UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |||

| (Name of registrant as specified in its charter) | ||||

| (Name of person(s) filing proxy statement, if other than the registrant) | ||||

Payment of filing fee (check the appropriate box):

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

Crown Holdings, Inc.

Hidden River Corporate Center Two

14025 Riveredge Drive, Suite 300

Tampa, Florida 33637

________________________

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

________________________

| Date: | May 2, 2024 | |

| Time: | 9:30 a.m. Eastern Time | |

| Place: | The Westin Tampa Waterside 725 South Harbour Island Boulevard, Tampa, FL 33602 | |

| Agenda: | · | Election of Directors |

| · | Ratification of appointment of independent auditors for the fiscal year ending December 31, 2024 |

| · | Advisory vote on a resolution to approve executive compensation for the Named Executive Officers as disclosed in this Proxy Statement |

| · | Proposal to amend Articles of Incorporation to reduce minimum and maximum size of the Board of Directors |

| · | If properly presented, consideration of a Shareholder proposal regarding transparency in political spending |

| · | Such other business as may properly come before the Annual Meeting |

Only Shareholders of Common Stock of record as of the close of business on March 12, 2024, the record date for the Annual Meeting, will be entitled to vote.

| By Order of the Board of Directors |

| ADAM J. DICKSTEIN |

| Corporate Secretary |

Tampa, Florida

March 25, 2024

Important Notice Regarding the Availability

of Proxy Materials for the

Shareholder Meeting to be Held on May 2, 2024:

The Proxy Statement and Proxy Card relating to the Annual Meeting of Shareholders

and the Annual Report to Shareholders are available at

WWW.CROWNCORK.COM/INVESTORS/GOVERNANCE/PROXY-ONLINE

TABLE OF CONTENTS

| 2024 Proxy Statement Summary | 1 | |

| Questions & Answers about the 2024 Annual Meeting | 14 | |

| Proposal 1: Election of Directors | 20 | |

| Director Compensation | 24 | |

| Common Stock Ownership of Certain Beneficial Owners, Directors and Executive Officers | 26 | |

| Corporate Governance | 28 | |

| Compensation Discussion and Analysis | 34 | |

| 2023 Say-On-Pay Vote Results | 34 | |

| At-Risk Compensation | 35 | |

| Pay-for-Performance Alignment -Performance-Based Compensation | 36 | |

| Role of the Compensation Committee | 36 | |

| Compensation Philosophy and Objectives | 36 | |

| Committee Process | 37 | |

| Role of Executive Officers in Compensation Decisions | 38 | |

| Executive Compensation Consultant | 38 | |

| Use of Benchmarking | 38 | |

| Peer Group Composition | 38 | |

| Compensation Strategy for CEO | 39 | |

| Compensation Strategy for NEOs other than the CEO | 40 | |

| Components of Compensation | 41 | |

| Base Salary | 41 | |

| Annual Incentive Bonus | 41 | |

| Long-Term Equity Incentives | 44 | |

| Retirement Benefits | 48 | |

| Perquisites | 49 | |

| Severance | 50 | |

| Tax Deductibility of Executive Compensation | 50 | |

| Compensation Committee Report | 50 | |

| Executive Compensation | 52 | |

| Summary Compensation Table | 52 | |

| Grants of Plan-Based Awards | 54 | |

| Outstanding Equity Awards at Fiscal Year-End | 56 | |

| Option Exercises and Stock Vested | 58 | |

| Pension Benefits | 59 | |

| Employment Agreements and Potential Payments upon Termination | 60 | |

| Pay Ratio Disclosure | 63 | |

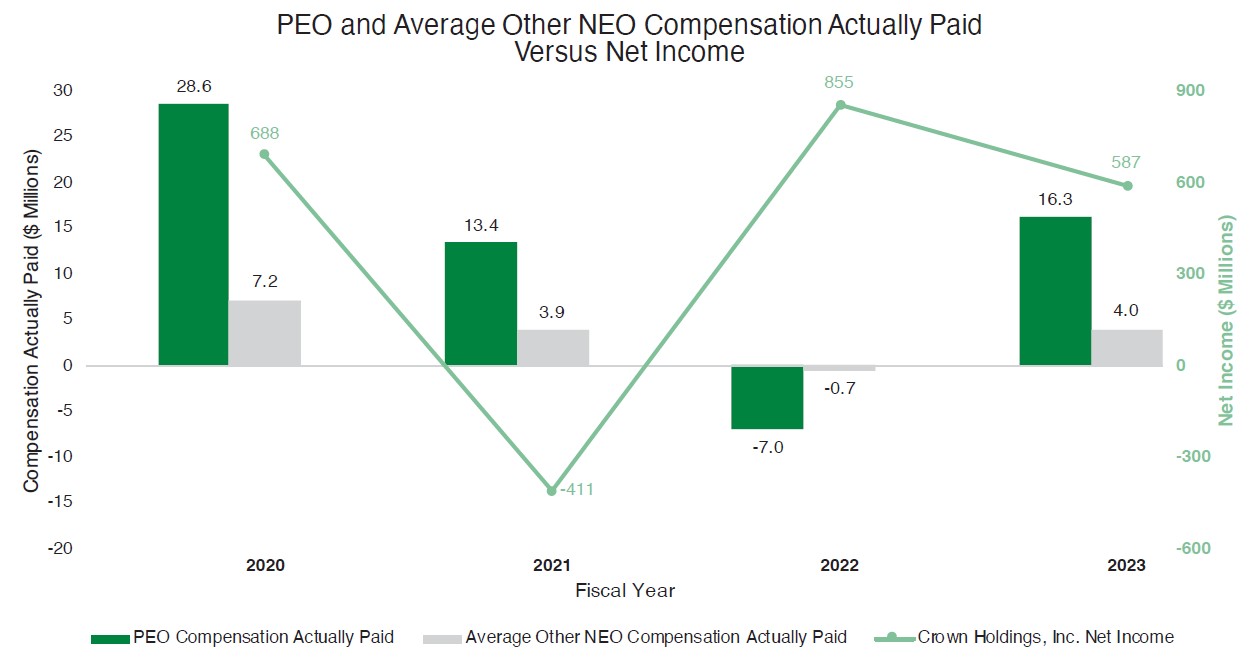

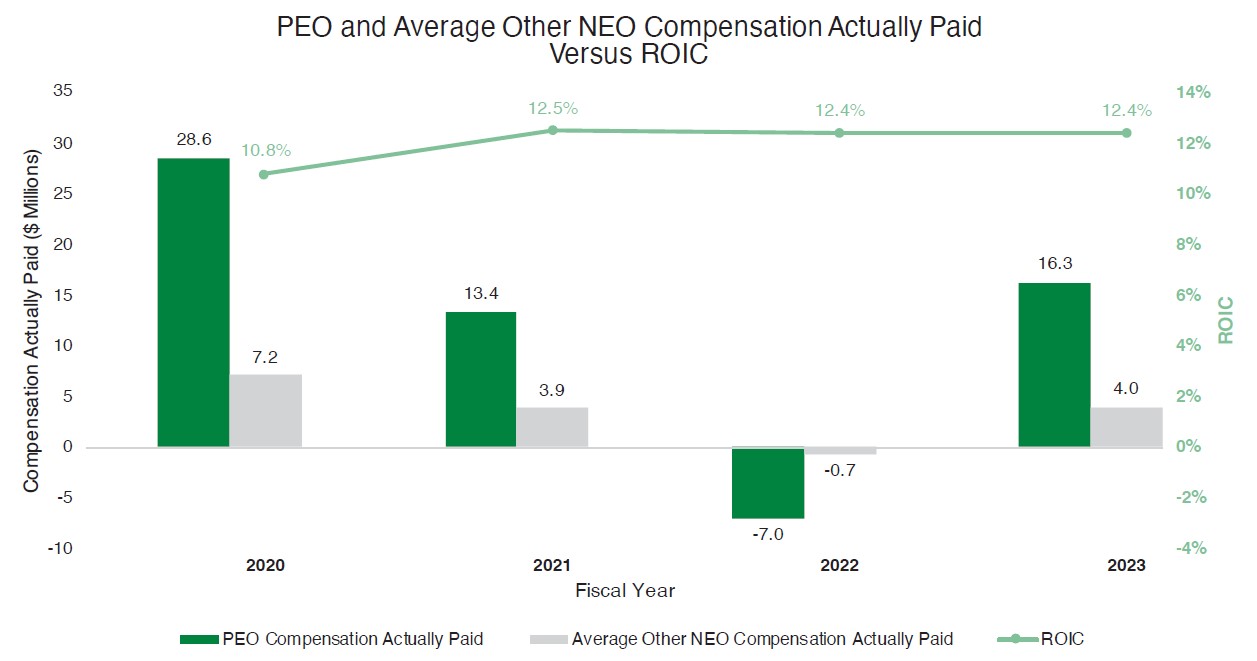

| Pay Versus Performance Disclosure | 63 | |

| Principal Accountant Fees and Services | 70 | |

| Audit Committee Report | 71 | |

| Proposal 2: Ratification of Appointment of Independent Auditors | 72 | |

| Proposal 3: Advisory Vote to Approve Executive Compensation | 73 | |

| Proposal 4: Proposal to Amend Articles of Incorporation to Reduce Minimum and Maximum Size of the Board of Directors | 74 | |

| Proposal 5: Consideration of a Shareholder Proposal Regarding Transparency in Political Spending | 75 | |

| Other Matters | 78 | |

| Appendix A | A-1 | |

| i |

2024 PROXY STATEMENT SUMMARY

This is a summary only and does not contain all the information that you should consider. We urge you to carefully read the entire Proxy Statement before voting.

Crown Holdings, Inc. - 2024 Annual Meeting

Time and Date: |

9:30 a.m. Eastern Time, May 2, 2024

|

|

Place: |

The Westin Tampa Waterside 725 South Harbour Island Boulevard Tampa, Florida 33602

|

|

Record Date: |

March 12, 2024. Only Shareholders of record of the Company’s Common Stock at the close of business on the Record Date will be entitled to vote at the Annual Meeting. |

2024 Annual Meeting Proposals

| Agenda Item | Board Recommendation | Page |

| 1. Election of Directors | FOR EACH DIRECTOR NOMINEE | 20 |

| 2. Ratification of appointment of Independent Auditors | FOR | 72 |

| 3. Advisory vote to approve executive compensation | FOR | 73 |

| 4. Proposal to amend Articles of Incorporation to reduce the minimum and maximum size of the Board of Directors | FOR | 74 |

| 5. Consideration of a Shareholder proposal regarding transparency in political spending | AGAINST | 75 |

How to Cast Your Vote

You can vote by any of the following methods:

| Internet | Phone | In Person | ||||

|

|

|

| |||

|

www.proxypush.com/cck Deadline for voting online is 11:59 p.m. (ET) on May 1, 2024. |

1-866-883-3382 Deadline for voting by phone is 11:59 p.m. (ET) on May 1, 2024. |

Mark, sign and date your proxy card and return it in the postage-paid envelope provided. Your proxy card must be received before the Annual Meeting. |

For instructions on attending the Annual Meeting, please see “Questions and Answers about the 2024 Annual Meeting” on page 14. | |||

| 1 |

Proposal 1 - Election of Directors

There are ten nominees for election to the Board of Directors. All of the nominees currently serve on the Board. Six of the Company’s current independent Directors have joined the Board in the last five years as a result of a Board refreshment process where Director candidates were identified during that period through Board, Shareholder and third-party search firm input.[1] Half of our nominees are or have been Chairs of U.S. public company Boards of Directors. Our Board refreshment strategy has further strengthened and diversified the skills and experiences of the Board. Each Director nominee is listed below, and you can find additional information about each nominee under Proposal 1: Election of Directors, beginning on page 20.

|

Director |

|

Committee Memberships | ||||||||||||

| Name and Primary Occupation | Age | Since | Independent | A | C | E | NCG | |||||||

|

Timothy J. Donahue Chairman, President and Chief Executive Officer of the Company |

61 | 2015 | No | ✓ | ||||||||||

|

Richard H. Fearon Former Vice Chairman and Chief Financial and Planning Officer of Eaton Corporation |

67 | 2019 | Yes | ✓ | ✓ | |||||||||

|

Andrea J. Funk Executive Vice President and Chief Financial Officer of EnerSys |

54 | 2017 | Yes | ✓ | ✓ | |||||||||

|

Stephen J. Hagge Former President and Chief Executive Officer of AptarGroup |

72 | 2019 | Yes | Chair | ✓ | ✓ | ||||||||

|

James H. Miller Former Chairman and Chief Executive Officer of PPL Corporation |

75 | 2010 | Yes | ✓ | ✓ | Chair | ||||||||

|

B. Craig Owens Former Chief Financial Officer and Chief Administrative Officer of Campbell Soup Company |

69 | 2019 | Yes | Chair | ✓ | |||||||||

|

Angela M. Snyder President of Fulton Financial Corporation and Fulton Bank |

59 | 2022 | Yes | ✓ | ✓ | |||||||||

|

Caesar F. Sweitzer Former Senior Advisor and Managing Director of Citigroup Global Markets |

73 | 2014 | Yes | ✓ | ✓ | ✓ | ||||||||

|

Marsha C. Williams Former Senior Vice President and Chief Financial Officer of Orbitz Worldwide |

72 | 2022 | Yes | ✓ | ||||||||||

|

Dwayne A. Wilson Former Senior Vice President of Fluor Corporation |

65 | 2020 | Yes | ✓ | ||||||||||

A: Audit Committee C: Compensation Committee E: Executive Committee NCG: Nominating and Corporate Governance Committee

1 Two additional Directors were appointed in 2022 pursuant to an agreement with a Shareholder and resigned in November 2023.

| 2 |

The Board elected Mr. Timothy Donahue as its Chairman following the 2022 Annual Meeting. Mr. James Miller is the Board’s Independent Lead Director. See the section below titled “Corporate Governance: Board Leadership and Risk Oversight” for a summary of the duties of our Independent Lead Director.

| Director Tenure | ||||

| Less than 6 years | 6 – 10 years | More than 10 years | ||

|

|

|

| ||

|

Ongoing Board Refreshment – eight new Directors in five years1 |

||||

| Board Independence and Diversity | |

|

Board Diversity · Three female Directors · One African American Director

|

The ten Director nominees standing for reelection to the Board have diverse backgrounds, skills and experiences. We believe their varied backgrounds contribute to an effective and well-balanced Board that is able to provide valuable insight to, and effective oversight of, our senior executive team.

1 Two additional Directors appointed pursuant to an agreement with a Shareholder served from December 2022 to November 2023.

| 3 |

| 4 |

Governance Best Practices

The Board of Directors is committed to implementing and maintaining strong corporate governance practices. The Board continually adopts emerging best practices in governance that enhance the effectiveness of the Board and our management and that serve the best interests of the Company’s Shareholders. The Corporate Governance section beginning on page 28 describes our governance framework. We call your attention to the following best practices.

|

ü Annual election of all Directors ü Resignation policy applicable to Directors who do not receive a majority of votes cast in uncontested elections ü Mandatory retirement policy for Directors ü Proxy access ü Active outreach and engagement with Shareholders throughout the year ü Overboarding limits ü Robust Board refreshment with eight new independent Directors joining the Board in the last five years1 ü 9 of 10 Directors independent – all key committees consisting solely of independent Directors ü Independent Lead Director with broad authority ü Executive sessions of independent Directors held regularly ü Annual review of Committee charters and Corporate Governance Guidelines ü Robust stock ownership guidelines for Directors and Named Executive Officers ü Prohibition on all pledging and hedging of the Company’s stock by Directors, Officers and other insiders ü Annual Say-on-Pay vote ü Code of Business Conduct and Ethics that applies to Directors and employees ü No supermajority voting requirement to amend By-Laws ü Shareholder right to call special meetings ü No poison pill ü Review of sustainability/environmental, social and governance (“ESG”) policy matters assigned to Nominating and Corporate Governance Committee and review of the Company’s ESG disclosures and reporting assigned to Audit Committee ü Integration of Diversity and Inclusion in the Company’s Sustainability program, overseen by the Nominating and Corporate Governance Committee ü Board oversight of information security ü Annual update from Management to the Board on the Company’s political contributions |

Shareholder Engagement

The Company has developed a multi-platform Shareholder engagement program that results in active dialogue with both current and prospective investors globally. Major elements of the program include individual or group investor meetings, scheduled teleconferences, participation in institutional investor conferences and investor visits to Company manufacturing, research and development or administrative facilities. Subjects of discussion at these events include long-term strategy, financial information, recent and pending acquisitions

1 Two Directors joined the Board in 2022 pursuant to an agreement with a Shareholder and resigned in November 2023.

| 5 |

and divestitures, major trends and issues affecting the Company’s businesses, industry dynamics, executive compensation, sustainability and corporate governance, among other matters. Every few years, as appropriate, the Company hosts investor day events, which may also include facility tours. In 2023, the Company released a comprehensive and updated investor presentation. The Company also cultivates relationships with the stewardship teams of its index-based Shareholders. In discussions with current and prospective Shareholders, our engagement includes eliciting Shareholder perspectives on our long-term strategy, financial performance, capital allocation policies and business portfolio, among other matters. During last year’s engagement cycle, we estimate that we had personal contact with investors owning well over 60% of the Company’s outstanding shares. On June 2, 2023, the Company was included into the S&P MidCap 400 Index.

Sustainability – Environmental and Social Responsibility

Sustainability is a core driver and priority within the Company's strategic approach. Under the general direction of the Board and in accordance with its charter, the Nominating and Corporate Governance Committee regularly reviews and assesses the Company's sustainability programs, policies and practices. Similarly, the Audit Committee reviews Environmental, Social and Governance (ESG) disclosures, reports and audits, as well as management’s assessment and measurement of the Company’s progress towards achieving its ESG goals and objectives. Robust governance frameworks govern all facets of the business, with a particular emphasis on sustainability. In addition to the responsibilities of the Board Committees described above, the Company monitors its sustainability efforts through a Global Executive Sustainability Committee, comprising senior Company executives.

In 2020, Crown established its comprehensive Twentyby30TM program, setting 20 measurable goals that the Company would attempt to reach by 2030 or sooner. These objectives encompass multiple aspects of sustainability and reflect areas which may be material to the Company’s business as well as areas where it believes it can create notable impact. Structured within five core program pillars of: Climate Action, Resource Efficiency, Optimum Circularity, Working Together and Never Compromise, these initiatives include efforts such as making operational improvements in energy, water and waste and elevating our focus on material use efficiency, recycling, responsible and ethical sourcing and food contact and safety.

The Company’s main raw material inputs, aluminum and steel, offer unparalleled sustainability credentials for packaging not only due to their superior recycling rates and recycled content, but also because both materials are infinitely recyclable, meaning they can be recycled repeatedly with no loss of physical properties or quality. This reuse into new containers or other metal products saves raw materials, energy and CO2 emissions. Most of the products made by the Company’s Transit Packaging Division use a high degree of recycled content, and many are made from 100% recycled content. In fact, the group recycles hundreds of millions of pounds of plastic every year for use in its products. The Transit Packaging Division also produces reusable top frames, which contribute to a lower carbon footprint.

Crown acknowledges that its sustainability efforts rely on collaboration throughout the value chain. The Company works to positively influence its upstream value chain by communicating its comprehensive environmental supplier standards. These standards grant the Company oversight of and visibility into the environmental practices of our suppliers, and the Company expects all suppliers to comply with them. Third-party risk assessments and audits further reinforce the Company’s commitment to sustainability in its raw material supply chains.

| 6 |

The Company issued its most recent complete Sustainability Report in June 2023. The report uses the Global Reporting Initiative’s 2021 guidelines and is available in full at https://www.crowncork.com/news/crowns-new-sustainability-report-underscores-continued-progress-toward-achieving-twentyby30tm.

This report details progress within the Company’s Twentyby30 program throughout 2022, which includes the following:

| · | Climate Action |

| · | Resource Efficiency |

| · | Optimum Circularity – Crown reduced the overall global average standard (12oz or 330ml) can weight of its beverage cans by 6.44%, which is over 60% of the way toward the Company's goal of a 10% reduction by 2030. |

| · | Working Together – Across its global businesses, 44% of Crown's new hires in executive roles were female – a 38% increase from 2019. |

| · | Never Compromise |

In 2023, the Company received recognition of its sustainability efforts from several sources, including:

| · | “Most Trustworthy Companies in America” by Newsweek and Statista: The Company was ranked as the top packaging company within the Transport, Logistics & Packaging category, based on evaluations of customer, investor and employee trust. |

| · | “America’s Most Responsible Companies” by Newsweek and Statista: The Company was featured among 500 honorees, based on evaluations of CSR and sustainability KPIs and public perception of the Company’s reputation. |

| 7 |

| · | “America’s Climate Leaders” by USA TODAY and Statista: The Company was ranked as one of the top performing companies for emissions reduction among 2,000 U.S.-based organizations. |

| · | EPA’s Top 30 Green Power Partners from the Fortune 500 List: The Company was featured within the top 30 companies for the third year in a row. |

| · | “Top Companies for Women” by Forbes: The Company was awarded #4 in our industry category and #77 overall out of 400 honorees. |

| · | Sustainalytics: The Company was awarded the #1 spot within the "Containers and Packaging" industry category for 2023, marking the 4th year in a row that we placed in the top 3% of our category. |

The Company’s next Sustainability Report will be issued in 2024 and will use the Global Reporting Initiative’s 2021 guidelines, which are effective for reports or other materials published on or after January 1, 2023. This next Sustainability Report will include alignment to recommendations of the Task Force on Climate Disclosure (“TCFD”). As with any material risk to the Company, Crown closely manages risks and opportunities that climate change and the transition to a low-carbon economy could create for the Company.

Information Security

The Company places a high priority on securing its confidential business information, as well as the confidential business information and personal information that we receive from and store about our business partners and employees.

The Company has systems in place to securely receive and store information and to detect, contain, and respond to data security incidents. The Company has information security compliance procedures in place to manage information security risk and conducts frequent security awareness training for all Company employees. This program provides training and testing at least annually on information security. To respond to the threat of security breaches and cyberattacks, the Company maintains a program, overseen by the Company’s Chief Information Security Officer, that is designed to protect and preserve the confidentiality, integrity and continued availability of all information owned or controlled by the Company. This program also includes a cyber incident response plan that provides controls and procedures for timely and accurate reporting of any material information security incident. The Company undergoes annual third-party security testing to gain an independent view of the strength of our information security defenses and audits its information technology and security compliance procedures annually in order to comply with the requirements of the Sarbanes Oxley Act. Auditors engaged by the Company for this purpose are best-in-class industry leaders in the information security industry that use standard cyber security frameworks such as NIST Cyber Security Framework and ISO 27001 standards. The Company also maintains an information security risk insurance policy.

The Board, the Audit Committee and Company management share top-level responsibility for management of information security risk. Day-to-day oversight rests with the Company’s Chief Information Security Officer, who reports to the Company’s Chief Financial Officer. The Audit Committee, which is tasked with oversight of certain risk issues, including information security risk, receives two to four reports annually from the Company’s senior leadership, including the Chief Information Security Officer, that includes an information security dashboard and discussion of emerging risks and trends. The Audit Committee then briefs the Board on these matters. The full Board receives a presentation, usually annually, from the Company’s senior leadership on information security matters. The Company has conducted training programs for Board members to enhance our Directors’ literacy on information security issues.

| 8 |

Proposal 2 – Ratification of Appointment of Independent Auditors

As a matter of good corporate governance, the Company asks its Shareholders to ratify the selection by the Audit Committee of PricewaterhouseCoopers LLP (“PwC”) as the Company’s independent auditors for 2024. The following table summarizes the fees PwC billed to the Company for 2023.

| Audit Fees | Audit-Related Fees | Tax-Related Fees | All Other Fees |

| $9,289,000 | $1,350,000 | $1,482,000 | $10,000 |

Additional information in the section titled “Principal Accountant Fees and Services” and the Audit Committee Report may be found on pages 70 and 71.

Proposal 3 – Advisory Vote to Approve Executive Compensation

At the 2023 Annual Meeting, the Say-on-Pay resolution with respect to Named Executive Officer (“NEO”) compensation received a favorable vote of over 92%. Accordingly, the general approach to the compensation of our NEOs, including the Chief Executive Officer (“CEO”), remained largely unchanged. Since 2022, a sustainability criterion has been part of the Board’s annual evaluation of the CEO. See the Compensation and Discussion Analysis (“CD&A”) section that begins on page 34. Below is a summary of the CEO’s compensation for 2021, 2022 and 2023. Compensation for Mr. Donahue and the other NEOs is more fully described in the Summary Compensation Table on page 52.

| Name and Position | Year | Salary |

Grant Date Projected Value of Unvested Restricted Stock Awards |

Non-Equity Incentive Plan Compensation | Change in Pension Value | All Other Compensation | Total Compensation |

|

Timothy Donahue President and Chief Executive Officer |

2023 | $1,370,000 | $7,671,945 | $2,820,488 | $0 | $65,790 | $11,928,223 |

| 2022 | 1,315,000 | 7,364,000 | 599,969 | 0 | 21,167 | 9,300,136 | |

| 2021 | 1,260,000 | 6,368,770 | 3,024,000 | 1,106,979 | 55,316 | 11,815,065 |

The lump-sum present value calculations required to be included for all of our NEOs in this Proxy Statement for certain components of Total Compensation (e.g., Changes in Pension Value) are affected strongly by interest rates. Future changes in interest rates could cause significant changes in the lump-sum value of such benefits. See page 59, footnote 4, for more information about interest rate sensitivity. Note also that not all of the pension benefits payable to our NEOs will be paid in a lump sum.

| 9 |

Pay-for-Performance Alignment – Performance-Based Compensation

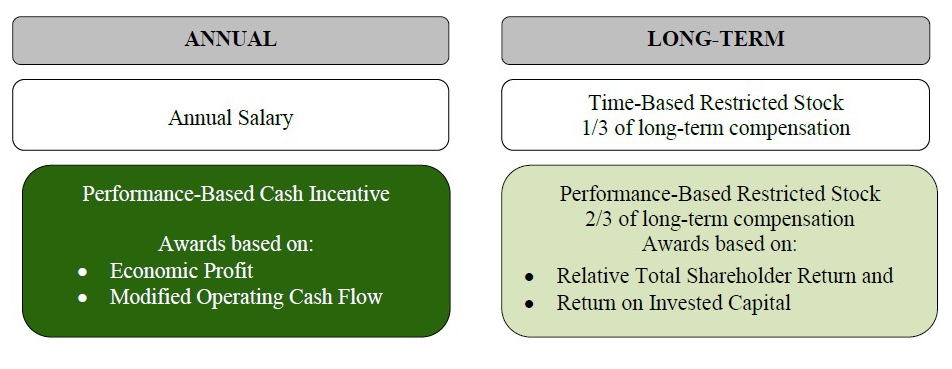

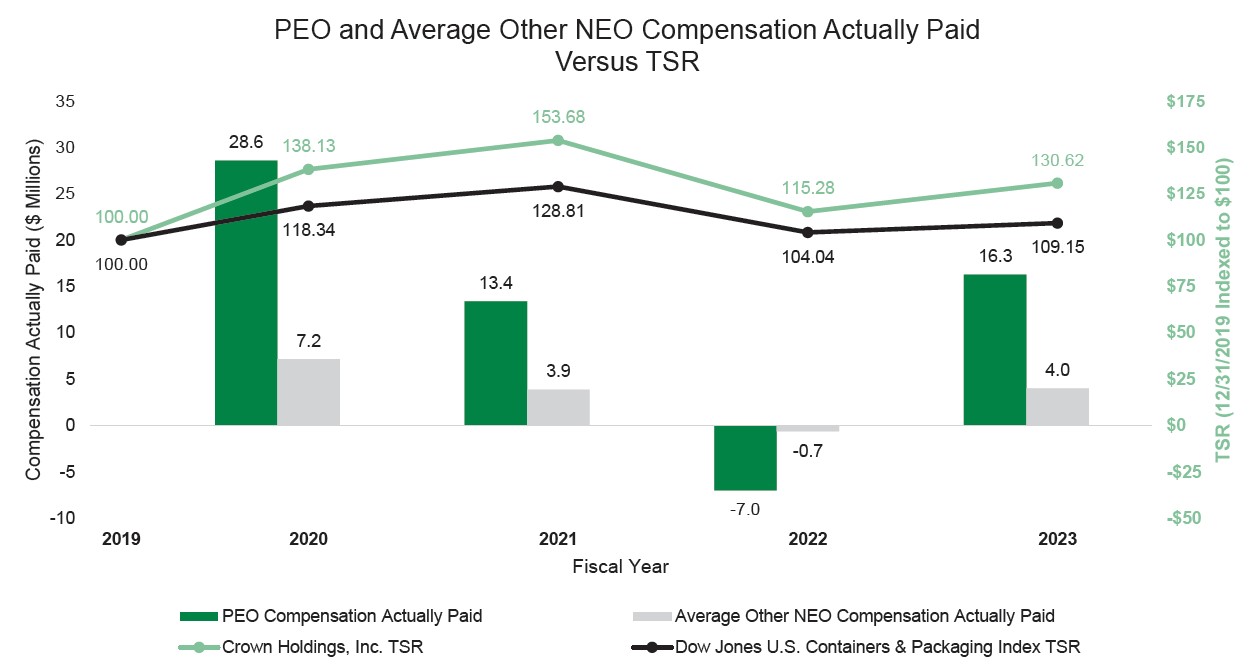

The Company has developed an executive compensation program that is ownership-oriented and that rewards the attainment of specific annual and long-term goals that will result in improvement in shareholder value. Approximately two-thirds of our NEOs’ share awards are performance-based. Vesting is based on two performance metrics: the Company’s relative total shareholder return (“TSR”) against a published index of company peers (the Dow Jones U.S. Containers & Packaging Index) and the Company’s return on invested capital (“ROIC”). Annual incentive bonuses are also based on two performance metrics: the Company’s modified operating cash flow (“MOCF”) and its economic profit.

Based on the Company’s performance for the measurement period related to the vesting of performance-based shares in 2024, the Company’s NEOs, including the CEO, received TSR-based awards that were 54.4% below target and ROIC-based awards that were 100% above target. For 2023, based on the Company’s over-performance on the MOCF component and under-performance on the economic profit component of the annual incentive bonus, corporate-level NEOs (including the CEO) received bonuses that were 52.5% above target. The Company’s corporate-level NEOs received annual incentive bonuses for 2022 that were 63.5% below target level and NEOs have forfeited 100% of their performance share vestings for two years out of the last ten. The Committee views these outcomes as demonstrative of the Company’s “pay-for-performance” philosophy.

| 10 |

Elements of Total Direct Compensation

The allocation of 2023 total direct compensation for our CEO and for our other NEOs among the various components of compensation is set forth in the following charts that highlight the Company’s emphasis on “at risk” and equity-based compensation.

| ||

|

|

| |

| 11 |

Executive Compensation Best Practices

|

WHAT WE DO ü Maintain a Compensation Committee comprised entirely of independent Directors ü Benchmark our NEOs’ total direct compensation at the 50th percentile of our peer group ü Review pay and performance alignment annually ü Target and provide a majority of the direct compensation paid to our NEOs in performance-based compensation ü Allocate approximately two-thirds of compensation under the Company’s long-term incentive plan to performance-based share awards and approximately one-third to time-based share awards ü Vest performance-based shares on the basis of two metrics (relative total shareholder return and return on invested capital) ü Require both a change in control and a qualifying employment termination for vesting of stock compensation (i.e., double-trigger vesting) ü Base payouts under the Company’s Annual Incentive Bonus Plan on the achievement of specified levels of economic profit and modified operating cash flow ü Maintain stock ownership and holding period requirements for our NEOs ü Pursuant to our new compensation recovery policy (the “Compensation Recovery Policy”) for incentive compensation paid or awarded on or after October 2, 2023, we may recover from certain current or former executive officers, including our NEOs, the amount of any erroneously awarded cash- or equity-based compensation paid on the basis of the achievement of financial performance measures in the event of an accounting restatement, without regard to whether the NEO engaged in intentional misconduct or fraud. The Compensation Recovery Policy applies in addition to any other rights of recovery under any similar policy, including under the Company’s general clawback policy pursuant to which the Company may recoup non-equity incentive bonus payments and performance-based equity awards from NEOs in the event of certain acts of misconduct. ü Engage an independent compensation consultant for our Compensation Committee ü Annually review the independence of the compensation consultant retained by the Compensation Committee ü Utilize tally sheets to review, for each NEO, total compensation, compensation mix, internal pay equity, total value of Company stock held by the NEO, payouts under certain potential termination scenarios and the aggregate value of retirement benefits and interest rate sensitivity of retirement benefits ü Hold annual Say-on-Pay votes ü Include a sustainability criterion for the Board’s annual evaluation of the CEO WHAT WE DON’T DO û Allow carry-forward or banking of economic profit or modified operating cash flow achievement in the Company’s Annual Incentive Bonus Plan û Enter into any new employment, severance or separation agreement, or establish any new severance plan or policy covering any NEO that provides for cash severance benefits exceeding 2.99 times the sum of the NEO’s base salary plus target bonus, without seeking Shareholder ratification of such agreement, plan or policy. û Use subjective individual qualitative factors in determining annual bonuses for our NEOs û Include any tax gross-up provisions in our executive employment agreements û Provide excessive perquisites û Permit any form of hedging or pledging of Company stock û Count unexercised stock options or unearned performance shares toward the achievement of ownership guidelines |

Please read the CD&A, beginning on page 34, for a more detailed description of the Company’s executive compensation program.

| 12 |

Proposal 4 – Proposal to Amend Articles of Incorporation to Reduce the Minimum and Maximum Size of Board of Directors

The Board believes that the proposed amendment will align the Company’s Board structure with current practice at U.S. public companies while continuing to allow for a Board with diverse talents and perspectives, as well as demonstrated experience and expertise. The proposed amendment to the Articles will result in a size range for the Board that the Board believes will support the culture of critical thinking and thoughtful discussion in the boardroom.

The Board recommends that you vote FOR Proposal 4.

Proposal 5 – Consideration of Shareholder Proposal Regarding Transparency in Political Spending

Mr. John Chevedden has advised he intends to present a Shareholder proposal regarding transparency in political spending.

The Board has carefully considered this Shareholder proposal and recommends that you vote AGAINST Proposal 5.

| 13 |

QUESTIONS & ANSWERS ABOUT THE 2024 ANNUAL MEETING

Why am I receiving these materials?

The Company is providing you this Proxy Statement, the accompanying Proxy Card and a copy of our Annual Report for the year ended December 31, 2023, containing audited financial statements, in connection with our Annual Meeting of Shareholders or any adjournments or postponements of the Annual Meeting. The Meeting will be held on May 2, 2024 at 9:30 a.m. Eastern Time at The Westin Tampa Waterside located at 725 South Harbour Island Boulevard, Tampa, Florida. As a Shareholder of the Company, you are cordially invited to attend the Annual Meeting and are encouraged to exercise your right to vote on the matters described in this Proxy Statement. The accompanying Proxy is solicited on behalf of the Board of Directors of the Company. We are mailing this Proxy Statement and the accompanying Proxy Card and Annual Report to our Shareholders on or about March 25, 2024.

What is a Proxy?

A Proxy is your legal designation of another person to vote the shares that you own in accordance with your instructions. The person you appoint to vote your shares is called a Proxy Holder. On the Proxy Card you will find the names of the persons designated by the Company to act as Proxy Holders to vote your shares at the Annual Meeting. The Board is asking you to allow any of the persons named as Proxy Holders on the Proxy Card (all of whom are Officers of the Company) to vote your shares at the Annual Meeting. The Proxy Holders must vote your shares in the manner you instruct.

Who is entitled to vote?

Only Shareholders as of the close of business on March 12, 2024 (“Record Date”) are entitled to receive notice of, to attend and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting. Each Shareholder has one vote per share on all matters to be voted on. As of the Record Date, there were 120,794,273 shares of Common Stock outstanding.

What is the difference between a “record owner” and a “beneficial owner”?

Record Owners: If your shares are registered directly in your name with EQ Shareowner Services, the Company’s stock transfer agent, you are considered the “Shareholder of record” or “record owner” with respect to those shares. You vote your shares directly and may attend the Annual Meeting. You also may participate in and vote at the Annual Meeting with no prior authorizations required.

Beneficial Owners: If your shares are held in an account at a brokerage firm, bank or trust as custodian on your behalf, you are considered the “beneficial owner” of those shares. Your shares are registered on the Company’s books in the name of the brokerage firm, bank or trust, or its nominee. Shares held in this manner are commonly referred to as being held in “street name.” As the beneficial owner of the shares, you have the right to direct your broker, bank or trustee how to vote your shares by using the voting instruction form sent to you along with this Proxy Statement. You also are invited to attend the Annual Meeting. However, because a beneficial owner is not the Shareholder of record, you may not vote these shares in person at the Annual Meeting, or participate in the Annual Meeting, unless you obtain a legal proxy from the broker, bank or trust who is the Shareholder of record, or holds a legal proxy from the Shareholder of record, giving you the right to vote the shares at the Annual Meeting.

| 14 |

What proposals will be voted on at the Annual Meeting?

Shareholders will vote on five proposals at the Annual Meeting:

| · | the election of Directors |

| · | the ratification of the appointment of the Company’s independent auditors for the fiscal year ending December 31, 2024 |

| · | the “Say-on-Pay” vote |

| · | an amendment to Articles of Incorporation to reduce the minimum and maximum size of the Board of Directors |

| · | if properly presented, a Shareholder proposal regarding transparency in political spending |

The Company also will consider any other business that properly comes before the Annual Meeting in accordance with Pennsylvania law and the Company’s By-Laws.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote your shares:

| · | “FOR” each of the nominees for election to the Board |

| · | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for 2024 |

| · | “FOR” the advisory resolution to approve the compensation of the Named Executive Officers as disclosed in this Proxy Statement |

| · | “FOR” the amendment to Articles of Incorporation to reduce the minimum and maximum size of the Board of Directors |

| · | “AGAINST” the Shareholder proposal regarding transparency in political spending |

What happens if additional matters are presented at the Annual Meeting?

Other than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Annual Meeting. If you grant a Proxy to the Proxy Holders named on the Proxy Card, they will have the discretion to vote your shares in their best judgment with respect to any additional matters properly brought before the Annual Meeting in accordance with Pennsylvania law and the Company’s By-Laws. Also, if for any reason any of our nominees are not available as candidates for Director, the Proxy Holders will vote the Proxies for any other candidate or candidates who may be nominated by the Board.

How do I vote my shares?

You may vote your shares by Proxy or in person.

You may vote by Proxy:

| · | by the Internet, at the web address provided on page 1 of this Proxy Statement or on your Proxy Card or voting instruction form; or |

| · | by telephone, using the toll-free number listed on page 1 of this Proxy Statement or on your Proxy Card or voting instruction form; or |

| · | by mail, by marking, signing, dating and mailing your Proxy Card or voting instruction form and returning it in the envelope provided. If you return your signed Proxy Card or voting instruction form but do not mark the boxes showing how you wish to vote, your shares will be voted FOR Proposals 1 through 4 and AGAINST Proposal 5. |

| 15 |

You may vote in person:

| · | with no prior authorization, if you are a record owner; |

| · | with a legal proxy from the brokerage firm, bank or trust that holds your shares in street name, if you are a beneficial owner. |

The deadline for voting by telephone or electronically through the Internet is 11:59 p.m. Eastern Time, May 1, 2024.

Will my shares be voted if I do not provide my Proxy?

It depends on whether you are a record owner or beneficial owner. If you are a record owner, your shares will NOT be voted unless you provide a Proxy or vote in person at the Annual Meeting. For beneficial owners who hold shares in street name through brokerage firms, those firms generally have the authority to vote their clients’ unvoted shares in their discretion on certain routine matters. For example, if you are a beneficial owner and you do not provide voting instructions, your brokerage firm may vote your shares with respect to the ratification of the appointment of independent auditors (Proposal 2), as this matter is considered routine under the applicable New York Stock Exchange (“NYSE”) rules. All other matters to be voted on at this year’s Annual Meeting are not considered routine, and your broker cannot vote your shares on those non-routine matters without your instruction (“broker non-votes”).

Beneficial Owners: The Company urges you to instruct your broker, bank or trust on how to vote your shares.

What constitutes a quorum?

The presence, in person or by Proxy, of Shareholders entitled to cast a majority of votes will be necessary to constitute a quorum for the transaction of business at the Annual Meeting. WITHHOLD votes with respect to Director nominees and abstain votes on the other proposals will be counted in determining the presence of a quorum, as will shares subject to broker non-votes if the broker votes the shares on a routine matter, such as the ratification of the appointment of the Company’s independent auditors (Proposal 2).

Under Pennsylvania law and the Company’s By-Laws, ABSTAIN votes and broker non-votes are not considered to be “votes cast” and, therefore, although they will be counted for purposes of determining a quorum, they will not be given effect either as FOR or WITHHOLD / AGAINST votes.

What vote is needed for the election of Directors, and what is the policy with respect to the resignation of Directors who do not receive a majority of the votes?

With regard to Proposal 1, Shareholders may vote FOR or WITHHOLD with respect to the election of Directors. Directors are elected by a plurality of the votes cast, in person or by Proxy, subject to the Company’s By-Law provision described below. The Company’s By-Laws set forth the procedures if a Director nominee does not receive at least a majority of votes cast in an uncontested election of Directors where a quorum is present. In an uncontested election, an incumbent Director nominee who receives the support of less than a majority of the votes cast at an Annual Meeting, although deemed to have been elected to the Board by plurality vote, must promptly tender his or her resignation to the Board. In an uncontested election, if a nominee who is not an incumbent does not receive the vote of at least a majority of the votes cast, the nominee will be deemed to have been elected to the Board by plurality vote and to have immediately resigned.

For this purpose, “majority of votes cast” means the number of shares voted FOR a Director’s election exceeds 50% of the total number of votes cast with respect to the Director’s election. “Votes cast” includes only FOR and WITHHOLD votes. Under Pennsylvania law and the Company’s By-Laws, broker non-votes are not considered to be “votes” and, therefore, will not be given effect either as FOR or WITHHOLD votes in the context of Proposal 1.

| 16 |

The Nominating and Corporate Governance Committee will evaluate the tendered resignation of an incumbent Director who does not receive a majority vote in an uncontested election and make a recommendation to the Board as to whether the resignation should be accepted. The Board will act on the tendered resignation and publicly disclose its decision within 90 days from the date of certification of election results. If the Board does not accept the incumbent’s resignation, such Director will continue to serve until the next Annual Meeting and until his or her successor is duly elected and qualified or until such Director’s earlier death, resignation or removal. If the Board accepts the Director’s resignation, the Board may fill the resulting vacancy or decrease the size of the Board pursuant to the Company’s By-Laws. To be eligible to stand for election, each nominee who agrees to be nominated must agree in writing to be bound by the By-Law resignation provisions in the event the nominee does not receive a majority of the votes cast in an uncontested election.

What vote is needed to approve all other proposals?

Proposals 2, 3, 4 and 5 require a FOR vote of a majority of the votes cast, in person and by Proxy, in order to be approved.

ABSTAIN votes and broker non-votes will not be considered as votes cast and will have no effect on the outcome of the votes on these proposals.

Can I change or revoke my vote after I have delivered my Proxy?

Yes. If you are a record owner, prior to the Annual Meeting you may change your vote by submitting a later-dated Proxy in one of the manners authorized and described in this Proxy Statement (by Proxy Card, via the Internet or by telephone). You also may give a written notice of revocation to the Company’s Corporate Secretary, so long as it is delivered to the Corporate Secretary at the Company’s principal executive offices prior to the beginning of the Annual Meeting, or given to the Corporate Secretary at the Annual Meeting prior to the time your Proxy is voted at the Annual Meeting. You also may revoke any Proxy given pursuant to this solicitation by attending the Annual Meeting and voting in person by ballot. If you are a beneficial owner, please follow the instructions provided by your broker, bank or trust as to how you may change your vote or obtain a legal proxy to vote your shares if you wish to cast your vote in person at the Annual Meeting.

Who can attend the Annual Meeting?

Only Company employees and Shareholders as of the March 12, 2024 Record Date may attend the Annual Meeting. Record owners may attend without any prior authorization. If you are a beneficial owner, to be admitted to the Annual Meeting you will need proof of beneficial ownership satisfactory to the Company in the form of a statement from the brokerage firm, bank or trust or a legal proxy from that institution showing you as a beneficial owner of Company shares or as the sole legal proxy of a beneficial owner. All Annual Meeting attendees may be asked to present valid, government-issued photo identification, such as a driver’s license or passport, before entering the Annual Meeting. Attendees will be subject to security inspections and will be required to comply with other security and procedural measures in place at the Annual Meeting. Please arrive early enough to allow yourself adequate time to clear security. You will not be allowed to use video or audio recording devices in the Annual Meeting. Representatives of the Company will be at the entrance to the Annual Meeting, and these representatives will be authorized on the Company’s behalf to determine whether the admission policies and procedures are being followed and whether you will be granted admission to the Annual Meeting.

Health Protocols:

For the health and safety of our Shareholders and employees, we ask that you follow all applicable health orders in place at the time of the Annual Meeting. As the state of applicable health orders are subject to change following the date of this Proxy Statement, we encourage Shareholders who plan to attend the Annual Meeting in person to review the latest guidance from the Centers for Disease Control

| 17 |

and Prevention and the Florida Department of Health, as well as the Company’s website at:

www.crowncork.com/investors/governance/proxy-online

prior to attending. Individuals experiencing cold/flu-like symptoms should not attend the Annual Meeting in person but are encouraged to vote prior to the meeting using one of the other methods described under “How do I vote my shares?” above.

Where can I find voting results of the Annual Meeting?

The Company will announce the preliminary voting results at the Annual Meeting and publish the final results in a Form 8-K or Form 10-Q filed with the Securities and Exchange Commission (“SEC”) within four business days after the date of the Annual Meeting.

Who conducts the Proxy solicitation, and how much will it cost?

The Company has engaged D.F. King to assist in the solicitation of Proxies for a fee of $10,000 plus reimbursement for out-of-pocket expenses and certain additional fees for services rendered in connection with such solicitation. Certain Officers and employees of the Company may also solicit Proxies by mail, telephone, Internet or facsimile or in person without any extra compensation. The Company bears the cost of soliciting Proxies.

What is the deadline for proposals for consideration or for nominations of individuals to serve as Directors at the 2025 Annual Meeting of Shareholders?

Proposals to be Considered for Inclusion in the Company’s Proxy Materials:

In order to be considered for inclusion in the Proxy Statement for the Company’s 2025 Annual Meeting of Shareholders, any Shareholder proposal intended to be presented at that meeting, in addition to meeting the shareholder eligibility and other requirements of the SEC rules governing such proposals, must be received in writing, via Certified Mail – Return Receipt Requested, by the Office of the Corporate Secretary, Crown Holdings, Inc., Hidden River Corporate Center Two, 14025 Riveredge Drive, Suite 300, Tampa, FL 33637 not later than November 25, 2024.

Director Nominations for Inclusion in the Company’s Proxy Materials (Proxy Access):

Under certain circumstances, Shareholders may submit nominations for Directors for inclusion in the Company’s proxy materials by complying with the proxy access requirements in the Company’s By-Laws, which require nominations to be submitted in writing, via Certified Mail – Return Receipt Requested, and received at the above address not before October 26, 2024 nor after November 25, 2024.

Other Business and Director Nominations to Be Brought Before the 2025 Annual Meeting of Shareholders:

The Company’s By-Laws currently provide that a Shareholder of record at the time that notice is given to the Company and who is entitled to vote at an annual meeting may bring business before the meeting or nominate a person for election to the Board of Directors if the Shareholder gives timely notice of such business or nomination. To be timely, and subject to certain exceptions, notice in writing to the Corporate Secretary must be delivered or mailed, via Certified Mail – Return Receipt Requested, and received at the above address not before October 26, 2024 nor after November 25, 2024. The notice must describe various matters regarding the nominee or proposed business. Any Shareholder desiring a copy of the Company’s By-Laws will be furnished one copy without charge upon written request to the Corporate Secretary.

| 18 |

How can I access the Proxy materials on the Internet?

The Company has made available copies of the following materials at the Company’s website at:

https://www.crowncork.com/investors/governance/proxy-online

| · | this Proxy Statement |

| · | the Proxy Card relating to the Annual Meeting of Shareholders |

| · | the Annual Report to Shareholders |

Information included on the Company’s website, other than this Proxy Statement, the Proxy Card and the Annual Report to Shareholders, is not part of the Proxy soliciting materials.

Whom should I contact to obtain a copy of the Annual Report on Form 10-K?

The Company filed its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 with the SEC on February 27, 2024. A copy of the Company’s Annual Report on Form 10-K was included as part of the Annual Report to Shareholders that you received along with the proxy materials. Any Shareholder can obtain a copy of the Annual Report, including the financial statements and schedules thereto and a list describing all the exhibits not contained therein, without charge. Requests for copies of the Annual Report should be sent to: Investor Relations Department, Crown Holdings, Inc., Hidden River Corporate Center Two, 14025 Riveredge Drive, Suite 300, Tampa, FL 33637 or you may call toll free 888-400-7789. Copies in electronic format of the Company’s Annual Report and filings with the SEC are available at the Company’s website at www.crowncork.com/investors/reports-filings in the “For Investors” section.

| 19 |

PROPOSAL 1: ELECTION OF DIRECTORS

The Proxy Holders shall vote the shares with respect to the nominees listed below, all of whom are now Directors of the Company, to serve as Directors for the ensuing year or until their successors shall be elected. None of the persons named as a nominee for Director has indicated that he or she will be unable or will decline to serve. In the event that any of the nominees are unable or decline to serve, which the Nominating and Corporate Governance Committee of the Board of Directors does not believe will happen, the Proxy Holders will vote with respect to the remaining nominees and others who may be nominated by the Board of Directors.

Mr. Josef Müller, a member of the Board of Directors of the Company since 2011, is retiring as a Director pursuant to our mandatory retirement policy and is not standing for re-election to the Company’s Board of Directors at the Annual Meeting. Messrs. Jesse Lynn and Andrew Teno resigned from the Board on November 20, 2023. Their resignations were delivered pursuant to the Director Appointment and Nomination Agreement, dated December 12, 2022, by and among the Company, Carl C. Icahn and the persons and entities listed therein, and were not due to any disagreement with the Company.

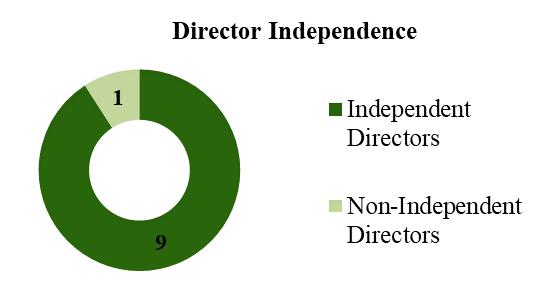

The Articles of Incorporation and By-Laws of the Company provide for a Board of Directors consisting of between 10 and 18 Directors, as determined by the Board of Directors. The Board of Directors has fixed the number of Directors at 10. It is intended that the Proxies will be voted for the election of the 10 nominees named below as Directors, and no more than 10 will be nominated by the Board. If all 10 Director nominees are elected, 9 of the Directors, representing 90% of the Board, will be “independent” as defined in the NYSE listing standards.

The Board is committed to regular review of its composition to ensure that the Board continues to have the right mix of skills, background and tenure. Six of the Company’s independent Directors nominated for re-election have joined the Board in the last five years as a result of a Board refreshment process during the period where Director candidates were identified through Board, Shareholder and third-party search firm input.1 Our ongoing Board refreshment strategy has further strengthened and diversified the skills and experiences of the Board. The Board believes that the collective combination of backgrounds, skills and experiences of its members has produced a Board that is well-equipped to exercise oversight responsibilities for the Company’s Shareholders and to help guide the Company to achieve its long-term strategic objectives.

Under the Company’s Corporate Governance Guidelines, no Director will commence a term of Board service if the Director is over 75 years old unless the Board determines that an additional term of Board service would be in the best interests of the Company.

The names of this year’s nominees and information concerning them and their associations as of March 12, 2024, as furnished by the nominees, follow. The principal occupations and the directorships stated include the nominees’ occupations and directorships with any U.S. publicly traded companies or registered investment companies during the last five years.

The Board of Directors Recommends that Shareholders Vote FOR Election

of Each of the Nominees Named Below.

1 Two additional Directors (Messrs. Lynn and Teno) joined the Board in 2022 pursuant to an agreement with a Shareholder and resigned in November 2023.

| 20 |

| Name | Age | Principal Occupation | Year Became Director | |

|

Timothy J. Donahue (e) |

61 | Chairman, President and Chief Executive Officer of the Company | 2015 | |

|

Richard H. Fearon (a) (ncg) |

67 | Former Vice Chairman and Chief Financial and Planning Officer and Director of Eaton Corporation; also Chairman of Avient Corporation and a Director of Waters Corporation and CRH plc | 2019 | |

|

Andrea J. Funk (a) (c) |

54 | Executive Vice President and Chief Financial Officer of EnerSys; former Chief Executive Officer of Cambridge-Lee Industries; former Director of Destination Maternity Corporation | 2017 | |

|

Stephen J. Hagge (c) (e) (ncg) |

72 | Former President, Chief Executive Officer and Director of AptarGroup; also Chairman of CF Industries Holdings | 2019 | |

|

James H. Miller (c) (e) (ncg) |

75 | Former Chairman and Chief Executive Officer of PPL Corporation; former Director of AES Corporation | 2010 | |

|

B. Craig Owens (a) (e) |

69 | Former Chief Financial Officer and Chief Administrative Officer of Campbell Soup Company; also a Director of AptarGroup; former Director of J C Penney Company | 2019 | |

|

Angela M. Snyder (a) (c) |

59 | President of Fulton Financial Corporation and Fulton Bank; also a Director of Fulton Bank | 2022 | |

|

Caesar F. Sweitzer (a) (e) (ncg) |

73 | Former Senior Advisor and Managing Director of Citigroup Global Markets | 2014 | |

|

Marsha C. Williams (c) |

72 | Former Senior Vice President and Chief Financial Officer of Orbitz Worldwide; also Chairperson of Modine Manufacturing Company and a Director of Fifth Third Bancorp | 2022 | |

|

Dwayne A. Wilson (a) |

65 | Former Senior Vice President of Fluor Corporation; also a Director of Sterling Infrastructure, Ingredion Incorporated and DT Midstream; former Director of AK Steel Holding Corporation | 2020 | |

| (a) Member of the Audit Committee | (c) Member of the Compensation Committee | |||

| (e) Member of the Executive Committee | (ncg) Member of the Nominating and Corporate Governance Committee | |||

| 21 |

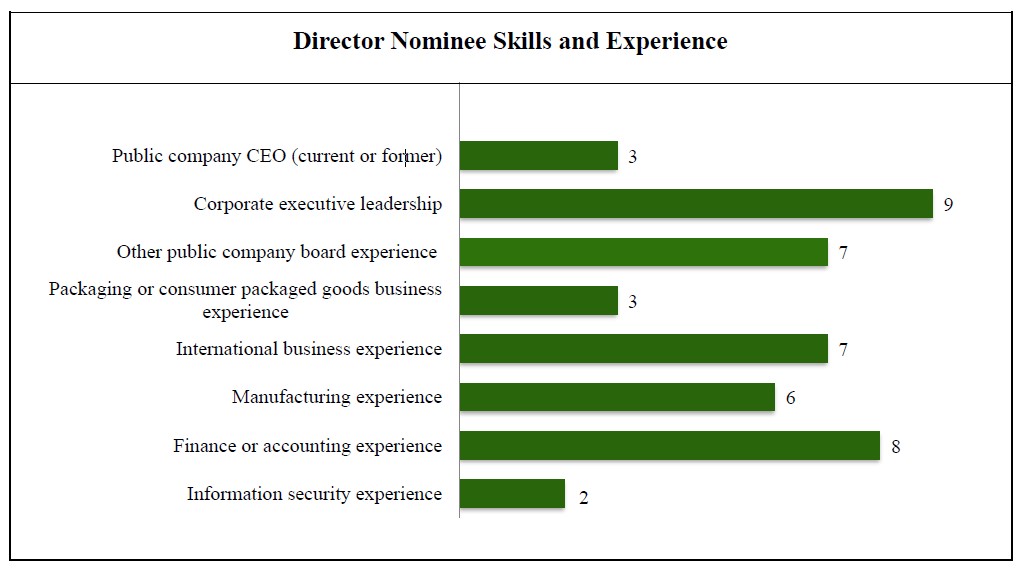

The Nominating and Corporate Governance Committee is responsible for leading the search for individuals qualified to become members of the Board of Directors and recommending candidates to the Board as Director nominees. The Board desires a diverse membership, including with respect to race, gender, nationality and ethnicity as well as professional background and geographic and industry experience. The Nominating and Corporate Governance Committee assesses each potential nominee’s overall mix of experiences, qualifications, perspectives, talents, education and skills as well as each potential nominee’s ability to contribute to the Board and to enhance the Board’s decision-making processes. Independence is a key factor when considering the Director nominees, as are critical thinking skills, practical wisdom and mature judgment in the decision-making process. For a description of the identifying and evaluating procedures of the Nominating and Corporate Governance Committee, see “Corporate Governance – Nominating and Corporate Governance Committee.” The Board believes that each of the nominees listed above has the sound character, integrity, judgment and record of achievement necessary to be a member of the Board. In addition, each of the nominees has exhibited the ability to operate constructively with the other members of the Board and to challenge and question management in a productive way.

The Board believes, moreover, that each nominee brings a strong and unique background and skill set to the Board, giving the Board, as a whole, competence and experience in diverse areas. These areas include organizational leadership; public company board service; manufacturing; finance; management in the packaging, food and beverage sectors and other relevant industries; international business and markets; and information security. Half of the nominees are or have been Chairs of U.S. public company Boards of Directors. The Board believes that the following specific experiences, qualifications and skills, together with the aforementioned attributes, qualify each of the nominees listed above to serve as a Director.

Timothy Donahue. Mr. Donahue was elected Chairman by the Board following the 2022 Annual Meeting and assumed the position of CEO of the Company in 2016. He has served as a member of the Board since 2015 and in other executive positions with the Company for over 33 years. He gives the Board seasoned leadership and an in-depth knowledge of the Company, especially its international business. He also brings to the Board an intimate understanding of the operations and finances of the Company from his prior experience as the Company’s Chief Operating Officer and Chief Financial Officer.

Richard Fearon. Mr. Fearon, the former Vice Chairman and CFO of an NYSE-listed global, diversified manufacturing company, brings to the Board comprehensive knowledge of financial accounting and extensive experience in financial reporting, corporate finance and capital markets, corporate development, strategic planning, mergers and acquisitions, risk management and investor relations. He also oversaw his company’s information security program for more than 10 years and chaired its senior management committee on information security. Mr. Fearon’s experience qualifies him as an “audit committee financial expert” within the meaning of SEC regulations. In addition, his service as Chairman of an NYSE-listed global provider of specialized polymers also provides significant governance experience. Mr. Fearon also serves as a director of two other NYSE-listed companies.

Andrea Funk. Ms. Funk’s experience as Senior Vice President and Chief Financial Officer of an NYSE-listed international manufacturing company and as former CEO and CFO of an international manufacturing and distribution business brings to the Board significant expertise in the areas of finance, operations and strategy. This, along with Ms. Funk’s prior experience in public accounting, enhances her contributions to the Audit Committee and qualifies her as an “audit committee financial expert” within the meaning of SEC regulations.

Stephen Hagge. Mr. Hagge brings to the Board substantial leadership and management experience in the packaging industry, public company governance, operations, international business, strategic initiatives and risk management from his roles as former CEO, CFO and COO of an NYSE-listed global packaging manufacturer. Mr. Hagge chairs the Compensation Committee and also serves as Chairman of another NYSE-listed company.

| 22 |

James Miller. Mr. Miller, the Company’s Independent Lead Director, brings to the Board substantial leadership and management experience, both domestic and international, from his role as former Chairman and CEO of an NYSE-listed international energy and utility holding company. Mr. Miller also brings to the Board significant safety, environmental, governmental relations and regulatory agency experience by virtue of his responsibilities at this highly regulated utility company. Mr. Miller chairs the Nominating and Corporate Governance Committee.

B. Craig Owens. Mr. Owens’ extensive experience in the consumer food and beverage industries, including his former service as the CFO and Chief Administrative Officer of a leading NYSE-listed international consumer food company, brings to the Board significant financial expertise, including all aspects of financial reporting, accounting, corporate finance and capital markets, as well as significant experience in strategic planning, business integration and operations, and in managing supply chain organizations. In his roles as CFO for several companies, he had over 15 years of senior-level management responsibility for information security. He also recently completed a Director-level certification course in information security. Mr. Owens also has considerable knowledge of the retail industry having served as CFO of a leading international grocery retailer. His experience qualifies him as an “audit committee financial expert” within the meaning of SEC regulations, and he chairs the Audit Committee. Mr. Owens also serves as a director of another NYSE-listed company.

Angela Snyder. Ms. Snyder brings to the Board extensive experience in the banking sector, leadership and management, strategic planning, risk management and corporate governance. She serves as President and as a Director of a NASDAQ-listed financial holding company and as President of its banking subsidiary. She possesses more than 30 years of experience in the financial services industry.

Caesar Sweitzer. Mr. Sweitzer spent over 35 years in finance, primarily as an investment banker focusing on industrial companies. Mr. Sweitzer brings to the Board significant knowledge of the global packaging industry as well as finance and investment matters, such as acquisitions, dispositions and corporate finance. Mr. Sweitzer’s experience qualifies him as an “audit committee financial expert” within the meaning of SEC regulations.

Marsha Williams. Ms. Williams brings to the Board extensive experience in strategic planning, corporate finance, operations, mergers and acquisitions, investor relations, information technology, liquidity management, risk management and corporate governance through her prior roles as Chief Financial Officer and Chief Administrative Officer of companies in diverse industries. Ms. Williams also serves as Chairperson of one publicly-listed company and as a director of another with global operations. In these roles, Ms. Williams has accumulated extensive knowledge of corporate governance, global finance, capital management, internal controls and human resources, including significant experience in the financial markets in which the Company competes for financing.

Dwayne Wilson. Mr. Wilson brings to the Board over 36 years of senior management experience at a leading NYSE-listed construction and engineering company. Mr. Wilson has gained a broad range of experience and exposure to a number of diverse end markets, and the Company benefits from his knowledge and perspective, particularly in the areas of manufacturing, technology, operational excellence and engineering. Mr. Wilson also serves as a director of three other publicly-listed companies.

The educational backgrounds of each of the Company’s Directors can be found on our website at www.crowncork.com/investors/governance/board-directors.

| 23 |

DIRECTOR COMPENSATION

The following table lists 2023 Director compensation for all independent Directors who received compensation as Directors in 2023. Compensation for Mr. Donahue, the Company’s Chief Executive Officer, is reported in the Summary Compensation Table included in the Executive Compensation section below. Mr. Donahue does not earn additional compensation for his service as Director or for his service as Chairman.

|

Name |

Fees Earned or Paid in Cash (1) |

Stock Awards (2) |

Total |

| Richard Fearon | $125,000 | $160,000 | $285,000 |

| Andrea Funk | 125,000 | 160,000 | 285,000 |

| Stephen Hagge | 130,000 | 160,000 | 290,000 |

| Jesse Lynn (3) | 110,000 | 160,000 | 270,000 |

| James Miller | 155,000 | 160,000 | 315,000 |

| Josef Müller (4) | 125,000 | 160,000 | 285,000 |

| B. Craig Owens | 125,000 | 160,000 | 285,000 |

| Angela Snyder | 115,000 | 160,000 | 275,000 |

| Caesar Sweitzer | 125,000 | 160,000 | 285,000 |

| Andrew Teno (3) | 125,000 | 160,000 | 285,000 |

| Marsha Williams | 110,000 | 160,000 | 270,000 |

| Dwayne Wilson | 115,000 | 160,000 | 275,000 |

|

(1) | Each Director may defer receipt of all, or any part, of his or her cash compensation until termination of service as a Director. At the election of the Director, deferred cash compensation amounts are paid in either a lump sum or quarterly installments over a period of either 5 or 10 years and are credited with interest at the prime rate until distributed. |

(2) | The annual grant of Company Common Stock for 2023 consisted of $160,000 of Company Common Stock under the 2022 Stock-Based Incentive Compensation Plan and was paid on a quarterly basis. The number of shares paid each quarter is determined based on the average of the closing market price of the Company’s Common Stock on each of the second through sixth business days following the date on which the Company publicly released its quarterly results. Beginning in 2024, each Director may defer receipt of all, or any part, of his or her annual stock grant until termination of service as a Director. At the election of the Director, deferred stock compensation amounts are paid in cash in either a lump sum or quarterly installments over a period of either 5 or 10 years and are credited with dividends when paid. |

(3) | Messrs. Lynn and Teno resigned as Directors of the Company in November 2023. |

|

(4) | Mr. Müller will retire as a Director of the Company in May 2024. |

| 24 |

The Board periodically receives benchmarking data regarding director compensation from Pay Governance LLC, an executive compensation consulting firm, and uses the 50th percentile of its peer group’s target total cash compensation and target total direct compensation as a market check in determining director compensation. For 2024, Directors who are not employees of the Company will receive annual cash base fees, grants of Company Common Stock and cash committee fees in the amounts set forth as follows.

| Cash Base Fee | $100,000 | |

| Equity Grant | 160,000 | |

| Supplemental Cash Committee Fees: | ||

| · | Audit Committee - Chair | 25,000 |

| · | Audit Committee - Other Members | 15,000 |

| · | Compensation Committee and Nominating and Corporate Governance Committee - Chair | 20,000 |

| · | Compensation Committee and Nominating and Corporate Governance Committee - Other Members | 10,000 |

| Independent Lead Director Fee | 25,000 | |

Directors do not receive any additional fees for their service on the Executive Committee. There are no Board or committee meeting attendance fees. Directors are reimbursed by the Company for travel and related expenses they incur in connection with their service on the Board and its committees.

Under the Company’s Corporate Governance Guidelines, after five years of service on the Board, independent Directors are expected to own Company Common Stock having a market value of at least five times the cash base annual Director’s fee. As of the date of this Proxy Statement, each independent Director with more than five years of service on the Board satisfies this requirement.

Non-employee Directors may participate in the Company’s Deferred Compensation Plan for Directors which permits Directors to defer receipt of all, or any part, of their cash Director fees and/or (beginning in 2024) stock awards. Deferred amounts are recorded in a notional bookkeeping account for the benefit of each deferring Director. Cash deferred fees accrue interest quarterly at the prime interest rate as reported in The Wall Street Journal. Stock deferrals are credited with dividends when paid. When a Director ceases to be a member of the Board, the Director’s account will be paid in cash in either a lump sum or quarterly installments over five or ten years as elected by the Director. The right of any Director to receive payments under the plan is an unsecured claim against the general assets of the Company.

| 25 |

COMMON STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS AND EXECUTIVE OFFICERS

The following table shows, as of March 12, 2024, the number of shares of Company Common Stock beneficially owned by each person or group that is known to the Company to be the beneficial owner of more than 5% of the Company’s outstanding Common Stock.

|

Name and Address

|

Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly |

Percentage of Outstanding Shares (1)

|

|

BlackRock, Inc. (2) 50 Hudson Yards New York, NY 10001

|

11,917,586 | 9.9% |

|

The Vanguard Group (3) 100 Vanguard Blvd. Malvern, PA 19355 |

11,825,703 | 9.8% |

|

(1) Percentages are derived based upon 120,794,273 shares of Common Stock outstanding as of March 12, 2024. (2) BlackRock, Inc., a parent holding company, reported that it may be deemed to be the beneficial owner of 11,917,586 shares of the Company’s Common Stock. BlackRock, Inc. reported that it had sole dispositive power with respect to 11,917,586 shares, including 11,283,267 shares for which it had sole voting power. (3) The Vanguard Group, an investment advisor, reported that it may be deemed to be the beneficial owner of 11,825,703 shares of the Company’s Common Stock. The Vanguard Group reported that it had sole dispositive power with respect to 11,665,247 shares, including 62,205 shares for which it had shared voting power, and shared dispositive power with respect to 160,456 shares. | ||

| 26 |

The following table shows, as of March 12, 2024, the number of shares of Common Stock beneficially owned by each Director; the Company’s Chief Executive Officer, Chief Financial Officer and the three other Executive Officers who were the highest paid during 2023; and all Directors and Executive Officers as a group. The Directors and Executive Officers of the Company have sole voting and dispositive power with respect to the securities of the Company listed in the table below.

|

Name |

Amount of Common Stock of the Company Owned Beneficially, Directly or Indirectly |

Percentage of Outstanding Shares (1) |

| Kevin Clothier (2) | 44,107 | * |

| Timothy Donahue (2) | 639,419 | * |

| Richard Fearon (3) | 8,675 | * |

| Andrea Funk | 13,708 | * |

| Gerard Gifford | 138,918 | * |

| Stephen Hagge | 7,482 | * |

| Matthew Madeksza | 31,451 | * |

| James Miller | 21,334 | * |

| Josef Müller | 30,040 | * |

| Djalma Novaes | 103,210 | * |

| B. Craig Owens (4) | 9,611 | * |

| Angela Snyder | 2,986 | * |

| Caesar Sweitzer | 21,058 | * |

| Marsha Williams | 3,796 | * |

| Dwayne Wilson | 5,512 | * |

| Directors and Executive | ||

| Officers as a Group of 17 | 1,114,902 | 0.9% |

| * Less than 1% | ||

| (1) |

Percentages are derived based upon 120,794,273 shares of Common Stock outstanding as of March 12, 2024. | |

| (2) | Excludes 3,000,000 shares of Common Stock held in the Crown Cork & Seal Company, Inc. Master Retirement Trust on behalf of various Company pension plans (“Trust Shares”). Messrs. Donahue and Clothier are members of the Benefits Plan Investment Committee of the trust that has sole voting and dispositive power with respect to the Trust Shares, but they disclaim beneficial ownership of the Trust Shares. | |

| (3) | Includes 16 shares of Common Stock held by the Fearon Family Trust, of which Mr. Fearon is a trustee and a beneficiary. | |

| (4) | Includes 2,000 shares of Common Stock held by The B Craig Owens Rev Trust U/A 1/25/08, of which Mr. Owens is a trustee and a beneficiary. | |

| 27 |

CORPORATE GOVERNANCE

Meetings of the Board of Directors. In 2023, there were five meetings of the Board of Directors. Each Director during his or her term of service attended at least 75% of the aggregate meetings of the Board and of the committees on which he or she served.

Attendance at the Annual Meeting. Under the Company’s Corporate Governance Guidelines, Directors are expected to attend the Company’s Annual Meeting of Shareholders. In 2023, each of the Directors serving on the Board at the time attended the Annual Meeting of Shareholders.

Director Independence. The Board has determined that all Directors standing for election, with the exception of Timothy Donahue, the Company’s Chairman and Chief Executive Officer, are independent under the listing standards of the NYSE. The Board made this determination based on the absence of any of the express disqualifying criteria set forth in the listing standards that require a majority of the Board nominees to be independent Directors.

In making the foregoing determinations, the Board considered the Directors’ affiliations with the Company or third parties and Company payments to such parties. For Mr. Fearon, the Board considered his role as a Chairman of Avient Corporation and ordinary course of business purchases of plastisol sealing compounds and lubricants by the Company from Avient. For Ms. Funk, the Board considered her role as an Officer of EnerSys in relation to ordinary course purchases of batteries and related accessories by the Company from EnerSys. For Mr. Hagge, who is a Director of Transcendia Topco Holdings, a privately-held company, the Board considered ordinary course of business purchases of high-density polyethylene and products purchased for re-sale by the Company from Transcendia. For Mr. Wilson, the Board considered his role as a Director of Ingredion Incorporated and ordinary course of business purchases of dry bag material for making adhesive used in corrugated paper and products purchased for re-sale by the Company from Ingredion. None of these relationships or transactions fell within the NYSE listing standards disqualifying criteria.

Board Leadership and Risk Oversight. Mr. Donahue has been the Chairman of the Board since 2022 and the Chief Executive Officer of the Company since 2016. Mr. Miller, as the Chair of the Nominating and Corporate Governance Committee, serves as the Independent Lead Director of the Board and presides over meetings of the executive sessions of the independent Directors.

The Board has carefully considered its leadership structure and believes that the Company and its Shareholders are best served by having Mr. Donahue serve as both Chairman of the Board and Chief Executive Officer. This structure gives the Board and management unified leadership and direction, and is tailored to present a single, clear focus for the execution of the Company’s strategic initiatives and business plans. In addition, because Mr. Donahue manages the day-to-day operations of the Company and is responsible for executing the Company’s business strategy, the Board believes it is most functional and efficient that Mr. Donahue presides at the meetings of the Board. Moreover, the Board believes that its other structural features, including nine independent Directors among the slate of ten Directors standing for election at the Company’s Annual Meeting, regular meetings of independent Directors in executive session, key committees consisting wholly of independent Directors and an Independent Lead Director with a wide range of duties, provide for substantial independent oversight of the Company’s management.

| 28 |

Mr. Miller serves as the Independent Lead Director of the Board. The Independent Lead Director is an independent Director designated by the other independent Directors of the Board and has a range of duties, including, among other things:

| · | presiding at all meetings of the Board in the Chairman’s absence; |

| · | presiding at all executive sessions of the Board’s independent Directors; |

| · | serving as a liaison between the Chairman of the Board and the Board’s independent Directors; |

| · | providing the Chairman with input on and approving the agendas and schedules for meetings of the Board and its committees; |

| · | advising the Chairman as to the quality, quantity and timeliness of the flow of information from senior management that is necessary for the independent Directors to effectively and responsibly perform their duties, including specifically requesting the inclusion of certain information in the materials provided for the Board by senior management when appropriate; |

| · | calling executive sessions of the Board’s independent Directors when appropriate; |

| · | being available for consultation with the Chairman regarding the concerns of the other Directors; |

| · | being available for consultation with members of senior management regarding the concerns of any members of senior management; |