SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

888 Seventh Ave, 31st Floor, New York, NY 10019

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

•

|

Daily, weekly and monthly data on share prices, net asset values, dividends and more

|

|

•

|

Portfolio overviews and performance analyses

|

|

•

|

Announcements, press releases and special notices

|

|

•

|

Fund and adviser contact information

|

|

(Unaudited)

|

October 31, 2019

|

President and Chief Executive Officer

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 3

|

DEAR SHAREHOLDER (Unaudited) continued

|

October 31, 2019

|

President and Chief Executive Officer of the

Advent Convertible and Income Fund

November 30, 2019

4 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited)

|

October 31, 2019

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 5

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

6 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

|

Index

|

Total Return

|

|

Bloomberg Barclays U.S. Aggregate Bond Index

|

11.51%

|

|

ICE Bank of America (“BofA”) Merrill Lynch U.S. Convertible Index

|

12.45%

|

|

ICE BofA Merrill Lynch U.S. High Yield Index

|

8.32%

|

|

Standard & Poor’s 500® (“S&P 500”) Index

|

14.32%

|

|

Thomson Reuters Convertible Global Focus USD Hedged Index

|

6.89%

|

|

MSCI World Index

|

12.69%

|

|

MSCI World 100% Hedged to USD Index

|

13.48%

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 7

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

|

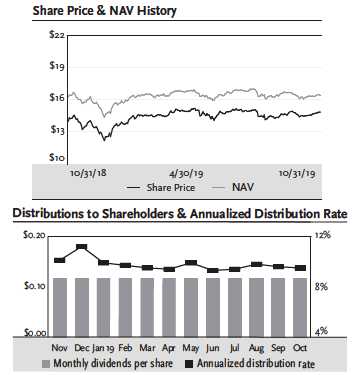

Payable Date

|

Amount

|

|

November 30, 2018

|

$0.1172

|

|

December 31, 2018

|

$0.1172

|

|

January 31, 2019

|

$0.1172

|

|

February 28, 2019

|

$0.1172

|

|

March 29, 2019

|

$0.1172

|

|

April 30, 2019

|

$0.1172

|

|

May 31, 2019

|

$0.1172

|

|

June 28, 2019

|

$0.1172

|

|

July 31, 2019

|

$0.1172

|

|

August 30, 2019

|

$0.1172

|

|

September 30, 2019

|

$0.1172

|

|

October 31, 2019

|

$0.1172

|

|

Total

|

$1.4064

|

8 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

10 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 11

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

12 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

QUESTIONS & ANSWERS (Unaudited) continued

|

October 31, 2019

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 13

|

FUND SUMMARY (Unaudited)

|

|

|

October 31, 2019

|

|

|

|

||||

|

Fund Statistics

|

|

|

|

|

|

Share Price

|

|

|

|

$14.79

|

|

Net Asset Value

|

|

|

|

$16.34

|

|

Discount to NAV

|

|

|

|

-9.49%

|

|

Net Assets ($000)

|

|

|

|

$564,148

|

|

|

||||

|

AVERAGE ANNUAL TOTAL RETURNS

|

|

|

|

|

|

FOR THE PERIOD ENDED October 31, 2019

|

|

|

|

|

|

|

One

|

Three

|

Five

|

Ten

|

|

|

Year

|

Year

|

Year

|

Year

|

|

Advent Convertible and

|

|

|

|

|

|

Income Fund

|

|

|

|

|

|

NAV

|

9.94%

|

8.48%

|

4.50%

|

7.40%

|

|

Market

|

17.01%

|

11.26%

|

5.31%

|

8.57%

|

|

Portfolio Breakdown

|

|

|

% of Net Assets

|

|

|

Corporate Bonds

|

|

|

|

72.0%

|

|

Convertible Bonds

|

|

|

|

65.6%

|

|

Convertible Preferred Stocks

|

|

|

|

14.5%

|

|

Common Stocks

|

|

|

|

8.8%

|

|

Money Market Fund

|

|

|

|

5.8%

|

|

Senior Floating Rate Interests

|

|

|

|

1.7%

|

|

Options Written

|

|

|

|

-0.1%

|

|

Total Investments

|

|

|

|

168.3%

|

|

Other Assets & Liabilities, net

|

|

|

|

-68.3%

|

|

Net Assets

|

|

|

|

100.0%

|

14 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

FUND SUMMARY (Unaudited) continued

|

October 31, 2019

|

|

Country Diversification

|

|

|

|

|

|

Country

|

% of Long-Term Investments

|

|

United States

|

77.2%

|

|

Cayman Islands

|

4.3%

|

|

Canada

|

3.6%

|

|

Netherlands

|

3.1%

|

|

France

|

1.8%

|

|

Japan

|

1.6%

|

|

Bermuda

|

1.4%

|

|

Luxembourg

|

0.9%

|

|

China

|

0.8%

|

|

United Kingdom

|

0.7%

|

|

Panama

|

0.7%

|

|

Australia

|

0.5%

|

|

Germany

|

0.5%

|

|

Jersey

|

0.4%

|

|

Greece

|

0.3%

|

|

Finland

|

0.3%

|

|

Spain

|

0.3%

|

|

Switzerland

|

0.3%

|

|

Monaco

|

0.2%

|

|

Virgin Islands (UK)

|

0.2%

|

|

Austria

|

0.2%

|

|

Hong Kong

|

0.2%

|

|

Malaysia

|

0.2%

|

|

Taiwan, Province of China

|

0.1%

|

|

Belgium

|

0.1%

|

|

Denmark

|

0.1%

|

|

Total Long-Term Investments

|

100.0%

|

|

|

|

|

|

|

|

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 15

|

|

PORTFOLIO OF INVESTMENTS

|

|

October 31, 2019

|

|

|

||

|

|

Shares

|

Value

|

|

|

||

|

COMMON STOCKS† – 8.8%

|

|

|

|

Consumer, Cyclical – 4.2%

|

|

|

|

Six Flags Entertainment Corp.1

|

163,000

|

$ 6,876,970

|

|

Carnival Corp.1

|

150,000

|

6,433,500

|

|

Delta Air Lines, Inc.1

|

100,000

|

5,508,000

|

|

Las Vegas Sands Corp.

|

75,000

|

4,638,000

|

|

Total Consumer, Cyclical

|

|

23,456,470

|

|

|

||

|

Industrial – 1.9%

|

|

|

|

Boeing Co.1

|

19,200

|

6,526,272

|

|

Eaton Corporation plc1

|

50,000

|

4,355,500

|

|

Total Industrial

|

|

10,881,772

|

|

|

||

|

Technology – 0.8%

|

|

|

|

Western Digital Corp.1

|

90,000

|

4,648,500

|

|

|

||

|

Financial – 0.7%

|

|

|

|

Citigroup, Inc.

|

50,000

|

3,593,000

|

|

|

||

|

Communications – 0.6%

|

|

|

|

Alibaba Group Holding Ltd. ADR*

|

20,000

|

3,533,400

|

|

|

||

|

Energy – 0.6%

|

|

|

|

Chevron Corp.1

|

30,000

|

3,484,200

|

|

Total Common Stocks

|

|

|

|

(Cost $51,049,683)

|

|

49,597,342

|

|

|

||

|

CONVERTIBLE PREFERRED STOCKS† – 14.5%

|

|

|

|

Financial – 3.6%

|

|

|

|

Wells Fargo & Co.

|

|

|

|

7.50% 1,4

|

6,000

|

9,067,975

|

|

Bank of America Corp.

|

|

|

|

7.25%1,4

|

4,000

|

6,066,360

|

|

Crown Castle International Corp.

|

|

|

|

6.88% due 08/01/201

|

1,996

|

2,486,397

|

|

QTS Realty Trust, Inc.

|

|

|

|

6.50%1,4

|

15,083

|

1,892,012

|

|

Assurant, Inc.

|

|

|

|

6.50% due 03/15/21

|

5,387

|

673,213

|

|

Total Financial

|

|

20,185,957

|

|

|

||

|

Consumer, Non-cyclical – 2.7%

|

|

|

|

Danaher Corp.

|

|

|

|

4.75% due 04/15/221

|

6,535

|

7,255,941

|

|

Bunge Ltd.

|

|

|

|

4.88%1,4

|

36,391

|

3,694,327

|

|

See notes to financial statements.

|

|

|

|

16 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT |

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Shares

|

Value

|

|

|

||

|

CONVERTIBLE PREFERRED STOCKS† – 14.5% (continued)

|

|

|

|

Consumer, Non-cyclical – 2.7% (continued)

|

|

|

|

Becton Dickinson and Co.

|

|

|

|

6.13% due 05/01/201

|

52,354

|

$ 3,229,195

|

|

Avantor, Inc.

|

|

|

|

6.25% due 05/15/221

|

25,867

|

1,345,343

|

|

Total Consumer, Non-cyclical

|

|

15,524,806

|

|

|

||

|

Technology – 2.7%

|

|

|

|

Broadcom, Inc.

|

|

|

|

8.00% due 09/30/221

|

13,158

|

14,250,377

|

|

Change Healthcare, Inc.

|

|

|

|

6.00% due 06/30/221

|

15,756

|

796,151

|

|

Total Technology

|

|

15,046,528

|

|

|

||

|

Industrial – 2.3%

|

|

|

|

Energizer Holdings, Inc.

|

|

|

|

7.50% due 01/15/221

|

97,842

|

9,085,608

|

|

Fortive Corp.

|

|

|

|

5.00% due 07/01/211

|

1,836

|

1,663,428

|

|

Stanley Black & Decker, Inc.

|

|

|

|

5.38% due 05/15/201

|

11,555

|

1,177,917

|

|

Colfax Corp.

|

|

|

|

5.75% due 01/15/221

|

5,343

|

783,337

|

|

Total Industrial

|

|

12,710,290

|

|

|

||

|

Utilities – 1.8%

|

|

|

|

Dominion Energy, Inc.

|

|

|

|

7.25% due 06/01/221

|

18,505

|

1,982,811

|

|

DTE Energy Co.

|

|

|

|

6.25% due 11/01/22*

|

38,565

|

1,958,330

|

|

Southern Co.

|

|

|

|

6.75% due 08/01/221

|

34,367

|

1,821,451

|

|

CenterPoint Energy, Inc.

|

|

|

|

7.00% due 09/01/211

|

25,266

|

1,288,566

|

|

Sempra Energy

|

|

|

|

6.75% due 07/15/211

|

10,450

|

1,214,238

|

|

American Electric Power Company, Inc.

|

|

|

|

6.13% due 03/15/221

|

18,997

|

1,044,645

|

|

NextEra Energy, Inc.

|

|

|

|

4.87% due 09/01/221

|

17,700

|

900,222

|

|

Total Utilities

|

|

10,210,263

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Shares

|

Value

|

|

|

||

|

CONVERTIBLE PREFERRED STOCKS† – 14.5% (continued)

|

|

|

|

Basic Materials – 1.4%

|

|

|

|

International Flavors & Fragrances, Inc.

|

|

|

|

6.00% due 09/15/211

|

169,564

|

$ 7,930,508

|

|

Total Convertible Preferred Stocks

|

|

|

|

(Cost $75,653,061)

|

|

81,608,352

|

|

|

||

|

MONEY MARKET FUND† – 5.8%

|

|

|

|

Morgan Stanley Institutional Liquidity Government Portfolio –

|

|

|

|

Institutional Class 1.72%2

|

32,701,173

|

32,701,173

|

|

Total Money Market Fund

|

|

|

|

(Cost $32,701,173)

|

|

32,701,173

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CORPORATE BONDS†† – 72.0%

|

|

|

|

Consumer, Non-cyclical – 13.2%

|

|

|

|

Bausch Health Companies, Inc.

|

|

|

|

5.75% due 08/15/271,3

|

4,690,000

|

$ 5,104,772

|

|

7.00% due 03/15/241,3

|

2,587,000

|

2,712,922

|

|

HCA, Inc.

|

|

|

|

7.50% due 02/15/221

|

5,190,000

|

5,771,280

|

|

7.69% due 06/15/251

|

1,112,000

|

1,345,520

|

|

Tenet Healthcare Corp.

|

|

|

|

4.63% due 07/15/241

|

2,146,000

|

2,218,428

|

|

4.88% due 01/01/263

|

1,983,000

|

2,054,884

|

|

7.00% due 08/01/25

|

1,837,000

|

1,908,551

|

|

Encompass Health Corp.

|

|

|

|

5.75% due 09/15/251

|

3,782,000

|

3,966,372

|

|

5.75% due 11/01/241

|

1,834,000

|

1,858,071

|

|

Land O’Lakes Capital Trust I

|

|

|

|

7.45% due 03/15/281,3

|

3,750,000

|

4,237,500

|

|

United Rentals North America, Inc.

|

|

|

|

6.50% due 12/15/261

|

3,793,000

|

4,120,146

|

|

Molina Healthcare, Inc.

|

|

|

|

5.38% due 11/15/221

|

3,830,000

|

4,055,013

|

|

Capitol Investment Merger Sub 2 LLC

|

|

|

|

10.00% due 08/01/241,3

|

3,597,000

|

3,713,902

|

|

MEDNAX, Inc.

|

|

|

|

6.25% due 01/15/271,3

|

3,729,000

|

3,701,032

|

|

Nielsen Finance LLC / Nielsen Finance Co.

|

|

|

|

5.00% due 04/15/221,3

|

3,596,000

|

3,632,032

|

|

Magellan Health, Inc.

|

|

|

|

4.90% due 09/22/241

|

3,556,000

|

3,538,220

|

|

Centene Corp.

|

|

|

|

4.75% due 05/15/221

|

3,430,000

|

3,515,750

|

|

See notes to financial statements.

|

|

|

|

18 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

|

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CORPORATE BONDS†† – 72.0% (continued)

|

|

|

|

Consumer, Non-cyclical – 13.2% (continued)

|

|

|

|

Ritchie Bros Auctioneers, Inc.

|

|

|

|

5.38% due 01/15/251,3

|

3,249,000

|

$ 3,403,328

|

|

Constellation Brands, Inc.

|

|

|

|

3.15% due 08/01/291

|

3,253,000

|

3,319,397

|

|

Cardtronics Incorporated / Cardtronics USA Inc

|

|

|

|

5.50% due 05/01/251,3

|

2,569,000

|

2,665,338

|

|

Ortho-Clinical Diagnostics Incorporated / Ortho-Clinical Diagnostics S.A.

|

|

|

|

6.63% due 05/15/221,3

|

2,233,000

|

2,160,428

|

|

Spectrum Brands, Inc.

|

|

|

|

5.75% due 07/15/251

|

1,758,000

|

1,841,505

|

|

Central Garden & Pet Co.

|

|

|

|

6.13% due 11/15/231

|

1,419,000

|

1,473,986

|

|

Envision Healthcare Corp.

|

|

|

|

8.75% due 10/15/263

|

1,857,000

|

1,077,060

|

|

Dean Foods Co.

|

|

|

|

6.50% due 03/15/233

|

2,132,000

|

1,012,700

|

|

Service Corporation International

|

|

|

|

8.00% due 11/15/21

|

159,000

|

175,695

|

|

Land O’ Lakes, Inc.

|

|

|

|

6.00% due 11/15/221,3

|

45,000

|

47,981

|

|

Total Consumer, Non-cyclical

|

|

74,631,813

|

|

|

||

|

Consumer, Cyclical – 12.8%

|

|

|

|

Scientific Games International, Inc.

|

|

|

|

10.00% due 12/01/221

|

3,336,000

|

3,440,250

|

|

8.25% due 03/15/261,3

|

1,868,000

|

1,980,080

|

|

Navistar International Corp.

|

|

|

|

6.63% due 11/01/253

|

4,500,000

|

4,612,500

|

|

Eagle Intermediate Global Holding BV/Ruyi US Finance LLC

|

|

|

|

7.50% due 05/01/251,3

|

5,230,000

|

4,582,788

|

|

Staples, Inc.

|

|

|

|

10.75% due 04/15/271,3

|

2,595,000

|

2,705,288

|

|

7.50% due 04/15/261,3

|

1,770,000

|

1,845,579

|

|

Dana Financing Luxembourg Sarl

|

|

|

|

6.50% due 06/01/261,3

|

3,636,000

|

3,835,980

|

|

Enterprise Development Authority

|

|

|

|

12.00% due 07/15/241,3

|

3,432,000

|

3,775,200

|

|

Downstream Development Authority of the Quapaw Tribe of Oklahoma

|

|

|

|

10.50% due 02/15/231,3

|

3,546,000

|

3,749,895

|

|

Churchill Downs, Inc.

|

|

|

|

4.75% due 01/15/281,3

|

3,011,000

|

3,131,440

|

|

5.50% due 04/01/271,3

|

428,000

|

454,750

|

|

Michaels Stores, Inc.

|

|

|

|

8.00% due 07/15/271,3

|

3,371,000

|

3,340,492

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CORPORATE BONDS†† – 72.0% (continued)

|

|

|

|

Consumer, Cyclical – 12.8% (continued)

|

|

|

|

Wolverine World Wide, Inc.

|

|

|

|

5.00% due 09/01/261,3

|

3,201,000

|

$ 3,249,015

|

|

Truck Hero, Inc.

|

|

|

|

8.50% due 04/21/241,3

|

3,174,000

|

3,162,097

|

|

Mattamy Group Corp.

|

|

|

|

6.88% due 12/15/231,3

|

3,037,000

|

3,154,684

|

|

Wynn Macau Ltd.

|

|

|

|

5.50% due 10/01/273

|

2,754,000

|

2,840,923

|

|

American Greetings Corp.

|

|

|

|

8.75% due 04/15/251,3

|

3,040,000

|

2,796,800

|

|

Carlson Travel, Inc.

|

|

|

|

9.50% due 12/15/243

|

2,600,000

|

2,632,500

|

|

TRI Pointe Group, Inc.

|

|

|

|

4.88% due 07/01/211

|

2,484,000

|

2,564,730

|

|

Delphi Technologies plc

|

|

|

|

5.00% due 10/01/251,3

|

2,745,000

|

2,388,150

|

|

Goodyear Tire & Rubber Co.

|

|

|

|

8.75% due 08/15/201

|

2,130,000

|

2,233,838

|

|

AAG FH Limited Partnership / AAG FH Finco, Inc.

|

|

|

|

9.75% due 07/15/241,3

|

2,254,000

|

2,090,585

|

|

Six Flags Entertainment Corp.

|

|

|

|

4.88% due 07/31/241,3

|

2,000,000

|

2,070,000

|

|

Tempur Sealy International, Inc.

|

|

|

|

5.63% due 10/15/231

|

2,000,000

|

2,065,000

|

|

Scotts Miracle-Gro Co.

|

|

|

|

5.25% due 12/15/261

|

1,716,000

|

1,812,525

|

|

GameStop Corp.

|

|

|

|

6.75% due 03/15/211,3

|

1,250,000

|

1,256,250

|

|

William Carter Co.

|

|

|

|

5.63% due 03/15/271,3

|

703,000

|

754,846

|

|

Total Consumer, Cyclical

|

|

72,526,185

|

|

|

||

|

Communications – 11.7%

|

|

|

|

Sprint Corp.

|

|

|

|

7.88% due 09/15/231

|

6,900,000

|

7,633,125

|

|

7.25% due 09/15/21

|

1,731,000

|

1,851,408

|

|

Sirius XM Radio, Inc.

|

|

|

|

5.38% due 04/15/251,3

|

5,000,000

|

5,218,750

|

|

3.88% due 08/01/221,3

|

2,689,000

|

2,759,586

|

|

5.00% due 08/01/271,3

|

297,000

|

313,335

|

|

CenturyLink, Inc.

|

|

|

|

6.45% due 06/15/211

|

3,312,000

|

3,494,160

|

|

6.88% due 01/15/281

|

1,284,000

|

1,367,460

|

|

CommScope, Inc.

|

|

|

|

8.25% due 03/01/271,3

|

4,674,000

|

4,444,881

|

|

|

||

|

See notes to financial statements.

|

|

|

|

20 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

|

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CORPORATE BONDS†† – 72.0% (continued)

|

|

|

|

Communications – 11.7% (continued)

|

|

|

|

Altice Luxembourg S.A.

|

|

|

|

10.50% due 05/15/271,3

|

3,547,000

|

$ 4,021,411

|

|

Charter Communications Operating LLC / Charter Communications Operating Capital

|

|

|

|

3.58% due 07/23/201

|

3,900,000

|

3,933,793

|

|

Symantec Corp.

|

|

|

|

5.00% due 04/15/251,3

|

3,775,000

|

3,873,401

|

|

DISH DBS Corp.

|

|

|

|

6.75% due 06/01/211

|

2,015,000

|

2,120,788

|

|

5.13% due 05/01/201

|

1,716,000

|

1,737,450

|

|

Diamond Sports Group LLC / Diamond Sports Finance Co.

|

|

|

|

5.38% due 08/15/261,3

|

3,360,000

|

3,519,600

|

|

Cincinnati Bell, Inc.

|

|

|

|

8.00% due 10/15/251,3

|

3,534,000

|

3,171,765

|

|

MDC Partners, Inc.

|

|

|

|

6.50% due 05/01/241,3

|

3,293,000

|

3,165,396

|

|

Meredith Corp.

|

|

|

|

6.88% due 02/01/261

|

2,601,000

|

2,693,934

|

|

National CineMedia LLC

|

|

|

|

6.00% due 04/15/221

|

1,774,000

|

1,796,352

|

|

5.88% due 04/15/281,3

|

659,000

|

694,323

|

|

Photo Holdings Merger Sub, Inc.

|

|

|

|

8.50% due 10/01/261,3

|

2,808,000

|

2,478,425

|

|

Nokia Oyj

|

|

|

|

3.38% due 06/12/221

|

2,361,000

|

2,393,464

|

|

T-Mobile USA, Inc.

|

|

|

|

4.00% due 04/15/221

|

1,741,000

|

1,801,430

|

|

GrubHub Holdings, Inc.

|

|

|

|

5.50% due 07/01/271,3

|

1,741,000

|

1,636,540

|

|

Total Communications

|

|

66,120,777

|

|

|

||

|

Basic Materials – 8.6%

|

|

|

|

Alcoa Nederland Holding BV

|

|

|

|

6.75% due 09/30/241,3

|

4,000,000

|

4,225,000

|

|

6.13% due 05/15/281,3

|

3,495,000

|

3,757,125

|

|

Commercial Metals Co.

|

|

|

|

5.75% due 04/15/261

|

3,019,000

|

3,120,891

|

|

4.88% due 05/15/231

|

3,000,000

|

3,112,500

|

|

FMG Resources August 2006 Pty Ltd.

|

|

|

|

4.75% due 05/15/221,3

|

2,756,000

|

2,849,015

|

|

5.13% due 03/15/231,3

|

2,000,000

|

2,087,500

|

|

First Quantum Minerals Ltd.

|

|

|

|

6.88% due 03/01/263

|

3,924,000

|

3,860,235

|

|

7.50% due 04/01/253

|

800,000

|

805,000

|

|

New Gold, Inc.

|

|

|

|

6.38% due 05/15/251,3

|

3,850,000

|

3,677,135

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CORPORATE BONDS†† – 72.0% (continued)

|

|

|

|

Basic Materials – 8.6% (continued)

|

|

|

|

Valvoline, Inc.

|

|

|

|

5.50% due 07/15/241

|

2,406,000

|

$ 2,509,007

|

|

4.38% due 08/15/251

|

1,000,000

|

1,022,500

|

|

Compass Minerals International, Inc.

|

|

|

|

4.88% due 07/15/241,3

|

3,281,000

|

3,215,380

|

|

AK Steel Corp.

|

|

|

|

7.50% due 07/15/231

|

3,100,000

|

3,123,250

|

|

Steel Dynamics, Inc.

|

|

|

|

5.50% due 10/01/241

|

2,563,000

|

2,647,015

|

|

Freeport-McMoRan, Inc.

|

|

|

|

3.55% due 03/01/221

|

2,293,000

|

2,324,529

|

|

TPC Group, Inc.

|

|

|

|

10.50% due 08/01/241,3

|

2,016,000

|

2,147,040

|

|

Kaiser Aluminum Corp.

|

|

|

|

5.88% due 05/15/241

|

2,038,000

|

2,124,615

|

|

Tronox Finance plc

|

|

|

|

5.75% due 10/01/251,3

|

1,983,000

|

1,878,892

|

|

Total Basic Materials

|

|

48,486,629

|

|

|

||

|

Energy – 8.6%

|

|

|

|

PBF Holding Company LLC / PBF Finance Corp.

|

|

|

|

7.25% due 06/15/251

|

3,857,000

|

4,045,029

|

|

Parsley Energy LLC / Parsley Finance Corp.

|

|

|

|

5.63% due 10/15/271,3

|

2,158,000

|

2,238,925

|

|

5.38% due 01/15/251,3

|

1,703,000

|

1,761,719

|

|

Calumet Specialty Products Partners Limited Partnership / Calumet Finance Corp.

|

|

|

|

11.00% due 04/15/251,3

|

3,698,000

|

3,716,490

|

|

Parkland Fuel Corp.

|

|

|

|

5.88% due 07/15/271,3

|

3,178,000

|

3,371,286

|

|

PDC Energy, Inc.

|

|

|

|

5.75% due 05/15/261

|

3,433,000

|

3,218,438

|

|

Genesis Energy Limited Partnership / Genesis Energy Finance Corp.

|

|

|

|

6.25% due 05/15/261

|

3,431,000

|

3,190,830

|

|

Oasis Petroleum, Inc.

|

|

|

|

6.25% due 05/01/261,3

|

4,465,000

|

3,058,525

|

|

Ascent Resources Utica Holdings LLC / ARU Finance Corp.

|

|

|

|

7.00% due 11/01/261,3

|

2,100,000

|

1,617,000

|

|

10.00% due 04/01/221,3

|

1,438,000

|

1,367,969

|

|

Murphy Oil Corp.

|

|

|

|

6.88% due 08/15/241

|

2,688,000

|

2,848,850

|

|

Plains All American Pipeline, LP

|

|

|

|

6.13% 4,5

|

3,000,000

|

2,802,060

|

|

Continental Resources, Inc.

|

|

|

|

5.00% due 09/15/221

|

2,598,000

|

2,619,566

|

|

|

||

|

See notes to financial statements.

|

|

|

|

22 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

|

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CORPORATE BONDS†† – 72.0% (continued)

|

|

|

|

Energy – 8.6% (continued)

|

|

|

|

Alliance Resource Operating Partners Limited Partnership / Alliance Resource Finance Corp.

|

|

|

|

7.50% due 05/01/251,3

|

2,859,000

|

$ 2,430,150

|

|

Summit Midstream Holdings LLC / Summit Midstream Finance Corp.

|

|

|

|

5.75% due 04/15/251

|

2,768,000

|

2,159,040

|

|

5.50% due 08/15/221

|

125,000

|

112,500

|

|

Gulfport Energy Corp.

|

|

|

|

6.00% due 10/15/24

|

3,430,000

|

2,220,925

|

|

SM Energy Co.

|

|

|

|

6.75% due 09/15/261

|

2,356,000

|

2,032,050

|

|

Indigo Natural Resources LLC

|

|

|

|

6.88% due 02/15/261,3

|

2,082,000

|

1,905,030

|

|

PBF Logistics Limited Partnership / PBF Logistics Finance Corp.

|

|

|

|

6.88% due 05/15/231

|

1,565,000

|

1,611,950

|

|

Total Energy

|

|

48,328,332

|

|

|

||

|

Financial – 5.9%

|

|

|

|

GMAC, Inc.

|

|

|

|

8.00% due 11/01/31

|

3,306,000

|

4,616,003

|

|

SBA Communications Corp.

|

|

|

|

4.00% due 10/01/221

|

3,697,000

|

3,789,980

|

|

Credit Acceptance Corp.

|

|

|

|

6.63% due 03/15/261,3

|

2,920,000

|

3,109,800

|

|

7.38% due 03/15/231

|

655,000

|

678,744

|

|

Springleaf Finance Corp.

|

|

|

|

7.75% due 10/01/211

|

3,347,000

|

3,660,848

|

|

Fidelity & Guaranty Life Holdings, Inc.

|

|

|

|

5.50% due 05/01/251,3

|

3,168,000

|

3,397,680

|

|

CIT Group, Inc.

|

|

|

|

5.00% due 08/15/221

|

2,920,000

|

3,111,464

|

|

Navient Corp.

|

|

|

|

8.00% due 03/25/201

|

3,008,000

|

3,079,440

|

|

Ardonagh Midco 3 plc

|

|

|

|

8.63% due 07/15/231,3

|

2,836,000

|

2,687,110

|

|

CoreCivic, Inc.

|

|

|

|

4.63% due 05/01/231

|

2,665,000

|

2,508,431

|

|

AG Merger Sub II, Inc.

|

|

|

|

10.75% due 08/01/271,3

|

2,510,000

|

2,497,450

|

|

Newmark Group, Inc.

|

|

|

|

6.13% due 11/15/231

|

90,000

|

98,219

|

|

Total Financial

|

|

33,235,169

|

|

|

||

|

Technology – 5.7%

|

|

|

|

Amkor Technology, Inc.

|

|

|

|

6.63% due 09/15/271,3

|

6,249,000

|

6,873,900

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CORPORATE BONDS†† – 72.0% (continued)

|

|

|

|

Technology – 5.7% (continued)

|

|

|

|

NCR Corp.

|

|

|

|

5.00% due 07/15/221

|

5,000,000

|

$ 5,050,000

|

|

Qorvo, Inc.

|

|

|

|

5.50% due 07/15/261

|

4,000,000

|

4,279,920

|

|

Seagate HDD Cayman

|

|

|

|

4.25% due 03/01/221

|

4,058,000

|

4,203,242

|

|

Infor US, Inc.

|

|

|

|

6.50% due 05/15/221

|

4,000,000

|

4,070,000

|

|

Western Digital Corp.

|

|

|

|

4.75% due 02/15/261

|

3,906,000

|

3,998,865

|

|

Dell, Inc.

|

|

|

|

4.63% due 04/01/21

|

3,675,000

|

3,789,384

|

|

Total Technology

|

|

32,265,311

|

|

|

||

|

Industrial – 5.1%

|

|

|

|

MasTec, Inc.

|

|

|

|

4.88% due 03/15/231

|

4,715,000

|

4,797,512

|

|

Louisiana-Pacific Corp.

|

|

|

|

4.88% due 09/15/241

|

3,779,000

|

3,901,818

|

|

WESCO Distribution, Inc.

|

|

|

|

5.38% due 06/15/241

|

3,433,000

|

3,561,737

|

|

Ball Corp.

|

|

|

|

4.38% due 12/15/201

|

3,432,000

|

3,502,785

|

|

Energizer Holdings, Inc.

|

|

|

|

6.38% due 07/15/261,3

|

3,000,000

|

3,206,400

|

|

Navios Maritime Acquisition Corporation / Navios Acquisition Finance US, Inc.

|

|

|

|

8.13% due 11/15/211,3

|

3,695,000

|

3,029,900

|

|

TransDigm, Inc.

|

|

|

|

6.00% due 07/15/221

|

2,558,000

|

2,604,684

|

|

Navios Maritime Holdings, Inc. / Navios Maritime Finance II US, Inc.

|

|

|

|

7.38% due 01/15/223

|

3,512,000

|

2,054,520

|

|

Mueller Water Products, Inc.

|

|

|

|

5.50% due 06/15/261,3

|

1,899,000

|

1,996,324

|

|

Total Industrial

|

|

28,655,680

|

|

|

||

|

Utilities – 0.4%

|

|

|

|

Talen Energy Supply LLC

|

|

|

|

10.50% due 01/15/261,3

|

1,700,000

|

1,466,250

|

|

6.63% due 01/15/281,3

|

776,000

|

752,720

|

|

Total Utilities

|

|

2,218,970

|

|

Total Corporate Bonds

|

|

|

|

(Cost $402,880,189)

|

|

406,468,866

|

|

PORTFOLIO OF INVESTMENTS continued

|

October 31, 2019

|

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6%

|

|

|

|

Technology – 16.4%

|

|

|

|

Microchip Technology, Inc.

|

|

|

|

1.63% due 02/15/271

|

8,554,000

|

$ 11,219,287

|

|

Alteryx, Inc.

|

|

|

|

1.00% due 08/01/261,3

|

7,211,000

|

6,536,829

|

|

Splunk, Inc.

|

|

|

|

0.50% due 09/15/231

|

5,744,000

|

6,265,118

|

|

Nuance Communications, Inc.

|

|

|

|

1.00% due 12/15/351

|

5,000,000

|

4,885,630

|

|

1.25% due 04/01/251

|

1,171,000

|

1,236,869

|

|

Akamai Technologies, Inc.

|

|

|

|

0.13% due 05/01/251

|

3,676,000

|

4,135,500

|

|

0.38% due 09/01/271,3

|

1,321,000

|

1,320,716

|

|

Workiva, Inc.

|

|

|

|

1.13% due 08/15/263

|

4,721,000

|

4,259,883

|

|

STMicroelectronics N.V.

|

|

|

|

0.25% due 07/03/24

|

3,200,000

|

4,155,360

|

|

ON Semiconductor Corp.

|

|

|

|

1.63% due 10/15/231

|

3,315,000

|

4,136,961

|

|

Rapid7, Inc.

|

|

|

|

1.25% due 08/01/231

|

2,899,000

|

4,020,416

|

|

Synaptics, Inc.

|

|

|

|

0.50% due 06/15/221

|

4,000,000

|

3,785,000

|

|

Talend S.A.

|

|

|

|

1.75% due 09/01/243

|

EUR 3,180,000

|

3,443,358

|

|

Workday, Inc.

|

|

|

|

0.25% due 10/01/221

|

2,675,000

|

3,415,426

|

|

Pure Storage, Inc.

|

|

|

|

0.13% due 04/15/231

|

3,173,000

|

3,343,737

|

|

Insight Enterprises, Inc.

|

|

|

|

0.75% due 02/15/251,3

|

2,002,000

|

2,189,155

|

|

Coupa Software, Inc.

|

|

|

|

0.13% due 06/15/251,3

|

1,804,000

|

2,048,828

|

|

Five9, Inc.

|

|

|

|

0.13% due 05/01/231

|

1,365,000

|

2,025,319

|

|

New Relic, Inc.

|

|

|

|

0.50% due 05/01/231

|

2,080,000

|

2,004,288

|

|

Zynga, Inc.

|

|

|

|

0.25% due 06/01/241,3

|

1,789,000

|

1,833,475

|

|

Lumentum Holdings, Inc.

|

|

|

|

0.25% due 03/15/241

|

1,353,000

|

1,714,100

|

|

DocuSign, Inc.

|

|

|

|

0.50% due 09/15/231

|

1,250,000

|

1,474,153

|

|

Pluralsight, Inc.

|

|

|

|

0.38% due 03/01/241,3

|

1,668,000

|

1,467,723

|

|

See notes to financial statements.

|

|

|

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 25

|

||

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6% (continued)

|

|

|

|

Technology – 16.4% (continued)

|

|

|

|

Lenovo Group Ltd.

|

|

|

|

3.38% due 01/24/241

|

1,350,000

|

$ 1,464,356

|

|

Envestnet, Inc.

|

|

|

|

1.75% due 06/01/231

|

1,288,000

|

1,459,809

|

|

ServiceNow, Inc.

|

|

|

|

due 06/01/221,6

|

711,000

|

1,333,677

|

|

LivePerson, Inc.

|

|

|

|

0.75% due 03/01/241,3

|

1,007,000

|

1,276,372

|

|

CSG Systems International, Inc.

|

|

|

|

4.25% due 03/15/361

|

999,000

|

1,173,924

|

|

Tabula Rasa HealthCare, Inc.

|

|

|

|

1.75% due 02/15/261,3

|

967,000

|

1,006,284

|

|

Altair Engineering, Inc.

|

|

|

|

0.25% due 06/01/241

|

953,000

|

990,119

|

|

Teradyne, Inc.

|

|

|

|

1.25% due 12/15/231

|

475,000

|

945,319

|

|

Twilio, Inc.

|

|

|

|

0.25% due 06/01/231

|

550,000

|

837,223

|

|

Verint Systems, Inc.

|

|

|

|

1.50% due 06/01/211

|

682,000

|

698,197

|

|

Cypress Semiconductor Corp.

|

|

|

|

4.50% due 01/15/221

|

330,000

|

573,053

|

|

Total Technology

|

|

92,675,464

|

|

|

||

|

Consumer, Non-cyclical – 15.7%

|

|

|

|

Exact Sciences Corp.

|

|

|

|

0.38% due 03/15/271

|

6,424,000

|

6,916,588

|

|

Herbalife Nutrition Ltd.

|

|

|

|

2.63% due 03/15/241

|

6,743,000

|

6,809,298

|

|

Wright Medical Group, Inc.

|

|

|

|

1.63% due 06/15/231

|

6,566,000

|

6,288,183

|

|

Jazz Investments I Ltd.

|

|

|

|

1.50% due 08/15/241

|

6,046,000

|

5,810,911

|

|

Heska Corp.

|

|

|

|

3.75% due 09/15/263

|

3,979,000

|

4,783,612

|

|

Square, Inc.

|

|

|

|

0.50% due 05/15/231

|

3,933,000

|

4,352,781

|

|

Lannett Company, Inc.

|

|

|

|

4.50% due 10/01/263

|

4,000,000

|

4,142,000

|

|

DexCom, Inc.

|

|

|

|

0.75% due 12/01/231,3

|

3,064,000

|

3,669,265

|

|

Illumina, Inc.

|

|

|

|

0.50% due 06/15/211

|

2,042,000

|

2,664,905

|

|

due 08/15/231,6

|

803,000

|

872,020

|

|

See notes to financial statements.

|

|

|

|

26 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

|

|

|

PORTFOLIO OF INVESTMENTS continued

|

October 31, 2019

|

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6% (continued)

|

|

|

|

Consumer, Non-cyclical – 15.7% (continued)

|

|

|

|

BioMarin Pharmaceutical, Inc.

|

|

|

|

1.50% due 10/15/201

|

3,307,000

|

$ 3,479,162

|

|

Intercept Pharmaceuticals, Inc.

|

|

|

|

3.25% due 07/01/231

|

3,548,000

|

3,125,887

|

|

Ionis Pharmaceuticals, Inc.

|

|

|

|

1.00% due 11/15/211

|

2,522,000

|

2,782,982

|

|

Insulet Corp.

|

|

|

|

0.38% due 09/01/261,3

|

2,791,000

|

2,681,104

|

|

Euronet Worldwide, Inc.

|

|

|

|

0.75% due 03/15/491,3

|

2,270,000

|

2,587,204

|

|

Chegg, Inc.

|

|

|

|

0.13% due 03/15/251,3

|

2,547,000

|

2,389,850

|

|

Wright Medical Group N.V.

|

|

|

|

2.25% due 11/15/211

|

1,942,000

|

2,291,124

|

|

NuVasive, Inc.

|

|

|

|

2.25% due 03/15/211

|

1,735,000

|

2,183,393

|

|

Teladoc Health, Inc.

|

|

|

|

1.38% due 05/15/251

|

1,150,000

|

1,869,441

|

|

Orpea

|

|

|

|

0.38% due 05/17/271

|

9,164**

|

1,641,512

|

|

QIAGEN N.V.

|

|

|

|

0.50% due 09/13/231

|

1,600,000

|

1,548,152

|

|

Horizon Pharma Investment Ltd.

|

|

|

|

2.50% due 03/15/221

|

1,257,000

|

1,511,143

|

|

Neurocrine Biosciences, Inc.

|

|

|

|

2.25% due 05/15/241

|

962,000

|

1,406,371

|

|

Yaoko Company Ltd.

|

|

|

|

due 06/20/246

|

JPY 120,000,000

|

1,152,379

|

|

Sarepta Therapeutics, Inc.

|

|

|

|

1.50% due 11/15/241

|

775,000

|

1,094,796

|

|

CONMED Corp.

|

|

|

|

2.63% due 02/01/241,3

|

729,000

|

1,004,035

|

|

Anthem, Inc.

|

|

|

|

2.75% due 10/15/421

|

264,000

|

999,064

|

|

WuXi AppTec Company Ltd.

|

|

|

|

due 09/17/241,6

|

900,000

|

986,782

|

|

Flexion Therapeutics, Inc.

|

|

|

|

3.38% due 05/01/241

|

1,019,000

|

983,614

|

|

Biocartis N.V.

|

|

|

|

4.00% due 05/09/24

|

EUR 1,100,000

|

926,548

|

|

Nipro Corp.

|

|

|

|

due 01/29/211,6

|

JPY 90,000,000

|

864,329

|

|

GMO Payment Gateway, Inc.

|

|

|

|

due 06/19/236

|

JPY 70,000,000

|

824,773

|

|

|

||

|

See notes to financial statements.

|

|

|

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 27

|

||

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6% (continued)

|

|

|

|

Consumer, Non-cyclical – 15.7% (continued)

|

|

|

|

Insmed, Inc.

|

|

|

|

1.75% due 01/15/251

|

918,000

|

$ 788,290

|

|

GN Store Nord A/S

|

|

|

|

due 05/21/241,6

|

EUR 700,000

|

775,450

|

|

Carrefour S.A.

|

|

|

|

due 03/27/241,6

|

800,000

|

772,720

|

|

Top Glove Labuan Ltd.

|

|

|

|

2.00% due 03/01/24

|

675,000

|

666,632

|

|

J Sainsbury plc

|

|

|

|

2.88% due 12/29/495

|

GBP 500,000

|

653,088

|

|

PTC Therapeutics, Inc.

|

|

|

|

1.50% due 09/15/261,3

|

248,000

|

258,881

|

|

Total Consumer, Non-cyclical

|

|

88,558,269

|

|

|

||

|

Communications – 13.7%

|

|

|

|

Liberty Media Corp.

|

|

|

|

1.38% due 10/15/23

|

4,138,000

|

5,231,839

|

|

2.25% due 12/01/481,3

|

2,839,000

|

3,365,144

|

|

YY, Inc.

|

|

|

|

1.38% due 06/15/261,3

|

4,000,000

|

3,715,704

|

|

0.75% due 06/15/251,3

|

3,149,000

|

2,923,157

|

|

Palo Alto Networks, Inc.

|

|

|

|

0.75% due 07/01/231

|

5,815,000

|

6,425,359

|

|

DISH Network Corp.

|

|

|

|

3.38% due 08/15/261

|

4,946,000

|

4,637,178

|

|

Booking Holdings, Inc.

|

|

|

|

0.90% due 09/15/211

|

2,042,000

|

2,405,043

|

|

0.35% due 06/15/201

|

1,094,000

|

1,706,035

|

|

Twitter, Inc.

|

|

|

|

0.25% due 06/15/241

|

4,294,000

|

4,110,438

|

|

IAC Financeco 2, Inc.

|

|

|

|

0.88% due 06/15/261,3

|

3,802,000

|

4,108,924

|

|

Proofpoint, Inc.

|

|

|

|

0.25% due 08/15/241,3

|

3,738,000

|

3,878,175

|

|

Viavi Solutions, Inc.

|

|

|

|

1.00% due 03/01/241

|

2,625,000

|

3,527,344

|

|

Snap, Inc.

|

|

|

|

0.75% due 08/01/261,3

|

2,759,000

|

2,795,502

|

|

Ctrip.com International Ltd.

|

|

|

|

1.99% due 07/01/251

|

2,436,000

|

2,553,232

|

|

Zillow Group, Inc.

|

|

|

|

0.75% due 09/01/241,3

|

2,425,000

|

2,445,662

|

|

GCI Liberty, Inc.

|

|

|

|

1.75% due 09/30/461,3

|

1,810,000

|

2,442,685

|

|

See notes to financial statements.

|

|

|

|

28 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

|

|

|

PORTFOLIO OF INVESTMENTS continued

|

October 31, 2019

|

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6% (continued)

|

|

|

|

Communications – 13.7% (continued)

|

|

|

|

Vonage Holdings Corp.

|

|

|

|

1.75% due 06/01/241,3

|

2,507,000

|

$ 2,436,892

|

|

Q2 Holdings, Inc.

|

|

|

|

0.75% due 06/01/261,3

|

2,238,000

|

2,374,005

|

|

Okta, Inc.

|

|

|

|

0.13% due 09/01/251,3

|

2,347,000

|

2,232,711

|

|

Etsy, Inc.

|

|

|

|

0.13% due 10/01/261,3

|

2,454,000

|

2,228,639

|

|

Wayfair, Inc.

|

|

|

|

1.00% due 08/15/261,3

|

2,146,000

|

1,918,896

|

|

1.13% due 11/01/241,3

|

205,000

|

209,829

|

|

Liberty Latin America Ltd.

|

|

|

|

2.00% due 07/15/243

|

1,874,000

|

1,951,905

|

|

iQIYI, Inc.

|

|

|

|

2.00% due 04/01/251,3

|

2,050,000

|

1,856,609

|

|

Zendesk, Inc.

|

|

|

|

0.25% due 03/15/231

|

1,218,000

|

1,589,042

|

|

FireEye, Inc.

|

|

|

|

0.88% due 06/01/241

|

1,357,000

|

1,345,525

|

|

8x8, Inc.

|

|

|

|

0.50% due 02/01/241,3

|

1,229,000

|

1,257,517

|

|

InterDigital, Inc.

|

|

|

|

2.00% due 06/01/241,3

|

1,063,000

|

1,050,831

|

|

Pinduoduo, Inc.

|

|

|

|

due 10/01/241,3,6

|

395,000

|

460,478

|

|

Total Communications

|

|

77,184,300

|

|

|

||

|

Industrial – 5.4%

|

|

|

|

Airbus SE

|

|

|

|

due 07/01/221,6

|

EUR 1,600,000

|

2,350,292

|

|

due 06/14/211,6

|

EUR 1,700,000

|

2,072,478

|

|

KBR, Inc.

|

|

|

|

2.50% due 11/01/231,3

|

3,379,000

|

4,243,423

|

|

Fortive Corp.

|

|

|

|

0.88% due 02/15/221,3

|

2,452,000

|

2,425,217

|

|

Cellnex Telecom S.A.

|

|

|

|

1.50% due 01/16/261

|

EUR 1,600,000

|

2,382,780

|

|

Sika A.G.

|

|

|

|

0.15% due 06/05/25

|

CHF 1,980,000

|

2,284,098

|

|

China Railway Construction Corporation Ltd.

|

|

|

|

due 01/29/211,6

|

2,000,000

|

2,120,554

|

|

Asia Cement Corp.

|

|

|

|

due 09/21/236

|

1,627,000

|

1,868,740

|

|

OSI Systems, Inc.

|

|

|

|

1.25% due 09/01/221

|

1,430,000

|

1,581,938

|

|

|

||

|

See notes to financial statements.

|

|

|

|

|

||

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 29

|

||

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6% (continued)

|

|

|

|

Industrial – 5.4% (continued)

|

|

|

|

Vinci S.A.

|

|

|

|

0.38% due 02/16/221

|

1,200,000

|

$ 1,483,380

|

|

MINEBEA MITSUMI, Inc.

|

|

|

|

due 08/03/226

|

JPY 120,000,000

|

1,320,301

|

|

Taiwan Cement Corp.

|

|

|

|

due 12/10/236

|

1,100,000

|

1,290,219

|

|

Chart Industries, Inc.

|

|

|

|

1.00% due 11/15/241,3

|

947,000

|

1,142,193

|

|

Vishay Intertechnology, Inc.

|

|

|

|

2.25% due 06/15/251

|

1,119,000

|

1,105,422

|

|

CRRC Corporation Ltd.

|

|

|

|

due 02/05/211,6

|

1,000,000

|

963,311

|

|

Mesa Laboratories, Inc.

|

|

|

|

1.38% due 08/15/25

|

781,000

|

820,538

|

|

Air Transport Services Group, Inc.

|

|

|

|

1.13% due 10/15/241

|

818,000

|

751,926

|

|

Total Industrial

|

|

30,206,810

|

|

|

||

|

Consumer, Cyclical – 4.7%

|

|

|

|

Huazhu Group Ltd.

|

|

|

|

0.38% due 11/01/221

|

5,025,000

|

5,511,797

|

|

Tesla, Inc.

|

|

|

|

2.00% due 05/15/241

|

2,175,000

|

2,667,252

|

|

1.25% due 03/01/211

|

909,000

|

990,441

|

|

Marriott Vacations Worldwide Corp.

|

|

|

|

1.50% due 09/15/221

|

2,542,000

|

2,601,515

|

|

Zhongsheng Group Holdings Ltd.

|

|

|

|

due 05/23/236

|

HKD 17,000,000

|

2,386,185

|

|

Harvest International Co.

|

|

|

|

due 11/21/226

|

HKD 16,000,000

|

2,069,036

|

|

Guess?, Inc.

|

|

|

|

2.00% due 04/15/241,3

|

1,982,000

|

1,899,004

|

|

Sony Corp.

|

|

|

|

due 09/30/226

|

JPY 147,000,000

|

1,898,064

|

|

Cie Generale des Etablissements Michelin SCA

|

|

|

|

due 01/10/221,6

|

1,800,000

|

1,825,884

|

|

Adidas AG

|

|

|

|

0.05% due 09/12/231

|

EUR 800,000

|

1,086,760

|

|

Meritor, Inc.

|

|

|

|

3.25% due 10/15/371

|

1,032,000

|

1,062,529

|

|

Suzuki Motor Corp.

|

|

|

|

due 03/31/236

|

JPY 70,000,000

|

823,749

|

|

EZCORP, Inc.

|

|

|

|

2.38% due 05/01/25

|

858,000

|

644,161

|

|

|

||

|

|

||

|

See notes to financial statements.

|

|

|

|

30 l AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT

|

|

|

|

PORTFOLIO OF INVESTMENTS continued

|

October 31, 2019

|

|

|

|

||

|

|

||

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6% (continued)

|

|

|

|

Consumer, Cyclical – 4.7% (continued)

|

|

|

|

Kering S.A.

|

|

|

|

due 09/30/221,6

|

EUR 400,000

|

$ 478,846

|

|

LVMH Moet Hennessy Louis Vuitton SE

|

|

|

|

due 02/16/216

|

1,031**

|

471,949

|

|

Total Consumer, Cyclical

|

|

26,417,172

|

|

|

||

|

Financial – 4.6%

|

|

|

|

AXA S.A.

|

|

|

|

7.25% due 05/15/211,3

|

4,371,000

|

4,540,376

|

|

SBI Holdings, Inc.

|

|

|

|

due 09/13/236

|

JPY 300,000,000

|

2,930,675

|

|

Poseidon Finance 1 Ltd.

|

|

|

|

due 02/01/251,6

|

2,424,000

|

2,431,719

|

|

Deutsche Wohnen SE

|

|

|

|

0.33% due 07/26/241

|

EUR 1,800,000

|

2,104,764

|

|

PRA Group, Inc.

|

|

|

|

3.50% due 06/01/231

|

1,960,000

|

1,991,588

|

|

Colony Capital, Inc.

|

|

|

|

3.88% due 01/15/211

|

1,909,000

|

1,880,371

|

|

IMMOFINANZ AG

|

|

|

|

1.50% due 01/24/241

|

EUR 1,300,000

|

1,840,271

|

|

BofA Finance LLC

|

|

|

|

0.25% due 05/01/231

|

1,523,000

|

1,536,333

|

|

Blackstone Mortgage Trust, Inc.

|

|

|

|

4.75% due 03/15/231

|

1,263,000

|

1,336,362

|

|

Aurelius SE

|

|

|

|

1.00% due 12/01/20

|

EUR 1,200,000

|

1,312,609

|

|

IH Merger Sub LLC

|

|

|

|

3.50% due 01/15/221

|

835,000

|

1,151,227

|

|

PHP Finance Jersey NO 2 Ltd.

|

|

|

|

2.88% due 07/15/25

|

GBP 785,000

|

1,092,644

|

|

Cindai Capital Ltd.

|

|

|

|

due 02/08/236

|

800,000

|

775,773

|

|

LEG Immobilien AG

|

|

|

|

0.88% due 09/01/251

|

EUR 600,000

|

770,555

|

|

Total Financial

|

|

25,695,267

|

|

|

||

|

Basic Materials – 2.1%

|

|

|

|

Toray Industries, Inc.

|

|

|

|

due 08/31/211,6

|

JPY 370,000,000

|

3,759,866

|

|

Brenntag Finance BV

|

|

|

|

1.88% due 12/02/221

|

3,500,000

|

3,457,300

|

|

Mitsubishi Chemical Holdings Corp.

|

|

|

|

due 03/29/241,6

|

JPY 130,000,000

|

1,246,078

|

|

|

||

|

See notes to financial statements.

|

|

|

|

AVK l ADVENT CONVERTIBLE AND INCOME FUND ANNUAL REPORT l 31

|

||

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

CONVERTIBLE BONDS†† – 65.6% (continued)

|

|

|

|

Basic Materials – 2.1% (continued)

|

|

|

|

Cleveland-Cliffs, Inc.

|

|

|

|

1.50% due 01/15/251

|

930,000

|

$ 1,022,620

|

|

Osisko Gold Royalties Ltd.

|

|

|

|

4.00% due 12/31/22

|

CAD 1,300,000

|

1,006,490

|

|

Pretium Resources, Inc.

|

|

|

|

2.25% due 03/15/22

|

837,000

|

892,995

|

|

Glencore Funding LLC6

|

|

|

|

due 03/27/25

|

800,000

|

678,072

|

|

Total Basic Materials

|

|

12,063,421

|

|

|

||

|

Energy – 1.8%

|

|

|

|

TOTAL S.A.

|

|

|

|

0.50% due 12/02/221

|

2,000,000

|

2,109,360

|

|

Transocean, Inc.

|

|

|

|

0.50% due 01/30/231

|

2,326,000

|

1,916,429

|

|

RAG-Stiftung

|

|

|

|

due 02/18/211,6

|

EUR 800,000

|

893,806

|

|

due 10/02/241,6

|

EUR 700,000

|

781,799

|

|

BP Capital Markets plc

|

|

|

|

1.00% due 04/28/231

|

GBP 1,000,000

|

1,564,898

|

|

Whiting Petroleum Corp.

|

|

|

|

1.25% due 04/01/201

|

1,380,000

|

1,363,321

|

|

Eni SpA

|

|

|

|

due 04/13/221,6

|

EUR 900,000

|

1,038,525

|

|

Helix Energy Solutions Group, Inc.

|

|

|

|

4.13% due 09/15/23

|

632,000

|

765,905

|

|

Total Energy

|

|

10,434,043

|

|

|

||

|

Utilities – 1.2%

|

|

|

|

NRG Energy, Inc.

|

|

|

|

2.75% due 06/01/481

|

2,318,000

|

2,635,633

|

|

CenterPoint Energy, Inc.

|

|

|

|

4.52% due 09/15/29

|

40,717**

|

2,369,322

|

|

China Yangtze Power International BVI 1 Ltd.

|

|

|

|

due 11/09/211,6

|

1,775,000

|

1,857,551

|

|

Total Utilities

|

|

6,862,506

|

|

Total Convertible Bonds

|

|

|

|

(Cost $352,213,811)

|

|

370,097,252

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

October 31, 2019

|

|

|

Face

|

|

|

|

Amount~

|

Value

|

|

|

||

|

SENIOR FLOATING RATE INTERESTS††,7 – 1.7%

|

|

|

|

Consumer, Cyclical – 1.0%

|

|

|

|

PetSmart, Inc.

|

|

|

|

5.04% (3 Month USD LIBOR + 3.00%, Rate Floor: 1.00%) due 03/11/22

|

3,878,150

|

$ 3,790,099

|

|

Alterra Mountain Co.

|

|

|

|

4.80% (3 Month USD LIBOR + 3.00%, Rate Floor: 0.00%) due 07/31/24

|

1,864,785

|

1,869,447

|

|

Total Consumer, Cyclical

|

|

5,659,546

|

|

|

||

|

Communications – 0.5%

|

|

|

|

Sprint Communications, Inc.

|

|

|

|

4.56% (3 Month USD LIBOR + 2.50%, Rate Floor: 0.75%) due 02/03/24

|

2,925,000

|

2,896,978

|

|

|

||

|

Consumer, Non-cyclical – 0.2%

|

|

|

|

Refinitiv US Holdings, Inc.

|

|

|

|

5.79% (3 Month USD LIBOR + 3.75%, Rate Floor: 0.00%) due 10/01/25

|

992,500

|

998,644

|

|

Total Senior Floating Rate Interests

|

|

|

|

(Cost $9,669,440)

|

|

9,555,168

|

|

Total Investments – 168.4%

|

|

|

|

(Cost $924,167,357)

|

|

$ 950,028,153

|

|

|

||

|

|

Contracts

|

Value

|

|

|

||

|

LISTED OPTIONS WRITTEN† – (0.1)%

|

|

|

|

Call options on:

|

|

|

|

Citigroup, Inc.

|

|

|

|

Expiring November 2019 with strike price of $72.50 (Notional Value $3,625,000)

|

500

|

$ (50,000)

|

|

Alibaba Group Holdings, Ltd.

|

|

|

|

Expiring November 2019 with strike price of $180.00 (Notional Value $3,600,000)

|

200

|

(89,000)

|

|

Las Vegas Sands Corp.

|

|

|

|

Expiring November 2019 with strike price of $60.00 (Notional Value $4,500,000)

|

750

|

(201,000)

|

|

Total Call Options

|

|

(340,000)

|

|

Total Listed Options Written

|

|

|

|

(Premiums received $202,770)

|

|

(340,000)

|

|

Other Assets & Liabilities, net – (68.3)%

|

|

(385,539,893)

|

|

Total Net Assets – 100.0%

|

|

$ 564,148,260

|

|

PORTFOLIO OF INVESTMENTS continued

|

|

|

October 31, 2019

|

||||

|

|

|||||||

|

|

|||||||

|

FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS††

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized

|

|

|

|

|

|

Settlement

|

Settlement

|

Value at

|

Appreciation

|

|

Counterparty

|

Contracts to Sell

|

Currency

|

Date

|

Value

|

October 31, 2019

|

(Depreciation)

|

|

|

Bank of New York Mellon

|

1,649,306,300

|

JPY

|

12/13/19

|

$15,410,265

|

$ 15,300,648

|

$ 109,617

|

|

|

Bank of New York Mellon

|

34,500,000

|

HKD

|

12/13/19

|

4,402,431

|

4,400,918

|

1,513

|

|

|

Bank of New York Mellon

|

1,361,891

|

CAD

|

12/13/19

|

1,037,284

|

1,036,377

|

907

|

|

|

Bank of New York Mellon

|

2,204,393

|

CHF

|

12/13/19

|

2,236,126

|

2,241,882

|

(5,756)

|

|

|

Bank of New York Mellon

|

2,578,424

|

GBP

|

12/13/19

|