Exhibit 13.1

ANNUAL INFORMATION FORM

For the year ended December 31, 2017

March 29, 2018

TABLE OF CONTENTS

| Annual Information Form for the year ended December 31, 2017 | Page | |

| Documents incorporated by reference | ||

| Forward Looking Statements | ||

| Item 1 - Date of the Annual Information Form | 1 | |

| Item 2 - Corporate Structure | 1 | |

| 2.1 Name, Address and Incorporation | 1 | |

| 2.2 Intercorporate Relationships | 1 | |

| Item 3 - General Development of the Business | 1 | |

| 3.1 Three Year History | 1 | |

| 3.2 Significant Acquisitions | 3 | |

| 3.3 Trends | 3 | |

| Item 4 - Description of the Business | 4 | |

| 4.1 General | 4 | |

| 4.2 Industry Sector Information | 4 | |

| 4.2.1 Packaging Products Sector | 4 | |

| 4.2.1.1 Containerboard Packaging Group | 4 | |

| 4.2.1.2 Boxboard Europe Group | 6 | |

| 4.2.1.3 Specialty Products Group | 6 | |

| 4.2.2 Tissue Papers Sector | 8 | |

| 4.2.2.1 Tissue Group | 8 | |

| 4.3 Research, Development and Innovation | 9 | |

| 4.4 Competitive Conditions | 10 | |

| 4.4.1 Our Markets | 10 | |

| 4.4.2 Our Competitive Strengths | 10 | |

| 4.5 Cyclical Considerations | 10 | |

| 4.6 Environmental Protection | 11 | |

| 4.6.1 Regulations | 11 | |

| 4.6.2 Commitment to Sustainable Development | 11 | |

| 4.7 Reorganizations | 11 | |

| 4.8 Social Policies | 11 | |

| 4.9 Risk Factors | 11 | |

| Item 5 - Dividends and Distributions | 11 | |

| Item 6 - Capital Structure | 11 | |

| 6.1 General Description of Capital Structure | 11 | |

| 6.2 Ratings | 12 | |

| Item 7 - Market for Securities | 13 | |

| 7.1 Trading Price and Volume | 13 | |

| Item 8 - Directors and Officers | 13 | |

| 8.1 Name, Occupation and Security Holding | 13 | |

| 8.2 Cease Trade Orders, Bankruptcies, Penalties or Sanctions | 20 | |

| 8.3 Information concerning Executive Officers | 20 | |

| Item 9 - Legal Proceedings and Regulatory Actions | 21 | |

| Item 10 - Transfer Agents and Registrars | 21 | |

| Item 11 - Material Contracts | 21 | |

| Item 12 - Interests of Experts | 21 | |

| Item 13 - Audit and Finance Committee | 22 | |

| 13.1 Composition and Mandate | 22 | |

| 13.2 Relevant Education and Experience of the Members | 22 | |

| 13.3 Independent Auditor Services Fees | 23 | |

| 13.4 Policies and Procedures for the Engagement of Audit and Non-Audit Services | 23 | |

| Item 14 - Additional Information | 24 | |

| Schedule A - Charter of the Audit and Finance Committee | 25 |

In this Annual Information Form, the terms “We”, “Us”, “Our”, “Corporation” and “Cascades” refer to Cascades Inc., its subsidiaries, divisions and its interests in joint ventures and associates. Except as otherwise indicated, all dollar amounts are expressed in Canadian dollars. The information in this Annual Information Form is stated as at December 31, 2017, except as otherwise indicated, and except for information in documents incorporated by reference that have a different date.

DOCUMENTS INCORPORATED BY REFERENCE

The documents in the table below contain information that is incorporated by reference into this Annual Information Form and may be found on SEDAR at www.sedar.com.

| Documents | Where they are incorporated in this Annual Information Form | |

| Cascades Inc.’s 2017 Annual Report - Management’s Discussion and Analysis, NEAR-TERM OUTLOOK, page 65, RISK FACTORS, page 70 | Items 3.3, 4.6.1 and 4.9 |

FORWARD-LOOKING STATEMENTS

Certain statements in this Annual Information Form or in documents incorporated by reference, including statements regarding future results and performance, are forward-looking statements within the meaning of the “Safe Harbour” provision of the United States Private Securities Litigation Reform Act of 1995 based on current expectations. The accuracy of these statements is subject to a number of risks, uncertainties and assumptions that may cause actual results to differ materially from those projected, including, but not limited to, the effect of general economic conditions, decreases in demand for the Corporation’s products, the prices and availability of raw materials, changes in the relative values of certain currencies, fluctuations in selling prices and adverse changes in general market and industry conditions (See heading Risk Factors).

| Annual Information Form |

ITEM 1 - DATE OF THE ANNUAL INFORMATION FORM

This Annual Information Form (“AIF”) is dated as at March 29, 2018. Except as otherwise indicated, the information contained in this AIF is stated as at December 31, 2017.

ITEM 2 - CORPORATE STRUCTURE

| 2.1 | Name, Address and Incorporation |

Cascades Inc. was incorporated under the name Papier Cascades Inc./Cascades Paper Inc. under the laws of the Province of Québec by letters patent issued on March 26, 1964. Supplementary letters patent were issued on March 11, 1968, July 4, 1979 and October 19, 1979 to amend the authorized capital stock and the restrictions and privileges attached to certain classes of shares of the Corporation.

Cascades was continued under the name Cascades Inc. under Part 1A of the Companies Act (Québec) by Certificate of Continuance dated October 26, 1982. Certificates of Amendment were issued on July 5, 1984, September 16, 1985 and May 13, 1986 to permit the subdivision of the Corporation's Common Shares, as well as on July 15, 1992, July 24, 1992, December 17, 1992 and July 20, 1993 in order to modify the authorized share-capital and/or the restrictions and privileges of certain classes of shares of the Corporation.

On December 30, 2003, in accordance with Article 123.129 of the Companies Act (Québec), Cascades, by simplified amalgamation, merged with 9135-2591 Québec Inc., a wholly owned subsidiary of the Corporation. The articles of amalgamation and schedules as well as the composition of the Board of Directors of the new company following the amalgamation are exactly the same as those of Cascades Inc. prior to the amalgamation.

Since February 14, 2011, all Québec corporations incorporated under Part IA of the Companies Act (Québec) are governed by the Business Corporations Act (Québec).

On July 27, 2011, the Corporation amended its Articles which essentially provide that (i) the Board of Directors may, at its discretion, appoint one or more directors, who shall hold office for a term expiring no later than the close of the next annual meeting of shareholders following their appointment, but the total number of directors so appointed may not exceed one-third of the number of directors elected at the annual meeting of shareholders preceding their appointment; and (ii) the Board of Directors may, at its discretion and from time to time, determine to hold a meeting of shareholders outside of the Province of Québec.

The head office and corporate offices of Cascades are located at 404 Marie Victorin Blvd, Kingsey Falls (Québec) J0A 1B0. Cascades also has executive offices located at 772 Sherbrooke Street West, Suite 100, Montréal (Québec) H3A 1G1. Cascades’ website can be found at www.cascades.com.

| 2.2 | Intercorporate Relationships |

The following list sets out the principal subsidiaries of the Corporation and their respective jurisdictions as at December 31, 2017:

| Corporate Name | Percentage owned (%) | Jurisdiction | ||

| Cascades Canada ULC | 100 | Alberta, Canada | ||

| Cascades USA Inc. | 100 | Delaware, U.S. | ||

| Reno de Medici S.p.A. | 57.8 | Italy |

ITEM 3 - GENERAL DEVELOPMENT OF THE BUSINESS

3.1 Three Year History

Financing activities

Bank Financing

On July 7, 2015, the Corporation entered into an agreement with its lenders to extend and amend its existing $750 million credit facility. The amendment provides that the term of the facility is extended to July 2019. The applicable pricing grid was slightly lowered to better reflect market conditions. The other existing financial conditions remained essentially unchanged.

On June 1, 2017, the Corporation entered into an agreement with its lenders to extend and amend its existing $750 million credit facility. The amendment extends the term of the facility to July 2021. The financial conditions remain essentially unchanged.

| 1 |

| Annual Information Form |

Debt Refinancing

On May 19, 2015, the Corporation issued US$250 million ($305 million) aggregate principal amount of 5.75% senior notes due in 2023. The Corporation used the proceeds from this offering of notes to repurchase a total of US$250 million ($305 million) aggregate principal amount of 7.875% senior notes due in 2020 for a total consideration of US$250 million ($305 million). The Corporation also paid premiums of US$11 million ($13 million) to repurchase the 2020 notes as well as fees and expenses in connection with the offering and the tender offer totalling $5 million. The refinancing of these notes will reduce the Corporation's future interest expense by approximately US$6 million annually.

On December 12, 2017, the Corporation announced the results of tender offers and proceeded with the purchase of US$150 million of its 5.500% unsecured senior notes due 2022 and US$50 million of its 5.75% unsecured senior notes due 2023.

Greenpac Debt Refinancing

On May 6, 2016, the Corporation announced that its associate company Greenpac, located in Niagara Falls, NY, successfully refinanced its debt. The debt package includes a term loan and a revolving credit facility. This five-year agreement allowed the mill to reduce its financing costs by approximately 225 basis points, increasing its flexibility to successfully address future market fluctuations.

Corporate Activities

On July 22, 2016, Cascades announced the appointment of Ms. Michelle A. Cormier and Messrs. Martin Couture and Patrick Lemaire to its Board of Directors.

On April 5, 2017, the Corporation announced that results from the Greenpac Mill LLC (Greenpac) would be consolidated with those of the Corporation following changes to the Greenpac equity holders agreement. As a result, the Corporation began consolidating Greenpac results on April 4, 2017. The agreement did not involve any cash consideration.

On March 21, 2017, the Corporation acquired 23% of Containerboard Partners (Ontario) Inc. for a consideration of US$12 million ($16 million ). This company is a member of Greenpac Holding LLC, of which it owns 12.1%. On November 30, 2017, the Corporation acquired an additional 30% of Containerboard Partners (Ontario) Inc. for a consideration of $19 million. These transactions add an indirect participation of 6.4% in Greenpac Holding LLC bringing total ownership to 66.1%.

On June 12, 2017, the Corporation announced that S&P Dow Jones Indices LLC confirmed that Cascades would be added to the S&P/TSX Composite Index and S&P/TSX Composite Dividend Index effective June 19, 2017.

On July 27, 2017, the Corporation announced the sale of its 17.3% equity holding in Boralex to the Caisse de Dépôt et Placement du Québec for $288 million.

Packaging Products Sector

Containerboard Packaging Group

On February 4, 2015, Cascades confirmed completion of the transaction relating to the sale of its North American boxboard manufacturing and converting assets to Graphic Packaging Holding Company for a cash consideration of $40 million, net of transactions fees. Included in the transaction were the Cascades boxboard units in East Angus and Jonquière (Québec), Winnipeg (Manitoba), and Mississauga and Cobourg (Ontario). This move, which reflects Cascades’ intention to refocus its activities on the strategic sectors in which it excels, did not affect the Corporation's European-based boxboard operations.

On April 10, 2015, Cascades announced major investments in a biorefinery project at its Cabano (Québec) plant. This project, worth a total of $26 million, represents a major advance in biorefinery development in Canada. Backed by a $10 million investment from Natural Resources Canada’s Investments in Forest Industry Transformation (IFIT) program and an additional $4 million from the Québec Ministère des Forêts, de la Faune et des Parcs, the Cabano plant replaced its process - the production of sodium carbonate-based chemical pulp - with this new, more environmentally friendly and economical one that was developed in conjunction with a U.S. partner.

In addition, Cascades invested $26 million in 2015 and 2016 in its Drummondville plant, for the expansion of the building and the installation of a new corrugator. It officially started operating at the beginning of 2016.

On January 13, 2016, the Corporation announced Mr. Marc-André Dépin's decision to step down as President and Chief Executive Officer of the Containerboard Packaging Group. Mr. Charles Malo succeeded him as President and Chief Operating Officer.

On June 1, 2016, the Corporation announced the completion of a transaction with US-based company Rand-Whitney Container LLC for the acquisition of its plant in Newtown, Connecticut. In return, Cascades transferred equipment and its customer list from its Thompson plant, located in Connecticut. The Corporation also paid US$12 million ($15 million) to Rand-Whitney.

On August 3, 2017, as part of its modernization and optimization efforts in the Northeastern United States, the Corporation announced an investment of US$80 million for the construction of a new containerboard packaging plant in Piscataway, New Jersey. This new plant will manufacture corrugated packaging products. The operation is planned to start in the second quarter of 2018. In addition, the Corporation announced on August 10, 2017, that it will close its containerboard converting plant in Maspeth, New York. On January 31, 2018, the Corporation completed the sale of the building and land of its Maspeth plant, NY, for US$72 million ($90 million) of which US$68 million ($85 million) was received at closing and US$4 million ($5 million) is held in escrow. Release of the escrow is contingent upon certain conditions being met over the next three years. The Corporation will continue to use the facility until December 31, 2018, the date the plant is scheduled to close. The volumes will be progressively redeployed to other Cascades units over the course of the year.

| 2 |

| Annual Information Form |

On December 4, 2017, the Corporation announced that it had acquired three converting plants from the Coyle Group in Ontario, Canada, to strengthen its position in the containerboard packaging sector.

Boxboard Europe Group

On June 30, 2016, the Corporation completed the transfer of its virgin fibre boxboard mill located in La Rochette, France, to its 57.8%-owned subsidiary Reno de Medici, for a consideration of €19 million ($27 million). The transaction combined the Corporation’s virgin and recycled boxboard activities in Europe. Apart from higher non-controlling interests after the closing, no impact was recorded on the Corporation’s financial statements, as both entities had been fully consolidated prior to the transaction.

On November 3, 2016, RdM appointed Mr. Michele Bianchi as its Chief Executive Officer, following the resignation of Mr. Ignazio Capuano as Chief Executive Officer on April 26, 2016.

On January 1, 2018, the Corporation, through its 57.8% equity ownership in Reno de Medici S.p.A., acquired 66.67% of PAC Service S.p.A., a boxboard converter for the packaging, publishing, cosmetics and food industries. The Corporation already had a 33.33% equity participation before the transaction.

Specialty Products Group

In the third quarter of 2015, the Specialty Products Group proceeded with the legal restructuring of its Norcan Flexible Packaging subsidiary, which was owned at 62.1%. As a result of the restructuring, the Corporation now owns 100% of this business through its Cascades Flexible Packaging subsidiary.

On November 27, 2015, the Corporation entered into an agreement for the acquisition of the 27% minority interest of its subsidiary Cascades Recovery Inc. for a cash consideration of $32 million, payable over a ten-year period.

On June 22, 2016, the Corporation announced the closure of its de-inked pulp mill located in Auburn (Maine, USA). The plant closed on July 15, 2016.

On October 30, 2017, the Corporation announced a $21 million investment in its Cascades Inopak and Plastiques Cascades plants, both in Québec, in order to acquire equipment enabling it to increase its production of food packaging, primarily for the fresh protein market.

Tissue Group

On April 17, 2015, Cascades announced the installation of a new converting line in the Candiac plant (Québec), for the manufacturing of high-quality paper towels. In addition, two converting lines were upgraded in Candiac and Kingsey Falls (Québec) that produce high-end tissue products. The new line in Candiac (Québec) started production in July 2015, while the improved converting lines began production in the second quarter of 2016.

On May 13, 2016, in order to optimize its supply chain and to maximize its profitability, the Corporation decided to close its tissue converting operations located in Toronto (Ontario), and transferred some of the equipment to other facilities.

During the first quarter of 2017, the Corporation successfully began production at its new tissue converting facility in Scappoose, Oregon, which houses three new state-of-the-art converting lines. The plant manufactures virgin and recycled bathroom tissue products and paper hand towels for the Cascades Pro brand (Away-from-Home market). The plant is supplied by the Corporation's tissue paper plant located 12 kilometers away in St. Helens.

On March 14, 2017, the Corporation announced the launch of a brand-new consumer line of tissue paper, Cascades Fluff TM and Cascades Tuff TM, consisting of three varieties of toilet paper and two varieties of paper towels.

| 3.2 | Significant Acquisitions |

No significant acquisition was completed by the Corporation during the financial year ended December 31, 2017 for which disclosure would have been required under Part 8 of National Instrument 51-102 of the Canadian Securities Administrators, namely the filing of a Business Acquisition Report.

| 3.3 | Trends |

Reference is made to Management’s Discussion and Analysis in the 2017 Annual Report, specifically on page 65 under the heading “NEAR-TERM OUTLOOK”, which is incorporated by reference.

| 3 |

| Annual Information Form |

ITEM 4 - DESCRIPTION OF THE BUSINESS

| 4.1 | General |

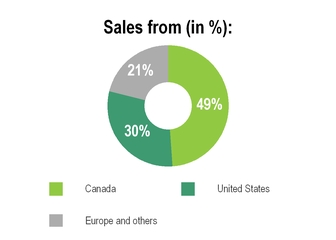

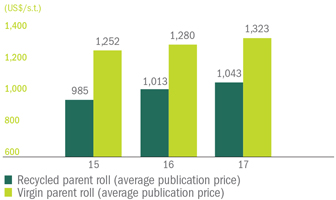

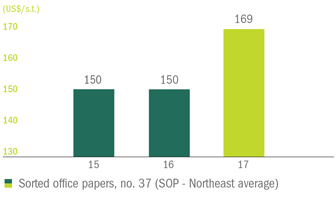

Established in 1964, Cascades is the parent company of a North American and European group of companies involved in the production, conversion and marketing of packaging products and tissue papers principally composed of recycled fibre. In 2017, including its 57.8% owned subsidiary Reno De Medici S.p.A. ("RdM"), Cascades consumed approximately 3.85 million short tons of fibre. Recycled fibre, wood fibre (chips and logs) and virgin pulp respectively accounted for 82%, 11% and 7% of the total fibre consumption. Cascades sources its supply of recycled fibre through its own recovery network as well as through mid- to long-term agreements with independent suppliers. Cascades sources its supply of wood fibre and pulp through contractual agreements with independent sawmills, timberland owners and pulp producers.

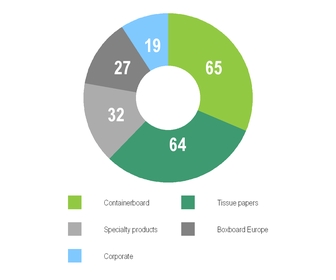

Cascades conducts its business principally through four (4) reporting groups in two (2) operating sectors, namely:

| 1) | The Packaging Products sector which includes: |

| i) | The Containerboard Packaging Group, a manufacturer of containerboard and leading converter of corrugated products in North America; |

| ii) | The Boxboard Europe Group, a manufacturer of premium coated recycled and virgin boxboard in Europe; and |

| iii) | The Specialty Products Group, which manufactures industrial and consumer packaging products, and is also involved in recovery and recycling. |

| 2) | The Tissue Papers sector which includes the Tissue Group, a manufacturer and converter of tissue papers for the Away-from-Home and consumer products markets. |

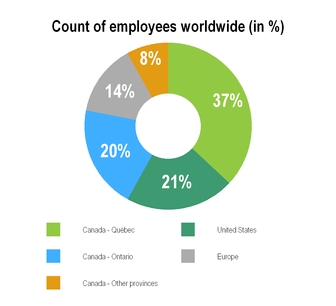

These two sectors include more than 90 operating units located in Canada, the United States and Europe. As at December 31, 2017, the Corporation employed approximately 11,000 employees, of which roughly 9,500 were employees of its Canadian and United States operations. Approximately 33% of the Corporation's Canadian and United States workforce is unionized under 30 separate collective bargaining agreements. In addition, in Europe, some of the Corporation's operations are subject to national industry collective bargaining agreements that are renewed on an annual basis. Of the 30 collective bargaining agreements in North America, 4 are expired and are currently under negotiation, 7 will expire in 2018 and 8 will expire in 2019.

Cascades sets the overall strategic guidelines and ensures that corporate policies concerning acquisition and financing strategies, legal affairs, human resources management and environmental protection are applied by its subsidiaries, divisions, joint ventures and associates.

| 4.2 | Industry Sector Information |

| 4.2.1 | Packaging Products sector |

| 4.2.1.1 | Containerboard Packaging Group |

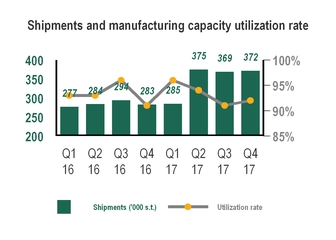

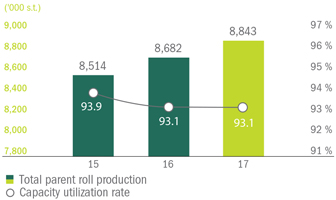

The Containerboard Packaging Group employs close to 4,000 employees, and operates six (6) linerboard and corrugated medium mills and twenty-one (21) converting plants across Canada and the Northeastern United States. The mills have a combined annual production capacity of 1,531,000 short tons, of which 48% is linerboard and 52% is corrugated medium. In 2017, approximately 53% of the mills output was converted by the Group’s converting facilities. This integration rate increases to 66% when associates and joint ventures are taken into consideration. The Group produces a broad range of products for regional and national customers in a variety of industries, including food, beverage and consumer products. Approximately 84% of the total pulp and fibre consumed by this Group is recycled fibre. Products are delivered by truck or rail.

On April 5, 2017, the Corporation announced that results from Greenpac Mill LLC (Greenpac) would be consolidated with those of the Corporation following an amendment to make certain changes to the Greenpac equity holders agreement. As a result, the Corporation began consolidating Greenpac results on April 4, 2017. The agreement did not involve any cash consideration. The Greenpac Mill, a state-of-the-art linerboard mill with annual production of 540,000 short tons, manufactures one of the best linerboards in the industry. The mill is located in Niagara Falls (NY, USA) and employs approximately 140 employees.

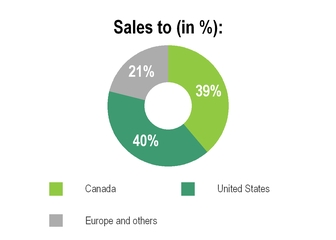

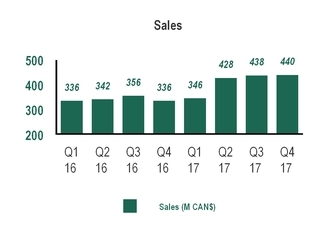

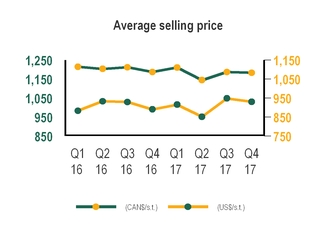

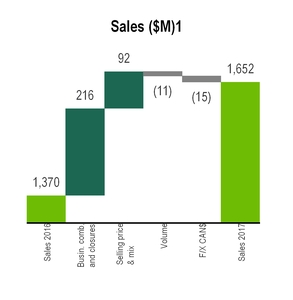

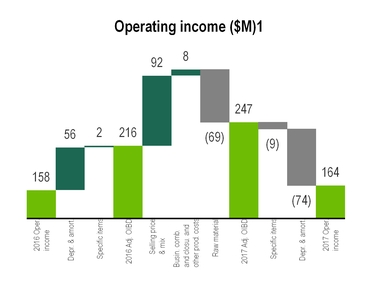

Sales from this Group totaled $1,652 million in 2017, compared to $1,370 million in 2016, of which 65% were in Canada and 35% were in the United States. This Group sells its products via its own sales force and external representatives when needed for export purposes.

The following table lists the mills and converting plants of the Containerboard Packaging Group and the approximate annual production capacity or shipments of each facility as well as the products manufactured or, where applicable, their activities in 2017:

| 4 |

| Annual Information Form |

| Facilities | Products / Services | Annual capacity or Shipments | |||

| Manufacturing | Annual Capacity in short tons | ||||

| Niagara Falls, New York, USA | 100% recycled corrugating medium | 275,000 | |||

| Greenpac, Niagara Falls, New York, USA | 100% recycled linerboard | 540,000 | |||

| Kingsey Falls, Québec | 100% recycled linerboard | 105,000 | |||

| Cabano, Québec | Corrugating medium in various basis weights | 244,000 | |||

| Trenton, Ontario | Corrugating medium in various basis weights | 194,000 | |||

| Mississauga, Ontario | 100% recycled linerboard | 173,000 | |||

| Converting | Shipments in square feet (000) | ||||

| Drummondville, Québec | Corrugated packaging | 1,769,000 | |||

| Victoriaville, Québec | Corrugated packaging | 274,000 | |||

| Vaudreuil, Québec | Corrugated packaging | 966,000 | |||

| Montréal, Québec | Micro-Litho packaging | 414,000 | |||

| Belleville, Ontario | Corrugated packaging | 233,000 | |||

| Etobicoke, Ontario | Corrugated packaging | 525,000 | |||

| Jellco, Barrie, Ontario | Corrugated packaging | 225,000 | |||

| St. Marys, Ontario | Corrugated packaging | 1,048,000 | |||

| Vaughan, Ontario | Corrugated packaging | 2,405,000 | |||

| Lithotech, Scarborough, Ontario | Micro-Litho packaging | 228,000 | |||

| Guelph, Ontario | Corrugated packaging | 254,000 | |||

| McLeish, Etobicoke, Ontario | Corrugated packaging | 165,000 | |||

| Burlington, Ontario | Corrugated packaging | 90,000 | |||

| Scarborough, Ontario | Corrugated packaging | 234,000 | |||

| Winnipeg, Manitoba | Corrugated packaging | 745,000 | |||

| Calgary, Alberta | Corrugated packaging | 652,000 | |||

| Richmond, British Columbia | Corrugated packaging | 594,000 | |||

| New York City, New York, USA | Corrugated packaging | 899,000 | |||

| Schenectady, New York, USA | Corrugated packaging | 581,000 | |||

| Lancaster, New York, USA | Corrugated packaging | 359,000 | |||

| Newtown, Connecticut, USA | Corrugated packaging | 755,000 | |||

|

Services |

|||||

| Art & Die, Etobicoke, Ontario | Graphic art and printing plates | N/A | |||

| 5 |

| Annual Information Form |

| 4.2.1.2 | Boxboard Europe Group |

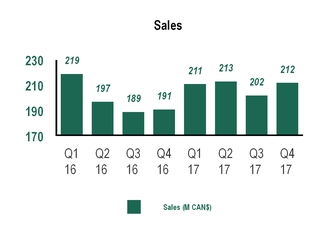

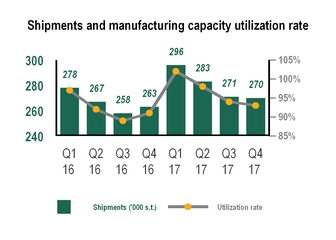

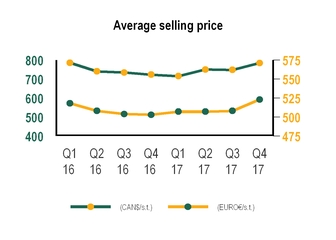

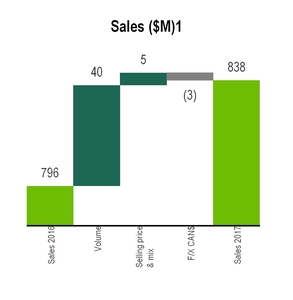

As at December 31, 2017, the Corporation's holding in its subsidiary RdM, the second largest European producer of coated recycled boxboard, stood at 57.8%. RdM operates five (5) recycled boxboard mills with an annual production capacity of 885,000 metric tonnes, one (1) virgin boxboard mill with an annual production capacity of 165,000 metric tonnes and three (3) sheeting centers. It employs approximately 1,500 employees. RdM is a public company listed on the Milan and Madrid stock exchanges. Information concerning RdM’s production facilities can be found at www.rdmgroup.com. Sales for the Boxboard Europe Group stood at $838 million in 2017 compared to $796 million in 2016.

The following table lists the mills of the Boxboard Europe Group and the approximate annual production capacity of each facility as well as the products manufactured or, where applicable, their activities in 2017:

| Facilities | Products | Annual

capacity in metric tonnes | ||

| Arnsberg, Germany | Coated recycled boxboard | 220,000 | ||

| Santa Giustina, Italy | Coated recycled boxboard | 240,000 | ||

| Ovaro, Italy | Coated recycled boxboard | 95,000 | ||

| Villa Santa Lucia, Italy | Coated recycled boxboard | 220,000 | ||

| Blendecques, France | Coated recycled boxboard | 110,000 | ||

| La Rochette, France | Coated virgin boxboard | 165,000 |

| 4.2.1.3 | Specialty Products Group |

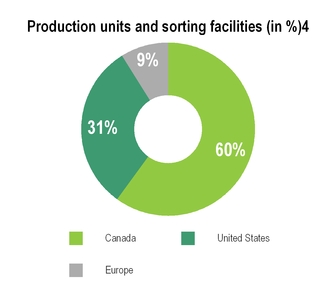

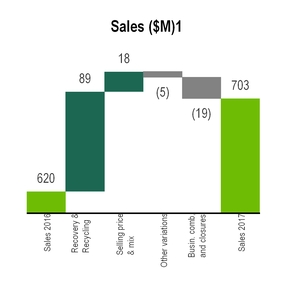

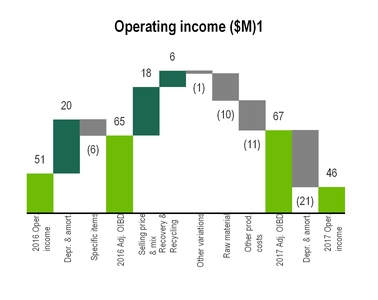

The Specialty Products Group operates in three (3) main sub-segments, namely industrial packaging, consumer products packaging, and recovery and recycling. This Group operates thirty-eight (38) facilities in North America and Europe, including nineteen (19) recovery centers across Canada and the Northeastern United States. It employs more than 2,200 employees. In 2017, sales from this Group amounted to $703 million, compared to $620 million in 2016, of which 56% were in Canada, 35% in the United States, and 9% were in Europe.

| a) | Industrial Packaging |

The Industrial Packaging sub-segment is active in four (4) markets: protective packaging, specialty containers, structural components and paperboard and fibre composites.

One plant produces uncoated recycled paperboard (URB) using 100% recycled fibres. The URB produced is mainly used by packaging converters and industrial users of headers and wrappers for the paper industry, as well as partitions used as protective packaging. Four (4) plants in Québec and in the United States manufacture honeycomb paperboard for industrial and commercial packaging as well as partitions, mostly for the beer, wine and spirits industry. One facility manufactures laminated paperboard that is used in the food packaging and furniture backing industries while another facility manufactures backing for vinyl flooring. Products are sold in Canada and the United States.

Two (2) plants in France manufacture roll headers made of linerboard and uncoated paperboard. All products are sold in Europe.

The following table lists the plants (including joint ventures, which are not consolidated) of the industrial packaging business sector and the approximate annual production capacity of each facility as well as the products manufactured or, where applicable, their activities in 2017:

| 6 |

| Annual Information Form |

| Facilities | Products | Annual

capacity in metric tonnes | ||

| Cascades Sonoco, Kingsey Falls, Québec* | Roll headers and wrappers | 80,000 | ||

| Cascades Sonoco, Berthierville, Québec* | Roll headers and wrappers | 50,000 | ||

| Cascades Sonoco, Birmingham, Alabama, USA* | Roll headers and wrappers | 50,000 | ||

| Cascades Sonoco, Tacoma, Washington, USA* | Roll headers and wrappers | 30,000 | ||

| Cascades Rollpack, Saulcy-sur-Meurthe, France | Roll headers and packaging reams | 40,000 | ||

| Cascades Rollpack, Châtenois, France | Packaging reams | 25,000 | ||

| Cascades Multi-Pro, Drummondville, Québec | Laminated paperboard and specialty containers | 18,000 | ||

| Cascades Enviropac, Berthierville, Québec | Honeycomb packaging products | 12,600 | ||

| Cascades Enviropac, St-Césaire, Québec | Uncoated paperboard partitions | 7,500 | ||

| Cascades Enviropac, Grand Rapids, Michigan, USA | Honeycomb packaging products and other packaging products | 10,000 | ||

| Cascades Enviropac, Aurora, Illinois, USA | Uncoated paperboard partitions | 6,000 | ||

| Cascades Papier Kingsey Falls, Kingsey Falls, Québec | Uncoated paperboard | 103,000 | ||

| Cascades Lupel, Trois-Rivières, Québec | Manufacture of backing for vinyl flooring | 55,000 |

*Joint ventures

| b) | Consumer Products Packaging |

The Consumer Products Packaging sub-segment designs and manufactures packaging for fresh foods, catering to the food processing, retailing and quick-service restaurant industries.

Two (2) plants manufacture egg filler flats for egg processors and four-cup carriers for the quick-service restaurant industry using 100% recycled material. Two (2) facilities manufacture polystyrene foam trays, marketed under the EVOK® brand, for processors and retailers in the food industry. Another plant manufactures rigid plastic packaging, under various brand names such as Ultratill™ and Poultray™, primarily for the food industry, processors and retailers. A facility specializes in the manufacturing of flexible film for packaging mainly for customers in the frozen foods, bakery and ice industries. This sub-segment has sales in both Canada and the United States.

The following table lists the plants in the consumer products packaging sub-segment and the approximate annual production capacity of each facility as well as the products manufactured or, where applicable, their activities in 2017:

| Facilities | Products | Annual

capacity in kilograms | ||

| Plastiques Cascades, Kingsey Falls, Québec | Polystyrene foam food packaging, plate and bowls | 9,500,000 | ||

| Cascades Plastics, Warrenton, Missouri, USA | Polystyrene foam food packaging | 8,500,000 | ||

| Cascades Inopak, Drummondville, Québec | Plastic food packaging | 7,000,000 | ||

| Cascades Flexible Packaging, Mississauga, Ontario | Film packaging | 7,941,000 | ||

| Cascades Forma-Pak, Kingsey Falls, Québec | Egg filler flats and beverage carry trays | 16,500,000 | ||

| Cascades Moulded Pulp, Rockingham, North Carolina, USA | Egg filler flats and beverage carry trays | 9,000,000 |

| c) | Recovery and Recycling |

The recovery and recycling sub-segment provides services to recover and process discarded materials for the municipal, industrial, commercial and institutional sectors. Services are offered across Canada and the Northeastern United States through nineteen (19) recovery facilities. In 2017, this sub-segment processed, brokered and bought over 1.45 million short tons of recovered papers through its recovery facilities.

| 7 |

| Annual Information Form |

| 4.2.2 | Tissue Papers Sector |

| 4.2.2.1 | Tissue Group |

The Tissue Group manufactures, converts and markets a wide variety of tissue paper products intended for the Away-from-Home and consumer products markets. The Group operates seven (7) manufacturing facilities, ten (10) converting facilities, and four (4) facilities with both manufacturing and converting activities. It also operates the Best Diamond Packaging, LLC joint venture in Kinston, NC, USA. The Group employs more than 2,200 employees.

The Group markets and sells its lines of bathroom tissue, facial tissue, paper towels, paper hand towels, paper napkins and other related products under the Decor®, North River®, Cascades®, Cascades Moka®, Tandem®, Tandem+®, Cascades Elite® and Wiping Solutions® brand labels in both the Canadian and American Away-from-Home markets. In 2016, the Tissue Group rebranded its Away-from-Home product offerings as Cascades PRO, and markets and sells its lines under the five brand names of Cascades PRO Signature™, Cascades PRO Perform™, Cascades PRO Select™, Cascades Pro Tandem™ and Cascades PRO Tuff-Job™. In the consumer products market, lines are principally marketed under private labels and under the Cascades Fluff TM, Cascades Tuff TM and April Soft® labels in Canada, and under the Nature’s Choice® label and other secondary marks in the United States. Products are sold principally through a direct sales force and are delivered by truck.

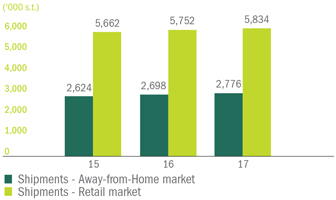

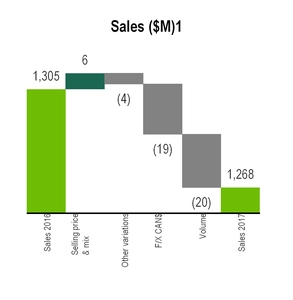

Sales from this Group amounted to $1,268 million in 2017, compared to $1,305 million in 2016, of which 74% were in the United States and the remaining 26% were in Canada. On a segmented basis, the Away-from-Home market represented 43% of sales in Canada and 50% in the US, while the retail market represented 57% in Canada and 50% in the US.

The following table lists the mills and converting plants (including joint ventures, which are not consolidated) of the Tissue Group and the approximate annual production capacity of each facility as well as the products manufactured or, where applicable, their activities in 2017:

| 8 |

| Annual Information Form |

| Facilities | Products / Services | (Manufacturing only) | ||

| Manufacturing / Converting | ||||

| Candiac, Québec | Parent rolls, paper towels, bathroom tissue | 74,000 | ||

| Lachute, Québec | Parent rolls, paper hand towels, bathroom tissue | 35,000 | ||

| Kingsey Falls, Québec | Parent rolls, facial tissue, bathroom tissue | 105,000 | ||

| Eau Claire, Wisconsin, USA | Parent rolls, paper towels, bathroom tissue, facial tissue and paper napkins | 56,000 | ||

| Manufacturing | ||||

| Toronto PM , Ontario (2) | Parent rolls | 54,000 | ||

| St-Helens, Oregon, USA | Parent rolls | 116,000 | ||

| Ransom, Pennsylvania, USA | Parent rolls | 59,000 | ||

| Memphis, Tennessee, USA | Parent rolls | 40,000 | ||

| Rockingham, North Carolina, USA | Parent rolls | 58,000 | ||

| Mechanicville, New York, USA | Parent rolls | 53,000 | ||

| Converting | ||||

| Laval, Québec | Paper napkins | N/A | ||

| Granby, Québec | Bathroom tissue, facial tissue and paper hand towels | N/A | ||

| Kingman, Arizona, USA | Paper towels, bathroom tissue, paper hand towels, paper napkins | N/A | ||

| Waterford, New York, USA | Paper towels, bathroom tissue, paper hand towels, paper napkins | N/A | ||

| Pittston, Pennsylvania, USA | Paper towels, bathroom tissue, facial tissue and paper napkins | N/A | ||

| Wagram, North Carolina, USA | Paper towels, bathroom tissue, paper hand towels, paper napkins | N/A | ||

| Kinston, North Carolina, USA* | Paper napkins | N/A | ||

| Grande Prairie, Texas, USA* | Paper towels, bathroom tissue, paper hand towels, paper napkins | N/A | ||

| Brownsville, Tennessee, USA | Industrial wipes | N/A | ||

| Scappoose, Oregon, USA | Bathroom tissue, paper hand towels | N/A |

* Joint ventures

| 4.3 | Research, Development and Innovation |

Cascades has its own research and development centre located in Kingsey Falls (Québec) and is composed of 70 employees. It provides Cascades’ business units with technical support in solving production problems and improving quality as well as the development of new products and processes. Moreover, it is strongly involved in innovation and sustainable development through its scientific and technical support to the Corporation’s marketing and innovation teams.

Cascades has adopted a clear strategy relative to innovation as it is one of the key enablers of the Corporation's strategic plan. Each Cascades Division has defined their strategic arena and their action plan in order to reach the ambitious goal of generating 20% of their sales relating to the introduction of new products by 2020. Cascades also put in place a centralized work team, the CIC (Cascades Innovation Center), to develop and support innovation within the Divisions. The team includes specialists in market research as well as product development.

Activities related to our ERP system and business process re-engineering increased our costs by $10 million in 2017 compared to 2016. These higher costs reflect the accelerated implementation of our ERP platform since the second half of 2016, and additional costs associated with the optimization of internal processes such as sales and operations planning, logistics and procurement during 2016 and the beginning of 2017. The implementation phase of these initiatives are completed and are expected to reduce cost levels beginning in 2018 through stabilization and optimization. In 2017, the Corporation invested $20 million in intangible and other assets compared to $15 million in 2016, for the implementation of our ERP information technology system.

| 9 |

| Annual Information Form |

| 4.4 | Competitive Conditions |

| 4.4.1 | Our Markets |

Cascades operates in large, highly competitive markets. Our products and services compete with similar products manufactured and distributed by others both domestically and globally. The success in our markets is influenced by many factors, including customer service, price, geographic location, quality, breadth and performance characteristics of our products. Given our products, integration level, markets and geographic diversification, we believe that we are well-positioned to compete in our packaging and tissue sectors.

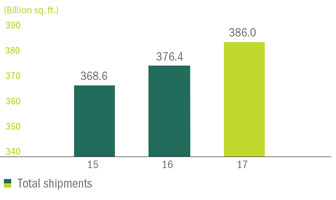

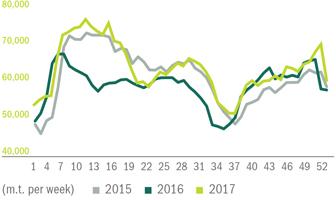

According to RISI and the Canadian Corrugated and Containerboard Association ("CCCA"), the total containerboard production in North America was approximately 39.3 million tons in 2017 while total containerboard production capacity totaled approximately 40.6 million tons. We estimate the five largest manufacturers, International Paper Company, WestRock Company(1), Georgia-Pacific LLC, Packaging Corporation of America and KapStone Paper and Packaging Corporation(1) to account for approximately 75% of total production capacity. Total U.S. containerboard production increased by 3.1% in 2017. With respect to demand, while the containerboard market is cyclical and impacted by economic conditions, it tends to be more resilient given that approximately 75% of the end demand for corrugated boxes comes from the non-durable goods industries according to the Fibre Box Association.

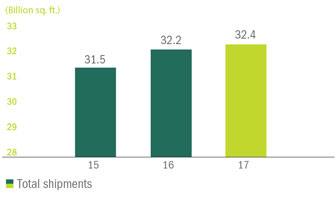

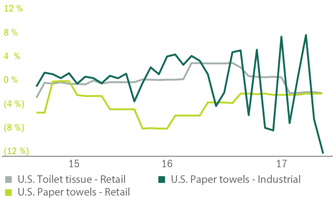

According to RISI, demand in the U.S. tissue paper market reached approximately 9.3 million tons in 2017. Tissue production capacity in North America totaled approximately 10.0 million tons during the same period. We estimate the five largest manufacturers, Georgia-Pacific LLC, The Procter & Gamble Company, Kimberly-Clark Corporation, Svenska Cellulosa Aktiebolaget (SCA) and Cascades Inc. to account for approximately 74% of total production capacity. The tissue paper market consists of both the consumer products and Away-from-Home markets. Shipments of consumer products and Away-from-Home tissue products represented approximately 68% and 32%, respectively, of total U.S. tissue paper shipments in 2017. The tissue market is considered to be the most stable paper sector with demand in North America growing at a 1.5% compound annual growth rate since 2005.

(1) On January 29, 2018, WestRock Company announced the signing of a definitive agreement, pursuant to which it would acquire KapStone Paper and Packaging Corporation.

| 4.4.2 | Our Competitive Strengths |

Leading Market Positions with Environmentally Sustainable Product Focus. We are one of the two leaders in Canada and hold one of the leading market positions in the packaging industry in North America. We also are a leading producer of coated recycled boxboard in Europe through our ownership of Reno de Medici, S.p.A. We believe our leading market positions and our environmental focus give us an advantage over many of our competitors. We believe the demand for green products is growing and we are well-positioned to take advantage of the growing environmental trend due to our strengths and diversity of product offerings.

Integrated Recycling Solutions Provider. We are an integrated manufacturer with both downstream recycled paper collection and processing capabilities and upstream manufacturing and converting operations. We have created the closed-loop systemTM that enables us to manufacture our products efficiently for our customers. In North America, 30% of the recycled fibre that we use in our products come from our own recovery facilities. We continually look for opportunities to increase our integration to further ensure the supply of raw materials to our mills and grow the development of our environmentally sustainable products.

Diversified Portfolio of Products, Markets and Geographic Locations. We manufacture and sell a diversified portfolio of packaging, tissue and specialty products for commercial, industrial and consumer products end markets in Canada, the United States, Europe and other regions. Our customers include Fortune 500, medium and small-sized companies across a broad range of industries. We believe that our product, geographic and customer diversification help us maintain our operating performance through economic downturns and changing market conditions. The size and diversity of our operations also allow us to cost-effectively serve customers on a regional and multinational basis, reducing delivery times and enhancing customer service.

Strong Presence in Consumer-Oriented End Markets. Our packaging, tissue and other products are sold primarily to consumer-oriented end markets, which tend to be less sensitive to economic cycles. As a result, products sold to these markets tend to exhibit a greater degree of stability and predictability in demand and product prices than products sold to commercial or industrial-oriented end markets. Our participation in consumer-oriented end markets has increased with our focus on selling tissue products.

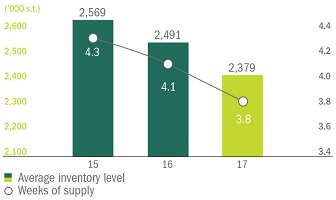

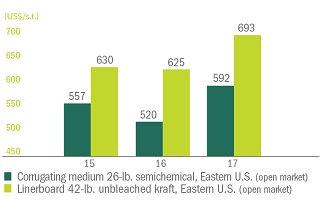

| 4.5 | Cyclical Considerations |

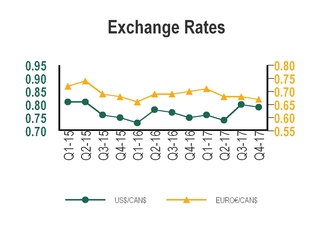

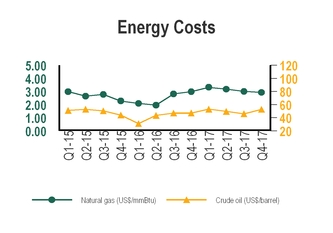

Although the Corporation believes that its products, integration level, market, and geographical diversification help to mitigate the adverse effects of industry conditions, the markets, for some of its products, notably containerboard and boxboard, remain cyclical. These markets are influenced by changes in the North American and global economies, industry capacity and inventory levels maintained by customers, all of which affect selling prices and profitability. The Corporation is also affected by the variation of the Canadian dollar against the U.S. dollar and the Euro, and the effect of the volatility of the costs of raw materials, particularly recycled fibre and energy prices.

| 10 |

| Annual Information Form |

| 4.6 | Environmental Protection |

| 4.6.1 | Regulations |

The Corporation’s activities are subject to environmental laws and regulations imposed by various governmental and regulatory authorities in all the countries where it operates. The Corporation is in compliance, in all material respects, with all applicable environmental legislation and regulations. However, ongoing capital and operating expenses are expected to be incurred to achieve and maintain compliance with applicable environmental requirements. For more information, reference is made to the heading “RISK FACTORS”, on page 70 of Management’s Discussion and Analysis in the 2017 Annual Report, which item is incorporated by reference.

In 2017, environmental protection requirements and the application of Cascades’ environmental mission required capital expenditures and led to operating costs as follows:

| Country | Capital Expenses | Operating Costs | ||||||

| Canada | $ | 504,821 | $ | 28,048,397 | ||||

| United States | $ | 1,730,819 | $ | 30,548,573 | ||||

| Total | $ | 2,235,640 | $ | 58,596,970 | ||||

| 4.6.2 | Commitment to Sustainable Development |

Since one of the deeply ingrained values of the Corporation is protecting the environment, Cascades has adopted a Commitment to Sustainable Development, which is available on the Corporation’s website at www.cascades.com.

| 4.7 | Reorganizations |

In 2017, no major legal reorganizations were undertaken by Cascades. In the normal course of business, some reorganizations of the subsidiaries of the Corporation could occasionally occur in order to improve the organizational structure, none of them having a material impact on the activities, operations or financial results of the Corporation.

In 2017, the Corporation finished implementing ONE Cascades, a major program to streamline its business processes. The focus for 2018 is the optimization of the different initiatives. ONE Cascades aims to strengthen our customer approach by optimizing and standardizing internal procedures. This program will include improving the supply chain to allow a better response to customers; discharging the plants from repetitive administrative tasks to allow them to focus on improving production; and improving the human resources processes to provide better support to the organization.

| 4.8 | Social Policies |

In 2017, the Corporation adopted a revised Code of Ethics and Business Conduct (the “Code”), which is meant to provide directors, officers, employees and consultants with general guidelines for acceptable behaviour in all relationships with each other, customers, suppliers, partners, and the communities where the Corporation operates. A copy of the Code is available on the Corporation' website at www.cascades.com.

| 4.9 | Risk Factors |

We refer the reader to Management’s Discussion and Analysis in the 2017 Annual Report, specifically on page 70 under the heading “RISK FACTORS”, incorporated by reference herein.

ITEM 5 - DIVIDENDS AND DISTRIBUTIONS

In 2015, 2016 and 2017, Cascades paid dividends on its Common Shares at the current rate of $0.04 per Common Share per quarter. Other than pursuant to the Indentures, which govern its Senior Notes, and the Credit Facilities, there are no material contractual restrictions on Cascades’ ability to declare and pay dividends on its Common Shares.

The dividend amount is reviewed annually by the Board of Directors and is determined taking into account Cascades’ financial situation, its results from operations, its capital requirements and any other factor deemed pertinent by the Board of Directors.

ITEM 6 - CAPITAL STRUCTURE

| 6.1 | General description of capital structure |

The share capital of the Corporation is composed of an unlimited number of Common Shares without par value, an unlimited number of Class “A” Preferred Shares without par value which may be issued in series and an unlimited number of Class “B” Preferred Shares without par value which may be issued in series.

| 11 |

| Annual Information Form |

The holders of common shares are entitled to the right to vote on the basis of one vote per share at any meetings of shareholders and the right to receive dividends and to share in the remaining assets in the event of a liquidation of the Corporation. As at March 16, 2018, there were 95,174,139 Common Shares issued and outstanding.

The Class “A” and “B” Preferred Shares are issuable in series and rank equally within their respective classes as to dividends and capital. Registered holders of any series of Class “A” or Class “B” are entitled to receive, in each fiscal year of the Corporation or on any other basis, cumulative or non-cumulative preferred dividends payable at the time, at the rates and for such amounts and at the place or places determined by the directors with respect to each series prior to the issuance of any Class “A” or Class “B” Preferred Shares. In the event of the liquidation, winding-up or dissolution of the Corporation or any other distribution of its assets to its shareholders, the holders of Class “A” and “B” Preferred Shares are entitled to receive, out of the assets of the Corporation, the amount paid in consideration of each share held by them. The holders of Class “A” and “B” Preferred Shares are not entitled as such to receive notice of or to attend or to vote at any meetings of shareholders. None of the Class “A” or “B” Preferred Shares of the capital stock of the Corporation are, as of the date hereof, issued and outstanding.

| 6.2 | Ratings |

Credit ratings are intended to provide investors with an independent measure of credit quality of an issuer or a security. Rating for issuers or for debt instruments are presented in ranges by each of the rating agencies. The highest qualities of securities are rated AAA in the case of Standard & Poor’s ("S&P") and Dominion Bond Rating Services (“DBRS”), or Aaa in the case of Moody’s Investors Service ("Moody’s”). The lowest quality of securities are rated D in the case of S&P and DBRS, or C in the case of Moody’s.

According to the S&P rating system (http://www.spratings.com/en_US/understanding-ratings), corporations or notes rated BB, B, CCC, CC, and C are regarded as having from low to significant speculative characteristics. A BB rating indicates the least degree of speculation and C the highest. While such corporations or notes will likely have some quality and protective characteristics, these may be outweighed by large uncertainties or major exposures to adverse conditions. The ratings from AAA to B may be modified by the addition of a plus (+) or minus (-) to show relative standing within the major rating categories.

According to the DBRS rating system (http://dbrs.com/ratingPolicies/list/name/rating+scales), corporations or notes rated BB are defined to be speculative and non-investment grade, where the degree of protection afforded interest and principal is uncertain, particularly during periods of economic recession. Entities in the BB range typically have limited access to capital markets and additional liquidity support. In many cases, deficiencies in critical mass, diversification, and competitive strength are additional negative considerations. The absence of either a high or low designation indicates the rating is in the middle of the category.

According to the Moody’s rating system (https://www.moodys.com/Pages/amr002002.aspx), corporations or notes, which are rated Ba, are judged to have speculative elements; their future cannot be considered as well assured. Often the protection of interest and principal payments may be very moderate, and thereby not well safeguarded during both good and bad times over the future. Uncertainty of position characterizes bonds in this class. Moody’s applies numerical modifiers 1, 2, and 3 in each generic rating classification from Aa through Caa. The modifier 1 indicates that the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking and the modifier 3 indicates a ranking in the lower end of that generic rating category.

| Credit Risk | Moody's | S & P | DBRS | |||

| Highest quality | Aaa | AAA | AAA | |||

| High quality (very strong) | Aa | AA | AA | |||

| Upper medium grade (strong) | A | A | A | |||

| Medium grade | Baa | BBB | BBB | |||

| Lower medium grade (somewhat speculative) | Ba | BB | BB | |||

| Low grade (speculative) | B | B | B | |||

| Poor quality (may default) | Caa | CCC | CCC | |||

| Most speculative | Ca | CC | CC | |||

| No interest being paid or bankruptcy petition filed | C | C | C | |||

| In default | C | D | D |

Source: Securities Industry and Financial Markets Association and “Dominion Bond Rating Services”

Cascades is rated by S&P, Moody’s and DBRS. The Corporation’s rating by these three agencies are listed below:

| Rating agency | Cascades Rating | Qualitative | Most recent update | |||

| S&P | BB- | Stable outlook | June 2016 | |||

| Moody’s | Ba2 | Stable outlook | May 2015 | |||

| DBRS | BB | Stable outlook | January 2015 |

It is to be noted that the credit ratings given by the rating agencies are not recommendations to purchase, hold or sell Cascades' notes or securities as such, given these ratings do not comment as to market price or suitability for a particular investor. There is no assurance that any rating will remain in effect for any given period of time or that any rating will not be revised or withdrawn by a rating agency in the future if in its judgment circumstances so warrant. The Corporation is not responsible for credit ratings given by the rating agencies.

| 12 |

| Annual Information Form |

ITEM 7 - MARKET FOR SECURITIES

| 7.1 | Trading Price and Volume |

Cascades’ Common Shares are traded on the Toronto Stock Exchange and alternative trading systems under the ticker symbol “CAS”. The following table sets forth the market price range, in Canadian dollars, and trading volumes of the Corporation’s Common Shares on the Toronto Stock Exchange for each month of the most recently completed financial year:

Toronto Stock Exchange - Market price range - Year 2017

| Month | High | Low | Closing

Market Price | Trading Volume | ||||||||||||

| January | 12.95 | 11.44 | 11.85 | 2,493,997 | ||||||||||||

| February | 14.39 | 11.78 | 13.25 | 4,323,610 | ||||||||||||

| March | 13.89 | 12.50 | 13.54 | 4,101,512 | ||||||||||||

| April | 16.45 | 13.43 | 16.44 | 8,023,280 | ||||||||||||

| May | 16.50 | 16.94 | 16.41 | 7,521,602 | ||||||||||||

| June | 17.73 | 16.10 | 17.69 | 7,820,738 | ||||||||||||

| July | 18.20 | 15.27 | 15.37 | 3,811,631 | ||||||||||||

| August | 15.65 | 13.76 | 14.60 | 4,480,699 | ||||||||||||

| September | 16.71 | 13.79 | 14.96 | 5,009,450 | ||||||||||||

| October | 16.41 | 14.71 | 15.54 | 2,499,719 | ||||||||||||

| November | 15.93 | 12.20 | 12.84 | 5,204,537 | ||||||||||||

| December | 14.88 | 12.55 | 13.62 | 5,252,733 | ||||||||||||

In 2016, in the normal course of business, the Corporation renewed its redemption program. Purchases began on March 17, 2016 and continued until March 16, 2017. The notice enabled Cascades to acquire up to 1,907,173 Common Shares, representing approximately 2% of the issued and outstanding Common Shares as of March 4, 2016. As of March 16, 2017, the Corporation had redeemed 902,738 Common Shares at an average weighted cost of $8.65.

In 2017, in the normal course of business, the Corporation renewed its redemption program. The period for purchasing began on March 17, 2017 and continued until March 16, 2018. The notice enabled Cascades to acquire up to 946,066 Common Shares, representing approximately 1% of the issued and outstanding Common Shares as of March 4, 2017. As of March 16, 2018, the Corporation had redeemed 178,380 Common Shares at an average weighted cost of $14.30.

On March 15, 2018, Cascades announced that the Toronto Stock Exchange had accepted its notice of intention to begin a normal course issuer bid in respect of its Common Shares. Purchases pursuant to the normal course issuer bid commenced on March 19, 2018 and will cease on March 18, 2019. The Common Shares purchased shall be cancelled. The notice will enable Cascades to acquire up to 951,641 Common Shares, which represents approximately 1% of the 95,164,119 issued and outstanding Common Shares as at March 9, 2018.

ITEM 8 - DIRECTORS AND OFFICERS

The Directors of the Corporation are elected annually to hold office until the next annual general meeting or until a successor is elected or appointed.

| 8.1 | Name, Occupation and Security Holding |

The following table sets out the name, age and place of residence of each director, its principal occupation, the year in which he or she first became a director of the Corporation, the number of common shares of the Corporation beneficially owned directly or indirectly by him or her, their independence status, the number of deferred share units he or she holds, if the Director sits on boards of directors and committees of other public companies, membership on the committees of the Board of Directors of the Corporation. Also disclosed in their respective biographies is their value of at-risk holdings as at December 31, 2017 and the percentage of votes voted in favour of their election at last year's meeting.

| 13 |

| Annual Information Form |

|

Principal occupation : | Executive Chair of the Board | |

| Committee(s) : | N.A. | ||

2017 Annual Meeting Votes in favour (%) : 95.69

|

|||

| Alain

Lemaire Age 70 Kingsey Falls (Québec) Canada Non-Independent Director since 1967 |

One of the founders of Cascades, Mr. Lemaire is Executive Chair of the Board of the Corporation. He held the position of President and Chief Executive Officer from 2004 to May 2013. He was Executive Vice-President of the Corporation from 1992 to 2004 and was President and Chief Executive Officer of Norampac Inc., from 1998 to 2004. A former student of the Institut des pâtes et papiers de Trois-Rivières (Québec), he holds an Honorary Doctorate in Business Administration from the University of Sherbrooke (Québec). He received an Honorary Doctorate in Civil Law from Bishop's University in Lennoxville (Québec) in 2013, and Doctorat Honoris Causa d'Université from Université Laval (Québec) in 2017. Mr. Lemaire is an Officer of the Order of Canada and was named a Chevalier de l'Ordre national du Québec in 2015. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES (2) | DSUs (4) | SHARES (2) | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 4,983,532 | — | 4,979,516 | — | 4,016 | 67,875,705 | |||||||||||||||||

|

Principal occupation : | President, Louis Garneau Sports Inc. | |

| Committee(s) : | Health and Safety, Environment and Sustainable Development (Member) | ||

2017 Annual Meeting Votes in favour (%) : 95.89

|

|||

| Louis

Garneau Age 59 St-Augustin-de-Desmaures (Québec) Canada Independent (1) Director since 1996 |

Mr. Garneau is President of Louis Garneau Sports Inc., a manufacturer and distributor of sports clothing and accessories throughout the world. He is a member of the Health and Safety, Environment and Sustainable Development Committee. A former international cycle racer, Mr. Garneau participated in the 1984 Olympic Games in Los Angeles. He is a Chevalier de l’Ordre national du Québec and an Officer of the Order of Canada. In June 2007, he was awarded an Honorary Doctorate from the Faculty of Administration of the University of Ottawa. In 2008, he received the “Gloire de l’Escolle” medal as a former graduate having honored Université Laval due to the extent of his professional activities and his contribution to society. In November 2014, he was awarded the Medal of Honour of the Assemblée nationale du Québec. This medal is awarded to public figures who are deserving of recognition by the Members of the Assembly. He was one of the personalities named Grand Québécois 2017 by the Chambre de commerce et d'industrie de Québec. |

||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 5,018 | 54,723 | 5,018 | 51,518 | 3,205 | 813,672 | |||||||||||||||||

| 14 |

| Annual Information Form |

|

Principal occupation : | Director of companies | |

| Committee(s) : | Health

and Safety, Environment and Sustainable Development (Chair) Corporate Governance and Nominating (Member) |

||

2017 Annual Meeting Votes in favour (%) : 87.46

|

|||

| Sylvie

Lemaire Age 55 Otterburn Park (Québec) Canada Non-Independent Director since 1999 |

Ms. Lemaire is a director of companies. She has held production, research and development and general management positions. She was co-owner of Dismed Inc., a distributor of medical products and Fempro Inc., a manufacturer of absorbent products, where she held the position of President until 2007. She is Chair of the Health and Safety, Environment and Sustainable Development Committee and a member of the Corporate Governance and Nominating Committee. Since June of 2014, Ms. Lemaire is a certified Director of Companies having successfully completed the governance program offered by the Collège des administrateurs de sociétés of Université Laval (Québec). Ms. Lemaire sits on the Boards of Groupe Marcelle Inc., involved in the manufacture of cosmetic products, and Harnois Groupe Pétrolier, wholesaler of petroleum products and propane gas. She holds the degree of Bachelor in Industrial Engineering from Polytechnique Montréal. |

||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES (3) | DSUs (4) | SHARES (3) | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 175,287 | 51,759 | 175,287 | 48,588 | 3,171 | 3,092,367 | |||||||||||||||||

|

Principal occupation : | Partner, McCarthy Tétrault | |

| Committee(s) : | Human

Resources (Chair) Corporate Governance and Nominating (Member) |

||

2017

Annual Meeting Votes in favour (%) : 94.05 |

|||

| David

McAusland Age 64 Baie d'Urfé (Québec) Canada Independent (1) Director since 2003 |

Mr. McAusland is a partner in the law firm of McCarthy Tétrault. From 1999 to February 2008, he held among others, the position of Executive Vice-President, Corporate Development and Chief Legal Officer of Alcan Inc., a large multinational industrial company. He is Chair of the Human Resources Committee and member of the Corporate Governance and Nominating Committee. Mr. McAusland sits on the Boards of Directors of Cogeco Inc., and Cogeco Communication Inc., two companies involved in the communications sector where he is a member of the Corporate Governance Committee and Chair of the Human Resources Committee of both these issuers. He is the Chairman of the Board of Directors of ATS Automation Tooling Systems Inc., a leader in automation manufacturing solutions, and sits on the Board of the Montreal General Hospital Foundation, a non-profit organization. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 4,000 | 68,372 | 4,000 | 62,438 | 5,934 | 985,707 | |||||||||||||||||

| 15 |

| Annual Information Form |

|

Principal occupation : | Director of companies | |

| Committee(s) : | Audit

and Finance (Chair) Corporate Governance and Nominating (Member) Lead Director |

||

2017

Annual Meeting Votes in favour (%) : 97.01 |

|||

| Georges

Kobrynsky Age 71 Outremont (Québec) Canada Independent (1) Director since 2010 |

Mr. Kobrynsky is a director of companies. He is Lead Director of the Board of Directors, Chair of the Audit and Finance Committee and member of the Corporate Governance and Nominating Committee. He held the position of Senior Vice-President, Investments, Forest Products of the Société générale de financement du Québec from 2005 to 2010. Mr. Kobrynsky has held, for more than 30 years, various senior positions at Domtar Inc., including Senior Vice-President, Pulp and Paper Sales, Marketing and Customer Relations Group from 2001 to 2005 and Senior Vice-President, Communication Papers Division from 1995 to 2001. He sat on the Board of Directors of Norampac Inc., from 1998 to 2006. He holds a Master of Business Administration from McGill University (Québec), a Bachelor’s degree in Forest Engineering from Université Laval (Québec) and a Bachelor of Arts from the Université de Montréal (Québec). He is a member of the Board of Directors of Supremex Inc., a Canadian manufacturer of stock and custom envelopes, and is Chair of the Pension Investment Committee and a member of the Audit and Human Resources Committees. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| — | 31,948 | — | 26,933 | 5,015 | 435,132 | |||||||||||||||||

|

Principal occupation : | Director of companies | |

| Committee(s) : | Human

Resources (Member) Health and Safety, Environment and Sustainable Development (Member) |

||

| 2017 Annual Meeting Votes in favour (%) : 99.23 | |||

| Élise

Pelletier Age 57 Chambly (Québec) Canada Independent (1) Director since 2011 |

Retired since 2003, Ms. Pelletier accumulated over 20 years of experience within the Corporation, having held the position of Vice-President, Human Resources of the Corporation during the period between 1995 and 1998, and thereafter, the position of Vice-President with Norampac Inc., from 1998 to 2003. She has extensive knowledge of the pulp and paper sector and was a member of the Board of Directors of the Corporation from 1993 to 2001. She is a member of the Human Resources Committee and of the Environment, Health and Safety and Sustainable Development Committee. She holds a Certificate in governance of companies from the Collège des administrateurs de sociétés, Université Laval (Québec). She holds the degree of Bachelor in Industrial Relations from the Université de Montréal (Québec). | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 1,500 | 19,832 | 1,500 | 17,032 | 2,800 | 290,542 | |||||||||||||||||

| 16 |

| Annual Information Form |

|

Principal occupation : | President and Chief Executive Officer, The Montreal Port Authority | |

| Committee(s) : | Audit

and Finance (Member) Human Resources (Member) |

||

2017

Annual Meeting Votes in favour (%) : 98.55 |

|||

| Sylvie

Vachon Age 58 Longueuil (Québec) Canada Independent (1) Director since 2013 |

Ms. Vachon is President and Chief Executive Officer of The Montreal Port Authority (MPA), an autonomous federal agency since 2009. From 1997 to 2009, she was Vice-President, Administration and Human Resources for the federal agency. She is a member of the Audit and Finance Committee and of the Human Resources Committee of the Corporation. Ms. Vachon is a member of the Board of Directors of Hardware Richelieu Ltd and a member of their Human Resources and Corporate Governance committee. She is also Chair of the Board of Directors of Cargo Montreal, the logistic and transportation metropolitan cluster. She is a member of the Board of Directors of the Association of Canadian Port Authorities and a governor member of the Conseil patronal de l’environnement du Québec whose mission is to mobilize Québec companies in order to promote their commitment towards environmental protection and the implementation of sustainable development. Ms. Vachon is also a member of the Board of Directors of SODES whose mission is to protect and promote the economic interests of the St. Lawrence maritime community from a sustainable development perspective. She also sits on the board of Green Marine, a voluntary environmental certification program for the North American marine industry. She also presides the Board of Directors of the Cercle des présidents (Québec). In 2014, she received the St. Lawrence Award, which is awarded to individuals whose actions have been noteworthy in the marine industry. In 2016, she was awarded the Medal of Honour of the National Assembly of Québec and became a member of the Conseil consultatif sur l’économie et l’innovation of the Québec Government. She holds the degree of Bachelor in Administration, majoring in Human Resources Management from the University of Sherbrooke (Québec). | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 2,000 | 15,012 | — | 11,222 | 5,790 | 231,703 | |||||||||||||||||

|

Principal occupation : | Business advisor and consultant, Corporate Director | |

| Committee(s) : | Audit

and Finance (Member) Corporate Governance and Nominating (Chair) |

||

| 2017

Annual Meeting Votes in favour (%) : 96.88 |

|||

| Laurence

Sellyn Age 68 Pointe-Claire (Québec) Canada Independent (1) Director since 2013 |

Mr. Sellyn retired at the end of 2015 from a career in leadership roles in the management of public companies. He is now active as an advisor and consultant to entrepreneurial CEOs. Mr. Sellyn was Executive Vice-President, Chief Financial and Administrative Officer of Gildan Activewear Inc. between April 1999 and August 2015. From 1992 to 1999, he held the position of Chief Financial Officer and Senior Vice-President of Finance and Corporate Development of Wajax Inc. Mr. Sellyn held successive positions of increasing responsibility at Domtar Inc., including acting as Corporate Controller from 1987 to 1991. Mr. Sellyn is Chair of the Corporate Governance and Nominating Committee, and a member of the Audit and Finance Committee of the Corporation. He is a U.K. Chartered Accountant. He holds a Masters degree in Modern Languages and Literature from Oxford University. Mr. Sellyn is also involved in fundraising for charitable and community activities. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 25,000 | 27,900 | 25,000 | 22,436 | 5,464 | 720,498 | |||||||||||||||||

| 17 |

| Annual Information Form |

|

Principal occupation : | President and Chief Executive Officer | |

| Committee(s) : | N.A. | ||

2017

Annual Meeting Votes in favour (%) : 96.87 |

|||

| Mario

Plourde Age 56 Kingsey Falls (Québec) Canada Non-Independent Director since 2014 |

Mr. Plourde is President and Chief Executive Officer of the Corporation since May 2013. He has been in the employ of the Corporation since 1985 and has held several senior management positions such as Vice-President and Chief Operating Officer of Cascades' Specialty Products Group. He was named President of this Group in 2000. In 2011, he was appointed Chief Operating Officer of the Corporation. He joined the Board of Directors of Cascades on November 6, 2014. Mr. Plourde sits on the Board of Directors of Transcontinental Inc., where he is Chair of the Governance Committee and also sits on the Board of Directors of the Fondation Centre de Cancérologie Charles-Bruneau. Actively involved in social and community affairs, he was awarded in 2012, the Prix bâtisseur - Tour CIBC Charles Bruneau, (a foundation for pediatric cancer research). Mr. Plourde holds a Bachelor's degree in Business Administration, majoring in Finance from the Université du Québec in Montréal. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 134,070 | — | 126,179 | — | 7,891 | 1,826,033 | |||||||||||||||||

|

Principal occupation : | Consultant, Wynnchurch Capital (Canada) Ltd | |

| Committee(s) : | Audit

and Finance (Member) Human Resources (Member) |

||

2017

Annual Meeting Votes in favour (%) : 98.48 |

|||

| Michelle Cormier, CPA,CA Age 61 Montréal (Québec) Canada Independent (1) Director since 2016 |

A senior-level executive with experience in financial management, strategic consulting as well as corporate financing, turnaround and governance, Michelle Cormier has in-depth knowledge of financial and public markets in Canada and the United States. She is a member of the Audit and Finance committee and a member of the Human Resources committee of the Corporation. Ms. Cormier has been acting as a consultant for Wynnchurch Capital (Canada) Ltd since 2014. She spent 13 years in senior management positions at TNG Capital Inc., and was CFO at a major North American forest products company. She also worked at Alcan Aluminium Limited and Ernst & Young. Ms. Cormier is a Certified Director of companies and sits on the Board of Directors of Dorel Industries Inc., Uni-Select Inc. and Champion Iron Ore Ltd. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 7,000 | 7,342 | — | 2,117 | 12,225 | 195,338 | |||||||||||||||||

| 18 |

| Annual Information Form |

|

Principal occupation : | President and Chief Executive Officer, Sanimax Inc. (Canada) | |

| Committee(s) : | Audit

and Finance (Member) Health and Safety, Environment and Sustainable Development (Member) |

||

2017

Annual Meeting Votes in favour (%) : 99.35 |

|||

| Martin Couture Age 49 Montréal (Québec) Canada Independent (1) Director since 2016 |

Recipient of a Bachelor's degree in Economics from St. Lawrence University (Canton, New York), Martin Couture is CEO of Sanimax Inc., where he has worked since 1990. He is a member of the Audit and Finance Committee and of the Health and Safety, Environment and Sustainable Development Committee of the Corporation. Combining strong leadership skills with extensive operational experience, Mr. Couture was named one of Canada's "Top 40 under 40," a Caldwell Partners award, in 2007. He received the Ernst & Young Entrepreneur of the Year award in 2008. He is an active member of the National Renderers Association, the professional association of the rendering industry in North America, and has also been deeply involved with the Young Presidents' Organization since 2003. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES (6) | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 12,100 | 10,885 | 1,600 | 3,527 | 17,858 | 313,056 | |||||||||||||||||

|

Principal occupation : | President and Chief Executive Officer, Boralex Inc. | |

| Committee(s) : | N/A | ||

2017

Annual Meeting Votes in favour (%) : 96.86 |

|||

Patrick Lemaire Age 54 Kingsey Falls (Québec) Canada Non-Independent Director since 2016 |

Patrick Lemaire has served as President and CEO of Boralex Inc. since September 2006. Over the last decade, he has profoundly transformed the company and helped position it as a renewable energy leader in Canada and France. In 1988, after obtaining his degree in Mechanical Engineering from Université Laval (Québec), he began his career at Cascades. He successively held the positions of project manager, maintenance manager and plant manager in France and the United States. His managerial skills and leadership were then put to use as General Manager of five plants and as Vice-President and Chief Operating Officer in the containerboard packaging sector. In 2016, he received the Prix d'excellence from the Cercle des Dirigeants d’Entreprises Franco-Québécois. In 2017, he was a finalist at the Quebec EY Entrepreneur of the year Awards, and ranked as the 58th most influential individual in the wind industry by the British magazine A Word about Wind. | ||

| INFORMATION ON EQUITY HOLDINGS | ||||||||||||||||||||||

| DECEMBER 31, 2017 | DECEMBER 31, 2016 | TOTAL NET CHANGE | TOTAL VALUE AT RISK | |||||||||||||||||||

| SHARES | DSUs (4) | SHARES | DSUs | (#) | AS OF DECEMBER 31, 2017 ($) (5) | |||||||||||||||||

| 13,628 | 4,082 | 6,628 | 1,465 | 9,617 | 241,210 | |||||||||||||||||

| (1) | "Independent" refers to the standards of independence established under Section 1.2 of the Canadian Securities Administrators’ National Instrument 58-101 (Disclosure of Corporate Governance Practices). |

| (2) | Held directly or indirectly by Gestion Alain Lemaire Inc., of which Alain Lemaire is the sole voting shareholder. |