Metal revenues projected in the KSM Project cash flow models were based on the average metal production values as follows:

| |

Years 1 to 7

|

Years 1

to 20

|

Life of Mine

|

|

Total Tonnes to Mill (000s)

|

310,062

|

926,916

|

2,164,419

|

|

Annual Tonnes to Mill (000s)

|

44,295

|

46,346

|

39,353

|

|

Average Grades

|

|

Gold (g/t)

|

0.79

|

0.67

|

0.549

|

|

Copper (%)

|

0.234

|

0.180

|

0.207

|

|

Silver (g/t)

|

2.385

|

2.737

|

2.740

|

|

Molybdenum (ppm)

|

46.2

|

61.4

|

44.8

|

|

Total Production

|

|

Gold (000s oz)

|

5,959

|

15,003

|

27,959

|

|

Copper (000s lb)

|

1,364,880

|

3,024,655

|

8,075,101

|

|

Silver (000s oz)

|

14,712

|

50,154

|

120,826

|

|

Molybdenum (000s lb)

|

9,067

|

41,477

|

62,679

|

|

Average Annual Production

|

|

Gold (000s oz)

|

851

|

750

|

508

|

|

Copper (000s lb)

|

194,983

|

151,233

|

146,820

|

|

Silver (000s oz)

|

2,102

|

2,508

|

2,197

|

|

Molybdenum (000s lb)

|

1,295

|

2,074

|

1,140

|

A cash flow analysis was prepared using three metals price scenarios. In the base case scenario, the three-year trailing average (as of April 15, 2012) prices for gold, copper, silver and molybdenum were used, consistent with industry standard and in compliance with the guidance of the United States Securities and Exchange Commission and NI 43-101. Two additional metal price scenarios were also developed: one using the spot metal prices on April 15, 2012, including the closing exchange rate of that day (Spot Price Case); the other using gold, copper, and silver prices 20% lower than the April 15 prices at the Base Case exchange rate (Alternate Case). The input parameters and results of all three scenarios on a pre-tax basis can be found in the following table.

|

Summary of the Pre-Tax Economic Evaluation

|

| |

| |

Unit

|

Base Case

|

Spot Price Case

|

Alternate Case

|

|

Metal Price

|

|

Gold

|

US$/oz

|

1,330.00

|

1,650.00

|

1,320.00

|

|

Copper

|

US$/lb

|

3.45

|

3.75

|

3.00

|

|

Silver

|

US$/oz

|

25.20

|

32.00

|

25.60

|

|

Molybdenum

|

US$/lb

|

15.00

|

15.00

|

15.00

|

|

Exchange Rate

|

US:Cdn

|

0.96

|

1.00

|

0.96

|

|

Economic Results

|

|

NPV (at 0%)

|

US$ M

|

20,473

|

31,160

|

16,776

|

|

NPV (at 3%)

|

US$ M

|

8,196

|

13,137

|

6,612

|

|

NPV (at 5%)

|

US$ M

|

4,511

|

7,748

|

3,503

|

|

NPV (at 8%)

|

US$ M

|

1,614

|

3,503

|

1,031

|

|

IRR

|

%

|

11.53

|

14.73

|

10.35

|

|

Payback

|

Years

|

6.19

|

5.16

|

6.68

|

|

Cash Cost/oz Au

|

US$/oz

|

141.30

|

60.04

|

263.54

|

|

Total Cost/oz Au

|

US$/oz

|

597.60

|

535.35

|

719.84

|

The post-tax economic evaluation also includes income and mining taxes. It was prepared using corporate income tax rates of 15% for federal and 11% for British Columbia, after permitted deductions. The provincial mining tax is a two tier tax of 2% of “net current proceeds” and 13% of “net revenue”, but the 2% tax is fully creditable against the 13% tax. Under the mining tax, “net current proceeds” is defined as gross revenue from the mine less mine operating expenditures, and “net revenue” is defined as gross revenue from the mine, less operating expenditures, less any amounts in the “cumulative expenditures account” (the aggregate of capital expenditures, mine development costs and fixed asset purchases). Therefore, the 13% tax is not assessed until all pre-production capital expenditures have been amortized. The mining tax is deductible for federal and provincial income tax purposes.

The input parameters and results of all three scenarios on an after-tax basis can be found in the following table.

|

Summary of the Post-Tax Economic Evaluation

|

| |

|

|

|

|

| |

Unit

|

Base Case

|

Spot Price Case

|

Alternate Case

|

|

Metal Price

|

|

Gold

|

US$/oz

|

1,330.00

|

1,650.00

|

1,320.00

|

|

Copper

|

US$/lb

|

3.45

|

3.75

|

3.00

|

|

Silver

|

US$/oz

|

25.20

|

32.00

|

25.60

|

|

Molybdenum

|

US$/lb

|

15.00

|

15.00

|

15.00

|

|

Exchange Rate

|

US:Cdn

|

0.96

|

1.00

|

0.96

|

|

Economic Results

|

|

NPV (at 0%)

|

US$ M

|

13,106

|

20,142

|

10,908

|

|

NPV (at 3%)

|

US$ M

|

5,004

|

8,302

|

4,080

|

|

NPV (at 5%)

|

US$ M

|

2,520

|

4,703

|

1,930

|

|

NPV (at 8%)

|

US$ M

|

539

|

1,834

|

189

|

|

IRR

|

%

|

9.38

|

12.19

|

8.50

|

|

Payback

|

Years

|

6.39

|

5.33

|

6.88

|

The analysis shows that the project would have a positive NPV of US$2.52 billion (US$4.511 billion pre-tax) at a 5% discount rate. The project NPV decreases to US$1.93 billion (US$3.503 billion pre-tax) in the alternate case but increases to US$4.703 billion (US$7.748 billion pre-tax) when using the metal spot prices. With the base case three-year metal price average ending April 15, 2012, the cash cost per ounce of gold (net of by-product credits) is US$141.30. The corresponding total cost per ounce of gold produced is US$597.60.

The financial analysis shows that the internal rate of return (“IRR”) would be 9.38% (11.53% pre-tax) for the base case, would decrease to 8.50% (10.35% pre-tax) for the alternate case and increase to 12.19% (14.73% pre-tax) for the spot price case. The payback period for the post-tax model is 6.39 years for the three-year base case, 6.88 years for the alternate case and 5.33 years for the spot price case.

Sensitivity analyses were carried out on gold, copper, silver, and molybdenum metal prices, exchange rate, capital expenditure and operating costs. The analyses are presented in the 2012 KSM PFS Report graphically as financial outcomes in terms of NPV, IRR and payback period on a pre-tax basis. The project NPV is most sensitive to gold price and exchange rate followed by operating costs, copper price, capital costs, silver price, and molybdenum price. The IRR is most sensitive to exchange rate and gold price followed by capital costs, operating costs, copper price, silver price, and molybdenum price. The payback period is most sensitive to gold price and exchange rate followed by capital costs, copper price, operating costs, silver price, and molybdenum price.

Recommendations

The central recommendation emerging from the work carried out in the 2012 KSM PFS Report, including the economic evaluation, is that the 2012 KSM PFS Report should be followed by a Feasibility Study in order to further assess the economic viability of the KSM Project. This general recommendation leads to several more specific recommendations in the 2012 KSM PFS Report that are driven by the need to complete more detailed work to meet the level of assurance required for a higher level study. In addition, recommendations are made to investigate certain identified opportunities for cost savings or risk management. These recommendations include:

|

·

|

the Mitchell pit design, as it relates to the 1,250 m high Mitchell pit wall, should be benchmarked with other operations and projects around the world to gain from comparative experience;

|

|

·

|

details of the water management plans, mine access and haul roads and waste management plans should be reviewed and optimized with a view to reducing capital and/or operating costs;

|

|

·

|

investigation and study of the use of higher lift dumps, the impact of phase size in Mitchell and the use of LNG power haul trucks for opportunities to lower costs;

|

|

·

|

drilling and testing for the proposed pit slopes to further refine geological interpretations in each zone, long term pumping tests in the three pits, stress testing and modelling of the Mitchell pit, refinement of the design of the Mitchell north slope dewatering adit and a risk assessment of potential water into the pit over the Mitchell pit east wall from the Mitchell glacier diversion tunnel; and

|

|

·

|

further metallurgical testing to optimize process conditions and to establish design related parameters.

|

Other Relevant Data and Information - Core Zone Exploration

As the Issuer was completing the 2012 KSM PFS Report, it decided to commence an exploration program designed to pursue an exploration thesis that: (1) porphyry deposits are known to have high-grade cores formed under higher temperature and pressure conditions in deeper parts of the system; (2) such a core has not been discovered at KSM; and (3) all the available data suggests that such a core exists and that it likely remains intact within the KSM claim boundaries. This exploration program used data assembled over many years of temperature and pressure variances, geochemical markers and deep penetrating geophysical surveys to vector from known mineralization towards a possible high-grade core.

In 2012 several promising targets were tested and three targets continued as priorities for exploration in 2013. The Deep Kerr zone had yielded the most compelling results and finding a core zone at Deep Kerr was identified as the focus of drilling in 2013. The Issuer completed 23,802 meters of drilling at the Deep Kerr deposit and confirmed it as a high grade copper/gold core zone. Based on the success of its drilling at Deep Kerr, the Issuer engaged RMI to prepare a resource estimate for the Deep Kerr deposit. Since substantial additional drilling and advanced engineering analysis will be required before it is possible to evaluate whether or not Kerr and Deep Kerr can be combined in a single underground operation, it was decided that the Deep Kerr deposit should be treated as a stand-alone occurrence, separate from the KSM Project’s existing reserves which have undergone detailed feasibility analysis.

The 2014 Deep Kerr Report was prepared by RMI under the direction of Michael J. Lechner (P. Geo British Columbia #155344, Arizona RPG #37753 and AIPG CPG #10690), a Qualified Person under NI-43-101. The 2014 Deep Kerr Report sets forth resources for the Deep Kerr deposit incorporating 2012 and 2013 drilling results and is available on SEDAR at www.sedar.com.

The 2012 KSM PFS Report includes a summary of the 2014 Deep Kerr Report. More detailed information supporting this summary is set forth in the 2014 Deep Kerr Report.

Geology and Mineralization

The Deep Kerr zone lies within an area known as “Stikinia”, which is a terrane consisting of Triassic and Jurassic volcanic arcs that were accreted onto the Paleozoic basement of the early North American plate. Early Jurassic sub-volcanic intrusive complexes are scattered through the Stikinia terrane and are host to numerous precious and base metal rich hydrothermal systems. These include several well known copper-gold porphyry systems such as Galore Creek, Red Chris, Kemess, and Mt. Milligan in addition to the large cluster of deposits in the Sulphurets district, which hosts KSM and the adjacent Snowfield and Brucejack deposits.

At KSM, volcanics and sediments of the Triassic arc assemblage belong the Stuhini Group, which is disconformably to unconformably overlain by Jurassic volcanics and sediments of the Hazelton Group. The Stuhini Group includes turbidic siltstone, minor limestone, basaltic flows and tuffs, and thick sequences of conglomerate. These are interpreted to have formed in a deep marine environment transitioning to a shallow marine environment. They have been subjected to multiple deformation events and exhibit a low greenstone facies metamorphic grade with penetrative cleavage. The Hazelton Group consists of andesite flows, breccias, pyroclastics, rhyodacitic welded tuffs, and interbedded sedimentary units. The Jack Formation is interpreted to be a basal conglomerate marking the beginning of the Hazelton Group. Hazelton Group rocks transition from shallow marine to a mixed marine and terrestrial environment, and are in turn conformably overlain by a thick back-arc assemblage of black siliclastic sediments of the Bowser Lake Group north and east of the property.

The property lies within the Skeena fold and thrust belt, which was formed during a Cretaceous deformational event. As a result, Triassic rocks have been thrust over Jurassic rocks at KSM, and a series of imbricate thrust sheets have dismembered much of the property and deposits into distinct structural panels. The principal thrust faults are the Sulphurets and Mitchell, which in general dip moderately to the northwest. However, geometry is complex as compressional stresses were preferentially accommodated by phyllic altered rocks with lower competency, and re-aligned around competent intrusive bodies that behaved as buttresses. Later folding and normal faulting resulted in further geometrical complexity.

The Deep Kerr deposit is considered to be within the spectrum of the gold-enriched copper porphyry environment and metals, chiefly gold and copper (in terms of economic value), are generally at low concentrations. Mineralization is typically finely disseminated, stockwork or sheeted veinlet controlled and pervasively dispersed over dimensions of hundreds of metres. At Deep Kerr, grade distribution is more erratic than observed at other KSM deposits especially in shallower parts. Variable pathways for mineralizing fluids were controlled by fracture induced permeability within the PAND1 intrusion (porphyritic andesite), and even more so in the overlying intrusive breccia and mixed unit. There are both gradational boundaries and sharp boundaries, which usually occur at lithological or alteration contacts, especially by a high quartz zone (>20% by volume of quartz stockwork veinlets). Mineralization within the PAND1 at the northern and deeper portions of Deep Kerr is more homogeneous, similar to the Mitchell deposit. However, as at Mitchell, due to the intensity of hydrothermal alteration and post-mineral deformation/metamorphism, it is difficult to recognize original protoliths.

Drilling and Sampling

Seabridge completed a helicopter supported diamond drilling program at the KSM Project in 2012. Three holes totaling 2,729m were drilled in 2012 (K-12-20, K-12-21, and K-12-22) to test select target areas. The holes were drilled at oblique angles to mineralization in order to observe vertical changes in mineral zoning over as long a distance as possible. The concept was that developing a better understanding of mineralization and alteration zoning would optimize targeting a potentially higher grade, bornite bearing core zone that was interpreted to exist at depth. Although the results of those drill holes returned the longest and highest grade intervals up to that time at the Kerr zone, the mineral and alteration zoning patterns were still unclear, as post-mineral deformation and metamorphism was proven to be more extensive than previously modeled.

In 2013, a drilling program was designed to explore for, and if possible, partially delineate a high grade zone of mineralization located below the existing Kerr near surface resource. In the first phase of the 2013 program, drill holes were vectored in an easterly azimuth to crosscut the mineralized trend. The holes were spaced at approximately 450m intervals and drilled up to 1,470m deep. Holes from the first phase covered approximately 1,600m of the north-south strike length of the recognized zone. In the second phase of the drill program two areas were selected for closer spaced drilling to assess mineralized continuity. This phase of the program reduced the drill hole spacing to approximately 140 metres. In total, 23,832m in 29 drill holes were drilled in 2013 to evaluate the Deep Kerr deposit.

For the 2013 campaign, Seabridge used directional drilling methods for a portion of their program. Drill holes with a letter designation after the hole number represent wedged drill holes that utilized the directional drilling method. Of the 29 drill holes completed in 2013, 15 were wedged off from mother holes at depths ranging from 180m to 750m.

The following Table summarizes significant drill hole intercepts from the 2013 Deep Kerr drilling campaign.

|

Drill Hole ID

|

From (m)

|

To (m)

|

Length (m)

|

Cu (%)

|

Au (g/t)

|

Ag (g/t)

|

|

K-13-23

|

1066.20

|

1362.40

|

296.20

|

0.73

|

0.40

|

1.15

|

|

K-13-23A

|

823.40

|

1007.80

|

184.40

|

0.56

|

0.21

|

2.11

|

|

K-13-23B

|

953.00

|

1249.40

|

296.40

|

0.65

|

0.59

|

1.10

|

|

K-13-23C

|

908.90

|

1224.40

|

315.50

|

0.65

|

0.45

|

1.20

|

|

K-13-24

|

807.00

|

929.70

|

122.70

|

0.85

|

0.86

|

2.64

|

|

K-13-24

|

813.00

|

874.90

|

61.90

|

1.02

|

0.44

|

2.80

|

|

K-13-24

|

889.60

|

929.70

|

40.10

|

0.83

|

1.72

|

3.16

|

|

K-13-24A

|

791.00

|

952.00

|

161.00

|

0.51

|

0.38

|

1.97

|

|

K-13-24A

|

1080.40

|

1139.60

|

59.20

|

0.62

|

0.26

|

1.26

|

|

K-13-24B

|

762.00

|

931.00

|

169.00

|

0.59

|

0.50

|

2.34

|

|

K-13-24C

|

825.00

|

1053.00

|

228.00

|

0.72

|

0.96

|

2.60

|

|

K-13-25

|

928.80

|

1171.00

|

242.20

|

0.61

|

0.26

|

2.28

|

|

K-13-25

|

1131.00

|

1171.00

|

40.00

|

1.02

|

0.35

|

2.84

|

|

K-13-25A

|

883.60

|

959.20

|

75.60

|

0.42

|

0.99

|

2.70

|

|

K-13-25A

|

1158.40

|

1334.40

|

176.00

|

0.62

|

0.28

|

1.80

|

|

K-13-25A

|

1158.40

|

1224.40

|

66.00

|

1.02

|

0.46

|

2.50

|

|

K-13-25B

|

878.80

|

938.80

|

60.00

|

0.60

|

0.36

|

2.60

|

|

K-13-25B

|

1035.10

|

1106.80

|

71.70

|

0.57

|

0.20

|

1.40

|

|

K-13-25C

|

1103.00

|

1230.10

|

127.10

|

0.75

|

0.47

|

1.70

|

|

K-13-26

|

1029.40

|

1184.80

|

155.40

|

0.28

|

0.11

|

1.30

|

|

K-13-26

|

1035.30

|

1059.30

|

24.00

|

0.49

|

0.15

|

1.50

|

|

K-13-28

|

710.00

|

739.10

|

29.10

|

0.60

|

2.04

|

11.63

|

|

K-13-28

|

904.00

|

1012.40

|

108.40

|

0.75

|

0.59

|

3.23

|

|

K-13-28A

|

886.40

|

1043.40

|

157.00

|

0.50

|

0.56

|

2.50

|

|

K-13-28A

|

907.90

|

974.50

|

66.60

|

0.65

|

0.71

|

3.10

|

|

K-13-28B

|

883.60

|

1022.40

|

138.80

|

0.68

|

0.43

|

2.10

|

|

K-13-28B

|

894.70

|

949.40

|

54.70

|

0.81

|

0.50

|

2.10

|

|

K-13-29

|

572.40

|

810.40

|

238.00

|

0.89

|

0.55

|

1.39

|

|

K-13-29

|

641.70

|

710.40

|

68.70

|

1.78

|

1.14

|

2.06

|

|

K-13-30

|

326.00

|

645.70

|

317.70

|

0.53

|

0.33

|

1.00

|

|

K-13-30

|

524.20

|

590.60

|

66.40

|

1.19

|

0.80

|

1.70

|

|

K-13-31

|

421.90

|

670.40

|

248.50

|

0.77

|

0.39

|

2.00

|

|

K-13-31

|

519.20

|

624.40

|

105.20

|

1.11

|

0.66

|

2.20

|

|

K-13-31A

|

450.40

|

704.40

|

254.00

|

0.77

|

0.52

|

2.40

|

|

K-13-31A

|

1105.20

|

1143.40

|

38.20

|

0.68

|

0.43

|

1.60

|

|

K-13-32

|

535.00

|

654.00

|

119.00

|

0.71

|

0.40

|

2.10

|

|

K-13-32

|

562.60

|

596.80

|

34.20

|

1.53

|

0.69

|

4.50

|

|

K-13-32A

|

449.00

|

616.00

|

167.00

|

0.63

|

0.37

|

2.00

|

|

K-13-32A

|

496.00

|

1136.50

|

640.50

|

0.85

|

0.42

|

1.90

|

|

K-13-32A

|

520.50

|

584.00

|

63.50

|

1.03

|

0.56

|

3.00

|

|

K-13-32A

|

581.00

|

729.70

|

148.70

|

1.86

|

0.89

|

4.50

|

|

K-13-32A

|

678.50

|

729.70

|

51.20

|

3.07

|

1.47

|

6.00

|

|

K-13-35

|

449.90

|

775.30

|

325.40

|

0.70

|

0.30

|

3.10

|

|

K-13-35

|

492.40

|

551.00

|

58.60

|

1.78

|

0.54

|

8.10

|

|

K-13-36

|

406.00

|

795.80

|

389.80

|

0.69

|

0.43

|

1.20

|

The 2013 drilling was designed to cross cut the west dipping mineralized system and the reported intervals are believed to approximate true widths.

The extents of the drilled area in the Deep Kerr zone are approximately 1,600m north-south, 600m east-west, and 1,200m vertical. The zone remains open in to the north, south, and down-dip directions. The Deep Kerr Inferred Resource was constrained by the three conceptual block cave shapes shown in the 2012 KSM PFS Report.

It is the opinion of RMI that Seabridge's 2012-2013 drilling programs were conducted in a professional manner, drilling data have been adequately analyzed, interpreted, and sampled so that the data can be used for the purpose of estimating mineral resources.

The sample preparation, analytical methods, sample security and quality assurance/quality control procedures followed are essentially the same as Seabridge’s previous programs, as described above.

Project Status

The newly discovered Deep Kerr zone will continue to be explored with a modest drilling program designed for the 2014 field season. The proposed program will utilize directional drilling methods like those used in 2013 to examine mineralized continuity in several key locations and will also attempt to extend the mineralized system to the north.

Geotechnical and preliminary bulk underground mining studies will continue to evaluate whether Deep Kerr could be mined using block caving methods. Several large consulting companies will conduct those studies. In addition, avalanche control studies will be undertaken during the 2014 field season.

Metallurgical testwork will continue to assess metallurgical performance and investigate potential flowsheet designs using Deep Kerr drill core. An additional six composites have been prepared from 2013 Deep Kerr drill core. These composites were selected to represent different geological regimes and different head grades from which copper head grade and recovery data could be developed for a Deep Kerr metallurgical model. Preliminary results indicate that Deep Kerr mineralized rock with copper grades around 0.5% copper, will produce copper recoveries in the range of 88 to 90 percent. Higher grade material, exceeding 1.0% copper, should produce copper recoveries in the range of 90 to 93 percent. Gold recoveries should vary between 60 to 70 percent depending upon gold head grades. Four of the Deep Kerr composites have Bond grinding work indices averaging 14.1 kWh/tonne and compares with the Mitchell open pit material at 14.5 kWh/tonne. This early test work has not indicated any significant or unexpected metallurgical issues with processing of Deep Kerr material.

No specific action has been taken at this time regarding environmental studies or permitting activities associated with the newly discovered Deep Kerr zone. However, Seabridge has been diligently working on various environmental and permitting activities for the greater KSM project.

Mineral Resources

The Deep Kerr zone was discovered in 2012 after Seabridge's geologic staff recognized the potential for a higher grade zone of mineralization beneath the Kerr open pit resource. Three holes were drilled in 2012, confirming the geologic concept of higher grade mineralization. Twenty-nine core holes were drilled by Seabridge in 2013 in order to begin outlining potentially higher grade mineralization.

Initial Mineral Resources were estimated for the Deep Kerr zone by creating a three-dimensional block model. Gold, copper, silver, and molybdenum grades were estimated using 15-metre-long drill hole composites by inverse distance and nearest neighbor methods. The estimated block grades were validated using visual and statistical methods. Based on these tests, the grade models are globally unbiased and represent a reasonable estimate of in situ resources. A portion of the estimated blocks were classified into Inferred Mineral Resources based on mineralized continuity and further constrained by conceptual block cave shapes.

Mineral Resources were tabulated for the Deep Kerr deposit using a net smelter return (NSR) cutoff of US$20.00 per tonne. The NSR cutoff was calculated using metal prices of US$3.30 per pound copper, US$1250/ounce gold, US$23/ounce silver, and US$ 14.40 per pound molybdenum. Metal recoveries were determined using grade recovery curves based on initial testwork completed from metallurgical composites collected from drill core. Recoveries were calculated on a block by block basis using estimated block grades and relationships established by the initial metallurgical testwork. An overall operating cost of US$16.00 per tonne has been estimating consisting of US$6.00/tonne mining and US$10.00/tonne processing. At this preliminary stage of the assessment of Deep Kerr it was decided to report undiluted resources using a NSR cutoff of US$20.00 per tonne due to the uncertainty of numerous factors. Block NSR values were calculated using the following expression:

|

NSR =

|

Cu/100 * RecCu/100 * NSPCu * 2204.6 + Au * RecAu/100 * NSPAu + Ag x RecAg/100 * NSPAg + Mo/1x106 * NSPMo x 2204.6

|

Where:

Cu = copper grade (%) from block model

Au = gold grade (g/t) from block model

Ag = silver grade (g/t) from block model

Mo = molybdenum grade (ppm) from block model

RecCu = copper recovery (%)

RecAu = gold recovery (%)

RecAg = silver recovery (%)

RecMo = molybdenum recovery (%)

NSPCu = net smelter price for copper (Cdn$/lb)

NSPAu = net smelter price for gold (Cdn$/g)

NSPAg = net smelter price for silver (Cdn$/g)

NSPMo = net smelter price for molybdenum (Cdn$/lb)

Three preliminary block cave footprints (conceptual draw point elevations) were identified by Golder Associates at the 135, 645, and 795 elevations. Those conceptual block cave footprints were extruded vertically 500m and clipped against the resource exclusion surface that separates Deep Kerr from the Kerr open pit resource/reserve. Deep Kerr Inferred Resources were restricted to the three conceptual block cave shapes. The following table summarizes undiluted Inferred Resources for the Deep Kerr zone at various net smelter royalty (NSR) cutoffs. Inferred Resources are being disclosed using a $20/tonne NSR cutoff as appearing in bold in the table below.

Undiluted Deep Kerr Inferred Resources

| NSR cutoff value ($/tonne) |

Tonnes

(000)

|

Copper

Grade

(%)

|

Copper (millions of lbs) |

Gold

Grade

(g/T)

|

Gold

(000 of ounces)

|

Silver

Grade

(g/t)

|

Silver

(000 of ounces)

|

Moly

(ppm)

|

Moly

(000 of lbs)

|

| 0 |

843,370 |

0.38

|

7,054 |

0.28 |

7,611 |

1.7 |

45,865 |

22

|

41,562 |

| 4.0 |

800,043 |

0.40

|

7,006 |

0.30 |

7,616 |

1.7 |

43,620 |

23 |

40,925 |

| 8.0 |

749,928 |

0.42

|

6,917 |

0.30 |

7,325 |

1.7 |

41,349 |

24 |

40,146

|

| 12.0 |

675,228 |

0.45

|

6,730 |

0.32 |

6,921 |

1.7 |

37,897 |

26 |

38,175 |

| 16.0 |

597,280 |

0.49 |

6,472 |

0.34 |

6,515

|

1.8 |

34,644 |

27 |

35,962 |

|

20.0

|

514,667 |

0.53 |

6,052 |

0.36 |

5,914 |

1.8 |

30,319 |

28 |

32,087 |

| 24.0 |

376,888 |

0.58

|

5,640 |

0.39 |

5,485 |

1.9 |

26,670 |

29 |

28,654 |

| 28.0 |

317,108 |

0.62 |

5,168 |

0.41 |

4,976 |

2.0 |

23,919 |

30 |

24,849 |

| 32.0 |

317,108 |

0.67 |

4,700 |

0.44 |

4,477 |

1.9 |

19,570 |

31 |

21,504 |

| 36.0 |

272,175 |

0.71 |

4,279 |

0.46 |

4,012 |

1.9 |

16,699 |

31

|

18,621 |

Note: These resource estimates have been prepared in accordance with NI 43-101. See “Cautionary Note to United States Investors”. Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. Inferred Mineral Resources have a high degree of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category.

Seabridge has contracted several consulting groups to begin looking at the Deep Kerr mineralization as a potential bulk tonnage mining target. Mining and metallurgy disciplines are being represented by the following consulting groups:

|

·

|

Golder Associates, Ltd. (Golder) - geotechnical and mining

|

|

·

|

ALS Metallurgy Kamloops - metallurgy/processing

|

|

·

|

Tetra Tech - provided a review of preliminary metallurgical results

|

Conclusions

Based on the current drill hole spacing, the Deep Kerr zone displays excellent continuity of grade both vertically and laterally within the deposit. Currently the deposit is open to the north and down dip, supporting the potential for an increase in the size of the deposit. The recent identification of a higher grade core zone of copper mineralization could result in an increase of resource grade if the current geologic and mineralogical models are confirmed by additional drilling.

Drilling completed to date on the Deep Kerr zone indicates vertical zonation of sulfide minerals within the deposit and suggests that higher grade bornite could become more abundant than chalcopyrite down plunge. The geological model for Deep Kerr used as the basis for the resource estimate defines a broad zone of altered rock that is about 600 meters wide and interpreted to be a relict intrusion. Intensive alteration within this unique lithological zone contains the same alteration mineralogy seen elsewhere in the district along with abundant anhydrite and magnetite. Coincident with this alteration, broad overlapping quartz stock work veins are dominated by chalcopyrite and locally bornite. The characteristic that distinguishes this zone from other KSM deposits is that pyrite is markedly decreased relative to copper-bearing minerals. These characteristics form a mineralized envelope that is consistent with a deep porphyry core deposit and were used to constrain the estimate of Mineral Resources.

Deep Kerr was treated as a block cave (bulk underground) mining target. Seabridge Gold has retained Golder Associates and AMEC, both leading experts in underground mining, to undertake conceptual bulk underground mining studies for Deep Kerr. These studies are in progress. The lateral and steep vertical continuity of the zone provides a geometric configuration that is likely to be amenable to these mining methods. At this time, the Deep Kerr deposit is being evaluated as a stand-alone occurrence. To insure that the Deep Kerr resource does not overlap with the Kerr deposit which lies above it, the previously reported Kerr open pit resource was isolated by a fifty (50) metre buffer separating it from the new Deep Kerr resource. Additional drilling and advanced engineering studies will be required before it is possible to evaluate whether or not Kerr and Deep Kerr could be combined into a single underground operation.

Preliminary metallurgical results indicate that Deep Kerr mineralization grading approximately 0.5% copper could produce copper recoveries in the range of 88 to 90 percent. Higher grades exceeding 1.0% copper, could potentially produce copper recoveries in the range of 90 to 93 percent. Initial testwork suggests that gold recoveries could vary between 60 to 70 percent depending upon gold head grades. Four of the Deep Kerr metallurgical composites have Bond grinding work indices averaging 14.1 kWh/tonne, which is slightly higher than testwork conducted with samples from the shallower Kerr open pit deposit which has Bond grinding Work Indices of 13.9 kWh/tonne. This early test work has not indicated any significant or unexpected metallurgical issues with processing of Deep Kerr mineralization.

Recommendations

|

·

|

Conduct a Phase 1 drilling campaign at Deep Kerr consisting of 15-20 diamond core holes totaling around 15,000 to 20,000 metres. This program would have two primary objectives: 1) test the continuity of mineralization both up and down dip in several key areas and 2) attempt to extend the mineralized system to the north. The cost for this program is estimated to range between US$5.25 and US$7 million.

|

|

·

|

If the Phase 1 drilling program is successful additional drilling will be required to upgrade the current Deep Kerr Inferred Resource. A drill hole spacing ranging between 75m and 100m will be required to upgrade the current Inferred Resource to Indicated. The cost for such a program is estimated to range between US$10 and US$20 million but this recommendation is totally dependent upon the results of the Phase 1 program.

|

|

·

|

Continue with geotechnical and underground mining studies to determine whether the Deep Kerr zone could be mined by block caving methods. A trade off study should be undertaken to determine the optimal mining method for the entire Kerr deposit. The cost for this activity is estimated to range between US$500,000 and US$1,000,000;

|

|

·

|

Evaluate metallurgical recovery and potential processing methods for Deep Kerr mineralization using drill hole core previously collected from the zone. The cost for this activity is estimated to range between US$300,000 and US$600,000;

|

|

·

|

Conduct avalanche control studies along the north facing slope of the Kerr deposit to see if measures could be taken to mitigate that danger so that the drilling season could be extended for exploring the Deep Kerr zone. The cost for this activity is estimated to range between US$150,000 and US$250,000;

|

|

·

|

Send approximately 100-200 original pulps from the 2013 Deep Kerr drilling campaign to an accredited lab to investigate the apparent bias in copper assaying. A variety of copper grade ranges should be selected for this comparison;

|

|

·

|

Obtain another source of "barren" material to submit as blanks for quality assurance/quality purposes. The current barren material used by Seabridge (Blank 5 and Blank 7) may contain low levels of copper which adds enough "noise" to complicate determining sample quality. The estimated cost of obtaining another source of blank material is estimated to range between US$2,500 to US$5,000.

|

Environmental Assessment Application/Environmental Impact Statement

In early 2013 the KSM Project also achieved another significant milestone in its development with the filing of its provincial EA Application for an Environmental Assessment certificate and its federal EIS.

In the years leading up to submission of the EA Application/EIS, Seabridge undertook extensive community engagement with the Nisga’a Nation, Aboriginal groups, public and stakeholders to provide information on the KSM Project and obtain feedback. Components of this program included site visits to operating and closed mines similar in size to KSM to highlight proposed project details, numerous site visits to the KSM Project area, meetings with the Nisga’a Nation, aboriginal and local government elected officials and public open houses. In addition, Seabridge has participated in a number of working group meetings with Canadian federal and provincial regulators, U.S. federal and Alaska State regulators and aboriginal groups to review the project in detail as it has evolved. In general, public feedback on the project has been constructive and input from this community engagement process has been used to make significant design changes to the project including:

|

·

|

Isolating and lining a portion of the proposed tailing management facility to contain the tailings that will result from the precious metals carbon leach circuit;

|

|

·

|

Re-routing proposed access from Highway 37 to the proposed process facility and tailing management area to avoid potential impacts on fisheries;

|

|

·

|

Relocating all discharges from the tailings management facility to protect sensitive fish habitats;

|

|

·

|

Shifting from open pit to underground panel cave mining in the later years for the Mitchell deposit and also block caving the Iron Cap deposit. Underground mining is expected to reduce waste rock storage by more than two billion tonnes, resulting in significantly less potential environmental impact;

|

|

·

|

Implementing a state of the art water treatment strategy to maximize environmental protection; and,

|

|

·

|

Removing planned surface infrastructure associated with the Mitchell Treaty Tunnel and placing it underground to minimize surface disturbance and facilitate wildlife access.

|

In addition, as the Issuer progressed through preparation of the material for the EA Application/EIS it made changes to the Project design set forth in the 2012 KSM PFS Report in order to reduce its environmental impact, including:

|

·

|

Eliminating the Sulphurets rock storage facility;

|

|

·

|

Isolating Kerr waste rock in the mined out Sulphurets pit;

|

|

·

|

Relocating the intake of the Mitchell diversion tunnels further upstream so that water intake is from an area of unaltered bedrock; and

|

|

·

|

Increasing the capacity of the water treatment facility so that the volume of discharge from the facility will mimic the natural hydrograph.

|

The KSM Project went through a joint environmental assessment as mandated by the Canadian Environmental Assessment Act and the British Columbia Environmental Assessment Act. The EA Application was accepted into formal review under the British Columbia Environmental Assessment Act in early June of 2013 and an Environmental Assessment Certificate was issued under that Act in July, 2014 approving the EA Application. In December 2014 the Federal Minister of the Environment issued a positive project decision.

2014 Exploration

Exploration activities at the KSM Project are being conducted by Seabridge personnel under the supervision of William E. Threlkeld, Senior Vice President of Seabridge. The following information regarding 2014 exploration at KSM was prepared by or under the supervision of William Threlkeld, a qualified person for the purposes of NI 43-101.

The primary focus of the 2014 exploration program is to expand the inferred resource found last year at Deep Kerr and also to increase its average grade. The second objective is to test several more identified and highly prospective core zone targets which have the potential for large, high grade deposits similar to Deep Kerr, including the Iron Cap deposit at depth.

At Deep Kerr, a total of 12,900 meters in 13 core holes successfully expanded the known dimensions of the deposit along strike to the north and south as well as at depth. Drilling also confirmed the geological and resource models developed following the 2013 discovery program.

Two holes (K-14-25D and 28C) were drilled into the existing resource to evaluate the performance of the model and the results showed mineralized intervals consistent with those predicted by the model (differences in copper grades ranging from -12% to +30%).

The northernmost drill holes in the 2013 program intersected well mineralized intrusive rocks. Three additional sections were completed this year at 140 meter intervals stepping north from the 2013 data. Mineralized zones consistent with the Deep Kerr deposit model were encountered in the first two cross section step-outs (holes K-14-39, 43, 44 and 48), 280 meters north of previous drilling. On the northern most section (holes K-14-41 and 41A), a large interval of post mineral intrusive rock was intersected. The high-grade Deep Kerr structures elsewhere are bounded by, or coincident with, fault structures which remain open along strike. It is not known if the Deep Kerr mineralization continues north of this intrusion.

Three drill holes (K-14-34A, 40 and 45) were targeted to provide mineralogical zoning indicators and extend the depth projection of the Deep Kerr zone. Holes K-14-34A and 45 were setup to drill down the interpreted Deep Kerr zone and encountered long sections of the mineralized zone, however, this orientation was difficult to maintain and technical limitations terminated the holes before reaching the limits of the deposit. These two holes therefore bottomed in strong mineralization. Hole K-14-40 was drilled perpendicular to the zone. These tests confirm that the Deep Kerr zone plunges west-northwest and continues to at least 1350 meters below surface.

In 2013, the south limit of the Deep Kerr deposit was provisionally established at the southernmost drill hole (K-13-26) in the zone at that time. As the 2014 program progressed, it became clear the southern boundary was arbitrary. Two drill holes were completed to confirm a southern extension, one hole (K-14-42) at the southern limit of the 2013 resource model and one hole (K-14-46) 550 meters beyond the 2013 model. These holes confirm significant strike potential but additional drilling is required to extend the resource model and establish the grade distribution.

The following table provides the final assay results from the 2014 holes drilled at Deep Kerr:

2014 Deep Kerr Intersections

|

Drill Hole ID

|

Total Depth

|

Target

|

From (meters)

|

To

(meters)

|

Interval

(meters)

|

Gold

(g/T)

|

Copper

%

|

Silver

(g/T)

|

|

K-14-25D

|

1515

including

|

Model

Confirmation

|

910.4

|

1011.4

|

101.0

|

0.29

|

0.37

|

2.2

|

|

1025.3

|

1133.4

|

108.1

|

0.21

|

0.35

|

2.1

|

|

1185.6

|

1231.0

|

45.5

|

1.25

|

0.06

|

17.1

|

|

1300.8

1300.8

|

1486.4

1350.1

|

185.6

49.3

|

0.18

0.31

|

0.47

0.53

|

2.2

2.8

|

|

K-14-28C

|

1306

including

|

Model Confirmation

|

900.0

900.0

|

1257.4

979.4

|

357.4

79.4

|

0.50

0.84

|

0.63

1.15

|

1.9

3.0

|

|

K-14-39

|

1272

including

|

North Strike Extension

|

508.0

|

694.4

|

186.4

|

0.19

|

0.43

|

1.0

|

|

781.4

|

945.4

|

164.0

|

0.34

|

0.33

|

1.0

|

|

945.4

963.4

|

1197.4

1106.4

|

252.0

143.0

|

0.55

0.68

|

0.69

0.81

|

1.4

1.7

|

|

K-14-41

|

1080

|

North Strike Extension

|

636.2

|

682.3

|

46.1

|

2.35

|

0.19

|

1.4

|

|

821.4

|

965.5

|

144.1

|

0.58

|

0.27

|

3.1

|

|

K-14-41A

|

1098

|

North Strike Extension

|

618.0

|

847.0

|

229.0

|

1.12

|

0.07

|

1.0

|

|

K-14-43

|

1045

including

|

North Strike Extension

|

512.5

512.5

|

659.5

546.5

|

147

34

|

0.53

0.64

|

0.71

1.01

|

2.5

5.3

|

|

689.5

|

757.5

|

68

|

0.31

|

0.31

|

0.8

|

|

K-14-44

|

995

|

North Strike Extension

|

529.0

|

565.9

|

36.9

|

0.26

|

0.60

|

1.6

|

|

580.1

|

676.8

|

96.7

|

0.28

|

0.39

|

0.9

|

|

823

|

936.8

|

113.8

|

0.29

|

0.31

|

1.6

|

|

K-14-48

|

1212 including

|

North Strike Extension

|

971.4

971.4

|

1161.3

1027.3

|

189.9

55.9

|

0.35

0.4

|

0.36

0.53

|

1.1

0.9

|

|

K-14-34A

|

1611

including

including

including

|

Depth Projection

|

450.0

697.4

|

806.4

744.5

|

356.4

47.1

|

0.19

0.33

|

0.62

1.01

|

2.0

3.0

|

|

871.4

915.4

1551.4

|

1608.4

1165.4

1577.4

|

737

250

26

|

0.36

0.39

0.31

|

0.59

0.78

1.01

|

1.1

1.5

1.3

|

|

K-14-40

|

1011

including

|

Depth Projection

|

704.4

794.6

|

926.3

918.9

|

221.9

124.3

|

0.24

0.29

|

0.45

0.54

|

1.5

1.8

|

|

K-14-45

|

1131

including

|

Depth Projection

|

271.4

|

368.4

|

97.0

|

0.26

|

0.48

|

1.4

|

|

400.4

831.7

|

1123.0

1117.4

|

722.6

285.7

|

0.36

0.51

|

0.59

0.77

|

2.6

3.8

|

|

K-14-42

|

951

|

South Extension

|

486.9

|

536.0

|

49.1

|

0.28

|

0.86

|

3.3

|

|

639.8

|

661

|

21.2

|

1.28

|

0.05

|

7.5

|

|

678.5

|

738.9

|

60.4

|

0.28

|

0.67

|

2.8

|

|

K-14-46

|

790

including

|

South Extension

|

193.0

193.0

|

344.4

241.4

|

151.4

48.4

|

0.17

0.26

|

0.36

0.43

|

1.7

2.5

|

The holes drilled to test the model and the north and south extensions and Hole K-14-40 were drilled in an orientation designed to intersect the mineralized zone perpendicular to the strike and accordingly such intervals are believed to approximate true widths of the mineralized zone. Holes K-14-34A and 45 were drilled to test the depth projections, were not designed to evaluate the true thickness of the mineralized interval and the width of these zones is indicated from previous drilling at between 150 and 300 meters.

At Iron Cap, drilling has confirmed a major new gold-copper occurrence beneath the Iron Cap deposit, referred to as the Iron Cap Lower Zone. Drilling below the Iron Cap deposit in 2013 obtained promising results, particularly IC-13-49 which returned 207 meters of 1.22 g/T gold. However, 2013 drilling did not test the width and strike of the projected core zone due to a lack of suitable drill pad locations. Holes in the 2014 program have been designed to cut across the projected core zone at Iron Cap to determine the width and strike of the zone using advanced steering equipment capable of altering the orientation of the drilling as it progresses. These new holes indicate that the Lower Zone has excellent size and continuity as well as higher grades than the Iron Cap deposit above it.

The Iron Cap Lower Zone is a series of related, intermediate-composition intrusions, each with a unique alteration mineral assemblage including potassic, phyllic, and silicic alteration, all of which contain copper, gold and silver. Drill holes that targeted the southwestern and southeastern strike projections of the target zone (IC-14-053, 054, 054A, 055 and 057) penetrated numerous intrusive events where variable grade is enhanced in the contact zones between these intrusions. Holes IC-14-53 and 54 demonstrate the intensive and extensive potassic alteration, characterized by secondary orthoclase and abundant quartz-feldspar-sulfide veins, which confirm the presence of a core zone and should lead to better grades at depth. The holes drilled along the northern strike projection (IC-14-056, 058, 059, 060, 061) encountered more consistent intrusive rock with much less grade variability. Hydrothermal alteration in these holes to the north exhibit vertical continuity over the 1,000 meters tested so far, indicating significant potential at depth, particularly down an apparent north-northwest plunge. Future work at Iron Cap will focus on this orientation to look for more of the higher grade material found in IC-14-059.

Drill hole IC-14-61 approaches to within 1,000 meters of the proposed Mitchell-Treaty Twin Tunnel alignment, potentially making the Iron Cap Lower Zone an attractive early development option with potentially lower capital and operating costs than other deposits at KSM which are further from key infrastructure.

The following table summarizes all the holes drilled into the Lower Zone. Holes drilled last year and previously released are included to provide a more complete picture of the deposit and its emerging resource potential. New drill data is separated in the table to ensure clarity.

Iron Cap Lower Zone Intercepts

|

Drill Hole ID

|

Total Depth

|

From (meters)

|

To

(meters)

|

Interval

(meters)

|

Gold

(g/T)

|

Copper

%

|

Silver

(g/T)

|

|

2013 Drill Results

|

|

IC-13-48

|

1011

including

|

346.5

|

839.8

|

493.3

|

0.30

|

0.30

|

3.2

|

|

346.5

|

425.4

|

78.9

|

0.72

|

0.37

|

5.4

|

|

IC-13-49

|

1035

including

|

9.0

|

1032.4

|

1023.4

|

0.77

|

0.24

|

5.2

|

|

485.2

|

692.4

|

207.2

|

1.22

|

0.45

|

4.5

|

|

IC-13-50

|

432

|

286.0

|

321.0

|

35.0

|

1.38

|

0.38

|

9.7

|

|

IC-13-51

|

1169

|

884.0

|

956.4

|

72.4

|

0.55

|

0.26

|

2.1

|

|

IC-13-52

|

1071

|

308.4

|

506.4

|

196.9

|

0.34

|

0.44

|

2.3

|

|

2014 Drill Results

|

|

IC-14-53

|

1329.4

|

488.4

|

1002.4

|

514.0

|

0.68

|

0.30

|

5.2

|

|

including

|

635.4

|

727.4

|

92.0

|

1.47

|

0.34

|

3.1

|

|

IC-14-54

|

1107.0

|

322.4

|

832.5

|

510.1

|

0.41

|

0.28

|

10.5

|

|

including

|

599.4

|

713.0

|

112.4

|

0.44

|

0.40

|

22.1

|

|

including

|

717.6

|

832.5

|

114.9

|

0.61

|

0.20

|

3.6

|

|

IC-14-54A

|

1050

|

604.4

|

872

|

267.6

|

0.39

|

0.23

|

4.8

|

|

including

|

823.8

|

852

|

28.2

|

1.20

|

0.29

|

1.7

|

|

IC-14-55

|

624.3

|

193.6

|

253.2

|

58.6

|

0.37

|

0.29

|

3.1

|

|

including

|

257.5

|

624.3

|

366.8

|

0.59

|

0.17

|

2.5

|

|

including

|

331.0

|

375.3

|

44.3

|

1.02

|

0.24

|

2.1

|

|

IC-14-56

|

1095.8

|

163.1

|

324

|

160.9

|

0.21

|

0.35

|

3.3

|

| |

396.4

|

556.4

|

160.0

|

0.45

|

0.30

|

6.5

|

| |

582.4

|

853.4

|

271.0

|

0.25

|

0.24

|

9.3

|

| |

879.4

|

1095.8

|

216.4

|

0.46

|

0.16

|

2.5

|

|

IC-14-57

|

927.4

|

176

|

600.2

|

424.2

|

0.40

|

0.22

|

4.0

|

|

including

|

459.4

|

589.4

|

130.0

|

0.31

|

0.35

|

2.6

|

|

IC-14-58

|

1143.3

|

5.9

|

802.4

|

796.5

|

0.39

|

0.22

|

4.8

|

|

including

|

404.3

|

802.4

|

397.4

|

0.52

|

0.22

|

1.6

|

| |

1001.3

|

1143.3

|

142.0

|

0.49

|

0.31

|

2.5

|

|

IC-14-59

|

1032.0

|

1.6

|

159.0

|

157.4

|

0.45

|

0.38

|

4.4

|

| |

178.7

|

771.4

|

592.7

|

1.14

|

0.37

|

3.7

|

|

including

|

221.8

|

400.0

|

178.2

|

1.68

|

0.38

|

3.9

|

|

IC-14-60

|

967.1

|

124

|

525.3

|

401.3

|

0.47

|

0.17

|

8.0

|

|

including

|

256.0

|

286.0

|

30.0

|

1.15

|

0.27

|

40.6

|

|

IC-14-61

|

1152.4

|

431.4

|

794.4

|

362.5

|

0.38

|

0.28

|

6.8

|

| |

876.2

|

1152.4

|

276.2

|

0.46

|

0.31

|

2.0

|

Holes IC-14-53 and 54 were oriented to cross the structure at approximate right angles and therefore these two intercepts likely represent a close approximation to true width. The other 2014 holes listed above were drilled at several angles and directional drilling tools were used to modify the orientation of holes while in progress. The current evaluation cannot establish the extent to which these intercepts represent true thickness of the mineral zones. Sectional and three-dimensional modeling will be employed to refine the true thickness of this zone in preparation for a resource estimate. Lower Zone holes have generally been drilled at 150 to 200 meter spacings to support the resource estimation process. The upper portions of some of the these holes are within the proposed Iron Cap mine plan and are therefore already included in current reserves and resources. This drilling data is expected to support an initial resource estimate for the Iron Cap Lower Zone.

Independent Geotechnical Review Board

In January, 2015, the Issuer established an Independent Geotechnical Review Board (IGRB) for the KSM Project to review and consider the Project’s Tailings Management Facility (TMF) and Water Storage Dam (WSD) with a focus on their structural stability and integrity. The IGRB will provide independent, expert oversight, opinion and advice to Seabridge on the design, construction, operational management and ultimate closure of the TMF and WSD. The IGRB will have unimpeded access to all technical data necessary to enable them to assess KSM’s TMF and WSD on an ongoing basis to ensure that these structures meet internationally accepted standards and practices which effectively minimize risks to employees, lands and communities.

Initially, there will be four core members of the IGRB and four support members whose expertise will be called upon as needed. The IGRB will comprise the following leading experts in their fields:

|

Name

|

Education and Experience

|

|

Dr. Andrew Robertson (Chairman, Core Member)

|

B.Sc. in Civil Engineering, a Ph.D. in Rock Mechanics and 45 years of experience in mining geotechnics, of which 37 years were gained while practicing from his home base in Vancouver, Canada.

|

|

Dr. Gabriel Fernandez (Core Member)

|

Civil Engineer, M.S. in Soil, Ph.D. in Geotechnical Engineering and has over 40 years of experience.

|

|

Mr. Terry Eldridge (Core Member)

|

P.Eng., FEC and has over 30 years of experience in the investigation, design, construction and closure of mine waste management facilities.

|

|

Mr. Anthony Rattue (Core Member)

|

P.Eng. and has over 40 years of experience in geotechnical engineering.

|

|

Dr. Leslie Smith (Support Member)

|

Professor in the Department of Earth, Ocean and Atmospheric Sciences at the University of British Columbia, where he holds the Cominco Chair in Minerals and the Environment, and has 40 years of experience in hydrogeology in the topic areas of groundwater flow and contaminant transport, numerical modeling, groundwater – surface water interactions, and applications of hydrogeology in mining.

|

|

Dr. Ian Hutchison (Support Member)

|

Ph.D. in Civil Engineering and has over 40 years of experience in the planning design and construction of mining and heavy civil engineering facilities in North and South America and Southern Africa.

|

|

Mr. Jim Obermeyer (Support Member

|

M.S. in Civil Engineering with a specialty in Geotechnical Engineering, a licensed professional engineer in Colorado, Arizona, New Mexico, Montana and Wyoming, and has 40 years of experience in Civil and Geotechnical Engineering and managing and coordinating multidisciplinary projects.

|

|

Dr. Jean Pierre Tournier (Support Member)

|

Ph.D. in Civil Engineering - Soil Mechanics and has 35 years of experience in the design and construction of hydroelectric developments.

|

Overview

The Courageous Lake Project is a gold project located approximately 240 kilometers northeast of Yellowknife in the Northwest Territories, Canada. The property is comprised of 61 federal mining leases, 26 federal mining claims and one optioned federal mining lease (Red 25, defined below) having a combined area of 124,189.9 acres. Seabridge has a 100% interest in the project, subject to a 2% NSR on certain portions of the property. The Project is located in the Slave Structural Province within the Courageous Lake greenstone belt (“CLGB”), which is a steeply east dipping homocline sequence of metavolcanic and metasedimentary rocks of the Yellowknife Supergroup. Felsic volcanic rocks and their intrusive equivalents in the CLGB were derived from peraluminous, sub-alkaline magmas of calc-alkaline affinity. These felsic volcanic lithologies are the predominant host of the FAT deposit.

The property lies in a historic mining district and includes two past producing gold mines. Year round access is available by air only, either by fixed wing aircraft to the airstrip at the former Salmita mine six kilometers to the south, or via float-equipped aircraft to several adjacent lakes. During mid-winter, access is available via a winter road which branches from the main Tibbitt to Contwoyto winter road.

Considerable exploration work was completed at the property before it was acquired by Seabridge in 2002. Seabridge has completed additional extensive exploration and development on the property, culminating in the preparation of a preliminary feasibility study in 2012. Since the preparation of the feasibility study the focus of activities on the property has been on finding new deposits along the CLGB and, in March, 2014, the Issuer announced a resource estimate for a newly discovered higher grade deposit at Walsh Lake.

Property Acquisition

In May 2002, the Issuer entered into a purchase agreement with Newmont Canada Limited and Total Resources Canada Limited on the Courageous Lake project comprised of 17 mining leases covering 18,178 acres. The purchase by Seabridge closed on July 31, 2002. Under the purchase agreement, Seabridge paid Newmont/Total US$2.5 million in cash and granted them a 2.0% NSR and agreed that it would be liable to make two (2) further payments of US$1.5 million, each subject to the price of gold passing certain thresholds, for a 100% interest in the property. A further US$1.5 million was paid to Newmont/Total in March 2003 as a result of the spot price of gold closing above US$360 per ounce for 10 consecutive days. The final US$1.5 million was paid to Newmont/Total in February 2004 as a result of the spot price of gold closing above US$400 per ounce for 10 consecutive days. Upon acquiring the Courageous Lake project, Seabridge assigned its right thereto to its wholly owned subsidiary, Seabridge Gold (NWT) Inc. (formerly, 5073 N.W.T. Ltd.). The obligations of Seabridge Gold (NWT) Inc. (“Seabridge NWT”) under the agreement, including the payment of the royalty, is secured by a debenture under which the vendors have been granted a security interest in the Courageous Lake property.

In 2004, an additional property ("Red 25") was optioned in the area. Under the terms of the agreement, the Issuer paid $50,000 on closing and is required to make option payments of $50,000 on each of the first two anniversary dates and subsequently $100,000 per year. In addition, the Red 25 property may be purchased at any time for $1,250,000 with any option payments being credited against the purchase price. Subsequent to this acquisition, Seabridge staked contiguous open ground totaling an additional 49,133 acres in 42 mining claims of which a portion is subject to the terms of the purchase agreement with Newmont/Total, including the 2% royalty.

Land Status

As of December 31, 2013, the Courageous Lake property is comprised of 61 Federal mining leases, 26 Federal mining claims and one optioned Federal mining lease, having a combined area of 124,189.9 acres. Seventeen of the mining leases were acquired from Newmont/Total as described above. The mining leases are encumbered by two Royalty Agreements and two Debentures registered in favour of Newmont Canada Limited and Total, respectively. The property is subject to a 2 km area of interest from and parallel to all exterior boundaries of the mining leases.

The 26 Federal mining claims were staked on behalf of Seabridge NWT and are currently recorded 100% to Seabridge NWT (under its former name 5073 NWT Ltd.). There are no liens, charges or encumbrances registered against title to the staked mining claims.

The Red 25 mining claim was optioned by Seabridge NWT from Bathurst Inlet Developments (1984) Limited in 2004, through an Option to Purchase Agreement, wherein, Seabridge NWT may, subject to making yearly option payments or a lump sum payment totaling $1,250,000.00, purchase 100% of the mining claim. Until such time as Seabridge NWT has exercised the Option, ownership of the mining claim remains in the name of Bathurst Inlet Developments (1984) Limited. The Red 25 mining claim was converted to a mining lease on February 6, 2012.

Courageous Lake Preliminary Feasibility Study of September 2012

In 2011 the Issuer completed a Preliminary Economic Assessment of the Courageous Lake Project and, based on the results of this assessment, decided to engage independent consultants to prepare the first Preliminary Feasibility Study for the Courageous Lake Project. On September 5, 2012, a preliminary feasibility study for the Courageous Lake Project was completed by Tetra Tech, and incorporates the work of a number of independent industry-leading consulting firms. The preliminary feasibility study was revised and reissued on November 11, 2014 to also state the economic analysis therein on an after-tax basis. This revised reported has an effective date of September 5, 2012, is entitled “Seabridge Gold Inc. – Courageous Lake Prefeasibility Study” (the “2012 CL PFS Report”) and is available on SEDAR at www.sedar.com. The consultants and their responsibilities are as follows:

|

·

|

Tetra Tech, under the direction of Dr. John Huang (overall report preparation, metallurgical testing review, mineral processing, infrastructures (excluding power supply and airstrip), operating costs (excluding mining operating costs), capital cost estimate and project development plan) and Dr. Sabry Abdel Hafez (financial evaluation)

|

|

·

|

Moose Mountain Technical Services under the direction of Jim Gray (mining, mine capital and mine operating costs)

|

|

·

|

W.N. Brazier Associates Inc. under the direction of W.N. Brazier (power generation)

|

|

·

|

ERM Consultants Canada Ltd. under the direction of Pierre Pelletier (environmental matters)

|

|

·

|

Golder Associates Ltd. under the direction of Albert Victor Chance (open pit slope stability)

|

|

·

|

Tetra Tech EBA Inc. (EBA) under the direction of Nigel Goldup (tailings, surface water management and waste rock storage facilities, and surficial geology) and Kevin Jones (airstrip upgrade)

|

|

·

|

SRK Consulting (Canada) Inc., under the direction of Stephen Day (metal leaching and acid rock drainage)

|

|

·

|

Resource Modeling Inc. under the direction of Michael Lechner (mineral resources)

|

The following (to “Recent Exploration”) summarizes information from the 2012 CL PFS Report.

Property Description and Location

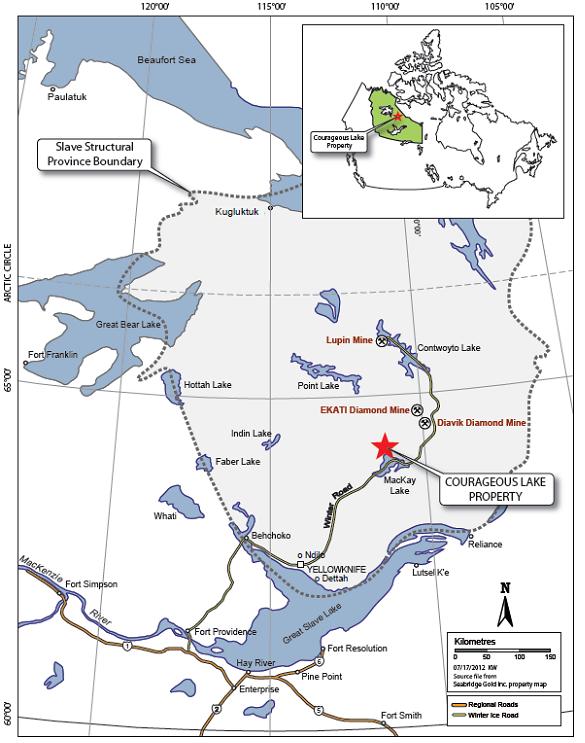

The Courageous Lake Property is located 240 km northeast of Yellowknife NWT, Canada and is approximately 124,190 acres. The property is situated within the Courageous Lake greenstone belt (“CLGB”) in the Slave Structural Province. Figure 4 shows the location of the Courageous Lake Project.

The property is a collection of mineral leases and mining claims that trend north-south along the approximately 54 km length of the CLGB. The property includes the past gold producing properties of the Salmita mine operated by Giant Yellowknife Mines, and the Tundra mine operated by Royal Oak Mines.

Mining projects in the NWT are subject to regulation under federal and territorial legislation to protect workers, the environment, and surrounding communities. The principal licences and permits required for the Courageous Lake Project include completing the environmental assessment process under the Part 5 of the Mackenzie Valley Resource Management Act (Northwest Territories), a water licence and land use permit granted by the Mackenzie Valley Land and Water Board, stream crossing authorizations from Fisheries and Oceans Canada, an explosive factory licence and, possibly, an authorization for waste water disposal under the Metal Mining Effluent Regulations of the Fisheries Act (Canada). A more comprehensive list of licences and permits appears in the 2012 CL PFS Report.

Accessibility, Climate, Infrastructure and Physiography

Year-round access to the property is possible by air only, either by helicopter or fixed wing aircraft to the airstrip at Salmita (located 6 km to the south), or by fixed wing aircraft equipped with skis or floats to nearby lakes. In addition, access in mid-winter is possible over an approximately 35 km winter road, which branches off the main Tibbitt to Contwoyto winter road. There are no significant population centres near the property, outside of Yellowknife. All supplies need to be brought in either by air or by road during the winter months.

The overall topography of this area is very gentle and is characterized by rolling hills that range from 418 to 450 m in elevation above sea level. Typically, the maximum change in elevation is only about 30 m. Tundra type vegetation and small scrub brush dominate the areas between outcrops, particularly along the ridges in the southern edge of the property. The northern part of the property is dominantly flat with little or no outcrop.

Temperatures range from a monthly average of -31.1°C to +18.2°C; with an average daily mean temperature of -8.5°C. The annual average wind speed is 4.4 m/s with maximum gusts of 19.4 m/s. Precipitation at the Courageous Lake Project is relatively low, with the majority of precipitation occurring during the summer months. Total annual precipitation recorded at the site between 2010 and 2011 averaged 199.1 mm. Average monthly precipitation was 16.6 mm. Regionally, the average snow depth between October and April ranges between 7 and 31 cm at Cambridge Bay and between 2 and 39 cm at Yellowknife.

Exploration History

Gold was first discovered in the Courageous Lake area in the early 1940’s. The Tundra deposit was discovered in 1944 and the Salmita deposit in 1947. Beginning in 1980, Noranda Exploration Ltd. initiated exploration in the Courageous Lake Volcanic Belt. Noranda’s work resulted in the discovery of two gold deposits: the Tundra deposit (Main Zone) or Fat Zone, and the Carbonate Zone, which together form the Courageous Lake property. In 1988, Noranda made the decision to sink a shaft to provide access for conducting an underground definition drilling program and to be able to test gold grade and continuity.

In 1997, Placer Dome optioned the property with the concept of developing a bulk tonnage open pit deposit. To test that concept, Placer Dome carried out surface diamond drilling programs during the fall of 1997 and summer/fall of 1998. Placer Dome completed 13,345 m of drilling and other basic exploration work.

In June 2002, Seabridge purchased the property from the Newmont-Total Tundra Joint Venture.

During 2003, Seabridge designed and executed a work program on the Courageous Lake property with the goal of evaluating and prioritizing potential gold targets. Four targets were developed: South FAT Extension, Olsen Lake target, Walsh Lake target, and Salmita Mine target. These targets were selected as those that represented the highest probability to develop new resources for the Project.