Confidential Draft of Form S-1

Exhibit 99.1

As filed with the Securities and Exchange Commission on

, 2012

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

iWatt Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| California (prior to reincorporation)

Delaware (after reincorporation) |

|

3674 |

|

77-0509865 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer Identification Number) |

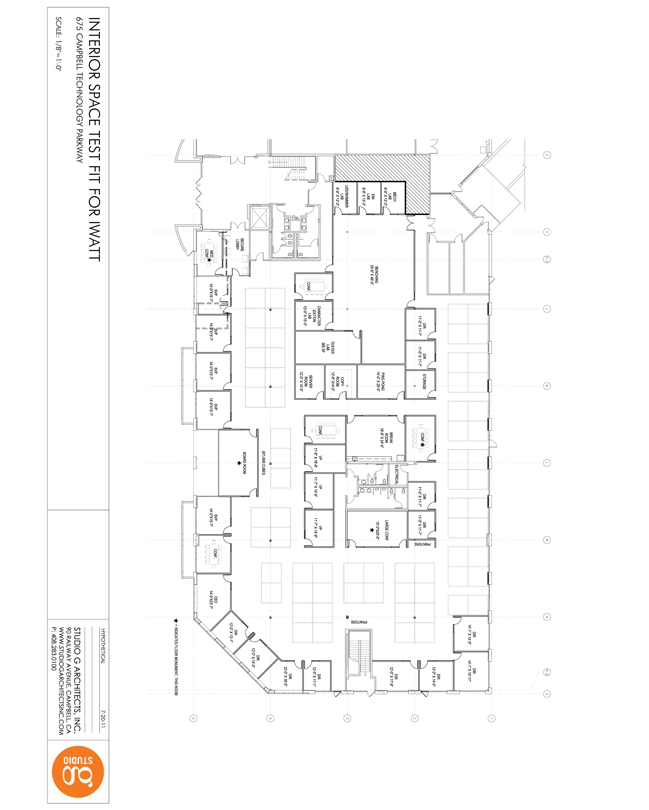

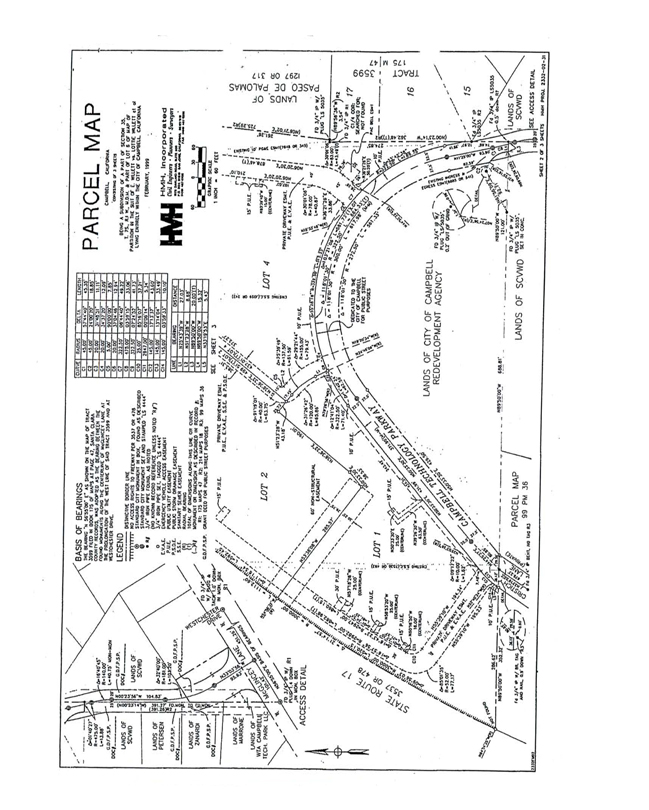

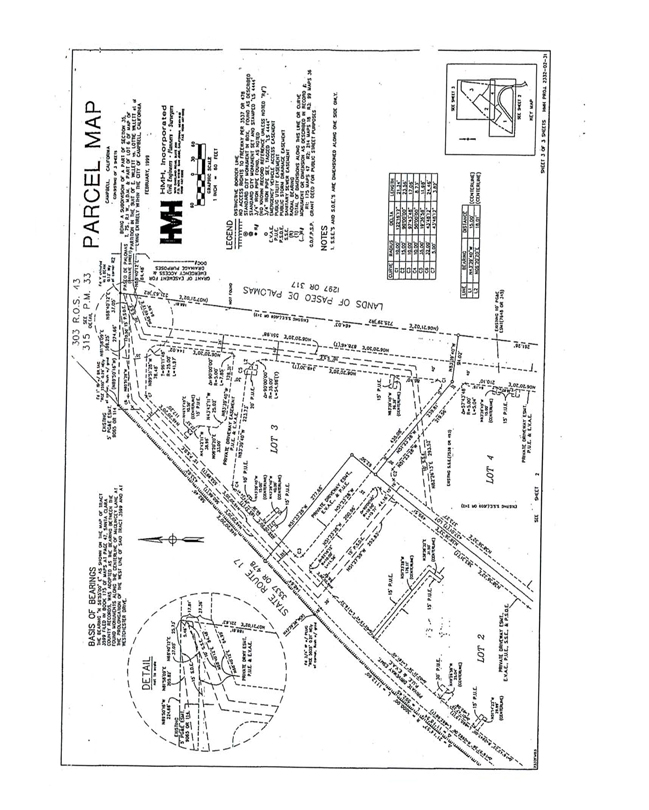

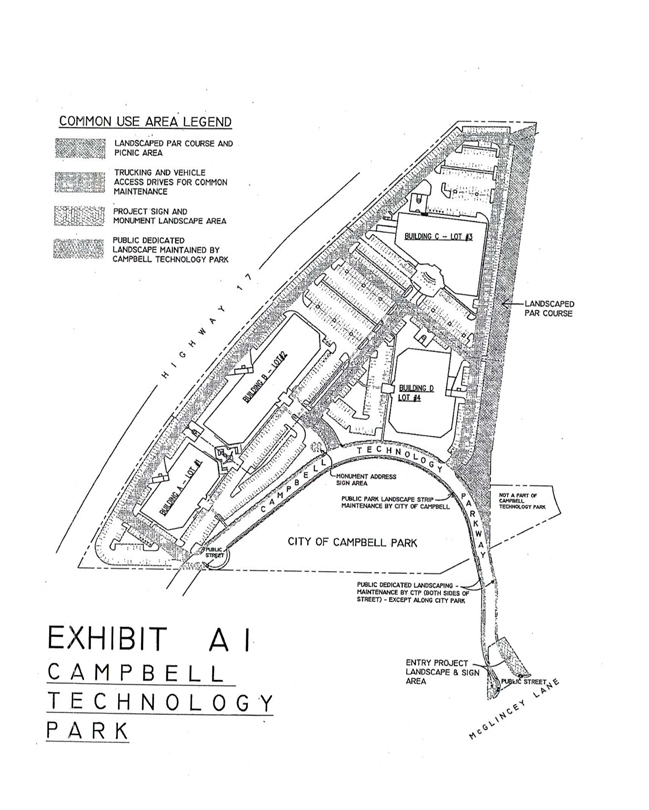

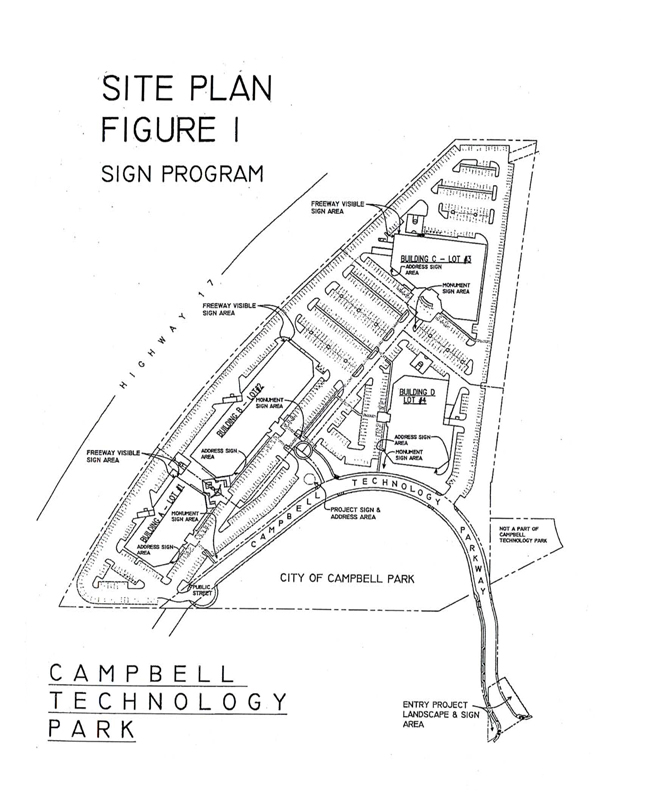

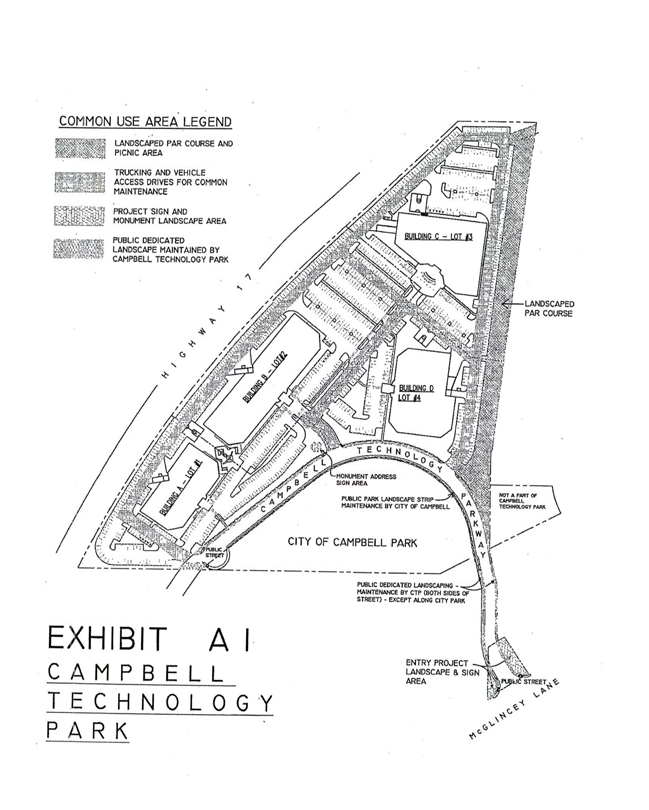

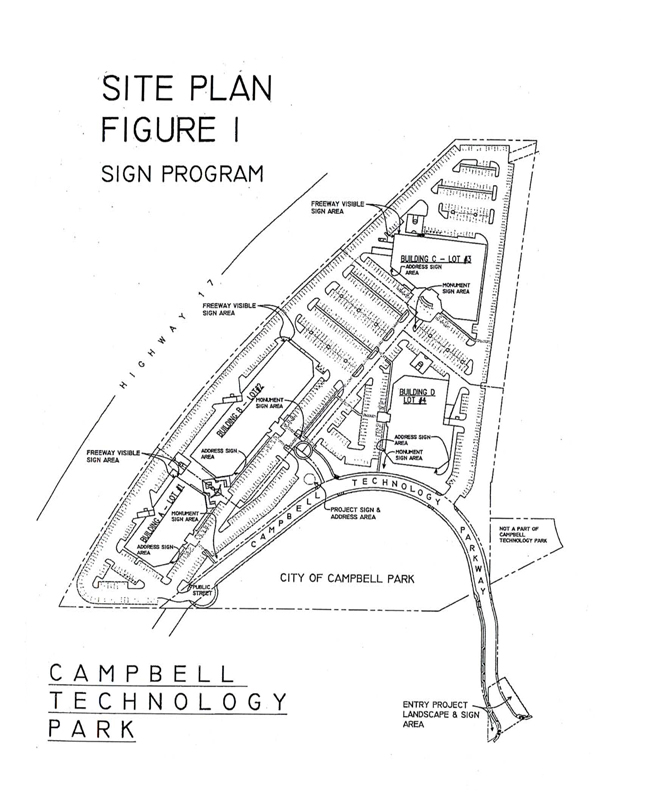

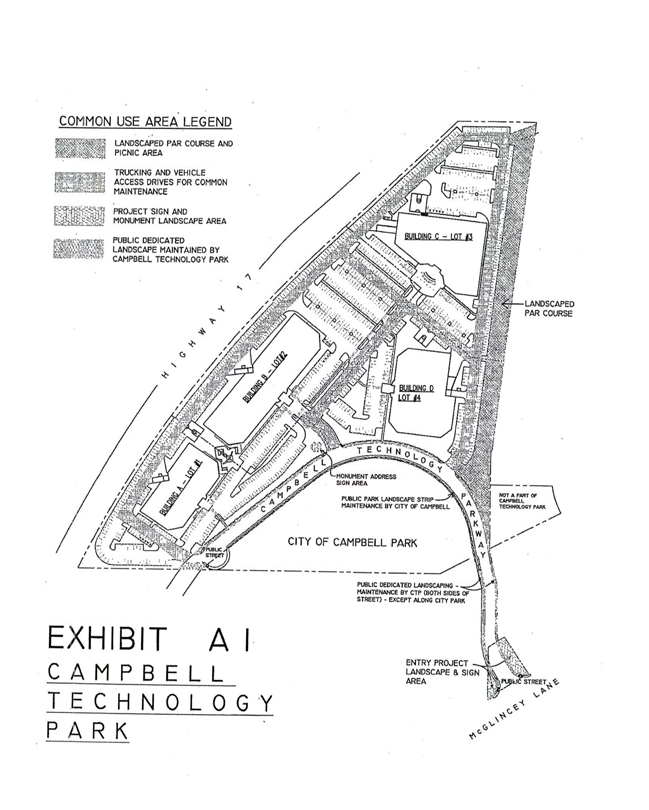

675 Campbell Technology Parkway, Suite 150

Campbell, California 95008

(408) 374-4200

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Ron Edgerton

President and Chief Executive Officer

675 Campbell Technology Parkway, Suite 150

Campbell, California 95008

(408) 374-4200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

| Steven E. Bochner Nathaniel P. Gallon Wilson Sonsini Goodrich & Rosati,

P.C. 650 Page Mill Road Palo Alto, California 94304-1050 (650) 493-9300 |

|

Jorge del Calvo Gabriella A. Lombardi Pillsbury Winthrop Shaw Pittman LLP

2475 Hanover Street Palo Alto, CA 94304-1114 (650) 233-4500 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this

Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous

basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

Indicate by check mark whether the registrant is

a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and smaller reporting company in Rule 12b-2 of

the Exchange Act (check one):

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

|

|

Accelerated |

|

¨ |

|

|

|

|

|

| Non-accelerated filer |

|

x |

|

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

| |

| Title of Securities Being Registered |

|

Proposed Maximum

Offering Price(1)(2) |

|

Amount of

Registration Fee |

| Common Stock, $0.0001 par value per share |

|

|

|

|

| |

| |

| (1) |

Includes shares of common stock issuable pursuant to an option granted to the underwriters to cover over-allotments, if

any. |

| (2) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall

become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling

stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling stockholders are

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated , 2012

PROSPECTUS

Shares

Common Stock

This is an initial public offering of shares of common stock of iWatt Inc. We are offering shares of our common stock to be sold in

the offering. The selling stockholders identified in this prospectus are offering an additional shares of our common stock. We will not receive any proceeds from the sale of

the shares by the selling stockholders. Prior to this offering, there has been no public market for our common stock. We have applied to list our common stock on The NASDAQ Global Market under the symbol “IWAT.”

It is currently estimated that the initial public offering price per share will be between

$ and $ .

Investing

in our common stock involves risks. See “Risk Factors” beginning on page 12 before you consider buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the accuracy or adequacy of this prospectus. Any recommendation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

| |

|

Per Share |

|

|

Total |

|

| Initial public offering price |

|

$ |

|

|

|

$ |

|

|

| Underwriting discounts and commissions |

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to iWatt |

|

$ |

|

|

|

$ |

|

|

| Proceeds, before expenses, to the selling stockholders |

|

$ |

|

|

|

$ |

|

|

To the extent that the underwriters sell more than

shares of common stock, the underwriters have the option to purchase up to an additional shares from

iWatt at the initial public offering price less the underwriting discount.

We are an emerging growth company as defined in

Section 2(a)(19) of the Securities Act of 1933 and Section 3(a)(80) of the Securities Exchange Act of 1934.

The

underwriters expect to deliver the shares of common stock to purchasers on , 2012.

|

|

|

|

|

| Deutsche Bank Securities |

|

|

|

Barclays |

|

|

|

|

|

| Canaccord Genuity |

|

Baird |

|

Needham & Company |

Prospectus dated

, 2012

TABLE OF CONTENTS

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information or to make any

representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial

condition, results of operations and prospects may have changed since that date.

Through and including,

, 2012 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not

participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: Neither we, the selling stockholders nor any of the underwriters have done anything that

would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions

relating to this offering and the distribution of this prospectus outside of the United States.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus. Because this is only a summary, it does not

contain all of the information you should consider before investing in our common stock. Before making an investment decision, you should carefully read the entire prospectus, especially the risks set forth under the heading “Risk Factors”

and our financial statements and related notes included elsewhere in this prospectus. References in this prospectus to “our company,” “we,” “us” and “our” refer to iWatt Inc. and its subsidiaries and

predecessors during the period presented unless the context requires otherwise.

Company Overview

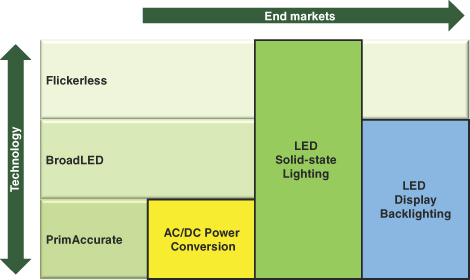

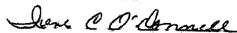

We are a leading provider of digital-centric power management integrated circuits or ICs. Our innovative PrimAccurate technology platform

enables high performance, efficient, small form factor and cost effective solutions for large and growing markets such as AC/DC power conversion, LED solid-state lighting, or LED SSL, and LED display backlighting. Our solutions are designed into the

products of leading global original equipment manufacturers, or OEMs. We have shipped more than one billion power management ICs since 2007, including more than 400 million ICs in 2011.

Our PrimAccurate technology platform enables real time performance optimization across a wide range of operating conditions and is

embedded in substantially all of our products. In the AC/DC power conversion market, our PrimAccurate technology platform enables small form factor, zero standby power, which is considered in the industry to be any standby power usage of 5

milliwatts or less, and cost effective adapters for mobile devices, including smartphones and tablets. We also leverage our PrimAccurate technology in the LED SSL market to provide small form factor and cost effective solutions for lighting

applications. Our solutions for the LED SSL market also incorporate our Flickerless technology and are compatible with a large installed base of lighting dimmers. Our solutions for the LED display backlighting market incorporate our BroadLED

technology, which reduces power consumption and heat generation in LED backlit displays. We intend to continue to leverage these technologies to move into additional low power markets and expand into adjacent end markets, including higher power

applications such as household appliances.

We have a history of technology innovation, as evidenced by 44 granted U.S.

patents and 26 U.S. and 26 foreign pending patent applications as of December 31, 2011. We design, develop and market our proprietary products and utilize third-party foundries and assembly and test subcontractors to manufacture, assemble, and

test our products. We grew our revenue from $18.6 million in 2009 to $50.4 million in 2011, representing a compounded annual growth rate, or CAGR, of 65%. We incurred a net loss of $(11.9) million in 2009 and generated net income of $0.2 million in

2011. We also incurred adjusted net loss of $(6.6) million in 2009 and generated adjusted net income of $2.6 million in 2011. Adjusted net income (loss) is a non-GAAP financial measure. A reconciliation of GAAP to non-GAAP financial information has

been provided in the section entitled “Summary Consolidated Financial Data.”

1

Market Opportunity

Large and growing end markets

The power management semiconductor

market was estimated to be $10.4 billion in 2011(1),

according to industry research firm Gartner. Within this market, we focus on the following large and high growth segments:

AC/DC power conversion. The mobile devices market represents one of the largest growth areas for AC/DC power conversion. According to Gartner, smartphones are projected to grow from

299 million units in 2010 to 1.2 billion units by

2015(2), representing a CAGR of 30%. In addition, Gartner projects tablets to grow from 18 million units in 2010 to 335

million units by 2015(3), representing a CAGR of 80%. Adapters for these devices consume

standby power when they are plugged into an outlet even if the device has been disconnected or is in a standby mode. The standby power drain from these power adapters accounts for approximately 10% of an average U.S. home’s annual power usage.

With the concern over the amount of energy wasted each year, the race to zero standby power has been one of the most important trends and a key focus area in the industry. There is an increasing need for efficient power solutions that have smaller

form factors and lower cost.

LED SSL. LED SSL adoption has increased due to regulatory mandates and

incentives and falling costs from improvements in technology and manufacturing yields. According to McKinsey, total LED SSL shipments are expected to grow from 272 million units in 2011 to 1.9 billion units in 2015, representing a CAGR of

approximately 63%. LED SSL has many advantages over competing light sources, including lower energy consumption, longer lifetime, higher quality of light, reduced form factor, and minimal environmental impact. Challenges associated with LED

adoption, such as flicker and compatibility with the installed base of existing fixtures and dimmers, demand high-performance solutions with smaller form factors.

LED display backlighting. Falling LED prices are also creating a significant opportunity in the LED

backlit LCD display market. According to McKinsey, LED TVs are expected to grow from 36 million units in 2010 to 248 million units by 2015, representing a CAGR of 47%. The most common method of LED backlighting is edge-lighting. As the cost of LEDs drop, manufacturers of LED TVs are

migrating to direct-lit and segment-edge-lit backlighting technologies that adjust the brightness of LEDs individually to improve the picture quality and reduce power consumption. However, these advanced backlighting technologies utilize hundreds,

or even thousands, of LEDs, driving the need for highly efficient driver ICs.

Environmental and regulatory catalysts

Worldwide demand for power is expected to grow over 20% from 2008 to 2020. Regulatory bodies such as the EPA, and the

International Energy Agency have launched a number of initiatives to encourage more efficient consumption of energy. Governments across the world are focused on improving energy efficiency by implementing policies and subsidies to accelerate the

transition to more efficient forms of lighting, including LEDs, by requiring the elimination of incandescent bulbs within specified timeframes.

Competitive solutions and their limitations

AC/DC power conversion. Several competitive solutions exist today to achieve this power conversion, but these solutions have limitations around technical issues, form factors and cost.

| (1) |

Gartner, Forecast: Semiconductor Consumption by Electronic Equipment Type, Worldwide, 2009–2016, 1Q12 Update, March 2012. |

| (2) |

Gartner, Forecast: Mobile Devices by Open Operating System, Worldwide, 2009–2016, 1Q12 Update, April 2012. |

| (3) |

Gartner, Forecast: Media Tablets by Operating System, Worldwide, 2010–2016, 1Q12 Update, March 2012. |

2

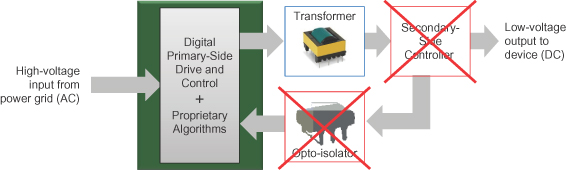

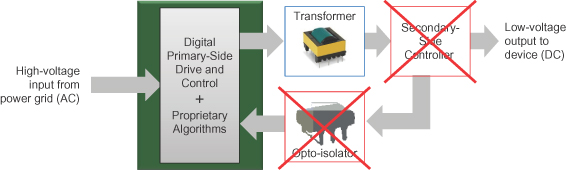

Traditional Analog Solutions. Traditional solutions use a purely analog approach

for power control that requires both a primary side driver and a secondary side controller. The secondary side monitors the output voltage and provides feedback to the primary side using optical signals through an opto-isolator. These solutions tend

to use a greater number of discrete components, leading to relatively high assembly costs, larger form factor and less reliability.

Analog and Digital Primary-side Solutions. Primary-side regulation eliminates the secondary side controller and opto-isolator, reducing the number of required components and overall system cost.

The output voltage and current is monitored and controlled from the primary side. However, these solutions often have less accurate output voltage and current regulation, resulting in slower charging times and increased power consumption.

Several competitive approaches offer a monolithic solution by integrating the output driver into the controller. While

monolithic solutions are easier to integrate, they often have larger form factors. The drive strength of the integrated driver is also typically application-specific, making the monolithic solutions less scalable. While these output drivers are very

simple to manufacture, integrating them into the controller subjects them to the increased complexity of manufacturing the controller, thereby increasing the overall cost of the solution.

LED SSL. Form factor constraints of existing LED driver modules sometimes make it difficult to fit them into replacement

bulbs. Available primary-side analog and digital solutions, while helping with bill of material costs, generally provide less accurate voltage and current outputs. Improving light quality and achieving compatibility with installed dimmers are key to

widespread LED SSL adoption but many competitive solutions lack such capabilities.

LED display backlighting.

Edge-lit solutions keep the LEDs illuminated at all times, resulting in increased power consumption. Direct-lit and segment-edge-lit solutions enable local dimming by controlling LEDs individually, which improves picture quality. These

advanced technologies require hundreds of LEDs configured in dozens of strings that are independently driven. Typical drivers that exist today can only handle eight to sixteen LED strings per IC, resulting in a large number of driver ICs per

display. Also, tolerances in the manufacture of LEDs lead to voltage variations in the strings, causing a significant amount of power to be wasted within the display, increasing heat generation and incidences of thermal stress-related LED failures.

Our Solutions

Our proprietary PrimAccurate technology platform provides highly integrated ICs that are efficient and performance optimized. Our platform approach enables significant reuse of our core intellectual

property across the three markets that we currently serve:

AC/DC power conversion. The higher levels of

integration in our designs eliminate components, leading to smaller form factor, lower production cost and improved reliability. Dynamic adaptive control inherent in our PrimAccurate technology improves performance by adjusting the internal

parameters in response to varying input, output and temperature conditions, thereby reducing overall power consumption and heat generation. In addition, dynamic control significantly reduces standby power consumption. Digital primary feedback in our

solutions also enables accurate control of the output voltage and current, resulting in faster charging of devices and reduced power consumption.

Our proprietary digital algorithms enable dynamic control of the switching of the output drive transistor, reducing the electromagnetic interference, or EMI, that is generated and lowering the associated

EMI filtering cost. Our digital designs enable testing under real world conditions using field programmable gate arrays, or FPGAs, before manufacture of the power management ICs, significantly reducing design errors.

3

Our PrimAccurate technology platform is scalable across applications with different

power requirements through the use of combinations of external components with our digital controller. For example, we are able to leverage a single design for five different products across all of our end markets by having it packaged together with

a different external driver for each application. Our products for this market include AC/DC digital controllers for up to 50 watt applications.

LED SSL. In addition to PrimAccurate technology, our LED SSL driver solutions incorporate our Flickerless technology, which helps eliminate flicker while maintaining compatibility with a

wide range of existing dimming technology. Our solutions eliminate components such as the opto-isolator, leading to smaller form factor, improved lifetime and reliability, and are easily retrofittable across existing light fixtures. Our digital LED

driver IC incorporating both PrimAccurate and Flickerless technologies was named a “Hot 100 Product of 2011” in the optoelectronics category by EDN magazine. Our products for the LED SSL market include drivers for a range of dimmable and

non-dimmable applications up to 40 watts, which is equivalent in brightness to a 200W incandescent bulb.

LED display

backlighting. Our solutions for the LED display backlighting market incorporate our BroadLED technology, which reduces power consumption and heat generation in LED displays. Our solutions utilize digital power control algorithms combined

with advanced mixed-signal technology to support 16, 32 or 64 parallel LED strings from a single driver IC and enable local dimming of the display by allowing independent control of LEDs. Our BroadLED technology also efficiently matches voltage

variations across parallel LED strings, reducing heat generation and thermal failures, and enabling control of a greater number of LED strings per driver IC.

Our Strategy

Our goal is to be the leader in innovative power management

ICs. Key elements of our strategy include:

| |

• |

|

Extend our technology advantage. We intend to continue to invest in the research and development of efficient power control solutions

designed to meet increasingly higher performance requirements as well as lower cost and lower power demands of our customers. We believe our proven technical ability will continue to foster innovation and extend our technology leadership as we

further penetrate our existing markets and develop solutions for additional target markets. |

| |

• |

|

Continue developing new, differentiated products to increase adoption in our current markets. We intend to continue leveraging our

technology platform to offer highly differentiated products. We believe these product enhancements increase adoption, resulting in additional growth opportunities. For example, we intend to develop products for the AC/DC power conversion market that

support multiple outputs and higher output power applications. In the LED SSL market, we intend to facilitate the integration of wireless controller and color controller functions directly into LED lamps to reduce overall energy costs and enhance

user experience. |

| |

• |

|

Target new applications requiring high-power, high-efficiency solutions. We intend to leverage our technical expertise and proprietary

design capabilities to enter additional markets. We intend to target adjacent markets that typically require higher power, multi-output solutions such as household appliances. |

| |

• |

|

Expand our global sales and marketing and distribution efforts. We intend to continue to expand our sales, design and technical support

organization. We also expect to increase the number of field applications engineers in Asia to provide local support to our customers. In addition to improving our sales capacity, we intend to leverage our channel partners to generate continued

demand for our products. |

4

| |

• |

|

Deepen key relationships with blue-chip OEM customers. We have established strong relationships with leading global OEMs. The close

relationships we have with our customers and our understanding of their requirements have helped us to define our products. In addition to continuing to build and strengthen our relationships with existing customers, we intend to focus our efforts

on diversifying our customer base by capturing new strategic accounts that currently do not use our solutions. |

Risk

Related to Our Business

Investing in our common stock involves substantial risks, including, but not limited to, the

following:

| |

• |

|

Dependence on a Limited Number of Customers. We depend on a limited number of customers for a substantial portion of our revenue. For

example, sales to one of our distributors accounted for 54%, 61% and 54% of our total revenue, and sales to one of our original design manufacturers accounted for an additional 16%, 15% and 12% of our total revenue, each for the years ended

December 31, 2009, 2010 and 2011, respectively. |

| |

• |

|

Lack of Long-Term Purchase Commitments. Substantially all of our sales are made on a purchase order basis, and we do not have

long-term purchase commitments with any of our customers. The loss of, or reduction in sales to, a key customer would materially and adversely affect us. |

| |

• |

|

Substantial Customer Negotiating Leverage. Many of our customers have substantial purchasing power and leverage in negotiating

contractual arrangements with us. These customers have and may continue to seek advantageous pricing and other commercial terms and may require us to develop additional features in the products we sell to them. |

| |

• |

|

Intense Competition. We expect competition to increase and intensify as additional and larger semiconductor companies enter our

markets and as our current competitors continue to develop new technologies and bring new products to these markets. Increased competition could materially and adversely affect our business, revenue and operating results.

|

| |

• |

|

Growth and Development of Target Markets. To date, we have generated a substantial amount of our revenue from the AC/DC power

conversion market. In addition, we are devoting significant resources to our solutions for the LED SSL and LED display backlighting markets. The growth of these markets depends on the continued growth of the corresponding consumer end markets. We

cannot be sure that they will continue to grow at the rates that we forecast, if at all. |

| |

• |

|

Lengthy Sales Cycle. We must participate in and win competitive bid processes, commonly known as “design wins,” to sell our

ICs. The design win process is lengthy, and we may not secure the design win or generate any revenue despite incurring significant expenditures. Even after securing a design win, we may experience delays in generating revenue or may never generate

revenue from that design win. |

| |

• |

|

Reliance on Third Parties for Manufacturing and Testing and Assembly. We rely on a limited number of third parties to manufacture,

assemble and test our products. The failure to manage our relationships with these third-party contractors and ensure timely delivery of quality products could adversely affect our business, financial condition and results of operations.

|

| |

• |

|

History of Losses and Accumulated Deficit. As of December 31, 2011, we had an accumulated deficit of $85.0 million and have

incurred net losses in each year from our inception through 2009, and we may incur net losses in the future. |

5

Before you invest in our common stock, you should carefully consider all the

information in this prospectus including matters set forth under the heading “Risk Factors.”

We are an emerging

growth company as defined in Section 2(a)(19) of the Securities Act and Section 3(a)(80) of the Exchange Act. Pursuant to Section 102 of the Jumpstart Our Business Startups Act, or JOBS Act, we have omitted selected consolidated

financial data for any period prior to 2009, have provided reduced executive compensation disclosure and have omitted a compensation discussion and analysis from this prospectus. We intend to file our initial confidential submission and all

amendments thereto as exhibits to the registration statement at such time as we make our first public filing.

Corporate Information

We were incorporated in the State of California in March 1999. Prior to completion of this offering, we will

reincorporate in the State of Delaware. Our principal executive offices are located at 675 Campbell Technology Parkway, Suite 150, Campbell, California 95008. Our telephone number at that location is (408) 374-4200. Our website address is

www.iwatt.com. Information on our website is not part of this prospectus and should not be relied upon in determining whether to make an investment decision.

“iWatt”, “PrimAccurate”, “Flickerless” and “BroadLED” and other trademarks or service marks of iWatt appearing in this prospectus are the property of iWatt Inc.

Other service marks, trademarks and trade names referred to in this prospectus are the property of their respective owners.

6

THE OFFERING

| Common stock offered by us |

shares |

| Common stock offered by selling stockholders |

shares |

| Common stock to be outstanding immediately after this offering |

shares ( if the underwriters exercise their

over-allotment in full) |

| Over-allotment option |

shares |

| Use of proceeds |

We intend to use the net proceeds from this offering for general corporate purposes, including working capital, sales and marketing activities, general and administrative matters and capital

expenditures. In addition, we may use a portion of the proceeds from this offering for acquisitions of complementary businesses, technologies or other assets. We will not receive any of the proceeds from the sale of shares to be offered by selling

stockholders. See “Use of Proceeds.” |

| Risk factors |

See “Risk Factors” beginning on page 12 and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest

in our common stock. |

| Proposed NASDAQ Global Market symbol |

IWAT |

The number of shares of common stock to be

outstanding immediately after this offering is based on 176,347,102 shares outstanding as of December 31, 2011, and excludes:

| |

• |

|

44,591,429 shares of common stock issuable upon the exercise of options outstanding under our 2000 Stock Plan and 2010 Equity Incentive Plan as of

December 31, 2011, at a weighted average exercise price of $0.17 per share; |

| |

• |

|

21,442,167 shares of common stock issuable upon the exercise of warrants outstanding as of December 31, 2011, at a weighted average exercise price

of $0.32 per share, which consists of: |

| |

• |

|

19,453,455 shares of common stock issuable upon the automatic exercise of warrants immediately prior to the completion of this offering unless

exercised prior to such time; and |

| |

• |

|

1,988,712 shares of common stock issuable upon the exercise of warrants that will remain outstanding following completion of this offering; and

|

| |

• |

|

8,847,215 shares of common stock reserved for future issuance under our 2010 Equity Incentive Plan. |

7

Unless otherwise stated, all information in this prospectus (other than historical

financial statements) is as of December 31, 2011 and assumes:

| |

• |

|

the automatic conversion of all outstanding shares of our preferred stock into an aggregate of 172,281,546 shares of our common stock;

|

| |

• |

|

no exercise of options or warrants outstanding as of December 31, 2011; |

| |

• |

|

no exercise of the underwriters’ over-allotment option; and |

| |

• |

|

our reincorporation in Delaware in connection with this offering. |

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial information. The information set forth below should be read together with

“Capitalization,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes,

included elsewhere in this prospectus.

The summary statements of operations data for the years ended December 31, 2009,

2010 and 2011 and the consolidated balance sheet data as of December 31, 2011 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the

results to be expected in the future.

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

| |

|

2009 |

|

|

2010 |

|

|

2011 |

|

| |

|

(in thousands, except share and

per share data) |

|

| Consolidated Statements of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

18,621 |

|

|

$ |

30,723 |

|

|

$ |

50,427 |

|

| Cost of goods sold(1) |

|

|

10,919 |

|

|

|

17,646 |

|

|

|

27,569 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

7,702 |

|

|

|

13,077 |

|

|

|

22,858 |

|

| Operating expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development(1) |

|

|

8,318 |

|

|

|

8,883 |

|

|

|

9,566 |

|

| Sales and marketing(1) |

|

|

3,704 |

|

|

|

4,855 |

|

|

|

7,564 |

|

| General and administrative(1) |

|

|

2,615 |

|

|

|

2,256 |

|

|

|

3,622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expense |

|

|

14,637 |

|

|

|

15,994 |

|

|

|

20,752 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from operations |

|

|

(6,935 |

) |

|

|

(2,917 |

) |

|

|

2,106 |

|

| Other expense |

|

|

(4,679 |

) |

|

|

(602 |

) |

|

|

(3,368 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before income taxes |

|

|

(11,614 |

) |

|

|

(3,519 |

) |

|

|

(1,262 |

) |

| Provision (benefit) for income taxes |

|

|

75 |

|

|

|

(44 |

) |

|

|

153 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss from continuing operations |

|

|

(11,689 |

) |

|

|

(3,475 |

) |

|

|

(1,415 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from discontinued operations and gain on sale of discontinued operations, net of income taxes (Note 3 to Notes to

Consolidated Financial Statements) |

|

|

(238 |

) |

|

|

3,778 |

|

|

|

1,601 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(11,927 |

) |

|

$ |

303 |

|

|

$ |

186 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per common share – basic and diluted |

|

$ |

(3.59 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares used in computing net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

|

3,322,187 |

|

|

|

3,565,019 |

|

|

|

3,789,373 |

|

|

|

|

|

| Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income (loss)(2) |

|

$ |

(6,580 |

) |

|

$ |

(2,404 |

) |

|

$ |

2,620 |

|

9

| (1) |

Stock-based compensation expense is included in our results of operations as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

| |

|

2009

|

|

|

2010

|

|

|

2011

|

|

| |

|

(in thousands) |

|

| Cost of goods sold |

|

$ |

24 |

|

|

$ |

44 |

|

|

$ |

72 |

|

| Research and development |

|

|

165 |

|

|

|

158 |

|

|

|

155 |

|

| Sales and marketing |

|

|

73 |

|

|

|

116 |

|

|

|

197 |

|

| General and administrative |

|

|

295 |

|

|

|

294 |

|

|

|

339 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

557 |

|

|

$ |

612 |

|

|

$ |

763 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) |

Adjusted net income (loss) is a non-GAAP financial measure. We disclose adjusted net income (loss) in this prospectus to provide investors with additional information

about our financial results. We have included adjusted net income (loss) in this prospectus because it is a key measure we use to evaluate our operating performance, generate future operating plans and make strategic decisions for the allocation of

capital. Accordingly, we believe that adjusted net income (loss) provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors. While we believe

that this non-GAAP financial measure is useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared in accordance with GAAP. The

following table presents a reconciliation of adjusted net income (loss) to net income (loss) for each of the periods indicated: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

| |

|

2009 |

|

|

2010 |

|

|

2011 |

|

| |

|

(in thousands) |

|

| Reconciliation of Adjusted Net Income (Loss) to Net Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(11,927 |

) |

|

$ |

303 |

|

|

$ |

186 |

|

| Loss from discontinued operations and gain on sale of discontinued operations, net of income taxes |

|

|

238 |

|

|

|

(3,778 |

) |

|

|

(1,601 |

) |

| Change in fair value of convertible preferred stock warrant liability |

|

|

2,788 |

|

|

|

190 |

|

|

|

3,145 |

|

| Amortization of debt discount and intangibles |

|

|

1,764 |

|

|

|

269 |

|

|

|

127 |

|

| Stock-based compensation |

|

|

557 |

|

|

|

612 |

|

|

|

763 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income (loss) |

|

$ |

(6,580 |

) |

|

$ |

(2,404 |

) |

|

$ |

2,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This non-GAAP financial measure should not be considered as a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP. Adjusted net income (loss) may be of limited value because it excludes charges that have a material impact on our reported financial results. In addition, other companies, including companies

in our industry, may calculate adjusted net income (loss) differently or not at all, which reduces its usefulness as a comparative measure. Therefore, adjusted net income (loss) should not be relied on as the sole financial measure to evaluate our

business. This non-GAAP financial measure is meant to supplement, and be viewed in conjunction with, our GAAP financial measures. We compensate for the material limitations of this non-GAAP financial measure by evaluating it in conjunction with our

GAAP financial measures.

10

Our consolidated balance sheet as of December 31, 2011 is presented on:

| |

• |

|

a pro forma basis, giving effect to (1) the automatic conversion of all outstanding shares of our convertible preferred stock into 172,281,546 shares

of common stock, (2) the conversion of all of our outstanding warrants to purchase preferred stock into warrants to purchase 21,442,167 shares of our common stock and (3) the effectiveness of our amended and restated certificate of incorporation

immediately prior to the completion of this offering, as if such conversion had occurred and our amended and restated certificate of incorporation had become effective on December 31, 2011; and |

| |

• |

|

a pro forma as adjusted basis, giving effect to the pro forma adjustments and the sale of

shares of common stock by us in this offering, based on an assumed initial public offering price of

$ per share, the midpoint of the range reflected on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated

offering expenses payable by us. |

The pro forma as adjusted information set forth in the table below is

illustrative only and will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing.

Consolidated Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, 2011 |

|

| |

|

Actual |

|

|

Pro Forma |

|

|

Pro Forma As

Adjusted(1) |

|

| |

|

(in thousands) |

|

| Cash and cash equivalents |

|

$ |

3,043 |

|

|

$ |

3,043 |

|

|

$ |

|

|

| Net working capital(2) |

|

|

4,612 |

|

|

|

4,612 |

|

|

|

|

|

| Total assets |

|

|

16,065 |

|

|

|

16,065 |

|

|

|

|

|

| Total debt, including current portion |

|

|

410 |

|

|

|

410 |

|

|

|

|

|

| Convertible preferred stock warrant liability |

|

|

8,500 |

|

|

|

— |

|

|

|

|

|

| Convertible preferred stock |

|

|

80,553 |

|

|

|

— |

|

|

|

|

|

| Total stockholders’ equity (deficit) |

|

|

(1,373 |

) |

|

|

7,127 |

|

|

|

|

|

| (1) |

Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the

midpoint of the price range reflected on the cover page of this prospectus, would increase (decrease) our cash and cash equivalents, net working capital, total assets, and total stockholders’ equity (deficit) by approximately

$ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting

discounts and commissions and estimated offering expenses payable by us. |

| (2) |

“Net Working Capital” is defined as current assets less current liabilities. |

11

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below before making a

decision to buy our common stock. The risks and uncertainties described below are not the only ones we face. If any of the following risks actually occurs, our business, financial condition, results of operations or prospects could be harmed. In

that case, the trading price of our common stock could decline and you might lose all or part of your investment in our common stock. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also impair

our business operations. You should also refer to the other information set forth in this prospectus, including our financial statements and the related notes.

Risks Related to Our Business

We depend on a limited number of customers for a

substantial portion of our revenue. The loss of, or a significant reduction in orders from, one or more of our major customers could negatively impact our revenue and operating results.

We derive a significant portion of our revenue from a limited number of distributors, original equipment manufacturers or OEMs and

original design manufacturers or ODMs. Sales to Cytech, one of our distributors, accounted for 54%, 61%, and 54% of our total revenue for the years ended December 31, 2009, 2010 and 2011, respectively, and Frontek Technology Corporation,

another distributor, accounted for an additional 12% of our total revenue for the year ended December 31, 2010. Sales to Haem, an ODM, accounted for an additional 16%, 15%, and 12% of our total revenue for the years ended December 31,

2009, 2010 and 2011, respectively. We anticipate that sales to a limited number of ODMs, OEMs and distributors will continue to account for a significant percentage of our total revenue for the foreseeable future. Our customer concentration may

cause our financial performance to fluctuate significantly from period to period based on the device release cycles and seasonal sales patterns of these ODMs, OEMs and the success of their products. The three end markets in which we currently sell

our IC products are prone to significant and unpredictable changes in demand, and our product sales are directly affected by the ability of our concentrated customer base to sell their products or electronic systems that incorporate our products. If

our OEM customers’ products are not commercially successful or if the development or commercial introduction of such products is delayed or fails to occur as planned or forecasted, or if our OEM customers or distributors do not consistently

manage their inventory of products we sell to them, our revenue and operating results will be negatively impacted. The loss of or any significant decline in total revenue from any OEM, ODM or distributor could have an adverse effect on our financial

condition and results of operations.

We do not have long-term purchase commitments from our customers. If our customers cancel or

change their purchase commitments, our revenue and operating results could suffer.

Substantially all of our sales to

date have been made on a purchase order basis. We do not have any long-term commitments with any of our significant customers. As a result, our significant customers may cancel, change or delay product purchase commitments with little or no notice

to us and without penalty. This in turn could cause our revenue to decline and materially and adversely affect our results of operations.

Our large customers have substantial negotiating leverage, which may require that we agree to terms and conditions that result in increased cost of

sales, decreased revenue and lower average selling prices and gross margins, all of which would harm our operating results.

Many of our customers are large electronics manufacturers that have substantial purchasing power and leverage in negotiating contractual arrangements with us. These customers have and may continue to seek

advantageous pricing and other commercial terms and may require us to develop additional features in the products we sell to them. We have and may continue to be required to reduce the average selling price, or

12

increase the average cost, of our products in response to these pressures or competitive pricing pressures. To maintain acceptable operating results, we will need to develop and introduce new

products and product enhancements on a timely basis and continue to reduce our costs.

We face intense competition and expect

competition to increase in the future. If we fail to compete effectively, it could have an adverse effect on our business, financial condition and results of operations.

The global semiconductor market in general, and our target markets in particular, are highly competitive. Many of our current and

potential competitors have longer operating histories, greater name recognition, access to larger customer bases and significantly greater financial, sales and marketing, manufacturing, distribution, technical and other resources than us. Many of

our competitors have more experience in developing or acquiring new products and technologies and in creating market awareness for those products and technologies. For example, in the AC/DC power conversion market, we consider our competitors to

include, but not be limited to, Power Integrations, Inc., Fairchild Semiconductor International, Inc., and BCD Semiconductor Manufacturing Limited. In the LED solid-state lighting or SSL market, we consider our competitors to include, but not be

limited to, NXP Semiconductors N.V., Texas Instruments Incorporated, and Power Integrations, Inc. In the LED display backlighting market, we consider our competitors to include, but not be limited to, austriamicrosystems AG, Rohm Co., Ltd., and

Skyworks Solutions, Inc. Due to our relatively small size and limited resources, we may be perceived to be at a competitive disadvantage and, as a result, we may lose competitive bidding processes as companies may hesitate to entrust us with a

critical supply relationship. We also compete with low-cost producers in China that can increase pricing pressure on us as well as a number of smaller companies that provide competition for a specific product, customer segment or geographic market.

Due to the narrower focus of their efforts, these competitors may achieve commercial availability of their products more quickly than we can and may provide attractive alternatives to our customers or potential customers.

We expect competition to increase and intensify as more semiconductor companies enter our markets and as our current competitors continue

to develop new technologies and bring new products to these markets. Increased competition could result in price pressure, reduced profitability and loss of market share, any of which could materially and adversely affect our business, financial

condition and operating results. Our ability to compete successfully depends on elements both within and outside of our control, including industry and general economic trends and attitudes. In some instances, our customers have the ability to

design their own ICs and may decide to produce ICs that are competitive with ours. Moreover, our relationships with some of our customers may deter other potential customers that compete with these customers from buying our products. During past

periods of downturns in our industry, competition in the markets in which we operate intensified as our customers reduced their purchase orders.

Our target markets may not grow or develop as we currently expect and are subject to market risks, any of which could materially harm our business, financial condition and results of operations.

To date, we have generated a substantial amount of our revenue from the AC/DC power conversion market. In addition,

we are devoting significant resources to our solutions for the LED SSL and LED display backlighting markets. The growth of these markets depends on the continued growth of the corresponding consumer end markets, such as smartphones and tablets as

well as LED lighting and LED display backlighting products such as televisions. While these markets have been growing in recent years, we cannot be sure that they will continue to grow at the rates that we forecast, if at all. For example, in the

AC/DC power conversion market, smartphones and tablets account for an increasing share of the larger mobile device market. A substantial majority of our revenue is expected to continue to come from demand for incorporating our semiconductor products

into the power adapters and chargers of these devices. If consumer demand for these devices or their adapters slows or manufacturers of these devices choose alternative suppliers for power management semiconductors or develop alternative power

adapter form factors or technologies that are either not compatible with our products or that do not require or products, it will have a material and adverse impact on our revenue and business. The continued growth of our LED SSL revenue, which we

expect to be an important component of

13

our overall revenue growth, depends on this end market’s continued acceptance of LED lighting as a compelling alternative to traditional lighting solutions. If alternative lighting

technologies replace LED solutions or LED lighting falls out of favor for any other reason, our LED SSL revenue will be materially and adversely affected. Similarly in the LED display backlighting market, if consumers choose other types of

televisions (for example, plasma and OLED) or other types of backlighting (for example, edge-lit) over direct and segment backlit LED televisions, it will negatively impact the demand for our LED backlight products, which could materially and

adversely harm our ability to compete in this market and hinder our ability to grow our overall future revenue, which would materially and adversely affect our business, financial condition and results of operations.

Our sales cycles can be long, which could result in uncertainty and delays in generating revenue.

Even after securing a design win, we may experience delays in generating revenue from our products as a result of the lengthy sales cycle

typically required. Our customers generally take a considerable amount of time to evaluate our products. Our sales cycle from initial engagement to volume shipment is typically nine to 12 months, and may in some instances take as long as 24 months

in the LED backlighting display market. The delays inherent in these lengthy sales cycles increase the risk that a customer will decide to cancel, curtail, reduce or delay its product plans or adopt a competing design from one of our competitors,

causing us to lose anticipated revenue. In addition, any delay or cancellation of a customer’s plans could materially and adversely affect our financial results, as we typically incur significant upfront expense without generating any revenue.

If we were unable to generate revenue after incurring substantial expenses to develop any of our products, our business would suffer.

If we fail to achieve initial design wins for our products, we may lose the opportunity to make sales for a significant period of time to customers

and may be unable to recoup our investments in our products, which could harm our results of operations.

We are

focused on winning more competitive bid processes, known as “design wins,” that enable us to sell our ICs for use in our customers’ products. These selection processes typically are lengthy and can require us to incur significant

upfront design and development expenditures and dedicate scarce engineering resources in pursuit of a particular customer opportunity. Our ability to achieve design wins is subject to numerous risks, including competitive pressures as well as

technological risks. We may not win the competitive selection process and may never generate any revenue despite incurring significant design and development expenditures. Failure to obtain a design win could prevent us from offering an entire

generation of a product. This could cause us to lose revenue and could weaken our position in future competitive selection processes. In addition, if we fail to achieve a design win for a particular product with a prospective customer, it is

difficult to sell our solutions for that product to such prospective customer in the future because once a customer has designed a supplier’s products into that particular product, the customer may be reluctant to change its source of

components for that product due to the significant cost, time, effort and risk associated with qualifying a new supplier and modifying its design platforms. Accordingly, if we fail to achieve design wins with key manufacturers, our market share and

revenue may be adversely affected.

Our substantial reliance on an indirect sales model subjects us to risks outside of our control,

which could harm our results of operations.

Aggregate sales to our distributors represented 60%, 75% and 71% of our

revenue for December 31, 2009, 2010 and 2011. Our substantial reliance on an indirect sales model whereby we sell substantially all of our ICs through ODMs and distributors rather than directly to OEM end customers subjects us to risks that are

outside of our control. If the relationship between the distributors and ODMs that purchase our products directly and our OEM end customers is disrupted or deteriorates, even if we are not responsible for the breakdown in the relationship between

distributor or ODM on the one hand and OEM on the other hand, we could lose the business of that OEM customer, which could have a significant negative impact on our business. We do not know the terms of these distributors’ or ODM’s

business relationships with our OEM end customers. Our OEM end

14

customers may also choose to work with other distributors or ODMs with whom we do not have a business relationship. The disruption of the relationship between the distributors and ODMs who

purchase our products and our OEM end customers could have a significant negative impact on our business.

In addition, once

we have secured design wins, due to our small sales force, we depend substantially on our distributors to fulfill supply orders resulting from such customer design wins. Our practice may dissuade potential customers from engaging us due to such

reliance. These developments may materially and adversely affect our current and future target markets and our ability to compete successfully in those markets.

We have identified a material weakness and two significant deficiencies in our internal control over financial reporting, and we cannot provide assurance that additional material weaknesses or

significant deficiencies will not occur in the future. If our internal control over financial reporting or our disclosure controls and procedures are not effective, we may not be able to accurately report our financial results, prevent fraud or file

our periodic reports in a timely manner, which may cause investors to lose confidence in our reported financial information and may lead to a decline in our stock price.

When we become a public company, we will be subject to reporting obligations under Section 404 of the Sarbanes-Oxley Act of 2002, or the

Sarbanes-Oxley Act, that will require us to include a management report on our internal control over financial reporting in our annual report, which contains management’s assessment of the effectiveness of our internal control over financial

reporting. These requirements will first apply to our annual report on Form 10-K for the year ending December 31, 2013.

Our

management may conclude that our internal control over our financial reporting is not effective. Moreover, our independent registered public accounting firm will be required to issue an attestation report on the effectiveness of our internal control

over financial reporting in the future. Even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm may issue a report that is qualified if it is not satisfied

with our controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. Because we qualify as an “emerging growth company” under the JOBS Act,

these auditor attestation requirements may not apply until our annual report on Form 10-K for the year ending December 31, 2017. Material weaknesses may be identified during the audit process or at other times. During the course of the evaluation,

documentation or attestation, we or our independent registered public accounting firm may identify weaknesses and deficiencies that we may not be able to remedy in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with

Section 404.

For example, in connection with the audit of our consolidated financial statements for the year ended December

31, 2011, we had a material weakness and two significant deficiencies in our internal control over financial reporting. A “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting

such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. A “significant deficiency” is a deficiency, or a combination of

deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of our financial reporting. The material weakness related to a

deficiency in the operation of our internal controls over the accounting for complex equity and debt instruments. The significant deficiencies related to the inadequate design of our financial closing and reporting processes and our lack of a formal

fraud risk assessment process and documentation. The material weakness and two significant deficiencies described above were originally identified (along with two other significant deficiencies that have since been remediated) in connection with the

audit of our consolidated financial statements for the years ended December 31, 2009 and 2010.

15

Our reporting obligations as a public company will place a significant strain on our

management, operational and financial resources and systems for the foreseeable future. Prior to this offering, we have been a private company with limited accounting personnel and other resources with which to address our internal controls and

procedures. If we fail to timely achieve and maintain the adequacy of our internal control over financial reporting, we may not be able to produce reliable financial reports or help prevent fraud. Our failure to achieve and maintain effective

internal control over financial reporting could prevent us from filing our periodic reports on a timely basis which could result in the loss of investor confidence in the reliability of our financial statements, harm our business and negatively

impact the trading price of our common stock.

Our customers require our products and our third-party contractors to undergo a lengthy

and expensive qualification process. If we are unsuccessful in or delayed in qualifying any of our products with a customer, our business and operating results would suffer.

Prior to purchasing our products, our customers require that both our products and our third-party contractors undergo extensive

qualification processes, which involve testing of our products in the customers’ systems, as well as testing for reliability. This qualification process may continue for several months. However, qualification of a product by a customer does not

assure any sales of the product to that customer. Even after successful qualification and sales of a product to a customer, a subsequent revision in our third party contractors’ manufacturing process or our selection of a new supplier may

require a new qualification process with our customers, which may result in delays and in our holding excess or obsolete inventory. After our products are qualified, it can take several months or more before the customer commences volume production

of components or systems that incorporate our products. Despite these uncertainties, we devote substantial resources, including design, engineering, sales, marketing and management efforts, to qualifying our products with customers in anticipation

of sales. If we are unsuccessful or delayed in qualifying any of our products with a customer, sales of those products to the customer may be precluded or delayed, which may harm our business and operating results.

We rely on a limited number of third parties to manufacture, assemble and test our products. The failure of any of these third-party vendors to

deliver products or otherwise perform as required could damage our relationships with our customers, decrease our revenue and limit our growth.

We operate using an outsourced manufacturing business model. As a result, we rely on third-party foundry wafer fabrication and assembly and test capacity. For example, in 2011, UMC Group, or UMC,

manufactured all of our ICs. We also use third-party contract manufacturers for our assembly and test operations, including ASE Group, Unisem, SPEL, ATEC, and Signetics. If these vendors do not provide us with high-quality products, services and

production and test capacity in a timely manner, or if one or more of these vendors terminates its relationship with us, we may be unable to obtain satisfactory replacements to fulfill customer orders on a timely basis, our relationships with our

customers could suffer and our sales could decrease. Other significant risks associated with relying on these third-party vendors include:

| |

• |

|

failure by us, our customers or their end customers to qualify a selected supplier; |

| |

• |

|

capacity shortages during periods of high demand; |

| |

• |

|

reduced control over delivery schedules and quality; |

| |

• |

|

shortages of materials; |

| |

• |

|

misappropriation of our intellectual property; |

| |

• |

|

limited warranties on wafers or products supplied to us; and |

| |

• |

|

potential increases in prices. |

We currently do not have long-term supply contracts with any of our third-party vendors. As a result, our third-party vendors may allocate capacity to the production of other companies’ products

while reducing

16

deliveries to us on short notice. In particular, other customers that are larger and better financed than us or that have long-term agreements with our third-party vendors may cause these vendors

to reallocate capacity to those customers, decreasing the capacity available to us. To secure or guarantee additional manufacturing capacity, we could be required to make a nonrefundable deposit, purchase equipment for our vendors to use, provide

our contract manufacturers with loans or commit to purchase specific quantities over extended periods of time. We may not be able to make any such arrangement in a timely fashion or at all, and any arrangements may be costly, reduce our financial

flexibility, and not be on terms favorable to us. Moreover, if we are able to secure manufacturing capacity, we may be obligated to use all of that capacity or incur penalties. These penalties may be expensive and could harm our financial results.

If we need another foundry or assembly and test subcontractor because of increased demand, or if we are unable to obtain timely and adequate deliveries from our providers, we may not be able to retain other vendors to satisfy our requirements and

meet our contractual obligations in a cost-effective and timely manner. These disruptions could have a material adverse effect on our business, financial condition and results of operations.

We manufacture our products based on estimates of customer demand, and if such estimates are incorrect, our financial results could be negatively impacted.

Our products are manufactured using third-party foundries and assembly and test vendors according to our estimates of customer demand,

which requires us to make separate demand forecast assumptions for every customer, each of which may introduce significant variability into our aggregate estimates. Many of our customers have difficulty accurately forecasting their product

requirements and estimating the timing of their new product introductions, which ultimately affects their demand for our products. It is difficult for us to forecast the demand for our products, in part, because of the complex supply chain between

us and the end-user markets that incorporate our products and the fact that we do not have long-term purchase commitments from our customers. In addition, purchase orders from our customers may be cancelled, changed or deferred without notice to us

or penalty.

If we overestimate demand for our solutions, or if purchase orders are cancelled or shipments delayed, we may

have excess inventory that we cannot sell and may incur significant fixed costs that may not be recouped. Conversely, if we underestimate demand, we may not have sufficient inventory to meet end-customer demand and damage our relationships with our

customers and we may have to forego potential revenue opportunities. Obtaining additional supply in the face of product shortages may be costly or impossible, particularly in the short term, which could prevent us from fulfilling orders in a timely

manner or at all.

In addition, we plan our operating expenses, including research and development expenses, hiring needs and

inventory investments, in part on our estimates of customer demand. If customer demand or revenue from a particular period is lower than we expect, we may not be able to proportionately reduce our fixed operating expenses for that period, which

would harm our operating results for that period.

We have an accumulated deficit and have incurred net losses in the past. We may incur

net losses in the future.

As of December 31, 2011, we had an accumulated deficit of $85.0 million. We have

incurred net losses in each year from inception through 2009. We may incur net losses in the future. Our ability to attain profitability in the future will be affected by, among other things, our ability to execute on our business strategy, the

continued acceptance of our existing and new products, the timing and size of orders, the average selling prices of our existing products and new products we may introduce in the future, and the extent to which we invest in our research and

development and selling, general and administrative resources. Any failure to increase revenue or manage our cost structure as we implement initiatives to grow our business could prevent us from achieving or sustaining profitability. Even if we do

achieve profitability, we may not be able to sustain or increase our profitability on an annual or quarterly basis.

17

If we are unable to obtain raw materials in a timely manner or if the price of raw materials increases

significantly, production time and product costs could increase, which may adversely affect our business.

Our

fabrication and packaging processes depend on raw materials such as silicon wafers, gold, copper, mold compound, petroleum and plastic materials and various chemicals and gases. From time to time, suppliers may extend lead times, limit supplies or

increase prices due to capacity constraints or other factors. If the prices of these raw materials rise significantly, we may be unable to pass on the increased cost to our customers. Our results of operations could be adversely affected if we are

unable to obtain adequate supplies of raw materials in a timely manner or at reasonable cost. In addition, from time to time, we may need to reject raw materials that do not meet our specifications, resulting in potential delays or declines in

production. Furthermore, problems with raw materials used in our products may give rise to compatibility or performance issues in our products, which could lead to an increase in customer returns or product warranty claims. Errors or defects may

arise from raw materials supplied by third parties that are beyond our detection or control, which could lead to additional customer returns or product warranty claims that may adversely affect our relationship with our customers, new business and

results of operations.

Our costs may increase if the wafer foundries that supply our products do not achieve satisfactory product

yields or quality.

The wafer fabrication process is complicated. The slightest changes in the design, specifications,

manufacturing process, or materials can result in material decreases in manufacturing yields or the suspension of production. From time to time, our third-party suppliers have experienced, and may in the future experience, manufacturing defects and

reduced manufacturing yields related to errors or problems in their manufacturing processes or the interrelationship of their processes with our designs. In some cases, our third-party suppliers may not be able to detect these defects early in the

fabrication process or determine the cause of such defects in a timely manner.

Generally, in pricing our ICs, we assume that

manufacturing yields will continue to meet industry standards, even as the complexity of our ICs increases. Once our ICs are initially qualified with our third-party suppliers, minimum acceptable yields are established. We are responsible for the

costs of the wafers if the actual yield is above the minimum. If actual yields are below the minimum, we are not required to purchase the wafers. The minimum acceptable yields for our new products are generally lower at first and increase as we

achieve full production. Unacceptably low product yields or other product manufacturing problems could substantially increase the overall production time and costs and materially and adversely impact our operating results. Poor product yield losses

will increase our costs and reduce our gross margin. In addition to significantly harming our operating results and cash flow, poor yields may delay shipment of our products and harm our relationships with existing and potential customers.