Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21284

AllianzGI Convertible & Income Fund

(Exact name of registrant as specified in charter)

| 1633 Broadway, New York, NY | 10019 | |

| (Address of principal executive offices) | (Zip code) |

Lawrence G. Altadonna – 1633 Broadway, New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: February 28, 2015

Date of reporting period: February 28, 2015

Table of Contents

Item 1. Report to Shareholders

AllianzGI Convertible & Income Fund

AllianzGI Convertible & Income Fund II

Annual Report

February 28, 2015

Table of Contents

Table of Contents

Letter from Chairman of the Board &

President

Hans W. Kertess

Chairman

Julian Sluyters

President & CEO

Dear Shareholder:

The US economy expanded during most of the twelve-month reporting period ended February 28, 2015. Both stocks and bonds posted positive returns during the reporting period.

12 Months in Review through February 28, 2015

| n | AllianzGI Convertible & Income Fund returned 0.33% on net asset value (“NAV”) and 0.37% on market price. |

| n | AllianzGI Convertible & Income Fund II returned 0.60% on NAV and -0.81% on market price. |

In comparison, the Standard & Poor’s (“S&P”) 500 Index, an unmanaged index generally representative of the US stock market, rose 15.51% and the BofA Merrill Lynch High Yield Master II Index, an unmanaged index generally representative of the high yield bond market, returned 2.84% during the 12-month reporting period. Convertible securities, which share characteristics of both stocks and bonds, also generated positive results. The BofA Merrill Lynch All Convertibles Index, an unmanaged index generally representative of the convertible securities market, advanced 6.71% for the period.

Turning to the US economy, gross domestic product (“GDP”), the value of goods and services produced in the country, the broadest measure of economic activity and the principal indicator of economic performance, contracted at an annual pace of 2.1% during the first quarter of 2014. However, the economy quickly regained its footing, as GDP grew at an annual pace of 4.6% and 5.0% during the second and third quarters, respectively. Economic growth then moderated, as the US Commerce Department reported that fourth quarter GDP expanded at a 2.2% annualized rate.

While the Federal Reserve (the “Fed”) maintained an accommodative monetary policy during the reporting period, it started to take actions to transition to a more normalized stance. In October 2014 the central bank announced that its asset purchase program had concluded. At its meeting in January 2015, the Fed said, “Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy.” At its meeting that ended in March 2015, after the reporting period had ended, the Fed removed the word “patient” from its official statement and said it “… anticipates that it will be appropriate to raise the target range for

| 2 | Annual Report | | February 28, 2015 |

Table of Contents

data have recently shown signs of improvement, thereby reflecting a tailwind from a weaker euro, as well as the stimulus stemming from the decline in oil prices. Elsewhere, Japanese economic data continue to edge up, but only moderately given the sharp decline in mid-2014. Finally, data in emerging markets has recently stabilized. Overall, we believe lower oil prices will be supportive for global growth.

From an investment standpoint, we currently favor global equities over cash, with a preference for developed market equities versus their emerging market counterparts. From a fixed income perspective, we anticipate a cyclical rise of US and UK sovereign yields due to change in monetary policy and stretched valuations. In contrast, we expect government bond yields in core euro-zone countries and Japan to remain low for the time being.

For specific information on the Funds and their performance, please review the following pages. If you have any questions regarding the information provided, we encourage you to contact your financial advisor or call the Funds’ shareholder servicing agent at (800) 254-5197. In addition, a wide range of information and resources is available on our website, us.allianzgi.com/closedendfunds.

Together with Allianz Global Investors Fund Management LLC, the Funds’ investment manager, and Allianz Global Investors U.S. LLC, the Funds’ sub-adviser, we thank you for investing with us.

We remain dedicated to serving your investment needs.

Sincerely,

|

| |

| Hans W. Kertess |

Julian Sluyters | |

| Chairman of the Board of Trustees |

President & Chief Executive Officer |

| February 28, 2015 | | Annual Report | 3 |

Table of Contents

AllianzGI Convertible & Income Funds

February 28, 2015 (unaudited)

| 4 | Annual Report | | February 28, 2015 |

Table of Contents

| February 28, 2015 | | Annual Report | 5 |

Table of Contents

AllianzGI Convertible & Income Fund

February 28, 2015 (unaudited)

| Total Return (1): | Market Price | NAV | ||||||

| 1 Year |

0.37% | 0.33% | ||||||

| 5 Year |

12.32% | 12.64% | ||||||

| 10 Year |

7.56% | 6.83% | ||||||

| Commencement of Operations (3/31/03) to 2/28/15 |

8.86% | 8.79% | ||||||

| 6 | Annual Report | | February 28, 2015 |

Table of Contents

Performance & Statistics

AllianzGI Convertible & Income Fund II

February 28, 2015 (unaudited)

| Total Return(1): | Market Price | NAV | ||||||

| 1 Year |

-0.81% | 0.60% | ||||||

| 5 Year |

12.59% | 12.66% | ||||||

| 10 Year |

7.68% | 6.10% | ||||||

| Commencement of Operations (7/31/03) to 2/28/15 |

7.96% | 7.51% | ||||||

| February 28, 2015 | | Annual Report | 7 |

Table of Contents

Performance & Statistics

AllianzGI Convertible & Income Funds

February 28, 2015 (unaudited)

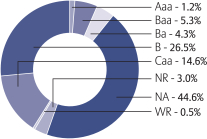

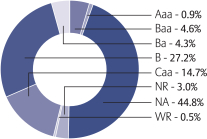

* Bond ratings apply to the underlying holdings of the Funds and not the Funds themselves and are divided into categories ranging from highest to lowest credit quality, determined for purposes of presentations in this report by using ratings provided by Moody’s Investors Service, Inc. (“Moody’s”). Credit ratings information in this report uses ratings provided by Moody’s for this purpose, among other reasons, because of the access to background information and other materials provided by Moody’s, as well as the Funds’ consideration of industry practice. Bonds not rated by Moody’s or bonds that do not have a rating available from Moody’s are designated as “NR” and “NA”, respectively. Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change periodically, even as frequently as daily. Ratings assigned by Moody’s or another rating agency are not absolute standards of credit quality and do not evaluate market risk. Rating agencies may fail to make timely changes in credit ratings, and an issuer’s current financial condition may be better or worse than a rating indicates. In formulating investment decisions for the Funds, Allianz Global Investors U.S. LLC, the sub-adviser to the Funds, develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agencies or third-party research.

(1) Past performance is no guarantee of future results. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Total return does not reflect broker commissions or sales charges in connection with the purchase or sale of Fund shares. Total return for a period of more than one year represents the average annual total return.

Performance at market price will differ from results at NAV. Although market price returns tend to reflect investment results over time, during shorter periods returns at market price can also be influenced by factors such as changing views about the Funds, market conditions, supply and demand for the Fund’s shares, or changes in each Fund’s dividends.

An investment in each Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets attributable to common shareholders less total liabilities divided by the number of common shares outstanding. Holdings are subject to change daily.

(2) Market Price Yield is determined by dividing the annualized current monthly dividend per common share (comprised of net investment income) by the market price per common share at February 28, 2015.

(3) Represents Preferred Shares (“Leverage”) outstanding, as a percentage of total managed assets. Total managed assets refer to total assets (including assets attributable to Leverage) minus liabilities (other than liabilities representing Leverage).

| 8 | Annual Report | | February 28, 2015 |

Table of Contents

AllianzGI Convertible & Income Fund

February 28, 2015

| Principal Amount (000s) |

Value | |||||||||

| Corporate Bonds & Notes – 41.3% | ||||||||||

| Advertising – 0.3% | ||||||||||

| $5,650 | Affinion Group, Inc., 7.875%, 12/15/18 | $3,827,875 | ||||||||

| Aerospace & Defense – 0.5% | ||||||||||

| 250 | Bombardier, Inc., 6.00%, 10/15/22 (a)(b) | 240,625 | ||||||||

| 6,570 | Erickson, Inc., 8.25%, 5/1/20 | 5,403,825 | ||||||||

| 5,644,450 | ||||||||||

| Air Freight & Logistics – 0.7% | ||||||||||

| 6,820 | XPO Logistics, Inc., 7.875%, 9/1/19 (a)(b) | 7,314,450 | ||||||||

| Auto Components – 0.8% | ||||||||||

| 4,180 | Chassix, Inc., 9.25%, 8/1/18 (a)(b)(c) | 3,051,400 | ||||||||

| 5,280 | Goodyear Tire & Rubber Co., 8.25%, 8/15/20 | 5,643,000 | ||||||||

| 8,694,400 | ||||||||||

| Auto Manufacturers – 0.8% | ||||||||||

| 7,410 | Chrysler Group LLC, 8.25%, 6/15/21 | 8,308,462 | ||||||||

| Commercial Services – 2.6% | ||||||||||

| 4,000 | Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 9.75%, 3/15/20 | 4,380,000 | ||||||||

| 11,500 | Cenveo Corp., 11.50%, 5/15/17 | 11,730,000 | ||||||||

| 5,705 | DynCorp International, Inc., 10.375%, 7/1/17 | 5,205,812 | ||||||||

| 7,375 | Monitronics International, Inc., 9.125%, 4/1/20 | 7,301,250 | ||||||||

| 28,617,062 | ||||||||||

| Commercial Services & Supplies – 0.6% | ||||||||||

| 5,645 | United Rentals North America, Inc., 8.375%, 9/15/20 | 6,068,375 | ||||||||

| Construction Materials – 0.7% | ||||||||||

| 7,310 | US Concrete, Inc., 8.50%, 12/1/18 | 7,785,150 | ||||||||

| Consumer Finance – 0.8% | ||||||||||

| 3,210 | Navient Corp., 8.45%, 6/15/18 | 3,675,450 | ||||||||

| 4,935 | Springleaf Finance Corp., 8.25%, 10/1/23 | 5,650,575 | ||||||||

| 9,326,025 | ||||||||||

| Distribution/Wholesale – 0.9% | ||||||||||

| 8,170 | HD Supply, Inc., 11.00%, 4/15/20 | 9,395,500 | ||||||||

| Diversified Consumer Services – 0.6% | ||||||||||

| 6,815 | Cambium Learning Group, Inc., 9.75%, 2/15/17 | 6,883,150 | ||||||||

| Diversified Financial Services – 1.8% | ||||||||||

| Community Choice Financial, Inc., | ||||||||||

| 10,085 | 10.75%, 5/1/19 | 6,555,250 | ||||||||

| 7,130 | 12.75%, 5/1/20 (a)(b) | 4,491,900 | ||||||||

| Nationstar Mortgage LLC / Nationstar Capital Corp., | ||||||||||

| 2,500 | 7.875%, 10/1/20 | 2,525,000 | ||||||||

| 5,300 | 9.625%, 5/1/19 | 5,671,000 | ||||||||

| 19,243,150 | ||||||||||

| Diversified Telecommunications – 0.5% | ||||||||||

| 4,923 | Cincinnati Bell, Inc., 8.75%, 3/15/18 | 5,041,152 | ||||||||

| Electrical Components & Equipment – 1.2% | ||||||||||

| 13,585 | WireCo WorldGroup, Inc., 9.50%, 5/15/17 | 13,449,150 | ||||||||

| Electronic Equipment, Instruments & Components – 1.5% | ||||||||||

| 7,725 | Kemet Corp., 10.50%, 5/1/18 | 7,956,750 | ||||||||

| 7,500 | Viasystems, Inc., 7.875%, 5/1/19 (a)(b) | 7,950,000 | ||||||||

| 15,906,750 | ||||||||||

| February 28, 2015 | | Annual Report | 9 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| Energy Equipment & Services – 0.1% | ||||||||||

| $2,830 | Hercules Offshore, Inc., 8.75%, 7/15/21 (a)(b) | $891,450 | ||||||||

| Food & Staples Retailing – 0.5% | ||||||||||

| 5,000 | US Foods, Inc., 8.50%, 6/30/19 | 5,256,250 | ||||||||

| Health Care Providers & Services – 1.7% | ||||||||||

| 8,875 | ExamWorks Group, Inc., 9.00%, 7/15/19 | 9,451,875 | ||||||||

| Tenet Healthcare Corp., | ||||||||||

| 3,500 | 5.00%, 3/1/19 (a)(b) | 3,526,250 | ||||||||

| 4,530 | 8.125%, 4/1/22 | 5,141,550 | ||||||||

| 18,119,675 | ||||||||||

| Healthcare-Products – 0.9% | ||||||||||

| 8,885 | Kinetic Concepts, Inc./KCI USA, Inc., 10.50%, 11/1/18 | 9,740,181 | ||||||||

| Hotels, Restaurants & Leisure – 0.9% | ||||||||||

| 8,405 | MGM Resorts International, 11.375%, 3/1/18 | 10,233,088 | ||||||||

| Household Durables – 1.1% | ||||||||||

| Beazer Homes USA, Inc., | ||||||||||

| 2,945 | 7.25%, 2/1/23 | 2,823,519 | ||||||||

| 5,045 | 9.125%, 5/15/19 | 5,215,268 | ||||||||

| 3,950 | Jarden Corp., 7.50%, 5/1/17 | 4,374,625 | ||||||||

| 12,413,412 | ||||||||||

| Household Products/Wares – 0.7% | ||||||||||

| 7,610 | Reynolds Group Issuer, Inc., 9.875%, 8/15/19 | 8,190,263 | ||||||||

| Internet – 0.5% | ||||||||||

| 8,395 | Affinion Investments LLC, 13.50%, 8/15/18 | 5,540,436 | ||||||||

| Internet Software & Services – 1.2% | ||||||||||

| EarthLink, Inc., | ||||||||||

| 2,800 | 7.375%, 6/1/20 | 2,877,000 | ||||||||

| 10,060 | 8.875%, 5/15/19 | 10,386,950 | ||||||||

| 13,263,950 | ||||||||||

| Iron/Steel – 0.6% | ||||||||||

| 7,305 | AK Steel Corp., 8.375%, 4/1/22 | 6,537,975 | ||||||||

| Lodging – 0.2% | ||||||||||

| 12,385 | Caesars Entertainment Operating Co., Inc., 12.75%, 4/15/18 (c) | 2,291,225 | ||||||||

| Machinery – 1.1% | ||||||||||

| 5,250 | BlueLine Rental Finance Corp., 7.00%, 2/1/19 (a)(b) | 5,460,000 | ||||||||

| 6,755 | Navistar International Corp., 8.25%, 11/1/21 | 6,814,106 | ||||||||

| 12,274,106 | ||||||||||

| Media – 2.9% | ||||||||||

| 5,500 | AMC Entertainment, Inc., 9.75%, 12/1/20 | 6,077,500 | ||||||||

| 8,355 | McClatchy Co., 9.00%, 12/15/22 | 8,522,100 | ||||||||

| 8,220 | McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance, 9.75%, 4/1/21 | 9,288,600 | ||||||||

| 3,745 | Mood Media Corp., 9.25%, 10/15/20 (a)(b) | 3,230,062 | ||||||||

| 4,671 | SFX Entertainment, Inc., 9.625%, 2/1/19 (a)(b) | 4,624,290 | ||||||||

| 31,742,552 | ||||||||||

| Metals & Mining – 2.0% | ||||||||||

| 6,590 | ArcelorMittal, 10.60%, 6/1/19 | 8,163,362 | ||||||||

| 3,680 | HudBay Minerals, Inc., 9.50%, 10/1/20 | 3,790,400 | ||||||||

| 10 | Annual Report | | February 28, 2015 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| Thompson Creek Metals Co., Inc., | ||||||||||

| $8,295 | 7.375%, 6/1/18 | $6,884,850 | ||||||||

| 2,830 | 12.50%, 5/1/19 | 2,518,700 | ||||||||

| 21,357,312 | ||||||||||

| Miscellaneous Manufacturing – 0.7% | ||||||||||

| 7,350 | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b) | 7,157,063 | ||||||||

| Oil & Gas – 1.3% | ||||||||||

| 9,050 | Energy XXI Gulf Coast, Inc., 9.25%, 12/15/17 | 6,606,500 | ||||||||

| 6,038 | United Refining Co., 10.50%, 2/28/18 | 6,397,261 | ||||||||

| 1,000 | Vanguard Natural Resources LLC / VNR Finance Corp., 7.875%, 4/1/20 | 918,750 | ||||||||

| 13,922,511 | ||||||||||

| Oil, Gas & Consumable Fuels – 1.5% | ||||||||||

| 2,840 | Arch Coal, Inc., 9.875%, 6/15/19 | 1,036,600 | ||||||||

| 5,050 | EP Energy LLC / Everest Acquisition Finance, Inc., 9.375%, 5/1/20 | 5,416,125 | ||||||||

| 4,500 | Laredo Petroleum, Inc., 9.50%, 2/15/19 | 4,702,500 | ||||||||

| 5,615 | Linn Energy LLC / Linn Energy Finance Corp., 6.50%, 5/15/19 | 4,941,200 | ||||||||

| 730 | Ultra Petroleum Corp., 6.125%, 10/1/24 (a)(b) | 697,150 | ||||||||

| 16,793,575 | ||||||||||

| Packaging & Containers – 0.7% | ||||||||||

| 6,692 | Tekni-Plex, Inc., 9.75%, 6/1/19 (a)(b) | 7,294,280 | ||||||||

| Paper & Forest Products – 0.3% | ||||||||||

| 3,000 | Louisiana-Pacific Corp., 7.50%, 6/1/20 | 3,217,500 | ||||||||

| Pharmaceuticals – 0.2% | ||||||||||

| 2,290 | Endo Finance LLC & Endo Finco, Inc., 5.375%, 1/15/23 (a)(b) | 2,335,800 | ||||||||

| Real Estate Investment Trust – 0.3% | ||||||||||

| 3,085 | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | 3,123,563 | ||||||||

| Retail – 0.9% | ||||||||||

| 9,465 | Neiman Marcus Group Ltd. LLC, 8.00%, 10/15/21 (a)(b) | 9,997,406 | ||||||||

| Semiconductors & Semiconductor Equipment – 1.0% | ||||||||||

| 3,745 | Amkor Technology, Inc., 6.375%, 10/1/22 | 3,904,162 | ||||||||

| 6,094 | Freescale Semiconductor, Inc., 10.75%, 8/1/20 | 6,646,269 | ||||||||

| 10,550,431 | ||||||||||

| Software – 1.7% | ||||||||||

| First Data Corp., | ||||||||||

| 5,645 | 8.25%, 1/15/21 (a)(b) | 6,082,488 | ||||||||

| 1,834 | 10.625%, 6/15/21 | 2,118,270 | ||||||||

| 9,045 | 12.625%, 1/15/21 | 10,835,910 | ||||||||

| 19,036,668 | ||||||||||

| Specialty Retail – 1.2% | ||||||||||

| 4,160 | Brown Shoe Co., Inc., 7.125%, 5/15/19 | 4,336,800 | ||||||||

| 3,500 | Claire’s Stores, Inc., 9.00%, 3/15/19 (a)(b) | 3,303,125 | ||||||||

| 5,500 | Conn’s, Inc., 7.25%, 7/15/22 (a)(b) | 4,984,375 | ||||||||

| 12,624,300 | ||||||||||

| Telecommunications – 1.3% | ||||||||||

| 7,415 | Consolidated Communications, Inc., 10.875%, 6/1/20 | 8,388,219 | ||||||||

| 5,660 | Windstream Corp., 7.50%, 4/1/23 | 5,617,550 | ||||||||

| 14,005,769 | ||||||||||

| February 28, 2015 | | Annual Report | 11 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| Transportation – 0.7% | ||||||||||

| $6,837 | Quality Distribution LLC, 9.875%, 11/1/18 | $7,195,943 | ||||||||

| Wireless Telecommunication Services – 0.8% | ||||||||||

| 7,205 | Sprint Communications, Inc., 11.50%, 11/15/21 | 8,934,200 | ||||||||

| Total Corporate Bonds & Notes (cost-$468,787,818) | 449,545,985 | |||||||||

| Shares | ||||||||||

| Convertible Preferred Stock – 40.8% | ||||||||||

| Aerospace & Defense – 1.4% | ||||||||||

| 239,625 | United Technologies Corp., 7.50%, 8/1/15 | 15,264,113 | ||||||||

| Automobiles – 1.7% | ||||||||||

| 532,000 | The Goldman Sachs Group, Inc., 8.00%, 12/17/15 (General Motors) (d) | 18,538,604 | ||||||||

| Banks – 4.3% | ||||||||||

| 9,695 | Huntington Bancshares, Inc., 8.50% (e) | 13,282,150 | ||||||||

| 1,064,500 | JPMorgan Chase & Co., 8.00%, 9/18/15 (Bank of America) (d) | 16,265,560 | ||||||||

| 13,990 | Wells Fargo & Co., 7.50%, Ser. L (e) | 16,962,315 | ||||||||

| 46,510,025 | ||||||||||

| Diversified Financial Services – 1.4% | ||||||||||

| 13,220 | Bank of America Corp., 7.25%, Ser. L (e) | 15,467,400 | ||||||||

| Electric Utilities – 0.4% | ||||||||||

| 85,390 | Exelon Corp., 6.50%, 6/1/17 | 4,235,344 | ||||||||

| Electronic Equipment, Instruments & Components – 1.7% | ||||||||||

| 738,000 | Bank of America Corp., 8.00%, 2/17/16 (Corning, Inc.) (d) | 18,073,620 | ||||||||

| Energy Equipment & Services – 1.6% | ||||||||||

| 313,380 | Credit Suisse, 8.00%, 3/5/15 (Baker Hughes) (d) | 17,643,294 | ||||||||

| Food Products – 1.4% | ||||||||||

| 326,360 | Wells Fargo & Co., 8.00%, 8/28/15 (Archer-Daniels-Midland Co.) (d) | 15,175,740 | ||||||||

| Health Care Equipment & Supplies – 1.8% | ||||||||||

| 273,890 | Credit Suisse, 8.00%, 6/23/15 (Medtronic, Inc.) (d) | 19,120,261 | ||||||||

| Health Care Providers & Services – 1.9% | ||||||||||

| 339,700 | JPMorgan Chase & Co., 8.00%, 5/5/15 (HCA Holdings, Inc.) (d) | 20,297,075 | ||||||||

| Independent Power & Renewable Electricity Producers – 0.8% | ||||||||||

| 91,960 | Dynegy, Inc., 5.375%, 11/1/17 | 9,237,382 | ||||||||

| Internet Software & Services – 1.5% | ||||||||||

| 349,200 | Barclays Bank PLC, 8.00%, 10/28/15 (Twitter, Inc.) (d) | 16,482,240 | ||||||||

| Machinery – 1.8% | ||||||||||

| 171,185 | Stanley Black & Decker, Inc., 6.25%, 11/17/16 | 19,744,478 | ||||||||

| Metals & Mining – 1.4% | ||||||||||

| 18,215 | Alcoa, Inc., 5.375%, 10/1/17 | 881,606 | ||||||||

| 792,720 | ArcelorMittal, 6.00%, 1/15/16 | 14,021,235 | ||||||||

| 14,902,841 | ||||||||||

| Multiline Retail – 1.5% | ||||||||||

| 258,000 | The Goldman Sachs Group, Inc., 8.00%, 1/14/16 (Macy’s, Inc.) (d) | 16,338,624 | ||||||||

| Multi-Utilities – 1.7% | ||||||||||

| 239,645 | AES Trust III, 6.75%, 10/15/29 | 12,205,120 | ||||||||

| 128,500 | Dominion Resources, Inc., 6.375%, 7/1/17 | 6,499,530 | ||||||||

| 18,704,650 | ||||||||||

| 12 | Annual Report | | February 28, 2015 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2015 (continued)

| Shares | Value | |||||||||

| Oil, Gas & Consumable Fuels – 1.8% | ||||||||||

| 191,170 | Credit Suisse, 8.00%, 3/5/15 (Occidental Petroleum Corp.) (d) | $14,301,428 | ||||||||

| 14,100 | Energy XXI Bermuda Ltd., 5.625% (e) | 738,048 | ||||||||

| 124,235 | PetroQuest Energy, Inc., 6.875% (e) | 3,354,345 | ||||||||

| 34,155 | Sanchez Energy Corp., 6.50%, 4/6/18 (e) | 1,434,510 | ||||||||

| 19,828,331 | ||||||||||

| Pharmaceuticals – 1.5% | ||||||||||

| 333,295 | JPMorgan Chase & Co., 8.00%, 4/30/15 (Mylan, Inc.) (d) | 16,504,768 | ||||||||

| Real Estate Investment Trust – 4.4% | ||||||||||

| 439,700 | Alexandria Real Estate Equities, Inc., 7.00% (e) | 12,751,300 | ||||||||

| 798,310 | FelCor Lodging Trust, Inc., 1.95%, Ser. A (e) | 20,556,483 | ||||||||

| 208,680 | Health Care REIT, Inc., 6.50%, 4/20/18, Ser. I (e) | 14,261,191 | ||||||||

| 47,568,974 | ||||||||||

| Semiconductors & Semiconductor Equipment – 3.0% | ||||||||||

| 246,000 | Barclays Bank PLC, 8.00%, 11/9/15 (Lam Research Corp.) (d) | 19,101,900 | ||||||||

| 530,000 | Wells Fargo & Co., 8.00%, 6/18/15 (Micron Technology, Inc.) (d) | 15,189,800 | ||||||||

| 34,291,700 | ||||||||||

| Specialty Retail – 1.8% | ||||||||||

| 13,250 | Barnes & Noble, Inc., 7.75%, 8/18/21 (a)(b) | 19,635,837 | ||||||||

| Technology Hardware, Storage & Peripherals – 2.0% | ||||||||||

| 27,900 | Bank of America Corp., 8.00%, 5/12/15 (Apple, Inc.) (d) | 21,315,600 | ||||||||

| Total Convertible Preferred Stock (cost-$421,942,788) | 444,880,901 | |||||||||

| Principal Amount (000s) |

||||||||||

| Convertible Bonds & Notes – 16.4% | ||||||||||

| Capital Markets – 3.3% | ||||||||||

| $7,740 | Ares Capital Corp., 5.75%, 2/1/16 | 8,044,762 | ||||||||

| 13,195 | BGC Partners, Inc., 4.50%, 7/15/16 | 14,341,316 | ||||||||

| 16,490 | Walter Investment Management Corp., 4.50%, 11/1/19 | 13,222,919 | ||||||||

| 35,608,997 | ||||||||||

| Commercial Services – 1.7% | ||||||||||

| 20,305 | Cenveo Corp., 7.00%, 5/15/17 | 18,769,434 | ||||||||

| Construction Materials – 0.7% | ||||||||||

| 7,645 | Cemex S.A.B. de C.V., 4.875%, 3/15/15 | 7,668,891 | ||||||||

| Diversified Consumer Services – 1.0% | ||||||||||

| 13,510 | Ascent Capital Group, Inc., 4.00%, 7/15/20 | 10,630,681 | ||||||||

| Hotels, Restaurants & Leisure – 0.4% | ||||||||||

| 4,270 | MGM Resorts International, 4.25%, 4/15/15 | 5,035,931 | ||||||||

| Insurance – 0.4% | ||||||||||

| 3,965 | HCI Group, Inc., 3.875%, 3/15/19 | 4,041,822 | ||||||||

| Life Sciences Tools & Services – 0.4% | ||||||||||

| 4,420 | Sequenom, Inc., 5.00%, 10/1/17 | 4,433,812 | ||||||||

| Machinery – 2.3% | ||||||||||

| Meritor, Inc., | ||||||||||

| 12,480 | 4.625%, 3/1/26 | 12,636,000 | ||||||||

| 6,225 | 7.875%, 3/1/26 | 10,057,266 | ||||||||

| 2,290 | Navistar International Corp., 4.75%, 4/15/19 (a)(b) | 2,026,650 | ||||||||

| 24,719,916 | ||||||||||

| February 28, 2015 | | Annual Report | 13 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| Oil, Gas & Consumable Fuels – 0.8% | ||||||||||

| $2,280 | Cobalt International Energy, Inc., 2.625%, 12/1/19 | $1,657,275 | ||||||||

| 9,960 | Goodrich Petroleum Corp., 5.00%, 10/1/32 | 5,029,800 | ||||||||

| 1,825 | Stone Energy Corp., 1.75%, 3/1/17 | 1,689,266 | ||||||||

| 8,376,341 | ||||||||||

| Personal Products – 1.0% | ||||||||||

| 15,310 | Herbalife Ltd., 2.00%, 8/15/19 (a) | 11,568,695 | ||||||||

| Real Estate Investment Trust – 0.6% | ||||||||||

| 7,070 | IAS Operating Partnership LP, 5.00%, 3/15/18 (a)(b) | 6,796,037 | ||||||||

| Software – 0.9% | ||||||||||

| 10,320 | TeleCommunication Systems, Inc., 7.75%, 6/30/18 | 9,752,400 | ||||||||

| Thrifts & Mortgage Finance – 0.7% | ||||||||||

| 6,535 | MGIC Investment Corp., 5.00%, 5/1/17 | 7,306,947 | ||||||||

| Tobacco – 2.1% | ||||||||||

| Vector Group Ltd., (f) | ||||||||||

| 5,665 | 1.75%, 4/15/20 | 6,114,659 | ||||||||

| 11,865 | 2.50%, 1/15/19 | 17,310,122 | ||||||||

| 23,424,781 | ||||||||||

| Trading Companies & Distribution – 0.1% | ||||||||||

| 1,190 | Titan Machinery, Inc., 3.75%, 5/1/19 | 869,444 | ||||||||

| Total Convertible Bonds & Notes (cost-$171,002,933) | 179,004,129 | |||||||||

| Shares | ||||||||||

| Common Stock – 0.3% | ||||||||||

| Banks – 0.3% | ||||||||||

| 60,947 | Citigroup, Inc. (cost-$3,568,159) | 3,194,842 | ||||||||

| Principal Amount (000s) |

||||||||||

| Short-Term Investment – 1.2% | ||||||||||

| Time Deposit – 1.2% | ||||||||||

| $12,599 | JPMorgan Chase & Co.-Nassau, 0.03%, 3/2/15 (cost-$12,599,082) | 12,599,082 | ||||||||

| Total Investments (cost-$1,077,900,780) – 100.0% | $1,089,224,939 | |||||||||

Notes to Schedule of Investments:

| (a) | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $122,659,333, representing 11.3% of total investments. |

| (b) | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. |

| (c) | In default. |

| (d) | Securities exchangeable or convertible into securities of an entity different than the issuer or structured by the issuer to provide exposure to securities of an entity different than the issuer (synthetic convertible securities). Such entity is identified in the parenthetical. |

| (e) | Perpetual maturity. The date shown, if any, is the next call date. |

| (f) | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. |

| 14 | Annual Report | | February 28, 2015 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2015 (continued)

| (g) | Fair Value Measurements-See Note 1(b) in Notes to Financial Statements. |

| Level 1 – Quoted Prices |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant Unobservable Inputs |

Value at 2/28/15 |

|||||||||||||

| Investments in Securities – Assets |

| |||||||||||||||

| Corporate Bonds & Notes |

$ | – | $449,545,985 | $ | – | $449,545,985 | ||||||||||

| Convertible Preferred Stock: |

||||||||||||||||

| Automobiles |

– | – | 18,538,604 | 18,538,604 | ||||||||||||

| Banks |

30,244,465 | – | 16,265,560 | 46,510,025 | ||||||||||||

| Electronic Equipment, Instruments & Components |

– | – | 18,073,620 | 18,073,620 | ||||||||||||

| Energy Equipment & Services |

– | – | 17,643,294 | 17,643,294 | ||||||||||||

| Food Products |

– | – | 15,175,740 | 15,175,740 | ||||||||||||

| Health Care Equipment & Supplies |

– | – | 19,120,261 | 19,120,261 | ||||||||||||

| Health Care Providers & Services |

– | – | 20,297,075 | 20,297,075 | ||||||||||||

| Internet Software & Services |

– | – | 16,482,240 | 16,482,240 | ||||||||||||

| Metals & Mining |

881,606 | 14,021,235 | – | 14,902,841 | ||||||||||||

| Multiline Retail |

– | – | 16,338,624 | 16,338,624 | ||||||||||||

| Oil, Gas & Consumable Fuels |

3,354,345 | 2,172,558 | 14,301,428 | 19,828,331 | ||||||||||||

| Pharmaceuticals |

– | – | 16,504,768 | 16,504,768 | ||||||||||||

| Semiconductors & Semiconductor Equipment |

– | – | 34,291,700 | 34,291,700 | ||||||||||||

| Specialty Retail |

– | 19,635,837 | – | 19,635,837 | ||||||||||||

| Technology Hardware, Storage & Peripherals |

– | – | 21,315,600 | 21,315,600 | ||||||||||||

| All Other |

130,222,341 | – | – | 130,222,341 | ||||||||||||

| Convertible Bonds & Notes |

– | 179,004,129 | – | 179,004,129 | ||||||||||||

| Common Stock |

3,194,842 | – | – | 3,194,842 | ||||||||||||

| Short-Term Investment |

– | 12,599,082 | – | 12,599,082 | ||||||||||||

| Totals |

$ | 167,897,599 | $676,978,826 | $ | 244,348,514 | $ | 1,089,224,939 | |||||||||

At February 28, 2015, a security valued at $3,354,345 was transferred from Level 2 to Level 1 due to the availability of an exchange-traded closing price.

| February 28, 2015 | | Annual Report | 15 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund

February 28, 2015 (continued)

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for the year ended February 28, 2015, was as follows:

| Beginning Balance 2/28/14 |

Purchases | Sales | Accrued Discounts (Premiums) |

Net (Loss) |

Net Change in Unrealized Appreciation/ Depreciation |

Transfers into Level 3 |

Transfers out of Level 3 |

Ending Balance 2/28/15 |

||||||||||||||||||||||||||||

| Investments in Securities – Assets |

|

|||||||||||||||||||||||||||||||||||

| Convertible Preferred Stock: |

|

|||||||||||||||||||||||||||||||||||

| Automobiles |

$13,802,523 | $21,749,086 | $(15,012,339 | ) | $ – | $(4,957,306 | ) | $2,956,640 | $ – | $ – | $18,538,604 | |||||||||||||||||||||||||

| Banks |

15,935,338 | 20,061,560 | (19,850,164 | ) | – | – | 118,826 | – | – | 16,265,560 | ||||||||||||||||||||||||||

| Computers & Peripherals |

12,985,586 | – | (13,019,681 | )† | – | – | 34,095 | – | – | – | ||||||||||||||||||||||||||

| Electronic Equipment, Instruments & Components |

– | 18,184,320 | – | – | – | (110,700 | ) | – | – | 18,073,620 | ||||||||||||||||||||||||||

| Energy Equipment & Services |

39,698,096 | – | (22,376,924 | ) | – | 3,560,974 | (3,238,852 | ) | – | – | 17,643,294 | |||||||||||||||||||||||||

| Food Products |

– | 16,381,771 | – | – | – | (1,206,031 | ) | – | – | 15,175,740 | ||||||||||||||||||||||||||

| Health Care Equipment & Supplies |

– | 17,767,244 | – | – | – | 1,353,017 | – | – | 19,120,261 | |||||||||||||||||||||||||||

| Health Care Providers & Services |

– | 18,043,098 | – | – | – | 2,253,977 | – | – | 20,297,075 | |||||||||||||||||||||||||||

| Household Durables |

14,324,200 | – | (13,840,543 | )† | – | – | (483,657 | ) | – | – | – | |||||||||||||||||||||||||

| Insurance |

14,641,250 | – | (14,915,891 | ) | – | 1,319,888 | (1,045,247 | ) | – | – | – | |||||||||||||||||||||||||

| Internet & Catalog Retail |

14,992,436 | – | (13,224,046 | ) | – | 2,121,459 | (3,889,849 | ) | – | – | – | |||||||||||||||||||||||||

| Internet Software & Services |

– | 18,022,212 | – | – | – | (1,539,972 | ) | – | – | 16,482,240 | ||||||||||||||||||||||||||

| Multiline Retail |

17,715,255 | 17,304,576 | (18,528,363 | ) | – | 687,965 | (840,809 | ) | – | – | 16,338,624 | |||||||||||||||||||||||||

| Oil, Gas & Consumable Fuels |

18,189,826 | – | – | – | – | (3,888,398 | ) | – | – | 14,301,428 | ||||||||||||||||||||||||||

| Pharmaceuticals |

17,363,636 | 16,702,079 | (24,398,651 | ) | – | 7,902,767 | (1,065,063 | ) | – | – | 16,504,768 | |||||||||||||||||||||||||

| Semiconductors & Semiconductor Equipment |

– | 36,882,342 | – | – | – | (2,590,642 | ) | – | – | 34,291,700 | ||||||||||||||||||||||||||

| Technology Hardware, Storage & Peripherals |

– | 16,735,165 | – | – | – | 4,580,435 | – | – | 21,315,600 | |||||||||||||||||||||||||||

| Totals |

$179,648,146 | $217,833,453 | $(155,166,602 | ) | $ – | $10,635,747 | $(8,602,230 | ) | $ – | $ – | $244,348,514 | |||||||||||||||||||||||||

| † | Conversion |

The following table presents additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 at February 28, 2015:

| Ending Balance at 2/28/15 |

Valuation Technique Used |

Unobservable Inputs |

Input Values | |||||||

| Investments in Securities – Assets |

||||||||||

| Convertible Preferred Stock |

$244,348,514 | Third-Party Pricing Vendor | Single Broker Quote | $15.28-$764.00 | ||||||

The net change in unrealized appreciation/depreciation of Level 3 investments held at February 28, 2015 was $(4,261,022). Net realized gain (loss) and change in unrealized appreciation/depreciation is reflected on the Statement of Operations.

Glossary:

| REIT | - | Real Estate Investment Trust |

| 16 | Annual Report | | February 28, 2015 | | See accompanying Notes to Financial Statements |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015

| Principal Amount (000s) |

Value | |||||||||

| Corporate Bonds & Notes – 42.0% | ||||||||||

| Advertising – 0.4% | ||||||||||

| $4,350 | Affinion Group, Inc., 7.875%, 12/15/18 | $2,947,125 | ||||||||

| Aerospace & Defense – 0.5% | ||||||||||

| 250 | Bombardier, Inc., 6.00%, 10/15/22 (a)(b) | 240,625 | ||||||||

| 5,030 | Erickson, Inc., 8.25%, 5/1/20 | 4,137,175 | ||||||||

| 4,377,800 | ||||||||||

| Air Freight & Logistics – 0.7% | ||||||||||

| 5,230 | XPO Logistics, Inc., 7.875%, 9/1/19 (a)(b) | 5,609,175 | ||||||||

| Auto Components – 0.8% | ||||||||||

| 3,320 | Chassix, Inc., 9.25%, 8/1/18 (a)(b)(c) | 2,423,600 | ||||||||

| 3,970 | Goodyear Tire & Rubber Co., 8.25%, 8/15/20 | 4,242,937 | ||||||||

| 6,666,537 | ||||||||||

| Auto Manufacturers – 0.8% | ||||||||||

| 5,590 | Chrysler Group LLC, 8.25%, 6/15/21 | 6,267,788 | ||||||||

| Commercial Services – 2.6% | ||||||||||

| 3,000 | Avis Budget Car Rental LLC/Avis Budget Finance, Inc., 9.75%, 3/15/20 | 3,285,000 | ||||||||

| 8,535 | Cenveo Corp., 11.50%, 5/15/17 | 8,705,700 | ||||||||

| 4,295 | DynCorp International, Inc., 10.375%, 7/1/17 | 3,919,187 | ||||||||

| 5,925 | Monitronics International, Inc., 9.125%, 4/1/20 | 5,865,750 | ||||||||

| 21,775,637 | ||||||||||

| Commercial Services & Supplies – 0.6% | ||||||||||

| 4,355 | United Rentals North America, Inc., 8.375%, 9/15/20 | 4,681,625 | ||||||||

| Construction Materials – 0.7% | ||||||||||

| 5,690 | US Concrete, Inc., 8.50%, 12/1/18 | 6,059,850 | ||||||||

| Consumer Finance – 0.9% | ||||||||||

| 2,605 | Navient Corp., 8.45%, 6/15/18 | 2,982,725 | ||||||||

| 3,865 | Springleaf Finance Corp., 8.25%, 10/1/23 | 4,425,425 | ||||||||

| 7,408,150 | ||||||||||

| Distribution/Wholesale – 0.9% | ||||||||||

| 6,430 | HD Supply, Inc., 11.00%, 4/15/20 | 7,394,500 | ||||||||

| Diversified Consumer Services – 0.6% | ||||||||||

| 5,270 | Cambium Learning Group, Inc., 9.75%, 2/15/17 | 5,322,700 | ||||||||

| Diversified Financial Services – 1.8% | ||||||||||

| Community Choice Financial, Inc., | ||||||||||

| 7,465 | 10.75%, 5/1/19 | 4,852,250 | ||||||||

| 5,370 | 12.75%, 5/1/20 (a)(b) | 3,383,100 | ||||||||

| Nationstar Mortgage LLC / Nationstar Capital Corp., | ||||||||||

| 2,000 | 7.875%, 10/1/20 | 2,020,000 | ||||||||

| 4,250 | 9.625%, 5/1/19 | 4,547,500 | ||||||||

| 14,802,850 | ||||||||||

| Diversified Telecommunications – 0.5% | ||||||||||

| 3,692 | Cincinnati Bell, Inc., 8.75%, 3/15/18 | 3,780,608 | ||||||||

| Electrical Components & Equipment – 1.2% | ||||||||||

| 10,275 | WireCo WorldGroup, Inc., 9.50%, 5/15/17 | 10,172,250 | ||||||||

| Electronic Equipment, Instruments & Components – 1.4% | ||||||||||

| 5,815 | Kemet Corp., 10.50%, 5/1/18 | 5,989,450 | ||||||||

| 5,500 | Viasystems, Inc., 7.875%, 5/1/19 (a)(b) | 5,830,000 | ||||||||

| 11,819,450 | ||||||||||

| February 28, 2015 | | Annual Report | 17 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| Energy Equipment & Services – 0.1% | ||||||||||

| $2,170 | Hercules Offshore, Inc., 8.75%, 7/15/21 (a)(b) | $683,550 | ||||||||

| Food & Staples Retailing – 0.6% | ||||||||||

| 5,000 | US Foods, Inc., 8.50%, 6/30/19 | 5,256,250 | ||||||||

| Health Care Providers & Services – 1.7% | ||||||||||

| 6,585 | ExamWorks Group, Inc., 9.00%, 7/15/19 | 7,013,025 | ||||||||

| Tenet Healthcare Corp., | ||||||||||

| 2,750 | 5.00%, 3/1/19 (a)(b) | 2,770,625 | ||||||||

| 3,470 | 8.125%, 4/1/22 | 3,938,450 | ||||||||

| 13,722,100 | ||||||||||

| Healthcare-Products – 0.9% | ||||||||||

| 6,785 | Kinetic Concepts, Inc./KCI USA, Inc., 10.50%, 11/1/18 | 7,438,056 | ||||||||

| Hotels, Restaurants & Leisure – 0.9% | ||||||||||

| 6,395 | MGM Resorts International, 11.375%, 3/1/18 | 7,785,913 | ||||||||

| Household Durables – 0.9% | ||||||||||

| Beazer Homes USA, Inc., | ||||||||||

| 2,245 | 7.25%, 2/1/23 | 2,152,394 | ||||||||

| 3,920 | 9.125%, 5/15/19 | 4,052,300 | ||||||||

| 1,390 | Jarden Corp., 7.50%, 5/1/17 | 1,539,425 | ||||||||

| 7,744,119 | ||||||||||

| Household Products/Wares – 0.8% | ||||||||||

| 5,725 | Reynolds Group Issuer, Inc., 9.875%, 8/15/19 | 6,161,531 | ||||||||

| Internet – 0.5% | ||||||||||

| 6,462 | Affinion Investments LLC, 13.50%, 8/15/18 | 4,264,722 | ||||||||

| Internet Software & Services – 1.2% | ||||||||||

| EarthLink, Inc., | ||||||||||

| 2,200 | 7.375%, 6/1/20 | 2,260,500 | ||||||||

| 7,590 | 8.875%, 5/15/19 | 7,836,675 | ||||||||

| 10,097,175 | ||||||||||

| Iron/Steel – 0.6% | ||||||||||

| 5,600 | AK Steel Corp., 8.375%, 4/1/22 | 5,012,000 | ||||||||

| Lodging – 0.2% | ||||||||||

| 9,455 | Caesars Entertainment Operating Co., Inc., 12.75%, 4/15/18 (c) | 1,749,175 | ||||||||

| Machinery – 1.2% | ||||||||||

| 4,225 | BlueLine Rental Finance Corp., 7.00%, 2/1/19 (a)(b) | 4,394,000 | ||||||||

| 5,495 | Navistar International Corp., 8.25%, 11/1/21 | 5,543,081 | ||||||||

| 9,937,081 | ||||||||||

| Media – 3.1% | ||||||||||

| 5,500 | AMC Entertainment, Inc., 9.75%, 12/1/20 | 6,077,500 | ||||||||

| 6,645 | McClatchy Co., 9.00%, 12/15/22 | 6,777,900 | ||||||||

| 6,280 | McGraw-Hill Global Education Holdings LLC / McGraw-Hill Global Education Finance, 9.75%, 4/1/21 | 7,096,400 | ||||||||

| 2,850 | Mood Media Corp., 9.25%, 10/15/20 (a)(b) | 2,458,125 | ||||||||

| 3,589 | SFX Entertainment, Inc., 9.625%, 2/1/19 (a)(b) | 3,553,110 | ||||||||

| 25,963,035 | ||||||||||

| Metals & Mining – 2.0% | ||||||||||

| 5,050 | ArcelorMittal, 10.60%, 6/1/19 | 6,255,687 | ||||||||

| 2,820 | HudBay Minerals, Inc., 9.50%, 10/1/20 | 2,904,600 | ||||||||

| 18 | Annual Report | | February 28, 2015 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| Thompson Creek Metals Co., Inc., | ||||||||||

| $6,145 | 7.375%, 6/1/18 | $5,100,350 | ||||||||

| 2,170 | 12.50%, 5/1/19 | 1,931,300 | ||||||||

| 16,191,937 | ||||||||||

| Miscellaneous Manufacturing – 0.7% | ||||||||||

| 5,650 | Harland Clarke Holdings Corp., 9.25%, 3/1/21 (a)(b) | 5,501,688 | ||||||||

| Oil & Gas – 1.3% | ||||||||||

| 7,000 | Energy XXI Gulf Coast, Inc., 9.25%, 12/15/17 | 5,110,000 | ||||||||

| 4,306 | United Refining Co., 10.50%, 2/28/18 | 4,562,207 | ||||||||

| 1,000 | Vanguard Natural Resources LLC / VNR Finance Corp., 7.875%, 4/1/20 | 918,750 | ||||||||

| 10,590,957 | ||||||||||

| Oil, Gas & Consumable Fuels – 1.7% | ||||||||||

| 2,160 | Arch Coal, Inc., 9.875%, 6/15/19 | 788,400 | ||||||||

| 4,550 | EP Energy LLC / Everest Acquisition Finance, Inc., 9.375%, 5/1/20 | 4,879,875 | ||||||||

| 4,200 | Laredo Petroleum, Inc., 9.50%, 2/15/19 | 4,389,000 | ||||||||

| 4,305 | Linn Energy LLC / Linn Energy Finance Corp., 6.50%, 5/15/19 | 3,788,400 | ||||||||

| 560 | Ultra Petroleum Corp., 6.125%, 10/1/24 (a)(b) | 534,800 | ||||||||

| 14,380,475 | ||||||||||

| Packaging & Containers – 0.8% | ||||||||||

| 5,903 | Tekni-Plex, Inc., 9.75%, 6/1/19 (a)(b) | 6,434,270 | ||||||||

| Paper & Forest Products – 0.3% | ||||||||||

| 2,000 | Louisiana-Pacific Corp., 7.50%, 6/1/20 | 2,145,000 | ||||||||

| Pharmaceuticals – 0.2% | ||||||||||

| 1,755 | Endo Finance LLC & Endo Finco, Inc., 5.375%, 1/15/23 (a)(b) | 1,790,100 | ||||||||

| Real Estate Investment Trust – 0.3% | ||||||||||

| 2,345 | Kennedy-Wilson, Inc., 5.875%, 4/1/24 | 2,374,313 | ||||||||

| Retail – 0.7% | ||||||||||

| 5,785 | Neiman Marcus Group Ltd. LLC, 8.00%, 10/15/21 (a)(b) | 6,110,406 | ||||||||

| Semiconductors & Semiconductor Equipment – 1.0% | ||||||||||

| 2,875 | Amkor Technology, Inc., 6.375%, 10/1/22 | 2,997,188 | ||||||||

| 4,717 | Freescale Semiconductor, Inc., 10.75%, 8/1/20 | 5,144,478 | ||||||||

| 8,141,666 | ||||||||||

| Software – 1.8% | ||||||||||

| First Data Corp., | ||||||||||

| 4,355 | 8.25%, 1/15/21 (a)(b) | 4,692,513 | ||||||||

| 1,465 | 10.625%, 6/15/21 | 1,692,075 | ||||||||

| 6,955 | 12.625%, 1/15/21 | 8,332,090 | ||||||||

| 14,716,678 | ||||||||||

| Specialty Retail – 1.3% | ||||||||||

| 3,140 | Brown Shoe Co., Inc., 7.125%, 5/15/19 | 3,273,450 | ||||||||

| 4,500 | Claire’s Stores, Inc., 9.00%, 3/15/19 (a)(b) | 4,246,875 | ||||||||

| 3,500 | Conn’s, Inc., 7.25%, 7/15/22 (a)(b) | 3,171,875 | ||||||||

| 10,692,200 | ||||||||||

| Telecommunications – 1.4% | ||||||||||

| 6,085 | Consolidated Communications, Inc., 10.875%, 6/1/20 | 6,883,656 | ||||||||

| 4,340 | Windstream Corp., 7.50%, 4/1/23 | 4,307,450 | ||||||||

| 11,191,106 | ||||||||||

| Transportation – 0.6% | ||||||||||

| 5,044 | Quality Distribution LLC, 9.875%, 11/1/18 | 5,308,810 | ||||||||

| February 28, 2015 | | Annual Report | 19 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| Wireless Telecommunication Services – 0.8% | ||||||||||

| $5,545 | Sprint Communications, Inc., 11.50%, 11/15/21 | $6,875,800 | ||||||||

| Total Corporate Bonds & Notes (cost-$362,325,982) | 347,346,158 | |||||||||

| Shares | ||||||||||

| Convertible Preferred Stock – 40.7% | ||||||||||

| Aerospace & Defense – 1.4% | ||||||||||

| 181,200 | United Technologies Corp., 7.50%, 8/1/15 | 11,542,440 | ||||||||

| Automobiles – 1.7% | ||||||||||

| 402,000 | The Goldman Sachs Group, Inc., 8.00%, 12/17/15 (General Motors) (d) | 14,008,494 | ||||||||

| Banks – 4.2% | ||||||||||

| 7,455 | Huntington Bancshares, Inc., 8.50% (e) | 10,213,350 | ||||||||

| 805,310 | JPMorgan Chase & Co., 8.00%, 9/18/15 (Bank of America) (d) | 12,305,137 | ||||||||

| 9,900 | Wells Fargo & Co., 7.50%, Ser. L (e) | 12,003,354 | ||||||||

| 34,521,841 | ||||||||||

| Diversified Financial Services – 1.4% | ||||||||||

| 10,100 | Bank of America Corp., 7.25%, Ser. L (e) | 11,817,000 | ||||||||

| Electric Utilities – 0.8% | ||||||||||

| 134,610 | Exelon Corp., 6.50%, 6/1/17 | 6,676,656 | ||||||||

| Electronic Equipment, Instruments & Components – 1.6% | ||||||||||

| 557,000 | Bank of America Corp., 8.00%, 2/17/16 (Corning, Inc.) (d) | 13,640,930 | ||||||||

| Energy Equipment & Services – 1.6% | ||||||||||

| 240,590 | Credit Suisse, 8.00%, 3/5/15 (Baker Hughes) (d) | 13,545,217 | ||||||||

| Food Products – 1.4% | ||||||||||

| 246,900 | Wells Fargo & Co., 8.00%, 8/28/15 (Archer-Daniels-Midland Co.) (d) | 11,480,850 | ||||||||

| Health Care Equipment & Supplies – 1.8% | ||||||||||

| 210,000 | Credit Suisse, 8.00%, 6/23/15 (Medtronic, Inc.) (d) | 14,660,100 | ||||||||

| Health Care Providers & Services – 1.9% | ||||||||||

| 257,800 | JPMorgan Chase & Co., 8.00%, 5/5/15 (HCA Holdings, Inc.) (d) | 15,403,550 | ||||||||

| Independent Power & Renewable Electricity Producers – 0.9% | ||||||||||

| 72,035 | Dynegy, Inc., 5.375%, 11/1/17 | 7,235,916 | ||||||||

| Internet Software & Services – 1.5% | ||||||||||

| 264,285 | Barclays Bank PLC, 8.00%, 10/28/15 (Twitter, Inc.) (d) | 12,474,252 | ||||||||

| Machinery – 1.8% | ||||||||||

| 128,815 | Stanley Black & Decker, Inc., 6.25%, 11/17/16 | 14,857,522 | ||||||||

| Metals & Mining – 1.4% | ||||||||||

| 13,785 | Alcoa, Inc., 5.375%, 10/1/17 | 667,194 | ||||||||

| 604,670 | ArcelorMittal, 6.00%, 1/15/16 | 10,695,100 | ||||||||

| 11,362,294 | ||||||||||

| Multiline Retail – 1.5% | ||||||||||

| 195,000 | The Goldman Sachs Group, Inc., 8.00%, 1/14/16 (Macy’s, Inc.) (d) | 12,348,960 | ||||||||

| Multi-Utilities – 1.1% | ||||||||||

| 186,560 | AES Trust III, 6.75%, 10/15/29 | 9,501,501 | ||||||||

| Oil, Gas & Consumable Fuels – 1.8% | ||||||||||

| 146,765 | Credit Suisse, 8.00%, 3/5/15 (Occidental Petroleum Corp.) (d) | 10,979,490 | ||||||||

| 10,900 | Energy XXI Bermuda Ltd., 5.625% (e) | 570,547 | ||||||||

| 94,905 | PetroQuest Energy, Inc., 6.875% (e) | 2,562,435 | ||||||||

| 20 | Annual Report | | February 28, 2015 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015 (continued)

| Shares | Value | |||||||||

| 25,840 | Sanchez Energy Corp., 6.50%, 4/6/18 (e) | $1,085,280 | ||||||||

| 15,197,752 | ||||||||||

| Pharmaceuticals – 1.5% | ||||||||||

| 253,015 | JPMorgan Chase & Co., 8.00%, 4/30/15 (Mylan, Inc.) (d) | 12,529,303 | ||||||||

| Real Estate Investment Trust – 4.4% | ||||||||||

| 335,200 | Alexandria Real Estate Equities, Inc., 7.00% (e) | 9,720,800 | ||||||||

| 610,095 | FelCor Lodging Trust, Inc., 1.95%, Ser. A (e) | 15,709,946 | ||||||||

| 159,235 | Health Care REIT, Inc., 6.50%, 4/20/18, Ser. I (e) | 10,882,120 | ||||||||

| 36,312,866 | ||||||||||

| Semiconductors & Semiconductor Equipment – 3.2% | ||||||||||

| 186,000 | Barclays Bank PLC, 8.00%, 11/9/15 (Lam Research Corp.) (d) | 14,442,900 | ||||||||

| 420,000 | Wells Fargo & Co., 8.00%, 6/18/15 (Micron Technology, Inc.) (d) | 12,037,200 | ||||||||

| 26,480,100 | ||||||||||

| Specialty Retail – 1.8% | ||||||||||

| 10,000 | Barnes & Noble, Inc., 7.75%, 8/18/21 (a)(b) | 14,819,500 | ||||||||

| Technology Hardware, Storage & Peripherals – 2.0% | ||||||||||

| 21,135 | Bank of America Corp., 8.00%, 5/12/15 (Apple, Inc.) (d) | 16,147,140 | ||||||||

| Total Convertible Preferred Stock (cost-$317,079,922) | 336,564,184 | |||||||||

| Principal Amount (000s) |

||||||||||

| Convertible Bonds & Notes – 16.1% | ||||||||||

| Capital Markets – 3.3% | ||||||||||

| $5,880 | Ares Capital Corp., 5.75%, 2/1/16 | 6,111,525 | ||||||||

| 10,075 | BGC Partners, Inc., 4.50%, 7/15/16 | 10,950,266 | ||||||||

| 12,440 | Walter Investment Management Corp., 4.50%, 11/1/19 | 9,975,325 | ||||||||

| 27,037,116 | ||||||||||

| Commercial Services – 1.7% | ||||||||||

| 15,600 | Cenveo Corp., 7.00%, 5/15/17 | 14,420,250 | ||||||||

| Construction Materials – 0.7% | ||||||||||

| 5,850 | Cemex S.A.B. de C.V., 4.875%, 3/15/15 | 5,868,281 | ||||||||

| Diversified Consumer Services – 1.0% | ||||||||||

| 10,220 | Ascent Capital Group, Inc., 4.00%, 7/15/20 | 8,041,862 | ||||||||

| Hotels, Restaurants & Leisure – 0.4% | ||||||||||

| 3,240 | MGM Resorts International, 4.25%, 4/15/15 | 3,821,175 | ||||||||

| Insurance – 0.4% | ||||||||||

| 3,035 | HCI Group, Inc., 3.875%, 3/15/19 | 3,093,803 | ||||||||

| Life Sciences Tools & Services – 0.4% | ||||||||||

| 3,470 | Sequenom, Inc., 5.00%, 10/1/17 | 3,480,844 | ||||||||

| Machinery – 2.3% | ||||||||||

| Meritor, Inc., | ||||||||||

| 9,545 | 4.625%, 3/1/26 | 9,664,312 | ||||||||

| 4,755 | 7.875%, 3/1/26 | 7,682,297 | ||||||||

| 1,710 | Navistar International Corp., 4.75%, 4/15/19 (a)(b) | 1,513,350 | ||||||||

| 18,859,959 | ||||||||||

| Oil, Gas & Consumable Fuels – 0.8% | ||||||||||

| 1,720 | Cobalt International Energy, Inc., 2.625%, 12/1/19 | 1,250,225 | ||||||||

| 7,540 | Goodrich Petroleum Corp., 5.00%, 10/1/32 | 3,807,700 | ||||||||

| February 28, 2015 | | Annual Report | 21 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015 (continued)

| Principal Amount (000s) |

Value | |||||||||

| $1,380 | Stone Energy Corp., 1.75%, 3/1/17 | $1,277,362 | ||||||||

| 6,335,287 | ||||||||||

| Personal Products – 1.0% | ||||||||||

| 11,615 | Herbalife Ltd., 2.00%, 8/15/19 (a) | 8,776,642 | ||||||||

| Real Estate Investment Trust – 0.3% | ||||||||||

| 2,430 | IAS Operating Partnership LP, 5.00%, 3/15/18 (a)(b) | 2,335,838 | ||||||||

| Software – 0.9% | ||||||||||

| 7,890 | TeleCommunication Systems, Inc., 7.75%, 6/30/18 | 7,456,050 | ||||||||

| Thrifts & Mortgage Finance – 0.7% | ||||||||||

| 4,965 | MGIC Investment Corp., 5.00%, 5/1/17 | 5,551,491 | ||||||||

| Tobacco – 2.1% | ||||||||||

| Vector Group Ltd., (f) | ||||||||||

| 4,335 | 1.75%, 4/15/20 | 4,679,091 | ||||||||

| 9,035 | 2.50%, 1/15/19 | 13,181,369 | ||||||||

| 17,860,460 | ||||||||||

| Trading Companies & Distribution – 0.1% | ||||||||||

| 910 | Titan Machinery, Inc., 3.75%, 5/1/19 | 664,869 | ||||||||

| Total Convertible Bonds & Notes (cost-$127,508,378) | 133,603,927 | |||||||||

| Shares | ||||||||||

| Common Stock – 0.3% | ||||||||||

| Banks – 0.3% | ||||||||||

| 46,017 | Citigroup, Inc. (cost-$2,692,376) | 2,412,211 | ||||||||

| Principal Amount (000s) |

||||||||||

| Short-Term Investment – 0.9% | ||||||||||

| Time Deposit – 0.9% | ||||||||||

| $7,246 | JPMorgan Chase & Co.-Nassau, 0.03%, 3/2/15 (cost-$7,245,721) | 7,245,721 | ||||||||

| Total Investments (cost-$816,852,379) – 100.0% | $827,172,201 | |||||||||

Notes to Schedule of Investments:

| (a) | Private Placement–Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $91,273,767, representing 11.0% of total investments. |

| (b) | 144A–Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Unless otherwise indicated, these securities are not considered to be illiquid. |

| (c) | In default. |

| (d) | Securities exchangeable or convertible into securities of an entity different than the issuer or structured by the issuer to provide exposure to securities of an entity different than the issuer (synthetic convertible securities). Such entity is identified in the parenthetical. |

| (e) | Perpetual maturity. The date shown, if any, is the next call date. |

| (f) | In addition to the coupon rate shown, the issuer is expected to pay additional interest based on the actual dividends paid on its common stock. |

| 22 | Annual Report | | February 28, 2015 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015 (continued)

| (g) | Fair Value Measurements – See Note 1(b) in Notes to Financial Statements. |

| Level 1 – Quoted Prices |

Level 2 – Other Significant Observable Inputs |

Level 3 – Significant Unobservable Inputs |

Value at 2/28/15 |

|||||||||||||

| Investments in Securities – Assets |

||||||||||||||||

| Corporate Bonds & Notes |

$ | – | $347,346,158 | $ | – | $347,346,158 | ||||||||||

| Convertible Preferred Stock: |

||||||||||||||||

| Automobiles |

– | – | 14,008,494 | 14,008,494 | ||||||||||||

| Banks |

22,216,704 | – | 12,305,137 | 34,521,841 | ||||||||||||

| Electronic Equipment, Instruments & Components |

– | – | 13,640,930 | 13,640,930 | ||||||||||||

| Energy Equipment & Services |

– | – | 13,545,217 | 13,545,217 | ||||||||||||

| Food Products |

– | – | 11,480,850 | 11,480,850 | ||||||||||||

| Health Care Equipment & Supplies |

– | – | 14,660,100 | 14,660,100 | ||||||||||||

| Health Care Providers & Services |

– | – | 15,403,550 | 15,403,550 | ||||||||||||

| Internet Software & Services |

– | – | 12,474,252 | 12,474,252 | ||||||||||||

| Metals & Mining |

667,194 | 10,695,100 | – | 11,362,294 | ||||||||||||

| Multiline Retail |

– | – | 12,348,960 | 12,348,960 | ||||||||||||

| Oil, Gas & Consumable Fuels |

2,562,435 | 1,655,827 | 10,979,490 | 15,197,752 | ||||||||||||

| Pharmaceuticals |

– | – | 12,529,303 | 12,529,303 | ||||||||||||

| Semiconductors & Semiconductor Equipment |

– | – | 26,480,100 | 26,480,100 | ||||||||||||

| Specialty Retail |

– | 14,819,500 | – | 14,819,500 | ||||||||||||

| Technology Hardware, Storage & Peripherals |

– | – | 16,147,140 | 16,147,140 | ||||||||||||

| All Other |

97,943,901 | – | – | 97,943,901 | ||||||||||||

| Convertible Bonds & Notes |

– | 133,603,927 | – | 133,603,927 | ||||||||||||

| Common Stock |

2,412,211 | – | – | 2,412,211 | ||||||||||||

| Short-Term Investment |

– | 7,245,721 | – | 7,245,721 | ||||||||||||

| Totals |

$ | 125,802,445 | $515,366,233 | $ | 186,003,523 | $827,172,201 | ||||||||||

At February 28, 2015, a security valued at $2,562,435 was transferred from Level 2 to Level 1 due to the availability of an exchange-traded closing price.

| February 28, 2015 | | Annual Report | 23 |

Table of Contents

Schedule of Investments

AllianzGI Convertible & Income Fund II

February 28, 2015 (continued)

A roll forward of fair value measurements using significant unobservable inputs (Level 3) for the year ended February 28, 2015, was as follows:

| Beginning Balance 2/28/14 |

Purchases | Sales | Accrued Discounts (Premiums) |

Net (Loss) |

Net Change in Unrealized |

Transfers into Level 3 |

Transfers out of Level 3 |

Ending Balance 2/28/15 |

||||||||||||||||||||||||||||

| Investments in Securities – Assets |

|

|||||||||||||||||||||||||||||||||||

| Convertible Preferred Stock: |

|

|||||||||||||||||||||||||||||||||||

| Automobiles |

$10,665,088 | $16,344,563 | $(11,461,048 | ) | $ – | $(3,803,124 | ) | $2,263,015 | $ – | $ – | $14,008,494 | |||||||||||||||||||||||||

| Banks |

12,419,982 | 15,196,336 | (15,435,092 | ) | – | – | 123,911 | – | – | 12,305,137 | ||||||||||||||||||||||||||

| Computers & Peripherals |

9,953,184 | – | (9,979,317 | )† | – | – | 26,133 | – | – | – | ||||||||||||||||||||||||||

| Electronic Equipment, Instruments & Components |

– | 13,724,480 | – | – | – | (83,550 | ) | – | – | 13,640,930 | ||||||||||||||||||||||||||

| Energy Equipment & Services |

30,527,518 | – | (17,234,994 | ) | – | 2,742,995 | (2,490,302 | ) | – | – | 13,545,217 | |||||||||||||||||||||||||

| Food Products |

– | 12,393,244 | – | – | – | (912,394 | ) | – | – | 11,480,850 | ||||||||||||||||||||||||||

| Health Care Equipment & Supplies |

– | 13,622,700 | – | – | – | 1,037,400 | – | – | 14,660,100 | |||||||||||||||||||||||||||

| Health Care Providers & Services |

– | 13,692,995 | – | – | – | 1,710,555 | – | – | 15,403,550 | |||||||||||||||||||||||||||

| Household Durables |

11,014,697 | – | (10,642,786 | )† | – | – | (371,911 | ) | – | – | – | |||||||||||||||||||||||||

| Insurance |

11,203,425 | – | (11,413,579 | ) | – | 1,009,973 | (799,819 | ) | – | – | – | |||||||||||||||||||||||||

| Internet Software & Services |

– | 13,639,749 | – | – | – | (1,165,497 | ) | – | – | 12,474,252 | ||||||||||||||||||||||||||

| Multiline Retail |

13,804,312 | 13,079,040 | (14,437,912 | ) | – | 536,085 | (632,565 | ) | – | – | 12,348,960 | |||||||||||||||||||||||||

| Oil, Gas & Consumable Fuels |

13,964,690 | – | – | – | – | (2,985,200 | ) | – | – | 10,979,490 | ||||||||||||||||||||||||||

| Pharmaceuticals |

13,436,449 | 12,679,088 | (18,861,262 | ) | – | 6,096,302 | (821,274 | ) | – | – | 12,529,303 | |||||||||||||||||||||||||

| Semiconductors & Semiconductor Equipment |

– | 28,511,508 | – | – | – | (2,031,408 | ) | – | – | 26,480,100 | ||||||||||||||||||||||||||

| Technology Hardware, Storage & Peripherals |

– | 12,677,337 | – | – | – | 3,469,803 | – | – | 16,147,140 | |||||||||||||||||||||||||||

| Totals |

$126,989,345 | $165,561,040 | $(109,465,990 | ) | $ – | $6,582,231 | $(3,663,103 | ) | $ – | $ – | $186,003,523 | |||||||||||||||||||||||||

| † | Conversion |

The following table presents additional information about valuation techniques and inputs used for investments that are measured at fair value and categorized within Level 3 at February 28, 2015:

| Ending Balance at 2/28/15 |

Valuation Technique Used |

Unobservable Inputs |

Input Values | |||||||

| Investments in Securities – Assets |

||||||||||

| Convertible Preferred Stock |

$186,003,523 | Third-Party Pricing Vendor | Single Broker Quote | $15.28 –$764.00 | ||||||

The net change in unrealized appreciation/depreciation of Level 3 investments held at February 28, 2015 was $(3,336,742). Net realized gain (loss) and change in unrealized appreciation/depreciation is reflected on the Statement of Operations.

Glossary:

| REIT | - | Real Estate Investment Trust |

| 24 | Annual Report | | February 28, 2015 | | See accompanying Notes to Financial Statements |

Table of Contents

Statements of Assets and Liabilities

AllianzGI Convertible & Income Funds

February 28, 2015

| Convertible & Income |

Convertible & Income II |

|||||||||||

| Assets: | ||||||||||||

| Investments, at value (cost-$1,077,900,780 and $816,852,379, respectively) | $1,089,224,939 | $827,172,201 | ||||||||||

| Interest and dividends receivable | 16,235,051 | 12,460,538 | ||||||||||

| Receivable for investments sold | 8,647,572 | 6,530,412 | ||||||||||

| Prepaid expenses | 21,701 | 48,876 | ||||||||||

| Total Assets |

1,114,129,263 | 846,212,027 | ||||||||||

| Liabilities: | ||||||||||||

| Dividends payable to common and preferred shareholders | 7,898,813 | 6,296,338 | ||||||||||

| Payable for investments purchased | 8,072,027 | 5,972,337 | ||||||||||

| Investment management fees payable | 584,789 | 444,266 | ||||||||||

| Accrued expenses and other liabilities | 590,356 | 157,239 | ||||||||||

| Total Liabilities |

17,145,985 | 12,870,180 | ||||||||||

| Preferred Shares ($0.00001 par value; $25,000 liquidation preference per share applicable to an aggregate 14,280 and 10,960 shares issued and outstanding, respectively) | 357,000,000 | 274,000,000 | ||||||||||

| Net Assets Applicable to Common Shareholders | $739,983,278 | $559,341,847 | ||||||||||

| Composition of Net Assets Applicable to Common Shareholders: | ||||||||||||

| Common Shares: | ||||||||||||

| Par value ($0.00001 per share) |

$877 | $740 | ||||||||||

| Paid-in-capital in excess of par |

1,172,680,070 | 967,480,780 | ||||||||||

| Undistributed (dividends in excess of) net investment income | 2,795,810 | (4,932,198) | ||||||||||

| Accumulated net realized loss | (446,817,638) | (413,527,297) | ||||||||||

| Net unrealized appreciation | 11,324,159 | 10,319,822 | ||||||||||

| Net Assets Applicable to Common Shareholders | $739,983,278 | $559,341,847 | ||||||||||

| Common Shares Issued and Outstanding | 87,702,659 | 74,032,570 | ||||||||||

| Net Asset Value Per Common Share | $8.44 | $7.56 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2015 | | Annual Report | 25 |

Table of Contents

AllianzGI Convertible & Income Funds

Year ended February 28, 2015

| Convertible & Income |

Convertible & Income II |

|||||||||||

| Investment Income: | ||||||||||||

| Interest | $51,694,692 | $39,617,996 | ||||||||||

| Dividends | 33,983,454 | 26,027,591 | ||||||||||

| Miscellaneous | 152,260 | 120,240 | ||||||||||

| Total Investment Income |

85,830,406 | 65,765,827 | ||||||||||

| Expenses: | ||||||||||||

| Investment management | 7,983,131 | 6,082,177 | ||||||||||

| Auction agent | 551,659 | 408,697 | ||||||||||

| Excise tax | 429,478 | – | ||||||||||

| Custodian and accounting agent | 167,333 | 142,862 | ||||||||||

| Audit and tax services | 89,486 | 95,234 | ||||||||||

| Shareholder communications | 84,280 | 72,921 | ||||||||||

| New York Stock Exchange listing | 79,866 | 67,978 | ||||||||||

| Legal | 74,867 | 57,522 | ||||||||||

| Trustees | 70,343 | 55,886 | ||||||||||

| Insurance | 29,922 | 24,118 | ||||||||||

| Transfer agent | 25,721 | 25,509 | ||||||||||

| Proxy | 7,600 | 5,808 | ||||||||||

| Miscellaneous | 21,860 | 36,363 | ||||||||||

| Total expenses |

9,615,546 | 7,075,075 | ||||||||||

| Net Investment Income | 76,214,860 | 58,690,752 | ||||||||||

| Realized and Change in Unrealized Gain (Loss): | ||||||||||||

| Net realized gain (loss) on investments | 532,297 | (494,929) | ||||||||||

| Payment from affiliate (See Note 8) | 166,674 | 120,146 | ||||||||||

| Net change in unrealized appreciation/depreciation of investments | (75,180,856) | (55,112,120) | ||||||||||

| Net realized and change in unrealized loss | (74,481,885) | (55,486,903) | ||||||||||

| Net Increase in Net Assets Resulting from Investment Operations | 1,732,975 | 3,203,849 | ||||||||||

| Dividends on Preferred Shares from Net Investment Income | (421,660) | (323,627) | ||||||||||

| Net Increase in Net Assets Applicable to Common Shareholders Resulting from Investments Operations | $1,311,315 | $2,880,222 | ||||||||||

| 26 | Annual Report | | February 28, 2015 | | See accompanying Notes to Financial Statements |

Table of Contents

Statement of Changes in Net Assets Applicable to Common Shareholders

AllianzGI Convertible & Income Fund

| Year ended February 28, 2015 |

Year ended February 28, 2014 |

|||||||||||

| Investments Operations: | ||||||||||||

| Net investment income | $76,214,860 | $82,352,257 | ||||||||||

| Net realized gain | 698,971 | 38,399,174 | ||||||||||

| Net change in unrealized appreciation/depreciation | (75,180,856) | 21,883,465 | ||||||||||

| Net increase in net assets resulting from investment operations | 1,732,975 | 142,634,896 | ||||||||||

| Dividends on Preferred Shares from Net Investment Income | (421,660) | (462,676) | ||||||||||

| Net increase in net assets applicable to common shareholders resulting from investment operations | 1,311,315 | 142,172,220 | ||||||||||

| Dividends to Common Shareholders from Net Investment Income | (94,257,466) | (87,527,246) | ||||||||||

| Common Share Transactions: | ||||||||||||

| Net proceeds from shares sold | 16,959,259 | 72,694,937 | ||||||||||

| Offering costs on sale of shares (See Note 7) | (16,983) | (214,454) | ||||||||||

| Reinvestment of dividends | 4,590,091 | 4,249,654 | ||||||||||

| Net increase in net assets from common share transactions | 21,532,367 | 76,730,137 | ||||||||||

| Total increase (decrease) in net assets applicable to common shareholders | (71,413,784) | 131,375,111 | ||||||||||

| Net Assets Applicable to Common Shareholders: | ||||||||||||

| Beginning of year | 811,397,062 | 680,021,951 | ||||||||||

| End of year* | $739,983,278 | $811,397,062 | ||||||||||

| *Including undistributed net investment income of: | $2,795,810 | $11,776,819 | ||||||||||

| Common Shares Issued: | ||||||||||||

| Shares sold | 1,678,728 | 7,635,105 | ||||||||||

| Reinvestment of dividends | 490,671 | 464,659 | ||||||||||

| Total increase in shares outstanding | 2,169,399 | 8,099,764 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2015 | | Annual Report | 27 |

Table of Contents

Statement of Changes in Net Assets Applicable to Common Shareholders

AllianzGI Convertible & Income Fund II

| Year ended February 28, 2015 |

Year ended February 28, 2014 |

|||||||||||

| Investments Operations: | ||||||||||||

| Net investment income | $58,690,752 | $66,319,859 | ||||||||||

| Net realized gain (loss) | (374,783) | 26,482,017 | ||||||||||

| Net change in unrealized appreciation/depreciation | (55,112,120) | 15,214,503 | ||||||||||

| Net increase in net assets resulting from investment operations | 3,203,849 | 108,016,379 | ||||||||||

| Dividends on Preferred Shares from Net Investment Income | (323,627) | (355,107) | ||||||||||

| Net increase in net assets applicable to common shareholders resulting from investment operations | 2,880,222 | 107,661,272 | ||||||||||

| Dividends to Common Shareholders from Net Investment Income | (75,259,709) | (71,177,580) | ||||||||||

| Common Share Transactions: | ||||||||||||

| Net proceeds from shares sold | – | 67,744,043 | ||||||||||

| Offering costs on sale of shares (See Note 7) | – | (202,305) | ||||||||||

| Reinvestment of dividends | 4,609,781 | 4,809,455 | ||||||||||

| Net increase in net assets from common share transactions | 4,609,781 | 72,351,193 | ||||||||||

| Total increase (decrease) in net assets applicable to common shareholders |

(67,769,706) | 108,834,885 | ||||||||||

| Net Assets Applicable to Common Shareholders: | ||||||||||||

| Beginning of year | 627,111,553 | 518,276,668 | ||||||||||

| End of year* | $559,341,847 | $627,111,553 | ||||||||||

| *Including undistributed (dividends in excess of) net investment income of: |

$(4,932,198) | $5,014,386 | ||||||||||

| Common Shares Issued: | ||||||||||||

| Shares sold | – | 7,869,665 | ||||||||||

| Reinvestment of dividends | 520,118 | 574,843 | ||||||||||

| Total increase in shares outstanding | 520,118 | 8,444,508 | ||||||||||

| 28 | Annual Report | | February 28, 2015 | | See accompanying Notes to Financial Statements |

Table of Contents

AllianzGI Convertible & Income Funds

Year ended February 28, 2015

| Convertible & Income |

Convertible & Income II |

|||||||||||

| Increase in Cash from: | ||||||||||||

| Cash Flows provided by Operating Activities: | ||||||||||||

| Net increase in net assets resulting from investment operations |

$1,732,975 | $3,203,849 | ||||||||||

| Adjustments to Reconcile Net Increase in Net Assets Resulting from Investment Operations to Net Cash provided by Operating Activities: | ||||||||||||

| Purchases of long-term investments |

(652,229,547) | (484,415,737) | ||||||||||

| Proceeds from sales of long-term investments |

625,798,735 | 480,979,573 | ||||||||||

| Proceeds from security litigation |

1,087,377 | 950,695 | ||||||||||

| Capital gain distributions received |

694,450 | 453,788 | ||||||||||

| Sales of short-term investments, net |

26,597,254 | 3,759,145 | ||||||||||

| Net change in unrealized appreciation/depreciation |

75,180,856 | 55,112,120 | ||||||||||

| Net amortization/accretion on investments |

(634,358) | (144,883) | ||||||||||

| Net realized (gain) loss |

(698,971) | 374,783 | ||||||||||

| Decrease in payable for investments purchased |

(36,363,554) | (22,954,645) | ||||||||||

| Decrease in receivable for investments sold |

29,537,247 | 32,844,630 | ||||||||||

| Decrease in interest and dividends receivable |

694,712 | 777,478 | ||||||||||

| Decrease in prepaid expenses |

83,094 | 62,942 | ||||||||||

| Increase (decrease) in accrued expenses and other liabilities |

148,278 | (41,915) | ||||||||||

| Decrease in investment management fees payable |

(31,948) | (33,750) | ||||||||||

| Net cash provided by operating activities | 71,596,600 | 70,928,073 | ||||||||||

| Cash Flows used for Financing Activities: | ||||||||||||

| Proceeds from shares sold |

18,245,613 | – | ||||||||||

| Cash dividends paid (excluding reinvestment of dividends of $4,590,091 and $4,609,781, respectively) |

(89,842,213) | (70,928,073) | ||||||||||

| Net cash used for financing activities | (71,596,600) | (70,928,073) | ||||||||||

| Net increase in cash | – | – | ||||||||||

| Cash, beginning of year | – | – | ||||||||||

| Cash, end of year | $– | $– | ||||||||||

| Noncash Investing and Financing Activities: | ||||||||||||

| Noncash investment transactions – Conversions of convertible preferred stock |

$187,733,014 | $145,870,804 | ||||||||||

| See accompanying Notes to Financial Statements | | February 28, 2015 | | Annual Report | 29 |

Table of Contents

AllianzGI Convertible & Income Funds

February 28, 2015

1. Organization and Significant

Accounting Policies

AllianzGI Convertible & Income Fund (“Convertible & Income”) and AllianzGI Convertible & Income Fund II (“Convertible & Income II”) (each a “Fund” and collectively the “Funds”), were organized as Massachusetts business trusts on January 17, 2003 and April 22, 2003, respectively. The Funds follow the investment company accounting and reporting guidance of Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies. Prior to commencing operations on March 31, 2003, and July 31, 2003, respectively, the Funds had no operations other than matters relating to their organization and registration as diversified, closed-end management investment companies under the Investment Company Act of 1940, as amended, and the rules and regulations thereunder. Allianz Global Investors Fund Management LLC (the “Investment Manager”) and Allianz Global Investors U.S. LLC (the “Sub-Adviser”) serve as the Funds’ investment manager and sub-adviser, respectively, and are indirect, wholly-owned subsidiaries of Allianz Asset Management of America L.P. (“AAM”). AAM is an indirect, wholly-owned subsidiary of Allianz SE, a publicly traded European insurance and financial services company. Each Fund has authorized an unlimited amount of common shares with $0.00001 par value.

Each Fund’s investment objective is to provide total return through a combination of capital appreciation and high current income. The Funds attempt to achieve this objective by investing in a portfolio of convertible securities and non-convertible income-producing securities. There can be no assurance that the Funds will meet their stated objectives.

The preparation of the Funds’ financial statements in accordance with accounting principles generally accepted in the United

States of America (“U.S. GAAP”) requires the Funds’ management to make estimates and assumptions that affect the reported amounts and disclosures in each Fund’s financial statements. Actual results could differ from those estimates.

In the normal course of business, the Funds enter into contracts that contain a variety of representations that provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred.

In June 2014, the FASB issued an Accounting Standards Update (“ASU”) 2014-11 that expands secured borrowing accounting for certain repurchase agreements. The ASU also sets forth additional disclosure requirements for certain transactions accounted for as sales, in order to provide financial statement users with information to compare to similar transactions accounted for as secured borrowings. The ASU is effective prospectively during interim or annual periods beginning after December 15, 2014. At this time, management is evaluating the implications of these changes on the Funds’ financial statements.

The following is a summary of significant accounting policies consistently followed by the Funds:

(a) Valuation of Investments

Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Market value is generally determined on the basis of official closing prices, last reported sales prices, or if no sales or closing prices are reported, on the basis of quotes obtained from a quotation reporting system, established market makers, or independent pricing services. The Funds’ investments are valued daily using prices supplied by an independent

| 30 | Annual Report | | February 28, 2015 |

Table of Contents

Notes to Financial Statements

AllianzGI Convertible & Income Funds

February 28, 2015

1. Organization and Significant

Accounting Policies (continued)

pricing service or broker/dealer quotations, or by using the last sale or settlement price on the exchange that is the primary market for such securities, or the mean between the last bid and ask quotations. Independent pricing services use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics.

The Board of Trustees (the “Board”) has adopted procedures for valuing portfolio securities and other financial instruments in circumstances where market quotations are not readily available, and has delegated primary responsibility for applying the valuation methods to the Investment Manager and Sub-Adviser. The Funds’ Valuation Committee was established by the Board to oversee the implementation of the Funds’ valuation methods and to make fair value determinations on behalf of the Board, as instructed by the Board. The Sub-Adviser monitors the continued appropriateness of methods applied and determines if adjustments should be made in light of market changes, events affecting the issuer or other factors. If the Sub-Adviser determines that a valuation method may no longer be appropriate, another valuation method may be selected or the Valuation Committee will be convened to consider the matter and take any appropriate action in accordance with procedures set forth by the Board. The Board shall review and ratify the appropriateness of the valuation methods and these methods may be amended or supplemented from time to time by the Valuation Committee.