UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: | 811-21335 |

| Exact name of registrant as specified in charter: | Optimum Fund Trust |

| Address of principal executive offices: |

610 Market Street |

| Name and address of agent for service: |

Anthony G. Ciavarelli, Esq. |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| Date of fiscal year end: | March 31 |

| Date of reporting period: | March 31, 2023 |

Item 1. Reports to Stockholders

Annual report

Optimum Fixed Income Fund

Optimum International Fund

Optimum Large Cap Growth Fund

Optimum Large Cap Value Fund

Optimum Small-Mid Cap Growth Fund

Optimum Small-Mid Cap Value Fund

March 31, 2023

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and, if available, their summary prospectuses, which may be obtained by visiting optimummutualfunds.com/ literature or calling 800 914-0278. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Other than Macquarie Bank Limited ABN 46 008 583 542 (“Macquarie Bank”), any Macquarie Group entity noted in this document is not an authorized deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these other Macquarie Group entities do not represent deposits or other liabilities of Macquarie Bank. Macquarie Bank does not guarantee or otherwise provide assurance in respect of the obligations of these other Macquarie Group entities. In addition, if this document relates to an investment, (a) the investor is subject to investment risk including possible delays in repayment and loss of income and principal invested and (b) none of Macquarie Bank or any other Macquarie Group entity guarantees any particular rate of return on or the performance of the investment, nor do they guarantee repayment of capital in respect of the investment.

The Funds are governed by US laws and regulations.

This annual report is for the information of Optimum Fund Trust shareholders, but it may be used with prospective investors when preceded or accompanied by a current prospectus for Optimum Fund Trust and the fact sheet for the most recently completed calendar quarter. The prospectus sets forth details about charges, expenses, investment objectives, and operating policies of the investment company. You should read the prospectus carefully before you invest. The figures in this report represent past results that are not a guarantee of future results. The return and principal value of an investment in the investment company will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

Unless otherwise noted, views expressed herein are current as of March 31, 2023, and subject to change for events occurring after such date.

The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested. Macquarie Asset Management (MAM) is the asset management division of Macquarie Group. MAM is a full-service asset manager offering a diverse range of products across public and private markets including fixed income, equities, multi-asset solutions, private credit, infrastructure, renewables, natural assets, real estate, and asset finance. The Public Investments business is a part of MAM which includes investment products and advisory services distributed and offered by and referred through affiliates which include Delaware Distributors, L.P., a registered broker/dealer and member of the Financial Industry Regulatory Authority (FINRA), and Macquarie Investment Management Business Trust (MIMBT), a Securities and Exchange Commission (SEC)-registered investment advisor. Investment advisory services are provided by a series of MIMBT. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

| All third-party marks cited are the property of their respective owners. | © 2023 Macquarie Management Holdings, Inc. |

| Optimum Fixed Income Fund | March 31, 2023 (Unaudited) |

Performance review (for the year ended March 31, 2023)

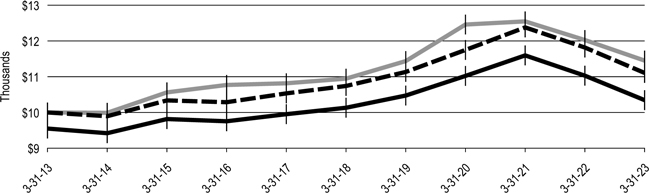

| Optimum Fixed Income Fund (Institutional Class shares)* | 1-year return | -6.01% |

| Optimum Fixed Income Fund (Class A shares)* | 1-year return | -6.21% |

| Bloomberg US Aggregate Index (benchmark) | 1-year return | -4.78% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Fixed Income Fund, please see the table on page 19.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 21 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

*Total returns for the report period presented in the table differs from the return in “Financial highlights.” The total returns presented in the above table are calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total returns presented in “Financial highlights” are calculated in the same manner, but also takes into account certain adjustments that are necessary under US generally accepted accounting principles (US GAAP) required in the annual report.

Fund objective

The Fund seeks a high level of income and may also seek growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisor

Pacific Investment Management Company LLC (PIMCO)

Market review

Early 2022 started with concerns over the Omicron COVID-19 variant, together with a focus on inflation and monetary policy tightening. Central bank policy and persistent inflation remained key themes, which, along with geopolitical tumult, a strong US dollar, and COVID-related shutdowns in China, led to significant financial market volatility and the worst bond bear market in many years. The Russian invasion of Ukraine had a major impact on commodities, particularly the energy and agricultural markets, with prices soaring and supplies tightening. This, in addition to COVID-related shutdowns in China, affected the broader inflation picture with the headline US Consumer Price Index (CPI) hitting its highest levels in 40 years.

Throughout 2022, central banks prioritized controlling inflation over the risk of prompting an economic recession. The US Federal Reserve led monetary policy tightening with the upper end of the federal funds target range moving from 0.25% to 4.50%, the highest level since 2007. After pushing back against aggressive policy tightening in early 2022, the European Central Bank hiked its deposit rate from -0.50% to 2.00%.

In developed sovereign bonds, yields rose sharply on persistent inflation and tighter monetary policy. In fact, 2022 saw the largest-ever year-to-date drawdown in the history of the Bloomberg Global Aggregate Index, with a -13.6% trough in October. There was a positive monthly total return in only two months of 2022, and a negative return in every month of the first half of 2022.

The yield moves were led by the front end, as the US 2-year to 10-year Treasury curve inverted, which is historically associated with an increased risk of recession over the following 12-24 months. Risk assets broadly suffered from the combination of hawkish monetary policy, persistent inflation, poor growth expectations, and geopolitical events. Credit spreads widened across corporate, securitized, and emerging market bonds.

At the start of 2023, developed market equities rallied, gaining 7.1% in January. Disinflationary signals and expectations that central banks would slow the pace of interest rate hikes in 2023 drove performance. Renewed hope of a soft landing sparked growth-oriented sectors of the market to rally. In February, persistently high inflation resurfaced as a major headwind to equity performance as central bankers emphasized the need for a prolonged period of tighter financial conditions. Strong US economic data and stickier-than-expected inflation signaled a stronger case for additional interest rate hikes.

After a strong start to March, fallout from the collapse of two US banks – Silicon Valley Bank and Signature Bank – and the takeover of Credit Suisse sent shockwaves through equity markets and fueled fears of a widespread bank run. Equities recovered on the back of a wide-ranging response to stabilize midsize banks in the US and actions of central banks to reinstate confidence in the health of the global banking system.

On the brighter side, higher yields were viewed as an opportunity for many fixed income investors and may have provided important technical support as central banks across most of the developed world raised short-term rates. Indeed, despite the Silicon Valley Bank and Signature Bank defaults and banking sector concerns, credit premiums have yet to match the highs seen during other stress periods. Looking forward, the silver lining for fixed income investors is

1

Portfolio management review

Optimum Fixed Income Fund

manifest in the higher yields that offer an income buffer against further price volatility.

Source: Bloomberg, unless otherwise noted.

Fund performance

For the fiscal year ended March 31, 2023, Optimum Fixed Income Fund declined, underperforming its benchmark index, the Bloomberg US Aggregate Index, which also declined. The following remarks describe factors that affected relative performance within these respective portions.

DMC

For the fiscal year ended March 31, 2023, DMC’s portion of Optimum Fixed Income Fund underperformed its benchmark, the Bloomberg US Aggregate Index.

In March 2022, the Fed began to raise rates and continued through March 2023 when the federal funds target rate reached a 4.75%-5.00% range. As rates rose, investors gradually shifted focus from inflation risk to recession risk and any unexpected consequences of the rapid liquidity withdrawal.

In managing its portion of the Fund, DMC seeks to be a provider rather than a taker of liquidity. Liquidity, in DMC’s view, enables it to take advantage of periods of uncertainty and provides the investment flexibility to take advantage of market opportunities as they arise. Throughout the most volatile period of the fiscal year, DMC increased its allocation to dislocated sectors, such as investment grade corporate bonds and mortgage-backed securities (MBS) when risk premiums increased amid investor fears. Conversely, DMC reduced allocations to credit-related securities, such as investment grade, high yield, and emerging market debt when liquidity improved, and risk premiums tightened excessively relative to expectations of higher recession risk.

The bank sector tremors in March 2023 detracted from performance as DMC held a modest overweight to certain regional banks. In particular, exposure to Silicon Valley Bank (SVB), which suffered a sudden depositor run and was quickly taken under conservatorship by the Federal Deposit Insurance Corporation (FDIC), was the key detractor from performance in DMC’s portion of the Fund. DMC has retained exposure to SVB securities, as it expects to have a more beneficial recovery outcome post-bankruptcy than the loss that would be incurred from selling securities at distressed market prices. We believe the high-quality assets available to SVB's holding company offer multiple paths to stronger-than-priced recovery scenarios. In addition, holdings in certain other banks that were caught in the headlines detracted from DMC’s performance. DMC’s exposure to senior securities of Citizens Bank N.A., a regional bank, and Credit Suisse AG, eventually taken over by UBS, detracted from performance. DMC reduced its exposure to both issuers but continues to hold positions in its portion of the Fund.

The heightened volatility in risk assets during the 12-month period resulted in indiscriminate underperformance for higher-quality securitized issues. As a result, DMC’s overweight to commercial mortgage-backed securities (CMBS) detracted from performance in its portion of the Fund. The focus on senior structures with ample subordination and fundamentally sound collateral is likely to benefit from an eventual stabilization in volatility, and DMC continues to hold the overweight with an expectation of opportunistically increasing exposure if weakness persists.

Lastly, while DMC reduced its allocation to plus sectors, such as emerging markets and high yield debt, its through-cycle exposure to these sectors modestly detracted from performance in its portion of the Fund in a spread-widening environment. Larger issuers, such as Bausch Health Companies Inc. within high yield corporates, underperformed amid higher volatility. DMC continues to hold exposure.

To manage interest rate risk, DMC positioned its portion of the Fund with a short duration position for most of the fiscal year before shifting to a neutral and long position once 10-year Treasury rates reached 4%. This risk management approach was advantageous to performance, along with positioning exposure to maturities that benefited from yield curve flattening.

In addition, DMC’s disciplined increase of its position in agency MBS to slim its underweight versus the benchmark when valuations became more attractive contributed to performance, as did its preference for higher yielding more-recent securities within the sector.

Within credit securities, DMC’s portion of the Fund benefited from exposure to bank loans such as Viasat Inc., a mobile satellite service provider that profited from new technology and an acquisition. DMC continues to hold the security in its portion of the Fund.

During the fiscal year, DMC used a variety of derivatives, including Treasury futures, options, and credit default swaps. Treasury futures and options were primarily used to manage interest rate risk. Credit default swaps and currency hedges were used to manage credit and foreign exchange risk. The use of derivatives materially contributed to performance for DMC’s portion of the Fund for the fiscal year.

PIMCO

PIMCO’s portion of the Fund underperformed its benchmark, the Bloomberg US Aggregate Index, for the 12 months ended March 31, 2023.

2

Interest rate strategies contributed to relative performance in PIMCO’s portion of the Fund. An overall underweight to US duration added to performance as US Treasury yields rose during the 12-month period. US yield curve positioning, with a focus on the intermediate portion of the curve, helped performance as short-end rates rose more than intermediate rates. Overall non-US interest rate strategies detracted from performance in PIMCO’s portion of the Fund, including exposure to Italian and Canadian duration as yields rose in these regions. This was partially offset by contributions from short exposure to UK interest rates as gilt yields also rose over the fiscal period. Lastly, emerging market interest rate strategies, including an allocation to Brazilian and Mexican local rates, detracted from PIMCO’s performance.

Spread sector strategies weighed on performance for PIMCO. Mortgage strategies modestly detracted from performance in PIMCO’s portion of the Fund. An overall underweight to agency MBS added to performance as the sector underperformed like-duration Treasurys while holdings of select non-agency MBS detracted from returns as non-agency mortgage spreads widened. Credit strategies detracted from performance for PIMCO’s portion of the Fund, including an allocation to high yield corporate credit, as high yield corporate credit spreads widened. Within investment grade corporate credit, contributions from an underweight to the sector were offset by security selection within financial names. Lastly, an allocation to US Treasury inflation-protected securities (TIPS) contributed to performance in PIMCO’s portion of the Fund, as inflation expectations rose.

Currency strategies were negative for PIMCO’s relative performance, including exposure to the Japanese yen and a basket of emerging market currencies that depreciated relative to the US dollar during the fiscal year.

At the end of the Fund’s fiscal year, PIMCO was modestly underweight duration, favoring US duration along with hedges in select regions such as the UK. PIMCO also held some diversifying rate exposure in Latin America, namely in higher-rated countries with what it viewed as compelling yield levels, benign inflation, and credible central banks.

Regarding spread strategies, PIMCO’s portion of the Fund was opportunistic in corporate credit while maintaining an underweight to generic investment grade corporate credit. PIMCO maintained diversified credit exposures and had a bias toward shorter-maturity and high-quality names while de-emphasizing generic corporate credit exposure. PIMCO actively sought compelling name and sector exposure given dispersion within the credit market. Within agency MBS, PIMCO favors higher coupons that it believes will be less likely to be affected by the Fed’s balance sheet unwind. PIMCO also continues to favor senior positions in mortgage credit given the inherent fundamental strength and the deleveraging nature of the asset.

PIMCO remains tactical with currency positioning and expects to find more individual currency opportunities over time. It will continue to seek opportunities from overshoots and undershoots that provide what PIMCO considers to be attractive risk-reward profiles and the ability to diversify sources of return.

PIMCO used credit default swaps, forwards, futures, interest rate swaps, options, and swaptions during the fiscal year, but these derivatives did not have a material impact on performance within its portion of the Fund during the fiscal year.

3

Portfolio management review

| Optimum International Fund | March 31, 2023 (Unaudited) |

| Performance review (for the year ended March 31, 2023) | ||

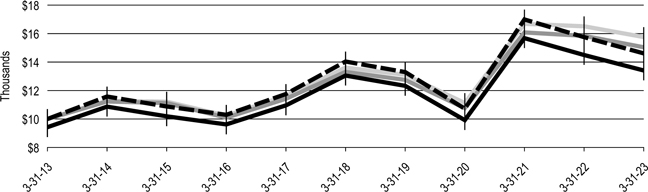

| Optimum International Fund (Institutional Class shares) | 1-year return | -7.24% |

| Optimum International Fund (Class A shares) | 1-year return | -7.49% |

| MSCI ACWI (All Country World Index) ex USA Index (net) (benchmark) | 1-year return | -5.07% |

| MSCI ACWI (All Country World Index) ex USA Index (gross) | 1-year return | -4.57% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum International Fund, please see the table on page 22.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 23 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Investment objective

The Fund seeks long-term growth of capital and may also seek income.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Acadian Asset Management LLC (Acadian)

Baillie Gifford

Overseas Limited (Baillie Gifford)

Market review

Global equity markets, as measured by the MSCI World Index (net) were down 7.02% for the fiscal year ended March 31, 2023, marking a highly challenging year for investors. In the second quarter of 2022, global equities had fallen 16.2%, the eighth-largest quarterly decline for global stocks in 50 years. Notably, both developed and emerging markets lagged as historically high levels of inflation, exacerbated by the Russia-Ukraine war and its effect on global food and energy prices, rattled world markets. Markets rebounded somewhat in the final half of the Fund's fiscal year.

Investors were concerned with inflation and the seismic shift in monetary policy that characterized the effort to control it throughout the fiscal year. Growth stocks suffered as the US Federal Reserve initiated a series of aggressive rate hikes that soared from near zero at the beginning of the 12-month period to a range of 4.75% to 5.0% at the end.

The Fed was joined by major central banks around the world, all raising interest rates to curb inflation despite concern that these actions could tip the global economy into a recession. After markets rallied in July, world stocks lost $9 trillion in value during a selloff that followed in August and September.

A milder-than-expected winter and timely investment in energy storage mitigated the effect of the Russia-Ukraine war on energy supplies and prices. Particularly in Europe, bottlenecks eased, and gas and electricity prices declined. At the same time, in the lead-up to the Chinese New Year, the Chinese Communist Party terminated its zero-COVID policy, boosting domestic demand for goods and services while providing relief to global supply-chain issues.

In the final month of the Fund’s fiscal year, the collapse of Silicon Valley Bank and Signature Bank in the US and Credit Suisse in Europe raised immediate concerns about the health of the financial system. As the fiscal period ended, those concerns eased somewhat as it appeared that the banking system was generally sound.

Source: Bloomberg, unless otherwise noted.

Fund performance

For the fiscal year ended March 31, 2023, Optimum International Fund declined, underperforming its benchmark, the MSCI ACWI ex USA Index (net), which also declined. Both Acadian’s and Baillie Gifford’s portions of the Fund underperformed the benchmark. Stock selection was a key detractor from performance in both Acadian’s and Baillie Gifford’s portions of the Fund. An allocation to China benefited both Acadian’s and Baillie Gifford’s portions of the Fund, as the lifting of COVID-19 restrictions enabled the economy to rebound while easing global supply-chain disruptions.

Acadian

Acadian focuses on its disciplined, value-focused, multi-factor approach and seeks to manage the Fund with consistency, objectivity, and appropriate risk controls. While the fiscal year was extremely challenging, as long-term investors, Acadian recognizes the inevitability of such episodes. Acadian’s approach to these extremes is to maintain a calm and measured perspective, removing emotion. Acadian believes it is counterproductive to overreact to exceptional conditions by making wholesale changes to its

4

quantitative model that has proven to be robust over the long term. Acadian remains confident in the resiliency and long-term efficacy of its process.

A combination of stock selection and an overweight position in the energy sector, along with advantageous stock selection in the communication services sector, contributed to relative performance in Acadian’s portion of the Fund. Energy was a significant concern for investors throughout the 12-month period, as tight supplies and rising demand fueled high energy prices. Acadian believes that concern is expected to continue as energy supply is likely to remain constrained due to disruptions stemming from the Russia-Ukraine war and years of low investment in production.

Meanwhile, the relentless pressure of inflation weighed on consumer confidence during the year and ultimately detracted from performance in the materials and consumer staples sectors as well as in Acadian’s portion of the Fund overall. Acadian’s exposure to the financials sector also detracted from performance in its portion of the Fund during the fiscal period.

Whitehaven Coal Ltd. and Novo Nordisk AS were leading contributors to relative performance in Acadian’s portion of the Fund for the fiscal year. Shares of Australian coal mining company Whitehaven surged as coal prices benefited from the global energy supply constraints the war in Ukraine created. At the end of the fiscal year, Acadian’s alpha forecast for Whitehaven was positive, driven by what it viewed as attractive quality and value measures. (Alpha is a measure of risk-adjusted performance.)

A holding in the Danish pharmaceutical giant Novo Nordisk proved successful for the fiscal period for Acadian’s portion of the Fund, as the company benefited from major market interest in semaglutide, a prescription drug that is a key component in diabetes and weight-loss medications. At the end of the fiscal year, Acadian’s alpha forecast for Novo Nordisk was favorable, owing to what it considered to be a combination of attractive technical, quality, and growth signals.

JBS SA and Sonova Holding AG were two leading detractors from performance in Acadian’s portion of the Fund for the fiscal year.

A position in Brazilian meat-processing company JBS detracted from relative returns for Acadian’s portion of the Fund, as consumer concern over the ethical and environmental effect of the cattle ranching industry, particularly in the Amazon, dampened the share price. At the end of the fiscal year, Acadian’s alpha forecast for JBS was slightly negative, owing mainly to an unfavorable outlook from Acadian’s top-down model, which looks at broad economic factors. Acadian continues to hold a small weighting in JBS in its portion of the Fund.

A position in Swiss hearing-aid company Sonova proved costly for Acadian’s portion of the Fund. Soaring costs and subdued demand from consumers hit hard by inflation weighed on the company. As a participant in the higher-priced hearing-aid market and distribution channel, Sonova also faced new competition from lower-priced hearing aids that can now be sold over the counter. At period end Acadian’s alpha forecast for Sonova was modestly positive, due largely to what it viewed as a favorable quality outlook.

At the end of the fiscal year, the largest country overweights in Acadian's portion of the Fund were Australia, China, and Israel. The largest underweight positions were in Japan, Switzerland, and the UK. In terms of sector positioning, Acadian’s focus for its portion of the Fund was on industrials, energy, and materials. Its largest underweight positions were in financials, consumer staples, and utilities.

Baillie Gifford

Baillie Gifford maintains its investment philosophy and process through changing market environments. Baillie Gifford fundamentally believes in long-term investing, and that share prices ultimately follow earnings growth. Baillie Gifford is focused on finding companies whose ability to generate earnings growth is independent of a particular market environment.

Although the Fund’s fiscal year was a difficult investment environment, Baillie Gifford remained focused on assessing each individual portfolio holding according to its merits. The volatility during the 12-month period gave Baillie Gifford, as a bottom-up (stock-by-stock) investor, the opportunity to add what it viewed as attractive companies at valuations not seen since the start of 2020.

From a sector perspective, industrials detracted the most from relative performance within Baillie Gifford’s portion of the Fund. Baillie Gifford’s exposure to industrials included a company specializing in innovative carbon capture, an auctioneer, and companies engaged in industrial automation. Baillie Gifford views its exposure to this sector as a mix of high-quality companies driven by idiosyncratic growth that it believes could play out in the long term.

While the lack of exposure to the energy sector also detracted from Baillie Gifford’s portion of the Fund, Baillie Gifford thinks these companies are reliant on increasing energy prices that are ultimately out of their control.

Two contributing sectors to performance within Baillie Gifford’s portion of the Fund were information technology (IT) and materials. Its holdings were comprised of several IT platforms across different regions and industries, including ecommerce, financial technology, wealth management, and real estate. These are businesses that Baillie Gifford believes can grow rapidly and improve inefficiencies in

5

Portfolio management review

Optimum International Fund

their respective marketplaces. An underweight position in materials also aided performance within Baillie Gifford’s portion of the Fund for the fiscal year.

MercadoLibre Inc. and CRH PLC were leading individual contributors to relative performance in Baillie Gifford’s portion of the Fund. The share price of MercadoLibre, Latin America’s leading ecommerce and online payments business, recovered strongly during the period. One of its main competitors, Americanas SA, recently filed for bankruptcy. MercadoLibre also reported strong recent quarterly results. The business continues to execute well, and Baillie Gifford added to its position.

Irish building materials business CRH also executed well and was rewarded by investors. Baillie Gifford thinks the company may benefit from stimulus measures in the US. Additionally, the company’s shift from being a pure building materials provider to offering higher-value solutions is driving margins upwards. CRH has put cash aside and is prepared to make value-accretive acquisitions, growing dividends and share buybacks.

Kingspan Group PLC and MonotaRo Co. Ltd. were two leading detractors from relative performance in Baillie Gifford’s portion of the Fund. Although both businesses met expectations from an operational perspective, they suffered from share-price weakness on the back of general sentiment and concern about a deteriorating economic outlook. Baillie Gifford continues to hold both companies, as it believes that their long-term growth opportunities remain strong.

Kingspan, an Irish insulation materials business, recently reported strong results that were in line with company guidance. Baillie Gifford found it encouraging that the company was able to raise prices to offset cost increases. Management also demonstrated a prudent approach to balance-sheet management and the discipline to acquire assets at sensible valuations.

MonotaRo, a Japanese maintenance, repair, and organization business, endured a difficult period in share-price terms despite strong execution. In its most recent results, the business reported 19% year-over-year revenue growth, exceeding management’s forecasts. The company’s progress in developing its digital offering is also encouraging. Although the market worries about the challenges presented by a weaker economic environment and rising input costs, Baillie Gifford remains optimistic, noting the company’s long runway of structural growth ahead and strong record of execution.

Overall, Optimum International Fund used derivatives, including foreign currency exchange contracts, during the fiscal year. However, these had a minimal effect on performance.

6

Portfolio management review

| Optimum Large Cap Growth Fund | March 31, 2023 (Unaudited) |

| Performance review (for the year ended March 31, 2023) | ||

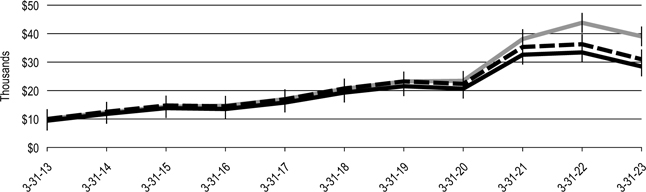

| Optimum Large Cap Growth Fund (Institutional Class shares) | 1-year return | -14.59% |

| Optimum Large Cap Growth Fund (Class A shares) | 1-year return | -14.76% |

| Russell 1000® Growth Index (benchmark) | 1-year return | -10.90% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Large Cap Growth Fund, please see the table on page 25.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 26 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Fund objective

The Fund seeks long-term growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Los Angeles Capital Management

LLC (Los Angeles Capital)

American Century Investment Management Inc. (American Century)

Significant Fund events

Effective July 22, 2022, American Century Investment Management, Inc. (American Century) replaced T. Rowe Price Associates, Inc. (T. Rowe Price) as one of the Fund's sub-advisors. American Century will manage the Fund along with Los Angeles Capital Management, LLC, the Fund's other sub-advisor.

Effective January 17, 2023, Los Angeles Capital replaced ClearBridge Investments, LLC (ClearBridge) as one of the Fund’s sub-advisors. Los Angeles Capital will manage the Fund along with American Century, the Fund’s other sub-advisor.

Market overview

The Fund's fiscal year ended March 31, 2023, was most notable for the most pervasive bout of inflation seen in 40 years and the US Federal Reserve’s rapid and aggressive effort to bring it under control. Beginning just a month prior to the start of the fiscal period, the Fed began raising interest rates, from near zero in March 2022 to a range of 4.75% to 5.00% by period end.

Inflationary pressures seemed not to respond at first, as the core inflation rate (excluding food and energy) rose to 6.6% in September before showing signs of easing. At the end of the fiscal year, however, inflation had dropped to 5.5%, still well above the Fed’s 2.0% target, but which investors took as a sign that the Fed was nearing the end of its rate-hike campaign.

While large-cap growth equities declined 10.9% overall in the fiscal year, as measured by the Russell 1000 Growth Index, the period ended on an up note as the asset class gained 14.4% in the final three months of the period, overcoming the threat of a banking collapse spawned by the failures of Silicon Valley Bank and Signature Bank in early March 2023. The sustained rise of interest rates throughout the period pressured the banks’ balance sheets to the point of collapse. Financial markets initially declined, as investors feared the problem might be widespread. The Fed quickly intervened, however, both guaranteeing all deposits and assuring investors that the banking system was sound. Nonetheless, there was a noticeable flight of deposits from banks in the last weeks of the period, foreshadowing a credit crunch that may portend economic weakness in the months ahead.

Source. Bloomberg, unless otherwise noted.

Fund performance

Optimum Large Cap Growth Fund posted a negative return that underperformed its benchmark, the Russell 1000 Growth Index, which also declined for the Fund’s fiscal year ended March 31, 2023. Both the T. Rowe Price and the Los Angeles Capital portions of the Fund underperformed relative to the benchmark during their respective management periods, while the American Century portion of the Fund performed generally in line with the benchmark and the ClearBridge portion of the Fund outperformed during their respective management periods.

While performance in individual sectors varied among the four managers depending on specific stock selection, one trend was clear: early in the fiscal year, the high-growth companies in the Fund suffered as higher yields pressured share prices. As the economic and market environments improved late in the fiscal period, high-growth companies rallied, finding increased favor with investors who had earlier been enamored with value stocks.

7

Portfolio management review

Optimum Large Cap Growth Fund

ClearBridge

ClearBridge normally invests in equity securities (or other instruments with similar economic characteristics) of US companies with large market capitalizations. ClearBridge’s core holdings are large-cap companies that it believes to be dominant in their industries due to product, distribution, or service strength.

During the time that ClearBridge managed its portion of the Fund it transitioned its portfolio into companies that possessed what it believed were the most attractive growth profiles over the next three to five years.

The consumer staples and consumer discretionary sectors were the primary contributors to performance in the ClearBridge portion of the Fund while information technology (IT) was the primary detractor from performance. Higher yields pressured valuations of long-duration growth companies, many of which reside in the IT sector and whose profits are discounted well into the future.

W.W. Grainger Inc., in the industrials sector, is a global distributor of maintenance, repair, and operating products and services. The company was a leading contributor for the ClearBridge portion of the Fund. The shares were supported by earnings that handily beat consensus expectations.

Monster Beverage Corp. also contributed significantly for ClearBridge’s portion of the Fund. In the consumer staples sector, Monster Beverage is a marketer and distributor of carbonated and non-carbonated energy drinks, shakes, and teas. In addition to its defensive characteristics that were in favor throughout 2022’s volatility, robust sales growth and declining prices for aluminum, a key input cost, have boosted Monster Beverage's stock.

Amazon.com Inc. was a leading detractor from performance for ClearBridge. The consumer discretionary company operates the leading ecommerce and hybrid cloud services platforms and has a burgeoning advertising business. A weaker-than-expected revenue forecast that indicated slowing demand in Amazon’s retail and cloud businesses negatively affected the stock.

Meta Platforms Inc. also detracted from performance in ClearBridge’s portion of the Fund. In the communication services sector, the company is a leading social media and digital advertising platform that operates the Facebook and Instagram social networks. A cyclical slowdown in digital advertising spending in its latest quarterly results pressured Meta shares.

T. Rowe Price

T. Rowe Price normally invests in stocks of large-capitalization companies with one or more of the following characteristics: strong cash flow and an above-average rate of earnings growth; the ability to sustain earnings momentum during economic downturns; and occupation of a lucrative niche in the economy and ability to expand even during times of slow economic growth. T. Rowe Price seeks to invest in high-quality businesses that can either provide defense in down markets or have the potential to outperform once inflation concerns are in the rear view.

Although security selection was the main driver for its relative underperformance, sector allocation also had a negative effect during the time that T. Rowe Price managed its portion of the Fund.

Consumer discretionary was the leading relative detractor in the T. Rowe Price portion of the Fund, primarily owing to stock selection. Within the sector, shares of online travel agency Expedia Group Inc. tumbled, reflecting the geopolitical tensions and inflationary pressures the global economy faced. Following the setback from the pandemic, travel in Europe was further affected by Russia’s invasion of Ukraine. This hurt Expedia’s retail segment, a major contributor to its revenues. Amazon.com Inc. also was a significant detractor in the T. Rowe Price portion of the Fund.

Stock choices and an overweight allocation in communication services likewise hindered relative returns in the T. Rowe Price portion of the Fund. Shares of Snap Inc. sold off sharply after management signaled a significant drop in advertising demand with macro headwinds putting downward pressure on advertiser budgets. Snap markets mobile-camera social media and technology-based applications to send and receive photos. The company’s gaming arm suffered due to a ban in the high-growth market of India coupled with the reopening of the global economy.

In contrast, stock selection in industrials and business services contributed to relative results in the T. Rowe Price portion of the Fund. Shares of FedEx Corp. advanced on forward guidance that exceeded consensus expectations with an emphasis on margin improvement in all business segments.

American Century

American Century seeks to invest in innovative, well-run companies that are reimagining their markets or creating entirely new ones. American Century takes a long-term view across the corporate life cycle, looking for companies in the early stages of growth and holds those companies over time, allowing them to potentially compound value for shareholders. Even during volatile, trying times, American

8

Century does not capitulate or change its approach, instead committing even stronger to fundamental research, risk controls, and diversification.

During the time that American Century managed its portion of the Fund, stock selection in the healthcare and financials sectors contributed the most to performance relative to the benchmark in the American Century portion of the Fund. Positioning in the industrials and IT sectors detracted from relative performance for American Century.

The leading individual contributor to relative performance in the American Century portion of the Fund was healthcare company Regeneron Pharmaceuticals Inc. The company reported better-than-expected revenue and earnings and announced strong trial results for Eylea, its drug for wet age-related macular degeneration. The results appear to be best in class and extend patent protection.

Another contributor to relative results in the American Century portion of the Fund was fast-casual restaurant chain Wingstop Inc. The company enjoyed strong unit growth and same-store sales growth. Its digital strategy is a key driver of transaction growth. During the reporting period, Wingstop reported strong results. New menu items and delivery platforms helped Wingstop achieve revenue and earnings that were much better than expected.

At the other end of the spectrum, Tesla Inc. was the leading detractor from relative performance in the American Century portion of the Fund. The electric vehicle maker’s stock struggled amid last year’s growth stock selloff and questions about CEO Elon Musk’s focus on Twitter. Tesla also faced concerns about softening demand amid a challenging macroeconomic environment. American Century retains high conviction in the stock and continues to hold the stock in its portion of the Fund. Given the company’s potential to transform industries, such as electric vehicles, self-driving cars, and power storage, American Century believes it’s short-sighted to react to every headline. American Century thinks short-term overreactions fail to take a holistic view of the company and its potential long-term business opportunities.

Advanced Drainage Systems Inc. was another notable detractor from relative results for the American Century portion of the Fund. The company is the leading provider of plastic-based solutions for stormwater and septic applications. The stock fell when the company lowered its revenue outlook but maintained earnings expectations. American Century added to the position on weakness, as its thesis around margin improvement and free cash flow generation remains intact.

Los Angeles Capital

Los Angeles Capital addresses the need for a forward-looking systematic approach to equity management, that allows for breadth of coverage, while seeking to avoid historical biases that can dictate traditional quantitative approaches. With an investment philosophy underpinned by Investor Preference Theory®, and an implementation process driven by a proprietary, dynamic model, Los Angeles Capital constructs portfolios that are designed to adapt and evolve to today's economic environment.

Los Angeles Capital’s investment process regularly surveys the market to understand what characteristics are driving investor preferences today. Rising uncertainty in the banking sector and ongoing inflationary and recessionary concerns have contributed to a more measured view among investors for valuation and risk.

During the time Los Angeles Capital managed its portion of the Fund, the financial and transportation sectors contributed to performance relative to the Russell 1000 Growth Index, while the technology and consumer cyclical sectors detracted from performance. Stock selection within the financial sector was particularly beneficial, whereas the Los Angeles Capital portion of the Fund benefited from both stock selection and an average underweight to the transportation group.

Technology and consumer cyclicals were beneficiaries of the market environment in 2023 as investors sought secular growth opportunities and the Los Angeles Capital portion of the Fund profited from its average overweight to those sectors. However, stock selection within each category held performance back.

Broadcom Inc. and Monolithic Power Systems Inc. were two notable contributors to relative returns for Los Angeles Capital in the technology sector during the management period. Both companies exhibited positive analyst sentiment and management quality relative to the broader US large-cap equity universe. Investors rewarded these two fundamental attributes during the reporting period.

NVIDIA Corp. and Microsoft Corp. were two notable detractors from relative performance for the Los Angeles Capital portion of the Fund during the reporting period. Because the stocks saw strong performance in 2023, the portfolio’s underweight allocations weighed down relative returns. Fundamental momentum has improved for these two firms, and should it persist, Los Angeles Capital believes the portfolio allocations should grow as market participants seek higher-quality growth opportunities in a weaker economic environment.

Neither American Century nor Los Angeles Capital utilized derivatives within the Fund during the fiscal year.

9

Portfolio management review

| Optimum Large Cap Value Fund | March 31, 2023 (Unaudited) |

| Performance review (for the year ended March 31, 2023) | ||

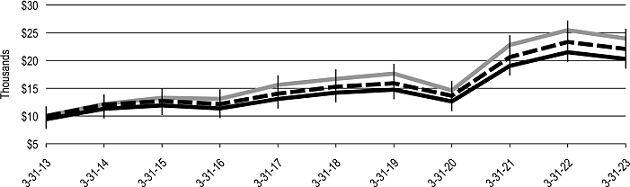

| Optimum Large Cap Value Fund (Institutional Class shares) | 1-year return | -5.40% |

| Optimum Large Cap Value Fund (Class A shares) | 1-year return | -5.61% |

| Russell 1000® Value Index (benchmark) | 1-year return | -5.91% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Large Cap Value Fund, please see the table on page 28.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 29 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Fund objective

The Fund seeks long-term growth of capital and may also seek income.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Massachusetts Financial Services

Company (MFS)

Great Lakes Advisors, LLC (Great Lakes) (formerly, Rothschild & Co)

Significant Fund event

Rothschild & Co Asset Management US (“Rothschild & Co”), the prior sub-advisor on the Fund, recently informed the Fund that Wintrust Financial Corporation (“Wintrust”) entered into an agreement to acquire Rothschild & Co (the “Transaction”). As part of the Transaction, Wintrust merged Rothschild & Co into Great Lakes Advisors, LLC (“Great Lakes”), an investment advisor wholly owned by Wintrust, as of the closing of the Transaction. The Transaction closed on April 3, 2023.

Market review

The most persistent and rapid bout of inflation in 40 years characterized the Fund's fiscal year ended March 31, 2023. The primary fuel for inflation was the unprecedented amount of fiscal and monetary stimulus provided during the pandemic. It was ignited by the boundless consumer demand that followed the lifting of economic restrictions, a breakdown in the global supply chain, and the disruption of energy supplies after the outbreak of war in Ukraine. The result was runaway prices throughout the global economy.

Within equity markets, value stocks outperformed growth stocks for much of the fiscal year, before reversing course toward the end of the period.

When the fiscal year began, the US Federal Reserve had just initiated a series of rate hikes to dampen inflation and was soon joined by other global central banks. Interest rates rose substantially throughout the 12-month period and, as the end of the fiscal year approached, it appeared that inflation was beginning to ease. The full effect of tighter monetary policy may not be felt for some time, however, given that monetary policy works with long and variable lags.

In the final month of the Fund’s fiscal year, higher rates caused visible stress for some small and regional US banks, culminating in the failures of Silicon Valley Bank and Signature Bank. Both banks lost depositors as customers sought higher yields on their savings. Given the importance of small- and mid-sized lenders to the provision of credit in the US, investors grew concerned that credit availability could shrink, leading to slower economic growth. On a more upbeat note, China’s abandonment of its zero-COVID policy unleashed pent-up demand in the world’s second-largest economy and led to improvements in the global supply chain.

Against an environment of still-tight labor markets, tighter global financial conditions, and volatile materials prices, investors grew concerned over the possibility that corporate profit margins may be past their peak in this cycle. That said, signs that supply chains have generally normalized, the lifting of COVID-19 restrictions in China, low levels of unemployment across developed markets, and hope that inflation levels may have peaked were supportive factors for the macroeconomic backdrop.

Source: Bloomberg, unless otherwise noted.

Fund performance

Optimum Large Cap Value Fund posted negative returns but outperformed its benchmark, the Russell 1000 Value Index, which also declined, for the Fund’s fiscal year ended March 31, 2023. Both the MFS and Great Lakes portions of the Fund outperformed the benchmark return.

10

The MFS portion of the Fund benefited from stock selection in the financials and information technology (IT) sectors, overcoming underperformance attributable to both stock selection and an underweight in the energy sector. Stock selection in the communication services sector also detracted from performance in the MFS portion of the Fund. In contrast, in Great Lakes’ portion of the Fund, outperformance was supported largely by favorable sector allocation which overcame modest underperformance attributable to stock selection. Overweight positioning in manufacturing, energy, and technology stocks contributed to performance in the Great Lakes portion of the Fund and was supported by favorable stock selection in those sectors. Great Lakes also maintained a position in cash throughout the fiscal year, which was beneficial in a down market.

MFS

MFS has maintained a consistent investment approach since this strategy’s inception. For its portion of the Fund, MFS uses a long-term time horizon in making investment decisions. MFS maintains a disciplined investment philosophy and process that is always focused on investing in high-quality companies trading at what it views as inexpensive valuations. As was the case last year, MFS assessed the impact of significant changes in the global economic outlook. During the fiscal year, these included rising inflation, interest rates, uncertain monetary policy, slowing growth, and the war in Ukraine.

An overweight position in The Progressive Corp., an insurance holding company, was a leading contributor to relative performance versus the benchmark in the MFS portion of the Fund. During the fiscal year, the company continued its impressive run of outperforming the market. The MFS allocation to the financials sector also benefited from a lack of investment in Bank of America Corp., which performed poorly during the fiscal year.

KLA Corp., a manufacturer and marketer of process-control equipment for the semiconductor industry, was an out-of-benchmark IT sector investment and a leading contributor to relative performance in the MFS portion of the Fund. MFS believes the company has been and will continue to be well positioned to benefit from the increasing complexity of semiconductor-wafer manufacturing.

Contributing to relative performance for the MFS portion of the Fund were overweight positions in industrial products and equipment manufacturer Illinois Tool Works Inc.; global security company Northrop Grumman Corp.; pharmaceutical company Merck & Co. Inc.; and health services company McKesson Corp. Additionally, a lack of investment in poorly performing diversified entertainment provider The Walt Disney Co. contributed to relative results versus the benchmark in the MFS portion of the Fund.

The energy sector performed well throughout much of the fiscal year as prices rose, resulting from both a post-recession boost in demand and the curtailment in supply following Russia’s invasion of Ukraine. The MFS portion of the Fund lacked an investment in integrated oil and gas company ExxonMobil Corp., which detracted from relative performance.

In the communications sector, an overweight investment in cable services provider Charter Communications Inc. detracted from performance in the MFS portion of the Fund, as the company significantly missed earnings in the fourth quarter of 2022. A lack of investment in Meta Platforms Inc., operator of Facebook and other social-media services, and in Netflix Inc., a provider of internet TV and movie-subscription services, also detracted from relative returns in the MFS portion of the Fund.

Stocks in other sectors that detracted from relative performance included MFS’s overweight positions in railroad and freight transportation services provider Union Pacific Corp., energy products and services supplier Dominion Energy Inc., consulting and IT services provider Accenture PLC, diversified financial services firm The PNC Financial Services Group Inc., and power and hand tools manufacturer Stanley Black & Decker Inc.

MFS exited its position in Stanley Black & Decker during the fiscal year. MFS continued to hold the other named detractors. Union Pacific is among potential beneficiaries of the long-term secular tailwind provided by the growth of ecommerce and enjoys embedded barriers to entry through its physical rail network. Dominion Energy is a regulated utility that stands to benefit as the power grid transitions to more renewable energy sources. IT consulting firm Accenture has long-range opportunities in helping its customers navigate the accelerated digitization of business taking place across industries. MFS continued to view PNC Financial Services Group as well positioned among regional bank peers given the strength of its balance sheet, funding sources, and capital levels.

Avoiding strong-performing biotech firm Gilead Sciences Inc. also detracted from relative performance in the MFS portion of the Fund.

Great Lakes

Great Lakes, formerly Rothschild & Co., employs an integrated approach that balances quantitative analysis, fundamental research, and risk management guidelines to identify stocks of companies it believes possess attractive relative valuation and an ability to exceed market expectations. Great Lakes’ investment process has been stable through many market cycles, maintaining a consistent approach even as economic and market environments fluctuate. Great Lakes believes that the market environment experienced during the most recent fiscal period was unprecedented, reflecting the Russia-Ukraine war, global central bank monetary tightening, and

11

Portfolio management review

Optimum Large Cap Value Fund

the failure of several banks. Great Lakes believes environments such as this, characterized by volatility, can unearth opportunities as pricing inefficiencies develop at the stock level, which is where Great Lakes focuses its attention.

Technology company ON Semiconductor Corp. was a leading contributor to relative performance in the Great Lakes portion of the Fund, even as the IT sector as a whole underperformed. The company is a leading supplier of semiconductors to broad end markets, including the automotive and industrial segments. ON Semiconductor has executed well in expanding margins and diversifying away from commoditized products. The next leg of its growth strategy is in silicon carbide relationships with major automotive companies. Two other IT companies that contributed to performance in Great Lakes’ portion of the Fund were Broadcom Inc. and Motorola Solutions Inc.

Manufacturing company Quanta Services Inc. was another leading contributor to performance for Great Lakes as the entire manufacturing sector outperformed. Quanta Services is an engineering and construction firm servicing utilities and telecommunications companies. Quanta Services benefited from strong secular spending trends by the utilities in transitioning to renewable energy and upgrading electric grids. Other contributors in the manufacturing sector included diversified manufacturer Parker-Hannifin Corp. and heavy equipment manufacturer Caterpillar Inc.

Telecommunications services provider Alphabet Inc. was a leading detractor from performance in the Great Lakes portion of the Fund.

The global provider of technology and related services, and best known for its Google search engine, was weak as Fed tightening resulted in a rotation from growth-oriented stocks that afflicted the technology sector generally. The company also confronted adverse company-specific news, including regulatory headwinds, slowing end-market trends, and increased competition. Great Lakes continues to hold the shares due to the stock’s attractive relative cash flow valuation metrics, the company’s dominance in important end markets, and optionality to expense-reduction efforts.

Real estate investment trust Boston Properties Inc. also detracted from performance for Great Lakes during the fiscal year. The company is a large owner of Class A office buildings in major cities. Its fundamentals have weakened against the backdrop of work-from-home trends and high office vacancies, which are pressuring results. Broader industry concerns, including higher interest rates, have weighed on the shares of the major owners of office properties. Great Lakes exited the position in its portion of the Fund during the fiscal year.

Other notable detractors from performance in the Great Lakes portion of the Fund included medical device manufacturer Baxter International Inc., online payments company PayPal Holdings Inc., consumer banking giant Bank of America Corp., and financial services provider The Charles Schwab Corp.

Neither Great Lakes nor MFS utilized derivatives within the Fund during the fiscal year.

12

Portfolio management review

| Optimum Small-Mid Cap Growth Fund | March 31, 2023 (Unaudited) |

| Performance review (for the year ended March 31, 2023) | ||

| Optimum Small-Mid Cap Growth Fund (Institutional Class shares) | 1-year return | -12.86% |

| Optimum Small-Mid Cap Growth Fund (Class A shares) | 1-year return | -13.08% |

| Russell 2500™ Growth Index (benchmark) | 1-year return | -10.35% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Small-Mid Cap Growth Fund, please see the table on page 30.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 31 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Fund objective

The Fund seeks long-term growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Principal Dynamic Growth (PDG)

Peregrine Capital Management,

LLC (PCM)

Market review

Throughout the Fund’s fiscal year ended March 31, 2023, equity markets were turbulent and challenging, characterized by a series of sharp declines interspersed with rebounds and reversals. The early months of the 12-month period featured double-digit market declines and was an especially challenging period for growth stocks. Small- to mid-cap stocks also significantly lagged their larger-cap peers. This reflected a sharp tightening of monetary conditions, rising bond yields, and the shock of Russia’s invasion of Ukraine, all of which were especially detrimental to longer-duration growth stocks. Energy stocks advanced by double digits in tandem with the spikes in oil and gas prices, although this was of little benefit to the small- to mid-cap growth universe.

Markets then staged a spirited rebound rally in June and early July, only to reverse course once again and slump through October, reaching new lows, driven by hawkish US Federal Reserve rhetoric and further interest rate hikes. Thanks to weaker-than-predicted inflation readings, markets rebounded sharply again in November and rallied through February 2023. More selling pressure ensued in March, as regional banking strains were ignited by the abrupt deposit runs at Silicon Valley Bank and Signature Bank. Encouragingly, prompt actions by the Federal Deposit Insurance Corporation (FDIC), the US Treasury, and the Fed appeared to avert further contagion, allowing market volatility to subside.

While the level of investor anxieties remained high at the end of the Fund’s fiscal year, these levels abated when the potential for a broader banking contagion seemed contained. The focus now for many investors is on the effect of the crisis on the availability of credit and the potential impact that tightening financial conditions could have on economic growth and market returns.

Source: Bloomberg, unless otherwise noted.

Fund performance

Optimum Small-Mid Cap Growth Fund underperformed its benchmark, the Russell 2500 Growth Index, for the fiscal year. PDG’s portion of the Fund trailed the benchmark as relatively cheap stocks outperformed the secular growth stocks that PDG favors. PCM’s portion of the Fund outperformed the benchmark, driven by stock selection in the consumer staples and consumer discretionary sectors.

PDG

Amid the chaotic market backdrop, sector and style leadership swung wildly throughout the period, with value stocks dramatically outperforming for much of the Fund’s fiscal year, followed by a sharp rebound in favor of growth over the final five months. Within the small- to mid-cap universe, results for growth and value finished the period neck in neck, masking the inter-period swings. However, both absolute and benchmark relative returns proved disappointing for PDG’s portion of the Fund.

The shortfall in relative portfolio results was concentrated primarily in the final quarter of calendar 2022, especially November amid the sharp rebound that was marked by outperformance among relatively cheap stocks at the expense of secular growth stocks, which PDG believes have strong fundamentals. It is these stocks that are typical of PDG’s investment discipline. Most notably, stocks in the highest quartile of sales growth lagged those in the lowest quartile by one of the widest margins in years.

13

Portfolio management review

Optimum Small-Mid Cap Growth Fund

There were no changes to PDG’s philosophy and process during the fiscal year. Reflecting the significant tightening of monetary conditions, rising bond yields, and increased risks of recession during the 12-month period, PDG consciously sought to reduce exposure to macroeconomic cyclicality, while opportunistically adding to durable structural growth beneficiaries that had been disfavored and derated during the fiscal year.

During the fiscal year, healthcare was the most challenging sector for PDG’s portion of the Fund. Its shortfalls reflected both derating of certain secular growth stocks it held as well as strong performance among stocks not held in PDG’s portion of the Fund. Industrials also detracted from performance as supply-chain challenges hurt certain holdings during the 12-month period.

Plug Power Inc. was among the largest individual detractors. Plug Power, a leading provider of hydrogen fuel cells and electrolyzers, was purchased when it appeared that demand for electrolyzers was set to accelerate following passage of the Inflation Reduction Act of 2022. This Act provided substantial tax credits for clean hydrogen producers in the US for several years to come. The stock subsequently underperformed, however, due to supply chain constraints squeezing its near-term profit margin and revenue performance. PDG sold the position from its portion of the Fund, given uncertainty over the timing of potentially improved revenue and earnings.

Shares of Qualtrics International Inc., a cloud-based software provider that is focused on innovative customer surveys and customer experience management, declined for the fiscal year. PDG owned Qualtrics in its portion of the Fund for secular penetration of its customer solutions and for cross-selling synergies related to acquisition of Clarabridge and its unstructured data software. Shares underperformed as part of a broad downturn of high-valuation software stocks in the face of rising interest rates and stagflation concerns. PDG sold the position from its portion of the Fund.

During the fiscal year, consumer discretionary and consumer staples were the largest contributors to relative performance for PDG’s portion of the Fund. Strong stock selection due to the secular and company-specific nature of the holdings in those sectors drove PDG’s performance. A favorable consumer backdrop that included continued strong employment, wage growth, and spending of excess savings also contributed to performance in PDG’s portion of the Fund.

e.l.f. Beauty Inc., a manufacturer of beauty and skincare products, was among the largest individual contributors to PDG’s portion of the Fund. The company benefited from market share gains, increased distribution at national retailers, and expansion into international markets. Its value proposition, innovation pipeline, and a highly engaged consumer base helped e.l.f. gain incremental shelf space planned for spring 2023, which we think should lead to continued robust results. PDG continues to hold the stock in its portion of the Fund.

Signify Health Inc., a healthcare provider that uses analytics, technology, and nationwide provider networks to support value-based programs, performed well for PDG’s portion of the Fund. PDG bought the stock for its accelerating revenue growth and improving margins as management refocused the business toward the higher-growth, home-based care segment, while announcing plans to exit the money-losing episodes of care business. While PDG’s view was initially validated by better-than-expected quarterly results and a raised outlook in the home health business, the stock rose further after initial takeover rumors were realized with CVS Health’s acquisition of the company. PDG exited the position in its portion of the Fund before the acquisition was completed.

PDG’s portion of the Fund continues to be most overweight to the consumer discretionary and consumer staples sectors, where it holds several companies tied to robust long-term trends in consumer services, brands, retailers taking market share, and housing-related holdings that could potentially benefit from stabilizing interest rates. Conversely, PDG’s portion of the Fund is most underweight the healthcare sector, which include service companies exposed to elevated labor costs, biotechnology owing to the binary nature, and the risk of small- to-mid-cap biotech names. PDG’s portion of the Fund also remains underweight the materials sector owing to a lack of what it views as compelling secular growth stories.

PCM

Despite the economic uncertainty, PCM’s high growth yet valuation sensitive approach generated relative outperformance for the fiscal year.

During the fiscal year, the consumer staples and consumer discretionary sectors were the largest contributors to performance for PCM’s portion of the Fund. PCM’s exposure to consumer staples benefited from stronger-than-predicted earnings results as well as the sector’s perceived safety in a volatile environment. In consumer discretionary, specialty and broadline retail drove outsized returns, particularly in discount-oriented segments. Discounters benefited from consumers trading down owing to rising inflation and economic uncertainty.

Healthcare and financials detracted the most from performance for PCM’s portion of the Fund. An industry overweight and stock selection in life science tools and services also hurt returns as a weaker biotech funding environment caused concern that companies exposed to biopharmaceutical research and development activity could be negatively affected. Additionally, in calendar years 2020 and 2021, many companies took advantage of COVID-related benefits

14

from both testing and drug development, which resulted in difficult comparisons and a slowdown in growth during the fiscal period.

The leading individual contributor to PCM’s portion of the Fund for the fiscal year was e.l.f. Beauty Inc. The firm sells high-end cosmetic products at affordable prices and is exposed to the attractive secular trend of demand for beauty and skin care products. The company has been successful in applying a fast fashion approach to product development and employing a digital-centric marketing strategy to retain and attract the Gen-Z cosmetic customer. As industry-wide COVID-related headwinds have lifted, e.l.f. has leveraged its strong marketing and product development strategies to gain meaningful market share. Additionally, it has benefited recently from a higher degree of trade down as economic prospects have weakened. This topline strength continues to benefit profit margins even as e.l.f. continues to invest in new products and marketing, resulting in strong fundamentals and stock performance.

Another strong contributor to PCM’s portion of the Fund was Lamb Weston Holdings Inc., one of the world’s largest producers of frozen potato products, supplying both foodservice and retail customers. French fries continue to be an area of growth for the company as they are a high-margin, low-cost menu item and consumer demand has been strong. Additionally, a historically poor potato harvest enabled Lamb Weston to renegotiate customer contract terms, giving it more favorable pricing and less price-to-cost (P/C) ratio mismatch. This, along with strong volume, contributed to both revenues and earnings throughout the fiscal year and drove the stock’s strong outperformance.

The leading detractor from performance in PCM’s portion of the Fund was Syneos Health Inc. Syneos is a contract research organization (CRO) that outsources clinical trial design and management for the biopharmaceutical industry. This is an industry with attractive industry tailwinds, in PCM’s view, as clinical trials are increasing in complexity and CROs offer expertise that many biopharmaceutical customers cannot replicate on their own. Although Syneos traded well below its peer group due to inconsistent execution, PCM believed it would continue to make progress and ultimately close this gap with its peers. However, this was not the case and in the third quarter of 2022, earnings results were well below consensus expectations. Weakness from small- and mid-sized customers, as well as limited visibility into potential future growth rates, caused the stock to underperform. PCM no longer holds Syneos in its portion of the Fund.

Omnicell Inc. also detracted from performance in PCM’s portion of the Fund. The company provides equipment used to automate medication dispensing by hospitals and pharmacies. Reducing costs and improving outcomes are at the forefront of healthcare providers’ minds. Omnicell’s products help improve efficiency for pharmacists, reduce theft, and integrate seamlessly with electronic health records. While significantly beneficial to hospitals, it is considered a capital sale. Accordingly, it can likely fall victim to timing surrounding budget and implementation cycles. Omnicell saw a pronounced change in customer behavior toward the end of 2022, which led to the deferral of some order deliveries. Much of this was labor related, as staffing shortages at hospitals have had wide-reaching effects. While no customers were lost and the backlog remained intact, Omnicell underperformed because of reduced visibility into the rate at which future revenue and bookings would be recognized. PCM continues to hold this position in its portion of the Fund because PCM believes the issues are transitory.

PCM’s process focuses on rapidly growing small-cap companies trading at valuations that do not yet reflect that strong growth. PCM’s portion of the Fund is currently most overweight the healthcare and industrials sectors. Conversely, it is most underweight the energy and consumer discretionary sectors.

Neither PDG nor PCM utilized derivatives within the Fund during the fiscal year.

15

Portfolio management review

| Optimum Small-Mid Cap Value Fund | March 31, 2023 (Unaudited) |

| Performance review (for the year ended March 31, 2023) | ||

| Optimum Small-Mid Cap Value Fund (Institutional Class shares) | 1-year return | -12.19% |

| Optimum Small-Mid Cap Value Fund (Class A shares) | 1-year return | -12.44% |

| Russell 2500™ Value Index (benchmark) | 1-year return | -10.53% |

Past performance does not guarantee future results.

For complete, annualized performance for Optimum Small-Mid Cap Value Fund, please see the table on page 32.

Institutional Class shares are not subject to a sales charge and are offered for sale exclusively to certain eligible investors. In addition, Institutional Class shares pay no distribution and service fee.

The performance of Class A shares excludes the applicable sales charge. The performance of both Institutional Class shares and Class A shares reflects the reinvestment of all distributions.

Please see page 33 for a description of the index. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Fund objective

The Fund seeks long-term growth of capital.

Advisor

Delaware Management Company (DMC)

Sub-advisors

LSV Asset Management (LSV)

Cardinal Capital Management LLC (Cardinal)

Market review

Small- and mid-cap value equities in the US fell during the Fund’s fiscal year ended March 31, 2023. Macroeconomic concerns dominated the stock and bond markets during the period and created a particularly challenging investment environment.

Persistent high inflation, significantly more restrictive monetary policy, the economic fallout from Russia’s invasion of Ukraine, and regional bank failures were the key issues. While inflation may have peaked, the US Federal Reserve's decision to continue aggressively raising short-term interest rates increased the likelihood of a recession in 2023.

Although economic growth in 2022 was tepid, the labor market remained quite healthy, even with increasing corporate layoffs. In fact, consumer spending has been resilient because the savings accumulated during the pandemic and prior strong wage gains have broadly offset higher prices and borrowing costs.

However, real estate and mergers-and-acquisitions activity decreased significantly during the fiscal year, as valuations adjusted to higher interest rates. A materially higher US dollar created another headwind for the profitability of many multinational companies. The Chinese government's abrupt decision to drop its zero-COVID policy also created more global economic challenges as China dealt with the impact of a surge in new COVID-19 cases. Corporate earnings began to reflect weaker economic conditions and higher input and interest costs. Considering these challenges, company guidance was generally more cautious during the 12-month period.

Within the US, value stocks broadly held up well relative to growth stocks during the fiscal period. Representing US small- to mid-cap stocks, the Russell 2500™ Index fell 10.39%, the Russell 2500 Value Index fell 10.53%, and the Russell 2500™ Growth Index fell 10.35%. US large-cap stocks held up more robustly than small-cap stocks for the fiscal year as the Russell 1000® Index fell 8.39, but the large cap index had trailed its smaller peers until the regional bank failures in March weighed down the smaller-cap indices. Similarly, value indices had outperformed their growth counterparts until the bank failures.

Within the Russell 2500 Value Index, energy was the only sector to generate a positive return while the communications, financials, and healthcare sectors suffered the steepest declines.

Source: Bloomberg, unless otherwise noted.

Fund performance