UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 000-54556

TROVAGENE INC.

(Name of small business issuer in its charter)

|

Delaware |

|

27-2004382 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

11055 Flintkote Avenue, Suite B, San Diego, California 92121

(Address of principal executive offices) (Zip Code)

Issuer’s telephone Number: (858) 952-7570

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Units, each consisting of two shares of Common Stock and one Warrant to purchase one share of Common Stock |

|

The NASDAQ Capital Market |

|

|

|

|

|

Common Stock, $0.0001 par value |

|

The NASDAQ Capital Market |

|

|

|

|

|

Warrants to purchase Common Stock |

|

The NASDAQ Capital Market |

Securities registered under Section 12(g) of the Exchange Act: None.

Indicate by check mark is the issuer is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes o No x

Indicate by check if the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes x No o

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if no disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer x |

|

|

|

|

|

Non-accelerated filer o |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates based on a closing sale price of $3.50 per share which was the last sale price of the common stock as of June 30, 2014 was $63,974,477.

As of February 27, 2015, the issuer had 24,123,790 outstanding shares of Common Stock.

PART I

ITEM 1. BUSINESS

We are a molecular diagnostic company that focuses on the development and commercialization of a proprietary molecular diagnostic technology for use in disease detection and monitoring across a variety of medical disciplines. Our primary internal focus is to leverage our novel cell-free molecular diagnostic platform to facilitate improvements in the field of oncology, while our external focus includes entering into license agreements or collaborations to develop our technology in areas such as infectious disease, transplant medicine, and prenatal genetics.

We are leveraging our proprietary molecular diagnostic technology for the detection of cell-free DNA originating from diseased cell death that can be isolated and detected from urine, blood, and tissue samples to improve disease management. These genetic materials are also collectively referred to as “cell-free nucleic acids”, which result when cells in the body die and release their DNA contents into the bloodstream. The circulating fragments of genetic material are eventually filtered through the kidneys and therefore, can be detected and measured in urine. Cell-free nucleic acids can be used as genetic markers of disease. As such, the contents of urine or blood samples represent systemic liquid biopsies that can allow for simple, non-invasive or minimally-invasive sample collection methods.

Our fundamental cell-free molecular diagnostic platform, also known as our “Precision Cancer MonitoringSM” platform, (“PCM”) platform is protected by a strong intellectual property portfolio. We have developed significant intellectual property around cell-free nucleic acids in urine, the extraction of cell-free nucleic acids from urine, as well as novel assay designs, particularly our proprietary non-naturally occurring primers. Through this proprietary technology, we believe that we are at the forefront of a shift in the way diagnostic medicine is practiced, using simple, non-invasive or minimally invasive sampling and analysis of nucleic acids, which we believe will ultimately lead to more effective treatment monitoring, better management of serious illnesses such as cancer, and the ability to detect the recurrence of cancer earlier. As of February 27, 2015, our property intellectual property portfolio consists of over 50 issued patents and over 60 pending patent applications globally. Our patent estate includes the detection of cell-free nucleic acids that pass through the kidney into the urine, as well as their application in specific disease areas, including oncology, infectious disease, transplantation, and prenatal genetics.

We believe that our proprietary PCM platform is uniquely positioned to address a high unmet clinical need in field of oncology. Our PCM platform is designed to offer better cancer monitoring by tracking and analyzing levels of cell-free DNA from either urine or blood samples, and is intended to provide important clinical information beyond the current standard of care. Using urine as a sample, our cancer monitoring technology enables more frequent, non-invasive monitoring of oncogene mutation status, disease progression and disease recurrence. Our extensive research and development efforts were strengthened, due to investments to expand our intellectual property portfolio and were made commercially feasible following improved next-generation sequencing (“NGS”) technologies which are now available at a significantly lower cost. This combined with our extensive patent portfolio around cell-free DNA in urine gives us a competitive advantage to leverage an emerging trend toward monitoring cancer using cell-free DNA as a marker of disease status. Our proprietary sample preparation process forms the basis of our PCM platform. It includes novel technology for the extraction and isolation of cell-free DNA from either a urine or blood sample, proprietary non-naturally occuring primers to enrich the sample for mutant alleles, and the ability to sequence nucleic acids of interest using one of several leading gene sequencing technologies such as NGS or droplet digital PCR (“ddPCR”). We believe that our quantitative cell-free DNA detection and monitoring platform offers industry leading sensitivity, featuring single nucleic acid molecule detection.

Our PCM platform is poised to overcome a significant clinical dilemma in the area of cancer treatment. Recent scientific evidence supports the molecular basis of cancer, and has resulted in a paradigm shift in the way cancer is treated. Researchers and clinicians are now focused on specific oncogene mutations that are believed to be the drivers of cancer at the molecular level, and, as a result, there is a trend in the pharmaceutical research community toward developing targeted therapies. As such, there is a need for oncologists to have an ability to track the mutational status of their patients, including a given patient’s response to treatments designed to target driver oncogene mutations. Current monitoring tools such as imaging procedures, tissue biopsy, and circulating tumor cells are insufficient to meet the challenge of monitoring oncogene mutations. Imaging only provides a rough indication of tumor size, and is an important tool for surgeons, but provides little practical advice to oncologists regarding mutational status and appropriate treatment options, especially for molecular targeted therapies. Tissue biopsy usually involves a major surgical procedure and, in many cases, is not repeatable as there are limitations related to access for serial biopsies. In some cases, biopsies may not be available, significantly increasing the need to determine mutational status using an alternative method. In addition, tumor heterogeneity is important, as the surgeon may not obtain the proper tissue from the tumor sample. In the case of circulating tumor cells, which are typically measured using blood tests, there is very low sensitivity, and such tests are technically difficult and can be expensive.

Targeted drug therapies themselves are not without issues. Targeted therapies are typically very expensive and can have significant side effects. In order to measure effectiveness, repeated monitoring is needed and serial biopsies can be difficult to obtain. If resistance develops, fast and accurate detection of emerging or changing oncogene mutations is critical. Our PCM platform provides a novel solution using urine, a non-invasive, plentiful sample source, and we are continuing to build a growing body of evidence supporting the clinical utility of our technology to monitor cancer using cell-free DNA.

Our goal is to improve treatment outcomes for cancer patients using our proprietary technology to detect and quantitatively monitor cell-free DNA using urine or blood samples.

Developing a Market for Molecular Diagnostic Tests based on Liquid Biopsies using Cell-free DNA

We intend to develop and expand our cell-free molecular diagnostic technology into a pipeline of potentially groundbreaking commercial molecular detection and monitoring products. Our Clinical Laboratory Improvement Amendments (“CLIA”)-certified, College of American Pathologists (“CAP”)-accredited laboratory in San Diego will enable us to initially commercialize our testing services and launch our platform technology and associated innovative molecular monitoring tests. Urine-based cell-free molecular diagnostics can provide relevant information across multiple therapeutic and clinical areas, and may lead to improvements in patient management. We are focused on the oncology treatment market, and the opportunity to enable clinicians to track oncogene mutational status in cancer patients. Repeat testing is expected with most cancer patients, and there also exists a need to chronically monitor for the re-emergence of oncogenes in people that are cancer survivors.

In order to facilitate early availability and use of our products and technologies, in February 2012, we acquired the CLIA laboratory assets of MultiGEN Diagnostics, Inc., (“MultiGEN”), which included CLIA approval and licensing documentation, laboratory procedures, customer lists, and marketing materials. A CLIA lab is a clinical reference laboratory that can perform high complexity diagnostic assays (e.g. those requiring polymerase chain reaction, (“PCR”) amplification). Through this CLIA laboratory, we are able to offer laboratory developed tests (“LDTs”), in compliance with CLIA guidelines.

Targeting cell-free nucleic acid markers will allow for the development of genetic tests that use non-invasive and easy-to-obtain urine samples, rather than other more traditional, more invasive methods. These methods include imaging, blood testing, and bone marrow and tissue biopsies. We are exploring a broad range of clinical utilities where cell-free nucleic acid technology holds the potential to replace more complex, less robust existing technologies, which are based on circulating cells and nucleic acids in blood. We are developing more effective, non-invasive diagnostics, which align with the current industry shift toward highly personalized medicine. Urine-based cell-free nucleic acid molecular tests can make it easier to address important health problems, and may lead to significant advancements in patient care.

Our patented technology uses safe, non-invasive, cost effective, and simple urine collection, which can be applied to a broad range of testing including tumor mutation detection and monitoring, infectious disease monitoring, transplantation monitoring, and prenatal genetic diagnostics. We believe that our technology is ideally suited to be used in developing molecular diagnostic assays that will allow physicians to provide simple, non-invasive, and convenient screening and monitoring tests for their patients by identifying specific biomarkers involved in a disease process. Our novel urine-based assays can facilitate improved testing compliance, resulting in more effective use of targeted therapies, earlier detection of disease, and improvements in both patient outcomes and cost of care.

The material terms of certain of our clinical collaboration, research and development, and technology license agreements that we have entered into are as follows:

In September 2014, under the strategic partnership we established in March 2014, we entered into a Sponsored Research Agreement with Catholic Health Initiatives Center for Translational Research to conduct clinical studies to evaluate use of our PCM technology in the management of cancer patients. Under the terms of the agreement, we may pay our collaborator in the study approximately $151,000 for services provided. As of December 31, 2014 we have incurred approximately $30,000 related to this agreement.

In June 2014, we entered into a Sponsored Research Agreement with Dana Farber Cancer Institute to conduct a clinical study to evaluate use of our precision cancer monitoring technology in the management of lung cancer patients. Under the agreement, we may pay our collaborator in the study approximately $42,000 for services provided. As of December 31, 2014 we have incurred approximately $8,000 related to this agreement.

In June 2014, we entered into a Sponsored Research Agreement with Memorial Sloan Cancer Center to conduct a clinical study for the detection of oncogenic tumor mutations in the urine of lung cancer patients. Under the agreement with Memorial Sloan Kettering, we may pay our collaborator approximately $146,000 for services provided. As of December 31, 2014 we have incurred approximately $25,000 related to this agreement.

In May 2014, we entered into a Strategic Research Alliance with the Robert H. Lurie Comprehensive Cancer Center of Northwestern University to conduct one or more research agreements to evaluate use of our precision cancer monitoring technology in the management of cancer patients. Under the agreement, each party will be responsible for its own costs and obligations under each agreement. No services or costs have been incurred by us as of December 31, 2014.

In May 2014, we entered into a Patent Assignment and License Agreement, effective as of April 23, 2014, with GenSignia IP Ltd., a United Kingdom company, pursuant to which we assigned all of our miRNA patents, including methods of using miRNA for detection of in vivo cell death and detecting cell-free miRNA in urine and blood. Concurrent with the assignment, GenSignia granted to us an exclusive, world-wide, royalty-free, fully paid, perpetual license under the transferred patents in the urine field. Pursuant to the agreement, GenSignia will pay us a low single digit royalty on net sales and will pay an aggregate $6.5 million in milestone payments upon the achievement of up to $150 million in net sales. GenSignia shall be responsible for the preparation, filing and maintenance of all patents under the agreement. As of December 31, 2014, we had recorded $10,000 in license fee revenue related to the agreement. Costs have been incurred through December 31, 2014 and reimbursed by GenSignia.

In December 2013, we entered into a Clinical Trial Agreement with US Oncology Research LLC (“USOR”), pursuant to which USOR will provide the principal investigator and conduct a clinical study related to examining the utility of cell-free quantitative KRAS testing to monitor disease in patients with metastatic pancreatic cancer. Under the agreement, we committed to pay USOR approximately $270,000 for services provided. During the years ended December 31, 2014 and 2013, we incurred and recorded approximately $16,000 and $29,000 of research and development expense related to this agreement.

In August 2013, we entered into a Clinical Trial Agreement with the University of Southern California (“USC”), pursuant to which USC will provide the principal investigator and conduct a clinical study related to the genetic characterization of metastatic colorectal cancers. Under the agreement, we are committed to pay USC approximately $232,000 for services provided. During the years ended December 31, 2014 and 2013, we incurred approximately $38,000 and $0, respectively for expenses related to this agreement.

In June 2013, we entered into a Research Agreement with Illumina, Inc. pursuant to which the parties will work together to evaluate the potential for integrating our cell-free technology for isolating, extracting, and analyzing nucleic acids from urine with Illumina’s genetic analysis sequencing technology. The parties have agreed to share all results and reagents from the Research Plan. The agreement will terminate upon the earlier of 30 days after completion of the Research Plan or the one year anniversary of the agreement unless extended by mutual written agreement. In October 2014, the agreement was extended for an additional year to June 2015.

During 2012, we entered into research agreements with University of Texas MD Anderson Cancer Center (“MDACC”) to provide samples and evaluate methods used by us to identify pancreatic cancer mutations, as well as to measure the degree of concordance between the results of cell-free DNA mutation analysis from urine samples and tumor tissue. An amendment in 2013 increased the scope of the research agreements. We have committed to pay approximately $266,000 for the services performed by MDACC. As of December 31, 2014, 2013 and 2012, we have incurred and recorded approximately $124,000, $142,000 and $0, respectively of research and development expenses related to this agreement.

In December 2012, we entered into a sublicense agreement with Genoptix, Inc. for non-exclusive worldwide rights to develop and market laboratory testing services for nucleophosmin protein (“NPM1”) for the diagnosis and monitoring of patients with acute myeloid leukemia (“AML”),. Under this agreement, we have granted a license to certain NPM1 patents in exchange for a one time license fee of $100,000 due upon execution of the agreement and royalty payments on net revenues. During the years ended December 31, 2014, 2013 and 2012, we have recorded royalty and license fee revenues of approximately $30,000, $10,000 and $100,000, respectively.

In November 2012, we entered into a sublicense agreement with Duke University and Duke University Health Systems for non-exclusive rights to develop and market laboratory testing services for NPM1 for the diagnosis and monitoring of patients with AML. Under this agreement, we have granted a license to certain NPM1 patents in exchange for a one time license fee of $5,000 due upon execution of the agreement and royalty payments on net revenues. During the years ended December 31, 2014, 2013 and 2012, we have recorded $1,000, $0 and $5,000, respectively of royalty and license fee revenues related to this agreement.

In September 2012, we entered into a collaboration and license agreement with Strand Life Sciences related to the validation and commercial launch of a urine-based DNA test for Human Papillomavirus (“HPV”). Under this agreement, we have granted a license for use of our tests to Strand in exchange for royalty payments on net sales earned in the territory specified in the agreement. During the years ended December 31, 2014, 2013 and 2012, no royalties or license fees had been received under this agreement.

In September 2012, we entered into a sublicense agreement with Quest Diagnostics for non-exclusive rights to develop and market laboratory testing services for NPM1 for the diagnosis and monitoring of patients with AML. Under this agreement, we have granted a license to certain NPM1 patents in exchange for a one time license fee of $20,000 due upon execution of the agreement and royalty payments on net sales of Quest Diagnostics and its affiliates. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty and license revenues of approximately $26,000, $14,000 and $20,000, respectively.

In December 2011, we entered into an exclusive license agreement with Columbia University to license the patent rights to hairy cell leukemia biomarkers. In consideration of the license we paid $1,000 as an upfront license fee and agreed to make royalty payments as a single digit percentage of net sales if sales are made by us or a single digit royalty rate as a percentage on sublicense income received by us if sales are made by sublicensees. The license agreement shall continue until May 10, 2021, which is the date of the last to expire of the licensed patent rights covering the license product. The license agreement may also be terminated upon a material breach by any party or by us if we determine that it is not commercially or scientifically appropriate to further develop the license product rights. For the years ended December 31, 2014, 2013 and 2012, there has been no royalty expense recorded related to this agreement.

In October 2011, we entered into an exclusive license agreement with Gianluca Gaidano, Robert Foa and Davide Rossi for the patent rights to a specific gene mutation with respect to chronic lymphoblastic leukemia. In consideration of the license, we paid $1,000 as an upfront license fee and agreed to make royalty payments as a single digit percentage of net sales if sales are made by us or a single digit royalty rate as a percentage of sublicense income received by us if sales are made by sublicensees. We have an option to purchase the licensed patent rights in the event the licensor decides to sell such licensed patent rights. The license agreement shall continue until September 29, 2031, which is the date of the last to expire of the licensed patent rights covering the license product. The license agreement may also be terminated upon a material breach by any party or by us if it is determined that it is not commercially or scientifically appropriate to further develop the license product rights. For the years ended December 31, 2014, 2013, and 2012, there has been no royalty expense recorded related to this agreement.

In July 2011, we entered into a sublicense agreement with Fairview Health Services (“Fairview”) for the non-exclusive rights to develop and market laboratory testing services for NPM1 for the diagnosis and monitoring of patients with AML. Fairview paid an initial license fee of $10,000 upon execution of the agreement and will also pay us a royalty on any net revenues during the term of the agreement, subject to certain minimums. Fairview is obligated to pay a royalty with annual minimums of $1,000 each year. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty and license fee revenues of approximately $2,000, $1,000 and $2,000, respectively.

In February 2011, we entered into a sublicense agreement with MLL Münchner Leukämielabor (“MLL”) for the non-exclusive rights to develop and market laboratory testing services for NPM1 for the diagnosis and monitoring of patients with AML. MLL paid an initial license fee of $20,000 upon execution of the agreement and will also pay us a royalty on any net revenues during the term of the agreement, subject to certain minimums. MLL is obligated to pay a royalty with annual minimums of $15,000 for the first year and $20,000 thereafter. The term of the license ends on October 28, 2025, which is the date of expiration of the issued patent rights. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty and license fee revenues of approximately $81,000, $85,000 and $71,000, respectively.

In June 2010, we signed a sublicensing agreement with Skyline Diagnostics BV for the non-exclusive rights to develop, commercialize and market, research and diagnostic laboratory services for the stratification and monitoring of patients with AML. Skyline Diagnostics BV paid an initial licensing fee of $10,000 upon execution of the agreement and may make future payments to us upon the attainment of certain regulatory and commercial milestones. Skyline Diagnostics BV will also pay us a royalty on any net revenues during the term of the agreement, subject to certain minimums. The term of the license ends on October 28, 2025 which is the date of expiration of the issued patent rights. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty and license revenues of approximately $0, $0 and $0, respectively. During those same periods, we did not record any license fee expenses.

In December 2008, we signed a sublicensing agreement with InVivoScribe Technologies, Inc. for the non-exclusive rights to develop and market lab testing services for NPM1 for the diagnosis and monitoring of patients with AML. InVivoScribe Technologies paid an initial licensing fee of $10,000 upon execution of the agreement. InVivoScribe Technologies will also pay us a royalty on any net revenues during the term of the agreement, subject to certain minimums. The term of the license ends on

October 28, 2025 which is the date of expiration of the issued patent rights. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty revenues of approximately $25,000, $25,000 and $27,000, respectively. During those same periods, we did not record any license fee expenses.

In August 2008, we signed a sublicensing agreement with LabCorp for the non-exclusive rights to develop and market lab testing services for NPM1, for the diagnosis and monitoring of patients with AML. LabCorp paid an initial licensing fee of $20,000 upon execution of the agreement. LabCorp will also pay us a royalty on any net revenues during the term of the agreement, subject to certain minimums. The term of the license ends August 25, 2018. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty and license fee revenues of approximately $28,000, $20,000 and $5,000, respectively. During those same periods, we did not record any license fee expenses.

In October 2007, we signed a license agreement with ASURAGEN, Inc. for the co-exclusive rights to develop, manufacture and market, research and diagnostic products for the stratification and monitoring of patients with AML.ASURAGEN paid an initial licensing fee of $120,000 upon execution of the agreement and may make future payments to us upon the attainment of certain regulatory and commercial milestones. In June 2010, we signed amendment No. 1 to the co-exclusive license agreement. The amendment asserts that we may require a license from a third-party to perform laboratory testing services. ASURAGEN will also pay us a royalty on any net revenues during the term of the agreement, subject to certain minimums. The term of the license ends on October 28, 2025 which is the date of expiration of the issued patent rights. In March 2013, we signed amendment No. 2 to the co-exclusive sublicense agreement with ASURAGEN. The amendment limited the field of use to research use only (RUO) kits. ASURAGEN was also granted a non-exclusive sublicense for NPM1 laboratory testing services. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty and license fee revenues of approximately $50,000, $50,000 and $50,000, respectively. During those same periods, we had no license fee expenses related to this agreement.

During August 2007, we signed a sublicensing agreement with IPSOGEN SAS, a leading molecular diagnostics company with operations in France and the United States for the co-exclusive rights to develop, manufacture and market, research and diagnostic products for the stratification and monitoring of patients with AML. Upon execution of this agreement, IPSOGEN paid an initial licensing fee of $120,000 and may make milestone payments upon the attainment of certain regulatory and commercial milestones. IPSOGEN will also pay us a royalty on any net revenues during the term of the agreement, subject to certain minimums. The term of the license ends on October 28, 2025, which is the date of expiration of the issued patent rights. In September 2010, we signed amendment No. 1 to the sublicensinging agreement. The amendment asserts that we may require a license from a third-party to perform laboratory testing services. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty, milestone and license fee revenues of approximately $60,000, $60,000 and $180,000, respectively. During those same periods, we had no license fee expenses.

In May 2006, we entered into a license agreement with Drs. Falini and Mecucci, wherein we obtained the exclusive rights for the genetic marker for AML with the intention to utilize these rights for the development of new diagnostic tools. In connection with this agreement, we paid $70,000 to Drs. Falini and Mecucci. In August 2010, we signed amendment No.1 to the license agreement with an obligation to pay royalties of 6% on royalty revenues and/or 10% of any sublicense income. During the years ended December 31, 2014, 2013 and 2012, we recorded royalty expenses of approximately $23,000, $30,000 and $24,000, respectively.

History

On April 26, 2002, we were incorporated in the State of Florida as Used Kar Parts, Inc. On July 2, 2004, we acquired Xenomics, a California corporation, which was in business to develop and commercialize urine-based molecular diagnostics technology. As part of the acquisition, our corporate name was changed to Xenomics, Inc. (“Xenomics”). In 2007, we changed our fiscal year end from January 31 to December 31. In January 2010, we re-domesticated our state of incorporation from Florida to Delaware and our name was changed to Trovagene, Inc. In June 2012, our common stock was listed on The NASDAQ Capital Market under the ticker symbol TROV.

The Basis for Our Urine-based Molecular Diagnostic Technology

Cell-free nucleic acids have been found in a variety of human bodily fluids, with the nucleic acids isolated from urine having been extensively characterized. Cell-free nucleic acids in urine have been proven to contain mutated DNA and other markers of disease, including microRNA. In contrast to other bodily fluids (e.g. blood plasma), urine allows for truly non-invasive collection of the sample, provides a larger sample size, and allows for frequent collection. Importantly, urine enables the collection of nucleic acid material from the systemic circulation over a period of time, and those DNA and RNA fragments remain stable in urine. These factors, combined with recently developed technologies to sequence, count, and track nucleic acids with low relative abundance, make the development of these non-invasive diagnostics commercially practical and scalable.

In the human body, about 1011 - 1012 cells die each day primarily as a consequence of natural physiological processes for tissue and organ maintenance, but also as a result of disease. Together, these dead and dying cells contain more than 1 gram of DNA, which is mostly degraded into short fragments by specific enzymes. A small proportion of these cell-free nucleic acids escapes complete degradation and appears in the bloodstream. Our scientists were the first to discover that circulating cell-free nucleic acids cross the kidney barrier and can be found in the urine as cell-free DNA. This simple yet remarkable discovery that genetic information from various cells throughout the body is present in urine enabled the development of new, non-invasive techniques for molecular diagnostics and genetic testing.

To unlock the full potential of cell-free nucleic acids, we have developed a proprietary method for the isolation of the short fragmented nucleic acids that pass through the kidneys, and proprietary “ultra-short” amplicon assays necessary for the efficient detection of cell-free nucleic acids, which can be analyzed at our San Diego-based CLIA laboratory.

Because of the small size of cell-free nucleic acids in urine, having an isolation method that efficiently captures short nucleic acids is critical. We have multiple methods (patents and pending patents) for the isolation of nucleic acids from bodily fluids, including urine. Many nucleic isolation methods are not properly suited for the isolation of cell-free nucleic acids in urine. For example, many DNA isolation kits only capture DNA greater than 200 base-pairs (“bp”) in length, with a few claiming 100 bp or longer. No manufacturer states that their product is suitable to capture DNA sequences shorter than 80 bp in length.

When compared to leading kits for the isolation of DNA from bodily fluids, we have observed by conducting internal studies, that our method is three to twenty times more efficient in isolating a 50 bp target. Our method is also suitable for the isolation of RNA, including miRNAs.

Paired with our cell-free nucleic acid isolation method, is our technology for detecting ultra-short amplicons (patents pending). By combining our proprietary nucleic acid isolation method with our ultra-short amplicon assays, we are able to detect at least six times more mutations in a urine-based cell-free DNA sample than any other PCR-based assay, according to our internal test data. We believe that these methods are also applicable to other small or fragmented nucleic acids, including cell-free DNA from blood and formalin-fixed, paraffin-embedded samples.

Determining DNA and RNA signatures using urine as a “systemic biopsy” may provide a more powerful and effective tool for following and uncovering both pre-clinical and clinical changes, which may include:

· monitoring cancer patients to determine therapeutic response or non-response and disease recurrence;

· following organ transplant status to watch for rejection;

· non-invasively securing samples for the clinical diagnosis of infectious diseases; and

· screening and testing expectant mothers, who’s fetus may be at risk for certain genetic abnormalities.

Currently, these clinical needs are addressed by the use of invasive blood and bone marrow tests, tissue biopsies, amniocentesis, as well as costly CT, MRI, and PET scans.

Urine is a relatively simple aqueous solution and, unlike plasma, contains few components that can attack and break down cell-free nucleic acid fragments. Since urine does not contain many cells, proteins and other contaminants, cell-free nucleic acid isolation is a procedure which can be easily automated for high throughput screening applications. Cell-free nucleic acid fragments can be accurately analyzed using conventional methods that are either in use or in development within many molecular genomics laboratories.

Our urine-based cell-free nucleic acid tests are based upon a proprietary method of nucleic acid isolation, followed by detection of specific genetic markers. These proven and well-established detection methods can be used to detect nucleic acids in blood, stool, and other specimen types. Using enhancements of these techniques, cell-free nucleic acid markers can be isolated from easily obtained urine specimens.

Our urine-based cell-free nucleic acid technology may be applied to the detection and monitoring of an extremely broad spectrum of medical conditions.

Characteristics of Urine-based Cell-free Nucleic Acid Testing

· The kidney acts as a filter, passing cell-free nucleic acids from complex, multicellular, multicomponent blood into urine, a much less complex aqueous environment.

· The collection procedure is non-invasive and does not require the involvement of trained medical staff.

· Urine as a sample type supports repeated testing when required and poses no discomfort for the patient.

· Cell-free nucleic acids in urine are stable at room temperature for extended periods of time with the addition of a simple preservative. Nucleic acids in blood and many other traditional samples are not.

· Sample processing and tests can often be easily automated.

· Isolation of cell-free markers from large sample volumes increases the sensitivity of the tests. This cannot be done as easily using blood or tissue specimens, which have inherent volume limitations.

· Blood or sputum samples for detection of infectious diseases may not be easily obtained from certain patients, including small children and the elderly. Urine specimens typically present minimal acquisition concerns.

· Blood and other bodily fluids can be highly infectious by nature, urine is not.

· Blood and other bodily fluids are legally considered biohazardous, urine is not.

Clinical Applications

We believe that our urine-based cell-free molecular diagnostic test will make it easier to address important health problems worldwide, and will lead to significant advances in personalized medicine for improved patient care. We intend to develop clinical evidence for our cancer monitoring tests in three distinct and potentially overlapping stages. Stage 1 studies are qualitative in nature and are designed to determine the mutational status of actionable biomarkers in urine especially when biopsy is not an option. These studies demonstrate concordance (agreement) of the oncogene mutation status between a urine sample and a tumor tissue sample. These studies are considered to have diagnostic value, and would prove that urine-based molecular test results match the tissue biopsy closely. The clinical utility of such a study would validate that mutational status of actionable biomarkers can be determined in urine when a biopsy is not an option. Stage 2 studies are quantitative in nature, and are designed to assess patient mutational status in urine longitudinally (over time) as an indicator of responsiveness to therapy and disease status of the patient. Demonstrated clinical utility includes quantitatively assessing mutation status in urine longitudinally as an indicator of responsiveness to therapy and disease status of the patient. Stage 3 studies are conducted with the goal to demonstrate improved patient outcomes and eventually could lead to changing medical guidelines and the clinical standard of care for managing certain cancers. Demonstrated clinical utility includes quantitatively assessing patient mutational status in urine longitudinally for mutational status as well as early detection of resistance to therapy as a decision tool for therapy selection. Generating data with our technology that supports better patient outcomes and more efficient use of healthcare resources is a key component of Stage 3.

We believe that there are several specific applications of our PCM platform technology with regard to helping oncologists monitor a patient’s mutational status, and thereby, optimize the treatment approach and improve outcomes. Our technology can be used to determinie a patient’s mutational status for the first time when a tissue biopsy is not feasible, or it can be used to monitor changes in mutational load over time to provide information that can be useful to direct treatment regimens. Should a patient have their tumor removed surgically, our technology can be used to broadly search for minimual residual disease, which can confirm a successful procedure, or can enable early detection of recurrent disease for improved patient management. Treatment-emergent mutations can also be a major problem, and may be drivers of resistance to first-line therapy. Examples of this include the emergent mutation EGFR T790M in lung cancer, or KRAS mutations in colorectal cancer. Because our platform uses a non-invasive, easy to obtain sample from the patient, the ability to monitor more accurately and more often with fewer barriers to doing so can provide us with key competitive advantages in the marketplace, particularly with regard to monitoring for treatment-emergent mutations.

Oncology

Urine may offer an alternative to blood-based tests such as circulating tumor cells, biopsy and imaging. By tracking mutations we can inform medical practice. Our initial pilot study was focused on the BRAF mutation because of its link to discreet cancers and associated treatments, as well as the KRAS mutation because of its broad applicability in many cancers. We are now developing

oncogene tracking tests using ddPCR and NGS for a variety of mutations seen in many cancer types. We believe the potential exists to expand the use of this latter technique across many cancer types for multiple mutations in test panels.

During 2014, we had over 15 ongoing clinical studies with leading cancer centers and pharmaceutical companies to demonstrate the qualitative and quantitative clinical utility of our tests. Clinical study sites include MD Anderson Cancer Center, USC Norris Cancer Center, US Oncology, pharmaceutical collaborators and other top cancer centers. In 2014, we signed clinical study collaboration agreements with Memorial Sloan Kettering Cancer Center, Catholic Health Initiatives Center for Translational Research, Dana Farber Cancer Insititute, The Robert H. Lurie Comprehensive Cancer Center of Northwestern University, City of Hope Comprehensive Care Center, and Genomac International Ltd, (also known as the Center for Applied Genomics of Solid Tumors, Genomac Research Institute).

Initial clinical results for KRAS and BRAF mutation assays

The MD Anderson Cancer Center clinical study is focused on detecting and monitoring BRAF and KRAS tumor mutations in cell-free DNA from urine in metastatic cancer patients. BRAF mutations are common in melanoma, thyroid, and other cancers. Within the U.S., it is estimated that nearly 730,000 patients have tumors with BRAF mutations. Several targeted therapies are either on the market or in development for BRAF-mutation positive cancers. Pancreatic cancer represents an additional diagnostic and treatment challenge. Each year, more than 43,000 new cases of pancreatic cancer are diagnosed, and 37,000 patients succumb to this disease. It is estimated that KRAS mutations occur in >90% of pancreatic cancers and 11%-17% of these patients do not express the CA19-9 marker, which makes their disease more difficult to track.

Initial results from the MD Anderson Cancer Center clinical study were published at the AACR-NCI-EROTC International Conference in October 2013. During the study, urine samples from metastatic cancer patients known to have BRAF V600E, KRAS G12D or KRAS G12V mutations were assessed. Our researchers analyzed the urine samples using our urine-based cell-free molecular diagnostic assays. Results demonstrated high concordance between urine and tissue mutational status. In addition, preliminary results indicate that cell-free BRAF V600E mutation monitoring in urine correlates with clinical response to therapy. The clinical study demonstrated that BRAF V600E mutations were detected in urine irrespective of the cancer type, and a multitude of different cancer types, including brain cancer (“glioblastoma”), were included in the initial study results. The BRAF V600E assay demonstrated 95% concordance vs. tissue biopsy (both detected and borderline), and also demonstrated that urine DNA can be used to detect DNA fragments from circulation that harbor tumor mutations. The following cancers were detected: non-small cell lung cancer, papillary thyroid carcinoma, melanoma, colorectal cancer, glioblastoma, adenocarcinoma of unknown primary, ovarian cancer, and appendiceal cancer. In addition, preliminary results indicate that cell-free BRAF V600E mutation monitoring in urine longitudinally correlates with clinical response to therapy.

The study also evaluated the feasibility of using massively parallel deep sequencing (i.e. NGS) to identify DNA mutations in the urine of metastatic cancer patients harboring known KRAS mutations. Leveraging proprietary enrichment methods, our researchers were able to detect mutant cell-free DNA in the urine of cancer patients with verified KRAS mutations.

CLIA validated BRAF mutation assay

In October 2013, our first urine test for cancer mutation monitoring was made available to clinicians through our CLIA laboratory. The robustness of our ultra-sensitive assay procedure has been demonstrated for the detection of the BRAF V600E mutation from cell-free DNA in urine. This mutation commonly occurs in melanoma. Of the more than 70,000 cases of melanoma diagnosed each year in the United States, up to 70 percent harbor a BRAF-type mutation and of those, 80 percent may be positive specifically for BRAF V600E. There are several approved targeted therapies for the treatment of BRAF-positive melanoma, making mutational status monitoring an area of clinical interest among treating physicians.

Our cell-free BRAF test is a LDT, designed to detect and monitor this mutation in metastatic cancer patients with biopsy-proven V600E BRAF mutation in their tumor. It is the first commercial assay within our cancer monitoring portfolio performed using a ddPCR platform. Using urine as a non-invasive, systemic sample, the cell-free BRAF test could help physicians monitor changes in mutation status for patients requiring therapy for cancers that have this mutation. For patients with difficult-to-biopsy metastatic tumors, urine-based mutation testing may also provide a viable alternative to gauge mutation status as part of the initial treatment workup.

In April, 2014, we announced the presentation of clinical study results at the American Association for Cancer Research (“AACR”) Annual Meeting. Of the 33 patients enrolled in the study, our BRAF V600E oncogene mutation assay was able to identify the mutation in 29 patients (88%) at least one time during the study, demonstrating a high level of concordance with tissue biopsy.

Longitudinal analysis was performed in 17 patients who had more than one urine-based test during the monitoring period. Of these patients, 13 (76%) showed a correlation between response to treatment and mutational status observed by the urine-based test. The results were presented by Filip Janku, M.D., Ph.D., University of Texas MD Anderson Cancer Center.

In June 2014, we announced that expanded clinical study results demonstrating the utility of our PCM platform were released at the 50th Annual Meeting of the American Society of Clinical Oncology (“ASCO”). Data from a study in multiple cancer types were published in the 2014 ASCO Annual Meeting Proceedings, a Journal of Clinical Oncology by Filip Janku, M.D., Ph.D., University of Texas MD Anderson Cancer. In this study, longitudinal analysis of sequential urine samples demonstrated a statistically significant correlation between changes in the amount of BRAF V600E mutation load and treatment response with targeted drug therapy (p=0.002), per RECIST 1.1 criteria. Results also demonstrated that patients with a decrease in BRAF V600E mutation load had a longer median time to treatment failure compared to those that did not (259 days vs. 61 days; p=0.002). Patients in the study had melanoma (n=7), non-small cell lung cancer (n=3), colorectal cancer (n=2), and other forms of cancer (n=5). Additionally, clinical results from a study in patients with histiocytic disease were presented by Eli Diamond, M.D., Memorial Sloan Kettering Cancer Center. In this study, the Company’s PCM technology demonstrated 93% concordance for identifying the BRAF V600E mutation, and confirmed the absence of the mutation in the six patients whose biopsies tested negative. Trovagene’s assay also detected the BRAF V600E mutation in two patients for whom tissue biopsy material was inadequate to determine mutational status, and these results were subsequently confirmed with follow-up biopsies. Our PCM platform showed 100% concordance in monitoring response to therapy in six study subjects who tested positive for the mutation and were treated with a BRAF inhibitor. Results from this study were published in clinical consensus guidelines for the diagnosis and treatment of patients with the histiocytic disease, Erdheim-Chester disease.

CLIA validated KRAS mutation assay

In March 2014, our urine based test for KRAS mutations became available to clinicians through our CLIA laboratory. This assay detects and monitors the seven most commonly encountered mutations of the KRAS oncogene, and is our first multiplexed oncogene mutation assay utilizing next-generation sequencing as a mutation detection platform. The robustness of our ultra-sensitive assays has been demonstrated for the detection of KRAS mutations from cell-free DNA in urine. This mutation commonly occurs in patients diagnosed with either colorectal cancer, pancreatic cancer, or lung cancer. Of the more than 1.1 million estimated cases of colorectal cancer in the United States, up to 40 percent are estimated to harbor KRAS mutations. In pancreatic cancer and lung cancer, approximately 90% and 15% of patients harbor KRAS mutations, respectively. Because of the prevalence of this mutation in several important cancer types, monitoring KRAS mutational status is an area of clinical interest among treating physicians.

The clinical study being conducted at the USC Norris Cancer Center is focused on mutation monitoring and the emergence of KRAS resistant mutations in colorectal cancer. With multiple targeted therapies for colorectal cancer on the market, detection of KRAS mutations in tissue has a direct impact on the initial treatment selection for these patients. The primary purpose of the collaborative study is to determine whether KRAS mutations can be evaluated in urine to monitor treatment response in patients that test either positive or negative for the mutation.

The US Oncology clinical study will test detection and monitoring of KRAS mutations in pancreatic cancer patients. In addition to the US Oncology Research affiliated community cancer care sites participating in this study, additional academic research institutions that specialize in oncology have also elected to participate. CT scans and CA19-9 blood levels are currently the only two methods available to clinicians to monitor metastatic pancreatic cancer tumor burden and response to therapy. However, approximately 11%-17% of patients will not display elevated CA 19-9, even with high tumor load. For patients that test negative for CA19-9, our method to follow disease status by detecting and monitoring KRAS mutations could be distinctly beneficial.

In November 2014, we presented clinical results at the EORTC-AACR-NCI International Symposium highlighting our ability to detect and quantitate KRAS mutations in blood and urine samples from patients with advanced colorectal cancer. Results showed a highly correlated response. Of the blinded retrospective plasma cell-free DNA samples evaluated, 95% displayed the KRAS mutation concordant with tumor tissue, and for evaluable urine samples in the study, 92% displayed the KRAS mutation concordant with tumor tissue. The majority of patients in the study underwent surgery and received neo-adjuvant or adjuvant therapy, and serial monitoring of KRAS mutations using our assay showed a clear correlation between blood and urine samples. An estimated analytical limit of detection of 7 copies per ~100,000 genome equivalents, or 0.0067% was observed in the study, demonstrating very high analytical sensitivity.

Research and Development of additional mutation assays

We have several programs to evaluate the detection and monitoring of EGFR mutational status in lung cancer patients. A focus of these studies is the emergence of the resistant mutation EGFR T790M in lung cancer patients, which can be important for therapeutic selection when this mutation type is or becomes present. Our collaborators for this program include Memorial Sloan Kettering Cancer Center, City of Hope Comprehensive Cancer Center, UC San Diego Moores Cancer Center, and Genomac Research Institute. In addition to our study collaborations with cancer centers for this indication, we also have an ongoing collaboration with a pharmaceutical company to determine and monitor EGFR T790 resistant mutations in lung cancer patients.

PIK3CA mutations are common in breast, colon and endometrial cancers. Within the U.S., nearly one million cancer patients are positive for these mutations. Among our platform applications in development, we are working on an assay for the detection and monitoring of PIK3CA oncogene mutations. Other mutation marker assays in development include: EGFR, NRAS, HER-2, and ALK rearrangements.

Infectious Disease

HPV-HR Detection Assay

Following the completion of a pilot clinical study with a urine-based DNA test for high-risk HPV, our first HPV-HR Detection assay became commercially available in March 2013. Initial data from the pilot study showed that our assay provided superior performance to the current leading HPV assay. Our HPV-HR Detection assay showed a sensitivity of 93.0% and specificity of 96.0% for the detection of HPV virus in a comparative study of 320 high-risk individuals.

In August 2014, we presented results from two clinical studies at the 29th International Papillomavirus conference for our urine-based diagnostic test for the detection of high risk strains of HPV. Results from both pilot studies consistently demonstrated that our urine-based HPV assay had sensitivity greater than 90% for identifying women with high grade cervical intraepithelial neoplasia (CIN2/3). Assay performance was comparable to traditional HPV testing with commercially available tests in patient-matched cervical samples. In one of the studies, urine collection was examined to establish standardization of urine as a clinical specimen for high-risk HPV testing.

Urine-based HPV testing offers a significant advantage over the traditional cervical swab sample, which can present a logistic, invasive, or privacy concern. A urine-based assay also makes both female and male carrier screening feasible.

Through licensing agreements, we are pursuing commercialization of our HPV-HR Detection test, particularly in those geographies where compliance with cervical cell sampling is problematic.

Prenatal Genetics

The combination of NGS or ddPCR with our proprietary cell-free nucleic acid technology would allow for truly non-invasive prenatal screening of aneuploidies and monogenic disorders. We may pursue the development of our technology for use in prenatal genetics through licensing agreements.

Transplant

Patients who receive solid organ or bone marrow transplants are at risk of rejection, particularly during the first few months following surgery. Non-invasive monitoring of transplant status could replace repeated biopsies and blood tests, while keeping both the patient and the physician informed about potential problems.

Changing the Molecular Diagnostic Paradigm

Diagnosis and detection of severe and life-threatening diseases are among the most important outcomes of the Human Genome Project (“HGP”). There are four requirements to realize the full benefit of the HGP in relation to cancer diagnostics; large catalogues of cancer mutations; affordable sequencing of patient samples; detection technologies capable of identifying and quantifying rare instances of mutations at affordable costs; and large, systemic samples that can be collected easily and frequently in order to monitor an individual’s cancer.

The first requirement has been met through the Sanger Centre’s Catalogue of Somatic Mutations in Cancer database, which has catalogued more than 233,000 mutations in more than 20,948 genes; and by the National Institutes of Health’s (“NIH”) The Cancer Genome Atlas, which has data on more than 20 cancer types and provides a host of tools for their analysis. The second requirement has been met through the dramatic and continuing decrease in the cost of both conventional sequencing and NGS. ddPCR, capable of detecting rare mutations among thousands of wild type molecules at a reasonable cost, fulfills the third requirement.

Our proprietary methods provide the fourth and final requirement, the provision of a large, systemic sample that allows the purification of cell-free nucleic acids in amounts necessary to detect rare mutations. Furthermore, the “liquid biopsy” provided by urine can be collected frequently, is truly non-invasive, and requires no specialized personnel to collect it.

Taken together, these developments will increase the effectiveness of cancer diagnostics, improve healthcare spending efficiency, and overall, enable better patient care. These developments have made the era of personalized precision medicine in cancer possible.

The Market

The global molecular diagnostics market is forecast to reach nearly $8.0 billion by 2018, a compound annual growth rate of 9.7% from 2013—2018. This molecular diagnostics market is segmented on the basis of application, technology, end user, product, and geography. Based on application, the market is further segmented into infectious diseases, oncology, genetics, blood screening, microbiology, and others. Infectious diseases secured the largest market share, whereas oncology was the fastest growing segment amongst the rest. The driving forces of the molecular diagnostics market include the rising incidences of infectious diseases, genetic disorders, and cancer, as well as technological advancements such as assay improvements, new diagnostic tests with novel clinical utility, and portability of equipment. The technology segment of the molecular diagnostics market comprises of polymerase chain reaction (“PCR”), Isothermal Nucleic Acid Amplification Technology, hybridization, DNA sequencing and NGS, microarray, and others. Among these, the PCR segment had the largest share in 2013 of the total molecular diagnostics technology market, whereas the microarray segment will be the fastest growing segment by 2018.

Based on products, the molecular diagnostics market is segmented into instruments, reagents, and services & software. Reagents occupy the largest market share and will also register the maximum growth rate in the forecasted period 2013-2018. These reagents include assays that detect and diagnose diseases and are also used as biomarkers that predict the biological properties of the potential drug compounds.

Based on end users, hospitals was the largest segment in 2013, whereas reference laboratories will grow at the highest CAGR between 2013 and 2018. Reference laboratories carry out complex, specialized, and obscure tests. The government regulations to cut down healthcare costs will lead to the rise in the reference laboratories segment. Therefore, reference laboratories are estimated to grow at highest CAGR.

North America accounted for the largest share in 2013 and is poised to grow at a high rate in the forecast period 2013 to 2018. The growth can be attributed to the rising infectious diseases, cancer prevalence, and genetic disorders that are further adding to the overall prevalence of chronic diseases. Europe was the second leading contributor to the molecular diagnostics market in 2013. However, the growth of this region is expected to be sluggish in the forecast period and is estimated to grow at a lower CAGR than North America, due to factors such as the uneven reimbursement policies and the European economic crisis. Asia is the most promising region for molecular diagnostics in the coming five years. It is expected to grow at a higher CAGR than North America and Europe over the forecast period. The high population base and improved purchasing power of patients are the major drivers of this market. Moreover, economic instability in some western countries enables companies to focus on the Asian region in order to meet their revenue targets.

Cell-free molecular diagnostics from urine and plasma provide relevant information that can lead to improvements in personalized patient management. Beyond cancer care and infectious diseases, new products that facilitate personalized care are also emerging in the areas of central nervous system diseases, diabetes, and autism. Most major pharmaceutical companies have active pharmacogenomic programs included in their clinical studies, anticipating the need to utilize diagnostic testing to stratify patients for clinical response. We believe that our broad intellectual property (“IP”) portfolio positions us to work within each of these markets, either alone or in partnership with other companies, to develop and market cell-free molecular diagnostic products, all of which we expect would address the large unmet market needs of simplicity, patient convenience and privacy, accuracy, and cost effectiveness. Such products could play key roles in their applications to improve testing compliance and as such, reduce morbidity and mortality. The use of urine as a sample should provide a paradigm shift in screening and monitoring practices as it provides an easier sample to acquire in a truly non-invasive fashion, with more nucleic acid targets present in the sample leading to greater sensitivity. We believe these modified screening practices will most likely meet with wide physician and patient acceptance in oncology, infectious disease, transplantation, and potentially, prenatal diagnostics.

Commercial Markets — Internal Focus

Oncology

Cancer mutation testing and monitoring is the priority area for our scientists and commercial personnel. Early data from ongoing clinical studies have shown that cell-free nucleic acid analysis may be useful for determining the presence or absence of actionable mutations, and for monitoring therapeutic response and recurrence in metastatic cancers. Such testing could serve to help physicians monitor ongoing response to therapy, identify signs of early progression, or see markers of resistance emerge prior to clinical presentation. Once therapy is completed, a simple urine test could be used to monitor for early signs of disease recurrence over time. The market for these tests—diagnosed cancer patients possessing mutations known to have clinical or therapeutic importance—is already established. Use of urine-based testing could be disruptive, and change the pattern of use of other cancer monitoring tools, including expensive imaging technologies, such as PET, CT and MRI scans.

According to the American Cancer Society’s (“ACS”) 2013 report, there are approximately 525,000 patients that die every year from cancer, not including cancers of the blood, bone marrow, or lymphatic system. Using this number as a proxy for metastatic cancers, it can be assumed that all of these patients are being treated within 12 months of death for their disease. Testing and monitoring these patients for response to therapy, progression while on therapy, or for markers of resistance to therapy (like T790M for lung cancer) would be a natural extension of our technology. The average lung, breast, or colon cancer patient receives between 18-21 radiographic imaging procedures (PET, CT, MRI, etc.) during the two years following their diagnosis. This averages to about 9-10 scans per patient per year. Use of a urine-based monitoring test at the start of therapy, at several time points during therapy, and at the completion of therapy would represent approximately six separate testing events that could occur within a 12 month period. At a reimbursed price of approximately $1,000 per test, the total available market (“TAM”) for treatment response monitoring in the U.S. could be worth more than $5.0 billion.

Once patients with cancer, primary or metastatic, have completed therapy, they will require monitoring for possible progression, and for the appearance of resistance markers, since many metastatic patients may remain on lower-dose “maintenance therapy” during the remainder of their lives, or until treatment is no longer considered an option. According to the ACS, as of 2012, there were over 11 million patients alive in the U.S. who have been treated for cancers that have metastatic potential, not including cancers of the blood, bone marrow, or lymphatic system. Use of a urine-based mutation monitoring test once a year at $1000 per test would equate to a TAM for recurrence monitoring in the U.S. at approximately $12 billion annually.

Both of these markets, treatment response and recurrence monitoring, are sizeable economic opportunities. Capturing 10% of the response monitoring market would produce revenues of ~$500 million, and 5% of the recurrence monitoring market would yield annual revenues of ~$600 million.

Beyond cancer patients being actively treated or monitored over time, cell-free nucleic acid testing may eventually emerge as a viable option for pre-cancerous screening. This was recently evaluated in a cancer clinical study at Thomas Jefferson University, funded jointly by the NIH and the National Cancer Institute (“NCI”). The study demonstrated that DNA fragments carrying a specific mutation (KRAS), and released from pre-cancerous colon polyps, can be detected in the urine of patients.

Studies have shown that cancer patients who have KRAS mutations do not respond successfully to treatment with anti-EGFR (epidermal growth factor receptor) drugs such as Erbitux, Iressa, Tarceva, Tykerb, and Vectibix.

These anti-EGFR agents, particularly Erbitux and Vectibix, are a mainstay of treatment for colorectal cancer. It has been estimated that 17-25% of all human cancers have been found to harbor KRAS mutations, with mutation rates as high as 59%-90% in pancreatic cancers and 35%-40% in colorectal cancers. These tumors have a low probability of responding to anti-EGFR drugs. By first testing for KRAS mutations, physicians will be able to better manage their patients and avoid costly treatments that are unlikely to have a positive clinical response.

Screening and monitoring for KRAS and other key biomarker mutations (i.e. BRAF, PIK3CA, EGFR, etc.) using urine-based tests would provide a simple, non-invasive, cost effective, and convenient testing alternative for physicians and patients. Specimens may even be collected in the patients’ home as required, or as requested by the physician.

Simple urine-based assays would likely lead to much improved personalized medicine for patients, resulting in the right drug being prescribed for the right disease at the right time. We believe this technology will lead to an improved quality of life for patients.

Drug Development and Monitoring of Therapeutic Outcomes

Cell-free DNA diagnostic technology has significant potential as a very simple, quick, non-invasive way of monitoring clinical responses to drugs in clinical development and evaluating patient-specific responses to already approved and marketed therapies. Specific target applications include, but are not limited to; the detection of metastasis following tumor surgery, monitoring of response and tumor progression during chemotherapy and/or radiation therapy, development of optimal hormonal and chemotherapeutic treatment protocols, and monitoring of transplantation patients on immunosuppressive drugs.

With cancer treatment today, it is often difficult to determine if a particular patient is responding to their current therapeutic regimen. Generally, patients are re-examined periodically to determine if a tumor has grown in size, reduced in size (i.e. partial response), disappeared (i.e. no sign of disease — complete response) or remained the same (stable disease). If the tumor has grown in size or remained the same, treatment may be adjusted. By measuring and monitoring tumor specific genetic markers in a patient’s urine pre-, peri- and post-chemotherapy, it may be possible to more quickly determine whether a patient is responding to therapy. Use of cell-free DNA diagnostics may permit more rapid and real-time therapeutic decisions on a patient-specific basis. About 1.6 million new cancer cases are diagnosed annually, and there are several hundred companies developing therapeutic agents in the United States alone. We believe this indicates a large potential application to use cell-free DNA diagnostic technology for both drug development and the monitoring of therapeutic outcomes.

One of the largest costs associated with development of a new therapy is the size of human clinical studies required to identify the cohort of responders, and the resulting statistical power required. By measuring specific genetic markers, it may be possible to pre-identify, and subsequently screen, for the most likely responders to the therapy, and to limit patient recruitment to this subset. This strategy could significantly reduce the cost to develop a drug, and can improve development timelines as well. We believe that there is significant commercial potential for our urine-based cell-free molecular diagnostic technology to be incorporated into these clinical trial protocols, and ultimately post-approval patient identification protocols.

Commercial Markets — External Focus

We will seek to license and/or partner with other companies who have vested interests or commercial strengths in the following areas in order to develop applicable diagnostic and/or monitoring tests using our cell-free molecular diagnostic technology.

Infectious Diseases — Human Papilloma Virus (“HPV”)

The rationale for screening HPV is that high-risk subtypes cause virtually all cases of cervical cancer. We have developed a urine-based HPV test capable of screening for known high-risk HPV types that are associated with the development of cervical cancer. Cervical cancer is the third most commonly diagnosed cancer, and the fourth leading cause of cancer deaths in females, worldwide. Deaths due to cervical cancer are a significant global problem, especially in the developing world where screening practices are far from adequate.

According to the American Cancer Society, India alone accounts for 27% (77,100) of total worldwide cervical cancer deaths. A recent clinical trial conducted in rural India found that a single round of HPV DNA testing was associated with about a 50% reduction in the risk of developing advanced cervical cancer and associated deaths. This compares with the United States, where better patient compliance and screening guidelines have reduced cervical cancer death rates to only 4,290 cases in 2011. The major drivers of poor screening in these developing regions are cultural acceptance, limited screening resources and funding, and poor cytology proficiency. Further exacerbating the compliance hurdles, is that the primary screening mechanism involves an invasive cervical scraping procedure (e.g. Pap smear). It is generally agreed that the early detection of cervical cancer leads to much higher cure rates, and lower rates of invasive disease.

Beyond women’s health and cervical cancer, HPV infection impacts the men who carry and help spread the virus. While not at risk for cervical cancer, men can experience clinical manifestations in the form of genital warts, as well as penile, anal, and oropharyngeal cancers. Determining male carrier status is an unmet medical need within the sexually-transmitted disease community. We intend to explore the viability of our urine-based HPV assay to be a potential screening test for both low-risk HPV types 6 and 11 (which cause up to 90% of all genital warts), as well as known high-risk HPV types that cause the development of cervical and other cancers. Knowing HPV carrier status may contribute to more stringent use of safe sex practices, and can prevent further spread of the disease during active infection periods. In addition to carrier screening, our test may also prove useful in monitoring patients with active HPV infection until resolution of the disease.

There is a tremendous unmet need for a new non-invasive, simple, private, and cost effective test to simplify the HPV screening process for patients, both male and female, and in turn improve compliance. We believe our urine-based HPV test can address these market needs.

Other areas beyond HPV detection and monitoring include those infectious diseases caused by viruses, bacteria, fungi, and parasites. Cell-free nucleic acid assays that detect molecular targets in such organisms can provide a quick, accurate, simple, and cost effective method for screening and monitoring disease. Specific areas of interest include testing for molecular targets from organisms that cause Lyme disease, JC Virus, valley fever, and various fungal infections. These organisms all tend to be difficult to identify with current technology, making differential diagnosis especially challenging, thus delaying the start of potentially curative anti-infective treatment.

Transplantation

According to government statistics, there are approximately 28,000 solid organ transplants performed in the U.S. annually. Post-transplant monitoring for organ rejection episodes requires a highly invasive tissue biopsy. Approximately 10 such biopsies are taken over a period of one year per patient. Because organ rejection is marked by the early death of cells, we believe that an early indication of rejection can be identified by measuring a unique series of genetic markers characteristic of the organ donor that can be easily detected in random urine specimens from the transplant recipient. Providing early evidence of tissue rejection is key to the administration and monitoring of immunosuppressive therapies used to fend off rejection. Given the annual number of transplants performed in the U.S. and the annual number of corresponding biopsies performed per patient, this would equate to a market opportunity in the U.S. of roughly 300,000 urine-based tests per year. Transplantation monitoring with our technology offers opportunities for partnering with companies developing drugs for controlling tissue rejection, developing cell transplantation, or developing novel transplantation technologies. This illustrates the breadth of commercial potential of our cell-free molecular testing platform technology, and we intend to leverage such potential applications to maximize shareholder value.

Ultra-sensitive Analytical and Detection System

As it relates to detection platforms, which are required for final assay analyses, we have potential to develop a new instrument that provides features that would be synergistic and complementary to our cell-free molecular diagnostic technology. In this regard, in August 2010 we acquired Etherogen, Inc. which owns the CMOS Sensor Detection Platform, and we may design a “next generation” version of this screening and detection device. The major differentiating features of this platform are simplicity, unsurpassed ultra-sensitive detection of nucleic acids and proteins without the need for target amplification or the resulting investments in amplification-related infrastructure or capital equipment, significantly heightened speed, and the ability to perform multi-analyte assays. We believe that such a platform would undoubtedly expand the user base for molecular diagnostics. Currently, the cost of adding these new testing modalities in hospitals can be daunting. These high costs include extensive capital equipment and infrastructure requirements (i.e. amplification technology, highly trained personnel, special facilities, etc.) that most hospitals cannot afford. Our platform may address cost efficiencies, and potentially could help overcome these adoption hurdles. Finalization of the system architecture, operating procedure, and software specifications for this platform are required, and system development will take place when resources are allocated to fund the project.

Technologies for the collection, shipment and storage of urine specimens, and cell-free nucleic acid extraction

Successful implementation of our cell-free nucleic acid technology in molecular testing is tightly linked to the availability of techniques and procedures for cell-free nucleic acid preservation, purification, and analysis. Our strategic plan includes the allocation of sufficient resources for the creation of robust, feasible, and inexpensive approaches to improve the efficiency of working with urine samples.

Instrumentation/System Platform

As part of our product offerings, we intend to provide various types of automation alternatives that will further enhance the acceptance and use of our urine-based assays incorporating our cell-free platform. In this regard, there are several alternatives that we will pursue. For example, in sample extraction, we will either develop applications for existing extraction systems that already exist in laboratories or recommend that they acquire instruments that can be used with our assays. An alternative will be to explore an OEM (original equipment manufacturer) arrangement with one of the instrument suppliers, which will allow us to private label the instrument thus supporting a complete system at the customer site.

Our Business Strategy

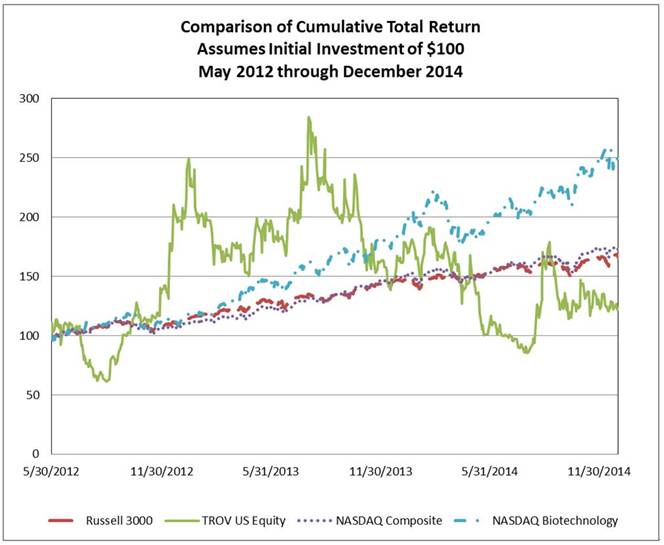

We plan to leverage our cell-free nucleic acid technology to develop and market, either independently or in conjunction with corporate partners, molecular diagnostic products in our core market, oncology, as well as other markets including infectious disease, transplantation, and prenatal diagnostics. Our marketing strategy includes approaches across multiple fronts. In the U.S. market, we have acquired a Clinical Laboratory Improvement Amendments of 1988 (“CLIA”) laboratory. At the late stages of development for