Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21331

Wells Fargo Multi-Sector Income Fund

(Exact name of registrant as specified in charter)

525 Market St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-222-8222

Date of fiscal year end: October 31

Date of reporting period: October 31, 2019

Table of Contents

ITEM 1. REPORT TO STOCKHOLDERS

1

Table of Contents

Wells Fargo

Multi-Sector Income Fund (ERC)

Beginning on January 1, 2021, as permitted by new regulations adopted by the Securities and Exchange Commission, paper copies of the Wells Fargo Funds’ annual and semi-annual shareholder reports issued after this date will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website, and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by calling 1-800-730-6001.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports; if you invest directly with the Fund, you can call 1-800-730-6001. Your election to receive reports in paper will apply to all Wells Fargo Funds held in your account with your financial intermediary or, if you are a direct investor, to all Wells Fargo Funds that you hold.

Table of Contents

The views expressed and any forward-looking statements are as of October 31, 2019, unless otherwise noted, and are those of the Fund managers and/or Wells Fargo Asset Management. Discussions of individual securities, or the markets generally, or any Wells Fargo Fund are not intended as individual recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

Wells Fargo Multi-Sector Income Fund | 1

Table of Contents

Letter to shareholders (unaudited)

| 1 | The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock’s weight in the index proportionate to its market value. You cannot invest directly in an index. |

| 2 | The Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index. |

| 3 | The MSCI Emerging Markets (EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of emerging markets. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The Bloomberg Barclays Global Aggregate ex-USD Index is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index. |

| 6 | The Bloomberg Barclays Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index. |

| 7 | The ICE BofAML U.S. High Yield Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

2 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Letter to shareholders (unaudited)

Wells Fargo Multi-Sector Income Fund | 3

Table of Contents

Letter to shareholders (unaudited)

4 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Letter to shareholders (unaudited)

Notice to Shareholders

| ∎ | On November 22, 2019, the Fund announced a renewal of its open-market share repurchase program (the “Buyback Program”). Under the renewed Buyback Program, the Fund may repurchase up to 10% of its outstanding shares in open-market transactions during the period beginning January 1, 2020 and ending on December 31, 2020. The Fund’s Board of Trustees has delegated to Wells Fargo Funds Management, LLC, the Fund’s adviser, discretion to administer the Buyback Program, including the determination of the amount and timing of repurchases in accordance with the best interests of the Fund and subject to applicable legal limitations. |

| ∎ | The Fund’s managed distribution plan provides for the declaration of monthly distributions to common shareholders of the Fund at an annual minimum fixed rate of 9% based on the Fund’s average monthly net asset value per share over the prior 12 months. Under the managed distribution plan, monthly distributions may be sourced from income, paid-in capital, and/or capital gains, if any. To the extent that sufficient investment income is not available on a monthly basis, the Fund may distribute paid-in capital and/or capital gains, if any, in order to maintain its managed distribution level. You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or from the terms of the managed distribution plan. Shareholders may elect to reinvest distributions received pursuant to the managed distribution plan in the Fund under the existing dividend reinvestment plan, which is described later in this report. |

Wells Fargo Multi-Sector Income Fund | 5

Table of Contents

Performance highlights (unaudited)

The Fund is leveraged through a revolving credit facility and also may incur leverage by issuing preferred shares in the future. The use of leverage results in certain risks, including, among others, the likelihood of greater volatility of the net asset value and the market value of common shares. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. These risks are generally intensified in emerging markets. Derivatives involve additional risks, including interest rate risk, credit risk, the risk of improper valuation, and the risk of non-correlation to the relevant instruments that they are designed to hedge or closely track. Bond values fluctuate in response to the financial condition of individual issuers, general market and economic conditions, and changes in interest rates. Changes in market conditions and government policies may lead to periods of heightened volatility in the bond market and reduced liquidity for certain bonds held by the Fund. In general, when interest rates rise, bond values fall and investors may lose principal value. Interest rate changes and their impact on the Fund and its share price can be sudden and unpredictable. High-yield securities have a greater risk of default and tend to be more volatile than higher-rated debt securities. The Fund is exposed to mortgage- and asset-backed securities risk. This closed-end fund is no longer available as an initial public offering and is only offered through broker/dealers on the secondary market. A closed-end fund is not required to buy back its shares from investors upon request.

Please see footnotes on page 10.

6 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Performance highlights (unaudited)

MANAGERS’ DISCUSSION

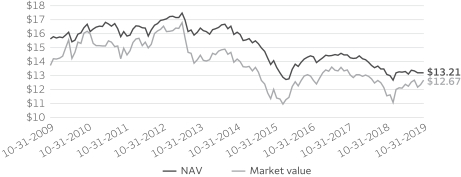

The Fund’s return based on market value was 20.91% for the 12-month period that ended October 31, 2019. During the same period, the Fund’s return based on its net asset value (NAV) was 11.34%. Based on its NAV based returns, the Fund outperformed the Multi-Sector Income Blended Index, which gained 10.32% over the same period.

Market conditions were aided by supportive central bank policies during the period.

During the reporting period, U.S. investment-grade corporate bonds, as measured by the Bloomberg Barclays U.S. Corporate Bond Index10, outperformed U.S. Treasuries, as measured by the Bloomberg Barclays U.S. Treasury Index11, by approximately 250 basis points (bps; 100 bps equal 1.00%). Negative performance in November and December 2018 was more than offset by spread tightening in 2019 as the U.S. Federal Reserve (Fed) pivoted to a more dovish stance.

Most securitized sectors also outperformed U.S. Treasuries, with non-agency commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS) outperforming U.S. Treasury bonds with the same duration by 150 bps and 59 bps, respectively. Non-agency collateralized mortgage obligation (CMO) performance during the period was also positive, with mezzanine bonds performing particularly well as consumer fundamentals remain strong. Performance within the mezzanine CMBS sector was also very strong, outperforming Treasuries of the same duration by 315 bps. Agency MBS modestly underperformed Treasuries, with spreads coming under pressure due to increased prepayment and supply concerns.

During the period, high-yield bonds returned 8.32%, as measured by the ICE BofAML U.S. High Yield Constrained Index, with a meaningful decline in November–December 2018 followed by a strong 2019 rally with positive returns in every month except May 2019. Spread widening over the period was more than offset by a decline in Treasury yields. The market was supported by solid and consistent gross domestic product growth, modest issuance over the past several years, and a relatively low default rate. Given the strong performance of Treasuries and spread widening, it is not surprising that higher-quality BB-rated bonds outperformed lower-quality bonds during the period. Indeed, lower-quality CCC-rated bonds had a negative return for the year. Loans returned 2.61%, as measured by the Credit Suisse Leveraged Loan Index12. Loans make up a portion of the high-yield sleeve and were a drag on overall performance.

There were strong gains among fixed-income assets across emerging markets over the reporting period, with increased monetary accommodation from core market central banks prompting a number of smaller central banks to follow suit. The slower pace of global growth, teamed with muted inflationary pressures, has been highly supportive for fixed income. It’s worth noting that emerging market bonds significantly outperformed emerging market currencies over the past year. The former are responsible for the bulk of overall gains while the latter has traded with a sideways bias.

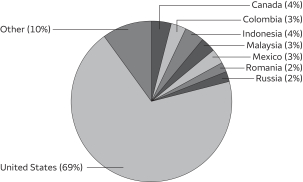

While the Fund maintained its tilt toward higher-yielding emerging markets, there were several changes to positioning. Positions in Australia, New Zealand, and India were sold after a period of strong gains drove yields to less attractive levels. The proceeds were used to build exposure to Romania and Russia. Changes to interest rate positioning were echoed at the currency level.

Please see footnotes on page 10.

Wells Fargo Multi-Sector Income Fund | 7

Table of Contents

Performance highlights (unaudited)

Contributors to performance included allocations to corporate bonds and higher-rated high-yield bonds as well as select countries.

Within the mortgage and corporate bond sleeve of the Fund, an overweight to corporate sectors contributed to relative performance, with finance and industrial sectors performing best. Securitized holdings also contributed. Lower-rated CMBS and residential MBS holdings were the largest contributors. AAA-rated CMBS and ABS were more modest contributors.

Within the Fund’s high-yield portfolio sleeve, rating allocation contributed to performance during the period. Less-than-market exposure to lower-quality CCC-rated credits and exposure to BBB-rated bonds added to relative performance. Compared with the broader high-yield market, the Fund benefited from less exposure to the energy exploration and production sector. Similarly, the lack of exposure to the metals and mining sectors contributed to relative performance. Fund holdings within the exploration and production sector also performed well on a relative basis.

Within the Fund’s allocation to international and emerging market bonds, yields in a number of bond markets moved significantly lower over the reporting period, but the gains seen in Brazil, Mexico, and India were particularly strong. At the currency level, exposure to the Indonesian rupiah and Mexican peso performed well.

The Fund’s use of leverage had a positive impact on total return performance during this reporting period.

Select securities and sector allocations detracted from performance.

The Fund’s mortgage/corporate credit sleeve holdings in certain agency MBS and CMBS positions modestly detracted from performance during the period due to security-specific prepayment and ratings changes.

Within the high-yield sleeve, sector allocation was modestly negative for the one-year period that ended October 31, 2019. Exposure to the banking, gaming and transportation, cable/satellite, health care, and information technology sectors all detracted from relative performance as those sectors lagged in return relative to the broader high-yield market.

Within international and emerging market bonds, the Brazilian real and Colombian peso underperformed over the reporting period and were a drag on performance. The Romanian bond market lagged its peers.

The Fund’s respective management teams have a mixed outlook on the market, seeing risks as well as opportunities.

The Fund’s mortgage and corporate bond sleeve’s management team agrees with the notion that current trade tensions threaten growth in the U.S. and abroad. This is based on the belief that the resilient U.S. consumer, aided by a solid job market, can continue to keep the overall economy out of recession, though some industries likely will continue to suffer from a combination of tariffs and uncertainty. It is likely, however, that the margin for error has eroded. Additional negative shocks could presage the end of this long-running expansion.

On a fundamental basis, credit metric trends deteriorated a bit as revenue and cash flow measures decelerated while leverage remained elevated. Profit margins remained at healthy levels. From a valuation perspective, the team believes current spread levels represent decent carry but with modest additional narrowing potential. The low absolute level of rates globally makes U.S. dollar bonds—and corporates, in particular—attractive to overseas buyers, providing an important source of support. The team thinks the BBB-rated category continues to offer good relative value. The mortgage and corporate bond sleeve’s management team still views financials as a better risk/reward proposition than industrials despite recent outperformance.

Within securitized sectors, the management team is focused on seasoned BBB-rated and A-rated CMBS conduit securities with lower retail property type concentrations and strong credit metrics.

Approximately 61% of the mortgage/corporate bond sleeve’s exposure is in corporate credit and around 34% is in fixed-rate and floating-rate mortgage securities. The largest industry exposures in the credit sector include insurance, energy, banking, and information technology companies.

The team for the Fund’s high-yield sleeve believes economic fundamentals are on solid footing, with a healthy consumer offsetting lower business investment in the economy. Economic conditions are benefiting from a strong labor market, giving consumers confidence to increase their spending. Meanwhile, uncertainty over trade and tariffs have delayed business investment. Absent something unexpected, we believe these conditions combined with accommodative central banks will continue and provide a solid backdrop for high-yield bond performance in the coming year. This view would be challenged by detrimental developments with trade policy or other policy changes as a result of the 2020 presidential election.

8 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Performance highlights (unaudited)

To that end, we think the market will continue to focus on U.S.-China trade and Fed monetary policy. As such, our outlook is unusually dependent on White House and Fed policies. If you take the view that the administration is committed to seeing fundamental changes to China and trade between the U.S. and China, then risk assets are likely on a long and challenging road as we think China may be reluctant to make such changes. On the other hand, to the extent you view more limited changes to the trading relationship between the U.S. and China to be acceptable to the White House, we believe there is significant room for a deal to be reached. The proposed phase one trade deal mirrors this more limited approach. To the extent that the phase one deal is completed and is designed to remain in place for some time, we believe it would likely prompt a positive reaction from risk assets. The Fed has been relatively aggressive, cutting rates three times and buying government debt through its overnight repo operations. These actions have been very supportive of risk assets and, absent meaningful increases in inflation, we expect the Fed to continue its accommodative stance.

Over the longer term, most asset classes are richly valued based on historical measures, and we expect that, at some point in the future, there may be a better entry point to buy most asset classes, including high-yield bonds. High yield, however, is rather unique in that it has historically benefited from relatively high coupons, which cushioned downside risks of potential price declines. With a benign default outlook, stable economy, and accommodative Fed, we believe that high-yield bonds should continue to perform well on a relative basis, though idiosyncratic or individual bond risk is high. The team leans toward spreads remaining flat from these levels in the short run before ultimately widening—potentially significantly—in the mid- to longer term.

Over a full cycle, the high-yield sleeve’s management team believes the best way to insulate the Fund from periodic bouts of systemic fears and rebalancing is by following a bottom-up investment process that attempts to minimize downside risk while capturing the return potential of high-yield issuers.

Within international and emerging market bonds, market sentiment has been volatile in recent quarters, with trade talks and geopolitics continuing to generate headlines. A key factor for the quarters ahead will be whether global growth can stabilize or whether weakness in manufacturing spreads into consumer spending. A comprehensive agreement between the U.S. and China could be a catalyst for a period of emerging market currency outperformance.

Please see footnotes on page 10.

Wells Fargo Multi-Sector Income Fund | 9

Table of Contents

Performance highlights (unaudited)

| ‡ | CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute. |

| 1 | Total returns based on market value are calculated assuming a purchase of common stock on the first day and a sale on the last day of the period reported. Total returns based on NAV are calculated based on the NAV at the beginning of the period and at the end of the period. Dividends and distributions, if any, are assumed for the purposes of these calculations to be reinvested at prices obtained under the Fund’s Automatic Dividend Reinvestment Plan. |

| 2 | Source: Wells Fargo Funds Management, LLC. Effective October 15, 2019, the ICE BofAML U.S. High Yield Constrained Index replaced the ICE BofAML U.S. Cash Pay High Yield Index in order to better match the Fund’s investment strategy. The Multi-Sector Income Blended Index is composed of 60% ICE BofAML U.S. High Yield Constrained Index, 18% J.P. Morgan GBI-EM Global Diversified Composite Index, 7.5% Bloomberg Barclays Credit Bond Index, 7.5% Bloomberg Barclays U.S. Securitized Index, and 7% J.P. Morgan Global Government Bond Index (ex U.S.). Prior to October 15, 2019, the Multi-Sector Income Blended Index was composed of 60% ICE BofAML U.S. Cash Pay High Yield Index, 18% J.P. Morgan GBI-EM Global Diversified Composite Index, 7.5% Bloomberg Barclays Credit Bond Index, 7.5% Bloomberg Barclays U.S. Securitized Index, and 7% J.P. Morgan Global Government Bond Index (ex U.S.). You cannot invest directly in an index. |

| 3 | The Bloomberg Barclays Credit Bond Index is an unmanaged index of fixed income securities composed of securities from the Bloomberg Barclays Government/Corporate Bond Index, Mortgage-Backed Securities Index, and the Asset- Backed Securities Index. You cannot invest directly in an index. |

| 4 | The Bloomberg Barclays U.S. Securitized Index is an unmanaged composite of asset-backed securities, collateralized mortgage-backed securities (ERISA eligible), and fixed-rate mortgage-backed securities. You cannot invest directly in an index. |

| 5 | The ICE BofAML U.S. Cash Pay High Yield Index tracks the performance of U.S. dollar-denominated below investment grade corporate debt, currently in a coupon paying period, that is publicly issued in the U.S. domestic market. You cannot invest directly in an index. |

| 6 | The ICE BofAML U.S. High Yield Constrained Index is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or more and have a credit rating lower than BBB-/Baa3 but are not in default. The ICE BofAML U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure. You cannot invest directly in an index. Copyright 2019. ICE Data Indices, LLC. All rights reserved. |

| 7 | The J.P. Morgan GBI-EM Global Diversified Composite Index is an unmanaged index of debt instruments of 31 emerging countries. You cannot invest directly in an index. |

| 8 | The J.P. Morgan Global Government Bond Index (ex U.S.) measures the total return from investing in 12 developed government bond markets: Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, the Netherlands, Spain, Sweden, and the U.K. You cannot invest directly in an index. |

| 9 | This chart does not reflect any brokerage commissions charged on the purchase and sale of the Fund’s common stock. Dividends and distributions paid by the Fund are included in the Fund’s average annual total returns but have the effect of reducing the Fund’s NAV. |

| 10 | The Bloomberg Barclays U.S. Corporate Bond Index is an unmanaged market-value-weighted index of investment-grade corporate fixed-rate debt issues with maturities of one year or more. You cannot invest directly in an index. |

| 11 | The Bloomberg Barclays U.S. Treasury Index is an unmanaged index of prices of U.S. Treasury bonds with maturities of 1 to 30 years. You cannot invest directly in an index. |

| 12 | The Credit Suisse Leveraged Loan Index tracks the investable market of the U.S. dollar denominated leveraged loan market. All loans are funded term loans with a tenor of at least one year and are made by issuers domiciled in developed countries. You cannot invest directly in an index. |

| 13 | The ten largest holdings, excluding cash, cash equivalents and any money market funds, are calculated based on the value of the investments divided by total net assets of the Fund. Holdings are subject to change and may have changed since the date specified. |

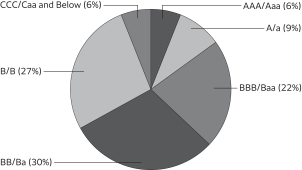

| 14 | The credit quality distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not to the Fund itself. The percentages of the Fund’s portfolio with the ratings depicted in the chart are calculated based on the total market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the middle rating was utilized. If rated by two of the three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard & Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified. |

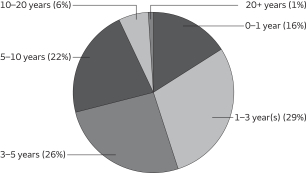

| 15 | Amounts are calculated based on the total long-term investments of the Fund. These amounts are subject to change and may have changed since the date specified. |

10 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Agency Securities: 1.33% |

| |||||||||||||||

| FHLMC (5 Year Treasury Constant Maturity +2.07%) ± |

3.54 | % | 9-1-2032 | $ | 676,535 | $ | 703,406 | |||||||||

| FHLMC |

8.50 | 7-1-2028 | 22,981 | 26,045 | ||||||||||||

| FHLMC Series 1383 (1 Year Treasury Constant Maturity +2.25%) ± |

4.79 | 2-1-2037 | 133,621 | 141,331 | ||||||||||||

| FHLMC Series 196 Class A (1 Month LIBOR +0.80%) ± |

2.72 | 12-15-2021 | 517 | 497 | ||||||||||||

| FHLMC Series 2011-K16 Class B 144A±± |

4.61 | 11-25-2046 | 1,000,000 | 1,044,712 | ||||||||||||

| FHLMC Series 2012-K17 Class B 144A±± |

4.33 | 12-25-2044 | 675,000 | 702,086 | ||||||||||||

| FHLMC Series 2012-K18 Class B 144A±± |

4.25 | 1-25-2045 | 810,000 | 842,097 | ||||||||||||

| FHLMC Series 2013-K30 Class B 144A±± |

3.56 | 6-25-2045 | 700,000 | 732,032 | ||||||||||||

| FHLMC Series 2390 Class FD (1 Month LIBOR +0.45%) ± |

2.37 | 12-15-2031 | 14,470 | 14,487 | ||||||||||||

| FHLMC Series 2567 Class FH (1 Month LIBOR +0.40%) ± |

2.32 | 2-15-2033 | 41,145 | 40,748 | ||||||||||||

| FHLMC Series 3987 Class CI (c) |

3.50 | 6-15-2026 | 4,805,320 | 233,210 | ||||||||||||

| FHLMC Series K007 Class X1 ±±(c) |

1.03 | 4-25-2020 | 574,423 | 1,002 | ||||||||||||

| FHLMC Series K016 Class X1 ±±(c) |

1.48 | 10-25-2021 | 323,486 | 8,006 | ||||||||||||

| FHLMC Series K020 Class X1 ±±(c) |

1.39 | 5-25-2022 | 6,154,971 | 183,952 | ||||||||||||

| FNMA (6 Month LIBOR +1.64%) ± |

4.14 | 9-1-2037 | 35,810 | 37,091 | ||||||||||||

| FNMA |

6.00 | 4-1-2033 | 55,795 | 57,667 | ||||||||||||

| FNMA |

7.50 | 2-1-2030 | 16,661 | 16,734 | ||||||||||||

| FNMA |

7.50 | 9-1-2030 | 22,145 | 22,279 | ||||||||||||

| FNMA Series 1996-46 Class FA (1 Month LIBOR +0.50%) ± |

2.32 | 8-25-2021 | 351 | 344 | ||||||||||||

| FNMA Series 1997-20 Class IO ±±(c) |

1.84 | 3-25-2027 | 252,391 | 6,447 | ||||||||||||

| FNMA Series 2001-25 Class Z |

6.00 | 6-25-2031 | 65,956 | 72,844 | ||||||||||||

| FNMA Series 2001-35 Class F (1 Month LIBOR +0.60%) ± |

2.42 | 7-25-2031 | 3,398 | 3,434 | ||||||||||||

| FNMA Series 2001-57 Class F (1 Month LIBOR +0.50%) ± |

2.32 | 6-25-2031 | 3,421 | 3,444 | ||||||||||||

| FNMA Series 2002-77 Class FH (1 Month LIBOR +0.40%) ± |

2.28 | 12-18-2032 | 23,179 | 23,241 | ||||||||||||

| FNMA Series 2002-97 Class FR (1 Month LIBOR +0.55%) ± |

2.37 | 1-25-2033 | 5,722 | 5,774 | ||||||||||||

| FNMA Series G91-16 Class F (1 Month LIBOR +0.45%) ± |

2.27 | 6-25-2021 | 1,164 | 1,167 | ||||||||||||

| FNMA Series G92-17 Class F (1 Month LIBOR +1.05%) ± |

2.87 | 3-25-2022 | 7,326 | 7,379 | ||||||||||||

| GNMA ±±(c) |

1.67 | 4-20-2069 | 9,947,769 | 427,607 | ||||||||||||

| GNMA |

6.50 | 6-15-2028 | 18,083 | 20,025 | ||||||||||||

| Total Agency Securities (Cost $5,120,072) |

|

5,379,088 | ||||||||||||||

|

|

|

|||||||||||||||

| Asset-Backed Securities: 0.74% |

| |||||||||||||||

| Asset-Backed Funding Certificates Series 2003-AHL1 Class A1 |

4.18 | 3-25-2033 | 135,236 | 137,377 | ||||||||||||

| Bear Stearns Asset Backed Securities Series 2002-2 Class A1 (1 Month LIBOR +0.66%) ± |

2.48 | 10-25-2032 | 118,939 | 119,404 | ||||||||||||

| Countrywide Asset Backed Certificates Series 2003-5 Class AF5 |

5.12 | 2-25-2034 | 73,985 | 74,036 | ||||||||||||

| CVS Pass-Through Trust Series T |

6.04 | 12-10-2028 | 430,349 | 484,727 | ||||||||||||

| Exeter Automobile Receivables Trust Series 15-3A Class D 144A |

6.55 | 10-17-2022 | 500,000 | 508,210 | ||||||||||||

| Five Guys Funding LLC Series 17-1A Class A2 144A |

4.60 | 7-25-2047 | 992,500 | 1,044,963 | ||||||||||||

| Mesa Trust Asset Backed Certificates Series 2001-5 Class A (1 Month LIBOR +0.80%) 144A± |

2.62 | 12-25-2031 | 9,047 | 8,970 | ||||||||||||

| MMAF Equipment Finance LLC Series 2017-AA Class A4 144A |

2.41 | 8-16-2024 | 170,000 | 171,107 | ||||||||||||

| Saxon Asset Securities Trust Series 2002-1 Class AF5 |

5.62 | 12-25-2030 | 104,605 | 108,884 | ||||||||||||

| Structured Asset Securities Corporation Series 1998-2 Class A (1 Month LIBOR +0.52%) ± |

2.34 | 2-25-2028 | 29,818 | 29,729 | ||||||||||||

| Structured Asset Securities Corporation Series 2002-9 Class A2 (1 Month LIBOR +0.60%) ± |

2.32 | 10-25-2027 | 27,144 | 27,075 | ||||||||||||

| Student Loan Consolidation Center Series 2011-1 Class A (1 Month LIBOR +1.22%) 144A± |

3.04 | 10-25-2027 | 273,401 | 274,216 | ||||||||||||

| Total Asset-Backed Securities (Cost $2,951,961) |

|

2,988,698 | ||||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 11

Table of Contents

Portfolio of investments—October 31, 2019

| Shares | Value | |||||||||||||||

| Common Stocks: 0.34% | ||||||||||||||||

| Energy: 0.34% |

||||||||||||||||

| Energy Equipment & Services: 0.34% | ||||||||||||||||

| Bristow Group Incorporated (a)‡ |

72,438 | $ | 1,389,651 | |||||||||||||

|

|

|

|||||||||||||||

| Materials: 0.00% |

||||||||||||||||

| Chemicals: 0.00% | ||||||||||||||||

| LyondellBasell Industries NV Class A |

9 | 807 | ||||||||||||||

|

|

|

|||||||||||||||

| Total Common Stocks (Cost $2,401,820) |

1,390,458 | |||||||||||||||

|

|

|

|||||||||||||||

| Interest rate |

Maturity date |

Principal | ||||||||||||||

| Corporate Bonds and Notes: 70.65% | ||||||||||||||||

| Communication Services: 12.06% |

||||||||||||||||

| Diversified Telecommunication Services: 0.80% | ||||||||||||||||

| AT&T Incorporated |

4.00 | % | 1-15-2022 | $ | 750,000 | 782,908 | ||||||||||

| Level 3 Financing Incorporated |

5.13 | 5-1-2023 | 975,000 | 987,188 | ||||||||||||

| Level 3 Financing Incorporated |

5.38 | 8-15-2022 | 252,000 | 252,945 | ||||||||||||

| Level 3 Financing Incorporated |

5.38 | 1-15-2024 | 700,000 | 713,125 | ||||||||||||

| Level 3 Financing Incorporated |

5.63 | 2-1-2023 | 500,000 | 505,000 | ||||||||||||

| 3,241,166 | ||||||||||||||||

|

|

|

|||||||||||||||

| Entertainment: 0.44% | ||||||||||||||||

| Live Nation Entertainment Incorporated 144A |

4.75 | 10-15-2027 | 50,000 | 52,130 | ||||||||||||

| Live Nation Entertainment Incorporated 144A |

4.88 | 11-1-2024 | 1,400,000 | 1,449,000 | ||||||||||||

| Live Nation Entertainment Incorporated 144A |

5.63 | 3-15-2026 | 250,000 | 266,250 | ||||||||||||

| 1,767,380 | ||||||||||||||||

|

|

|

|||||||||||||||

| Media: 9.05% | ||||||||||||||||

| CCO Holdings LLC 144A |

4.00 | 3-1-2023 | 100,000 | 101,750 | ||||||||||||

| CCO Holdings LLC 144A |

5.00 | 2-1-2028 | 150,000 | 156,938 | ||||||||||||

| CCO Holdings LLC |

5.13 | 2-15-2023 | 100,000 | 102,125 | ||||||||||||

| CCO Holdings LLC 144A |

5.13 | 5-1-2027 | 450,000 | 474,188 | ||||||||||||

| CCO Holdings LLC |

5.25 | 9-30-2022 | 1,250,000 | 1,267,188 | ||||||||||||

| CCO Holdings LLC 144A |

5.38 | 5-1-2025 | 3,550,000 | 3,683,125 | ||||||||||||

| CCO Holdings LLC 144A |

5.50 | 5-1-2026 | 215,000 | 226,556 | ||||||||||||

| CCO Holdings LLC |

5.75 | 9-1-2023 | 50,000 | 51,000 | ||||||||||||

| CCO Holdings LLC 144A |

5.75 | 2-15-2026 | 3,375,000 | 3,564,000 | ||||||||||||

| CCO Holdings LLC 144A |

5.88 | 4-1-2024 | 1,250,000 | 1,303,125 | ||||||||||||

| Charter Communications Operating LLC |

5.05 | 3-30-2029 | 675,000 | 761,355 | ||||||||||||

| CSC Holdings LLC 144A |

5.38 | 7-15-2023 | 1,395,000 | 1,429,847 | ||||||||||||

| CSC Holdings LLC 144A |

5.38 | 2-1-2028 | 425,000 | 449,438 | ||||||||||||

| CSC Holdings LLC 144A |

5.50 | 5-15-2026 | 1,275,000 | 1,343,531 | ||||||||||||

| CSC Holdings LLC 144A |

7.75 | 7-15-2025 | 2,030,000 | 2,177,175 | ||||||||||||

| Diamond Sports Group LLC 144A |

5.38 | 8-15-2026 | 175,000 | 182,656 | ||||||||||||

| Diamond Sports Group LLC 144A |

6.63 | 8-15-2027 | 175,000 | 180,250 | ||||||||||||

| DISH Network Corporation |

3.38 | 8-15-2026 | 1,300,000 | 1,215,580 | ||||||||||||

| Gray Television Incorporated 144A |

5.13 | 10-15-2024 | 450,000 | 466,313 | ||||||||||||

| Gray Television Incorporated 144A |

5.88 | 7-15-2026 | 3,875,000 | 4,073,671 | ||||||||||||

| Gray Television Incorporated 144A |

7.00 | 5-15-2027 | 325,000 | 355,638 | ||||||||||||

| Interpublic Group of Companies |

4.00 | 3-15-2022 | 750,000 | 779,458 | ||||||||||||

| Lamar Media Corporation |

5.38 | 1-15-2024 | 375,000 | 384,304 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

12 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Media (continued) | ||||||||||||||||

| Lamar Media Corporation |

5.75 | % | 2-1-2026 | $ | 100,000 | $ | 105,875 | |||||||||

| National CineMedia LLC 144A |

5.88 | 4-15-2028 | 1,500,000 | 1,576,650 | ||||||||||||

| National CineMedia LLC |

6.00 | 4-15-2022 | 1,900,000 | 1,919,190 | ||||||||||||

| Nexstar Broadcasting Group Incorporated 144A |

6.13 | 2-15-2022 | 1,025,000 | 1,039,094 | ||||||||||||

| Nexstar Escrow Incorporated 144A |

5.63 | 7-15-2027 | 150,000 | 158,205 | ||||||||||||

| Nielsen Finance LLC 144A |

5.00 | 4-15-2022 | 1,725,000 | 1,733,660 | ||||||||||||

| Outfront Media Capital Corporation |

5.63 | 2-15-2024 | 20,000 | 20,525 | ||||||||||||

| Outfront Media Capital Corporation |

5.88 | 3-15-2025 | 775,000 | 800,188 | ||||||||||||

| Salem Media Group Incorporated 144A |

6.75 | 6-1-2024 | 2,200,000 | 1,892,000 | ||||||||||||

| Scripps Escrow Incorporated 144A |

5.88 | 7-15-2027 | 100,000 | 102,470 | ||||||||||||

| The E.W. Scripps Company 144A |

5.13 | 5-15-2025 | 2,460,000 | 2,493,825 | ||||||||||||

| 36,570,893 | ||||||||||||||||

|

|

|

|||||||||||||||

| Wireless Telecommunication Services: 1.77% | ||||||||||||||||

| Sprint Capital Corporation |

6.88 | 11-15-2028 | 175,000 | 189,875 | ||||||||||||

| Sprint Capital Corporation |

8.75 | 3-15-2032 | 975,000 | 1,188,896 | ||||||||||||

| Sprint Communications Incorporated |

7.00 | 8-15-2020 | 225,000 | 231,788 | ||||||||||||

| Sprint Spectrum Company 144A |

5.15 | 9-20-2029 | 750,000 | 816,518 | ||||||||||||

| T-Mobile USA Incorporated |

4.00 | 4-15-2022 | 650,000 | 670,937 | ||||||||||||

| T-Mobile USA Incorporated |

4.50 | 2-1-2026 | 125,000 | 128,906 | ||||||||||||

| T-Mobile USA Incorporated |

4.75 | 2-1-2028 | 425,000 | 447,844 | ||||||||||||

| T-Mobile USA Incorporated |

5.13 | 4-15-2025 | 425,000 | 441,596 | ||||||||||||

| T-Mobile USA Incorporated |

5.38 | 4-15-2027 | 1,500,000 | 1,612,500 | ||||||||||||

| T-Mobile USA Incorporated |

6.00 | 3-1-2023 | 300,000 | 305,625 | ||||||||||||

| T-Mobile USA Incorporated |

6.38 | 3-1-2025 | 975,000 | 1,011,767 | ||||||||||||

| T-Mobile USA Incorporated |

6.50 | 1-15-2024 | 80,000 | 83,100 | ||||||||||||

| 7,129,352 | ||||||||||||||||

|

|

|

|||||||||||||||

| Consumer Discretionary: 9.00% |

| |||||||||||||||

| Auto Components: 1.63% | ||||||||||||||||

| Allison Transmission Incorporated 144A |

4.75 | 10-1-2027 | 650,000 | 664,625 | ||||||||||||

| Allison Transmission Incorporated 144A |

5.00 | 10-1-2024 | 2,250,000 | 2,306,250 | ||||||||||||

| Allison Transmission Incorporated 144A |

5.88 | 6-1-2029 | 400,000 | 431,000 | ||||||||||||

| Cooper Tire & Rubber Company |

7.63 | 3-15-2027 | 1,710,000 | 1,968,638 | ||||||||||||

| Cooper Tire & Rubber Company |

8.00 | 12-15-2019 | 600,000 | 603,000 | ||||||||||||

| Goodyear Tire & Rubber Company |

8.75 | 8-15-2020 | 468,000 | 489,060 | ||||||||||||

| Panther BF Aggregator 2 LP 144A |

6.25 | 5-15-2026 | 125,000 | 132,150 | ||||||||||||

| 6,594,723 | ||||||||||||||||

|

|

|

|||||||||||||||

| Distributors: 0.62% | ||||||||||||||||

| IAA Spinco Incorporated 144A |

5.50 | 6-15-2027 | 1,300,000 | 1,392,820 | ||||||||||||

| LKQ Corporation |

4.75 | 5-15-2023 | 1,075,000 | 1,096,156 | ||||||||||||

| 2,488,976 | ||||||||||||||||

|

|

|

|||||||||||||||

| Diversified Consumer Services: 1.72% | ||||||||||||||||

| Carriage Services Incorporated 144A |

6.63 | 6-1-2026 | 1,025,000 | 1,066,000 | ||||||||||||

| Service Corporation International |

4.63 | 12-15-2027 | 650,000 | 679,250 | ||||||||||||

| Service Corporation International |

5.38 | 5-15-2024 | 100,000 | 103,125 | ||||||||||||

| Service Corporation International |

7.50 | 4-1-2027 | 3,400,000 | 4,148,000 | ||||||||||||

| Service Corporation International |

8.00 | 11-15-2021 | 850,000 | 935,000 | ||||||||||||

| 6,931,375 | ||||||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 13

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Hotels, Restaurants & Leisure: 1.60% | ||||||||||||||||

| CCM Merger Incorporated 144A |

6.00 | % | 3-15-2022 | $ | 3,698,000 | $ | 3,785,828 | |||||||||

| Hilton Domestic Operating Company Incorporated 144A |

4.88 | 1-15-2030 | 100,000 | 106,250 | ||||||||||||

| Hilton Domestic Operating Company Incorporated |

5.13 | 5-1-2026 | 425,000 | 446,250 | ||||||||||||

| Wyndham Hotels & Resorts Company 144A |

5.38 | 4-15-2026 | 1,875,000 | 1,978,125 | ||||||||||||

| Yum! Brands Incorporated 144A |

4.75 | 1-15-2030 | 150,000 | 157,313 | ||||||||||||

| 6,473,766 | ||||||||||||||||

|

|

|

|||||||||||||||

| Internet & Direct Marketing Retail: 0.19% | ||||||||||||||||

| Expedia Incorporated |

5.95 | 8-15-2020 | 750,000 | 772,201 | ||||||||||||

|

|

|

|||||||||||||||

| Multiline Retail: 0.15% | ||||||||||||||||

| Macy’s Retail Holdings Incorporated |

3.88 | 1-15-2022 | 600,000 | 614,889 | ||||||||||||

|

|

|

|||||||||||||||

| Specialty Retail: 2.52% | ||||||||||||||||

| Advance Auto Parts Incorporated |

4.50 | 1-15-2022 | 600,000 | 625,241 | ||||||||||||

| Asbury Automotive Group Incorporated |

6.00 | 12-15-2024 | 1,175,000 | 1,216,125 | ||||||||||||

| Group 1 Automotive Incorporated |

5.00 | 6-1-2022 | 200,000 | 202,310 | ||||||||||||

| Group 1 Automotive Incorporated 144A |

5.25 | 12-15-2023 | 1,500,000 | 1,537,500 | ||||||||||||

| Lithia Motors Incorporated 144A |

5.25 | 8-1-2025 | 945,000 | 989,888 | ||||||||||||

| Penske Auto Group Incorporated |

3.75 | 8-15-2020 | 540,000 | 542,700 | ||||||||||||

| Penske Auto Group Incorporated |

5.38 | 12-1-2024 | 2,150,000 | 2,209,125 | ||||||||||||

| Penske Auto Group Incorporated |

5.75 | 10-1-2022 | 1,155,000 | 1,169,438 | ||||||||||||

| Sonic Automotive Incorporated |

5.00 | 5-15-2023 | 849,000 | 861,735 | ||||||||||||

| Sonic Automotive Incorporated |

6.13 | 3-15-2027 | 775,000 | 802,125 | ||||||||||||

| 10,156,187 | ||||||||||||||||

|

|

|

|||||||||||||||

| Textiles, Apparel & Luxury Goods: 0.57% | ||||||||||||||||

| The William Carter Company 144A |

5.63 | 3-15-2027 | 825,000 | 879,656 | ||||||||||||

| Wolverine World Wide Incorporated 144A |

5.00 | 9-1-2026 | 1,411,000 | 1,428,638 | ||||||||||||

| 2,308,294 | ||||||||||||||||

|

|

|

|||||||||||||||

| Consumer Staples: 1.03% |

| |||||||||||||||

| Beverages: 0.17% | ||||||||||||||||

| Cott Beverages Incorporated 144A |

5.50 | 4-1-2025 | 675,000 | 703,688 | ||||||||||||

|

|

|

|||||||||||||||

| Food Products: 0.62% | ||||||||||||||||

| Darling Ingredients Incorporated 144A |

5.25 | 4-15-2027 | 500,000 | 525,000 | ||||||||||||

| Lamb Weston Holdings Incorporated 144A |

4.63 | 11-1-2024 | 175,000 | 183,969 | ||||||||||||

| Pilgrim’s Pride Corporation 144A |

5.75 | 3-15-2025 | 1,305,000 | 1,353,938 | ||||||||||||

| Pilgrim’s Pride Corporation 144A |

5.88 | 9-30-2027 | 150,000 | 160,728 | ||||||||||||

| Prestige Brands Incorporated 144A |

6.38 | 3-1-2024 | 280,000 | 292,250 | ||||||||||||

| 2,515,885 | ||||||||||||||||

|

|

|

|||||||||||||||

| Household Products: 0.07% | ||||||||||||||||

| Central Garden & Pet Company |

5.13 | 2-1-2028 | 225,000 | 231,143 | ||||||||||||

| Spectrum Brands Incorporated |

5.75 | 7-15-2025 | 50,000 | 52,125 | ||||||||||||

| 283,268 | ||||||||||||||||

|

|

|

|||||||||||||||

| Tobacco: 0.17% | ||||||||||||||||

| Reynolds American Incorporated |

6.88 | 5-1-2020 | 650,000 | 664,702 | ||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of these financial statements.

14 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Energy: 13.98% |

| |||||||||||||||

| Energy Equipment & Services: 2.62% | ||||||||||||||||

| Diamond Offshore Drilling Incorporated |

4.88 | % | 11-1-2043 | $ | 1,325,000 | $ | 674,094 | |||||||||

| Era Group Incorporated |

7.75 | 12-15-2022 | 2,350,000 | 2,361,750 | ||||||||||||

| Hilcorp Energy Company 144A |

5.00 | 12-1-2024 | 1,450,000 | 1,287,310 | ||||||||||||

| Hilcorp Energy Company 144A |

5.75 | 10-1-2025 | 1,875,000 | 1,673,438 | ||||||||||||

| Hilcorp Energy Company 144A |

6.25 | 11-1-2028 | 350,000 | 295,750 | ||||||||||||

| NGPL PipeCo LLC 144A |

4.38 | 8-15-2022 | 350,000 | 363,389 | ||||||||||||

| NGPL PipeCo LLC 144A |

7.77 | 12-15-2037 | 1,135,000 | 1,462,496 | ||||||||||||

| Oceaneering International Incorporated |

6.00 | 2-1-2028 | 1,725,000 | 1,595,625 | ||||||||||||

| USA Compression Partners LP |

6.88 | 4-1-2026 | 850,000 | 858,500 | ||||||||||||

| 10,572,352 | ||||||||||||||||

|

|

|

|||||||||||||||

| Oil, Gas & Consumable Fuels: 11.36% | ||||||||||||||||

| Antero Midstream Partners LP 144A |

5.75 | 1-15-2028 | 650,000 | 482,625 | ||||||||||||

| Apache Corporation |

4.38 | 10-15-2028 | 750,000 | 744,404 | ||||||||||||

| Archrock Partners LP 144A |

6.88 | 4-1-2027 | 500,000 | 516,200 | ||||||||||||

| Boardwalk Pipelines LP |

4.80 | 5-3-2029 | 750,000 | 797,268 | ||||||||||||

| Buckeye Partners LP |

5.85 | 11-15-2043 | 1,400,000 | 1,209,470 | ||||||||||||

| Carrizo Oil & Gas Incorporated |

8.25 | 7-15-2025 | 1,000,000 | 950,000 | ||||||||||||

| Carrizo Oil & Gas Incorporated |

6.25 | 4-15-2023 | 350,000 | 325,500 | ||||||||||||

| Cheniere Corpus Christi Holdings LLC |

5.13 | 6-30-2027 | 900,000 | 969,750 | ||||||||||||

| Cheniere Energy Partners LP 144A |

4.50 | 10-1-2029 | 400,000 | 408,500 | ||||||||||||

| Cheniere Energy Partners LP |

5.25 | 10-1-2025 | 3,925,000 | 4,062,375 | ||||||||||||

| Cheniere Energy Partners LP |

5.63 | 10-1-2026 | 300,000 | 316,875 | ||||||||||||

| Denbury Resources Incorporated |

6.38 | 12-31-2024 | 802,000 | 434,447 | ||||||||||||

| Denbury Resources Incorporated 144A |

7.75 | 2-15-2024 | 1,123,000 | 825,405 | ||||||||||||

| Denbury Resources Incorporated 144A |

9.00 | 5-15-2021 | 800,000 | 700,000 | ||||||||||||

| Denbury Resources Incorporated 144A |

9.25 | 3-31-2022 | 676,000 | 554,320 | ||||||||||||

| El Paso LLC |

6.50 | 4-1-2020 | 750,000 | 763,031 | ||||||||||||

| Energy Transfer Partners LP |

5.20 | 2-1-2022 | 750,000 | 789,671 | ||||||||||||

| EnLink Midstream Partners LP |

4.40 | 4-1-2024 | 3,200,000 | 3,000,000 | ||||||||||||

| EnLink Midstream Partners LP |

4.85 | 7-15-2026 | 600,000 | 549,000 | ||||||||||||

| EnLink Midstream Partners LP |

5.38 | 6-1-2029 | 50,000 | 44,375 | ||||||||||||

| Gulfport Energy Corporation |

6.00 | 10-15-2024 | 1,250,000 | 803,125 | ||||||||||||

| Indigo Natural Resources LLC 144A |

6.88 | 2-15-2026 | 400,000 | 364,000 | ||||||||||||

| Kinder Morgan Energy Partners LP |

3.95 | 9-1-2022 | 750,000 | 781,950 | ||||||||||||

| Kinder Morgan Incorporated |

6.50 | 9-15-2020 | 285,000 | 295,631 | ||||||||||||

| Kinder Morgan Incorporated |

7.42 | 2-15-2037 | 800,000 | 1,011,741 | ||||||||||||

| MPLX LP 144A |

6.38 | 5-1-2024 | 450,000 | 472,587 | ||||||||||||

| Murphy Oil Corporation |

4.20 | 12-1-2022 | 1,250,000 | 1,271,875 | ||||||||||||

| Murphy Oil Corporation |

4.75 | 9-15-2029 | 75,000 | 78,281 | ||||||||||||

| Murphy Oil Corporation |

5.75 | 8-15-2025 | 185,000 | 187,547 | ||||||||||||

| Murphy Oil Corporation |

6.88 | 8-15-2024 | 850,000 | 896,614 | ||||||||||||

| Nabors Industries Incorporated |

0.75 | 1-15-2024 | 1,425,000 | 902,470 | ||||||||||||

| Nabors Industries Incorporated |

4.63 | 9-15-2021 | 750,000 | 695,625 | ||||||||||||

| Phillips 66 |

4.30 | 4-1-2022 | 625,000 | 660,383 | ||||||||||||

| Pioneer Natural Resources Company |

3.95 | 7-15-2022 | 750,000 | 782,160 | ||||||||||||

| Rockies Express Pipeline LLC 144A |

5.63 | 4-15-2020 | 2,625,000 | 2,669,092 | ||||||||||||

| Rockies Express Pipeline LLC 144A |

6.88 | 4-15-2040 | 1,974,000 | 2,082,767 | ||||||||||||

| Rockies Express Pipeline LLC 144A |

7.50 | 7-15-2038 | 240,000 | 265,500 | ||||||||||||

| Rose Rock Midstream LP |

5.63 | 7-15-2022 | 1,300,000 | 1,314,326 | ||||||||||||

| Rose Rock Midstream LP |

5.63 | 11-15-2023 | 825,000 | 843,563 | ||||||||||||

| SemGroup Corporation |

6.38 | 3-15-2025 | 3,425,000 | 3,549,156 | ||||||||||||

| SemGroup Corporation |

7.25 | 3-15-2026 | 1,000,000 | 1,080,000 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 15

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Oil, Gas & Consumable Fuels (continued) | ||||||||||||||||

| Southern Star Central Corporation 144A |

5.13 | % | 7-15-2022 | $ | 925,000 | $ | 936,387 | |||||||||

| Southwestern Energy Company |

7.50 | 4-1-2026 | 400,000 | 351,036 | ||||||||||||

| Southwestern Energy Company |

7.75 | 10-1-2027 | 400,000 | 344,000 | ||||||||||||

| Summit Midstream Holdings LLC |

5.75 | 4-15-2025 | 225,000 | 174,375 | ||||||||||||

| Tallgrass Energy Partners LP 144A |

5.50 | 9-15-2024 | 3,850,000 | 3,744,125 | ||||||||||||

| Ultra Resources Incorporated 144A |

7.13 | 4-15-2025 | 2,425,000 | 242,500 | ||||||||||||

| Whiting Petroleum Corporation |

1.25 | 4-1-2020 | 683,000 | 671,330 | ||||||||||||

| 45,915,362 | ||||||||||||||||

|

|

|

|||||||||||||||

| Financials: 6.87% |

| |||||||||||||||

| Banks: 1.42% | ||||||||||||||||

| Bank of America Corporation |

5.70 | 1-24-2022 | 250,000 | 270,831 | ||||||||||||

| Citigroup Incorporated |

4.13 | 3-9-2021 | 60,000 | 61,350 | ||||||||||||

| Citigroup Incorporated |

4.50 | 1-14-2022 | 250,000 | 262,879 | ||||||||||||

| Citigroup Incorporated |

6.13 | 3-9-2028 | 75,000 | 88,500 | ||||||||||||

| City National Bank |

5.38 | 7-15-2022 | 500,000 | 538,627 | ||||||||||||

| International Finance Corporation |

7.50 | 5-9-2022 | 9,000,000 | 2,410,824 | ||||||||||||

| International Finance Corporation |

7.50 | 5-9-2022 | 5,000,000 | 1,339,347 | ||||||||||||

| JPMorgan Chase & Company (3 Month LIBOR +3.25%) ± |

5.15 | 12-29-2049 | 750,000 | 777,188 | ||||||||||||

| 5,749,546 | ||||||||||||||||

|

|

|

|||||||||||||||

| Capital Markets: 0.22% | ||||||||||||||||

| ACE Securities Corporation (1 Month LIBOR +2.63%) ± |

4.45 | 6-25-2033 | 85,080 | 85,131 | ||||||||||||

| Goldman Sachs Group Incorporated |

5.75 | 1-24-2022 | 750,000 | 808,254 | ||||||||||||

| 893,385 | ||||||||||||||||

|

|

|

|||||||||||||||

| Consumer Finance: 1.51% | ||||||||||||||||

| Ally Financial Incorporated |

8.00 | 3-15-2020 | 880,000 | 896,122 | ||||||||||||

| Discover Financial Services |

5.20 | 4-27-2022 | 750,000 | 804,718 | ||||||||||||

| FirstCash Incorporated 144A |

5.38 | 6-1-2024 | 575,000 | 595,125 | ||||||||||||

| Navient Corporation |

8.00 | 3-25-2020 | 930,000 | 949,763 | ||||||||||||

| Springleaf Finance Corporation |

6.13 | 3-15-2024 | 750,000 | 820,313 | ||||||||||||

| Springleaf Finance Corporation |

6.63 | 1-15-2028 | 100,000 | 110,750 | ||||||||||||

| Springleaf Finance Corporation |

7.13 | 3-15-2026 | 925,000 | 1,056,813 | ||||||||||||

| Synchrony Financial |

5.15 | 3-19-2029 | 750,000 | 842,241 | ||||||||||||

| 6,075,845 | ||||||||||||||||

|

|

|

|||||||||||||||

| Diversified Financial Services: 1.22% | ||||||||||||||||

| Jefferies Finance LLC 144A |

6.25 | 6-3-2026 | 1,075,000 | 1,104,563 | ||||||||||||

| LPL Holdings Incorporated 144A |

5.75 | 9-15-2025 | 3,700,000 | 3,838,750 | ||||||||||||

| 4,943,313 | ||||||||||||||||

|

|

|

|||||||||||||||

| Insurance: 2.50% | ||||||||||||||||

| Alliant Holdings Intermediate LLC 144A |

6.75 | 10-15-2027 | 150,000 | 156,017 | ||||||||||||

| American International Group Incorporated |

4.88 | 6-1-2022 | 750,000 | 804,233 | ||||||||||||

| AmWINS Group Incorporated 144A |

7.75 | 7-1-2026 | 1,125,000 | 1,209,375 | ||||||||||||

| Assurant Incorporated |

3.70 | 2-22-2030 | 750,000 | 764,046 | ||||||||||||

| Athene Holding Limited |

4.13 | 1-12-2028 | 750,000 | 779,753 | ||||||||||||

| Brighthouse Financial Incorporated |

4.70 | 6-22-2047 | 850,000 | 761,714 | ||||||||||||

| HUB International Limited 144A |

7.00 | 5-1-2026 | 500,000 | 515,000 | ||||||||||||

| Liberty Mutual Group Incorporated 144A |

4.57 | 2-1-2029 | 750,000 | 847,530 | ||||||||||||

| ProAssurance Corporation |

5.30 | 11-15-2023 | 750,000 | 821,945 | ||||||||||||

| Prudential Financial Incorporated (3 Month LIBOR +2.38%) ± |

4.50 | 9-15-2047 | 750,000 | 780,720 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

16 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Insurance (continued) | ||||||||||||||||

| Sammons Financial Group Incorporated 144A |

4.45 | % | 5-12-2027 | $ | 750,000 | $ | 776,337 | |||||||||

| USI Incorporated 144A |

6.88 | 5-1-2025 | 1,175,000 | 1,195,563 | ||||||||||||

| W.R. Berkley Corporation |

4.63 | 3-15-2022 | 650,000 | 688,616 | ||||||||||||

| 10,100,849 | ||||||||||||||||

|

|

|

|||||||||||||||

| Health Care: 5.67% |

| |||||||||||||||

| Health Care Equipment & Supplies: 0.78% | ||||||||||||||||

| Hill-Rom Holdings Incorporated 144A |

4.38 | 9-15-2027 | 75,000 | 77,250 | ||||||||||||

| Hill-Rom Holdings Incorporated 144A |

5.00 | 2-15-2025 | 400,000 | 414,500 | ||||||||||||

| Hologic Incorporated 144A |

4.38 | 10-15-2025 | 1,925,000 | 1,972,220 | ||||||||||||

| Hologic Incorporated 144A |

4.63 | 2-1-2028 | 225,000 | 235,406 | ||||||||||||

| Surgery Center Holdings Incorporated 144A |

6.75 | 7-1-2025 | 500,000 | 457,500 | ||||||||||||

| 3,156,876 | ||||||||||||||||

|

|

|

|||||||||||||||

| Health Care Providers & Services: 4.08% | ||||||||||||||||

| Acadia Healthcare Company Incorporated |

6.50 | 3-1-2024 | 190,000 | 196,650 | ||||||||||||

| Centene Corporation 144A |

5.38 | 6-1-2026 | 575,000 | 608,638 | ||||||||||||

| Centene Corporation |

6.13 | 2-15-2024 | 325,000 | 337,899 | ||||||||||||

| CHS Incorporated |

5.13 | 8-1-2021 | 2,350,000 | 2,344,125 | ||||||||||||

| Cigna Corporation 144A |

3.90 | 2-15-2022 | 315,000 | 326,715 | ||||||||||||

| Davita Incorporated |

5.00 | 5-1-2025 | 950,000 | 961,875 | ||||||||||||

| Encompass Health Corporation |

4.50 | 2-1-2028 | 125,000 | 127,813 | ||||||||||||

| Encompass Health Corporation |

4.75 | 2-1-2030 | 125,000 | 128,906 | ||||||||||||

| HCA Incorporated |

5.25 | 6-15-2026 | 325,000 | 363,684 | ||||||||||||

| HealthSouth Corporation |

5.75 | 9-15-2025 | 575,000 | 600,156 | ||||||||||||

| MEDNAX Incorporated 144A |

5.25 | 12-1-2023 | 475,000 | 480,938 | ||||||||||||

| MEDNAX Incorporated 144A |

6.25 | 1-15-2027 | 550,000 | 544,170 | ||||||||||||

| MPH Acquisition Holdings LLC 144A |

7.13 | 6-1-2024 | 2,861,000 | 2,667,883 | ||||||||||||

| MPT Operating Partnership LP |

4.63 | 8-1-2029 | 325,000 | 339,021 | ||||||||||||

| MPT Operating Partnership LP |

5.00 | 10-15-2027 | 1,100,000 | 1,160,500 | ||||||||||||

| MPT Operating Partnership LP |

5.25 | 8-1-2026 | 1,575,000 | 1,653,750 | ||||||||||||

| MPT Operating Partnership LP |

6.38 | 3-1-2024 | 110,000 | 114,813 | ||||||||||||

| NVA Holdings Company 144A |

6.88 | 4-1-2026 | 200,000 | 214,500 | ||||||||||||

| Polaris Intermediate Corporation 144A |

8.50 | 12-1-2022 | 475,000 | 399,000 | ||||||||||||

| Select Medical Corporation 144A |

6.25 | 8-15-2026 | 800,000 | 852,000 | ||||||||||||

| Tenet Healthcare Corporation |

4.63 | 7-15-2024 | 436,000 | 449,080 | ||||||||||||

| Tenet Healthcare Corporation 144A |

4.88 | 1-1-2026 | 1,025,000 | 1,060,234 | ||||||||||||

| Tenet Healthcare Corporation 144A |

5.13 | 11-1-2027 | 225,000 | 234,558 | ||||||||||||

| Vizient Incorporated 144A |

6.25 | 5-15-2027 | 175,000 | 188,725 | ||||||||||||

| WellCare Health Plans Incorporated 144A |

5.38 | 8-15-2026 | 125,000 | 132,969 | ||||||||||||

| 16,488,602 | ||||||||||||||||

|

|

|

|||||||||||||||

| Health Care Technology: 0.55% | ||||||||||||||||

| Change Healthcare Holdings Incorporated 144A |

5.75 | 3-1-2025 | 1,950,000 | 1,995,240 | ||||||||||||

| Quintiles IMS Holdings Incorporated 144A |

5.00 | 10-15-2026 | 225,000 | 237,375 | ||||||||||||

| 2,232,615 | ||||||||||||||||

|

|

|

|||||||||||||||

| Life Sciences Tools & Services: 0.09% | ||||||||||||||||

| Charles River Laboratories Incorporated 144A |

5.50 | 4-1-2026 | 275,000 | 292,875 | ||||||||||||

| Charles River Laboratories Incorporated 144A |

4.25 | 5-1-2028 | 75,000 | 76,414 | ||||||||||||

| 369,289 | ||||||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 17

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Pharmaceuticals: 0.17% | ||||||||||||||||

| Bausch Health Companies Incorporated 144A |

5.75 | % | 8-15-2027 | $ | 75,000 | $ | 81,445 | |||||||||

| Bausch Health Companies Incorporated 144A |

7.00 | 1-15-2028 | 100,000 | 107,875 | ||||||||||||

| Bausch Health Companies Incorporated 144A |

7.25 | 5-30-2029 | 50,000 | 55,063 | ||||||||||||

| Bausch Health Companies Incorporated 144A |

8.50 | 1-31-2027 | 375,000 | 421,875 | ||||||||||||

| 666,258 | ||||||||||||||||

|

|

|

|||||||||||||||

| Industrials: 5.45% |

| |||||||||||||||

| Aerospace & Defense: 0.72% | ||||||||||||||||

| BBA US Holdings Incorporated 144A%% |

4.00 | 3-1-2028 | 600,000 | 595,500 | ||||||||||||

| L3Harris Technologies Incorporated 144A |

4.95 | 2-15-2021 | 750,000 | 771,056 | ||||||||||||

| RBS Global & Rexnord LLC 144A |

4.88 | 12-15-2025 | 1,500,000 | 1,546,875 | ||||||||||||

| 2,913,431 | ||||||||||||||||

|

|

|

|||||||||||||||

| Airlines: 0.88% | ||||||||||||||||

| Aviation Capital Group Corporation 144A |

6.75 | 4-6-2021 | 1,100,000 | 1,165,401 | ||||||||||||

| BBA US Holdings Incorporated 144A |

5.38 | 5-1-2026 | 2,025,000 | 2,116,125 | ||||||||||||

| Delta Air Lines Incorporated |

4.75 | 11-7-2021 | 283,730 | 286,695 | ||||||||||||

| 3,568,221 | ||||||||||||||||

|

|

|

|||||||||||||||

| Commercial Services & Supplies: 2.40% | ||||||||||||||||

| Advanced Disposal Services Incorporated 144A |

5.63 | 11-15-2024 | 1,750,000 | 1,826,563 | ||||||||||||

| Covanta Holding Corporation |

5.88 | 3-1-2024 | 1,530,000 | 1,572,075 | ||||||||||||

| Covanta Holding Corporation |

5.88 | 7-1-2025 | 515,000 | 534,313 | ||||||||||||

| Covanta Holding Corporation |

6.00 | 1-1-2027 | 575,000 | 600,875 | ||||||||||||

| KAR Auction Services Incorporated 144A |

5.13 | 6-1-2025 | 4,950,000 | 5,166,563 | ||||||||||||

| 9,700,389 | ||||||||||||||||

|

|

|

|||||||||||||||

| Industrial Conglomerates: 0.18% | ||||||||||||||||

| General Electric Capital Corporation |

4.65 | 10-17-2021 | 187,000 | 195,184 | ||||||||||||

| General Electric Company |

4.63 | 1-7-2021 | 505,000 | 518,342 | ||||||||||||

| 713,526 | ||||||||||||||||

|

|

|

|||||||||||||||

| Machinery: 0.90% | ||||||||||||||||

| Harsco Corporation 144A |

5.75 | 7-31-2027 | 75,000 | 77,908 | ||||||||||||

| Stevens Holding Company Incorporated 144A |

6.13 | 10-1-2026 | 1,425,000 | 1,531,875 | ||||||||||||

| Trimas Corporation 144A |

4.88 | 10-15-2025 | 1,997,000 | 2,031,948 | ||||||||||||

| 3,641,731 | ||||||||||||||||

|

|

|

|||||||||||||||

| Professional Services: 0.14% | ||||||||||||||||

| Verisk Analytics Incorporated |

5.80 | 5-1-2021 | 530,000 | 557,712 | ||||||||||||

|

|

|

|||||||||||||||

| Trading Companies & Distributors: 0.23% | ||||||||||||||||

| Fortress Transportation and Infrastructure Investors LLC 144A |

6.50 | 10-1-2025 | 900,000 | 909,000 | ||||||||||||

|

|

|

|||||||||||||||

| Information Technology: 6.13% |

| |||||||||||||||

| Communications Equipment: 0.19% | ||||||||||||||||

| CommScope Technologies Finance LLC 144A |

6.00 | 6-15-2025 | 825,000 | 739,613 | ||||||||||||

| CommScope Technologies Finance LLC 144A |

8.25 | 3-1-2027 | 50,000 | 47,362 | ||||||||||||

| 786,975 | ||||||||||||||||

|

|

|

|||||||||||||||

| Electronic Equipment, Instruments & Components: 0.17% | ||||||||||||||||

| Keysight Technologies |

4.60 | 4-6-2027 | 600,000 | 668,094 | ||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of these financial statements.

18 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| IT Services: 1.68% | ||||||||||||||||

| Cardtronics Incorporated 144A |

5.50 | % | 5-1-2025 | $ | 2,830,000 | $ | 2,921,975 | |||||||||

| Gartner Incorporated 144A |

5.13 | 4-1-2025 | 1,525,000 | 1,599,268 | ||||||||||||

| Infor US Incorporated |

6.50 | 5-15-2022 | 550,000 | 557,563 | ||||||||||||

| Zayo Group LLC 144A |

5.75 | 1-15-2027 | 625,000 | 635,238 | ||||||||||||

| Zayo Group LLC |

6.38 | 5-15-2025 | 1,043,000 | 1,072,204 | ||||||||||||

| 6,786,248 | ||||||||||||||||

|

|

|

|||||||||||||||

| Semiconductors & Semiconductor Equipment: 0.23% | ||||||||||||||||

| Broadcom Corporation |

3.50 | 1-15-2028 | 750,000 | 733,764 | ||||||||||||

| Qorvo Incorporated 144A |

4.38 | 10-15-2029 | 175,000 | 175,984 | ||||||||||||

| 909,748 | ||||||||||||||||

|

|

|

|||||||||||||||

| Software: 0.92% | ||||||||||||||||

| CDK Global Incorporated |

5.00 | 10-15-2024 | 225,000 | 243,338 | ||||||||||||

| CDK Global Incorporated 144A |

5.25 | 5-15-2029 | 175,000 | 185,828 | ||||||||||||

| CDK Global Incorporated |

5.88 | 6-15-2026 | 175,000 | 187,250 | ||||||||||||

| Fair Isaac Corporation 144A |

5.25 | 5-15-2026 | 950,000 | 1,030,750 | ||||||||||||

| IQVIA Incorporated 144A |

5.00 | 5-15-2027 | 250,000 | 265,000 | ||||||||||||

| SS&C Technologies Incorporated 144A |

5.50 | 9-30-2027 | 500,000 | 533,438 | ||||||||||||

| Symantec Corporation 144A |

5.00 | 4-15-2025 | 475,000 | 486,875 | ||||||||||||

| VMware Incorporated |

3.90 | 8-21-2027 | 750,000 | 774,175 | ||||||||||||

| 3,706,654 | ||||||||||||||||

|

|

|

|||||||||||||||

| Technology Hardware, Storage & Peripherals: 2.94% | ||||||||||||||||

| Dell International LLC 144A |

5.88 | 6-15-2021 | 662,000 | 672,182 | ||||||||||||

| Dell International LLC 144A |

7.13 | 6-15-2024 | 4,525,000 | 4,797,631 | ||||||||||||

| Diamond 1 Finance Corporation 144A |

6.02 | 6-15-2026 | 750,000 | 855,922 | ||||||||||||

| Hewlett-Packard Company |

4.05 | 9-15-2022 | 750,000 | 792,199 | ||||||||||||

| NCR Corporation |

5.88 | 12-15-2021 | 5,000 | 5,013 | ||||||||||||

| NCR Corporation |

6.38 | 12-15-2023 | 4,650,000 | 4,766,250 | ||||||||||||

| 11,889,197 | ||||||||||||||||

|

|

|

|||||||||||||||

| Materials: 2.46% |

| |||||||||||||||

| Chemicals: 0.29% | ||||||||||||||||

| Dow Chemical Company |

4.13 | 11-15-2021 | 750,000 | 777,289 | ||||||||||||

| Valvoline Incorporated |

5.50 | 7-15-2024 | 375,000 | 389,180 | ||||||||||||

| 1,166,469 | ||||||||||||||||

|

|

|

|||||||||||||||

| Containers & Packaging: 2.07% | ||||||||||||||||

| Ball Corporation |

4.88 | 3-15-2026 | 575,000 | 623,875 | ||||||||||||

| Ball Corporation |

5.00 | 3-15-2022 | 25,000 | 26,438 | ||||||||||||

| Ball Corporation |

5.25 | 7-1-2025 | 190,000 | 211,375 | ||||||||||||

| Berry Global Escrow Corporation 144A |

5.63 | 7-15-2027 | 175,000 | 185,719 | ||||||||||||

| Berry Global Incorporated |

5.13 | 7-15-2023 | 350,000 | 358,750 | ||||||||||||

| Berry Global Incorporated |

6.00 | 10-15-2022 | 215,000 | 218,763 | ||||||||||||

| Crown Americas Capital Corporation V |

4.25 | 9-30-2026 | 100,000 | 104,375 | ||||||||||||

| Crown Americas Capital Corporation VI |

4.75 | 2-1-2026 | 975,000 | 1,023,750 | ||||||||||||

| Crown Cork & Seal Company Incorporated |

7.38 | 12-15-2026 | 35,000 | 42,000 | ||||||||||||

| Flex Acquisition Company Incorporated 144A |

6.88 | 1-15-2025 | 1,500,000 | 1,406,250 | ||||||||||||

| Flex Acquisition Company Incorporated 144A |

7.88 | 7-15-2026 | 275,000 | 258,500 | ||||||||||||

| Owens-Brockway Glass Container Incorporated 144A |

5.88 | 8-15-2023 | 325,000 | 343,281 | ||||||||||||

| Owens-Illinois Incorporated 144A |

6.38 | 8-15-2025 | 2,375,000 | 2,499,688 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 19

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Containers & Packaging (continued) | ||||||||||||||||

| Reynolds Group Issuer Incorporated 144A |

5.13 | % | 7-15-2023 | $ | 675,000 | $ | 692,516 | |||||||||

| Sealed Air Corporation 144A |

5.25 | 4-1-2023 | 325,000 | 346,938 | ||||||||||||

| 8,342,218 | ||||||||||||||||

|

|

|

|||||||||||||||

| Metals & Mining: 0.10% | ||||||||||||||||

| Indalex Holdings Corporation (a)† |

11.50 | 2-1-2020 | 3,108,611 | 0 | ||||||||||||

| Novelis Corporation 144A |

5.88 | 9-30-2026 | 400,000 | 420,040 | ||||||||||||

| 420,040 | ||||||||||||||||

|

|

|

|||||||||||||||

| Real Estate: 3.00% |

| |||||||||||||||

| Equity REITs: 3.00% | ||||||||||||||||

| American Tower Corporation |

5.90 | 11-1-2021 | 650,000 | 697,861 | ||||||||||||

| CoreCivic Incorporated |

5.00 | 10-15-2022 | 575,000 | 569,969 | ||||||||||||

| DDR Corporation |

4.70 | 6-1-2027 | 600,000 | 657,894 | ||||||||||||

| Equinix Incorporated |

5.75 | 1-1-2025 | 1,375,000 | 1,421,448 | ||||||||||||

| Equinix Incorporated |

5.88 | 1-15-2026 | 425,000 | 451,435 | ||||||||||||

| ESH Hospitality Incorporated 144A |

4.63 | 10-1-2027 | 150,000 | 150,390 | ||||||||||||

| ESH Hospitality Incorporated 144A |

5.25 | 5-1-2025 | 1,750,000 | 1,804,688 | ||||||||||||

| Iron Mountain Incorporated 144A |

5.38 | 6-1-2026 | 150,000 | 155,625 | ||||||||||||

| Iron Mountain Incorporated |

6.00 | 8-15-2023 | 2,500,000 | 2,553,125 | ||||||||||||

| Omega HealthCare Investors Incorporated |

4.50 | 4-1-2027 | 600,000 | 647,904 | ||||||||||||

| SBA Communications Corporation |

4.00 | 10-1-2022 | 225,000 | 229,534 | ||||||||||||

| SBA Communications Corporation |

4.88 | 7-15-2022 | 640,000 | 646,803 | ||||||||||||

| The Geo Group Incorporated |

5.13 | 4-1-2023 | 800,000 | 704,000 | ||||||||||||

| The Geo Group Incorporated |

5.88 | 1-15-2022 | 600,000 | 580,500 | ||||||||||||

| The Geo Group Incorporated |

5.88 | 10-15-2024 | 840,000 | 701,400 | ||||||||||||

| The Geo Group Incorporated |

6.00 | 4-15-2026 | 184,000 | 145,820 | ||||||||||||

| 12,118,396 | ||||||||||||||||

|

|

|

|||||||||||||||

| Utilities: 4.99% |

| |||||||||||||||

| Electric Utilities: 0.75% | ||||||||||||||||

| Great Plains Energy Incorporated |

4.85 | 6-1-2021 | 750,000 | 777,101 | ||||||||||||

| NextEra Energy Operating Partners LP 144A |

4.25 | 7-15-2024 | 775,000 | 796,080 | ||||||||||||

| NextEra Energy Operating Partners LP 144A |

4.25 | 9-15-2024 | 175,000 | 182,000 | ||||||||||||

| NextEra Energy Operating Partners LP 144A |

4.50 | 9-15-2027 | 1,250,000 | 1,275,000 | ||||||||||||

| 3,030,181 | ||||||||||||||||

|

|

|

|||||||||||||||

| Gas Utilities: 0.33% | ||||||||||||||||

| AmeriGas Partners LP |

5.75 | 5-20-2027 | 1,000,000 | 1,095,000 | ||||||||||||

| Suburban Propane Partners LP |

5.88 | 3-1-2027 | 225,000 | 232,875 | ||||||||||||

| 1,327,875 | ||||||||||||||||

|

|

|

|||||||||||||||

| Independent Power & Renewable Electricity Producers: 3.71% | ||||||||||||||||

| NSG Holdings LLC 144A |

7.75 | 12-15-2025 | 3,901,856 | 4,214,005 | ||||||||||||

| Pattern Energy Group Incorporated 144A |

5.88 | 2-1-2024 | 5,225,000 | 5,355,625 | ||||||||||||

| TerraForm Global Operating LLC 144A |

6.13 | 3-1-2026 | 1,175,000 | 1,201,438 | ||||||||||||

| TerraForm Power Operating LLC 144A |

4.25 | 1-31-2023 | 3,025,000 | 3,115,750 | ||||||||||||

| TerraForm Power Operating LLC 144A |

4.75 | 1-15-2030 | 375,000 | 387,656 | ||||||||||||

| TerraForm Power Operating LLC 144A |

5.00 | 1-31-2028 | 675,000 | 711,923 | ||||||||||||

| 14,986,397 | ||||||||||||||||

|

|

|

|||||||||||||||

The accompanying notes are an integral part of these financial statements.

20 | Wells Fargo Multi-Sector Income Fund

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Multi-Utilities: 0.20% | ||||||||||||||||

| CMS Energy Corporation |

5.05 | % | 3-15-2022 | $ | 750,000 | $ | 795,441 | |||||||||

|

|

|

|||||||||||||||

| Total Corporate Bonds and Notes (Cost $282,721,590) |

|

285,318,980 | ||||||||||||||

|

|

|

|||||||||||||||

| Foreign Corporate Bonds and Notes: 4.97% |

| |||||||||||||||

| Financials: 4.97% |

| |||||||||||||||

| Banks: 4.91% | ||||||||||||||||

| European Investment Bank |

7.25 | 6-28-2021 | BRL | 9,000,000 | 2,353,622 | |||||||||||

| European Investment Bank |

7.50 | 4-13-2022 | BRL | 9,000,000 | 2,407,929 | |||||||||||

| European Investment Bank |

8.00 | 5-5-2027 | ZAR | 21,000,000 | 1,427,216 | |||||||||||

| European Investment Bank |

8.38 | 7-29-2022 | ZAR | 40,000,000 | 2,763,959 | |||||||||||

| European Investment Bank |

8.75 | 8-18-2025 | ZAR | 20,000,000 | 1,410,344 | |||||||||||

| European Investment Bank |

9.00 | 3-31-2021 | ZAR | 17,400,000 | 1,187,283 | |||||||||||

| International Bank for Reconstruction & Development |

7.00 | 6-7-2023 | ZAR | 15,000,000 | 995,864 | |||||||||||

| International Bank for Reconstruction & Development |

7.50 | 6-9-2021 | BRL | 5,000,000 | 1,307,069 | |||||||||||

| International Bank for Reconstruction & Development |

8.25 | 6-22-2023 | BRL | 9,000,000 | 2,516,544 | |||||||||||

| KfW |

7.50 | 11-10-2022 | ZAR | 36,000,000 | 2,424,842 | |||||||||||

| Landwirtschaftliche Rentenbank |

8.25 | 5-23-2022 | ZAR | 15,000,000 | 1,019,954 | |||||||||||

| 19,814,626 | ||||||||||||||||

|

|

|

|||||||||||||||

| Diversified Financial Services: 0.06% | ||||||||||||||||

| AA Bond Company Limited |

4.25 | 7-31-2043 | GBP | 200,000 | 261,538 | |||||||||||

|

|

|

|||||||||||||||

| Total Foreign Corporate Bonds and Notes (Cost $21,500,619) |

|

20,076,164 | ||||||||||||||

|

|

|

|||||||||||||||

| Foreign Government Bonds: 24.60% |

| |||||||||||||||

| Colombia |

6.00 | 4-28-2028 | COP | 6,800,000,000 | 2,037,003 | |||||||||||

| Colombia |

7.50 | 8-26-2026 | COP | 22,725,000,000 | 7,443,735 | |||||||||||

| Colombia |

7.75 | 9-18-2030 | COP | 16,000,000,000 | 5,371,870 | |||||||||||

| Indonesia |

7.50 | 8-15-2032 | IDR | 57,000,000,000 | 4,104,356 | |||||||||||

| Indonesia |

8.25 | 5-15-2029 | IDR | 88,615,000,000 | 6,863,827 | |||||||||||

| Indonesia |

8.38 | 9-15-2026 | IDR | 110,000,000,000 | 8,561,448 | |||||||||||

| Malaysia |

4.18 | 7-15-2024 | MYR | 19,850,000 | 4,920,524 | |||||||||||

| Malaysia |

4.23 | 6-30-2031 | MYR | 51,300,000 | 12,949,985 | |||||||||||

| Mexico |

5.75 | 3-5-2026 | MXN | 117,000,000 | 5,788,540 | |||||||||||

| Mexico |

8.50 | 5-31-2029 | MXN | 200,000,000 | 11,650,456 | |||||||||||

| Republic of Peru |

6.35 | 8-12-2028 | PEN | 16,400,000 | 5,712,626 | |||||||||||

| Republic of Trinidad and Tobago 144A |

4.50 | 8-4-2026 | TTD | 750,000 | 777,195 | |||||||||||

| Romania |

3.25 | 4-29-2024 | RON | 46,000,000 | 10,545,317 | |||||||||||

| Russia |

6.50 | 2-28-2024 | RUB | 390,000,000 | 6,181,186 | |||||||||||

| Russia |

6.90 | 5-23-2029 | RUB | 400,000,000 | 6,469,554 | |||||||||||

| Total Foreign Government Bonds (Cost $95,306,987) |

|

99,377,622 | ||||||||||||||

|

|

|

|||||||||||||||

| Loans: 19.88% |

| |||||||||||||||

| Communication Services: 3.86% |

| |||||||||||||||

| Diversified Telecommunication Services: 0.74% | ||||||||||||||||

| Level 3 Financing Incorporated (1 Month LIBOR +2.25%) ± |

4.04 | 2-22-2024 | $ | 555,420 | 555,837 | |||||||||||

| Telesat Canada (3 Month LIBOR +2.50%) ± |

4.61 | 11-17-2023 | 2,411,137 | 2,409,329 | ||||||||||||

| 2,965,166 | ||||||||||||||||

|

|

|

|||||||||||||||

| Media: 2.80% | ||||||||||||||||

| Ancestry.com Incorporated (1 Month LIBOR +4.25%) ±‡ |

6.04 | 8-27-2026 | 5,847,310 | 5,174,869 | ||||||||||||

| Charter Communications Operating LLC (1 Month LIBOR +1.75%) ± |

3.58 | 4-30-2025 | 1,080,750 | 1,083,452 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

Wells Fargo Multi-Sector Income Fund | 21

Table of Contents

Portfolio of investments—October 31, 2019

| Interest rate |

Maturity date |

Principal | Value | |||||||||||||

| Media (continued) | ||||||||||||||||

| CSC Holdings LLC (2 Month LIBOR +2.50%) ± |