Filed Pursuant To Rule 433

Registration No. 333-180974

September 23, 2013

Gold: A Time-Tested Core Holding Presented by Robert Alderman Managing Director — Private Investment | September 2013 WORLD GOLD COUNCIL

Summary WORLD GOLD COUNCIL • Don’t Sell or Trade Your Hedge 1. No perfect foresight 2. Not rotatable 3. Hedge Asset — Cheaper Today 4. Foundation Asset which offers: a) Diversification b) Increased Liquidity c) Protection against several types of risk World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Summary WORLD GOLD COUNCIL • Don’t Sell or Trade Your Hedge • “April” Correction was Brutal and Fast (After a 12 Year Run) 1. Market reaction to a potential US recovery (along with Fed tapering), may be extreme 2. Futures experienced a short squeeze rally 3. ETF short interest continues to be at a high level; net long positions are relatively low (versus 2012) 4. Demand for physical gold is very high 5. Speculators have exited 3 World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Summary 4 •Don’t Sell or Trade Your Hedge •Correction was Brutal and Fast (After a 12 Year Run) •Long Term Fundamental Drivers are in Place 1.Demand a)EMs: Strong demographics, savings rates, cultural affinity, etc. b)Central Banks remain net buyers c)Consumption demand is expected to rise significantly over the 3 to 5 years d)Jewellery demand is recovering 2.Supply a)Mine supply will likely be cut if prices remain at low levels b)Recycled gold, (? 1/3 supply) is likely to contract as less jewellery and coins are sold World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Who is The World Gold Council? 5 •Founded by the world’s leading gold mining companies •Create and sustain demand for gold in major international markets •4 Primary Sectors: -Jewellery -Investments -Industry -Official Sector •Based in the UK, with operations in: -India -Japan -China -United States •GLD — Sponsor and SSgA Strategic Partner Members African Barrick Agnico-Eagle Mines Alamos Gold AngloGold Ashanti Barrick Gold Buenaventura Centerra Gold Eldorado Gold Goldcorp Golden Star Resources Gold Fields IAMGOLD Kinross Gold Newcrest Mining New Gold Newmont Mining Primero Mining Yamana Gold Associates Franco-Nevada China Gold Group The Hutti Gold Mines Company Mitsubishi Materials Corporation Royal Gold World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Agenda 6 Market Update Recent Activity in the Gold Market Gold Fundamentals Strategic Portfolio Asset versus “Hot Dot” Spotlight Gold’s Relationship with US Real Rates World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Market Update 2012: Gold Demand Rises to Record High Value 7 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 Global gold demand (value) and the gold price (US $/oz) US$BN Jewellery Technology Investments Official sector purchases London PM fix (US$ /oz, rhs)

Market Update Gold has experienced several pullbacks over the past decade 8 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 The gold price has previously fallen by more than 10% seven times since 2001 Note: Days shown on the chart are trading days and exclude weekends and holidays. Source: LBMA, Bloomberg, World Gold Council

Market Update What Has Driven the Latest Pullback in the Gold Price? 9 Macroeconomic Backdrop •Fed’s discussion of the possible reduction of asset purchases has led to a spike in 10 year yields of over 100 bps •Inflation expectations throughout the developed world have fallen during Q2 •Weakness in emerging markets, particularly India and China, has led some to question whether the fundamental story is in place Momentum •Weak sentiment exacerbated the move in the gold price •Momentum and margin related selling was partly responsible for the 10% drop between April 12th and April 15th •As a result, many tactical, non-core investors exited the market World Gold Council | Gold: A Time-Tested Core Holding | September 2013

10 From To Market Update How Did the Market React? World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Agenda 11 Gold Fundamentals Strategic Portfolio Asset vs. “Hot Dot” Market Update Recent Activity in the Gold Market Spotlight Gold’s Relationship with US Real Rates World Gold Council | Gold: A Time-Tested Core Holding | September 2013

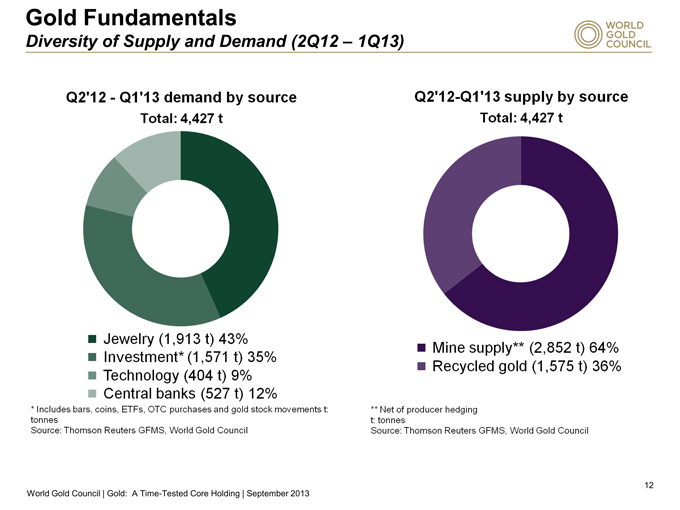

Gold Fundamentals Diversity of Supply and Demand (2Q12 – 1Q13) 12 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 Q2’12 – Q1’13 demand by source Total: 4,427 t Jewelry (1,913 t) 43% Investment* (1,571 t) 35% Technology (404 t) 9% Central banks (527 t) 12% *includes bars, coins, ETFs, OTC purchases and gold stock movements t: tones Source: Thomson Reuters GFMS, World Gold Council Mine supply** (2,852 t) 64% Recycled gold (1,575 t) 36% ** Net of producer hedging tones Source: Thomson Reuters GFMS, World Gold Council

13 Gold’s fundamental supply and demand story: Remains in Place 1.As current prices are close to the cost of extraction, mine exploration activities are likely to be scaled back 2.Supply coming from recycling is likely to decline due to price drop 3.New supply of gold will unlikely meet physical demand leading to the use of large wholesale bars — straining the supply chain 4.Investors could add the portfolio risk management and capital preservation benefits of gold at a lower price Gold Fundamentals Supply and Demand World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Gold Fundamentals Supply and Demand 14 1 Based on end-2012 volume and Q4 2012 average gold price of US$1,721.8/oz 2 Includes “other fabrication” (12%) and “unaccounted for” (2%) Note: Totals may not sum due to independent rounding. Source: Thomson Reuters GFMS, US Geological Survey, World Gold Council Total above ground stocks = 174,100 tonnes (US$9.6 trillion)1 2 0 .8 m 20.8m World Gold Council | Gold: A Time-Tested Core Holding | September 2013 Below ground stocks 52,000t Private Investment 34,700t 20% Official sector 30,100t 17% Jewellery 84, 600t 49% other2 24,800t 14% 20.8m

Gold Fundamentals Supply and Demand 15 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 Asian Markets -China and India represent more than half of total gold demand -Cultural affinity to gold coupled with economic development (2020 300 MM new middle class HHs) others 18% North America 9% Europe& Russia 15% Middle East 9% Indian subcontinent 25% Greater China 24%

Gold Fundamentals Supply and Demand 16 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 Central Banks -Strong net buyers lead by emerging countries -Trend is likely to continue Net official sector transactions* Source: Thomason Reuters GFMS, World Gold Council What is now a source of demand… used to be a source of supply

Gold as a Strategic Portfolio Asset The Case for Strategic Allocation to Gold 17 Portfolio Risk Management -“True” portfolio diversification 1.Lack of correlation to most other asset classes 2.Tail-risk hedging -Moderate volatility -Deep and liquid market -No credit or counterparty risk Capital Preservation -Inflation/deflation hedging -Currency hedging World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Gold as a Strategic Portfolio Asset Low Correlation Relative to Most Asset Classes in the Long-Run 18 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 TW dollar Commodities Global bonds EM equities Global equities Source: Bloomberg, J.P. Morgan, World Gold Council Q1 2013 2012 Past 25 years correlation

Gold as a Strategic Portfolio Asset Gold is Negatively Correlated in Tail Risk Events 19 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 Long-term weekly-return correlation between equities, gold and commodities to S&P 500 during extreme moves* All

Gold as a Strategic Portfolio Asset Liquidity: High-Quality Liquid Global Asset that Trades 24/7 20 02004006008001,0001,200US$/euroUS TreasuriesUS$/yenJapanese government bondsUS$/sterlingGoldEuro/yenUS AgenciesUK GiltsGerman BundsDow Jones (all stocks)US$ billionAverage daily volume in US dollars for variousassetsSource: German Finance Agency, Japanese MOF, SIFMA, CPM Group, UK DMO, LBMA, World Gold CouncilWorld Gold Council | Gold: A Time-Tested Core Holding | September 2013

Gold as a Strategic Portfolio Asset Optimal Allocation: Range Between 2% and 10% 21 Gold Holdings < 1% of Total Global Assets (Dec 2012) World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Gold as a Strategic Portfolio Asset Great Rotation: Gold Remains a Foundation Asset 22 Research by Mercer, JP Morgan, New Frontier Advisors and World Gold Council has shown that optimal gold allocations are positive regardless of allocation Higher allocations to equities call for higher strategic gold allocations World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Agenda 23 Market Update Recent Activity in the Gold Market Gold Fundamentals Strategic Portfolio Asset vs. “Hot Dot” Spotlight Gold’s Relationship with US Real Rates World Gold Council | Gold: A Time-Tested Core Holding | September 2013

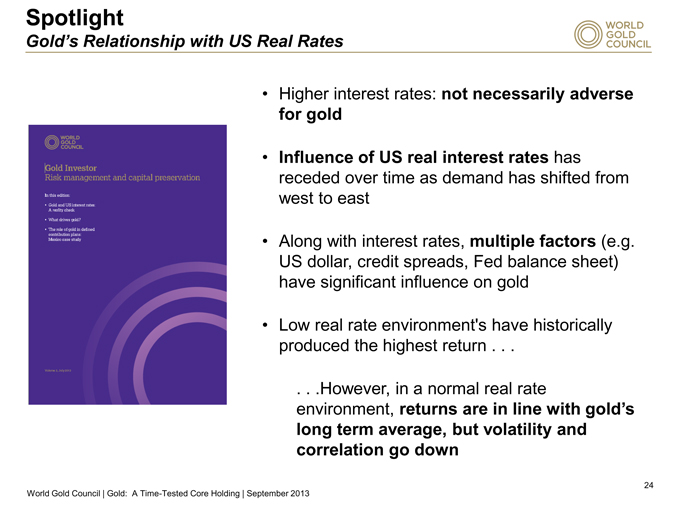

Spotlight Gold’s Relationship with US Real Rates 24 •Higher interest rates: not necessarily adverse for gold •Influence of US real interest rates has receded over time as demand has shifted from west to east •Along with interest rates, multiple factors (e.g. US dollar, credit spreads, Fed balance sheet) have significant influence on gold •Low real rate environment’s have historically produced the highest return . . . . . .However, in a normal real rate environment, returns are in line with gold’s long term average, but volatility and correlation go down World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Spotlight Influence of US Real Rates on Gold 25 World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Spotlight Real Interest Rates Are Not The Most Influential Factor 26 •Gold’s performance cannot be viewed against interest rates in isolation; could lead to false conclusions •The importance of real rates becomes less significant when other macro drivers are considered World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Two Flagship Publications: Gold Demand Trends and Gold Investor 27 World Gold Council | Gold: A Time-Tested Core Holding | September 2013

Accessing the Gold Market Options to Suit Needs and Preferences 28 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 1.Coins and bars ?Bullion vs. Numismatic 2.Gold accounts 3.Mining equities 4.Over-the-counter products 5.ETFs 6.Gold futures and options

Accessing the Gold Market World Gold Council research — simple to access 29 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 Ease of navigation, several views available Research app for investors — available on iPad/iPhone To download or subscribe to our gold investment research studies: www.gold.org/investment/research Or click on the link below: Or scan:

Disclaimer 30 World Gold Council | Gold: A Time-Tested Core Holding | September 2013 This presentation is provided solely for general information and educational purposes. It is not, and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, gold, any gold related products or any other products, securities or investments. It does not, and should not be construed as acting to, sponsor, advocate, endorse or promote gold, any gold related products or any other products, securities or investments. This presentation does not purport to make any recommendations or provide any investment or other advice with respect to the purchase, sale or other disposition of gold, any gold related products or any other products, securities or investments, including without limitation, any advice to the effect that any gold related transaction is appropriate for any investment objective or financial situation of a prospective investor. A decision to invest in gold, any gold related products or any other products, securities or investments should not be made in reliance on any of the statements in this presentation. Before making any investment decision, prospective investors should seek advice from their financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision. No part of this presentation may be copied, reproduced, republished, sold, distributed, transmitted, circulated, modified, displayed or otherwise used for any purpose whatsoever, including, without limitation, as a basis for preparing derivative works, without the prior written authorization of the World Gold Council. While the accuracy of any information communicated herewith has been checked, neither the World Gold Council nor any of its affiliates can guarantee such accuracy. In no event will the World Gold Council or any of its affiliates be liable for any decision made or action taken in reliance on the information in this presentation or for any consequential, special, punitive, incidental, indirect or similar damages arising from, related to or connected with this presentation even if notified of the possibility of such damages. Expressions of opinion are those of the author and are subject to change without notice. IBG-9730

World Gold Trust Services, LLC 510 Madison Avenue, 9th Floor New York, NY 10022, United States of America T +1 212 317 3800 F +1 212 688 0410 W www.gold.org Thank you

SPDR® GOLD TRUST has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any Authorized Participant will arrange to send you the prospectus if you request it by calling toll free at 1-866-320-4053 or contacting State Street Global Markets, LLC, One Lincoln Street, Attn: SPDR® Gold Shares, 30th Floor, Boston, MA 02111.