JPMORGAN SMARTRETIREMENT BLEND FUNDS

JPMorgan SmartRetirement® Blend Income Fund

JPMorgan SmartRetirement® Blend 2020 Fund

JPMorgan SmartRetirement® Blend 2025 Fund

JPMorgan SmartRetirement® Blend 2030 Fund

JPMorgan SmartRetirement® Blend 2035 Fund

JPMorgan SmartRetirement® Blend 2040 Fund

JPMorgan SmartRetirement® Blend 2045 Fund

JPMorgan SmartRetirement® Blend 2050 Fund

JPMorgan SmartRetirement® Blend 2055 Fund

JPMorgan SmartRetirement® Blend 2060 Fund

JPMORGAN TRUST IV

JPMorgan SmartRetirement® Blend 2065 Fund

(All Share Classes)

(each, a “Fund” and collectively, the “Funds”)

Supplement dated January 4, 2024 to the current

Summary Prospectuses and Prospectuses dated November 1, 2023

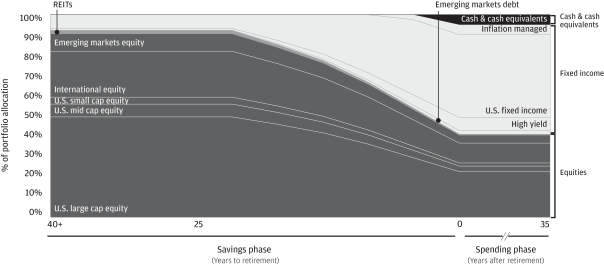

As part of the annual review process, effective January 31, 2024, the glide path in the “What are the Fund’s main investment strategies?” and the “More About the Funds — Principal Investment Strategies” sections of each Fund’s summary prospectuses and prospectuses (other than the JPMorgan SmartRetirement Blend Income Fund) will be revised and replaced with the following:

SUP‑SRB‑124

Effective January 31, 2024, the Target Allocations table in the “What are the Fund’s main investment strategies?” section of each Fund’s summary prospectuses and prospectuses will be revised and replaced with the following:

JPMorgan SmartRetirement Blend Income Fund and JPMorgan SmartRetirement Blend 2020 Fund

| Target Allocations1 | ||||

| Fixed income | 55.00% | |||

| U.S. fixed income | 41.60% | |||

| Inflation managed | 5.00% | |||

| High yield fixed income | 6.60% | |||

| Emerging markets debt | 1.80% | |||

| Equity | 40.00% | |||

| U.S. large cap equity | 21.15% | |||

| U.S. mid cap equity | 2.80% | |||

| U.S. small cap equity | 1.55% | |||

| REITs | 0.80% | |||

| International equity | 10.00% | |||

| Emerging markets equity | 3.70% | |||

| Money market/Cash and cash equivalents | 5.00% | |||

| Money market/Cash and cash equivalents | 5.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

JPMorgan SmartRetirement Blend 2025 Fund

| Target Allocations1 | ||||

| Fixed income | 51.80% | |||

| U.S. fixed income | 40.14% | |||

| Inflation managed | 4.00% | |||

| High yield fixed income | 6.02% | |||

| Emerging markets debt | 1.64% | |||

| Equity | 45.20% | |||

| U.S. large cap equity | 23.91% | |||

| U.S. mid cap equity | 3.16% | |||

| U.S. small cap equity | 1.75% | |||

| REITs | 0.90% | |||

| International equity | 11.30% | |||

| Emerging markets equity | 4.18% | |||

| Money market/Cash and cash equivalents | 3.00% | |||

| Money market/Cash and cash equivalents | 3.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

JPMorgan SmartRetirement Blend 2030 Fund

| Target Allocations1 | ||||

| Equity | 58.20% | |||

| U.S. large cap equity | 30.81% | |||

| U.S. mid cap equity | 4.06% | |||

| U.S. small cap equity | 2.23% | |||

| REITs | 1.15% | |||

| International equity | 14.57% | |||

| Emerging markets equity | 5.38% | |||

| Fixed income | 41.80% | |||

| U.S. fixed income | 34.47% | |||

| Inflation managed | 1.50% | |||

| High yield fixed income | 4.59% | |||

| Emerging markets debt | 1.24% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

JPMorgan SmartRetirement Blend 2035 Fund

| Target Allocations1 | ||||

| Equity | 70.40% | |||

| U.S. large cap equity | 37.23% | |||

| U.S. mid cap equity | 4.92% | |||

| U.S. small cap equity | 2.68% | |||

| REITs | 1.40% | |||

| International equity | 17.65% | |||

| Emerging markets equity | 6.52% | |||

| Fixed income | 29.60% | |||

| U.S. fixed income | 25.45% | |||

| Inflation managed | 0.00% | |||

| High yield fixed income | 3.27% | |||

| Emerging markets debt | 0.88% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

JPMorgan SmartRetirement Blend 2040 Fund

| Target Allocations1 | ||||

| Equity | 80.20% | |||

| U.S. large cap equity | 42.37% | |||

| U.S. mid cap equity | 5.62% | |||

| U.S. small cap equity | 3.07% | |||

| REITs | 1.61% | |||

| International equity | 20.10% | |||

| Emerging markets equity | 7.43% | |||

| Fixed income | 19.80% | |||

| U.S. fixed income | 17.01% | |||

| Inflation managed | 0.00% | |||

| High yield fixed income | 2.19% | |||

| Emerging markets debt | 0.60% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

JPMorgan SmartRetirement Blend 2045 Fund

| Target Allocations1 | ||||

| Equity | 87.80% | |||

| U.S. large cap equity | 46.43% | |||

| U.S. mid cap equity | 6.15% | |||

| U.S. small cap equity | 3.35% | |||

| REITs | 1.76% | |||

| International equity | 22.00% | |||

| Emerging markets equity | 8.11% | |||

| Fixed income | 12.20% | |||

| U.S. fixed income | 10.48% | |||

| Inflation managed | 0.00% | |||

| High yield fixed income | 1.35% | |||

| Emerging markets debt | 0.37% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

JPMorgan SmartRetirement Blend 2050 Fund, JPMorgan SmartRetirement Blend 2055 Fund, JPMorgan SmartRetirement Blend 2060 Fund and JPMorgan SmartRetirement Blend 2065 Fund

| Target Allocations1 | ||||

| Equity | 92.00% | |||

| U.S. large cap equity | 48.65% | |||

| U.S. mid cap equity | 6.45% | |||

| U.S. small cap equity | 3.50% | |||

| REITs | 1.85% | |||

| International equity | 23.05% | |||

| Emerging markets equity | 8.50% | |||

| Fixed income | 8.00% | |||

| U.S. fixed income | 6.85% | |||

| Inflation managed | 0.00% | |||

| High yield fixed income | 0.90% | |||

| Emerging markets debt | 0.25% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

| Money market/Cash and cash equivalents | 0.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

Effective January 31, 2024, the Target Allocations table in the “More About the Funds — Principal Investment Strategies” section of the JPMorgan SmartRetirement Blend Income Fund will be revised and replaced with the following:

| Target Allocations1 | ||||

| Fixed income | 55.00% | |||

| U.S. fixed income | 41.60% | |||

| Inflation managed | 5.00% | |||

| High yield fixed income | 6.60% | |||

| Emerging markets debt | 1.80% | |||

| Equity | 40.00% | |||

| U.S. large cap equity | 21.15% | |||

| U.S. mid cap equity | 2.80% | |||

| U.S. small cap equity | 1.55% | |||

| REITs | 0.80% | |||

| International equity | 10.00% | |||

| Emerging markets equity | 3.70% | |||

| Money market/Cash and cash equivalents | 5.00% | |||

| Money market/Cash and cash equivalents | 5.00% | |||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

Effective January 31, 2024, the Target Allocations table in the “More About the Funds — Principal Investment Strategies” section of the Funds’ prospectuses (other than the JPMorgan SmartRetirement Blend Income Fund) will be revised and replaced with the following:

| Target Allocations1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Years to Target Date | 40+ | 35 | 30 | 25 | 20 | 15 | 10 | 5 | 0 | -5 | -10 | -20 | -35 | |||||||||||||||||||||||||||||||||||||||

| Equity | 92.00 | % | 92.00 | % | 92.00 | % | 92.00 | % | 85.00 | % | 77.00 | % | 66.00 | % | 53.00 | % | 40.00 | % | 40.00 | % | 40.00 | % | 40.00 | % | 40.00 | % | ||||||||||||||||||||||||||

| U.S. large cap equity |

48.65 | % | 48.65 | % | 48.65 | % | 48.65 | % | 44.95 | % | 40.65 | % | 34.95 | % | 28.05 | % | 21.15 | % | 21.15 | % | 21.15 | % | 21.15 | % | 21.15 | % | ||||||||||||||||||||||||||

| U.S. mid cap equity |

6.45 | % | 6.45 | % | 6.45 | % | 6.45 | % | 5.95 | % | 5.40 | % | 4.60 | % | 3.70 | % | 2.80 | % | 2.80 | % | 2.80 | % | 2.80 | % | 2.80 | % | ||||||||||||||||||||||||||

| U.S. small cap equity |

3.50 | % | 3.50 | % | 3.50 | % | 3.50 | % | 3.25 | % | 2.95 | % | 2.50 | % | 2.05 | % | 1.55 | % | 1.55 | % | 1.55 | % | 1.55 | % | 1.55 | % | ||||||||||||||||||||||||||

| REITs |

1.85 | % | 1.85 | % | 1.85 | % | 1.85 | % | 1.70 | % | 1.55 | % | 1.30 | % | 1.05 | % | 0.80 | % | 0.80 | % | 0.80 | % | 0.80 | % | 0.80 | % | ||||||||||||||||||||||||||

| International equity |

23.05 | % | 23.05 | % | 23.05 | % | 23.05 | % | 21.30 | % | 19.30 | % | 16.55 | % | 13.25 | % | 10.00 | % | 10.00 | % | 10.00 | % | 10.00 | % | 10.00 | % | ||||||||||||||||||||||||||

| Emerging markets equity |

8.50 | % | 8.50 | % | 8.50 | % | 8.50 | % | 7.85 | % | 7.15 | % | 6.10 | % | 4.90 | % | 3.70 | % | 3.70 | % | 3.70 | % | 3.70 | % | 3.70 | % | ||||||||||||||||||||||||||

| Fixed income | 8.00 | % | 8.00 | % | 8.00 | % | 8.00 | % | 15.00 | % | 23.00 | % | 34.00 | % | 47.00 | % | 55.00 | % | 55.00 | % | 55.00 | % | 55.00 | % | 55.00 | % | ||||||||||||||||||||||||||

| U.S. fixed income |

6.85 | % | 6.85 | % | 6.85 | % | 6.85 | % | 12.90 | % | 19.75 | % | 29.25 | % | 37.95 | % | 41.60 | % | 41.60 | % | 41.60 | % | 41.60 | % | 41.60 | % | ||||||||||||||||||||||||||

| Inflation managed |

0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 2.50 | % | 5.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | ||||||||||||||||||||||||||

| High yield fixed income |

0.90 | % | 0.90 | % | 0.90 | % | 0.90 | % | 1.65 | % | 2.55 | % | 3.75 | % | 5.15 | % | 6.60 | % | 6.60 | % | 6.60 | % | 6.60 | % | 6.60 | % | ||||||||||||||||||||||||||

| Emerging markets debt |

0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.45 | % | 0.70 | % | 1.00 | % | 1.40 | % | 1.80 | % | 1.80 | % | 1.80 | % | 1.80 | % | 1.80 | % | ||||||||||||||||||||||||||

| Money market funds/Cash and cash equivalents | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | ||||||||||||||||||||||||||

| Money market funds/Cash and cash equivalents |

0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | 5.00 | % | ||||||||||||||||||||||||||

Note: Above allocations may not sum up to 100% due to rounding.

| 1 | As of the date of this prospectus, the Fund utilizes both underlying funds and direct investments to implement its target allocations. The amount of the Fund’s assets allocated to underlying funds and direct investments will vary over time. The Fund also has flexibility to utilize derivatives to implement its target allocations. |

As a result of the glidepath modifications, the second paragraph after the Target Allocations table in the “More About the Funds — Principal Investment Strategies” section of the Funds’ prospectuses (other than the JPMorgan SmartRetirement Blend Income Fund) have been revised and replaced with the following:

Each of the Funds may invest in one or more underlying funds in an asset class in an amount equal to the allocation ranges for the applicable asset class. For example, the JPMorgan SmartRetirement Blend 2060 Fund may invest up to 63.65% of its assets in a single underlying fund that is a U.S. Large Cap Equity Fund, or may invest up to 63.65% across multiple underlying funds that are U.S. Large Cap Equity Funds.

INVESTORS SHOULD RETAIN THIS SUPPLEMENT WITH THE

PROSPECTUSES AND SUMMARY PROSPECTUSES FOR FUTURE REFERENCE