Table of Contents

As filed with the Securities and Exchange Commission on July 9, 2014

Registration No. 333-197044

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM F-10

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Form F-10

MAG SILVER CORP.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 1040 | Not applicable | ||

| (Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number, if applicable) |

(I.R.S. Employer Identification No., if applicable) |

#770-800 West Pender Street

Vancouver, BC, Canada V6C 2V6

Tel: 604-630-1399

(Address and telephone number of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

Telephone: 302-738-6680

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

| Copies to: | ||||||

| Christopher J. Cummings, Esq. Paul, Weiss, Rifkind, Wharton & Garrison LLP 77 King Street West Suite 3100 Toronto, ON, Canada M5K 1J3 Tel: 416-504-0522 Fax: 416-504-0530 |

Bob J. Wooder Blake, Cassels & Graydon LLP 595 Burrard Street P.O. Box 49314 Suite 2600, Three Bentall Centre Vancouver, BC, Canada V7X 1L3 Tel: 604-631-3330 Fax: 604-631-3309 |

Riccardo A. Leofanti Skadden, Arps, Slate, Meagher & Flom LLP 222 Bay Street Suite 1750, P.O. Box 258 Toronto, ON, Canada M5K 1J5 Tel: 416-777-4703 Fax: 416-777-4747 |

Neville J. McClure Stikeman Elliott LLP Suite 1700, Park Place 666 Burrard Street Vancouver, BC, Canada V6C 2X8 Tel: 604-631-1324 Fax: 604-681-1825 | |||

Approximate date of commencement of proposed sale to the public:. As soon as practicable after this Registration Statement becomes effective.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box below):

| A. |

x |

upon filing with the Commission pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). | ||||

| B. |

¨ |

at some future date (check the appropriate box below): | ||||

| 1. |

¨ |

pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing). | ||||

| 2. |

¨ |

pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). | ||||

| 3. |

¨ |

pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. | ||||

| 4. |

¨ |

after the filing of the next amendment to this Form (if preliminary material is being filed). | ||||

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction’s shelf prospectus offering procedures, check the following box. ¨

Table of Contents

| Prospectus | July 9, 2014 |

MAG SILVER CORP.

C$10.25 Per Offered Share

7,320,000 Common Shares

This short form prospectus qualifies the distribution (the “Offering”) of 7,320,000 Common Shares (the “Offered Shares”) of MAG Silver Corp. (the “Company” or “MAG”) at a price of C$10.25 per Offered Share (the “Offering Price”). The Offered Shares will be sold pursuant to an underwriting agreement (the “Underwriting Agreement”) dated June 27, 2014, as amended, between the Company and BMO Nesbitt Burns Inc., Raymond James Ltd., Macquarie Capital Markets Canada Ltd., Scotia Capital Inc., H.C. Wainwright & Co. LLC, National Bank Financial Inc., TD Securities Inc. and PI Financial Corp. (collectively, the “Underwriters”). H.C. Wainwright & Co. LLC is not registered as a dealer in any Canadian jurisdiction and, accordingly, will only sell Common Shares into the United States and will not, directly or indirectly, solicit offers to purchase or sell the Common Shares in Canada. The Offering Price has been determined by negotiation between the Company and the Underwriters. See “Plan of Distribution”.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE COMMON SHARES NOR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS SHORT FORM PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

This offering is made by a foreign private issuer that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this short form prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. Financial statements included or incorporated herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), and thus may not be comparable to financial statements of United States companies.

Prospective investors should be aware that the acquisition of the Common Shares described herein may have tax consequences both in the United States and Canada, including the Canadian federal income tax consequences applicable to a foreign controlled Canadian corporation that acquires Offered Shares. This short form prospectus may not fully describe such consequences for investors who are resident in, or citizens of, the United States.

The enforcement by investors of civil liabilities under the federal securities laws of the United States may be affected adversely by the fact that the Company is incorporated under the laws of British Columbia, that some or all of its officers and directors are Canadian residents, that some or all of the experts named in the registration statement are Canadian residents, and that all or a substantial portion of the assets of the Company and said persons may be located outside the United States.

The outstanding Common Shares of the Company are listed and posted for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “MAG” and on the NYSE Market LLC (the “NYSE MKT”) under the symbol “MVG”. On June 25, 2014, the last trading day prior to the announcement of the Offering, the closing price of the Common Shares on the TSX and NYSE MKT was C$11.15 and US$10.44, respectively.

Price: C$10.25 per Offered Share

| Price to the Public | Underwriters’ Fee(1) | Net Proceeds to the Company(2)(3) | ||||

| Per Offered Share |

C$10.25 | C$0.5125 | C$9.7375 | |||

|

Total(3) |

C$75,030,000 | C$3,751,500 | C$71,278,500 |

Table of Contents

Notes:

| (1) | Pursuant to the terms and conditions of the Underwriting Agreement, the Company has agreed to pay to the Underwriters a fee equal to 5.0% of the gross proceeds of the Offering (the “Underwriters’ Fee”). See “Plan of Distribution” for a description of all compensation payable to the Underwriters. |

| (2) | After deducting the Underwriters’ Fee, but before deducting expenses of the Offering, estimated to be C$500,000, which will be paid from the proceeds of the Offering. |

| (3) | The Company has granted to the Underwriters an option (the “Over-Allotment Option”), exercisable in whole or in part in the sole discretion of the Underwriters at any time until the date which is 30 days following the Closing Date, to purchase up to an additional 1,098,000 Common Shares of the Company at a price of C$10.25 per Common Share (the “Over-Allotment Shares”), to cover over-allotments, if any, and for market stabilization purposes. If the Over-Allotment Option is exercised in full, the total price to the public, the Underwriters’ Fee and the net proceeds to the Company (before deducting expenses of the Offering), will be C$86,284,500, C$4,314,225 and C$81,970,275, respectively. This short form prospectus also qualifies the distribution of the Over-Allotment Shares to be issued or sold upon exercise of the Over-Allotment Option. A purchaser who acquires Over-Allotment Shares forming part of the Underwriters’ over-allocation position acquires those Over-Allotment Shares under this short form prospectus, regardless of whether the over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases. Unless the context otherwise requires, the term “Offered Shares” includes any Over-Allotment Shares issued upon exercise of the Over-Allotment Option. See “Plan of Distribution”. |

The Underwriters, as principals, conditionally offer the Offered Shares, subject to prior sale, if, as and when issued by the Company and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under “Plan of Distribution” and subject to approval of certain Canadian legal matters on behalf of the Company by Blake, Cassels & Graydon LLP, certain United States legal matters on behalf of the Company by Paul, Weiss, Rifkind, Wharton & Garrison LLP, certain Canadian legal matters on behalf of the Underwriters by Stikeman Elliott LLP and certain United States legal matters on behalf of the Underwriters by Skadden, Arps, Slate, Meagher & Flom LLP. In connection with the Offering and subject to applicable laws, the Underwriters may over-allot or effect transactions that are intended to stabilize or maintain the market price of the Offered Shares at levels other than that which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time and must be brought to an end after a limited period. See “Plan of Distribution”. The Underwriters may offer the Offered Shares at prices lower than the Offering Price. Notwithstanding any reduction by the Underwriters on the Offering Price, the Company will still receive net proceeds of C$9.7375 per Offered Share purchased by the Underwriters pursuant to this Offering. See “Plan of Distribution”.

Subscriptions for the Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. Closing is expected to take place on or about July 16, 2014, or such other date as may be agreed between the Company and the Underwriters but in any event not later than 42 days following the date of a final receipt for the final prospectus (the “Closing Date”). Certificates (in physical or electronic form) representing the Offered Shares will be issued on the Closing Date.

The following table sets forth the number of Over-Allotment Shares issuable under the Over-Allotment Option:

| Underwriters’ Position |

Maximum Number of Over-Allotment Shares |

Exercise Period |

Exercise Price | |||

| Over-Allotment Option | 1,098,000 Over-Allotment Shares |

At any time up to 30 days from the Closing Date |

C$10.25 per Over-Allotment Share |

The head office of the Company is located at 770 – 800 West Pender Street, Vancouver, British Columbia, Canada V6C 2V6, and its registered office is located at 2600 – 595 Burrard Street, Vancouver, British Columbia, Canada V7X 1L3.

An investment in the Offered Shares involves a high degree of risk. It is important for a prospective purchaser to consider the risk factors described or referred to in this short form prospectus. See “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors”.

Investors should rely only on the information contained or incorporated by reference in this short form prospectus. The Company and the Underwriters have not authorized anyone to provide investors with different information. The Underwriters are offering to sell, and seeking offers to buy, the Offered Shares only in jurisdictions where, and to persons to whom, offers and sales are lawfully permitted. Investors should not assume that the information contained in this short form prospectus is accurate as of any date other than the date on the front of this short form prospectus. The Company’s business, operating results, financial condition and prospects may have changed since that date.

Dr. Peter Megaw, who has provided a consent to the incorporation by reference into this short form prospectus of certain technical information for which he is the responsible qualified person, resides outside of Canada.

Dr. Megaw has appointed the following agent for service of process:

| Name of Person or Company |

Name and Address of Agent |

|||

| Dr. Peter Megaw |

MAG Silver Corp. | |||

| Suite 770, 800 West Pender Street | ||||

| Vancouver, British Columbia | ||||

| Canada, V6C 2V6 |

Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

Table of Contents

| Page | ||||

| i | ||||

| ii | ||||

| iv | ||||

| iv | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 2 | ||||

| 10 | ||||

| 24 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 33 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

The Company’s consolidated financial statements that are incorporated by reference into this short form prospectus have been prepared in accordance with IFRS, which differs from U.S. generally accepted accounting principles (“U.S. GAAP”). Therefore, the Company’s consolidated financial statements incorporated by reference into this short form prospectus and in the documents incorporated herein by reference, may not be comparable to financial statements prepared in accordance with U.S. GAAP. Unless otherwise indicated, all information in this short form prospectus assumes no exercise of the Over-Allotment Option.

Unless the context otherwise requires, references in this short form prospectus to “MAG” or the “Company” includes MAG Silver Corp. and its subsidiaries.

CURRENCY AND EXCHANGE RATE INFORMATION

Unless stated otherwise or the context otherwise requires, all references to dollar amounts in this short form prospectus are references to United States dollars. References to “US$” are to United States dollars and references to “C$” are to Canadian dollars.

The noon rate of exchange on July 8, 2014 as reported by the Bank of Canada for the conversion of United States dollars into Canadian dollars was US$1.00 equals C$1.0674 (C$1.00 equals US$0.9369).

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This short form prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities laws. Such forward-looking statements and information include, but are not limited to:

| · | the future price of silver, gold, lead and zinc; |

| · | the estimation of mineral resources; |

| · | preliminary economic estimates relating to the Juanicipio Project (as defined herein); |

| · | estimates of the time and amount of future silver, gold, lead and zinc production for specific operations; |

| · | estimated future exploration and development expenditures and other expenses for specific operations; |

| · | permitting time lines; |

| · | the Company’s expectations regarding impairments of mineral properties; |

| · | the Company’s expectations regarding its negotiations with the Ejido to obtain surface access to the Cinco de Mayo Property (as defined herein); |

| · | the anticipated timing of an updated resource estimate for Minera Juanicipio (as defined herein); |

| · | the Company’s expectations regarding the sufficiency of its capital resources and requirements for additional capital; |

| · | litigation risks; |

| · | currency fluctuations; and |

| · | environmental risks and reclamation cost. |

When used in this short form prospectus, any statements that express or involve discussions with respect to predictions, beliefs, plans, projections, objectives, assumptions or future events of performance (often but not always using words or phrases such as “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “strategy”, “goals”, “objectives”, “project”, “potential” or variations thereof or stating that certain actions, events, or results “may”, “could”, “would”, “might” or “will” be taken, occur, or be achieved, or the negative of any of these terms and similar expressions), as they relate to the Company or management, are intended to identify forward-looking statements and information. Such statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions.

Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements and information, including, among others:

| · | the potential for no commercially mineable deposits due to the speculative nature of the Company’s business; |

| · | none of the properties in which the Company has an interest having any mineral reserves; |

| · | estimates of mineral resources being based on interpretation and assumptions which are inherently imprecise; |

| · | no guarantee of surface rights for the Company’s mineral properties; |

| · | no guarantee of the Company’s ability to obtain all necessary licenses and permits that may be required to carry out exploration and development of its mineral properties and business activities; |

| · | risks related to all of the properties in which the Company has an interest being located in Mexico; |

| · | the effect of global economic and political instability on the Company’s business; |

| · | risks related to the Company’s ability to finance substantial expenditures required for commercial operations on its mineral properties; |

| · | the Company’s history of losses and no revenues from operations; |

ii

Table of Contents

| · | risks related to the Company’s ability to arrange additional financing, and possible loss of the Company’s interests in its properties due to a lack of adequate funding; |

| · | risks related to the development of the Juanicipio Project, particularly, Minera Juanicipio not yet having made a formal “production decision”, and no guarantee that the financial results and the contemplated development timeline will be consistent with the Amended Technical Report (as defined herein); |

| · | risks relating to the capital requirements for the Juanicipio Project and the timeline to production; |

| · | risks related to title, challenge to title, or potential title disputes regarding the Company’s mineral properties; |

| · | risks related to the Company being a minority shareholder of Minera Juanicipio; |

| · | risks related to disputes with joint venture partners and optionors; |

| · | risks related to the influence of the Company’s significant shareholders over the direction of the Company’s business; |

| · | the potential for legal proceedings to be brought against the Company; |

| · | risks related to environmental regulations; |

| · | the highly competitive nature of mineral exploration industry; |

| · | risks related to equipment shortages, access restrictions and lack of infrastructure; |

| · | the Company’s dependence upon qualified management; |

| · | the Company’s dependence on certain service providers (Minera Cascabel S.A. de C.V. (“Cascabel”) and IMDEX Inc. (“IMDEX”)) to supervise operations in Mexico; |

| · | risks related to directors being, or becoming, associated with other natural resource companies which may give rise to conflicts of interest; |

| · | currency fluctuations (particularly the C$/US$ and US$/Mexican Peso exchange rates) and inflationary pressures; |

| · | risks related to mining operations generally; |

| · | risks related to fluctuation of mineral prices and marketability; |

| · | the Company being subject to anti-corruption laws, human rights laws, and Mexican foreign investment and income tax laws; |

| · | the Company being subject to Canadian disclosure practices concerning its mineral resources which allow for more disclosure than is permitted for domestic U.S. reporting companies; |

| · | risks related to maintaining adequate internal control over financial reporting; |

| · | funding and property commitments resulting in dilution to the Company’s shareholders; |

| · | the volatility of the price of the Company’s Common Shares; |

| · | the absence of a liquid trading market for the Company’s Common Shares; |

| · | the Company being a “passive foreign investment company” which may have adverse U.S. federal income tax consequences for U.S. shareholders; |

| · | the difficulty of U.S. litigants effecting service of process or enforcing any judgments against the Company, as the Company, its principals and assets are located outside of the United States; |

| · | all of the Company’s assets being located outside of Canada; |

| · | risks related to the decrease of the market price of the Common Shares if the Company’s shareholders sell substantial amounts of Common Shares following the Offering; |

| · | risks related to dilution to existing shareholders if stock options are exercised; |

| · | the Company’s discretion in the use of the net proceeds from the Offering; and |

| · | the history of the Company with respect to not paying dividends and anticipation of not paying dividends in the foreseeable future. |

iii

Table of Contents

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements and information. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements and information due to a variety of risks, uncertainties and other factors, including without limitation, those referred to in this short form prospectus under the heading “Risk Factors” and documents incorporated by reference herein. The Company’s forward-looking statements and information are based on the reasonable beliefs, expectations and opinions of management on the date the statements are made and, other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management’s beliefs, expectations or opinions should change. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements and information.

A registration statement on Form F-10 has been filed by the Company with the United States Securities and Exchange Commission’s (the “SEC”) in respect of the distribution of the Offered Shares. The registration statement, of which this short form prospectus constitutes a part, contains additional information not included in this short form prospectus, certain items of which are contained in the exhibits to such registration statement, pursuant to the rules and regulations of the SEC.

In addition to the Company’s continuous disclosure obligations under the securities laws of the provinces of Canada, the Company is subject to the information requirements of the U.S. Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), and in accordance therewith the Company files with or furnishes to the SEC reports and other information. The reports and other information that the Company files with or furnishes to the SEC are prepared in accordance with the disclosure requirements of Canada, which differ in certain respects from those of the United States. As a foreign private issuer, the Company is exempt from the rules under the U.S. Exchange Act prescribing the furnishing and content of proxy statements, and the Company’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the U.S. Exchange Act. In addition, the Company may not be required to publish financial statements as promptly as U.S. companies. Copies of any documents that the Company has filed with the SEC may be read at the SEC’s public reference room at Room 1500, 100 F Street N.E., Washington, D.C., 20549. Copies of the same documents may also be obtained from the public reference room of the SEC by paying a fee. Please call the SEC at 1-800-SEC-0330 or access its website at www.sec.gov for further information about the public reference room.

Additional information about the Company and its business activities is available under the Company’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) at www.sedar.com and on the SEC’s Electronic Data Gathering, Analysis and Retrieval System (“EDGAR”) at www.sec.gov.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC as part of the registration statement on Form F-10 of which this short form prospectus forms a part: (a) the documents referred to under the heading ‘‘Documents Incorporated by Reference’’; (b) consents of each of the following: Blake, Cassels & Graydon LLP, Stikeman Elliott LLP, Deloitte LLP, Jason Cox, Holger Krutzelmann, Michael Thomas, Henrik Thalenhorst, Alan Riles, David Ross and Dr. Peter Megaw; (c) the Underwriting Agreement; and (d) powers of attorney from certain of the Company’s directors and officers (included on the signature pages of the registration statement).

CAUTIONARY NOTE TO UNITED STATES INVESTORS

Technical disclosure regarding the Company’s properties included or incorporated by reference herein (the “Technical Disclosure”) has been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of the United States securities laws. Without limiting the foregoing, the Technical Disclosure uses terms that comply with reporting standards in Canada and certain estimates are made in accordance with National

iv

Table of Contents

Instrument 43-101 of the Canadian Securities administrators (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral resource estimates contained in the Technical Disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ significantly from the requirements of the SEC, and resource information contained in the Technical Disclosure may not be comparable to similar information disclosed by U.S. companies subject to reporting and disclosure requirements under U.S. federal securities laws.

The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Additionally, disclosure of “contained ounces” in a resource is permitted disclosure under Canadian securities laws, however the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measurements. Accordingly, information contained in the Technical Disclosure may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this short form prospectus from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of the Company at Suite 770, 800 West Pender Street, Vancouver, British Columbia, Canada, V6C 2V6, telephone (604) 630-1399 and are also available electronically under the Company’s profile on SEDAR at www.sedar.com and on the SEC’s EDGAR system at www.sec.gov.

The following documents filed by the Company with the various securities commissions or similar authorities in the Provinces of Canada, are specifically incorporated by reference and form an integral part of this short form prospectus:

| (a) | annual information form of the Company dated March 27, 2014 for the year ended December 31, 2013 (the “Annual Information Form”); |

| (b) | audited consolidated financial statements of the Company as at and for the year ended December 31, 2013, together with the notes thereto and the report of the independent registered public accounting firm thereon; |

| (c) | management’s discussion and analysis of the financial condition and results of operations of the Company for the year ended December 31, 2013; |

| (d) | unaudited condensed interim consolidated financial statements of the Company as at and for the three months ended March 31, 2014; |

| (e) | management’s discussion and analysis of the financial condition and results of operations of the Company for the three months ended March 31, 2014; |

| (f) | management information circular of the Company dated for reference May 20, 2014 prepared for the purposes of the annual and special meeting of the Company held on June 24, 2014; |

| (g) | the report filed pursuant to NI 43-101 entitled “Technical Report on the Mineral Resource Update for the Juanicipio Joint Venture, Zacatecas State, Mexico” authored by Roscoe Postle Associates Inc. (“RPA”), dated June 12, 2014, as amended on June 30, 2014 and filed on SEDAR on July 3, 2014 (the “Amended Technical Report”); and |

| (h) | material change report dated June 27, 2014 relating to the announcement of the Offering. |

v

Table of Contents

For the avoidance of doubt, all technical information contained in the Annual Information Form which is derived from the technical report dated July 1, 2012 entitled “Minera Juanicipio Property, Zacatecas State, Mexico, Technical Report for Minera Juanicipio S.A. de C.V. (the “2012 Technical Report”) is expressly not incorporated by reference into this Prospectus, and all such information is superseded in its entirety by the Amended Technical Report.

To the extent that any document or information incorporated by reference into this prospectus is included in a report filed or furnished on Form 40-F, 20-F, 10-K, 10-Q, 8-K or 6-K (or any respective successor form), such document or information shall also be deemed to be incorporated by reference as an exhibit to the registration statement relating to the Common Shares of which this short form prospectus forms a part.

A reference herein to this short form prospectus also means any and all documents incorporated by reference in this short form prospectus. Any document of the type referred to above, including audited annual consolidated financial statements, unaudited condensed interim consolidated financial statements and the related management’s discussion and analysis, material change reports (excluding confidential material change reports), any business acquisition reports, the content of any news release disclosing financial information for a period more recent than the period for which financial information is deemed incorporated by reference in this short form prospectus and certain other disclosure documents as set forth in Item 11.1 of Form 44-101F1 of National Instrument 44-101 of the Canadian Securities Administrators filed by the Company with the securities commissions or similar regulatory authorities in Canada after the date of this short form prospectus and prior to the termination of the Offering shall be deemed to be incorporated by reference in this short form prospectus.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein is not incorporated by reference to the extent that any such statement is modified or superseded by a statement herein or in any subsequently filed document that is also or is deemed to be incorporated by reference herein. Any such modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded shall not be considered in its unmodified or superseded form to constitute a part of this short form prospectus; rather only such statement as so modified or superseded shall be considered to constitute part of this short form prospectus.

References to our website in any documents that are incorporated by reference into this prospectus do not incorporate by reference the information on such website into this prospectus, and the Company disclaims any such incorporation by reference.

vi

Table of Contents

Name, Address and Incorporation

The Company was incorporated under the Company Act (British Columbia) on April 21, 1999 under the name “583882 B.C. Ltd.” On June 28, 1999, in anticipation of becoming a capital pool company, the Company changed its name to “Mega Capital Investments Inc.” On April 22, 2003, the Company changed its name to “MAG Silver Corp.” to reflect its new business upon the completion of its qualifying transaction on the TSX Venture Exchange. Effective March 29, 2004, the Company Act (British Columbia) was replaced by the Business Corporations Act (British Columbia). Accordingly, on July 27, 2005, the Company transitioned under the Business Corporations Act (British Columbia) and adopted new articles and concurrently increased its authorized capital from 1,000,000,000 Common Shares to an unlimited number of Common Shares without par value and an unlimited number of Preferred Shares without par value.

The Company’s head office is located at Suite 770, 800 West Pender Street, Vancouver, British Columbia, Canada, V6C 2V6. The Company’s registered office is located at 2600 – 595 Burrard Street, Vancouver, British Columbia, Canada, V7X 1L3.

Intercorporate Relationships

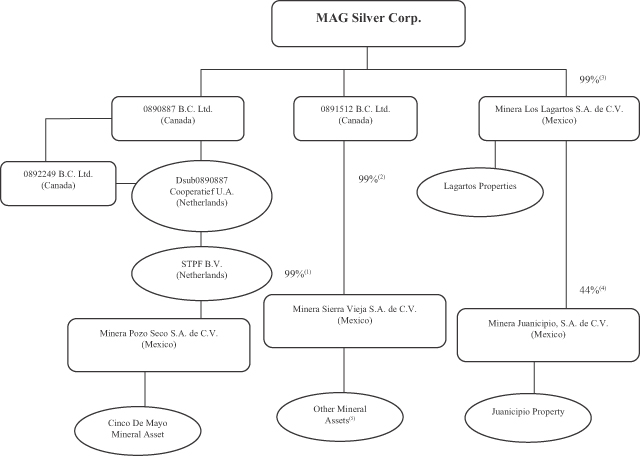

The following chart illustrates the Company’s significant subsidiaries, including the jurisdiction of incorporation of each company and its properties.

| (1) | The Company is the beneficial owner of 99% of the issued Class I shares of Minera Pozo Seco S.A. de C.V. (“Pozo Seco”). The remaining 1% of the issued Class I shares of Pozo Seco are held by Dan MacInnis, a director of the Company, on behalf of the Company. |

| (2) | The Company is the beneficial owner of 99% of the issued Class I shares of Minera Sierra Vieja S.A. de C.V. (“Sierra Vieja”). The remaining 1% of the issued Class I shares of Sierra Vieja are held by Dan MacInnis, a director of the Company, on behalf of the Company. |

1

Table of Contents

| (3) | The Company is the registered owner of 99% of the issued Class I shares of Minera Los Lagartos, S.A. DE C.V. (“Lagartos”), a corporation incorporated under the laws of Mexico. The remaining 1% of the issued Class I shares of Lagartos are held by Dan MacInnis, a director of the Company, on behalf of the Company. |

| (4) | Lagartos is the registered owner of a 44% interest in Minera Juanicipio, S.A. De C.V. (“Minera Juanicipio”), and Fresnillo plc (“Fresnillo”), a London Stock Exchange listed company controlled by Industrias Peñoles, S.A. De C.V. (“Peñoles”), holds the remaining 56% interest in Minera Juanicipio. |

| (5) | Other Mineral Assets = Batopilas and Guigui. |

Summary Description of Business

The Company is a Vancouver-based mineral exploration company that is focused on the acquisition, exploration and development of mineral exploration properties, with its primary focus being grassroots district scale silver projects located in the Mexican Silver Belt in Mexico. The principal properties of the Company include the Company’s 44% interest in the Juanicipio Joint Venture, a primarily silver exploration and development project (the “Juanicipio Project”), and its 100% owned Cinco de Mayo property, a silver, gold, lead and zinc exploration project (the “Cinco de Mayo Property”). The Company currently considers the Juanicipio Project and the Cinco de Mayo Property to be its material properties for the purposes of NI 43-101.

The Company also owns or holds an interest in a number of other property assets in Mexico.

Principal Projects

Juanicipio Project

The Juanicipio Project is located in the Fresnillo District, Zacatecas State, Mexico, approximately 6 kilometres west of the mining town of Fresnillo, and covers approximately 7,679 hectares. The Company initially acquired a 100% interest in the Juanicipio Project in 2002. From 2005 to 2007, Peñoles earned a 56% interest in the Juanicipio Project by conducting US$5,000,000 of exploration on the property and purchasing US$1,000,000 worth of Common Shares of the Company at market price at the time of purchase. In December 2007, Lagartos and Peñoles established Minera Juanicipio to hold and operate all mineral and surface rights related to the Juanicipio Project. Minera Juanicipio is governed by a shareholders agreement dated October 10, 2005 (the “Shareholders Agreement”). Pursuant to the Shareholders Agreement, each shareholder is to provide funding pro rata to its interest in Minera Juanicipio, with Fresnillo contributing 56% and the Company, through Lagartos, contributing 44%, respectively.

The Juanicipio Project hosts, at this time, three significant high grade silver (gold, lead and zinc) veins: the Valdecañas Vein, with its footwall offshoot the Desprendido Vein and the Juanicipio Vein. In 2014, the Amended Technical Report was authored by RPA. Fresnillo prepares its own internal resource estimate annually. Fresnillo’s estimates are not prepared in compliance with NI 43-101, and were not used in the Amended Technical Report and are not relied upon by the Company.

Cinco de Mayo Property

The 100% owned Cinco de Mayo Property is located approximately 190 kilometres northwest of the city of Chihuahua, in northern Chihuahua State, Mexico, and covers approximately 25,113 hectares. The primary concessions of Cinco de Mayo Property were acquired by way of an option agreement dated February 26, 2004, and the property remains subject to a 2.5% net smelter returns royalty.

Other Exploration Properties

The Company also holds interests in various other early stage exploration properties located in Mexico. The Company continues to evaluate exploration opportunities both on currently owned properties and on new prospects.

MINERAL PROPERTY – JUANICIPIO PROJECT

The following is an extracted summary section from the Amended Technical Report. The Amended Technical Report is incorporated by reference herein and, for full technical details, reference should be made to the complete text of the Amended Technical Report. The following summary does not purport to be a complete summary of the Juanicipio Project and is subject to all the assumptions, qualifications and procedures set out in the Amended Technical Report

2

Table of Contents

and is qualified in its entirety with reference to the full text of the Amended Technical Report. Readers should read this summary in conjunction with the Amended Technical Report. Readers are cautioned that the Amended Technical Report supersedes and replaces in all respects the 2012 Technical Report.

Executive Summary

RPA was retained by MAG to update the mineral resource estimate and prepare an independent Technical Report on the Juanicipio Joint Venture in Zacatecas State, Mexico. This Technical Report conforms to NI 43-101. MAG requires this report to support the updated mineral resource estimate for the property prepared by RPA and disclosed in a press release. RPA has visited the property several times, most recently on May 27, 2014. This Technical Report was amended as of June 30, 2014, to include enhanced cautionary language.

The Juanicipio property is owned by Minera Juanicipio, a joint venture between Fresnillo plc (Fresnillo, 56%) and MAG (44%), with Fresnillo acting as the operator. The major asset associated with the Juanicipio Joint Venture is a silver-gold-lead-zinc epithermal vein deposit.

An updated Preliminary Economic Assessment (“PEA”) was carried out by AMC Mining Consultants (Canada) Ltd. (“AMC”) in 2012 (the “2012 PEA”). The study defined Juanicipio as an economically robust, high-grade underground silver project exhibiting minimal financial or development risks that will produce an average of 15.1 million payable ounces of silver over the first full six years of commercial production and 10.3 million payable ounces per year over a 14.8 year total mine life. The 2012 PEA did not take into account any potential mining, processing, or infrastructure synergies from any association with the adjoining property owned by Fresnillo. The 2012 PEA was based on the resource estimate and model developed by Strathcona Mineral Services (“Strathcona”) dated November 2011.

The economic analysis in the PEA is preliminary in nature and is based, in part, on Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized.

On October 28, 2013, MAG announced that the Joint Venture had commenced underground development. The ramp advancement work is being conducted by a contractor using a conventional drill and blast method and a continuous miner where possible.

Conclusions

MAG and joint venture partner Fresnillo have made a major discovery of low-sulphidation epithermal vein mineralization, located in the southwest part of the world-class Fresnillo silver mining district. The discovery is located in the northeast corner of the property and consists of two silver-gold-lead-zinc epithermal structures known as the Valdecañas and Juanicipio vein systems. Most exploration on the property has focused on these two vein systems. There is good exploration potential remaining at the Juanicipio Vein and elsewhere on the property, which remains largely underexplored. A significant exploration budget is warranted.

The updated Mineral Resource estimate reflects the drill results available as of December 31, 2013 including 40 new infill diamond drill holes completed since the previous resource estimate. The new estimate demonstrates a conversion of previously classified Inferred Resources into the Indicated category and reports a deep lower grade resource separately. The Mineral Resources on the Juanicipio Property are contained within the Valdecañas Vein system and the Juanicipio Vein. The updated resource estimate uses a cut-off of US$70/tonne Net Smelter Return (“NSR”), which includes values for silver, gold and base metals.

The Valdecañas and Juanicipio Veins display the vertical grade transition from upper silver rich zones to deep gold and base metal dominant areas that is typical of Fresnillo District veins, and epithermal silver veins in general. Previous resource estimates were largely based on the upper silver rich zones with limited influence from the deep base metal dominant zone. The recent infill drilling has greatly improved discrimination of the vertical compositional zonations, allowing the updated Mineral Resource estimate reported here to be manually divided into the upper Bonanza Grade Silver Zone (“BGS Zone”) and the Deep Zone (Tables 1-1 and 1-2). This division highlights both the improved confidence in the BGS Zone, through conversion of previously categorized Inferred Resources into Indicated Resources, and the initial definition of the Deep Zone.

The increased drill density provides a better understanding of the vein geometry and indicates that the Valdecañas Vein comprises two overlapping “en-echelon” veins rather than a single vein offset by a fault. This reveals an area of overlap, with incrementally increased tonnage, especially in the BGS Zone. A number of new holes, targeted below the

3

Table of Contents

limits of the previous resource estimate, intersected significant widths (10.5 m to 25.8 m true thickness) of lower grade mineralization, which combined with previous deep intercepts led to the definition of the new Deep Zone resource.

TABLE 1-1 MINERAL RESOURCES BY METAL ZONE (100% BASIS)

MAG Silver Corp. – Juanicipio Joint Venture

| Grade | Contained Metal | |||||||||||||||||||||||||||||||||||||

| Zone/Classification |

Tonnage (Mt) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (M oz) |

Au (k oz) |

Pb (M lb) |

Zn (M lb) |

|||||||||||||||||||||||||||||

| Bonanza Grade Silver Zone |

||||||||||||||||||||||||||||||||||||||

| Indicated |

8.3 | 601 | 1.7 | 2.0 | 3.7 | 160 | 448 | 365 | 676 | |||||||||||||||||||||||||||||

| Inferred |

2.4 | 626 | 1.9 | 1.4 | 2.2 | 48 | 146 | 74 | 114 | |||||||||||||||||||||||||||||

| Deep Zone |

||||||||||||||||||||||||||||||||||||||

| Indicated |

1.8 | 93 | 1.7 | 1.4 | 2.6 | 5 | 97 | 54 | 102 | |||||||||||||||||||||||||||||

| Inferred |

2.7 | 146 | 2.0 | 2.1 | 3.4 | 13 | 173 | 128 | 203 | |||||||||||||||||||||||||||||

Notes:

| 1. | CIM definitions were followed for the classification of Mineral Resources. |

| 2. | Mineral Resources are estimated at an incremental NSR cut-off value of US$70/tonne |

| 3. | NSR values are calculated in US$ using factors of $0.57 per g/t Ag, $30.11 per g/t Au, $9.07 per % Pb, and $12.21 per % Zn. These factors are based on metal prices of US$21.50/oz Ag, US$1,250/oz Au, $0.91/lb Pb, and $0.99/lb Zn and estimated recoveries and smelter terms. |

| 4. | The Mineral Resource estimate uses drill hole data available as of December 31, 2013. |

| 5. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 6. | Totals may not add correctly due to rounding. |

Combining the BSG Zone and the Deep Zone into a total resource by category, results in an overall increase in tonnage and a lower overall silver grade (Table 1-2).

TABLE 1-2 JUANICIPIO JOINT VENTURE MINERAL RESOURCES (100% BASIS)

MAG Silver Corp. – Juanicipio Joint Venture

| Grade | Contained Metal | |||||||||||||||||||||||||||||||||||||

| Classification |

Tonnage (Mt) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (M oz) |

Au (k oz) |

Pb (M lb) |

Zn (M lb) |

|||||||||||||||||||||||||||||

| Indicated |

10.1 | 511 | 1.7 | 1.9 | 3.5 | 166 | 544 | 419 | 778 | |||||||||||||||||||||||||||||

| Inferred |

5.1 | 372 | 2.0 | 1.8 | 2.8 | 61 | 319 | 202 | 317 | |||||||||||||||||||||||||||||

Notes:

| 1. | CIM definitions were followed for the classification of Mineral Resources. |

| 2. | Mineral Resources are estimated at an incremental NSR cut-off value of US$70 per tonne. |

| 3. | NSR values are calculated in US$ using factors of $0.57 per g/t Ag, $30.11 per g/t Au, $9.07 per % Pb, and $12.21 per % Zn. These factors are based on metal prices of $21.50/oz Ag, $1,250/oz Au, $0.91/lb Pb, and $0.99/lb Zn and estimated recoveries and smelter terms. |

| 4. | The Mineral Resource estimate uses drill hole data available as of December 31, 2013. |

| 5. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 6. | Totals may not add correctly due to rounding. |

In RPA’s opinion the Juanicipio project has the potential to be developed into an economically robust, high-grade underground silver project. Further drilling and investigation work aimed at upgrading Inferred Mineral Resources and increasing the geotechnical and hydrogeological understanding of the deposit is required to form a firm base for the next stage of project design and evaluation.

RPA notes several changes since the 2012 PEA that would have an insignificant impact on the overall economic results:

| · | Updated Mineral Resource as described in this report |

| · | Metal Prices |

| · | Payment Terms for concentrate |

| · | Cost Escalation |

| · | New Gold and Silver Tax (0.5% Gross Revenue) |

| · | New Mining Tax (7.5% on EBITDA) |

| · | Increased Corporate Tax rate (30% from 28%) |

| · | Increase in cut-off grade used to report Mineral Resources |

RPA would expect an updated PEA to have similar economic results as the 2012 PEA.

4

Table of Contents

Recommendations

The Juanicipio property hosts a significant silver-gold-lead-zinc deposit and merits considerable additional exploration and development work. RPA recommends a budget of US$22.6 million (Table 1-3) for 2014 to advance the access ramp to the Valdecañas vein system and to explore elsewhere on the property. Work should include:

| · | Continuing to advance the underground access ramp. The budget in the 2012 PEA estimates this work to be $11.4 million with MAG’s 44% share being $5 million. |

| · | 10,000 m of drilling at the Valdecañas vein system to obtain a drill hole spacing no greater than 100 m in both the along-strike and up- and down-dip directions. |

| · | 10,000 m of drilling for a property-wide exploration program including mapping, and drilling of new targets. Key criteria should be known mineralization, lineaments, and alteration. |

In addition to the ramp advancement and continued drilling, RPA recommends the continuation of the environmental, engineering, and metallurgical studies as recommended in the 2012 PEA.

TABLE 1-3 PROPOSED BUDGET (100% BASIS)

MAG Silver Corp. – Juanicipio Joint Venture

| Item |

US$ M | |||

| Ramp advancement |

11.4 | |||

| Drilling (~20,000 m) |

3.6 | |||

| Interpretation, resource update, etc. |

0.1 | |||

| Geotechnical and Engineering Studies |

1.2 | |||

| Metallurgical and Mill Design Studies |

1.1 | |||

| Permitting and Environmental Work |

0.9 | |||

| Operating Costs / Office |

1.2 | |||

| Infrastructure Studies |

1.0 | |||

| Sub-total |

20.5 | |||

| Contingency (10%) |

2.1 | |||

|

|

|

|||

| Total |

22.6 | |||

|

|

|

|||

Technical Summary

Property Description and Location

The Juanicipio Joint Venture consists of a single concession covering 7,679.21 ha in central Zacatecas State, Mexico. It is centred at approximately 102° 58’ east longitude and 23° 05’ north latitude.

Land Tenure

The Juanicipio 1 exploitation concession has a 50 year life from the date it was issued and will expire on December 12, 2055. The Juanicipio Joint Venture holds the surface ownership over the area of interest in the northeast portion of the property which encompasses the Valdecañas Vein system, Juanicipio Vein, and the proposed tailings storage site north of the Juanicipio 1 mining concession.

Site Infrastructure

Site infrastructure consists of the following items:

| · | a series of roads used to access drill sites, the decline and the mill site, |

| · | an underground access portal, and the start of an underground access ramp, |

| · | a surface explosive magazine, and |

| · | interim power lines. |

5

Table of Contents

History

Silver mineralization in the Fresnillo area was discovered in 1554. Although no records exist prior to the 1970s, the Juanicipio property was likely prospected sporadically over the years because of its proximity to the Fresnillo mining area.

Industrias Peñoles S.A. de C.V. (“Peñoles”) drilled several holes to the northeast of the property in the 1970s and 1980s. Detailed exploration of the areas adjoining the Juanicipio property was initiated by Fresnillo in 2006 based on results from the Valdecañas Vein discovery.

From 1998 to 2001, Minera Sunshine S.A. de C.V. (“Minera Sunshine”) completed an exploration program consisting of property-wide geological mapping, preliminary rock chip sampling, and Landsat image and air photo analysis. This was followed by more detailed geological mapping in areas of interest, additional Landsat image analysis, detailed geochemical sampling, and a limited Natural Source Audio Magnetotelluric (“NSAMT”) geophysical survey. Drilling targets were identified, prioritized and fully permitted but never drilled due to Minera Sunshine’s bankruptcy.

In July 2002, Minera Lagartos S.A. de C.V. (“Minera Lagartos”) optioned the Juanicipio 1 concession. On August 8, 2002, MAG entered into an agreement whereby it could acquire 98% of the issued and outstanding shares of Minera Lagartos. This agreement was later amended such that MAG could acquire a 99% interest in Minera Lagartos and a beneficial ownership of the remaining 1% interest.

From May 2003 to June 2004, MAG completed 10 drill holes for a total of 7,595 m and during this exploration program, discovered the Juanicipio Vein and cut what would later be discovered to be the upper and deep parts of the Valdecañas Vein outside of the thick and high grade Bonanza Zone.

On April 4, 2005, MAG announced that it had entered into a joint venture agreement with Peñoles whereby Peñoles could earn a 56% interest in the property. Fresnillo, then Peñoles’ wholly-owned operating division, and MAG formed a new company, Minera Juanicipio, to operate the joint venture.

On July 25, 2008, MAG filed a technical report on the Juanicipio Project which included an initial Mineral Resource estimate. That report covered work on the property to December 31, 2007. The Mineral Resource estimate was then updated by RPA (then Scott Wilson RPA) in early 2009 based on drill hole results available to January 29, 2009. On September 14, 2009, MAG announced the results of the independent preliminary assessment by Tetra Tech WEI Inc. for development of the Valdecañas Vein as a potential stand-alone silver mine. On December 1, 2010, MAG announced a Juanicipio resource estimation and update prepared by RPA (then Scott Wilson RPA). A NI 43-101 technical report to support the resource update was filed on SEDAR on January 14, 2011. On November 10, 2011, MAG announced an updated Juanicipio resource estimate prepared by Strathcona on behalf of Minera Juanicipio. On December 19, 2011, MAG announced an updated resource estimate by RPA. On June 14, 2012, MAG announced an updated PEA study prepared by AMC on behalf of Minera Juanicipio. The 2012 PEA was based on the resource model prepared by Strathcona.

Geology

The Juanicipio property lies on the western flank of the Central Altiplano, just east of the Sierra Madre Occidental range. Basement rocks underlying the western Altiplano are a late Palaeozoic to Mesozoic assemblage of marine sedimentary and submarine volcanic rocks belonging to the Guerrero Terrane that were obducted onto older Palaeozoic and Precambrian continental rocks during the early Jurassic. These were then overlapped by a Jurassic-Cretaceous epi-continental marine and volcanic arc sequence that in the Fresnillo area is represented by the Proaño and Chilitos formations. The late Cretaceous to early Tertiary Laramide Orogeny folded and thrust faulted the basement rocks in the entire area and preceded the emplacement of mid-Tertiary plutons and related dykes and stocks.

On the Juanicipio property, the dominant structural features are: (i) 340° to 020°, or north-south structures; (ii) 290° to 310° trending, steeply dipping faults; and (iii) lesser 040° to 050° structures. From field observations, the north-south structures appear to be steeply dipping normal faults that cut and down-drop blocks of silicified tuff, especially in the vicinity of Linares Canyon. More important to the silicification appears to be the 290° to 310° trending, steeply to moderately dipping faults. These faults occur where silicification and advanced argillic alteration are most intense and may have served as major hydrothermal fluid pathways.

6

Table of Contents

The two significant silver-gold epithermal structures discovered to date on the Juanicipio property are known as the Valdecañas and Juanicipio vein systems. Both veins strike east-southeast and dip 35o to 55o southwest. The Valdecañas structure hosts the majority of the Mineral Resources currently estimated on the property.

Mineralization consists of precious metal rich, banded, or brecciated quartz-pyrargyrite-acanthite-polybasite-galena-sphalerite veins. The veins have undergone multiple mineralizing events as suggested by various stages of brecciation and quartz sealing, local rhythmic microcrystalline quartz-pyrargyrite banding, and open-space cocks-comb textures and vuggy silica. The vein exhibits the characteristic metal zoning of the principal veins in the Fresnillo district, observed as a change from silver and gold rich zones at the top to increased base metals in the deeper intersections.

Mineral Resources

A set of cross sections and plan views were interpreted to construct three-dimensional wireframe models of the mineralized veins using the descriptive logs, a minimum NSR value of approximately US$70 per tonne, and a minimum thickness of two metres. Prior to compositing to two metre lengths, high grades were cut to 6,000 g/t Ag, 16 g/t Au, and 15% for both lead and zinc. Classification into the Indicated and Inferred categories was guided by the drill hole density and the apparent continuity of the mineralized zones.

The updated Mineral Resource estimate dated December 31, 2013 is listed in Table 1-1.

The following summary sections are summarized from the NI 43-101 Technical Report on the Juanicipio Property prepared by AMC dated July 1, 2012. In RPA’s opinion, these sections remain reasonable for this stage of study.

Geotechnical Considerations

Cretaceous sedimentary rocks, which host the veins, are overlain by Tertiary volcanic rocks across the majority of the project site, except for two surface outcrops located southwest of the Valdecañas Vein. Rock quality in moderate to slightly weathered Cretaceous sedimentary rocks typically consist of poor to fair quality rocks with localized zones of high fracture frequency. Rock quality within the Tertiary volcanic rocks varies greatly from extremely poor to good. Veins are characterized by typically good rock quality, but geotechnical data relating to the veins is extremely limited.

Hydrogeological information on the project area has not yet been collected. The study assumes that the rock mass in the project area will be generally dry except in fault zones, which have been assumed to produce medium inflows.

Mining Methods

AMC considered use of the following stoping methods at the project:

| · | Down-hole benching with uncemented rockfill (modified Avoca). |

| · | Long-hole open stoping (“LHOS”) with cemented backfill. |

| · | Cut-and-fill with uncemented backfill. |

In AMC’s opinion, LHOS with cemented backfill is the most suitable method for the veins, mainly because of the higher recovery achievable using this method. LHOS with cemented backfill can be used in both steeply dipping and shallow dipping parts of the deposit. It is envisaged that some steeper dipping lower grade parts of the veins will be mined using the lower cost Avoca method.

Truck haulage, shaft hoisting, and conveying were considered for transferring ore and waste from the mine workings to surface. The trucking option was selected on the basis of its lower up-front capital cost and lower overall net present cost. However, there are relatively small cost differences between the options and the trucking option is sensitive to future increases in fuel and labour costs. In AMC’s opinion ongoing consideration is warranted on the option of constructing a hoisting shaft to a depth of about 450 m.

It is envisaged that access to the mine will be via a decline driven at a nominal gradient of 1:7. The access decline will connect to a number of internal declines providing access to stoping levels positioned at either 15 m or 20 m vertical

7

Table of Contents

intervals, depending on the dip of the vein. It is envisaged that mining will be carried out using modern trackless mining equipment. The proposed mine ventilation circuit will include a number of ventilation shafts, raise bored from surface.

Mineral Processing

Two sets of metallurgical test work were carried out in 2008 and 2009, on metallurgical samples composited from drill holes samples taken from the Valdecañas Vein. No metallurgical test work has yet been carried out relating to the Juanicipio Vein.

The proposed process plant consists of a comminution circuit followed by the sequential flotation of a silver-rich lead concentrate, a zinc concentrate, and a gold-rich pyrite concentrate.

It is envisaged that the process plant will commence operation at a throughput rate of 850,000 tpa, which will be increased to 950,000 tpa when production from the Juanicipio Vein commences.

Estimated mill recoveries and concentrate grades are summarized in Table 1-4.

TABLE 1-4 MILL RECOVERIES AND CONCENTRATE GRADES

MAG Silver Corp. – Juanicipio Joint Venture

| Gold | Silver | Lead | Zinc | |||||

| Recoveries to lead concentrate |

69% | 81% | 93% | 8% | ||||

| Lead concentrate grades |

30.3 g/t | 10,265 g/t | 43.0% | 6.7% | ||||

| Recoveries to zinc concentrate |

3% | 7% | 1% | 87% | ||||

| Zinc concentrate grades |

0.95 g/t | 637 g/t | 0.33% | 52.0% | ||||

| Recovery to pyrite concentrate |

19% | 6% | – | – |

Project Infrastructure

A 9.8 km access road, mostly over hilly terrain, will be required to access the site. A two-lane unsealed road suitable for use by heavy vehicles hauling concentrates is proposed.

Power would be supplied to a main substation at the site via a 115 kV overhead power line from an existing power line and substation located to the north of the property. The line would have a length of approximately 5.2 km. The average power demand for the site is estimated at 11.9 MW.

Three water catchment dams are envisaged for the site. The dams would be used to store water from the mine dewatering system and from rainfall. A hydrogeological study will be carried out during further studies.

The Joint Venture has purchased 125 ha of relatively flat-lying land suitable and adequate for the proposed five million cubic metres tailings storage facility (“TSF”). This land lies to the northeast of the proposed mill site along the proposed access road from the JV area to the regional highway. The necessary detailed environmental and geotechnical studies for this TSF site have been outlined but not yet initiated.

Project Development and Production Schedule

Following satisfactory completion of further studies, and subject to the application for and grant of the necessary permits and licences, it is estimated that it will take approximately three and a half years to develop the project from the start of the box cut and portal to mill start-up.

8

Table of Contents

The estimated tonnage and grade of material mined and processed that forms the basis for the economic assessment is set out in Table 1-5. Mill feed from vein development comprises approximately 19% of total mill feed, with the remainder from stoping operations.

TABLE 1-5 TONNAGE OF MATERIAL MINED AND PROCESSED AS A BASIS FOR

THE PRELIMINARY ECONOMIC ASSESSMENT

MAG Silver Corp. – Juanicipio Joint Venture

| Grade | Contained Metal | |||||||||||||||||||||||||||||||||||

| Million Tonnes |

Au (g/t) |

Ag (g/t) |

Pb (%) |

Zn (%) |

Au (koz) |

Ag (Moz) |

Pb (Mlb) |

Zn (Mlb) |

||||||||||||||||||||||||||||

| Material derived from Indicated Resources |

5.3 | 1.88 | 667 | 2.1 | 4.1 | 318 | 113 | 242 | 472 | |||||||||||||||||||||||||||

| Material derived from Inferred Resources |

4.9 | 1.45 | 408 | 1.6 | 2.9 | 230 | 65 | 169 | 311 | |||||||||||||||||||||||||||

| External dilution |

0.2 | 1.80 | 209 | 1.8 | 3.0 | 9 | 1 | 6 | 11 | |||||||||||||||||||||||||||

| Waste |

3.0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||||

Note: The tonnage and grades of the material mined and processed were derived from the 2011 Strathcona Mineral Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability

The tonnages and grades shown in Table 1-5 do not reflect the 2014 updated Mineral Resource estimate that includes 40 new infill diamond drill holes completed since the previous resource estimate, but rather have been derived from the Mineral Resource estimate and vein model prepared in 2011 by Strathcona by applying a $65 NSR cut-off grade to the resource model and then allowing for dilution, and design and mining losses. Metal prices used in the NSR calculation were $1,210 per ounce gold, $22.10 per ounce silver, $0.94 per pound lead, and $0.90 per pound zinc and an exchange rate of 12.50 Mexican pesos to one US dollar. In developing the tonnage and grade estimates, stope blocks that were in contact with the property boundaries were excluded and zero grades have been assumed for the dilution material.

Capital and Operating Costs

Project capital is estimated at $302 million, inclusive of capitalized operating costs (costs usually related to the operation of the mine, but incurred prior to first concentrate production). Sustaining capital of $267 million results mainly from the need for ongoing mine development after concentrate production commences, including development of the Juanicipio Vein, and the need for mobile equipment replacements over the mine life.

Total site operating costs have been estimated at approximately $67/t milled. The unit costs are broken down as follows:

| · | Mining: $43.92/t milled. |

| · | Milling: $19.18/t milled. |

| · | General and Administration: $3.46/t milled. |

Project Revenue

Project economics have been analyzed using the following metal prices (Base Case Prices), which are based on the three year trailing average prices to the year ending December 2011:

| · | Silver price = $23.39/oz |

| · | Gold price = $1,257/oz |

| · | Lead price = $0.95/lb |

| · | Zinc price = $0.91/lb |

It is envisaged that silver rich zinc concentrate will be sold primarily to smelters in the Asian region. Lead concentrate could potentially be sold to a smelter in Mexico or exported to offshore smelters. The gold-rich pyrite concentrate will be sold to a customer able to recover the gold and silver values.

Economic Analysis

The economic analysis in the PEA is preliminary in nature and is based, in part, on Inferred Mineral Resources that are considered too spectulative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA will be realized.

9

Table of Contents

Table 1-6 summarizes the results of the economic analysis. Employee profit sharing (“PTU”) is not included in the financial estimates and the net present value (“NPV”) and internal rate of return (“IRR”) of the project may fluctuate depending on how the project is structured once it is in operation.

TABLE 1-6 SUMMARY OF FINANCIAL RESULTS

MAG Silver Corp. – Juanicipio Joint Venture

| Item |

Units | Value | ||

| Revenue |

$M | 4,992 | ||

| Cash flow before tax |

$M | 3,013 | ||

| Tax |

$M | 851 | ||

| Cash flow after tax |

$M | 2,162 | ||

| Discount rate |

% | 5% | ||

| NPV before tax (5% discount rate) |

$M | 1,762 | ||

| IRR before tax |

% | 54% | ||

| NPV after tax (5% discount rate) |

$M | 1,233 | ||

| IRR after tax |

% | 43% | ||

| Peak debt |

$M | (302) | ||

| Payback from Year 1 (approximate) |

yrs | 5.6 | ||

| Payback from mill start-up (approximate) |

yrs | 2.1 | ||

| Project life from Year 1 |

yrs | 19 |

Note: PTU is not included in the financial estimates.

Sensitivity

The NPV of the project is most sensitive to changes in the silver price and will have similar sensitivity to silver head grade. The NPV is less sensitive to costs. The project maintains a positive NPV over the range of sensitivities tested.

Any investment in the Offered Shares is highly speculative due to the nature of the Company’s business and the present stage of exploration and development of its mineral properties. There are a number of risks that may have a material and adverse impact on the future operating and financial performance of the Company and the value of its Common Shares. These include risks that are widespread risks associated with any form of business and specific risks associated with the Company’s business and its involvement in the exploration and mining industry. Most risk factors are largely beyond the control of the Company. A prospective investor should carefully consider, in light of its own financial circumstances, the risk factors set out herein, as well as other information contained or incorporated by reference in this short form prospectus, including, in particular, the “Risk Factors” section of the Annual Information Form and management’s discussion and analysis incorporated by reference in this short form prospectus.

Risks Relating to the Company’s Business Operations

Mineral exploration and development is a highly speculative business and most exploration projects do not result in the discovery of commercially mineable deposits.

Exploration for minerals is a highly speculative venture necessarily involving substantial risk. The expenditures made by the Company described herein may not result in discoveries of commercial quantities of minerals. The failure to find an economic mineral deposit on any of the Company’s exploration concessions will have a negative effect on the Company.

None of the properties in which the Company has an interest has any mineral reserves.

Currently, there are no mineral reserves (within the meaning of NI 43-101) on any of the properties in which the Company has an interest. Only those mineral deposits that the Company can economically and legally extract or produce, based on a comprehensive evaluation of cost, grade, recovery and other factors, are considered mineral

10

Table of Contents

reserves. The resource estimates contained in the Amended Technical Report are indicated and inferred resource estimates only and no assurance can be given that any particular level of recovery of silver or other minerals from mineralized material will in fact be realized or that an identified mineralized deposit will ever qualify as a commercially mineable (or viable) reserve. In particular, inferred mineral resources have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Further, the preliminary economic assessment contained in the Amended Technical Report is preliminary in nature, and actual capital costs, operating costs, production, economic returns and other estimates contained in studies or estimates prepared by or for the Company may differ from those described therein and herein, and there can be no assurance that actual costs will not be higher than anticipated. Substantial additional work, including mine design and mining schedules, metallurgical flow sheets and process plant designs, would be required in order to determine if any economic deposits exist on the Company’s properties. Substantial expenditures would be required to establish mineral reserves through drilling and metallurgical and other testing techniques. The costs, timing and complexities of upgrading the mineralized material to proven or probable reserves may be greater than the Company reserves on a mineral property will require the Company to write-off the costs capitalized for that property in its financial statements. The Company cannot provide any assurance that future feasibility studies will establish mineral reserves at its properties. The failure to establish mineral reserves could restrict the Company’s ability to successfully implement its strategies for long-term growth.

The properties in which the Company has an interest are primarily in the exploration stage, and most exploration projects do not result in commercially mineable deposits.

Other than the Juanicipio Project where development has commenced, all of the Company’s property interests are at the exploration stage. None of the Company’s properties have known commercial quantities of minerals. Development of mineral properties involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. The commercial viability of a mineral deposit is dependent upon a number of factors which are beyond the Company’s control, including the attributes of the deposit, commodity prices, government policies and regulation and environmental protection. Fluctuations in the market prices of minerals may render resources and deposits containing relatively lower grades of mineralization uneconomic. Further exploration or delineation will be required before a final evaluation as to the economic and legal feasibility of any of the Company’s properties is determined. Even if the Company completes its exploration programs and is successful in identifying mineral deposits, it will have to spend substantial funds on further drilling and engineering studies before it will know if it has a commercially viable mineral deposit or reserve. Most exploration projects do not result in the discovery of commercially mineable deposits of ores.

Estimates of reserves and resources, mineral deposits and production costs can be affected by such factors as environmental permit regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. As a result, there is a risk such estimates are inaccurate. The Amended Technical Report includes a resource estimate prepared by RPA in accordance with NI 43-101. The grade of precious and base metals ultimately discovered may differ from the indicated by drilling results. If the grade of the resource was lower, there would be a negative impact on the economics of the Juanicipio Project. There can be no assurance that precious metals recovered in small-scale tests will be duplicated in large-scale tests under on-site conditions or in production scale. The probability of an individual prospect ever having reserves is extremely remote. If a property does not contain any reserves, any funds spent on exploration of that property will be lost. The failure of the Company to find an economic mineral deposit on any of its exploration concessions will have a negative effect on the Company.

Estimates of mineral resources are based on interpretation and assumptions and are inherently imprecise.