cmp-20200630000122765412/312020Q2false9.310.70.010.01200,000,000200,000,00035,367,26435,367,2641,446,0721,481,611————0.30.10.30.10.720.720.720.72us-gaap:OtherAssetsus-gaap:PropertyPlantAndEquipmentNetus-gaap:AccruedLiabilitiesCurrentus-gaap:AccruedLiabilitiesCurrentus-gaap:OtherLiabilitiesNoncurrentus-gaap:OtherLiabilitiesNoncurrent4.8753.76.75P4YP1YP3YP3Ytwo2.84.875250.0500.0P3Y00012276542020-01-012020-06-30xbrli:shares00012276542020-07-31iso4217:USD00012276542020-06-3000012276542019-12-31iso4217:USDxbrli:shares00012276542020-04-012020-06-3000012276542019-04-012019-06-3000012276542019-01-012019-06-300001227654us-gaap:ShippingAndHandlingMember2020-04-012020-06-300001227654us-gaap:ShippingAndHandlingMember2019-04-012019-06-300001227654us-gaap:ShippingAndHandlingMember2020-01-012020-06-300001227654us-gaap:ShippingAndHandlingMember2019-01-012019-06-300001227654us-gaap:ProductMember2020-04-012020-06-300001227654us-gaap:ProductMember2019-04-012019-06-300001227654us-gaap:ProductMember2020-01-012020-06-300001227654us-gaap:ProductMember2019-01-012019-06-300001227654us-gaap:CommonStockMember2019-12-310001227654us-gaap:AdditionalPaidInCapitalMember2019-12-310001227654us-gaap:TreasuryStockMember2019-12-310001227654us-gaap:RetainedEarningsMember2019-12-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001227654us-gaap:RetainedEarningsMember2020-01-012020-03-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-3100012276542020-01-012020-03-310001227654us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001227654us-gaap:TreasuryStockMember2020-01-012020-03-310001227654us-gaap:CommonStockMember2020-03-310001227654us-gaap:AdditionalPaidInCapitalMember2020-03-310001227654us-gaap:TreasuryStockMember2020-03-310001227654us-gaap:RetainedEarningsMember2020-03-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-3100012276542020-03-310001227654us-gaap:RetainedEarningsMember2020-04-012020-06-300001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001227654us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300001227654us-gaap:TreasuryStockMember2020-04-012020-06-300001227654us-gaap:CommonStockMember2020-06-300001227654us-gaap:AdditionalPaidInCapitalMember2020-06-300001227654us-gaap:TreasuryStockMember2020-06-300001227654us-gaap:RetainedEarningsMember2020-06-300001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001227654us-gaap:CommonStockMember2018-12-310001227654us-gaap:AdditionalPaidInCapitalMember2018-12-310001227654us-gaap:TreasuryStockMember2018-12-310001227654us-gaap:RetainedEarningsMember2018-12-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-3100012276542018-12-310001227654us-gaap:RetainedEarningsMember2019-01-012019-03-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-3100012276542019-01-012019-03-310001227654us-gaap:RetainedEarningsMembercmp:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001227654cmp:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-12-310001227654us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310001227654us-gaap:TreasuryStockMember2019-01-012019-03-310001227654us-gaap:CommonStockMember2019-03-310001227654us-gaap:AdditionalPaidInCapitalMember2019-03-310001227654us-gaap:TreasuryStockMember2019-03-310001227654us-gaap:RetainedEarningsMember2019-03-310001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-3100012276542019-03-310001227654us-gaap:RetainedEarningsMember2019-04-012019-06-300001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001227654us-gaap:AdditionalPaidInCapitalMember2019-04-012019-06-300001227654us-gaap:TreasuryStockMember2019-04-012019-06-300001227654us-gaap:CommonStockMember2019-06-300001227654us-gaap:AdditionalPaidInCapitalMember2019-06-300001227654us-gaap:TreasuryStockMember2019-06-300001227654us-gaap:RetainedEarningsMember2019-06-300001227654us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-3000012276542019-06-300001227654us-gaap:RetainedEarningsMembercmp:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-01-010001227654us-gaap:AccountingStandardsUpdate201613Member2020-01-010001227654us-gaap:AccountingStandardsUpdate201613Member2020-03-31xbrli:pure0001227654us-gaap:LandBuildingsAndImprovementsMember2020-06-300001227654us-gaap:LandBuildingsAndImprovementsMember2019-12-310001227654us-gaap:MachineryAndEquipmentMember2020-06-300001227654us-gaap:MachineryAndEquipmentMember2019-12-310001227654us-gaap:FurnitureAndFixturesMember2020-06-300001227654us-gaap:FurnitureAndFixturesMember2019-12-310001227654us-gaap:MiningPropertiesAndMineralRightsMember2020-06-300001227654us-gaap:MiningPropertiesAndMineralRightsMember2019-12-310001227654us-gaap:ConstructionInProgressMember2020-06-300001227654us-gaap:ConstructionInProgressMember2019-12-310001227654us-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-06-300001227654us-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-12-310001227654cmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-06-300001227654cmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-12-310001227654us-gaap:CorporateNonSegmentMember2020-06-300001227654us-gaap:CorporateNonSegmentMember2019-12-310001227654us-gaap:ForeignCountryMember2020-06-300001227654us-gaap:ForeignCountryMember2019-12-310001227654us-gaap:ForeignCountryMembercmp:NOLCarryforwardsExpireBeginningIn2033Member2020-06-300001227654us-gaap:ForeignCountryMembercmp:NOLCarryforwardsExpireBeginningIn2033Member2019-12-310001227654cmp:NOLCarryforwardsExpireBeginningIn2027Memberus-gaap:StateAndLocalJurisdictionMember2020-06-300001227654cmp:NOLCarryforwardsExpireBeginningIn2027Memberus-gaap:StateAndLocalJurisdictionMember2019-12-310001227654us-gaap:ForeignCountryMemberus-gaap:CanadaRevenueAgencyMember2020-06-300001227654us-gaap:ForeignCountryMemberus-gaap:CanadaRevenueAgencyMembercmp:TaxYear2007Through2016Member2017-01-012017-12-3100012276542017-01-012017-12-310001227654cmp:TaxYear2007Through2016Member2018-01-012018-12-310001227654us-gaap:ForeignCountryMembercmp:TaxYear2007Through2016Member2018-01-012018-12-3100012276542019-01-012019-12-310001227654us-gaap:DomesticCountryMembercmp:TaxYear2007Through2016Member2019-01-012019-12-310001227654us-gaap:DomesticCountryMembersrt:ScenarioForecastMembercmp:TaxYear2007Through2016Member2020-12-3100012276542018-10-012018-12-310001227654cmp:TaxYear2013Through2021Member2019-01-012019-12-310001227654us-gaap:ForeignCountryMembercmp:TaxYear2013Through2021Member2019-01-012019-12-310001227654us-gaap:ForeignCountryMembersrt:ScenarioForecastMembercmp:TaxYear2013Through2021Member2020-12-310001227654us-gaap:DomesticCountryMembercmp:TaxYear2013Through2021Member2020-01-012020-06-300001227654cmp:TaxYear2013Through2021Member2020-01-012020-03-310001227654us-gaap:DomesticCountryMembersrt:ScenarioForecastMembercmp:TaxYear2013Through2021Member2020-12-310001227654us-gaap:SeniorNotesMembercmp:A4.875SeniorNotesJuly2024Member2020-06-300001227654us-gaap:SeniorNotesMembercmp:A4.875SeniorNotesJuly2024Member2019-12-310001227654cmp:TermLoanDueJanuary2025Member2020-06-300001227654cmp:TermLoanDueJanuary2025Member2019-12-310001227654cmp:RevolvingCreditFacilityDueJanuary2025Memberus-gaap:RevolvingCreditFacilityMember2020-06-300001227654cmp:RevolvingCreditFacilityDueJanuary2025Memberus-gaap:RevolvingCreditFacilityMember2019-12-310001227654cmp:SeniorNotesDecember2027Member2020-06-300001227654cmp:SeniorNotesDecember2027Member2019-12-310001227654cmp:A3.7BancoItaLoanDueMarch2020Member2020-06-300001227654cmp:A3.7BancoItaLoanDueMarch2020Member2019-12-310001227654cmp:BancoSantanderloanDueOctober2020Member2020-06-300001227654cmp:BancoSantanderloanDueOctober2020Member2019-12-310001227654cmp:BancoItauLoanDueFebruary2021Member2020-06-300001227654cmp:BancoItauLoanDueFebruary2021Member2019-12-310001227654cmp:BancoRabobankDueJuly2021Member2020-06-300001227654cmp:BancoRabobankDueJuly2021Member2019-12-310001227654cmp:BancoSantanderLoanDueSeptember2021Member2020-06-300001227654cmp:BancoSantanderLoanDueSeptember2021Member2019-12-310001227654cmp:BancoDoBrasildueSeptember2021Member2020-06-300001227654cmp:BancoDoBrasildueSeptember2021Member2019-12-310001227654cmp:BancoRabobankLoanDueNovember2021Member2020-06-300001227654cmp:BancoRabobankLoanDueNovember2021Member2019-12-310001227654cmp:BancoSantanderDueDecember2021Member2020-06-300001227654cmp:BancoSantanderDueDecember2021Member2019-12-310001227654cmp:BancoVotorantimFebruary2022Member2020-06-300001227654cmp:BancoVotorantimFebruary2022Member2019-12-310001227654cmp:BancoSantanderDueMarch2022Member2020-06-300001227654cmp:BancoSantanderDueMarch2022Member2019-12-310001227654cmp:FinanciadoraDeEstudosEProjetosLoanDueNovember2023Member2020-06-300001227654cmp:FinanciadoraDeEstudosEProjetosLoanDueNovember2023Member2019-12-31cmp:loan0001227654cmp:BrazilianReaisdenominatedLoansMember2020-01-012020-03-310001227654cmp:BrazilianReaisdenominatedLoansMember2020-03-310001227654cmp:EuroDenominatedLoansMember2020-01-012020-03-310001227654cmp:BrazilianReaisdenominatedLoansMembercmp:CertificadoDeDepositoInterbancarioCDIMembersrt:MinimumMember2020-03-310001227654cmp:BrazilianReaisdenominatedLoansMembercmp:CertificadoDeDepositoInterbancarioCDIMembersrt:MaximumMember2020-03-310001227654cmp:BrazilianTaxLitigationAndAssessmentsMember2020-06-300001227654cmp:BrazilianTaxLitigationAndAssessmentsMember2019-12-310001227654cmp:ProduqumicaIndstriaeComrcioS.A.Member2020-06-300001227654cmp:ProduqumicaIndstriaeComrcioS.A.Member2019-12-31cmp:segmentcmp:Business0001227654cmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654us-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654cmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654us-gaap:CorporateNonSegmentMember2020-04-012020-06-300001227654us-gaap:IntersegmentEliminationMembercmp:SaltMember2020-04-012020-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionSouthAmericaMember2020-04-012020-06-300001227654us-gaap:IntersegmentEliminationMember2020-04-012020-06-300001227654us-gaap:ShippingAndHandlingMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654us-gaap:ShippingAndHandlingMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:CorporateNonSegmentMember2020-04-012020-06-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2020-06-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654us-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654cmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654us-gaap:CorporateNonSegmentMember2019-04-012019-06-300001227654us-gaap:IntersegmentEliminationMembercmp:SaltMember2019-04-012019-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionSouthAmericaMember2019-04-012019-06-300001227654us-gaap:IntersegmentEliminationMember2019-04-012019-06-300001227654us-gaap:ShippingAndHandlingMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654us-gaap:ShippingAndHandlingMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:CorporateNonSegmentMember2019-04-012019-06-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2019-06-300001227654us-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-06-300001227654cmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-06-300001227654us-gaap:CorporateNonSegmentMember2019-06-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654us-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654us-gaap:CorporateNonSegmentMember2020-01-012020-06-300001227654us-gaap:IntersegmentEliminationMembercmp:SaltMember2020-01-012020-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionSouthAmericaMember2020-01-012020-06-300001227654us-gaap:IntersegmentEliminationMember2020-01-012020-06-300001227654us-gaap:ShippingAndHandlingMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654us-gaap:ShippingAndHandlingMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:CorporateNonSegmentMember2020-01-012020-06-300001227654cmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654us-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654cmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654us-gaap:CorporateNonSegmentMember2019-01-012019-06-300001227654us-gaap:IntersegmentEliminationMembercmp:SaltMember2019-01-012019-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654us-gaap:IntersegmentEliminationMembercmp:PlantNutritionSouthAmericaMember2019-01-012019-06-300001227654us-gaap:IntersegmentEliminationMember2019-01-012019-06-300001227654us-gaap:ShippingAndHandlingMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654us-gaap:ShippingAndHandlingMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654us-gaap:ShippingAndHandlingMemberus-gaap:CorporateNonSegmentMember2019-01-012019-06-300001227654cmp:HighwayDeicingSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654cmp:HighwayDeicingSaltMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:CorporateNonSegmentMember2020-04-012020-06-300001227654cmp:HighwayDeicingSaltMember2020-04-012020-06-300001227654cmp:ConsumerIndustrialSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:CorporateNonSegmentMember2020-04-012020-06-300001227654cmp:ConsumerIndustrialSaltMember2020-04-012020-06-300001227654cmp:SaltMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:CorporateNonSegmentMember2020-04-012020-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMember2020-04-012020-06-300001227654cmp:IndustrialChemicalsMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654cmp:IndustrialChemicalsMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:CorporateNonSegmentMember2020-04-012020-06-300001227654cmp:IndustrialChemicalsMember2020-04-012020-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-04-012020-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:CorporateNonSegmentMember2020-04-012020-06-300001227654us-gaap:IntersegmentEliminationMemberus-gaap:ProductAndServiceOtherMember2020-04-012020-06-300001227654cmp:HighwayDeicingSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654cmp:HighwayDeicingSaltMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:CorporateNonSegmentMember2019-04-012019-06-300001227654cmp:HighwayDeicingSaltMember2019-04-012019-06-300001227654cmp:ConsumerIndustrialSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:CorporateNonSegmentMember2019-04-012019-06-300001227654cmp:ConsumerIndustrialSaltMember2019-04-012019-06-300001227654cmp:SaltMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:CorporateNonSegmentMember2019-04-012019-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMember2019-04-012019-06-300001227654cmp:IndustrialChemicalsMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654cmp:IndustrialChemicalsMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:CorporateNonSegmentMember2019-04-012019-06-300001227654cmp:IndustrialChemicalsMember2019-04-012019-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-04-012019-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:CorporateNonSegmentMember2019-04-012019-06-300001227654us-gaap:IntersegmentEliminationMemberus-gaap:ProductAndServiceOtherMember2019-04-012019-06-300001227654cmp:HighwayDeicingSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654cmp:HighwayDeicingSaltMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:CorporateNonSegmentMember2020-01-012020-06-300001227654cmp:HighwayDeicingSaltMember2020-01-012020-06-300001227654cmp:ConsumerIndustrialSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:CorporateNonSegmentMember2020-01-012020-06-300001227654cmp:ConsumerIndustrialSaltMember2020-01-012020-06-300001227654cmp:SaltMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:CorporateNonSegmentMember2020-01-012020-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMember2020-01-012020-06-300001227654cmp:IndustrialChemicalsMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654cmp:IndustrialChemicalsMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:CorporateNonSegmentMember2020-01-012020-06-300001227654cmp:IndustrialChemicalsMember2020-01-012020-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2020-01-012020-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:CorporateNonSegmentMember2020-01-012020-06-300001227654us-gaap:IntersegmentEliminationMemberus-gaap:ProductAndServiceOtherMember2020-01-012020-06-300001227654cmp:HighwayDeicingSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654cmp:HighwayDeicingSaltMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:HighwayDeicingSaltMemberus-gaap:CorporateNonSegmentMember2019-01-012019-06-300001227654cmp:HighwayDeicingSaltMember2019-01-012019-06-300001227654cmp:ConsumerIndustrialSaltMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:ConsumerIndustrialSaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:ConsumerIndustrialSaltMemberus-gaap:CorporateNonSegmentMember2019-01-012019-06-300001227654cmp:ConsumerIndustrialSaltMember2019-01-012019-06-300001227654cmp:SaltMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654cmp:PlantNutritionSouthAmericaMembercmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMemberus-gaap:CorporateNonSegmentMember2019-01-012019-06-300001227654cmp:SOPandSpecialtyPlantNutrientsMember2019-01-012019-06-300001227654cmp:IndustrialChemicalsMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654cmp:IndustrialChemicalsMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654cmp:IndustrialChemicalsMemberus-gaap:CorporateNonSegmentMember2019-01-012019-06-300001227654cmp:IndustrialChemicalsMember2019-01-012019-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:SaltMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:OperatingSegmentsMembercmp:PlantNutritionNorthAmericaMember2019-01-012019-06-300001227654us-gaap:ProductAndServiceOtherMembercmp:PlantNutritionSouthAmericaMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300001227654us-gaap:ProductAndServiceOtherMemberus-gaap:CorporateNonSegmentMember2019-01-012019-06-300001227654us-gaap:IntersegmentEliminationMemberus-gaap:ProductAndServiceOtherMember2019-01-012019-06-300001227654country:US2020-04-012020-06-300001227654country:US2020-01-012020-06-300001227654country:CA2020-04-012020-06-300001227654country:CA2020-01-012020-06-300001227654country:BR2020-04-012020-06-300001227654country:BR2020-01-012020-06-300001227654country:GB2020-04-012020-06-300001227654country:GB2020-01-012020-06-300001227654cmp:OtherGeographicAreasMember2020-04-012020-06-300001227654cmp:OtherGeographicAreasMember2020-01-012020-06-300001227654country:US2019-04-012019-06-300001227654country:US2019-01-012019-06-300001227654country:CA2019-04-012019-06-300001227654country:CA2019-01-012019-06-300001227654country:BR2019-04-012019-06-300001227654country:BR2019-01-012019-06-300001227654country:GB2019-04-012019-06-300001227654country:GB2019-01-012019-06-300001227654cmp:OtherGeographicAreasMember2019-04-012019-06-300001227654cmp:OtherGeographicAreasMember2019-01-012019-06-300001227654cmp:A2020IncentiveAwardPlanMember2020-05-310001227654us-gaap:EmployeeStockOptionMember2020-01-012020-06-300001227654us-gaap:EmployeeStockOptionMember2020-06-300001227654us-gaap:RestrictedStockUnitsRSUMembercmp:Two015IncentiveAwardPlanMember2020-01-012020-06-300001227654cmp:A2020IncentiveAwardPlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-06-300001227654us-gaap:RestrictedStockUnitsRSUMember2020-06-300001227654cmp:TotalShareholderReturnPerformanceStockUnitsMember2020-01-012020-06-300001227654cmp:TotalShareholderReturnPerformanceStockUnitsMembersrt:MinimumMember2020-01-012020-06-300001227654cmp:TotalShareholderReturnPerformanceStockUnitsMembersrt:MaximumMember2020-01-012020-06-300001227654cmp:ReturnOnInvestedCapitalPerformanceStockUnitsMember2020-01-012020-06-300001227654srt:MinimumMembercmp:ReturnOnInvestedCapitalPerformanceStockUnitsMember2020-01-012020-06-300001227654srt:MaximumMembercmp:ReturnOnInvestedCapitalPerformanceStockUnitsMember2020-01-012020-06-300001227654us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-06-300001227654cmp:PerformanceStockUnitsPsuMember2020-01-012020-06-300001227654cmp:StockPaymentsMember2020-01-012020-06-300001227654cmp:RestrictedStockUnitsAndPerformanceStockUnitsMember2020-01-012020-06-300001227654us-gaap:EmployeeStockOptionMember2019-12-310001227654us-gaap:RestrictedStockUnitsRSUMember2019-12-310001227654cmp:PerformanceStockUnitsPsuMember2019-12-310001227654cmp:PerformanceStockUnitsPsuMember2020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-03-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-03-310001227654us-gaap:AccumulatedTranslationAdjustmentMember2020-03-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-04-012020-06-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-04-012020-06-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2020-04-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-06-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-06-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-03-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-03-310001227654us-gaap:AccumulatedTranslationAdjustmentMember2019-03-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-04-012019-06-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-04-012019-06-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2019-04-012019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-06-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-06-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310001227654us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-06-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-06-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2018-12-310001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2018-12-310001227654us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-01-012019-06-300001227654us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-06-300001227654us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-06-300001227654us-gaap:ProductMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-04-012020-06-300001227654us-gaap:ProductMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-04-012020-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-01-012020-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001227654us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-06-300001227654us-gaap:ProductMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-04-012019-06-300001227654us-gaap:ProductMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-04-012019-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-01-012019-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300001227654us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2019-01-012019-06-300001227654us-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-01-012020-06-30utr:MMBTU0001227654us-gaap:CommodityContractMember2020-01-012020-06-300001227654us-gaap:CommodityContractMember2019-01-012019-12-310001227654us-gaap:CommodityContractMember2020-03-312020-03-310001227654us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-06-300001227654us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2020-01-012020-06-300001227654us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654cmp:AccruedExpensesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:CommodityContractMemberus-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:CurrencySwapMemberus-gaap:OtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:CurrencySwapMembercmp:AccruedExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:DesignatedAsHedgingInstrumentMember2020-06-300001227654us-gaap:CommodityContractMember2020-06-30cmp:counterparty0001227654us-gaap:CurrencySwapMember2020-06-300001227654us-gaap:CommodityContractMemberus-gaap:OtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001227654cmp:AccruedExpensesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001227654us-gaap:CommodityContractMemberus-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001227654us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:CommodityContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001227654us-gaap:CurrencySwapMemberus-gaap:OtherCurrentAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001227654us-gaap:CurrencySwapMembercmp:AccruedExpensesMemberus-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001227654us-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001227654us-gaap:CommodityContractMember2019-12-310001227654us-gaap:CurrencySwapMember2019-12-310001227654us-gaap:CommodityContractMember2019-12-312019-12-310001227654us-gaap:FairValueMeasurementsRecurringMember2020-06-300001227654us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-06-300001227654us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-06-300001227654us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-06-300001227654cmp:CommonstockLargeCapUSCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMember2020-01-012020-06-300001227654cmp:CommonStockOfSmallToMidCapUSCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMember2020-01-012020-06-300001227654cmp:CommonStockInternationalCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMember2020-01-012020-06-300001227654cmp:BondFundsMembercmp:MutualFundInvestmentsConcentrationRiskMember2020-01-012020-06-300001227654us-gaap:ShortTermInvestmentsMembercmp:MutualFundInvestmentsConcentrationRiskMember2020-01-012020-06-300001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:BlendedFundsMember2020-01-012020-06-300001227654us-gaap:FairValueMeasurementsRecurringMember2019-12-310001227654us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001227654us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001227654us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001227654cmp:CommonstockLargeCapUSCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMember2019-01-012019-12-310001227654cmp:CommonStockOfSmallToMidCapUSCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMember2019-01-012019-12-310001227654cmp:CommonStockInternationalCompaniesMembercmp:MutualFundInvestmentsConcentrationRiskMember2019-01-012019-12-310001227654cmp:BondFundsMembercmp:MutualFundInvestmentsConcentrationRiskMember2019-01-012019-12-310001227654us-gaap:ShortTermInvestmentsMembercmp:MutualFundInvestmentsConcentrationRiskMember2019-01-012019-12-310001227654cmp:MutualFundInvestmentsConcentrationRiskMembercmp:BlendedFundsMember2019-01-012019-12-310001227654us-gaap:SeniorNotesMembercmp:SeniorNotesDecember2027Member2020-06-300001227654us-gaap:SeniorNotesMembercmp:SeniorNotesDecember2027Member2019-12-310001227654cmp:SeniorNotesdue2027Member2020-06-300001227654cmp:CreditAgreementMember2020-06-300001227654cmp:CreditAgreementMember2019-12-310001227654cmp:SeniorNotesdue2027Member2019-12-310001227654cmp:AccountReceivableFinancingReceivableMemberus-gaap:UnallocatedFinancingReceivablesMember2020-06-302020-06-300001227654cmp:AccountReceivableFinancingReceivableMemberus-gaap:UnallocatedFinancingReceivablesMember2020-06-300001227654us-gaap:SubsequentEventMembercmp:AccountReceivableFinancingReceivableMemberus-gaap:UnallocatedFinancingReceivablesMember2020-07-012020-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________________ to __________________________

Commission File Number 001-31921

Compass Minerals International, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 36-3972986 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer

Identification Number) |

9900 West 109th Street

Suite 100

Overland Park, KS 66210

(913) 344-9200

(Address of principal executive offices, zip code and telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value | | CMP | | The New York Stock Exchange |

| | | | | | | | | | | | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to | | | | |

file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes | ☑ | No | ☐ |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period | | | | |

| that the registrant was required to submit and post such files) | Yes | ☑ | No | ☐ |

| | | | | | | | | | | | | | | | | | | | | | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

| | | | | | | | | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange | | | | |

| Act. | | | | ☐ |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☑ |

The number of shares outstanding of the registrant’s common stock, $0.01 par value per share, as of July 31, 2020, was 33,944,311 shares.

COMPASS MINERALS INTERNATIONAL, INC.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| PART I. FINANCIAL INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| PART II. OTHER INFORMATION | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

COMPASS MINERALS INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

(in millions, except share data)

| | | | | | | | | | | |

| (Unaudited) | | |

| | June 30,

2020 | | December 31,

2019 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 67.2 | | | $ | 34.7 | |

| Receivables, less allowance for doubtful accounts of $9.3 in 2020 and $10.7 in 2019 | 168.6 | | | 342.4 | |

| Inventories | 325.1 | | | 311.5 | |

| Other | 59.5 | | | 96.4 | |

| Total current assets | 620.4 | | | 785.0 | |

| Property, plant and equipment, net | 948.0 | | | 1,030.8 | |

| Intangible assets, net | 86.0 | | | 103.0 | |

| Goodwill | 264.9 | | | 343.0 | |

| Investment in equity investee | 23.5 | | | 24.9 | |

| Other | 143.0 | | | 156.5 | |

| Total assets | $ | 2,085.8 | | | $ | 2,443.2 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 39.0 | | | $ | 52.1 | |

| Accounts payable | 108.1 | | | 126.2 | |

| Accrued salaries and wages | 28.3 | | | 34.4 | |

| Income taxes payable | 12.2 | | | 10.4 | |

| Accrued interest | 11.7 | | | 11.3 | |

| Accrued expenses and other current liabilities | 61.7 | | | 61.5 | |

| Total current liabilities | 261.0 | | | 295.9 | |

| Long-term debt, net of current portion | 1,247.5 | | | 1,363.9 | |

| Deferred income taxes, net | 80.6 | | | 89.9 | |

| Other noncurrent liabilities | 153.1 | | | 163.9 | |

Commitments and contingencies (Note 9) | | | |

| Stockholders’ equity: | | | |

Common stock: $0.01 par value, 200,000,000 authorized shares; 35,367,264 issued shares | 0.4 | | | 0.4 | |

| Additional paid-in capital | 122.3 | | | 117.1 | |

Treasury stock, at cost — 1,446,072 shares at June 30, 2020 and 1,481,611 shares at December 31, 2019 | (3.8) | | | (3.2) | |

| Retained earnings | 587.0 | | | 607.4 | |

| Accumulated other comprehensive loss | (362.3) | | | (192.1) | |

| Total stockholders’ equity | 343.6 | | | 529.6 | |

| Total liabilities and stockholders’ equity | $ | 2,085.8 | | | $ | 2,443.2 | |

The accompanying notes are an integral part of the consolidated financial statements.

COMPASS MINERALS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

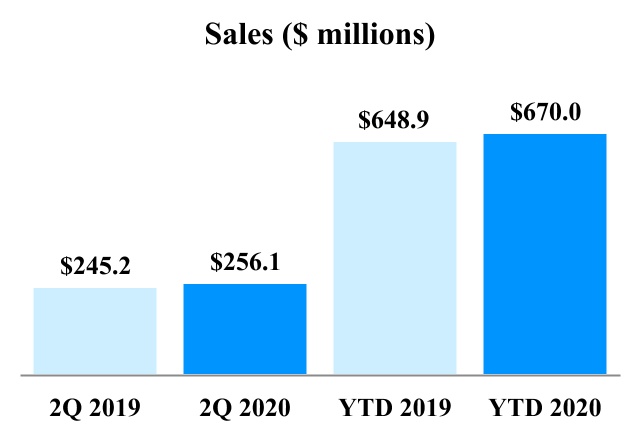

| Sales | $ | 256.1 | | | $ | 245.2 | | | $ | 670.0 | | | $ | 648.9 | |

| Shipping and handling cost | 40.5 | | | 48.0 | | | 142.3 | | | 160.9 | |

| Product cost | 149.3 | | | 151.4 | | | 374.1 | | | 369.6 | |

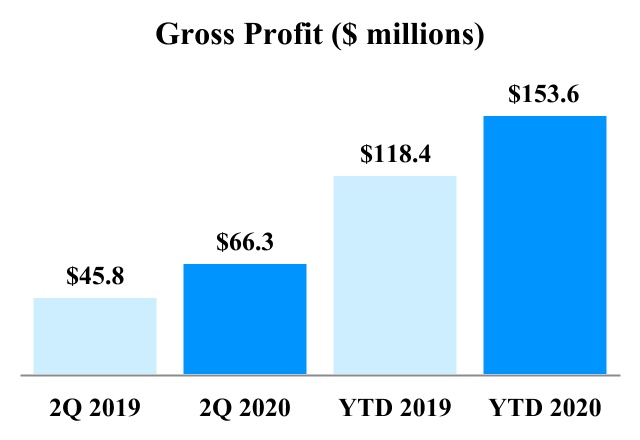

| Gross profit | 66.3 | | | 45.8 | | | 153.6 | | | 118.4 | |

| Selling, general and administrative expenses | 41.8 | | | 41.7 | | | 84.9 | | | 81.1 | |

| Operating earnings | 24.5 | | | 4.1 | | | 68.7 | | | 37.3 | |

| | | | | | | |

| Other expense (income): | | | | | | | |

| Interest expense | 17.2 | | | 16.8 | | | 36.2 | | | 33.0 | |

| Net earnings in equity investee | (0.2) | | | (0.1) | | | (0.1) | | | — | |

| Loss (gain) on foreign exchange | 5.0 | | | 4.1 | | | (9.3) | | | 9.0 | |

| Other, net | (0.4) | | | (0.5) | | | (0.3) | | | (1.0) | |

| Earnings (loss) before income taxes | 2.9 | | | (16.2) | | | 42.2 | | | (3.7) | |

| Income tax expense (benefit) | 1.2 | | | (4.4) | | | 12.9 | | | 0.5 | |

| Net earnings (loss) | $ | 1.7 | | | $ | (11.8) | | | $ | 29.3 | | | $ | (4.2) | |

| | | | | | | |

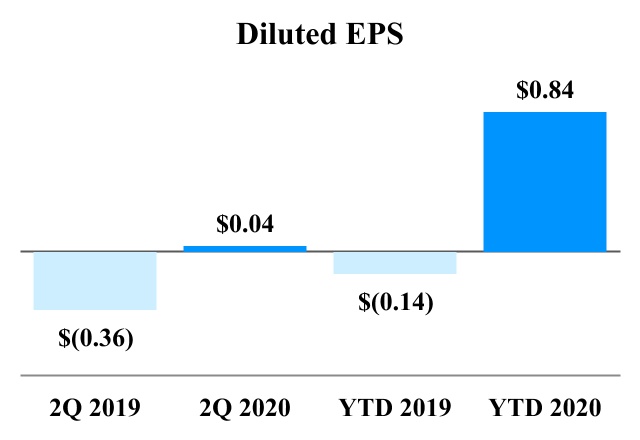

| Basic net earnings (loss) per common share | $ | 0.04 | | | $ | (0.36) | | | $ | 0.85 | | | $ | (0.14) | |

| Diluted net earnings (loss) per common share | $ | 0.04 | | | $ | (0.36) | | | $ | 0.84 | | | $ | (0.14) | |

| | | | | | | |

| Weighted-average common shares outstanding (in thousands): | | | | | | | |

| Basic | 33,915 | | | 33,883 | | | 33,903 | | | 33,878 | |

| Diluted | 33,915 | | | 33,883 | | | 33,903 | | | 33,878 | |

The accompanying notes are an integral part of the consolidated financial statements.

COMPASS MINERALS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Net earnings (loss) | $ | 1.7 | | | $ | (11.8) | | | $ | 29.3 | | | $ | (4.2) | |

| Other comprehensive income (loss): | | | | | | | |

Unrealized gain from change in pension obligations, net of tax of $(0.0) for the three and six months ending June 30, 2020 and 2019, respectively. | 0.2 | | | 0.1 | | | 0.4 | | | 0.2 | |

Unrealized gain (loss) on cash flow hedges, net of tax of $(0.3) in the both the three and six months ended June 30, 2020 and $0.1 in the three and six months ended June 30, 2019, respectively. | 0.7 | | | (0.4) | | | 0.8 | | | (0.3) | |

| | | | | | | |

| Cumulative translation adjustment | 2.1 | | | 18.3 | | | (171.4) | | | 32.8 | |

| Comprehensive income (loss) | $ | 4.7 | | | $ | 6.2 | | | $ | (140.9) | | | $ | 28.5 | |

The accompanying notes are an integral part of the consolidated financial statements.

COMPASS MINERALS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the three and six months ended June 30, 2020 and 2019

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common

Stock | | Additional

Paid-In

Capital | | Treasury

Stock | | Retained

Earnings | | Accumulated

Other

Comprehensive

Loss | | Total |

| Balance, December 31, 2019 | $ | 0.4 | | | $ | 117.1 | | | $ | (3.2) | | | $ | 607.4 | | | $ | (192.1) | | | $ | 529.6 | |

| Comprehensive income (loss) | | | | | | | 27.6 | | | (173.2) | | | (145.6) | |

Dividends on common stock ($0.72 per share) | | | 0.1 | | | | | (24.9) | | | | | (24.8) | |

Shares issued for stock units, net of shares withheld for taxes | | | | | (0.1) | | | | | | | (0.1) | |

| Stock-based compensation | | | 2.4 | | | | | | | | | 2.4 | |

| Balance, March 31, 2020 | $ | 0.4 | | | $ | 119.6 | | | $ | (3.3) | | | $ | 610.1 | | | $ | (365.3) | | | $ | 361.5 | |

| Comprehensive income | | | | | | | 1.7 | | | 3.0 | | | 4.7 | |

Dividends on common stock ($0.72 per share) | | | 0.1 | | | | | (24.8) | | | | | (24.7) | |

Shares issued for stock units, net of shares withheld for taxes | | | (0.1) | | | (0.5) | | | | | | | (0.6) | |

| | | | | | | | | | | |

| Stock-based compensation | | | 2.7 | | | | | | | | | 2.7 | |

| Balance, June 30, 2020 | $ | 0.4 | | | $ | 122.3 | | | $ | (3.8) | | | $ | 587.0 | | | $ | (362.3) | | | $ | 343.6 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common

Stock | | Additional

Paid-In

Capital | | Treasury

Stock | | Retained

Earnings | | Accumulated

Other

Comprehensive

Loss | | Total |

| Balance, December 31, 2018 | $ | 0.4 | | | $ | 110.1 | | | $ | (2.9) | | | $ | 643.5 | | | $ | (210.9) | | | $ | 540.2 | |

| Comprehensive income | | | | | | | 7.6 | | | 14.7 | | | 22.3 | |

Cumulative effect of change in accounting principle | | | | | | | (0.1) | | | | | (0.1) | |

Dividends on common stock ($0.72 per share) | | | 0.1 | | | | | (24.6) | | | | | (24.5) | |

Shares issued for stock units, net of shares withheld for taxes | | | | | (0.2) | | | | | | | (0.2) | |

| Stock-based compensation | | | 1.1 | | | | | | | | | 1.1 | |

| Balance, March 31, 2019 | $ | 0.4 | | | $ | 111.3 | | | $ | (3.1) | | | $ | 626.4 | | | $ | (196.2) | | | $ | 538.8 | |

| Comprehensive (loss) income | | | | | | | (11.8) | | | 18.0 | | | 6.2 | |

Dividends on common stock ($0.72 per share) | | | 0.1 | | | | | (24.8) | | | | | (24.7) | |

Shares issued for stock units, net of shares withheld for taxes | | | | | (0.1) | | | | | | | (0.1) | |

| Stock-based compensation | | | 2.7 | | | | | | | | | 2.7 | |

| Balance, June 30, 2019 | $ | 0.4 | | | $ | 114.1 | | | $ | (3.2) | | | $ | 589.8 | | | $ | (178.2) | | | $ | 522.9 | |

The accompanying notes are an integral part of the consolidated financial statements.

COMPASS MINERALS INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

| | | | | | | | | | | |

| | Six Months Ended

June 30, | | |

| | 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Net earnings (loss) | $ | 29.3 | | | $ | (4.2) | |

| Adjustments to reconcile net earnings to net cash flows provided by operating activities: | | | |

| Depreciation, depletion and amortization | 68.0 | | | 68.9 | |

| Finance fee amortization | 1.5 | | | 1.4 | |

| | | |

| Stock-based compensation | 5.1 | | | 3.4 | |

| Deferred income taxes | 6.6 | | | (9.8) | |

| Net earnings in equity investee | (0.1) | | | — | |

| Unrealized foreign exchange (gain) loss | (12.6) | | | 8.4 | |

| Other, net | 4.1 | | | 1.4 | |

| Changes in operating assets and liabilities: | | | |

| Receivables | 139.2 | | | 136.6 | |

| Inventories | (35.4) | | | (39.5) | |

| Other assets | 33.7 | | | 9.2 | |

| Accounts payable and accrued expenses and other current liabilities | (1.5) | | | (52.1) | |

| Other liabilities | (4.0) | | | (11.8) | |

| Net cash provided by operating activities | 233.9 | | | 111.9 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (42.7) | | | (49.8) | |

| Other, net | (1.3) | | | (1.0) | |

| Net cash used in investing activities | (44.0) | | | (50.8) | |

| Cash flows from financing activities: | | | |

| Proceeds from revolving credit facility borrowings | 64.2 | | | 172.9 | |

| Principal payments on revolving credit facility borrowings | (165.2) | | | (199.1) | |

| Proceeds from issuance of long-term debt | 22.2 | | | 20.1 | |

| Principal payments on long-term debt | (21.7) | | | (11.8) | |

| Dividends paid | (49.5) | | | (49.2) | |

| Deferred financing costs | (0.1) | | | — | |

| Shares withheld to satisfy employee tax obligations | (0.7) | | | (0.3) | |

| Other, net | (0.9) | | | (0.6) | |

| Net cash used in financing activities | (151.7) | | | (68.0) | |

| Effect of exchange rate changes on cash and cash equivalents | (5.7) | | | 0.3 | |

| Net change in cash and cash equivalents | 32.5 | | | (6.6) | |

| Cash and cash equivalents, beginning of the year | 34.7 | | | 27.0 | |

| Cash and cash equivalents, end of period | $ | 67.2 | | | $ | 20.4 | |

| | | |

| | | |

| | | | | | | | | | | |

| Supplemental cash flow information: | | | |

| Interest paid, net of amounts capitalized | $ | 32.5 | | | $ | 27.8 | |

| Income taxes paid, net of refunds | $ | (37.7) | | | $ | 44.9 | |

The accompanying notes are an integral part of the consolidated financial statements.

COMPASS MINERALS INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Accounting Policies and Basis of Presentation:

Compass Minerals International, Inc. (“CMI”), through its subsidiaries (collectively, the “Company”), is a leading producer of essential minerals that solve nature’s challenges, including salt for winter roadway safety and other consumer, industrial and agricultural uses, specialty plant nutrition minerals that improve the quality and yield of crops, and specialty chemicals for water treatment and other industrial processes. The Company’s principal products are salt, consisting of sodium chloride and magnesium chloride; plant nutrients, consisting of sulfate of potash (“SOP”), secondary nutrients and micronutrients; and specialty chemicals. The Company also provides records management services to businesses located in the United Kingdom (the “U.K.”). The Company’s production sites are located in the United States (“U.S.”), Canada, Brazil and the U.K. Except where otherwise noted, references to North America include only the continental U.S. and Canada, and references to the U.K. include only England, Scotland and Wales. References to “Compass Minerals,” “our,” “us” and “we” refer to CMI and its consolidated subsidiaries.

CMI is a holding company with no significant operations other than those of its wholly-owned subsidiaries. The consolidated financial statements include the accounts of CMI and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation.

The Company uses the equity method of accounting for equity securities when it has significant influence or when it has more than a minor ownership interest or more than minor influence over an investee’s operations but does not have a controlling financial interest. Initial investments are recorded at cost (including certain transaction costs) and are adjusted by the Company’s share of the investees’ undistributed earnings and losses.

The accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. These unaudited consolidated financial statements should be read in conjunction with the consolidated financial statements of the Company for the year ended December 31, 2019, as filed with the Securities and Exchange Commission (“SEC”) in its Annual Report on Form 10-K. In the opinion of management, all adjustments, consisting of normal recurring adjustments considered necessary for a fair presentation, have been included.

The Company experiences a substantial amount of seasonality in its sales with respect to its deicing salt products. As a result, sales and operating earnings are generally higher in the first and fourth quarters and lower during the second and third quarters of each year. In particular, sales of highway and consumer deicing salt and magnesium chloride products vary based on the severity of the winter conditions in areas where the products are used. Following industry practice in North America and the U.K., the Company seeks to stockpile sufficient quantities of deicing salt throughout the second, third and fourth quarters to meet the estimated requirements for the upcoming winter season. Production of deicing salt can also vary based on the severity or mildness of the preceding winter season. Due to the seasonal nature of the deicing product lines, operating results for the interim periods are not necessarily indicative of the results that may be expected for the full year.

The Company’s plant nutrition business is also seasonal. For example, the strongest demand for the Company’s plant nutrition products in Brazil typically occurs during the spring planting season. As a result, the Company and its customers generally build inventories during the low demand periods of the year to ensure timely product availability during the peak sales season. The seasonality of this demand results in the Company’s sales volumes and operating income for the Plant Nutrition South America segment usually being the highest during the third and fourth quarters of each year (as the spring planting season begins in September in Brazil).

Significant Accounting Policies

The Company’s significant accounting policies are detailed in “Note 2 – Summary of Significant Accounting Policies” within Item 8 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

Recent Accounting Pronouncements

In January 2017, the Financial Accounting Standards Board (“FASB”) issued guidance to simplify the accounting for goodwill impairment. The guidance removes Step 2 of the goodwill impairment test, which requires a hypothetical purchase price

allocation. A goodwill impairment will now be the amount by which a reporting unit’s carrying value exceeds its fair value, not to exceed the carrying amount of goodwill. All other goodwill impairment guidance remains largely unchanged. The adoption of this guidance on January 1, 2020 did not have an impact on the Company’s consolidated financial statements.

On January 1, 2020, the Company adopted guidance issued by the FASB related to credit losses for financial instruments, which replaces the incurred loss methodology with a current expected credit loss methodology (“CECL”). The Company has determined that its trade receivables are the only financial instrument that is within scope of this CECL guidance. The CECL methodology requires financial assets to be recorded at the net amount expected to be collected over the lifetime of the asset such that the estimated losses are accrued on the day the asset is acquired. The CECL methodology also requires financial assets to be aggregated and evaluated within pools with similar risk characteristics.

The Company has recorded an allowance on its trade receivables based on historical loss rates modified to consider supportable forecasts related to customer-specific and macroeconomic factors. For instance, the Company’s 2020 allowance for doubtful accounts considered the potential impact that the coronavirus pandemic could have on the collectability of its outstanding receivables. The Company’s customer pools are comprised of North American highway deicing customers, North American consumer and industrial customers, Plant Nutrition North America customers, Plant Nutrition South America customers and customers whose outstanding receivable balances have been sent to collections. Customers grouped within these pools have similar risk characteristics. The Company’s allowance for doubtful accounts consists of estimates of expected credit losses and accruals for returns and allowances. At the transition date of January 1, 2020, the implementation of CECL had an immaterial impact of less than $0.1 million on the Company’s consolidated financial statements. Under CECL, the Company had an allowance for doubtful accounts of $9.4 million and $8.2 million as of January 1, 2020, and June 30, 2020, respectively.

2. Revenue Recognition:

Nature of Products and Services

The Company’s Salt segment products include salt and magnesium chloride for use in road deicing and dust control, food processing, water softeners, and agricultural and industrial applications. The Company’s plant nutrition products include SOP, secondary nutrients, micronutrients and chemicals for the industrial chemical industry. In the U.K., the Company operates a records management business utilizing excavated areas of the Winsford salt mine with one other location in London, England.

Identifying the Contract

The Company accounts for a customer contract when there is approval and commitment from both parties, the rights of the parties and payment terms are identified, the contract has commercial substance and collectability of consideration is probable.

Identifying the Performance Obligations

At contract inception, the Company assesses the goods and services it has promised to its customers and identifies a performance obligation for each promise to transfer to the customer a distinct good or service (or bundle of goods or services). Determining whether products and services are considered distinct performance obligations that should be accounted for separately or aggregated together may require significant judgment.

Identifying and Allocating the Transaction Price

The Company’s revenues are measured based on consideration specified in the customer contract, net of any sales incentives and amounts collected on behalf of third parties such as sales taxes. In certain cases, the Company’s customer contracts may include promises to transfer multiple products and services to a customer. For multiple-element arrangements, the Company generally allocates the transaction price to each performance obligation in proportion to its stand-alone selling price.

When Performance Obligations Are Satisfied

The vast majority of the Company’s revenues are recognized at a point in time when the performance obligations are satisfied based upon transfer of control of the product or service to a customer. To determine when the control of goods is transferred, the Company typically assesses, among other things, the shipping terms of the contract, as shipping is an indicator of transfer of control. Some of the Company’s products are sold when the control of the goods transfers to the customer at the time of shipment. There are also instances when the Company provides shipping services to deliver its products. Shipping and handling costs that occur before the customer obtains control of the goods are deemed to be fulfillment activities and are accounted for as fulfillment costs. The Company recognizes shipping and handling costs that are incurred after the customer obtains control of the goods as fulfillment costs which are accrued at the time of revenue recognition.

Significant Payment Terms

The customer contract states the final terms of the sale, including the description, quantity and price of each product or service purchased. Payment is typically due in full within 30 days of delivery. The Company does not adjust the consideration for the effects of a significant financing component if the Company expects, at contract inception, that the period between when the good or service is transferred to the customer and when the customer pays for that good or service will be one year or less.

Refunds, Returns and Warranties

The Company’s products are generally not sold with a right of return and the Company does not generally provide credits or incentives, which may be required to be accounted for as variable consideration when estimating the amount of revenue to be recognized. The Company uses historical experience to estimate accruals for refunds due to manufacturing or other defects.

See Note 10 for disaggregation of revenue by segment, type and geographical region.

3. Leases:

In February 2016, the FASB issued guidance which requires lessees to recognize on their balance sheet a right-of-use asset which represents a lessee’s right to use the underlying asset and a lease liability which represents a lessee’s obligation to make lease payments for the right to use the asset. In addition, the guidance requires expanded qualitative and quantitative disclosures. The Company adopted this guidance beginning in the first quarter of 2019, using a modified retrospective transition method, which required the cumulative effect of this change in accounting of $0.1 million to be recorded as an adjustment to beginning retained earnings. The Company elected the package of transition provisions available for existing contracts, which allowed entities to carryforward the historical assessment of whether the contract contained a lease and the lease classification.

The Company enters into leases for warehouses and depots, rail cars, vehicles, mobile equipment, office space and certain other types of property and equipment. The Company determines whether an arrangement is or contains a lease at the inception of the contract. The right-of-use asset and lease liability are recognized based on the present value of the future minimum lease payments over the estimated lease term. Lease expense for minimum lease payments is recognized on a straight-line basis over the lease term. The Company estimates its incremental borrowing rate for each lease based upon the estimated lease term, the type of asset and the location of the leased asset. The most significant judgments in the application of the FASB guidance include whether a contract contains a lease and the lease term.

Leases with an initial term of 12 months or less are not recorded on the Company’s Consolidated Balance Sheets. The Company recognizes lease expense for these short-term leases on a straight-line basis over the lease term. Many of the Company’s leases include one or more options to renew and extend the initial lease term. The exercise of lease renewal options is generally at the Company’s discretion. The lease term includes renewal periods in only those instances in which the Company determines it is reasonably assured of renewal.

The depreciable life of assets and leasehold improvements are limited by the expected lease term, unless there is a transfer of title or purchase option reasonably certain of exercise. In these instances, the assets are depreciated over the useful life of the asset.

The Company has elected the practical expedient available under the FASB guidance to not separate lease and nonlease components on all of its lease categories. As a result, many of the Company’s leases include variable payments for services (such as handling or storage) or payments based on the usage of the asset. In addition, certain of the Company’s lease agreements include rental payments that are adjusted periodically for inflation. The Company’s lease agreements do not contain any material residual value guarantees or any material restrictive covenants. The Company’s sublease income is immaterial.

The Company’s Consolidated Balance Sheets includes the following (in millions):

| | | | | | | | | | | | | | |

| Consolidated Balance Sheets Location | June 30,

2020 | | December 31,

2019 |

| Assets | | | | |

| Operating leases | Other assets | $ | 45.8 | | | $ | 53.7 | |

| Finance leases | Property, plant and equipment, net | 5.2 | | | 5.8 | |

| Total leased assets | | $ | 51.0 | | | $ | 59.5 | |

| Liabilities | | | | |

| Current liabilities: | | | | |

| Operating leases | Accrued expenses and other current liabilities | $ | 8.0 | | | $ | 12.8 | |

| Finance leases | Accrued expenses and other current liabilities | 1.6 | | | 1.1 | |

| Noncurrent liabilities: | | | | |

| Operating leases | Other noncurrent liabilities | 38.1 | | | 41.0 | |

| Finance leases | Other noncurrent liabilities | 4.6 | | | 6.2 | |

| Total lease liabilities | | $ | 52.3 | | | $ | 61.1 | |

The Company’s components of lease cost are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | | | Six Months Ended

June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| Finance lease cost: | | | | | | | |

| Amortization of lease assets | $ | 0.4 | | | $ | 0.3 | | | $ | 0.9 | | | $ | 0.6 | |

| Interest on lease liabilities | 0.2 | | | 0.1 | | | 0.3 | | | 0.3 | |

| Operating lease cost | 3.5 | | | 4.9 | | | 8.1 | | | 9.7 | |

Variable lease cost(a) | 1.8 | | | 3.9 | | | 6.9 | | | 10.0 | |

| Net lease cost | $ | 5.9 | | | $ | 9.2 | | | $ | 16.2 | | | $ | 20.6 | |

(a)Short-term leases are immaterial and included in variable lease cost.

Maturities of lease liabilities are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | |

| June 30, 2020 | | Operating Leases | | Finance Leases | | Total |

| Remainder of 2020 | | $ | 4.5 | | | $ | 1.0 | | | $ | 5.5 | |

| 2021 | | 10.0 | | | 1.5 | | | 11.5 | |

| 2022 | | 7.4 | | | 0.9 | | | 8.3 | |

| 2023 | | 6.3 | | | 0.9 | | | 7.2 | |

| 2024 | | 5.2 | | | 0.8 | | | 6.0 | |

| After 2024 | | 22.4 | | | 2.6 | | | 25.0 | |

| Total lease payments | | 55.8 | | | 7.7 | | | 63.5 | |

| Less: Interest | | (9.7) | | | (1.5) | | | (11.2) | |

| Present value of lease liabilities | | $ | 46.1 | | | $ | 6.2 | | | $ | 52.3 | |

Supplemental lease term and discount rate information related to leases is as follows:

| | | | | | | | | | | |

| June 30, 2020 | | December 31, 2019 |

| Weighted-average remaining lease term (years) | | | |

| Operating leases | 7.9 | | 7.7 |

| Finance leases | 6.3 | | 7.2 |

| Weighted-average discount rate | | | |

| Operating leases | 4.3 | % | | 4.3 | % |

| Finance leases | 7.1 | % | | 7.6 | % |

Supplemental cash flow information related to leases is as follows (in millions):

| | | | | | | | | | | | | | |

| | Six Months Ended

June 30, | | |

| | 2020 | | 2019 |

| Cash paid for amounts included in the measurement of lease liabilities | | | | |

| Operating cash flows from operating leases | | $ | 7.9 | | | $ | 9.8 | |

| Operating cash flows from finance leases | | 0.3 | | | 0.3 | |

| Financing cash flows from finance leases | | 1.0 | | | 0.6 | |

| Leased assets obtained in exchange for new operating lease liabilities | | 0.4 | | | 2.6 | |

| Leased assets obtained in exchange for new finance lease liabilities | | 1.2 | | | 0.1 | |

4. Inventories:

Inventories consist of the following (in millions):

| | | | | | | | | | | |

| | June 30,

2020 | | December 31,

2019 |

| Finished goods | $ | 250.0 | | | $ | 235.3 | |

| Raw materials and supplies | 75.1 | | | 76.2 | |

| Total inventories | $ | 325.1 | | | $ | 311.5 | |

5. Property, Plant and Equipment, Net:

Property, plant and equipment, net, consists of the following (in millions):

| | | | | | | | | | | |

| | June 30,

2020 | | December 31,

2019 |

| Land, buildings and structures, and leasehold improvements | $ | 603.9 | | | $ | 596.0 | |

| Machinery and equipment | 1,003.9 | | | 1,001.9 | |

| Office furniture and equipment | 62.3 | | | 60.7 | |

| Mineral interests | 167.8 | | | 171.1 | |

| Construction in progress | 76.4 | | | 141.3 | |

| | 1,914.3 | | | 1,971.0 | |

| Less accumulated depreciation and depletion | (966.3) | | | (940.2) | |

| Property, plant and equipment, net | $ | 948.0 | | | $ | 1,030.8 | |

6. Goodwill and Intangible Assets, Net:

Amounts related to the Company’s amortization of intangible assets are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| Aggregate amortization expense | | $ | 2.7 | | | $ | 3.4 | | | $ | 5.9 | | | $ | 7.0 | |

Amounts related to the Company’s goodwill are as follows (in millions):

| | | | | | | | | | | |

| June 30,

2020 | | December 31,

2019 |

| Goodwill - Plant Nutrition North America Segment | $ | 52.8 | | | $ | 55.4 | |

| Goodwill - Plant Nutrition South America Segment | 206.3 | | | 281.6 | |

| Other | 5.8 | | | 6.0 | |

| Total | $ | 264.9 | | | $ | 343.0 | |

The change in goodwill between December 31, 2019 and June 30, 2020 was due to the impact from translating foreign-denominated amounts to U.S. dollars.

7. Income Taxes:

The Company’s effective income tax rate differs from the U.S. statutory federal income tax rate primarily due to U.S. statutory depletion, state income taxes (net of federal tax benefit), foreign income, mining and withholding taxes, global intangible low-taxed income and interest expense recognition differences for book and tax purposes.

The Company had $11.4 million and $18.8 million as of June 30, 2020 and December 31, 2019, respectively, of gross foreign federal net operating loss (“NOL”) carryforwards that have no expiration date, $1.3 million and $1.7 million, respectively, of gross foreign federal NOL carryforwards which expire beginning in 2033 and $0.2 million and $0.3 million, respectively, of net operating tax-effected state NOL carryforwards which expire beginning in 2027.

Canadian provincial tax authorities have challenged tax positions claimed by one of the Company’s Canadian subsidiaries and have issued tax reassessments for years 2002-2015. The reassessments are a result of ongoing audits and total $127.4 million, including interest, through June 30, 2020. The Company disputes these reassessments and will continue to work with the appropriate authorities in Canada to resolve the dispute. There is a reasonable possibility that the ultimate resolution of this dispute, and any related disputes for other open tax years, may be materially higher or lower than the amounts the Company has reserved for such disputes. In connection with this dispute, local regulations require the Company to post security with the tax authority until the dispute is resolved. The Company has posted collateral in the form of a $93.7 million performance bond and has paid $36.3 million to the Canadian tax authorities (most of which is recorded in other assets in the Consolidated Balance Sheets).

The Company expects that it will be required by local regulations to provide security for additional interest on the above unresolved disputed amounts and for any future reassessments issued by these Canadian tax authorities in the form of cash, letters of credit, performance bonds, asset liens or other arrangements agreeable with the tax authorities until the disputes are resolved.

The Company expects that the ultimate outcome of these matters will not have a material impact on its results of operations or financial condition. However, the Company can provide no assurance as to the ultimate outcome of these matters, and the impact could be material if they are not resolved in the Company’s favor. As of June 30, 2020, the Company believes it has adequately reserved for these reassessments.

Additionally, the Company has other uncertain tax positions as well as assessments and disputed positions with taxing authorities in its various jurisdictions, which are consistent with those matters disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

Settlements

In the fourth quarter of 2017, the Company, the Canadian Revenue Authority (“CRA”) and the U.S. Internal Revenue Service (“IRS”) reached a settlement agreement on transfer pricing issues for the Company’s 2007-2012 tax years. As a result of this settlement agreement, the Company recognized $13.8 million of tax expense in its 2017 Consolidated Statements of Operations related to the Company’s Canadian tax positions for the years 2007-2016. The recording of this settlement resulted in increased sales for the Company’s Canadian subsidiary of $85.7 million and increased offsetting expenses for the Company’s U.S. subsidiary in 2017 causing a domestic loss and significant foreign income. During 2018, in accordance with the settlement agreement, the Company’s U.S. subsidiary made intercompany cash payments of $85.7 million to its Canadian subsidiary and tax payments to Canadian taxing authorities of $17.5 million. The remaining liability was satisfied in 2019 with tax payments of $5.3 million. Corresponding tax refunds of $21.4 million were received primarily in 2019 from U.S. taxing authorities, with the remaining refund of approximately $1.6 million expected in 2020 (recorded in other current assets in the Consolidated Balance Sheets).