Use these links to rapidly review the document

PROXY STATEMENT TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| Piper Jaffray Companies | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

![]()

800 Nicollet Mall, Suite 800

Mail Stop J09SSH

Minneapolis, Minnesota 55402

612 303-6000

March 22, 2013

Dear Shareholders:

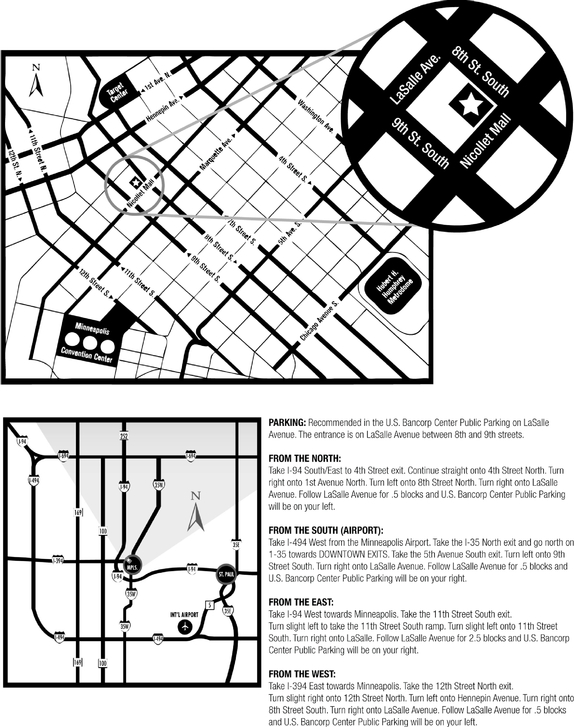

You are cordially invited to join us for our 2013 annual meeting of shareholders, which will be held on Wednesday, May 8, 2013, at 2:30 p.m., Central Time, in the Huber Room on the 12th floor of our Minneapolis headquarters in the U.S. Bancorp Center, 800 Nicollet Mall, Minneapolis, Minnesota. The Notice of Annual Meeting of Shareholders and the proxy statement that follow describe the business to be conducted at the meeting.

We are furnishing our proxy materials to you over the Internet, which will reduce our costs and the environmental impact of our annual meeting. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials to you, which contains instructions on how to access our proxy statement and annual report and vote online. The Notice of Availability also contains instructions on how to request a printed set of proxy materials.

Whether or not you plan to attend the meeting, your vote is important and we encourage you to vote your shares promptly. You may vote your shares using a toll-free telephone number or the Internet. If you received a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided. Instructions regarding the three methods of voting are contained on the Notice of Availability and the proxy card.

We look forward to seeing you at the annual meeting.

| Sincerely, | ||

|

||

Andrew S. Duff Chairman and Chief Executive Officer |

![]()

800 Nicollet Mall, Suite 800

Mail Stop J09SSH

Minneapolis, Minnesota 55402

612 303-6000

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS | |||||

Date and Time: |

Wednesday, May 8, 2013, at 2:30 p.m., Central Time |

||||

Place: |

The Huber Room in our Minneapolis Headquarters 12th Floor, U.S. Bancorp Center 800 Nicollet Mall Minneapolis, MN 55402 |

||||

Items of Business: |

1. |

The election of eight directors, each for a one-year term. |

|||

2. |

Ratification of the selection of Ernst & Young LLP as the independent auditor of Piper Jaffray Companies for the fiscal year ending December 31, 2013. |

||||

3. |

Approval of our Amended and Restated 2003 Annual and Long-Term Incentive Plan. |

||||

4. |

An advisory vote to approve the compensation of the officers disclosed in the attached proxy statement, or a "say-on-pay" vote. |

||||

5. |

Any other business that may properly be considered at the meeting or any adjournment or postponement of the meeting. |

||||

Record Date: |

You may vote at the meeting if you were a shareholder of record at the close of business on March 13, 2013. |

||||

Voting by Proxy: |

Whether or not you plan to attend the annual meeting, please vote your shares by proxy to ensure they are represented at the meeting. You may submit your proxy vote by telephone or Internet, as described in the Notice of Internet Availability of Proxy Materials and the following proxy statement, by no later than 11:59 p.m. Eastern Daylight Time on Tuesday, May 7, 2013. If you received a paper copy of the proxy card by mail, you may sign, date and mail the proxy card in the envelope provided. The envelope is addressed to our vote tabulator, Broadridge Financial Solutions, Inc., and no postage is required if mailed in the United States. |

||||

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting to be held on May 8, 2013

Our proxy statement and 2012 annual report are available at www.piperjaffray.com/proxymaterials

| By Order of the Board of Directors | ||

|

||

John W. Geelan Secretary |

March 22, 2013

PROXY STATEMENT

TABLE OF CONTENTS

i

ii

PROXY STATEMENT

2013 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 8, 2013

The Board of Directors of Piper Jaffray Companies is soliciting proxies for use at the annual meeting of shareholders to be held on May 8, 2013, and at any adjournment or postponement of the meeting. Notice of Internet Availability of Proxy Materials, which contains instructions on how to access this proxy statement and our annual report online, is first being mailed to shareholders on or about March 22, 2013.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of the meeting?

At our annual meeting, shareholders will act upon the matters outlined in the Notice of Annual Meeting of Shareholders, and management will report on matters of current interest to our shareholders and respond to questions from our shareholders. The matters outlined in the notice include the election of directors, the ratification of the selection of our independent auditor for 2013, approval of the amendment and restatement of our Amended and Restated 2003 Annual and Long-Term Incentive Plan (the "Incentive Plan") and an advisory vote to approve the compensation of our officers disclosed in this proxy statement, or a "say-on-pay" vote.

Who is entitled to vote at the meeting?

The Board has set March 13, 2013 as the record date for the annual meeting. If you were a shareholder of record at the close of business on March 13, 2013, you are entitled to vote at the meeting. As of the record date, 17,676,991 shares of common stock, representing all of our voting stock, were issued and outstanding and, therefore, eligible to vote at the meeting.

Holders of our common stock are entitled to one vote per share. Therefore, a total of 17,676,991 votes are entitled to be cast at the meeting. There is no cumulative voting.

How many shares must be present to hold the meeting?

In accordance with our bylaws, shares equal to a majority of the voting power of the outstanding shares of common stock entitled to vote generally in the election of directors as of the record date must be present at the annual meeting in order to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if:

- •

- you are present and vote in person at the meeting; or

- •

- you have properly and timely submitted your proxy as described below under "How do I submit my proxy?"

It is your designation of another person to vote stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. When you designate a proxy, you also may direct the proxy how to vote your shares. We refer to this as your "proxy vote." Two executive officers have been designated as proxies for our 2013 annual meeting of shareholders. These executive officers are John W. Geelan and Debbra L. Schoneman.

It is a document that we are required to make available to you by Internet or, if you request, by mail in accordance with regulations of the Securities and Exchange Commission, when we ask you to designate proxies to vote your shares of Piper Jaffray Companies common stock at a meeting of our shareholders. The proxy statement includes information regarding the matters to be acted upon at the meeting and certain other information required by regulations of the Securities and Exchange Commission and rules of the New York Stock Exchange.

Why did I receive a one-page Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

As permitted by Securities and Exchange Commission rules, we have elected to provide access to our proxy materials over the Internet, which reduces our costs and the environmental impact of our annual meeting. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials to our shareholders of record and beneficial owners who have not previously requested a printed set of proxy materials. The Notice of Availability contains instructions on how to access our proxy statement and annual report and vote online, as well as instructions on how to request a printed set of proxy materials.

How can I get electronic access to the proxy materials if I don't already receive them via e-mail?

To get electronic access to the proxy materials, you will need your control number, which was provided to you in the Notice of Internet Availability of Proxy Materials or the proxy card included in your printed set of proxy materials. Once you have your control number, you may either go to www.proxyvote.com and enter your control number when prompted, or send an e-mail requesting electronic delivery of the materials to sendmaterial@proxyvote.com.

What is the difference between a shareholder of record and a "street name" holder?

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares. If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the shareholder of record with respect to those shares, while you are considered the beneficial owner of those shares. In that case, your shares are said to be held in "street name." Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the method described below under "How do I submit my proxy?"

If you are a shareholder of record, you can submit a proxy to be voted at the meeting in any of the following ways:

- •

- through the Internet using www.proxyvote.com;

- •

- over the telephone by calling a toll-free number; or

- •

- if you receive a paper copy of the proxy card after requesting the proxy materials by mail, you may sign, date and mail the proxy card.

To vote by Internet or telephone, you will need to use a control number that was provided to you by our vote tabulator, Broadridge Financial Solutions, and then follow the additional steps when prompted. The steps have been designed to authenticate your identity, allow you to give voting instructions, and confirm that those instructions have been recorded properly. If you hold your shares in street name, you must vote your shares in the manner prescribed by your broker, bank, trust or other nominee, which is similar to the voting procedures

2

for shareholders of record. However, if you request the proxy materials by mail after receiving a Notice of Internet Availability of Proxy Materials from your broker, bank, trust or other nominee, you will receive a voting instruction form (not a proxy card) to use in directing the broker, bank, trust or other nominee how to vote your shares.

How do I vote if I hold shares in the Piper Jaffray Companies Retirement Plan or U.S. Bank 401(k) Savings Plan?

If you hold shares of Piper Jaffray common stock in the Piper Jaffray Companies Retirement Plan or U.S. Bank 401(k) Savings Plan, the submission of your proxy by Internet or telephone or your completed proxy card will serve as voting instructions to the respective plan's trustee. Your voting instructions must be received at least five days prior to the annual meeting in order to count. In accordance with the terms of the Piper Jaffray Companies Retirement Plan and U.S. Bank 401(k) Savings Plan, the trustee of each plan will vote all of the shares held in the plan in the same proportion as the actual proxy votes submitted by plan participants at least five days prior to the annual meeting.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials or printed set of proxy materials?

If you receive more than one Notice of Internet Availability of Proxy Materials or printed set of proxy materials, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, vote once for each control number you receive as described above under "How do I submit my proxy?"

Can I vote my shares in person at the meeting?

If you are a shareholder of record, you may vote your shares in person at the meeting by completing a ballot at the meeting. Even if you currently plan to attend the meeting, we recommend that you submit your proxy as described above so your vote will be counted if you later decide not to attend the meeting. If you submit your vote by proxy and later decide to vote in person at the annual meeting, the vote you submit at the meeting will override your proxy vote.

If you are a street name holder, you may vote your shares in person at the meeting only if you obtain and bring to the meeting a signed letter or other form of proxy from your broker, bank, trust or other nominee giving you the right to vote the shares at the meeting.

If you are a participant in the Piper Jaffray Companies Retirement Plan or U.S. Bank 401(k) Savings Plan, you may submit voting instructions as described above, but you may not vote your Piper Jaffray shares held in the Piper Jaffray Companies Retirement Plan or U.S. Bank 401(k) Savings Plan in person at the meeting.

How does the Board recommend that I vote?

The Board of Directors recommends a vote:

- •

- FOR all of the nominees for director;

- •

- FOR the ratification of the selection of Ernst & Young LLP

as the independent auditor of Piper Jaffray Companies for the year ending December 31, 2013;

- •

- FOR approval of the Incentive Plan, which will preserve our ability to qualify incentive compensation paid under the Incentive Plan as tax-deductible "performance-based compensation" for purposes of

3

- •

- FOR the advisory approval of the compensation of our officers included in this proxy statement.

Section 162(m) of the Internal Revenue Code and make certain other changes to the Incentive Plan; and

What if I do not specify how I want my shares voted?

If you are a shareholder of record and submit a signed proxy card or submit your proxy by Internet or telephone but do not specify how you want to vote your shares on a particular matter, we will vote your shares as follows:

- •

- FOR all of the nominees for director;

- •

- FOR the ratification of the selection of Ernst & Young LLP

as the independent auditor of Piper Jaffray Companies for the year ending December 31, 2013;

- •

- FOR approval of the Incentive Plan; and

- •

- FOR the advisory approval of the compensation of our officers included in this proxy statement.

Your vote is important. We urge you to vote, or to instruct your broker, bank, trust or other nominee how to vote, on all matters before the annual meeting. If you are a street name holder and fail to instruct the shareholder of record how you want to vote your shares on a particular matter, those shares are considered to be "uninstructed." New York Stock Exchange rules determine the circumstances under which member brokers of the New York Stock Exchange may exercise discretion to vote "uninstructed" shares held by them on behalf of their clients who are street name holders. Other than the ratification of the selection of Ernst & Young LLP as our independent auditor for the year ending December 31, 2013, the rules do not permit member brokers to exercise voting discretion as to the uninstructed shares on any matter included in the notice of meeting. With respect to the ratification of the selection of Ernst & Young LLP as our independent auditor for the year ending December 31, 2013, the rules permit member brokers (other than our broker-dealer subsidiary, Piper Jaffray & Co.) to exercise voting discretion as to the uninstructed shares. For matters with respect to which the broker, bank or other nominee does not have voting discretion or has, but does not exercise, voting discretion, the uninstructed shares will be referred to as a "broker non-vote." For more information regarding the effect of broker non-votes on the outcome of the vote, see below under "How are votes counted?"

Our broker-dealer subsidiary, Piper Jaffray & Co., is a member broker of the New York Stock Exchange and may be a shareholder of record with respect to shares of our common stock held in street name on behalf of Piper Jaffray & Co. clients. Because Piper Jaffray & Co. is our affiliate, New York Stock Exchange rules prohibit Piper Jaffray & Co. from voting uninstructed shares even on routine matters. Instead, Piper Jaffray & Co. may vote uninstructed shares on such matters only in the same proportion as the shares represented by the votes cast by all shareholders of record with respect to such matters.

Can I change my vote after submitting my proxy?

Yes. You may revoke your proxy and change your vote at any time before your proxy is voted at the annual meeting, in any of the following ways:

- •

- by submitting a later-dated proxy by Internet or telephone before 11:59 p.m. Eastern Daylight Time on Tuesday,

May 7, 2013;

- •

- by submitting a later-dated proxy to the corporate secretary of Piper Jaffray Companies, which must be received by us

before the time of the annual meeting;

- •

- by sending a written notice of revocation to the corporate secretary of Piper Jaffray Companies, which must be received by

us before the time of the annual meeting; or

- •

- by voting in person at the meeting.

4

What vote is required to approve each item of business included in the notice of meeting?

- •

- The eight director nominees who receive the most votes cast at the meeting in person or by proxy will be elected.

- •

- The affirmative vote of the holders of a majority of the outstanding shares of common stock present in person or

represented by proxy and entitled to vote at the annual meeting is required to ratify the selection of our independent auditor and to amend and restate the Incentive Plan.

- •

- If the advisory vote on the compensation of our officers included in this proxy statement receives more votes "for" than "against," then it will be deemed to be approved.

The advisory vote on the compensation of our executives is not binding on us or the Board, but we will consider the shareholders' advisory input on this matter when establishing compensation for our executive officers in future years.

You may either vote "FOR" or "WITHHOLD" authority to vote for each director nominee. You may vote "FOR," "AGAINST" or "ABSTAIN" on the other proposals. If you properly submit your proxy but withhold authority to vote for one or more director nominees or abstain from voting on the other proposals, your shares will be counted as present at the meeting for the purpose of determining a quorum and for the purpose of calculating the vote on the particular matter(s) with respect to which you abstained from voting or withheld authority to vote. If you do not submit your proxy or voting instructions and also do not vote by ballot at the annual meeting, your shares will not be counted as present at the meeting for the purpose of determining a quorum unless you hold your shares in street name and the broker, bank, trust or other nominee has discretion to vote your shares and does so. For more information regarding discretionary voting, see the information above under "What if I do not specify how I want my shares voted?"

If you withhold authority to vote for one or more of the director nominees or you do not vote your shares on this matter (whether by broker non-vote or otherwise), this will have no effect on the outcome of the vote. With respect to the proposals to ratify the selection of Ernst & Young LLP as our independent auditor and to amend and restate the Incentive Plan, if you abstain from voting, doing so will have the same effect as a vote against the proposal, but if you do not vote your shares (or, for shares held in street name, if you do not submit voting instructions and your broker, bank, trust or other nominee does not or may not vote your shares), this will have no effect on the outcome of the vote. With respect to the proposal to approve the advisory say-on-pay vote, if you abstain from voting or if you do not vote your shares or submit voting instructions, this will have no effect on the outcome of the vote.

All of our shareholders are invited to attend the annual meeting. You may be asked to present valid photo identification, such as a driver's license or passport, before being admitted to the meeting. If you hold your shares in street name, you also may be asked to present proof of ownership to be admitted to the meeting. A brokerage statement or letter from your broker, bank, trust or other nominee are examples of proof of ownership. To help us plan for the meeting, please let us know whether you expect to attend, by responding affirmatively when prompted during Internet or telephone voting or by marking the attendance box on the proxy card.

Who pays for the cost of proxy preparation and solicitation?

Piper Jaffray pays for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks, trusts or other nominees for forwarding proxy materials to street name

5

holders. We have retained Innisfree M&A Incorporated to assist in the solicitation of proxies for the annual meeting for a fee of approximately $15,000 plus reimbursement of out-of-pocket expenses. We are soliciting proxies primarily by mail. In addition, our directors, officers and regular employees may solicit proxies personally, telephonically, electronically or by other means of communication. Our directors, officers and regular employees will receive no additional compensation for their services other than their regular compensation.

ITEM 1 — ELECTION OF DIRECTORS

The number of directors currently serving on our Board of Directors is ten. Frank L. Sims and Jean M. Taylor, who currently serve on our Board of Directors, will not be standing for re-election at the 2013 annual meeting of shareholders. Effective at the close of the annual meeting, the size of our Board of Directors will be decreased to eight directors. Upon the recommendation of the Nominating and Governance Committee, the Board has nominated eight current members of the Board for election at the 2013 annual meeting, who are Andrew S. Duff, Michael R. Francis, B. Kristine Johnson, Addison L. Piper, Lisa K. Polsky, Philip E. Soran, Michele Volpi and Hope B. Woodhouse. Each of these individuals will be a candidate for election to the Board to serve until our 2014 annual meeting of shareholders or until his or her successor is elected and qualified. Each of the nominees has agreed to serve as a director if elected. The eight nominees receiving a plurality of the votes cast at the meeting in person or by proxy will be elected. Proxies may not be voted for more than eight directors. If, for any reason, any nominee becomes unable to serve before the annual meeting occurs, the persons named as proxies may vote your shares for a substitute nominee selected by our Board of Directors.

Philip E. Soran was appointed to the Board of Directors on February 5, 2013. He was initially recommended to the Board of Directors as a candidate by one of our non-management directors.

The Board of Directors recommends a vote FOR the election of the eight director nominees. Proxies will be voted FOR the election of the eight nominees unless otherwise specified.

Following is biographical information for each of the nominees for election as a director.

ANDREW S. DUFF: Age 55, chairman and chief executive officer since December 31, 2003. Mr. Duff became chairman and chief executive officer of Piper Jaffray Companies following completion of our spin-off from U.S. Bancorp on December 31, 2003. He has served as chairman of our broker-dealer subsidiary since 2003, as chief executive officer of our broker-dealer subsidiary since 2000 and as president of our broker-dealer subsidiary since 1996. He has been with Piper Jaffray since 1980. Prior to the spin-off from U.S. Bancorp, Mr. Duff also was a vice chairman of U.S. Bancorp from 1999 through 2003.

MICHAEL R. FRANCIS: Age 50, director since December 31, 2003. Mr. Francis has served as global brand officer of DreamWorks Animation SKG since December 2012. In June 2012, prior to joining DreamWorks, Mr. Francis founded Farview Associates, LLC, a global brand agency. From October 2011 to June 2012, Mr. Francis served as president of J.C. Penney Company, Inc., a department store and online retail company. Prior to joining J.C. Penney, Mr. Francis was the executive vice president and chief marketing officer for Target Corporation from August 2008 to October 2011. He previously served Target Corporation as executive vice president, marketing from 2003 until August 2008, senior vice president, marketing from 2001 to 2003, and as senior vice president, marketing and visual presentation of the department store division from 1995 to 2001. Prior to that, he held a variety of positions within Target Corporation. Mr. Francis served as a director of Lenox Group, Inc. (formerly known as Department 56, Inc.), a publicly traded company, from July 2001 through September 2005.

6

B. KRISTINE JOHNSON: Age 61, director since December 31, 2003. Since 2000, Ms. Johnson has been president of Affinity Capital Management, a Minneapolis-based venture capital firm that invests primarily in seed and early-stage health care companies in the United States. Ms. Johnson served as a consultant to Affinity Capital Management in 1999. Prior to that, she was employed for 17 years at Medtronic, Inc., a manufacturer of cardiac pacemakers, neurological and spinal devices and other medical products, serving most recently as senior vice president and chief administrative officer from 1998 to 1999. Her experience at Medtronic also included service as president of the vascular business and president of the tachyarrhythmia management business, among other roles. Ms. Johnson currently serves on the board of directors for The Spectranetics Corporation, a medical device company, and served as a director of ADC Telecommunications, Inc. from 1990 through 2006.

ADDISON L. PIPER: Age 66, director since December 31, 2003. Mr. Piper retired from Piper Jaffray effective at the end of 2006, having served as vice chairman of Piper Jaffray Companies since the completion of our spin-off from U.S. Bancorp on December 31, 2003. He worked for Piper Jaffray from 1969 through 2006, serving as assistant equity syndicate manager, director of securities trading and director of sales and marketing. He served as chief executive officer from 1983 to 2000 and as chairman from 1988 to 2003. From 1998 through August 2006, Mr. Piper had responsibility for our venture and private capital fund activities. Mr. Piper served as a member of the board of directors of Renaissance Learning from 2001 until October 2011.

LISA K. POLSKY: Age 56, director since May 2, 2007. Since May 2010, Ms. Polsky has been executive vice president, chief risk officer of CIT Group, Inc., a bank holding company that focuses on small business and middle market lending and financing. Prior to joining CIT Group, Ms. Polsky worked at Jane Street Capital, LLC, a New York-based quantitative proprietary trading firm, from February 2009 until May 2010. From March 2008 until joining Jane Street Capital, she served as partner and head of global investment solutions for Duff Capital Advisors, which provided portfolio solutions to funding liabilities and fulfilling investment needs, particularly in the retirement space. She previously served as the president of Polsky Partners, a New York-based consulting firm specializing in hedge fund allocation, risk management and valuation policy, which she founded in 2002. Ms. Polsky also has served as managing director, head of client financing services and head of leveraged client channel with Merrill Lynch & Co., Inc. from 2000 to 2002, and as managing director, chief risk officer, head of risk policy, chief derivative strategist and head of product development at Morgan Stanley DW Inc. from 1996 to 2000. Ms. Polsky served as a member of the board of directors of thinkorswim Group Inc. from 2007 until June 2009 while it was a publicly traded company.

PHILIP E. SORAN: Age 56, director since February 5, 2013. Mr. Soran served as president, chief executive officer and a director of Compellent Technologies, Inc., a Minnesota-based publicly traded company which he co-founded in March 2002, until its acquisition by Dell Inc. in February 2011. Following the acquisition, he served as the president of Dell Compellent from February 2011 to March 2012. From July 1995 to August 2001, Mr. Soran served as president, chief executive officer and a member of the board of directors of Xiotech, which Mr. Soran co-founded in July 1995. Xiotech was acquired by Seagate in January 2000. From October 1993 to April 1995, Mr. Soran served as executive vice president of Prodea Software Corporation, a data warehousing software company. Mr. Soran also held a variety of management, sales, marketing and technical positions with IBM. Mr. Soran currently serves on the board of directors for Hutchinson Technology, Inc., a technology manufacturer, and SPS Commerce, Inc., a provider of on-demand supply chain management solutions.

MICHELE VOLPI: Age 49, director since February 3, 2010. Since October 2011, Mr. Volpi has served as the chief executive officer of Betafence, a global provider of fencing solutions. Prior to joining Betafence, Mr. Volpi served as the president and chief executive officer and as a director of H.B. Fuller Company from December 2006 to November 2010. H.B. Fuller and its subsidiaries manufacture and market adhesives and specialty chemical products worldwide. Prior to becoming president and chief executive officer,

7

he was group president, general manager of the global adhesives division of H.B. Fuller from December 2004 to December 2006. Mr. Volpi also served as global strategic business unit manager, assembly for H.B. Fuller from June 2002 to December 2004. From 1999 to June 2002, Mr. Volpi served as general manager, marketing for General Electric Company. He currently serves as a member of the board of directors of Saipem, S.p.A.

HOPE B. WOODHOUSE: Age 56, director since September 22, 2011. Ms. Woodhouse most recently served as the chief operating officer of Bridgewater Associates, LP, a large investment advisory firm, a position she held from 2005 to 2008. Prior to that, Ms. Woodhouse served as the president and chief operating officer of Auspex Group, L.P., a global macro hedge fund, and as the chief operating officer of Soros Fund Management LLC, a privately owned hedge fund sponsor. Ms. Woodhouse also held a variety of positions at Salomon Brothers Inc. from 1983 to 1998, including serving as managing director of the global finance department from 1997 to 1998. Ms. Woodhouse currently serves on the board of directors for Two Harbors Investment Corp., a real estate investment trust focused on residential mortgage-backed securities.

Each nominee brings unique capabilities to the Board. The Board believes the nominees as a group have the experience and skills in areas such as general business management, corporate governance, leadership development, investment banking, asset management, finance and risk management that are necessary to effectively oversee our company. In addition, the Board believes that each of our directors possesses high standards of ethics, integrity and professionalism, sound judgment, community leadership and a commitment to representing the long-term interests of our shareholders. The following is information as to why each nominee should serve as a director of our company:

- •

- Mr. Duff has been our chairman and chief executive officer since our spin-off from U.S. Bancorp in

2003, and has more than 30 years of experience in the capital markets industry with Piper Jaffray. The Board believes he has the knowledge of our company and its business necessary to help

formulate and execute our business plans and growth strategies.

- •

- Mr. Francis provides the Board with extensive marketing knowledge and expertise from his more than 25 years

in the retail industry, including his service as president of J.C. Penney Company, Inc., and as chief marketing officer for Target Corporation. Through his current role with DreamWorks,

Mr. Francis serves as an executive officer for a company within one of our focus industries for investment banking. More broadly, his role with DreamWorks, as well as his prior service as an

executive officer of Target and J.C. Penney, provide him with significant senior-level management experience with public companies that is valuable to the Board and our management. Mr. Francis

also has prior experience as a public company director.

- •

- Ms. Johnson has extensive experience in both the health care industry and the venture capital business, with the

health care industry being one of our primary areas of focus. She has served as president of a venture capital firm investing in health care companies and as a senior officer in various roles at

Medtronic, a global leader in medical technology and a Minnesota-based public company. Her deep ties to the health care industry and the venture capital business provide the Board with valuable

insights and knowledge, both from a client and public company perspective. Ms. Johnson also has prior experience as a public company director in the telecommunications and industrial

manufacturing industries.

- •

- Mr. Piper has been a part of our company since 1969, serving in many roles, including chief executive officer from

1983 to 2000 and vice chairman following our spin-off from U.S. Bancorp until his retirement. His experience with the company provides deep institutional knowledge as well as a

comprehensive understanding of the financial services industry. Mr. Piper also has experience as a public company director, having served on the board of directors of Renaissance Learning, an

education software company, from July 2001 until its sale in October 2011.

- •

- Ms. Polsky has extensive experience in the financial services industry, having served as a managing director at both Morgan Stanley and Merrill Lynch. Ms. Polsky currently serves as chief risk officer of

8

- •

- Mr. Soran's experience founding and building technology companies provides meaningful strategic guidance to the

Board and management, and his experience in the technology industry is valuable to the Company as it is focus area for our investment banking business. He also has extensive management experience as a

chief executive officer of a publicly traded company of a similar size to that of our company. Mr. Soran's perspectives as a member of the board of directors of two other publicly traded

companies also provide valuable insights to the Board.

- •

- Mr. Volpi has significant international management experience, currently serving as chief executive officer of

Betafence, a global provider of fencing solutions located in Belgium, and previously serving as the president and chief executive officer and a director of H.B. Fuller Company, a large, global public

company based in Minnesota. His international experience and extensive management skills provide valuable perspective and insight to our management and to the Board.

- •

- Ms. Woodhouse has more than 25 years of experience in the financial services industry, most recently serving as chief operating officer of Bridgewater Associates, LP, a large global hedge fund. Her deep experience at leading, global alternative asset management firms and broker-dealers provides the Board valuable perspectives on the Company's operations and strategic decisions. Ms. Woodhouse's significant financial experience caused the Board to determine that she is an audit committee financial expert under applicable rules of the Securities and Exchange Commission.

CIT Group, a position she previously held at Morgan Stanley, providing valuable experience and insights relating to risk management, an important discipline for a securities firm such as our company. Ms. Polsky's significant financial experience caused the Board to determine that she is an audit committee financial expert under applicable rules of the Securities and Exchange Commission. Ms. Polsky also has experience as a public company director, having served on the board of directors of thinkorswim Group Inc., an online brokerage specializing in options, from 2007 until its sale to TD Ameritrade in June 2009.

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

The Board of Directors conducts its business through meetings of the Board and the following standing committees: Audit, Compensation, and Nominating and Governance. Each of the standing committees has adopted and operates under a written charter, and, annually in November, each committee reviews its charter, performs a self-evaluation and establishes a plan for committee activity for the upcoming year. The committee charters are all available on our website at www.piperjaffray.com, together with our Corporate Governance Principles, Director Independence Standards, Director Nominee Selection Policy, Procedures for Contacting the Board of Directors, Codes of Ethics and Business Conduct, and Complaint Procedures Regarding Accounting and Auditing Matters.

Codes of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct applicable to our employees, including our principal executive officer, principal financial officer, principal accounting officer, controller and other employees performing similar functions, and a separate Code of Ethics and Business Conduct applicable to our directors. Directors who also serve as officers of Piper Jaffray must comply with both codes. Both codes are available on our website at www.piperjaffray.com. We will post on our website at www.piperjaffray.com or file a Form 8-K with the Securities and Exchange Commission disclosing any amendment to, or waiver from, a provision of either of our Codes of Ethics and Business Conduct within four business days following the date of such amendment or waiver.

9

Under applicable rules of the New York Stock Exchange, a majority of the members of our Board of Directors must be independent, and no director qualifies as independent unless the Board of Directors affirmatively determines that the director has no material relationship with Piper Jaffray. To assist the Board with these determinations, the Board has adopted Director Independence Standards, which are available on our website at www.piperjaffray.com.

The Board has affirmatively determined, in accordance with our Director Independence Standards, that none of our non-employee directors has a material relationship with Piper Jaffray and that each of them is independent. When determining the independence of our independent directors, the Board considered the following types of transactions or arrangements: (i) with respect to Ms. Johnson, Ms. Polsky and Mr. Volpi, the Board considered immaterial commercial relationships (i.e., less than $2,500 in each case) involving Piper Jaffray and the directors or the director's primary business affiliation, (ii) with respect to Ms. Johnson and Ms. Taylor, the Board considered immaterial commercial relationships between Piper Jaffray and companies with which an immediate family member of the director is associated, (iii) with respect to Messrs. Francis, Piper and Sims, and Ms. Johnson and Ms. Taylor, the Board considered immaterial relationships between Piper Jaffray and charitable foundations or other non-profit organizations with which each of those directors is associated, and (iv) with respect to Ms. Johnson, Mr. Piper and Ms. Woodhouse, the Board considered each person's service on the board of directors of an entity that has a commercial relationship with Piper Jaffray. All of these relationships are deemed to be immaterial under our Director Independence Standards.

Mr. Duff cannot be considered an independent director under New York Stock Exchange corporate governance rules because he is employed as our chief executive officer.

Board Leadership Structure and Lead Director

Since our spin-off from U.S. Bancorp, Mr. Duff has served in the combined roles of chairman and chief executive officer. Since 2006, the Board has appointed a lead director of the Board. Ms. Johnson currently serves as the lead director. The lead director has the following duties and responsibilities, as described in our Corporate Governance Principles:

- •

- presides at all meetings of the Board at which the chairman is not present, including executive sessions of the

independent directors, and coordinates the agenda for and moderates these executive sessions;

- •

- serves formally as a liaison between the chief executive officer and the independent directors;

- •

- monitors Board meeting schedules and agendas to ensure that appropriate matters are covered and that there is sufficient

time for discussion of all agenda items;

- •

- monitors information sent to the Board and advises the chairman as to the quality, quantity and timeliness of the flow of

information;

- •

- has authority to call meetings of the independent directors; and

- •

- if requested by major shareholders, makes herself available for consultation and direct communication.

We believe that Mr. Duff's combined service as chairman and chief executive officer creates unified leadership for the Board and the company, with one cohesive vision for our organization. This leadership structure, which is common among U.S.-based publicly traded companies, demonstrates to our clients, employees and shareholders that the company is under strong leadership. As chairman and chief executive officer, Mr. Duff helps shape the strategy ultimately set by the entire Board and also leverages his operational experience to balance growth and risk management. We believe the oversight provided by the Board's independent directors, the work of the Board's committees described below and the coordination between the

10

chief executive officer and the independent directors conducted by the lead director help provide effective oversight of our company's strategic plans and operations. We believe having one person serve as chairman and chief executive officer is in the best interests of our company and our shareholders at this time.

Board Involvement in Risk Oversight

The company's management is responsible for defining the various risks facing the company, formulating risk management policies and procedures, and managing the company's risk exposures on a day-to-day basis. The Board's responsibility is to monitor the company's risk management processes by informing itself concerning the company's material risks and evaluating whether management has reasonable controls in place to address the material risks; the Board is not responsible, however, for defining or managing the company's various risks. The Audit Committee of the Board of Directors is primarily responsible for monitoring management's responsibility in the area of risk oversight, and risk management is a factor the Board and the Nominating and Governance Committee consider when determining which directors serve on the Audit Committee. Accordingly, management regularly reported to the Audit Committee on risk management during 2012. The Audit Committee, in turn, reports on the matters discussed at the committee level to the full Board. The Audit Committee and the full Board focus on the material risks facing the company, including market, credit, liquidity, legal and regulatory and operational risks, to assess whether management has reasonable controls in place to address these risks. In addition, the Compensation Committee is charged with reviewing and discussing with management whether the company's compensation arrangements are consistent with effective controls and sound risk management. The Board believes this division of responsibilities provides an effective and efficient approach for addressing risk management.

Meetings of the Outside Directors

At both the Board and committee levels, our non-employee directors meet regularly in executive sessions in which Mr. Duff and other members of management do not participate. Ms. Johnson, our lead director, serves as the presiding director at executive sessions of the Board, and the chairperson of each committee serves as the presiding director at executive sessions of that committee. Our independent directors meet in executive session regularly without Mr. Duff, the only non-independent director under New York Stock Exchange rules.

We have three standing committees of the Board: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The table below shows the current membership of these committees:

Director

|

Audit Committee | Compensation Committee | Nominating and Governance Committee |

|||

|---|---|---|---|---|---|---|

| Michael R. Francis | X | |||||

B. Kristine Johnson |

Chair |

|||||

Lisa K. Polsky |

X |

X |

||||

Frank L. Sims |

Chair |

|||||

Philip E. Soran |

X |

|||||

Jean M. Taylor |

X |

X |

X |

|||

Michele Volpi |

Chair |

|||||

Hope B. Woodhouse |

X |

X |

11

Effective May 8, 2013, Ms. Polsky will become chair of the Audit Committee, Mr. Volpi will join the Nominating and Governance Committee, Mr. Francis will join the Compensation Committee and Mr. Sims and Ms. Taylor will cease to serve on any committees of the Board.

The Audit Committee's purpose is to oversee the integrity of our financial statements, the independent auditor's qualifications and independence, the performance of our internal audit function and independent auditor, and compliance with legal and regulatory requirements. The Audit Committee has sole authority to retain and terminate the independent auditor and is directly responsible for the compensation and oversight of the work of the independent auditor. As discussed above, the Audit Committee is primarily responsible for monitoring management's responsibility in the area of risk oversight. The Audit Committee also meets with management and the independent auditor to review and discuss the annual audited and quarterly unaudited financial statements, reviews the integrity of our accounting and financial reporting processes and audits of our financial statements, and prepares the Audit Committee Report included in the proxy statement.

The responsibilities of the Audit Committee are more fully described in the Committee's charter. The Audit Committee met eleven times during 2012. The Board has determined that all members of the Audit Committee are independent (as that term is defined in the applicable New York Stock Exchange rules and in regulations of the Securities and Exchange Commission), that all members are financially literate and have the accounting or related financial expertise required by the New York Stock Exchange rules, and that each of Mr. Sims, Ms. Polsky and Ms. Woodhouse is an "audit committee financial expert" as defined by regulations of the Securities and Exchange Commission.

The Compensation Committee discharges the Board's responsibilities relating to compensation of the executive officers, oversees succession planning for the executive officers jointly with the Nominating and Governance Committee and ensures that our compensation and employee benefit programs are aligned with our compensation and benefits philosophy. These responsibilities also include reviewing and discussing with management whether the company's compensation arrangements are consistent with effective controls and sound risk management. The Committee has full discretion to determine the amount of compensation to be paid to the executive officers. The Committee also has sole authority to evaluate the chief executive officer's performance and determine the compensation of the chief executive officer based on this evaluation. The Committee is responsible for recommending stock ownership guidelines for the executive officers and directors, for recommending the compensation and benefits to be provided to our non-employee directors, for reviewing and approving the establishment of broad-based incentive compensation, equity-based, retirement or other material employee benefit plans, and for discharging any duties under the terms of these plans.

The Committee has delegated authority to our chief executive officer under the Incentive Plan to allocate awards to employees (other than our executive officers) in connection with our annual restricted stock grants made in the first quarter of each year (as part of the payment of incentive compensation for the preceding year). Under this delegated authority, the Committee approves the aggregate amount of equity to be awarded to all employees other than executive officers, and the chief executive officer approves the award recipients and specific amount of equity to be granted to each recipient. All other terms of the awards are determined by the Committee. The Committee also has delegated authority to the chief executive officer to grant restricted stock awards to employees other than executive officers in connection with recruiting and retention. This delegation permits the chief executive officer to determine the recipient of the award as well the amount of the award, subject to an annual share limitation set by the Committee each year. All awards granted pursuant to this delegated authority must be made in accordance with our equity grant timing policy described below in "Compensation Discussion and Analysis — Equity Grant Timing Policy." All other terms of the awards are determined by the Committee.

12

The work of the Committee is supported by our human capital department, primarily through our global head of human capital, as well as by our finance department, primarily through our chief financial officer. These personnel work closely with the chief executive officer and, as appropriate, the general counsel and assistant general counsel, to prepare and present information and recommendations for review and consideration by the Committee, as described below under "Compensation Discussion and Analysis — Setting Compensation — Involvement of Executive Officers."

The Compensation Committee has engaged an independent outside compensation consultant, Frederic W. Cook & Co., to provide strategic planning, market context, and general advice to the Committee with respect to executive compensation, as described below under "Compensation Discussion and Analysis — Setting Compensation — Compensation Consultant."

The Compensation Committee reviews and discusses with management the disclosures regarding executive compensation to be included in our annual proxy statement, and recommends to the Board inclusion of the Compensation Discussion and Analysis in our annual proxy statement. The responsibilities of the Compensation Committee are more fully described in the Committee's charter. For more information regarding the Committee's process in setting compensation, please see "Compensation Discussion and Analysis — Setting Compensation" below. The Compensation Committee met seven times during 2012. The Board has determined that all members of the Compensation Committee are independent (as that term is defined in applicable New York Stock Exchange rules).

The Nominating and Governance Committee identifies and recommends individuals qualified to become members of the Board of Directors and recommends to the Board sound corporate governance principles and practices for Piper Jaffray. In particular, the Committee assesses the independence of our Board members, identifies and evaluates candidates for nomination as directors, responds to director nominations submitted by shareholders, recommends the slate of director nominees for election at the annual meeting of shareholders and candidates to fill vacancies between annual meetings, recommends qualified members of the Board for membership on committees, oversees the director orientation and continuing education programs, reviews the Board's committee structure, reviews and assesses the adequacy of our Corporate Governance Principles, reviews the annual evaluation process for the chief executive officer, the Board and Board committees, and oversees the succession planning process for the executive officers jointly with the Compensation Committee. The Nominating and Governance Committee also oversees administration of our related person transaction policy and reviews the transactions submitted to it pursuant to such policy. The responsibilities of the Nominating and Governance Committee are more fully described in the Committee's charter. The Nominating and Governance Committee met four times during 2012. The Board has determined that all members of the Nominating and Governance Committee are independent (as that term is defined in applicable New York Stock Exchange rules).

Our Corporate Governance Principles provide that our directors are expected to attend meetings of the Board and of the committees on which they serve, as well as our annual meeting of shareholders. Our Board of Directors held seven meetings during 2012. Each of our incumbent directors attended at least 75% of the meetings of the Board of Directors and the committees on which he or she served during 2012, with the incumbent directors collectively attending 97.7% of the meetings of the Board of Directors and the committees on which they served during the year. All of our directors who were serving on the Board as of the date of our 2012 annual meeting of shareholders attended the meeting.

13

Procedures for Contacting the Board of Directors

The Board has established a process for shareholders and other interested parties to send written communications to the Board or to individual directors. Such communications should be sent by U.S. mail to the attention of the Office of the Secretary, Piper Jaffray Companies, 800 Nicollet Mall, Suite 800, Mail Stop J09SSH, Minneapolis, Minnesota 55402. Communications regarding accounting and auditing matters will be handled in accordance with our Complaint Procedures Regarding Accounting and Auditing Matters. Other communications will be collected by the secretary of the company and delivered, in the form received, to the lead director or, if so addressed, to a specified director.

Procedures for Selecting and Nominating Director Candidates

The Nominating and Governance Committee will consider director candidates recommended by shareholders and has adopted a policy that contemplates shareholders recommending and nominating director candidates. A shareholder who wishes to recommend a director candidate for nomination by the Board at the annual meeting of shareholders or for vacancies on the Board that arise between shareholder meetings must timely provide the Nominating and Governance Committee with sufficient written documentation to permit a determination by the Board whether such candidate meets the required and desired director selection criteria set forth in our bylaws, our Corporate Governance Principles and our Director Nominee Selection Policy described below. Such documentation and the name of the director candidate must be sent by U.S. mail to the Chairperson, Nominating and Governance Committee, c/o the Office of the Secretary, Piper Jaffray Companies, 800 Nicollet Mall, Suite 800, Mail Stop J09SSH, Minneapolis, Minnesota 55402.

Alternatively, shareholders may directly nominate a person for election to our Board by complying with the procedures set forth in Article II, Section 2.4 of our bylaws, and with the rules and regulations of the Securities and Exchange Commission. Under our bylaws, only persons nominated in accordance with the procedures set forth in the bylaws will be eligible to serve as directors. In order to nominate a candidate for service as a director, you must be a shareholder at the time you give the Board notice of your nomination, and you must be entitled to vote for the election of directors at the meeting at which your nominee will be considered. In accordance with our bylaws, director nominations generally must be made pursuant to notice delivered to, or mailed and received at, our principal executive offices at the address above, not later than the 90th day, nor earlier than the 120th day, prior to the first anniversary of the prior year's annual meeting of shareholders. Your notice must set forth all information relating to the nominee that is required to be disclosed in solicitations of proxies for the election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including the nominee's written consent to being named in the proxy statement as a nominee and to serving as a director if elected).

As required by our Corporate Governance Principles and our Director Nominee Selection Policy, when evaluating the appropriate characteristics of candidates for service as a director, the Nominating and Governance Committee takes into account many factors. At a minimum, director candidates must demonstrate high standards of ethics, integrity and professionalism, independence, sound judgment, community leadership and meaningful experience in business, law or finance or other appropriate endeavor. Candidates also must be committed to representing the long-term interests of our shareholders. In addition to these minimum qualifications, the Committee considers other factors it deems appropriate based on the current needs and desires of the Board, including specific business and financial expertise, experience as a director of a public company, and diversity. The Board considers a number of factors in its evaluation of diversity, including geography, age, gender, and ethnicity. Based on these factors and the qualifications and background of each director, the Board believes that its current composition is diverse. As indicated above, diversity is one factor in the total mix of information the Board considers when evaluating director candidates. The Committee will reassess the qualifications of a director, including the director's attendance, involvement at Board and committee meetings and contribution to Board diversity, prior to recommending a director for reelection.

14

Compensation Program for Non-Employee Directors

During 2012, non-employee directors received a $60,000 annual cash retainer for service on our Board and Board committees. Also, the lead director and the chairperson of the Audit Committee each received an additional annual cash retainer of $20,000, the chairperson of the Compensation Committee received an additional annual cash retainer of $10,000, and the chairperson of the Nominating and Governance Committee received an additional annual cash retainer of $5,000. Our non-employee director compensation program provides that each non-employee director receives a $60,000 grant of stock on the date of a director's initial election or appointment to the Board for a number of shares determined by dividing $60,000 by the closing price of our common stock on the date of initial election or appointment. Directors whose service on the Board continues following each annual meeting of our shareholders receive an annual equity grant of $60,000 as of the date of the annual meeting. All equity awards granted to our non-employee directors are granted under the Incentive Plan. Non-employee directors who join our Board after the first month of a calendar year are paid a pro rata annual retainer and awarded a pro rata annual equity award based on the period they serve as a director during the year.

Our non-employee directors may participate in the Piper Jaffray Companies Deferred Compensation Plan for Non-Employee Directors, which was designed to facilitate increased equity ownership in the company. The plan permits our non-employee directors to defer all or a portion of the cash payable to them and shares of common stock granted to them for service as a director of Piper Jaffray for any calendar year. All cash amounts and share grants deferred by a participating director are credited to a recordkeeping account and deemed invested in shares of our common stock as of the date the deferred fees otherwise would have been paid or the shares otherwise would have been issued to the director. This deemed investment is measured in phantom stock, and no shares of common stock are reserved, repurchased or issued pursuant to the plan. With respect to cash amounts that have been deferred, the fair market value of all phantom stock credited to a director's account will be paid out to the director (or, in the event of the director's death, to his or her beneficiary) in a single lump-sum cash payment following the director's cessation of service. The amount paid out will be determined based on the fair market value of the stock on the last day of the year in which the director's service with us terminates. Share amounts that have been deferred will be paid out to the director (or, in the event of the director's death, to his or her beneficiary) in the form of shares of common stock in an amount equal to the full number of shares credited to the non-employee director's account as of the last day of the year in which the cessation of service occurred. Directors who elect to participate in the plan are not required to pay income taxes on amounts or grants deferred but will instead pay income taxes on the amount of the lump-sum distribution paid to the director (or beneficiary) at the time of such payment. Our obligations under the plan are unsecured general obligations to pay in the future the value of the participant's account pursuant to the terms of the plan.

Non-employee directors may participate in our charitable gift matching program, pursuant to which we will match a director's gifts to eligible organizations dollar for dollar from a minimum of $50 up to an aggregate maximum of $1,500 per year. We also reimburse for reasonable out-of-pocket expenses incurred in connection with their service on the Board and committees of the Board. Employees of Piper Jaffray who also serve as directors receive compensation for their service as employees, but they do not receive any additional compensation for their service as directors. No other compensation is paid to our Board members in their capacity as directors. Non-employee directors do not participate in our employee benefit plans.

15

The following table contains compensation information for our non-employee directors for the year ended December 31, 2012.

Non-Employee Director Compensation for 2012

| |

Fees Earned or Paid in Cash | |

|

|

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Director

|

Annual Retainer ($) |

Additional Retainer ($) |

Stock Awards(1)(2) ($) |

All Other Compensation(3) ($) |

Total ($) |

|||||||||||

Michael R. Francis |

60,000 | 25,000 | 60,018 | — | 145,018 | |||||||||||

B. Kristine Johnson |

60,000 | 9,495 | (4) | 60,018 | 1,500 | 131,013 | ||||||||||

Addison L. Piper |

60,000 | — | 60,018 | 1,500 | 121,518 | |||||||||||

Lisa K. Polsky |

60,000 | (5) | — | 60,018 | (5) | — | 120,018 | |||||||||

Frank L. Sims |

60,000 | 20,000 | 60,018 | (5) | 1,500 | 141,518 | ||||||||||

Jean M. Taylor |

60,000 | — | 60,018 | (5) | — | 120,018 | ||||||||||

Michele Volpi |

60,000 | 10,000 | 60,018 | — | 130,018 | |||||||||||

Hope B. Woodhouse |

60,000 | — | 60,018 | (5) | 1,500 | 121,518 | ||||||||||

- (1)

- Represents

the aggregate grant date fair value calculated in accordance with generally accepted accounting principles.

- (2)

- The aggregate number of outstanding stock and option awards granted to our non-employee directors as of December 31, 2012 is set forth in the table below. The stock award values are based on the $32.13 closing sale price of our common stock on the New York Stock Exchange on December 31, 2012, and the option award values are based on the difference between the per share exercise price of the in-the-money stock options and $32.13. The amounts for Mr. Piper include restricted stock and stock option awards granted to him in 2004, 2005 and 2006 during his tenure as an executive officer of the company.

Director

|

Stock Awards (#) |

Year-End Value of Stock Awards ($) |

Option Awards (#) |

Year-End Value of Option Awards ($) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Michael R. Francis |

8,983 | 288,624 | 11,880 | 23,538 | |||||||||

B. Kristine Johnson |

8,983 | 288,624 | 11,880 | 23,538 | |||||||||

Addison L. Piper |

16,278 | 523,012 | 11,614 | — | |||||||||

Lisa K. Polsky |

9,152 | 294,054 | — | — | |||||||||

Frank L. Sims |

8,983 | 288,624 | 11,880 | 23,538 | |||||||||

Jean M. Taylor |

8,983 | 288,624 | 5,963 | — | |||||||||

Michele Volpi |

6,326 | 203,254 | — | — | |||||||||

Hope B. Woodhouse |

6,845 | 219,930 | — | — | |||||||||

- (3)

- Consists

of charitable matching contributions made by Piper Jaffray.

- (4)

- Reflects

a pro rata portion of the full additional annual cash retainer for the portion of the year Ms. Johnson served as lead director

(August 15, 2012 — December 31, 2012).

- (5)

- These amounts were deferred pursuant to the Piper Jaffray Companies Deferred Compensation Plan for Non-Employee Directors.

16

COMPENSATION DISCUSSION AND ANALYSIS

2012 Financial Performance

We generated strong performance and returns for our shareholders during 2012 as compared to 2011, and executed several strategic initiatives. The table below highlights critical aspects of our 2012 financial performance:

Metric(1)

|

2012 | 2011 | % Change | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Closing Stock Price |

$ | 32.13 | $ | 20.20 | 59.1 | % | ||||

Net Revenues |

$ | 489.0 million | $ | 432.1 million | 13.2 | % | ||||

Net Income/(Loss) |

$ | 47.1 million | $ | (90.8 million | )(2) | Not calculable | ||||

Investment Banking Revenues |

$ | 230.9 million | $ | 200.5 million | 15.2 | % | ||||

Institutional Brokerage Revenues |

$ | 172.0 million | $ | 136.1 million | 26.4 | % | ||||

Asset Management Revenues |

$ | 65.2 million | $ | 63.3 million | 3.0 | % | ||||

Non-Interest Operating Expenses |

$ | 419.9 million | $ | 512.3 million | (2) | (18.0 | )% | |||

Non-Compensation Expenses |

$ | 123.1 million | $ | 247.3 million | (2) | (50.2 | )% | |||

- (1)

- All

operating metrics reflect only our continuing operations.

- (2)

- Includes a non-cash goodwill impairment charge, which was $118.4 million on an after-tax basis and $120.3 million on a pre-tax basis.

We achieved these positive results despite continued macroeconomic uncertainty throughout 2012, with tepid job growth and persistently high unemployment, concerns about the budget deficit and federal spending cuts, and continued difficulties in European economies. While our businesses experienced improved equity markets in the second half of the year, the continued macroeconomic challenges were reflected in a continued lull in initial public offerings, which is a key product for our capital markets business. We mitigated the effects of this challenging operating environment through significantly improved results in fixed income institutional brokerage, public finance investment banking, and U.S. advisory services revenues, while asset management and equity investment banking were largely unchanged year-over-year. We also remained focused on effectively managing our costs, which is evidenced by the year-over-year decrease to our non-interest operating expenses from continuing operations by $92.4 million and the $124.2 million year-over-year decrease to our non-compensation expenses. On a non-GAAP basis, excluding the goodwill impairment charge noted in the table above, our non-compensation expenses decreased by 3.2% in 2012 compared to 2011. This strong financial performance significantly increased our total shareholder return, as our stock price increased 59.1% during the year and increased another 20% since the beginning of 2012 as of February 28, 2013.

With respect to strategic execution, we added key personnel to our higher margin mergers and acquisitions advisory team and to our public finance and fixed income teams during 2012. These personnel additions contributed to the financial successes highlighted above and resulted in market share gains for our public finance operations and a ranking of second nationally based on public finance deal volume. We also reorganized our FAMCO and Advisory Research divisions within asset management, after determining that FAMCO MLP was better aligned with Advisory Research, both strategically and from a client perspective. To improve our return for shareholders, we amended and later refinanced our syndicated credit facility, providing us additional operating flexibility that ultimately permitted us to repurchase approximately $47.2 million of our common stock during 2012. Lastly, we ceased our Hong Kong capital markets business in an effort to

17

improve profitability, and are in the process of selling the remaining FAMCO business, as it is no longer a strategic fit with our larger asset management operations.

Overview of Compensation Governance

Our compensation practices demonstrate sound corporate governance. We continually review our executive compensation program to ensure it reflects good governance practices and the best interests of shareholders. Our executive compensation program currently includes:

- •

- Annual incentives directly tied to profitability for each year

- •

- Long-term incentives directly tied to returns generated for our shareholders

- •

- Meaningful annual equity awards granted in lieu of — not in addition to — annual

cash incentives

- •

- No stand-alone change-in-control agreements

- •

- Implementation of a "double trigger" change-in-control provision for all future equity awards

- •

- No employment agreements with our executives other than our head of asset management

- •

- Executive officers (and directors) are prohibited from hedging shares of Piper Jaffray Companies common stock

- •

- Limited perquisites

- •

- No tax gross-ups

- •

- No repricing of underwater stock options

Overview of 2012 Compensation

Throughout this proxy statement, we refer to our chief executive officer, chief financial officer, and each of our three other most highly compensated executive officers for 2012, as the "named executive officers." In addition to our chief executive officer and chief financial officer, this group includes our head of asset management, head of fixed income services and global co-head of investment banking and capital markets.

The most significant actions taken in 2012 with respect to our named executive officers' compensation were:

- •

- Increases in year-over-year incentives rewarding our improved performance;

- •

- Adoption of the Piper Jaffray Companies Mutual Fund Restricted Shares Investment Plan (the "MFRS Plan"), which allows

recipients of restricted stock of the company to instead elect to receive 10% to 50% of their equity grant in the form of restricted shares of selected mutual funds managed by our asset management

business;

- •

- Increases to the portion of annual incentives paid to our chief executive officer and chief financial officer in the form

of equity, subject to their ability to allocate a portion of the compensation they would otherwise receive in restricted stock to the MFRS Plan;

- •

- Execution of our employment agreement with Brien M. O'Brien, our head of asset management; and

- •

- Long-term incentive awards to our named executive officers other than Mr. O'Brien in the form of performance share units ("PSUs") that will be earned based on our total shareholder return measured on an absolute and relative basis compared to a our peer group over a 36-month period.

During 2012, the Compensation Committee, which we refer to as the "Committee" in this Compensation Discussion and Analysis, the Committee increased year-over-year incentives as our financial performance for

18

2012 improved in almost every major category, including a 13.2% increase in net revenues from continuing operations and an increase in net income from continuing operations to $47.1 million from a net loss from continuing operations of $90.8 million in 2011. The Committee also increased the portion of the annual incentive paid to our chief executive officer in the form of equity for 2012 performance from 50% to 60%, and similarly increased the portion of the annual incentive paid to our chief financial officer in the form of equity from 40% to 50%. Our chief executive officer and chief financial officer, like all of our executive officers, may elect to receive 10% to 50% of their equity grant in the form of restricted shares of selected mutual funds managed by our asset management business pursuant the MFRS Plan. We believe the MFRS Plan will help us to attract and retain talent and the increased portion of restricted compensation strengthens the retention value of the incentive awards.

Effective January 1, 2012, we entered into a three-year employment agreement with Brien M. O'Brien pursuant to which he serves as our head of asset management and chairman and chief executive officer of our subsidiary, Advisory Research, Inc. The agreement provides Mr. O'Brien the right to receive quarterly and annual incentive payments directly tied to the profitability of our asset management business, the business unit that he manages. We entered into this agreement as a means to retain Mr. O'Brien and incent him to sustain and grow our asset management operations, which we believe are a strategically important factor to long-term growth of our revenues and profitability.

The Committee also awarded the named executive officers other than Mr. O'Brien a long-term incentive award in the form of PSUs, which will be earned based on our total shareholder return ("TSR") measured on an absolute and relative basis compared to our peer group over a 36-month performance period. The Committee believes these awards align the interests of the recipients and our shareholders by directly tying a portion of our named executive officer's compensation to our long-term stock performance and will incentivize the recipients to focus on creating long-term value.

Compensation Philosophy and Objectives

Our executive compensation program is designed to drive and reward corporate performance annually and over the long term, as measured by increasing shareholder value. Compensation also must be internally equitable and externally competitive. We continually review our executive compensation program to ensure it reflects good governance practices and the best interests of shareholders, while meeting the following core objectives:

- •

- Pay for performance — A large portion of the total

compensation paid to our named executive officers (other than Mr. O'Brien) is based on the profitability of the company and each business unit. Mr. O'Brien's incentive compensation is

determined solely based on the profitability of our asset management business. Our named executive officers' performance is also measured against defined objectives in areas such as strategic