Exhibit (a)(5)(A)

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

| JAMIE DORN, individually and on | ) | |||

| behalf of all others similarly situated, | ) | |||

| ) | ||||

| Plaintiff, | ) | |||

| ) | C.A. No.: | |||

| v. | ) | |||

| ) | CLASS ACTION | |||

| JESPER ANDERSEN, RICHARD E. | ) | |||

| BELLUZZO, LAURA C. | ) | |||

| CONIGLIARO, PHILIP FASANO, | ) | |||

| FRED M. GERSON, DANIEL J. | ) | |||

| PHELPS, and EDZARD OVERBEEK, | ) | |||

| ) | ||||

| Defendants. | ) | |||

| ) | ||||

| ) |

VERIFIED CLASS ACTION COMPLAINT

FOR BREACH OF FIDUCIARY DUTY

Plaintiff Jamie Dorn (“Plaintiff”), on behalf of herself and all others similarly situated, by her undersigned attorneys, alleges the following upon information and belief, including the investigation of counsel and review of publicly-available information, except as to those allegations pertaining to Plaintiff, which are alleged upon personal knowledge:

NATURE OF THE ACTION

1. Plaintiff brings this stockholder class action on behalf of herself and all other public stockholders of Infoblox, Inc. (“Infoblox” or the “Company”) other than Defendants (defined herein), against Infoblox’s Board of Directors (the “Board” or the “Individual Defendants”) for breaches of fiduciary duties.

2. Headquartered in Santa Clara, California, Infoblox manufactures a device that allows users to create and manage dynamic computer networks. The device provides automated network control, which allows real-time network discovery and visibility, scalability, device configuration, and policy implementation. The Company sells its products through distributors, integrators, and managed service providers.

3. After receiving extensive pressure from two activist investors on September 19, 2016, the Company announced that it had entered into a Definitive Agreement (the “Merger Agreement”), pursuant to which Infoblox stockholders will receive $26.50 per share of common stock in cash per Infoblox share (the “Merger Consideration”) through a tender offer (the “Proposed Transaction”). The Proposed Transaction values Infoblox at approximately $1.6 billion. The tender offer expires on November 4, 2016.

4. As alleged herein, the Proposed Transaction is the result of a flawed sale process, and substantially undervalues Infoblox’s stock.

5. First, the Merger Consideration is valued at just $26.50 per share, which is lower than the Company’s value based on their own financial advisor’s valuation analysis.

2

6. Second, given the overall strength of the Company and its poise for future success, Vista will acquire Infoblox at an unreasonably low price if the Proposed Transaction is permitted to close. Indeed, prior to the announcement of the deal, the Company reported record revenues on August 30, 2016.

7. Third, and unsurprisingly in light of the low Merger Consideration, the Proposed Transaction was agreed to in an effort to appease the interests of Starboard Value LP (“Starboard”) and Hound Partners, LLC (“Hound Partners”) in making a quick short term profit. Moreover, the sale process was run by a conflicted financial advisor, Morgan Stanley & Co. LLC (“Morgan Stanley”), who engineered the transaction to favor Vista, who it has and continues to receive substantial fees from. Even more troubling, in order to allow the Board to approve the Proposed Transaction, Morgan Stanley prepared a flawed valuation analysis that was skewed to make the Proposed Transaction appear fair.

8. Fourth, Defendants have further breached their fiduciary duties by agreeing to various deal protection devices that deter other bidders from making a competing offer for the Company. Specifically, pursuant to the Merger Agreement, Defendants agreed to: (i) a strict no-solicitation provision that prevents the Company from soliciting other potential acquirers or even continuing discussions and negotiations with potential acquirers; (ii) an information rights provision that requires the Company to disclose the identity of any competing

3

bidder and to furnish Vista with the terms of any competing bid and confidentiality agreement; (iii) a matching rights provision which gives Vista three business days to match any competing bid; and (iv) a provision that requires the Company to pay Vista a termination fee as follows. If the termination fee becomes payable as a result of the Company terminating the Merger Agreement in order to enter into a definitive acquisition agreement providing for a Superior Proposal received during the Go-Shop Period with an Excluded Party, the amount of the termination fee will be $19.483 million. If the termination fee becomes payable in certain other circumstances, the amount of the termination fee will be $42.862 million. If the Merger Agreement is terminated as a result of an intentional breach by the Company, the Company will also be required to reimburse Parent for up to $5 million of its actual and reasonable expenses. Importantly, one of the potential purchasers that made an offer $0.50 per share higher than Vista is considered an “Excluded Party.” Thus, because there were 56,328,022 shares outstanding as of September 30, 2016 that means that the most likely higher buyer would have to pay at least $0.76 per share higher to top Vista’s offer as a practical matter, thereby shutting them out of the artificial “go-shop” process.

9. These deal protection provisions, particularly when considered collectively, substantially and improperly limit the Board’s ability to act with respect to investigating and pursuing superior proposals and alternatives.

4

10. Fifth, on October 7, 2016, Defendants filed a Schedule 14D-9 Recommendation Statement (the “Recommendation Statement”) with the United States Securities and Exchange Commission (“SEC”) in connection with the Proposed Transaction. The Recommendation Statement was devoid of material information regarding: (i) the sale process, including Starboard’s involvement in and impact on the sale process; (ii) key inputs for the analysis performed by Infoblox’s financial advisor, Morgan Stanley; (iii) conflicts of interest possessed by Morgan Stanley; and (iv) the Company’s projected financial information.

11. For these reasons and as set forth in detail herein, Plaintiff seeks, among other things, an injunction or to recover damages resulting from the Individual Defendants’ violations of their fiduciary duties of loyalty and due care.

PARTIES

12. Plaintiff is, and has been at all relevant times, an Infoblox stockholder.

13. Infoblox is a Delaware Corporation that maintains its principal executive offices at 3111 Coronado Drive, Santa Clara, California 95054. The Company trades on the New York Stock Exchange under the ticker symbol “BLOX.” Infoblox delivers actionable network intelligence to enterprise, government and service provider customers throughout the world. As the industry leader in Domain Name System (DNS), Dynamic Host Configuration Protocol (DHCP) and IP address management (IPAM) services, Infoblox empowers organizations to control and secure their networks.

5

14. Defendant Jesper Andersen (“Andersen”) has been the President and the Chief Executive Officer of the Company since December 2014.

15. Defendant Richard E. Belluzzo (“Belluzzo”) became a director of the Company in January 2013. He is the Chairman of the Company’s Board of Directors.

16. Defendant Laura C. Conigliaro (“Conigliaro”) became a director of the Company in January 2012.

17. Defendant Philip Fasano (“Fasano”) has served as a member of the Company’s Board since May 2014.

18. Defendant Fred M. Gerson (“Gerson”) has served as a member of the Company’s Board since November 2011.

19. Defendant Daniel J. Phelps (“Phelps”) has served as a director of the Company since September 2000.

20. Defendant Edzard Overbeek (“Overbeek”) has served as a director of the Company since January 2016.

6

21. Non-party Vista Equity Partners (“Vista”) is a U.S. based private equity firm incorporated in Delaware with a principal place of business at 4 Embarcadero Center, 20th floor, San Francisco, CA. Vista has more than $26 billion in cumulative capital commitments. It invests in software, data and technology-based organizations. As of June 30, 2016, Vista was the second largest holder of Infoblox stock, holding 2,718,943 shares, or 4.84% of Infoblox’s outstanding shares.

THE INDIVIDUAL DEFENDANTS’ FIDUCIARY DUTIES

22. By reason of the Individual Defendants’ positions with the Company as officers and/or directors, they are in a fiduciary relationship with Plaintiff and the other public stockholders of Infoblox and owe them, as well as the Company, the duties of care and loyalty.

23. To comply diligently with their fiduciary duties, the directors and/or officers may not take any action that:

| a. | Adversely affects the value provided to the corporation’s stockholders; |

| b. | Will unnecessarily discourage or inhibit alternative offers to purchase control of the corporation or its assets; |

| c. | Contractually prohibits themselves from complying with their fiduciary duties; |

| d. | Will otherwise adversely affect their duty to search for and secure the best value reasonably available under the circumstances for the corporation’s stockholders; and/or |

| e. | Will provide the directors and/or officers with preferential treatment at the expense of, or separate from, the public stockholders. |

7

24. In accordance with their duties of loyalty and good faith, the Individual Defendants are obligated to refrain from:

| a. | Participating in any transaction where the Individual Defendants’ loyalties are divided; |

| b. | Participating in any transaction in which they receive, or are entitled to receive, a personal financial benefit not equally shared by the public stockholders of the corporation; and/or |

| c. | Unjustly enriching themselves at the expense or to the detriment of the public stockholders. |

25. Plaintiff alleges herein that the Individual Defendants, separately and together, in connection with the Proposed Transaction, are knowingly or recklessly violating their fiduciary duties, including their duties of loyalty and care owed to Plaintiff and the other public stockholders of Infoblox.

CLASS ACTION ALLEGATIONS

26. Plaintiff brings this action on her own behalf and as a class action, pursuant to Court of Chancery Rule 23, on behalf of all Infoblox stockholders (except Defendants herein and any person, firm, trust, corporation or other entity related to or affiliated with any of the Defendants) and their successors in interest, who are threatened with injury arising from Defendants’ actions as more fully described herein (the “Class”).

8

27. This action is properly maintainable as a class action. The Class is so numerous that joinder of all members is impracticable. As of September 30, 2016, there were over 56 million shares of Infoblox common stock outstanding, likely owned by thousands of stockholders who are geographically dispersed.

28. Questions of law and fact are common to the Class, including, inter alia:

a. Whether the Individual Defendants breached their fiduciary duties of loyalty or due care with respect to Plaintiff and the Class in connection with the Proposed Transaction;

b. Whether the Individual Defendants breached their fiduciary duties to achieve a reasonable price for the benefit of Plaintiff and the Class in connection with the Proposed Transaction;

c. Whether Plaintiff and the Class would be irreparably harmed were the transactions complained of herein consummated; and

d. Whether Plaintiff and the Class are entitled to damages as a result of the Defendants’ wrongful conduct.

9

29. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff has the same interests as the other Class members. Accordingly, Plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

30. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications that would establish incompatible standards of conduct for Defendants, or adjudications that would, as a practical matter, be dispositive of the interests of individual members of the Class who are not parties to the adjudications or would substantially impair or impede those non-party Class members’ ability to protect their interests.

31. Defendants have acted, or refused to act, on grounds generally applicable to the Class as a whole, and are causing injury to the entire Class.

THE FLAWED SALE PROCESS

32. Between 2012 and September 2015, Infoblox considered a sale of the Company, and even had discussions regarding long term growth strategy with Vista during this time period, but the Company did not take any steps to actively sell the Company.

10

33. However, everything changed after Starboard filed a Schedule 13D with the SEC disclosing that it had acquired beneficial ownership of 7.1% of Infoblox’s outstanding common stock. Starboard’s 13D claimed that it was acquiring a stake in Infoblox based on its “belief that the Shares, when purchased, were undervalued and represented an attractive investment opportunity.”

34. Starboard’s 13D makes clear that it did not intend to be a passive investor in Infoblox. Rather, it planned to “engag[e] in communications with management and the Board of Directors of [Infoblox], engag[e] in discussions with stockholders of [Infoblox] or other third parties about [Infoblox] and [Starboard’s] investment, including potential business combinations or dispositions involving [Infoblox] or certain of its businesses, making recommendations or proposals to [Infoblox] concerning changes to the capitalization, ownership structure, board structure (including board composition), potential business combinations or dispositions involving the Issuer or certain of its businesses, or suggestions for improving [Infoblox’s] financial and/or operational performance . . .. .”

35. Rather than take steps to ward off a hostile sale, such as putting a stockholders’ rights plan in place, the Board, in fear of replacement by Starboard, did exactly as Starboard wished.

11

36. The Board’s fear of Starboard is unsurprising given the activist fund’s long history of successfully waging proxy contests with only relatively small ownership positions. Before 2014, Starboard was a relatively obscure hedge fund. But then in October 2014, Starboard’s CEO, Jeffrey Smith, did the impossible and replaced all twelve board members of Darden Restaurants, Inc., despite only owning an 8.8% stake in that Company.

37. Interestingly, the “activist assault” on Darden did not begin with Starboard or Smith. Rather in 2013, another activist hedge fund had sent the Board a letter recommending the Company split in two and place its real estate in a real estate investment trust (“REIT”) due to the company’s lackluster stock performance. In response, the Board introduced a plan to divest its Red Lobster restaurants and cut costs. The stock price continued to fall.

38. Seeing an opportunity in Darden, Starboard began accumulating a stake in that company. Starboard immediately began voicing its concerns with the company’s plan and support for the non-management plan. Starboard went as far as filing a preliminary solicitation requesting a special meeting to vote on the sale, which subsequently hampered the bidding process the company had started.

39. Despite mounting pressure, the company moved forward and sold Red Lobster to a private-equity firm. One director explained:

As board members, we took into account the long-term best interest of our shareholders, even though our shareholders really didn’t understand that it was in their best interest, and we couldn’t really tell them because we couldn’t communicate how bad Red Lobster was performing without screwing up our sale. And so we made a very difficult decision. We went ahead with the sale, and from that day on, the handwriting was on the wall that we were going to lose the entire board.

12

40. Shortly after, Smith announced his intention to nominate his own slate of directors. The Board then reached out to compromise, but during negotiations, Smith continued to recant his offers once the Board approved them. All the while, Smith was gaining support from other large investors as well as proxy advisors, ISS and Glass Lewis.

41. By the time of the vote, the Board’s fate was sealed and Smith effectively took control having only accumulated an 8.8% stake in the company.

42. Commentators were stunned by Smith’s ability to accomplish the impossible. Fortune referred to Smith as “the most feared man in corporate America” and referred to “[t]he story of how Starboard outmaneuvered Darden’s leadership [as] a cautionary tale for managers and directors everywhere.” Notably, Morgan Stanley, who is the financial advisor to Infoblox, was Darden’s financial advisor who Starboard outmaneuvered.

43. A Darden sponsored nominee, who lost to a Starboard nominee, stated: “My sense from having met the Darden Board members is that they’re highly qualified people. As I look at it, I say, ‘Gee, this could happen to any board.’ These people had followed everything that was good governance and done what they were supposed to do, and it happened to them.”

13

44. As Smith and Starboard moved on from Darden, it became clear that boards and management had noticed, and feared, the consequences of not playing along with Smith’s plans. As one article noted, “the executives and directors at companies targeted by Starboard are proving quick to act when the fund lays on the pressure.”

45. For instance, Starboard pushed a plan for Yahoo to sell off its stake in Alibaba and Yahoo Japan; and ultimately merge with AOL. Yahoo CEO Marissa Mayer, in an attempt to stave off Starboard, quickly agreed to sell off its Alibaba stake. Most astonishing is that Starboard had not even disclosed its 1.7% stake in Yahoo at the time it began applying pressure.

46. Starboard continued pressuring Yahoo to sell its core assets. When the board and management did not move fast enough, Starboard threatened to run a proxy contest nominating its own slate of directors. Ultimately, Yahoo gave four board seats to Starboard.

47. But these are just two examples of Starboard’s ability to make a company’s board do what it sees fit. In fact, Starboard has gone after 105 board seats since 2011. Of those 105, Starboard gained 66: some through proxy battles and others as concessions by management. As one commentator pointed out: “In some instances, company managements just gave in to all of Starboard’s demands.”

14

48. It is clear why boards and management are giving into Starboard’s demands. In the case of Tessera Technologies, Starboard went as far as accusing the current CEO of having an inappropriate relationship with a female employee. When the board requested proof, Starboard responded by telling the board it had no obligation to provide information and then issued a public letter accusing the board of not taking appropriate actions. Ultimately, Tessera and Starboard came to an agreement where the CEO resigned, and Starboard gained control of Tessera’s board.

49. Starboard has developed a reputation of attacking company managements who do not follow his lead and leaving ones alone when they adhere to its demands. Starboard has shown that it will go to no bounds to push its plan to “unlock value.”

50. Starboard’s average holding period for a particular position is 4.04 quarters, meaning once Starboard acquires a stake, as here, they focus on turning a quick profit.

51. Following Starboard’s 13D filing, rather than look after the Company’s best interests and taking steps to delay a sale, the Company’s management met with representatives of several investment banking firms to discuss retaining one of the firms as strategic advisor to the Company. Following these discussions, the Company’s management retained Morgan Stanley as its financial advisor.

15

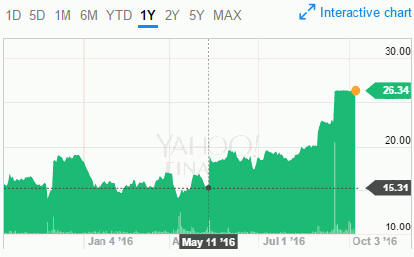

52. Immediately after contacts began with Morgan Stanley, leaks of the sale process hit the press. After the close of trading on May 11, 2016, a news outlet published an article stating that a private equity firm had made an offer to acquire Infoblox (the “May Article”). Infoblox’s share price increased approximately 24% in one day from a closing price of $15.31 on May 11, 2016 to a closing price of $19.04 per share on May 12, 2016. Shortly after the publication of the May Article, five financial sponsors, including Vista, contacted the Company to indicate interest in exploring a potential transaction, but no formal proposals were made.

53. Days later on May 16, 2016, in an effort to appease Starboard, the Company had a call with representatives of Starboard at Starboard’s request. During the call, the representatives of Starboard encouraged the Company to consider an acquisition proposal that valued Infoblox at what the Recommendation Statement describes as an “appropriate valuation.”

54. On May 20, 2016, another activist fund, Hound Partners, filed a 13G with the SEC disclosing that it holds 6.2% of Infoblox’s stock.

16

55. On May 24, 2016, recognizing that the markets substantially undervalued Infoblox’s stock, the Board determined to increase the Company’s existing stock repurchase authorization by $150 million. The Board also reviewed measures that could be taken to reduce costs across all functions of Infoblox, and directed management to develop a restructuring plan (the “Restructuring Plan”) for consideration and approval by the Audit Committee of the Board.

56. On June 1, 2016, it was leaked to the press that Infoblox supposedly hired Morgan Stanley for a hostile takeover defense.

57. On June 9, 2016, Starboard sent a private letter to the Board, which has not been disclosed to Infoblox stockholders, stating that Starboard remained open to discussing a revised stand-alone plan with Infoblox that would result in value creation for the benefit of all Infoblox stockholders, but that Starboard believed the Board should also be exploring a sale of the Company concurrently so that both outcomes could be compared and the best risk-adjusted solution for Infoblox stockholders could be pursued.

58. On June 14, 2016, the Audit Committee approved the Restructuring Plan, which Infoblox announced on June 16, 2016. Under the Restructuring Plan, Infoblox would reprioritize and reduce investments in all functions of the Company, with the largest reductions in the sales and marketing functions, and additional reductions in the research and development and the general and administrative functions. The Restructuring Plan includes actions intended to optimize program-based and discretionary spending; to revise hiring priorities with

17

a goal to support customer-facing sales coverage while improving overall sales and marketing efficiency; and to reduce headcount in higher cost locations and for certain identified positions. Pursuant to the Restructuring Plan, the Company expected to reduce net global headcount by approximately 110 positions, or 12%, through position eliminations. The Company estimated that it would incur total costs in connection with the restructuring of approximately $6.5 million, of which approximately $5.8 million was expected to be for severance and termination benefits and the remainder for facilities closures, contract termination and relocation and other restructuring-related costs. Substantially all of these charges were expected to consist of cash expenditures. The Company expected to substantially complete these actions in the fourth quarter of fiscal 2016, with some actions to be completed in the first quarter of fiscal 2017. Because the Board swiftly moved forward with a sale to satisfy the demands of Starboard, Infoblox stockholders will never receive the benefits of the Restructuring Plan.

59. Rather than focus on the Restructuring Plan or take steps to ward off a hostile offer, on July 14, 2016 the Board continued to move forward consistent with Starboard’s wishes and instructed Morgan Stanley to contact several potential purchasers to explore a sale of the Company.

60. Throughout the sale process, due to conflicts of interest, Morgan Stanley focused on three potential purchasers: Vista, Bidder A, and Bidder B. Not surprisingly Morgan Stanley has substantial financial ties to its preferred bidders, Vista and Bidder A.

18

61. As to Vista, Morgan Stanley and its affiliates were engaged on financial advisory and financing assignments for Vista, and received approximately $21.9 million in fees (roughly the same amount Morgan Stanley will receive for the Proposed Transaction) in the two years prior to the date of Morgan Stanley’s opinion. For instance, Morgan Stanley is currently providing advice to Vista in connection with its attempts to sell Vista-owned Aptean. Morgan Stanley also represented Vista in connection with their 2015 acquisition of Pearson and their 2014 buyout of Advanced Computer Software Group. In 2015, Vista and Morgan Stanley entered into a sale-leaseback agreement regarding property Vista acquired in its 2014 acquisition of TIBCO Software.

62. In addition to representing Vista, Morgan Stanley has also represented at least two other Vista targets in 2016 alone. More specifically, Morgan Stanley represents Marketo Inc., a company that entered into an acquisition agreement with Vista in May 2016; and Cvent Inc., a company that entered into an acquisition agreement with Vista in April 2016. If consummated, Morgan Stanley will earn $48.4 million on those deals, collectively.

63. Morgan Stanley also received between $15 and $20 million for services it provided to Bidder A in the past two years. Morgan Stanley was motivated to favor Vista and Party A so that it would continue to receive fees from both entities in the future.

19

64. As part of the sale process, initial offers were due on August 30, 2016. On August 30, 2016, Vista submitted a low ball indication of interest of $24 per share. Bidder B submitted an indication of interest of $26 to $28 per share.

65. The next day Vista increased its indication of interest to $24 to $26 per share.

66. On September 11, 2016, another leak occurred and a news outlet published an article regarding the rumored Infoblox sale and stating that one bidder was moving quickly to submit a final bid ahead of the original timeline. Consistent with the leak, Party A was in fact planning to move forward more quickly in the sale process.

67. On September 14, 2016, Vista submitted an offer of $25 per share. The next day Party A submitted an offer of $27 per share (above the Proposed Transaction price). After learning that it was not the highest potential purchaser, on September 16, 2016 Vista increased its offer to $26.50 per share.

68. Despite the fact that Morgan Stanley’s own financial analysis shows Infoblox was worth more than $26.50 per share, the Board agreed to sell the Company at that price. On September 19, 2016, Infoblox and Vista jointly announced the Proposed Transaction:

20

Santa Clara, California – September 19, 2016 – Infoblox Inc. (NYSE: BLOX), the network control company, today announced that it has entered into a definitive agreement to be acquired by Vista Equity Partners (“Vista”), a leading private equity firm focused on software, data and technology-enabled businesses. Under the terms of the agreement, Infoblox stockholders will receive $26.50 per share of common stock in cash, which represents a 33% premium to Infoblox’s average closing share price over the last 60 trading days, and a 73% premium to Infoblox’s unaffected closing price as of May 11, 2016, when media reports of interest in acquiring Infoblox were first published. The transaction values Infoblox at approximately $1.6 billion. The agreement was unanimously approved by Infoblox’s Board of Directors.

“Vista has an excellent track record of supporting and adding value to technology companies, and we are thrilled to bring on a partner of their caliber and strategic expertise,” said Jesper Andersen, President and CEO of Infoblox. “This transaction will provide immediate and substantial value to Infoblox stockholders, while also giving Infoblox greater flexibility to execute on our long-term strategy to drive increased DDI automation and DNS security into the enterprise market. We are excited to begin our partnership with Vista and look forward to leveraging their operational insights as we continue to deliver the industry-leading products, solutions and customer service on which our customers rely.”

“As all industries are moving to the cloud in record speed, and as connected devices proliferate, companies depend more than ever on network automation and security,” said Brian Sheth, Co-Founder and President of Vista Equity Partners. “Infoblox is the trusted market leader in DDI solutions, and their strategy and portfolio of secure automated networking solutions make the company uniquely positioned to deliver for its customers. We are looking forward to working with the talented team at Infoblox to support the company’s strategic vision and grow its industry leadership.”

21

Infoblox’s Board of Directors received and thoroughly evaluated multiple indications of interest before deciding to proceed with this transaction. The transaction will be effected by means of a tender offer followed by a merger, and the Infoblox Board of Directors unanimously recommends Infoblox stockholders tender their shares in the offer. The transaction is expected to close in Infoblox’s fiscal second quarter, subject to customary closing conditions and regulatory approvals. Infoblox will maintain its corporate headquarters in Santa Clara, California and continue to be led by its current executive team.

69. After the merger was announced, Infoblox was permitted to shop itself for a mere 11 days. Not surprisingly, as a result of the deal protection devices and meager time the go shop was open, no potential purchasers made a superior proposal.

INFOBLOX IS WELL POSITIONED TO GROW

FOLLOWING THE RESTRUCTURING PLAN

70. Shortly prior to the announcement of the Proposed Transaction, on August 30, 2016, the Company announced bullish financial results. More specifically, Infoblox reported total net revenue for the fourth quarter of fiscal 2016 of $86 million. Total net revenue for fiscal 2016 was a record $358 million, an increase of 17% compared with the total net revenue of $306 million in fiscal 2015. On a non-GAAP basis, the Company reported net income of $4 million, or $0.08 net income per diluted share for the fourth quarter of fiscal 2016. For fiscal 2016, on a non-GAAP basis, the Company reported net income of $26 million, or $0.43 net income per diluted share compared with net income of $23 million, or $0.38 net income per diluted share, in fiscal 2015.

22

71. The Company’s CEO, Jesper Anderson, touted Infoblox’s success in the fourth quarter of 2016 stating: “We had a strong finish to fiscal 2016 . . . Fourth quarter revenue grew 5% sequentially, and we achieved record fiscal 2016 revenue. We delivered this top line growth while generating strong cash flow and improving profitability in what continues to be a relatively challenging global business environment . . . The number of security and cloud related deals grew as we successfully diversified our revenue stream and expanded our addressable market. These achievements are the result of the hard work of our highly talented and committed Infoblox team of employees. Looking forward, we continue to see multiple growth drivers for our business and believe we are very well positioned to execute on the opportunities ahead.”

Morgan Stanley’s Flawed “Fairness Opinion”

72. Morgan Stanley’s own “fairness” opinion demonstrates the transaction was undervalued. For example, Morgan Stanley’s discounted cash flow analysis using the “base case” projections resulted in a value of Infoblox of $28.23 to $40.78, a range entirely above the Proposed Transaction price.

23

73. Because Morgan Stanley could not justify the transaction based on established valuation principles, Morgan Stanley skewed its analysis so it could claim the Proposed Transaction was fair.

74. First, because management’s base case projections resulted in too high a value for the Company, Morgan Stanley ensured that management also prepared a lower set of risk-adjusted projections (the “Risk Adjusted Case”). The Risk Adjusted Case was not provided to Vista or any of the other bidders. The Risk Adjusted Case assumed the same financial projections for fiscal year 2017 as the base case, but utilized a slower compound annual revenue growth rate of 14% for fiscal year 2016 through fiscal year 2021. The Risk Adjusted Case took into greater consideration the risks involved in the growth of the subscription-based business model and in developing and achieving market acceptance for these new, unproven services, as well as other execution risks, industry risks and macroeconomic risks. By using the Risk Adjusted Case, Morgan Stanley was able to create a discounted cash flow valuation that was within the range of the Proposed Transaction price.

75. Second, although Morgan Stanley’s Public Trading Comparables Analysis suggested a mean AV to Estimated 2017 Revenue multiple of 4.2X, Morgan Stanley selected a range entirely below the mean (1.5X – 3X).

24

76. Third, Morgan Stanley improperly skewed its discounted cash flow analysis downward because it calculated a weighted average cost of capital of 8.75%, but used a weighted average cost of capital of 10.3% based on its “professional judgement.” Morgan Stanley claimed it was inappropriate to use the 8.75% weighted average cost of capital because it “was less than the Company’s estimated marginal cost of debt and therefore likely not an accurate reflection of the Company’s true cost of capital.” To correct this issue, Morgan Stanley focused on the beta assumption. Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. A beta of 1 indicates that the security’s price moves with the market. A beta of less than 1 means that the security is theoretically less volatile than the market. A beta of greater than 1 indicates that the security’s price is theoretically more volatile than the market. For example, if a stock’s beta is 1.2, it’s theoretically 20% more volatile than the market. Conversely, if an ETF’s beta is 0.65, it is theoretically 35% less volatile than the market.

77. Here, Morgan Stanley did not use the Company’s predicted beta of 1.18 in part because it was affected by “the volatility in the Company’s stock price following public reports in May 2016 that a financial sponsor had submitted a proposal to purchase all outstanding shares of the Company.” This makes no sense, however, because Infoblox’s stock was more volatile after news of the

25

Proposed Merger leaked around May 11, 2016. This means that the Company’s predicted beta should have been higher during this time period not lower. Thus, if Morgan Stanley made any adjustment to beta it should have used a lower beta, which would have decreased the weighted average cost of capital and increased the Company’s value. Notably, Morgan Stanley could have also used the Barra predicted beta on May 11, 2016 (when the leaks did not affect the Company’s beta) instead of August 31, 2016. Morgan Stanley’s claim that Barra predicted beta may have been affected by volatility associated with the leaks is also pure speculation since Barra does not publicly disclose how it calculates its proprietary predicted beta using over 40 data metrics including earnings growth, share turnover and senior debt rating and risk factors associated with three main components: Industry risk, risk from exposure to different investment themes, and company-specific risk.

78. As demonstrated by the chart attached hereto as Exhibits A (monthly beta) and B (weekly beta), raw levered beta was higher (resulting in a lower value) after the May 11, 2016 leaks than prior to it, regardless of whether you used a weekly or monthly beta measuring period, meaning if Morgan Stanley wanted to correctly account for anomalous volatility associated with the leaks it should have used a lower, not higher beta.

26

79. The assumption that Infoblox’s stock was more volatile after the May 11, 2016 leaks is further confirmed by the below stock chart for the Company:

80. Thus, even if a WACC of 8.75% was not an accurate reflection of the Company’s true cost of capital (because Morgan Stanley claimed it was less than the Company’s estimated marginal cost of debt), the rationale to discard the Company’s Barra Predicted Beta of 1.18 due to increased volatility undermines Morgan Stanley’s decisions to use a concocted median predicted beta for comparable companies of 1.43.

81. Morgan Stanley further skewed its discounted cash flow analysis by reducing the EBITDA margin assumptions for fiscal years 2022 to 2026. Morgan Stanley justified this adjustment “[b]ecause the estimated EBITDA margins for fiscal years 2022 to 2026 that were extrapolated from each of the Base Case and the Risk-Adjusted Case was well above the estimated 2016 and 2017 calendar year

27

EBITDA margins for the comparable companies.” Morgan Stanley claimed the reduced margins “reflect[ed] more normalized industry EBITDA margins.” Thus, Morgan Stanley expressly disagreed with management. And while it may make sense to use normalized EBITDA margin assumptions during the perpetuity period, Morgan Stanley offers no reason to assume management did not correctly predict its margins just a few years out.

82. Finally, Morgan Stanley came up with an artificially deflated value from its discounted cash flow analysis because it treated stock-based compensation as a cash expense.

83. In sum, to ensure it would receive future fees from Vista, Morgan Stanley made unreasonable valuation assumptions in order to justify the Proposed Transaction which did not reflect Infoblox’s value.

The Materially False and Misleading Recommendation Statement

84. The Individual Defendants filed a Recommendation Statement with the SEC on October 7, 2016 in connection with the Proposed Transaction.

85. The Recommendation Statement contains a number of materially false and misleading statements.

28

86. For example, the Recommendation Statement does not disclose whether Starboard had any role in the sale process or whether Morgan Stanley provided any advice related to activist defense or even if Morgan Stanley was retained at the request of Starboard. Disclosure of this information is necessary so stockholders fully understand the degree of pressure Starboard placed on the Company to engage in a sale process. Likewise, the Recommendation Statement does not disclose any information regarding whether Hound Partners had any involvement in or made any statements regarding the sale process.

87. Page 17 of the Recommendation Statement states that “[d]uring the period since Infoblox’s initial public offering in 2012 and prior to the contacts described below and the process that resulted in Infoblox’s entry into the Merger Agreement, Infoblox has received unsolicited inquiries from, and engaged in informal communications with, various third parties who have expressed interest in a potential transaction with Infoblox.” The Recommendation Statement should describe any ranges of values indicated by potential purchasers in connection with these “unsolicited inquiries.”

88. Page 18 of the Recommendation Statement states that “[o]n May 16, 2016, Mr. Andersen and Ms. Renee Lyall, Senior Director of Investor Relations for the Company, had a call with representatives of Starboard at Starboard’s request. During the call, the representatives of Starboard encouraged Mr. Andersen to consider favorably an acquisition proposal that valued Infoblox at an appropriate valuation.” The Recommendation Statement was required to disclose any range of values suggested by Starboard as an “appropriate valuation” of the Company. This information is material and should be disclosed so that stockholders are fully informed regarding Infoblox’s value.

29

89. Page 19 of the Recommendation Statement indicates that “[o]n June 9, 2016, Starboard sent a private letter to the Board stating that Starboard remained open to discussing a revised stand-alone plan with Infoblox that would result in value creation for the benefit of all Infoblox stockholders, but that Starboard believed the Board should also be exploring a sale of the Company concurrently so that both outcomes could be compared and the best risk-adjusted solution for Infoblox stockholders could be pursued.” The Recommendation Statement should have disclosed the full text of Starboard’s letter.

90. Pages 38-39 of the Recommendation Statement includes Morgan Stanley’s “Precedent Multiples Analysis.” The summary of that analysis, however, is only partially disclosed and misleading because unlike Morgan Stanley’s Public Trading Comparables Analysis on pages 35 and 36, Morgan Stanley did not disclose the transaction specific multiples. Once the Board traveled down the road of partial disclosure, it was required to provide a full and accurate description of the information partially disclosed. The transaction specific multiples are also material because the Recommendation Statement leaves the implicit assumption that Morgan Stanley’s multiples included data from all of the transactions. However, it is unclear whether Morgan Stanley used data from all of the precedent transactions or only some of them which was the case for some of the multiples relied on in its Public Trading Comparables Analysis.

30

91. Pages 42 through 45 of the Recommendation Statement contain a summary of “Certain Unaudited Prospective Financial Information of the Company.” The summary includes two sets of projections referred to as the “Base Case” and the “Risk-Adjusted Case.” The Recommendation Statement, however, does not indicate which projection set management believed represented their best estimates for the Company. This information is particularly material because Morgan Stanley’s Discounted Cash Flow analysis on page 37 of the Recommendation Statement arrives at a range of values entirely above the Proposed Transaction price using the “Base Case” ($28.23-$40.78), but a range of values within the Proposed Transaction price using the “Risk-Adjusted Case” ($22.70-$32.00).

92. The summary of “Certain Unaudited Prospective Financial Information of the Company” is also materially incomplete because it did not include all of the projections considered by Morgan Stanley. In particular, page 34 of the Recommendation Statement states that: “[i]n performing the financial analysis summarized below and arriving at its opinion, Morgan Stanley used and relied upon certain financial projections provided by the Company’s management and referred to in this Schedule 14D-9 (and defined in the following section

31

captioned “Certain Unaudited Prospective Financial Information of the Company”) as the “Base Case,” the “Risk-Adjusted Case,” and, together, the “Management Projections,” and certain financial projections based on Wall Street research reports and referred to in this Schedule 14D-9 as the “Street Case.” It then refers stockholders to “the section of this Schedule 14D-9 captioned ‘Certain Unaudited Prospective Financial Information of the Company’” “[f]or more information.” That section of the Recommendation Statement, however, does not include a summary of the financial projections based on Wall Street research reports Morgan Stanley relied on. Particularly in deciding whether to seek appraisal, stockholders are entitled to a fair summary of all projection sets relied on by Morgan Stanley.

93. Page 37 of the Recommendation Statement includes a summary of Morgan Stanley’s “Discounted Cash Flow Analysis.” In describing the weighted average cost of capital assumption used by Morgan Stanley the Recommendation Statement states: “Morgan Stanley first noted that the weighted average cost of capital of the Company as calculated on a standalone basis was 8.75%, which amount was less than the Company’s estimated marginal cost of debt and therefore likely not an accurate reflection of the Company’s true cost of capital. As a result, in order to provide a more appropriate estimate of the Company’s true cost of capital, Morgan Stanley calculated the Company’s weighted average cost of capital

32

for purposes of its discounted cash flow analysis using a beta of 1.43, equal to the median unlevered Barra Predicted Beta for the comparable companies, as opposed to the Company’s unlevered Barra Predicted Beta of 1.18 (which beta Morgan Stanley also considered less reliable given the volatility in the Company’s stock price following public reports in May 2016 that a financial sponsor had submitted a proposal to purchase all outstanding shares of the Company).” The Recommendation Statement should have disclosed the basis for using a higher beta of 1.43 when the volatility in the Company’s stock price following public reports in May 2016 that a financial sponsor had submitted a proposal to purchase all outstanding shares of the Company potentially resulted in beta being artificially high, not low. Stockholders are entitled to this description so they understand Morgan Stanley’s basis for using a higher beta which had the effect of lowering the values from its discounted cash flow analysis.

94. By reason of the foregoing, each member of the Class will suffer irreparable injury and damages absent injunctive relief by this Court.

95. Accordingly, Plaintiff seeks injunctive and other equitable relief to prevent the irreparable injury that the Company’s stockholders will continue to suffer absent judicial intervention.

33

The Preclusive Deal Protections

96. On top of the inadequate Merger Consideration and conflicts of interest, the Board also agreed to terms in the Merger Agreement that substantially favor Vista and are calculated to unreasonably dissuade potential suitors from making competing offers. The terms of the Merger Agreement demonstrate that the Individual Defendants agreed to numerous terms designed to ensure that no other potential bidder would emerge to offer a superior bid for the Company.

97. Specifically, the Merger Agreement provides for, inter alia: (i) a strict no-solicitation provision that prevents the Company from soliciting other potential acquirers or even continuing discussions and negotiations with potential acquirers; (ii) an information rights provision that requires the Company to disclose the identity of any competing bidder and to furnish Vista with the terms of any competing bid or confidentiality agreement; (iii) a matching rights provision which gives Vista three business days to match any competing bid; and (iv) a provision that requires the Company to pay Vista a termination fee of up to $19.483 million to enter into a transaction with a superior bidder during the go-shop period and $42.862 following the go-shop period.

34

98. First, Section 4.3 of the Merger Agreement includes a “No Solicitation” provision which broadly provides that neither Infoblox, nor any of its affiliates, may solicit or proactively seek a competing and better offer, nor can they provide information to, or engage in discussions with, any potential bidder for the Company. In effect, this provision prohibits the Individual Defendants from soliciting alternative proposals and severely constrains their ability to communicate and negotiate with potential buyers who wish to submit or have submitted unsolicited alternative proposals, all but ensuring that another entity will not emerge with a competing proposal.

99. Second, Section 4.3(d) of the Merger Agreement also includes an “Information Rights” provision pursuant to which the Company is required to promptly notify Vista, within twenty-four hours, of any proposals or inquiries received from other parties, including, inter alia, the material terms and conditions of the proposal and the identity of the party making the proposal. Vista may then use this unfettered access to confidential, non-public information about competing proposals from third parties to formulate a matching bid, virtually eliminating any leverage that the Company has in receiving the unsolicited offer, and significantly deterring an alternative buyer from coming forward.

100. Third, Section 6.2(b) of the Merger Agreement includes a “Termination Fee” provision which required the Company to pay a termination fee of $19,483,000 in the event the Board rescinded its recommendation in favor of the Proposed Transaction and recommends a competing proposal pursuant to the lawful exercise of its fiduciary duties prior to 11:59 p.m. on September 30, 2016.

35

Currently, the Proposed Transaction is subject to a $42,862,000 termination fee in the event the Board rescinded its recommendation in favor of the Proposed Transaction and recommends a competing proposal pursuant to the lawful exercise of its fiduciary duties. This further reduces the possibility of a superior proposal from a third party because a competing bidder would ultimately be required to pay a premium for the right to provide Infoblox stockholders with a superior offer.

101. Ultimately, these preclusive deal protection devices improperly restrain the Company’s ability to solicit or engage in negotiations with any third party regarding a proposal to acquire all of or a significant interest in the Company. The narrow circumstances under which the Individual Defendants may respond to alternative proposals, and the Company’s inability to terminate the Merger Agreement if it accepts a superior proposal, fail to provide an effective “fiduciary out” under the Merger Agreement. By agreeing to these onerous deal protections, the Board has breached its fiduciary duties to Infoblox stockholders, including Plaintiff.

FIRST CAUSE OF ACTION

Breach of Fiduciary Duties

(Against the Individual Defendants)

102. Plaintiff repeats and realleges each and every allegation above as if set forth in full herein.

36

103. The Individual Defendants have violated their fiduciary duties owed to the public stockholders of Infoblox. By the acts, transactions and courses of conduct alleged herein, the Individual Defendants, individually and acting as a part of a common plan, are attempting to unfairly deprive Plaintiff and the Class of the true value of their investment in Infoblox.

104. As demonstrated by the allegations above, the Individual Defendants have failed to exercise the necessary care required and have breached their fiduciary duties because, among other reasons:

a. failing to properly value the Company;

b. failing to take steps to obtain a reasonable price for Infoblox and its public stockholders;

c. failing to act independently to protect the interests of the Company’s public stockholders;

d. failing to adequately ensure that no conflicts of interest exist between the Individual Defendants’ own interests and their fiduciary obligations, and, if such conflicts exist, to ensure that all conflicts are resolved in the best interests of Infoblox’s public stockholders;

e. failing to actively evaluate the Proposed Transaction and engage in a meaningful auction with third parties in an attempt to obtain the best value on any sale of Infoblox; and

f. filing a materially false and misleading Recommendation Statement with the SEC.

37

105. Unless enjoined by this Court, the Individual Defendants will continue to breach their fiduciary duties owed to Plaintiff and the Class, and may consummate the Proposed Transaction, which will deprive the Class of its proportionate share of Infoblox’s valuable assets and businesses.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands relief, in Plaintiff’s favor and in favor of the Class and against Defendants, as follows:

A. Declaring that this action is properly maintainable as a class action and designating Plaintiff as Class representative;

B. Enjoining Defendants, their agents, counsel, employees, and all persons acting in concert with them from consummating the Proposed Transaction, unless and until the Company adopts and implements a procedure or process to obtain a reasonable price for stockholders;

C. In the event that the Proposed Transaction is consummated prior to the entry of this Court’s final judgment, rescinding it or awarding Plaintiff and the Class rescissory damages;

D. Directing that Defendants account to Plaintiff and the Class for all damages caused by them and account for all profits and any special benefits obtained as a result of their breaches of their fiduciary duties or aiding and abetting thereof;

38

E. Awarding Plaintiff and the class money damages;

F. Awarding Plaintiff the costs of this action, including a reasonable allowance for the fees and expenses of Plaintiff’s attorneys and experts; and

G. Granting Plaintiff and the Class such further relief as the Court deems just and proper.

| Dated: October 10, 2016 | FARUQI & FARUQI, LLP | |

| By: /s/ Derrick B. Farrell | ||

| Derrick B. Farrell (#5747) | ||

| James R. Banko (#4518) | ||

| Michael Van Gorder (#6214) | ||

| OF COUNSEL:

|

20 Montchanin Road, Suite 145 | |

| Wilmington, DE 19807 | ||

| Nadeem Faruqi | (302) 482-3182 | |

| FARUQI & FARUQI, LLP | Email: jbanko@faruqilaw.com | |

| 685 Third Avenue, 26th Fl. | Email: dfarrell@faruqilaw.com | |

| New York, NY 10017 | Email: mvangorder@faruqilaw.com | |

| Tel.: (212) 983-9330 | ||

| Email: nfaruqi@faruqilaw.com | Attorneys for Plaintiff | |

| Juan E. Monteverde | ||

| MONTEVERDE & ASSOCIATES PC | ||

| 350 Fifth Avenue, 59th Fl. | ||

| New York, NY 10118 | ||

| Tel: (212) 971-1341 | ||

| Email: jmonteverde@monteverdelaw.com | ||

| Attorneys for Plaintiff | ||

39

EXHIBIT A

| Date |

BLOX US Equity - Overridable Raw Beta |

BLOX US Equity - Percent |

SPX Index - Overridable Raw Beta |

SPX Index - Percent |

BLOX US Equity - Fitted |

BLOX US Equity - | ||||||

| 09/30/2016 |

1.6551 | -2.7741 | 0.97 | -0.09 | -56.0873 | -53.3133 | ||||||

| 08/31/2016 |

1.7023 | 0.8221 | 0.97 | -0.94 | -45.0692 | -45.8913 | ||||||

| 07/29/2016 |

1.6884 | -7.5723 | 0.98 | 0.68 | -65.9856 | -58.4133 | ||||||

| 06/30/2016 |

1.8267 | 0.1018 | 0.97 | -0.13 | -55.4944 | -55.5961 | ||||||

| 05/31/2016 |

1.8249 | 18.876 | 0.97 | -0.5 | -50.8067 | -69.6827 | ||||||

| 04/29/2016 |

1.5351 | 0.202 | 0.98 | 0.01 | -57.3945 | -57.5965 | ||||||

| 03/31/2016 |

1.532 | 3.3679 | 0.98 | -1.17 | -42.1157 | -45.4836 | ||||||

| 02/29/2016 |

1.4821 | 72.7573 | 0.99 | -0.45 | -51.3583 | -124.1156 | ||||||

| 01/29/2016 |

0.8579 | 61.9547 | 0.99 | 3.1 | -97.1863 | -159.141 | ||||||

| 12/31/2015 |

0.5297 | -31.8271 | 0.96 | 0.33 | -61.4397 | -29.6126 | ||||||

| 11/30/2015 |

0.777 | 40.5852 | 0.96 | 1.8 | -80.4434 | -121.0286 | ||||||

| 10/30/2015 |

0.5527 | -16.7899 | 0.94 | -1.59 | -36.6803 | -19.8904 | ||||||

| 09/30/2015 |

0.6642 | 50.6357 | 0.96 | 1.57 | -77.4651 | -128.1008 | ||||||

| 08/31/2015 |

0.4409 | 351.3538 | 0.94 | 3.62 | -104.0286 | -455.3824 | ||||||

| 07/31/2015 |

-0.1754 | -66.3376 | 0.91 | -0.15 | -55.2697 | 11.0679 | ||||||

| 06/30/2015 |

-0.1055 | 23.323 | 0.91 | -1.82 | -33.6767 | -56.9997 | ||||||

| 05/29/2015 |

-0.1375 | -62.987 | 0.93 | 0.01 | -57.2929 | 5.6941 | ||||||

| 04/30/2015 |

-0.0844 | 6.1782 | 0.93 | -0.03 | -56.8041 | -62.9823 | ||||||

| 03/31/2015 |

-0.0899 | -54.6134 | 0.93 | 1.11 | -71.5721 | -16.9587 | ||||||

| 02/27/2015 |

-0.0582 | 92.1988 | 0.92 | -0.08 | -56.2042 | -148.4031 | ||||||

| 01/30/2015 |

-0.7457 | 24.8803 | 0.92 | 2.38 | -87.9668 | -112.8471 | ||||||

| 12/31/2014 |

-0.9927 | -22.6007 | 0.9 | 0.67 | -65.8219 | -43.2212 | ||||||

| 11/28/2014 |

-0.8097 | 18.8095 | 0.89 | 0.26 | -60.5297 | -79.3392 | ||||||

| 10/31/2014 |

-0.9973 | 5.3154 | 0.89 | 0.04 | -57.7532 | -63.0686 | ||||||

| 09/30/2014 |

-1.0533 | -2190.1929 | 0.89 | 1.67 | -78.7384 | 2111.4544 | ||||||

| 08/29/2014 |

-0.046 | 80.2184 | 0.87 | 0.95 | -69.4412 | -149.6596 | ||||||

| 07/31/2014 |

-0.2325 | 44.947 | 0.87 | 1.4 | -75.3524 | -120.2993 | ||||||

| 06/30/2014 |

-0.4223 | -1025.8189 | 0.85 | -0.44 | -51.5848 | 974.2342 | ||||||

| 05/30/2014 |

0.0456 | -76.0098 | 0.86 | -5.49 | 13.6754 | 89.6851 | ||||||

| 04/30/2014 |

0.1901 | 6.3643 | 0.91 | 0.06 | -57.9742 | -64.3386 | ||||||

| 03/31/2014 |

0.1788 | 37.9541 | 0.91 | -0.99 | -44.4415 | -82.3955 | ||||||

| 02/28/2014 |

0.1296 | -82.9846 | 0.92 | -0.65 | -48.7712 | 34.2134 | ||||||

| 01/31/2014 |

0.7616 | -21.2868 | 0.92 | -3.47 | -12.3614 | 8.9254 | ||||||

| 12/31/2013 |

0.9675 | -0.2164 | 0.95 | -1.84 | -33.4557 | -33.2393 | ||||||

| 11/29/2013 |

0.9696 | -25.0903 | 0.97 | -1.71 | -35.1572 | -10.0669 | ||||||

| 10/31/2013 |

1.2944 | -4.9599 | 0.99 | -2.62 | -23.3312 | -18.3713 | ||||||

| 09/30/2013 |

1.3619 | 14.6886 | 1.02 | -2.96 | -18.9706 | -33.6592 | ||||||

| 08/30/2013 |

1.1875 | -19.0699 | 1.05 | -2.85 | -20.3704 | -1.3005 | ||||||

| 07/31/2013 |

1.4673 | 6.687 | 1.08 | -0.98 | -44.5144 | -51.2014 | ||||||

| 06/28/2013 |

1.3753 | -29.166 | 1.09 | -0.31 | -53.2681 | -24.1021 | ||||||

| 05/31/2013 |

1.9416 | 3.1612 | 1.09 | 0.03 | -57.5563 | -60.7175 | ||||||

| 04/30/2013 |

1.8821 | -0.2841 | 1.09 | 2.03 | -83.4098 | -83.1257 | ||||||

| 03/29/2013 |

1.8875 | -4.8858 | 1.07 | -0.31 | -53.2189 | -48.3331 | ||||||

| 02/28/2013 |

1.9845 | 1.6376 | 1.07 | -0.23 | -54.2024 | -55.8401 | ||||||

| 01/31/2013 |

1.9525 | -10.4496 | 1.08 | -1.51 | -37.7048 | -27.2552 | ||||||

| 12/31/2012 |

2.1803 | -1.6782 | 1.09 | -1.21 | -41.5405 | -39.8622 | ||||||

| 11/30/2012 |

2.2175 | 0.5089 | 1.11 | -0.37 | -52.394 | -52.903 |

Page 1

| 10/31/2012 |

2.2063 | 67.1127 | 1.11 | -0.6 | -49.5104 | -116.6231 | ||||||

| 09/28/2012 |

1.3203 | 4.0231 | 1.12 | -0.5 | -50.7488 | -54.772 | ||||||

| 08/31/2012 |

1.2692 | -1.7802 | 1.12 | -0.2 | -54.6126 | -52.8324 | ||||||

| 07/31/2012 |

1.2922 | -29.9605 | 1.12 | 1.55 | -77.2692 | -47.3086 | ||||||

| 06/29/2012 |

1.845 | 1.11 |

Page 2

EXHIBIT B

| Date |

BLOX US Equity - |

BLOX US |

SPX Index - |

SPX Index - |

BLOX US |

BLOX US Equity - | ||||||

| 10/07/2016 |

1.3718 | -3.4832 | 0.98 | -0.34 | 0.9664 | 4.4496 | ||||||

| 09/30/2016 |

1.4213 | 0.5145 | 0.99 | -0.04 | 2.1567 | 1.6422 | ||||||

| 09/23/2016 |

1.4141 | 5.7644 | 0.99 | -0.05 | 2.1369 | -3.6275 | ||||||

| 09/16/2016 |

1.337 | 1.6758 | 0.99 | 0.22 | 3.2145 | 1.5386 | ||||||

| 09/09/2016 |

1.315 | -0.6444 | 0.98 | 0.09 | 2.663 | 3.3073 | ||||||

| 09/02/2016 |

1.3235 | 0.86 | 0.98 | 0 | 2.3127 | 1.4526 | ||||||

| 08/26/2016 |

1.3122 | -1.1155 | 0.98 | -0.06 | 2.0643 | 3.1798 | ||||||

| 08/19/2016 |

1.327 | 0.4034 | 0.98 | 0.15 | 2.9362 | 2.5328 | ||||||

| 08/12/2016 |

1.3217 | 0.5198 | 0.98 | -0.09 | 1.9746 | 1.4548 | ||||||

| 08/05/2016 |

1.3148 | -0.1486 | 0.98 | -0.02 | 2.234 | 2.3825 | ||||||

| 07/29/2016 |

1.3168 | 1.1179 | 0.98 | -0.15 | 1.7289 | 0.611 | ||||||

| 07/22/2016 |

1.3022 | -0.1166 | 0.98 | 0.22 | 3.1985 | 3.315 | ||||||

| 07/15/2016 |

1.3038 | -0.5652 | 0.98 | -0.19 | 1.5457 | 2.1109 | ||||||

| 07/08/2016 |

1.3112 | -1.0619 | 0.98 | 0.01 | 2.3633 | 3.4252 | ||||||

| 07/01/2016 |

1.3252 | 0.1956 | 0.98 | 0.1 | 2.7241 | 2.5284 | ||||||

| 06/24/2016 |

1.3227 | 0.5901 | 0.98 | 0.13 | 2.8465 | 2.2563 | ||||||

| 06/17/2016 |

1.3149 | 1.325 | 0.98 | -0.05 | 2.1259 | 0.8009 | ||||||

| 06/10/2016 |

1.2977 | 1.1808 | 0.98 | 0.01 | 2.3519 | 1.1711 | ||||||

| 06/03/2016 |

1.2826 | 0.674 | 0.98 | -0.08 | 2.0061 | 1.332 | ||||||

| 05/27/2016 |

1.274 | 9.0601 | 0.98 | 0.01 | 2.3404 | -6.7197 | ||||||

| 05/20/2016 |

1.1681 | -1.5226 | 0.98 | -0.12 | 1.8251 | 3.3477 | ||||||

| 05/13/2016 |

1.1862 | -2.4799 | 0.98 | -0.13 | 1.8181 | 4.298 | ||||||

| 05/06/2016 |

1.2164 | 0.1789 | 0.99 | 0.08 | 2.6235 | 2.4447 | ||||||

| 04/29/2016 |

1.2142 | -3.0272 | 0.99 | 0 | 2.3309 | 5.358 | ||||||

| 04/22/2016 |

1.2521 | 0.3076 | 0.98 | 0.01 | 2.354 | 2.0465 | ||||||

| 04/15/2016 |

1.2482 | -4.9974 | 0.98 | -0.32 | 1.0417 | 6.0391 | ||||||

| 04/08/2016 |

1.3139 | 1.1399 | 0.99 | -0.23 | 1.4084 | 0.2685 | ||||||

| 04/01/2016 |

1.2991 | 0.743 | 0.99 | 0.12 | 2.7793 | 2.0363 | ||||||

| 03/25/2016 |

1.2895 | -0.9859 | 0.99 | 0.04 | 2.4771 | 3.463 | ||||||

| 03/18/2016 |

1.3024 | 3.208 | 0.99 | -0.52 | 0.243 | -2.965 | ||||||

| 03/11/2016 |

1.2619 | -0.4085 | 0.99 | 0.2 | 3.1036 | 3.5121 | ||||||

| 03/04/2016 |

1.2671 | -0.4017 | 0.99 | 0.24 | 3.2854 | 3.6872 | ||||||

| 02/26/2016 |

1.2722 | -2.2209 | 0.99 | 0.06 | 2.5728 | 4.7937 | ||||||

| 02/19/2016 |

1.3011 | -1.0406 | 0.99 | 0.19 | 3.0769 | 4.1175 | ||||||

| 02/12/2016 |

1.3147 | 26.9934 | 0.99 | -0.27 | 1.2481 | -25.7453 | ||||||

| 02/05/2016 |

1.0353 | 2.8717 | 0.99 | 0.73 | 5.2081 | 2.3364 | ||||||

| 01/29/2016 |

1.0064 | 0.4536 | 0.98 | -0.16 | 1.6834 | 1.2298 | ||||||

| 01/22/2016 |

1.0018 | -3.1779 | 0.98 | 0.94 | 6.0595 | 9.2374 | ||||||

| 01/15/2016 |

1.0347 | 2.9178 | 0.98 | 0.07 | 2.582 | -0.3358 | ||||||

| 01/08/2016 |

1.0054 | 3.2754 | 0.97 | 0.02 | 2.4128 | -0.8626 | ||||||

| 01/01/2016 |

0.9735 | 2.2847 | 0.97 | 0.02 | 2.4132 | 0.1285 | ||||||

| 12/25/2015 |

0.9518 | 0.3637 | 0.97 | 0.42 | 3.974 | 3.6103 | ||||||

| 12/18/2015 |

0.9483 | -7.4449 | 0.97 | 0.35 | 3.7056 | 11.1505 | ||||||

| 12/11/2015 |

1.0246 | -3.3 | 0.97 | 0.73 | 5.2153 | 8.5153 | ||||||

| 12/04/2015 |

1.0596 | -0.7339 | 0.96 | 0.04 | 2.4914 | 3.2253 |

Page 1

| 11/27/2015 |

1.0674 | -0.5393 | 0.96 | -0.01 | 2.2765 | 2.8157 | ||||||

| 11/20/2015 |

1.0732 | -0.6601 | 0.96 | 0.06 | 2.5789 | 3.2389 | ||||||

| 11/13/2015 |

1.0803 | -0.4736 | 0.96 | 0.03 | 2.4473 | 2.9209 | ||||||

| 11/06/2015 |

1.0854 | 0.6759 | 0.96 | -0.07 | 2.0295 | 1.3537 | ||||||

| 10/30/2015 |

1.0782 | -0.0397 | 0.96 | 0.01 | 2.3671 | 2.4068 | ||||||

| 10/23/2015 |

1.0786 | -2.05 | 0.96 | -0.25 | 1.3198 | 3.3698 | ||||||

| 10/16/2015 |

1.1012 | -1.6688 | 0.96 | -0.45 | 0.5257 | 2.1945 | ||||||

| 10/09/2015 |

1.1198 | -6.0924 | 0.97 | -0.41 | 0.6849 | 6.7773 | ||||||

| 10/02/2015 |

1.1925 | -0.5424 | 0.97 | 0.55 | 4.4997 | 5.0421 | ||||||

| 09/25/2015 |

1.199 | 5.0809 | 0.96 | 0.24 | 3.2597 | -1.8212 | ||||||

| 09/18/2015 |

1.141 | 3.392 | 0.96 | -0.13 | 1.8089 | -1.5832 | ||||||

| 09/11/2015 |

1.1036 | -6.6945 | 0.96 | 1.18 | 7.0389 | 13.7334 | ||||||

| 09/04/2015 |

1.1828 | -1.6496 | 0.95 | 0.38 | 3.8256 | 5.4752 | ||||||

| 08/28/2015 |

1.2026 | 2.0549 | 0.95 | -0.47 | 0.4526 | -1.6024 | ||||||

| 08/21/2015 |

1.1784 | 11.6785 | 0.95 | 1.08 | 6.6146 | -5.0638 | ||||||

| 08/14/2015 |

1.0552 | 5.5975 | 0.94 | -0.1 | 1.9362 | -3.6612 | ||||||

| 08/07/2015 |

0.9992 | 0.6266 | 0.94 | -0.13 | 1.8211 | 1.1945 | ||||||

| 07/31/2015 |

0.993 | -2.2737 | 0.94 | 0.02 | 2.4058 | 4.6795 | ||||||

| 07/24/2015 |

1.0161 | 1.7547 | 0.94 | -0.59 | -0.0267 | -1.7815 | ||||||

| 07/17/2015 |

0.9986 | -2.3409 | 0.95 | 0.45 | 4.1153 | 6.4562 | ||||||

| 07/10/2015 |

1.0225 | 3.1116 | 0.95 | -0.78 | -0.797 | -3.9086 | ||||||

| 07/03/2015 |

0.9917 | 0.1159 | 0.95 | 0.04 | 2.4652 | 2.3493 | ||||||

| 06/26/2015 |

0.9905 | 0.0906 | 0.95 | 0.02 | 2.3853 | 2.2947 | ||||||

| 06/19/2015 |

0.9896 | 11.02 | 0.95 | -0.43 | 0.5933 | -10.4268 | ||||||

| 06/12/2015 |

0.8914 | 4.488 | 0.96 | 0 | 2.305 | -2.183 | ||||||

| 06/05/2015 |

0.8531 | -3.984 | 0.96 | 0.01 | 2.3616 | 6.3456 | ||||||

| 05/29/2015 |

0.8885 | -3.2295 | 0.96 | -0.16 | 1.6728 | 4.9022 | ||||||

| 05/22/2015 |

0.9182 | 8.8678 | 0.96 | -0.25 | 1.3338 | -7.534 | ||||||

| 05/15/2015 |

0.8434 | -3.4367 | 0.96 | -0.33 | 1.0107 | 4.4474 | ||||||

| 05/08/2015 |

0.8734 | 6.4814 | 0.96 | -0.26 | 1.2672 | -5.2142 | ||||||

| 05/01/2015 |

0.8202 | -3.0511 | 0.97 | -0.11 | 1.8893 | 4.9405 | ||||||

| 04/24/2015 |

0.846 | 1.5425 | 0.97 | -0.07 | 2.0368 | 0.4942 | ||||||

| 04/17/2015 |

0.8332 | 3.5614 | 0.97 | -0.24 | 1.3558 | -2.2056 | ||||||

| 04/10/2015 |

0.8045 | 0.983 | 0.97 | -0.16 | 1.6672 | 0.6842 | ||||||

| 04/03/2015 |

0.7967 | -0.5658 | 0.97 | -0.13 | 1.798 | 2.3638 | ||||||

| 03/27/2015 |

0.8012 | 1.4911 | 0.97 | 0.07 | 2.5912 | 1.1001 | ||||||

| 03/20/2015 |

0.7895 | 1.509 | 0.97 | 0.41 | 3.964 | 2.455 | ||||||

| 03/13/2015 |

0.7777 | 0.9275 | 0.97 | 0.2 | 3.1249 | 2.1974 | ||||||

| 03/06/2015 |

0.7706 | -2.7398 | 0.97 | 0.17 | 2.9803 | 5.7201 | ||||||

| 02/27/2015 |

0.7923 | -3.7337 | 0.97 | 0.13 | 2.8522 | 6.5859 | ||||||

| 02/20/2015 |

0.823 | 6.493 | 0.96 | -0.04 | 2.1434 | -4.3496 | ||||||

| 02/13/2015 |

0.7728 | 6.1853 | 0.96 | 0.37 | 3.781 | -2.4043 | ||||||

| 02/06/2015 |

0.7278 | -0.8726 | 0.96 | -1.22 | -2.5468 | -1.6742 | ||||||

| 01/30/2015 |

0.7342 | 9.8179 | 0.97 | 0.14 | 2.8678 | -6.9501 | ||||||

| 01/23/2015 |

0.6686 | 0.3735 | 0.97 | 0.75 | 5.3152 | 4.9416 | ||||||

| 01/16/2015 |

0.6661 | 3.7462 | 0.96 | 0.19 | 3.0738 | -0.6724 | ||||||

| 01/09/2015 |

0.642 | -4.2524 | 0.96 | 0.09 | 2.6642 | 6.9166 |

Page 2

| 01/02/2015 |

0.6706 | 4.3451 | 0.96 | -1.1 | -2.0531 | -6.3982 | ||||||

| 12/26/2014 |

0.6426 | -3.4019 | 0.97 | -0.44 | 0.5604 | 3.9623 | ||||||

| 12/19/2014 |

0.6653 | 34.0348 | 0.98 | 0.46 | 4.1372 | -29.8976 | ||||||

| 12/12/2014 |

0.4963 | 20.955 | 0.97 | -0.22 | 1.4591 | -19.4958 | ||||||

| 12/05/2014 |

0.4104 | -2.5037 | 0.97 | 0.24 | 3.269 | 5.7727 | ||||||

| 11/28/2014 |

0.4209 | -5.2638 | 0.97 | 0.03 | 2.432 | 7.6958 | ||||||

| 11/21/2014 |

0.4443 | 6.4211 | 0.97 | -0.41 | 0.6861 | -5.7351 | ||||||

| 11/14/2014 |

0.4175 | 11.7914 | 0.98 | 0.21 | 3.1722 | -8.6192 | ||||||

| 11/07/2014 |

0.3734 | -24.8323 | 0.97 | -0.66 | -0.323 | 24.5093 | ||||||

| 10/31/2014 |

0.4968 | 9.0406 | 0.98 | -1.2 | -2.4675 | -11.5081 | ||||||

| 10/24/2014 |

0.4556 | 27.6158 | 0.99 | 1.99 | 10.2547 | -17.3611 | ||||||

| 10/17/2014 |

0.357 | -2.284 | 0.97 | 0.09 | 2.6671 | 4.9511 | ||||||

| 10/10/2014 |

0.3654 | 41.561 | 0.97 | 0.53 | 4.423 | -37.138 | ||||||

| 10/03/2014 |

0.2581 | 24.7256 | 0.97 | 0.07 | 2.5854 | -22.1403 | ||||||

| 09/26/2014 |

0.2069 | -29.9407 | 0.97 | 0.06 | 2.546 | 32.4867 | ||||||

| 09/19/2014 |

0.2954 | -4.5927 | 0.97 | -0.46 | 0.5027 | 5.0954 | ||||||

| 09/12/2014 |

0.3096 | -26.2722 | 0.97 | 0.44 | 4.075 | 30.3472 | ||||||

| 09/05/2014 |

0.4199 | 12.7644 | 0.97 | -0.39 | 0.7571 | -12.0074 | ||||||

| 08/29/2014 |

0.3724 | 6.0126 | 0.97 | 0.05 | 2.5162 | -3.4964 | ||||||

| 08/22/2014 |

0.3513 | 3.621 | 0.97 | -0.18 | 1.6106 | -2.0104 | ||||||

| 08/15/2014 |

0.339 | 0.5118 | 0.97 | 0.07 | 2.5839 | 2.072 | ||||||

| 08/08/2014 |

0.3373 | 1.8997 | 0.97 | -0.06 | 2.0984 | 0.1987 | ||||||

| 08/01/2014 |

0.331 | 1.1939 | 0.97 | 0.19 | 3.0853 | 1.8914 | ||||||

| 07/25/2014 |

0.3271 | -13.1037 | 0.97 | -0.14 | 1.7643 | 14.868 | ||||||

| 07/18/2014 |

0.3764 | 0.0491 | 0.97 | -0.15 | 1.7032 | 1.654 | ||||||

| 07/11/2014 |

0.3762 | 10.776 | 0.97 | 0.16 | 2.9674 | -7.8085 | ||||||

| 07/04/2014 |

0.3396 | -9.8205 | 0.97 | 0.05 | 2.5003 | 12.3208 | ||||||

| 06/27/2014 |

0.3766 | -18.6416 | 0.97 | -0.24 | 1.3532 | 19.9948 | ||||||

| 06/20/2014 |

0.4629 | 3.6035 | 0.97 | 0.31 | 3.5485 | -0.0551 | ||||||

| 06/13/2014 |

0.4468 | -12.2242 | 0.97 | 0.29 | 3.479 | 15.7032 | ||||||

| 06/06/2014 |

0.509 | 19.2816 | 0.97 | -0.24 | 1.3731 | -17.9084 | ||||||

| 05/30/2014 |

0.4267 | -24.6637 | 0.97 | -0.63 | -0.2069 | 24.4568 | ||||||

| 05/23/2014 |

0.5664 | 2.2225 | 0.97 | -0.11 | 1.9013 | -0.3212 | ||||||

| 05/16/2014 |

0.5541 | -17.4514 | 0.98 | -1.76 | -4.6977 | 12.7537 | ||||||

| 05/09/2014 |

0.6712 | -1.3495 | 0.99 | 0.32 | 3.5881 | 4.9376 | ||||||

| 05/02/2014 |

0.6804 | 7.9589 | 0.99 | -0.8 | -0.8778 | -8.8367 | ||||||

| 04/25/2014 |

0.6303 | 0.3342 | 1 | -0.15 | 1.7389 | 1.4047 | ||||||

| 04/18/2014 |

0.6282 | 16.7109 | 1 | 0.69 | 5.0648 | -11.6461 | ||||||

| 04/11/2014 |

0.5382 | 14.6682 | 0.99 | 0.06 | 2.5651 | -12.1031 | ||||||

| 04/04/2014 |

0.4694 | -0.167 | 0.99 | 0.18 | 3.0271 | 3.1941 | ||||||

| 03/28/2014 |

0.4702 | 5.0423 | 0.99 | 0.11 | 2.776 | -2.2663 | ||||||

| 03/21/2014 |

0.4476 | -7.8395 | 0.99 | 0.25 | 3.315 | 11.1545 | ||||||

| 03/14/2014 |

0.4857 | 3.0986 | 0.99 | -0.3 | 1.1121 | -1.9865 | ||||||

| 03/07/2014 |

0.4711 | -0.0513 | 0.99 | 0.16 | 2.9693 | 3.0206 | ||||||

| 02/28/2014 |

0.4713 | 6.6573 | 0.99 | -0.05 | 2.1215 | -4.5358 | ||||||

| 02/21/2014 |

0.4419 | -4.1194 | 0.99 | -0.02 | 2.2214 | 6.3409 | ||||||

| 02/14/2014 |

0.4609 | -45.5346 | 0.99 | -0.09 | 1.9742 | 47.5088 |

Page 3

| 02/07/2014 |

0.8462 | -1.4826 | 0.99 | 0.09 | 2.683 | 4.1656 | ||||||

| 01/31/2014 |

0.8589 | 0.0082 | 0.99 | -0.69 | -0.435 | -0.4432 | ||||||

| 01/24/2014 |

0.8588 | 11.1418 | 1 | -1.26 | -2.7156 | -13.8574 | ||||||

| 01/17/2014 |

0.7727 | 0.2274 | 1.01 | 0.48 | 4.2382 | 4.0108 | ||||||

| 01/10/2014 |

0.771 | 1.7282 | 1 | -0.2 | 1.5399 | -0.1882 | ||||||

| 01/03/2014 |

0.7579 | -3.2216 | 1.01 | -0.06 | 2.0987 | 5.3203 | ||||||

| 12/27/2013 |

0.7831 | -1.72 | 1.01 | -0.27 | 1.2298 | 2.9498 | ||||||

| 12/20/2013 |

0.7968 | 13.282 | 1.01 | -0.82 | -0.9478 | -14.2298 | ||||||

| 12/13/2013 |

0.7034 | 8.6475 | 1.02 | -0.29 | 1.166 | -7.4816 | ||||||

| 12/06/2013 |

0.6474 | 0.4904 | 1.02 | 0.2 | 3.102 | 2.6116 | ||||||

| 11/29/2013 |

0.6443 | 5.5416 | 1.02 | -0.41 | 0.6853 | -4.8562 | ||||||

| 11/22/2013 |

0.6104 | -0.1917 | 1.02 | 0.18 | 3.0254 | 3.2171 | ||||||

| 11/15/2013 |

0.6116 | 3.6544 | 1.02 | -0.86 | -1.1107 | -4.7651 | ||||||

| 11/08/2013 |

0.59 | -0.3837 | 1.03 | 0.14 | 2.8831 | 3.2669 | ||||||

| 11/01/2013 |

0.5923 | 0.6138 | 1.03 | -0.33 | 0.9874 | 0.3736 | ||||||

| 10/25/2013 |

0.5887 | -2.9229 | 1.03 | -0.11 | 1.8689 | 4.7919 | ||||||

| 10/18/2013 |

0.6064 | 6.6616 | 1.03 | 0.44 | 4.091 | -2.5706 | ||||||

| 10/11/2013 |

0.5685 | 2.1464 | 1.03 | -1.27 | -2.7582 | -4.9045 | ||||||

| 10/04/2013 |

0.5566 | 0.6395 | 1.04 | -0.59 | -0.0496 | -0.6891 | ||||||

| 09/27/2013 |

0.5531 | -3.6274 | 1.05 | 0.42 | 3.9849 | 7.6123 | ||||||

| 09/20/2013 |

0.5739 | -8.1251 | 1.04 | 0.22 | 3.1954 | 11.3205 | ||||||

| 09/13/2013 |

0.6246 | 11.047 | 1.04 | -1.24 | -2.6359 | -13.6829 | ||||||

| 09/06/2013 |

0.5625 | 17.8025 | 1.05 | 0.42 | 3.986 | -13.8165 | ||||||

| 08/30/2013 |

0.4775 | -6.2435 | 1.05 | 0.21 | 3.1442 | 9.3876 | ||||||

| 08/23/2013 |

0.5093 | 0.591 | 1.05 | -0.33 | 1.018 | 0.427 | ||||||

| 08/16/2013 |

0.5063 | -6.9457 | 1.05 | -0.61 | -0.1184 | 6.8272 | ||||||

| 08/09/2013 |

0.5441 | 1.5002 | 1.06 | -0.24 | 1.363 | -0.1372 | ||||||

| 08/02/2013 |

0.536 | -1.7435 | 1.06 | -1.32 | -2.9371 | -1.1937 | ||||||

| 07/26/2013 |

0.5456 | -2.4799 | 1.07 | 0.55 | 4.5037 | 6.9836 | ||||||

| 07/19/2013 |

0.5594 | -1.2004 | 1.07 | -0.11 | 1.8681 | 3.0685 | ||||||

| 07/12/2013 |

0.5662 | -4.7551 | 1.07 | 0.06 | 2.5569 | 7.312 | ||||||

| 07/05/2013 |

0.5945 | 4.8554 | 1.07 | 0.02 | 2.3887 | -2.4667 | ||||||

| 06/28/2013 |

0.567 | -0.551 | 1.07 | 0.19 | 3.0818 | 3.6328 | ||||||

| 06/21/2013 |

0.5701 | -17.0835 | 1.07 | 0.13 | 2.8417 | 19.9251 | ||||||

| 06/14/2013 |

0.6876 | -6.8737 | 1.07 | -0.04 | 2.1416 | 9.0152 | ||||||

| 06/07/2013 |

0.7383 | 1.7533 | 1.07 | -0.19 | 1.5594 | -0.1939 | ||||||

| 05/31/2013 |

0.7256 | 3.6654 | 1.07 | 0.04 | 2.4603 | -1.2051 | ||||||

| 05/24/2013 |

0.6999 | -14.2916 | 1.07 | 0.14 | 2.8623 | 17.1539 | ||||||

| 05/17/2013 |

0.8166 | 6.1709 | 1.07 | 0.16 | 2.945 | -3.2259 | ||||||

| 05/10/2013 |

0.7692 | -8.6711 | 1.06 | 0.04 | 2.4775 | 11.1486 | ||||||

| 05/03/2013 |

0.8422 | 7.6792 | 1.06 | -0.04 | 2.1525 | -5.5268 | ||||||

| 04/26/2013 |

0.7821 | 2.3678 | 1.06 | 0.36 | 3.7399 | 1.3721 | ||||||

| 04/19/2013 |

0.7641 | -5.8679 | 1.06 | -0.06 | 2.1009 | 7.9687 | ||||||

| 04/12/2013 |

0.8117 | -3.1782 | 1.06 | 0.01 | 2.3691 | 5.5473 | ||||||

| 04/05/2013 |

0.8383 | 0.61 | 1.06 | 0.04 | 2.4646 | 1.8547 | ||||||

| 03/29/2013 |

0.8332 | -0.5129 | 1.06 | 0 | 2.3266 | 2.8395 | ||||||

| 03/22/2013 |

0.8375 | 0.0748 | 1.06 | 0.28 | 3.4426 | 3.3677 |

Page 4

| 03/15/2013 |

0.8369 | 0.1875 | 1.06 | -0.11 | 1.8636 | 1.6761 | ||||||

| 03/08/2013 |

0.8353 | -3.6907 | 1.06 | -0.08 | 1.9848 | 5.6755 | ||||||

| 03/01/2013 |

0.8674 | 0.2188 | 1.06 | -0.04 | 2.1788 | 1.96 | ||||||

| 02/22/2013 |

0.8655 | -7.6236 | 1.06 | 0.21 | 3.1654 | 10.789 | ||||||

| 02/15/2013 |

0.9369 | -0.1652 | 1.06 | -0.01 | 2.269 | 2.4342 | ||||||

| 02/08/2013 |

0.9384 | -0.0318 | 1.06 | 0.02 | 2.4078 | 2.4395 | ||||||

| 02/01/2013 |

0.9387 | 0.0102 | 1.06 | -0.14 | 1.7732 | 1.763 | ||||||

| 01/25/2013 |

0.9386 | -2.7237 | 1.06 | -0.24 | 1.377 | 4.1007 | ||||||

| 01/18/2013 |

0.9649 | 0.2272 | 1.06 | 0.09 | 2.6927 | 2.4655 | ||||||

| 01/11/2013 |

0.9627 | 0.6877 | 1.06 | -0.1 | 1.9143 | 1.2267 | ||||||

| 01/04/2013 |

0.9562 | -1.473 | 1.06 | 0.31 | 3.5455 | 5.0185 | ||||||

| 12/28/2012 |

0.9705 | 3.7469 | 1.06 | -0.04 | 2.1767 | -1.5702 | ||||||

| 12/21/2012 |

0.9354 | 1.1972 | 1.06 | 0.01 | 2.3477 | 1.1506 | ||||||

| 12/14/2012 |

0.9243 | -2.1186 | 1.06 | 0.06 | 2.5439 | 4.6626 | ||||||

| 12/07/2012 |

0.9444 | -0.2649 | 1.06 | -0.16 | 1.6841 | 1.949 | ||||||

| 11/30/2012 |

0.9469 | 11.2894 | 1.06 | -0.09 | 1.9645 | -9.3248 | ||||||

| 11/23/2012 |

0.8508 | -11.499 | 1.06 | 0.08 | 2.6465 | 14.1456 | ||||||

| 11/16/2012 |

0.9614 | -10.7563 | 1.06 | -0.16 | 1.7012 | 12.4575 | ||||||

| 11/09/2012 |

1.0772 | 23.7309 | 1.06 | 0.15 | 2.9036 | -20.8273 | ||||||

| 11/02/2012 |

0.8706 | -0.353 | 1.06 | -0.26 | 1.267 | 1.62 | ||||||

| 10/26/2012 |

0.8737 | 1.7555 | 1.06 | -0.14 | 1.7778 | 0.0223 | ||||||

| 10/19/2012 |

0.8586 | -2.2873 | 1.06 | 0 | 2.3336 | 4.6209 | ||||||

| 10/12/2012 |

0.8787 | 3.6074 | 1.06 | -0.02 | 2.2561 | -1.3513 | ||||||

| 10/05/2012 |

0.8481 | -19.0922 | 1.06 | 0.03 | 2.4413 | 21.5335 | ||||||

| 09/28/2012 |

1.0483 | 3.4879 | 1.06 | 0.06 | 2.5665 | -0.9214 | ||||||

| 09/21/2012 |

1.0129 | -2.5338 | 1.06 | 0.21 | 3.1619 | 5.6957 | ||||||

| 09/14/2012 |

1.0393 | 29.3461 | 1.06 | -0.12 | 1.8433 | -27.5027 | ||||||

| 09/07/2012 |

0.8035 | -20.0138 | 1.06 | 0.13 | 2.8395 | 22.8533 | ||||||

| 08/31/2012 |

1.0045 | -0.8225 | 1.06 | -0.34 | 0.9473 | 1.7698 | ||||||

| 08/24/2012 |

1.0129 | -1.7195 | 1.06 | -0.1 | 1.9366 | 3.6561 | ||||||

| 08/17/2012 |

1.0306 | -2.6469 | 1.07 | 0.06 | 2.5657 | 5.2126 | ||||||

| 08/10/2012 |

1.0586 | -3.8586 | 1.07 | -0.16 | 1.6873 | 5.5459 | ||||||

| 08/03/2012 |

1.1011 | -0.2116 | 1.07 | 0.02 | 2.41 | 2.6216 | ||||||

| 07/27/2012 |

1.1034 | 16.7269 | 1.07 | -0.11 | 1.8922 | -14.8347 | ||||||

| 07/20/2012 |

0.9453 | -0.6363 | 1.07 | -0.05 | 2.116 | 2.7523 | ||||||

| 07/13/2012 |

0.9514 | -1.8777 | 1.07 | -0.04 | 2.1653 | 4.043 | ||||||

| 07/06/2012 |

0.9696 | 5.6887 | 1.07 | 0.12 | 2.7926 | -2.8961 | ||||||

| 06/29/2012 |

0.9174 | 54.5297 | 1.07 | -0.15 | 1.7143 | -52.8154 | ||||||

| 06/22/2012 |

0.5937 | -6.5577 | 1.07 | -0.34 | 0.9497 | 7.5073 | ||||||

| 06/15/2012 |

0.6353 | 70.3877 | 1.07 | -0.08 | 2.0128 | -68.3749 | ||||||

| 06/08/2012 |

0.3729 | -54.5371 | 1.07 | 0.14 | 2.8844 | 57.4216 | ||||||

| 06/01/2012 |

0.8202 | -17.0144 | 1.07 | 0.02 | 2.4158 | 19.4302 | ||||||

| 05/25/2012 |

0.9883 | 88.2246 | 1.07 | 0.18 | 3.0266 | -85.198 | ||||||

| 05/18/2012 |

0.5251 | 193.3543 | 1.07 | 0.37 | 3.8108 | -189.5436 | ||||||