00000122082023FYfalse0.1http://fasb.org/us-gaap/2023#OperatingIncomeLosshttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#NotesAndLoansPayableCurrenthttp://fasb.org/us-gaap/2023#NotesAndLoansPayableCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligations00000122082023-01-012023-12-310000012208us-gaap:CommonClassAMember2023-01-012023-12-310000012208us-gaap:CommonClassBMember2023-01-012023-12-310000012208us-gaap:CommonClassAMember2023-06-30iso4217:USD0000012208us-gaap:CommonClassBMember2023-06-300000012208us-gaap:CommonClassAMember2024-02-13xbrli:shares0000012208us-gaap:CommonClassBMember2024-02-1300000122082023-12-3100000122082022-12-310000012208us-gaap:CommonClassAMember2022-12-31iso4217:USDxbrli:shares0000012208us-gaap:CommonClassAMember2023-12-310000012208us-gaap:CommonClassBMember2022-12-310000012208us-gaap:CommonClassBMember2023-12-3100000122082022-01-012022-12-3100000122082021-01-012021-12-3100000122082021-12-3100000122082020-12-310000012208us-gaap:CommonStockMember2020-12-310000012208us-gaap:AdditionalPaidInCapitalMember2020-12-310000012208us-gaap:TreasuryStockCommonMember2020-12-310000012208us-gaap:RetainedEarningsMember2020-12-310000012208us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000012208us-gaap:RetainedEarningsMember2021-01-012021-12-310000012208us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000012208us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000012208us-gaap:TreasuryStockCommonMember2021-01-012021-12-310000012208us-gaap:CommonStockMember2021-12-310000012208us-gaap:AdditionalPaidInCapitalMember2021-12-310000012208us-gaap:TreasuryStockCommonMember2021-12-310000012208us-gaap:RetainedEarningsMember2021-12-310000012208us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000012208us-gaap:RetainedEarningsMember2022-01-012022-12-310000012208us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000012208us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000012208us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000012208us-gaap:CommonStockMember2022-12-310000012208us-gaap:AdditionalPaidInCapitalMember2022-12-310000012208us-gaap:TreasuryStockCommonMember2022-12-310000012208us-gaap:RetainedEarningsMember2022-12-310000012208us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000012208us-gaap:RetainedEarningsMember2023-01-012023-12-310000012208us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000012208us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000012208us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000012208us-gaap:CommonStockMember2023-12-310000012208us-gaap:AdditionalPaidInCapitalMember2023-12-310000012208us-gaap:TreasuryStockCommonMember2023-12-310000012208us-gaap:RetainedEarningsMember2023-12-310000012208us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000012208srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310000012208srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310000012208bio:ReagentRentalEquipmentMembersrt:MinimumMember2023-12-310000012208bio:ReagentRentalEquipmentMembersrt:MaximumMember2023-12-310000012208us-gaap:EquipmentMembersrt:MinimumMember2023-12-310000012208us-gaap:EquipmentMembersrt:MaximumMember2023-12-310000012208srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2023-12-310000012208srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2023-12-310000012208us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-12-310000012208us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-12-310000012208us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MaximumMember2023-12-310000012208us-gaap:DevelopedTechnologyRightsMembersrt:MinimumMember2023-12-310000012208us-gaap:DevelopedTechnologyRightsMembersrt:MaximumMember2023-12-310000012208us-gaap:LicenseMembersrt:MinimumMember2023-12-310000012208us-gaap:LicenseMembersrt:MaximumMember2023-12-310000012208us-gaap:TradeNamesMembersrt:MinimumMember2023-12-310000012208us-gaap:TradeNamesMembersrt:MaximumMember2023-12-310000012208us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2023-12-310000012208us-gaap:NoncompeteAgreementsMembersrt:MaximumMember2023-12-31xbrli:pure0000012208us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel1Memberus-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel3Memberus-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310000012208us-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel1Memberus-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel3Memberus-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:BankTimeDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310000012208us-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CashEquivalentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208bio:RestrictedInvestmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208bio:RestrictedInvestmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:OtherInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:OtherInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:FairValueMeasurementsRecurringMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310000012208us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310000012208bio:OrdinaryVotingSharesMember2023-12-310000012208bio:PreferenceSharesMember2023-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000012208us-gaap:CorporateDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:MunicipalBondsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:AssetBackedSecuritiesMemberus-gaap:ShortTermInvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:ForeignGovernmentDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208us-gaap:ShortTermInvestmentsMemberus-gaap:DebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000012208bio:ForwardforeignexchangecontracttosellforeigncurrencyMember2023-12-310000012208bio:ForwardforeignexchangecontracttosellforeigncurrencyMember2023-01-012023-12-310000012208bio:ForwardforeignexchangecontracttopurchaseforeigncurrencyMember2023-12-310000012208bio:ForwardforeignexchangecontracttopurchaseforeigncurrencyMember2023-01-012023-12-310000012208us-gaap:SeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000012208us-gaap:SeniorNotesMemberus-gaap:SeniorNotesMember2022-12-310000012208bio:OtherLongTermDebtMemberbio:OtherLongTermDebtMember2023-12-310000012208bio:OtherLongTermDebtMemberbio:OtherLongTermDebtMember2022-12-31iso4217:EUR0000012208bio:FairValueOfAppreciationRightsMember2023-12-310000012208bio:LifeScienceMember2022-12-310000012208bio:ClinicalDiagnosticsMember2022-12-310000012208bio:LifeScienceMember2021-12-310000012208bio:ClinicalDiagnosticsMember2021-12-310000012208bio:LifeScienceMember2023-01-012023-12-310000012208bio:ClinicalDiagnosticsMember2023-01-012023-12-310000012208bio:LifeScienceMember2022-01-012022-12-310000012208bio:ClinicalDiagnosticsMember2022-01-012022-12-310000012208bio:LifeScienceMember2023-12-310000012208bio:ClinicalDiagnosticsMember2023-12-310000012208us-gaap:CustomerRelationshipsMember2023-12-310000012208bio:KnowHowMember2023-12-310000012208us-gaap:DevelopedTechnologyRightsMember2023-12-310000012208us-gaap:LicensingAgreementsMember2023-12-310000012208us-gaap:TradeNamesMember2023-12-310000012208us-gaap:NoncompeteAgreementsMember2023-12-310000012208us-gaap:InProcessResearchAndDevelopmentMember2023-12-310000012208us-gaap:CustomerRelationshipsMember2022-12-310000012208bio:KnowHowMember2022-12-310000012208us-gaap:DevelopedTechnologyRightsMember2022-12-310000012208us-gaap:LicensingAgreementsMember2022-12-310000012208us-gaap:TradeNamesMember2022-12-310000012208us-gaap:NoncompeteAgreementsMember2022-12-310000012208us-gaap:InProcessResearchAndDevelopmentMember2022-12-310000012208us-gaap:LandAndLandImprovementsMember2023-12-310000012208us-gaap:LandAndLandImprovementsMember2022-12-310000012208bio:BuildingAndLeaseholdImprovementsMember2023-12-310000012208bio:BuildingAndLeaseholdImprovementsMember2022-12-310000012208us-gaap:EquipmentMember2023-12-310000012208us-gaap:EquipmentMember2022-12-310000012208bio:A33SeniorNotesDue2027Memberbio:A33SeniorNotesDue2027Member2023-12-31utr:Rate0000012208us-gaap:SeniorNotesMemberbio:A33SeniorNotesDue2027Member2023-12-310000012208us-gaap:SeniorNotesMemberbio:A33SeniorNotesDue2027Member2022-12-310000012208bio:A37SeniorNotesDue2032Memberbio:A37SeniorNotesDue2032Member2023-12-310000012208bio:A37SeniorNotesDue2032Memberus-gaap:SeniorNotesMember2023-12-310000012208bio:A37SeniorNotesDue2032Memberus-gaap:SeniorNotesMember2022-12-310000012208bio:FinanceLeaseObligationsMemberbio:FinanceLeasesandOtherDebtMember2023-12-310000012208bio:FinanceLeaseObligationsMemberbio:FinanceLeasesandOtherDebtMember2022-12-310000012208us-gaap:PerformanceGuaranteeMember2023-12-310000012208bio:A33SeniorNotesDue2027Member2023-12-310000012208bio:A37SeniorNotesDue2032Member2023-12-310000012208bio:A33SeniorNotesDue2027Memberbio:A33SeniorNotesDue2027Member2023-01-012023-12-310000012208bio:A37SeniorNotesDue2032Memberbio:A37SeniorNotesDue2032Member2023-01-012023-12-310000012208us-gaap:SeniorNotesMember2023-12-310000012208us-gaap:LineOfCreditMember2019-04-300000012208us-gaap:LineOfCreditMember2023-12-310000012208us-gaap:DomesticCountryMember2023-01-012023-12-310000012208us-gaap:DomesticCountryMember2022-01-012022-12-310000012208us-gaap:DomesticCountryMember2021-01-012021-12-310000012208bio:OperatingleaseobligationsMember2023-12-310000012208bio:OperatingleaseobligationsMember2022-12-310000012208bio:OperatingleaseassetsMember2023-12-310000012208bio:OperatingleaseassetsMember2022-12-310000012208us-gaap:StateAndLocalJurisdictionMember2023-12-310000012208sic:Z88882023-12-310000012208us-gaap:ForeignCountryMember2023-12-310000012208bio:IncludingaccruedinterestandpenaltiesMember2023-12-310000012208bio:NetofprepaidtaxesMember2023-12-310000012208us-gaap:CommonClassAMember2020-12-310000012208us-gaap:CommonClassBMember2020-12-310000012208us-gaap:CommonClassAMember2021-01-012021-12-310000012208us-gaap:CommonClassBMember2021-01-012021-12-310000012208us-gaap:CommonClassAMember2021-12-310000012208us-gaap:CommonClassBMember2021-12-310000012208us-gaap:CommonClassAMember2022-01-012022-12-310000012208us-gaap:CommonClassBMember2022-01-012022-12-3100000122082021-03-012021-03-3100000122082021-03-3100000122082022-05-012022-05-3100000122082022-05-3100000122082022-11-012022-11-3000000122082022-11-3000000122082023-05-012023-05-3100000122082023-05-3100000122082023-09-012023-09-3000000122082023-09-3000000122082023-11-012023-11-3000000122082023-11-300000012208us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000012208us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000012208us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310000012208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000012208us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310000012208us-gaap:ParentMember2021-12-310000012208us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310000012208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000012208us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-12-310000012208us-gaap:ParentMember2022-01-012022-12-310000012208us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000012208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000012208us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310000012208us-gaap:ParentMember2022-12-310000012208us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310000012208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000012208us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310000012208us-gaap:ParentMember2023-01-012023-12-310000012208us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000012208us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000012208us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310000012208us-gaap:ParentMember2023-12-310000012208us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000012208us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000012208bio:IncentiveAwardPlan2017Memberbio:StockOptionAndAwardPlansMember2023-12-310000012208bio:PerformanceBasedStockUnitsPSUsMember2023-01-012023-12-310000012208bio:PerformanceBasedStockUnitsPSUsMembersrt:MinimumMember2023-01-012023-12-310000012208bio:PerformanceBasedStockUnitsPSUsMembersrt:MaximumMember2023-01-012023-12-310000012208us-gaap:EmployeeStockMember2023-12-310000012208us-gaap:EmployeeStockMember2023-01-012023-12-310000012208bio:A2011EmployeeStockPurchasePlanMember2023-12-310000012208bio:CostOfGoodsSoldMember2023-01-012023-12-310000012208bio:CostOfGoodsSoldMember2022-01-012022-12-310000012208bio:CostOfGoodsSoldMember2021-01-012021-12-310000012208us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310000012208us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000012208us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310000012208us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310000012208us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310000012208us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310000012208us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000012208us-gaap:EmployeeStockOptionMember2022-12-310000012208us-gaap:EmployeeStockOptionMember2023-12-310000012208us-gaap:RestrictedStockUnitsRSUMember2022-12-310000012208us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000012208us-gaap:RestrictedStockUnitsRSUMember2023-12-310000012208bio:PerformanceBasedStockUnitsPSUsMember2022-12-310000012208bio:PerformanceBasedStockUnitsPSUsMember2023-12-310000012208us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000012208us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000012208us-gaap:EmployeeStockMember2022-01-012022-12-310000012208us-gaap:EmployeeStockMember2021-01-012021-12-310000012208us-gaap:EmployeeStockMember2022-12-310000012208us-gaap:EmployeeStockMember2021-12-310000012208country:US2023-12-31bio:segment0000012208us-gaap:AllOtherSegmentsMember2023-01-012023-12-310000012208us-gaap:AllOtherSegmentsMember2022-01-012022-12-310000012208bio:LifeScienceMember2021-01-012021-12-310000012208bio:ClinicalDiagnosticsMember2021-01-012021-12-310000012208us-gaap:AllOtherSegmentsMember2021-01-012021-12-310000012208bio:LifeScienceMemberus-gaap:OperatingSegmentsMember2023-12-310000012208us-gaap:OperatingSegmentsMemberbio:ClinicalDiagnosticsMember2023-12-310000012208us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-12-310000012208bio:LifeScienceMemberus-gaap:OperatingSegmentsMember2022-12-310000012208us-gaap:OperatingSegmentsMemberbio:ClinicalDiagnosticsMember2022-12-310000012208us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-12-310000012208bio:LifeScienceMemberus-gaap:OperatingSegmentsMember2021-12-310000012208us-gaap:OperatingSegmentsMemberbio:ClinicalDiagnosticsMember2021-12-310000012208us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2021-12-310000012208us-gaap:OperatingSegmentsMember2023-01-012023-12-310000012208us-gaap:OperatingSegmentsMember2022-01-012022-12-310000012208us-gaap:OperatingSegmentsMember2021-01-012021-12-310000012208us-gaap:InterestExpenseMemberus-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310000012208us-gaap:InterestExpenseMemberus-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310000012208us-gaap:InterestExpenseMemberus-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310000012208us-gaap:MaterialReconcilingItemsMember2023-01-012023-12-310000012208us-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310000012208us-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310000012208us-gaap:OperatingSegmentsMember2023-12-310000012208us-gaap:OperatingSegmentsMember2022-12-310000012208us-gaap:MaterialReconcilingItemsMember2023-12-310000012208us-gaap:MaterialReconcilingItemsMember2022-12-310000012208country:US2023-01-012023-12-310000012208country:US2022-01-012022-12-310000012208country:US2021-01-012021-12-310000012208srt:EuropeMember2023-01-012023-12-310000012208srt:EuropeMember2022-01-012022-12-310000012208srt:EuropeMember2021-01-012021-12-310000012208srt:AsiaPacificMember2023-01-012023-12-310000012208srt:AsiaPacificMember2022-01-012022-12-310000012208srt:AsiaPacificMember2021-01-012021-12-310000012208srt:AmericasMember2023-01-012023-12-310000012208srt:AmericasMember2022-01-012022-12-310000012208srt:AmericasMember2021-01-012021-12-310000012208country:US2023-12-310000012208country:US2022-12-310000012208srt:EuropeMember2023-12-310000012208srt:EuropeMember2022-12-310000012208srt:AsiaPacificMember2023-12-310000012208srt:AsiaPacificMember2022-12-310000012208srt:AmericasMember2023-12-310000012208srt:AmericasMember2022-12-310000012208bio:EuropeanReorganizationMember2021-02-012023-12-310000012208bio:LifeScienceMemberbio:EuropeanReorganizationMember2022-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanReorganizationMember2022-12-310000012208bio:EuropeanReorganizationMember2022-12-310000012208bio:LifeScienceMemberbio:EuropeanReorganizationMember2021-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanReorganizationMember2021-12-310000012208bio:EuropeanReorganizationMember2021-12-310000012208bio:LifeScienceMemberbio:EuropeanReorganizationMember2023-01-012023-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanReorganizationMember2023-01-012023-12-310000012208bio:EuropeanReorganizationMember2023-01-012023-12-310000012208bio:LifeScienceMemberbio:EuropeanReorganizationMember2022-01-012022-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanReorganizationMember2022-01-012022-12-310000012208bio:EuropeanReorganizationMember2022-01-012022-12-310000012208bio:LifeScienceMemberbio:EuropeanReorganizationMember2023-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanReorganizationMember2023-12-310000012208bio:EuropeanReorganizationMember2023-12-310000012208bio:EuropeanAndAmericanReorganizationMember2023-02-012023-12-310000012208bio:LifeScienceMemberbio:EuropeanAndAmericanReorganizationMember2022-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanAndAmericanReorganizationMember2022-12-310000012208bio:EuropeanAndAmericanReorganizationMember2022-12-310000012208bio:LifeScienceMemberbio:EuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:EuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:LifeScienceMemberbio:EuropeanAndAmericanReorganizationMember2023-12-310000012208bio:ClinicalDiagnosticsMemberbio:EuropeanAndAmericanReorganizationMember2023-12-310000012208bio:EuropeanAndAmericanReorganizationMember2023-12-310000012208bio:AdditionalEuropeanAndAmericanReorganizationMember2023-06-012023-12-310000012208bio:LifeScienceMemberbio:AdditionalEuropeanAndAmericanReorganizationMember2022-12-310000012208bio:ClinicalDiagnosticsMemberbio:AdditionalEuropeanAndAmericanReorganizationMember2022-12-310000012208bio:AdditionalEuropeanAndAmericanReorganizationMember2022-12-310000012208bio:LifeScienceMemberbio:AdditionalEuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:ClinicalDiagnosticsMemberbio:AdditionalEuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:AdditionalEuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:LifeScienceMemberbio:AdditionalEuropeanAndAmericanReorganizationMember2023-12-310000012208bio:ClinicalDiagnosticsMemberbio:AdditionalEuropeanAndAmericanReorganizationMember2023-12-310000012208bio:AdditionalEuropeanAndAmericanReorganizationMember2023-12-310000012208bio:OtherEuropeanAndAmericanReorganizationMember2023-10-012023-12-310000012208bio:LifeScienceMemberbio:OtherEuropeanAndAmericanReorganizationMember2022-12-310000012208bio:OtherEuropeanAndAmericanReorganizationMemberbio:ClinicalDiagnosticsMember2022-12-310000012208bio:OtherEuropeanAndAmericanReorganizationMember2022-12-310000012208bio:LifeScienceMemberbio:OtherEuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:OtherEuropeanAndAmericanReorganizationMemberbio:ClinicalDiagnosticsMember2023-01-012023-12-310000012208bio:OtherEuropeanAndAmericanReorganizationMember2023-01-012023-12-310000012208bio:LifeScienceMemberbio:OtherEuropeanAndAmericanReorganizationMember2023-12-310000012208bio:OtherEuropeanAndAmericanReorganizationMemberbio:ClinicalDiagnosticsMember2023-12-310000012208bio:OtherEuropeanAndAmericanReorganizationMember2023-12-310000012208us-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-12-310000012208us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310000012208us-gaap:CostOfSalesMember2023-01-012023-12-310000012208us-gaap:CostOfSalesMember2022-01-012022-12-310000012208us-gaap:CostOfSalesMember2021-01-012021-12-310000012208us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310000012208us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000012208us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310000012208us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310000012208us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310000012208us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310000012208srt:MinimumMember2023-01-012023-12-310000012208srt:MaximumMember2023-01-012023-12-310000012208us-gaap:PropertyPlantAndEquipmentMember2023-12-310000012208us-gaap:PropertyPlantAndEquipmentMember2022-12-3100000122082023-01-012023-03-3100000122082023-04-012023-06-3000000122082023-07-012023-09-3000000122082023-10-012023-12-3100000122082022-01-012022-03-3100000122082022-04-012022-06-3000000122082022-07-012022-09-3000000122082022-10-012022-12-3100000122082023-01-012023-09-300000012208us-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2024-02-13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

|

| FORM | 10-K |

| (Mark One) | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the fiscal year ended | December 31, 2023 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from ___________________________ to _________________________________ |

|

| Commission file number | 1-7928 |

|

| BIO-RAD LABORATORIES, INC. |

| (Exact name of registrant as specified in its charter) |

|

| Delaware | | 94-1381833 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| | |

| 1000 Alfred Nobel Drive, | Hercules, | California | | 94547 |

| (Address of principal executive offices) | | (Zip Code) |

| |

| Registrant's telephone number, including area code | (510) | 724-7000 |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered |

| Class A Common Stock Par Value $0.0001 per share | BIO | New York Stock Exchange |

| Class B Common Stock Par Value $0.0001 per share | BIO.B | New York Stock Exchange |

|

| Securities registered pursuant to Section 12(g) of the Act: NONE |

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| ☒ | Yes | ☐ | No | |

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. |

| ☐ | Yes | ☒ | No |

| Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange |

| Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been |

| subject to such filing requirements for the past 90 days. | ☒ | Yes | ¨ No |

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to |

| Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). |

| ☒ | Yes | ¨ No |

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| | | | | |

| Large accelerated filer | ☒ | | | Accelerated filer | ☐ |

| Non-accelerated file | ☐ | | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

| | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | | |

| Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☒ | | | |

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | ☐ | | | |

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). | ☐ | | | |

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | ☐ | Yes | ☒ No |

As of June 30, 2023, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the Registrant's Class A Common Stock held by non-affiliates was approximately $7,746,096,434 and the aggregate market value of the registrant's Class B Common Stock held by non-affiliates was approximately $49,750,401.

As of February 13, 2024, there were 23,422,506 shares of Class A Common Stock and 5,095,930 shares of Class B Common Stock outstanding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Documents Incorporated by Reference |

| | | | Document | | | Form 10-K Parts |

| (1) | Definitive Proxy Statement to be mailed to stockholders in connection with the | | | | | | | | |

| | | | registrant's 2024 Annual Meeting of Stockholders (specified portions) | | | III |

BIO-RAD LABORATORIES, INC.

FORM 10-K DECEMBER 31, 2023

TABLE OF CONTENTS

INFORMATION RELATING TO FORWARD-LOOKING STATEMENTS

Other than statements of historical fact, statements made in this report include forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements we make regarding our future financial performance, operating results, plans and objectives. Forward-looking statements generally can be identified by the use of forward-looking terminology, such as “believe,” “expect,” “anticipate,” “may,” “will,” “intend,” “estimate,” “continue,” or similar expressions or the negative of those terms or expressions. Such statements involve risks and uncertainties, which could cause actual results to vary materially from those expressed in or indicated by the forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. However, actual results may differ materially from those currently anticipated depending on a variety of risk factors including, but not limited to, the risks relating to our international operations, supply chain issues, global economic and geopolitical conditions, our ability to develop and market new or improved products, our ability to compete effectively, foreign currency exchange fluctuations, reductions in government funding or capital spending of our customers, international legal and regulatory risks, product quality and liability issues, our ability to integrate acquired companies, products or technologies into our company successfully, changes in the healthcare industry, natural disasters and other catastrophic events beyond our control, and other risks and uncertainties identified under “Part 1, Item 1A, Risk Factors” of this Annual Report. We caution you not to place undue reliance on forward-looking statements, which reflect an analysis only and speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

PART I.

General

Bio-Rad Laboratories, Inc. (referred to in this report as “Bio-Rad,” “we,” “us,” and “our”) is a multinational manufacturer and worldwide distributor of our own life science research and clinical diagnostics products. Bio-Rad manufactures and supplies the life science research, healthcare, analytical chemistry and other markets with a broad range of products and systems used to separate complex chemical and biological materials and to identify, analyze and purify their components.

We have direct distribution channels in over 35 countries outside the United States through subsidiaries whose focus is sales, customer service and product distribution. In some locations outside and inside these 35 countries, sales efforts are supplemented by distributors and agents.

Description of Business

Business Segments

Bio-Rad operates in two industry segments designated as Life Science and Clinical Diagnostics. Both segments operate worldwide. Our Life Science segment and our Clinical Diagnostics segment generated 44% and 56%, respectively, of our consolidated net sales for the year ended December 31, 2023. We generated approximately 42% of our consolidated net sales for the year ended December 31, 2023 from the U.S. and approximately 58% from our international locations, with Europe being our largest international region .

Life Science Segment

Our Life Science segment is at the forefront of discovery, creating advanced tools to answer complex biological questions. These instruments, systems, reagents, and consumables are typically used to separate, purify, characterize, or quantitate biological materials such as cells, proteins, and nucleic acids in the research laboratory or the biopharmaceutical manufacturing and quality control process, for food safety and science education and literacy. Many of our products are used in established research techniques, biopharmaceutical production processes and food

testing regimes. We are focused on the translational research market segment where our products help accelerate the timelines from discovery in the lab to use in the clinic and with patients. We are a leader in the life sciences market and develop, manufacture and market a broad portfolio of many thousands of products that serve a global customer base. We focus on specific segments of the life sciences market in proteomics (the study of proteins), genomics (the study of genes), biopharmaceutical production, cellular biology and food safety. We estimate that the worldwide sales for products in the markets we serve is approximately $19 billion. Our principal life science customers include universities and medical schools, industrial research organizations, government agencies, pharmaceutical manufacturers, biotechnology researchers, food producers and food testing laboratories.

Clinical Diagnostics Segment

Our Clinical Diagnostics segment designs, manufactures, markets and supports test systems, informatics systems, test kits and specialized quality controls that serve clinical laboratories in the global diagnostics market. Our products currently address specific niches within the in vitro diagnostics (IVD) test market, and we seek to focus on the higher margin, higher growth segments of this market.

We supply several thousand products that cover more than 300 clinical diagnostic tests to the IVD test market. We estimate that the worldwide sales for products in the markets we serve is approximately $16 billion. IVD tests are conducted outside the human body and are used to identify and measure substances in a patient’s tissue, blood or urine. Our products consist of reagents, instruments and software, typically provided to our customers as an integrated package to allow them to generate reproducible test results. Revenue in this business is highly recurring, as laboratories typically standardize test methodologies, which are dependent on a particular supplier’s equipment, reagent and consumable products. An installed base of diagnostic test systems therefore typically creates a recurring source of revenue through the sale of test kits for each sample analyzed on an installed system. Our principal clinical diagnostic customers include hospital laboratories, diagnostic reference laboratories, transfusion laboratories and physician office laboratories.

Raw Materials and Components

We utilize a wide variety of chemicals, biological materials, electronic components, machined metal parts, optical parts, computing and peripheral devices. Most of these materials and components are available from numerous sources, and while we experienced challenges as a result of the impact of COVID-19 on our suppliers' operations, we are now experiencing more normal supply levels of raw materials and components used in the production of our products. For more discussion relating to the impacts of the COVID-19 pandemic and the difficulty of securing adequate supplies, please see “Item 1A, Risk Factors” of this Annual Report. In certain instances, we acquire components and materials from a sole supplier. Due to the regulatory environment in which we operate, we may be unable to quickly establish additional or replacement sources for some components or materials.

Patents, Trademarks and Licenses

We own over 2,300 U.S. and international patents and numerous trademarks. We also hold licenses under U.S. and foreign patents owned by third parties and pay royalties on the sales of certain products under these licenses. In addition, we also receive royalties for licenses of our intellectual property. We view these patents, trademarks and license agreements as valuable assets; however, we believe that our ability to develop and manufacture our products depends primarily on our knowledge, technology and special skills rather than our patent, trademark and licensing positions.

Seasonal Operations

Our business is not inherently seasonal. However, the European custom of concentrating vacation during the summer months usually tempers third quarter sales volume and operating income.

Sales and Marketing

We conduct our worldwide operations through an extensive direct sales force, employing approximately 810 direct sales and sales management personnel around the world. Our sales force typically consists of experienced industry professionals with scientific training, and we maintain a separate specialized sales force for each of our segments. We believe that this direct sales approach allows us to sell a broader range of our products that creates more brand awareness and long-term relationships with our customers.

We also use a range of sales and marketing intermediaries (SMIs) in our international markets. The types of SMIs we utilize are distributors, agents, brokers and resellers. We have programs and policies in place with our SMIs requiring their compliance with all applicable laws, including adhering to our anti-corruption standards to ensure a transparent sale to our customers.

Our customer base is broad and diversified. Our worldwide customer base includes (1) prominent university and research institutions; (2) hospital, public health and commercial laboratories; (3) other leading diagnostic manufacturers; and (4) leading companies in the biotechnology, pharmaceutical, chemical and food industries.

Our sales are affected by a number of external factors. For example, a number of our customers, particularly in the Life Science segment, are substantially dependent on government grants and research contracts for their funding.

Competition

The markets served by our product groups are highly competitive. Our competitors range in size from start-ups to large multinational corporations with significant resources and reach. We seek to compete primarily in market segments where the technology and efficacy of our products offer customers specific advantages over the competition.

Our Life Science segment does not face the same competitors for all of its products due to the breadth of its product lines. Major competitors in this market include Becton Dickinson, Danaher, Merck Millipore and Thermo Fisher Scientific. We compete primarily based on meeting performance specifications and offering comprehensive solutions.

Major competitors for our products in the Clinical Diagnostics segment include Roche, Abbott Laboratories, Siemens, Danaher, Thermo Fisher Scientific, Becton Dickinson, bioMérieux, Ortho Clinical Diagnostics, Tosoh, Immucor and DiaSorin. We compete across a variety of attributes including quality, service and product portfolio.

Research and Development

We conduct extensive research and development activities in all areas of our business. Research and development has played a major role in Bio-Rad’s growth and is expected to continue to do so in the future. Our research teams are continuously developing new products and new applications for existing products. In our development of new products and applications, we interact with scientific and medical professionals at pharma and bio-pharma companies, universities, hospitals and medical schools, and within our industry. In addition, we regularly invest in companies that are engaged in the development of new technologies that either complement or expand our existing portfolio of products. We have approximately 1,110 employees worldwide focused on research and development, including degreed scientists, engineers, software developers and other technical support staff.

Regulatory Matters

The development, testing, manufacturing, marketing, post-market surveillance, distribution, advertising and labeling of certain of our products (primarily diagnostic and donor screening products) are subject to regulation in the United States by the Center for Devices and Radiological Health (CDRH) and/or the Center for Biologics Evaluation and Research (CBER) of the U.S. Food and Drug Administration (FDA) and in other jurisdictions by state and foreign government authorities. FDA regulations require that some new products have pre-marketing notification (“510(k)”) or approval (“PMA” or Biologics License Application – “BLA”) by the FDA and require certain products to be manufactured in accordance with FDA’s “good manufacturing practice” regulations, to be extensively tested and to

be properly labeled to disclose test results and performance claims and limitations. The FDA’s 510(k) clearance process requires regulatory competence to execute and usually takes four to nine months, but it can take longer. The FDA’s PMA and BLA processes require extensive regulatory competence to execute and may take one to two years.

A clinical trial is generally required to support a PMA or BLA application and is sometimes required for a 510(k) clearance or a de novo authorization. Conducting clinical trials is a complex and costly activity and frequently requires the use of outsourced resources that specialize in planning and conducting the clinical trial for the medical device manufacturer.

The European Union (“EU”) has adopted the EU in-vitro Diagnostics Regulation (the “EU IVDR”), which imposes stricter requirements for the marketing and sale of in-vitro diagnostics products (as compared to the predecessor in-vitro Diagnostics Directive (IVDD)), including in the areas of clinical evaluation requirements, quality systems, economic operators and post-market surveillance. Bio-Rad's IVD products currently meet the applicable requirements of the EU IVDR.

Our manufacturing facilities, as well as those of certain suppliers, are subject to periodic inspections by the FDA and other regulatory bodies to verify compliance with regulatory requirements. Similar inspections are performed by Notified Bodies to verify compliance to applicable ISO standards (e.g. ISO 13485:2016), requirements under the Medical Device Single Audit Program ("MDSAP") applicable to regulatory requirements of Australia, Brazil, Canada, Japan and the U.S. and/or medical device regulations and requirements from the countries in which we distribute product and other specified audits by regulatory authorities. If a regulatory body were to find that we or certain suppliers have failed to comply with applicable regulations (e.g. recordkeeping, reporting of adverse events), it could institute a wide variety of enforcement actions, ranging from issuance of a warning or untitled letter to more severe sanctions, such as mandatory product recalls or seizures, civil penalties, consent decrees, injunctions, criminal prosecution, operating restrictions, partial suspension or shutdown of production, refusal to permit importation or exportation, refusal to grant, or delays in granting, clearances or approvals or withdrawal or suspension of existing clearances or approvals. Any of these actions could have an adverse effect on our business.

We are also subject to additional regulation and enforcement by the federal government and by authorities in the states and foreign jurisdictions in which we conduct our business. Such laws include, without limitation, state and federal anti-kickback, fraud and abuse, false claims, privacy and security and physician sunshine laws and regulations. If our operations are found to be in violation of any such laws or any other governmental regulations that apply to us, we may be subject to penalties, including, without limitation, civil and criminal penalties, damages, fines, the curtailment or restructuring of our operations, and exclusion from participation in federal and state healthcare programs and imprisonment.

Sales of our products will depend, in part, on the extent to which our products or diagnostic tests using our products will be covered by third-party payors, such as government health care programs, commercial insurance and managed healthcare organizations. These third-party payors are increasingly adjusting reimbursements for certain medical products and services. In addition, the U.S. government, state legislatures and foreign governments have continued implementing cost containment programs, including price controls and restrictions on reimbursement. Adoption of price controls and cost-containment measures, and adoption of more restrictive policies in jurisdictions with existing controls and measures, could further limit our net revenue and results. Decreases in third-party reimbursement for our products or diagnostic tests using our products, or a decision by a third-party payor to not cover our products could reduce or eliminate utilization of our products and have a material adverse effect on our sales, results of operations and financial condition. In addition, healthcare reform measures have been and will be adopted in the future, any of which could limit the amounts that governments will pay for healthcare products and services, which could result in reduced demand for our products or additional pricing pressures.

As a multinational manufacturer and distributor of sophisticated instrumentation, we must meet a wide array of electromagnetic compatibility and safety compliance requirements to satisfy regulations in the United States, the European Union and other jurisdictions.

Our operations are subject to federal, state, local and foreign environmental laws and regulations that govern activities such as transportation of goods, emissions to air and discharges to water, as well as handling and disposal practices for solid, hazardous and medical wastes. In addition to environmental laws that regulate our operations, we are also subject to environmental laws and regulations that create liabilities and clean-up responsibility for spills, disposals or other releases of hazardous substances into the environment as a result of our operations or otherwise impacting real property that we own or operate. The environmental laws and regulations could also subject us to claims by third parties for damages resulting from any spills, disposals or releases resulting from our operations or at any of our properties.

These regulatory requirements vary widely among countries.

Human Capital Resources

At Bio-Rad, we consider our employees to be our most valuable asset, and critical to the effective development, manufacture, sale, distribution and servicing of our vast array of products and services. Our employees are essential to satisfying our customers’ needs for products to advance science and healthcare. At December 31, 2023, we had approximately 8,030 employees, the overwhelming majority of which are full-time employees. Our employees are located throughout the world with roughly 47% in the Americas, 36% in Europe, the Middle-East and Africa, and 17% in Asia Pacific. Our employees work in over 140 locations in 36 different countries around the world.

Diversity, Equity and Inclusion

At Bio-Rad, we recognize that diversity is a strength. Our differences offer new and unique ideas and perspectives to our organization. We foster a work culture that embraces the diverse experience and knowledge of every employee, creating an inclusive culture regardless of race, gender, age, sexual orientation, disability, or nationality. We have been purposeful in our efforts to hire, develop and retain diverse talent as well as in our efforts to create an inclusive culture. We actively encourage employee engagement and regularly solicit feedback regarding job satisfaction, career growth and development, collaboration, empowerment, ethics, and manager effectiveness. We use employee input to help our managers make focused and strategic commitments to improve and sustain engagement in their teams. Bio-Rad requires that all management and employees participate in ongoing training intended to increase awareness of the importance of a diverse and inclusive culture.

Compensation and Benefits

We provide a competitive total rewards program consisting of broad-based salary and bonus plans as well as annual stock grants to senior management level employees. These programs combine to recognize and reward employees based on individual, group, and overall company performance. We provide competitive health and welfare programs which include medical, dental, vision and life insurance, a 401(k) plan, an employee stock purchase program, local pension plans, profit sharing, employee assistance, child and elder care programs, employee recognition and a host of other localized programs tied to the unique needs of our employees. Pay equity is an integral part of our compensation strategy. We have established ongoing processes and protocols to help us pay each individual employee appropriately based on the employee's skills, performance, experience, location, market practices, etc., regardless of race, gender, and other non-performance related attributes. Starting in 2023, we introduced an upgraded and streamlined mental health/Employee Assistance Program solution tailored to the need and preference of employees and families. In addition, we added a fertility benefit giving employees access to a suite of services including pregnancy resources, in vitro fertilization (“IVF”), adoption, donor and surrogate services resources.

Health, Wellness and Safety

The health and welfare of our employees is of the highest importance to Bio-Rad. We prioritize, manage, and carefully track safety performance at all locations globally and integrate sound safety practices in every aspect of our operations. We provide work site hazard evaluations, workplace safety surveys, safety equipment selection, safety program reviews, chemical exposure monitoring, safety training, and disposal of hazardous chemical and infectious waste.

Training and Talent Development

We provide training programs for managers and employees to support their growth and development. Our management series of courses cover essential management and leadership learning to provide our managers with the necessary skills and experience needed to more effectively lead and develop their teams. In addition, available courses for employees help them to be more effective at work, enhance interpersonal effectiveness, and help them achieve their full potential. We also support employees’ professional development by providing a reimbursement program for qualified educational expenses.

Investment in Sartorius AG

Sartorius AG ("Sartorius") is an international laboratory and process technology provider for the biotech, pharmaceutical, and food industries. It operates in two divisions – Bioprocess Solutions Division and Lab Products & Services Division. Sartorius is headquartered in Gottingen, Niedersachsen, Germany and has voting ordinary shares as well as non-voting preference shares listed on XETRA and the Frankfurt Stock Exchanges.

As of December 31, 2023, we own 12,987,900 ordinary voting shares and 9,588,908 preference shares of Sartorius, representing approximately 38% of the outstanding ordinary shares (excluding treasury shares) and 28% of the preference shares of Sartorius. As of December 31, 2023, the fair value of the investment in Sartorius was $7,331.9 million. We account for our investment in Sartorius at fair market value and do not include any of the financial information summarized below in our consolidated financial statements.

The following summarizes certain financial data of Sartorius as of and for the year ended December 31, 2022, (in millions).

| | | | | |

| December 31, 2022 (1) |

| Current assets | € | 2,023.2 | |

| Non-current assets | 4,954.6 | |

| Current liabilities | 1,803.4 | |

| Non-current liabilities | 2,515.5 | |

| Equity | 2,658.9 | |

| |

| Year Ended December 31, 2022 (1) |

| Sales revenue | € | 4,174.7 | |

| Gross profit on sales | 2,196.5 | |

| Earnings before interest and taxes (EBIT) | 1,064.8 | |

| Net profit | 913.1 | |

| |

| Cash flow from operating activities | 734.2 | |

| Cash flow from investing activities | (1,129.9) | |

| Cash flow from financing activities | 209.9 | |

(1) As disclosed in Sartorius AG's consolidated financial statements for the year ended December 31, 2022, prepared in accordance with the International Financial Reporting Standards (IFRS), the International Financial Reporting Interpretations Committee (IFRIC) Standards, and the International Accounting Standards Board (IASB) as required to be applied by the European Union, and based upon information publicly disclosed by Sartorius. Bio-Rad does not assume, and by way of referencing the financial data of Sartorius above shall not be deemed to assume, any responsibility or liability for any errors or omissions in the information publicly disclosed by Sartorius.

Refer to Sartorius’ 2022 Annual Report for further details, which can be found at https://www.sartorius.com/en/company/investor-relations/sartorius-ag-investor-relations. The Sartorius website and any information disclosed thereon are not incorporated by reference into this report.

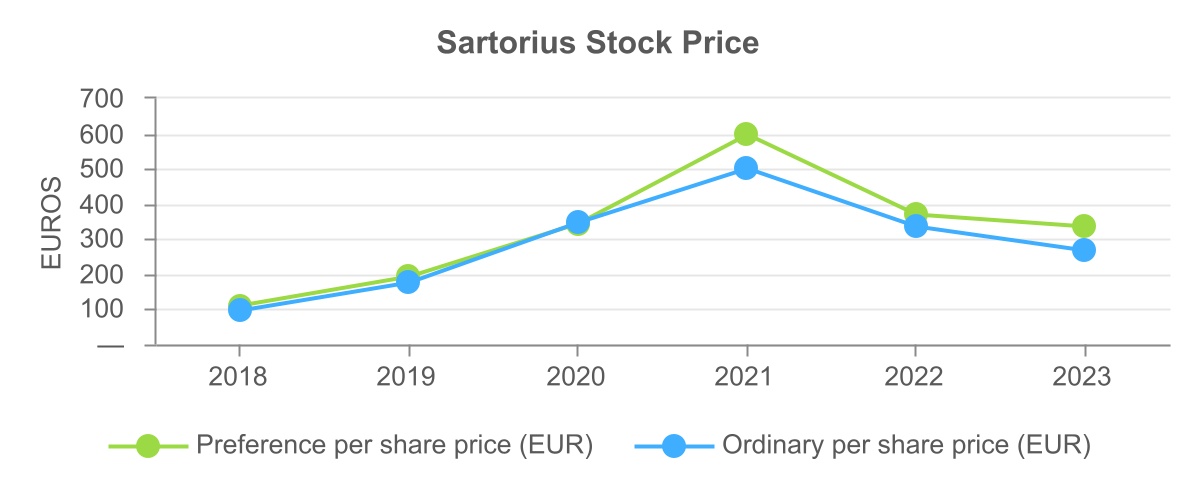

The following graph reflects the changes in the Sartorius share price over the most recent five annual periods:

Available Information

Bio-Rad files annual, quarterly, and current reports, proxy statements, and other documents with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934, as amended. The SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers, including Bio-Rad, that file electronically with the SEC. The public can obtain any documents that we file with the SEC at http://www.sec.gov.

Bio-Rad’s website address is www.bio-rad.com. We make available, free of charge through our website, our Form 10-Ks, 10-Qs and 8-Ks, and any amendments to these forms, as soon as reasonably practicable after filing with the SEC. The information on our website is not part of this Annual Report on Form 10-K.

ITEM 1A. RISK FACTORS

In evaluating our business and whether to invest in any of our securities, you should carefully read the following risk factors in addition to the other information contained in this report. We believe that any of the following risks could have a material effect on our business, results of operations or financial condition, our industry or the trading price of our common stock. We operate in a continually changing business environment, and new risks and uncertainties emerge from time to time. We cannot predict these new risks and uncertainties, nor can we assess the extent to which any such new risks and uncertainties or the extent to which the risks and uncertainties set forth below may adversely affect our business, results of operations, financial condition, our industry, the value of our equity holdings, or the trading price of our common stock. Please carefully consider the following discussion of significant factors, events and uncertainties that make an investment in our securities risky and provide important information for the understanding of the “forward-looking” statements discussed this report. Additional or unforeseen effects from the COVID-19 pandemic and the global economic climate may give rise to or amplify many of these risks discussed below.

Business, Economic, Legal and Industry Risks

Our international operations expose us to additional costs and legal and regulatory risks, which could have a material adverse effect on our business, results of operations and financial condition.

We have significant international operations. We have direct distribution channels in over 35 countries outside the United States, and during the twelve months ended December 31, 2023 our foreign entities generated 58% of our net sales. Compliance with complex foreign and U.S. laws and regulations that apply to our international operations increases our cost of doing business. These numerous and sometimes conflicting laws and regulations include, among others, data privacy requirements, labor relations laws, tax laws, unfair competition regulations, import and trade restrictions, tariffs, duties, quotas and other trade barriers, export requirements, U.S. laws such as the Foreign Corrupt Practices Act ("FCPA") and other U.S. federal laws and regulations established by the office of Foreign Asset Control, foreign laws such as the UK Bribery Act 2010 or other foreign laws which prohibit corrupt payments to governmental officials or certain payments or remunerations to customers. In addition, changes in laws or regulations potentially could be disruptive to our operations and business relationships in the affected regions.

Given the high level of complexity of the foreign and U.S. laws and regulations that apply to our international operations, we may inadvertently breach some provisions, for example, through fraudulent or negligent behavior of individual employees, our failure to comply with certain formal documentation requirements, or otherwise. In addition, we operate in some countries in which the business environment is subject to a higher risk of corruption. Our success depends, in part, on our ability to anticipate these risks and manage these challenges through policies, procedures and internal controls. However, we have a dispersed international sales organization, and we use distributors and agents in many of our international operations. This structure makes it more difficult for us to ensure that our international selling operations comply with laws and regulations, and our global policies and procedures.

Violations of these laws and regulations could result in fines, criminal sanctions against us, our officers or our employees, requirements to obtain export licenses, cessation of business activities in sanctioned countries, implementation of compliance programs, and prohibitions on the conduct of our business. Violations of laws and regulations also could result in prohibitions on our ability to offer our products in one or more countries and could materially damage our reputation, our brand, our international expansion efforts, our ability to attract and retain employees, or our business, results of operations and financial condition. See also our risk factors regarding the COVID-19 pandemic, government regulations, and global economic conditions below.

The industries and market segments in which we operate are highly competitive, and we may not be able to compete effectively.

The life science and clinical diagnostics markets are each highly competitive. Some of our competitors have greater financial resources than we do, making them better equipped to license technologies and intellectual property from third parties or to fund research and development, manufacturing and marketing efforts, or to source high-demand

materials and components. Moreover, competitive and regulatory conditions in many markets in which we operate restrict our ability to fully recover, through price increases, higher costs of acquired goods and services resulting from inflation and other drivers of cost increases. Many public tenders have become more competitive due to governments lengthening the commitments of their public tenders to multiple years, which reduce the number of tenders in which we can participate annually. Because the value of these multiple-year tenders is so high, our competitors have been more aggressive with their pricing. Our failure to compete effectively and/or pricing pressures resulting from competition could adversely affect our business, results of operations and financial condition.

We may not be able to grow our business because of our failure to develop new or improved products.

Our future growth depends in part on our ability to continue to improve our product offerings and develop and introduce new products that integrate technological advances. If we are unable to integrate technological advances into our product offerings or to design, develop, manufacture and market new products successfully and in a timely manner, our business, results of operations and financial condition will be adversely affected. Supply chain disruptions, including those caused by the COVID-19 pandemic, have caused some delays to our ability to develop and introduce new products. We have experienced product launch delays in the past and may do so in the future. We cannot assure you that our product and process development efforts will be successful or that new products we introduce will achieve market acceptance. Failure to launch successful new products or improvements to existing products may cause our products to become obsolete, which could harm our business, results of operations and financial condition.

Global economic and geopolitical conditions could adversely affect our operations.

In recent years, we have been faced with challenging global economic conditions. U.S. and international markets have experienced inflationary pressures, and inflation rates in the U.S. and in other countries in which we operate have been at elevated levels. Our raw material costs have increased, and we are not always able to recover these increased costs from our customers. Russia’s invasion of Ukraine and sanctions against Russia also are causing disruptions to global economic conditions and are negatively impacting our business in Russia. The escalation, in October 2023, of the conflict between Israel and Hamas also has caused some disruptions to the global business environment (including impacting international logistics), the stability of the Middle East region and our business in that region. It is unknown how long any of these disruptions will continue and whether such disruptions will become more severe. In addition, we expect moderating economic growth and changing government policies in China will continue to affect our commercial opportunities in the country. The bank failures in March 2023 and the resulting volatility in the banking sector did cause and could continue to cause disruptions to global economic conditions and may impact access to cash and other financial resources by our customers and suppliers. A deterioration in the global economic environment may result in a decrease in demand for our products, increased competition, downward pressure on prices for our products and longer sales cycles. A weakening of macroeconomic conditions is also adversely affecting our suppliers, which could continue to result in interruptions in the supply of components and raw materials necessary for our products and raw material cost increases. Additionally, the United States and other countries, such as China and India, have imposed tariffs on certain goods. Further escalation of tariffs or other trade barriers could adversely impact our profitability and/or our competitiveness. See also our risk factors regarding our international operations above and regarding the COVID-19 pandemic and government regulations below.

Reductions in government funding and the capital spending programs of our customers could have a material adverse effect on our business, results of operations or financial condition.

Our customers include universities, clinical diagnostics laboratories, government agencies, hospitals and pharmaceutical, biotechnology and chemical companies. The capital spending programs of these institutions and companies have a significant effect on the demand for our products. Such programs are based on a wide variety of factors, including the resources available to make such purchases, the availability of funding from grants by governments or government agencies, the spending priorities for various types of equipment and the policies regarding capital expenditures during industry downturns or recessionary periods. If funding to our customers were to decrease, or if our customers were to decrease or reallocate their budgets in a manner adverse to us, our business, results of operations or financial condition could be materially and adversely affected.

A reduction or interruption in the supply of components and raw materials has adversely affected and could continue to adversely affect our manufacturing operations and related product sales.

The manufacture of our products requires the timely delivery of sufficient amounts of quality components and materials. We manufacture our products in numerous manufacturing facilities around the world. We acquire our components and materials from many suppliers in various countries. We work closely with our suppliers to ensure the continuity of supply, but we cannot guarantee these efforts will always be successful. Further, while we seek to diversify our sources of components and materials, in certain instances we acquire components and materials from a sole supplier. The COVID-19 pandemic created delays and shortages in the supply of components and raw materials. These shortages, along with challenges in ramping up new production facilities, caused a backlog of sales orders, some of which we consider to be significant, and delays in certain new product development activities. Some of the backlog of sales orders continued into 2023, but has now moderated to a more typical level. We have experienced raw material cost increases, some of which will likely continue. In addition, due to the regulatory environment in which we operate, we may need to cease use of certain essential components and materials and be unable to establish acceptable replacement sources for such components or materials. When our supply is reduced or interrupted or of poor quality, and we are unable to develop alternative sources for such supply, our ability to manufacture our products in a timely or cost-effective manner is adversely affected, which affects our ability to sell our products. See also our risk factor regarding the COVID-19 pandemic below.

Pandemics or disease outbreaks, such as the COVID-19 pandemic, have affected and could materially adversely affect our business, operations, financial condition and results of operations.

The COVID-19 pandemic has had, and similar outbreaks could again have, an adverse effect on the United States and global economies, as well as on aspects of our business, operations and financial condition and those of third parties on whom we rely. If a new pandemic were to occur, we expect that parts of our business could again suffer negative impacts, and that our customers, suppliers, logistics providers, and the global economy could also be negatively impacted.

Breaches of our information systems could have a material adverse effect on our business and results of operations.