UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21289

Birmiwal Investment Trust

(Exact name of registrant as specified in charter)

24140 E. Greystone Lane, Woodway, WA 98020

(Address of principal executive offices) (Zip code)

Kailash Birmiwal

24140 E. Greystone Lane, Woodway, WA 98020

(Name and address of agent for service)

Registrant's telephone number, including area code: (206) 542-7652

Date of fiscal year end: March 31

Date of reporting period: March 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e -1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Birmiwal Oasis Fund

For Investors Seeking Capital Appreciation

ANNUAL REPORT

March 31, 2011

Birmiwal Investment Trust

www.birmiwal.com

1-800-417-5525

Birmiwal Oasis Fund

Annual Report

June 8, 2011

Dear Fellow Shareholders,

The last fiscal year was disappointing. For the fiscal year ended March 31, 2011 the Fund was down 20.91% versus its benchmark index, the S&P 500, which was up 15.66% .

I had a rude awakening after the May 6, 2010 event when the market plunged more than 1000 points in less than ten minutes without any external shocking event triggering it. To minimize the risks associated with such events and to enhance further the fund's performance, there was a need to develop appropriate strategies which required better understanding of how the markets work. I have spent a significant time towards this and I believe it has laid the groundwork for better outcomes in the future.

In 2010, the fund was severely impacted by one security, China MediaExpress (CCME). This stock plunged sharply in a very short time. Another factor of the fund's poor performance in 2010 was the use of derivatives. Let me briefly describe events surrounding CCME. The story is still unfolding.

China MediaExpress operates the largest television advertising network on inter-city and airport express buses in China. Based on both fundamentals and technicals, it appeared until recently that CCME was poised to move much higher. The stock was very inexpensive based on the traditional ways of valuing a stock. A Big Four auditing firm had audited the company's 2009 financial. Analysts were very positive on CCME, one even calling CCME its top pick for 2011. Some major institutions had also started accumulating CCME's shares. Then, multiple negative 'research' articles started appearing in the media, beginning January 31, 2011. These reports presented information in a way to give the impression the authors were presenting solid research rather than stating an opinion. Since I was following the company, I found the articles were, in general, fabricated and far from the truth. In the past I have discussed the impact on the markets of those parties (presumably hedge funds) that engage aggressively in short sales of securities. I call them collectively, the "shorts". I did not know at that time that the shorts who were engaged in helping produce these articles had a bigger agenda. The shorts first wanted the stock price of CCME to go down, and then influence CCME's auditor to resign. The auditor did resign. The auditor did not cite any specific wrong doing by CCME, but mentioned several serious potential issues. The auditor's resignation, among others, caused Nasdaq to delist the company and subsequently the price of the stock plunged when it resumed trading after being halted.

CCME is fighting back. First, it responded to all allegations of wrong doing. It provided full access to an analyst who went to CCME to verify details after allegations were made. The analyst subsequently came back and endorsed its "buy" opinion of CCME. Later CCME hired DLA Piper, the world's largest law firm who in turn hired PriceWaterhouseCoopers to conduct investigations which are ongoing. The company is further appealing Nasdaq's decision to delist the company.

I have been pondering over the following for some time. Many individual investors have tried to verify the details of the allegations and the responses by CCME and the CCME story seems to be checking out. The audit firm that resigned raised issues very late in the audit process and did not state any specific wrong doing by the company. Furthermore, the allegations made by the shorts don't seem to hold water in general. The concern is that the shorts may have fabricated information to manipulate the price of the stock. I wish Nasdaq had waited for the PriceWaterhouseCoopers' report before delisting CCME. By delisting the company, Nasdaq essentially gave an opportunity for shorts to cover their short positions at very low prices. If the PriceWaterhouseCoopers' report cleared CCME of any major wrong doing, the shorts could have lost big. True long term investors became the biggest losers and shorts the winners by the Nasdaq's action. Also, it was not only the company's auditor

2011 Annual Report 1

who resigned. Several other top auditors resigned their engagements with other Chinese firms about the same time frame. I am concerned that there could have been coercion resulting in these resignations. This seems far-fetched but when several heads at the audit firm see websites publishing issues regarding the accurateness of the financial reports and the company's business in general, wouldn't the firm minimize its losses by resigning? Some of these websites are now gone, presumably after having served their purpose. Another company, China Agritech (CAGC) was attacked on the same date (February 3, 2011) by similar tricks. Its auditor also resigned, the stock was halted and subsequently delisted from the exchange on which it was traded. A major institutional investor in the stock, Glickenhaus & Company, decided to check out some of the shorts' allegations by actually visiting the company. Their report is available on their website (Glickenhaus.com) along with a video. It seems that shorts just made up the story to bring the CAGC stock price down. Interestingly, the report contains an email from a hedge fund manager, John Hempton from Australia, to several SEC officials, the auditors and several representatives of Carlyle Group (a major investor in CAGC) with 'evidence' of fraud at CAGC. It turns out that this evidence itself was apparently fabricated. The email seems to support my theory of these events related to CAGC. In the email, the hedge fund manager threatens class-action litigation against the auditors, major institutional investors and others causing action by the named potential defendants and causing the price of the security to slide.

Additionally, Universal Travel (UTA) is another Chinese company whose auditor resigned citing reasons similar to the CCME's case. UTA just filed their annual report today with the SEC with a clean audit. Preliminary review of the 10-K shows that UTA had strong performance in 2010. However, the stock is still halted.

CCME had indicated in March 2011 that they expect significantly different performance in 2010 compared to 2009. Based on the understanding of their business, I expect the performance to be better. But only time will tell.

Mitchell Nussbaum of Loeb and Loeb, the law firm representing CCME and several other Chinese companies, recently wrote an article (http://www.thedeal.com/magazine/ID/039114/community/bridging-the-information-gap.php) stating that, "large accounting firms have refused to sign off on the audits of these companies out of fear that they may face litigation or SEC investigation. Absent timely financial information, our exchanges have been forced to halt trading, allowing short sellers to cover their positions at unbelievably low levels while wiping out investors" and, "authors of these reports and their underlying short sellers should be held accountable for information they disseminate … To date, there has been no legal consequence or enforcement actions brought against any short sellers for disseminating false information on Chinese companies, while the reward has been substantial."

There is always a possibility of something seriously wrong at China MediaExpress. But the stock is currently trading as if there is a known major issue. What if it turns out that there is no major issue? In that case, the stock should move significantly higher. I won't be surprised if CCME decides to delist from US stock exchanges and moves to Hong Kong. This will be a story similar to Fairfax Financial, a leading foreign (in this case Canadian) insurance company whose stock was heavily shorted, negative research reports were written, and eventually company decided to delist from the New York Stock Exchange. Currently, the stock trades near at all time high on the Toronto Stock Exchange. A hedge fund manager was the mastermind behind the Fairfax fiasco and appears to be involved in fabricating facts to bring down some of the Chinese companies like CCME.

It is not pleasant to write such a negative story but I think it is worth knowing what goes on behind the scene. And I have learned a very expensive lesson. The fund must not have significant holding in any security - the risk is just too high.

Thank you for your continued support and trust in us.

Kailash Birmiwal

2011 Annual Report 2

BIRMIWAL OASIS FUND (Unaudited)

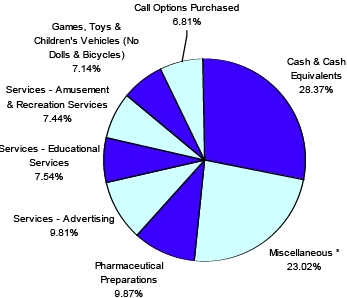

Birmiwal Oasis Fund

by Industry Sectors (as a percentage of Total Investment

Securities)

UNAUDITED

| * Includes industry sectors that individually constitute no more than 4% of net assets. See Schedule of Investments for additional information. |

Availability of Quarterly Schedule of Investments (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC's website at http://www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Proxy Voting Guidelines (Unaudited)

Birmiwal Asset Management, Inc., the Fund’s Adviser (“Adviser”), is responsible for exercising the voting rights associated with the securities held by the Fund. For existing shareholders, a description of the policies and procedures used by the Adviser in fulfilling this responsibility is available without charge on the Fund’s website at www.birmiwal.com. It is also included in the Fund’s Statement of Additional Information, which is available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Information regarding how the Fund voted proxies, contained on Form N-PX, relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling our toll free number (1-800-417-5525). This information is also available on the SEC’s website at http://www.sec.gov.

2011 Annual Report 3

BIRMIWAL OASIS FUND (Unaudited)

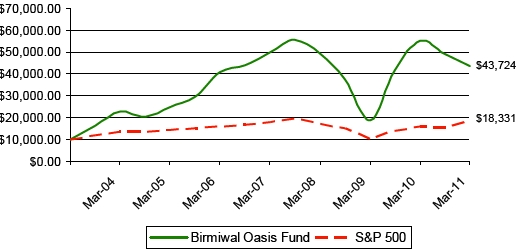

The Value of a $10,000 Investment In Birmiwal Oasis Fund

From April 1, 2003 to March 31, 2011

As Compared To The Standard & Poor's 500 Index

PERFORMANCE INFORMATION

AVERAGE ANNUAL RATE OF RETURN (%) FOR THE PERIODS ENDED MARCH 31, 2011.

3/31/11 NAV $19.83

| Since | ||||||||

| 1 Year(A) | 3 Years(A) | 5 Years(A) | Inception(A) | |||||

| Birmiwal Oasis Fund | -20.91% | -3.75% | 1.35% | 20.24% | ||||

| S&P 500(B) | 15.66% | 2.36% | 2.63% | 7.86% |

(A)1 Year, 3 Year, 5 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Birmiwal Oasis Fund was April 1, 2003.

(B)The S&P 500 is a broad market-weighted average dominated by blue-chip stocks and is an unmanaged group of stocks whose composition is different from the Fund.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-417-5525.

2011 Annual Report 4

Disclosure of Expenses

(Unaudited)

Shareholders of this Fund incur ongoing operating expenses consisting solely of a base management fee and a performance-based management fee. The following example is intended to help you understand your ongoing costs of investing in the Fund and to compare these costs with similar costs of investing in other mutual funds. The example is based on an investment of $1,000 invested in the Fund on October 1, 2010 and held through March 31, 2011.

The first line of the table below provides information about actual account values and actual expenses. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) and then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period."

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid by a shareholder for the period. Shareholders may use this information to compare the ongoing costs of investing in this Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in other funds' shareholder reports.

| Expenses Paid | ||||||

| Beginning | Ending | During the Period* | ||||

| Account Value | Account Value | October 1, 2010 | ||||

| October 1, 2010 | March 31,2011 | to March 31, 2011 | ||||

| Actual | $1,000.00 | $888.47 | $18.97 | |||

| Hypothetical | $1,000.00 | $1,004.84 | $20.14 | |||

| (5% annual return | ||||||

| before expenses) | ||||||

|

* Expenses are equal to the Fund’s annualized expense ratio of 4.03%, multiplied |

2011 Annual Report 5

| Birmiwal Oasis Fund | ||||||

| Schedule of Investments | ||||||

| March 31, 2011 | ||||||

| Shares/Principal Amount | Fair Value | % of Net Assets | ||||

| COMMON STOCKS | ||||||

| Agricultural Chemicals | ||||||

| 508,178 | Bodisen Biotech Inc. * | $ 406,542 | 2.62 | % | ||

| Agricultural Production - Crops | ||||||

| 95,000 | Agria Corporation * ** | 133,950 | 0.86 | % | ||

| Converted Paper & Paperboard Products (No Containers/Boxes) | ||||||

| 50,000 | Orient Paper, Inc. * (Canada) | 231,000 | 1.49 | % | ||

| Games, Toys & Children's Vehicles (No Dolls & Bicycles) | ||||||

| 488,375 | Mad Catz Interactive Inc. * | 1,069,541 | 6.88 | % | ||

| Gold & Silver Ores | ||||||

| 100,000 | Northgate Minerals Corp. * (Canada) | 270,000 | 1.74 | % | ||

| Instruments for Measuring & Testing of Electricity & Electric Signals | ||||||

| 10,000 | EXFO Inc. * (Canada) | 109,300 | 0.70 | % | ||

| Motor Vehicles & Passenger Car Bodies | ||||||

| 1,000 | Tata Motors Ltd. ** | 27,790 | 0.18 | % | ||

| National Commercial Banks | ||||||

| 155,801 | Citizens Republic Bancorp, Inc. * | 138,647 | 0.89 | % | ||

| Pharmaceutical Preparations | ||||||

| 380,000 | Pharmathene, Inc. * | 1,212,200 | ||||

| 29,900 | Spectrum Pharmaceuticals, Inc. * | 265,811 | ||||

| 1,478,011 | 9.51 | % | ||||

| Retail - Food Stores | ||||||

| 15,000 | Krispy Kreme Doughnuts, Inc. * | 105,600 | 0.68 | % | ||

| Retail - Jewelry Stores | ||||||

| 50,000 | Zale Corporation * | 199,500 | 1.28 | % | ||

| Semiconductors & Related Devices | ||||||

| 164,307 | Actions Semiconductor Co., Ltd. * ** | 409,125 | ||||

| 20,000 | Hanwha SolarOne Co., Ltd. * (China) | 151,600 | ||||

| 560,725 | 3.61 | % | ||||

| Services - Advertising | ||||||

| 322,868 | China MediaExpress Holdings, Inc. * (China) + | 1,469,049 | 9.45 | % | ||

| Services - Advertising Agencies | ||||||

| 11,000 | VisionChina Media Inc. * ** | 47,630 | 0.31 | % | ||

| Services - Amusement & Recreation Services | ||||||

| 115,980 Asia Entertainment & Resources Ltd. * (China) | 1,113,408 | 7.16 | % | |||

| Services - Educational Services | ||||||

| 255,400 | Corinthian Colleges Inc. * | 1,128,868 | 7.26 | % | ||

| Services - Prepackaged Software | ||||||

| 1,000 | Microsoft Corp. | 25,390 | 0.16 | % | ||

| Telephone & Telegraph Apparatus | ||||||

| 2,000 | CIENA Corp. * | 51,880 | ||||

| 114,096 | Qiao Xing Mobile Communication Co., Ltd. * (China) | 466,653 | ||||

| 518,533 | 3.34 | % | ||||

| Wholesale - Drugs, Proprietaries & Druggists' Sundries | ||||||

| 200,000 | China Medicine Corporation * (China) | 180,000 | 1.16 | % | ||

| Total for Common Stock (Cost $13,342,238) | 9,213,484 | 59.28 | % | |||

| EXCHANGE TRADED FUNDS | ||||||

| 6,000 | Direxion Daily Real Estate Bear 3X Shares * | 85,500 | ||||

| 8,000 | ProShares UltraShort QQQ * | 407,680 | ||||

| Total for Exchange Traded Funds (Cost $782,731) | 493,180 | 3.17 | % | |||

| CALL OPTIONS | Shares Subject | |||||

| Expiration Date/Exercise Price | to Call | |||||

| Accenture plc Class A * (Ireland) | 80,500 | $ 72,450 | ||||

| April 2011 Calls @ 55.00 | ||||||

| Agnico-Eagle Mines Ltd. * (Canada) | 10,000 | 23,600 | ||||

| April 2011 Calls @ 65.00 | ||||||

| *Non-Income Producing Securities. **ADR - American Depositary Receipt. + Illiquid Security and Level 3 Investment; See Note 3. The accompanying notes are an integral part of the financial statements. |

2011 Annual Report 6

| Birmiwal Oasis Fund | ||||||

| Schedule of Investments | ||||||

| March 31, 2011 | ||||||

| Shares/Principal Amount | Fair Value | % of Net Assets | ||||

| CALL OPTIONS | Shares Subject | |||||

| Expiration Date/Exercise Price | to Call | |||||

| Alcatel-Lucent * ** | ||||||

| May 2011 Calls @ 6.00 | 108,900 | $ 38,115 | ||||

| June 2011 Calls @ 5.00 | 300,000 | 309,000 | ||||

| September 2011 Calls @ 6.00 | 100,000 | 68,000 | ||||

| 415,115 | ||||||

| China MediaExpress Holdings, Inc. * (China) | 33,800 | - | ||||

| June 2011 Calls @ 15.00 | ||||||

| Corinthian Colleges Inc. * | ||||||

| May 2011 Calls @ 4.50 | 50,000 | 17,500 | ||||

| May 2011 Calls @ 5.00 | 50,000 | 7,500 | ||||

| May 2011 Calls @ 6.00 | 50,000 | 2,500 | ||||

| August 2011 Calls @ 5.00 | 100,000 | 45,000 | ||||

| January 2012 Calls @ 5.00 | 100,000 | 70,000 | ||||

| 142,500 | ||||||

| PPG Industries Inc. * | 30,000 | 55,500 | ||||

| April 2011 Calls @ 95.00 | ||||||

| Resources Connection Inc. * | 30,000 | 69,000 | ||||

| April 2011 Calls @ 17.50 | ||||||

| Ruby Tuesday, Inc. * | 80,000 | 88,000 | ||||

| April 2011 Calls @ 12.50 | ||||||

| Superior Industries International, Inc. * | 30,000 | 153,000 | ||||

| April 2011 Calls @ 20.00 | ||||||

| Total (Premiums Paid - $912,104) | 1,019,165 | 6.56 | % | |||

| Money Market Funds | ||||||

| 4,247,416 Fidelity Institutional Government Portfolio 0.05% *** | 4,247,416 | 27.33 | % | |||

| (Cost $4,247,416) | ||||||

| Total Investment Securities | 14,973,245 | 96.34 | % | |||

| (Cost $19,284,489) | ||||||

| Other Assets In Excess of Liabilities | 569,063 | 3.66 | % | |||

| Net Assets | $ 15,542,308 | 100.00 | % | |||

| *Non-Income Producing Securities. **ADR - American Depositary Receipt. *** Variable Rate Security; The Yield Rate shown represents the rate at March 31, 2011. The accompanying notes are an integral part of the financial statements. |

2011 Annual Report 7

| Birmiwal Oasis Fund | |||

| Statement of Assets and Liabilities | |||

| March 31, 2011 | |||

| Assets: | |||

| Investment Securities at Fair Value | $ 14,973,245 | ||

| (Identified Cost - $19,284,489) | |||

| Cash Held at Custodian and Broker | 469,069 | ||

| Receivables: | |||

| Dividends and Interest | 41 | ||

| Performance Adjustment Due From Adviser | 44,147 | ||

| Receivable for Securities Sold | 1,176,462 | ||

| Total Assets | 16,662,964 | ||

| Liabilities | |||

| Payable for Securities Purchased | 1,037,341 | ||

| Shareholder Redemptions | 39,292 | ||

| Base Management Fee Payable to Adviser | 44,023 | ||

| Total Liabilities | 1,120,656 | ||

| Net Assets | $ 15,542,308 | ||

| Net Assets Consist of: | |||

| Paid In Capital | $ 22,944,843 | ||

| Accumulated Realized Loss on Investments - Net | (3,091,291 | ) | |

| Unrealized Depreciation in Value of Investments and Options | |||

| Purchased Based on Identified Cost - Net | (4,311,244 | ) | |

| Net Assets, for 783,908 Shares Outstanding | $ 15,542,308 | ||

| (Unlimited number of shares authorized without par value) | |||

| Net Asset Value, Offering and Redemption Price | |||

| Per Share ($15,542,308/783,908 shares) | $ 19.83 | ||

| Statement of Operations | |||

| For the fiscal year ended March 31, 2011 | |||

| Investment Income: | |||

| Dividends (Net of foreign withholding taxes of $15) | $ 1,382 | ||

| Interest | 5,111 | ||

| Total Investment Income | 6,493 | ||

| Expenses: (Note 4) | |||

| Management Fees | |||

| Base Management Fees | 554,307 | ||

| Performance Based Management Fee Earned by Adviser - Net | 207,018 | ||

| Net Management Fees | 761,325 | ||

| Borrowing Expense on Securities Sold Short | 2,568 | ||

| Other Expense | 5,846 | ||

| Total Expenses | 769,739 | ||

| Net Investment Loss | (763,246 | ) | |

| Realized and Unrealized Gain (Loss) on Investments, Securities Sold Short, | |||

| Options Purchased & Options Written: | |||

| Net Realized Gain on Investments | 2,818,699 | ||

| Net Realized Gain on Securities Sold Short | 26,656 | ||

| Net Realized Loss on Options Purchased | (3,656,020 | ) | |

| Net Realized Gain on Options Written | 91,995 | ||

| Net Change In Unrealized Depreciation on Investments | (3,610,626 | ) | |

| Net Change In Unrealized Appreciation on Options Written | (18,670 | ) | |

| Net Change In Unrealized Appreciation/(Depreciation) on Options Purchased | 976,289 | ||

| Net Realized and Unrealized Gain/(Loss) on Investments, Securities | |||

| Sold Short, Options Purchased & Options Written | (3,371,677 | ) | |

| Net Decrease in Net Assets from Operations | $ (4,134,923 | ) | |

|

The accompanying notes are an integral part of the financial |

2011 Annual Report 8

| Birmiwal Oasis Fund | |||||

| Statements of Changes in Net Assets | |||||

| 4/1/2010 | 4/1/2009 | ||||

| to | to | ||||

| 3/31/2011 | 3/31/2010 | ||||

| From Operations: | |||||

| Net Investment Loss | $(763,246 | ) | $(432,231 | ) | |

| Net Realized Gain/(Loss) on Investments, Securities Sold Short, | (718,670 | ) | 5,167,280 | ||

| Options Purchased and Options Written | |||||

| Net Change In Unrealized Appreciation/(Depreciation) | (2,653,007 | ) | 8,432,469 | ||

| Increase/(Decrease) in Net Assets from Operations | (4,134,923 | ) | 13,167,518 | ||

| From Distributions to Shareholders: | |||||

| Net Investment Income | 0 | 0 | |||

| Net Realized Gain from Security Transactions | (400,223 | ) | 0 | ||

| Change in Net Assets from Distributions | (400,223 | ) | 0 | ||

| From Capital Share Transactions: | |||||

| Proceeds From Sale of Shares | 141,891 | 146,598 | |||

| Shares Issued on Reinvestment of Dividends | 399,512 | 0 | |||

| Cost of Shares Redeemed | (317,045 | ) | (175,925 | ) | |

| Net Increase/(Decrease) from Shareholder Activity | 224,358 | (29,327 | ) | ||

| Net Increase/(Decrease) in Net Assets | (4,310,788 | ) | 13,138,191 | ||

| Net Assets at Beginning of Period | 19,853,096 | 6,714,905 | |||

| Net Assets at End of Period (including accumulated | $15,542,308 | $19,853,096 | |||

| undistributed net investment income of $0 and $0, respectively) | |||||

| Share Transactions: | |||||

| Issued | 5,295 | 7,473 | |||

| Reinvested | 15,923 | 0 | |||

| Redeemed | (13,178 | ) | (9,331 | ) | |

| Net Increase/(Decrease) in Shares | 8,040 | (1,858 | ) | ||

| Shares Outstanding Beginning of Period | 775,868 | 777,726 | |||

| Shares Outstanding End of Period | 783,908 | 775,868 | |||

| Financial Highlights | ||||||||||

| Selected data for a share outstanding | 4/1/2010 | 4/1/2009 | 4/1/2008 | 4/1/2007 | 4/1/2006 | |||||

| throughout the period: | to | to | to | to | to | |||||

| 3/31/2011 | 3/31/2010 | 3/31/2009 | 3/31/2008 | 3/31/2007 | ||||||

| Net Asset Value - | ||||||||||

| Beginning of Period | $ 25.59 | $ 8.63 | $ 23.20 | $ 32.56 | $ 37.19 | |||||

| Net Investment Income/(Loss) (a) | (0.98 | ) | (0.56 | ) | (0.32 | ) | (0.80 | ) | (1.27 | ) |

| Net Gains or Losses on Securities | ||||||||||

| (realized and unrealized) (b) | (4.26 | ) | 17.52 | (14.01 | ) | 2.05 | 9.26 | |||

| Total from Investment Operations | (5.24 | ) | 16.96 | (14.33 | ) | 1.25 | 7.99 | |||

| Distributions (From Net Investment Income) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Distributions (From Capital Gains) | (0.52 | ) | 0.00 | (0.24 | ) | (10.61 | ) | (12.62 | ) | |

| Total Distributions | (0.52 | ) | 0.00 | (0.24 | ) | (10.61 | ) | (12.62 | ) | |

| Net Asset Value - | ||||||||||

| End of Period | $ 19.83 | $ 25.59 | $ 8.63 | $ 23.20 | $ 32.56 | |||||

| Total Return (c) | (20.91) | % | 196.52 | % | (61.97) | % | (2.12) | % | 22.51 | % |

| Ratios/Supplemental Data | ||||||||||

| Net Assets - End of Period (Thousands) | $ 15,542 | $ 19,853 | $ 6,715 | $ 19,074 | $ 20,292 | |||||

| Ratio of Expenses to Average Net Assets | 4.03 | % | 3.25 | % | 2.57 | % | 4.28 | % | 4.85 | % |

| Ratio of Net Investment Loss to Average Net Assets | -4.00 | % | -3.08 | % | -1.81 | % | -2.58 | % | -3.46 | % |

| Portfolio Turnover Rate | 1383.38 | % | 1477.97 | % | 998.97 | % | 932.44 | % | 688.12 | % |

|

(a) Per share amounts were calculated using the average shares method. |

| The accompanying notes are an integral part of these financial statements. |

2011 Annual Report 9

NOTES TO THE FINANCIAL STATEMENTS

BIRMIWAL OASIS FUND

March 31, 2011

1.) ORGANIZATION

Birmiwal Oasis Fund (the "Fund") is a non-diversified series of the Birmiwal Investment Trust (the "Trust"), an open-end investment company that commenced operations on April 1, 2003. The Trust was organized in Ohio as a business trust on January 3, 2003. The Trust may offer shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. At present, there is only one series authorized by the Trust. Birmiwal Asset Management, Inc. is the adviser to the Fund (the "Adviser"). As of August 1, 2006, the Fund revised its policies with respect to permitted investments in the Fund to reflect the following: The Fund remained closed to new investors except for non-profit organizations. Existing shareholders can purchase additional shares either by making new investments in their existing account(s) and/or by opening new account(s). The total of such new investments will be limited to a maximum of $25,000 per calendar year per taxpayer identification number/social security number. Existing shareholders may also continue to add to their existing accounts through the reinvestment of dividends and/or capital gain distributions from shares owned and may continue to participate in the Automatic Investment Plan (AIP). Non-profit organizations qualifying under Section 501(c)(3) of the Internal Revenue Code can open new accounts subject to a maximum investment limit of $25,000 per calendar year per taxpayer identification number. Trustees of the Fund, as well as directors, officers and employees of the Adviser, may continue to open new accounts and make additional purchases in existing accounts. The Fund’s primary investment objective is to seek capital apreciation. Significant accounting policies of the Fund are presented below:

2.) SIGNIFICANT ACCOUNTING POLICIES

SECURITY VALUATION: All investments in securities are recorded at their estimated fair value, as described in Note 3.

SHORT SALES: The Fund may sell a security it does not own in anticipation of a decline in the fair value of that security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker-dealer through which it made the short sale. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale.

OPTION WRITING: When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from investments. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a written call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or a loss. If a written put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund as writer of an option bears the market risk of an unfavorable change in the price of the security underlying the written option. See Note 8 for additional information.

FEDERAL INCOME TAXES: The Fund’s policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of its taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Fund’s policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Fund’s policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Fund recognizes the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years (2007 -2009), or expected to be taken on the Fund’s 2010 tax return. The Fund identifies its major tax jurisdictions as U.S. Federal tax authorities; however the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

2011 Annual Report 10

Notes to the Financial Statements - continued

DISTRIBUTIONS TO SHAREHOLDERS: Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense, or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations, or net asset values per share of the Fund. At March 31, 2011, the net impact of permanent book to tax adjustments resulted in net investment loss in the amount of $763,246 to be reclassified to paid-in capital.

USE OF ESTIMATES: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

OTHER: The Fund records security transactions based on a trade date. Dividend income is recognized on the ex-dividend date, and interest income is recognized on an accrual basis. Discounts and premiums on securities purchased are amortized over the lives of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

3.) SECURITIES VALUATIONS

As described in Note 2, the Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

FAIR VALUE MEASUREMENTS

A description of the valuation techniques applied to the Fund’s major categories of assets and liabilities measured at fair value on a recurring basis follows.

Equity securities (common stock, exchange traded funds, real estate investment trusts, and warrants). Equity securities that are traded on any exchange or on the NASDAQ over-the-counter market are valued at the last quoted sale price. Lacking a last sale price, a security is valued at its last bid price except when, in the Adviser's opinion, the last bid price does not accurately reflect the current value of the security. All other securities for which over-the-counter market quotations are not readily available are valued at their last bid price. Generally, if the security is traded in an active market and is valued at the last sale price, the security is categorized as a level 1 security. When the security position is not considered to be part of an active market or when the security is

2011 Annual Report 11

Notes to the Financial Statements - continued

valued at the bid price, the position is generally categorized as a level 2. When market quotations are not readily available, when the Adviser determines the last bid price does not accurately reflect the current value or when restricted securities are being valued, such securities are valued as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review of the Board of Trustees and are generally categorized in level 3 of the fair value hierarchy.

Money markets. Money Market securities are valued at a net asset value of $1.00 and are classified in level 1 of the fair value hierarchy.

Options. Option positions that are traded on any exchange or on the NASDAQ over-the-counter market are valued at the last quoted sale price. To the extent these option positions are actively traded and valuation adjustments are not applied, they are classified in level 1 of the fair value hierarchy. Lacking a last sale price, an option position, is valued at its last bid price except when, in the Adviser’s opinion, the last bid price does not accurately reflect the current value of the option position. When a bid price is used for valuation or when the security is not actively traded, those securities are generally categorized in level 2 or level 3 of the fair value hierarchy.

The following table summarizes the inputs used to value the Fund’s assets measured at fair value as of March 31, 2011:

| Valuation Inputs of Assets | Level 1 | Level 2 | Level 3 | Total | ||||

| Common Stock | $ 7,744,435 | $0 | $1,469,049 | $9,213,484 | ||||

| Exchange Traded Funds | 493,180 | 0 | 0 | 493,180 | ||||

| Options Purchased | 0 | 1,019,165 | 0 | 1,019,165 | ||||

| Money Market Funds | 4,247,416 | 0 | 0 | 4,247,416 | ||||

| Total | $ 12,485,031 | $1,019,165 | $1,469,049 | $14,973,245 |

Refer to the Fund’s Schedule of Investments for a listing of securities by industry. It is the Fund’s policy to consider transfers into or out of level 1 or level 2 as of the end of the reporting period. As of March 31, 2011, Common stock with a fair value of $1,469,049 and call options purchased with a fair value of $0 were transferred from level 1 to level 3. The transfer occurred when the related security ceased trading on its primary exchange during March 2011 and was subsequently valued in accordance with the good faith pricing policies as adopted by the Fund. No other transfers occurred during the period.

The Fund’s assets assigned to level 3 input category are valued at fair value as determined in good faith under procedures established by and under the general supervision of the Board. To determine fair value, management will utilize the valuation technique that they deem the most appropriate in the circumstances. Securities which no longer trade on their primary exchange have been valued based upon a market approach in which management assesses quantitative factors, such as the last trade price and financial condition of the underlying issuer, as well as qualitative factors, such as reputation of the underlying issuer. Once such securities trade again on their primary exchange, the Advisor reviews the subsequent trading activity to determine if the valuation techniques used were reasonable.

The following is a reconciliation of assets for which level 3 inputs were used in determining value:

| Common Stock | Options Purchased | |||

| Beginning balance | $ 0 | $ 0 | ||

| Total realized gain (loss) | 0 | 0 | ||

| Change in unrealized appreciation (depreciation) | 0 | 0 | ||

| Cost of purchases | 0 | 0 | ||

| Net transfers in/out of level 3 | 1,469,049 | 0 | ||

| Ending balance | $ 1,469,049 | $ 0 |

The total change in unrealized appreciation (depreciation) included in the statement of operations attributable to level 3 investments still held at March 31, 2011 includes $(2,900,508) attributable to common stock and $(59,420) attributable to options purchased.

4.) INVESTMENT ADVISORY AGREEMENT

The Fund has entered into an Investment Advisory Agreement with Birmiwal Asset Management, Inc. (the “Adviser”). Under the terms of the Investment Advisory Agreement, the Adviser manages the investment portfolio of the Fund, subject to policies adopted by the Trust’s Board of Trustees. Under the Investment Advisory Agreement, the Adviser, at its own expense and without reimbursement from the Trust, furnishes office space and all necessary office facilities, equipment and executive personnel necessary for managing the assets of the Fund. The Adviser also pays the salaries and fees of all of its officers and employees that serve as officers and trustees of the Trust. The Adviser pays all operating expenses of the Fund, with the exception of taxes, borrow-

2011 Annual Report 12

Notes to the Financial Statements - continued

ing expenses (such as (i) interest and (ii) dividend expenses on securities sold short), brokerage commissions, indirect expenses (such as the expenses of other investment companies in which the Fund may invest) and extraordinary expenses.

For its services and its agreement to pay the Fund’s operating expenses, the Adviser receives an annual variable performance-based management fee comprised of a base rate of 2.90% of the Fund's average daily net assets and a performance adjustment, which is in accordance with a rate schedule. The performance adjustment increases or decreases the fee paid by the Fund to the Adviser based on the Fund's performance relative to the S&P 500 Index over the most recent 12-month period. If the Fund's return for the period is within 2.00% (two percentage points) of the return on the S&P 500 Index, no adjustment is made. If the difference between the performance of the Fund and the S&P 500 Index exceeds 2.00% (two percentage points), the performance adjustment is made at a rate that varies linearly with the difference between the Fund's performance and that of the S&P 500 Index. The resulting performance adjustment rate can be as high as 2.40% if the Fund outperforms the S&P 500 Index by 14% (fourteen percentage points) or more, and as low as -2.40% if the Fund underperforms the S&P 500 Index by 14% (fourteen percentage points) or more.

For the fiscal year ended March 31, 2011, the Adviser earned base management fees totaling $554,307 and performance-based management fees totaling $207,018. At March 31, 2011, the Fund owed the Adviser base management fees in the amount of $44,023, and there was $44,147 which was due from the Adviser as a result of the performance adjustment.

5.) RELATED PARTY TRANSACTIONS

Kailash Birmiwal, Ph.D. is the control person of the Adviser and also serves as a trustee/officer of the Fund. This individual receives benefits from the Adviser resulting from management fees paid to the Adviser by the Fund.

The Trustees who are not interested persons of the Fund were paid a total of $0 in Trustee fees for the fiscal year ended March 31, 2011. Pursuant to the Investment Advisory Agreement, these fees are paid by the Adviser.

6.) CAPITAL STOCK

The Trust is authorized to issue an unlimited number of shares without par value. Paid in capital at March 31, 2011 was $22,944,843 representing 783,908 shares outstanding.

7.) INVESTMENT TRANSACTIONS

For the fiscal year ended March 31, 2011, purchases and sales of investment securities other than U.S. Government obligations and short-term investments aggregated $161,169,721 and $162,455,734, respectively. Purchases and sales of U.S. Government obligations aggregated $0 and $0, respectively.

For federal income tax purposes, the cost of total investment securities owned at March 31, 2011 was $20,462,672. At March 31, 2011, the composition of unrealized appreciation (the excess of value over tax cost) and depreciation (the excess of tax cost over value), was as follows:

| Appreciation | (Depreciation) | Net Appreciation (Depreciation) | |||||

| $2,189,791 | ($7,679,218) | ($5,489,427) |

8.) DERIVATIVES

Transactions in written options during the fiscal year ended March 31, 2011, were as follows:

| Number of | Premiums | |||

| Contracts | Received | |||

| Options outstanding at March 31, 2010 | 500 | $61,170 | ||

| Options written | 6,061 | $320,540 | ||

| Options terminated in closing transactions | (3,961 | ) | ($208,653 | ) |

| Options expired | (1,500 | ) | ($74,249 | ) |

| Options exercised | (1,100 | ) | ($98,808 | ) |

| Options outstanding at March 31, 2011 | 0 | $0 |

Transactions in purchased options during the fiscal year ended March 31, 2011, were as follows:

2011 Annual Report 13

Notes to the Financial Statements - continued

| Number of | Premiums | |||

| Contracts | Paid | |||

| Options outstanding at March 31, 2010 | 139,424 | $3,785,242 | ||

| Options purchased | 444,353 | $26,108,200 | ||

| Options terminated in closing transactions | (300,018 | ) | ($21,490,680 | ) |

| Options expired | (246,177 | ) | ($5,984,949 | ) |

| Options exercised | (26,050 | ) | ($1,505,709 | ) |

| Options outstanding at March 31, 2011 | 11,532 | $912,104 |

The locations on the Statement of Assets and Liabilities of the Fund's derivative positions, which are not accounted for as hedging instruments under GAAP, is as follows:

| Asset | Liability | ||||

| Derivatives | Derivatives | ||||

| Options purchased: | Written Options at | ||||

| Included In Investments in | $1,019,165 | Fair Value | $0 | ||

| Securities at Fair Value |

Realized and unrealized gains and losses on derivatives contracts entered into during the fiscal year ended March 31, 2011, by the Fund are recorded in the following locations in the Statement of Operations:

| Realized | Unrealized | |||||||

| Equity Contracts | Location | Gain/(Loss) | Location | Gain/(Loss) | ||||

| Options | Net Realized | Change In Unrealized | ||||||

| Purchased | Loss on Options | ($3,656,020) | Appreciation/(Depreciation) | $976,289 | ||||

| Purchased | on Options Purchased | |||||||

| Options | Net Realized | Change In Unrealized | ||||||

| Written | Gain on Options | $91,995 | Appreciation/(Depreciation) | ($18,670) | ||||

| Written | on Options Written | |||||||

The Fund engages in option transactions involving individual securities and stock indexes. An option involves either: (a) the right or the obligation to buy or sell a specific instrument at a specific price until the expiration date of the option; or (b) the right to receive payments or the obligation to make payments representing the difference between the closing price of a stock index and the exercise price of the option expressed in dollars times a specified multiple until the expiration date of the option. The Fund may purchase and write options. Options are sold (written) on securities and stock indexes. The purchaser of an option on a security pays the seller (the writer) a premium for the right granted but is not obligated to buy or sell the underlying security. The purchaser of an option on a stock index pays the seller a premium for the right granted, and in return the seller of such an option is obligated to make the payment. A writer of an option may terminate the obligation prior to expiration of the option by making an offsetting purchase of an identical option. Options are traded on organized exchanges and in the over-the-counter market. To cover the potential obligations involved in writing options, a Fund will either: (a) own the underlying security, or in the case of an option on a market index, will hold a portfolio of stocks substantially replicating the movement of the index; or (b) the Fund will segregate with the custodian high grade liquid assets sufficient to purchase the underlying security or equal to the fair value of the stock index option, marked to market daily.

The purchase of options limits the Fund's potential loss to the amount of the premium paid and can afford the Fund the opportunity to profit from favorable movements in the price of an underlying security to a greater extent than if transactions were effected in the security directly. However, the purchase of an option could result in the Fund losing a greater percentage of its investment than if the transaction were effected directly. When the Fund writes a call option, it will receive a premium, but it will give up the opportunity to profit from a price increase in the underlying security above the exercise price as long as its obligation as a writer continues. When the Fund writes a put option, it will assume the risk that the price of the underlying security or instrument will fall below the exercise price, in which case the Fund may be required to purchase the security or instrument at a higher price than the market price of the security or instrument. In addition, there can be no assurance that the Fund can effect a closing transaction on a particular option it has written. Further, the total premium paid for any option may be lost if the Fund does not exercise the option.

The Fund engages in option transactions involving securities and stock indices in order to gain exposure to particular securities or markets, in connection with hedging transactions, or to try to enhance returns. Options require additional skills and techniques beyond normal portfolio management. The Fund's use of options involves risk that such instruments may not work as intended

2011 Annual Report 14

Notes to the Financial Statements - continued

due to unanticipated developments, especially in abnormal market conditions, or if the Adviser makes an error in judgment, or other causes. The use of options may magnify the increase or decrease in the performance of the Fund, and may also subject the Fund to higher price volatility.

The premiums paid for the options represent the cost of the investment and the options are valued daily at their closing price. The Fund recognize a realized gain or loss when the option is sold or expired. Option holdings within the Fund, which may include put options and call options, are subject to loss of value with the passage of time, and may experience a total loss of value upon expiration. With options, there is minimal counterparty risk to the Fund since they are exchange traded.

9.) CONTROL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of March 31, 2011, Kailash Birmiwal, Ph.D., the control person of the Adviser, held, in aggregate, approximately 74% of the Fund.

10.) DISTRIBUTIONS TO SHAREHOLDERS

The tax character of distributions paid during the fiscal year ended March 31, 2011 and the fiscal year ended March 31, 2010 were as follows: Distributions paid from:

| Year ended | Year ended | |||

| March 31, 2011 | March 31, 2010 | |||

| Ordinary Income: | $ 0 | $ 0 | ||

| Short-term Capital Gain | 400,223 | 0 | ||

| Long-term Capital Gain | 0 | 0 | ||

| $ 400,223 | $ 0 |

As of March 31, 2011, the components of distributable earnings/(accumulated losses) on a tax basis were as follows:

| Undistributed long-term capital gain/(accumulated losses) | $ (1,913,108 | ) | |

| Unrealized appreciation/(depreciation) | (5,489,427 | ) | |

| $ (7,402,535 | ) |

The differences between book basis and tax basis unrealized depreciation are attributable to the tax deferral of losses on wash sales and current year Post-October losses. The Fund elected to defer post-October losses in the amount of $114,006.

11.) LOSS CARRYFORWARDS

As of March 31, 2011, the Fund had available for federal purposes an unused capital loss carryfor-ward of $1,913,108, all of which expires in 2019. Capital loss carryforwards are available to offset future realized capital gains. To the extent that these carryforwards are used to offset future capital gains, it is probable that the amount that is offset will not be distributed to shareholders.

12.)FOREIGN SECURITIES RISK

The Fund could be subject to greater risks because the Fund's performance may depend on issues other than the performance of a particular company. Changes in foreign economies and political climates are more likely to affect the Fund than a fund that invests exclusively in U.S. companies. The value of foreign securities also is affected by the value of the local currency relative to the U.S. dollar. There also may be less government supervision of foreign markets, resulting in non-uniform accounting practices and less publicly available information.

Investment in securities of issuers based in underdeveloped emerging markets entails all of the risks of investing in securities of foreign issuers outlined in this section to a heightened degree. These heightened risks include: (i) greater risks of expropriation, confiscatory taxation, nationalization, and less social, political and economic stability; (ii) the smaller size of the market for such securities and a low or nonexistent volume of trading, resulting in lack of liquidity and in price volatility; (iii) certain national policies which may restrict a Fund's investment opportunities; and (iv) in the case of Eastern Europe, China and other Asian countries, the absence of developed capital markets and legal structures governing private or foreign investment and private property, and the possibility that recent favorable economic and political developments could be slowed or reversed by unanticipated events.

2011 Annual Report 15

|

Cohen Fund Audit Services, Ltd. |

800 Westpoint Pkwy, Ste 1100 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees

Birmiwal Investment Trust

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Birmiwal Investment Trust, comprising the Birmiwal Oasis Fund (the "Fund") as of March 31, 2011 and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of Fund management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2011 by correspondence with the custodian and broker. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the Fund as of March 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Westlake, Ohio

June 14, 2011

2011 Annual Report 16

TRUSTEES AND OFFICERS - Unaudited

The Board of Trustees supervises the business activities of the Trust. The names of the Trustees and executive officers of the Trust are shown below. Each Trustee serves until the Trustee dies, resigns, retires or is removed. Officers hold office for one year and until their respective successors are chosen and qualified. For more information regarding the Trustees, please refer to the Statement of Additional Information, which is available upon request by calling 1-800-417-5525. The trustees and officers of the Trust and their principal business activities during the past five years are:

Interested Trustees & Officers

| Other | |||||

| Name, | Position | Length of | Principal | Number of | Directorships |

| Address(1), | with the | Time Served | Occupation(s) | Portfolios | Held By |

| and Year of Birth | Trust | During | Overseen By | Trustee or | |

| Past 5 Years | Trustee | Officer | |||

| Kailash Birmiwal, Ph.D.(2) | President, | Since 2003 | President of the Fund’s Adviser | 1 | None |

| 1957 | Treasurer, | since 2003. | |||

| Chief | |||||

| Compliance | |||||

| Officer and | |||||

| Trustee | |||||

| Lea R. Birmiwal, Ph.D. | Secretary | Since 2003 | Homemaker. | N/A | None |

| 1960 | |||||

(1)The address of each trustee and officer is c/o Birmiwal Investment Trust, 24140 E. Greystone Lane, Woodway, WA 98020.

(2) Kailash Birmiwal is considered an "interested persons" as defined in Section 2(a)(19) of the Investment Company Act of 1940 by virtue of his affiliation with the Adviser.

Independent Trustees

| Principal | Number of | Other | |||

| Name, | Position | Length of | Occupation(s) | Portfolios | Directorships |

| Address(3), | with the | Time Served | During | Overseen By | Held By |

| and Year of Birth | Trust | Past 5 Years | Trustee | Trustee or | |

| Officer | |||||

| Rajendra K. Bordia, Ph.D. | Trustee | Since 2003 | Professor, Department of | 1 | None |

| 1957 | Materials Science and | ||||

| Engineering, University of | |||||

| Washington (2003-Present). Chair | |||||

| (1998-2005), Associate Professor | |||||

| (1991-2003), Department of | |||||

| Materials Science and | |||||

| Engineering, University of | |||||

| Washington. | |||||

| Hemant K. Gupta, Ph.D. | Trustee | Since 2003 | President of Gupta Inc., a Retail | 1 | None |

| 1958 | Corporation (1996-2006). | ||||

| Assistant Professor, University of | |||||

| Connecticut (1986-1998). | |||||

| Veera S. Karukonda | Trustee | Since 2003 | Signal Systems Engineer, City of | 1 | None |

| 1957 | Stamford, CT (2004-Present). Civil | ||||

| Engineering Consultant (2003- | |||||

| 2004). Civil Engineer, City of | |||||

| Hartford, CT (1988-2003). | |||||

| Bal K. Sharma, Dr. | Trustee | Since 2003 | Administrator (Chief of | 1 | None |

| 1953 | Respiratory Division), V.A. Medical | ||||

| Center, North Chicago (1990- | |||||

| Present). | |||||

(3)The address of each trustee and officer is c/o Birmiwal Investment Trust, 24140 E. Greystone Lane, Woodway, WA 98020.

2011 Annual Report 17

|

Board of Trustees

|

| This report is provided for the general information of the shareholders of the Birmiwal Oasis Fund. This report is not intended for distribution to prospective investors in the funds, unless preceded or accompanied by an effective prospectus. |

| Birmiwal Oasis Fund 24140 E. Greystone Lane Woodway, WA 98020 |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and the principal financial officer. The registrant has made minor administrative changes and amended its code of ethics during the covered period. The registrant has not granted any waivers from any provisions of the code of ethics during the covered period. A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Trustees has determined that it does not have an audit committee financial expert serving on its audit committee. The registrant believes that the experience provided by each member of the audit committee together offers the registrant adequate oversight for the registrant’s level of financial complexity.

Item 4. Principal Accountant Fees and Services.

(a-d) The following table details the aggregate fees billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant to the registrant. The principal accountant has provided no services to the adviser or any entity controlled by, or under common control with the adviser that provides ongoing services to the registrant.

| FYE 3/31/11 | FYE 3/31/10 | |||

| Audit Fees | $15,650 | $15,150 | ||

| Audit-Related Fees | $0 | $0 | ||

| Tax Fees | $3,500 | $3,500 | ||

| All Other Fees | $600 | $600 |

Nature of Tax Fees: preparation of Excise Tax Statement and 1120 RIC. Nature of All Other Fees: Review of Semi-Annual Report.

(e) (1) The audit committee approves all audit and non-audit related services and, therefore, has not adopted pre-approval policies and procedures described in paragraph (c)(7) of Rule 2-01 of Regulation S-X.

(e) (2) None of the services described in paragraph (b) through (d) of this Item were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the aggregate non-audit fees billed by the registrant’s principal accountant for services to the registrant , the registrant’s investment adviser (not sub-adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant, for the last two years.

| Non-Audit Fees | FYE 3/31/11 | FYE 3/31/10 | ||

| Registrant | $4,100 | $4,100 | ||

| Registrant’s Investment Adviser | $0 | $0 |

(h) The principal accountant provided no services to the investment adviser or any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant.

Item 5. Audit Committee of Listed Companies. Not applicable.

Item 6. Schedule of Investments. Schedule filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. Not applicable.

Item 8. Portfolio Managers of Closed End Management Investment Companies. Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers. Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) The registrant’s president and chief financial officer concluded that the disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) were effective as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of Ethics. Filed herewith.

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(b) Certification pursuant to Section 906 Certification of the Sarbanes-Oxley Act of 2002. Filed herewith.

| SIGNATURES |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Birmiwal Investment Trust

|

| By: /s/ Kailash Birmiwal

Kailash Birmiwal President |

| Date: 6-21-11 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: /s/ Kailash Birmiwal

Kailash Birmiwal President |

| Date: 6-21-11 |

|

By: /s/ Kailash Birmiwal

|

| Date: 6-21-11 |