ANNUAL

INFORMATION

FORM

FOR THE YEAR ENDED

DECEMBER 31, 2017

DATED MARCH 20, 2018

TABLE OF CONTENTS

Contents

| PRELIMINARY NOTES |

i |

| Date of Information |

i |

| Reporting Currency |

i |

| Units of Measure |

i |

| Cautionary Note to United States Investors Regarding Resource Estimates |

i |

| ITEM 1: CORPORATE STRUCTURE |

1 |

| Incorporation of the Issuer |

1 |

| Incorporate Relationships |

1 |

| ITEM 2: GENERAL DEVELOPMENT OF THE BUSINESS |

2 |

| Overview |

2 |

| Three Year History |

4 |

| ITEM 3: DESCRIPTION OF THE ISSUER'S BUSINESS |

7 |

| General |

7 |

| Cautionary Note Regarding Forward-Looking Statements |

8 |

| KSM Project |

10 |

| Courageous Lake Project |

45 |

| Iskut Project |

63 |

| ITEM 4: RISK FACTORS |

71 |

| Risks Related to the Issuer and its Industry |

71 |

| Risks Related to the Common Shares |

80 |

| ITEM 5: DIVIDENDS |

82 |

| ITEM 6: GENERAL DESCRIPTION OF CAPITAL STRUCTURE |

82 |

| ITEM 7: MARKET FOR SECURITIES |

83 |

| Trading Price and Volume |

83 |

| ITEM 8: DIRECTORS AND OFFICERS |

83 |

| ITEM 9: AUDIT COMMITTEE INFORMATION |

86 |

| Audit Committee Charter |

86 |

| Composition of the Audit Committee |

86 |

| Relevant Education and Experience |

86 |

| External Auditor Services Fees (by Category) |

87 |

| Pre-Approval of Audit and Non-Audit Services Provided by Independent Auditors |

87 |

| ITEM 10: CONFLICTS OF INTEREST |

88 |

| ITEM 11: LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

88 |

| Legal Proceedings |

88 |

| Regulatory Actions |

88 |

| ITEM 12: INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

88 |

| ITEM 13: TRANSFER AGENTS AND REGISTRARS |

89 |

| ITEM 14: MATERIAL CONTRACTS |

89 |

| ITEM 15: INTERESTS OF EXPERTS |

89 |

| ITEM 16: ADDITIONAL INFORMATION |

90 |

PRELIMINARY

NOTES

Date

of Information

The information in this Annual Information

Form (“AIF”) is presented as of December 31, 2017 unless specified otherwise.

Reporting

Currency

All dollar amounts are expressed in Canadian

dollars unless otherwise indicated. The Issuer’s quarterly and annual financial statements are presented in Canadian dollars.

Units

of Measure

In this AIF a combination of Imperial and

metric measures are used with respect to the Issuer’s mineral properties. Conversion rates from Imperial measure to metric

and from metric to Imperial are provided below:

| Imperial Measure = Metric Unit |

Metric Measure = Imperial Unit |

| 2.47 acres |

1 hectare (h) |

0.4047 hectares |

1 acre |

| 3.28 feet |

1 meter (m) |

0.3048 meters |

1 foot |

| 0.62 miles |

1 kilometer (km) |

1.609 kilometers |

1 mile |

| 0.032 ounces (troy) (oz) |

1 gram (g) |

31.1035 grams |

1 ounce (troy) |

| 1.102 tons (short) |

1 tonne (t) |

0.907 tonnes |

1 ton |

| 0.029 ounces (troy)/ton |

1 gram/tonne (g/T) |

34.28 grams/tonne |

1 ounce (troy/ton) |

Abbreviations of unit measures are used in this AIF in addition

to those in brackets in the table above as follows:

| Bt - Billion tonnes |

Ga – Giga-annum |

kWh - Kilowatt hours |

Mlb - Million pounds |

| Mm³ - Million cubic meters |

Moz - Million ounces |

m/s - Meters per second |

Mt - Million tonnes |

| MWh - Megawatt hours |

ppm - Parts per million |

ppb – parts per billion |

tpd – tonnes per day |

| W/m²- Watt per square meter |

|

|

|

See “Glossary of Technical Terms”

for a description of some important technical terms used in this AIF.

Cautionary

Note to United States Investors Regarding Resource Estimates

National Instrument 43-101 – Standards

of Disclosure for Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators

that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral

projects. Unless otherwise indicated, all resource and reserve estimates contained in or incorporated by reference in this AIF

have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and

Petroleum (the “CIM”) Standards on Mineral Resource and the Mineral Reserves, adopted by the CIM Council (the

“CIM Standards”).

United States investors are cautioned that

the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements of the SEC, including

Industry Guide 7 under the US Securities Act of 1933. Accordingly, the Issuer’s disclosures regarding mineralization may

not be comparable to similar information disclosed by companies subject to the SEC’s Industry Guide 7. Without limiting the

foregoing, while the terms “measured resources”, “indicated resources” and “inferred resources”

are recognized and required by Canadian securities laws, they are not recognized by the SEC and are not permitted to be used in

documents filed with the SEC by companies subject to Industry Guide 7. Under U.S. Standards, mineralization may not be classified

as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced

or extracted at the time the reserve determination is made. Mineral resources which are not mineral reserves do not have demonstrated

economic viability and U.S. investors are cautioned not to assume that all or any part of a mineral resource will ever be converted

into reserves.

U.S. investors should also understand that

“inferred resources” are based on limited geologic evidence and sampling and have great uncertainty as to their economic

and legal feasibility. Although it is reasonably expected that the majority of “inferred resources” could be upgraded

to “indicated resources” with continued exploration, U.S. investors are also cautioned not to assume that all or any

part of an “inferred resource” exists, is economically mineable or will ever be upgraded to a higher category. Disclosure

of “contained ounces” in a mineral resource is permitted disclosure under Canadian regulations. In contrast, under

U.S. rules, companies are normally only permitted to report “resources” as in place tonnage and grade without reference

to unit measures.

Seabridge

Gold Inc.

ANNUAL

INFORMATION FORM

| ITEM 1: | CORPORATE STRUCTURE |

Incorporation of the Issuer

Seabridge Gold Inc. (the “Issuer”

or “Seabridge”) was incorporated under the Company Act (British Columbia) on September 14, 1979 under

the name of Chopper Mines Ltd., which was subsequently changed to Dragoon Resources Ltd. on November 9, 1984, and then changed

again to Seabridge Resources Inc. on May 20, 1998. On June 20, 2002, the Issuer changed its name to “Seabridge Gold Inc.”

and on October 31, 2002, the Issuer was continued under the Canada Business Corporations Act.

The Issuer’s corporate offices are

located at 106 Front Street East, 4th Floor, Toronto, Ontario, Canada M5A 1E1. The Issuer’s telephone number is

(416) 367-9292. The Issuer’s Shares are currently listed for trading on the Toronto Stock Exchange (the “TSX”)

under the symbol “SEA” and on the New York Stock Exchange (the “NYSE”) under the symbol “SA”.

The Issuer’s registered office is located at 10th Floor, 595 Howe Street, Vancouver, British Columbia, Canada

V6C 2T5.

Incorporate Relationships

The Issuer presently has eight wholly-owned

subsidiaries: Seabridge Gold (NWT) Inc., a company incorporated under the laws of the Northwest Territories of Canada; SnipGold

Corp., Hattrick Resources Corp. (“Hattrick”) and Tuksi Mining & Development Company Ltd. (“Tuksi”),

companies incorporated under the laws of British Columbia, Canada; and Seabridge Gold Corporation, Pacific Intermountain Gold,

Corporation, 5555 Gold Inc. and 555 Silver Inc., each Nevada Corporations. The following diagram illustrates the inter-corporate

relationship between the Issuer, its active subsidiaries and its projects as of December 31, 2017.

| |

SEABRIDGE GOLD INC. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

100% |

|

|

|

100% |

100% |

|

|

Seabridge Gold

(NWT) Inc.

(Northwest

Territories) |

|

|

|

|

SnipGold Corp.

(British Columbia)

and its subsidiaries, Hattrick and Tuksi |

|

Seabridge Gold Corporation (Nevada) |

|

| 100% |

|

|

|

100% |

|

100%2 |

|

|

|

|

100% |

|

Courageous Lake

Project (Northwest Territories) |

KSM Project

(British Columbia)

|

|

Iskut Project

(BritishColumbia) |

|

Snowstorm

Project (Nevada) |

|

|

| |

|

|

|

|

|

100% |

|

|

| |

Quartz Mountain Project (Oregon)1 |

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Certain of Seabridge’s US

subsidiaries have been omitted as they are inactive and own no property.

1 - Seabridge has entered into

an option agreement under which a 100% interest in the Quartz Mountain Project may be acquired by a third party.

2 – SnipGold, through one of its

subsidiaries, only owns 95% of certain of the claims.

| ITEM 2: | GENERAL DEVELOPMENT OF THE BUSINESS |

Overview

Since 1999, Seabridge has taken steps to

achieve its goal of providing strong returns to shareholders by maximizing leverage to the price of gold. The Issuer’s strategy

to achieve this goal is to optimize gold ownership per Common share by increasing gold resources more rapidly than shares outstanding.

This ratio of gold ownership per Common share has provided a simple but effective measure for evaluating dollars spent on behalf

of shareholders.

In 1999, management decided that Seabridge’s

strategic focus would be on acquiring, exploring and developing gold deposits. Seabridge determined it would not build or operate

mines, but that it would look to partner or sell assets that were advancing toward production. In the Issuer’s view, building

mines adds considerable technical and financial risks and requires a different set of skills and resources. Seabridge also decided

it would focus on exploration projects with known gold deposits but exploration upside to reduce risk in terms of trying to achieve

a growing ratio of gold ownership per Common share. The Issuer therefore narrowed the activities it would undertake to the following

three phases, which phases it planned to progress through in the order set forth and in response to increases in the price of gold:

(i) acquiring known gold deposits, (ii) expanding the deposits, and (iii) defining the economic parameters of the deposits through

engineering studies and upgrading mineral resources to reserves. The Issuer believed this was a relatively lower-risk and less

capital-intensive strategy consistent with the goal of optimizing gold ownership per Common share.

In 1999, Seabridge set out to buy gold

deposits in North America that were not economic in a low gold price environment. North America was selected as the preferred jurisdiction

because of its established mineral tenure and permitting procedures, political stability and infrastructure advantages. At that

time, many projects were for sale at distressed prices as producers struggled to stay in business. Seabridge decided it would acquire

projects with three main characteristics:

| 1. | Proven resources with quality work done by reputable companies; |

| 2. | Upside exploration potential; and |

| 3. | Low holding costs to conserve cash in the event that a higher gold price was not achieved. |

From 1999 to 2002, Seabridge acquired eight

deposits with gold resources in North America, paying less than US$1.00 per ounce of resource (using aggregate ounces from all

resource categories) and has been paying less than US$0.10 per ounce per year in holding costs. Previous owners had spent an estimated

US$300 million exploring and developing these deposits.

By 2002, with the gold price on the rise,

the Issuer believed that it was becoming more expensive to acquire existing resources, and the cost-benefit equation tilted in

favor of increasing gold ownership through exploration. Seabridge’s strategy entered its second phase, which was to expand

the Issuer’s resource base by carefully targeted exploration. These efforts have proved highly successful, with measured

and indicated gold resources now totaling 61 million ounces with an additional 54 million ounces of gold in the inferred resource

category (see Mineral Resources Table on page 7) against a backdrop of only 57.7 million shares outstanding.

By 2008, the gold price had risen sufficiently

to make Seabridge think that a number of its projects might be economic. Therefore Seabridge began work on the third phase of its

strategy: defining the economics of its projects through engineering studies and upgrading resources to reserves. This effort focused

on the KSM Project, which, during the exploration phase, had emerged as the Issuer’s most important asset. The permitting

process began and the Issuer undertook substantial infill drilling programs to raise the confidence level in the project’s

resources. The Issuer completed its initial Preliminary Feasibility Study for the KSM Project in March 2010, which was updated

in June, 2011. The Issuer then undertook further optimization work at the KSM Project and revised its project design based on input

received from regulatory authorities and local aboriginal groups during a joint harmonized environmental assessment process managed

by the Province of British Columbia and Canada. This work is reflected in the third Preliminary Feasibility Study for the KSM Project

completed in June 2012. The Issuer submitted its Environmental Impact Statement/Environmental Assessment Application in the first

quarter of 2013, it was accepted for formal review by British Columbia in August, 2013 and it was approved by both the federal

and provincial authorities in 2014. The Environmental Impact Statement/Environmental Assessment Application is based on the KSM

Project design in the 2012 KSM Preliminary Feasibility Study.

In conjunction with advancing the EA Application

and EIS, the Issuer has been working to build its relationships with the Nisga’a Nation and other First Nations, including

pursuing impacts and benefits agreements with potentially impacted aboriginal groups. In June, 2014, the Issuer and the Nisga’a

Nation entered into a formal Benefits Agreement. In September, 2013, the Gitxsan Treaty Society, representing the Gitxsan Hereditary

Chiefs, delivered a letter to regulators expressing its support of Seabridge Gold's KSM Project. In June, 2014 the Issuer announced

it had reached an agreement with the Gitanyow Hereditary Chiefs Office and the wilps represented by Gitanyow Hereditary

Chiefs Office. Work to maintain and improve these relationships, as well as relationships with the other aboriginal groups in the

area is ongoing.

In September, 2014, the Issuer received

early-stage construction permits for its KSM Project from the Province of British Columbia. The permits issued include: (1) authority

to construct and use roadways along Coulter Creek and Treaty Creek; (2) rights-of-way for the proposed Mitchell-Treaty tunnels

connecting project facilities; (3) permits for constructing and operating numerous camps required to support constructions activities;

and (4) permits authorizing early-stage construction activities at the mine site and tailings management facility.

In 2010 the Issuer also turned its attention

to its second-largest asset, the Courageous Lake Project. A preliminary economic assessment of this project was completed in early

2008 and indicated that the project’s economics were marginal at the then prevailing gold price. However, with the increase

in the gold price by 2010, the Issuer decided to start taking the Courageous Lake Project along a similar development path to the

KSM Project, including additional drilling and further engineering work, and completed a preliminary feasibility study in September,

2012.

In 2012 the Issuer refocused its exploration

activities and began undertaking drilling of new targets at both the KSM Project, in search of higher grade core zones, and the

Courageous Lake Project, in search of deposits of higher grade material, that could improve the economics of each project. The

exploration programs in the 2012 to 2017 seasons were very successful, with the generation of successive resource estimates for

the Kerr deposit and the Iron Cap deposit at the KSM Project and a resource estimate at the Walsh Lake deposit at the Courageous

Lake Project. Over that time exploration success at the KSM Project has resulted in the aggregate mineral resources increasing

significantly since 2012, with large newly identified zones of higher grade mineralization below the Kerr deposit and the Iron

Cap deposit potentially having important positive impacts on the economics of the KSM Project.

After several years of declines in the

price of gold, in late 2015 the Issuer decided to look once again for opportunities to acquire gold properties as they were becoming

available at more attractive prices. Since the Issuer is much larger than it was in the 1999-2002 period when it was first acquiring

properties, it has focused on identifying larger properties with potential for major deposits. In April, 2016, the Issuer reached

an agreement to acquire SnipGold Corp., the owner of the highly prospective Iskut Project, and completed the acquisition in June

2016. In February, 2017, the Issuer announced that it had entered into a letter of intent to acquire the Snowstorm Project in Northern

Nevada and completed the acquisition in June, 2017.

To date, work on the KSM Project and the

Courageous Lake Project has been funded in part by the sale of, or the optioning of, non-core assets, consistent with the Issuer’s

strategy of limiting share dilution. The Issuer has sold the Noche Buena Project and its early-stage Nevada properties and entered

into option agreements in respect of each of the Grassy Mountain, Red Mountain, Quartz Mountain and Castle Black Rock projects

under which the respective optionees could acquire a 100% interest in such properties. The Grassy Mountain project was sold in

February, 2013 upon exercise of the option to acquire a 100% interest in the Grassy Mountain property granted by the Issuer in

2011. In February, 2017, the option to acquire a 100% interest in the Castle Black Rock Project was exercised and the Project was

sold. In May, 2017, the holder of the option on the Red Mountain Project acquired the Project from the Issuer. In addition to the

proceeds received on the sale of these Projects, the Issuer has the potential to receive additional payments in respect of the

Grassy Mountain and Red Mountain Projects in the form of a net profits royalty (Grassy Mountain) and a metal stream (Red Mountain).

Seabridge intends to seek a sale or joint

venture of its two core assets, the KSM Project and the Courageous Lake Project, or a sale of the Issuer, while the current phase

of finding and delineating higher grade zones to improve the economics of these projects and additional de-risking of these projects

is being advanced. One of the goals of the search for high grade core zones at the KSM Project was to change its economic profile.

Before finding the higher grade mineralized zones below the Kerr deposit, KSM was a gold project with a robust copper credit that

would appeal primarily to gold miners as prospective partners. Now, KSM has a much stronger copper profile which opens up the potential

for a joint venture with a large base metal producer. Realizing value for the Issuer’s shareholders will depend on the potential

financial return for a prospective purchaser or partner, successfully addressing regulatory and aboriginal concerns as well as

market conditions at the time, especially gold and copper prices. The timing of sales or partnership agreements, if any, cannot

be determined at this juncture.

The continuing success of the Issuer is

dependent on (1) the Issuer being able to raise capital as needed (2) strength in the price of gold and copper (3) exploration

success on projects it is exploring on its own account and/or (4) advancing its projects through optimization work, regulatory

reviews and permitting.

Three Year History

During the three most recently completed

financial years, the Issuer has principally focused its exploration and development efforts on its core project, KSM, in British

Columbia. Minimal work was undertaken at Courageous Lake over those years. In addition, in 2016 the Issuer began exploration and

reclamation work at the Iskut Project, which continued in 2017.

After its announcement in September, 2014

of a discovery of a major gold-copper occurrence below the Iron Cap zone at higher grades than the Iron Cap reserve, the Issuer

intensified drilling of the occurrence in an effort to be able to generate a resource estimate for the zone. In March, 2015 the

Issuer announced updated inferred resource estimates for Deep Kerr and the Iron Cap Lower Zone.

In 2015 the Issuer continued with its core

zone exploration program, with a focus on drilling to confirm the continuity of the mineralized zone below the inferred resources

at Deep Kerr and to drill test the plunge projection of the higher grade central zone of the Mitchell deposit. Drilling at the

Mitchell deposit yielded an intercept of 174 m averaging 0.55 g/T gold and 0.28% copper more than 200 m to the southwest of another

intercept of 167 m averaging 0.81 g/T gold and 0.25% copper, which appear to evidence an extension of the Mitchell central zone.

The Issuer decided that evidence of faulting in these holes needed to be analyzed before further drilling is undertaken. Drilling

at Deep Kerr in 2015 confirmed a major extension of the deposit. On March 8, 2016, the Issuer announced a new inferred resource

estimate at Deep Kerr, which incorporates the results of 2015 exploration work.

In 2016 the Issuer advanced the KSM Project

in several respects. The Issuer decided to update the 2012 Pre-Feasibility Study but also to complete a preliminary economic assessment

that takes a different approach to developing the KSM Project by incorporating the expanded Kerr Zone and the Iron Cap Lower Zone

into a conceptual project design. The new Prefeasibility Feasibility Report, which included within it the preliminary economic

assessment, was completed in early November, 2016.

The 2016 exploration program at KSM successfully

extended the Kerr deposit in a manner that is expected to expand block cave designs for a new mine plan and drilling at the Iron

Cap deposit not only successfully found the down plunge extension of Iron Cap Lower Zone but also intersected a new shallower mineralized

zone in a 61m interval that averaged 1.2 g/T gold, 0.95% copper and 4.4 g/T silver. A new resource estimate for the Kerr deposit

was announced in February, 2017.

In 2016, the Issuer also received a permit

to construct an adit at Kerr, which would allow access for exploration drilling into the lower zones of the Kerr deposit and test

for deeper extensions, and a water license from the Government of Canada under the International Rivers Improvements Act

required for the construction, operation and maintenance of the Water Storage Facility and associated ancillary water works at

Mitchell Creek. The Issuer released the initial report of its Independent Geotechnical Review Board in 2016, which concluded the

KSM Project’s tailing facility and water storage dam designs were appropriate and a Best Available Tailings Technology review

of its tailings facility design which concluded the proposed design of the tailing facility utilizes the best available technology.

In 2016, the Issuer also completed its

first major property acquisition in many years with the acquisition of all of the shares of SnipGold Corp. by way of Plan of Arrangement.

At the time, SnipGold Corp. was the owner of a 100% interest in the Iskut Project, as well as the owner, subject to an option agreement,

of the neighbouring KSP Project. The Issuer issued 695,277 shares to acquire SnipGold Corp. At the Iskut Project, in 2016 the Issuer

conducted an exploration involving 3,000 meters of core drilling designed to help determine controls on gold mineralization for

several known occurrences, including past high grade producers. A geophysical program was also conducted at the Iskut Project,

using full tensor magnetotellurics (MT) to provide resistivity images of target areas. These resistivity images are being used

to identify altered structures and extensive hydrothermal alteration associated with mineralization. After analyzing the results

of the 2016 program at the Iskut Project the Issuer considered that these data pointed to a large and compelling target for the

potential discovery of an intermediate-sulfidation epithermal precious metals system overlying porphyry copper-gold mineralization.

In addition, in 2016 the Issuer commenced remediation work at the Iskut Project in respect of historical workings, debris and equipment

from the previously operated Johnny Mountain mine.

In 2017, the Issuer’s exploration

program at KSM followed up on the exciting results from drilling at the Iron Cap deposit in 2016. There were two targets; the down

plunge projection of the Lower Iron Cap zone and the shallower high grade zone discovered in 2016 in hole IC-16-62. The Issuer

completed 10,383m of drilling in 11 holes at Iron Cap, all of which encountered wide zones of significant grade. In some holes

the Issuer encountered some of the best grades to date over long intervals at the Project. A new resource estimate was announced

for Iron Cap in February, 2018, that incorporated all previous drilling results at Iron Cap and increased gold and copper resources

at Iron Cap by more than 300%. The Issuer now believes that Iron Cap has the potential to make a strong contribution to improving

KSM Project economics on account of its higher grade and its location close to planned infrastructure, in particular the Mitchell-Treaty

Tunnels.

At the Iskut Project, in 2017 drilling

focused on the Quartz Rise target where 4,459 m of drilling was completed in 10 core holes. Drilling found evidence of a gold-bearing

intermediate sulfidation epithermal system beneath the Quartz Rise lithocap, as anticipated. Gold was intercepted over short intervals.

Sampling of a cliff face north of Quartz Rise returned very high grades ranging from 1.49 to 125.3 g/T gold. A source for these

gold concentrations was not found in the 2017 drilling but the data acquired in this year’s program has defined a target

which could account for these high grade results. An exploration program is being planned for 2018 to pursue this target.

Progress was also made in 2017 on permitting

at KSM, environmental remediation at the old Johnny Mountain mine site (on the Iskut Project), and relations with indigenous groups

in the area of the KSM Project. Amongst other permitting advances, the federal government approved an amendment to Schedule 2 of

the Metal Mining Effluent Regulations under the Fisheries Act (Canada) authorizing aspects of the proposed tailings

management facility for the KSM Project. At the Johnny Mountain mine the Issuer also completed structural work on the tailings

pond, removed a tank farm, closed old mine portals and progressed clean-up of the mill, amongst other things.

In accordance with its initiative to acquire

new larger properties with potential for major deposits, the Issuer completed the acquisition of a 100% interest in the Snowstorm

Project in June, 2017. The Snowstorm Project consists of 31 square miles of land holdings strategically located at the projected

intersection of three of the most important gold trends in Northern Nevada: the Carlin Trend, the Getchell Trend and the Northern

Nevada Rift Zone. Snowstorm is contiguous and on strike with several large, successful gold producers including the Getchell/Turquoise

Ridge Joint Venture operated by Barrick Gold, Newmont Mining’s Twin Creeks and Klondex Mines’ Midas operations. The

Snowstorm acquisition also includes an extensive package of data generated by previous operators. Although potential targets are

hidden under Tertiary cover, the existing data supports the project’s outstanding exploration potential. Geological and geochemical

evaluations of Snowstorm have documented hydrothermal alteration zones consistent with large Northern Nevada deposit types. Geophysical

surveys have confirmed the structural settings which host large Northern Nevada deposit types. Limited drilling has demonstrated

that some of the target areas are at a depth amenable to surface exploration and resource delineation.

The Issuer continued to realize proceeds

from the sale of its non-core assets in 2017. The Castle Blackrock property was sold in February, 2017 and the holder of the option

on the Red Mountain Project completed the exercise of its option and acquired this property in May, 2017. The Issuer also sold

its residual interest in the KSP Project, which is adjacent to its Iskut Project, as the holder of an option to acquire an 80%

interest in the KSP property was close to completing its earn-in.

At the date of this AIF, over 80% of the

mineral resources at all of its projects combined are at the KSM Project and accordingly the majority of the Issuer’s focus

will be on its KSM Project in 2018. The Issuer resumed exploration work at its Courageous Lake Project in February, 2018. The Issuer

also considers the Iskut Project to have good potential for a sizeable discovery and plans to make it one of the focuses of the

Issuer’s exploration efforts in 2018.

| ITEM 3: | DESCRIPTION OF THE ISSUER'S BUSINESS |

General

The Issuer owns 5 properties, 4 of which

have gold resources, and its material properties are its KSM Project and its Courageous Lake Project. The Issuer holds a 100% interest

in each of its properties other than a small portion of the Iskut Project, in which it owns a 95% interest. The Quartz Mountain

project is subject to an option agreement under which the optionee may acquire a 100% interest in such project. At the date of

this AIF, the estimated gold resources at the Issuer’s properties are set forth in the following table and are broken down

by project and resource category.

Mineral Resources (Gold and Copper)

| PROJECT |

Cut-Off

Grade

(g/T) |

Measured |

Indicated |

Inferred |

Tonnes

(000’s) |

Gold

Grade

(g/T) |

Gold

(000’s ozs) |

Copper

Grade

(%) |

Copper

(million

lbs) |

Tonnes

(000’s) |

Gold

Grade

(g/T) |

Gold

(000’s ozs) |

Copper

Grade

(%) |

Copper

(million

lbs) |

Tonnes

(000’s) |

Gold

Grade

(g/T) |

Gold

(000’s ozs) |

Copper

Grade

(%) |

Copper

(million

lbs) |

| KSM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mitchell |

See Note 1 |

750,100 |

0.63 |

15,127 |

0.17 |

2,844 |

1,044,600 |

0.57 |

19,183 |

0.16 |

3,794 |

478,400 |

0.38 |

6,414 |

0.10 |

1,232 |

| Iron Cap |

See Note 1 |

-- |

-- |

-- |

-- |

-- |

370,000 |

0.43 |

5,112 |

0.23 |

1,874 |

1,297,000 |

0.48 |

20,023 |

0.30 |

8,579 |

| Sulphurets |

See Note 1 |

-- |

-- |

-- |

-- |

-- |

381,600 |

0.58 |

7,116 |

0.21 |

1,766 |

182,300 |

0.46 |

2,696 |

0.14 |

563 |

| Kerr |

See Note 1 |

-- |

-- |

-- |

-- |

-- |

378,400 |

0.22 |

2,692 |

0.41 |

3,445 |

2,001,500 |

0.31 |

19,746 |

0.40 |

17,672 |

| KSM Total² |

-- |

750,100 |

0.63 |

15,127 |

0.17 |

2,844 |

2,174,600 |

0.49 |

34,103 |

0.23 |

10,879 |

3,959,200 |

0.38 |

48,879 |

0.36 |

28,046 |

|

Courageous

Lake:

Fat Deposit²

Walsh Lake² |

0.83

0.60 |

13,401

-- |

2.53

-- |

1,090

-- |

--

-- |

--

-- |

93,914

-- |

2.28

-- |

6,884

-- |

--

-- |

--

-- |

48,963

4,624 |

2.18

3.24 |

3,432

482 |

--

-- |

--

-- |

Quartz

Mountain3 |

0.34 |

3,480 |

0.98 |

110 |

-- |

-- |

54,330 |

0.91 |

1,591 |

-- |

-- |

44,800 |

0.72 |

1,043 |

-- |

-- |

| Iskut (Bronson Slope) |

See Note 4 |

84,150 |

0.42 |

1,140 |

0.15 |

280 |

102,740 |

0.31 |

1,020 |

0.10 |

222 |

-- |

-- |

-- |

-- |

-- |

| Note: | The resource estimates have been prepared in accordance with NI 43-101. See “Cautionary Note

to United States Investors Regarding Resource Estimates” in the Preliminary Notes. |

| 1. | The cut-off grade for KSM is CDN$9 in net smelter return (NSR) for the open pits and CDN$16 in

NSR for the underground mining. |

| 2. | The effective dates of the KSM and Courageous Lake resource estimates above are as follows: KSM

(Mitchell and Sulphurets) May 31, 2016; KSM (Kerr) February, 2017; KSM (Iron Cap) February, 2018; Courageous Lake (Fat), September

2012; and Courageous Lake (Walsh Lake), March, 2014. |

| 3. | Seabridge has entered into an option agreement under which a 100% interest in the Quartz Mountain

project may be acquired. |

| 4. | The cut-off grade for the Iskut Project resource is CDN$9.00 in NSR. |

The measured and indicated mineral resources

at the KSM Project and Courageous Lake Project are inclusive of mineral reserves. Mineral resources which are not mineral reserves

do not have demonstrated economic viability.

Cautionary Note Regarding

Forward-Looking Statements

This AIF contains forward-looking statements

within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within

the meaning of Canadian securities laws concerning future events or future performance with respect to the Issuer’s projects,

business approach and plans, including production, capital, operating and cash flow estimates; business transactions such as the

potential sale or joint venture of the Issuer’s KSM Project and Courageous Lake Project (each as defined herein) and the

acquisition of interests in mineral properties; requirements for additional capital; the estimation of mineral resources and reserves;

and the timing of completion and success of exploration and development activities, community relations, required regulatory and

third party consents, permitting and related programs in relation to the KSM Project, Courageous Lake Project or Iskut Project.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives

or future events or performance (often, but not always, using words or phrases such as “expects”, “anticipates”,

“believes”, “plans”, “projects”, “estimates”, “intends”, “strategy”,

“goals”, “objectives” or variations thereof or stating that certain actions, events or results “may”,

“could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative

of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements and

forward-looking information (collectively referred to in the following information simply as “forward-looking statements”).

In addition, statements concerning mineral reserve and mineral resource estimates constitute forward-looking statements to the

extent that they involve estimates of the mineralization expected to be encountered if a mineral property is developed and the

economics of developing a property and producing minerals.

Forward-looking statements are necessarily

based on estimates and assumptions made by the Issuer in light of its experience and perception of historical trends, current conditions

and expected future developments. In making the forward-looking statements in this AIF the Issuer has applied several material

assumptions including, but not limited to, the assumption that: (1) market fundamentals will result in sustained demand and prices

for gold and copper, and to a much lesser degree, silver and molybdenum; (2) the potential for production at its mineral projects

will continue operationally, legally and economically; (3) any additional financing needed will be available on reasonable terms;

and (4) estimated reserves and resources at the Issuer’s projects have merit and there is continuity of mineralization as

reflected in such estimates.

Forward-looking statements are subject

to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from

those expressed or implied by the forward-looking statements, including, without limitation:

| · | the Issuer’s history of net losses and negative cash flows from operations and expectation

of future losses and negative cash flows from operations; |

| · | risks related to the Issuer’s ability to continue its exploration activities and future development

activities, and to continue to maintain corporate office support of these activities, which are dependent on the Issuer’s

ability to enter into joint ventures, to sell property interests or to obtain suitable financing; |

| · | uncertainty of whether the reserves estimated on the Issuer’s mineral properties will be

brought into production; |

| · | uncertainties relating to the assumptions underlying the Issuer’s reserve and resource estimates; |

| · | uncertainty of estimates of capital costs, operating costs, production and economic returns; |

| · | risks related to commercially producing precious metals from the Issuer’s mineral properties; |

| · | risks related to fluctuations in the market price of gold, copper and other metals; |

| · | risks related to fluctuations in foreign exchange rates; |

| · | mining, exploration and development risks that could result in damage to mineral properties, plant

and equipment, personal injury, environmental damage and delays in mining, which may be uninsurable or not insurable in adequate

amounts; |

| · | risks related to obtaining all necessary permits and governmental approvals for exploration and

development activities, including in respect of environmental regulation; |

| · | uncertainty related to title to the Issuer’s mineral properties and rights of access over

or through lands subject to third party rights, interests and mineral tenures; |

| · | risks related to unsettled First Nations rights and title and settled Treaty Nations’ rights; |

| · | risks related to increases in demand for exploration, development and construction services equipment,

and related cost increases; |

| · | increased competition in the mining industry; |

| · | the Issuer’s need to attract and retain qualified management and personnel; |

| · | risks related to some of the Issuer’s directors’ and officers’ involvement with

other natural resource companies; |

| · | our classification as a "passive foreign investment company" under the United States

tax code; |

| · | risks associated with the use of information technology systems and cybersecurity; and |

| · | uncertainty surrounding an audit by the Canada Revenue Agency of the Issuer's refund claim in respect

of the British Columbia Mining Exploration Tax Credit. |

This list is not exhaustive of the factors

that may affect any of the Issuer’s forward-looking statements. Forward-looking statements are statements about the future

and are inherently uncertain, and actual achievements of the Issuer or other future events or conditions may differ materially

from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without

limitation, those referred to in this AIF under the heading “Risk Factors” and elsewhere in this AIF. In addition,

although the Issuer has attempted to identify important factors that could cause actual achievements, events or conditions to differ

materially from those identified in the forward-looking statements, there may be other factors that cause achievements, events

or conditions not to be as anticipated, estimated or intended. Many of the foregoing factors are beyond the Issuer’s ability

to control or predict. It is also noted that while Seabridge engages in exploration and development of its properties, it will

not undertake production activities by itself.

These forward-looking statements are based

on the beliefs, expectations and opinions of management on the date the statements are made and the Issuer does not assume any

obligation to update forward-looking statements, except as required by applicable securities laws, if circumstances or management’s

beliefs, expectations or opinions should change. For the reasons set forth above, investors should not place undue reliance on

forward-looking statements.

KSM Project

Overview

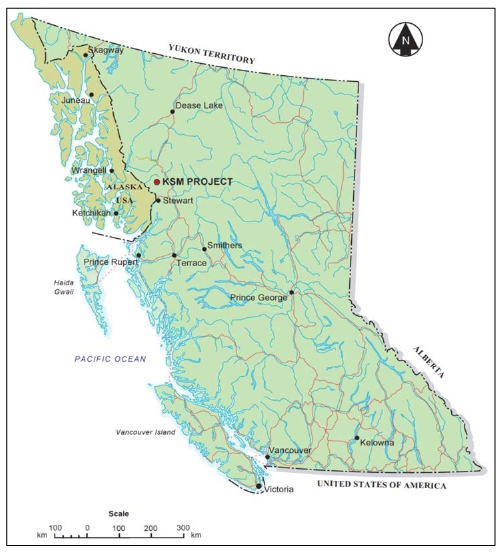

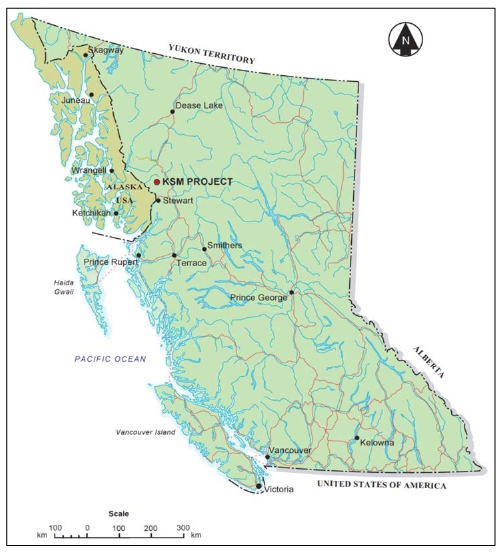

The KSM Project is located within the Iskut-Stikine

region of British Columbia, approximately 21 kilometers south-southeast of the former Eskay Creek Mine and approximately 65 kilometers

north-northwest of Stewart, British Columbia. (See Figure 1.) The provincial government has recognized the significance of historical

mining activity in this area, which includes the past producing Eskay Creek, Snip, Granduc, and Premier mines. Recently the Red

Chris Mine commenced mining operations and the Brucejack Mine is at an advanced stage of construction.

Access to the property is by helicopter

from Bell II Crossing on the Stewart Cassiar Highway or Stewart, British Columbia. Mobilization of equipment and personnel is staged

from kilometer 54 on the private Eskay Creek Mine Road (about 25 km from the Project) and from Bell II Crossing on the Stewart

Cassiar Highway (about 40 km from the Project).

At the time the Issuer acquired the KSM

Project in 2001, the project consisted of two distinct zones (Kerr and Sulphurets) which had been modeled separately by Placer

Dome (CLA) Limited (“Placer Dome”). Subsequent drilling and engineering work by the Issuer has defined two new

zones, the very large Mitchell Zone and the Iron Cap Zone, as well as dramatically expanding the mineralized zone beneath the Kerr

zone.

From 2008 to 2012 Seabridge focused on

further exploration and development of the four known deposits at the KSM Project and generated successive resource estimates

and three preliminary feasibility studies, the last of which being the 2012 KSM PFS Report (as defined herein) with an effective

date of June 22, 2012. In 2012 Seabridge continued development efforts, including work required for the submission of its EIS/EA

Application, but changed its exploration focus at KSM to a search for higher temperature core zones that typically concentrate

high-grade metals within very large porphyry systems such as KSM. Exploration since 2011 has resulted in the discovery of two

core zones, Deep Kerr and Iron Cap Lower Zone, an extension of the Mitchell zone and other promising core targets. (See “Core

Zone Exploration”)

After completing drilling in 2017 the drill

hole database for the KSM Project now includes 673 drill holes totaling approximately 260,533 meters. More than 95% of the holes

at Mitchell and 95% of the holes at Iron Cap were drilled by Seabridge between 2006 and 2016.

In July, 2014, the Issuer’s provincial

EA Application for the KSM Project under the British Columbia Environmental Assessment Act was approved. The Canadian Environmental

Assessment Agency (CEAA) issued its Comprehensive Study Report in July 2014, as required by the Canadian Environmental Assessment

Act, which concluded that the KSM Project would not have significant impacts to the environment, including the environment

situated downstream at the Alaska border. In December 2014 the Federal Minister of the Environment issued a positive project decision

which endorsed the conclusions of the Comprehensive Study Report. The Issuer believes that the EA Application/EIS materials and

subsequent approvals demonstrate that the KSM project, as designed, is an environmentally responsible and a generally socially

accepted Project.

Figure 1 - KSM

Project Location Map

After completion of the 2015 exploration

season the Issuer announced a resource estimate for the Kerr/Deep Kerr zone that exceeded 1 billion tonnes and at higher grade

than much of the material in the mine plan used for the 2012 KSM PFS Report. This new deposit presented great potential for improving

Project economics if it was incorporated into the Issuer’s development plan at the Project. In addition, in the course of

the EA/EIS review process, the Issuer made commitments to enhance the environmental mitigation and protection offered by the Project,

which the Issuer knew would increase the cost of building KSM Project infrastructure. Since the 2012 KSM PFS Report did not incorporate

the Deep Kerr deposit or these increased infrastructure costs, and given the change in the market prices used in the 2012 KSM PFS

Report, the Issuer decided in early 2016 to update the 2012 KSM PFS Report. In November, 2016, the Issuer completed a new pre-feasibility

study report which reflected more current market conditions and included the costs associated with the Issuer’s EA/EIS commitments,

but otherwise used essentially the same development plan and mine plan as in the 2012 KSM PFS Report. The report also presented

an alternative development plan for the Project, at a preliminary economic assessment level, that incorporated material from the

Deep Kerr deposit. Overall, this new report showed that the projected economics of the original development plan had declined since

2012, but that the projected economics of the development plan that incorporated the Kerr deposit in its entirety showed meaningful

improvement.

Additional drilling was completed at the

Iron Cap deposit in 2017 with great success. In February, 2018, an updated resource estimate was completed for the Iron Cap deposit

that significantly increased inferred resources.

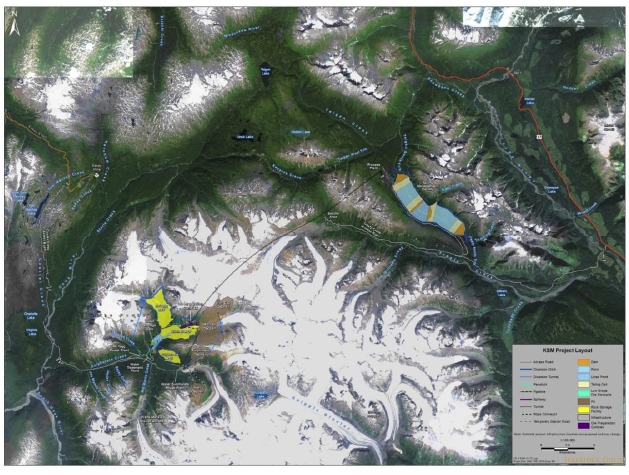

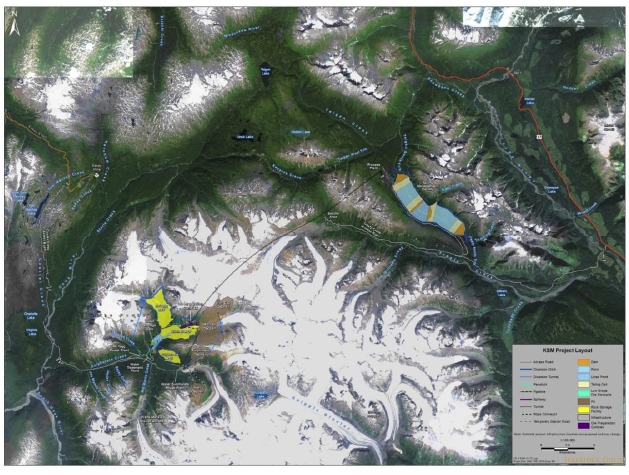

Land Status

The KSM property is comprised of three

discontinuous claim blocks (see Figure 2). These claim blocks are referred to as:

| 2. | the Seabee/Tina claims; and |

| 3. | the KSM placer claim block. |

The first two claim blocks (KSM and Seabee/Tina)

contain two mineral leases and 77 mineral claims, consisting of both cell and legacy claims. The total area of the first two claim

blocks is 39,148 hectares. The Seabee/Tina claim block is about 19 km northeast of the KSM claim group. The KSM claim group includes:

| (a) | 1 mineral lease (previously 30 contiguous mineral cell claims) covering an area of 6,085 hectares

within which the mineral deposits lie; |

| (b) | 1 mineral lease (previously 16 mineral legacy “BJ” claims) covering approximately 5,162

hectares within which certain infrastructure for the proposed mining operation would lie; |

| (c) | 20 mineral legacy “New BJ” claims covering approximately 6,097 hectares that are adjacent

to the “BJ” claims described in paragraph (b). |

The Seabee/Tina claims include 50 mineral

cell claims (Seabee Property) and 7 mineral legacy claims (Tina Property), covering approximately 21,727 hectares, that are located

about 19 kilometers northeast of the KSM property where certain of the KSM Project’s proposed processing plants and tailings

management facility (TMF”) would be located.

The KSM placer claims include 3 placer

cell claims covering an area of 178.6 hectares which are along Sulphurets Creek and Mitchell Creek in areas where certain of the

Project’s proposed infrastructure will be located.

These claims are 100% owned by the Issuer.

Barrick Gold Corporation retains a 1% NSR Royalty that is capped at $4.5 million. Two of the pre-converted claims at the Sulphurets

property (Xray 2 and 6) are also subject to an effective 1% NSR capped at US$650,000. The two groups of BJ legacy claims are subject

to royalties, however, none of the mineral deposits at the KSM Project lie within the BJ legacy claims. In addition, the Issuer

has granted two options to a subsidiary of Royal Gold, Inc. under which such subsidiary can acquire a 1.25% NSR Royalty and a 0.75%

NSR Royalty in gold and silver produced from the KSM Property for $100 million and $60 million, respectively, subject to certain

conditions. Under the Benefits Agreement with the Nisga'a Nation, the Issuer has agreed to pay the Nisga'a Nation annual payments

equal to a percentage of the tax payable under the Mineral Tax Act (British Columbia), which is a tax on net profits. Effectively,

0.1% of net operating profits is payable while capital is being recovered and, once capital is recovered, 1.43% of net profits

is payable to the Nisga'a Nation, as determined under the provisions of the Mineral Tax Act.

Figure 2 - KSM Project Claim

Map

The property is located on Crown land;

therefore, all surface and access rights are granted under, and subject to, the Land Act (British Columbia) and the Mineral

Tenure Act (British Columbia). Approximately 13 km of the proposed 23 km Mitchell-Treaty tunnels (the “MTT”) pass

under Crown Land subject to mineral claims held by third parties. The Issuer has been granted a licence of occupation, a form of

land tenure that grants it rights to occupy the area through which the proposed MTT will pass, subject to the rights of the third

party mineral claims holders. In the Issuer’s opinion, these rights are addressed by the Issuer’s obligation under

the licence of occupation to segregate and deliver to such claims holders all earth and rock material removed from the third party

claims during construction of the MTT. Certain lands which the Issuer proposes to use for infrastructure are subject to placer

claims held by third parties, parts of which could be adversely affected by the proposed KSM Project.

The four gold-copper deposits, and the

proposed waste rock storage areas, lie within the Unuk River drainage in the area covered by the Cassiar-Iskut-Stikine Land and

Resource Management Plan approved by the British Columbia Government in 2000. A part of the proposed ore transport tunnel lies

within the boundaries of the South Nass Sustainable Resource Management Plan that is currently in development. The proposed sites

for the tailing management and plant facilities lie outside of the boundaries of any provincial land-use planning process.

Relationships with

Aboriginal Groups in KSM Region

The KSM Project site is located in a region

historically used by several aboriginal groups. Part of the Project, including the proposed plant and TMF but excluding the mineral

deposits and their immediately-related infrastructure, lies within the boundaries of the Nass Area, as defined in the Nisga'a

Final Agreement. In this area, consultation, led by the federal and provincial governments, is required with the Nisga'a

Lisims Government under the terms of the Final Agreement. Similarly, the Tahltan First Nation has asserted rights and title over

the area of the proposed plant and tailings management facility but excluding the mineral deposits. Tsetsaut Skii km Lax Ha, an

aboriginal group asserting independent nation status which the Issuer understands is viewed by the Crown as being a wilp of the

Gitxsan Nation, assert aboriginal rights and title over the entire KSM Project footprint. Additionally, the Gitanyow Huwilp may

have some interests within the broader region potentially affected by the KSM Project, particularly downstream of the plant site

and TMF. Accordingly, the Issuer has been directed to engage with the Tahltan First Nation, with the Tsetsaut Ski km Lax Ha as

a wilp of the Gitxsan Nation and the Gitanyow Nation on the basis of potential effects of the plant site and TMF and related downstream

effects.

On June 16, 2014, the Issuer entered into

a comprehensive Benefits Agreement with the Nisga’a Nation in respect of the KSM Project. The Benefits Agreement establishes

a long-term co-operative relationship between Seabridge and the Nisga’a Nation under which the Nisga’a

Nation will support development of the Project, participate in economic benefits from the Project and provide ongoing advice. Highlights

of the Benefits Agreement include:

| · | Nisga’a Nation agreement to provide letters in support of the KSM Project to British Columbian and Canadian regulators,

as well as potential investors in Seabridge or the Project. |

| · | Financial payments upon the achievement of certain Project milestones and annual production payments based on a percentage

of net profits, with the net profits payable normalizing after the Project has recovered its capital costs, as determined under

the terms of the Agreement. |

| · | Strong commitments to education and training of Nisga’a citizens so that they will be better able to take advantage

of the economic benefits the KSM Project offers. |

| · | Mutual co-operation on completing the operational permitting process for the Project. |

| · | A framework for the Nisga’a Nation and Seabridge to work together to achieve employment targets and to ensure

Nisga’a businesses will have preferred access to contracting opportunities. |

| · | Mutual co-operation on responding to social impacts which Nisga’a Villages may experience as a result of the Project. |

The Agreement with the Nisga’a

Nation will remain in effect throughout the life of the KSM Project and will apply to future partners in the Project.

In June, 2014, the Issuer entered into

an agreement with the Gitanyow Huwilp in respect of the KSM Project. Under the agreement, Seabridge agrees to provide funding for

certain programs relating to wildlife, fish and water quality monitoring to address some of the concerns raised by the Gitanyow

Huwilp, as well as for a committee to establish a means of maintaining communications about KSM Project related issues.

In September, 2013, the Gitxsan Hereditary

Chiefs Office provided a letter to British Columbia and federal regulators expressing support for the KSM Project. The Issuer has

engaged directly with the Tsetsaut Skii km Lax Ha with respect to the KSM Project and it is making efforts to establish a good

relationship with the Tsetsaut Skii km Lax Ha.

The Tahltan Nation were active participants

in the EA Application and EIS review processes and have met with Seabridge many times regarding the KSM Project. Seabridge has

made numerous commitments to address issues raised by the Tahltan Nation arising from this process and believes that it has a good

relationship with the Tahltan Nation.

The Issuer believes that, after considering:

| · | the location of the KSM Project in relation to areas of asserted aboriginal rights and title, |

| · | the consultation the Issuer and the governments have undertaken with aboriginal groups, |

| · | the agreements the Issuer has negotiated with aboriginal groups, and |

| · | the information the Issuer has learned about historic aboriginal use of the area on which KSM Project infrastructure is located, |

the Supreme Court of Canada decision of

June 26, 2014 in Tsilhqot’in Nation v. British Columbia, which declares aboriginal title for the first time in a certain

area in Canada and outlines the rights associated with aboriginal title, is unlikely to significantly impact the KSM Project.

Updated and Revised

2016 Preliminary Feasibility Study at the KSM Project

In June 2012, an updated Preliminary Feasibility

Study for the KSM Project (the “2012 KSM PFS Report”) was completed. The development plan in the 2012 KSM PFS

Report was the one approved in the EA/EIS review processes, with certain enhancements to the Project infrastructure to improve

environmental protection and various mitigation measures. Since the date of the 2012 KSM PFS Report Seabridge continued exploration

activities at KSM which led to the discovery of the higher-grade Deep Kerr and Lower Iron Cap deposits. In early 2016, the Issuer

decided to update the 2012 KSM PFS Report to present the same development plan as in the 2012 KSM PFS Report at a pre-feasibility

level using more current market values in the financial analysis but, in addition, to incorporate into that development plan the

infrastructure enhancements committed to in the EA/EIS processes and to incorporate other design improvements identified by the

Issuer. Accordingly, the prefeasibility study level development plan (the “2016 PFS Plan”) does not include

material from recent higher-grade discoveries at Kerr and the Iron Cap Lower Zone. Given the positive impact these new deposits

were expected to have on Project economics, the Issuer also decided to complete a study that would present an analysis of the integration

of these deposits into the proposed KSM Project design as an alternative development plan (the “2016 PEA Plan”)

at a preliminary economic assessment level and include the results in the new prefeasibility report. The new report, which presents

both the 2016 PFS Plan and the 2016 PEA Plan, was completed in November, 2016, is entitled “2016 KSM (Kerr-Sulphurets-Mitchell)

Prefeasibility Study Update and Preliminary Economic Assessment” (the “2016 KSM PFS/PEA Report”),

has an effective date of October 6, 2016, and is available among Seabridge’s documents at www.sedar.com.

The overall 2016 KSM PFS/PEA Report was

coordinated by Tetra Tech Canada Inc. (formerly Tetra Tech, Inc.) (“Tetra Tech”) and incorporates the work of

a number of industry-leading consulting firms. The principal consultants who contributed to the 2016 PFS Plan, and their Qualified

Persons are listed below along with their areas of responsibility:

| · | Tetra Tech, under the direction of Hassan Ghaffari (surface and underground infrastructure, TMF

costs, WSF costs, construction schedule, capital estimate and financial analysis), John Huang (metallurgical testing review, permanent

water treatment, mineral process design and operating cost estimation for process, G&A and site services, and overall report

preparation), Kevin Jones (winter access road); |

| · | Moose Mountain Technical Services under the direction of Jim Gray (open pit Mineral Reserves, open

pit mining operations, mine capital and mine operating costs, MTT and rail ore conveyance design); |

| · | W.N. Brazier Associates Inc. under the direction of W.N. Brazier (power supply, energy recovery

plants, underground electrical systems and associated costs); |

| · | ERM (Environmental Resources Management) under the direction of Pierre Pelletier (environment and

permitting); |

| · | Klohn Crippen Berger Ltd. under the direction of Graham Parkinson (design of surface water diversion,

diversion tunnels and seepage collection ponds, tailing dam, water treatment dam and rock storage facility (RSF) and tunnel geotechnical); |

| · | Resource Modeling Inc. under the direction of Michael Lechner (Mineral Resources); |

| · | Golder Associates Inc. under the direction of Ross Hammett (underground Mineral Reserves, block

caving assessments, mine design and associated costs); |

| · | BGC Engineering Inc. under the direction of Derek Kinakin (rock mechanics and mining pit slopes); |

| · | McElhanney Consulting Services Ltd. under the direction of Robert Parolin (permanent access roads

and associated costs). |

The 2016 PEA Plan was prepared by Amec

Foster Wheeler and the principal consultants who contributed to the 2016 PEA Plan, and their Qualified Persons are listed below

along with their areas of responsibility:

| · | Amec Foster Wheeler. under the direction of Simon Allard P.Eng., Mark Ramirez RM SME and Tony Lipiec

P.Eng (Underground and open pit design , RSF design, process design and capital and operating costs). |

| · | Klohn Crippen Berger Ltd. under the direction of Graham Parkinson P. Geo. (Design of surface water

diversion, diversion tunnels and seepage collection ponds, tailing dam, water storage dam and tunnel geotechnical). Graham Parkinson

has been to the site. |

| · | Resource Modeling Inc. under the direction of Michael Lechner P.Geo (Mineral Resources). Michael

Lechner has been to site. |

| · | Golder Associates Inc. under the direction of Ross Hammett P. Eng (Block caving assessments). Ross

Hammett has been to the site. |

The following (to “2016 and 2017

Exploration”) summarizes information from the 2016 KSM PFS/PEA Report.

Location and Climate

The KSM Project is situated about 950 km

northwest of Vancouver, 65 km by air north-northwest of Stewart, BC and 21 km south-southeast of the former Eskay Creek Mine. The

property is located at latitude 56.50° North and longitude 130.30° West (see Figure 1).

The proposed pit areas lie within the headwaters

of Sulphurets Creek, which is a tributary of the Unuk River and flows into the Pacific through Alaska. The proposed process plant

and TMF will be located within the tributaries of Teigen and Treaty creeks. Teigen and Treaty creeks are tributaries of the Bell-Irving

River, which is itself a major tributary of the Nass River. The Nass river flows to the Pacific Ocean entirely within Canada.

The climate is generally typical of a temperate

or northern coastal rainforest, with sub-arctic conditions at high elevations. Precipitation at the mine site has an estimated

average of 1,652 mm and at the process plant and TMF area has an estimated average of 1,371 mm. The length of the snow-free season

varies from about May through November at lower elevations, and from July through September at higher elevations.

Local Resources,

Infrastructure and Physiography

The KSM property lies in the rugged Coastal

Mountains of northwest British Columbia, with elevations ranging from 520 meters in Sulphurets Creek valley to over 2,300 meters

at the highest peaks. Valley glaciers fill the upper portions of the larger valleys from just below tree line and upwards.

Deep-water loading facilities for shipping

bulk mineral concentrates exist in Stewart, and are currently utilized by the Red Chris Mine. Historically they have been used

by several other mines in northern, BC. The nearest railway is the CNR Yellowhead route, which is located approximately 220 km

southeast of the Property. This line runs east-west, and can deliver concentrate to deep-water ports near Prince Rupert and Vancouver,

BC.

There are no settlements or privately owned

land in the area of the Project; there is limited commercial recreational activity in the form of helicopter skiing and guided

fishing adventures. The closest power transmission lines run along Highway 37, 40 km east of the Project.

Stewart, a town of approximately 500 inhabitants,

is the closest population center to the KSM Project. It is connected to the provincial highway system via paved, all weather Highway

37A. The larger population centers of Prince Rupert, Terrace, and Smithers, with a total population of about 32,000, are located

approximately 270 km to the southeast.

Exploration History

There is evidence that prospectors were

active in the area prior to 1935. The modern exploration history of the area began in the 1960’s, with brief programs conducted

by Newmont Mining Corp., Granduc Mines Ltd., Phelps Dodge Corp., and the Meridian Syndicate. All of these programs were focused

towards gold exploration. The Sulphurets Zone was first drilled by Esso Minerals in 1969; Kerr was first drilled by Brinco Ltd.

in 1985 and Mitchell Creek by Newhawk Gold Mines Ltd. in 1991.

There is no recorded mineral production,

nor evidence of it, from the property. Immediately west of the property, small-scale placer gold mining has occurred in Sulphurets

and Mitchell Creeks. On the Brucejack property immediately to the east and currently owned by Pretium Resources Inc. (now named

the Brucejack property), limited underground development and test mining was undertaken in the 1990’s on narrow, gold-silver

bearing quartz veins at the West Zone.

During 2003-2005, under its option to earn

up to a 65% interest in the project from Seabridge, Falconbridge conducted geophysics, surface mapping, surface sampling and completed

approximately 4,100 m of drilling at the project.

Since 2006, Seabridge has been conducting

exploration and development activities at the project.

Geology

The region lies within “Stikinia”,

a terrane of Triassic and Jurassic volcanic arcs that were accreted onto the Paleozoic basement. Stikinia is the largest of several

fault bounded, allochthonous terranes within the Intermontane belt, which lies between the post-accretionary, Tertiary intrusives

of the Coast belt and continental margin sedimentary prisms of the Foreland (Rocky Mountain) belt. In the Kerr-Sulphurets area,

Stikinia is dominated by variably deformed, oceanic island arc complexes of the Triassic Stuhini and Jurassic Hazelton groups.

Backarc basins formed eastward of the KSM Property in the Late Jurassic and Cretaceous were filled with thick accumulations of

fine black clastic sediments of the Bowser Group. Folding and thrusting due to sinistral transpression tectonics in the mid-Cretaceous

followed by extensional conditions generated the area’s current structural features. The most important structure is the

north-northeast striking, moderately west-northwest dipping Sulphurets Thrust Fault (STF), which transects the Property and is

spatially and genetically related to mineralization at KSM. Remnants of Quaternary basaltic eruptions occur throughout the region.

Early Jurassic sub-volcanic intrusive complexes

are common in the Stikinia terrane, and several host well-known precious and base metal rich hydrothermal systems. These include

copper-gold porphyry deposits such as Galore Creek, Red Chris, Kemess, Mt. Milligan, and Kerr-Sulphurets. In addition, there are

a number of related polymetallic deposits including skarns at Premier, epithermal veins and subaqueous vein and replacement sulfide

deposits at Eskay Creek, Snip, Brucejack, and Granduc.

The Kerr deposit is a strongly-deformed

copper-gold porphyry, where copper and gold grades have been upgraded due to remobilization of metals during later and/or possibly

syn-intrusive deformation. Alteration is the result of a relatively shallow, long lived hydrothermal system generated by intrusion

of monzonite. Subsequent deformation along the STF was diverted into the Kerr area along pre-existing structures. The mineralized

area forms a fairly continuous, north-south trending west dipping irregular body measuring about 1,700 m long and up to 200 m thick.

Deep drilling since 2012 has identified two sub-parallel, north-south trending, steep west-dipping mineralized zones that appear

to coalesce near the topographic surface. After significant deep drilling was completed at the Kerr deposit, an updated geological

interpretation and subsequent updated Mineral Resource model were completed. That new model forms the basis for the 2016 Mineral

Resources and Mineral Reserves.

The Sulphurets deposit comprises two distinct

zones referred to as the Raewyn Copper-Gold Zone and the Breccia Gold Zone. The Raewyn Copper-Gold Zone hosts mostly porphyry style

disseminated chalcopyrite and associated gold mineralization in moderately quartz stockworked, chlorite-biotite-sericite-magnetite

altered volcanics. The Raewyn Copper-Gold Zone strikes north-easterly and dips about 45° to the northwest. The Breccia Gold

Zone hosts mostly gold-bearing pyritic material mineralization with minor chalcopyrite and sulfosalts in a potassium-feldspar-siliceous

hydrothermal breccia that apparently crosscuts the Raewyn Copper-Gold Zone. The Breccia Gold Zone strikes northerly and dips westerly.

The Mitchell Zone is underlain by foliated,

schistose, intrusive, volcanic, and clastic rocks that are exposed in an erosional window below the shallow north dipping Mitchell

Thrust Fault (MTF). These rocks tend to be intensely altered and characterized by abundant sericite and pyrite with numerous quartz

stockwork veins and sheeted quartz veins (phyllic alteration) that are often deformed and flattened. Towards the west end of the

zone, the extent and intensity of phyllic alteration diminishes and chlorite-magnetite alteration becomes more dominant along with

lower contained metal grades. In the core of the zone, pyrite content ranges between 1 to 20%, averages 5%, and typically occurs

as fine disseminations. Gold and copper tends to be relatively low-grade but is dispersed over a very large area and related to

hydrothermal activity associated with Early Jurassic hypabyssal porphyritic intrusions. In general, within the currently drilled

limits of the Mitchell Zone, gold and copper grades are remarkably consistent between drill holes, which is common with a large,

stable, and long-lived hydrothermal systems.

The Iron Cap Zone, which is located about

2,300 m northeast of the Mitchell Zone, is well exposed and consists of intensely altered intrusive, sedimentary, and volcanic

rocks. The Iron Cap deposit is a separate, distinct mineralized zone within the KSM district. It is thought to be related to the

other mineralized zones but differs in that much of the host rock is hydrothermally altered intrusive (porphyritic monzonite to

diorite) rather than altered volcanic and sedimentary rocks. There is a high degree of silicification that overprints earlier potassic

and chloritic alteration. Intense phyllic alteration and high density of stockwork veining, which are pervasive at the nearby Mitchell

Zone, are less pervasive at Iron Cap. The surface expression of the Iron Cap Zone measures about 1,500 m (northeast-southwest)

by 600 m (northwest-southeast). Significant drilling has been completed at the Iron Cap deposit since the 2012 KSM PFS Report,

which resulted in an updated geological interpretation and subsequent updated Mineral Resource model that forms the basis for the

2016 Mineral Resources and Mineral Reserves.

Security of Samples

The Issuer follows an ongoing and rigorous

sample preparation, security, quality control/quality assurance protocol for its exploration programs, including blank and reference

standards in every batch of assays. Cross-check analyses are conducted at a second external laboratory on no less than 10% of the

samples. The details of these procedures are outlined in the 2016 KSM PFS/PEA Report.

Mineral Resources

RMI constructed 3D block models for the

Kerr, Sulphurets, Mitchell, and Iron Cap Zones using various 3D wireframes. Inverse distance estimation methods were used for all

Mineral Resource models. In the case of the Sulphurets and Mitchell deposits, a multi-pass interpolation strategy was used, using

a combination of grade shells or specific geological lithological/alteration assemblages to constrain the estimate. 3D search ellipses

oriented with the trend of mineralization were used to find drill hole composites. Similar strategies were used for the more recent

models constructed for the Kerr and Iron Cap deposits. Deeper exploration in those two areas has demonstrated that higher-grade

mineralization is associated with various structures. Instead of using conventional search ellipses to collect drill hole composites

for block grade estimation, a trend plane search was used for the Kerr and Iron Cap models. That search method appears to do a

better job of honoring the currently recognized structural controls in those deposits.

The measured and indicated mineral resources

estimated by RMI are set forth in the Table below and are inclusive of mineral reserves.

KSM Undiluted Mineral Resources as of

May 31, 2016

| Zone |

Type of

Constraint |

NSR

Cut-off

(Cdn$/t) |

Tonnes

(000 t) |

Grades |

Contained Metal |

Au

(g/T) |

Cu

(%) |

Ag

(g/T) |

Mo

(ppm) |

Au

(000 oz) |

Cu

(Mlb) |

Ag

(000 oz) |

Mo

(Mlb) |

| Measured Mineral Resources |

| Mitchell |

Conceptual LG Pit |

9 |

698,800 |

0.63 |

0.17 |

3.1 |

59 |

14,154 |

2,618 |

69,647 |

91 |

| Conceptual Block Cave |

16 |

51,300 |

0.59 |

0.20 |

4.7 |

41 |

973 |

226 |

7,752 |

5 |

| Total Mitchell Measured |

n/a |

750,100 |

0.63 |

0.17 |

3.2 |

58 |

15,127 |

2,844 |

77,399 |

96 |

| Total Measured |

n/a |

n/a |

750,100 |

0.63 |

0.17 |

3.2 |

58 |

15,127 |

2,844 |

77,399 |

96 |

| Indicated Mineral Resources |

| Kerr |

Conceptual LG Pit |

9 |

355,000 |

0.22 |

0.41 |

1.1 |

4 |

2,511 |

3,208 |

12,555 |

3 |

| Conceptual Block Cave |

16 |

24,400 |

0.24 |

0.48 |

2.0 |

14 |

188 |

258 |

1,569 |

1 |

| Total Kerr Indicated |

n/a |

379,400 |

0.22 |

0.41 |

1.2 |

5 |

2,699 |

3,466 |

14,124 |

4 |

| Sulphurets |

Conceptual LG Pit |

9 |

381,600 |

0.58 |

0.21 |

0.8 |

48 |

7,116 |

1,766 |

9,815 |

40 |

| Mitchell |

Conceptual LG Pit |

9 |

919,900 |

0.57 |

0.16 |

2.8 |

61 |

16,858 |

3,244 |

82,811 |

124 |

| Conceptual Block Cave |

16 |

124,700 |

0.58 |

0.20 |

4.7 |

38 |

2,325 |

550 |

18,843 |

10 |

| Total Mitchell Indicated |

n/a |

1,044,600 |

0.57 |

0.16 |

3.0 |

58 |

19,183 |

3,794 |

101,654 |

134 |

| Iron Cap |

Conceptual Block Cave |

16 |

346,800 |

0.51 |

0.23 |

4.5 |

14 |

5,686 |

1,758 |

50,174 |

11 |

| Total Indicated |

n/a |

n/a |

2,152,400 |

0.50 |