00012276542021FYfalsehttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrentP1Y00012276542021-01-012021-09-30iso4217:USD00012276542021-03-31xbrli:shares00012276542021-11-2400012276542021-09-3000012276542020-12-31iso4217:USDxbrli:shares00012276542020-01-012020-12-3100012276542019-01-012019-12-310001227654us-gaap:ShippingAndHandlingMember2021-01-012021-09-300001227654us-gaap:ShippingAndHandlingMember2020-01-012020-12-310001227654us-gaap:ShippingAndHandlingMember2019-01-012019-12-310001227654us-gaap:ProductMember2021-01-012021-09-300001227654us-gaap:ProductMember2020-01-012020-12-310001227654us-gaap:ProductMember2019-01-012019-12-310001227654us-gaap:CommonStockMember2018-12-310001227654us-gaap:AdditionalPaidInCapitalMember2018-12-310001227654us-gaap:TreasuryStockMember2018-12-310001227654us-gaap:RetainedEarningsMember2018-12-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-3100012276542018-12-310001227654us-gaap:RetainedEarningsMember2019-01-012019-12-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001227654us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001227654srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001227654us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001227654us-gaap:TreasuryStockMember2019-01-012019-12-310001227654us-gaap:CommonStockMember2019-12-310001227654us-gaap:AdditionalPaidInCapitalMember2019-12-310001227654us-gaap:TreasuryStockMember2019-12-310001227654us-gaap:RetainedEarningsMember2019-12-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-3100012276542019-12-310001227654us-gaap:RetainedEarningsMember2020-01-012020-12-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001227654us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001227654us-gaap:TreasuryStockMember2020-01-012020-12-310001227654us-gaap:CommonStockMember2020-12-310001227654us-gaap:AdditionalPaidInCapitalMember2020-12-310001227654us-gaap:TreasuryStockMember2020-12-310001227654us-gaap:RetainedEarningsMember2020-12-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001227654us-gaap:RetainedEarningsMember2021-01-012021-09-300001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001227654us-gaap:AdditionalPaidInCapitalMember2021-01-012021-09-300001227654us-gaap:TreasuryStockMember2021-01-012021-09-300001227654us-gaap:CommonStockMember2021-09-300001227654us-gaap:AdditionalPaidInCapitalMember2021-09-300001227654us-gaap:TreasuryStockMember2021-09-300001227654us-gaap:RetainedEarningsMember2021-09-300001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-30cmp:segment0001227654cmp:FermaviElectroquimicaMember2021-01-012021-09-300001227654us-gaap:OtherCurrentAssetsMembercmp:WaterRightsMember2020-12-310001227654us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-09-300001227654us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2020-12-31cmp:extension_period0001227654cmp:CoteBlancheMiningPropertiesAndMineralRightsMember2021-01-012021-09-300001227654cmp:LeasedMineralRightsMember2021-01-012021-09-300001227654cmp:OtherMineralPropertiesMember2021-01-012021-09-300001227654srt:MinimumMemberus-gaap:BuildingMember2021-01-012021-09-300001227654srt:MaximumMemberus-gaap:BuildingMember2021-01-012021-09-300001227654srt:MinimumMembercmp:TypicalMaximumLifeLeaseholdAndBuildingImprovementsMember2021-01-012021-09-300001227654srt:MaximumMembercmp:TypicalMaximumLifeLeaseholdAndBuildingImprovementsMember2021-01-012021-09-300001227654us-gaap:LandImprovementsMembersrt:MinimumMember2021-01-012021-09-300001227654us-gaap:LandImprovementsMembersrt:MaximumMember2021-01-012021-09-300001227654srt:MinimumMembercmp:LeaseholdAndBuildingImprovementsMember2021-01-012021-09-300001227654srt:MaximumMembercmp:LeaseholdAndBuildingImprovementsMember2021-01-012021-09-300001227654srt:MinimumMemberus-gaap:TransportationEquipmentMember2021-01-012021-09-300001227654srt:MaximumMemberus-gaap:TransportationEquipmentMember2021-01-012021-09-300001227654cmp:MachineryAndEquipmentOtherMiningAndProductionMembersrt:MinimumMember2021-01-012021-09-300001227654cmp:MachineryAndEquipmentOtherMiningAndProductionMembersrt:MaximumMember2021-01-012021-09-300001227654us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2021-01-012021-09-300001227654us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-01-012021-09-300001227654srt:MinimumMemberus-gaap:MiningPropertiesAndMineralRightsMember2021-01-012021-09-300001227654srt:MaximumMemberus-gaap:MiningPropertiesAndMineralRightsMember2021-01-012021-09-300001227654us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-01-010001227654srt:MinimumMember2021-01-012021-09-300001227654srt:MaximumMember2021-01-012021-09-300001227654us-gaap:SubsequentEventMembercmp:FortressNorthAmericaMember2021-11-022021-11-240001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembercmp:PlantNutritionSouthAmericaMember2021-07-010001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembercmp:PlantNutritionSouthAmericaMember2021-07-012021-07-01iso4217:BRL0001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMembercmp:PlantNutritionSouthAmericaMember2021-03-2300012276542021-03-232021-03-230001227654cmp:NorthAmericaMicronutrientAssetsMemberus-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-05-040001227654cmp:NorthAmericaMicronutrientAssetsMemberus-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-05-042021-05-040001227654cmp:FermaviMember2021-06-282021-06-280001227654cmp:FermaviMember2021-08-202021-08-200001227654cmp:FermaviMember2021-08-200001227654cmp:SpecialtyPlantNutritionBussinesMember2021-01-012021-09-300001227654cmp:ChemicalsBusinessMember2021-01-012021-09-300001227654cmp:NorthAmericaMicronutrientAssetsMember2021-01-012021-09-300001227654cmp:NorthAmericaMicronutrientAssetsMemberus-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2020-12-31xbrli:pure0001227654cmp:SpecialtyPlantNutritionBussinesMember2020-12-310001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-09-300001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2020-12-310001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-01-012021-09-300001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2020-01-012020-12-310001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2019-01-012019-12-310001227654us-gaap:ShippingAndHandlingMemberus-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2021-01-012021-09-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2020-01-012020-12-310001227654us-gaap:ShippingAndHandlingMemberus-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMember2019-01-012019-12-310001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:ProductMember2021-01-012021-09-300001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:ProductMember2020-01-012020-12-310001227654us-gaap:DiscontinuedOperationsHeldForSaleOrDisposedOfBySaleMemberus-gaap:ProductMember2019-01-012019-12-310001227654us-gaap:LandBuildingsAndImprovementsMember2021-09-300001227654us-gaap:LandBuildingsAndImprovementsMember2020-12-310001227654us-gaap:MachineryAndEquipmentMember2021-09-300001227654us-gaap:MachineryAndEquipmentMember2020-12-310001227654us-gaap:FurnitureAndFixturesMember2021-09-300001227654us-gaap:FurnitureAndFixturesMember2020-12-310001227654us-gaap:MiningPropertiesAndMineralRightsMember2021-09-300001227654us-gaap:MiningPropertiesAndMineralRightsMember2020-12-310001227654us-gaap:ConstructionInProgressMember2021-09-300001227654us-gaap:ConstructionInProgressMember2020-12-310001227654us-gaap:DistributionRightsMember2021-09-300001227654us-gaap:UseRightsMember2021-09-300001227654cmp:LeaseRightsMember2021-09-300001227654us-gaap:DistributionRightsMember2020-12-310001227654us-gaap:UseRightsMember2020-12-310001227654cmp:LeaseRightsMember2020-12-310001227654us-gaap:DistributionRightsMember2021-01-012021-09-300001227654us-gaap:UseRightsMember2021-01-012021-09-300001227654cmp:LeaseRightsMember2021-01-012021-09-300001227654us-gaap:ContractualRightsMember2021-09-300001227654us-gaap:ContractualRightsMember2020-12-310001227654us-gaap:TradeNamesMember2021-09-300001227654us-gaap:TradeNamesMember2020-12-310001227654cmp:PlantNutritionNorthAmericaMember2021-09-300001227654cmp:PlantNutritionNorthAmericaMember2020-12-310001227654cmp:DeferredTaxAssetNettingStatusNotToBeNettedMember2021-09-300001227654cmp:DeferredTaxAssetNettingStatusNotToBeNettedMember2020-12-310001227654cmp:DeferredTaxLiabilitiesToBeNettedMember2021-09-300001227654cmp:DeferredTaxLiabilitiesToBeNettedMember2020-12-310001227654cmp:DeferredTaxAssetNettingStatusToBeNettedMember2021-09-300001227654cmp:DeferredTaxAssetNettingStatusToBeNettedMember2020-12-310001227654us-gaap:ForeignCountryMember2021-09-300001227654us-gaap:ForeignCountryMember2020-12-310001227654cmp:ForeignCountryWithExpire2033Member2021-09-300001227654cmp:ForeignCountryWithExpire2033Member2020-12-310001227654us-gaap:StateAndLocalJurisdictionMember2021-09-300001227654us-gaap:StateAndLocalJurisdictionMember2020-12-310001227654cmp:ResolutionWithVariousTaxingAuthoritiesMember2021-09-3000012276542018-01-012018-12-310001227654us-gaap:StateAndLocalJurisdictionMember2018-01-012018-12-3100012276542021-09-012021-09-300001227654cmp:CanadianProvincialMember2021-09-300001227654srt:ScenarioForecastMember2022-01-012022-12-310001227654us-gaap:DomesticCountryMember2021-01-012021-09-300001227654us-gaap:DomesticCountryMember2020-12-310001227654cmp:CanadianAndProvincialMember2018-01-012018-12-310001227654us-gaap:ForeignCountryMember2019-12-310001227654cmp:TaxYear2013Through2021Memberus-gaap:DomesticCountryMember2021-01-012021-09-300001227654cmp:TaxYear2013Through2021Membersrt:ScenarioForecastMemberus-gaap:DomesticCountryMember2022-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMembercmp:BlendedFundsMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMembercmp:BlendedFundsMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanDebtSecurityMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMember2020-12-310001227654us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2021-09-300001227654us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMembercmp:BlendedFundsMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercmp:BlendedFundsMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Membercmp:BlendedFundsMember2021-09-300001227654us-gaap:USTreasurySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2021-09-300001227654us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2021-09-300001227654us-gaap:USTreasurySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-09-300001227654us-gaap:USTreasurySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-09-300001227654us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2021-09-300001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2021-09-300001227654us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2020-12-310001227654us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMembercmp:BlendedFundsMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Membercmp:BlendedFundsMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Membercmp:BlendedFundsMember2020-12-310001227654us-gaap:USTreasurySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001227654us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001227654us-gaap:USTreasurySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001227654us-gaap:USTreasurySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001227654us-gaap:FairValueInputsLevel1Memberus-gaap:PensionPlansDefinedBenefitMember2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2020-12-310001227654us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-09-300001227654us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001227654us-gaap:PensionPlansDefinedBenefitMember2019-01-012019-12-310001227654us-gaap:PensionPlansDefinedBenefitMember2019-12-310001227654us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-09-300001227654us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-12-310001227654us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2019-12-310001227654us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-09-300001227654us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001227654cmp:A4.875SeniorNotesJuly2024Member2021-09-300001227654cmp:A4.875SeniorNotesJuly2024Member2020-12-310001227654cmp:TermLoanDueJanuary2025Member2021-09-300001227654cmp:TermLoanDueJanuary2025Member2020-12-310001227654cmp:RevolvingCreditFacilityDueJanuary2025Memberus-gaap:RevolvingCreditFacilityMember2021-09-300001227654cmp:RevolvingCreditFacilityDueJanuary2025Memberus-gaap:RevolvingCreditFacilityMember2020-12-310001227654cmp:SeniorNotesDecember2027Member2021-09-300001227654cmp:SeniorNotesDecember2027Member2020-12-310001227654cmp:AccountsReceivableSecuritizationFacilityMember2021-09-300001227654cmp:AccountsReceivableSecuritizationFacilityMember2020-12-310001227654us-gaap:SecuredDebtMembercmp:TermLoanDueJanuary2025Member2019-11-300001227654us-gaap:LineOfCreditMembercmp:RevolvingCreditFacilityDueJanuary2025Memberus-gaap:RevolvingCreditFacilityMember2019-11-300001227654us-gaap:SecuredDebtMembercmp:TermLoanDueJanuary2025Member2019-11-012019-11-300001227654us-gaap:SecuredDebtMemberus-gaap:BaseRateMember2019-10-312019-10-310001227654cmp:TwentyNineteenCreditAgreementMember2021-09-300001227654us-gaap:LineOfCreditMembercmp:RevolvingCreditFacilityDueJanuary2025Memberus-gaap:RevolvingCreditFacilityMember2021-09-300001227654us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMembercmp:RevolvingCreditFacilityDueJanuary2025Member2021-09-300001227654cmp:RevolvingCreditFacilityDueJanuary2025Memberus-gaap:RevolvingCreditFacilityMember2021-07-012021-07-310001227654cmp:TermLoanDueJanuary2025Member2021-07-012021-07-310001227654cmp:TermLoanDueJanuary2025Member2021-01-012021-03-310001227654cmp:TwentyNineteenCreditAgreementMember2019-11-012019-11-300001227654cmp:TwentyNineteenCreditAgreementMember2019-11-300001227654cmp:SeniorNotesdue2027Memberus-gaap:SeniorNotesMember2019-11-300001227654cmp:SeniorNotesJuly2024Memberus-gaap:SeniorNotesMember2021-09-300001227654cmp:SeniorNotesdue2027Memberus-gaap:SeniorNotesMember2021-09-300001227654us-gaap:UnallocatedFinancingReceivablesMembercmp:AccountReceivableFinancingReceivableMember2020-06-302020-06-300001227654us-gaap:UnallocatedFinancingReceivablesMembercmp:AccountReceivableFinancingReceivableMember2020-06-30cmp:subsidiary00012276542020-06-30cmp:agreement0001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2021-01-012021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMember2021-01-012021-09-300001227654us-gaap:CorporateNonSegmentMember2021-01-012021-09-300001227654us-gaap:IntersegmentEliminationMembercmp:SaltMember2021-01-012021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:IntersegmentEliminationMember2021-01-012021-09-300001227654us-gaap:IntersegmentEliminationMember2021-01-012021-09-300001227654us-gaap:ShippingAndHandlingMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2021-01-012021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:ShippingAndHandlingMemberus-gaap:OperatingSegmentsMember2021-01-012021-09-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:CorporateNonSegmentMember2021-01-012021-09-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMember2021-09-300001227654us-gaap:CorporateNonSegmentMember2021-09-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001227654us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001227654us-gaap:IntersegmentEliminationMembercmp:SaltMember2020-01-012020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001227654us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001227654us-gaap:ShippingAndHandlingMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:ShippingAndHandlingMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001227654us-gaap:ShippingAndHandlingMemberus-gaap:CorporateNonSegmentMember2020-01-012020-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMember2020-12-310001227654us-gaap:CorporateNonSegmentMember2020-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001227654us-gaap:CorporateNonSegmentMember2019-01-012019-12-310001227654us-gaap:IntersegmentEliminationMembercmp:SaltMember2019-01-012019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:IntersegmentEliminationMember2019-01-012019-12-310001227654us-gaap:IntersegmentEliminationMember2019-01-012019-12-310001227654us-gaap:ShippingAndHandlingMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:ShippingAndHandlingMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001227654us-gaap:ShippingAndHandlingMemberus-gaap:CorporateNonSegmentMember2019-01-012019-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMember2019-12-310001227654us-gaap:CorporateNonSegmentMember2019-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:HighwayDeicingSaltMember2021-01-012021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:HighwayDeicingSaltMember2021-01-012021-09-300001227654us-gaap:CorporateNonSegmentMembercmp:HighwayDeicingSaltMember2021-01-012021-09-300001227654cmp:HighwayDeicingSaltMember2021-01-012021-09-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:ConsumerIndustrialSaltMember2021-01-012021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:ConsumerIndustrialSaltMember2021-01-012021-09-300001227654us-gaap:CorporateNonSegmentMembercmp:ConsumerIndustrialSaltMember2021-01-012021-09-300001227654cmp:ConsumerIndustrialSaltMember2021-01-012021-09-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:SOPandSpecialtyPlantNutrientsMember2021-01-012021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:SOPandSpecialtyPlantNutrientsMember2021-01-012021-09-300001227654us-gaap:CorporateNonSegmentMembercmp:SOPandSpecialtyPlantNutrientsMember2021-01-012021-09-300001227654cmp:SOPandSpecialtyPlantNutrientsMember2021-01-012021-09-300001227654us-gaap:ProductAndServiceOtherMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2021-01-012021-09-300001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2021-01-012021-09-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:CorporateNonSegmentMember2021-01-012021-09-300001227654us-gaap:ProductAndServiceOtherMember2021-01-012021-09-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:HighwayDeicingSaltMember2020-01-012020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:HighwayDeicingSaltMember2020-01-012020-12-310001227654us-gaap:CorporateNonSegmentMembercmp:HighwayDeicingSaltMember2020-01-012020-12-310001227654cmp:HighwayDeicingSaltMember2020-01-012020-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:ConsumerIndustrialSaltMember2020-01-012020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:ConsumerIndustrialSaltMember2020-01-012020-12-310001227654us-gaap:CorporateNonSegmentMembercmp:ConsumerIndustrialSaltMember2020-01-012020-12-310001227654cmp:ConsumerIndustrialSaltMember2020-01-012020-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:SOPandSpecialtyPlantNutrientsMember2020-01-012020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:SOPandSpecialtyPlantNutrientsMember2020-01-012020-12-310001227654us-gaap:CorporateNonSegmentMembercmp:SOPandSpecialtyPlantNutrientsMember2020-01-012020-12-310001227654cmp:SOPandSpecialtyPlantNutrientsMember2020-01-012020-12-310001227654us-gaap:ProductAndServiceOtherMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001227654us-gaap:ProductAndServiceOtherMemberus-gaap:CorporateNonSegmentMember2020-01-012020-12-310001227654us-gaap:ProductAndServiceOtherMember2020-01-012020-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:HighwayDeicingSaltMember2019-01-012019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:HighwayDeicingSaltMember2019-01-012019-12-310001227654us-gaap:CorporateNonSegmentMembercmp:HighwayDeicingSaltMember2019-01-012019-12-310001227654cmp:HighwayDeicingSaltMember2019-01-012019-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:ConsumerIndustrialSaltMember2019-01-012019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:ConsumerIndustrialSaltMember2019-01-012019-12-310001227654us-gaap:CorporateNonSegmentMembercmp:ConsumerIndustrialSaltMember2019-01-012019-12-310001227654cmp:ConsumerIndustrialSaltMember2019-01-012019-12-310001227654cmp:SaltMemberus-gaap:OperatingSegmentsMembercmp:SOPandSpecialtyPlantNutrientsMember2019-01-012019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:OperatingSegmentsMembercmp:SOPandSpecialtyPlantNutrientsMember2019-01-012019-12-310001227654us-gaap:CorporateNonSegmentMembercmp:SOPandSpecialtyPlantNutrientsMember2019-01-012019-12-310001227654cmp:SOPandSpecialtyPlantNutrientsMember2019-01-012019-12-310001227654us-gaap:ProductAndServiceOtherMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001227654cmp:PlantNutritionNorthAmericaMemberus-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001227654us-gaap:ProductAndServiceOtherMemberus-gaap:CorporateNonSegmentMember2019-01-012019-12-310001227654us-gaap:ProductAndServiceOtherMember2019-01-012019-12-310001227654country:US2021-01-012021-09-300001227654country:US2020-01-012020-12-310001227654country:US2019-01-012019-12-310001227654country:CA2021-01-012021-09-300001227654country:CA2020-01-012020-12-310001227654country:CA2019-01-012019-12-310001227654country:GB2021-01-012021-09-300001227654country:GB2020-01-012020-12-310001227654country:GB2019-01-012019-12-310001227654cmp:OtherGeographicAreasMember2021-01-012021-09-300001227654cmp:OtherGeographicAreasMember2020-01-012020-12-310001227654cmp:OtherGeographicAreasMember2019-01-012019-12-310001227654country:US2021-09-300001227654country:US2020-12-310001227654country:US2019-12-310001227654country:CA2021-09-300001227654country:CA2020-12-310001227654country:CA2019-12-310001227654country:GB2021-09-300001227654country:GB2020-12-310001227654country:GB2019-12-310001227654cmp:OtherGeographicAreasMember2021-09-300001227654cmp:OtherGeographicAreasMember2020-12-310001227654cmp:OtherGeographicAreasMember2019-12-310001227654us-gaap:DeferredCompensationShareBasedPaymentsMember2021-01-012021-09-300001227654us-gaap:DeferredCompensationShareBasedPaymentsMember2020-01-012020-12-310001227654us-gaap:DeferredCompensationShareBasedPaymentsMember2019-01-012019-12-310001227654us-gaap:DeferredCompensationShareBasedPaymentsMemberus-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2021-01-012021-09-300001227654us-gaap:DeferredCompensationShareBasedPaymentsMemberus-gaap:RestrictedStockUnitsRSUMembersrt:DirectorMember2020-01-012020-12-310001227654us-gaap:DeferredCompensationShareBasedPaymentsMembersrt:DirectorMember2021-01-012021-09-300001227654us-gaap:DeferredCompensationShareBasedPaymentsMembersrt:DirectorMember2020-01-012020-12-310001227654us-gaap:DeferredCompensationShareBasedPaymentsMembersrt:DirectorMember2019-01-012019-12-310001227654us-gaap:SeriesAPreferredStockMember2021-09-300001227654cmp:EquityCompensation2005PlanMember2005-12-310001227654cmp:EquityCompensation2015PlanMember2015-05-310001227654cmp:A2020IncentiveAwardPlanMember2020-05-310001227654us-gaap:EmployeeStockOptionMember2021-01-012021-09-300001227654us-gaap:EmployeeStockOptionMember2021-09-300001227654us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001227654us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001227654srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-09-300001227654srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-09-300001227654us-gaap:RestrictedStockUnitsRSUMember2021-09-300001227654cmp:TotalShareholderReturnPerformanceStockUnitsMember2021-01-012021-09-300001227654srt:MinimumMembercmp:TotalShareholderReturnPerformanceStockUnitsMember2021-01-012021-09-300001227654srt:MaximumMembercmp:TotalShareholderReturnPerformanceStockUnitsMember2021-01-012021-09-300001227654srt:MinimumMembercmp:TargetNumberOfSharesMember2021-01-012021-09-300001227654srt:MaximumMembercmp:TargetNumberOfSharesMember2021-01-012021-09-300001227654srt:MinimumMembercmp:EBITDAPerformanceStockUnitsMember2021-01-012021-09-300001227654srt:MaximumMembercmp:EBITDAPerformanceStockUnitsMember2021-01-012021-09-300001227654srt:MinimumMembercmp:GrowthPSUsMember2021-01-012021-09-300001227654srt:MaximumMembercmp:GrowthPSUsMember2021-01-012021-09-300001227654cmp:EBITDAPerformanceStockUnitsMember2021-01-012021-09-300001227654us-gaap:EmployeeStockOptionMember2018-12-310001227654us-gaap:RestrictedStockUnitsRSUMember2018-12-310001227654cmp:PerformanceStockUnitsPsuMember2018-12-310001227654us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001227654cmp:PerformanceStockUnitsPsuMember2019-01-012019-12-310001227654us-gaap:EmployeeStockOptionMember2019-12-310001227654us-gaap:RestrictedStockUnitsRSUMember2019-12-310001227654cmp:PerformanceStockUnitsPsuMember2019-12-310001227654us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001227654cmp:PerformanceStockUnitsPsuMember2020-01-012020-12-310001227654us-gaap:EmployeeStockOptionMember2020-12-310001227654us-gaap:RestrictedStockUnitsRSUMember2020-12-310001227654cmp:PerformanceStockUnitsPsuMember2020-12-310001227654us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-09-300001227654cmp:PerformanceStockUnitsPsuMember2021-01-012021-09-300001227654cmp:PerformanceStockUnitsPsuMember2021-09-300001227654cmp:ExercisePriceRange1Member2021-01-012021-09-300001227654cmp:ExercisePriceRange1Member2021-09-300001227654cmp:ExercisePriceRange2Member2021-01-012021-09-300001227654cmp:ExercisePriceRange2Member2021-09-300001227654cmp:ExercisePriceRange3Member2021-01-012021-09-300001227654cmp:ExercisePriceRange3Member2021-09-300001227654cmp:ExercisePriceRange4Member2021-01-012021-09-300001227654cmp:ExercisePriceRange4Member2021-09-300001227654cmp:ExercisePriceRange5Member2021-01-012021-09-300001227654cmp:ExercisePriceRange5Member2021-09-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001227654us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-09-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-09-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-09-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-09-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-09-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2021-09-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001227654us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-12-310001227654us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-12-310001227654us-gaap:CommodityContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001227654cmp:CTADueToSaleOfForeignEntityMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-09-300001227654us-gaap:CommodityContractMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001227654us-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-300001227654us-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-01-012021-09-30utr:MMBTU0001227654us-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-12-310001227654us-gaap:ForeignExchangeForwardMember2021-04-300001227654us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-04-300001227654us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-04-012020-04-300001227654us-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-300001227654cmp:AccruedExensesandOtherCurrentLiabilitiesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-300001227654us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-300001227654us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-09-300001227654us-gaap:DesignatedAsHedgingInstrumentMember2021-09-300001227654us-gaap:CommodityContractMember2021-09-300001227654us-gaap:OtherCurrentAssetsMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001227654cmp:AccruedExensesandOtherCurrentLiabilitiesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001227654us-gaap:CommodityContractMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001227654us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001227654us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001227654us-gaap:CommodityContractMember2020-12-310001227654us-gaap:CommodityContractMemberus-gaap:CostOfSalesMemberus-gaap:CashFlowHedgingMember2021-01-012021-09-300001227654us-gaap:CashFlowHedgingMember2021-01-012021-09-300001227654us-gaap:CommodityContractMemberus-gaap:CostOfSalesMemberus-gaap:CashFlowHedgingMember2020-01-012020-12-310001227654us-gaap:CashFlowHedgingMember2020-01-012020-12-310001227654us-gaap:FairValueInputsLevel1Member2021-09-300001227654us-gaap:FairValueInputsLevel2Member2021-09-300001227654us-gaap:FairValueInputsLevel3Member2021-09-300001227654us-gaap:EnergyRelatedDerivativeMember2021-09-300001227654us-gaap:FairValueInputsLevel1Memberus-gaap:EnergyRelatedDerivativeMember2021-09-300001227654us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueInputsLevel2Member2021-09-300001227654us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-09-300001227654cmp:CommonstockLargeCapUSCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMember2021-01-012021-09-300001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:CommonStockOfSmallToMidCapUSCompaniesMembercmp:InvestmentBenchmarkMember2021-01-012021-09-300001227654cmp:CommonStockInternationalCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMember2021-01-012021-09-300001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMembercmp:BondFundsMember2021-01-012021-09-300001227654us-gaap:ShortTermInvestmentsMembercmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMember2021-01-012021-09-300001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMembercmp:BlendedFundsMember2021-01-012021-09-300001227654us-gaap:FairValueInputsLevel1Member2020-12-310001227654us-gaap:FairValueInputsLevel2Member2020-12-310001227654us-gaap:FairValueInputsLevel3Member2020-12-310001227654us-gaap:EnergyRelatedDerivativeMember2020-12-310001227654us-gaap:FairValueInputsLevel1Memberus-gaap:EnergyRelatedDerivativeMember2020-12-310001227654us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueInputsLevel2Member2020-12-310001227654us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueInputsLevel3Member2020-12-310001227654cmp:CommonstockLargeCapUSCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMember2020-01-012020-12-310001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:CommonStockOfSmallToMidCapUSCompaniesMembercmp:InvestmentBenchmarkMember2020-01-012020-12-310001227654cmp:CommonStockInternationalCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMember2020-01-012020-12-310001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMembercmp:BondFundsMember2020-01-012020-12-310001227654us-gaap:ShortTermInvestmentsMembercmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMember2020-01-012020-12-310001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:InvestmentBenchmarkMembercmp:BlendedFundsMember2020-01-012020-12-310001227654cmp:SeniorNotesJuly2024Member2021-09-300001227654cmp:SeniorNotesJuly2024Member2020-12-310001227654cmp:SeniorNotesJuly2024Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-09-300001227654cmp:SeniorNotesJuly2024Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001227654us-gaap:CarryingReportedAmountFairValueDisclosureMembercmp:SeniorNotesJuly2024Member2021-09-300001227654us-gaap:CarryingReportedAmountFairValueDisclosureMembercmp:SeniorNotesJuly2024Member2020-12-310001227654cmp:SeniorNotesDecember2027Memberus-gaap:SeniorNotesMember2021-09-300001227654cmp:SeniorNotesDecember2027Memberus-gaap:SeniorNotesMember2020-12-310001227654cmp:SeniorNotesdue2027Member2020-12-310001227654cmp:SeniorNotesdue2027Member2021-09-300001227654us-gaap:EstimateOfFairValueFairValueDisclosureMembercmp:CreditAgreementMember2021-09-300001227654us-gaap:EstimateOfFairValueFairValueDisclosureMembercmp:CreditAgreementMember2020-12-310001227654us-gaap:CarryingReportedAmountFairValueDisclosureMembercmp:CreditAgreementMember2021-09-300001227654us-gaap:CarryingReportedAmountFairValueDisclosureMembercmp:CreditAgreementMember2020-12-310001227654us-gaap:EmployeeStockOptionMember2021-01-012021-09-300001227654us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001227654us-gaap:EmployeeStockOptionMember2019-01-012019-12-3100012276542020-01-012020-09-300001227654us-gaap:ShippingAndHandlingMember2020-01-012020-09-300001227654us-gaap:ProductMember2020-01-012020-09-3000012276542020-09-300001227654us-gaap:SubsequentEventMember2021-11-142021-11-140001227654us-gaap:SubsequentEventMember2021-10-012021-11-1400012276542021-07-012021-09-300001227654us-gaap:AllowanceForCreditLossMember2020-12-310001227654us-gaap:AllowanceForCreditLossMember2021-01-012021-09-300001227654us-gaap:AllowanceForCreditLossMember2021-09-300001227654us-gaap:AllowanceForCreditLossMember2019-12-310001227654us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310001227654us-gaap:AllowanceForCreditLossMember2018-12-310001227654us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310001227654us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001227654us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-09-300001227654us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-09-300001227654us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310001227654us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310001227654us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310001227654us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-31

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-KT

(MARK ONE)

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from January 1, 2021 to September 30, 2021

Commission File Number 001-31921

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 36-3972986 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 9900 West 109th Street, | Suite 100 | | 66210 |

| Overland Park, | Kansas | | (Zip Code) |

| (Address of principal executive offices) | | |

Registrant’s telephone number, including area code:

(913) 344-9200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | CMP | | The New York Stock Exchange |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(g) of the Act: None |

| | | | | | | | | | | | | | |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes | þ | No | ☐ |

| | | | | | | | | | | | | | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | ☐ | No | þ |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing |

| requirements for the past 90 days. | Yes | þ | No | ☐ |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). |

| Yes | þ | No | ☐ |

| | | | | | | | | | | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| Large accelerated filer | þ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act | ☐ |

| | | | | |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☑ |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | þ |

As of March 31, 2021, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $2,111,172,134, based on the closing sale price of $62.72 per share, as reported on the New York Stock Exchange.

The number of shares outstanding of the registrant’s $0.01 par value common stock at November 24, 2021 was 34,057,748 shares.

DOCUMENTS INCORPORATED BY REFERENCE

| | | | | | | | |

| Document | | Parts into which Incorporated |

| Portions of the Proxy Statement for the Annual Meeting of Stockholders to be held February 24, 2022 | | Part III, Items 10, 11, 12, 13 and 14 |

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

TABLE OF CONTENTS

| | | | | | | | |

| PART I | | Page No. |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| PART II | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

| PART III | | |

| | | |

| | |

| | |

| | |

| | |

| | |

| | | |

| PART IV | | |

| | | |

| | |

| | |

| | |

| |

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

PART I

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this Transition Report on Form 10-KT (this “report”), including without limitation our or management’s beliefs, expectations or opinions; statements regarding future events or future financial performance; our plans, objectives and strategies; plans to develop our lithium resource, including market entry; the impact of the COVID-19 pandemic on us; our outlook, including expected sales volumes and prices; the timing and outcome of the potential sale of our Brazil chemical solutions business; the useful life of our mine properties; our expectation of extending the Goderich mineral lease; conversion of mineral resources into mineral reserves; existing or potential capital expenditures, capital projects and investments; the industry and our competition; projected sources of cash flow; potential legal liability; proposed legislation and regulatory action; the seasonal distribution of working capital requirements; our reinvestment of foreign earnings outside the United States (“U.S.”); repatriation of foreign earnings to the U.S.; payment of future dividends and ability to reinvest in our business; our ability to optimize cash accessibility and minimize tax expense; our debt service requirements; our liquidity needs; funding obligations for our United Kingdom (“U.K.”) pension plan; outcomes of matters with taxing authorities; and the seasonality of our business, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that predict or describe future events or trends and that do not relate solely to historical matters. We use words such as “may,” “would,” “could,” “should,” “will,” “likely,” “expect,” “anticipate,” “believe,” “intend,” “plan,” “forecast,” “outlook,” “project,” “estimate” and similar expressions suggesting future outcomes or events to identify forward-looking statements or forward-looking information. These statements are based on our current expectations and involve risks and uncertainties that could cause our actual results to differ materially. In evaluating these statements, you should carefully consider various risks, uncertainties and factors including, but not limited to, those listed under “Risk Factors” and elsewhere in this report. Forward-looking statements are only predictions and are subject to certain risks and uncertainties that may cause our actual results to differ materially from the forward-looking statements expressed or implied in this report as a result of factors, risks, and uncertainties, over many of which we do not have control.

Although we believe that the expectations reflected in the forward-looking statements are reasonable as of the date of this report, we cannot guarantee future results, levels of activity, performance or achievements. We do not undertake, and hereby disclaim any obligation or duty, unless otherwise required to do so by applicable laws, to update any forward-looking statement after the date of this report regardless of any new information, future events or other factors. The inclusion of any statement in this report does not constitute our admission that the events or circumstances described in such statement are material to us.

Factors that could cause actual results, levels of activity, performance, or achievements to differ materially from those expressed or implied by the forward-looking statements include, but are not limited to, the following:

•risks related to our mining and industrial operations;

•geological conditions;

•dependency on a limited number of key production and distribution facilities and critical equipment;

•weather conditions;

•uncertainties in estimating our economically recoverable reserves and resources;

•strikes, other forms of work stoppage or slowdown or other union activities;

•the inability to fund necessary capital expenditures or successfully complete capital projects;

•supply constraints or price increases for energy and raw materials used in our production processes;

•our indebtedness and inability to pay our indebtedness;

•restrictions in our debt agreements that may limit our ability to operate our business or require accelerated debt payments;

•tax liabilities;

•the inability of our customers to access credit or a default by our customers of trade credit extended by us or financing we have guaranteed;

•our payment of any dividends;

•financial assurance requirements;

•risks related to the potential phasing out of LIBOR;

•the impact of competition on the sales of our products;

•risks associated with our international operations and sales, including changes in currency exchange rates and inflation risks;

•increasing costs or a lack of availability of transportation services;

•the seasonal demand for our products;

•the impact of anticipated changes in potash product prices and customer application rates;

•conditions in the sectors where we sell products and supply and demand imbalances for competing products;

•our rights and governmental authorizations to mine and operate our properties;

•risks related to unanticipated litigation or investigations or pending litigation or investigations or other contingencies;

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

•compliance with foreign and U.S. laws and regulations related to import and export requirements and anti-corruption laws;

•compliance with environmental, health and safety laws and regulations;

•environmental liabilities;

•product liability claims and product recalls;

•changes in laws, industry standards and regulatory requirements;

•misappropriation or infringement claims relating to intellectual property;

•the impact of the COVID-19 pandemic, or other outbreaks of infectious disease or similar public health threats;

•our ability to successfully implement our strategies, including the timing and outcome of the potential sale of our Brazil chemical solutions business;

•risks related to labor shortages and the loss of key personnel;

•a compromise of our computer systems, information technology or operations technology or the inability to protect confidential or proprietary data;

•climate change and related laws and regulations;

•our ability to expand our business through acquisitions and investments, realize anticipated benefits from acquisitions and investments and integrate acquired businesses;

•the impact of Brazil currency changes on the earn-out consideration we may be entitled to receive with respect to the sale of our South America specialty plant nutrition business;

•domestic and international general business and economic conditions; and

•other risk factors included in this report or reported from time to time in our filings with the Securities and Exchange Commission (the “SEC”). See “Where You Can Find More Information.”

MARKET AND INDUSTRY DATA AND FORECASTS

This report includes market share and industry data and forecasts that we obtained from publicly available information and industry publications, surveys, market research, internal company surveys and consultant surveys. Industry publications and surveys, consultant surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy and completeness of such information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal company surveys, industry forecasts and market research, which we believe to be reliable based upon management’s knowledge of the industry, have not been verified by any independent sources. Except where otherwise noted, references to North America include only the continental U.S. and Canada, references to the U.K., include only England, Scotland and Wales, and statements as to our position relative to our competitors or as to market share refer to the most recent available data. Statements concerning (a) North American consumer and industrial salt and highway deicing salt markets are generally based on historical sales volumes, (b) U.K. highway deicing salt sales are generally based on historical sales volumes, and (c) sulfate of potash are generally based on historical sales volumes. Except where otherwise noted, all references to tons refer to “short tons” and all amounts are in U.S. dollars. One short ton equals 2,000 pounds.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports and other information with the SEC and our SEC filings are available at the SEC’s website at www.sec.gov. Copies of these documents are also available on our website, www.compassminerals.com. The information on these websites is not part of this report and is not incorporated by reference into this report. Further, our references to website URLs are intended to be inactive textual references only.

You may also request a copy of any of our filings, at no cost, by writing or telephoning:

Investor Relations

Compass Minerals International, Inc.

9900 West 109th Street, Suite 100

Overland Park, Kansas 66210

For general inquiries concerning us, please call (913) 344-9200.

Unless the context requires otherwise, references in this transition report to the “Company,” “Compass Minerals,” “CMP,” “we,” “us” and “our” refer to Compass Minerals International, Inc. (“CMI,” the parent holding company) and its consolidated subsidiaries collectively.

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

ITEM 1. BUSINESS

COMPANY OVERVIEW

Compass Minerals is a leading provider of essential minerals focused on safely delivering where and when it matters to help solve nature’s challenges for customers and communities. Our salt products help keep roadways safe during winter weather and are used in numerous other consumer, industrial and agricultural applications. Our plant nutrition products improve the quality and yield of crops, while supporting sustainable agriculture. As of September 30, 2021, we operate 15 production and packaging facilities (including 3 production facilities in South America that are part of our discontinued operations, which is discussed further below) with more than 2,000 personnel throughout the U.S., Canada, the U.K. and Brazil, including:

•The largest underground rock salt mine in the world in Goderich, Ontario, Canada;

•The largest dedicated rock salt mine in the U.K. in Winsford, Cheshire;

•A solar evaporation facility located near Ogden, Utah, which is both the largest sulfate of potash specialty fertilizer (“SOP”) production site and the largest solar salt production site in the Western Hemisphere;

•Several mechanical evaporation facilities producing consumer and industrial salt; and

•Three facilities producing specialty chemicals in Brazil.

See Item 2, “Properties,” for a discussion of our mining properties, including processing methods, facilities, production and summaries of our mineral resources and reserves, both in the aggregate and for our individual material mining properties. Our Salt segment provides highway deicing salt to customers in North America and the U.K. as well as consumer deicing and water conditioning products, ingredients used in consumer and commercial food preparation and other salt-based products for consumer, agricultural and industrial applications in North America. In the U.K., we operate a records management business utilizing excavated areas of our Winsford salt mine with one other location in London, England.

Our Plant Nutrition segment produces and markets SOP products in various grades worldwide to distributors and retailers of crop inputs, as well as growers and for industrial uses. We market our SOP under the trade name Protassium+.

We sell our salt and plant nutrition products primarily in the U.S., Canada and the U.K. See Part II, Item 8, Note 13 to our Consolidated Financial Statements for financial information relating to our operations by geographic areas. During fiscal 2020, we initiated an evaluation of the strategic fit of certain of our businesses. On February 16, 2021, we announced our plan to restructure our former Plant Nutrition South America segment to enable targeted and separate sales processes for each portion of the former segment, including our chemicals and specialty plant nutrition businesses along with our equity method investment in Fermavi Eletroquímica Ltda. (“Fermavi”). Concurrently, to optimize our asset base in North America, we evaluated the strategic fit of our North America micronutrient product business. On March 16, 2021, our Board of Directors approved a plan to sell our South America chemicals and specialty plant nutrition businesses, our investment in Fermavi and our North America micronutrient product business (collectively, the “Specialty Businesses”) with the goal of reducing our leverage and enabling increased focus on optimizing our core businesses.

As described further in Part II, Item 8, Note 1 and Note 3 to the Consolidated Financial Statements, on March 23, 2021, April 7, 2021 and June 28, 2021, we entered into definitive agreements to sell our South America specialty plant nutrition business, a component of our North America micronutrient business and our Fermavi investment, respectively. The South America specialty plant nutrition business sale closed on July 1, 2021, the North America micronutrient sale closed on May 4, 2021, and the sale of our Fermavi investment closed on August 20, 2021. We continue to actively pursue the sale of the South America chemicals business, and we believe this sale is probable to occur within the next twelve months. In the first quarter of 2021, we concluded that certain of our assets met the criteria for classification as held for sale and discontinued operations. As a result, we are presenting two reportable segments in continuing operations, Salt and Plant Nutrition (which was previously known as the Plant Nutrition North America segment) in this Form 10-KT. See Part II, Item 8, Note 13 to the Consolidated Financial Statements for more information. Unless otherwise indicated, the information and amounts provided in Part I of this Form 10-KT include both continuing and discontinued operations that have not yet been sold. Our Brazil chemical solutions business serves the water treatment industry and other industrial processes and is presented as assets held for sale and discontinued operations in our Consolidated Balance Sheets and Consolidated Statements of Operations in this Form 10-KT, respectively.

Change in Fiscal Year

On June 23, 2021, our Board of Directors approved a change in our fiscal year from December 31 to September 30, effective January 1, 2021. Our results of operations, cash flows, and all transactions impacting shareholders’ equity presented in this Transition Report on Form 10-KT are for the nine months ended September 30, 2021, and our fiscal years 2020 and 2019 are for the twelve months ended December 31, 2020 and December 31, 2019 unless otherwise noted. As such, our fiscal year 2021, or fiscal 2021, refers to the period from January 1, 2021 to September 30, 2021. This Transition Report on Form 10-KT also includes an unaudited consolidated statement of operations for the comparable stub period of January 1, 2020 to September 30, 2020; see Part II, Item 8, Note 18 for additional information.

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

SALT SEGMENT

Overview

Salt is indispensable and enormously versatile with thousands of reported uses. In addition, there are no known cost-effective alternatives for most high-volume uses. Through the use of effective mining techniques and efficient production processes, we leverage our high-grade salt deposits, which are among the most extensive in the world. Further, many of our Salt segment assets are in locations that are logistically favorable to our core markets. Our strategy for this segment is to focus on driving profitability from every ton we produce through cost efficiency as well as commercial and operational execution.

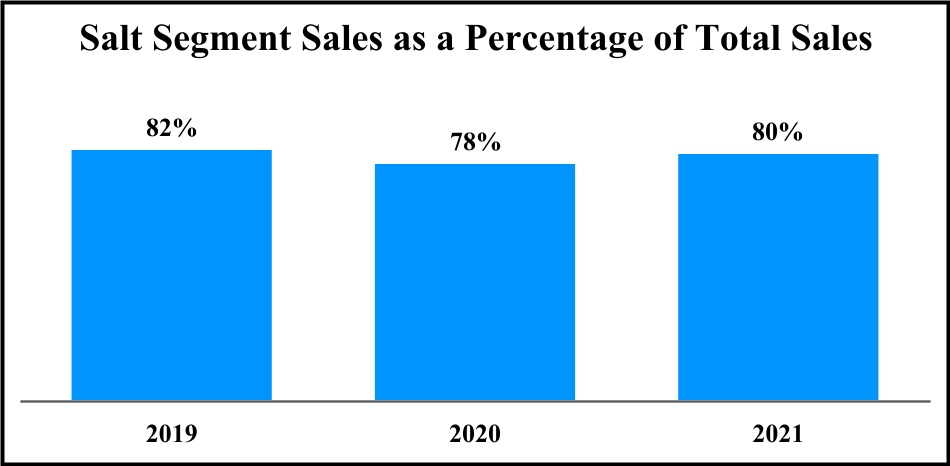

Through our Salt segment, we produce, market and sell salt (sodium chloride) and magnesium chloride in North America and sodium chloride in the U.K. Our Salt products include rock salt, mechanically-evaporated salt, solar-evaporated salt, brine magnesium chloride and flake magnesium chloride. While we also purchase potassium chloride (“KCl”) and calcium chloride to sell as finished products or to blend with sodium chloride to produce specialty products, sodium chloride represents the vast majority of the products we produce, market and sell. In fiscal 2021, the Salt segment accounted for approximately 80% of our sales (see Part II, Item 8, Note 13 to our Consolidated Financial Statements for segment financial information). Salt segment sales as a percentage of total sales from continuing operations for the nine months ended September 30, 2021 and the fiscal years ended December 31, 2020 and 2019 are as follows:

Our Salt segment products are used in a wide variety of applications, including as a deicer for roadways, consumer and professional use, as an ingredient in chemical production, for water treatment, human and animal nutrition and for a variety of other consumer and industrial uses.

Historical demand for salt has remained relatively stable during periods of rising prices and through a variety of economic cycles due to its relatively low cost and diverse number of end uses. As a result, our cash flows from our Salt segment are not materially impacted by economic cycles. However, demand for deicing salt products is primarily affected by the number and intensity of snow events and temperatures in our service territories.

Salt Industry Overview

In our primary markets, we estimate that the consumption of highway deicing rock salt in North America, including rock salt used in chemical manufacturing processes, is approximately 39 million tons per year, assuming average winter weather conditions, while the consumer and industrial market is approximately 10 million tons per year. In the U.K., we estimate that the consumption of highway deicing salt is approximately 2 million tons per year, assuming average winter weather conditions. We also estimate that salt consumption in the U.S. has increased at a historical average rate of approximately 1% per year, although there have been recent fluctuations above and below this average driven primarily by winter weather variability.

Salt prices vary according to purity, end use and variations in refining and packaging processes. Management estimates that salt prices in the U.S. have increased at a historical average rate of approximately 3% to 4% per year, although there have been recent fluctuations above and below this average. Due to salt’s relatively low production cost, transportation and handling costs tend to be a significant component of the total delivered cost, which makes logistics management and customer service key competitive factors in the industry. The high relative cost associated with transportation of salt tends to favor producers located nearest to customers.

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

Products and Sales

We sell our Salt segment products through our highway deicing product line (which includes brine magnesium chloride as well as rock salt treated with this mineral) and our consumer and industrial product line (which includes salt as well as products containing magnesium chloride and calcium chloride in both pure form and blended with salt).

Highway deicing, including salt sold to chemical customers, constituted 66% of our fiscal 2021 Salt segment sales. Our principal customers are states, provinces, counties, municipalities and road maintenance contractors that purchase bulk deicing salt, both treated and untreated, for ice control on public roadways. Highway deicing salt in North America is sold primarily through an annual tendered bid contract process with governmental entities, as well as through multi-year contracts, with price, product quality and delivery capabilities as the primary competitive market factors. Some sales also occur through negotiated sales contracts with third-party customers, particularly in the U.K. Since transportation costs are a relatively large portion of the delivered cost of our products to customers, locations of salt sources and distribution networks also play a significant role in the ability of suppliers to cost-effectively serve customers. We have an extensive network of approximately 80 depots for storage and distribution of highway deicing salt in North America. The majority of these depots are located on the Great Lakes and the Mississippi River and Ohio River systems. Deicing salt product from our Ogden facility supplies customers in the Western and upper Midwest regions of the U.S. Treated rock salt, which is typically rock salt with magnesium chloride brine and organic materials that enhance the salt’s performance, is sold throughout our markets.

We believe our production capability at our Winsford mine and favorable logistics position enhance our ability to meet the U.K.’s winter demands. Due to our strong position, we are viewed as a key supplier by the U.K.’s Highways Agency. In the U.K., approximately 55% of our highway deicing customers have multi-year contracts.

Winter weather variability is the most significant factor affecting salt sales for deicing applications, because mild winters reduce the need for salt used in ice and snow control. On average, over the last three years, approximately two-thirds of our deicing product sales occurred during the North American and European winter months of November through March. The vast majority of our North American deicing sales are made in Canada and the Midwestern U.S. where inclement weather during the winter months causes dangerous road conditions. In keeping with industry practice, we stockpile salt to meet estimated requirements for the next winter season. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality” for more information on the seasonality of our Salt segment results.

Our principal chemical customers are producers of intermediate chemical products used in the production of vinyls and other chemicals, pulp and paper, as well as water treatment and a variety of other industrial uses. We typically have multi-year supply agreements with these customers. Price, service, product quality and security of supply are the major competitive market factors.

Sales of our consumer and industrial products accounted for 34% of our fiscal 2021 Salt segment sales. We are the third largest producer of consumer and industrial salt products in North America. These products include commercial and consumer applications, such as water conditioning, consumer and professional ice control, food processing, agricultural applications, table salt and a variety of industrial applications. We believe we are among the largest private-label producers of water conditioning salt in North America and of table salt in Canada. Our Sifto brand encompasses a full line of salt products, which are well recognized in Canada.

Our consumer and industrial business has broad product lines with both private-label and Company brands. Our consumer and industrial product line is distributed through many channels, including retail, agricultural, industrial, janitorial and sanitation, and resellers. These consumer and industrial products are channeled from our plants and third-party warehouses to our customers using a combination of direct sales personnel, contract personnel and a network of brokers or manufacturers’ representatives.

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

The chart below shows our annual sales volumes of Salt segment products for the nine months ended September 30, 2021, and the fiscal years ended December 31, 2020 and 2019:

Competition

We face strong competition in each of the markets in which we operate. In North America, other large, nationally and internationally recognized companies compete with our Salt segment products. In addition, there are also several smaller regional producers of salt. There are several importers of salt into North America, which mostly impact the East Coast and West Coast of the U.S. where we have minimal market presence. Two competitors serve the highway deicing salt market in the U.K., one in Northern England and one in Northern Ireland. Typically, there are not significant imports of highway deicing salt into the U.K.

Salt is a commodity, which limits the potential for product differentiation and increases competition. Additionally, low barriers to entry in the consumer and industrial markets increase competition. Our advantageous geographical locations, superior assets and distribution network strengthen our competitive position.

PLANT NUTRITION SEGMENT (FORMERLY PLANT NUTRITION NORTH AMERICA)

Industry Overview

Fertilizers are critical for efficient crop production using the limited arable land resources available around the world. The nutrients needed to ensure plant health can be divided into three categories:

•macro nutrients - the traditional NPK fertilizers (nitrogen (N), phosphorus (P) and potassium (K));

•secondary nutrients - calcium, magnesium and sulfur; and

•specialty plant nutrients - trace elements of iron, manganese, copper, boron, zinc, molybdenum, chlorine and nickel.

Factors influencing the plant nutrition market include world grain and food supply, currency fluctuations, weather and climate change, grower incomes, changes in consumer diets, general levels of economic activity, government food programs, governmental agriculture and energy policies in the U.S. and around the world, and the amount or type of crop grown in certain locations, or the type or amount of fertilizer product used. In addition, our Plant Nutrition segment results can be impacted by seasonality (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Seasonality” for more information).

Our Plant Nutrition segment currently generates most of its sales and earnings through the production and sale of SOP. There are two major forms of potassium-based fertilizer, SOP, a specialty form of potassium which also provides plant-ready sulfur, and muriate of potash (“MOP” or “KCl”). Based on management’s estimates, the average annual worldwide consumption of all potash fertilizers is approximately 92 million tons, with MOP accounting for over 85% of all potash used in fertilizer production. SOP represents approximately 9% of all potash production. The remainder of potash is supplied in forms containing varying concentrations of potassium (expressed as potassium oxide) along with different combinations of co-nutrients. SOP, which contains the equivalent of approximately 50% potassium oxide, maintains a price premium over MOP due to the fact that it contains the secondary nutrient, sulfur, does not contain chlorides and is more expensive to produce than MOP. Additionally, many high-value or chloride-sensitive crops experience improved yields and quality when SOP is applied instead of MOP. SOP is also a more cost-effective alternative to other forms of specialty potash.

Our SOP sales are concentrated in the Western and Southeastern U.S. where the crops and soil conditions favor the use of low-chloride potassium nutrients. Consequently, weather patterns and field conditions in these locations can impact Plant Nutrition sales volumes.

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

While long-term global consumption of potash has increased in response to growing populations and the need for additional food supplies, the market for commodity potash has been challenged over the last few years due to a downturn in the broader crop market which has pressured grower incomes. However, recently improved economics for row crops has led to an improved commodity potash market. Additionally, demand for our SOP products has been resilient despite the challenges facing the global potash market.

We expect the long-term demand for potassium nutrients to continue to grow as arable land per capita decreases, thereby encouraging improved crop yield efficiencies. We expect our future growth to stem from the conversion of certain commodity potassium applications into higher yield SOP applications.

Approximately 91% of our Plant Nutrition segment sales in fiscal 2021 were made to U.S. customers, who include retail fertilizer dealers and distributors of agricultural products as well as professional turf care customers. In some cases, these dealers and distributors combine or blend our Plant Nutrition segment products with other fertilizers and minerals to produce fertilizer blends tailored to individual requirements.

Products and Sales

We currently generate our sales and earnings in our Plant Nutrition segment through the production and sale of SOP. Our SOP is sold in various grades under our Protassium+ brand. Our Protassium+ product line consists of different grades sized for use in broadcast spreaders, direct application and liquid fertilizer solutions. Our turf product line consists of grades sized for use by the turf and ornamental markets and for blends used on golf course greens. We also provide an organic product line with grades sized for a wide range of applications.

Our Protassium+ product line is generally sold to crop input distributors and dealers who may blend our products with other fertilizer products to sell to farmers and growers, or it may be sold as the final product. Our commercial efforts focus on educating and selling the agronomic benefits of SOP as a source of potassium nutrients.

Competition

SOP is marketed globally, with approximately 65% of the world’s 13 million tons of estimated capacity located in China. Management estimates global SOP capacity to be as follows:

We are the leading SOP producer and marketer in North America and we also market SOP products internationally, depending on market conditions. Our major competition for SOP sales in North America includes imports from the European Union. Fluctuations in the values of foreign currencies in relation to the U.S. dollar coupled with Baltic freight rates impact the level of international competition we face. As the only SOP producer with production facilities in North America, and as a result of our logistically favorable production site near Ogden, Utah, we estimate that our share of the North American market is sizable. In addition to imported SOP, there is functional competition between SOP and other forms of potassium crop nutrients, such as MOP. The specialty plant nutrient market is highly fragmented. Commodity and specialty crops require specialty plant nutrients in varying degrees depending on the crop and soil conditions.

| | | | | | | | |

| | COMPASS MINERALS INTERNATIONAL, INC. |

DISCONTINUED OPERATIONS

Our Brazil chemical solutions business is presented as assets held for sale and discontinued operations in our Consolidated Balance Sheets and Consolidated Statements of Operations in this Form 10-KT, respectively. For more information, see Part II, Item 8, Note 1 and Note 3 to the Consolidated Financial Statements.

Industry Overview

Our Brazil chemical solutions business produces water and wastewater treatment chemicals in Brazil for cleaning, decontaminating and purifying water as well as process chemicals for industrial use. This business benefits from the rapidly expanding focus on, and increased investment in, improving standards for drinking water purification and wastewater treatment. Our water treatment customers include state and municipal entities, wastewater treatment companies and manufacturing companies that treat their own wastewater. Our Brazil chemical solutions business also benefits from growth in Brazilian industrial sectors that use our products, including the oil and gas exploration, mining, pulp and paper production and ethanol production industries.

Operations and Facilities

Our Brazil chemical solutions business operates at three production facilities located in the Southeast and Northeast parts of Brazil, which are our Suzano I, Igarassu and Reluz Nordeste properties. Our Brazil chemical solutions products are produced through a series of chemical and physical transformations in automated reactors, granulators, grinders and mixers. Our equipment is capable of processing both primary and secondary sources of raw materials, thus enabling us to rapidly remodel our production process to deal with variations in element concentration in raw material feeds. This also allows us flexibility with regard to raw material purchasing opportunities, allowing us to purchase products that are less expensive on a percentage-contained-metal-basis.

Products and Sales

As of September 30, 2021, our Brazil chemical solutions portfolio consisted of approximately 225 products. Through our Brazil chemical solutions business, we manufacture, market and supply water treatment products and chemicals for industrial processes. Our water treatment products have many different uses, including algae control, alkalinity control, disinfection control, odor and corrosion control, water filtration and water clarification.