Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2016

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-32356

SPDR® GOLD TRUST

SPONSORED BY WORLD GOLD TRUST SERVICES, LLC

(Exact name of registrant as specified in its charter)

| New York | 81-6124035 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

c/o World Gold Trust Services, LLC

685 Third Avenue, 27th Floor

New York, New York 10017

(212) 317-3800

(Address of principal executive offices, telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| (Title of each class) |

Name of each exchange on which registered | |

| SPDR® GOLD Shares | NYSE Arca, Inc. |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

x | Accelerated filer ¨ |

Non-Accelerated filer ¨ |

Smaller reporting company ¨ | ||||

| (Do not check if a smaller reporting company) | ||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Aggregate market value of registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock on March 31, 2016 as reported by the NYSE Arca, Inc. on that date: $32,760,852,000.

Number of shares of the registrant’s common stock outstanding as of November 25, 2016: 298,400,000.

DOCUMENTS INCORPORATED BY REFERENCE: None

Table of Contents

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and within the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements usually include the verbs “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “understands,” and other verbs suggesting uncertainty. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, or our achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Trust undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Additional significant uncertainties and other factors affecting forward-looking statements are presented in Item 1A. “Risk Factors”.

“SPDR” is a product of S&P Dow Jones Indices LLC (“SPDJI”) and has been licensed for use by State Street Corporation. Standard & Poor’s and S&P are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); “SPDR” is a trademark of SPDJI; and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions or interruptions of SPDR®. Further limitations that could affect investors’ rights may be found in this Annual Report.

WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL S&P HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

ALL REFERENCES TO LBMA GOLD PRICE PM ARE USED WITH THE PERMISSION OF ICE BENCHMARK ADMINISTRATION LIMITED AND HAVE BEEN PROVIDED FOR INFORMATIONAL PURPOSES ONLY. ICE BENCHMARK ADMINISTRATION LIMITED ACCEPTS NO LIABILITY OR RESPONSIBILITY FOR THE ACCURACY OF THE PRICES OR THE UNDERLYING PRODUCT TO WHICH THE PRICES MAY BE REFERENCED.

i

Table of Contents

| Page | ||||||

| 1 | ||||||

| Item 1. | 1 | |||||

| 1 | ||||||

| 2 | ||||||

| 4 | ||||||

| 7 | ||||||

| 7 | ||||||

| 11 | ||||||

| 13 | ||||||

| 14 | ||||||

| 14 | ||||||

| 16 | ||||||

| 16 | ||||||

| 18 | ||||||

| 20 | ||||||

| 21 | ||||||

| 25 | ||||||

| Item 1A. | 26 | |||||

| Item 1B. | 34 | |||||

| Item 2. | 34 | |||||

| Item 3. | 34 | |||||

| Item 4. | 34 | |||||

| 35 | ||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 35 | ||||

| Item 6. | 37 | |||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 39 | ||||

| Item 7A. | 45 | |||||

| Item 8. | 45 | |||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 46 | ||||

| Item 9A. | 46 | |||||

| Item 9B. | 48 | |||||

ii

Table of Contents

| Page | ||||||

| 49 | ||||||

| Item 10. | 49 | |||||

| Item 11. | 51 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 51 | ||||

| Item 13. | Certain Relationships and Related Transactions and Director Independence |

51 | ||||

| Item 14. | 51 | |||||

| 53 | ||||||

| Item 15. | 53 | |||||

iii

Table of Contents

| Item 1. Business |

SPDR® Gold Trust, or the Trust, is an investment trust, formed on November 12, 2004 under New York law pursuant to a trust indenture, or the Trust Indenture. The Trust holds gold and from time to time issues SPDR® Gold Shares, or Shares, in Baskets in exchange for deposits of gold and distributes gold in connection with redemptions of Baskets. A Basket equals a block of 100,000 Shares. The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the Trust’s expenses. World Gold Trust Services, LLC, or WGTS, is the sponsor of the Trust, or the Sponsor. BNY Mellon Asset Servicing, a division of The Bank of New York Mellon, or BNYM, is the trustee of the Trust, or the Trustee. State Street Global Markets, LLC, or SSGM, is the marketing agent of the Trust, or the Marketing Agent. HSBC Bank plc, or HSBC, is the custodian of the Trust, or the Custodian.

The Sponsor of the registrant maintains an Internet website at www.spdrgoldshares.com, through which the registrant’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, are made available free of charge after they have been filed or furnished to the Securities and Exchange Commission, or the SEC. Additional information regarding the Trust may also be found on the SEC’s EDGAR database at www.sec.gov.

The Shares are intended to offer investors an opportunity to participate in the gold market through an investment in securities. Historically, the logistics of buying, storing and insuring gold have constituted a barrier to entry for some institutional and retail investors. The ownership of the Shares is intended to overcome these barriers to entry. The logistics of storing and insuring gold are dealt with by the Custodian, and the related expenses are built into the price of the Shares. Therefore, the investor does not have any additional tasks or costs over and above those associated with investing in any other publicly traded security.

The Shares are intended to provide institutional and retail investors with a simple and cost-efficient means of gaining investment benefits similar to those of holding allocated gold bullion. The Shares offer an investment that is:

| • | Easily Accessible. Investors can access the gold market through a traditional brokerage account. The Sponsor believes that investors will be able to more effectively implement strategic and tactical asset allocation strategies that use gold by using the Shares instead of using the traditional means of purchasing, trading and holding gold. |

| • | Relatively Cost Efficient. The Sponsor believes that, for many investors, transaction costs related to the Shares will be lower than those associated with the purchase, storage and insurance of allocated gold. |

| • | Exchange Traded. The Shares trade on NYSE Arca, Inc., or NYSE Arca, providing investors with an efficient means to buy, sell, or sell short in order to implement a variety of investment strategies. The Shares are eligible for margin accounts. The Shares are also listed on the Mexican Stock Exchange (Bolsa Mexicana de Valores), the Singapore Exchange Limited, the Stock Exchange of Hong Kong Limited and the Tokyo Stock Exchange. |

| • | Backed by Gold Held by the Custodian on Behalf of the Trust. The Shares are backed by the assets of the Trust and the Trust does not hold or employ any derivative securities. Further, the Trust’s holdings and their value based on current market prices are reported on the Trust’s website each business day. The Trustee’s arrangements with the Custodian provide that at the end of each business day there can be in the Trust account maintained by the Custodian no gold in an unallocated form. Accordingly, the Trust’s gold holdings are identified on the Custodian’s books as the property of the Trust and held in London. |

1

Table of Contents

The Shares represent units of fractional undivided beneficial interest in and ownership of the Trust. The Trust is not managed like a corporation or an active investment vehicle. The gold held by the Trust will only be sold: (1) on an as-needed basis to pay Trust expenses, (2) in the event the Trust terminates and liquidates its assets, or (3) as otherwise required by law or regulation. The sale of gold by the Trust is a taxable event to shareholders of the Trust, or Shareholders. See “United States Federal Tax Consequences—Taxation of U.S. Shareholders.”

The Trust is not registered as an investment company under the Investment Company Act of 1940 and is not required to register under such act. The Trust will not hold or trade in commodity futures contracts regulated by the Commodity Exchange Act of 1936, or the CEA, as administered by the Commodity Futures Trading Commission, or the CFTC. The Trust is not a commodity pool for purposes of the CEA, and none of the Sponsor, the Trustee or the Marketing Agent is subject to regulation as a commodity pool operator or a commodity trading advisor in connection with the Shares.

The Trust creates and redeems Shares from time to time, but only in Baskets. The number of outstanding Shares changes from time to time as a result of the creation and redemption of Baskets. The creation and redemption of Baskets requires the delivery to the Trust or the distribution by the Trust of the amount of gold and any cash represented by the Baskets being created or redeemed. The total amount of gold and any cash required for the creation of Baskets is based on the combined net asset value, or NAV, of the number of Baskets being created or redeemed. The number of ounces of gold required to create a Basket or to be delivered upon the redemption of a Basket will continue to gradually decrease over time. This is because the Shares comprising a Basket will represent a decreasing amount of gold due to the sale of the Trust’s gold to pay the Trust’s expenses.

Baskets may be created or redeemed only by Authorized Participants. An Authorized Participant is a person who (1) is a registered broker-dealer or other securities market participant such as a bank or other financial institution which is not required to register as a broker-dealer to engage in securities transactions, (2) is a participant in the Depository Trust Company system, or DTC, (3) has entered into an agreement with the Sponsor and the Trustee which provides the procedures for the creation and redemption of Baskets and for the delivery of the gold and any cash required for such creations and redemptions, or a Participant Agreement, and (4) has established an unallocated gold account with the Custodian, or an Authorized Participant Unallocated Account. Authorized Participants pay a transaction fee of $2,000 for each order to create or redeem Baskets. Authorized Participants may sell to other investors all or part of the Shares included in the Baskets they purchase from the Trust.

On March 20, 2015, the LBMA Gold Price replaced the London Gold Fix. The ICE Benchmark Administration Limited, or the IBA, provides the auction platform and methodology as well as the overall independent administration and governance for the LBMA Gold Price. In determining the NAV of the Trust, the Trustee values the gold held by the Trust on the basis of the price of an ounce of gold determined by the IBA 3:00 PM auction process, or LBMA Gold Price PM, which is an electronic auction, with the imbalance calculated, and the price adjusted in rounds (45 seconds in duration). The auction runs twice daily at 10:30 AM and 3:00 PM London time. Prior to March 20, 2015, the Trustee valued the gold held by the Trust on the basis of the price of an ounce of gold set by the afternoon session of the twice daily fix of the price of an ounce of gold which started at 3:00 PM London time and was performed by the four members of the London Gold Fix. Since March 20, 2015, the Trustee determines the NAV of the Trust on each day the NYSE Arca is open for regular trading, at the earlier of the LBMA Gold Price PM for the day or 12:00 PM New York time. If no LBMA Gold Price PM is announced on a particular evaluation day or if the LBMA Gold Price PM has not been announced by 12:00 PM New York time on a particular evaluation day, the next most recent LBMA Gold Price (AM or PM) is used in the determination of the NAV of the Trust, unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate to use as the basis for such determination.

As of the LBMA Gold Price PM on each day that the NYSE Arca is open for regular trading or, if there is no LBMA Gold Price PM on such day or the LBMA Gold Price PM has not been announced by

2

Table of Contents

12:00 PM New York time on such day, as of 12:00 PM New York time on such day, or Valuation Time, the Trustee values the gold held by the Trust and determines the NAV of the Trust.

At the Valuation Time, the Trustee values the Trust’s gold on the basis of that day’s LBMA Gold Price PM or, if no LBMA Gold Price PM is made on such day or has not been announced by the Valuation Time, the next most recent LBMA Gold Price (AM or PM) determined prior to the Valuation Time will be used, unless the Trustee, in consultation with the Sponsor, determines that such price is inappropriate as a basis for valuation. In the event the Trustee and the Sponsor determine that the LBMA Gold Price PM or last prior LBMA Gold Price (AM or PM) is not an appropriate basis for valuation of the Trust’s gold, they will identify an alternative basis for such valuation to be employed by the Trustee. While we believe that the LBMA Gold Price is an appropriate indicator of the value of gold, there are other indicators that are available that could be different than the LBMA Gold Price. The use of such an alternative indicator could result in materially different fair value pricing of the gold in the Trust which could result in different market value adjustments of our outstanding redeemable Shares.

To determine the Trust’s NAV, the Trustee subtracts all estimated accrued fees, expenses and other liabilities of the Trust from the total value of the gold and all other assets of the Trust.

Effective July 17, 2015, the Trust’s only recurring fixed expense is the Sponsor’s fee which accrues daily at an annual rate equal to 0.40% of the daily NAV, in exchange for the Sponsor assuming the responsibility to pay all ordinary fees and expenses of the Trust which include the fees and expenses of the Trustee, the fees and expenses of the Custodian for the custody of the Trust’s gold bars, the fees and expenses of the Sponsor, certain taxes, the fees of the Marketing Agent, printing and mailing costs, legal and audit fees, registration fees, NYSE Arca listing fees and other marketing costs and expenses.

The Trust’s assets only consist of allocated gold bullion and gold receivable when recorded; representing gold covered by contractually binding orders for the creation of Shares where the gold has not yet been transferred to the Trust’s account and, from time to time, cash, which will be used to pay expenses. Cash held by the Trust will not generate any income. The Trust does not hold any derivative instruments. Each Share represents a proportional interest, based on the total number of Shares outstanding, in the gold and any cash held by the Trust, less the Trust’s liabilities (which include accrued expenses). While the secondary market trading price of the Shares has fluctuated in response to the price of gold, the Sponsor believes that the trading price of the Shares reflects the estimated accrued expenses of the Trust.

Sales of Gold

The Trustee, at the direction of the Sponsor or in its own discretion, sells the Trust’s gold as necessary to pay the Trust’s expenses. As a result, the amount of gold sold will vary from time to time depending on the level of the Trust’s expenses and the market price of gold. Unless otherwise directed by the Sponsor, the Trustee will sell gold to the Custodian at the next LBMA Gold Price PM following the sale order. Neither the Trustee nor the Sponsor is liable for depreciation or loss incurred by reason of any sale. See “United States Federal Tax Consequences—Taxation of U.S. Shareholders” for information on the tax treatment of gold sales.

The Trustee may also sell the Trust’s gold if the Sponsor notifies the Trustee that the sale of gold is required by applicable law or regulation or in connection with the termination and liquidation of the Trust. The Trustee will not be liable or responsible in any way for depreciation or loss incurred by reason of any sale of gold directed by the Sponsor. Any property received by the Trust other than gold, cash or an amount receivable in cash (such as, for example, an insurance claim) will be promptly sold or otherwise disposed of by the Trustee.

Gold Price Information

Investors may obtain on a 24-hour basis gold pricing information based on the spot price for an ounce of gold from various financial information service providers. Current spot prices are also generally available

3

Table of Contents

with bid/ask spreads from gold bullion dealers. In addition, the Trust’s website provides ongoing pricing information for gold spot prices and the Shares. Market prices for the Shares are available from a variety of sources including brokerage firms, information websites and other information service providers. The NAV of the Trust is published by the Sponsor on each day that NYSE Arca is open for regular trading and is posted on the Trust’s website at www.spdrgoldshares.com.

Gold Supply and Demand

Gold is a physical asset that is accumulated rather than consumed. As a result, virtually all the gold that has ever been mined still exists today in one form or another. Metals Focus Gold Focus 2016, published by Metals Focus, a precious metals research consultancy based in London, estimates that existing above-ground stocks of gold amounted to in excess 180,000 tonnes (approximately 5.8 billion ounces) at the end of 2015.(1)

World Gold Supply and Demand (2011—2015)

The following table is a summary of the world gold supply and demand for the past 5 years. It is based on information reported in the Metals Focus Gold Focus 2016.

World Gold Supply and Demand, 2011-2015

Gold Supply and Demand Balance(2),(3)

| Tonnes |

2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||

| SUPPLY |

||||||||||||||||||||

| Mine Production |

2,849 | 2,938 | 3,074 | 3,153 | 3,211 | |||||||||||||||

| Recycling |

1,674 | 1,659 | 1,266 | 1,202 | 1,127 | |||||||||||||||

| Net Hedging Supply |

32 | – | – | 106 | 9 | |||||||||||||||

| Total Supply |

4,555 | 4,597 | 4,340 | 4,462 | 4,348 | |||||||||||||||

| DEMAND |

||||||||||||||||||||

| Jewellery Fabrication |

2,164 | 2,180 | 2,728 | 2,503 | 2,439 | |||||||||||||||

| Industrial Fabrication |

385 | 364 | 351 | 349 | 334 | |||||||||||||||

| Net Physical Investment |

1,380 | 1,283 | 1,700 | 1,008 | 1,021 | |||||||||||||||

| Net Hedging Demand |

– | 47 | 28 | – | – | |||||||||||||||

| Net Central Bank Buying |

516 | 582 | 646 | 584 | 566 | |||||||||||||||

| Total Demand |

4,445 | 4,456 | 5,452 | 4,443 | 4,359 | |||||||||||||||

| Market Balance |

110 | 141 | (1,112 | ) | 19 | (12 | ) | |||||||||||||

| Net Investment in ETFs |

239 | 307 | (916 | ) | (185 | ) | (134 | ) | ||||||||||||

| Market Balance less ETFs |

(128 | ) | (166 | ) | (197 | ) | 204 | 122 | ||||||||||||

| Gold Price (US$/oz, PM fix) |

1,572 | 1,669 | 1,411 | 1,266 | 1,160 | |||||||||||||||

Source: Metals Focus Gold Focus 2016

Sources of Gold Supply

Based on data from Metals Focus Gold Focus 2016, gold supply averaged 4,460 tonnes (t) per year between 2011 and 2015. Sources of gold supply include both mine production and recycled above-ground stocks and, to a lesser extent, producer net hedging. The largest portion of gold supplied to the market is from mine production, which averaged approximately 3,045t per year from 2011 through 2015. The second largest source of annual gold supply is recycling gold, which is gold that has been recovered from jewelry and other fabricated products and converted back into marketable gold. Recycled gold averaged approximately 1,386t annually between 2011 through 2015.

| (1) | When used in this annual report “tonne” refers to one metric tonne, which is equivalent to 1,000 kilograms or 32,151 troy ounces. |

| (2) | Metals Focus Gold Focus 2016. |

| (3) | Totals may vary due to rounding. |

4

Table of Contents

Sources of Gold Demand

Based on data from Metals Focus Gold Focus 2016, gold demand averaged 4,632t per year between 2011 and 2015. Gold demand generally comes from four sources: jewelry, industry (including medical applications), investment and the official sector (including central banks and supranational organizations). The largest source of demand comes from jewelry fabrication, which accounted for approximately 52% of the identifiable demand from 2011 through 2015 followed by net physical investment, which represents identifiable investment demand, which accounted for approximately 28%.

Gold demand is widely dispersed throughout the world with significant contributions from India and China. In many countries there are seasonal fluctuations in the levels of demand for gold—especially jewelry. However, as a result of variations in the timing of seasons throughout the world, seasonal fluctuations in demand do not appear to have a significant impact on the global gold price.

Having been a source of gold supply for many years, the official sector became a source of net demand in 2010. Between 2011 and 2015, according to Metals Focus Gold Focus 2016, central bank purchases averaged 579t. The prominence given by market commentators to this activity coupled with the total amount of gold held by the official sector has resulted in this area being one of the more visible shifts in the gold market.

Operation of the Gold Bullion Market

The global trade in gold consists of over-the-counter, or OTC, transactions in spot, forwards, and options and other derivatives, together with exchange-traded futures and options.

Global Over-the-Counter Market

The OTC market trades on a continuous basis and accounts for most global gold trading. Market makers and participants in the OTC market trade with each other and their clients on a principal-to-principal basis. All risks and issues of credit are between the parties directly involved in the transaction. The three products relevant to London Bullion Market Association, or LBMA, market making are Spot (S), Forwards (F) and Options (O)(4). There are thirteen LBMA Market Makers who provide the service in one, two or all three products. Of the thirteen LBMA Market Makers, there are five Full Market Makers and eight Market Makers. The five Full Market Makers quoting prices in all three products are: Citibank N.A., Goldman Sachs International, HSBC, JP Morgan Chase Bank and UBS AG. The eight LBMA Market Makers who provide two-way pricing in either one or two products are: ICBC Standard Bank (S), Merrill Lynch International Plc (S, O), Morgan Stanley & Co International (S, O), Societe Generale (S), Standard Chartered Bank (S, O), Bank of Nova Scotia -ScotiaMocatta (S, F), Toronto-Dominion Bank (F) and BNP Paribas SA (F).

The OTC market provides a relatively flexible market in term of quotes, price, size, destinations for delivery and other factors. Bullion dealers customize transactions to meet their clients’ requirements. The OTC market has no formal structure and no open-outcry meeting place.

The main centers of the OTC market are London, New York and Zurich. Mining companies, central banks, manufacturers of jewelry and industrial products, together with investors and speculators, tend to transact their business through one of these centers. Centers such as Dubai and several cities in the Far East also transact substantial OTC market business. Bullion dealers have offices around the world and most of the world’s major bullion dealers are either members or associate members of the LBMA.

In the OTC market, the standard size of gold trades ranges between 5,000 and 10,000 ounces. Bid-offer spreads are typically $0.50 per ounce. Transaction costs in the OTC market are negotiable between the parties and therefore vary widely, with some dealers willing to offer clients competitive prices for larger volumes, although this will vary according to the dealer, the client and market conditions. Cost indicators can be obtained from various information service providers as well as dealers.

| (4) | http://www.lbma.org.uk/membership. |

5

Table of Contents

Liquidity in the OTC market can vary from time to time during the course of the 24-hour trading day. Fluctuations in liquidity are reflected in adjustments to dealing spreads—the difference between a dealer’s “buy” and “sell” prices. The period of greatest liquidity in the gold market generally occurs at the time of day when trading in the European time zones overlaps with trading in the United States, which is when OTC market trading in London, New York and other centers coincides with futures and options trading on the Commodity Exchange Inc., or the COMEX.

The London Bullion Market

Although the market for physical gold is global, most OTC market trades are cleared through London. In addition to coordinating market activities, the LBMA acts as the principal point of contact between the market and its regulators. A primary function of the LBMA is its involvement in the promotion of refining standards by maintenance of the “London Good Delivery Lists,” which are the lists of LBMA accredited melters and assayers of gold. The LBMA also coordinates market clearing and vaulting, promotes good trading practices and develops standard documentation.

The term “loco London” refers to gold bars physically held in London that meet the specifications for weight, dimensions, fineness (or purity), identifying marks (including the assay stamp of an LBMA acceptable refiner) and appearance set forth in “The Good Delivery Rules for Gold and Silver Bars” published by the LBMA. Gold bars meeting these requirements are known as “London Good Delivery Bars.” The unit of trade in London is the troy ounce, whose conversion between grams is: 1,000 grams = 32.1507465 troy ounces and 1 troy ounce = 31.1034768 grams. A London Good Delivery Bar is acceptable for delivery in settlement of a transaction on the OTC market. Typically referred to as 400-ounce bars, a London Good Delivery Bar must contain between 350 and 430 fine troy ounces of gold, with a minimum fineness (or purity) of 995 parts per 1,000 (99.5%), be of good appearance and be easy to handle and stack. The fine gold content of a gold bar is calculated by multiplying the gross weight of the bar (expressed in units of 0.025 troy ounces) by the fineness of the bar.

LBMA Gold Price

The LBMA Gold Price is determined twice daily during London trading hours through an auction which provides reference gold prices for that day’s trading. The LBMA Gold Price was initiated on March 20, 2015 and replaced the London PM Gold Fix. The auction that determines the LBMA Gold Price is a physically settled, electronic and tradeable auction, with the ability to settle trades in U.S. dollars, euros or British pounds. The IBA provides the auction platform and methodology as well as the overall administration and governance for the LBMA Gold Price. Many long-term contracts are expected to be priced on the basis of either the morning (AM) or afternoon (PM) LBMA Gold Price, and many market participants are expected to refer to one or the other of these prices when looking for a basis for valuations.

The Financial Conduct Authority, or FCA, in the U.K. regulates the LBMA Gold Price.

Futures Exchanges

The most significant gold futures exchange is the COMEX, part of the CME Group. It began to offer trading in gold futures contracts in 1974, and for most of the period since that date, it has been the largest exchange in the world for trading precious metals futures and options. The Tokyo Commodity Exchange, or the TOCOM, is another significant futures exchange and has been trading gold since 1982. Trading on these exchanges is based on fixed delivery dates and transaction sizes for the futures and options contracts traded. Trading costs are negotiable. As a matter of practice, only a small percentage of the futures market turnover ever comes to physical delivery of the gold represented by the contracts traded. Both exchanges permit trading on margin. Margin trading can add to the speculative risk involved given the potential for margin calls if the price moves against the contract holder. Both the COMEX and the TOCOM operate through a central clearance system, and in each case, the exchange acts as a counterparty for each member for clearing purposes.

6

Table of Contents

Over recent years China has become an important source of gold demand, and its futures markets have grown. Gold futures contracts are traded on the Shanghai Gold Exchange and the Shanghai Futures Exchange.

Market Regulation

The global gold markets are overseen and regulated by both governmental and self-regulatory organizations. In addition, certain trade associations have established rules and protocols for market practices and participants.

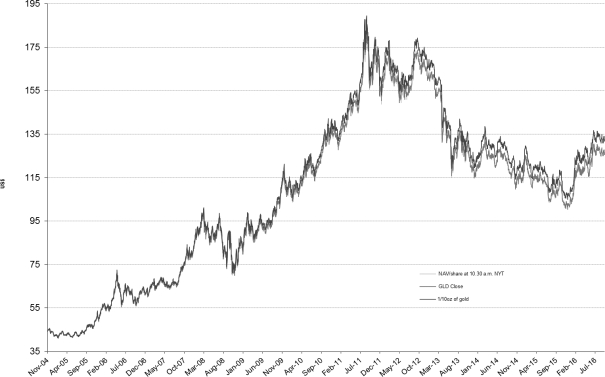

The following chart provides historical background on the price of gold. The chart illustrates movements in the price of gold in U.S. dollars per ounce over the period from the day the Shares began trading on the NYSE on November 18, 2004 to September 30, 2016, and is based on the London PM Fix until March 19, 2015 and thereafter is based on the LBMA Gold Price PM.

Daily gold price - November 18, 2004 to September 30, 2016

The investment objective of the Trust is for the Shares to reflect the performance of the price of gold bullion, less the Trust’s expenses. The Sponsor believes that, for many investors, the Shares represent a cost-effective investment relative to traditional means of investing in gold. The Trust has no fixed termination date and will terminate upon the occurrence of a termination event listed in the Trust Indenture.

Creation and Redemption of Shares

The Trust creates and redeems Shares from time to time, but only in one or more Baskets (a Basket equals a block of 100,000 Shares). The creation and redemption of Baskets is only made in exchange for the delivery to the Trust or the distribution by the Trust of the amount of gold and any cash represented by the Baskets being created or redeemed, the amount of which is based on the combined NAV of the

7

Table of Contents

number of Shares included in the Baskets being created or redeemed determined on the day the order to create or redeem Baskets is properly received. Creations of Baskets may only be settled after the requisite gold is deposited in the allocated account of the Trust.

Authorized Participants are the only persons that may place orders to create and redeem Baskets. To become an Authorized Participant, a person must enter into a Participant Agreement with the Sponsor and the Trustee. The Participant Agreement and the related procedures attached thereto may be amended by the Trustee and the Sponsor without the consent of any Shareholder or Authorized Participant. Authorized Participants who make deposits with the Trust in exchange for Baskets receive no fees, commissions or other form of compensation or inducement of any kind from either the Sponsor or the Trust, and no such person has any obligation or responsibility to the Sponsor or the Trust to effect any sale or resale of Shares.

Some of the activities of Authorized Participants will result in their being deemed participants in a distribution in a manner which would render them statutory underwriters and subject them to the prospectus-delivery and liability provisions of the Securities Act of 1933, as amended, or the Securities Act. As of the date of this annual report, Credit Suisse Securities (USA) LLC, Goldman, Sachs & Co., Goldman Sachs Execution & Clearing, L.P., HSBC Securities (USA) Inc., J.P. Morgan Securities Inc., Merrill Lynch Professional Clearing Corp., Morgan Stanley & Co. LLC, RBC Capital Markets LLC, Scotia Capital (USA) Inc., UBS Securities LLC and Virtu Financial BD LLC are our Authorized Participants. An updated list of Authorized Participants can be obtained from the Trustee or the Sponsor.

Prior to initiating any creation or redemption order, an Authorized Participant must have entered into an agreement with the Custodian to establish an Authorized Participant Unallocated Account in London, or a Participant Unallocated Bullion Account Agreement. Authorized Participant Unallocated Accounts may only be used for transactions with the Trust. An unallocated account is an account with a bullion dealer, which may also be a bank, to which a fine weight amount of gold is credited. Transfers to or from an unallocated account are made by crediting or debiting the number of ounces of gold being deposited or withdrawn. The account holder is entitled to direct the bullion dealer to deliver an amount of physical gold equal to the amount of gold standing to the credit of the account holder. Gold held in an unallocated account is not segregated from the Custodian’s assets. The account holder therefore has no ownership interest in any specific bars of gold that the bullion dealer holds or owns. The account holder is an unsecured creditor of the bullion dealer, and credits to an unallocated account are at risk of the bullion dealer’s insolvency, in which event it may not be possible for a liquidator to identify any gold held in an unallocated account as belonging to the account holder rather than to the bullion dealer.

Certain Authorized Participants are able to participate directly in the gold bullion market and the gold futures market. In some cases, an Authorized Participant may from time to time acquire gold from or sell gold to its affiliated gold trading desk, which may profit in these instances. The Sponsor believes that the size and operation of the gold bullion market make it unlikely that an Authorized Participant’s direct activities in the gold or securities markets will impact the price of gold or the price of the Shares. Authorized Participants must be (1) a DTC Participant; (2) registered as a broker-dealer under the Exchange Act, and regulated by FINRA or some other self-regulatory organization or will be exempt from being or otherwise not be required to be so regulated or registered; and (3) qualified to act as a broker or dealer in the states or other jurisdictions where the nature of its business so requires. Each Authorized Participant will have its own set of rules and procedures, internal controls and information barriers as it determines is appropriate in light of its own regulatory regime.

Authorized Participants may act for their own accounts or as agents for broker-dealers, custodians and other securities market participants that wish to create or redeem Baskets. An order for one or more Baskets may be placed by an Authorized Participant on behalf of multiple clients. Persons interested in purchasing Baskets should contact the Sponsor or the Trustee to obtain the contact information for the Authorized Participants. Shareholders who are not Authorized Participants will only be able to redeem their Shares through an Authorized Participant.

8

Table of Contents

All gold bullion must be delivered to the Trust and distributed by the Trust in unallocated form through credits and debits between Authorized Participant Unallocated Accounts and the Trust Unallocated Account.

All gold bullion must be of at least a minimum fineness (or purity) of 995 parts per 1,000 (99.5%) and otherwise conform to the rules, regulations, practices and customs of the LBMA, including the specifications for a London Good Delivery Bar.

Under the Participant Agreement, the Sponsor has agreed to indemnify the Authorized Participants against certain liabilities, including liabilities under the Securities Act, and to contribute to the payments the Authorized Participants may be required to make in respect of those liabilities. The Trustee has agreed to reimburse the Authorized Participants, solely from and to the extent of the Trust’s assets, for indemnification and contribution amounts due from the Sponsor to the extent the Sponsor has not paid such amounts when due.

The following description of the procedures for the creation and redemption of Baskets is only a summary and investors should review the description of the procedures for the creation and redemption of Baskets set forth in the Trust Indenture, the form of Participant Agreement and the form of Participant Unallocated Bullion Account Agreement, each of which has been filed as an exhibit to this report.

Creation Procedures

On any business day, an Authorized Participant may place an order with the Trustee to create one or more Baskets. Purchase orders must be placed by 4:00 PM or the close of regular trading on NYSE Arca, whichever is earlier. The day on which the Trustee receives a valid purchase order is the purchase order date.

By placing a purchase order, an Authorized Participant agrees to deposit gold with the Trust, or a combination of gold and cash, as described below. Prior to the delivery of Baskets for a purchase order, the Authorized Participant must also have wired to the Trustee the non-refundable transaction fee due for the purchase order.

Determination of Required Deposits

The total deposit required to create each Basket, or a Creation Basket Deposit, is an amount of gold and cash, if any, that is in the same proportion to the total assets of the Trust (net of estimated accrued expenses and other liabilities) on the date the order to purchase is properly received as the number of Shares to be created under the purchase order is in proportion to the total number of Shares outstanding on the date the order is received.

Delivery of Required Deposits

An Authorized Participant who places a purchase order is responsible for crediting its Authorized Participant Unallocated Account with the required gold deposit amount by the end of the second business day in London following the purchase order date. The Custodian, after receiving appropriate instructions from the Authorized Participant and the Trustee, will transfer on the third business day following the purchase order date the gold deposit amount by debiting such amount from the Authorized Participant Unallocated Account and by crediting such amount to the Trust Unallocated Account and by delivery of the gold to the Trust Allocated Account. The expense and risk of delivery, ownership and safekeeping of gold until such gold has been received by the Trust will be borne solely by the Authorized Participant. If gold is to be delivered other than as described above, the Sponsor is authorized to establish such procedures and to appoint such custodians and establish such custody accounts as the Sponsor determines to be desirable.

Acting on standing instructions given by the Trustee, the Custodian will transfer the gold deposit amount from the Trust Unallocated Account to the Trust Allocated Account on the third business day following the purchase order date by allocating to the Trust Allocated Account specific bars of gold from unallocated bars which the Custodian holds or instructing a subcustodian to allocate specific bars of gold

9

Table of Contents

from unallocated bars held by or for the subcustodian. The gold bars in an allocated gold account are specific to that account and are identified by a list which shows, for each gold bar, the refiner, assay or fineness, serial number and gross and fine weight. Gold held in the Trust’s allocated account is the property of the Trust and is not traded, leased or loaned under any circumstances.

The Custodian will transfer the gold deposit amount from the Trust Unallocated Account to the Trust Allocated Account by 2:00 PM (London time) unless the Custodian is required to use a subcustodian in the allocation process, in which event the Custodian will use its best efforts to complete the transfer by 2:00 PM (London time). Upon Trustee’s receipt of confirmation from the Custodian that the gold deposit amount has been transferred from the Trust Unallocated Account to the Trust Allocated Account, the Trustee will direct DTC to credit the number of Baskets ordered by the Authorized Participant to the Authorized Participant’s DTC account. During the period of the transfer, all Shareholders will be exposed to the risks of unallocated gold to the extent of that gold deposit amount until the Custodian completes the allocation process.

Redemption Procedures

The procedures by which an Authorized Participant can redeem one or more Baskets mirror the procedures for the creation of Baskets. On any business day, an Authorized Participant may place an order with the Trustee to redeem one or more Baskets. Redemption orders must be placed by 4:00 PM or the close of regular trading on NYSE Arca, whichever is earlier. A redemption order so received is effective on the date it is received in satisfactory form by the Trustee.

Determination of Redemption Distribution

The redemption distribution from the Trust consists of a credit to the redeeming Authorized Participant’s Authorized Participant Unallocated Account representing the amount of the gold held by the Trust evidenced by the Shares being redeemed plus, or minus, the cash redemption amount. The cash redemption amount is equal to the value of all assets of the Trust other than gold less all estimated accrued expenses and other liabilities, divided by the number of Baskets outstanding and multiplied by the number of Baskets included in the Authorized Participant’s redemption order. The Sponsor anticipates that in the ordinary course of the Trust’s operations there will be no cash distributions made to Authorized Participants upon redemptions. Fractions of a fine ounce of gold included in the redemption distribution smaller than 0.001 of a fine ounce are disregarded. Redemption distributions are subject to the deduction of any applicable tax or other governmental charges which may be due.

Delivery of Redemption Distribution

The redemption distribution due from the Trust is delivered to the Authorized Participant on the third business day following the redemption order date if, by 9:00 AM New York time on such third business day, the Trustee’s DTC account has been credited with the Baskets to be redeemed. If the Trustee’s DTC account has not been credited with all of the Baskets to be redeemed by such time, the redemption distribution is delivered to the extent of whole Baskets received. Any remainder of the redemption distribution is delivered on the next business day to the extent of remaining whole Baskets received if the Trustee receives the fee applicable to the extension of the redemption distribution date which the Trustee may, from time to time, determine and the remaining Baskets to be redeemed are credited to the Trustee’s DTC account by 9:00 AM New York time on such next business day. Any further outstanding amount of the redemption order may be cancelled. The Trustee is also authorized to deliver the redemption distribution notwithstanding that the Baskets to be redeemed are not credited to the Trustee’s DTC account by 9:00 AM New York time on the third business day following the redemption order date if the Authorized Participant has collateralized its obligation to deliver the Baskets through DTC’s book entry system on such terms as the Sponsor and the Trustee may from time to time agree upon.

The Custodian transfers the redemption gold amount from the Trust Allocated Account to the Trust Unallocated Account and, thereafter, to the redeeming Authorized Participant’s Authorized Participant Unallocated Account. The Authorized Participant and the Trust are each at risk in respect of

10

Table of Contents

gold credited to their respective unallocated accounts in the event of the Custodian’s insolvency. See “Risk Factors—Gold held in the Trust’s unallocated gold account and any Authorized Participant’s unallocated gold account will not be segregated from the Custodian’s assets.”

Suspension or Rejection of Redemption Orders

The Trustee may, in its discretion, and will when directed by the Sponsor, suspend the right of redemption, or postpone the redemption settlement date for: (1) any period during which NYSE Arca is closed other than customary weekend or holiday closings, or trading on NYSE Arca is suspended or restricted; (2) any period during which an emergency exists as a result of which delivery, disposal or evaluation of gold is not reasonably practicable; or (3) such other period as the Sponsor determines to be necessary for the protection of the Shareholders.

The Trustee will reject a redemption order if (1) the order is not in proper form as described in the Participant Agreement; (2) the fulfillment of the order, in the opinion of its counsel, might be unlawful; (3) the order would have adverse tax consequences to the Trust or its Shareholders; or (4) circumstances outside the control of the Trustee, the Sponsor or the Custodian make the redemption, for all practical purposes, not feasible to process.

None of the Sponsor, the Trustee or the Custodian will be liable to any person or in any way for any loss or damages that may result from any such suspension, postponement or rejection.

Creation and Redemption Transaction Fee

An Authorized Participant is required to pay a transaction fee to the Trustee of $2,000 per order to create or redeem Baskets. An order may include multiple Baskets. The transaction fee may be changed by the Trustee with the consent of the Sponsor. The Trustee shall notify DTC of any agreement to change the transaction fee and will not implement any increase in the fee for the redemption of Baskets until 30 days after the date of the notice. A transaction fee may not exceed 0.10% of the value of a Basket at the time the creation and redemption order is accepted.

Tax Responsibility

Authorized Participants are responsible for any transfer tax, sales or use tax, recording tax, value added tax or similar tax or governmental charge applicable to the creation or redemption of Baskets, regardless of whether or not such tax or charge is imposed directly on the Authorized Participant, and agree to indemnify the Sponsor, the Trustee and the Trust if they are required by law to pay any such tax, together with any applicable penalties, additions to tax or interest thereon.

The Trustee sells gold as needed to pay the expenses of the Trust. As a result, the amount of gold sold will vary from time to time depending on the level of the Trust’s expenses and the market price of gold. Cash held by the Trustee does not bear any interest. The Trust’s estimated ordinary operating expenses are accrued daily and reflected in the NAV of the Trust.

Effective July 17, 2015, the Trust’s only recurring fixed expense is the Sponsor’s fee which accrues daily at an annual rate equal to 0.40% of the daily NAV, in exchange for the Sponsor assuming the responsibility to pay all ordinary fees and expenses of the Trust which include fees and expenses of the Trustee, the fees and expenses of the Custodian for the custody of the Trust’s gold bars, the fees and expenses of the Sponsor, certain taxes, the fees of the Marketing Agent, printing and mailing costs, legal and audit fees, registration fees, NYSE Arca listing fees and other marketing costs and expenses. The Sponsor was paid $20,324,038 for its services for the period from July 17, 2015 through September 30, 2015. The Sponsor was paid $127,076,728 for its services for the year ending September 30, 2016.

In addition, the following expenses may be accrued and paid by the Trust:

| • | Expenses and other charges of the Custodian payable by the Trustee on behalf of the Trust under the Allocated Bullion Account Agreement and the Unallocated Bullion Account Agreement |

11

Table of Contents

| (including (1) any relevant taxes, duties and governmental charges; and (2) the obligation to indemnify the Custodian) and, subject to the prior written approval of the Sponsor, (A) other expenses and charges for the custody, deposit or delivery of gold and services related to the custody and safekeeping of gold; and (B) expenses and charges charged by other custodians pursuant to a Custody Agreement; |

| • | Expenses of the Trustee for uncustomary and extraordinary out-of pocket expenses and fees of the Trustee for extraordinary services performed under the Trust Indenture; |

| • | Certain taxes and various other governmental charges; |

| • | Various taxes and governmental charges and any taxes, fees and charges payable by the Trustee with respect to the creation or redemption of Baskets; |

| • | Any taxes or other governmental charges imposed on the Sponsor in respect of the Trust, its assets, including gold, or the SPDR® Gold Shares; |

| • | Expenses and costs of any action taken by the Trustee or the Sponsor to protect the Trust and the rights and interests of Shareholders; |

| • | Amounts for indemnification of the Trustee or the Sponsor as permitted under the Trust Indenture; |

| • | Expenses incurred in contacting Shareholders exceeding an aggregate amount for any fiscal year of $500,000; |

| • | Amounts for reimbursement in respect of certain claims described under “Risk Factors—The Trust’s obligation to reimburse the Marketing Agent and the Authorized Participants for certain liabilities;” |

| • | The amount of any legal fees and expenses (including the costs of any litigation) of (i) the Sponsor and the Trust, (ii) the Custodian and (iii) the Trustee in excess of an aggregate amount for any fiscal year of $500,000; and |

| • | All other expenses of the Trust not otherwise assumed by the Sponsor under the Trust Indenture. |

Expenses Prior to July 17, 2015

Prior to July 17, 2015, the ordinary operating expenses of the Trust included: (1) fees paid to the Sponsor; (2) fees paid to the Trustee; (3) fees paid to the Custodian; (4) fees paid to the Marketing Agent and other marketing costs; and (5) various Trust administration fees, including printing and mailing costs, legal and audit fees, registration fees and listing fees.

Fees were paid to the Sponsor as compensation for services performed under the Trust Indenture and for services performed in connection with maintaining the Trust’s website and marketing the Shares. The Sponsor’s fee was payable monthly in arrears and accrued daily at an annual rate equal to 0.15% of the Adjusted Net Asset Value, or ANAV, of the Trust, subject to reduction as described below. The Sponsor received reimbursement from the Trust for all of its disbursements and expenses incurred in connection with the Trust. The Sponsor was paid $31,585,897 by the Trust for its services for the period from October 1, 2014 through July 16, 2015.

Fees were paid to the Trustee as compensation for services performed under the Trust Indenture. The Trustee’s fee was payable monthly in arrears and was accrued daily at an annual rate equal to 0.02% of the ANAV of the Trust, subject to a minimum fee of $500,000 and a maximum fee of $2,000,000 per year. The Trustee’s fee was subject to modification as determined by the Trustee and the Sponsor in good faith to account for significant changes in the Trust’s administration or the Trustee’s duties. The Trustee was entitled to reimbursement for expenses and disbursements incurred in connection with the Trust (including the expenses of the Custodian paid by the Trustee), exclusive of fees of agents for services to be performed by the Trustee, and for any extraordinary services performed by the Trustee for the Trust. The Trustee was paid $1,583,561 by the Trust for its services for the period from October 1, 2014 through July 16, 2015.

12

Table of Contents

Fees were paid to the Custodian as compensation for its custody services in connection with the Trust Allocated Account and the Trust Unallocated Account. Under the Allocated Bullion Account Agreement, as amended, or the Allocated Bullion Account Agreement, the Custodian’s fee was computed at an annual rate equal to 0.10% of the average daily aggregate value of the first 4.5 million ounces of gold held in the Trust Allocated Account and the Trust Unallocated Account and 0.06% of the average daily aggregate value of all gold held in the Trust Allocated Account and the Trust Unallocated Account in excess of 4.5 million ounces. The Custodian did not receive a fee under the Unallocated Bullion Account Agreement. The Custodian was paid $15,395,780 by the Trustee for its services for the period from October 1, 2014 through July 16, 2015.

Fees were paid to the Marketing Agent by the Trustee from the assets of the Trust as compensation for services performed pursuant to the Marketing Agent Agreement. The Marketing Agent’s fee was payable monthly in arrears and accrued daily at an annual rate equal to 0.15% of the ANAV of the Trust, subject to reduction as described below. The Marketing Agent was paid $31,585,897 by the Trustee for its services for the period from October 1, 2014 through July 16, 2015. Other marketing and shareholder communication costs in this period were $6,907,461.

Prior to July 17, 2015, if at the end of any month, the estimated ordinary expenses of the Trust exceeded for such month an amount equal to 0.40% per year of the daily ANAV of the Trust for such month, the Sponsor and the Marketing Agent would reduce the amount of such excess from the fees payable to them from the assets of the Trust for such month in equal shares up to the amount of their fees. For the period from October 1, 2014 through July 16, 2015, payables to the Sponsor and the Marketing Agent were reduced by $2,047,695, respectively. For the year ended September 30, 2014, the fees payable to the Sponsor and the Marketing Agent from the assets of the Trust were not reduced.

The administration fees of the Trust for the period from October 1, 2014 through July, 16, 2015 were $2,631,039. These fees included: (1) SEC registration fees and other regulatory fees of $793,528; (2) legal fees of $783,733; (3) audit and quarterly review fees of $436,557; (4) internal auditor fees in respect of Sarbanes-Oxley compliance of $258,874; (5) printing fees of $303,741; and (6) other costs of $54,606.

The Sponsor is a Delaware limited liability company formed on July 17, 2002. The Sponsor was responsible for establishing the Trust and for the registration of the Shares. The Sponsor generally oversees the performance of the Trustee and the Trust’s principal service providers, but does not exercise day-to-day oversight over the Trustee or such service providers. The Sponsor regularly communicates with the Trustee to monitor the overall performance of the Trust. The Sponsor may direct the Trustee, but only as provided in the Trust Indenture. The Sponsor, with assistance and support from the Trustee, is responsible for preparing and filing periodic reports on behalf of the Trust with the SEC and will provide any required certification for such reports. The Sponsor will designate the independent registered public accounting firm of the Trust and may from time to time employ legal counsel for the Trust. To assist the Sponsor in marketing the Shares, the Sponsor has entered into the Marketing Agent Agreement with the Marketing Agent and the Trust. See “The Marketing Agent” for more information about the Marketing Agent. The Sponsor maintains a public website on behalf of the Trust (www.spdrgoldshares.com), which contains information about the Trust and the Shares.

The Sponsor will not be liable to the Trustee or any Shareholder for any action taken or for refraining from taking any action in good faith, or for errors in judgment or for depreciation or loss incurred by reason of the sale of any gold or other assets of the Trust. However, the preceding liability exclusion will not protect the Sponsor against any liability resulting from its own gross negligence, bad faith, willful misconduct or willful malfeasance in the performance of its duties or the reckless disregard of its obligations and duties to the Trust.

The Sponsor and its shareholders, members, directors, officers, employees, affiliates and subsidiaries are indemnified from the Trust and held harmless against certain losses, liabilities or expenses incurred in the performance of its duties under the Trust Indenture without gross negligence, bad faith, willful misconduct, willful malfeasance or reckless disregard of the indemnified party’s obligations and duties

13

Table of Contents

under the Trust Indenture. Such indemnity includes payment from the Trust of the costs and expenses incurred in defending against any claim or liability under the Trust Indenture. Under the Trust Indenture, the Sponsor may be able to seek indemnification from the Trust for payments it makes in connection with the Sponsor’s activities under the Trust Indenture to the extent its conduct does not disqualify it from receiving such indemnification under the terms of the Trust Indenture. The Sponsor will also be indemnified from the Trust and held harmless against any loss, liability or expense arising under the Marketing Agent Agreement or any Participant Agreement insofar as such loss, liability or expense arises from any untrue statement or alleged untrue statement of a material fact contained in any written statement provided to the Sponsor by the Trustee. Any amounts payable to the Sponsor are secured by a lien on the Trust.

BNYM, a banking corporation organized under the laws of the State of New York with trust powers, serves as the Trustee. BNYM has a trust office at 2 Hanson Place, Brooklyn, New York 11217. BNYM is subject to supervision by the New York State Department of Financial Services and the Board of Governors of the Federal Reserve System. Information regarding creation and redemption Basket composition, NAV of the Trust, transaction fees and the names of the parties that have each executed a Participant Agreement may be obtained from BNYM. A copy of the Trust Indenture is filed as an exhibit to this report and is available at BNYM’s trust office identified above. Under the Trust Indenture, the Trustee is required to maintain capital, surplus and undivided profits of $500 million.

The Trustee is generally responsible for the day-to-day administration of the Trust, including keeping the Trust’s operational records. The Trustee’s principal responsibilities include: (1) selling the Trust’s gold as needed to pay the Trust’s expenses (gold sales occur monthly in the ordinary course); (2) calculating the NAV of the Trust and the NAV per Share; (3) receiving and processing orders from Authorized Participants to create and redeem Baskets and coordinating the processing of such orders with the Custodian and DTC; and (4) monitoring the Custodian. If the Trustee determines that maintaining gold with the Custodian is not in the best interest of the Trust, the Trustee must so advise the Sponsor, who may direct the Trustee to take certain actions in respect of the Custodian. In the absence of such instructions, the Trustee may initiate action to remove the gold from the Custodian. The ability of the Trustee to monitor the performance of the Custodian may be limited because under the Custody Agreements the Trustee may, only up to twice a year, visit the premises of the Custodian for the purpose of examining the Trust’s gold and certain related records maintained by the Custodian. Inspectorate International Limited conducts two counts each year of the gold bullion stock held on behalf of the Trust at the vaults of the Custodian. A complete bar count is conducted once per year and coincides with the Trust’s financial year end at September 30th. The second count is a random sample count and is conducted at a date which falls within the same financial year and was conducted most recently on March 14, 2016. The Trustee has no right to visit the premises of any subcustodian for the purposes of examining the Trust’s gold or any records maintained by the subcustodian, and no subcustodian is obligated to cooperate in any review the Trustee may wish to conduct of the facilities, procedures, records or creditworthiness of such subcustodian. The Trustee regularly communicates with the Sponsor to monitor the overall performance of the Trust. The Trustee, along with the Sponsor, liaises with the Trust’s legal, accounting and other professional service providers as needed. The Trustee assists and supports the Sponsor with the preparation of all periodic reports required to be filed with the SEC on behalf of the Trust.

Affiliates of the Trustee may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

State Street Global Markets, or SSGM, a wholly-owned subsidiary of State Street Corporation, acts as the Marketing Agent. The Marketing Agent is a registered broker-dealer with the SEC and is a member

14

Table of Contents

of FINRA, the Municipal Securities Rulemaking Board, the National Futures Association and the Boston Stock Exchange. The Marketing Agent’s office is located at State Street Financial Center, One Lincoln Street, Boston, Massachusetts 02111.

The Marketing Agent’s Role and the Marketing Agent Agreement

The Marketing Agent assists the Sponsor in: (1) developing a marketing plan for the Trust on an ongoing basis; (2) preparing marketing materials regarding the Shares, including the content of the Trust’s website; (3) executing the marketing plan for the Trust; (4) incorporating gold into its strategic and tactical exchange-traded fund research; (5) sublicensing the “SPDR®” trademark; and (6) assisting with certain shareholder services, such as a call center and prospectus fulfillment.

The Marketing Agent and its affiliates may from time to time become Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

The Sponsor and the Marketing Agent entered into an Amended and Restated Marketing Agent Agreement effective July 17, 2015 which contains customary representations, warranties and covenants. In addition, the Sponsor has agreed to indemnify the Marketing Agent from and against certain liabilities, including liabilities under the Securities Act and to contribute to payments that the Marketing Agent may be required to make in respect thereof. The Trustee has agreed to reimburse the Marketing Agent, solely from and to the extent of the Trust’s assets, for indemnification and contribution amounts due from the Sponsor in respect of such liabilities to the extent the Sponsor has not paid such amounts when due.

The Amended and Restated Marketing Agent Agreement will expire on July 17, 2022 and thereafter automatically renews for successive two year periods unless terminated in accordance with that agreement by either party twelve months prior to the end of the then-current term. If the Sponsor or Marketing Agent terminates that agreement for certain reasons specified in it, the Sponsor is required to pay the Marketing Agent the present market value of the future payments the Marketing Agent would otherwise receive under that agreement over the subsequent five year period.

License Agreement with the Marketing Agent

The Sponsor and the World Gold Council, or the WGC, entered into a license agreement, dated as of November 16, 2004, with the Marketing Agent. Under the license agreement, the Sponsor and the WGC granted the Marketing Agent a royalty-free, worldwide, non-exclusive, non-transferable: (1) sublicense under the license agreement among the Sponsor, the WGC and BNYM, to BNYM’s patents and patent applications that cover securitized gold products in connection with the Marketing Agent’s performance of its services under the Marketing Agent Agreement; and (2) a license to the Sponsor’s and the WGC’s patents, patent applications and intellectual property and trade name and trademark rights in connection with the Marketing Agent’s performance of its services under the Marketing Agent Agreement and for the purpose of establishing, operating and marketing financial products involving the securitization of gold.

The license agreement will expire upon the expiration or termination of the Marketing Agent Agreement. Either party may terminate the license agreement prior to such term if the other party materially breaches the license agreement and fails to cure such breach within 30 days following written notice of such breach from the non-breaching party. The license agreement contains customary representations, warranties and covenants. In addition, the Sponsor, the WGC and the Marketing Agent have agreed to indemnify each other for breaches of their respective representations and warranties and the Sponsor and the WGC have agreed to indemnify the Marketing Agent for violations of the intellectual property rights of others as a result of the Marketing Agent’s use of the licensed intellectual property.

SPDR Sublicense Agreement

“SPDR” is a trademark of SPDJI and has been licensed for use by the SPDR® Gold Trust pursuant to a SPDR Sublicense Agreement, dated May 20, 2008, between the Sponsor, the WGC, the Marketing

15

Table of Contents

Agent and State Street Corporation, pursuant to which the Marketing Agent and State Street Corporation granted the Sponsor and the WGC a royalty-free, worldwide, non-exclusive, non-transferable sublicense to use the “SPDR®” trademark (in accordance with the SPDR Trademark License Agreement dated as of November 29, 2006, as amended, between State Street Global Advisors, a division of State Street Bank and Trust Company, and S&P), for the purpose of establishing and operating the Trust, issuing and distributing the Shares, as part of the name of the Shares, and listing the Shares on exchanges.

The sublicense agreement will expire upon the expiration or termination of the earlier of (i) the Marketing Agent Agreement or (ii) the SPDR® Trademark License Agreement. Either party may terminate the sublicense agreement prior to such term if the other party materially breaches the license agreement and fails to cure such breach within 30 days following written notice of such breach from the non-breaching party. The sublicense agreement contains customary representations, warranties and covenants. In addition, the Sponsor, the WGC, the Marketing Agent and State Street Corporation have agreed to indemnify each other for breaches of their respective representations, warranties and covenants.

The Custodian is HSBC. HSBC’s London custodian office is located at 8 Canada Square, London, E14 5HQ, United Kingdom. HSBC’s London custodian operations are subject to supervision by the FCA. HSBC is authorized by the Prudential Regulation Authority and regulated by the Prudential Regulation Authority and the FCA in the U.K.

The global parent company of HSBC is HSBC Holdings plc, or HSBC Group, a public limited company incorporated in England. HSBC Group had $187 billion in regulatory capital resources according to HSBC Holdings plc’s Interim Report as of June 30, 2016.

The Custodian is responsible for safekeeping of the Trust gold deposited with it by Authorized Participants in connection with the creation of Baskets. The Custodian facilitates the transfer of gold in and out of the Trust through the unallocated gold accounts it maintains for each Authorized Participant and the unallocated and allocated gold accounts it maintains for the Trust. The Custodian is responsible for allocating specific bars of gold bullion to the Trust Allocated Account. The Custodian provides the Trustee with regular reports detailing the gold transfers in and out of the Trust Unallocated Account and the Trust Allocated Account and identifying the gold bars held in the Trust Allocated Account.

The Custodian and its affiliates may from time to time act as Authorized Participants or purchase or sell gold or Shares for their own account, as agent for their customers and for accounts over which they exercise investment discretion.

Custody of the gold bullion deposited with and held by the Trust is provided by the Custodian at its London, England vaults. The Custodian will hold all of the Trust’s gold in its own vault premises except when the gold has been allocated in the vault of a subcustodian, and in such cases the Custodian has agreed that it will use commercially reasonable efforts promptly to transport the gold from the subcustodian’s vault to the Custodian’s vault, at the Custodian’s cost and risk. The Custodian is a market maker, clearer and approved weigher under the rules of the LBMA.

The Custodian, as instructed by the Trustee, is authorized to accept, on behalf of the Trust, deposits of gold in unallocated form. Acting on standing instructions given by the Trustee, the Custodian allocates gold deposited in unallocated form with the Trust by selecting bars of gold bullion for deposit to the Trust Allocated Account from unallocated bars which the Custodian holds or by instructing a subcustodian to allocate bars from unallocated bars held by the subcustodian. All gold bullion allocated to the Trust must conform to the rules, regulations, practices and customs of the LBMA and the Custodian must replace any non-conforming gold bullion with conforming bullion as soon as practical.

16

Table of Contents

The Trustee and the Custodian have entered into the Custody Agreements which establish the Trust Unallocated Account and the Trust Allocated Account. The Trust Unallocated Account is used to facilitate the transfer of gold deposits and gold redemption distributions between Authorized Participants and the Trust in connection with the creation and redemption of Baskets and the sales of gold made by the Trustee for the Trust. Except when gold is transferred in and out of the Trust, all gold deposited with the Trust is held in the Trust Allocated Account.

The Custodian is authorized to appoint from time to time one or more subcustodians to hold the Trust’s gold until it can be transported to the Custodian’s vault. The subcustodians that the Custodian currently uses are the Bank of England, The Bank of Nova Scotia-ScotiaMocatta, ICBC Standard Bank London, JPMorgan Chase Bank and UBS AG. In accordance with LBMA practices and customs, the Custodian does not have written custody agreements with the subcustodians it selects. The Custodian’s selected subcustodians may appoint further subcustodians. These further subcustodians are not expected to have written custody agreements with the Custodian’s subcustodians that selected them. The lack of such written contracts could affect the recourse of the Trust and the Custodian against any subcustodian in the event a subcustodian does not use due care in the safekeeping of the Trust’s gold. See “Risk Factors—The ability of the Trustee and the Custodian to take legal action against subcustodians may be limited.”

The Custodian is required to use reasonable care in selecting subcustodians, but otherwise has limited responsibility in relation to the subcustodians appointed by it. The Custodian is obliged under the Allocated Bullion Account Agreement to use commercially reasonable efforts to obtain delivery of gold from those subcustodians appointed by it. However, the Custodian may not have the right to, and does not have the obligation to, seek recovery of the gold from any subcustodian appointed by a subcustodian. Otherwise, the Custodian does not undertake to monitor the performance by subcustodians of their custody functions or their selection of additional subcustodians and is not responsible for the actions or inactions of subcustodians. During the year ended September 30, 2016, the only time that gold was held by a subcustodian (the Bank of England) was during the period January through March 2016, and the greatest amount of gold held during such period was approximately 29 tonnes, or approximately 3.8% of the Trust’s gold. During the two years ended September 30, 2015 and 2014, respectively, the Custodian did not utilize any subcustodians on behalf of the Trust.

Under the customs and practices of the London bullion market, allocated gold is held by custodians and, on their behalf, by subcustodians under arrangements that permit each entity for which gold is being held: (1) to request from the entity’s custodian (and a custodian or subcustodian to request from its subcustodian) a list identifying each gold bar being held and the identity of the particular custodian or subcustodian holding the gold bar and (2) to request the entity’s custodian to release the entity’s gold within two business days following demand for release. Each custodian or subcustodian is obligated under the customs and practices of the London bullion market to provide the bar list and the identification of custodians and subcustodians referred to in (1) above, and each custodian is obligated to release gold as requested. Under English law, unless otherwise provided in any applicable custody agreement, a custodian generally is liable to its customer for failing to take reasonable care of the customer’s gold and for failing to release the customer’s gold upon demand. The Custodian will not be liable for the acts or omissions, or for the solvency, of any subcustodian that it selects unless the selection of that subcustodian was made negligently or in bad faith.