As Filed with the Securities and Exchange Commission on August 14, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

DYADIC INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

45-0486747

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

140 Intracoastal Pointe Drive, Suite 404

Jupiter, Florida 33477

(Address of principal executive offices) (Zip Code)

(561) 743-8333

(Registrant’s telephone number, including area code)

Copies to:

Karen Dempsey, Esq.

Andrew Thorpe, Esq.

Orrick, Herrington & Sutcliffe LLP

405 Howard Street

San Francisco, CA 94105

(415) 773-5700

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

|

Common Stock, par value $0.001 per share

|

|

(Title of class)

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer o

|

Non-Accelerated Filer o

|

Smaller Reporting Company x

|

|

|

|

(Do not check if a smaller reporting company)

|

|

DYADIC INTERNATIONAL, INC.

|

|

|

Page

|

|

|

|

|

|

|

PART I

|

2

|

|

|

|

|

|

Item 1.

|

2

|

|

|

Item 1A.

|

26

|

|

|

Item 2.

|

46

|

|

|

Item 3.

|

65

|

|

|

Item 4.

|

66

|

|

|

Item 5.

|

68

|

|

|

Item 6.

|

72

|

|

|

Item 7.

|

79

|

|

|

Item 8.

|

81

|

|

|

Item 9.

|

84

|

|

|

Item 10.

|

85

|

|

|

Item 11.

|

86

|

|

|

Item 12.

|

88

|

|

|

Item 13.

|

89

|

|

|

Item 14.

|

89

|

|

|

Item 15.

|

90

|

INFORMATION REQUIRED IN REGISTRATION STATEMENT

EXPLANATORY NOTE

You should rely only on the information contained in this General Form for Registration of Securities on Form 10 (the “Registration Statement”) or to which we have referred you. We have not authorized anyone to provide you with information that is different. You should assume that the information contained in this document is accurate as of the date of this Registration Statement only.

On the date of effectiveness of this Registration Statement we will become subject to the requirements of Regulation 13(a) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and will be required to file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and will be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act. Our periodic and current report will be available on the website, www.dyadic.com, free of charge, as soon as reasonable practicable after such materials are filed with, or furnished to the U.S. Securities and Exchange Commission (the “SEC”).

As used in this Registration Statement, unless the context otherwise requires the terms “we,” “us,” “our,” “Dyadic” and the “Company” refer to Dyadic International, Inc., a Delaware corporation, and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information (other than historical facts) set forth in this Registration Statement contains forward-looking statements within the meaning of the Federal Securities Laws, which involve a number of risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward-looking statements. Forward-looking statements generally can be identified by use of the words “expect,” “should,” “intend,” “anticipate,” “will,” “project,” “may,” “might,” potential” or “continue” and other similar terms or variations of them or similar terminology. Such forward-looking statements are included under Item 1. “Business” and Item 2. “Financial Information - Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Dyadic cautions readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information. Such statements reflect the current views of our management with respect to our operations, results of operations and future financial performance. Forward-looking statements involve a number of risks, uncertainties or other factors beyond Dyadic’s control. These factors include, but are not limited to, our ability to implement our strategic initiatives, our ability to execute and achieve our research and development objectives, our ability to obtain new license agreements, our dependence on our licensees for research and development funding, milestones and royalties for the products and/or processes that utilize licensed rights, our ability to maintain uninterrupted access to toll manufacturing at the quantities needed and at a competitive cost structure, our ability to hire and maintain, as well as our reliance on qualified employees and professionals, economic, political and market conditions and price fluctuations, government and industry regulation, U.S. and global competition, upgrade financial staffing, implement and monitor internal controls, and comply with financial reporting requirements, and other factors. We caution you that the foregoing list of important factors is not exclusive. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These statements are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Before investing in our common stock, investors should be aware that the occurrence of the events described under the caption “Risk Factors” and elsewhere in this Registration Statement could have a material adverse effect on our business, results of operations and financial condition.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or occur. Except as required by law, we undertake no obligation to publicly update any forward-looking statements for any reason after the date of this Registration Statement to conform these statements to actual results or to changes in our expectations.

Overview

The biotechnology bottleneck

The genomic revolution has seen billions of dollars invested in technology to discover new genes, the building blocks that carry out instructions encoded in DNA. With the advent and maturation of high-throughput robotic sequencing technology, gene sequencing costs have been spiraling downward from $100 million to sequence a single genome in the early 2000s to approximately $1,000 today according to the U.S. National Human Genome Research Institute. Facilitated by the recent affordability of gene discovery, new genes along with their functions are being identified at a greatly accelerated pace. These genes have the potential for commercial applications in multi-billion dollar opportunities across diverse end markets:

| · | Biofuels and bio-based chemicals – including bioethanol, biodiesel, renewable plastics and polymers as replacements for petroleum-based products and a variety of bio-based chemicals such as acrylic acid, succinic acid, butanediol, phthalate, solvents, and nutritious oils (e.g., omega 3) |

| · | Biopharmaceuticals – including therapeutic proteins, vaccines, monoclonal antibodies, biogenerics and other biologics used in the treatment of many diseases |

| · | Industrial – including enzymes that stonewash blue jeans; enable pulp & paper mills to operate more cleanly and efficiently; improve food production; create more nutritious animal feed; and aid in making beer, wine and fruit juice |

Modern biotechnology has enabled the discovery of numerous next-generation enzymes and other proteins that are more effective, cost efficient and environmentally sustainable. The current bottleneck in commercializing these novel genes lies in the inability to develop and manufacture them economically at industrial scale.

Our solution

Dyadic has developed, optimized and successfully commercialized an industrially proven expression system that turns genes into a broad range of valuable products. At the heart of Dyadic's technology are specially engineered strains of the filamentous fungi Myceliophthora thermophila, which we brand as "C1.” The C1 Expression System overcomes many of the inadequacies of existing technologies used for gene discovery, product development and commercialization. Our patented and proprietary C1 Expression System is one of the few commercially available solutions able to take genes and develop highly scalable industrial processes to produce enzymes and other protein products. This fully programmable system is robust, flexible, and safe and has produced products in some of the largest fermenters used in the industry.

Experts in academia and industry regard Dyadic’s C1 technology to be among the foremost expression systems in the world. It is well-recognized that the development of an expression system like C1 is an expensive and risky proposition that requires many years to overcome numerous scientific challenges. Thus, there is a high barrier of entry for competitors in this highly specialized technology sector.

Enzymes for biofuels and bio-based chemicals

Our C1-based enzyme technology is a critical element in the conversion of fibers from plant material (“biomass”) into second-generation cellulosic ethanol and a host of other high value bio-based fuels and chemicals such as butanol, polyurethane, acrylic acid, succinic acid, 1,4-butanediol, biopolymers, and phthalate. We believe that three key factors have enabled Dyadic to become a leader in this nascent industry:

| · | Highly effective CMAX product line: Robust and tolerant to higher temperatures and pH, C1-based enzymes are particularly adept at converting various types of biomass into the fermentable sugars used to produce biofuels and bio-based chemicals |

| · | Agile, cost efficient research and development platform: Our C1 Expression System has a genome rich in plant-degrading enzymes, enabling researchers to analyze and select enzymes best suited for their targeted applications quickly and effectively |

| · | On-site manufacturing business model: By allowing our customers to produce enzymes under license on-site at biofuel refineries, versus centralized production of enzymes, we are able to pass along anticipated savings of 30-50% of operating costs to the customer |

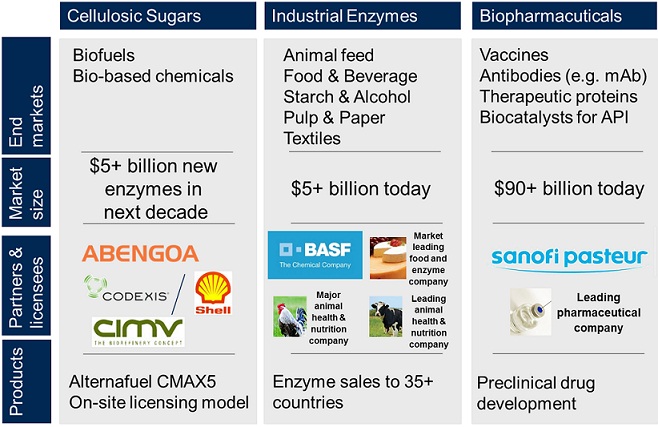

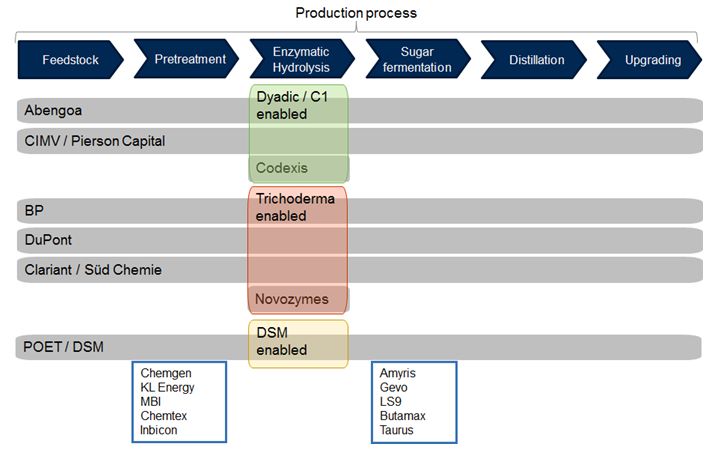

We believe the demand for plant-degrading enzymes will increase substantially, especially as the cellulosic ethanol industry gains traction as the first commercial-scale facilities set to come online in 2014. McKinsey & Co., a management consultancy, projects worldwide cellulosic ethanol demand to be 20 billion gallons per year by 2020, which if realized we estimate would create an additional $5 billion market for lingocellulosic enzymes. While we expect that McKinsey’s target may be delayed beyond 2020, there remains a belief among many that the industry will grow rapidly. We provide our C1 technology to Abengoa Bioenergy (“Abengoa”) and Compagnie Industrielle de la Matière Végétale (“CIMV”), both pioneers and leaders in the emerging cellulosic ethanol industry.

| · | Abengoa: Anticipated to begin operations at its 25 million gallon advanced biofuels plant in Hugoton, Kansas in the third quarter of 2014, Abengoa has reported that they will be using enzymes manufactured under its C1 Expression System license as they start up their Hugoton plant. We expect this facility to generate royalties for Dyadic by the end of 2014 |

| · | CIMV: We recently entered into a collaboration with CIMV, a leader in developing innovative technologies to process biomass, to create an efficient, fully integrated system to produce environmentally low impact biofuels and bio-based chemicals. Dyadic anticipates supplying enzymes to CIMV’s planned 2015 demonstration plant and licensing its C1 technology for on-site production of enzymes at CIMV’s future commercial scale plants |

A new way to make biopharmaceuticals

In 2012, biologics accounted for approximately 18% of total global spending on drugs and to reach an overall market revenue of over $169 billion by 2012, and expected to grow to over $220 billion by 2020 according to IMS Health, a leading healthcare market research company. Within the next five years, seven of the top ten global medicines by revenue will be a biologic. However, biotechnology companies today are facing significant challenges in finding suitable systems to produce certain biologic drugs. Novel expression systems may offer significant advantages over the most commonly used production hosts (mammalian cells, bacteria, and yeast) such as lower manufacturing costs, more human-like or better controlled glycosylation of proteins, proper protein folding, and higher purity.

Expression systems based on filamentous fungi, like C1, may provide particular advantages over mammalian cell lines, such as faster cell line development, thereby reducing the initial drug development period. Further, fungal expression systems tend to offer a combination of high yields and shorter growth periods, promising significantly lower production costs. Downstream processing (“DSP”) is streamlined as well, since proteins are typically secreted and the product is easier to isolate and purify. Despite these advantages, filamentous fungal systems are not prevalent today as expression systems for biologics, as the genetic tools for engineering filamentous fungal hosts have historically not been developed to meet the needs of the pharmaceutical industry. We believe that the C1 system has the potential to overcome these challenges and dramatically reduce the cost and time to market for biologics. Given the progress we have already achieved, it is apparent that engineering the C1 Expression System for biologics represents a very lucrative, but risky opportunity that Dyadic has only just begun to pursue.

Our growing industrial enzyme business

Within Dyadic, we have successfully leveraged our technologies to develop a growing industrial enzymes business, with sales of $10 million to more than 35 countries in 2013. We believe that enzymes have particular advantages as biocatalysts and will increasingly replace existing chemicals and other technologies that are potentially more harmful to the environment or human body. According to Freedonia, a leading market research group, industrial enzymes represented a $5.1 billion market worldwide in 2012 and are expected to grow to $7 billion by 2017. Our current business selling proprietary enzyme products for the animal feed, pulp and paper, textiles, and food and beverage end-markets is well-positioned for expansion, and we expect substantial growth. We are expanding our new product development pipeline of proprietary enzymes to compete against the limited number of competitors in the field that also have advanced technologies to commercialize large volumes of low cost industrial enzymes.

Scientific expertise and a pioneering management team

The rich history of Dyadic represents a microcosm of how modern biotechnology is revolutionizing science, medicine, agriculture, and engineering to improve how we feed, fuel, and heal the world. For Dyadic, the journey can be described as going from "jeans to genes”: pioneering the use of pumice stones to stonewash blue jeans in the early 1980s, shifting along with the industry to enzymes at the end of the decade, then beginning a new journey with the discovery of a filamentous fungal strain suitable for producing enzymes in the early 1990s. For the next two decades, Dyadic has built the knowledge, expertise, molecular tools, and technology needed to create and commercialize one of the world’s premiere gene expression systems. During development we identified two separate mutations: the first changed the morphology of our organism, resulting in high productivity and better growth conditions; and the second created our C1 White StrainTM, which allows for the production of purer enzymes. We believe our research and development ("R&D") laboratory, located in the Netherlands near the prestigious Wageningen University, is world class and we have some of the leading scientists and scientific advisors in the field. Dyadic today is still led by its pioneering founder, and its management team has a unique mix of established industry veterans and dynamic youth.

Partnered with leaders in industry and academia

Dyadic has a number of prominent, global commercial partners and licensees of our technology that are leveraging the C1 Expression System across industries, markets, and continents. These partners and licensees are leaders in their respective markets and include Abengoa and CIMV in biofuels, BASF and a confidential animal feed partner in industrial enzymes, and Sanofi Pasteur (“Sanofi”) in vaccines. We are involved in nine innovative private-public programs funded by the European Union and the Dutch government in application areas ranging from cosmetics, algae-based products, bioplastics, baking, and paper waste and starch processing. These research partnerships provide many benefits including revenue to offset R&D costs, business development opportunities, and access to industry knowledge in related fields. Dyadic also enjoys strong, productive, and effective relationships with biotechnology research groups at prestigious institutions around the world, including the Scripps Research Institute, Wageningen University (The Netherlands), Moscow State University, The Netherlands Organization for Applied Scientific Research (TNO), and Bio-Technical Resources (BTR).

What Are Enzymes?

Enzymes are large biological molecules produced by all living cells. They are proteins that act as natural catalysts and are essential for the regulation of tens of thousands of biochemical functions performed by cells and organisms. Whenever one substance needs to be transformed into another, nature uses enzymes to initiate and accelerate the process and to make it more efficient. Everything from the conversion of sunlight and carbon dioxide to oxygen and energy by plants to the digestion and absorption of food requires enzymes.

Diverse with many applications

Microorganisms found in nature, mainly fungi and bacteria, produce thousands of different enzymes, including many commonly used in industrial processes. The key challenges for industry are to identify the ideal enzyme for a specific need, create an expression host that can produce that enzyme at high levels and high purity, and optimize the microorganism used to manufacture the enzyme for robust, reliable growth in a controlled, large-scale industrial fermentation system. Dyadic has achieved this with its C1 fungal expression system.

Nature has finely tuned enzymes to make them ideally suited to performing a particular function, and one function only. These unique proteins are highly specialized not only in what they do, but also under what conditions they will carry out their task. The combination of so many different types of enzymes available in nature and the availability of modern high throughput screening techniques to sort through gene libraries rapidly and efficiently creates an almost unlimited number of opportunities to discover and develop enzymes with desired properties across industries and multiple billion dollar markets. The C1 system may then be used to develop and produce these enzymes at high yields and low costs in commercial scale processes.

One of the earliest commercial applications of enzymes was in the food and beverage industry, where enzymes have long been used successfully in baking and brewing applications and in starch processing to ensure more consistent and safer production of high quality end-products. Another early application of enzymes was in the textiles industry, where amylases, proteases, cellulases, and other enzymes have been developed for use in the washing and finishing of various textiles. Currently, the markets for industrial enzymes encompass a large and diverse range of products, including animal feed, food (e.g., baking, dairy) and beverage (e.g., brewing, fruit juice, and wine production), textiles, pulp and paper, detergents and personal care products, biofuels and grain (starch) processing, and biopharmaceuticals.

An environmentally friendly alternative

An enzyme works much like a key opens a lock: when it finds the correct substrate, the molecule that fits within its active catalytic site, a specific biochemical reaction takes place. An important advantage of the specificity of enzymes is the absence of unexpected, unwanted side reactions that could disrupt industrial processes and generate undesired by-products. Therefore, enzymes can safely be added to many industrial processes to enable or speed up reactions or improve product yields. An enzyme that transforms starch into glucose, for example, will catalyze only that specific reaction, and no other material or process will be altered or affected. Further, as natural molecules, enzymes are completely biodegradable. When the biochemical reaction for which an enzyme is needed has finished, the enzyme can be disposed of in the process waste water. It will harmlessly degrade into its amino acid components, which may be reused to form a new protein. Industrial use of enzymes is truly a “green” alternative to many chemical processes used today.

What is a Protein Expression System?

“The expression system is not everything, but everything is nothing without a good expression system”

The DNA sequence of a gene encodes the information needed to make a protein. By transferring this gene into a host microorganism, a mini factory is created that produces the encoded proteins (an "expression host"). Every living cell is essentially an expression system, capable of producing hundreds of enzymes and other proteins. The gene for a desired protein may normally be present in an expression host (a homologous gene), or it can be inserted using molecular engineering (a heterologous gene). For the purposes of this document, we refer to an expression system as a microorganism or host cell line with the necessary molecular tools to enable recombinant engineering for the development and production of targeted enzymes and other proteins. Dyadic's C1 Expression System is built around its patented and proprietary filamentous fungal expression host Myceliophthora thermophila.

Finding the right gene that encodes for a specific enzyme of interest is a key challenge for Dyadic and the broader biotechnology industry. The process of using an expression system to develop a product requires several distinct phases that begin with gene discovery and end with the optimization and manufacturing of a protein product. This process, from beginning to end, typically takes between six months to two years, and sometimes even longer. While each phase presents technical challenges, Dyadic has developed the molecular tools and advanced technologies needed to meet these challenges and fine-tune each aspect of this process.

| · | Gene Library Creation: At the heart of an expression system is the collection of genes and gene sequences available to be over-expressed by the microorganism. A gene library consists of genes with potential industrial utility that may be native to the expression host or have been collected from a variety of sources, including other organisms or environmental samples. Gene collections can number in the thousands or even millions. In addition to libraries of full-length genes are collections of DNA sequences that are being identified, synthesized, and catalogued at an accelerated rate. These gene fragments may serve a variety of functions, including acting as promoters to regulate gene expression, or producing cofactors that enhance enzyme activity. These genes and DNA sequence libraries provide a virtually untapped pool of new product opportunities waiting to be expressed. Dyadic has created its own proprietary gene library based on C1’s rich genome, as well as genes from other organisms. |

| · | Gene Discovery: Using advanced automation and robotic processing technology, the biotechnology industry can screen at a rapid rate for target enzymes or other proteins expressed by genes in their libraries during the gene discovery phase. Once an enzyme or protein with the desired activity and functional characteristics is identified, you can easily isolate the gene responsible for that activity. |

| · | Gene Expression: The goal of gene expression is to construct a microorganism capable of producing the protein encoded for by the gene selected during gene discovery. Transfer of the gene of interest into the host microorganism, if successful, typically results in levels of protein production too low for commercial use. Based on extensive experience and expertise, our scientists can apply a wide range of molecular biology techniques to increase expression in the best producing strains. Dyadic’s C1 Expression System includes several C1-based expression hosts and an extensive toolkit that has the potential to enable high levels of expression of genes present in nature. |

| · | Product Optimization: Once our scientists have achieved high levels of gene expression in a variety of production strains in the laboratory, they then work to improve production processes and make them even more productive. During fermentation process optimization, we adjust the culture media, nutrients, and environmental conditions to optimize growth of the production strain in large-scale bioreactors. |

| · | Manufacturing: Dyadic's C1 Expression System avoids the challenges involved in switching from a laboratory organism to a commercial production strain. The "one-stop shop" capabilities of C1-based expression hosts are highly prized. The ability to use a single organism in the lab and the factory significantly increases the probability of success for producing a commercially viable product from a gene library in a shorter time frame. |

Our C1 Expression System

"The search for novel and/or improved industrial enzymes and enzyme production systems is intensifying as market demand increases. One such new system was developed based on a recently discovered fungal isolate, C1... The filamentous fungus C1 was developed into a mature technology and protein-production platform. C1's inherent richness of genes encoding industrially relevant enzymes and its high-producing characteristics have been a proven starting point for the development of different C1 strains producing enzymes and enzyme mixtures." - Industrial Biotechnology, June 2011

Figure 1 – The C1 Expression System turns DNA into products

The filamentous fungus Myceliophthora thermophila was isolated by Dyadic scientists in the early 1990s and christened C1. Classical ultraviolet light-induced experiments led to a mutation with beneficial morphological changes in the fungus, resulting in a high-yielding strain that exhibits a low viscosity profile when growing at high density. What began as experiments to identify and produce cellulase enzymes used for stonewashing blue jeans has led to the creation of a world class technology platform for producing all types of enzymes and proteins across several diverse multi-billion dollar markets. Significant milestones in the evolution of C1 have included the following:

| · | 1992: Discovery of the wild-type C1 strain |

| · | 1995-96: Identification of the high cellulase (“HC”) C1 strain derived from mutagenesis experiments resulting in a morphological change in the fungus and over-expression of cellulase enzymes; especially advantageous initially for stonewashing denim and later modified to be used in converting cellulose and other lignocellulosic polymers to sugars for applications in the biofuels industry |

| · | 2003: Dyadic established an R&D facility in The Netherlands (“Dyadic Netherlands” or “DNL”) |

| · | 2005: Sequenced the C1 genome, enabling new gene discovery and facilitating targeted genetic modification |

| · | 2005-08: Further developed the low cellulase C1 strain (the “White StrainTM”) using mutagenesis and gene knock-out and knock-in technology to shut down fungal production of the background enzymes and to minimize synthesis of proteases (enzymes that degrade proteins), while increasing enzyme and other protein productivity; allowing for genetic reprogramming of C1 and over-expression and secretion of highly pure enzymes of interest cost effectively and at commercial scale |

| · | 2006: Abengoa invests in Dyadic with funds targeted for R&D of C1-based enzymes for second-generation biofuels and bio-based chemicals |

| · | 2008: Licensed the C1 technology platform for use in biofuels and bio-based chemicals on a non-exclusive basis to Codexis in partnership with Shell |

| · | 2009: Licensed the C1 technology platform for use in second-generation biofuels and bio-based chemicals on a non-exclusive basis to Abengoa |

| · | 2011: Began collaborations to develop a vaccine with Sanofi and entered into a license agreement to develop an animal feed enzyme with a confidential leading animal nutrition company |

| · | 2012: Expanded Abengoa’s non-exclusive rights for use in second-generation biofuels and bio-based chemicals, and first generation ethanol; began EU-funded Bio-Mimetic program with partners including Proctor & Gamble and CIMV |

| · | 2013: Licensed the C1 technology for use in certain markets on a non-exclusive basis to BASF and expanded our Dutch research center |

| · | 2014: Further breakthroughs with our White Strain in expressing heterologous genes at even higher levels; established new partnership with CIMV to develop second-generation biofuels; began second funded biopharmaceutical project to develop a therapeutic protein an animal health application |

We are continually working to refine, enhance, and expand our patented and proprietary C1 technology. Together with our licensees, we continue to invest substantial dollars and resources toward improving the platform through further strain engineering and fermentation process optimization.

Advantages for turning genes into products

Selection of an expression system to create a product from a gene is a critical decision in a new product development process. Our C1 technology is a robust and versatile platform system that aids in de-risking and improves the productivity of the entire process, from genes to commercial products. Strengths of the C1 Expression System include:

| · | Comprehensive molecular toolkit: Dyadic invested substantial time and resources early to develop a state-of-the art genetic toolkit for optimizing C1-based recombinant protein development and production. We can design C1 microorganisms that produce purer enzymes from our White Strain or versatile enzyme combinations from our high cellulase strain lineage. The toolkit encompasses a wide range of C1 host strains and gene promoters, techniques to knock out genes or increase gene copy number, and methods to enhance the secretion of enzymes and other protein products. |

| · | Easy to grow and highly scalable: Thanks to its unique morphology, C1 has very favorable fermentation properties; oxygen transfer and nutrient supply are not hampered by high viscosity, allowing for high yields at low production costs. Our C1 organism has been in commercial use since 1996 and has a long history of scale-up from lab fermenters to commercial-scale vessels. These attributes make C1 a "one-stop shop" for use in the lab and in commercial production, reducing product development time and the cost to deliver targeted products. |

| · | Versatile, commercially relevant genetic make-up: Since native, homologous genes are typically expressed at higher levels than are heterologous genes that derive from another organism, it is beneficial to start with an expression system that has a genome rich in the types of proteins targeted for industrial applications. In addition, homologous genes are likely to receive more lenient treatment with regard to regulations targeting genetically modified organisms (“GMOs”) in certain countries. The C1 genome has more than 200 potentially industrially relevant genes, including nine times more polysaccharide monooxygenase enzyme-coding genes, nearly 3-fold more oxidoreductases, four times more cellulose binding domains, and more than 1.5-fold more cellulases than Trichoderma, the major competitive filamentous fungal expression system being used to develop and manufacture enzymes for use in the production of second-generation biofuels and bio-based chemicals. |

| · | High yields: Yields of protein from C1 are high, above 100 grams of protein per liter of fermentation broth when using the C1 high cellulase strains for biofuel applications. Using the White Strain, we have achieved up to 70 grams of protein per liter, of which up to 70-80% of the protein produced is the target protein. Recently, we have been able to achieve these results with both homologous and the more difficult heterologous genes. These results are quite unique in the biotech industry. |

| · | Robust proteins: Selection of an expression system can affect the attributes of the enzyme or protein produced. Enzymes and other proteins expressed from C1 are robust and exhibit activity at broad temperature and pH ranges, making them suitable for use in a broad range of applications. |

| · | Safe: C1 has a proven safety profile and has qualified for Generally Regarded as Safe (“GRAS”) status from the U.S. Food and Drug Administration (“FDA”). GRAS Notification letters are broadly recognized in the food and consumer products industries as the safety standard. Thorough testing showed the strain to be non-infectious and to produce no known toxins or mycotoxins. |

| · | Intellectual property: Unlike other commonly used fungal expression systems such as Aspergillus and Trichoderma, C1 technology enjoys greater freedom to operate for Dyadic and its licensees. Historically, there has been significant litigation between firms using Aspergillus and Trichoderma, where freedom to operate is less clear. In addition, all of Dyadic’s C1 licensees to date have a covenant not to sue against other users of C1. |

The White Strain

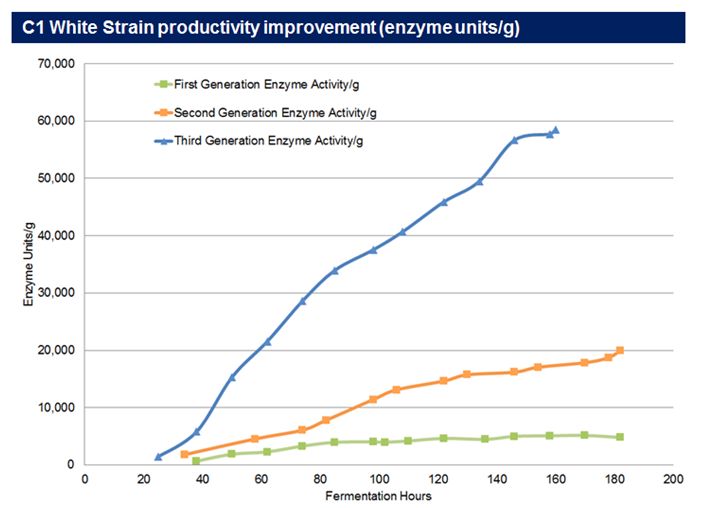

We, our collaborators and licensees have had multiple technological breakthroughs recently in the ongoing development and optimization of the C1 Expression System. In particular, the development of the White Strain potentially offers us, our licensees and collaborators significant technological and commercial advantages, and we have focused on accelerating the development and commercial exploitation of this strain. The ability to produce purer enzymes and other proteins at high productivity has opened the door for the production of next-generation C1-based products in many industries including pharmaceutical, food, and animal nutrition and health. Many of our key third-party projects begun within the last three years use the White Strain as the primary development host. During the period between 2011 and 2014, we have increased the productivity of the White Strain approximately 12-fold.

Figure 2 – Generation-over-generation productivity improvements of the C1 White Strain

Fibrezyme®G4, a high performance cellulase enzyme launched by Dyadic, is an example of a product produced using the C1 White Strain. Fibrezyme®G4 enhances paper and textile quality: it softens denim and creates a stonewashed effect for the textile industry; it also restores fiber strength and increases inter-fiber bonding in paper-making applications. Fibrezyme®G4 was created by combining three genes with desired activities. Most of the products based on our new C1 White Strain technology are still in development and will not be ready for regulatory approval and commercial launch until 2017 or beyond.

Our Business Model

Dyadic's business model builds on three well-established sources of revenue and growth potential: proprietary enzyme sales, licensing and royalties, and third-party R&D. This strategy allows us to leverage our technology across a broad range of industries and application areas:

| · | Proprietary enzyme sales – Dyadic manufactures enzymes using its proprietary and patented C1 and Trichoderma industrial strains and sells those enzymes in a variety of industrial markets, including animal feed, food and beverage, pulp and paper, and textiles. We have been producing and selling our own proprietary enzymes since 1994, and our global market now spans 35 countries to over 100 customers worldwide. |

Our business plan focuses on expanding our distribution network, continued cost reductions, supply chain optimization efforts, and pursuing new opportunities for registration of our existing products. We will continue to build our sales and marketing leadership team with targeted additions in Europe, Asia, and the Americas. We are currently laying the groundwork for planned new product launches and related growth and expansion to accompany the anticipated White Strain-based product pipeline that will emerge in 2017 and beyond.

| · | Licensing and royalty revenues – We license our C1 Expression System with leading companies worldwide, including BASF, Abengoa, Codexis and others. To date, these licenses have allowed us to realize more than $20 million in upfront revenues, in addition to the potential for future milestones, royalties, and in some cases possible payments for expansion of rights from our licensees. Our strategy to date has been to enter into non-exclusive licenses with leading companies that will |

use our technology in large markets. The non-exclusive nature of our licenses gives us total flexibility to enter into any kind of future collaboration, partnership or license with other parties.

Our on-site licensing model in the biofuels area is more specific, in that we expect to receive an upfront license to use our production strain to make enzymes at our licensee’s facility. For each new facility opened and strain transferred, we anticipate receiving a milestone payment. We anticipate a royalty, either per gallon of biofuel produced or, in the case of bio-based chemicals, per ton of biomass processed. Given our strong track record for improving the cost performance of our CMAX enzymes, we also plan to potentially follow-on the licenses with some of these partners by introducing new, upgraded strains over time and potentially share in the cost savings achieved.

| · | Research and development revenues – Strategic R&D collaborations with industry leading partners are a potentially valuable source of revenues, and historically have been shown to lead to the signing of significant license agreements. Through these R&D partnerships and establishing a close and productive working relationship with major corporations we are able to demonstrate the value that the C1 Expression System can bring to their processes and product development goals. |

Our competitive strengths

Dyadic has several key competitive advantages that we will continue to leverage as we expand the commercialization of our technology platform into a global industrial enzymes business:

| · | C1 Expression System: Our C1 Expression System is an industry leading filamentous fungal platform for enzyme and other protein development and production, and one of only three types of industrially proven filamentous fungi being used for the commercial production of enzymes to meet the needs of second-generation biofuels and bio-based chemicals markets. The C1 Expression System is proven at commercial scale, programmable to produce both purer enzymes and enzyme mixtures tailored for specific applications, and capable of performing as a research or commercial production system; thereby potentially reducing both product development timelines and risk. |

| · | Freedom to operate within the framework of a strong patent portfolio: Having established a strong patent portfolio gives us wide freedom to operate using our C1 Expression System. This freedom to operate is rather unique with expression systems, as historically many of our competitors have faced challenges and litigation related to their use of systems based on Trichoderma, Aspergillus, and others. |

| · | Partnerships with leading companies: In each of our end markets, Dyadic enjoys strong partnerships with top-tier global companies: BASF and our confidential animal feed licensee in the industrial enzyme industry; Sanofi, a world leader in vaccines; and Abengoa and CIMV, pioneers in the development and commercialization of first generation as well as advanced biofuels. Our ability to build and maintain strong relationships with strategic partners and licensees has clear short-term and long-term benefits: increasing the probability of receiving future royalties; helping advance our technology and supporting our leadership position in the field; and providing credibility in negotiations and future dealings with other third parties. |

| · | Global industrial enzymes business: Our burgeoning industrial enzymes business is expected to provide a strong foundation for continued growth in revenues, profits, and market share. As we, our collaborators and licensees, develop new enzymes using the C1 platform, we have in place a well-established sales network to distribute our products in nearly all end-markets and major geographic regions. |

| · | State-of-the-art R&D capabilities: Our Dutch research team has a proven track record of developing industry leading products in a cost-effective manner and has been working with C1 for more than a decade. We have also partnered with some of the world's leading research institutions, including The Scripps Research Institute, Moscow State University, Wageningen Universiteit, TNO, Bio-Technical Resources, and BE-Basic Foundation. |

| · | Experienced management team: With founder and industry pioneer Mark Emalfarb at the helm, our management team has the scientific, business, and strategic experience and expertise needed to manage a successful and growing company. We have recently strengthened our team with the hiring of a new Chief Operating Officer, Chief Financial Officer, Board Member with substantial pharmaceutical experience, Head of European sales, and several leading scientists. Many of our |

scientists are leaders in their respective fields, and we have developed sophisticated capabilities to develop new products and improve our C1 platform.

Our Markets

We are leveraging the C1 Expression System to develop and manufacture enzymes and other proteins for a variety of end-markets. Currently we are mainly focusing our resources and efforts on three primary categories: (i) biofuels and bio-based chemicals; (ii) industrial enzymes including the animal feed, food and beverage, pulp and paper, and textiles end-markets; and (iii) biopharmaceuticals including vaccines, antibodies and other therapeutic proteins. We have a substantially different strategy with each end-market. For biofuels, one of the strategies that we have employed is to license our technology for on-site production of our enzymes. In the pharmaceutical world, we are focused on developing biologics through the preclinical phase. In the industrial enzyme markets, we have a hybrid model of both licensing and direct sales, depending on the specific product category. Through ongoing efforts to advance and broaden our evolving C1 technology platform, Dyadic is also focused on expanding our product offerings and partnerships into new markets.

Figure 3 – Dyadic’s strategy overview by end market

Biofuels and bio-based chemicals

As the demand for energy, commodities, and materials derived from natural resources reach unprecedented levels, governments and consumers are seeking sustainable solutions and renewable resources to satisfy their needs and minimize the impact on the environment. Biofuels currently represent one of the most viable and consumer-friendly solutions available. First-generation fuels based on corn, rather than second-generation non-edible plant biomass, are already widely used in automobiles, trucks, and airplanes in the form of bioethanol, biodiesel, and biojet fuel. Since the infrastructure, retail outlets and consumer awareness, acceptance and support for renewable fuels has already been established with first-generation biofuels.

We believe that second-generation biofuels over time have the potential to be cheaper to produce than first-generation ethanol. Since non-edible plant biomass is much cheaper to grow per ton than corn, and there continues to be rapid reductions in cost of enzymes, production processes, and facility construction, second-generation biofuels are projected to become cost competitive. There are also innovative technologies such as those being commercialized by Abengoa and

under development by companies such CIMV. Technology being developed by CIMV is expected to create pure lignin as a byproduct of the biofuel process, which could be sold as a raw material for the production of renewable plastic and may materially change the economics of second-generation biofuel production. In addition, using non-edible plant matter eliminates the “feed vs. fuel” dilemma of using corn or other edible crops for the production of ethanol.

In 2014, we are seeing the first commercial scale advanced biofuels plants coming online. Three are based in the United States, built by DuPont, POET/DSM, and our licensee Abengoa for an aggregate 80 million gallon per year capacity. We expect the next wave of second-generation biofuel plants to be built in Brazil, China, and elsewhere in Asia. The leading management consultancy McKinsey & Company expects the nascent cellulosic ethanol market to grow rapidly, projecting a global market of about 20 billion gallons per year by 2020. Based on these projections, we estimate the biofuels enzymes market to potentially be greater than $5 billion within the next decade.

In addition to biofuels, our enzymes can also be used in similar production processes that utilize fermentable sugars to create high-value bio-based chemicals efficiently at industrial scale. A growing number of technologies being developed and commercialized are expected to depend on access to sizeable volumes of affordable fermentable sugars created by applying C1 enzymes to plant biomass. Interest in bio-based chemicals is increasing and many technology companies have shifted their strategy from biofuels to produce bio-based chemicals, which address a wide and expanding range of multi-billion dollar markets such as polyurethane, acrylic acid, succinic acid, butanediol, biopolymers, phthalate, solvents, and nutritious oils (e.g., omega 3).

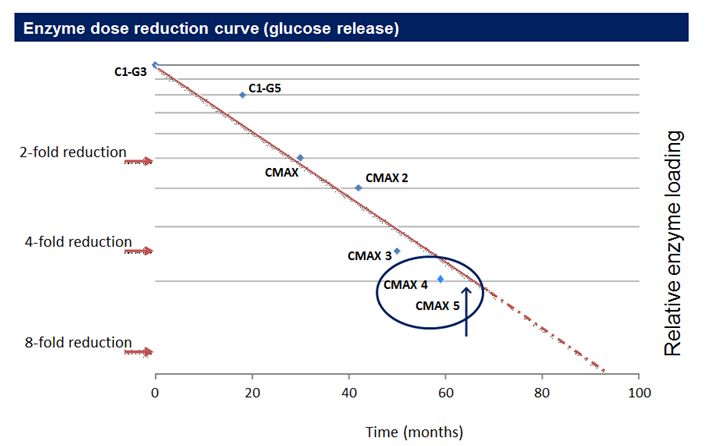

Dyadic's primary product for the biofuels and bio-based products market is AlternaFuel® CMAX™, a cocktail of enzymes that is now in its fifth generation, with CMAX5 expected to be introduced in late 2014. Produced by a single engineered C1 host organism, the CMAX liquid cellulase preparation includes a variety of carbohydrase enzymes capable of degrading various lignocellulosic biomass substrates, such as corn stover,wheat straw and sugar cane bagasse, all in one fermentation production run Among our numerous competitive advantages in the biofuels and bio-based products markets, we emphasize the following:

| · | Robust enzymes: Dyadic currently has a wide variety of well-characterized, engineered fungal C1 strains and enzymes, including CMAX, within our portfolio that enable the efficient conversion of multiple forms of non-food plant biomass into fermentable sugars. |

| · | Customization: We also have the capability and flexibility to develop highly customized enzyme solutions for diverse biomass feedstocks that are pretreated in different ways. C1 itself is feedstock agnostic and readily grows on a variety of biomass including agricultural residues and energy crops. Rather than focusing on the development of one product for every user and every application, we are committed to working with our commercial partners to create tailored solutions for their specific needs. |

| · | On-site licensing model: Dyadic has pioneered a business model that offers licensees the option to produce enzymes on-site at a biorefinery. We believe that 30-50% of the cost of delivered biofuel enzymes derives from downstream processing, stabilization, shipping, handling, and warehousing. On-site production avoids these costs. We are committed to ensuring our customers long-term cost control of their enzyme products and providing them with a more secure supply chain and reduced inventory requirements. In the on-site model, we anticipate to receive an upfront licensing fee, milestones and a royalty per gallon of ethanol produced using our C1 enzyme technology. |

| · | Lower development costs: C1's rich genetic make-up and reliability of scale-up from the lab to commercial production gives Dyadic and our licensees a potential competitive advantage by lowering overall product development costs and improving time to market. Our Dutch research team has a proven track record of developing leading products in a cost effective manner. Our scientists have been able to achieve significant improvements in the glucose conversion rates of our CMAX biofuel enzymes over the past 5 years, thereby lowering the doses needed and allowing us to realize an 80% cost reduction (Figure 4). |

Figure 4 - Cost reduction of Dyadic CMAX-series enzymes over the past 5 years

We believe the performance expected from our CMAX enzymes which are in development is anticipated to be a critical factor for our customers' ability to produce biofuels and bio-based chemicals at costs over time that can be potentially competitive to first generation sugars and from oil.. Given the potential size of the market, and the leading status of our technology, we plan to continue to invest a sizable amount of our R&D budget in the CMAX biofuel and bio-based chemical program.

Industrial enzymes

Global demand for industrial enzymes totaled over $5 billion in 2013, with established markets in North America and Western Europe and high growth in the emerging markets of Asia, Latin America, Eastern Europe, and Africa. Developed regions with more mature markets are demonstrating relatively rapid uptake of new enzyme technologies to address environmental issues, increase productivity, reduce costs, and improve product value. Developing regions offer attractive long-term market growth opportunities. We divide our industrial enzyme markets into four primary segments: animal feed; food and beverage; pulp and paper; and textiles, as outlined below.

Animal Feed

With the continuous increase in the world's population, a critical target for enzyme additives is more efficient and environmentally friendly production and use of animal feed. Enzymes used as feed additives can unlock more of the nutrient value present in feed products and improve the digestibility and quality of animal feed. The result is more productive poultry, swine, and other livestock, more efficient farming operations, and less environmental waste and pollution. Enzymes used in animal feed fall into two product families: phytases to degrade phytate, and enzymes to break down non-starch polysaccharides (“NSP”).

Phytase enzymes degrade the phytate found in plant-based ingredients, releasing phosphorus that would otherwise be unavailable. Indigestible phytate in animal feed accounts for 50-75% of the grain phosphorus. The use of phytase also facilitates the release of calcium and other nutrients. Extensive testing shows that use of phytase can save up to $7 or more per feed ton by resolving phytate anti-nutrient effects that create lost performance. In addition to the economic benefit, phytase enzymes may be marketed as a “green” feed additive as they reduce the amount of polluting waste from feed. However, while a large market, we believe that phytase enzyme margins are less attractive than the NSP enzyme market, on which we have focused on to date.

Xylanase cocktails such as Dyadic’s Xylanase 2XP are tailored to break down NSPs into more digestible components. Numerous reports have documented the negative effects of NSP on nutrient digestibility and absorption in poultry, and application testing data strongly support the use of enzymes in animal feed. Liberating NSP xylans reduces the viscosity of the feed in the intestinal track in chickens and pigs, which allows for better uptake of nutrients and better accessibility of starch by the animal’s own enzymes. A 2014 research study by Texas A&M using Dyadic enzymes showed that enzyme supplementation in chicken feed allowed for a 5% reduction in required calorie intake, resulting in a substantial improvement in food conversion efficiency (“FCE”). Based on this study, our analysis shows that for less than 1 cent per animal, enzyme supplementation can potentially reduce total diet costs by as much as 17 to 26 cents. Egg-laying chickens also benefit from NSP enzyme supplementation of feed, which are shown to upgrade the nutritional value of small grains, making it possible to use increased amounts of sunflower, small grains, and grain byproducts as sources of protein and energy, removing the upper limit of their inclusion in animal feed. Based on current data, even with these reduced-cost diets, overall egg size is improved.

The estimated revenue from the global feed enzyme market was approximately $1.0 billion in 2013, of which approximately 55% are NSP enzymes and 45% phytases. Markets and Markets, a research group, expects the animal feed enzyme market to reach $1.2 billion by 2018. High growth has been driven both by advancements in enzyme technology and a rapidly increasing cost of commercially manufactured compound feed, which represents up to 70% of the total production cost per animal. Asia has had a particularly high growth in feed for poultry and swine, and we expect that market to continue to expand.

Our lead animal feed enzyme, Xylanase 2XP, the company’s largest product in overall sales, is a xylanase-based enzyme cocktail that also contains betaglucanase, cellulase and other beneficial enzymes that work in concert to optimize the available energy and protein of feed for chickens and swine. Registration of these products is ongoing in various countries worldwide and through a number of collaborations. Our key markets for the product are in Europe, the U.S., China and other parts of Asia.

In addition to our current product offerings, we are developing new, innovative products for animal feed applications. One example is a thermostable xylanase enzyme mixture native to C1 that retains a significant amount of its activity during the hign temperature pelletizing process. Additionally, we plan to develop more efficient enzymes designed for use in animal feed products for specific diets in which effective enzymes are currently not commercially available or existing solutions are not cost efficient. These new products using the C1 White Strain will not be introduced for several years due to product development and registration timelines, but could have a very positive long-term impact on our animal feed enzyme business.

Food and Beverage

Demand for enzymes in the food and beverage market was approximately $2 billion worldwide in 2013. In the food and beverage industries, manufacturers face increasing pressure to lower costs and reduce processing times while improving the overall quality of product processes and addressing ethical and health-related concerns. Key drivers in this sector will continue to be rising raw material prices, an emphasis on the nutritional benefits of foods and beverages, and emerging market growth. Enzymes offer significant benefits over traditional alternatives for meeting industry needs, and we believe they will play an increasingly important role across multiple end-markets. In the food and beverage end market, we focus on customers in the brewing, baking and starch & alcohol segments.

Brewing

Our enzymes can enhance brewing products and processes, helping to increase our customers' productivity and profitability. They can reduce the cost and improve the efficiency of brewing by contributing to greater flexibility in raw materials, reducing viscosity, and enabling more effective mashing, filtration, and other processes. We believe that our products have the potential to capture an increasing share of the estimated $200 million global market for brewing enzymes.

It is well recognized in the brewing industry that the presence of NSPs, mainly beta glucans and xylans in cereal grains, can cause processing problems. Water-soluble NSPs increase the viscosity of the solution and block the filters used in production, thereby decreasing process efficiency. The addition of beta glucanase and xylanase enzymes to degrade these NSPs reduces the viscosity of the solution, resulting in cleaner filters and faster, more efficient production processes. Our BrewZyme product contains carbohydrases that improve the efficiency and productivity of filtering and lautering wort and enhance the conversion of poor quality barley to produce acceptable malts.

Amylase enzymes also have an important role in brewing applications. During brewing with high quality malt, endogenous enzymes (those already present in the process broth) degrade the starch of the malt into glucose, which is later fermented to ethanol. However, the use of lower quality malt results in incomplete starch degradation and ultimately less ethanol production. The addition of amylase enzymes to these types of malts improves starch degradation.

Baking

In the baking market, enzymes can improve product quality, extend product shelf-life, and help drive market growth by contributing to new product innovation. The total global enzymes market for baked goods is projected by Market and Markets, a research organization, to increase from $430 million in 2013 to nearly $700 million in 2019.

We believe the applications and importance of enzymes will increase in this market as consumers demand more natural, nutritionally superior products that are free of chemical additives, stay fresher longer, and offer added health benefits. Consider, for example, the continuing trend toward increased consumption of whole wheat breads due to their health-promoting effects. Enzymes can play an important role in improving the quality of both whole wheat and white breads. They can help degrade the fibers in whole grain breads, enhancing the elasticity of the dough and resulting in larger, less dense loaves. Enzymes such as amylases and xylanases are used in baking to change the structure of the starch and to improve dough qualities such as workability, stability, and uniformity of rising, and to extend the shelf-life of the product. Baking enzymes can also enhance and stabilize the crumb structure and the volume, texture, and appearance of breads, cakes, pastries, and other baked goods. Another advantage of enzymes is their ability to reduce the amount of acrylamide -- a carcinogenic compound -- that can form during baking when the amino acid asparagine reacts with sugars such as glucose or fructose at high temperatures.

In addition to amylases and xylanases, we are performing innovative research in conjunction with the Healthbread and Bakenzyme programs to uncover opportunities for the development of new enzymes to improve dough-making and dough quality, such as feruloyl esterases and oxidative enzymes. These enzymes can replace chemical oxidizing agents in dough and breads as processing aids to improve dough properties, increase production volume, extend freshness, and enhance end-product structure and appearance.

Starch and Alcohol

The starch industry is one of the longest-standing markets for enzymes within the food and beverage end-market, dating back to the use of glucoamylase in starch processing in the early 1960s. Market and Markets estimates that the current $1.5 billion alcohol and starch enzyme market will grow annually by 7.9% from 2013 to over $2.2 billion by 2018. Enzymes enable the breakdown of starch into a wide variety of syrups and modified starches without the use of harsh chemicals.

In recent years, it has become increasingly popular to use xylanase or hemicellulase to facilitate conversion of wheat starch into fermentable sugars using industrial-scale liquefaction and saccharification processes. The use of enzymes to lower viscosity during the initial stages of starch conversion, during which long-chain glucose molecules are broken down, makes it possible to decrease overall processing times. Starch manufacturers benefit from additional cost savings, higher quality yield, and reliable production volumes from variable substrates. Our CeluStar XL product has demonstrated unique capabilities to reduce viscosity at very low enzyme doses. Based on the performance of CeluStar XL in application testing, we are now investing to expand our efforts in this end-market.

Pulp and Paper

Traditional manufacturing methods used in the pulp and paper industry depend on large amounts of water, energy, and chemicals for pulp bleaching. The use of enzymes such as xylanases and hemicellulases to break down wood polymers and make it easier to solubilize and remove the lignin component offers a cost-effective, environmentally friendly alternative to conventional chemical methods. Market research estimates the North American enzyme market for pulp and paper is well positioned for growth, and we believe the global market will grow substantially as the adoption rate at mills increases. Driving demand for pulp and paper enzymes will be rising paper raw material prices, interest in reducing the use of harsh chemicals and other methods with negative environmental implications, and growth in emerging markets. In particular, mills in China have a policy-driven interest in reducing their environmental impact. We are actively advancing our products and corporate capabilities to leverage this substantial market opportunity.

Over the past decade, we have demonstrated continued progress in successfully integrating our enzymatic treatments into the production processes of pulp and paper mills. Fibrezyme G4®, our flagship product for this application, has capabilities in bio-refining, bleach boosting, deinking, and waste water treatment. Our Fibrezyme products have demonstrated the ability to improve the efficiency of multiple different components of the pulp and paper manufacturing process, and in particular bleaching, refining, and drying of both virgin and recycled pulp. The drying process is an important target for enzymatic treatment as faster, more efficient drying can translate to reduced energy consumption and increased production rates. Our products also contribute to decreased dependence on virgin pulp by improving numerous steps involved in processing recycled pulp. In addition, our treatments can enhance several important features of pulp and paper products, including strength, brightness, and cleanliness.

Textiles

Dyadic helped pioneer the stonewashing process for denim first selling pumice stones followed by selling cellulase enzymes in the 1980s, and has enjoyed a long history of technology leadership in the textiles industry launching our first generation C1 neutral textile cellulase enzyme in 1996. Today, stonewashing of jeans still depend on cellulases, and the processing of many other textiles relies on a variety of enzymes that can alter fiber structure to soften leather, for example, or make fabrics stronger and more durable. While the market for enzymes in the textile market remains sizable, we believe most products in this segment are characterized by lower margins.

We continue to help our customers gain a competitive advantage by offering quality enzyme products that faciliate more efficient and effective processing of a variety of textiles, decrease dependence on conventional chemicals and reduce consumption of natural resources which lead to lower overall production costs. Fibrezyme® G4, our newly launched next-generation C1 textile enzyme product opeates under wide pH and temperature ranges, allowing for integration into a variety of potential textile manufacturing processes and other high-end niche markets within the textile industry.

Other Industrial Enzyme Markets

R&D leading to advanced biotechnological tools for gene discovery and protein engineering provides a wide variety of highly effective enzymes that have replaced and enhanced traditional chemical processes. These enzymes can now operate at a wider range of temperatures, pH levels, and manufacturing conditions, making them suitable in numerous industrial and consumer applications, including the detergents and nutraceuticals end-markets:

| · | Detergents: For more than 30 years, enzymes have been used in detergents and household care items to degrade proteins that cause stains, such as grass or wine stains. Currently, enzymes are used in cleaning products to enhance cleaning ability, preventing color fading, and optimize performance at lower temperatures to improve energy efficiency. Biological enzymes products have a smaller environmental footprint than the oil-based and other non-renewable chemicals they are replacing, allowing manufacturers to offer consumers an alternative high performance product that is also more sustainable. The global demand for enzymes in the cleaning products market was approximately $750 million in 2012. |

| · | Nutraceuticals: Though still in its formative years, we are confident the nutraceuticals end-market will grow into a billion-dollar industry as consumers increasingly turn to nutraceuticals to prevent illness, manage chronic conditions, and achieve optimum health and wellness. We believe our integrated C1 technology platform will play a major role in delivering functionally superior, cost-effective new ingredients to manufacturers of dietary and herbal supplements and processed foods such as cereals, soups, and beverages. |

Biopharmaceuticals

Perhaps nowhere is the need for novel expression systems greater than in the biopharmaceuticals industry, where recombinant protein therapeutics, monoclonal antibodies, biogenerics (biosimilars), and vaccines have long developmental timelines, high development costs, and face challenging safety and regulatory issues. The global market for protein therapeutics was valued at more than $169 billion in 2012 and is projected to grow to in excess of $220 billion by 2018. At present more than 165 recombinant protein drugs are approved for human use and another 500 protein drug candidates are in preclinical and clinical development. All of these biologics are made by transferring a target gene into an expression system and growing the host cells in industrial-scale bioreactors to produce commercial quantities of the recombinant proteins.

The demand is increasing for novel expression systems to overcome the shortcomings of the common production hosts used today (mammalian, bacterial, and yeast). The potential benefits of a new expression system include significantly lower manufacturing costs, better control of protein glycosylation and protein folding, and higher purity. The most commonly used expression system at present is Chinese Hamster Ovary (“CHO”) cells. Efforts to increase CHO cell productivity and prolong the life span of cells in culture have led to volumetric productivity greater than 5 grams per liter under conditions of controlled nutrient feeding. This is a fraction of the potential production capability of Dyadic’s C1 White Strain. In addition to productivity, C1 offers many other potential advantages:

| · | Versatile genetic tools that enable efficient gene transfer with relatively short strain selection timelines |

| · | Effective in the expression of high value proteins derived from indigenous and heterologous genetic sources |

| · | Ability to secrete the expressed protein from host cells into the culture media, which significantly reduces the downstream processing costs |

| · | Analysis of proteins expressed by C1 shows less over-glycosylation compared to yeast which we believe has a structure potentially more amenable to humanization of the glycosylation pattern of mammalian proteins |

| · | Proven in commercial-scale production since 1996 |

| · | The C1 White Strain can produce a single heterologous protein at a level of up to 50 grams per liter with high purity |

| · | Direct, linear scale-up from lab to commercial scale fermentation processes, potentially saving years of preclinical development time |

| · | Much lower cost raw materials used in manufacturing than those typically seen with CHO cells |

However, CHO and other systems are well established and proven to be reliable. Further, about 70% of the recombinant biopharmaceuticals currently on the market or in development are glycosylated proteins and require the addition of various sugars to the expressed proteins, giving them their highly specific glycosylation patterns that confer unique properties and functionality. While C1’s glycosylation capabilities have been found to be more similar to human glycosylation than traditional yeast expression hosts, significant research will be required to access that segment of the market.

As our partnership with Sanofi has demonstrated, using a novel expression system like C1 gives a drug developer another “shot on goal” to find an organism that will accept a foreign gene of interest. Sanofi was not able to sufficiently express the DNA needed to produce its vaccine with the readily available expression systems used for biologics. We believe that pharmaceutical companies will find C1, among the novel, cutting-edge expression systems now available, to be one of the most attractive because of its long track record in industrial applications, its robust growth and fermentation characteristics, and its ability to be readily programmed and easily scaled.

Generic Biopharmaceuticals

Another area of intense growth and an important strategic target for new expression systems is in the production of generic biopharmaceuticals, also known as biosimilars or biogenerics. For innovators developing novel biopharmaceuticals, unique expression systems provide protection against later competition from follow-on/biosimilar products. This is particularly relevant for products that are proprietary (involve trade secrets), have exclusive licensing, and have unique molecular properties (e.g., glycosylation patterns) that are hard to replicate using other systems. This appears to be an important factor in recent acquisitions and exclusive licensing of novel expression systems and related technology by many large pharmaceutical companies. For example, Merck acquired GlycoFi, which was developing a yeast expression system that can replicate human-like protein glycosylation, for $400 million. Numerous companies are pursuing biosimilar versions of blockbuster drugs that will go off patent within the next few years, including some of the leading monoclonal antibody-based therapeutics.

Follow-on biogeneric and biosimilar developers are also searching for superior expression systems to optimize the cost effectiveness of their manufacturing processes. These companies operate in a highly competitive environment. Biogeneric manufacturers have to compete against experienced and well-established innovators with world-class manufacturing facilities, well-developed revenue streams, and market dominance. Contrary to the expectations of many, biogenerics may not cost less than innovator products to manufacture, and innovators may be willing and able to undercut the price of follow-on protein drugs to maintain their market share. Most innovators will already have a replacement product or portfolio of products for the same indication available by the time biogenerics would enter the picture, so they would have little to lose by competing against new entrants on the basis of price.

The prevailing opinion is that many follow-on proteins will likely be manufactured using novel expression systems and we are already seeing this with biogenerics. However, the regulatory environment for biogenerics continues to be somewhat uncertain, and it remains unclear how readily these products will receive approval for marketing. The manufacturing process still largely controls and defines biotech products (i.e., the process equals the product paradigm). Therefore, the use of a substantially different manufacturing process introduces the risk that regulators could consider a follow-on protein to be inherently dissimilar to the innovator product, leading them not to allow the comparative and abbreviated testing needed for approval.

Active Pharmaceutical Ingredients

A smaller, yet increasingly important sector of the market is the use of industrial enzymes as biocatalysts in the manufacturing of Active Pharmaceutical Ingredients (APIs). The overall API market was estimated at about $30 billion in 2011, and the number of small molecule APIs that rely on biocatalysis to drive their chemical synthesis reactions is rising rapidly. We are actively exploring opportunities in the API space.

Primary Strategic Partnerships and Licensees

BASF

On May 6, 2013, Dyadic entered into a non-exclusive worldwide research, development, and license agreement with BASF SE (BASF). Under the terms of the agreement, BASF will be able to apply Dyadic's C1 Expression System to the development, production, distribution, and sales of industrial enzymes in certain markets for a variety of applications. The agreement also includes certain funding by BASF to support R&D at Dyadic's research center in The Netherlands, a non-refundable upfront license fee of $6 million dollars paid by BASF, and various potential research milestone fees and royalties to be paid to Dyadic on product commercialization.

BASF has the freedom to develop, manufacture, and sell new products using C1 and to explore new business opportunities in a variety of markets, including animal nutrition. A major R&D project currently underway between Dyadic and BASF has been very successful to date, and we expect continued success with this and other future joint projects. We are confident and expect that this interactive partnership will drive continued collaboration and will have a long-lasting, beneficial impact on the industrial enzymes businesses of BASF and Dyadic.

Abengoa Bioenergy

Abengoa is the European market leader in corn-based ethanol production and the seventh largest corn-based ethanol producer in North America. On November 8, 2006, Abengoa acquired 2.14 million shares of Dyadic stock for $10 million to fund R&D for the development of enzymes used to degrade biomass for second-generation biofuel applications.

On February 18, 2009, Dyadic and Abengoa entered into a non-exclusive license agreement (the Abengoa License Agreement), which became effective on May 12, 2009. The agreement gave Abengoa access to certain patent rights and know-how owned by Dyadic related to use of the C1 Expression System for large-scale production of enzymes for use in manufacturing biofuels (including cellulosic ethanol and butanol), energy, and/or chemicals. The Abengoa License Agreement provides for facility fees and royalties to be paid to Dyadic on the commercialization of biofuels and other products that utilize our materials and technologies.

On April 23, 2012, the Abengoa License Agreement was amended and restated to provide Abengoa with additional rights, including worldwide rights to use Dyadic's C1 Expression System in the licensed fields. In addition, the amended agreement clarifies Abengoa's rights to sell enzymes produced using C1 technology to third parties for use in both first- and second- generation biorefining processes for the production of fuels, chemicals, and or/power. Abengoa paid Dyadic an additional $5.5 million non-refundable upfront license fee in exchange for the expanded rights. Dyadic will also receive additional payments, such as royalties, on the commercialization of biofuels and other products that utilize our C1 materials and technologies licensed to Abengoa.