SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Securities Exchange Act of 1934 (Amendment No. )

VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND

VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND II

VIRTUS ALLIANZGI CONVERTIBLE & INCOME 2024 TARGET TERM FUND

VIRTUS ALLIANZGI DIVERSIFIED INCOME & CONVERTIBLE FUND

VIRTUS ALLIANZGI EQUITY & CONVERTIBLE INCOME FUND

VIRTUS DIVIDEND, INTEREST & PREMIUM STRATEGY FUND

Greenfield, MA 01301-9668

Secretary

Virtus AllianzGI Convertible & Income Fund

Virtus AllianzGI Convertible & Income Fund II

| | |

IMPORTANT:

|

| |

| | |

Shareholders are cordially invited to attend the Annual Meeting (virtually). In order to avoid delay and additional expense, and to assure that your shares are represented, please vote as promptly as possible, even if you plan to attend the Annual Meeting (virtually). Please refer to the website and telephone number indicated on your proxy card for instructions on how to cast your vote. To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. To vote by mail, please complete, sign, date, and mail the enclosed proxy card. No postage is required if you use the accompanying envelope to mail the proxy card in the United States. The proxy is revocable and will not affect your right to vote in person (virtually) if you attend the Annual Meeting and elect to vote in person (virtually).

|

| |

| | | |

Registrations

|

| |

Valid Signature

|

|

|

Corporate Accounts

|

| |

(1) ABC Corp

|

| |

(1) ABC Corp

|

|

| | (2) ABC Corp | | | (2) John Doe, Treasurer | | ||

| |

(3) ABC Corp. c/o John Doe, Treasurer

|

| | (3) John Doe | | ||

| | (4) ABC Corp. Profit Sharing Plan | | | (4) John Doe, Trustee | | ||

|

Partnership Accounts

|

| |

(1) The XYZ partnership

|

| |

(1) Jane B. Smith, Partner

|

|

| |

(2) Smith and Jones, limited partnership

|

| |

(2) Jane B. Smith, General Partner

|

| ||

|

Trust Accounts

|

| |

(1) ABC Trust

|

| |

(1) John Doe, Trustee

|

|

| |

(2) Jane B. Doe, Trustee u/t/d 12/28/78

|

| | (2) Jane B. Doe | | ||

|

Custodial or Estate Accounts

|

| |

(1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA

|

| |

(1) John B. Smith

|

|

| | (2) Estate of John B. Smith | | | (2) John B. Smith, Jr., Executor | |

FOR

JOINT ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON

JULY 12, 2022

|

Proposal

|

| |

Shareholders

Entitled to Vote |

| |||

| 1a | | |

Elect George R. Aylward as a Class III trustee of AIO

|

| | AIO shareholders | |

| 1b | | | Elect Sarah E. Cogan as a Class III trustee of AIO | | | AIO shareholders | |

| 1c | | |

Elect Deborah A. DeCotis as a Class III trustee of AIO

|

| | AIO shareholders | |

| 1d | | | Elect Brian T. Zino as a Class I trustee of AIO | | | AIO shareholders | |

| 1e | | |

Elect William B. Ogden, IV as a Class I trustee of NCV

|

| | NCV shareholders | |

| 1f | | |

Elect Philip R. McLoughlin as a Class I trustee of NCV

|

| | NCV shareholders of preferred shares | |

| 1g | | | Elect Alan Rappaport as a Class I trustee of NCV | | | NCV shareholders | |

|

Proposal

|

| |

Shareholders

Entitled to Vote |

| |||

| 1h | | | Elect Brian T. Zino as a Class III trustee of NCV | | | NCV shareholders | |

| 1i | | | Elect Sarah E. Cogan as a Class I trustee of NCZ | | | NCZ shareholders of preferred shares | |

| 1j | | |

Elect William B. Ogden, IV as a Class I trustee of NCZ

|

| | NCZ shareholders | |

| 1k | | | Elect Alan Rappaport as a Class I trustee of NCZ | | | NCZ shareholders | |

| 1l | | | Elect Brian T. Zino as a Class I trustee of NCZ | | | NCZ shareholders | |

| 1m | | |

Elect F. Ford Drummond as a Class II trustee of CBH

|

| | CBH shareholders | |

| 1n | | |

Elect James S. MacLeod as a Class II trustee of CBH

|

| | CBH shareholders | |

| 1o | | |

Elect Philip R. McLoughlin as a Class I trustee of CBH

|

| | CBH shareholders | |

| 1p | | | Elect Brian T. Zino as a Class I trustee of CBH | | | CBH shareholders | |

| 1q | | |

Elect William B. Ogden, IV as a Class I trustee of ACV

|

| | ACV shareholders | |

| 1r | | | Elect Alan Rappaport as a Class I trustee of ACV | | | ACV shareholders | |

| 1s | | | Elect R. Keith Walton as a Class II trustee of ACV | | | ACV shareholders | |

| 1t | | | Elect Brian T. Zino as a Class I trustee of ACV | | | ACV shareholders of preferred shares | |

| 1u | | |

Elect George R. Aylward as a Class III trustee of NIE

|

| | NIE shareholders | |

| 1v | | | Elect Sarah E. Cogan as a Class III trustee of NIE | | | NIE shareholders | |

| 1w | | |

Elect Deborah A. DeCotis as a Class III trustee of NIE

|

| | NIE shareholders | |

| 1x | | | Elect Brian T. Zino as a Class I trustee of NIE | | | NIE shareholders | |

| 1y | | |

Elect George R. Aylward as a Class II trustee of NFJ

|

| | NFJ shareholders | |

| 1z | | |

Elect Deborah A. DeCotis as a Class II trustee of NFJ

|

| | NFJ shareholders | |

| 1aa | | |

Elect Philip R. McLoughlin as a Class II trustee of NFJ

|

| | NFJ shareholders | |

| 1bb | | | Elect Brian T. Zino as a Class I trustee of NFJ | | | NFJ shareholders | |

| 2 | | | Transact such additional business as properly comes before the Meeting | | | AIO, NCV, NCZ, CBH, ACV, NIE and/or NFJ shareholders | |

| | | |

Outstanding

Common Shares |

| |

Outstanding

Preferred Shares |

| ||||||

|

AIO

|

| | | | 34,340,972 | | | | | | N/A | | |

|

NCV

|

| | | | 90,373,569 | | | | | | 4,008,931(1) | | |

|

NCZ

|

| | | | 76,115,749 | | | | | | 4,366,501(2) | | |

|

CBH

|

| | | | 18,263,597 | | | | | | N/A | | |

|

ACV

|

| | | | 10,362,954 | | | | | | 1,200,000 | | |

|

NIE

|

| | | | 27,708,965 | | | | | | N/A | | |

|

NFJ

|

| | | | 94,801,581 | | | | | | N/A | | |

JULY 12, 2022:

AND ADVISORY BOARD MEMBER

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| Independent Trustees | | | | | | | | |||

|

Cogan, Sarah E.

YOB: 1956 Portfolios Overseen: 110 |

| |

Class III Trustee of AIO since 2019, nominee for term expiring 2025

Class II Trustee of NCV since 2019, term expires at the 2023 Annual Meeting

Class I Trustee of NCZ since 2019, nominee for term expiring 2025(4)

Class III Trustee of CBH since 2019, term expires at the 2023 Annual Meeting

Class III Trustee of ACV since 2019, term expires at the 2024 Annual Meeting

Class III Trustee of NIE since 2019, nominee for term expiring 2025

Class III Trustee of NFJ since 2019, term expires at the 2023 Annual Meeting

|

| | Retired Partner, Simpson Thacher & Bartlett LLP (“STB”) (law firm)(since 2019); Director, Girl Scouts of Greater New York (since 2016); Trustee, Natural Resources Defense Council, Inc. (since 2013); and formerly, Partner, STB (1989 to 2018). | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2019), PIMCO Closed-End Funds(5) (29 portfolios); Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, and Virtus Event Opportunities Trust (2 portfolios); Advisory Board Member (since 2021), Virtus Alternative Solutions Trust (2 portfolios), Virtus Mutual Fund Family (61 portfolios) and Virtus Variable Insurance Trust (8 portfolios); Advisory Board Member (February 2021 to June 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee (since 2021), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Trustee (since 2019), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee (since 2019), Virtus AllianzGI Closed-End Funds (7 portfolios). | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

|

DeCotis, Deborah A.

YOB: 1952 Portfolios Overseen: 110 |

| |

Class III Trustee of AIO since 2019, nominee for term expiring 2025

Class III Trustee of NCV since 2011, term expires at the 2024 Annual Meeting

Class II Trustee of NCZ since 2011, term expires at the 2023 Annual Meeting

Class III Trustee of CBH since 2017, term expires at the 2023 Annual Meeting

Class III Trustee of ACV since 2015, term expires at the 2024 Annual Meeting

Class III Trustee of NIE since 2011, nominee for term expiring 2025

Class II Trustee of NFJ since 2011, nominee for term expiring 2025

|

| | Advisory Director, Morgan Stanley & Co., Inc. (since 1996); Member, Circle Financial Group (since 2009); Member, Council on Foreign Relations (since 2013); and Trustee, Smith College (since 2017). Formerly, Director, Watford Re (2017 to 2021); Co-Chair Special Projects Committee, Memorial Sloan Kettering (2005 to 2015); Trustee, Stanford University (2010 to 2015); Principal, LaLoop LLC, a retail accessories company (1999 to 2014); Director, Helena Rubenstein Foundation (1997 to 2010); and Director, Armor Holdings (2002 to 2010). | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2011), PIMCO Closed-End Funds(5) (29 portfolios); Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, and Virtus Event Opportunities Trust (2 portfolios); Advisory Board Member (since 2021), Virtus Alternative Solutions Trust (2 portfolios), Virtus Mutual Fund Family (61 portfolios) and Virtus Variable Insurance Trust (8 portfolios); Advisory Board Member (February 2021 to June 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee (since 2021), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Trustee (since 2019), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund; Trustee (since 2017), Virtus AllianzGI Convertible & Income 2024 Target Term Fund; Trustee (since 2015), Virtus AllianzGI Diversified Income & Convertible Fund; | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | | | | | | | | Trustee (since 2014), Virtus Investment Trust (13 portfolios); Trustee (since 2011), Virtus Strategy Trust (11 portfolios); and Trustee (since 2011), Virtus AllianzGI Convertible & Income Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus AllianzGI Equity & Convertible Income Fund, and Virtus Dividend, Interest & Premium Strategy Fund. | |

|

Drummond, F. Ford

YOB: 1962 Portfolios Overseen: 110 |

| |

Class II Trustee of AIO since 2019, term expires at the 2024 Annual Meeting

Class III Trustee of NCV since 2015, term expires at the 2024 Annual Meeting

Class III Trustee of NCZ since 2015, term expires at the 2024 Annual Meeting

Class II Trustee of CBH since 2017, nominee for term expiring 2025

Class II Trustee of ACV since 2015, term expires at the 2023 Annual Meeting

Class II Trustee of NIE since 2015, term expires at the 2024 Annual Meeting

|

| | Owner/Operator (since 1998), Drummond Ranch; and Director (since 2015), Texas and Southwestern Cattle Raisers Association. Formerly, Chairman, Oklahoma Nature Conservancy (2019 to 2020); formerly Board Member (2006 to 2020) and Chairman (2016 to 2018), Oklahoma Water Resources Board; Director (1998 to 2008), The Cleveland Bank; and General Counsel (1998 to 2008), BMIHealth | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, and Virtus Event Opportunities Trust (2 portfolios); Advisory Board Member (since 2021), Virtus Alternative Solutions Trust (2 portfolios), Virtus Mutual Fund Family (61 portfolios) and Virtus Variable Insurance Trust (8 portfolios); Advisory Board Member (February 2021 to June 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee (since | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | | Class III Trustee of NFJ since 2015, term expires at the 2023 Annual Meeting | | | Plans (benefits administration). | | | 2021), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Trustee (since 2019), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund; Trustee (since 2017), Virtus AllianzGI Convertible & Income 2024 Target Term Fund; Trustee (since 2015), Virtus AllianzGI Convertible & Income Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus AllianzGI Diversified Income & Convertible Fund, Virtus Dividend, Interest & Premium Strategy Fund and Virtus AllianzGI Equity & Convertible Income Fund; Trustee (since 2014), Virtus Strategy Trust (11 portfolios); Director (since 2011), Bancfirst Corporation; and Trustee (since 2006), Virtus Investment Trust (13 portfolios). | |

|

MacLeod, James S.

YOB: 1947 Portfolios Overseen: 7 |

| |

Class II Trustee of AIO since 2019, term expires at the 2024 Annual Meeting

Class III Trustee of NCV since 2015, term expires at the 2024 Annual Meeting

Class III Trustee of NCZ

|

| | Chief Executive Officer (2010 to 2018), CoastalSouth Bancshares; President and Chief Operating Officer (2007 to 2018), Coastal States | | | Trustee since 2015, Virtus AllianzGI Closed-End Funds (7 portfolios); Non-Executive Chairman (since 2018), CoastalSouth Bancshares, Inc.; Director (since 2004) and Chairman (since 2018), Coastal States Bank; Chairman and | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | |

since 2015, term expires at the 2024 Annual Meeting

Class II Trustee of CBH since 2017, nominee for term expiring 2025

Class II Trustee of ACV since 2015, term expires at the 2023 Annual Meeting

Class II Trustee of NIE since 2015, term expires at the 2024 Annual Meeting

Class I Trustee of NFJ since 2015, term expires at the 2024 Annual Meeting

|

| | Bank; Managing Director and President (2007 to 2018), Homeowners Mortgage, a President (2007 to 2018), Homeowners Mortgage a subsidiary of Coastal States Bank. | | | Director (since 2018), Coastal States Mortgage, Inc.; Director (since 2016) and Vice Chairman (since 2019), MUSC Foundation; Chairman of the Board of Trustees (since 2019), University of Tampa; and Director (2005 to 2021) and Non-Executive Chairman (2016 to 2021), Sykes Enterprises, Inc. | |

|

McLoughlin, Philip R.

YOB: 1946 Portfolios Overseen: 113 |

| |

Class II Trustee of AIO since 2021, term expires at the 2024 Annual Meeting

Class I Trustee of NCV since 2022, nominee for term expiring 2025(4)

Class I Trustee of NCZ since 2021, term expires at the 2022 Annual Meeting

Class I Trustee of CBH since 2022, nominee for term expiring 2024

Class III Trustee of ACV since 2021, term expires at the 2024 Annual Meeting

Class II Trustee of NIE since 2021, term expires at the 2024 Annual

|

| | Private investor since 2010. | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2021), Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust (2 portfolios), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee (since 2021), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | |

Meeting

Class II Trustee of NFJ since 2021, nominee for term expiring 2025

|

| | | | | AllianzGI Diversified Income & Convertible Fund, Virtus AllianzGI Equity & Convertible Income Fund and Virtus Dividend, Interest & Premium Strategy Fund; Trustee (since 2022) and Advisory Board Member (2021), Virtus AllianzGI Convertible & Income 2024 Target Term Fund and Virtus AllianzGI Convertible & Income Fund; Director and Chairman (since 2016), Virtus Total Return Fund Inc.; Director and Chairman (2016 to 2019), the former Virtus Total Return Fund Inc.; Director and Chairman (2014 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee and Chairman (since 2013), Virtus Alternative Solutions Trust (2 portfolios); Trustee and Chairman (since 2011), Virtus Global Multi-Sector Income Fund; Chairman and Trustee (since 2003), Virtus Variable Insurance Trust (8 portfolios); Director (since 1995), closed-end funds managed by Duff & Phelps Investment Management Co. (3 funds); Director (1991 to 2019) and Chairman (2010 to 2019), Lazard World Trust Fund | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | | | | | | | | (closed-end investment firm in Luxembourg); and Trustee (since 1989) and Chairman (since 2002), Virtus Mutual Fund Family (61 portfolios). | |

|

Ogden, IV, William B.

YOB: 1945 Portfolios Overseen: 7 |

| |

Class I Trustee of AIO since 2019, term expires at the 2023 Annual Meeting

Class I Trustee of NCV since 2006, nominee for term expiring 2025

Class I Trustee of NCZ since 2006, nominee for term expiring 2025

Class I Trustee of CBH since 2017, term expires at the 2024 Annual Meeting

Class I Trustee of ACV since 2015, nominee for term expiring 2025

Class I Trustee of NIE since 2007, term expires at the 2023 Annual Meeting

Class I Trustee of NFJ since 2006, term expires at the 2024 Annual Meeting

|

| | Retired. Formerly, Asset Management Industry Consultant; and Managing Director, Investment Banking Division of Citigroup Global Markets Inc. | | | Trustee (since 2006), Virtus AllianzGI Closed-End Funds (7 portfolios); Trustee, PIMCO Closed-End Funds(5) (29 portfolios). | |

|

Rappaport, Alan

YOB: 1953 Portfolios Overseen: 7 |

| |

Class I Trustee of AIO since 2019, term expires at the 2023 Annual Meeting

Class I Trustee of NCV since 2010, nominee for term expiring 2025

|

| | Director, Victory Capital Holdings, Inc., an asset management firm (since 2013). Formerly, Adjunct Professor, New York University | | | Trustee (since 2010), Virtus AllianzGI Closed-End Funds (7 portfolios); and Trustee, PIMCO Closed-End Funds(5) (29 portfolios). | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | |

Class I Trustee of NCZ since 2010, nominee for term expiring 2025

Class I Trustee of CBH since 2017, term expires at the 2024 Annual Meeting

Class I Trustee of ACV since 2015, nominee for term expiring 2025

Class I Trustee of NIE since 2010, term expires at the 2023 Annual Meeting

Class III Trustee of NFJ since 2010, term expires at the 2023 Annual Meeting

|

| | Stern School of Business (2011 to 2020); Lecturer, Stanford University Graduate School of Business (2013 to 2020); Advisory Director (formerly, Vice Chairman), Roundtable Investment Partners (2009 to 2018); Member of Board of Overseers, NYU Langone Medical Center (2015 to 2016); Trustee, American Museum of Natural History (2005 to 2015); Trustee, NYU Langone Medical Center (2007 to 2015); and Vice Chairman (formerly, Chairman and President), U.S. Trust (formerly, Private Bank of Bank of America, the predecessor entity of U.S. Trust) (2001-2008). | | | | |

|

Walton, R. Keith

YOB: 1964 Portfolios Overseen: 110 |

| |

Class II Trustee of ACV since 2022, nominee for term expiring 2023

Advisory Board Member of AIO, NCV, NCZ, CBH, NIE and NFJ since 2022

|

| | Venture and Operating Partner (since 2020), Plexo Capital, LLC; Venture Partner (since 2019) and | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | | | | |

Senior Adviser (2018 to 2019), Plexo, LLC; and Partner (since 2006), Global Infrastructure Partners. Formerly, Managing Director (2020 to 2021), Lafayette Square Holding Company LLC; Senior Adviser (2018 to 2019), Vatic Labs, LLC; Executive Vice President, Strategy (2017 to 2019), Zero Mass Water, LLC; Vice President, Strategy

(2013 to 2017), Arizona State University.

|

| | (since 2022), Virtus AllianzGI Diversified Income & Convertible Fund; Advisory Board Member (since 2022), Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund, Virtus AllianzGI Convertible & Income 2024 Target Term Fund, Virtus AllianzGI Convertible & Income Fund, Virtus AllianzGI Convertible & Income Fund II, Virtus AllianzGI Equity & Convertible Income Fund and Virtus Dividend, Interest & Premium Strategy Fund; Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust (2 portfolios), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee (since 2020) Virtus Alternative Solutions Trust (2 portfolios), Virtus Variable Insurance Trust (8 portfolios) and Virtus Mutual Fund Family (61 portfolios); Director (since 2017), certain funds advised by Bessemer Investment Management LLC; Director (2016 to 2021), Duff & Phelps Select MLP and Midstream Energy | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | | | | | | | | Fund Inc.; Trustee (since 2016), Virtus Global Multi-Sector Income Fund; Director (2006 to 2019), Systematica Investments Limited Funds; Director (2006 to 2017), BlueCrest Capital Management Funds; Trustee (2014 to 2017), AZ Service; Director (since 2004), Virtus Total Return Fund Inc.; and Director (2004 to 2019), the former Virtus Total Return Fund Inc. | |

|

Zino, Brian T.

YOB: 1952 Portfolios Overseen: 110 |

| |

Class I Trustee of AIO since 2022, nominee for term expiring 2023

Class III Trustee of NCV since 2022, nominee for term expiring 2024

Class I Trustee of NCZ since 2022, nominee for term expiring 2025

Class I Trustee of CBH since 2022, nominee for term expiring 2024

Class I Trustee of ACV since 2022, nominee for term expiring 2025(4)

Class I Trustee of NIE since 2022, nominee for term expiring 2023

Class I Trustee of NFJ since 2022, nominee for term expiring 2024

|

| | Retired. Various roles at J. & W. Seligman & Co. Incorporated (1982 to 2009) including President (1994 to 2009). | | | Trustee (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Trustee (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust (2 portfolios), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee (since 2022) and Advisory Board Member (2021), Virtus AllianzGI Closed-End Funds (7 portfolios); Trustee (since 2020) Virtus Alternative Solutions Trust (2 portfolios), Virtus Variable Insurance Trust (8 portfolios) and Virtus Mutual Fund Family (61 | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | | | | | | | | portfolios); Director (2016 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee (since 2016), Virtus Global Multi-Sector Income Fund; Director (since 2014), Virtus Total Return Fund Inc.; Director (2014 to 2019), the former Virtus Total Return Fund Inc.; Trustee (since 2011), Bentley University; Director (1986 to 2009) and President (1994 to 2009), J&W Seligman Co. Inc.; Director (1998 to 2009), Chairman (2002 to 2004) and Vice Chairman (2000 to 2002), ICI Mutual Insurance Company; Member, Board of Governors of ICI (1998 to 2008). | |

|

Interested Trustee

|

| | | | | | | | | |

|

Aylward, George R.*

YOB: 1964 Portfolios Overseen: 115 |

| |

Class III Trustee of AIO since 2021, nominee for term expiring 2025

Class II Trustee of NCV since 2021, term expires at the 2023 Annual Meeting

Class II Trustee of NCZ since 2021, term expires at the 2023 Annual Meeting

Class III Trustee of CBH since 2021, term expires at the 2023 Annual

|

| | Director, President and Chief Executive Officer (since 2008), Virtus Investment Partners, Inc. and/or certain of its subsidiaries; various senior officer positions with Virtus affiliates (since 2005). | | | Trustee, President and Chief Executive Officer (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Member, Board of Governors of the Investment Company Institute (since 2021); Trustee and President (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | |

Meeting

Class II Trustee of ACV since 2021, term expires at the 2023 Annual Meeting

Class III Trustee of NIE since 2021, nominee for term expiring 2025

Class II Trustee of NFJ since 2021, nominee for term expiring 2025

|

| | | | | Opportunities Trust (2 portfolios), Virtus Investment Trust (13 portfolios) and Virtus Strategy Trust (11 portfolios); Trustee, President and Chief Executive Officer (since 2021), Virtus AllianzGI Closed-End Funds (7 portfolios); Chairman and Trustee (since 2015), Virtus ETF Trust II (5 portfolios); Director, President and Chief Executive Officer (2014 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Trustee and President (since 2013), Virtus Alternative Solutions Trust (2 portfolios); Director (since 2013), Virtus Global Funds, PLC (5 portfolios); Trustee (since 2012) and President (since 2010), Virtus Variable Insurance Trust (8 portfolios); Trustee, President and Chief Executive Officer (since 2011), Virtus Global Multi-Sector Income Fund; Trustee and President (since 2006) and Executive Vice President (2004 to 2006), Virtus Mutual Fund Family (61 portfolios); Director, President and Chief Executive Officer (since 2006), Virtus Total Return Fund Inc.; and | |

|

Name, Year of

Birth and Number of Portfolios in Funds Complex Overseen by Trustee(1)(2) |

| |

Term of Office and

Length of Time Served(3) |

| |

Principal

Occupation(s) During Past Five Years |

| |

Other Directorships/

Trusteeships Held by Trustee During the Past Five Years |

|

| | | | | | | | | | Director, President and Chief Executive Officer (2006 to 2019), the former Virtus Total Return Fund Inc. | |

| Advisory Board Member(6) | | | | | | | | |||

|

Walton, R. Keith

YOB: 1964 Portfolios Overseen: 110 |

| | Advisory Board Member of AIO, NCV, NCZ, CBH, NIE and NFJ since 2022 | | | See above. | | | See above. | |

THE ELECTION OF EACH TRUSTEE NOMINEE IN

PROPOSALS 1a THROUGH 1bb.

|

Name and Year of Birth

|

| |

Position(s) Held with

the Fund and Length of Time Served |

| |

Principal Occupation(s)

During Past 5 Years |

|

|

Batchelar, Peter J.

YOB: 1970 |

| | Senior Vice President (since 2021), AIO, NCV, NCZ, CBH, ACV, NIE and NFJ. | | | Senior Vice President, Product Development (since 2017), Vice President, Product Development (2008 to 2017) and various officer positions (since 2008), Virtus Investment Partners, Inc. and/or certain of its subsidiaries; Senior Vice President (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Senior Vice President (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust, Virtus Investment Trust, Virtus Strategy Trust and Virtus AllianzGI Closed-End Funds; Senior Vice President (since 2017) and Vice President (2008 to 2016), Virtus Mutual Fund Family; Senior Vice President (since 2017) and Vice President (2010 to 2016), Virtus Variable Insurance Trust; Senior Vice President (since 2017) | |

|

Name and Year of Birth

|

| |

Position(s) Held with

the Fund and Length of Time Served |

| |

Principal Occupation(s)

During Past 5 Years |

|

| | | | | | | and Vice President (2013 to 2016), Virtus Alternative Solutions Trust; Senior Vice President (2017 to 2021) and Vice President (2016 to 2017), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Senior Vice President (since 2017) and Vice President (2016 to 2017), Virtus Total Return Fund Inc. and Virtus Global Multi-Sector Income Fund; and Senior Vice President (2017 to 2019) and Vice President (2016 to 2017), the former Virtus Total Return Fund Inc. | |

|

Bradley, W. Patrick

YOB: 1972 |

| | Executive Vice President, Chief Financial Officer and Treasurer (since 2021), AIO, NCV, NCZ, CBH, ACV, NIE and NFJ. | | | Executive Vice President, Fund Services (since 2016), Senior Vice President, Fund Services (2010 to 2016) and various officer positions (since 2006), Virtus Investment Partners, Inc. and/or certain of its subsidiaries; Executive Vice President, Chief Financial Officer and Treasurer (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Executive Vice President, Chief Financial Officer and Treasurer (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust, Virtus Investment Trust, Virtus Strategy Trust and Virtus AllianzGI Closed-End Funds; Director (since 2019), Virtus Global Funds ICAV; Executive Vice President (since 2016), Senior Vice President (2013 to 2016), Vice President (2011 to 2013), Chief Financial Officer and Treasurer (since 2004), Virtus Variable Insurance Trust; Executive Vice President (since 2016), Senior Vice President (2013 to 2016), Vice President (2011 to 2013), Chief Financial Officer and Treasurer (since 2006), Virtus Mutual Fund Family; | |

|

Name and Year of Birth

|

| |

Position(s) Held with

the Fund and Length of Time Served |

| |

Principal Occupation(s)

During Past 5 Years |

|

| | | | | | | Executive Vice President (since 2016), Senior Vice President (2013 to 2016), Vice President (2012 to 2013) and Chief Financial Officer and Treasurer (since 2010), Virtus Total Return Fund Inc.; Executive Vice President (2016 to 2019), Senior Vice President (2013 to 2016), Vice President (2012 to 2013), Chief Financial Officer and Treasurer (since 2010), the former Virtus Total Return Fund Inc.; Executive Vice President (since 2016), Senior Vice President (2013 to 2016), Vice President (2011 to 2013), Chief Financial Officer and Treasurer (since 2011), Virtus Global Multi-Sector Income Fund; Executive Vice President (2016 to 2021), Senior Vice President (2014 to 2016), Chief Financial Officer and Treasurer (2014 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Executive Vice President (since 2016), Senior Vice President (2013 to 2016) and Chief Financial Officer and Treasurer (since 2013), Virtus Alternative Solutions Trust; Director (since 2013), Virtus Global Funds, PLC; and Vice President and Assistant Treasurer (since 2011), Duff & Phelps Utility and Infrastructure Fund Inc. | |

|

Engberg, Nancy J.

YOB: 1956 |

| | Senior Vice President and Chief Compliance Officer (since 2021), AIO, NCV, NCZ, CBH, ACV, NIE and NFJ. | | | Senior Vice President (since 2017), Vice President (2008 to 2017), Chief Compliance Officer (2008 to 2011 and since 2016) and various officer positions (since 2003), Virtus Investment Partners, Inc. and/or certain of its subsidiaries; Senior Vice President and Chief Compliance Officer (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Senior Vice | |

|

Name and Year of Birth

|

| |

Position(s) Held with

the Fund and Length of Time Served |

| |

Principal Occupation(s)

During Past 5 Years |

|

| | | | | | | President and Chief Compliance Officer (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust, Virtus Investment Trust, Virtus Strategy Trust and Virtus AllianzGI Closed-End Funds; Senior Vice President (since 2017), Vice President (2011 to 2017) and Chief Compliance Officer (since 2011), Virtus Mutual Fund Family; Senior Vice President (since 2017), Vice President (2010 to 2017) and Chief Compliance Officer (since 2011), Virtus Variable Insurance Trust; Senior Vice President (since 2017), Vice President (2011 to 2017) and Chief Compliance Officer (since 2011), Virtus Global Multi-Sector Income Fund; Senior Vice President (since 2017), Vice President (2012 to 2017) and Chief Compliance Officer (since 2012), Virtus Total Return Fund Inc.; Senior Vice President (2017 to 2019), Vice President (2012 to 2017) and Chief Compliance Officer (2012 to 2019), the former Virtus Total Return Fund Inc.; Senior Vice President (since 2017), Vice President (2013 to 2017 and Chief Compliance Officer (since 2013), Virtus Alternative Solutions Trust; Senior Vice President (2017 to 2021), Vice President (2014 to 2017) and Chief Compliance Officer (2014 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Chief Compliance Officer (since 2015), ETFis Series Trust I; and Chief Compliance Officer (since 2015), Virtus ETF Trust II. | |

|

Fromm, Jennifer

YOB: 1973 |

| | Vice President (since 2021), Assistant Secretary (2021 to 2022) and Chief Legal | | | Vice President (since 2016) and Senior Counsel, Legal (since 2007) and various officer positions (since 2008), Virtus Investment Partners, Inc. and/or certain of | |

|

Name and Year of Birth

|

| |

Position(s) Held with

the Fund and Length of Time Served |

| |

Principal Occupation(s)

During Past 5 Years |

|

| | | | Officer, Counsel and Secretary (since 2022), AIO, NCV, NCZ, CBH, ACV, NIE and NFJ. | | | its subsidiaries; Vice President, Chief Legal Officer, Counsel and Secretary (since 2022), Virtus Stone Harbor Emerging Markets Income Fund and Virtus Stone Harbor Emerging Markets Total Income Fund; Vice President, Chief Legal Officer, Counsel and Secretary (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust, Virtus Investment Trust and Virtus Strategy Trust; Vice President (since 2021), Assistant Secretary (2021 to 2022) and Chief Legal Officer, Counsel and Secretary (since 2022), Virtus AllianzGI Closed-End Funds; Vice President and Secretary (since 2020), DNP Select Income Fund Inc., Duff & Phelps Utility and Infrastructure Fund Inc. and DTF Tax-Free Income 2028 Term Fund Inc.; Vice President, Chief Legal Officer, Counsel and Secretary (2020 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Vice President, Chief Legal Officer, Counsel and Secretary (since 2020), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Vice President (since 2017) and Assistant Secretary (since 2008), Virtus Mutual Funds Family; Vice President, Chief Legal Officer, Counsel and Secretary (since 2013), Virtus Variable Insurance Trust; and Vice President, Chief Legal Officer, Counsel and Secretary (since 2013), Virtus Alternative Solutions Trust. | |

|

Short, Julia R.

YOB: 1972 |

| | Senior Vice President (since 2021), AIO, NCV, NCZ, CBH, ACV, NIE and NFJ. | | | Senior Vice President, Product Development (since 2017), Virtus Investment Partners, Inc. and/or certain of its subsidiaries; Senior Vice President (since 2022), Virtus Stone Harbor | |

|

Name and Year of Birth

|

| |

Position(s) Held with

the Fund and Length of Time Served |

| |

Principal Occupation(s)

During Past 5 Years |

|

| | | | | | | Emerging Markets Income Fund, Virtus Stone Harbor Emerging Markets Total Income Fund, ETFis Series Trust I and Virtus ETF Trust II; Senior Vice President (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust, Virtus Investment Trust, Virtus Strategy Trust and Virtus AllianzGI Closed-End Funds; Senior Vice President (2018 to 2021), Duff & Phelps Select MLP and Midstream Energy Fund Inc.; Senior Vice President (since 2018), Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Senior Vice President (2018 to 2019), the former Virtus Total Return Fund Inc.; Senior Vice President (since 2017), Virtus Mutual Fund Family; and Managing Director, Product Manager, RidgeWorth Investments (2004 to 2017). | |

|

Smirl, Richard W.

YOB: 1967 |

| | Executive Vice President (since 2021), AIO, NCV, NCZ, CBH, ACV, NIE and NFJ. | | | Executive Vice President, Product Management (since 2021) and Executive Vice President and Chief Operating Officer (since 2021), Virtus Investment Partners, Inc. and/or certain of its subsidiaries; Executive Vice President (since 2022), Virtus Stone Harbor Emerging Markets Income Fund, Virtus Stone Harbor Emerging Markets Total Income Fund, ETFis Series Trust I and Virtus ETF Trust II; Executive Vice President (since 2021), The Merger Fund®, The Merger Fund® VL, Virtus Event Opportunities Trust, Virtus Mutual Fund Family, Virtus Investment Trust, Virtus Strategy Trust, Virtus AllianzGI Closed-End Funds, Virtus Global Multi-Sector Income Fund and Virtus Total Return Fund Inc.; Executive Vice President (May to June 2021), Duff & | |

|

Name and Year of Birth

|

| |

Position(s) Held with

the Fund and Length of Time Served |

| |

Principal Occupation(s)

During Past 5 Years |

|

| | | | | | | Phelps Select MLP and Midstream Energy Fund Inc.; Chief Operating Officer (2018 to 2021), Russell Investments; Executive Director (Jan. to July 2018), State of Wisconsin Investment Board; and Partner and Chief Operating Officer (2004 to 2018), William Blair Investment Management. | |

|

Name of Trustee

|

| |

Dollar Range

of Equity Securities in AIO |

| |

Dollar Range

of Equity Securities in NCV |

| |

Dollar Range

of Equity Securities in NCZ |

| |

Dollar Range

of Equity Securities in CBH |

|

| Independent Trustees | | | | | | | | | | | |||

| Sarah E. Cogan | | |

$10,001 – $50,000

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

$10,001 – $50,000

|

|

| Deborah A. DeCotis | | |

$10,001 – $50,000

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

None

|

|

| F. Ford Drummond | | |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

|

| James S. Macleod | | |

$50,001 – $100,000

|

| |

$50,001 – $100,000

|

| |

$50,001 – $100,000

|

| |

None

|

|

| Philip R. McLoughlin | | |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

None

|

| |

None

|

|

| William B. Ogden, IV | | |

None

|

| |

None

|

| |

None

|

| |

None

|

|

| Alan Rappaport | | |

$10,001 – $50,000

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

$10,001 – $50,000

|

|

| R. Keith Walton | | |

None

|

| |

None

|

| |

None

|

| |

None

|

|

| Brian T. Zino | | |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

$1 – $10,000

|

| |

None

|

|

| Interested Trustee | | | | | | | | | | | |||

| George R. Aylward | | |

$50,001 – $100,000

|

| |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

None

|

|

|

Name of Trustee

|

| |

Dollar Range

of Equity Securities in ACV |

| |

Dollar Range

of Equity Securities in NIE |

| |

Dollar Range

of Equity Securities in NFJ |

| |

Aggregate Dollar Range

of Equity Securities in All Funds Overseen by Trustees in Family of Registered Investment Companies* |

|

| Independent Trustees | | | | | | | | | | | |||

| Sarah E. Cogan | | |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

Over $100,000

|

|

|

Deborah A. DeCotis

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

Over $100,000

|

|

| F. Ford Drummond | | |

$50,001 – $100,000

|

| |

$1 – $10,000

|

| |

$1 – $10,000

|

| |

Over $100,000

|

|

| James S. Macleod | | |

None

|

| |

$10,001 – $50,000

|

| |

$50,001 – $100,000

|

| |

Over $100,000

|

|

|

Philip R. McLoughlin

|

| |

None

|

| |

$1 – $10,000

|

| |

None

|

| |

Over $100,000

|

|

|

William B. Ogden, IV

|

| |

None

|

| |

None

|

| |

None

|

| |

Over $100,000

|

|

| Alan Rappaport | | |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

Over $100,000

|

|

| R. Keith Walton | | |

$1 – $10,000

|

| |

None

|

| |

None

|

| |

Over $100,000

|

|

| Brian T. Zino | | |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

$10,001 – $50,000

|

| |

Over $100,000

|

|

| Interested Trustee | | | | | | | | | | | |||

| George R. Aylward | | |

$10,001 – $50,000

|

| |

$50,001 – $100,000

|

| |

$50,001 – $100,000

|

| |

Over $100,000

|

|

| | |

Name of Trustee

|

| | |

Aggregate

Compensation from ACV |

| | |

Aggregate

Compensation from NIE |

| | |

Aggregate

Compensation from NFJ |

| | |

Aggregate

Compensation from NCV |

| | ||||||||||||

| | | Sarah E. Cogan | | | | | $ | 6,072 | | | | | | $ | 14,764 | | | | | | $ | 25,109 | | | | | | $ | 9,279 | | | |

| | | Deborah A. DeCotis | | | | | $ | 5,205 | | | | | | $ | 12,655 | | | | | | $ | 21,522 | | | | | | $ | 7,953 | | | |

| | | F. Ford Drummond | | | | | $ | 5,638 | | | | | | $ | 13,709 | | | | | | $ | 23,315 | | | | | | $ | 8,616 | | | |

| | | Hans W. Kertess(1) | | | | | $ | 10,244 | | | | | | $ | 24,685 | | | | | | $ | 42,026 | | | | | | $ | 15,775 | | | |

| | | James S. MacLeod | | | | | $ | 13,879 | | | | | | $ | 33,745 | | | | | | $ | 57,392 | | | | | | $ | 21,209 | | | |

| | |

Philip R. McLoughlin(2)

|

| | | | $ | 5,205 | | | | | | $ | 12,655 | | | | | | $ | 21,522 | | | | | | $ | 7,953 | | | |

| | | William B. Ogden, IV | | | | | $ | 13,445 | | | | | | $ | 32,691 | | | | | | $ | 55,598 | | | | | | $ | 20,547 | | | |

| | | Alan Rappaport | | | | | $ | 15,180 | | | | | | $ | 36,909 | | | | | | $ | 62,772 | | | | | | $ | 23,198 | | | |

| | | Davey S. Scoon(1) | | | | | $ | 11,268 | | | | | | $ | 27,153 | | | | | | $ | 46,229 | | | | | | $ | 17,352 | | | |

| | | R. Keith Walton(2) | | | | | $ | 1,107 | | | | | | $ | 2,781 | | | | | | $ | 4,712 | | | | | | $ | 1,644 | | | |

| | | Brian T. Zino(2) | | | | | $ | 5,481 | | | | | | $ | 13,350 | | | | | | $ | 22,700 | | | | | | $ | 8,364 | | | |

| | |

Name of Trustee

|

| | |

Aggregate

Compensation from NCZ |

| | |

Aggregate

Compensation from CBH |

| | |

Aggregate

Compensation from AIO |

| | |

Total

Compensation from the Funds and Fund Complex(3) |

| | ||||||||||||

| | | Sarah E. Cogan | | | | | $ | 7,009 | | | | | | $ | 3,106 | | | | | | $ | 16,328 | | | | | | $ | 302,500 | | | |

| | | Deborah A. DeCotis | | | | | $ | 6,007 | | | | | | $ | 2,662 | | | | | | $ | 13,996 | | | | | | $ | 293,333 | | | |

| | | F. Ford Drummond | | | | | $ | 6,508 | | | | | | $ | 2,884 | | | | | | $ | 15,162 | | | | | | $ | 297,917 | | | |

| | | Hans W. Kertess(1) | | | | | $ | 11,915 | | | | | | $ | 5,303 | | | | | | $ | 27,553 | | | | | | $ | 137,500 | | | |

| | | James S. MacLeod | | | | | $ | 16,020 | | | | | | $ | 7,099 | | | | | | $ | 37,322 | | | | | | $ | 146,668 | | | |

| | |

Philip R. McLoughlin(2)

|

| | | | $ | 6,007 | | | | | | $ | 2,662 | | | | | | $ | 13,996 | | | | | | $ | 671,917 | | | |

| | | William B. Ogden, IV | | | | | $ | 15,519 | | | | | | $ | 6,877 | | | | | | $ | 36,156 | | | | | | $ | 142,083 | | | |

| | | Alan Rappaport | | | | | $ | 17,522 | | | | | | $ | 7,765 | | | | | | $ | 40,821 | | | | | | $ | 160,417 | | | |

| | | Davey S. Scoon(1) | | | | | $ | 13,106 | | | | | | $ | 5,833 | | | | | | $ | 30,308 | | | | | | $ | 151,250 | | | |

| | | R. Keith Walton(2) | | | | | $ | 1,241 | | | | | | $ | 541 | | | | | | $ | 2,975 | | | | | | $ | 316,667 | | | |

| | | Brian T. Zino(2) | | | | | $ | 6,318 | | | | | | $ | 2,797 | | | | | | $ | 14,740 | | | | | | $ | 345,833 | | | |

AND THE FUNDS

|

Fund

|

| |

Fiscal Year Ended

|

| |

Audit Fees

|

| |

Audit-Related

Fees* |

| |

Tax Fees**

|

| |

All Other Fees

|

| ||||||||||||

|

AIO

|

| | January 31, 2022 | | | | $ | 40,500 | | | | | $ | 2,158 | | | | | $ | 14,950 | | | | | $ | 0 | | |

|

AIO

|

| | January 31, 2022 | | | | $ | 72,520 | | | | | $ | 0 | | | | | $ | 12,000 | | | | | $ | 0 | | |

|

NCV

|

| | January 31, 2022 | | | | $ | 44,000 | | | | | $ | 19,158 | | | | | $ | 14,950 | | | | | $ | 0 | | |

|

NCV

|

| | January 31, 2022 | | | | $ | 83,356 | | | | | $ | 17,738 | | | | | $ | 12,000 | | | | | $ | 0 | | |

|

NCZ

|

| | January 31, 2022 | | | | $ | 44,000 | | | | | $ | 19,158 | | | | | $ | 14,950 | | | | | $ | 0 | | |

|

NCZ

|

| | January 31, 2022 | | | | $ | 80,459 | | | | | $ | 17,738 | | | | | $ | 12,000 | | | | | $ | 0 | | |

|

CBH

|

| | January 31, 2022 | | | | $ | 44,000 | | | | | $ | 19,158 | | | | | $ | 14,950 | | | | | $ | 0 | | |

|

CBH

|

| | January 31, 2022 | | | | $ | 74,500 | | | | | $ | 17,738 | | | | | $ | 12,000 | | | | | $ | 0 | | |

|

ACV

|

| | January 31, 2022 | | | | $ | 40,500 | | | | | $ | 2,289 | | | | | $ | 14,950 | | | | | $ | 0 | | |

|

ACV

|

| | January 31, 2021 | | | | $ | 75,993 | | | | | $ | 0 | | | | | $ | 12,000 | | | | | $ | 0 | | |

|

NIE

|

| | January 31, 2022 | | | | $ | 40,500 | | | | | $ | 2,833 | | | | | $ | 14,950 | | | | | $ | 0 | | |

|

NIE

|

| | January 31, 2021 | | | | $ | 66,503 | | | | | $ | 0 | | | | | $ | 12,000 | | | | | $ | 0 | | |

|

NFJ

|

| | January 31, 2022 | | | | $ | 40,500 | | | | | $ | 3,501 | | | | | $ | 14,950 | | | | | $ | 0 | | |

|

NFJ

|

| | January 31, 2021 | | | | $ | 78,671 | | | | | $ | 0 | | | | | $ | 12,000 | | | | | $ | 0 | | |

|

Title of Class

|

| |

Name and Address of Beneficial Ownership

|

| |

No. of

Shares |

| |

Percent

of Class |

| ||||||

|

Common Shares of

CBH |

| |

Morgan Stanley

1585 Broadway New York, NY 10036 |

| | | | 1,034,495 | | | | | | 5.66% | | |

|

Common Shares of

CBH |

| |

Punch & Associates Investment Management

Inc.7701 France Ave South, Suite 300 Edina MN 55435 |

| | | | 939,219 | | | | | | 5.14% | | |

|

Preferred Shares of

NCV |

| |

UBS Group AG

Bahnhofstrasse 45 PO Box CH-8021 Zurich, Switzerland |

| | | | 8,056 | | | | | | 67.83%(1) | | |

|

Cumulative Preferred

Shares of NCV |

| |

RiverNorth Capital Management LLC

325 N. LaSalle Street, Suite 645 Chicago, IL 60654 |

| | | | 331,750 | | | | | | 8.29% | | |

|

Cumulative Preferred

Shares of NCV |

| |

Louisiana Workers Compensation Corp

2237 South Acadian Thruway Baton Rouge LA 70808 |

| | | | 324,146 | | | | | | 8.10% | | |

|

Cumulative Preferred

Shares of NCV |

| |

Fidelity National Financial, Inc.,

601 Riverside Ave, Jacksonville, FL 32204 |

| | | | 231,936 | | | | | | 5.80% | | |

|

Cumulative Preferred

Shares of NCV |

| |

Americo Financial Life & Annuity Ins

PO Box 410288 Kansas City MO 64141-0288 |

| | | | 215,000 | | | | | | 5.38% | | |

|

Common Shares of

NCV |

| |

Bank of America Corp

100 N Tryon St Charlotte NC 28255 |

| | | | 4,719,727 | | | | | | 5.22% | | |

|

Preferred Shares of

NCZ |

| |

UBS Group AG

Bahnhofstrasse 45 PO Box CH-8021 Zurich, Switzerland |

| | | | 5,636 | | | | | | 52.35%(1) | | |

|

Cumulative Preferred

Shares of NCZ |

| |

Fidelity National Financial, Inc.,

601 Riverside Ave, Jacksonville, FL 32204 |

| | | | 475,000 | | | | | | 10.89% | | |

|

Preferred Shares of

ACV |

| |

Metropolitan Life Insurance Co/NY

One MetLife Way Whippany, NJ 07981 |

| | | | 1,200,000 | | | | | | 100% | | |

|

Title of Class

|

| |

Name and Address of Beneficial Ownership

|

| |

No. of

Shares |

| |

Percent

of Class |

| ||||||

|

Common Shares of

ACV |

| |

First Trust Portfolios L.P. First Trust Advisors L.P.

The Charger Corporation 120 East Liberty Drive, Suite 400 Wheaton, Illinois 60187 |

| | | | 646,535 | | | | | | 6.24% | | |

|

Common Shares of

ACV |

| |

Advisors Asset Management Inc.

18925 Base Camp Road Monument CO 80132 |

| | | | 560,706 | | | | | | 5.50% | | |

|

Common Shares of

NIE |

| |

First Trust Portfolios L.P. First Trust Advisors L.P.

The Charger Corporation 120 East Liberty Drive, Suite 400 Wheaton, Illinois 60187 |

| | | | 1,420,006 | | | | | | 5.12% | | |

|

Common Shares of

NFJ |

| |

Parametric Portfolio Associates LLC

800 Fifth Avenue, Suite 2800 Seattle, WA 98104 |

| | | | 7,748,300 | | | | | | 8.17% | | |

Secretary

Virtus AllianzGI Convertible & Income Fund Virtus AllianzGI Convertible & Income Fund II Virtus AllianzGI Convertible & Income

2024 Target Term Fund

Virtus AllianzGI Diversified Income & Convertible Fund

Virtus AllianzGI Equity & Convertible Income Fund

Virtus Dividend, Interest & Premium

Strategy Fund.

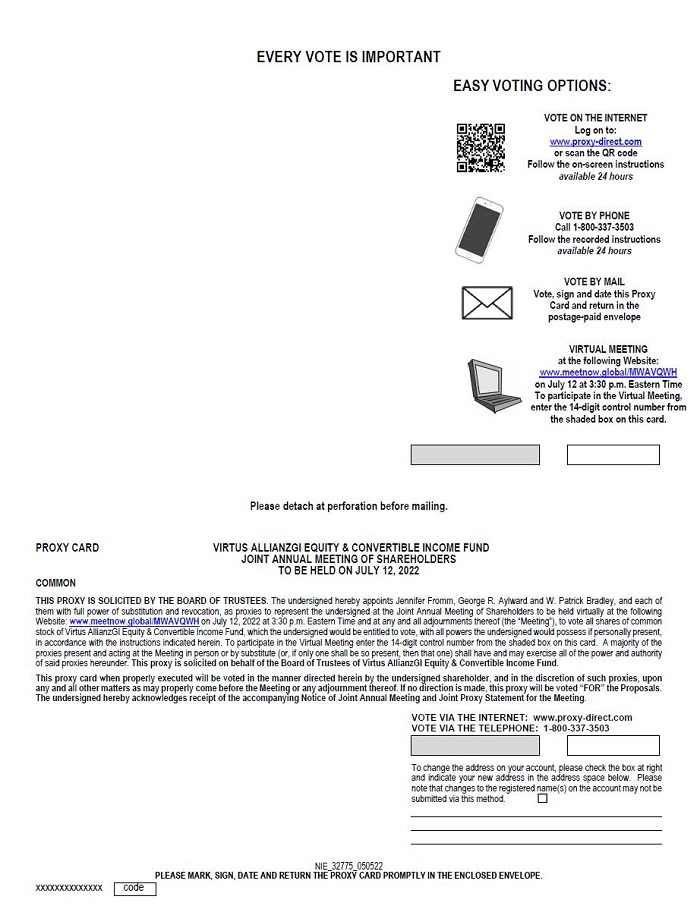

EVERY VOTE IS IMPORTANT EASY VOTING OPTIONS: VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VIRTUAL MEETING at the following Website: www.meetnow.global/MWAVQWH on July 12 at 3:30 p.m. Eastern Time To participate in the Virtual Meeting, enter the 14-digit control number from the shaded box on this card. Please detach at perforation before mailing. PROXY CARD VIRTUS ALLIANZGI ARTIFICIAL INTELLIGENCE & TECHNOLOGY OPPORTUNITIES FUND JOINT ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 12, 2022 COMMON STOCK THIS PROXY IS SOLICITED BY THE BOARD OF TRUSTEES. The undersigned hereby appoints Jennifer Fromm, George R. Aylward and W. Patrick Bradley, and each of them with full power of substitution and revocation, as proxies to represent the undersigned at the Joint Annual Meeting of Shareholders to be held virtually at the following Website: www.meetnow.global/MWAVQWH on July 12, 2022 at 3:30 p.m. Eastern Time and at any and all adjournments thereof (the “Meeting”), to vote all shares of common stock of Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund, which the undersigned would be entitled to vote, with all powers the undersigned would possess if personally present, in accordance with the instructions indicated herein. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this card. A majority of the proxies present and acting at the Meeting in person or by substitute (or, if only one shall be so present, then that one) shall have and may exercise all of the power and authority of said proxies hereunder. This proxy is solicited on behalf of the Board of Trustees of Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund. This proxy card when properly executed will be voted in the manner directed herein by the undersigned shareholder, and in the discretion of such proxies, upon any and all other matters as may properly come before the Meeting or any adjournment thereof. If no direction is made, this proxy will be voted “FOR” the Proposals. The undersigned hereby acknowledges receipt of the accompanying Notice of Joint Annual Meeting and Joint Proxy Statement for the Meeting. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 To change the address on your account, please check the box at right and indicate your new address in the address space below. Please note that changes to the registered name(s) on the account may not be submitted via this method. AIO_32775_050522 PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code

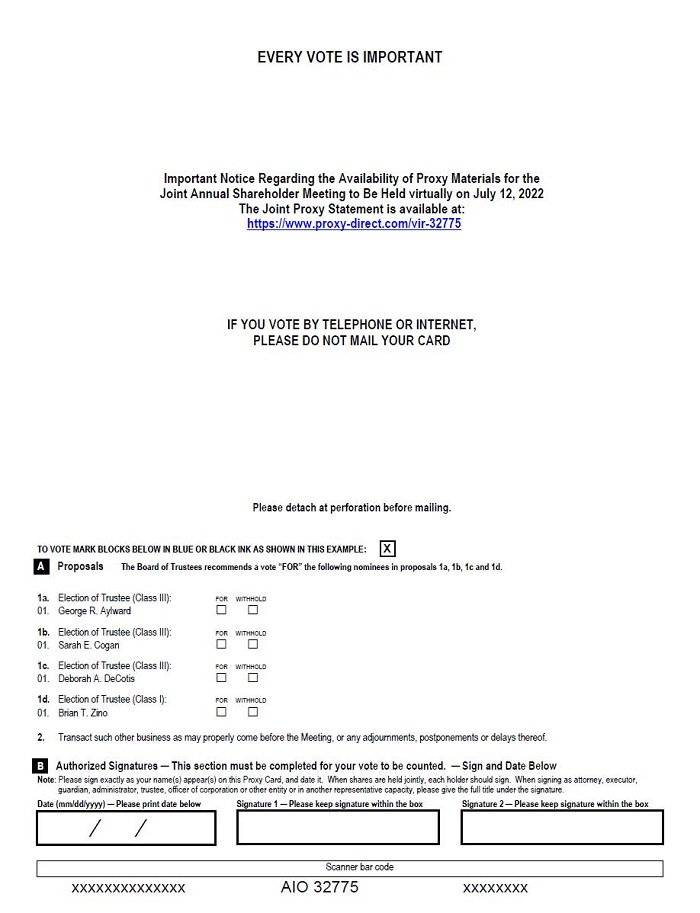

EVERY VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Joint Annual Shareholder Meeting to Be Held virtually on July 12, 2022 The Joint Proxy Statement is available at: https://www.proxy-direct.com/vir-32775 IF YOU VOTE BY TELEPHONE OR INTERNET, PLEASE DO NOT MAIL YOUR CARD Please detach at perforation before mailing. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X A Proposals The Board of Trustees recommends a vote “FOR” the following nominees in proposals 1a, 1b, 1c and 1d. FOR AGAINST ABSTAIN 1a. Election of Trustee (Class III): FOR WITHHOLD George R. Aylward 1b. Election of Trustee (Class III): FOR WITHHOLD 01. Sarah E. Cogan 1c. Election of Trustee (Class III): FOR WITHHOLD 01. Deborah A. DeCotis 1d. Election of Trustee (Class I): FOR WITHHOLD 01. Brian T. Zino Transact such other business as may properly come before the Meeting, or any adjournments, postponements or delays thereof. B Authorized Signatures This section must be completed for your vote to be counted. Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) Please print date below Signature 1 Please keep signature within the box Signature 2 Please keep signature within the box Scanner bar code xxxxxxxxxxxxxx AIO 32775 xxxxxxxx FOR AGAINST ABSTAIN

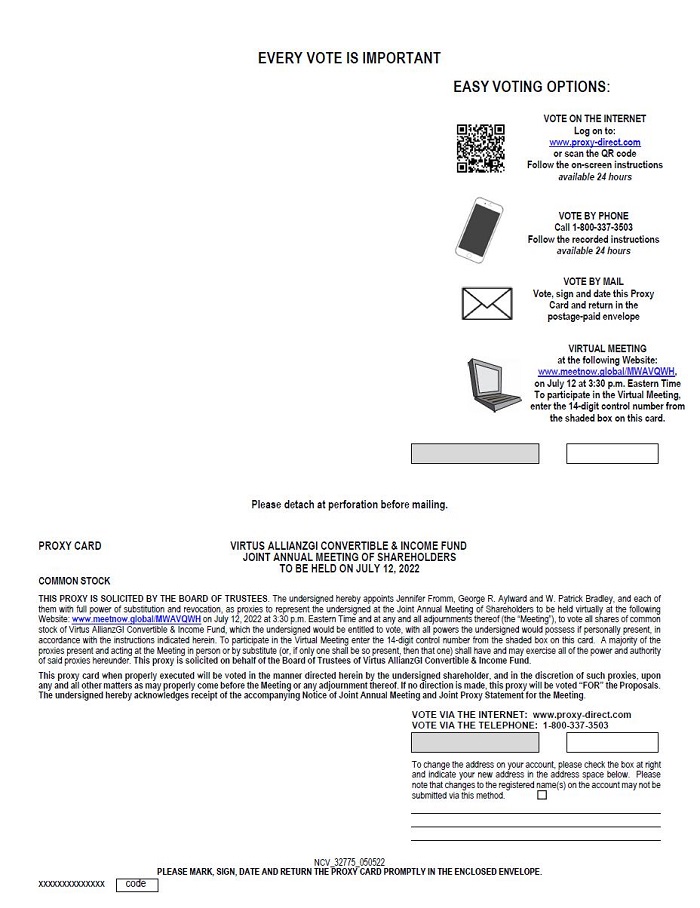

EVERY VOTE IS IMPORTANT EASY VOTING OPTIONS: VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VIRTUAL MEETING at the following Website: www.meetnow.global/MWAVQWH, on July 12 at 3:30 p.m. Eastern Time To participate in the Virtual Meeting, enter the 14-digit control number from the shaded box on this card. Please detach at perforation before mailing. PROXY CARD VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND JOINT ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 12, 2022 COMMON STOCK THIS PROXY IS SOLICITED BY THE BOARD OF TRUSTEES. The undersigned hereby appoints Jennifer Fromm, George R. Aylward and W. Patrick Bradley, and each of them with full power of substitution and revocation, as proxies to represent the undersigned at the Joint Annual Meeting of Shareholders to be held virtually at the following Website: www.meetnow.global/MWAVQWH on July 12, 2022 at 3:30 p.m. Eastern Time and at any and all adjournments thereof (the “Meeting”), to vote all shares of common stock of Virtus AllianzGI Convertible & Income Fund, which the undersigned would be entitled to vote, with all powers the undersigned would possess if personally present, in accordance with the instructions indicated herein. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this card. A majority of the proxies present and acting at the Meeting in person or by substitute (or, if only one shall be so present, then that one) shall have and may exercise all of the power and authority of said proxies hereunder. This proxy is solicited on behalf of the Board of Trustees of Virtus AllianzGI Convertible & Income Fund. This proxy card when properly executed will be voted in the manner directed herein by the undersigned shareholder, and in the discretion of such proxies, upon any and all other matters as may properly come before the Meeting or any adjournment thereof. If no direction is made, this proxy will be voted “FOR” the Proposals. The undersigned hereby acknowledges receipt of the accompanying Notice of Joint Annual Meeting and Joint Proxy Statement for the Meeting. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 To change the address on your account, please check the box at right and indicate your new address in the address space below. Please note that changes to the registered name(s) on the account may not be submitted via this method. NCV_32775_050522 PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code

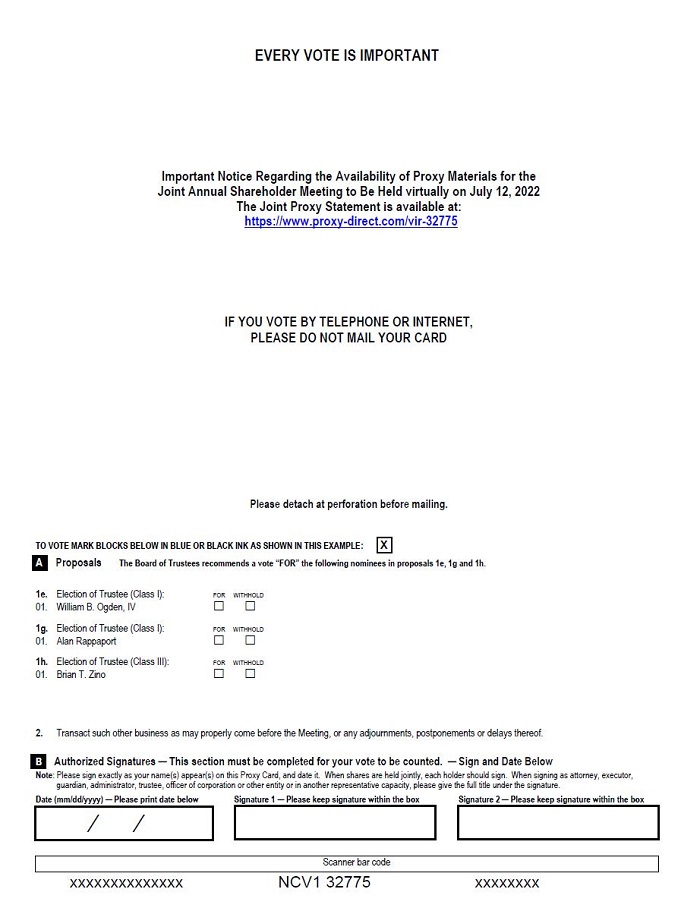

EVERY VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Joint Annual Shareholder Meeting to Be Held virtually on July 12, 2022 The Joint Proxy Statement is available at: https://www.proxy-direct.com/vir-32775 IF YOU VOTE BY TELEPHONE OR INTERNET, PLEASE DO NOT MAIL YOUR CARD Please detach at perforation before mailing. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X A Proposals The Board of Trustees recommends a vote “FOR” the following nominees in proposals 1e, 1g and 1h. 1e. Election of Trustee (Class I): FOR WITHHOLD William B. Ogden, IV 1g. Election of Trustee (Class I): FOR WITHHOLD 01. Alan Rappaport 1h. Election of Trustee (Class III): FOR WITHHOLD 01. Brian T. Zino Transact such other business as may properly come before the Meeting, or any adjournments, postponements or delays thereof. B Authorized Signatures This section must be completed for your vote to be counted. Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) Please print date below Signature 1 Please keep signature within the box Signature 2 Please keep signature within the box Scanner bar code xxxxxxxxxxxxxx NCV1 32775 xxxxxxxx FOR AGAINST ABSTAIN

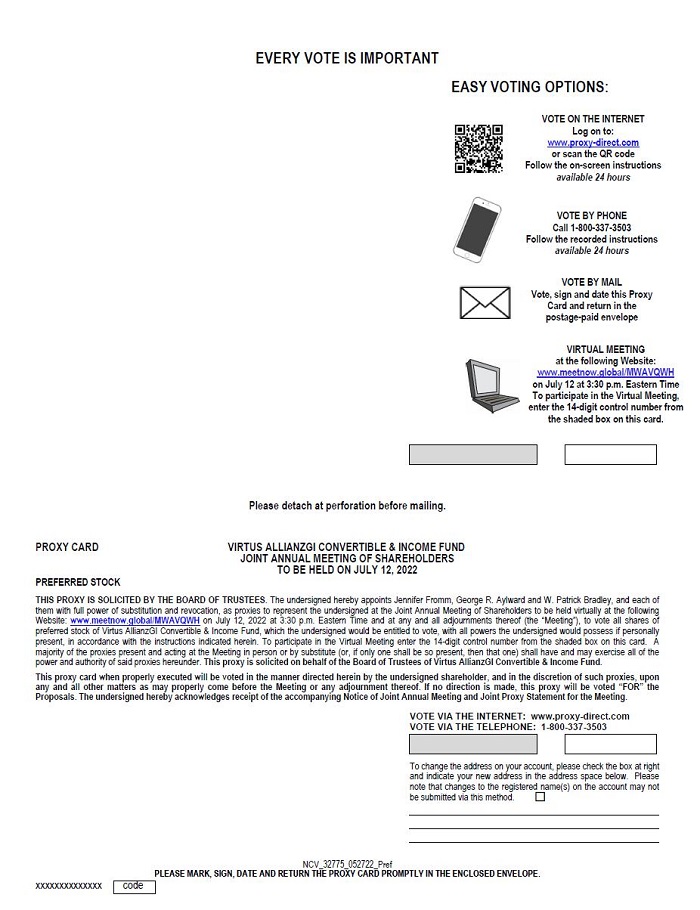

EVERY VOTE IS IMPORTANT EASY VOTING OPTIONS: VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours Please detach at perforation before mailing. PROXY CARD VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND JOINT ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 12, 2022 PREFERRED STOCK THIS PROXY IS SOLICITED BY THE BOARD OF TRUSTEES. The undersigned hereby appoints Jennifer Fromm, George R. Aylward and W. Patrick Bradley, and each of them with full power of substitution and revocation, as proxies to represent the undersigned at the Joint Annual Meeting of Shareholders to be held virtually at the following Website: www.meetnow.global/MWAVQWH on July 12, 2022 at 3:30 p.m. Eastern Time and at any and all adjournments thereof (the “Meeting”), to vote all shares of preferred stock of Virtus AllianzGI Convertible & Income Fund, which the undersigned would be entitled to vote, with all powers the undersigned would possess if personally present, in accordance with the instructions indicated herein. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this card. A majority of the proxies present and acting at the Meeting in person or by substitute (or, if only one shall be so present, then that one) shall have and may exercise all of the power and authority of said proxies hereunder. This proxy is solicited on behalf of the Board of Trustees of Virtus AllianzGI Convertible & Income Fund. This proxy card when properly executed will be voted in the manner directed herein by the undersigned shareholder, and in the discretion of such proxies, upon any and all other matters as may properly come before the Meeting or any adjournment thereof. If no direction is made, this proxy will be voted “FOR” the Proposals. The undersigned hereby acknowledges receipt of the accompanying Notice of Joint Annual Meeting and Joint Proxy Statement for the Meeting. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 To change the address on your account, please check the box at right and indicate your new address in the address space below. Please note that changes to the registered name(s) on the account may not be submitted via this method. NCV_32775_052722_Pref PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code

EVERY VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Joint Annual Shareholder Meeting to Be Held virtually on July 12, 2022 The Joint Proxy Statement is available at: https://www.proxy-direct.com/vir-32775 IF YOU VOTE BY TELEPHONE OR INTERNET, PLEASE DO NOT MAIL YOUR CARD Please detach at perforation before mailing. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: X A Proposals The Board of Trustees recommends a vote “FOR” the following nominees in proposals 1e, 1f, 1g and 1h. 1e. Election of Trustee (Class I): FOR WITHHOLD William B. Ogden, IV 1f. Election of Trustee (Class I): FOR WITHHOLD Philip R. McLoughlin 1g. Election of Trustee (Class I): FOR WITHHOLD 01. Alan Rappaport 1h. Election of Trustee (Class III): FOR WITHHOLD 01. Brian T. Zino Transact such other business as may properly come before the Meeting, or any adjournments, postponements or delays thereof. B Authorized Signatures This section must be completed for your vote to be counted. Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) Please print date below Signature 1 Please keep signature within the box Signature 2 Please keep signature within the box Scanner bar code xxxxxxxxxxxxxx NCV2 32775 xxxxxxxx FOR AGAINST ABSTAIN

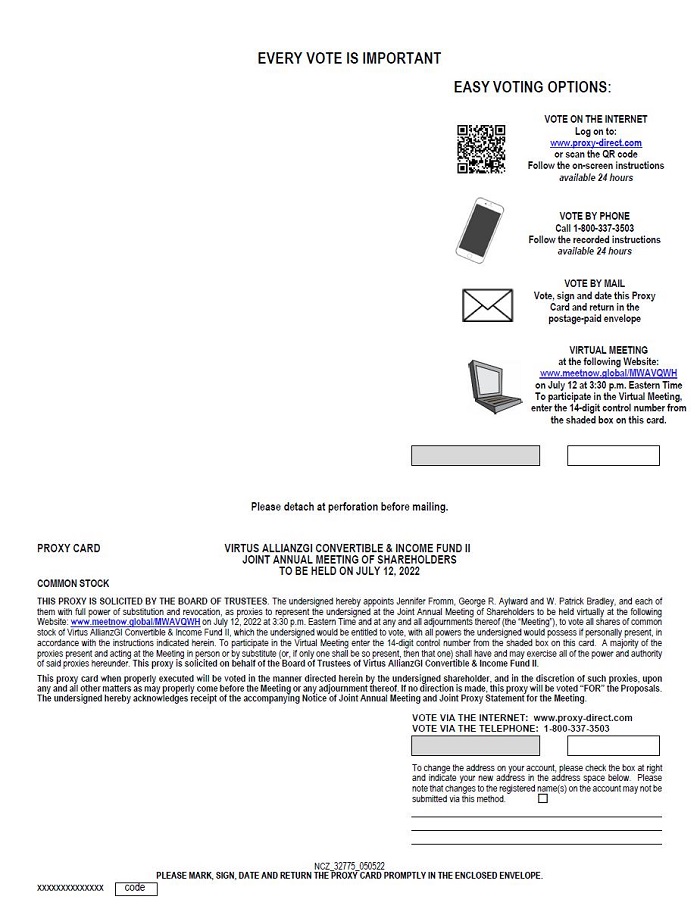

EVERY VOTE IS IMPORTANT EASY VOTING OPTIONS: VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VIRTUAL MEETING at the following Website: www.meetnow.global/MWAVQWH on July 12 at 3:30 p.m. Eastern Time To participate in the Virtual Meeting, enter the 14-digit control number from the shaded box on this card. Please detach at perforation before mailing. PROXY CARD VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND II JOINT ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 12, 2022 COMMON STOCK THIS PROXY IS SOLICITED BY THE BOARD OF TRUSTEES. The undersigned hereby appoints Jennifer Fromm, George R. Aylward and W. Patrick Bradley, and each of them with full power of substitution and revocation, as proxies to represent the undersigned at the Joint Annual Meeting of Shareholders to be held virtually at the following Website: www.meetnow.global/MWAVQWH on July 12, 2022 at 3:30 p.m. Eastern Time and at any and all adjournments thereof (the “Meeting”), to vote all shares of common stock of Virtus AllianzGI Convertible & Income Fund II, which the undersigned would be entitled to vote, with all powers the undersigned would possess if personally present, in accordance with the instructions indicated herein. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this card. A majority of the proxies present and acting at the Meeting in person or by substitute (or, if only one shall be so present, then that one) shall have and may exercise all of the power and authority of said proxies hereunder. This proxy is solicited on behalf of the Board of Trustees of Virtus AllianzGI Convertible & Income Fund II. This proxy card when properly executed will be voted in the manner directed herein by the undersigned shareholder, and in the discretion of such proxies, upon any and all other matters as may properly come before the Meeting or any adjournment thereof. If no direction is made, this proxy will be voted “FOR” the Proposals. The undersigned hereby acknowledges receipt of the accompanying Notice of Joint Annual Meeting and Joint Proxy Statement for the Meeting. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 To change the address on your account, please check the box at right and indicate your new address in the address space below. Please note that changes to the registered name(s) on the account may not be submitted via this method. NCZ_32775_050522 PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE. Xxxxxxxxxxxxxx code

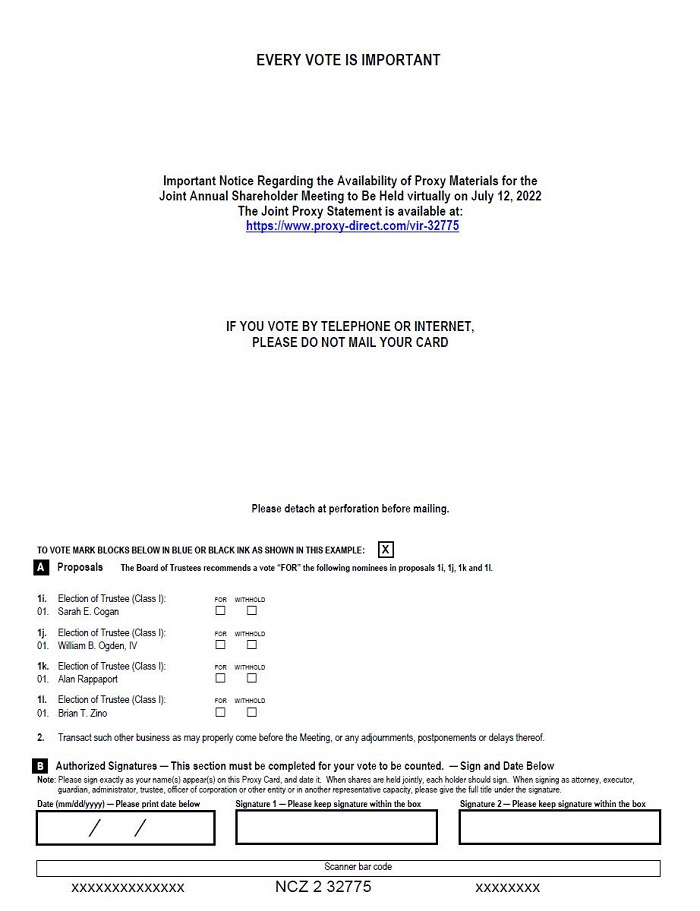

EVERY VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Joint Annual Shareholder Meeting to Be Held virtually on July 12, 2022 The Joint Proxy Statement is available at: https://www.proxy-direct.com/vir-32775 IF YOU VOTE BY TELEPHONE OR INTERNET, PLEASE DO NOT MAIL YOUR CARD Please detach at perforation before mailing. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE: A A.Proposals The Board of Trustees recommends a vote “FOR” the following nominees in proposals 1j, 1k and 1l. 1j. Election of Trustee (Class I): FOR WITHHOLD William B. Ogden, IV 1k. Election of Trustee (Class I): FOR WITHHOLD 01. Alan Rappaport 1l. Election of Trustee (Class I): FOR WITHHOLD 01. Brian T. Zino Transact such other business as may properly come before the Meeting, or any adjournments, postponements or delays thereof. B Authorized Signatures This section must be completed for your vote to be counted. Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) Please print date below Signature 1 Please keep signature within the box Signature 2 Please keep signature within the box Scanner bar code xxxxxxxxxxxxxx NCZ1 32775 xxxxxxxx FOR AGAINST ABSTAIN

EVERY VOTE IS IMPORTANT EASY VOTING OPTIONS: VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope VIRTUAL MEETING at the following Website: www.meetnow.global/MWAVQWH on July 12 at 3:30 p.m. Eastern Time To participate in the Virtual Meeting, enter the 14-digit control number from the shaded box on this card. VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours Please detach at perforation before mailing. PROXY CARD VIRTUS ALLIANZGI CONVERTIBLE & INCOME FUND II JOINT ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 12, 2022 PREFERRED STOCK THIS PROXY IS SOLICITED BY THE BOARD OF TRUSTEES. The undersigned hereby appoints Jennifer Fromm, George R. Aylward and W. Patrick Bradley, and each of them with full power of substitution and revocation, as proxies to represent the undersigned at the Joint Annual Meeting of Shareholders to be held virtually at the following Website: www.meetnow.global/MWAVQWH on July 12, 2022 at 3:30 p.m. Eastern Time and at any and all adjournments thereof (the “Meeting”), to vote all shares of preferred stock of Virtus AllianzGI Convertible & Income Fund II, which the undersigned would be entitled to vote, with all powers the undersigned would possess if personally present, in accordance with the instructions indicated herein. To participate in the Virtual Meeting enter the 14-digit control number from the shaded box on this card. A majority of the proxies present and acting at the Meeting in person or by substitute (or, if only one shall be so present, then that one) shall have and may exercise all of the power and authority of said proxies hereunder. This proxy is solicited on behalf of the Board of Trustees of Virtus AllianzGI Convertible & Income Fund II. This proxy card when properly executed will be voted in the manner directed herein by the undersigned shareholder, and in the discretion of such proxies, upon any and all other matters as may properly come before the Meeting or any adjournment thereof. If no direction is made, this proxy will be voted “FOR” the Proposals. The undersigned hereby acknowledges receipt of the accompanying Notice of Joint Annual Meeting and Joint Proxy Statement for the Meeting. VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 To change the address on your account, please check the box at right and indicate your new address in the address space below. Please note that changes to the registered name(s) on the account may not be submitted via this method. NCZ_32775_052722_Pref PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY IN THE ENCLOSED ENVELOPE. xxxxxxxxxxxxxx code

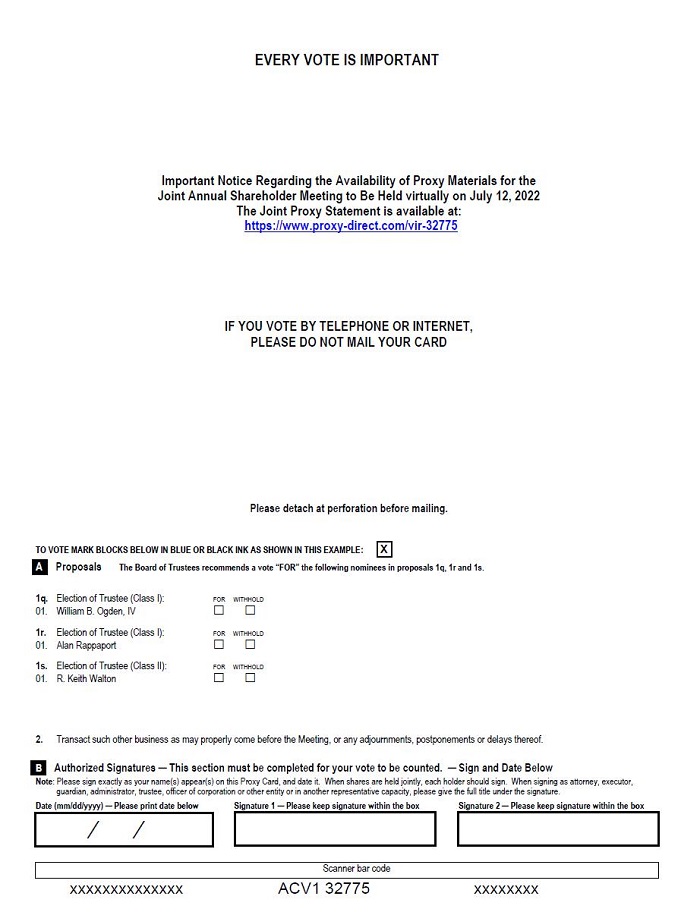

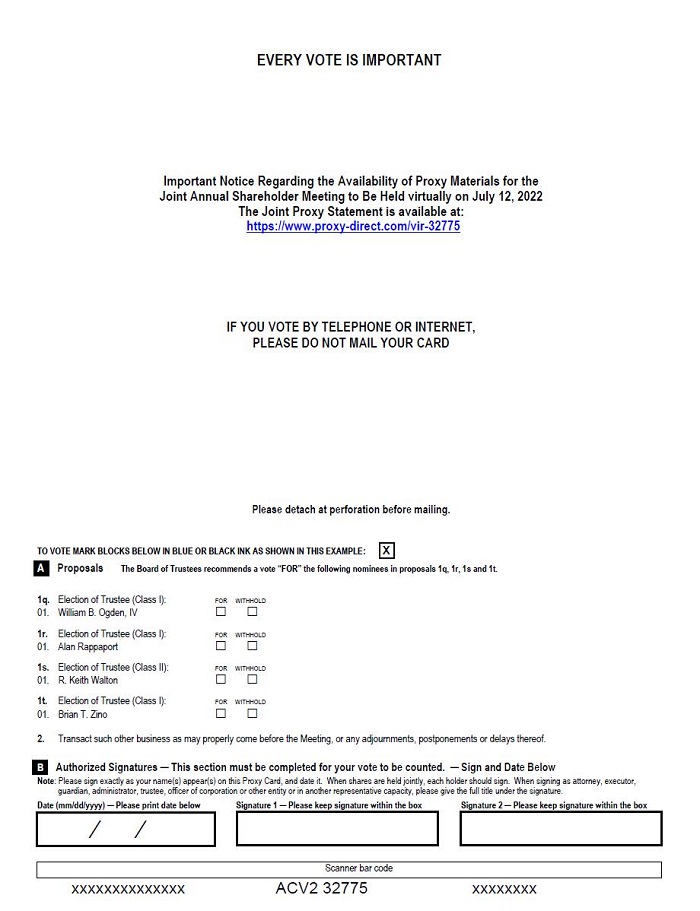

EVERY VOTE IS IMPORTANT Important Notice Regarding the Availability of Proxy Materials for the Joint Annual Shareholder Meeting to Be Held virtually on July 12, 2022 The Joint Proxy Statement is available at: https://www.proxy-direct.com/vir-32775 IF YOU VOTE BY TELEPHONE OR INTERNET, PLEASE DO NOT MAIL YOUR CARD Please detach at perforation before mailing. TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE A Proposals The Board of Trustees recommends a vote “FOR” the following nominees in proposals 1i, 1j, 1k and 1l. 1i. Election of Trustee (Class I): FOR WITHHOLD Sarah E. Cogan 1j. Election of Trustee (Class I): FOR WITHHOLD William B. Ogden, IV 1k. Election of Trustee (Class I): FOR WITHHOLD 01. Alan Rappaport 1l. Election of Trustee (Class I): FOR WITHHOLD 01. Brian T. Zino Transact such other business as may properly come before the Meeting, or any adjournments, postponements or delays thereof. B Authorized Signatures This section must be completed for your vote to be counted. Sign and Date Below Note: Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly, each holder should sign. When signing as attorney, executor, guardian, administrator, trustee, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. Date (mm/dd/yyyy) Please print date below Signature 1 Please keep signature within the box Signature 2 Please keep signature within the box Scanner bar code xxxxxxxxxxxxxx NCZ 2 32775 xxxxxxxx FOR AGAINST ABSTAIN