

|

||||||

|

End of period

|

$

|

105,682,071

|

$

|

101,104,170

|

||||

|

Distributions in excess of net investment income

|

$

|

(106,011

|

)

|

$

|

(34,780

|

)

|

||

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 25

|

FINANCIAL HIGHLIGHTS

|

July 31, 2016

|

||||||||||||||||||

|

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

Year Ended

|

||||||||||||||

|

|

July 31,

|

July 31,

|

July 31,

|

July 31,

|

July 31,

|

||||||||||||||

|

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||

|

Per Share Data:

|

|||||||||||||||||||

|

Net asset value, beginning of period

|

$

|

14.87

|

$

|

14.72

|

$

|

13.61

|

$

|

15.41

|

$

|

14.02

|

|||||||||

|

Income from investment operations:

|

|||||||||||||||||||

|

Net investment income(a)

|

0.84

|

0.88

|

0.95

|

1.02

|

1.09

|

||||||||||||||

|

Net gain (loss) on investments (realized and unrealized)

|

0.72

|

0.17

|

1.13

|

(1.74

|

)

|

1.43

|

|||||||||||||

|

Distributions to preferred shareholders from net investment

|

|||||||||||||||||||

|

income (common share equivalent basis)

|

(0.16

|

)

|

(0.14

|

)

|

(0.13

|

)

|

(0.14

|

)

|

(0.14

|

)

|

|||||||||

|

Total from investment operations

|

1.40

|

0.91

|

1.95

|

(0.86

|

)

|

2.38

|

|||||||||||||

|

Less distributions from:

|

|||||||||||||||||||

|

Net investment income

|

(0.70

|

)

|

(0.76

|

)

|

(0.84

|

)

|

(0.94

|

)

|

(0.99

|

)

|

|||||||||

|

Return of capital

|

(0.03

|

)

|

–

|

–

|

–

|

–

|

|||||||||||||

|

Total distributions

|

(0.73

|

)

|

(0.76

|

)

|

(0.84

|

)

|

(0.94

|

)

|

(0.99

|

)

|

|||||||||

|

Net asset value, end of period

|

$

|

15.54

|

$

|

14.87

|

$

|

14.72

|

$

|

13.61

|

$

|

15.41

|

|||||||||

|

Market value, end of period

|

$

|

14.62

|

$

|

13.66

|

$

|

13.57

|

$

|

12.46

|

$

|

16.21

|

|||||||||

|

Total Return(b)

|

|||||||||||||||||||

|

Net asset value

|

9.68

|

%

|

6.19

|

%

|

14.87

|

%

|

-6.01

|

%

|

17.50

|

%

|

|||||||||

|

Market value

|

12.79

|

%

|

6.43

|

%

|

16.29

|

%

|

-18.13

|

%

|

28.56

|

%

|

|||||||||

|

Ratios/Supplemental Data:

|

|||||||||||||||||||

|

Net assets, end of period (in thousands)

|

$

|

105,682

|

$

|

101,104

|

$

|

100,125

|

$

|

92,573

|

$

|

104,622

|

|||||||||

|

Preferred shares, at redemption value ($25,000 per share

|

|||||||||||||||||||

|

liquidation preference) (thousands)

|

$

|

69,450

|

$

|

69,450

|

$

|

69,450

|

$

|

69,450

|

$

|

69,450

|

|||||||||

|

Preferred shares asset coverage per share

|

$

|

63,043

|

$

|

61,395

|

$

|

61,042

|

$

|

58,324

|

$

|

62,661

|

|||||||||

|

Ratio to average net assets of:

|

|||||||||||||||||||

|

Net investment income(c)

|

5.57

|

%

|

5.85

|

%

|

6.86

|

%

|

6.70

|

%

|

7.38

|

%

|

|||||||||

|

Expenses (including interest expense and net of fee waivers)(c)(d)

|

1.34

|

%

|

1.35

|

%

|

1.40

|

%

|

1.33

|

%

|

1.36

|

%

|

|||||||||

|

Expenses (including interest expense and excluding fee waivers)(c)(d)

|

1.59

|

%

|

1.60

|

%

|

1.66

|

%

|

1.58

|

%

|

1.62

|

%

|

|||||||||

|

Portfolio turnover rate(e)

|

14

|

%

|

12

|

%

|

15

|

%

|

23

|

%

|

15

|

%

|

|||||||||

|

(a)

|

Based on average shares outstanding.

|

|

(b)

|

Total investment return is calculated assuming a purchase of a common share at the beginning of the period and a sale on the last day of the period reported either at net asset value (“NAV”) or market price per share. Dividends and distributions are assumed to be reinvested at NAV for NAV returns or the prices obtained under the Fund’s Dividend Reinvestment Plan for market value returns. Total investment return does not reflect brokerage commissions. A return calculated for a period of less than one year is not annualized.

|

|

(c)

|

Calculated on the basis of income and expense applicable to both common and preferred shares relative to average net assets of common shareholders.

|

|

(d)

|

The impact of interest expense is less than 0.01%.

|

|

(e)

|

Portfolio turnover is not annualized for periods less than one year.

|

See notes to financial statements.

26 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

NOTES TO FINANCIAL STATEMENTS

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 27

|

NOTES TO FINANCIAL STATEMENTS continued

|

July 31, 2016

|

28 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

NOTES TO FINANCIAL STATEMENTS continued

|

July 31, 2016

|

|

Managed Assets

|

Rate

|

|

First $200,000,000

|

0.0275%

|

|

Next $300,000,000

|

0.0200%

|

|

Next $500,000,000

|

0.0150%

|

|

Over $1,000,000,000

|

0.0100%

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 29

|

NOTES TO FINANCIAL STATEMENTS continued

|

July 31, 2016

|

|

|

Accumulated Net

|

Accumulated Net

|

Additional

|

|

|

Investment Loss

|

Realized Loss

|

Paid-in Capital

|

|

|

$77,769

|

$–

|

$(77,769)

|

|

Information on the tax components of investments as of July 31, 2016, is as follows:

|

|

||

|

|

|||

|

|

|

|

Net Tax

|

|

|

Gross Tax

|

Gross Tax

|

Unrealized

|

|

Cost of Investments

|

Unrealized

|

Unrealized

|

Appreciation

|

|

for Tax Purposes

|

Appreciation

|

Depreciation

|

on Investments

|

|

$164,375,524

|

$16,059,892

|

$(319,812)

|

$15,740,080

|

|

Undistributed

|

|

Accumulated

|

|

Other

|

|

|

Tax-Exempt

|

Undistributed

|

Capital

|

Unrealized

|

Temporary

|

|

|

Income

|

Ordinary Income

|

and Other Losses

|

Appreciation

|

Differences

|

Total

|

|

$–

|

$–

|

$(5,016,275)

|

$15,740,080

|

$(106,011)

|

$10,617,794

|

30 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

NOTES TO FINANCIAL STATEMENTS continued

|

July 31, 2016

|

| Ordinary | Capital |

|

$–

|

$(557,530)

|

|

|

Tax-exempt income

|

Ordinary income

|

Return of capital

|

Total distributions

|

|

2016

|

$ 5,639,827

|

$ 218,725

|

$ 210,547

|

$ 6,069,099

|

|

2015

|

$ 5,956,165

|

$ 149,098

|

$ –

|

$ 6,105,263

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 31

|

NOTES TO FINANCIAL STATEMENTS continued

|

July 31, 2016

|

|

|

|

|

|

Next

|

|

Series

|

Low

|

High

|

At 7/31/16

|

Auction Date

|

|

M7

|

1.399%

|

1.935%

|

1.935%

|

8/1/16

|

|

W28

|

1.399%

|

1.906%

|

1.906%

|

8/3/16

|

32 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

July 31, 2016

|

September 29, 2016

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 33

|

SUPPLEMENTAL INFORMATION (Unaudited)

|

July 31, 2016

|

|

|

|

|

|

Number of

|

|

|

|

Position(s)

|

Term of Office

|

|

Portfolios

|

|

|

|

Held

|

and Length

|

|

in Fund Complex

|

|

|

Name, Address*,

|

with

|

of Time

|

Principal Occupation(s)

|

Overseen

|

Other Directorships

|

|

and Year of Birth

|

Trust

|

Served**

|

during Past Five Years

|

by Trustee***

|

Held by Trustees

|

|

Independent Trustees:

|

|

|

|

|

|

|

Randall C. Barnes

|

Trustee

|

Since 2006

|

Current: Private Investor (2001-present).

|

101

|

Current: Trustee, Purpose

|

|

(1951)

|

|

|

|

|

Investments Funds (2014-

|

|

|

|

|

Former: Senior Vice President and Treasurer,

|

|

present).

|

|

|

|

|

PepsiCo, Inc. (1993-1997); President, Pizza

|

|

|

|

Hut International (1991-1993); Senior Vice

|

|||||

| President, Strategic Planning and New | |||||

| Business Development, PepsiCo, Inc. (1987- | |||||

| 1990). | |||||

|

Ronald A. Nyberg

|

Trustee and

|

Since 2003

|

Current: Partner, Momkus McCluskey Roberts,

|

103

|

Current: Edward-Elmhurst

|

|

Chairman of

|

LLC (2016-present). | Healthcare System | |||

|

the Nominating

|

|

|

|

(2012-present).

|

|

|

|

and Governance

|

|

Former: Partner, Nyberg & Cassioppi, LLC

|

|

|

|

Committee

|

(2000-2016); Executive Vice President, General | ||||

|

|

|

Counsel, and Corporate Secretary, Van

|

|

|

|

|

|

|

Kampen Investments (1982-1999).

|

|

|

|

34 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

SUPPLEMENTAL INFORMATION (Unaudited) continued

|

July 31, 2016

|

|

|

|

|

|

Number of

|

|

|

|

Position(s)

|

Term of Office

|

|

Portfolios

|

|

|

|

Held

|

and Length

|

|

in Fund Complex

|

|

|

Name, Address*,

|

with

|

of Time

|

Principal Occupation(s)

|

Overseen

|

Other Directorships

|

|

and Year of Birth

|

Trust

|

Served**

|

during Past Five Years

|

by Trustee***

|

Held by Trustees

|

|

Independent Trustees continued:

|

|

|

|

|

|

|

Ronald E.

|

Trustee and

|

Since 2003

|

Current: Portfolio Consultant (2010-present).

|

100

|

Former: Bennett Group

|

|

Toupin, Jr.

|

Chairman of

|

|

|

|

of Funds (2011-2013).

|

|

(1958)

|

the Board

|

|

Former: Vice President, Manager and Portfolio

|

|

|

|

|

|

|

Manager, Nuveen Asset Management (1998-

|

|

|

| 1999); Vice President, Nuveen Investment | |||||

|

|

|

|

Advisory Corp. (1992-1999); Vice President

|

|

|

|

|

|

|

and Manager, Nuveen Unit Investment Trusts

|

|

|

| (1991-1999); and Assistant Vice President and | |||||

|

|

|

|

Portfolio Manager,Nuveen Unit Investment

|

|

|

| Trusts (1988-1999), each of John Nuveen & | |||||

|

|

|

|

Co., Inc. (1982-1999).

|

|

|

|

Interested Trustees:

|

|

|

|

|

|

|

Donald C.

|

Trustee

|

Since 2012

|

Current: President and CEO, certain other

|

232

|

Current: Clear Spring Life

|

|

Cacciapaglia†

|

|

|

funds in the Fund Complex (2012-present);

|

|

Insurance Company

|

|

(1951)

|

Vice Chairman, Guggenheim Investments | (2015-present); | |||

| (2010-present). | Guggenheim Partners | ||||

|

|

|

|

|

Japan, Ltd. (2014-

|

|

|

|

|

|

Former: Chairman and CEO, Channel Capital

|

|

present); Delaware Life

|

|

|

|

|

Group, Inc. (2002-2010).

|

|

(2013-present);

|

| Guggenheim Life and | |||||

| Annuity Company (2011- | |||||

|

|

|

|

|

|

present); Paragon Life

|

| Insurance Company of | |||||

|

|

|

|

|

|

Indiana (2011-present).

|

|

Clifford D.

|

Trustee,

|

Since 2003

|

Current: CEO Insight Investment of North

|

1

|

None

|

|

Corso††

|

Chief

|

|

America, Executive Vice President & Chief

|

|

|

|

200 Park Avenue

|

Executive

|

|

Investment Officer (2008-present), Vice

|

|

|

|

New York, NY 10166

|

Officer and

|

|

President (2004-2008), MBIA Inc. Chief

|

|

|

|

(1961)

|

President

|

|

Executive Officer & Chief Investment Officer

|

|

|

| (2010-present), President (2004-2010), | |||||

| Managing Director (2000-2004), Cutwater | |||||

| Holdings, LLC. Chief Executive Officer & Chief | |||||

| Investment Officer (2010-present), President | |||||

|

|

|

|

and Investment Officer (2000-2010), Cutwater

|

|

|

|

|

|

|

Asset Management Corp.

|

|

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 35

|

SUPPLEMENTAL INFORMATION (Unaudited) continued

|

July 31, 2016

|

|

*

|

The business address of each Trustee unless otherwise noted is c/o Guggenheim Investments, 227 West Monroe Street, Chicago, IL 60606.

|

|

**

|

Each Trustee is expected to serve a three-year term concurrent with the class of Trustees for which he serves:

|

|

|

-Messrs. Barnes and Corso are Class III Trustees. Class III Trustees are expected to stand for re-election at the Fund’s annual meeting of shareholders to be held in 2016.

|

|

|

-Mr. Nyberg, as a holdover Class I Trustee, and Mr. Toupin, as a holdover Class II Trustee, are expected to stand for re-election at the Fund’s annual meeting of shareholders to be held in 2017 and 2018, respectively.

|

|

|

-Mr. Donald Cacciapaglia is a Class II Trustee. A Class II Trustee is expected to stand for re-election at the Fund’s annual meeting of shareholders to be held in 2018.

|

|

***

|

As of period end. The Guggenheim Investments Fund Complex consists of U.S. registered investment companies advised or serviced by Guggenheim Funds Investment Advisors, LLC or Guggenheim Funds Distributors, LLC and/or affiliates of such entities. The Guggenheim Investments Fund Complex is overseen by multiple Boards of Trustees.

|

|

†

|

Mr. Donald C. Cacciapaglia is an “interested person” (as defined in Section 2(a)(19) of the 1940 Act) (“Interested Trustee”) of the Fund because of his position as an officer of Guggenheim Funds Distributors, LLC, the Fund’s Servicing Agent and certain of its affiliates.

|

|

††

|

Mr. Clifford D. Corso is an “interested person” (as defined in Section 2(a)(19) of the 1940 Act) (“Interested Trustee”) of the Fund because of his position as an officer of Cutwater Investor Services Corp., the Fund’s Investment Adviser.

|

Officers

|

|

Position(s)

|

|

|

|

|

held

|

Term of Office**

|

|

|

Name, Address*

|

with the

|

and Length of

|

|

|

and Year of Birth

|

Trust

|

Time Served

|

Principal Occupations During Past Five Years

|

|

Officers:

|

|

|

|

|

James M. Howley

|

Assistant

|

Since 2006

|

Current: Director, Guggenheim Investments (2004-present); Assistant Treasurer, certain other funds in the

|

|

(1972)

|

Treasurer

|

|

Fund Complex (2006-present).

|

|

|

|

|

Former: Manager, Mutual Fund Administration of Van Kampen Investments, Inc. (1996-2004).

|

|

Amy J. Lee

|

Chief Legal

|

Since 2013

|

Current: Chief Legal Officer, certain other funds in the Fund Complex (2013-present); Senior

|

|

(1961)

|

Officer

|

|

Managing Director, Guggenheim Investments (2012-present).

|

|

|

|||

|

|

|

|

Former: Vice President, Associate General Counsel and Assistant Secretary, Security Benefit Life

|

|

|

|

|

Insurance Company and Security Benefit Corporation (2004-2012).

|

36 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

SUPPLEMENTAL INFORMATION (Unaudited) continued

|

July 31, 2016

|

|

|

Position(s)

|

|

|

|

|

held

|

Term of Office**

|

|

|

Name, Address*

|

with the

|

and Length of

|

|

|

and Year of Birth

|

Trust

|

Time Served

|

Principal Occupations During Past Five Years

|

|

Officers continued:

|

|

|

|

|

Mark E. Mathiasen

|

Secretary

|

Since 2007

|

Current: Secretary, certain other funds in the Fund Complex (2007-present); Managing Director,

|

|

(1978)

|

|

|

Guggenheim Investments (2007-present).

|

|

Michael P. Megaris

|

Assistant

|

Since 2014

|

Current: Assistant Secretary, certain other funds in the Fund Complex (2014-present); Vice President,

|

|

(1984)

|

Secretary

|

Guggenheim Investments (2012-present). | |

|

|

|

||

|

|

|

|

Former: J.D., University of Kansas School of Law (2009-2012).

|

|

Adam Nelson

|

Assistant

|

Since 2015

|

Current: Vice President, Guggenheim Investments (2015-present); Assistant Treasurer, certain other

|

|

(1979)

|

Treasurer

|

funds in the Fund Complex (2015-present). | |

|

|

|

||

|

|

|

|

Former: Assistant Vice President and Fund Administration Director, State Street Corporation (2013-

|

| 2015); Fund Administration Assistant Director, State Street (2011-2013); Fund Administration Manager, | |||

|

|

|

|

State Street (2009-2011).

|

|

Kimberly J. Scott

|

Assistant

|

Since 2012

|

Current: Vice President, Guggenheim Investments (2012-present); Assistant Treasurer, certain other

|

|

(1974)

|

Treasurer

|

funds in the Fund Complex (2012-present). | |

|

|

|

||

|

|

|

|

Former: Financial Reporting Manager, Invesco, Ltd. (2010-2011); Vice President/Assistant Treasurer of

|

| Mutual Fund Administration, Van Kampen Investments, Inc./Morgan Stanley Investment Management | |||

|

|

|

|

(2009-2010); Manager of Mutual Fund Administration, Van Kampen Investments, Inc./Morgan Stanley

|

|

|

|

|

Investment Management (2005-2009).

|

|

Robin J. Shulman

|

Chief

|

Since 2015

|

Current: Managing Director and Chief Compliance Officer, Cutwater Asset Management / Chief

|

|

(1964)

|

Compliance

|

|

Compliance Officer, Insight Investment – North America (2015-present); Chief Compliance Officer,

|

|

Officer

|

Cutwater Select Income Fund (2015-present). | ||

|

|

|

|

|

|

|

|

|

Former: Chief Compliance Officer, Horizon Kinetics (2010-2015); Compliance Officer, Seix Investment

|

| Advisors LLC (2004-2010); Director, Business Risk Management and Compliance Groups of Deutsch | |||

|

|

|

|

Asset Management, Americas (1998-2004); Compliance Manager, Ernst & Young, LLP (1997-1998);

|

|

Compliance Manager, Prudential Financial (1986-1997).

|

|||

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 37

|

SUPPLEMENTAL INFORMATION (Unaudited) continued

|

July 31, 2016

|

|

|

Position(s)

|

|

|

|

|

held

|

Term of Office**

|

|

|

Name, Address*

|

with the

|

and Length of

|

|

|

and Year of Birth

|

Trust

|

Time Served

|

Principal Occupations During Past Five Years

|

|

Officers continued:

|

|

|

|

|

John L. Sullivan

|

Chief

|

Since 2010

|

Current: CFO, Chief Accounting Officer and Treasurer, certain other funds in the Fund Complex (2010-

|

|

(1955)

|

Financial

|

|

present); Senior Managing Director, Guggenheim Investments (2010-present).

|

|

|

Officer,

|

|

|

|

|

Chief

|

|

Former: Managing Director and CCO, each of the funds in the Van Kampen Investments fund complex

|

|

|

Accounting

|

|

(2004-2010); Managing Director and Head of Fund Accounting and Administration, Morgan Stanley

|

|

|

Officer and

|

|

Investment Management (2002-2004); CFO and Treasurer, Van Kampen Funds (1996-2004).

|

|

|

Treasurer

|

|

|

|

*

|

The business address of each officer is c/o Guggenheim Investments, 227 West Monroe Street, Chicago, IL 60606.

|

|

**

|

Officers serve at the pleasure of the Board of Trustees and until his or her successor is appointed and qualified or until his or her earlier resignation or removal.

|

38 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

DIVIDEND REINVESTMENT PLAN (Unaudited)

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 39

|

DIVIDEND REINVESTMENT PLAN (Unaudited) continued

|

July 31, 2016

|

40 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

APPROVAL OF ADVISORY AGREEMENTS – MANAGED

|

|

|

DURATION INVESTMENT GRADE MUNICIPAL FUND (MZF)

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 41

|

APPROVAL OF ADVISORY AGREEMENTS – MANAGED

|

|

|

DURATION INVESTMENT GRADE MUNICIPAL FUND (MZF) continued

|

July 31, 2016

|

42 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

APPROVAL OF ADVISORY AGREEMENTS – MANAGED

|

|

|

DURATION INVESTMENT GRADE MUNICIPAL FUND (MZF) continued

|

July 31, 2016

|

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 43

|

FUND INFORMATION

|

July 31, 2016

|

|

Board of Trustees

|

Investment Adviser

|

|

Randall C. Barnes

|

Cutwater Investor Services Corp.

|

|

|

New York, NY

|

|

Donald C. Cacciapaglia*

|

|

|

Servicing Agent

|

|

|

Clifford D. Corso**

|

Guggenheim Funds Distributors, LLC

|

|

|

Chicago, IL

|

|

Ronald A. Nyberg

|

|

|

|

Administrator

|

|

Ronald E. Toupin, Jr.,

|

Rydex Fund Services, LLC

|

|

Chairperson

|

Rockville, MD

|

|

|

|

|

* Trustee is an “interested person” (as defined

|

Accounting Agent, Custodian and

|

|

in section 2 (a) (19) of the 1040 Act)

|

Auction Agent

|

|

(“Interested Trustee”) of the Fund because of

|

The Bank of New York Mellon

|

|

his position as an officer of the Fund’s

|

New York, NY

|

|

Servicing Agent and certain of its affiliates.

|

|

|

Legal Counsel

|

|

|

** Trustee is an “interested person” of the

|

Simpson Thacher & Bartlett LLP

|

|

Fund as defined in the Investment Company

|

New York, NY

|

|

Act of 1940, as amended, as a result of his

|

|

|

position as an officer of the Fund’s

|

Independent Registered Public

|

|

Investment Adviser.

|

Accounting Firm

|

|

Ernst & Young LLP

|

|

|

Principal Executive Officers

|

Chicago, IL

|

|

Clifford D. Corso

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

Amy J. Lee

|

|

|

Chief Legal Officer

|

|

|

|

|

|

Mark E. Mathiasen

|

|

|

Secretary

|

|

|

|

|

|

Robin J. Shulman

|

|

|

Chief Compliance Officer

|

|

|

|

|

|

John L. Sullivan

|

|

|

Chief Financial Officer,

|

|

|

Chief Accounting Officer and Treasurer

|

|

44 l MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT

|

FUND INFORMATION continued

|

July 31, 2016

|

|

·

|

If your shares are held in a Brokerage Account, contact your Broker.

|

|

·

|

If you have physical possession of your shares in certificate form, contact the Fund’s Transfer Agent:

Computershare Trust Company N.A., P.O. Box 30170, College Station, TX 77842-3170; (866) 488-3559 or online at www.computershare.com/investor |

MZF l MANAGED DURATION INVESTMENT GRADE MUNICIPAL FUND ANNUAL REPORT l 45

|

ABOUT THE FUND MANAGER

|

|

Cutwater Investor Services Corp.

|

Guggenheim Funds Distributors, LLC

|

|

200 Park Avenue

|

227 West Monroe Street

|

|

New York, NY 10166

|

Chicago, IL 60606

|

|

(09/16)

|

Member FINRA/SIPC

|

|

|

(09/16)

|

|

(a)

|

The categories of services to be reviewed and considered for pre-approval include the following (collectively, “Identified Services”):

|

|

·

|

Annual financial statement audits

|

|

·

|

Seed audits (related to new product filings, as required)

|

|

·

|

SEC and regulatory filings and consents

|

|

·

|

Accounting consultations

|

|

·

|

Fund merger/reorganization support services

|

|

·

|

Other accounting related matters

|

|

·

|

Agreed upon procedures reports

|

|

·

|

Attestation reports

|

|

·

|

Other internal control reports

|

|

·

|

Recurring tax services:

|

|

o

|

Preparation of Federal and state income tax returns, including extensions

|

|

o

|

Preparation of calculations of taxable income, including fiscal year tax designations

|

|

o

|

Preparation of annual Federal excise tax returns (if applicable)

|

|

o

|

Preparation of calendar year excise distribution calculations

|

|

o

|

Calculation of tax equalization on an as-needed basis

|

|

o

|

Preparation of the estimated excise distribution calculations on an as-needed basis

|

|

o

|

Preparation of quarterly Federal, state and local and franchise tax estimated tax payments on an as-needed basis

|

|

o

|

Preparation of state apportionment calculations to properly allocate Fund taxable income among the states for state tax filing purposes

|

|

o

|

Provision of tax compliance services in India for Funds with direct investments in India

|

|

o

|

Assistance with management’s identification of passive foreign investment companies (PFICs) for tax purposes

|

|

·

|

Permissible non-recurring tax services upon request:

|

|

o

|

Assistance with determining ownership changes which impact a Fund’s utilization of loss carryforwards

|

|

o

|