UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT

COMPANIES

| Investment Company Act file number: | 811-21335 |

| Exact name of registrant as specified in charter: | Optimum Fund Trust |

| Address of principal executive offices: | 2005 Market Street |

| Philadelphia, PA 19103 | |

| Name and address of agent for service: | David F. Connor, Esq. |

| 2005 Market Street | |

| Philadelphia, PA 19103 | |

| Registrant’s telephone number, including area code: | (800) 523-1918 |

| Date of fiscal year end: | March 31 |

| Date of reporting period: | March 31, 2012 |

Item 1. Reports to Stockholders

| |

|||

|

Optimum

Fixed Income Fund |

|||

|

Optimum International

Fund |

|||

| Optimum Large Cap Growth Fund | |||

| Optimum Large Cap Value Fund | |||

| Optimum Small-Mid Cap Growth Fund | |||

| Optimum Small-Mid Cap Value Fund | |||

| Annual Report | |||

| March 31, 2012 | |||

Carefully consider the Funds’ investment objectives, risk factors, charges, and expenses before investing. This and other information can be found in the Funds’ prospectus and, if available, their summary prospectus, which may be obtained by visiting www.optimummutualfunds.com or calling 800 914-0278. Investors should read the prospectus and, if available, the summary prospectus carefully before investing.

Table of contents

| Portfolio management review | |

| Optimum Fixed Income Fund | 1 |

| Optimum International Fund | 3 |

| Optimum Large Cap Growth Fund | 6 |

| Optimum Large Cap Value Fund | 9 |

| Optimum Small-Mid Cap Growth Fund | 12 |

| Optimum Small-Mid Cap Value Fund | 14 |

| Performance summary | |

| Optimum Fixed Income Fund | 18 |

| Optimum International Fund | 22 |

| Optimum Large Cap Growth Fund | 24 |

| Optimum Large Cap Value Fund | 26 |

| Optimum Small-Mid Cap Growth Fund | 28 |

| Optimum Small-Mid Cap Value Fund | 30 |

| Disclosure of Fund expenses | 32 |

| Security type/sector/country allocations | |

| and top 10 equity holdings | 34 |

| Financial statements | |

| Statements of net assets | 38 |

| Statements of assets and liabilities | 83 |

| Statements of operations | 84 |

| Statements of changes in net assets | 85 |

| Financial highlights | 88 |

| Notes to financial statements | 112 |

| Report of independent | |

| registered public accounting firm | 129 |

| Other Fund information | 130 |

| Board of trustees and officers addendum | 131 |

| About the organization | 133 |

Investments in Optimum Fixed Income Fund, Optimum International Fund, Optimum Large Cap Growth Fund, Optimum Large Cap Value Fund, Optimum Small-Mid Cap Growth Fund, and Optimum Small-Mid Cap Value Fund are not and will not be deposits with or liabilities of Macquarie Bank Limited ABN 46 008 583 542 and its holding companies, including their subsidiaries or related companies, and are subject to investment risk, including possible delays in repayment and loss of income and capital invested. No Macquarie Group company guarantees or will guarantee the performance of the Funds, the repayment of capital from the Funds, or any particular rate of return.

Unless otherwise noted, views expressed herein are current as of March 31, 2012, and subject to change. Holdings are as of the date indicated and subject to change.

Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management Business Trust, which is a registered investment advisor. Delaware Investments, a member of Macquarie Group, refers to Delaware Management Holdings, Inc. and its subsidiaries, including the Funds’ distributor, Delaware Distributors, L.P. Macquarie Group refers to Macquarie Group Limited and its subsidiaries and affiliates worldwide.

All third-party marks cited are the property of their respective owners.

© 2012 Delaware Management Holdings, Inc.

Portfolio management review

Optimum Fixed Income

Fund

April 10, 2012

| Performance review (for the year ended March 31, 2012) | ||||

| Optimum Fixed Income Fund (Class A shares) | 1-year return | +6.71% | ||

| Optimum Fixed Income Fund (Institutional Class shares) | 1-year return | +7.20% | ||

| Barclays U.S. Aggregate Bond Index (benchmark) | 1-year return | +7.71% |

For complete, annualized performance for Optimum Fixed Income Fund, please see the table on page 18.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Advisor

Delaware Management Company (DMC)

Sub-advisor

Delaware Management Company

(DMC)

Pacific Investment Management Company

LLC (PIMCO)

Market overview

Throughout the Fund’s fiscal year, political and economic policy makers around the world continued to have a significant effect on global financial markets, which were characterized by growing uncertainty.

Volatility was amplified during the first half of the Fund’s fiscal year on concerns surrounding the sovereign debt crisis in Europe, news of Standard & Poor’s downgrade of the long-term U.S. credit rating, and disappointing global growth expectations. During this period, the markets experienced a massive selloff in risky assets and a flight to U.S. Treasurys. The move caused interest rates across the yield curve to fall sharply. In response, the U.S. Federal Reserve signaled its intent to buy $400 billion of long-dated U.S. Treasurys through “Operation Twist,” which further fueled the rally in U.S. Treasurys.

Risk appetite cautiously returned in the second half of the Fund’s fiscal year amid improving U.S. economic data and short-term prevention of a disorderly default by a European sovereign. The European Central Bank instituted long-term refinancing operations in December 2011, which had an immediate stabilizing effect on markets. To further support the nascent recovery, the Fed indicated that economic conditions were likely to warrant exceptionally low rates at least through late 2014. Markets reflected optimism over these policy measures, and risk assets rallied during this period.

Fund performance

Although Optimum Fixed Income Fund lagged its benchmark index for the fiscal year, the Fund posted a positive return for the period. In general, returns for the Fund were aided by exposures to corporate bonds, both investment grade and high yield, while allocations to Treasurys detracted from returns.

DMC

DMC’s portion of Optimum Fixed Income Fund employs a diversified “core plus” investment strategy. This means that DMC seeks to invest the core of its assets under management in U.S. investment grade securities, and then strategically allocates other assets to additional fixed income markets. These additional sectors include U.S. high yield bonds as well as established and emerging international markets.

Within the investment grade market, emphasis on lower-medium and medium-grade (BBB- and A-rated) issues, as well as the generally positive effects of security selection, contributed to performance within DMC’s portion of the Fund.

The high yield bond market was a tale of two halves throughout the Fund’s fiscal year. As the period began, it underperformed other fixed income sectors as lower-quality issues did not directly participate in the interest-rate-driven rally in bond prices. However,

(continues) 1

Portfolio management review

Optimum Fixed Income Fund

exposure to the sector aided the performance of the DMC portion of the Fund during the second half of the fiscal year, as lower-quality issues produced both income and price appreciation benefits.

DMC’s focus continued to be about quality ratings, liquidity, potential downside protection, and seeking exceptional value for taking risk. For instance, it generally remained underweight in government-backed or agency mortgage-backed securities (MBS) as the team believed that such securities remained expensive for much of the Fund’s fiscal year. Though these areas of the market underperformed during much of the period, they did improve toward the end as rates rose slightly. Overall, however, the Fund’s portfolio holdings in agency mortgage-backed securities had a neutral effect for the Fund’s fiscal year.

Despite DMC’s bias toward higher-quality commercial mortgage-backed securities (CMBS), its overweight position in this category detracted from Fund performance early in its fiscal year, but became a positive as conditions improved. An overweight allocation to asset-backed securities (ABS) had a similar effect.

Finally, bonds issued within developed markets (denominated in local currencies) contributed to the Fund’s total returns during its fiscal year, despite lagging U.S. markets. Security selection, for example, was positive with benefits from the portfolio’s currency exposures in Australia and Canada.

PIMCO

In this environment, the PIMCO portion of Optimum Fixed Income Fund posted positive returns over the Fund’s fiscal year, both on an absolute basis and relative to its benchmark. It maintained an underweight allocation to U.S. duration, which detracted from returns as rates fell, especially in the third calendar quarter of 2011.

Tactical curve positioning, including an underweight position to the long end of the yield curve, also hurt returns. The negative effects of U.S. duration positioning were partially offset by duration exposure in other developed markets, particularly the United Kingdom and Australia, where interest rates also fell over concerns of a muted global economic recovery.

Corporate bond exposure near the benchmark was neutral for returns in PIMCO’s sleeve of the Fund, but an emphasis on the bonds of banks and other financial institutions hurt performance. These securities lagged the broader corporate sector amid fears of contagion related to European sovereign risk, although they recouped a portion of their losses in late 2011 as risk appetite returned and investors appreciated their relatively robust fundamentals. Within the mortgage-backed securities sector, an underweight to Ginnie Mae MBS hurt returns as Ginnie Mae MBS outperformed conventional MBS due to regulation-driven demand from banks and international investors. Modest holdings of nonagency MBS generally benefited performance amid strong demand for higher yielding assets in the second half of the fiscal year, although they hurt returns in periods of risk aversion earlier in the fiscal year.

Beyond core sectors, holdings of taxable Build America Bonds contributed to returns in PIMCO’s sleeve of the Fund as the sector outpaced like-duration Treasurys on limited supply and reduced negative headlines for municipal bonds. A modest allocation to local debt in Brazil also added to performance amid a sharp fall in Brazilian interest rates. Exposure to a select basket of emerging market currencies, which depreciated against the U.S. dollar, detracted from performance. This was mitigated by exposure to the Chinese renminbi, which was permitted to cautiously appreciate as economic imbalances persisted.

2

Optimum International

Fund

April 10, 2012

| Performance review (for the year ended March 31, 2012) | ||||

| Optimum International Fund (Class A shares) | 1-year return | -5.30% | ||

| Optimum International Fund (Institutional Class shares) | 1-year return | -4.93% | ||

| MSCI EAFE Index (gross) (benchmark) | 1-year return | -5.31% | ||

| MSCI EAFE Index (net) (benchmark) | 1-year return | -5.77% | ||

| Past performance does not guarantee future

results. For complete, annualized performance for Optimum International Fund, please see the table on page 22. The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions. Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. | ||||

Advisor

Delaware Management Company (DMC)

Sub-advisors

BlackRock Advisors, LLC

(BlackRock)

Mondrian Investment Partners Ltd. (Mondrian)

Market overview

Unless otherwise noted, regional performance cited below is based on each region’s respective MSCI index.

The Fund’s fiscal year was dominated by two distinct periods: the broad equity market selloff during the third calendar quarter of 2011, and the recovery that began during the subsequent quarter and continued into the first calendar quarter of 2012. The extent of the perceived flight from risk during the third calendar quarter, primarily driven by the sovereign debt crisis in Europe and political squabbling in the United States, was reflected in the MSCI EAFE Index, as it slid nearly 20% during the quarter.

Fortunately, the final quarter of the Fund’s fiscal year brought some relief for financial markets, as investors were somewhat appeased by the coordinated efforts of central banks and European politicians. The European Central Bank’s injection of liquidity into the European banking system, together with political initiatives to lay the groundwork for fiscal unity, were probably the most noteworthy events. Moving into the first three months of 2012, economic data out of the euro zone were less negative than expected, lending further support to investors’ appetite for risk.

Additional notes on regional developments during the fiscal year:

- In Europe, countries outside the euro zone

tended to perform well on a relative basis. The

U.K. equity market was among the

strongest-performing markets, up by 1.1%, as

the U.K. coalition government pressed ahead

with tough austerity measures.

- The energy-intensive Norwegian equity

market delivered one of the best relative

returns, although it still fell

3.1%.

- In contrast, euro zone equity markets tended

to underperform the broader index as sovereign

debt tensions lingered. For example, Greece had

by far the weakest-performing equity market,

down 63.3%; Portugal, Italy, and Spain each

fell more than 25%; and the French and German

equity markets decreased 15.6% and 7.8%,

respectively.

- In the Asia-Pacific region, the equity market in New Zealand generated the best relative return, up 17.9%. The Japanese equity market recovered well after the natural disasters and ended the period marginally positive.

Fund performance

Optimum International Fund generally performed in line with its benchmark index for the fiscal year, as Class A and Institutional Class shares posted slightly better returns than the MSCI EAFE Index (both gross and net figures).

(continues) 3

Portfolio management review

Optimum International Fund

The positive bias toward the Fund’s relative performance was due primarily to the performance of Mondrian’s portion of the Fund.

BlackRock

For the fiscal year ended March 31, 2012, BlackRock’s portion of the Fund underperformed its benchmark index. The majority of underperformance occurred during the dramatic selloff during the third calendar quarter of 2011. It was BlackRock’s intention to avoid making a macroeconomic directional bet on the economy, and to maintain sector weights similar to the benchmark. BlackRock generally kept its portion of the Fund’s portfolio at a low level of tracking error (measured as the tendency of portfolio returns to follow along those of the benchmark index). This approach, combined with minimal sector bets and a modest overweight allocation to cyclical categories, was a strategy framework that BlackRock believed should have served investors well.

The BlackRock portfolio sleeve began to suffer, however, and it lagged the benchmark notably during the third calendar quarter of 2011. There were three reasons for this result.

First, BlackRock’s holdings in the consumer discretionary and information technology (IT) sectors had greater exposure to China and other faster-growing end markets. More specifically within IT, internet software holdings included Tencent Holdings. The company is part of the social media industry in China and was negatively affected by speculations of a hard landing for China’s economy. The negative effects of stock selection in the consumer discretionary sector detracted from performance, as positions in the casinos-and-gaming and education services sectors had direct exposure to economic growth in China.

The second reason for BlackRock’s underperformance can be attributed to its positioning in the energy sector, where its holdings in the coal and oil-and-gas industries detracted from relative returns.

Lastly, an underweight allocation to healthcare industries, which was predicated on threats of austerity programs in Europe and the pressures they would put on drug reimbursement systems across the region, hurt relative performance. Looking across all major sectors in the benchmark index, healthcare proved to be the most resilient sector during the equity market downturn.

Despite the underperformance during the third calendar quarter of 2011, the BlackRock portion of the Fund rebounded strongly during the final six months of the fiscal year. Stock selection in sectors such as financials, IT, and utilities proved to be areas of relative strength. Within financials, emerging-market banks such as China Merchants Bank and Banco Bradesco benefited from easing fiscal and monetary conditions in their local markets. Positioning in IT was another contributor to the BlackRock portfolio — specifically after the market selloff during the third quarter of 2011 — as an overweight to semiconductors positively influenced returns. BlackRock favors so-called mission-critical software providers like Check Point Software Technologies, because it believes corporate IT departments will continue to purchase products in areas like security and business analytics to protect their businesses.

Mondrian

The Mondrian portion of the Fund led the benchmark index for the fiscal year.

The overall country allocations across the Mondrian portion of the Fund held back performance relative to the benchmark. In Europe, returns were hampered by the negative effects of an overweight exposure to the relatively weak Spanish and Italian markets, more than offsetting the positive effects of avoiding any exposure in Greece and Portugal. The Mondrian portion of the Fund benefited from an underweight position in Australia, as well as an overweight exposure to the Singaporean market and an out-of-benchmark position in Taiwan.

4

At the sector level, Mondrian’s overweight allocation to the healthcare and consumer staples sectors, as well as an underweight position in the materials sector, all resulted in positive returns versus the benchmark. The healthcare and consumer staples sectors were among the strongest performers within the index for the year. This positive performance was slightly offset by the negative effects of Mondrian’s overweight positioning in the weaker-performing telecommunications sector and an underweight position in the consumer discretionary sector.

Across Mondrian’s portfolio, the effect of stock selection was the dominant factor for outperformance during the fiscal year. At the country level, stock selection was notably strong in Japan, the United Kingdom, and Australia. Stock selection was also generally strong at the sector level, particularly within IT, energy, and industrials.

Both the aforementioned consumer staples and healthcare sectors demonstrated defensive qualities in what was generally a weak market for equities. Notable gains were recorded by names that included the consumer staples companies operated by Japanese food retailer Seven & i Holdings, and Unilever, the Anglo-Dutch food producer. Other notable performers included the pharmaceutical companies GlaxoSmithKline in the U.K., Sanofi in France, and Astellas Pharma in Japan; shares for these firms advanced 23.3%, 15.2%, and 15.3%, respectively during the fiscal year. In addition, Australian telecommunications company Telstra saw its shares gain 26.8% during the Fund’s fiscal year as a network transaction with the government progressed toward resolution.

Conversely, weak performance was recorded by companies that included the French food retailer Carrefour, which fell 32.2% during the fiscal year following several profit warnings that were triggered by strategic indecision and competitive pressures in the French market. Amid ongoing euro-zone sovereign debt tensions, Intesa Sanpaolo, the Italian retail bank, fell 31.6% during the fiscal year. In the telecommunication services sector, certain companies reacted to competition and a weak economy by reducing their guidance for shareholder distributions. Such companies included France Telecom and Telefonica, both of which lagged the broader market, declining by 25.8% and 28.2%, respectively.

(continues) 5

Portfolio management review

Optimum Large Cap Growth

Fund

April 10, 2012

| Performance review (for the year ended March 31, 2012) | ||||

| Optimum Large Cap Growth Fund (Class A shares) | 1-year return | +8.45% | ||

| Optimum Large Cap Growth Fund (Institutional Class shares) | 1-year return | +8.78% | ||

| Russell 1000® Growth Index (benchmark) | 1-year return | +11.02% | ||

| Past performance does not guarantee future

results. For complete, annualized performance for Optimum Large Cap Growth Fund, please see the table on page 24. The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions. Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index. | ||||

Advisor

Delaware Management Company (DMC)

Sub-advisors

Fred Alger Management, Inc. (Alger)

T.

Rowe Price Associates, Inc. (T. Rowe Price)

Marsico Capital Management, LLC

(Marsico)

Market overview

Most major U.S. stock market indices rose in the one-year period ended March 31, 2012. Driven by economic uncertainty and geopolitical concerns, however, market volatility was high during the Fund’s fiscal year.

At the beginning of the period, equities climbed despite turmoil in various Middle Eastern and North African countries, and sharp increases in oil and other commodity prices. Stocks started falling in May 2011, however, as U.S. and European economies weakened and the European sovereign debt crisis intensified. Shares bottomed in early October 2011, and staged a significant rally through the end of the Fund’s fiscal year. Investors were generally reacting to more sustainable signs of strengthening within the U.S. economy as well as central banks’ commitment across the developed world to continue implementing measures to suppress interest rates and stimulate economic growth.

Over the course of the entire fiscal year, the Russell 1000 Growth Index generated a solid, double-digit return.

Fund performance

Optimum Large Cap Growth Fund lagged its benchmark index for the fiscal year, due in part to underperformance within the financials sector by each of the Fund’s three sub-advisors. Returns within the energy and consumer staples sectors also detracted from the Fund’s performance.

Fred Alger Management, Inc.

Alger attempts to invest in companies that it believes are undergoing positive dynamic change, meaning that these companies are typically high-quality generating strong organic revenue, earnings, and free cash-flow growth. They also tend to be market-dominant companies with high barriers to competitive entry. During the latter months of 2011, the shares of these types of companies underperformed the benchmark. Fortunes changed during the first quarter of 2012, as investors generally rewarded the shares of companies that reported strong earnings growth.

As the equity markets started to decline during the summer of 2011, Alger became somewhat more defensive within its portion of the Fund by reducing cyclically sensitive exposure in the technology, energy, and industrials sectors, and increasing exposure to the more defensive consumer staples sector. Several months later as market conditions began to improve, it again increased holdings of companies in those cyclically sensitive sectors.

6

Within Alger’s portion of the Fund, relative outperformance within the industrials and information technology sectors were the most important contributors to performance. Alger’s large exposure to the information technology sector is based on its positive view of increased usage of the internet, as well as the continued global penetration of smartphone devices.

Alternatively, Alger’s positions within the energy and financials sectors detracted from performance within its portion of the Fund during the fiscal year. Its generally lower exposure to the energy sector was based on a reduced view of global oil demand combined with continued low natural gas prices.

Apple was the most important contributor to Alger’s portion of the Fund. As of the end of the fiscal year, shares of Apple stock continued to be reasonably priced in Alger’s opinion, despite the stock’s already strong positive price movement. Lowe’s was also a strong contributor to Alger’s portion of the Fund.

Several of the companies that detracted from Alger’s portion of the Fund were in the energy sector, primarily natural gas and coal related. Alger believes that the ongoing earnings pressure on many companies in these sectors may continue. As a result, Alger lessened its exposure in the portfolio and sold notable detractors Baker Hughes and Newfield Exploration during the fiscal year.

T. Rowe Price

Overall, stock selection and sector weighting decisions both contributed to the portion of the Fund managed by T. Rowe Price. The information technology, telecommunication services, and consumer discretionary sectors were leading outperformers, while healthcare, consumer staples, and financials were its principal detractors.

Information technology was by far T. Rowe Price’s primary contributor to relative performance, mostly due to stock selection, but its significant weighting also aided results. Shares of Apple were up sharply, largely due to robust demand for its products. The company released an upgraded version of the popular iPad tablet and announced a stock buyback and dividend payment plan.

The telecommunication services sector outperformed primarily due to stock selection decisions, with holdings concentrated in the wireless telecommunication services industry. Tower companies Crown Castle International and American Tower, which recently converted to a real estate investment trust, were among the top overall contributors to portfolio performance.

Stock selection in the healthcare sector was the primary detractor from T. Rowe Price’s portion of the Fund. Shares of biotechnology firm Human Genome Sciences tumbled after the company reported missing sales targets of its promising lupus drug, Benlysta. Although investors had expected a quick adoption of the drug, the time frame for its widespread use has lengthened.

T. Rowe Price remained underweight consumer staples stocks within its portion of the Fund — it does not typically place an emphasis on this sector as the manager believes it does not generally offer an opportunity for sustained double-digit growth. In this case, the underweighting hurt performance, as investors apparently favored defensive sectors during much of the fiscal year.

Marsico

The Marsico investment approach emphasizes owning stocks of high-quality companies with, in its view, compelling potential for long-term capital appreciation. Marsico’s investment process combines top-down macroeconomic and industry analysis with individual stock selection.

Marsico came into 2011 with optimism about the U.S. economy. However, as exogenous events occurred, such as the Japanese earthquake and tsunami, the Arab Spring, Congressional debt-ceiling discussions, and increasing concerns surrounding European sovereign debt, confidence among consumers and corporations declined. Marsico lowered its expectations for growth and positioned its sleeve of the Fund into more defensive growth names.

During the Fund’s fiscal year, positions in consumer-oriented companies generated strong returns. Within the sector, Marsico favored companies with durable

Portfolio management review

Optimum Large Cap Growth Fund

franchises and dependable revenue streams over time that could grow earnings in a “slow growth” environment. Companies that offered a cost savings to consumers such as TJX, priceline.com, Yum! Brands, and McDonald’s were material contributors to Marsico’s portion of the Fund. In addition, its overweight to consumer discretionary, among the best-performing sectors in the benchmark index, helped performance.

While Marsico’s holdings in the information technology sector posted positive returns in aggregate, led by its largest holding, Apple, the collective return of its technology holdings lagged that of the benchmark index, which hampered performance. In addition, the Marsico sleeve maintained an underweighted posture to information technology, the strongest-performing sector in the benchmark index, which also weighed on relative performance.

Stock selection in the financials sector also dampened returns as positions in Goldman Sachs Group, Citigroup, and PNC Financial Services Group were material detractors, and were sold from the Fund during the fiscal year. Marsico’s holdings in the financials sector were reduced significantly early in the reporting period as it became more concerned that the regulatory environment for financial companies had become considerably more complex and could ultimately result in regulations that could impact future profitability of some companies. Additionally, a particular holding in the energy sector, Halliburton, was a significant individual detractor as the market appeared to discount its earnings potential due to lower natural gas prices in the United States.

8

Optimum Large Cap Value

Fund

April 10, 2012

| Performance review (for the year ended March 31, 2012) | |||||

| Optimum Large Cap Value Fund (Class A shares) | 1-year return | +7.01 | % | ||

| Optimum Large Cap Value Fund (Institutional Class shares) | 1-year return | +7.32 | % | ||

| Russell 1000® Value Index (benchmark) | 1-year return | +4.79 | % |

For complete, annualized performance for Optimum Large Cap Value Fund, please see the table on page 26.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Herndon Capital Management, LLC (Herndon)

Massachusetts Financial Services Company (MFS)

Market overview

Back in early 2011, prior to the beginning of the Fund’s fiscal year, looser U.S. monetary and fiscal policy fostered a sharp rebound in market risk sentiment. By the beginning of the fiscal year, however, global macroeconomic conditions had begun to weaken and renewed concerns surrounding euro-zone sovereign debt arose, causing the recovery in asset valuations to level off.

As the period progressed, worries about U.S. sovereign debt default and the long-term sustainability of the trend in U.S. fiscal policy resulted in Standard & Poor’s downgrading U.S. credit quality. Amid this turmoil, global equity markets declined sharply and credit spreads widened. At the same time, global consumer and producer sentiment indicators fell precipitously and highly-rated sovereign bond yields hit multi-decade lows.

In the latter part of the fiscal year, however, improved global macroeconomic conditions coupled with additional liquidity from the U.S. Federal Reserve in the form of “Operation Twist” (in which it sold approximately $400 billion of its short-term security holdings while simultaneously purchasing an equivalent amount of longer-dated government securities) and from the European Central Bank in the form of 3-year, longer-term refinancing operations (LTROs), ushered in improved market dynamics.

In addition, multiple metrics used to define the health of consumers, corporations, and the broader U.S. economy — including employment data, consumer sentiment readings, and manufacturing and productivity measures — trended positively throughout the Fund’s fiscal year. As a result, U.S. stocks rose in three of the last four quarters and were boosted by encouraging data on both consumer spending and corporate profitability. The numbers in the first quarter of 2012 were particularly strong: both the Dow Jones Industrial Average and S&P 500® Index recorded historic first-quarter gains. These encouraging results, coupled with what appeared to be at least an interim solution to the Greek debt crisis, buoyed risk assets and seemed to provide optimism and comfort to many U.S. equity investors. (Source: Bloomberg.)

Fund performance

Optimum Large Cap Value Fund’s outperformance versus the benchmark index was due primarily to strong returns by several high-profile holdings in the Fund. The names, which represented a number of sectors and were held by different sub-advisors for the Fund, included Accenture, International Business Machines (IBM), Lockheed Martin, and MasterCard.

Herndon

Herndon’s approach in this market environment has been to seek out value-creating opportunities at the individual stock level and aggregate the individual stock information to determine the sector’s weighting. This approach led to outperformance during the Fund’s fiscal year.

(continues) 9

Portfolio management review

Optimum Large Cap Value Fund

Two sectors that outperformed and contributed the most to Herndon’s portion of the Fund were the consumer discretionary and information technology sectors. Gains in the consumer discretionary sector resulted from a diversified set of holdings leveraged to positive trends and growth in discount retailing (including Ross Stores and TJX) as well as international market growth and upscale retailing (Yum! Brands and Coach). Holdings within the technology sector, including Apple, IBM, Microsoft, and Accenture, were notable for their robust business models as well as being leveraged to major technological innovation and positive industry shifts, including smartphone and mobile computing growth, a rollout of cloud-based IT solutions, and continued demand for high-margin IT service, to name a few.

Two sectors detracted from Herndon’s portion of the Fund: financial services and energy. The financial services sector was one of three sectors in the benchmark index to post negative returns during the fiscal year. Strong performance in the financial services sector during the first quarter of 2012 was not enough to overcome the weakness of the first three quarters of the fiscal year. An overweight position in the energy sector, coupled with poor performance from several names that are more leveraged to natural gas production, detracted from performance for Herndon’s portion of the Fund.

TJX, advancing more than 60% during the fiscal year, was a key contributor to performance in Herndon’s portion of the Fund. TJX Companies is the leading off-price retailer of apparel and home fashions in the United States and worldwide. The company’s recent strong performance was driven, in part, by robust monthly sales numbers. TJX continues to take market share from department stores with similar-quality merchandise at better prices. Additionally, the company’s European business is beginning to report strong sales numbers. Management recently expressed optimism regarding this division’s early-stage turnaround after a challenging couple of years.

In terms of laggards for Herndon’s portion of the Fund, Lazard (declining approximately 40%), hurt performance as the company saw multiple macroeconomic trends pressure its stock. Lazard is a global financial advisory and asset management firm, focused on providing money-management and investment-banking services to corporations, partnerships, institutions, governments, and high net worth individuals. Like many financial institutions, particularly those leveraged to Europe, Lazard’s stock felt pressure from the global and European declines in investment banking, mergers and acquisitions, and initial public offerings. Herndon no longer holds this stock in the Fund.

MFS

MFS’s investment philosophy and approach remains consistent in all market environments because the management team believes focusing on investing in high-quality, undervalued stocks gives it the best potential for delivering long-term, strong risk-adjusted returns. Therefore, MFS did not make any changes to its approach during the course of the Fund’s fiscal year.

The combination of stock selection and an overweight position in the consumer staples sector contributed to Fund performance. An overweight allocation to tobacco company Philip Morris International aided returns within MFS’s portion of the Fund. Holdings of alcoholic-drink producer Diageo also contributed positively to performance.

Stock selection in the special products and services sector also contributed positively to performance within MFS’s portion of the Fund. Global consulting and outsourcing company Accenture was among the top relative contributors for its portion of the Fund during the fiscal year.

Stock selection in the industrial goods and services sector strengthened relative performance for MFS’s portion of the Fund. An overweight position in defense contractor Lockheed Martin had a positive effect on relative returns as the stock outperformed the benchmark.

10

Elsewhere, holdings of diversified technology products and services company IBM and debit and credit transaction processing company MasterCard aided relative returns. An overweight position in pharmaceutical and medical products maker Abbott Laboratories, and MFS’s avoidance of poor-performing financial services firm Citigroup, also contributed to performance relative to the benchmark.

Security selection in the healthcare sector detracted from the Fund’s relative performance. Not holding shares of strong-performing health insurance and Medicare/Medicaid provider UnitedHealth Group negatively affected relative results.

Stock selection in the financial services sector also weakened relative performance. Overweight positions in investment banking firm Goldman Sachs Group, financial firm Bank of New York Mellon, and insurance company MetLife hurt relative performance over the Fund’s fiscal year.

Elsewhere, the Fund’s holdings in enterprise software products maker Oracle, oil and gas exploration and production company Apache, and offshore drilling company Transocean were among the worst performers for MFS’s portion of the Fund. Not holding shares of global payments technology company Visa also detracted from performance. Additionally, strong-performing network equipment company Cisco Systems had a negative effect on relative performance — in the second quarter of 2011, the security underperformed and wasn’t in the benchmark. However, for the rest of the fiscal year, where performance was better, it was a large benchmark constituent and the Fund was underweight.

(continues) 11

Portfolio management review

Optimum Small-Mid Cap Growth

Fund

April 10, 2012

| Performance review (for the year ended March 31, 2012) | |||||

| Optimum Small-Mid Cap Growth Fund (Class A shares) | 1-year return | +0.33 | % | ||

| Optimum Small-Mid Cap Growth Fund (Institutional Class shares) | 1-year return | +0.68 | % | ||

| Russell 2500™ Growth Index (benchmark) | 1-year return | +2.70 | % |

For complete, annualized performance for Optimum Small-Mid Cap Growth Fund, please see the table on page 28.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Advisor

Delaware Management Company (DMC)

Sub-advisors

Wellington Management Company, LLP

(Wellington)

Columbia Wanger Asset Management, LLC (Columbia WAM)

Market overview

The Fund’s fiscal year was a volatile one for equity markets around the globe. Fueled by growing concerns regarding economic problems in Europe and the United States, markets came under significant pressure during the first half of the fiscal year as investors reacted to greater uncertainty and the prospect of slower growth.

Beginning in the latter half of the fiscal year, equity markets reversed course, gaining back much of the losses from earlier in the period. Generally, better-than-feared global economic data, interest rate cuts by the European Central Bank, and speculation that China may ease its monetary policy, outweighed continued uncertainty over the outcome of the euro-zone debt crisis.

Fund performance

Optimum Small-Mid Cap Growth Fund lagged its benchmark index for the fiscal year, due in part to poor returns by well-known holdings in the portfolios of both sub-advisors, including Shutterfly and James River Coal.

Wellington

During the Fund’s fiscal year, the investment team at Wellington continued to adhere to its disciplined and focused investment approach in managing its portion of the Fund, even as company fundamentals seemingly took a back seat to macroeconomic concerns during much of the period. The investment team’s research continued to focus on identifying companies that it believes are able to sustain superior revenue and earnings growth by virtue of their advantaged market positions. The team also remained conservative in the assumptions it used to estimate companies’ potential future earnings and cash flows, as well as in the valuation metrics it employed to set target prices.

Due to strong security selection, holdings in the healthcare and materials sectors contributed to relative results for Wellington’s portion of the Fund for the fiscal year. Conversely, weak security selection within the information technology, consumer staples, and industrials sectors was the main driver of underperformance.

At the individual security level, top relative contributors for the Fund’s fiscal year included mattress maker Tempur-Pedic International and contract research organization (CRO) Pharmaceutical Product Development. Share prices of Tempur-Pedic, a leading global manufacturer and distributor of premium mattresses and pillows with operations in approximately 80 countries, moved higher based on strong earnings results and better-than-expected earnings guidance. The investment team maintained its position in this name as it continues to believe the company has an impressive growth outlook. Alternately, the team sold its position in the stock of Pharmaceutical Product Development. The company, a CRO providing discovery, development, and

12

lifecycle management services, agreed to be acquired by private equity investors The Carlyle Group and Hellman & Friedman in an all-cash transaction.

Top relative detractors from Wellington’s portion of the Fund included technology hardware company Acme Packet, and energy company James River Coal. Acme Packet is a leading provider of session border control solutions that enable the delivery of voice over internet protocol (VoIP) and data communications across network borders. The stock underperformed after the company posted disappointing quarterly earnings due to higher-than-expected operating expenditures. The investment team maintains a positive view of Acme Packet based on the firm’s leading position in a fast growing market. James River Coal is a thermal and metallurgical coal producer. Lower production levels, increased costs, and concerns about slowing macroeconomic growth during the fiscal year negatively pressured share prices. James River Coal was ultimately eliminated from Wellington’s portion of the Fund.

Columbia WAM

Columbia WAM’s portion of the Fund employs a low-turnover, bottom-up, fundamental strategy. The investment team focuses on the merits of individual companies rather than macroeconomic headlines.

At the sector level, this portion of the Fund benefited from overweight allocations in the healthcare sector and an underweight position in the materials sector. Healthcare performed well given investors’ generally defensive stance during the period. Though its individual stock selection within healthcare was not positive for the period, Columbia WAM’s decision to overweight allocations in the sector was beneficial. Stocks owned in the materials sector (one of the poorest performing sectors within the Fund’s benchmark), outperformed the benchmark, and a relative underweight allocation there also helped returns.

The utilities and financials sectors were the largest detractors from performance. An underweight allocation in utilities is fairly standard for Columbia WAM’s growth strategy. The sector performed well during 2011 as investors looked for positive yield opportunities. As a result, the underweight allocation hurt returns, though this was beginning to reverse at the start of 2012. Columbia WAM’s portion of the Fund maintains a large underweight allocation to financials, though its holdings in the financials sector performed well relative to the benchmark. Ultimately, an underweight position in this sector detracted from returns within its portion of the Fund.

At the individual stock level, top contributors to performance for the Fund’s fiscal year included Alexion Pharmaceuticals and Lululemon Athletica. Alexion is a biotech company that focuses on orphan diseases; it performed well as its primary drug, Soliris, was approved for treating a severe neurological condition. Performance of Lululemon Athletica, a yoga-inspired athletic apparel company, was volatile during the Fund’s fiscal year, but was positive for the fiscal year as increased awareness of its brand name and product contributed to strong sales growth.

Detractors for the period included Shutterfly and InterMune. Internet photo-centric retailer Shutterfly fell victim to a fierce price war waged by all the internet photo book and photo card companies during the 2011 holiday season, resulting in a steep drop in stock prices for the year. InterMune is a biotechnology company focused on the research, development, and commercialization of innovative therapies in pulmonology and fibrotic diseases. The stock price suffered after the company received a negative ruling from a drug reimbursement board in Germany.

(continues) 13

Portfolio management review

Optimum Small-Mid Cap Value

Fund

April 10, 2012

| Performance review (for the year ended March 31, 2012) | |||||

| Optimum Small-Mid Cap Value Fund (Class A shares) | 1-year return | +1.01 | % | ||

| Optimum Small-Mid Cap Value Fund (Institutional Class shares) | 1-year return | +1.37 | % | ||

| Russell 2500™ Value Index (benchmark) | 1-year return | +0.09 | % |

For complete, annualized performance for Optimum Small-Mid Cap Value Fund please see the table on page 30.

The performance of Class A shares excludes the applicable sales charge and reflects the reinvestment of all distributions.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

Advisor

Delaware Management Company (DMC)

Sub-advisors

The Delafield Group, a division of

Tocqueville Asset Management L.P. (Tocqueville)

The Killen Group, Inc. (Killen)

Westwood Management Corp. (Westwood)

Market overview

The Fund’s fiscal year was a volatile one for equity markets around the globe. Fueled by growing concerns regarding economic problems in Europe and the United States, markets came under significant pressure during the first half of the fiscal year as investors reacted to increasing uncertainty and the prospect of slower economic growth.

Beginning in the latter half of the Fund’s fiscal year, equity markets reversed course, gaining back much of the losses from earlier in the period. Generally, better-than-feared global economic data, interest rate cuts by the European Central Bank, and speculation that China may ease its monetary policy, outweighed continued uncertainty over the outcome of the debt crisis in the euro zone. Amid this volatility, the benchmark Russell 2500 Value Index finished the fiscal year slightly above where it began, notching a small gain.

Fund performance

Security selection in the energy sector by two of Optimum Small-Mid Cap Value Fund’s three sub-advisors contributed to its outperformance versus the Fund’s benchmark.

Tocqueville

Despite the volatility, Tocqueville remained steadfast in its approach to investing. This company’s analytical, bottom-up (stock by stock) approach to investing generated a number of attractively priced investment prospects during the market’s downturn, which it opportunistically acted upon. Tocqueville also used cash reserves to add to its favorite holdings at what it believed to be reasonable valuations.

Tocqueville’s portion of the Fund had limited exposure to the energy sector. This limited position benefited performance relative to the benchmark, as energy was the weakest-performing sector for the fiscal year. Tocqueville also had virtually no exposure to financials, but this negatively affected relative performance within its portion of the Fund, as financials performed well for the Fund’s fiscal year. An overweight position in materials was also a negative for performance, as the sector underperformed during this period.

Stock selection was an overall positive for Tocqueville’s portion of the Fund, as it outperformed the corresponding benchmark returns in six of eight sectors. Investments in the industrials sector were the most beneficial to performance relative to the benchmark. Foot Locker, Solutia, and El Paso were the top contributors to performance. Foot Locker reported improving sales trends during the second half of the Fund’s fiscal year, and its earnings showed improved operational performance. Both Solutia and El Paso received takeover proposals at substantial premiums, which benefited Fund performance. In contrast, Ferro and Checkpoint

14

Systems detracted from performance for its portion of the Fund. Investors penalized Ferro for its exposure to the solar industry and European end markets. Checkpoint Systems experienced a sluggish business environment and disappointing topline results throughout the fiscal year.

Killen

Killen’s portion of the Fund generally performed well during the Fund’s fiscal year. It entered the Fund’s fiscal year with a larger-than-normal cash position, a result of strong performance late in the previous fiscal year that led Killen to take gains. This cash was beneficial to performance during the weak first half of the period and enabled Killen to buy stocks that were viewed as attractively priced as the year progressed. By the fall of 2011, it was essentially fully invested.

Killen uses a company-by-company approach, looking at the long-term potential for each business, and then judges its valuation based on that analysis. With this in mind, the company’s value-based, bottom-up approach led it to invest in situations that many investors seemed to view negatively, at least from a macroeconomic perspective. By focusing on individual companies and taking a long-term viewpoint, the company was able to look past the headlines surrounding Greece and other European debt problems, and invest in what were believed to be strong businesses with solid prospects.

The best-performing sectors for Killen’s portion of the Fund were consumer discretionary, energy, and materials. Its consumer discretionary stocks had broad strength with several holdings showing sizable gains. In energy, stock selection resulted in strong absolute gains for the sector despite energy stocks, in general, performing poorly during this period. In materials, both of its holdings turned in solid absolute gains for the fiscal year even though the sector as a whole struggled.

The only significantly underperforming sector was healthcare. The one healthcare holding produced negative returns while the sector as a whole was up (Killen sold its healthcare holding during the fiscal year). The underperformance in this area was not of a significant enough magnitude, however, to seriously hurt overall returns.

The two biggest positive contributors to its portion of the Fund were in the consumer discretionary sector: Sturm Ruger, a manufacturer of firearms, and Genesco, a shoe and hat retailer, each generated strong absolute returns. Both companies had significant revenue growth during the fiscal year, expanded profit margins, and gained market share in their respective specialty fields. The solid fundamental results, combined with low market expectations, caused their stocks to be revalued significantly higher.

SkyWest and Ducommun detracted from its portion of the Fund. SkyWest operates regional airlines that act as feeders to the hubs of the major airlines. The company experienced reduced profitability due to increased training costs and a less-than-smooth integration of an acquired rival. The poor results led Killen to re-evaluate the company’s long-term potential; it decided to begin selling its SkyWest position just prior to the end of the Fund’s fiscal year.

Ducommun also struggled with the integration of a large acquisition, and experienced a decline in profit margins. Killen believes that the acquisition could negatively affect Ducommun over the long term — therefore its position in the stock was reduced during the period.

Westwood

Westwood continued to use the consistent and disciplined investment approach that it employs through all market environments; that is, focusing on high-quality companies with strong fundamental characteristics and visible earnings prospects.

Security selection in the energy and technology sectors was the primary contributor to performance for this portion of the Fund. A number of the energy companies it held are beneficiaries of new exploration techniques, such as hydraulic fracturing, and persistently high crude-oil prices buoyed the earnings of exploration

(continues) 15

Portfolio management review

Optimum Small-Mid Cap Value Fund

and production firms. Within technology, its holdings generally performed well due to the strong earnings results of companies in that sector, as investor sentiment surrounding global economic growth generally improved toward the end of the Fund’s fiscal year.

Security selection within the financial services and producer durables sectors hindered relative performance. Holdings within financial services lagged because of concerns about bank capital levels and lack of loan growth, though the sector bounced back toward the end of the fiscal year after receiving mostly positive results from government “stress tests.” Despite the continued solid operating results of many companies in producer durables, this economically sensitive sector performed poorly due to extreme macroeconomic fears that were pervasive throughout much of this period. Like the financial services sector, however, these stocks, particularly those with global exposure, rebounded nicely late in the Fund’s fiscal year due to the renewed optimism about the global economy.

The top-performing security in this portion of the Fund was Motorola Mobility Holdings, which provides technologies, products, and services for mobile and wireline digital communication. The company’s August 2011 announcement that it was being acquired by Google at a significant premium to its market value drove its strong performance. Electronics manufacturer Hubbell was another strong performer. Its shares climbed after the company reported that its order growth remains strong despite still-poor commercial construction activity.

The poorest-performing stocks in Westwood’s portion of the Fund included Veeco Instruments, a provider of solutions and services within the LED lighting industry, and trucking parts manufacturer Navistar International. Veeco’s stock was weak as many investors grew concerned about overcapacity in the growing LED industry, while Navistar sold off after reporting disappointing second quarter 2011 earnings and on concerns of lower truck and transport demand as the economy weakened.

16

Performance summary

Optimum Fixed Income Fund

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 914-0278 or visiting our website at www.optimummutualfunds.com.

| Fund performance1, 2 | ||||||||

| Average annual total returns | ||||||||

| Through March 31, 2012 | 1 year | 3 years | 5 years | Lifetime | ||||

| Class A (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +6.71% | +13.56% | +6.98% | +6.12% | ||||

| Including sales charge | +1.91% | +11.81% | +5.99% | +5.56% | ||||

| Class B (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +6.15% | +12.90% | +6.30% | +5.45% | ||||

| Including sales charge | +2.15% | +12.31% | +6.06% | +5.45% | ||||

| Class C (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +6.15% | +12.85% | +6.30% | +5.45% | ||||

| Including sales charge | +5.15% | +12.85% | +6.30% | +5.45% | ||||

| Institutional Class (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +7.20% | +14.01% | +7.35% | +6.50% | ||||

| Including sales charge | +7.20% | +14.01% | +7.35% | +6.50% |

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 19. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.35% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses (excluding any 12b-1 fees and certain other expenses) from exceeding 1.00% of the Fund’s average daily net assets from July 29, 2011, through July 29, 2012. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

18

| Fund expense ratios | Class A | Class B | Class C | Institutional Class | |||

| Total annual operating expenses | |||||||

| (without fee waivers) | 1.46% | 2.11% | 2.11% | 1.11% | |||

| Net expenses | |||||||

| (including fee waivers, if any) | 1.35% | 2.00% | 2.00% | 1.00% | |||

| Type of waiver | Contractual | Contractual | Contractual | Contractual |

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds. The high yield secondary market is particularly susceptible to liquidity problems when institutional investors, such as mutual funds and certain other financial institutions, temporarily stop buying bonds for regulatory, financial, or other reasons. In addition, a less liquid secondary market makes it more difficult for the Fund to obtain precise valuations of the high yield securities in its portfolio.

If and when the Fund invests in forward foreign currency contracts or uses other investments to hedge against currency risks, the Fund will be subject to special risks, including counterparty risk.

The Fund may invest in derivatives, which may involve additional expenses and are subject to risk, including the risk that an underlying security or securities index moves in the opposite direction from what the portfolio manager anticipated. A derivative transaction depends upon the counterparties’ ability to fulfill their contractual obligations.

The Fund may experience portfolio turnover in excess of 100%, which could result in higher transaction costs and tax liability.

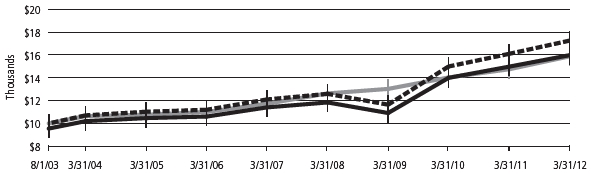

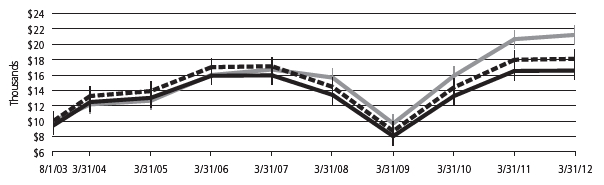

Performance of a $10,000

Investment1

Aug. 1, 2003

(Fund’s inception) through March 31, 2012

| Starting value (Aug. 1, 2003) | Ending value (March 31, 2012) | ||||

|

|

Optimum Fixed Income Fund — | ||||

| Institutional Class shares | $10,000 | $17,257 | |||

|

|

Optimum Fixed Income Fund — Class A shares | $9,550 | $15,982 | ||

|

|

Barclays U.S. Aggregate Bond Index | $10,000 | $15,882 | ||

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A and Institutional Class shares of the Fund on Aug. 1, 2003, and includes the effect of a 4.50% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table above. Please note additional details on pages 18 through 20.

(continues) 19

Performance summary

Optimum Fixed Income Fund

The chart also assumes $10,000 invested in the Barclays U.S. Aggregate Bond Index as of Aug. 1, 2003. The Barclays U.S. Aggregate Bond Index is a broad composite of more than 8,000 securities that tracks the investment grade domestic bond market.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Stock symbols and CUSIP numbers | ||||

| Nasdaq symbols | CUSIPs | |||

| Class A | OAFIX | 246118681 | ||

| Class B | OBFIX | 246118673 | ||

| Class C | OCFIX | 246118665 | ||

| Institutional Class | OIFIX | 246118657 |

20

Performance summary

Optimum International Fund

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 914-0278 or visiting our website at www.optimummutualfunds.com.

| Fund performance | ||||||||

| Average annual total returns | ||||||||

| Through March 31, 2012 | 1 year | 3 years | 5 years | Lifetime | ||||

| Class A (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | -5.30% | +16.18% | -4.28% | +6.12% | ||||

| Including sales charge | -10.72% | +13.90% | -5.41% | +5.39% | ||||

| Class B (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | -5.94% | +15.45% | -4.90% | +5.43% | ||||

| Including sales charge | -9.68% | +14.76% | -5.27% | +5.43% | ||||

| Class C (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | -5.94% | +15.43% | -4.90% | +5.44% | ||||

| Including sales charge | -6.87% | +15.43% | -4.90% | +5.44% | ||||

| Institutional Class (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | -4.93% | +16.61% | -3.94% | +6.49% | ||||

| Including sales charge | -4.93% | +16.61% | -3.94% | +6.49% |

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 23. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.35% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses, (excluding any 12b-1 fees and certain other expenses) from exceeding 1.40% of the Fund’s average daily net assets from July 29, 2011, through July 29, 2012. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

22

| Fund expense ratios | Class A | Class B | Class C | Institutional Class | |||

| Total annual operating expenses | |||||||

| (without fee waivers) | 1.88% | 2.53% | 2.53% | 1.53% | |||

| Net expenses | |||||||

| (including fee waivers, if any) | 1.75% | 2.40% | 2.40% | 1.40% | |||

| Type of waiver | Contractual | Contractual | Contractual | Contractual |

International investments entail risks not ordinarily associated with U.S. investments including fluctuation in currency values, differences in accounting principles, or economic or political instability in other nations. Investing in emerging markets can be riskier than investing in established foreign markets due to increased volatility and lower trading volume.

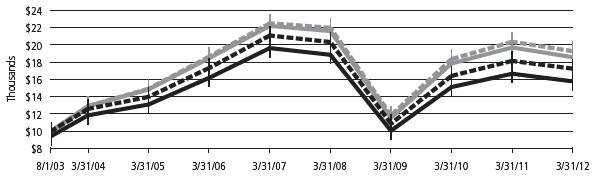

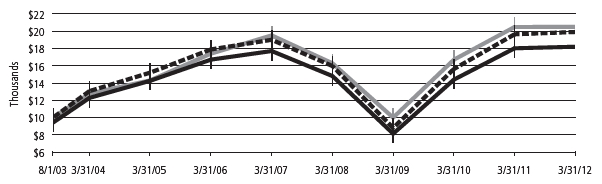

Performance of a $10,000

Investment

Aug. 1, 2003 (Fund’s inception)

through March 31, 2012

| Starting value (Aug. 1, 2003) | Ending value (March 31, 2012) | ||||

|

|

MSCI EAFE Index (gross) | $10,000 | $19,266 | ||

|

|

MSCI EAFE Index (net) | $10,000 | $18,557 | ||

|

|

Optimum International Fund — Institutional Class shares |

$10,000 | $17,240 | ||

|

|

Optimum International Fund — Class A shares | $9,425 | $15,768 | ||

1The “Performance of a $10,000 investment” graph assumes $10,000 invested in Class A and Institutional Class shares of the Fund on Aug. 1, 2003, and includes the effect of a 5.75% front-end sales charge (for Class A shares) and the reinvestment of all distributions. The graph does not reflect the deduction of taxes shareholders would pay on Fund distributions or redemptions of Fund shares. Expense limitations were in effect for some or all of the periods shown. Performance would have been lower had expense limitations not been in effect. Current expenses are listed in the “Fund expense ratios” table above. Please note additional details on pages 22 through 23.

The chart also assumes $10,000 invested in the MSCI EAFE Index as of Aug. 1, 2003. The MSCI EAFE Index measures equity market performance across developed market countries in Europe, Australasia, and the Far East. Index “gross” return approximates the maximum possible dividend reinvestment. Index “net” return approximates the minimum possible dividend reinvestment, after deduction of withholding tax at the highest possible rate.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indices are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Performance of other Fund classes will vary due to different charges and expenses.

| Stock symbols and CUSIP numbers | ||||

| Nasdaq symbols | CUSIPs | |||

| Class A | OAIEX | 246118731 | ||

| Class B | OBIEX | 246118723 | ||

| Class C | OCIEX | 246118715 | ||

| Institutional Class | OIIEX | 246118699 |

(continues) 23

Performance summary

Optimum Large Cap Growth Fund

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Please obtain the performance data for the most recent month end by calling 800 914-0278 or visiting our website at www.optimummutualfunds.com.

| Fund performance1, 2 | ||||||||

| Average annual total returns | ||||||||

| Through March 31, 2012 | 1 year | 3 years | 5 years | Lifetime | ||||

| Class A (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +8.45% | +24.47% | +2.92% | +6.01% | ||||

| Including sales charge | +2.20% | +22.02% | +1.71% | +5.28% | ||||

| Class B (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +7.70% | +23.67% | +2.25% | +5.32% | ||||

| Including sales charge | +3.70% | +23.07% | +1.84% | +5.32% | ||||

| Class C (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +7.61% | +23.64% | +2.23% | +5.31% | ||||

| Including sales charge | +6.61% | +23.64% | +2.23% | +5.31% | ||||

| Institutional Class (Est. Aug. 1, 2003) | ||||||||

| Excluding sales charge | +8.78% | +24.91% | +3.27% | +6.37% | ||||

| Including sales charge | +8.78% | +24.91% | +3.27% | +6.37% |

1Returns reflect the reinvestment of all distributions and are presented both with and without the applicable sales charges described below. Returns do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Expense limitations were in effect for certain classes during some or all of the periods shown in the “Fund performance” chart. The current expenses for each class are listed on the “Fund expense ratios” table on page 25. Performance would have been lower had expense limitations not been in effect.

Class A shares are sold with a maximum front-end sales charge of up to 5.75%, and have an annual distribution and service fee of up to 0.35% of average daily net assets. Performance for Class A shares, excluding sales charges, assumes that no front-end sales charge applied.

Class B shares may be purchased only through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B shares. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. Lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Institutional Class shares are available without sales or asset-based distribution charges only to certain eligible institutional accounts.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

2The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Management Company has agreed to reimburse certain expenses and/or waive certain fees in order to prevent total fund operating expenses, (excluding any 12b-1 fees and certain other expenses) from exceeding 1.25% of the Fund’s average daily net assets from July 29, 2011, through July 29, 2012. Please see the most recent prospectus and any applicable supplement(s) for additional information on these fee waivers and/or reimbursements.

24

| Fund expense ratios | Class A | Class B | Class C | Institutional Class | |||

| Total annual operating expenses | |||||||

| (without fee waivers) | 1.64% | 2.29% | 2.29% | 1.29% | |||

| Net expenses | |||||||

| (including fee waivers, if any) | 1.60% | 2.25% | 2.25% | 1.25% | |||

| Type of waiver | Contractual | Contractual | Contractual | Contractual |

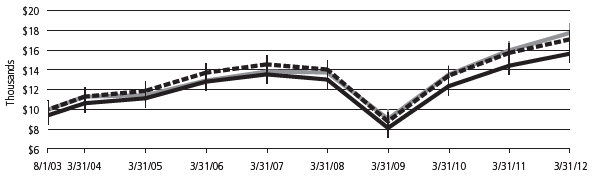

Performance of a $10,000

Investment1