| A, C, Select Shares | JPMorgan Global Allocation Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| JPMorgan Global Allocation Fund Class/Ticker: A/GAOAX; C/GAOCX; Select/GAOSX | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What is the goal of the Fund? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund seeks to maximize long-term total return. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The following tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A Shares if you and your family invest, or agree to invest in the future, at least $100,000 in the J.P. Morgan Funds. More information about these and other discounts is available from your financial intermediary and in “Investing with J.P. Morgan Funds — SALES CHARGES AND FINANCIAL INTERMEDIARY COMPENSATION” on page 43 of the prospectus and in “PURCHASES, REDEMPTIONS AND EXCHANGES” in Appendix A to Part II of the Statement of Additional Information. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (Fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| “Acquired Fund Fees and Expenses” are expenses incurred indirectly by the Fund through its ownership of shares in other investment companies, including affiliated money market funds, other mutual funds, exchange-traded funds and business development companies. The impact of Acquired Fund Fees and Expenses is included in the total returns of the Fund. Acquired Fund Fees and Expenses are not direct costs of the Fund, are not used to calculate the Fund’s net asset value per share and are not included in the calculation of the ratio of expenses to average net assets shown in the Financial Highlights section of the Fund’s prospectus. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (Expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Example | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses are equal to the total annual fund operating expenses after fee waivers and expense reimbursements shown in the fee table through 2/28/18, and total annual fund operating expenses thereafter. Your actual costs may be higher or lower. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IF YOU SELL YOUR SHARES, YOUR COST WOULD BE: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| IF YOU DO NOT SELL YOUR SHARES, YOUR COST WOULD BE: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses, or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year, the Fund’s portfolio turnover rate was 64% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| What are the Fund’s main investment strategies? | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

The Fund has significant flexibility to invest in a broad range of equity, fixed income and alternative asset classes in the U.S. and other markets throughout the world, both developed and emerging. J.P. Morgan Investment Management Inc. (JPMIM or adviser) uses a flexible asset allocation approach in constructing the Fund's portfolio. Under normal circumstances, the Fund will invest at least 40% of its total assets in countries other than the United States (Non-U.S. Countries) unless the adviser determines, in its sole discretion, that conditions are not favorable. If the adviser determines that conditions are not favorable, the Fund may invest under 40% of its total assets in Non-U.S. Countries provided that the Fund will not invest less than 30% of its total assets in Non-U.S. Countries under normal circumstances except for temporary defensive purposes. In managing the Fund, the adviser will invest in issuers in at least three countries other than the U.S. under normal circumstances. The Fund will invest across the full range of asset classes. Ranges for broad asset classes are:

The Fund's equity investments may include common stock, preferred stock, exchange traded funds (ETFs), convertible securities, depositary receipts, warrants to buy common stocks, master limited partnerships (MLPs), and J.P. Morgan Funds. The Fund is generally unconstrained by any particular capitalization with regard to its equity investments. The Fund's fixed income investments may include bank obligations, convertible securities, U.S. government securities (including agencies and instrumentalities), mortgage-backed and mortgage-related securities (which may include securities that are issued by non-governmental entities), domestic and foreign corporate bonds, high yield securities (junk bonds), loan assignments and participations (Loans), debt obligations issued or guaranteed by a foreign sovereign government or its agencies, authorities or political subdivisions, floating rate securities, inflation-indexed bonds, inflation-linked securities such as Treasury Inflation Protected Securities (TIPS), J.P. Morgan Funds, and ETFs. The Fund is generally unconstrained with regard to the duration of its fixed income investments. The Fund's alternative investments include securities that are not a part of the Fund's global equity or global fixed income investments. These investments may include individual securities (such as convertible securities, inflation-sensitive securities and preferred stock), J.P. Morgan Funds, ETFs, exchange traded notes (ETNs) and exchange traded commodities (ETCs). The investments in this asset class may give the Fund exposure to: market neutral strategies, long/short strategies, real estate (including real estate investment trusts (REITS)), currencies and commodities. The Fund may invest in ETFs in order to gain exposure to particular asset classes. The Fund expects that, to the extent it invests in ETFs, it will primarily invest in passively managed ETFs. A passively managed ETF is a registered investment company that seeks to track the performance of a particular market index or security. These indexes include not only broad-based market indexes but more specific indexes as well, including those relating to particular sectors, markets, regions, industries or factors. In addition to direct investments in securities, derivatives, which are instruments that have a value based on another instrument, exchange rate or index, may also be used as substitutes for securities in which the Fund can invest. For example, in implementing equity market neutral strategies and macro based strategies, the Fund may use a total return swap to establish both long and short positions in order to gain the desired exposure rather than physically purchasing and selling short each instrument. The Fund may use futures contracts, options, forwards, and swaps to more effectively gain targeted equity and fixed income exposure from its cash positions, to hedge investments, for risk management and to attempt to increase the Fund's gain. The Fund may use futures contracts, forward contracts, options (including options on interest rate futures contracts and interest rate swaps), swaps, and credit default swaps to help manage duration, sector and yield curve exposure and credit and spread volatility. The Fund may utilize exchange traded futures contracts for cash management and to gain exposure to equities pending investment in individual securities. To the extent that the Fund does not utilize underlying funds to gain exposure to commodities, it may utilize commodity linked derivatives or commodity swaps to gain exposure to commodities. The Fund may invest in securities denominated in any currency. The Fund may utilize forward currency transactions to hedge exposure to non-dollar investments back to the U.S. dollar. As part of the underlying strategies, the Fund may enter into short sales. In short selling transactions, the Fund sells a security it does not own in anticipation of a decline in the market value of the security. To complete the transaction, the Fund must borrow the security to make delivery to the buyer. The Fund is obligated to replace the security borrowed by purchasing it subsequently at the market price at the time of replacement. The Fund will likely engage in active and frequent trading. Investment Process: As attractive investments across asset classes and strategies arise, the adviser attempts to capture these opportunities and has wide latitude to allocate the Fund's assets among strategies and asset classes. The adviser establishes the strategic and tactical allocation for the Fund and makes decisions concerning strategies, sectors, and overall portfolio construction. The adviser develops its investment insights through the combination of top-down macro views, together with the bottom-up views of the separate asset class specialists within J.P. Morgan Asset Management globally. In buying and selling investments for the Fund, the adviser employs a continuous four-step process: (1) making asset allocation decisions based on JPMIM's assessment of the intermediate term (6–18 months) market outlook; (2) constructing the portfolio after considering the Fund's risk and return target, by determining the weightings of the asset classes, selecting the underlying securities, funds and other instruments; (3) analyzing the investment capabilities of the underlying portfolio managers and funds, and (4) monitoring portfolio exposures and weightings and rebalancing portfolio exposures and weightings in response to market price action and changes in JPMIM's shorter term market outlook. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund’s Main Investment Risks | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund is subject to management risk and may not achieve its objective if the adviser's expectations regarding particular instruments or markets are not met. An investment in this Fund or any other fund may not provide a complete investment program. The suitability of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you. The Fund is subject to the main risks noted below, any of which may adversely affect the Fund's performance and ability to meet its investment objective. Equity Market Risk. The price of equity securities may rise or fall because of changes in the broad market or changes in a company's financial condition, sometimes rapidly or unpredictably. These price movements may result from factors affecting individual companies, sectors or industries selected for the Fund's portfolio or the securities market as a whole, such as changes in economic or political conditions. When the value of the Fund's securities goes down, your investment in the Fund decreases in value. General Market Risk. Economies and financial markets throughout the world are becoming increasingly interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions. Securities in the Fund's portfolio may underperform in comparison to the general financial markets, a particular financial market or other asset classes, due to a number of factors, including inflation, interest rates, global demand for particular products or resources, natural disasters or events, terrorism, regulatory events and government controls. Interest Rate and Credit Risk. The Fund's investments in bonds and other debt securities will change in value based on changes in interest rates. If rates rise, the value of these investments generally declines. Securities with greater interest rate sensitivity and longer maturities generally are subject to greater fluctuations in value. The Fund may invest in variable and floating rate Loans and other variable and floating rate securities. Although these instruments are generally less sensitive to interest rate changes than fixed rate instruments, the value of variable and floating rate Loans and other securities may decline if their interest rates do not rise as quickly, or as much, as general interest rates. Given the historically low interest rate environment, risks associated with rising rates are heightened. The Fund's investments are subject to the risk that issuers and/or counterparties will fail to make payments when due or default completely. Prices of the Fund's investments may be adversely affected if any of the issuers or counterparties it is invested in are subject to an actual or perceived deterioration in their credit quality. Credit spreads may increase, which may reduce the market values of the Fund's securities. Credit spread risk is the risk that economic and market conditions or any actual or perceived credit deterioration may lead to an increase in the credit spreads (i.e., the difference in yield between two securities of similar maturity but different credit quality) and a decline in price of the issuer's securities. Industry and Sector Focus Risk. At times the Fund may increase the relative emphasis of its investments in a particular industry or sector. The prices of securities of issuers in a particular industry or sector may be more susceptible to fluctuations due to changes in economic or business conditions, government regulations, availability of basic resources or supplies, or other events that affect that industry or sector more than securities of issuers in other industries and sectors. To the extent that the Fund increases the relative emphasis of its investments in a particular industry or sector, its shares' values may fluctuate in response to events affecting that industry or sector. Foreign Securities, Emerging Markets, and Currency Risk. The Fund may invest all of its assets in securities denominated in foreign currencies. Investments in foreign currencies, foreign issuers and foreign securities (including depositary receipts) are subject to additional risks, including political and economic risks, civil conflicts and war, greater volatility, expropriation and nationalization risks, sanctions or other measures by the United States or other governments, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, and less stringent investor protection and disclosure standards of foreign markets. In certain markets where securities and other instruments are not traded "delivery versus payment," the Fund may not receive timely payment for securities or other instruments it has delivered or receive delivery of securities paid for and may be subject to increased risk that the counterparty will fail to make payments or delivery when due or default completely. Events and evolving conditions in certain economies or markets may alter the risks associated with investments tied to countries or regions that historically were perceived as comparatively stable becoming riskier and more volatile. These risks are magnified in countries in "emerging markets." Emerging market countries typically have less-established market economies than developed countries and may face greater social, economic, regulatory and political uncertainties. In addition, emerging markets typically present greater illiquidity and price volatility concerns due to smaller or limited local capital markets and greater difficulty in determining market valuations of securities due to limited public information on issuers. While the Fund may engage in various strategies to hedge against currency risk, it is not required to do so. Derivatives Risk. Derivatives, including futures contracts, options, forwards, swaps, and commodity linked derivatives, may be riskier than other types of investments because they may be more sensitive to changes in economic or market conditions than other types of investments and could result in losses that significantly exceed the Fund's original investment. Many derivatives create leverage thereby causing the Fund to be more volatile than it would be if it had not used derivatives. Derivatives also expose the Fund to counterparty risk (the risk that the derivative counterparty will not fulfill its contractual obligations), including the credit risk of the derivative counterparty. Certain derivatives are synthetic instruments that attempt to replicate performance of certain reference assets. With regard to such derivatives, the Fund does not have a claim on the reference assets and is subject to enhanced counterparty risk. High Yield Securities and Loan Risk. The Fund invests in instruments including junk bonds, Loans and instruments that are issued by companies that are highly leveraged, less creditworthy or financially distressed. These investments are considered to be speculative and may be subject to greater risk of loss, greater sensitivity to economic changes, valuation difficulties and potential illiquidity. Such investments are subject to additional risks including subordination to other creditors, no collateral or limited rights in collateral, lack of a regular trading market, extended settlement periods, liquidity risks, prepayment risks, potentially less protections under the federal securities laws and lack of publicly available information. High yield securities and Loans that are deemed to be liquid at the time of purchase may become illiquid. No active trading market may exist for some instruments and certain investments may be subject to restrictions on resale. In addition, the settlement period for Loans is uncertain as there is no standardized settlement schedule applicable to such investments. The inability to dispose of the Fund's securities and other investments in a timely fashion could result in losses to the Fund. Because some instruments may have a more limited secondary market, liquidity risk is more pronounced for the Fund than for funds that invest primarily in other types of fixed income instruments or equity securities. When Loans and other instruments are prepaid, the Fund may have to reinvest in instruments with a lower yield or fail to recover additional amounts (i.e., premiums) paid for these instruments, resulting in an unexpected capital loss and/or a decrease in the amount of dividends and yield. Certain Loans may not be considered securities under the federal securities laws and, therefore, investments in such Loans may not be subject to certain protections under those laws. In addition, the adviser may not have access to material non-public information to which other investors may have access. Mortgage-Related and Other Mortgage-Backed Securities Risk. The Fund may invest in both residential or commercial mortgage-related and mortgage-backed securities that are subject to certain other risks including prepayment and call risks. When mortgages and other obligations are prepaid and when securities are called, the Fund may have to reinvest in securities with a lower yield or fail to recover additional amounts (i.e., premiums) paid for securities with higher interest rates, resulting in an unexpected capital loss and/or a decrease in the amount of dividends and yield. In periods of rising interest rates, the Fund may be subject to extension risk, and may receive principal later than expected. As a result, in periods of rising interest rates, the Fund may exhibit additional volatility. During periods of difficult or frozen credit markets, significant changes in interest rates or deteriorating economic conditions, such securities may decline in value, face valuation difficulties, become more volatile and/or become illiquid. Real Estate Securities Risk. The Fund's investments in real estate securities, including REITs, are subject to the same risks as direct investments in real estate and mortgages, and their value will depend on the value of the underlying real estate interests. These risks include default, prepayments, changes in value resulting from changes in interest rates and demand for real and rental property, and the management skill and credit-worthiness of REIT issuers. The Fund will indirectly bear its proportionate share of expenses, including management fees, paid by each REIT in which it invests in addition to the expenses of the Fund. MLP Risk. MLPs may trade infrequently and in limited volume and they may be subject to more abrupt or erratic price movements than securities of larger or more broadly-based companies. MLPs are subject to "commodity risks" as well as the risks associated with the specific industry or industries in which the partnership invests. In addition, the managing general partner of an MLP may receive an incentive allocation based on increases in the amount and growth of cash distributions to investors in the MLP. This method of compensation may create an incentive for the managing general partner to make investments that are riskier or more speculative than would be the case in the absence of such compensation arrangements. Certain MLPs may operate in, or have exposure to, the energy sector. The energy sector can be significantly affected by changes in the prices and supplies of oil and other energy fuels, energy conservation, the success of exploration projects, and tax and other government regulations, policies of the Organization of Petroleum Exporting Countries (OPEC) and relationships among OPEC members and between OPEC and oil importing nations. Investment Company and Pooled Investment Vehicle Risk. The Fund may invest in shares of other investment companies, including closed-end funds, ETFs and other pooled investment vehicles, including those holding commodities, currencies or commodity futures. Shareholders bear both their proportionate share of the Fund's expenses and similar expenses of the investment company or pooled investment vehicle. ETFs and other investment companies or pooled investment vehicles that invest in commodities or currencies are subject to the risks associated with direct investments in commodities or currencies. The price and movement of an ETF, closed-end fund or pooled investment vehicle designed to track an index may not track the index and may result in a loss. In addition, closed-end funds that trade on an exchange often trade at a price below their net asset value (also known as a discount). Certain ETFs, closed-end funds or pooled investment vehicles traded on exchanges may be thinly traded and experience large spreads between the "ask" price quoted by a seller and the "bid" price offered by a buyer. There may be no active market for shares of certain closed-end funds or pooled investment vehicles (especially those not traded on exchanges) and such shares may be highly illiquid. Certain pooled investment vehicles do not have the protections applicable to other types of investments under federal securities or commodities laws and may be subject to counterparty or credit risk. Government Securities Risk. The Fund invests in securities issued or guaranteed by the U.S. government or its agencies and instrumentalities (such as securities issued by the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), or the Federal Home Loan Mortgage Corporation (Freddie Mac)). U.S. government securities are subject to market risk, interest rate risk and credit risk. Securities, such as those issued or guaranteed by Ginnie Mae or the U.S. Treasury, that are backed by the full faith and credit of the United States are guaranteed only as to the timely payment of interest and principal when held to maturity and the market prices for such securities will fluctuate. Notwithstanding that these securities are backed by the full faith and credit of the United States, circumstances could arise that would prevent the payment of interest or principal. This would result in losses to the Fund. Securities issued or guaranteed by U.S. government related organizations, such as Fannie Mae and Freddie Mac, are not backed by the full faith and credit of the U.S. government and no assurance can be given that the U.S. government would provide financial support. Therefore, U.S. government-related organizations may not have the funds to meet their payment obligations in the future. Inflation-Linked Securities Risk. Unlike conventional bonds, the principal or interest of inflation-linked securities such as TIPS is adjusted periodically to a specified rate of inflation (e.g., Consumer Price Index for all Urban Consumers (CPI-U)). There can be no assurance that the inflation index used will accurately measure the real rate of inflation. These securities may lose value in the event that the actual rate of inflation is different than the rate of the inflation index. ETN Risk. Generally, ETNs are structured as senior, unsecured notes in which an issuer such as a bank agrees to pay a return based on the target commodity index less any fees. ETNs are synthetic instruments that allow individual investors to have access to derivatives linked to commodities and assets such as oil, Currencies and foreign stock indexes. ETNs combine certain aspects of bond and ETFs. Similar to ETFs, ETNs are traded on a major exchange (e.g., the New York Stock Exchange) during normal trading hours. However, investors can also hold the ETN until maturity. At maturity, the issuer pays to the investor a cash amount equal to the principal amount, subject to the day's index factor. ETN returns are based upon the performance of a market index minus applicable fees. The value of an ETN may be influenced by time to maturity, level of supply and demand for the ETN, volatility and lack of liquidity in underlying commodities markets, changes in the applicable interest rates, changes in the issuer's credit rating and economic, legal, political or geographic events that affect the referenced commodity. The value of the ETN may drop due to a downgrade in the issuer's credit rating, even if the underlying index remains unchanged. Investments in ETNs are subject to the risks facing income securities in general including the risk that a counterparty will fail to make payments when due or default. In addition, investors in ETNs generally have no right with respect to the instruments underlying the index or any right to receive delivery of the instruments underlying the index. Short Selling Risk. The Fund will incur a loss as a result of a short sale if the price of the security sold short increases in value between the date of the short sale and the date on which the fund purchases the security to replace the borrowed security. In addition, a lender may request, or market conditions may dictate, that securities sold short be returned to the lender on short notice, and the Fund may have to buy the securities sold short at an unfavorable price. If this occurs, any anticipated gain to the Fund may be reduced or eliminated or the short sale may result in a loss. The Fund's losses are potentially unlimited in a short sale transaction. Short sales are speculative transactions and involve special risks, including greater reliance on the adviser's ability to accurately anticipate the future value of a security. Furthermore, taking short positions in securities results in a form of leverage, which may cause the Fund to be more volatile. Commodity Risk. Exposure to commodities, commodity-related securities and derivatives may subject the Fund to greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity. Convertible Securities Risk. The value of convertible securities tends to decline as interest rates rise and, because of the conversion feature, tends to vary with fluctuations in the market value of the underlying securities. High Portfolio Turnover Risk. The Fund may engage in active and frequent trading leading to increased portfolio turnover, higher transaction costs, and the possibility of increased capital gains, including short-term capital gains that will generally be taxable to shareholders as ordinary income. Transactions Risk. The Fund could experience a loss and its liquidity may be negatively impacted when selling securities to meet redemption requests by shareholders. The risk of loss increases if the redemption requests are unusually large or frequent or occur in times of overall market turmoil or declining prices. Similarly, large purchases of Fund shares may adversely affect the Fund's performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

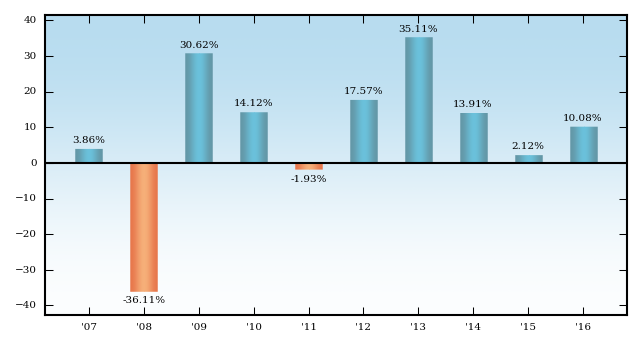

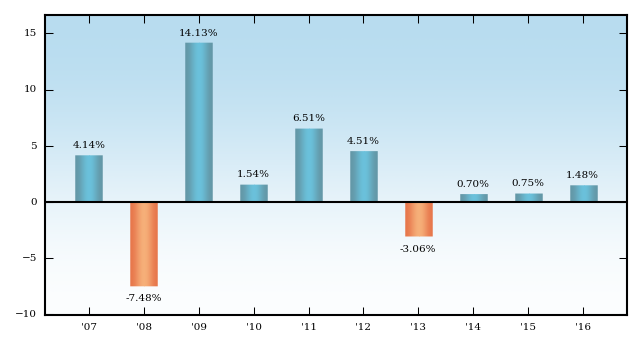

| The Fund’s Past Performance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

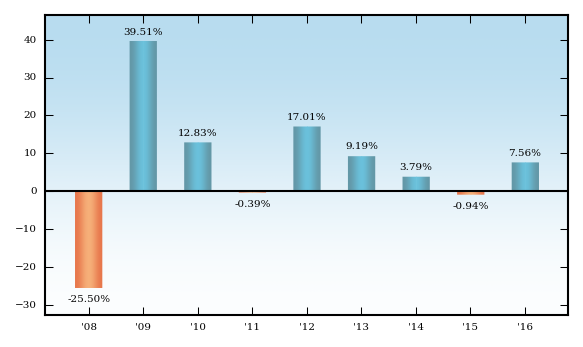

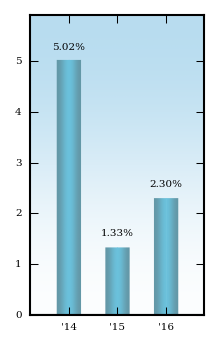

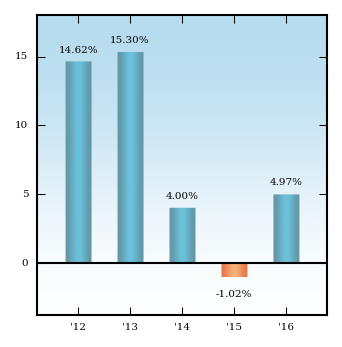

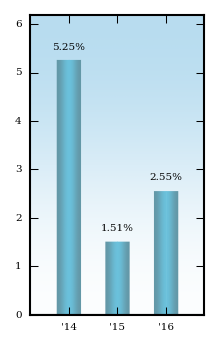

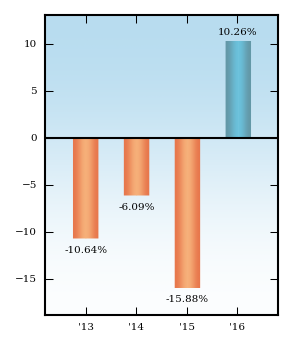

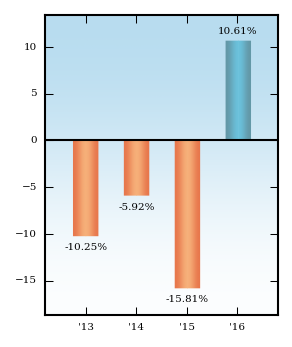

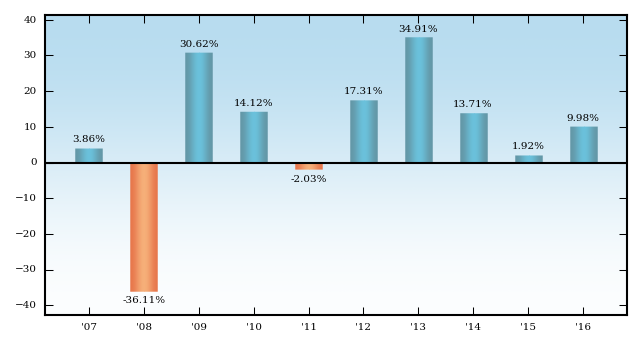

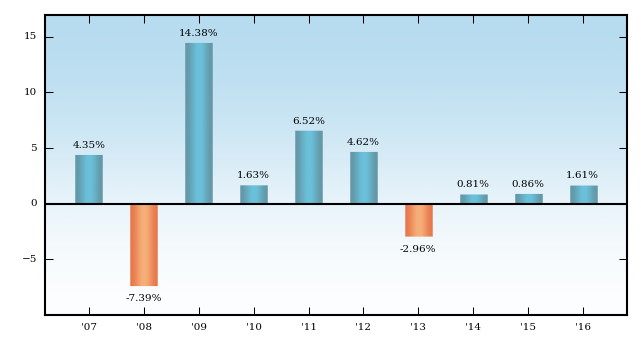

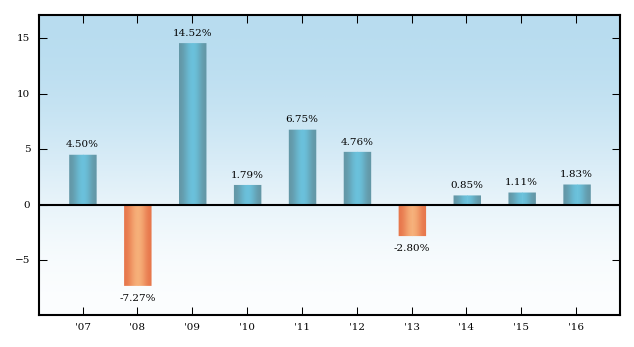

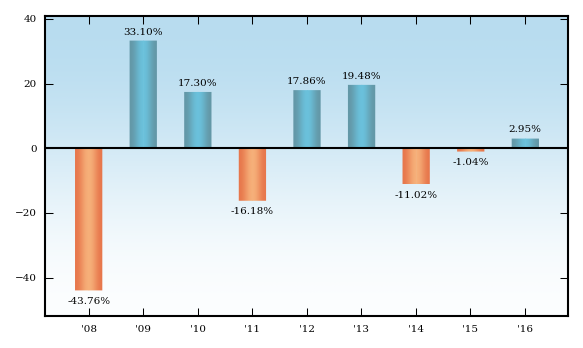

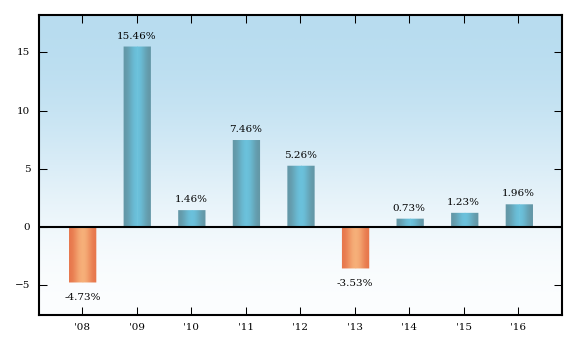

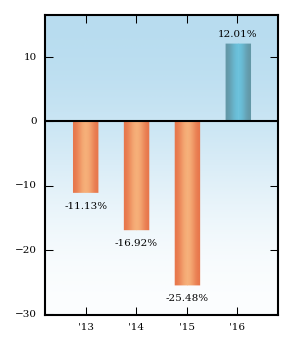

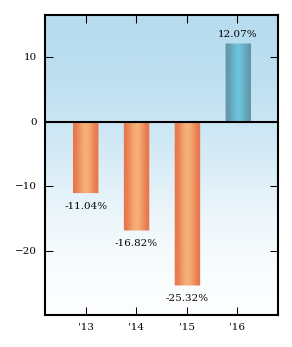

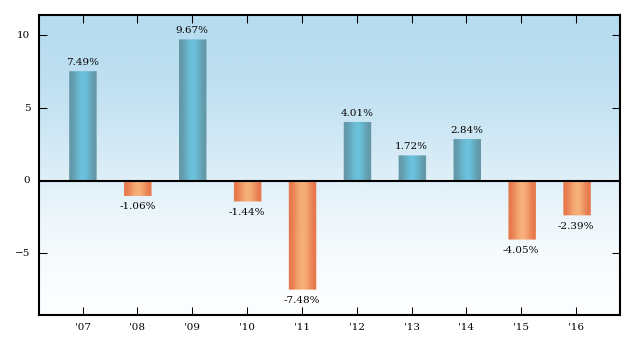

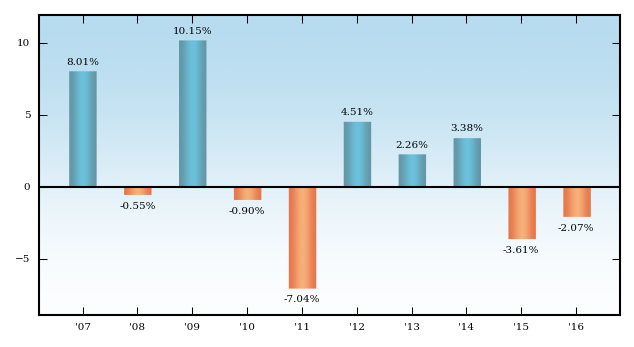

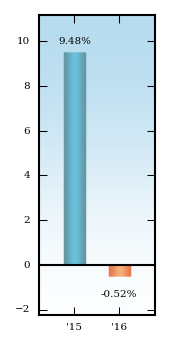

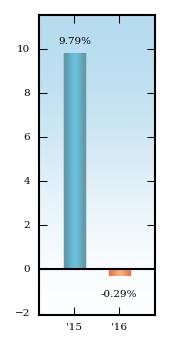

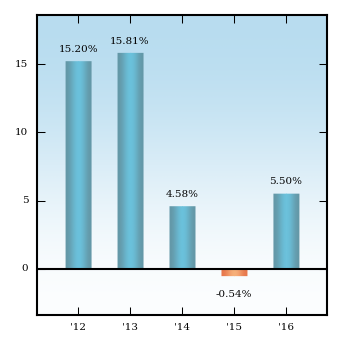

| This section provides some indication of the risks of investing in the Fund. The bar chart shows how the performance of the Fund’s Select Class Shares has varied from year to year for the past five calendar years. The table shows the average annual total returns for the past one year, five years and life of the Fund. The table compares that performance to the MSCI World Index (net of foreign withholding taxes), the Bloomberg Barclays Global Aggregate Index — Unhedged USD (new benchmark), the Bloomberg Barclays U.S. Aggregate Index (old benchmark), the Global Allocation Composite Benchmark, comprised of 60% MSCI World Index (net of foreign withholding taxes) and 40% Bloomberg Barclays Global Aggregate Index — Unhedged USD, and the Lipper Flexible Portfolio Funds Index. The Lipper index is based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper. Unlike the other indexes, the Lipper index includes the fees and expenses of the mutual funds included in the index. Past performance (before and after taxes) is not necessarily an indication of how any class of the Fund will performance in the future. Updated performance information is available by visiting www.jpmorganfunds.com or by calling 1-800-480-4111. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| YEAR-BY-YEAR RETURNS – SELECT CLASS SHARES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURNS (For periods ended December 31, 2016) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| After-tax returns are shown only for the Select Class Shares, and after-tax returns for the other classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on your tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||