UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number | 811-21327 | |||||

| BNY Mellon Investment Funds VI | ||||||

| (Exact name of Registrant as specified in charter) | ||||||

|

c/o BNY Mellon Investment Adviser, Inc. 240 Greenwich Street New York, New York 10286 |

||||||

| (Address of principal executive offices) (Zip code) | ||||||

|

Deirdre Cunnane, Esq. 240 Greenwich Street New York, New York 10286 |

||||||

| (Name and address of agent for service) | ||||||

| Registrant's telephone number, including area code: | (212) 922-6400 | |||||

|

Date of fiscal year end:

|

11/30 | |||||

| Date of reporting period: |

11/30/23

|

|||||

FORM N-CSR

Item 1. Reports to Stockholders.

BNY Mellon Balanced Opportunity Fund

ANNUAL REPORT November 30, 2023 |

|

IMPORTANT NOTICE – UPCOMING CHANGES TO ANNUAL AND SEMI-ANNUAL REPORTS

The Securities and Exchange Commission (the “SEC”) has adopted rule and form amendments that will result in changes to the design and delivery of annual and semi-annual fund reports (“Reports”). Beginning in July 2024, Reports will be streamlined to highlight key information. Certain information currently included in Reports, including financial statements, will no longer appear in the Reports but will be available online, delivered free of charge to shareholders upon request, and filed with the SEC.

If you previously elected to receive the fund’s Reports electronically, you will continue to do so. Otherwise, you will receive paper copies of the fund’s re-designed Reports by USPS mail in the future. If you would like to receive the fund’s Reports (and/or other communications) electronically instead of by mail, please contact your financial advisor or, if you are a direct investor, please log into your mutual fund account at www.bnymellonim.com/us and select “E-Delivery” under the Profile page. You must be registered for online account access before you can enroll in E-Delivery.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

THE FUND

FOR MORE INFORMATION

Back Cover

DISCUSSION OF FUND PERFORMANCE (Unaudited)

For the period from December 1, 2022, through November 30, 2023, as provided by Torrey Zaches, CFA and James Stavena, Asset Allocation Portfolio Managers, Brian Ferguson, John C. Bailer, CFA, James A. Lydotes, CFA, Karen Behr, Keith Howell, John R. Porter III, portfolio managers employed by the fund’s sub-adviser, Newton Investment Management North America, LLC, and primary portfolio managers for the fund’s fixed income investments Howard Cunningham and Martin Chambers employed by Newton Investment Management Limited, sub-sub adviser.

Market and Fund Performance Overview

For the 12-month period ended November 30, 2023, the BNY Mellon Balanced Opportunity Fund (the “fund”) produced a total return of 8.72% for Class A shares, 7.99% for Class C shares, 9.01% for Class I shares, 9.05% for Class J shares, 9.75% for Class Y shares and 8.95% for Class Z shares.1 In comparison, the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index (the “Bloomberg Index”), produced total returns of 13.83% and 1.18%, respectively, for the same period.2,3 Separately, a Customized Blended Index composed of 60% S&P 500® Index and 40% Bloomberg Index produced a total return of 8.76% for the same period.4

Stocks and bonds gained ground during the reporting period as inflationary pressures eased, the U.S. Federal Reserve (the “Fed”) reduced the pace of interest-rate hikes, and economic growth remained positive. The fund performed in line with the Customized Blended Index due to the mixed performance of the fund’s strategies.

The Fund’s Investment Approach

The fund seeks high total return through a combination of capital appreciation and current income. To pursue its goal, the fund invests in a diversified mix of stocks and fixed-income securities. BNY Mellon Investment Adviser, Inc., the fund’s investment adviser, has engaged its affiliate, Newton Investment Management North America, LLC (NIMNA), to serve as the fund’s sub-adviser responsible for overall asset allocation for the fund and for the portion of the fund’s assets allocated to equity investments and fixed-income investments. NIMNA has engaged its affiliate, Newton Investment Management Limited (NIM) to provide the day-to-day management of the portion of the fund’s assets allocated to fixed-income investments. The fund varies the mix of stocks and bonds, but normally the fund allocates between 25% and 50% to fixed-income securities and between 75% and 50% to equities. NIMNA allocates the fund’s assets between the fund’s equity and fixed-income portfolio managers, based on an assessment of the relative return and risk of each asset class and an analysis of several factors, including general economic conditions, anticipated future changes in interest rates and the outlook for stocks generally.

In the equity portion of the fund’s portfolio, we strive to create a broadly diversified blend of growth and value stocks. Stock selection is made through extensive quantitative and fundamental research. The fund may invest up to 20% of its assets in foreign equity securities.

In the fixed-income portion of the fund’s portfolio, we may include corporate bonds, debentures, notes, mortgage-related securities, including collateralized mortgage obligations

2

(CMOs), asset-backed securities, convertible securities, municipal obligations, zero-coupon bonds and money market instruments.

Stocks and Bonds Gain Ground Despite Macroeconomic and Geopolitical Concerns

The outlook for inflation and the trajectory of monetary policy continued to dominate the narrative within financial markets during the reporting period. Despite hawkish rhetoric and actions from central banks, the early months of the period saw evidence of decelerating price growth in the United States, raising hopes that inflation had peaked and driving risk assets higher. Markets were also encouraged by China’s easing of its strict COVID-19 restrictions. In Europe, mild winter weather and effective management of reserves averted a potential energy crisis related to the absence of Russian oil.

In February and March 2023, signs of interest-rate-related stress emerged within the U.S. banking sector as two major regional banks failed, followed by the enforced takeover of Credit Suisse by UBS under the auspices of the Swiss authorities. Equities dipped broadly, before swift action from federal authorities and major banks eased investors’ concerns, enabling markets to regain upward momentum in mid-March. Global economic growth remained generally positive despite high inflation and rising interest rates. The U.S. economy continued to expand, supported by historically high levels of employment, strong wage growth and steady consumer spending. European economies remained in broadly positive territory as well, despite some notably weak areas, such as Germany. China’s reopening proved uneven, faltering in May, while worsening U.S.-China relations further challenged the world’s second-largest economy, bringing the threat of U.S. restrictions on investments in China in areas such as artificial intelligence (AI), quantum computing and semiconductors.

Equity Positioning Bolsters Relative Performance

From an overall allocation perspective, the fund held slightly underweight allocation to equities relative to the Customized Blended Index throughout the reporting period. Among equities, allocations to large-cap growth increased marginally due to the asset class’s outsized appreciation. The fund’s bond allocation increased as well, as we deployed cash in that direction in August and September 2023, given an improving fixed-income landscape and rising yields.

On the equity side, the fund’s large-cap growth allocation benefited from strong returns in the industrials and consumer discretionary sectors. Among industrials, top performers included transportation provider Uber Technologies, Inc., which added drivers and expanded delivery services; diversified machinery manufacturer Ingersoll Rand, Inc. which benefited from growing demand; and online real estate information provider CoStar Group, Inc., which gained market share. In the consumer discretionary sector, Amazon.com, Inc. produced strong returns, while tactical trading in shares of electric vehicle maker Tesla further contributed to relative results. Other leading performers included video semiconductor chip maker NVIDIA Corp. and commerce platform Shopify, Inc. Conversely, positioning in the health care and materials sectors detracted from relative returns. In health care, genetic equipment maker Illumina, Inc. faced headwinds from China’s hospital spending policies and from customer inventory build-downs, while shares

3

DISCUSSION OF FUND PERFORMANCE (Unaudited) (continued)

of biotechnology firm Sarepta Therapeutics, Inc. struggled when the U.S. Food and Drug Administration granted a disappointingly limited approval for one of the company’s drugs. In materials, shares in aluminum producer Alcoa Corp. were undermined by shifting supply and demand dynamics, leading us to sell the fund’s position.

The fund’s large-cap value allocation produced weaker absolute returns during a period in which value-oriented shares significantly underperformed their growth-oriented counterparts. Nevertheless, fund’s large-cap value holdings materially outperformed averages for value-oriented shares, as measured against the 1.36% return of the Russell 1000® Value Index, which is used internally by the fund as a benchmark of large-cap value performance. Within large-cap value, strong issue selection in the financials sector led gains, as did underweight exposure to the banking area. Top performers included futures and options exchange CME Group, Inc., which reported high margins and a strong balance sheet despite an uncertain economic environment; consumer purchase insurer Assurant Inc., which saw an improving business mix for the company’s capital-light, high-return business model; and property & casualty insurer The Progressive Co., which saw improved pricing in the automotive insurance area. Underperforming sectors included materials, consumer discretionary and communication services. Within materials, Alcoa Corp. and chemical products producer CF Industries Holdings, Inc. generated disappointing returns, while in consumer discretionary, toy maker Hasbro failed to meet expectations, leading us to sell the fund’s position. While issue selection bolstered returns in communication services, underweight sector exposure detracted.

A small allocation to international equities, which generally performed in line with their U.S. counterparts, had little impact on the fund’s relative returns.

The fixed-income portion of the fund mildly outperformed the Bloomberg Index, generating the strongest returns during the final six weeks of the reporting period. Performance benefited from a skew toward credit and away from government securities during most of the period. Major changes to the portfolio included trimming the fund’s overweight exposure to investment-grade securities, reducing duration to approximately neutral, trimming overweight exposure to asset-backed and agency securities, and increasing exposure to the energy and health care sectors.

Providing Experienced Management Within Each Asset Class

As of the end of the reporting period, we anticipate further market volatility as the Fed works to constrain inflationary pressures, with the possibility of a recession still on the horizon. While many companies have effectively controlled costs and continued to report reasonably strong earnings despite those pressures, we expect businesses to face increasing difficulties in meeting financial expectations if economic growth falters.

We believe the fund’s holdings are relatively well positioned to outperform in the face of prevailing market uncertainties due to our investment approach. We allocate assets to growth-oriented equities and value-oriented equities roughly in proportion to the asset-class composition of the S&P 500® Index, and add a significant allocation to fixed-income instruments for increased diversification and added stability. For each asset class, we assign investment responsibilities to a team of portfolio managers with extensive experience within

4

that asset class, leveraging their expertise to construct a portfolio that we believe can outperform the relevant benchmarks over time. As of November 30, 2023, relative to the Customized Blended Index, the fund held slightly overweight allocations to fixed-income securities and slightly underweight allocations to equities, with the balance of assets allocated to cash and other instruments to better manage liquidity and cash flows.

December 15, 2023

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost. The fund’s return reflects the absorption of certain fund expenses by BNY Mellon Investment Adviser, Inc. pursuant to an agreement in effect through March 31, 2024, at which time it may be extended, modified or terminated. Had these expenses not been absorbed, returns would have been lower.

2 Source: Lipper Inc. — The S&P 500® Index is widely regarded as the best single gauge of large-cap, U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. Investors cannot invest directly in any index.

3 Source: Lipper Inc. — The Bloomberg U.S. Aggregate Bond Index is a broad-based, flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate, taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). Investors cannot invest directly in any index.

4 The source for the Customized Blended Index is FactSet.

Equities are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Bonds are subject generally to interest-rate, credit, liquidity and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

The fund may, but is not required to, use derivative instruments. A small investment in derivatives could have a potentially large impact on the fund’s performance. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets.

Please note: the position in any security highlighted with italicized typeface was sold during the reporting period.

5

FUND PERFORMANCE (Unaudited)

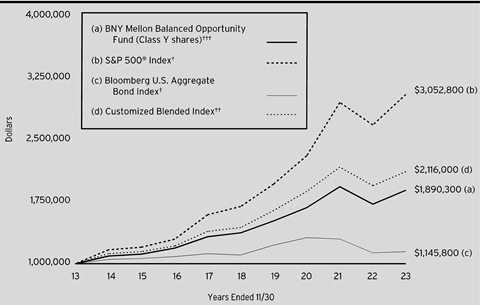

Comparison of change in value of a $10,000 investment in Class A shares, Class C shares, Class I shares, Class J shares and Class Z shares of BNY Mellon Balanced Opportunity Fund with a hypothetical investment of $10,000 in the S&P 500® Index, Bloomberg U.S. Aggregate Bond Index and an index comprised of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index (the “Customized Blended Index”).

† Source: Lipper Inc.

†† Source: FactSet

Past performance is not predictive of future performance.

The above graph compares a hypothetical $10,000 investment made in Class A shares, Class C shares, Class I shares, Class J shares and Class Z shares of BNY Mellon Balanced Opportunity Fund on 11/30/13 to a hypothetical investment of $10,000 made in the S&P 500® Index, Bloomberg U.S. Aggregate Bond Index and Customized Blended Index on that date. All dividends and capital gain distributions are reinvested. Returns for the Customized Blended Index are re-balanced monthly.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

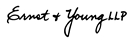

Comparison of change in value of a $1,000,000 investment in Class Y shares of BNY Mellon Balanced Opportunity Fund with a hypothetical investment of $1,000,000 in the S&P 500® Index, Bloomberg U.S. Aggregate Bond Index and an index comprised of 60% S&P 500® Index and 40% Bloomberg U.S. Aggregate Bond Index (the “Customized Blended Index”).

† Source: Lipper Inc.

†† Source: FactSet

††† The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 9/30/16 (the inception date for Class Y shares).

Past performance is not predictive of future performance.

The above graph compares a hypothetical $1,000,000 investment made in Class Y shares of BNY Mellon Balanced Opportunity Fund on 11/30/13 to a hypothetical investment of $1,000,000 made in the S&P 500® Index, Bloomberg U.S. Aggregate Bond Index and Customized Blended Index on that date. All dividends and capital gain distributions are reinvested. Returns for the Customized Blended Index are re-balanced monthly.

The fund’s performance shown in the line graph above takes into account all other applicable fees and expenses of the fund’s Class Y Shares. The S&P 500® Index is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and nonagency). Unlike a mutual fund, the indices are not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

7

FUND PERFORMANCE (Unaudited) (continued)

Average Annual Total Returns as of 11/30/2023 | |||||

| Inception | 1 Year | 5 Years | 10 Years | |

Class A shares | |||||

with maximum sales charge (5.75%) | 1/30/04 | 2.49% | 4.92% | 5.61% | |

without sales charge | 1/30/04 | 8.72% | 6.18% | 6.23% | |

Class C shares | |||||

with applicable redemption charge† | 1/30/04 | 6.99% | 5.40% | 5.44% | |

without redemption | 1/30/04 | 7.99% | 5.40% | 5.44% | |

Class I shares | 1/30/04 | 9.01% | 6.46% | 6.50% | |

Class J shares | 3/16/87 | 9.05% | 6.46% | 6.50% | |

Class Y shares | 9/30/16 | 9.75% | 6.59% | 6.57%†† | |

Class Z shares | 12/17/04 | 8.95% | 6.37% | 6.42% | |

S&P 500® Index | 13.83% | 12.51% | 11.81% | ||

Bloomberg U.S. Aggregate Bond Index | 1.18% | .71% | 1.37% | ||

Customized Blended Index | 8.76% | 8.03% | 7.78% | ||

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class I shares for the period prior to 9/30/16 (the inception date for Class Y shares).

The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. Go to www.im.bnymellon.com for the fund’s most recent month-end returns.

The fund’s performance shown in the graphs and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

8

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in BNY Mellon Balanced Opportunity Fund from June 1, 2023 to November 30, 2023. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment | ||||||

Assume actual returns for the six months ended November 30, 2023 | ||||||

|

|

|

|

|

| |

| Class A | Class C | Class I | Class J | Class Y | Class Z |

Expenses paid per $1,000† | $5.70 | $9.53 | $4.42 | $4.42 | $4.57 | $4.83 |

Ending value (after expenses) | $1,047.50 | $1,044.10 | $1,049.20 | $1,049.40 | $1,048.10 | $1,048.80 |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (“SEC”) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment |

| |||||||

Assuming a hypothetical 5% annualized return for the six months ended November 30, 2023 |

| |||||||

|

|

|

|

|

|

|

|

|

|

| Class A | Class C | Class I | Class J | Class Y | Class Z | |

Expenses paid per $1,000† | $5.62 | $9.40 | $4.36 | $4.36 | $4.51 | $4.76 | ||

Ending value (after expenses) | $1,019.50 | $1,015.74 | $1,020.76 | $1,020.76 | $1,020.61 | $1,020.36 | ||

† | Expenses are equal to the fund’s annualized expense ratio of 1.11% for Class A, 1.86% for Class C, .86% for Class I, .86% for Class J, .89% for Class Y and .94% for Class Z, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). | |||||||

9

STATEMENT OF INVESTMENTS

November 30, 2023

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% | |||||||||

Aerospace & Defense - .3% | |||||||||

HEICO Corp., Gtd. Notes | 5.35 | 8/1/2033 | 71,000 | 69,445 | |||||

Lockheed Martin Corp., Sr. Unscd. Notes | 5.20 | 2/15/2055 | 320,000 | 313,225 | |||||

RTX Corp., Sr. Unscd. Notes | 4.13 | 11/16/2028 | 200,000 | 190,449 | |||||

The Boeing Company, Sr. Unscd. Notes | 3.20 | 3/1/2029 | 280,000 | 253,577 | |||||

826,696 | |||||||||

Agriculture - .0% | |||||||||

Philip Morris International, Inc., Sr. Unscd. Notes | 5.63 | 11/17/2029 | 50,000 | 50,821 | |||||

Asset-Backed Certificates - .3% | |||||||||

CNH Equipment Trust, Ser. 2021-A, Cl. A3 | 0.40 | 12/15/2025 | 181,619 | 176,788 | |||||

John Deere Owner Trust, Ser. 2023-B, Cl. A3 | 5.18 | 3/15/2028 | 225,000 | 225,123 | |||||

New Economy Assets Phase 1 Sponsor LLC, Ser. 2021-1, Cl. A1 | 1.91 | 10/20/2061 | 495,000 | a | 428,502 | ||||

830,413 | |||||||||

Asset-Backed Certificates/Auto Receivables - 1.2% | |||||||||

Carvana Auto Receivables Trust, Ser. 2021-P4, Cl. A3 | 1.31 | 1/11/2027 | 296,041 | 285,051 | |||||

Enterprise Fleet Financing LLC, Ser. 2023-1, Cl. A3 | 5.42 | 10/22/2029 | 245,000 | a | 244,101 | ||||

Hertz Vehicle Financing LLC, Ser. 2021-1A, CI. A | 1.21 | 12/26/2025 | 575,000 | a | 552,125 | ||||

Honda Auto Receivables Owner Trust, Ser. 2023-1, Cl. A3 | 5.04 | 4/21/2027 | 178,000 | 177,031 | |||||

Hyundai Auto Receivables Trust, Ser. 2022-C, CI. A4 | 5.52 | 10/16/2028 | 376,000 | 377,582 | |||||

Mercedes-Benz Auto Receivables Trust, Ser. 2023-1, CI. A3 | 4.51 | 11/15/2027 | 247,000 | 243,564 | |||||

Nissan Auto Lease Trust, Ser. 2023-A, CI. A3 | 4.91 | 1/15/2026 | 348,000 | 345,432 | |||||

OSCAR US Funding XII LLC, Ser. 2021-1A, Cl. A4 | 1.00 | 4/10/2028 | 380,000 | a | 360,486 | ||||

Toyota Auto Receivables Owner Trust, Ser. 2022-D, CI. A3 | 5.30 | 9/15/2027 | 579,000 | 577,765 | |||||

Toyota Auto Receivables Owner Trust, Ser. 2023-A, CI. A3 | 4.63 | 9/15/2027 | 202,000 | 199,498 | |||||

3,362,635 | |||||||||

Automobiles & Components - .4% | |||||||||

General Motors Financial Co., Inc., Sr. Unscd. Notes | 2.35 | 1/8/2031 | 280,000 | 223,069 | |||||

10

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Automobiles & Components - .4% (continued) | |||||||||

General Motors Financial Co., Inc., Sr. Unscd. Notes | 2.40 | 4/10/2028 | 545,000 | 477,126 | |||||

Volkswagen Group of America Finance LLC, Gtd. Notes | 3.35 | 5/13/2025 | 420,000 | a | 405,334 | ||||

1,105,529 | |||||||||

Banks - 3.1% | |||||||||

Bank of America Corp., Sr. Unscd. Notes | 1.20 | 10/24/2026 | 110,000 | 100,834 | |||||

Bank of America Corp., Sr. Unscd. Notes | 3.42 | 12/20/2028 | 105,000 | 96,494 | |||||

Bank of America Corp., Sr. Unscd. Notes | 3.97 | 2/7/2030 | 250,000 | 231,146 | |||||

Bank of America Corp., Sr. Unscd. Notes | 4.00 | 4/1/2024 | 68,000 | 67,585 | |||||

Bank of America Corp., Sr. Unscd. Notes | 5.29 | 4/25/2034 | 600,000 | 577,079 | |||||

Bank of Montreal, Covered Bonds | 3.75 | 7/25/2025 | 310,000 | a | 302,517 | ||||

Barclays PLC, Sr. Unscd. Notes | 3.93 | 5/7/2025 | 405,000 | 401,026 | |||||

BNP Paribas SA, Sr. Notes | 1.68 | 6/30/2027 | 250,000 | a | 224,996 | ||||

Citigroup, Inc., Sr. Unscd. Notes | 4.65 | 7/30/2045 | 260,000 | 223,340 | |||||

Citizens Bank NA, Sr. Unscd. Notes | 3.75 | 2/18/2026 | 250,000 | 234,987 | |||||

Commonwealth Bank of Australia, Covered Bonds | 3.21 | 5/27/2025 | 420,000 | a | 407,512 | ||||

Cooperatieve Rabobank UA, Sr. Notes | 1.34 | 6/24/2026 | 280,000 | a | 261,068 | ||||

ING Groep NV, Sr. Unscd. Notes | 3.55 | 4/9/2024 | 200,000 | 198,440 | |||||

Intesa Sanpaolo SpA, Sr. Notes | 7.20 | 11/28/2033 | 300,000 | 304,196 | |||||

JPMorgan Chase & Co., Sr. Unscd. Notes | 3.70 | 5/6/2030 | 400,000 | 366,360 | |||||

JPMorgan Chase & Co., Sr. Unscd. Notes | 3.96 | 1/29/2027 | 255,000 | 246,760 | |||||

JPMorgan Chase & Co., Sr. Unscd. Notes | 4.45 | 12/5/2029 | 185,000 | 177,270 | |||||

JPMorgan Chase & Co., Sr. Unscd. Notes | 5.35 | 6/1/2034 | 590,000 | 576,396 | |||||

Lloyds Banking Group PLC, Sr. Unscd. Notes | 1.63 | 5/11/2027 | 280,000 | 252,829 | |||||

Morgan Stanley, Sr. Unscd. Notes | 4.00 | 7/23/2025 | 75,000 | 73,289 | |||||

Morgan Stanley, Sr. Unscd. Notes | 4.43 | 1/23/2030 | 300,000 | 284,917 | |||||

NatWest Group PLC, Sr. Unscd. Notes | 1.64 | 6/14/2027 | 200,000 | 179,571 | |||||

NatWest Group PLC, Sr. Unscd. Notes | 4.27 | 3/22/2025 | 250,000 | 248,449 | |||||

Royal Bank of Canada, Sr. Unscd. Notes | 2.55 | 7/16/2024 | 230,000 | 225,614 | |||||

11

STATEMENT OF INVESTMENTS (continued)

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Banks - 3.1% (continued) | |||||||||

The Goldman Sachs Group, Inc., Sr. Unscd. Notes | 3.81 | 4/23/2029 | 610,000 | 567,024 | |||||

The Toronto-Dominion Bank, Sr. Unscd. Notes | 5.52 | 7/17/2028 | 360,000 | 362,909 | |||||

Truist Financial Corp., Sr. Unscd. Notes | 2.50 | 8/1/2024 | 265,000 | 259,026 | |||||

U.S. Bancorp, Sr. Unscd. Notes | 2.40 | 7/30/2024 | 205,000 | 200,498 | |||||

Wells Fargo & Co., Sr. Unscd. Notes | 4.15 | 1/24/2029 | 405,000 | 383,628 | |||||

Wells Fargo & Co., Sub. Notes | 4.30 | 7/22/2027 | 320,000 | 307,283 | |||||

8,343,043 | |||||||||

Beverage Products - .1% | |||||||||

Bacardi Ltd./Bacardi-Martini BV, Sr. Unscd. Notes | 5.40 | 6/15/2033 | 191,000 | a | 185,395 | ||||

Building Materials - .2% | |||||||||

Carrier Global Corp., Sr. Unscd. Notes | 2.49 | 2/15/2027 | 395,000 | 361,932 | |||||

Trane Technologies Financing Ltd., Gtd. Notes | 5.25 | 3/3/2033 | 100,000 | 99,382 | |||||

461,314 | |||||||||

Chemicals - .1% | |||||||||

Nutrien Ltd., Sr. Unscd. Notes | 3.95 | 5/13/2050 | 220,000 | 163,513 | |||||

The Sherwin-Williams Company, Sr. Unscd. Notes | 2.30 | 5/15/2030 | 75,000 | 62,983 | |||||

226,496 | |||||||||

Commercial Mortgage Pass-Through Certificates - .7% | |||||||||

CAMB Commercial Mortgage Trust, Ser. 2019-LIFE, Cl. A, (1 Month TSFR +1.12%) | 6.44 | 12/15/2037 | 225,000 | a,b | 223,904 | ||||

Citigroup Commercial Mortgage Trust, Ser. 2020-GC46, Cl. A2 | 2.71 | 2/15/2053 | 140,000 | 124,343 | |||||

Commercial Mortgage Trust, Ser. 2014-UBS3, Cl. A3 | 3.55 | 6/10/2047 | 337,330 | 334,474 | |||||

CSAIL Commercial Mortgage Trust, Ser. 2017-CX10, Cl. A4 | 3.19 | 11/15/2050 | 240,000 | 219,166 | |||||

DBCG Mortgage Trust, Ser. 2017-BBG, Cl. A, (1 Month PRIME +0.70%) | 8.50 | 6/15/2034 | 335,000 | a,b | 335,017 | ||||

GS Mortgage Securities Trust, Ser. 2019-GC39, Cl. A3 | 3.31 | 5/10/2052 | 215,000 | 189,362 | |||||

Tricon American Homes Trust, Ser. 2017-SFR2, Cl. A | 2.93 | 1/17/2036 | 180,384 | a | 179,367 | ||||

Wells Fargo Commercial Mortgage Trust, Ser. 2014-LC18, Cl. A4 | 3.15 | 12/15/2047 | 139,152 | 134,929 | |||||

Wells Fargo Commercial Mortgage Trust, Ser. 2020-C56, CI. A5 | 2.45 | 6/15/2053 | 135,000 | 110,989 | |||||

12

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Commercial Mortgage Pass-Through Certificates - .7% (continued) | |||||||||

WFRBS Commercial Mortgage Trust, Ser. 2014-C22, Cl. A4 | 3.49 | 9/15/2057 | 160,337 | 157,032 | |||||

2,008,583 | |||||||||

Consumer Discretionary - .1% | |||||||||

Marriott International, Inc., Sr. Unscd. Notes, Ser. HH | 2.85 | 4/15/2031 | 465,000 | 388,158 | |||||

Diversified Financials - .7% | |||||||||

Aercap Ireland Capital DAC/AerCap Global Aviation Trust, Gtd. Notes | 1.75 | 1/30/2026 | 225,000 | 205,830 | |||||

Air Lease Corp., Sr. Unscd. Notes | 1.88 | 8/15/2026 | 215,000 | 194,577 | |||||

Air Lease Corp., Sr. Unscd. Notes | 2.88 | 1/15/2026 | 135,000 | 127,075 | |||||

American Express Co., Sr. Unscd. Notes | 2.50 | 7/30/2024 | 300,000 | 293,845 | |||||

Capital One Financial Corp., Sr. Unscd. Notes | 6.31 | 6/8/2029 | 198,000 | 196,964 | |||||

Discover Financial Services, Sr. Unscd. Notes | 6.70 | 11/29/2032 | 342,000 | 339,652 | |||||

Intercontinental Exchange, Inc., Sr. Unscd. Notes | 4.35 | 6/15/2029 | 130,000 | 125,427 | |||||

Nasdaq, Inc., Sr. Unscd. Notes | 5.95 | 8/15/2053 | 140,000 | 141,939 | |||||

USAA Capital Corp., Sr. Unscd. Notes | 2.13 | 5/1/2030 | 165,000 | a | 135,183 | ||||

1,760,492 | |||||||||

Electronic Components - .1% | |||||||||

Trimble, Inc., Sr. Unscd. Notes | 6.10 | 3/15/2033 | 260,000 | 263,847 | |||||

Energy - 1.0% | |||||||||

Cameron LNG LLC, Sr. Scd. Notes | 3.30 | 1/15/2035 | 260,000 | a | 212,218 | ||||

Cheniere Corpus Christi Holdings LLC, Sr. Scd. Notes | 3.70 | 11/15/2029 | 285,000 | 259,845 | |||||

EIG Pearl Holdings SARL, Sr. Scd. Bonds | 3.55 | 8/31/2036 | 385,000 | a | 321,334 | ||||

Enbridge, Inc., Gtd. Notes | 5.70 | 3/8/2033 | 188,000 | 188,105 | |||||

Energy Transfer LP, Sr. Unscd. Notes | 4.90 | 2/1/2024 | 225,000 | 224,465 | |||||

Enterprise Products Operating LLC, Gtd. Notes | 2.80 | 1/31/2030 | 185,000 | 162,168 | |||||

Enterprise Products Operating LLC, Gtd. Notes | 3.30 | 2/15/2053 | 190,000 | 132,753 | |||||

Equinor ASA, Gtd. Notes | 3.25 | 11/18/2049 | 660,000 | 467,722 | |||||

Kinder Morgan Energy Partners LP, Gtd. Notes | 5.00 | 3/1/2043 | 140,000 | 117,536 | |||||

Kinder Morgan Energy Partners LP, Gtd. Notes | 6.55 | 9/15/2040 | 210,000 | 212,410 | |||||

MPLX LP, Sr. Unscd. Notes | 4.13 | 3/1/2027 | 110,000 | 105,701 | |||||

MPLX LP, Sr. Unscd. Notes | 5.20 | 3/1/2047 | 210,000 | 182,687 | |||||

ONEOK, Inc., Gtd. Notes | 5.65 | 11/1/2028 | 76,000 | 76,539 | |||||

13

STATEMENT OF INVESTMENTS (continued)

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Energy - 1.0% (continued) | |||||||||

Spectra Energy Partners LP, Gtd. Notes | 4.75 | 3/15/2024 | 75,000 | 74,771 | |||||

Western Midstream Operating LP, Sr. Unscd. Notes | 6.15 | 4/1/2033 | 42,000 | 42,335 | |||||

2,780,589 | |||||||||

Environmental Control - .3% | |||||||||

Republic Services, Inc., Sr. Unscd. Notes | 2.38 | 3/15/2033 | 525,000 | 420,583 | |||||

Republic Services, Inc., Sr. Unscd. Notes | 2.50 | 8/15/2024 | 100,000 | 98,004 | |||||

Waste Management, Inc., Gtd. Notes | 2.00 | 6/1/2029 | 365,000 | 313,230 | |||||

Waste Management, Inc., Gtd. Notes | 3.15 | 11/15/2027 | 100,000 | 93,846 | |||||

925,663 | |||||||||

Food Products - .2% | |||||||||

Conagra Brands, Inc., Sr. Unscd. Notes | 1.38 | 11/1/2027 | 180,000 | 154,770 | |||||

Kraft Heinz Foods Co., Gtd. Notes | 4.38 | 6/1/2046 | 270,000 | 220,576 | |||||

Mondelez International, Inc., Sr. Unscd. Notes | 2.13 | 3/17/2024 | 151,000 | 149,431 | |||||

524,777 | |||||||||

Foreign Governmental - .7% | |||||||||

British Columbia, Sr. Unscd. Bonds | 2.25 | 6/2/2026 | 520,000 | 489,639 | |||||

Hungary, Sr. Unscd. Notes | 2.13 | 9/22/2031 | 200,000 | a | 154,542 | ||||

Hungary, Sr. Unscd. Notes | 5.25 | 6/16/2029 | 250,000 | a | 244,805 | ||||

Italy, Sr. Unscd. Notes | 1.25 | 2/17/2026 | 400,000 | 365,941 | |||||

Italy, Sr. Unscd. Notes | 2.88 | 10/17/2029 | 225,000 | 197,142 | |||||

Mexico, Sr. Unscd. Notes | 2.66 | 5/24/2031 | 310,000 | 254,128 | |||||

Uruguay, Sr. Unscd. Bonds | 4.38 | 1/23/2031 | 60,000 | 58,273 | |||||

1,764,470 | |||||||||

Health Care - 1.5% | |||||||||

AbbVie, Inc., Sr. Unscd. Notes | 3.20 | 11/21/2029 | 220,000 | 199,814 | |||||

Amgen, Inc., Sr. Unscd. Notes | 3.15 | 2/21/2040 | 255,000 | 188,216 | |||||

Amgen, Inc., Sr. Unscd. Notes | 5.65 | 3/2/2053 | 225,000 | 222,082 | |||||

AstraZeneca PLC, Sr. Unscd. Notes | 1.38 | 8/6/2030 | 160,000 | 128,821 | |||||

Biogen, Inc., Sr. Unscd. Notes | 2.25 | 5/1/2030 | 235,000 | 193,388 | |||||

Bio-Rad Laboratories, Inc., Sr. Unscd. Notes | 3.70 | 3/15/2032 | 430,000 | 369,197 | |||||

Bristol-Myers Squibb Co., Sr. Unscd. Notes | 3.20 | 6/15/2026 | 89,000 | 85,604 | |||||

Bristol-Myers Squibb Co., Sr. Unscd. Notes | 3.40 | 7/26/2029 | 25,000 | 23,221 | |||||

Cencora, Inc., Sr. Unscd. Notes | 3.25 | 3/1/2025 | 130,000 | 126,552 | |||||

CVS Health Corp., Sr. Unscd. Notes | 4.30 | 3/25/2028 | 50,000 | 48,403 | |||||

CVS Health Corp., Sr. Unscd. Notes | 5.05 | 3/25/2048 | 350,000 | 307,126 | |||||

14

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Health Care - 1.5% (continued) | |||||||||

DH Europe Finance II SARL, Gtd. Notes | 2.60 | 11/15/2029 | 180,000 | 157,669 | |||||

GE HealthCare Technologies, Inc., Sr. Unscd. Notes | 5.91 | 11/22/2032 | 380,000 | 387,947 | |||||

Gilead Sciences, Inc., Sr. Unscd. Notes | 3.65 | 3/1/2026 | 75,000 | 72,585 | |||||

Gilead Sciences, Inc., Sr. Unscd. Notes | 4.75 | 3/1/2046 | 110,000 | 99,020 | |||||

Illumina, Inc., Sr. Unscd. Notes | 5.75 | 12/13/2027 | 86,000 | 86,212 | |||||

Laboratory Corp. of America Holdings, Sr. Unscd. Notes | 3.60 | 2/1/2025 | 350,000 | 341,883 | |||||

Medtronic, Inc., Gtd. Notes | 4.63 | 3/15/2045 | 50,000 | 45,556 | |||||

Merck & Co., Inc., Sr. Unscd. Notes | 3.40 | 3/7/2029 | 60,000 | 56,292 | |||||

Pfizer, Inc., Sr. Unscd. Notes | 3.45 | 3/15/2029 | 55,000 | 51,827 | |||||

Regeneron Pharmaceuticals, Inc., Sr. Unscd. Notes | 1.75 | 9/15/2030 | 112,000 | 88,976 | |||||

Royalty Pharma PLC, Gtd. Notes | 2.15 | 9/2/2031 | 325,000 | 254,110 | |||||

The Cigna Group, Gtd. Notes | 4.38 | 10/15/2028 | 295,000 | 284,731 | |||||

UnitedHealth Group, Inc., Sr. Unscd. Notes | 2.88 | 8/15/2029 | 150,000 | 135,287 | |||||

UnitedHealth Group, Inc., Sr. Unscd. Notes | 4.75 | 7/15/2045 | 155,000 | 141,708 | |||||

4,096,227 | |||||||||

Industrial - .1% | |||||||||

GE Capital Funding LLC, Gtd. Notes | 4.55 | 5/15/2032 | 247,000 | 232,448 | |||||

Insurance - .9% | |||||||||

American International Group, Inc., Sr. Unscd. Notes | 4.38 | 6/30/2050 | 200,000 | 162,893 | |||||

Five Corners Funding Trust II, Sr. Unscd. Notes | 2.85 | 5/15/2030 | 260,000 | a | 222,442 | ||||

Jackson Financial, Inc., Sr. Unscd. Notes | 3.13 | 11/23/2031 | 195,000 | 155,351 | |||||

Massachusetts Mutual Life Insurance Co., Sub. Notes | 3.38 | 4/15/2050 | 225,000 | a | 152,113 | ||||

MassMutual Global Funding II, Scd. Notes | 2.95 | 1/11/2025 | 200,000 | a | 194,665 | ||||

Metropolitan Life Global Funding I, Sr. Scd. Notes | 3.00 | 9/19/2027 | 545,000 | a | 501,125 | ||||

New York Life Insurance Co., Sub. Notes | 3.75 | 5/15/2050 | 205,000 | a | 149,657 | ||||

Pacific Life Global Funding II, Scd. Notes | 1.20 | 6/24/2025 | 375,000 | a | 351,481 | ||||

Pacific Life Global Funding II, Scd. Notes | 1.38 | 4/14/2026 | 270,000 | a | 246,422 | ||||

Pricoa Global Funding I, Scd. Notes | 2.40 | 9/23/2024 | 155,000 | a | 151,069 | ||||

15

STATEMENT OF INVESTMENTS (continued)

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Insurance - .9% (continued) | |||||||||

Principal Financial Group, Inc., Gtd. Notes | 4.30 | 11/15/2046 | 125,000 | 97,520 | |||||

2,384,738 | |||||||||

Internet Software & Services - .1% | |||||||||

Meta Platforms, Inc., Sr. Unscd. Notes | 5.60 | 5/15/2053 | 225,000 | 228,771 | |||||

Media - .3% | |||||||||

Charter Communications Operating LLC/Charter Communications Operating Capital, Sr. Scd. Notes | 4.91 | 7/23/2025 | 185,000 | 182,012 | |||||

Comcast Corp., Gtd. Notes | 2.65 | 2/1/2030 | 335,000 | 293,067 | |||||

Comcast Corp., Gtd. Notes | 2.89 | 11/1/2051 | 210,000 | 132,406 | |||||

Comcast Corp., Gtd. Notes | 6.50 | 11/15/2035 | 43,000 | 46,949 | |||||

The Walt Disney Company, Gtd. Notes | 6.65 | 11/15/2037 | 245,000 | 275,146 | |||||

929,580 | |||||||||

Metals & Mining - .2% | |||||||||

Anglo American Capital PLC, Gtd. Notes | 2.63 | 9/10/2030 | 400,000 | a | 330,630 | ||||

Glencore Funding LLC, Gtd. Notes | 2.63 | 9/23/2031 | 415,000 | a | 334,150 | ||||

664,780 | |||||||||

Municipal Securities - .6% | |||||||||

California, GO, Ser. A | 2.38 | 10/1/2026 | 230,000 | 215,260 | |||||

Central Florida Tourism Oversight District, GO, Refunding, Ser. A | 2.40 | 6/1/2032 | 65,000 | 52,222 | |||||

Central Florida Tourism Oversight District, GO, Refunding, Ser. A | 2.45 | 6/1/2033 | 65,000 | 51,095 | |||||

Central Florida Tourism Oversight District, GO, Refunding, Ser. A | 2.50 | 6/1/2034 | 50,000 | 38,500 | |||||

Connecticut, GO, Ser. A | 2.10 | 7/1/2025 | 40,000 | 38,115 | |||||

Dallas Fort Worth International Airport, Revenue Bonds, Refunding, Ser. C | 2.92 | 11/1/2050 | 160,000 | 109,109 | |||||

Honolulu City & County Wastewater System, Revenue Bonds, Refunding, Ser. B | 2.50 | 7/1/2027 | 25,000 | 23,074 | |||||

Los Angeles Department of Water & Power, Revenue Bonds (Build America Bonds) | 5.72 | 7/1/2039 | 120,000 | 122,326 | |||||

Massachusetts School Building Authority, Revenue Bonds, Refunding, Ser. B | 2.44 | 10/15/2027 | 115,000 | 105,278 | |||||

Metropolitan Transportation Authority, Revenue Bonds (Build America Bonds) | 6.55 | 11/15/2031 | 225,000 | 232,710 | |||||

16

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Municipal Securities - .6% (continued) | |||||||||

Metropolitan Transportation Authority, Revenue Bonds (Build America Bonds) Ser. A2 | 6.09 | 11/15/2040 | 10,000 | 10,370 | |||||

Miami-Dade County Water & Sewer System, Revenue Bonds, Refunding, Ser. C | 2.55 | 10/1/2028 | 250,000 | 225,653 | |||||

New York City, GO (Build America Bonds) Ser. D | 5.99 | 12/1/2036 | 135,000 | 139,421 | |||||

Wisconsin, Revenue Bonds, Refunding, Ser. A | 2.20 | 5/1/2027 | 135,000 | 124,173 | |||||

1,487,306 | |||||||||

Real Estate - 1.0% | |||||||||

Alexandria Real Estate Equities, Inc., Gtd. Notes | 3.80 | 4/15/2026 | 225,000 | 216,680 | |||||

American Homes 4 Rent LP, Sr. Unscd. Notes | 2.38 | 7/15/2031 | 90,000 | 70,695 | |||||

American Tower Corp., Sr. Unscd. Notes | 5.55 | 7/15/2033 | 240,000 | 237,492 | |||||

AvalonBay Communities, Inc., Sr. Unscd. Notes | 3.30 | 6/1/2029 | 215,000 | 194,413 | |||||

Crown Castle, Inc., Sr. Unscd. Notes | 2.25 | 1/15/2031 | 740,000 | 592,545 | |||||

Healthcare Realty Holdings LP, Gtd. Notes | 3.10 | 2/15/2030 | 235,000 | 199,585 | |||||

Prologis LP, Sr. Unscd. Notes | 2.13 | 4/15/2027 | 40,000 | 36,243 | |||||

Prologis LP, Sr. Unscd. Notes | 2.25 | 4/15/2030 | 120,000 | 100,273 | |||||

Realty Income Corp., Sr. Unscd. Notes | 2.85 | 12/15/2032 | 225,000 | 182,321 | |||||

SBA Tower Trust, Asset Backed Notes | 2.84 | 1/15/2025 | 210,000 | a | 202,212 | ||||

Simon Property Group LP, Sr. Unscd. Notes | 3.50 | 9/1/2025 | 230,000 | 221,955 | |||||

WP Carey, Inc., Sr. Unscd. Notes | 2.25 | 4/1/2033 | 295,000 | 218,427 | |||||

WP Carey, Inc., Sr. Unscd. Notes | 2.40 | 2/1/2031 | 175,000 | 141,464 | |||||

2,614,305 | |||||||||

Retailing - .2% | |||||||||

7-Eleven, Inc., Sr. Unscd. Notes | 2.80 | 2/10/2051 | 280,000 | a | 165,172 | ||||

Dollar General Corp., Sr. Unscd. Notes | 3.50 | 4/3/2030 | 200,000 | 178,682 | |||||

Dollar Tree, Inc., Sr. Unscd. Notes | 4.20 | 5/15/2028 | 110,000 | 104,685 | |||||

Lowe's Cos., Inc., Sr. Unscd. Notes | 5.63 | 4/15/2053 | 230,000 | 223,956 | |||||

672,495 | |||||||||

Semiconductors & Semiconductor Equipment - .2% | |||||||||

Broadcom, Inc., Sr. Unscd. Notes | 3.42 | 4/15/2033 | 225,000 | a | 189,198 | ||||

17

STATEMENT OF INVESTMENTS (continued)

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Semiconductors & Semiconductor Equipment - .2% (continued) | |||||||||

NXP BV/ NXP Funding LLC/ NXP USA, Inc., Gtd. Notes | 2.65 | 2/15/2032 | 410,000 | 330,691 | |||||

519,889 | |||||||||

Supranational Bank - ..4% | |||||||||

Asian Development Bank, Sr. Unscd. Notes | 4.00 | 1/12/2033 | 520,000 | 500,238 | |||||

International Finance Facility for Immunisation Co., Sr. Unscd. Notes | 1.00 | 4/21/2026 | 560,000 | 511,926 | |||||

1,012,164 | |||||||||

Technology Hardware & Equipment - .1% | |||||||||

Dell International LLC/EMC Corp., Sr. Unscd. Notes | 6.02 | 6/15/2026 | 68,000 | 68,758 | |||||

Hewlett Packard Enterprise Co., Sr. Unscd. Notes | 4.90 | 10/15/2025 | 105,000 | 103,995 | |||||

172,753 | |||||||||

Telecommunication Services - .6% | |||||||||

AT&T, Inc., Sr. Unscd. Notes | 2.55 | 12/1/2033 | 438,000 | 341,111 | |||||

Sprint Spectrum Co. LLC/ Sprint Spectrum Co. II LLC/ Sprint Spectrum Co. III LLC, Sr. Scd. Notes | 4.74 | 3/20/2025 | 75,000 | a | 74,390 | ||||

Telefonica Emisiones SA, Gtd. Notes | 5.21 | 3/8/2047 | 150,000 | 128,852 | |||||

T-Mobile USA, Inc., Gtd. Notes | 2.55 | 2/15/2031 | 155,000 | 128,536 | |||||

T-Mobile USA, Inc., Gtd. Notes | 3.88 | 4/15/2030 | 270,000 | 248,067 | |||||

T-Mobile USA, Inc., Gtd. Notes | 5.20 | 1/15/2033 | 180,000 | 177,305 | |||||

Verizon Communications, Inc., Sr. Unscd. Notes | 2.36 | 3/15/2032 | 51,000 | 40,704 | |||||

Verizon Communications, Inc., Sr. Unscd. Notes | 3.88 | 2/8/2029 | 140,000 | 132,454 | |||||

Verizon Communications, Inc., Sr. Unscd. Notes | 4.02 | 12/3/2029 | 495,000 | 464,932 | |||||

1,736,351 | |||||||||

Transportation - .4% | |||||||||

Canadian Pacific Railway Co., Gtd. Notes | 2.45 | 12/2/2031 | 130,000 | 117,917 | |||||

Canadian Pacific Railway Co., Gtd. Notes | 3.00 | 12/2/2041 | 125,000 | 109,966 | |||||

CSX Corp., Sr. Unscd. Notes | 2.60 | 11/1/2026 | 380,000 | 355,696 | |||||

CSX Corp., Sr. Unscd. Notes | 3.35 | 11/1/2025 | 205,000 | 197,789 | |||||

FedEx Corp., Gtd. Notes | 4.40 | 1/15/2047 | 205,000 | 167,620 | |||||

Ryder System, Inc., Sr. Unscd. Notes | 5.25 | 6/1/2028 | 158,000 | 157,270 | |||||

1,106,258 | |||||||||

18

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

U.S. Government Agencies Collateralized Mortgage Obligations - .4% | |||||||||

Federal Home Loan Mortgage Corp. Seasoned Loans Structured Transaction Trust, Ser. 2019-2, Cl. A2C | 2.75 | 9/25/2029 | 265,000 | c | 232,148 | ||||

Federal Home Loan Mortgage Corp. Seasoned Loans Structured Transaction Trust, Ser. 2019-3, Cl. A2C | 2.75 | 11/25/2029 | 255,000 | c | 217,879 | ||||

Government National Mortgage Association, Ser. 2022-173, Cl. PQ | 5.00 | 6/20/2051 | 478,962 | 465,632 | |||||

Government National Mortgage Association, Ser. 2022-177, CI. PL | 6.00 | 6/20/2051 | 246,616 | 249,748 | |||||

1,165,407 | |||||||||

U.S. Government Agencies Collateralized Municipal-Backed Securities - .6% | |||||||||

Federal Home Loan Mortgage Corp. Multifamily Structured Pass Through Certificates, Ser. K089, Cl. A2 | 3.56 | 1/25/2029 | 560,000 | c | 527,813 | ||||

Federal Home Loan Mortgage Corp. Multifamily Structured Pass Through Certificates, Ser. K090, Cl. A2 | 3.42 | 2/25/2029 | 545,000 | c | 509,821 | ||||

Federal Home Loan Mortgage Corp. Multifamily Structured Pass Through Certificates, Ser. K095, Cl. A2 | 2.79 | 6/25/2029 | 515,000 | c | 464,233 | ||||

1,501,867 | |||||||||

U.S. Government Agencies Mortgage-Backed - 10.1% | |||||||||

Federal Home Loan Mortgage Corp.: | |||||||||

2.00%, 9/1/2050-12/1/2051 | 2,407,288 | c | 1,880,194 | ||||||

2.50%, 11/1/2027-9/1/2050 | 1,291,039 | c | 1,061,233 | ||||||

3.00%, 6/1/2031-12/1/2046 | 483,873 | c | 426,469 | ||||||

3.50%, 4/1/2035-9/1/2049 | 1,273,075 | c | 1,171,016 | ||||||

5.50%, 1/1/2036-8/1/2053 | 985,160 | c | 979,146 | ||||||

Federal National Mortgage Association: | |||||||||

1.50%, 3/1/2051 | 488,721 | c | 361,497 | ||||||

2.00%, 8/1/2036-12/1/2051 | 5,802,010 | c | 4,591,109 | ||||||

2.50%, 9/1/2028-1/1/2052 | 3,873,436 | c | 3,196,078 | ||||||

3.00%, 6/1/2028-12/1/2050 | 3,213,758 | c | 2,835,499 | ||||||

3.50%, 8/1/2034-10/1/2050 | 3,080,494 | c | 2,786,571 | ||||||

4.00%, 7/1/2042-8/1/2052 | 3,871,010 | c | 3,554,426 | ||||||

4.50%, 2/1/2039-10/1/2052 | 2,230,992 | c | 2,121,560 | ||||||

5.00%, 4/1/2035-12/1/2048 | 246,695 | c | 244,329 | ||||||

5.50%, 9/1/2034-5/1/2039 | 21,750 | c | 22,093 | ||||||

19

STATEMENT OF INVESTMENTS (continued)

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

U.S. Government Agencies Mortgage-Backed - 10.1% (continued) | |||||||||

8.00%, 3/1/2030 | 70 | c | 70 | ||||||

Government National Mortgage Association I: | |||||||||

5.50%, 4/15/2033 | 7,196 |

| 7,190 | ||||||

Government National Mortgage Association II: | |||||||||

3.00%, 1/20/2045-9/20/2051 | 1,253,089 |

| 1,090,910 | ||||||

3.50%, 7/20/2047-2/20/2052 | 790,909 |

| 710,891 | ||||||

4.00%, 10/20/2047-1/20/2048 | 191,453 |

| 179,526 | ||||||

4.50%, 7/20/2048 | 61,438 |

| 58,935 | ||||||

27,278,742 | |||||||||

U.S. Treasury Securities - 8.7% | |||||||||

U.S. Treasury Bonds | 1.75 | 8/15/2041 | 5,675,000 | 3,654,057 | |||||

U.S. Treasury Bonds | 2.25 | 2/15/2052 | 6,280,000 | 4,002,028 | |||||

U.S. Treasury Bonds | 2.38 | 5/15/2051 | 2,353,000 | 1,546,362 | |||||

U.S. Treasury Bonds | 2.88 | 5/15/2043 | 940,000 | 718,513 | |||||

U.S. Treasury Inflation Indexed Notes | 0.13 | 4/15/2027 | 599,560 | d | 555,516 | ||||

U.S. Treasury Notes | 0.88 | 9/30/2026 | 1,125,000 | 1,019,421 | |||||

U.S. Treasury Notes | 1.13 | 1/15/2025 | 1,850,000 | 1,770,074 | |||||

U.S. Treasury Notes | 2.38 | 5/15/2029 | 880,000 | 796,125 | |||||

U.S. Treasury Notes | 3.63 | 5/31/2028 | 2,250,000 | 2,186,323 | |||||

U.S. Treasury Notes | 3.63 | 3/31/2030 | 915,000 | 877,221 | |||||

U.S. Treasury Notes | 4.13 | 7/31/2028 | 2,034,000 | 2,017,355 | |||||

U.S. Treasury Notes | 4.75 | 7/31/2025 | 4,500,000 | 4,492,969 | |||||

23,635,964 | |||||||||

Utilities - .9% | |||||||||

American Electric Power Co., Inc., Sr. Unscd. Notes | 3.25 | 3/1/2050 | 155,000 | 101,975 | |||||

Berkshire Hathaway Energy Co., Sr. Unscd. Notes | 3.25 | 4/15/2028 | 95,000 | 87,737 | |||||

Consolidated Edison Company of New York, Inc., Sr. Unscd. Debs., Ser. 20A | 3.35 | 4/1/2030 | 170,000 | 153,200 | |||||

Dominion Energy, Inc., Sr. Unscd. Notes | 3.90 | 10/1/2025 | 165,000 | 160,163 | |||||

Duke Energy Corp., Sr. Unscd. Notes | 3.15 | 8/15/2027 | 275,000 | 255,286 | |||||

Electricite de France SA, Sr. Unscd. Notes | 6.25 | 5/23/2033 | 200,000 | a | 206,781 | ||||

Eversource Energy, Sr. Unscd. Notes, Ser. O | 4.25 | 4/1/2029 | 215,000 | 203,418 | |||||

Kentucky Utilities Co., First Mortgage Bonds | 4.38 | 10/1/2045 | 105,000 | 84,524 | |||||

Louisville Gas & Electric Co., First Mortgage Bonds | 4.38 | 10/1/2045 | 125,000 | 100,718 | |||||

NiSource, Inc., Sr. Unscd. Notes | 5.25 | 3/30/2028 | 25,000 | 24,986 | |||||

20

Description | Coupon

| Maturity Date | Principal Amount ($) |

| Value ($) | ||||

Bonds and Notes - 36.8% (continued) | |||||||||

Utilities - .9% (continued) | |||||||||

NiSource, Inc., Sr. Unscd. Notes | 5.65 | 2/1/2045 | 230,000 | 218,857 | |||||

NRG Energy, Inc., Sr. Scd. Notes | 2.45 | 12/2/2027 | 440,000 | a | 385,898 | ||||

Sempra, Sr. Unscd. Notes | 3.40 | 2/1/2028 | 100,000 | 92,757 | |||||

Sierra Pacific Power Co., Mortgage Notes, Ser. P | 6.75 | 7/1/2037 | 25,000 | 26,645 | |||||

Southern California Edison Co., First Mortgage Bonds | 3.65 | 2/1/2050 | 40,000 | 28,330 | |||||

Southern California Edison Co., First Mortgage Bonds, Ser. A | 4.20 | 3/1/2029 | 235,000 | 223,078 | |||||

The AES Corp., Sr. Unscd. Notes | 5.45 | 6/1/2028 | 132,000 | 130,902 | |||||

2,485,255 | |||||||||

Total Bonds

and Notes | 99,734,221 | ||||||||

Description | Shares |

| Value ($) | ||||||

Common Stocks - 56.5% | |||||||||

Advertising - .8% | |||||||||

Omnicom Group, Inc. | 9,218 | 743,247 | |||||||

Publicis Groupe SA | 7,278 | 614,597 | |||||||

The Interpublic Group of Companies, Inc. | 23,762 | 730,444 | |||||||

2,088,288 | |||||||||

Aerospace & Defense - 1.3% | |||||||||

BAE Systems PLC | 16,870 | 223,624 | |||||||

Howmet Aerospace, Inc. | 21,322 | 1,121,537 | |||||||

Melrose Industries PLC | 16,118 | 105,526 | |||||||

Northrop Grumman Corp. | 2,514 | 1,194,552 | |||||||

The Boeing Company | 3,570 | e | 826,919 | ||||||

3,472,158 | |||||||||

Agriculture - .5% | |||||||||

British American Tobacco PLC | 7,972 | 252,814 | |||||||

Bunge Global SA | 5,642 | 619,887 | |||||||

Philip Morris International, Inc. | 4,843 | 452,142 | |||||||

1,324,843 | |||||||||

Automobiles & Components - .5% | |||||||||

Cie Generale des Etablissements Michelin SCA | 10,708 | 359,111 | |||||||

Daimler Truck Holding AG | 2,279 | 73,999 | |||||||

General Motors Co. | 11,696 | 369,594 | |||||||

Mercedes-Benz Group AG | 7,349 | 476,603 | |||||||

1,279,307 | |||||||||

Banks - 1.5% | |||||||||

BNP Paribas SA | 9,150 | 575,376 | |||||||

ING Groep NV | 35,122 | 492,330 | |||||||

JPMorgan Chase & Co. | 16,361 | 2,553,625 | |||||||

21

STATEMENT OF INVESTMENTS (continued)

Description | Shares |

| Value ($) | ||||||

Common Stocks - 56.5% (continued) | |||||||||

Banks - 1.5% (continued) | |||||||||

Mizuho Financial Group, Inc. | 6,300 | 106,742 | |||||||

Sumitomo Mitsui Financial Group, Inc. | 9,100 | 445,486 | |||||||

4,173,559 | |||||||||

Beverage Products - .4% | |||||||||

Diageo PLC | 14,411 | 502,768 | |||||||

The Coca-Cola Company | 8,749 | 511,292 | |||||||

1,014,060 | |||||||||

Building Materials - 1.0% | |||||||||

CRH PLC | 16,736 | 1,050,184 | |||||||

CRH PLC | 6,370 | 400,964 | |||||||

Trane Technologies PLC | 6,140 | 1,384,017 | |||||||

2,835,165 | |||||||||

Chemicals - .6% | |||||||||

CF Industries Holdings, Inc. | 13,574 | 1,020,086 | |||||||

Evonik Industries AG | 11,173 | 208,575 | |||||||

Vulcan Materials Co. | 1,727 | 368,818 | |||||||

Yara International ASA | 2,525 | 85,482 | |||||||

1,682,961 | |||||||||

Commercial & Professional Services - 1.7% | |||||||||

Ashtead Group PLC | 2,546 | 153,092 | |||||||

Block, Inc. | 22,820 | e | 1,447,473 | ||||||

Brambles Ltd. | 10,236 | 90,224 | |||||||

Cintas Corp. | 1,885 | 1,042,876 | |||||||

CoStar Group, Inc. | 21,584 | e | 1,792,335 | ||||||

4,526,000 | |||||||||

Consumer Discretionary - 1.3% | |||||||||

Aristocrat Leisure Ltd. | 2,074 | 55,624 | |||||||

Bunzl PLC | 2,364 | 89,593 | |||||||

Dolby Laboratories, Inc., Cl. A | 6,197 | 533,748 | |||||||

Ferguson PLC | 665 | 112,329 | |||||||

International Game Technology PLC | 20,972 | 560,582 | |||||||

ITOCHU Corp. | 10,800 | 417,985 | |||||||

Las Vegas Sands Corp. | 18,057 | 832,789 | |||||||

Peloton Interactive, Inc., Cl. A | 43,385 | e | 245,559 | ||||||

Planet Fitness, Inc., Cl. A | 8,190 | e | 556,429 | ||||||

Sony Group Corp. | 2,400 | 207,527 | |||||||

3,612,165 | |||||||||

Consumer Durables & Apparel - .2% | |||||||||

Burberry Group PLC | 9,047 | 167,152 | |||||||

LVMH Moet Hennessy Louis Vuitton SE | 393 | 300,601 | |||||||

467,753 | |||||||||

22

Description | Shares |

| Value ($) | ||||||

Common Stocks - 56.5% (continued) | |||||||||

Consumer Staples - .4% | |||||||||

Haleon PLC | 21,596 | 89,984 | |||||||

Kenvue, Inc. | 41,860 | 855,618 | |||||||

Unilever PLC | 1,638 | 77,949 | |||||||

1,023,551 | |||||||||

Diversified Financials - 2.2% | |||||||||

Ameriprise Financial, Inc. | 1,285 | 454,260 | |||||||

ASX Ltd. | 10,246 | 393,204 | |||||||

CME Group, Inc. | 6,608 | 1,442,923 | |||||||

LPL Financial Holdings, Inc. | 2,156 | 479,279 | |||||||

Morgan Stanley | 9,561 | 758,570 | |||||||

Singapore Exchange Ltd. | 28,700 | 202,318 | |||||||

The Goldman Sachs Group, Inc. | 3,233 | 1,104,199 | |||||||

Voya Financial, Inc. | 14,772 | 1,056,346 | |||||||

5,891,099 | |||||||||

Electronic Components - .9% | |||||||||

AMETEK, Inc. | 8,821 | 1,369,284 | |||||||

Casio Computer Co. Ltd. | 15,600 | 131,420 | |||||||

Eaton Corp. PLC | 2,559 | 582,659 | |||||||

Hubbell, Inc. | 1,562 | 468,600 | |||||||

2,551,963 | |||||||||

Energy - 3.9% | |||||||||

BP PLC | 32,854 | 198,714 | |||||||

ConocoPhillips | 14,168 | 1,637,396 | |||||||

Diamondback Energy, Inc. | 2,679 | 413,664 | |||||||

Eni SpA | 13,099 | 216,269 | |||||||

EQT Corp. | 72,525 | 2,898,099 | |||||||

Marathon Oil Corp. | 14,573 | 370,591 | |||||||

Marathon Petroleum Corp. | 5,344 | 797,271 | |||||||

Occidental Petroleum Corp. | 20,819 | 1,231,444 | |||||||

OMV AG | 4,276 | 182,221 | |||||||

Phillips 66 | 6,217 | 801,309 | |||||||

Schlumberger NV | 24,697 | 1,285,232 | |||||||

Shell PLC | 16,843 | 544,344 | |||||||

10,576,554 | |||||||||

Environmental Control - .5% | |||||||||

Veralto Corp. | 11,874 | e | 917,267 | ||||||

Waste Connections, Inc. | 3,968 | 537,624 | |||||||

1,454,891 | |||||||||

Financials - .4% | |||||||||

Ares Management Corp., Cl. A | 10,370 | 1,164,033 | |||||||

Food Products - .4% | |||||||||

Koninklijke Ahold Delhaize NV | 7,368 | 213,013 | |||||||

Mondelez International, Inc., Cl. A | 6,351 | 451,302 | |||||||

23

STATEMENT OF INVESTMENTS (continued)

Description | Shares |

| Value ($) | ||||||

Common Stocks - 56.5% (continued) | |||||||||

Food Products - .4% (continued) | |||||||||

Tate & Lyle PLC | 35,667 | 277,822 | |||||||

942,137 | |||||||||

Health Care - 9.8% | |||||||||

AbbVie, Inc. | 5,451 | 776,168 | |||||||

Alcon, Inc. | 5,824 | 440,469 | |||||||

Align Technology, Inc. | 3,302 | e | 705,968 | ||||||

Alnylam Pharmaceuticals, Inc. | 4,320 | e | 726,840 | ||||||

Bayer AG | 11,000 | 375,489 | |||||||

Becton, Dickinson and Co. | 5,372 | 1,268,759 | |||||||

Biogen, Inc. | 1,194 | e | 279,492 | ||||||

BioMarin Pharmaceutical, Inc. | 12,213 | e | 1,112,360 | ||||||

Bio-Techne Corp. | 10,511 | 661,142 | |||||||

Boston Scientific Corp. | 33,156 | e | 1,853,089 | ||||||

Centene Corp. | 11,031 | e | 812,764 | ||||||

Danaher Corp. | 12,415 | 2,772,394 | |||||||

DexCom, Inc. | 12,527 | e | 1,447,119 | ||||||

Eli Lilly & Co. | 1,903 | 1,124,749 | |||||||

Euroapi SA | 191 | e | 1,081 | ||||||

FUJIFILM Holdings Corp. | 1,900 | 110,981 | |||||||

Globus Medical, Inc., Cl. A | 9,392 | e | 421,889 | ||||||

GSK PLC | 18,471 | 330,986 | |||||||

Illumina, Inc. | 10,240 | e | 1,043,968 | ||||||

Intuitive Surgical, Inc. | 4,172 | e | 1,296,824 | ||||||

Medtronic PLC | 21,350 | 1,692,415 | |||||||

Novartis AG | 979 | 95,161 | |||||||

Regeneron Pharmaceuticals, Inc. | 1,015 | e | 836,167 | ||||||

Repligen Corp. | 3,593 | e | 564,999 | ||||||

Roche Holding AG | 1,888 | 508,921 | |||||||

Sanofi SA | 5,350 | 497,674 | |||||||

Sanofi, ADR | 17,953 | 839,303 | |||||||

Sarepta Therapeutics, Inc. | 8,522 | e | 692,668 | ||||||

Shionogi & Co. Ltd. | 2,000 | 94,132 | |||||||

Sonova Holding AG | 944 | 271,978 | |||||||

UnitedHealth Group, Inc. | 4,238 | 2,343,487 | |||||||

Zoetis, Inc. | 3,002 | 530,363 | |||||||

26,529,799 | |||||||||

Industrial - .7% | |||||||||

ACS Actividades de Construccion y Servicios SA | 3,356 | 133,883 | |||||||

Ingersoll Rand, Inc. | 18,179 | 1,298,526 | |||||||

Mitsubishi Electric Corp. | 6,700 | 90,788 | |||||||

Vinci SA | 2,283 | 279,071 | |||||||

1,802,268 | |||||||||

24

Description | Shares |

| Value ($) | ||||||

Common Stocks - 56.5% (continued) | |||||||||

Information Technology - 6.2% | |||||||||

Akamai Technologies, Inc. | 5,731 | e | 662,102 | ||||||

Ansys, Inc. | 3,625 | e | 1,063,430 | ||||||

Bill Holdings, Inc. | 4,915 | e | 321,785 | ||||||

CACI International, Inc., Cl. A | 1,801 | e | 578,031 | ||||||

Dynatrace, Inc. | 12,061 | e | 645,867 | ||||||

HubSpot, Inc. | 2,486 | e | 1,227,910 | ||||||

International Business Machines Corp. | 4,679 | 741,902 | |||||||

Microsoft Corp. | 20,232 | 7,666,107 | |||||||

MongoDB, Inc. | 1,591 | e | 661,442 | ||||||

Roper Technologies, Inc. | 2,416 | 1,300,412 | |||||||

Snowflake, Inc., Cl. A | 4,325 | e | 811,716 | ||||||

Twilio, Inc., Cl. A | 16,840 | e | 1,089,211 | ||||||

16,769,915 | |||||||||

Insurance - 3.8% | |||||||||

Allianz SE | 850 | 213,357 | |||||||

American International Group, Inc. | 16,141 | 1,062,239 | |||||||

Aon PLC, Cl. A | 2,347 | 770,966 | |||||||

Assurant, Inc. | 6,928 | 1,164,043 | |||||||

AXA SA | 4,700 | 146,291 | |||||||

Berkshire Hathaway, Inc., Cl. B | 7,364 | e | 2,651,040 | ||||||

Hiscox Ltd. | 25,195 | 323,163 | |||||||

Muenchener Rueckversicherungs-Gesellschaft AG | 329 | 139,952 | |||||||

RenaissanceRe Holdings Ltd. | 5,760 | 1,234,714 | |||||||

The Allstate Corp. | 8,389 | 1,156,591 | |||||||

The Progressive Corp. | 3,212 | 526,864 | |||||||

Willis Towers Watson PLC | 3,373 | 830,770 | |||||||

10,219,990 | |||||||||

Internet Software & Services - 6.3% | |||||||||

Alphabet, Inc., Cl. A | 4,310 | e | 571,204 | ||||||

Alphabet, Inc., Cl. C | 46,149 | e | 6,180,274 | ||||||

Amazon.com, Inc. | 46,374 | e | 6,774,778 | ||||||

Chewy, Inc., Cl. A | 13,195 | e | 229,857 | ||||||

Meta Platforms, Inc., Cl. A | 930 | e | 304,250 | ||||||

Shopify, Inc., Cl. A | 26,565 | e | 1,934,463 | ||||||

Trend Micro, Inc. | 1,100 | 55,749 | |||||||

Uber Technologies, Inc. | 20,148 | e | 1,135,944 | ||||||

17,186,519 | |||||||||

Media - .5% | |||||||||

Netflix, Inc. | 1,462 | e | 692,944 | ||||||

The Walt Disney Company | 7,696 | 713,342 | |||||||

1,406,286 | |||||||||

25

STATEMENT OF INVESTMENTS (continued)

Description | Shares |

| Value ($) | ||||||

Common Stocks - 56.5% (continued) | |||||||||

Metals & Mining - ..9% | |||||||||

Alcoa Corp. | 24,762 | 665,107 | |||||||

Freeport-McMoRan, Inc. | 25,008 | 933,299 | |||||||

Newmont Corp. | 11,006 | 442,331 | |||||||

Rio Tinto PLC | 3,983 | 271,480 | |||||||

2,312,217 | |||||||||

Real Estate - .1% | |||||||||

Klepierre SA | 4,781 | 120,215 | |||||||

Sun Hung Kai Properties Ltd. | 15,500 | 152,097 | |||||||

272,312 | |||||||||

Retailing - .7% | |||||||||

Lululemon Athletica, Inc. | 1,157 | e | 516,948 | ||||||

Restaurant Brands International, Inc. | 7,788 | 553,571 | |||||||

RH | 1,555 | e | 419,803 | ||||||

Ross Stores, Inc. | 3,035 | 395,703 | |||||||

1,886,025 | |||||||||

Semiconductors & Semiconductor Equipment - 4.0% | |||||||||

Advantest Corp. | 2,800 | 88,404 | |||||||

Applied Materials, Inc. | 11,480 | 1,719,474 | |||||||

ASML Holding NV | 570 | 386,537 | |||||||

Intel Corp. | 25,228 | 1,127,692 | |||||||

Lam Research Corp. | 843 | 603,521 | |||||||

Micron Technology, Inc. | 11,107 | 845,465 | |||||||

NVIDIA Corp. | 11,926 | 5,577,790 | |||||||

Renesas Electronics Corp. | 10,900 | e | 191,408 | ||||||

STMicroelectronics NV | 1,848 | 87,412 | |||||||

Tokyo Electron Ltd. | 1,200 | 194,456 | |||||||

10,822,159 | |||||||||

Technology Hardware & Equipment - 2.9% | |||||||||

Apple, Inc. | 40,624 | 7,716,529 | |||||||

Fujitsu Ltd. | 1,100 | 156,698 | |||||||

7,873,227 | |||||||||

Telecommunication Services - .8% | |||||||||

AT&T, Inc. | 41,646 | 690,074 | |||||||

Cisco Systems, Inc. | 16,026 | 775,338 | |||||||

Nippon Telegraph & Telephone Corp. | 190,000 | 221,833 | |||||||

Orange SA | 44,060 | 542,132 | |||||||

2,229,377 | |||||||||

Transportation - .5% | |||||||||

AP Moller - Maersk A/S, Cl. B | 39 | 61,501 | |||||||

DHL Group | 5,345 | 250,408 | |||||||

FedEx Corp. | 3,606 | 933,341 | |||||||

26

Description | Shares |

| Value ($) | ||||||

Common Stocks - 56.5% (continued) | |||||||||

Transportation - .5% (continued) | |||||||||

Kuehne + Nagel International AG | 791 | 228,710 | |||||||

1,473,960 | |||||||||

Utilities - .8% | |||||||||

Constellation Energy Corp. | 10,600 | 1,283,024 | |||||||

Dominion Energy, Inc. | 12,186 | 552,513 | |||||||

Enel SpA | 25,892 | 182,798 | |||||||

SSE PLC | 10,197 | 235,901 | |||||||

2,254,236 | |||||||||

Total Common

Stocks | 153,118,777 | ||||||||

Preferred

Dividend |

| ||||||||

Preferred Stocks - .1% | |||||||||

Automobiles & Components - .1% | |||||||||

Volkswagen

AG | 23.95 | 1,687 | 195,419 | ||||||

| |||||||||

Exchange-Traded Funds - 4.5% | |||||||||

Registered Investment Companies - 4.5% | |||||||||

iShares Core U.S. Aggregate Bond ETF | 97,733 | 9,407,779 | |||||||

iShares MSCI EAFE ETF | 5,516 | 399,469 | |||||||

SPDR S&P 500 ETF Trust | 5,564 | 2,539,410 | |||||||

Total Exchange-Traded

Funds | 12,346,658 | ||||||||

27

STATEMENT OF INVESTMENTS (continued)

Description | 1-Day | Shares |

| Value ($) | |||||

Investment Companies - 1.8% | |||||||||

Registered Investment Companies - 1.8% | |||||||||

Dreyfus

Institutional Preferred Government Plus Money Market Fund, Institutional Shares | 5.41 | 4,791,114 | f | 4,791,114 | |||||

Total Investments (cost $245,887,211) | 99.7% | 270,186,189 | |||||||

Cash and Receivables (Net) | 0.3% | 759,161 | |||||||

Net Assets | 100.0% | 270,945,350 | |||||||

ADR—American Depositary Receipt

ETF—Exchange-Traded Fund

GO—General Obligation

PRIME—Prime Lending Rate

SPDR—Standard & Poor's Depository Receipt

TSFR—Term Secured Overnight Financing Rate Reference Rates

a Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2023, these securities were valued at $9,035,811 or 3.33% of net assets.

b Variable rate security—interest rate resets periodically and rate shown is the interest rate in effect at period end. Security description also includes the reference rate and spread if published and available.

c The Federal Housing Finance Agency (“FHFA”) placed the Federal Home Loan Mortgage Corporation and Federal National Mortgage Association into conservatorship with FHFA as the conservator. As such, the FHFA oversees the continuing affairs of these companies.

d Principal amount for accrual purposes is periodically adjusted based on changes in the Consumer Price Index.

e Non-income producing security.

f Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

Portfolio Summary (Unaudited) † | Value (%) |

Consumer, Non-cyclical | 14.8 |

Financial | 13.6 |

Technology | 13.3 |

Mortgage Securities | 11.8 |

Government | 10.3 |

Communications | 9.5 |

Industrial | 6.6 |

Investment Companies | 6.3 |

Energy | 4.9 |

Consumer, Cyclical | 3.5 |

Utilities | 1.8 |

Basic Materials | 1.7 |

Asset Backed Securities | 1.6 |

99.7 |

† Based on net assets.

See notes to financial statements.

28

Affiliated Issuers | ||||||

Description | Value ($) 11/30/2022 | Purchases ($)† | Sales ($) | Value ($) 11/30/2023 | Dividends/ | |

Registered Investment Companies - 1.8% | ||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - 1.8% | 17,486,986 | 75,644,347 | (88,340,219) | 4,791,114 | 705,981 | |

Investment of Cash Collateral for Securities Loaned - .0%†† | ||||||

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .0% | - | 37,705,513 | (37,705,513) | - | 10,560 | ††† |

Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares - .0% | 4,696,375 | 59,236,033 | (63,932,408) | - | 8,421 | ††† |

Total - 1.8% | 22,183,361 | 172,585,893 | (189,978,140) | 4,791,114 | 724,962 | |

† Includes reinvested dividends/distributions.

†† Effective July 3, 2023, cash collateral for securities lending was transferred from Dreyfus Institutional Preferred Government Plus Money Market Fund, SL Shares to Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares.

††† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

29

STATEMENT OF ASSETS AND LIABILITIES

November 30, 2023

|

|

|

|

|

|

|

|

|

| Cost |

| Value |

|

Assets ($): |

|

|

|

| ||

Investments in securities—See Statement of Investments |

|

|

| |||

Unaffiliated issuers | 241,096,097 |

| 265,395,075 |

| ||

Affiliated issuers |

| 4,791,114 |

| 4,791,114 |

| |

Cash |

|

|

|

| 5,169,330 |

|

Cash denominated in foreign currency |

|

| 44,243 |

| 44,477 |

|

Receivable for investment securities sold |

| 948,466 |

| |||

Dividends, interest and securities lending income receivable |

| 887,550 |

| |||

Tax reclaim receivable—Note 1(b) |

| 65,771 |

| |||

Receivable for shares of Beneficial Interest subscribed |

| 7,700 |

| |||

Prepaid expenses |

|

|

|

| 89,442 |

|

|

|

|

|

| 277,398,925 |

|

Liabilities ($): |

|

|

|

| ||

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) |

| 237,495 |

| |||

Payable for investment securities purchased |

| 5,887,147 |

| |||

Payable for shares of Beneficial Interest redeemed |

| 228,481 |

| |||

Trustees’ fees and expenses payable |

| 4,369 |

| |||

Cash collateral payable to broker—Note 4 |

| 626 |

| |||

Other accrued expenses |

|

|

|

| 95,457 |

|

|

|

|

|

| 6,453,575 |

|

Net Assets ($) |

|

| 270,945,350 |

| ||

Composition of Net Assets ($): |

|

|

|

| ||

Paid-in capital |

|

|

|

| 238,266,393 |

|

Total distributable earnings (loss) |

|

|

|

| 32,678,957 |

|

Net Assets ($) |

|

| 270,945,350 |

| ||

Net Asset Value Per Share | Class A | Class C | Class I | Class J | Class Y | Class Z |

|

Net Assets ($) | 209,736,525 | 8,279,029 | 11,645,373 | 11,441,426 | 10,870 | 29,832,127 |

|

Shares Outstanding | 9,416,331 | 375,869 | 525,300 | 512,677 | 484.75 | 1,348,039 |

|

Net Asset Value Per Share ($) | 22.27 | 22.03 | 22.17 | 22.32 | 22.42 | 22.13 |

|

|

|

|

|

|

|

|

|

See notes to financial statements. |

|

|

|

|

|

|

|

30

STATEMENT OF OPERATIONS

Year Ended November 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment Income ($): |

|

|

|

| ||

Income: |

|

|

|

| ||

Interest |

|

| 3,231,827 |

| ||

Dividends (net of $85,958 foreign taxes withheld at source): |

| |||||

Unaffiliated issuers |

|

| 2,461,641 |

| ||

Affiliated issuers |

|

| 705,981 |

| ||

Income from securities lending—Note 1(c) |

|

| 18,981 |

| ||

Total Income |

|

| 6,418,430 |

| ||

Expenses: |

|

|

|

| ||

Management fee—Note 3(a) |

|

| 2,179,517 |

| ||

Shareholder servicing costs—Note 3(c) |

|

| 791,715 |

| ||

Professional fees |

|

| 147,811 |

| ||

Registration fees |

|

| 105,426 |

| ||

Distribution fees—Note 3(b) |

|

| 63,561 |

| ||

Prospectus and shareholders’ reports |

|

| 41,448 |

| ||

Custodian fees—Note 3(c) |

|

| 29,282 |

| ||

Chief Compliance Officer fees—Note 3(c) |

|

| 26,295 |

| ||

Trustees’ fees and expenses—Note 3(d) |

|

| 24,193 |

| ||

Loan commitment fees—Note 2 |

|

| 7,472 |

| ||

Miscellaneous |

|

| 51,758 |

| ||

Total Expenses |

|

| 3,468,478 |

| ||

Less—reduction in expenses due to undertaking—Note 3(a) |

|

| (371,079) |

| ||

Less—reduction in fees due to earnings credits—Note 3(c) |

|

| (79,214) |

| ||

Net Expenses |

|

| 3,018,185 |

| ||

Net Investment Income |

|

| 3,400,245 |

| ||

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): |

|

| ||||

Net realized gain (loss) on investments and foreign currency transactions | 10,061,250 |

| ||||

Net realized gain (loss) on futures | (343,854) |

| ||||

Net Realized Gain (Loss) |

|

| 9,717,396 |

| ||

Net

change in unrealized appreciation (depreciation) on investments | 9,600,539 |

| ||||

Net change in unrealized appreciation (depreciation) on futures | (32,617) |

| ||||

Net Change in Unrealized Appreciation (Depreciation) |

|

| 9,567,922 |

| ||

Net Realized and Unrealized Gain (Loss) on Investments |

|

| 19,285,318 |

| ||

Net Increase in Net Assets Resulting from Operations |

| 22,685,563 |

| |||

|

|

|

|

|

|

|

See notes to financial statements. | ||||||

31

STATEMENT OF CHANGES IN NET ASSETS

|

|

|

| Year Ended November 30, | |||||

|

|

|

| 2023 |

| 2022 |

| ||

Operations ($): |

|

|

|

|

|

|

|

| |

Net investment income |

|

| 3,400,245 |

|

|

| 1,891,563 |

| |