Form S-3

As filed with the Securities and Exchange Commission on October 27, 2011

Registration No. 333-

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WESTERN ALLIANCE BANCORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

| Nevada |

|

88-0365922 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

One E. Washington Street, Suite 1400

Phoenix, Arizona 85004

Telephone: (602) 952-5408

(Address, including zip code, and

telephone number, including area code, of registrant’s principal executive offices)

Robert G.

Sarver

Chairman and Chief Executive Officer

One E. Washington Street, Suite 1400

Phoenix, Arizona 85004

Telephone: (602) 952-5408

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Daniel Keating, Esq.

Hogan Lovells US LLP

555 Thirteenth Street, N.W.

Washington, D.C. 20004

Telephone: (202) 637-5490

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box. ¨

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this form is filed to register additional securities for an offering pursuant

to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this form is a registration statement pursuant to

General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ¨

If this form is a post-effective amendment to a

registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Each Class of

Securities to be Registered |

|

Amount

to be

Registered |

|

Proposed

Maximum

Offering Price

Per Security |

|

Proposed

Maximum

Aggregate Offering Price |

|

Amount of

Registration Fee (1) |

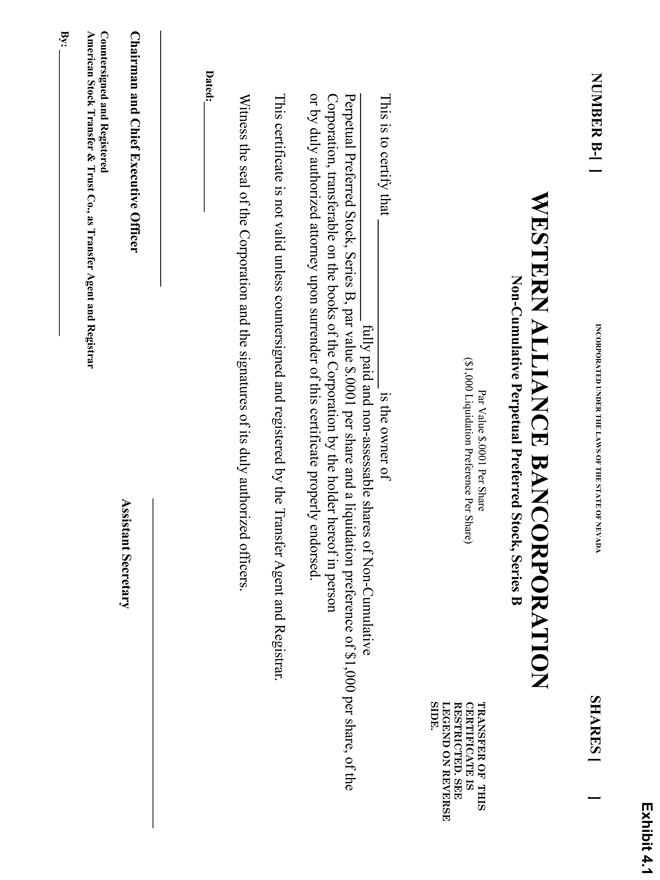

| Non-Cumulative Perpetual Preferred Stock, Series B |

|

141,000(2) |

|

$1,000(3) |

|

$141,000,000 |

|

$16,159 |

| Depository Shares (4) |

|

— |

|

— |

|

— |

|

— |

| Total: |

|

|

|

|

|

$141,000,000 |

|

$16,159 |

| |

| |

| (1) |

Calculated in accordance with Rule 457(a). |

| (2) |

Includes such additional number of shares of Non-Cumulative Perpetual Preferred Stock, Series B (“Series B Preferred Stock”), of a currently indeterminable

amount, as may from time to time become issuable by reason of stock splits and stock dividends, which shares of Series B Preferred Stock are registered for resale hereunder pursuant to Rule 416 promulgated under the Securities Act of 1933, as

amended. |

| (3) |

Represents the liquidation preference amount of the Series B Preferred Stock that was sold by Western Alliance Bancorporation in a non-public offering to the United

States Department of the Treasury (“Treasury”) under the Small Business Lending Fund, which shares of Series B Preferred Stock are registered for resale hereunder pursuant to Rule 416 promulgated under the Securities Act of 1933, as

amended. |

| (4) |

In the event Treasury requests that we deposit the shares of Series B Preferred Stock with a depository pursuant to a depository arrangement, depository shares

evidencing fractional shares of Series B Preferred Stock may be sold pursuant to this registration statement in lieu of whole shares of Series B Preferred Stock. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling

securityholders may not sell these securities or accept an offer to buy these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and

it is not soliciting offers to buy these securities in any state where such offer or sale is not permitted.

Subject To Completion, Dated October 27, 2011

PROSPECTUS

WESTERN ALLIANCE BANCORPORATION

141,000 Shares of Non-Cumulative Perpetual Preferred Stock, Series B,

$1,000 Per Share Liquidation Value

(or Depositary Shares Evidencing Fractional Interests in Such Shares)

This prospectus

relates to the potential resale from time to time by selling securityholders of some or all of the shares of our Non-Cumulative Perpetual Preferred Stock, Series B, or the Series B Preferred Stock. The Series B Preferred Stock was originally issued

by us pursuant to a Securities Purchase Agreement dated September 27, 2011 between us and the Secretary of the Treasury, which we refer to as the initial selling securityholder or Treasury, in a transaction exempt from the registration

requirements of the Securities Act of 1933, as amended, or the Securities Act.

The initial selling securityholder and its

successors, including transferees, which we collectively refer to as the selling securityholders, may offer the securities from time to time directly or through underwriters, broker-dealers or agents and in one or more public or private transactions

and at fixed prices, prevailing market prices, at prices related to prevailing market prices or at negotiated prices. If these securities are sold through underwriters, broker-dealers or agents, the selling securityholders will be responsible for

underwriting discounts or commissions or agents’ commissions. We will not receive any proceeds from the sale of the securities by the selling securityholders.

Our common stock is listed on the New York Stock Exchange under the ticker symbol “WAL.” The Series B Preferred Stock is not listed on any securities exchange or included in any automated

quotation system, and we do not intend to list the Series B Preferred Stock on any exchange.

Our principal executive offices

are located at One E. Washington Street, Suite 1400, Phoenix, Arizona, 85004, and our telephone number at that address is (602) 952-5408.

Investing in

our common stock involves risks. See “Risk Factors” beginning on page 6 of this prospectus and the risk factors that are incorporated by reference in this prospectus from our Annual Report on Form 10-K for

the year ended December 31, 2010, for information that you should consider before purchasing the securities offered by this prospectus.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should rely only on the information contained or incorporated by reference in this prospectus or any supplement. Neither we nor the

selling securityholders have authorized anyone to provide you with different information. You should not assume that the information in this prospectus or any supplement is accurate as of any date other than the date on the front of such documents.

The selling securityholders are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

The

securities offered by this prospectus are not savings accounts, deposits or other obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The date of this prospectus is

, 2011.

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a

“shelf” registration process for the delayed offering and sale of securities pursuant to Rule 415 under the Securities Act. Under the shelf process, the selling securityholders may, from time to time, sell the offered securities

described in this prospectus in one or more offerings. Additionally, under the shelf process, in certain circumstances, we may provide a prospectus supplement that will contain specific information about the terms of a particular offering by one or

more stockholders. We may also provide a prospectus supplement to add information to, or update or change information contained in, this prospectus.

We have filed with the SEC a registration statement on Form S-3, of which this prospectus is a part, under the Securities Act, with respect to the offered securities. This prospectus does not contain all

of the information set forth in the registration statement, portions of which we have omitted as permitted by the rules and regulations of the SEC. Statements contained in this prospectus as to the contents of any contract or other document are not

necessarily complete. You should refer to the copy of each contract or document filed as an exhibit to the registration statement for a complete description.

You should read this prospectus together with any additional information you may need to make your investment decision. You should also read and carefully consider the information in the documents we have

referred you to in “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” below. Information incorporated by reference after the date of this prospectus may add, update or change information

contained in this prospectus. Any information in such subsequent filings that is inconsistent with this prospectus will supersede the information in this prospectus or any earlier prospectus supplement.

As used in this prospectus, unless the context otherwise requires, the terms “we,” “us,” “our” and the

“Company” mean, collectively, Western Alliance Bancorporation and its subsidiaries and their predecessors.

WHERE YOU CAN FIND MORE INFORMATION

Western Alliance Bancorporation, or Western Alliance, is subject to the

information requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and files annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any materials we file with

the SEC at the Public Reference Room of the SEC at Room 1580, 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, we file many of our

documents electronically with the SEC, and you may access those documents over the Internet. The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with

the SEC. The address of the SEC’s website is www.sec.gov. Documents we have filed with the SEC are also available on our website at www.westernalliancebancorp.com. Except as expressly stated herein, information contained on our website does not

constitute a part of this prospectus and is not incorporated by reference herein.

INCORPORATION OF

CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with it

in this prospectus. This helps us disclose certain information to you by referring you to the documents we file. The information we incorporate by reference is an important part of this prospectus. We incorporate by reference each of the documents

listed below.

| |

(a) |

Our Annual Report on Form 10-K for the year ended December 31, 2010, filed with the SEC on March 7, 2011; |

| |

(b) |

Our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2011 and June 30, 2011, filed with the SEC on May 6, 2011

and August 5, 2011, respectively; |

| |

(c) |

Our Current Reports on Form 8-K filed with the SEC on April 28, 2011, September 2, 2011, September 23, 2011 and September 28, 2011 (except,

with respect to each of the foregoing, for portions of such reports which were deemed to be furnished and not filed); and |

1

| |

(d) |

The description of our capital securities contained in our registration statement on Form 8-A, filed with the SEC on June 27, 2005, including any amendment or

report filed for the purpose of updating such description; and |

| |

(e) |

Portions of our proxy statement for the annual meeting of stockholders held on April 26, 2011, that have been incorporated by reference in our Annual Report on

Form 10-K for the year ended December 31, 2010. |

All filings filed by Western Alliance pursuant to the

Exchange Act subsequent to the date hereof and prior to effectiveness of this registration statement shall be deemed to be incorporated in this registration statement and to be a part hereof from the date of filing of such documents or reports. In

addition, all documents and reports filed by Western Alliance subsequent to the date hereof pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities

offered have been sold or which deregisters all securities remaining unsold, shall be deemed to be incorporated by reference in this registration statement and to be a part hereof from the date of filing of such documents or reports. Any statement

contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this registration statement to the extent that a statement contained herein or in any other

subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this registration statement.

You may obtain copies of these documents from us, without charge (other than exhibits,

unless the exhibits are specifically incorporated by reference), by requesting them in writing or by telephone at the following address:

Western Alliance Bancorporation

One E. Washington Street, Suite 1400

Phoenix, Arizona 85004

(602) 952-5408

Attn: Dale Gibbons, Executive Vice President and Chief Financial

Officer

Internet Website: www.westernalliancebancorp.com

THE INFORMATION CONTAINED ON OUR WEBSITE DOES NOT

CONSTITUTE A PART OF THIS PROSPECTUS.

2

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in it, as well as any prospectus supplement that accompanies it, include

“forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. We intend our forward-looking statements to be covered by the safe harbor provisions for

forward-looking statements in these sections. All statements regarding our expected financial position and operating results, our business strategy, forecasted demographic and economic trends relating to our industry and similar matters are

forward-looking statements. These statements can sometimes be identified by our use of forward-looking words such as “may,” “will,” “should,” “could,” “expects,” “intends,”

“plans,” “anticipates,” “believes,” “estimate,” “potential” or “continue,” or the negative of these terms or other comparable terminology. Forward-looking statements relate to expectations,

beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. Except as required by law, the Company disclaims any obligation to update any such

forward-looking statements or to publicly announce the results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

Forward-looking statements contained in this prospectus involve substantial risks and uncertainties, many of which are difficult to

predict and are generally beyond the control of the Company and may cause our actual results to differ significantly from historical results and those expressed in any forward-looking statement. Risks and uncertainties include those set forth in our

filings with the Securities and Exchange Commission and the following factors that could cause actual results to differ materially from those presented:

| |

• |

|

dependency on real estate and events that negatively impact real estate; |

| |

• |

|

high concentration of commercial real estate, construction and development and commercial and industrial loans; |

| |

• |

|

actual credit losses may exceed expected losses in the loan portfolio; |

| |

• |

|

possible need for a valuation allowance against deferred tax assets; |

| |

• |

|

stock transactions could require revalue of deferred tax assets; |

| |

• |

|

exposure of financial instruments to certain market risks may cause volatility in earnings; |

| |

• |

|

dependence on low-cost deposits; |

| |

• |

|

ability to borrow from Federal Home Loan Bank or Board of Governors of the Federal Reserve; |

| |

• |

|

events that further impair goodwill; |

| |

• |

|

increase in the cost of funding as a result of changes to our credit rating; |

| |

• |

|

expansion strategies may not be successful; |

| |

• |

|

our ability to control costs; |

| |

• |

|

risk associated with changes in internal controls and processes; |

| |

• |

|

our ability to compete in a highly competitive market; |

| |

• |

|

our ability to recruit and retain qualified employees, especially seasoned relationship bankers; |

| |

• |

|

the effects of terrorist attacks or threats of war; |

| |

• |

|

risk of audit of U.S. federal tax deductions; |

| |

• |

|

perpetration of internal fraud; |

| |

• |

|

risk of operating in a highly regulated industry and our ability to remain in compliance; |

| |

• |

|

the effects of interest rates and interest rate policy; |

| |

• |

|

exposure to environmental liabilities related to the properties we acquire title; |

| |

• |

|

recent legislative and regulatory changes including Emergency Economic Stabilization Act of 2008, or EESA, the American Recovery and Reinvestment Act

of 2009, or ARRA, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and the rules and regulations that might be promulgated thereunder; and |

| |

• |

|

risks related to ownership and price of our common stock. |

We cannot promise you that our expectations in such forward-looking statements will turn out to be correct. Our actual results may differ materially from those projected in these statements because of

various factors, including those discussed in this prospectus under the caption “Risk Factors” and those discussed in our Securities and Exchange Commission reports on Forms 10-K, 10-Q and 8-K, which are incorporated by reference in

this prospectus.

3

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in, or incorporated by reference into, this prospectus. As a result, it

does not contain all of the information that may be important to you or that you should consider before investing in our securities. You should read this entire prospectus, including the “Risk Factors” section, and the documents

incorporated by reference, which are described under “Incorporation of Certain Documents by Reference.”

Our Company

Western Alliance Bancorporation, incorporated in the State of Nevada, is a multi-bank holding company headquartered in

Phoenix, Arizona, providing full service banking and related services to locally owned businesses, professional firms, real estate developers and investors, local non-profit organizations, high net worth individuals and other consumers through its

subsidiary banks and financial services companies located in Nevada, Arizona, California and Colorado. Western Alliance provides virtually all aspects of commercial and consumer lending and deposit services. In addition, its non-bank subsidiaries

offer an array of financial products and services aimed at satisfying the needs of small to mid-sized businesses and their proprietors, including investments and equipment leasing. On a consolidated basis, as of September 30, 2011, we had

approximately $6.55 billion in total assets, $4.53 billion in total loans, net of deferred fees, $5.63 billion in deposits and $632.3 million in stockholders’ equity.

Our common stock is traded on the New York Stock Exchange under the ticker symbol “WAL.” Our principal executive offices

are located at One E. Washington Street, Suite 1400, Phoenix, Arizona, 85004, and our telephone number at that address is (602) 952-5408. Our website is www.westernalliancebancorp.com. References to our website and those of our

subsidiaries are not intended to be active links and the information on such websites is not, and you must not consider the information to be, a part of this prospectus.

Securities Being Offered

On September 27, 2011, pursuant to the Small

Business Lending Fund, or the SBLF, program of the United States Department of the Treasury, we sold to the Secretary of the Treasury, or Treasury, 141,000 shares of our Non-Cumulative Perpetual Preferred Stock, Series B, or the Series B Preferred

Stock, liquidation preference amount $1,000 per share, for an aggregate purchase price of $141,000,000. The issuance of the Series B Preferred Stock was completed in a private placement exempt from the registration requirements of the

Securities Act. We were required under the terms of the related securities purchase agreement between us and Treasury to register for resale the shares of the Series B Preferred Stock. This registration includes depositary shares,

representing fractional interests in the Series B Preferred Stock, which may be resold pursuant to this prospectus in lieu of whole shares of Series B Preferred Stock in the event Treasury requests that we deposit the Series B Preferred Stock held

by Treasury with a depositary under a depositary arrangement entered into in accordance with the securities purchase agreement. See “Description of Depositary Shares.” The terms of the Series B Preferred Stock are described under

“Description of Series B Preferred Stock.” The securities purchase agreement between us and Treasury was attached as Exhibit 10.1 to our Current Report on Form 8-K filed on September 28, 2011, which report is incorporated into

this prospectus by reference. See “Incorporation of Certain Documents By Reference.”

4

RATIO OF EARNINGS TO FIXED CHARGED AND PREFERRED STOCK

DIVIDENDS

Our historical ratios of earnings to fixed charges and preferred stock dividends for the periods indicated are

set forth in the table below. As of December 31, 2010 and the nine months ended September 30, 2011, we had 140,000 shares of Fixed Rate Cumulative Perpetual Preferred Stock, Series A, outstanding, all of which were issued on

November 21, 2008, and 141,000 shares of Series B Preferred Stock outstanding, all of which were issued on September 27, 2011, respectively. The ratio of earnings to fixed charges and preferred stock dividends is computed by dividing

(1) income from continuing operations before income taxes and fixed charges by (2) total fixed charges and pre-tax earnings required for preferred stock dividends. For purposes of computing these ratios:

| |

• |

|

earnings consist of income from continuing operations before income taxes, including goodwill impairment charges, securities mark-to-market gains and

losses and securities impairment charges; |

| |

• |

|

fixed charges, excluding interest on deposits, include interest expense (other than on deposits) and the estimated portion of rental expense

attributable to interest, net of income from subleases; |

| |

• |

|

fixed charges, including interest on deposits, include all interest expense and the estimated portion of rental expense attributable to interest, net

of income from subleases; and |

| |

• |

|

pre-tax earnings required for preferred stock dividends were computed using tax rates for the applicable year. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At or for the Nine

Months Ended

September 30, |

|

|

At or for the Year Ended

December 31, |

|

| |

|

2011 |

|

|

2010 |

|

|

2010 |

|

|

2009 |

|

|

2008 |

|

|

2007 |

|

|

2006 |

|

| Ratio of Earnings to Fixed Charges and Preferred Stock Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Including interest on deposits |

|

|

1.58 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.41 |

|

|

|

1.73 |

|

| Excluding interest on deposits |

|

|

2.16 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.74 |

|

|

|

4.29 |

|

5

RISK FACTORS

Before purchasing the securities offered by this prospectus you should carefully consider the risk factors relating to Western Alliance

incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2010, as well as the risks, uncertainties and additional information described in Forms 10-K, 10-Q and 8-K that we may file with

the SEC in the future, all of which are incorporated by reference in this prospectus and any accompanying prospectus supplement.

For a description of these reports and documents, and information about where you can find them, see “Where You Can Find More Information” and “Incorporation of Certain Documents By

Reference.”

Additional risks not presently known or that are currently deemed immaterial could also materially and

adversely affect our financial condition, results of operations, business and prospects. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual

results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described in the documents incorporated herein by reference.

Risks Related to the Series B Preferred Stock

An active trading market for the Series B Preferred Stock might not develop.

The Series B Preferred Stock is not currently listed on any securities exchange and we do not anticipate listing the Series B Preferred Stock on an exchange. There can be no assurance that an active

trading market for the Series B Preferred Stock will develop, or, if developed, that an active trading market will be maintained. If an active market is not developed or sustained, the market value and liquidity of the Series B Preferred Stock

may be adversely affected.

Dividends on the Series B Preferred Stock are non-cumulative.

Dividends on the Series B Preferred Stock are non-cumulative and payable only out of lawfully available funds. Consequently, if our

board of directors does not authorize and declare a dividend on the Series B Preferred Stock for any dividend period, holders of the Series B Preferred Stock will not be entitled to receive any such dividend, and such unpaid dividend will not accrue

and will not be payable, regardless of whether dividends are declared for any subsequent dividend period.

Holders of the Series B

Preferred Stock have limited voting rights.

Until and unless we fail to pay full dividends on the Series B Preferred

Stock for six or more quarterly dividend periods, whether or not consecutive, and the aggregate liquidation preference amount of the then-outstanding shares of Series B Preferred Stock is at least $25.0 million, the holders of the Series B Preferred

Stock will have no voting rights except with respect to certain fundamental changes in the terms of the Series B Preferred Stock and except as may be required by law. If dividends on the Series B Preferred Stock are not paid in full for six

quarterly dividend periods, whether or not consecutive, and if the aggregate liquidation preference amount of the then-outstanding shares of Series B Preferred Stock is at least $25.0 million, the total number of positions on our Board of Directors

will automatically increase by two and the holders of the Series B Preferred Stock, acting as a single class, will have the right to elect two individuals to serve in the new director positions. This right and the terms of such directors will

end when we have paid full dividends for at least four consecutive quarterly dividend periods. If full dividends have not been paid on the Series B Preferred Stock for five or more quarterly dividend periods, whether or not consecutive, we must

invite a representative selected by the holders of a majority of the outstanding shares of Series B Preferred Stock, voting as a single class, to attend all meetings of our Board of Directors in a nonvoting observer capacity. Any such

representative would not be obligated to attend any Board meeting to which he or she is invited, and this right will end when we have paid full dividends for at least four consecutive dividend periods.

6

The Series B Preferred Stock might be junior in rights and preferences to our future preferred stock.

Subject to the written consent of Treasury, if Treasury holds any shares of Series B Preferred Stock, or the holders

of a majority of the outstanding shares of the Series B Preferred Stock, voting as a single class, if Treasury does not hold any shares of the Series B Preferred Stock, as well as any other vote of stockholders required by law, we may issue

preferred stock in the future, the terms of which may be senior to the Series B Preferred Stock. The terms of any such future preferred stock expressly senior to the Series B Preferred Stock may restrict dividend payments on the Series B Preferred

Stock, which could result in dividends on the Series B Preferred Stock not being paid when contemplated by the terms of the Series B Preferred Stock. In addition, in the event of our liquidation, dissolution or winding-up, the terms of any such

senior preferred stock may prohibit us from making payments on the Series B Preferred Stock until all amounts due to holders of any such senior preferred stock in such circumstances are paid in full.

The Series B Preferred Stock is equity and is subordinate to all of our existing and future indebtedness; regulatory restrictions may limit or

prevent us from paying dividends on the Series B Preferred Stock; and the Series B Preferred Stock places no limitations on the amount of indebtedness we and our subsidiaries may incur in the future.

Shares of the Series B Preferred Stock are equity interests in Western Alliance and do not constitute indebtedness. As such, the

Series B Preferred Stock, like our common stock, ranks junior to all indebtedness and other non-equity claims on Western Alliance with respect to assets available to satisfy claims on Western Alliance, including in a liquidation of Western Alliance.

Additionally, unlike indebtedness, where principal and interest would customarily be payable on specified due dates, in the case of preferred stock like the Series B Preferred Stock, (1) dividends are payable only when, as and if authorized and

declared by, our Board of Directors and depend on, among other things, our results of operations, financial condition, debt service requirements, other cash needs and any other factors our Board of Directors deems relevant, and (2) as a Nevada

corporation and as a state and federally regulated depository institution and bank holding company, under Nevada law and applicable banking regulations we are subject to restrictions on payments of dividends out of lawfully available funds.

In addition, the Series B Preferred Stock does not limit the amount of debt or other obligations we or our subsidiaries may

incur in the future. Accordingly, we and our subsidiaries may incur substantial amounts of additional debt and other obligations that will rank senior to the Series B Preferred Stock or to which the Series B Preferred Stock will be structurally

subordinated.

The dividend rate on the Series B Preferred Stock will fluctuate initially from 1% to 5% based on our level of

“Qualified Small Business Lending,” or “QSBL,” as compared to our “baseline” level. The cost of the capital we received from the Series B Preferred Stock will increase significantly if the level of our

“QSBL” as of September 30, 2013 does not represent an increase from our “baseline” level. This cost also will increase significantly if we have not redeemed the Series B Preferred Stock before the fourth anniversary of

the SBLF transaction.

The per annum dividend rate on the Series B Preferred Stock can fluctuate on a quarterly basis

during the first 10 quarters during which the Series B Preferred Stock is outstanding, based upon changes in the amount of “QSBL” (as defined in “Description of Series B Preferred Stock – Dividends Payable on Shares of Series B

Preferred Stock”) from a “baseline” level. The dividend rate for the initial dividend period is 3.8742411%. For the second dividend period through the tenth dividend period, the dividend rate may be adjusted to between 1%

and 5%, to reflect the amount of percentage change in the Bank’s level of QSBL from the baseline level to the level as of the end of the second quarter preceding the dividend period in question. For the eleventh dividend period to the

fourth anniversary of the SBLF transaction, the dividend rate will be fixed at between 1% and 5%, based upon the percentage increase in QSBL from the baseline level to the level as of the end of the ninth dividend period (i.e., as of

September 30, 2013); however, if there is no increase in QSBL from the baseline level to the level as of the end of the ninth dividend period (or if QSBL has decreased during that time period), the dividend rate will be fixed at 7.0%. In

addition, because of our participation in the TARP Capital Purchase Program, if our QSBL is not above the baseline level at the end of the ninth dividend period, we must also pay a lending incentive fee of 0.5%, calculated based on the liquidation

value of the outstanding Series B Preferred Stock as of the end of that quarter, beginning with dividend payment dates on or after April 1, 2014 and ending on April 1, 2016. From and after the four and one-half year anniversary of the

issuance date, the dividend rate will be fixed at 9.0%, regardless of the level of QSBL. Depending on our financial condition at the time, any such increases in the dividend rate could have a material negative effect on our liquidity.

7

USE OF PROCEEDS

This prospectus relates to the securities that may be offered and sold from time to time by the selling securityholders who will receive

all of the proceeds from the sale of the securities. Western Alliance will not receive any of the proceeds from the sales of the securities by the selling securityholders. Most of the costs and expenses incurred in connection with the registration

under the Securities Act of the offered securities will be paid by Western Alliance. The selling securityholders will pay any brokerage fees and commissions, fees and disbursements of legal counsel for the selling securityholders, and share transfer

and other taxes attributable to the sale of the offered securities.

DESCRIPTION OF SERIES B

PREFERRED STOCK

This section summarizes specific terms and provisions of the Series B Preferred Stock. The

description of the Series B Preferred Stock contained in this section is qualified in its entirety by the actual terms of the Series B Preferred Stock, as are stated in the Certificate of Designation, a copy of which was attached as Exhibit 3.1 to

our Current Report on Form 8-K filed on September 28, 2011, which is incorporated by reference into this prospectus. See “Incorporation of Certain Documents by Reference.” For purposes of this section, “Bank” means,

collectively, Western Alliance Bank, Torrey Pines Bank and Bank of Nevada, each wholly owned subsidiaries of Western Alliance.

General

The Series B Preferred Stock constitutes a single series of our preferred stock, consisting of 141,000 shares, par value

$0.0001 per share, having a liquidation preference amount of $1,000 per share. The Series B Preferred Stock has no maturity date. We issued the shares of Series B Preferred Stock to Treasury on September 27, 2011 in connection with

the SBLF program for a purchase price of $141,000,000.

Dividends

General. Dividends on the Series B Preferred Stock are payable quarterly in arrears, when, as and if authorized and declared

by our Board of Directors out of legally available funds, on a non-cumulative basis, on the $1,000 per share liquidation preference amount. Dividends are payable on January 1, April 1, July 1 and October 1 of each

year, beginning October 1, 2011.

Each dividend will be payable to holders of record as they appear on our stock register

on the applicable record date, which will be the 15th calendar day immediately preceding the related dividend payment date (whether or not a business day), or such other record date determined by our board of directors that is not more than 60 nor

less than ten days prior to the related dividend payment date. Each period from and including a dividend payment date (or from and including the date of the issuance of the Series B Preferred Stock, in the case of the initial dividend period)

to but excluding the following dividend payment date is referred to as a “dividend period.” Dividends payable for each dividend period are computed on the basis of a 360-day year consisting of four 90-day quarters, and actual days

elapsed over a 90-day quarter. If a scheduled dividend payment date falls on a day that is not a business day, the dividend payment will be postponed to the next day that is a business day and no additional dividends will accrue as a result of that

postponement. The term “business day” means any day except Saturday, Sunday and any day on which banking institutions in the State of New York or the District of Columbia generally are authorized or required by law or other governmental

actions to close.

Rate. The per annum dividend rate, as a percentage of the liquidation amount, can fluctuate on

a quarterly basis during the first ten quarters during which the Series B Preferred Stock is outstanding, based upon changes in the amount of “Qualified Small Business Lending” or “QSBL” (as defined below) by the Bank from the

“Baseline” (as defined below). The dividend rate for the initial dividend period (which ends on September 30, 2011) is 3.8742411%. For the second dividend period through the tenth dividend period after the issuance date, the

dividend

8

rate may be adjusted to between 1% and 5%, to reflect the change in the Bank’s level of QSBL from the Baseline to the level as of the end of the second dividend period preceding the dividend

period in question. For the eleventh dividend period after the issuance date to four and one half years after the issuance date, the dividend rate will be fixed at between 1% and 5%, based upon the increase in QSBL from the Baseline to the

level as of the end of the ninth dividend period (i.e., as of September 30, 2013), or will be fixed at 7% if there is no increase or there is a decrease in QSBL from the Baseline to the level as of the end of the ninth dividend period. In

addition, because of our participation in the TARP Capital Purchase Program, if our QSBL is not above the baseline level at the end of the ninth dividend period, we must also pay a lending incentive fee of 0.5%, calculated based on the liquidation

value of the outstanding Series B Preferred Stock as of the end of that quarter, beginning with dividend payment dates on or after April 1, 2014 and ending on April 1, 2016. From and after four and one-half years from the issuance date,

the dividend rate will be fixed at nine percent (9%), regardless of the amount of QSBL.

Any reduction in the dividend rate to

below 5% prior to the four and one-half year anniversary of the issuance date will not apply to the portion of the aggregate liquidation amount of the then-outstanding shares of Series B Preferred Stock that is greater than the amount of the

increase in QSBL from the Baseline. Dividends on any portion of the aggregate liquidation amount of the then-outstanding shares of Series B Preferred Stock that is in excess of the amount of the increase in the amount of QSBL from the Baseline

will be payable at 5% per annum until the four and one-half year anniversary of the issuance date, resulting in a blended dividend rate that will apply to each outstanding share of Series B Preferred Stock. As noted above, from and after

the four and one-half year anniversary of the issuance date, the dividend rate applicable to each outstanding share of Series B Preferred Stock will be 9%, regardless of the amount of QSBL.

“Qualified Small Business Lending,” or “QSBL,” is defined as the sum of all lending by the Bank of the following

types:

| |

(i) |

commercial and industrial loans; |

| |

(ii) |

owner-occupied, nonfarm, nonresidential real estate loans; |

| |

(iii) |

loans to finance agricultural production and other loans to farmers; and |

| |

(iv) |

loans secured by farmland; |

and, within these

loan categories, excluding (A) any loan or group of loans to the same borrower and its affiliates with an original principal or commitment amount greater than $10 million or that is made to a borrower that had (or whose ultimate parent company

had) more than $50 million in revenues during the most recent fiscal year ended as of the date of origination; (B) to the extent not included in (A) or (C), the portion of any loans guaranteed by the U.S. Small Business

Administration, any other U.S. government agency, or a U.S. government-sponsored enterprise; and (C) to the extent not included in (A) or (B), the portion of any loans held by the Bank for which the risk is assumed by a third party (e.g.,

the portion of loans that have been participated), while, further, adding to the amount determined above the cumulative amount of net charge-offs with respect to QSBL as measured since June 30, 2010.

The “Baseline” is defined as the average of the Bank’s quarter-end QSBL for the four quarters ended June 30,

2010. The Bank’s “Baseline” is $1,517,375,000.

Non-Cumulative. Dividends on the Series B

Preferred Stock will be non-cumulative. If for any reason our Board of Directors does not declare a dividend on the Series B Preferred Stock for a particular dividend period, then the holders of the Series B Preferred Stock will have no right

to receive any dividend for that dividend period, and we will have no obligation to pay a dividend for that dividend period. We must, however, within five calendar days, deliver to the holders of the Series B Preferred Stock a written notice

executed by our Chief Executive Officer and Chief Financial Officer stating our Board of Directors’ rationale for not declaring dividends. Our failure to pay a dividend on the Series B Preferred Stock also will restrict our ability to pay

dividends on and repurchase other classes and series of our stock. See “- Restrictions on Dividends and Repurchases.”

9

When dividends have not been declared and paid in full on the Series B Preferred Stock for

an aggregate of four or more dividend periods, and during that time we were not subject to a regulatory determination that prohibits the declaration and payment of dividends, we must, within five calendar days of each missed payment, deliver to the

holders of the Series B Preferred Stock a certificate executed by at least a majority of the members of our Board of Directors stating that the Board of Directors used its best efforts to declare and pay such dividends in a manner consistent with

safe and sound banking practices and the directors’ fiduciary obligations. In addition, our failure to pay dividends on the Series B Preferred Stock for five or more dividend periods will give the holders of the Series B Preferred Stock

the right to appoint a non-voting observer on our Board of Directors, and our failure to pay dividends on the Series B Preferred Stock for six or more dividend periods will give the holders of the Series B Preferred Stock the right to elect two

directors. See “- Voting Rights.”

No Sinking Fund. There is no sinking fund with respect to

dividends on the Series B Preferred Stock.

Restrictions on Dividends and Repurchases

Restrictions on Dividends. So long as the Series B Preferred Stock remains outstanding, we may declare and pay dividends on

our common stock, any other shares of Junior Stock (as defined below) or Parity Stock (as defined below) only if after giving effect to the dividend, our Tier 1 capital would be at least equal to the Tier 1 Dividend Threshold (as defined below) and

full dividends on all outstanding shares of Series B Preferred Stock for the most recently completed dividend period have been or are contemporaneously declared and paid.

If a dividend is not declared and paid in full on the Series B Preferred Stock for any dividend period, then from the last day of that dividend period until the last day of the third dividend period

immediately following it, no dividend or distribution may be declared or paid on our common stock or any other shares of Junior Stock (other than dividends payable solely in shares of Common Stock) or Parity Stock; provided, however,

that in any such dividend period in which a dividend is declared and paid on the Series B Preferred Stock, dividends may be paid on Parity Stock to the extent necessary to avoid any material covenant breach.

The “Tier 1 Dividend Threshold” means 90% of (A) $489,383,720 (the Company’s consolidated Tier 1 capital as of

June 30, 2011) plus (B) $141,000,000 (the aggregate liquidation amount of the Series B Preferred Stock issued) minus (C) the net amount of loans charged off by the Company’s bank subsidiaries since September 27,

2011. The Tier 1 Dividend Threshold is subject to reduction, beginning on the first day of the eleventh dividend period following the date of issuance of the Series B Preferred Stock, by $14,100,000 (ten percent of the aggregate liquidation

amount of the Series B Preferred Stock initially issued, without regard to any subsequent partial redemptions) for each one percent increase in QSBL from the Baseline level to the ninth dividend period.

“Junior Stock” means our common stock and any other class or series of our stock the terms of which expressly provide that it

ranks junior to the Series B Preferred Stock as to dividend and redemption rights and/or as to rights on liquidation, dissolution or winding up of Western Alliance. We currently have no outstanding class or series of stock constituting Junior

Stock other than our common stock.

“Parity Stock” means any class or series of our stock, other than the Series B

Preferred Stock, the terms of which do not expressly provide that such class or series will rank senior or junior to the Series B Preferred Stock as to dividend rights and/or as to rights on liquidation, dissolution or winding up of Western

Alliance, in each case without regard to whether dividends accrue cumulatively or non-cumulatively. We currently have no outstanding class or series of stock constituting Parity Stock.

Restrictions on Repurchases. So long as the Series B Preferred Stock remains outstanding, we may repurchase or redeem shares

of Capital Stock (as defined below) only if (i) after giving effect to such repurchase or redemption, our Tier 1 capital would be at least equal to the Tier 1 Dividend Threshold and (ii) dividends on all outstanding shares of Series B

Preferred Stock for the most recently completed dividend period have been or are contemporaneously declared and paid (or have been declared and a sum sufficient for payment has been set aside for the benefit of the holders of the Series B Preferred

Stock as of the applicable record date).

If a dividend is not declared and paid on the Series B Preferred Stock for any

dividend period, then from the last day of that dividend period until the last day of the third dividend period immediately following it, neither we nor any of our subsidiaries may redeem, purchase or acquire any shares of our common

stock, Junior Stock, Parity Stock or other capital stock or other equity securities of any kind of ours or of any of our subsidiaries, or any

10

trust preferred securities issued by us or by any of our affiliates, or the Capital Stock, (other than (i) redemptions, purchases, repurchases or other acquisitions of the Series B Preferred

Stock and (ii) repurchases of common stock or other Junior Stock in connection with the administration of any employee benefit plan in the ordinary course of business (including purchases to offset any Share Dilution Amount (as defined below)

pursuant to a publicly announced repurchase plan) and consistent with past practice; provided that any purchases to offset the Share Dilution Amount may not exceed the Share Dilution Amount, (iii) the acquisition by us or by

any of our subsidiaries of record ownership in Junior Stock or Parity Stock for the beneficial ownership of any other persons (other than us or any of our subsidiaries), including as trustees or custodians, (iv) the exchange or conversion of

Junior Stock for or into other Junior Stock or of Parity Stock or trust preferred securities for or into other Parity Stock (with the same or lesser aggregate liquidation amount) or Junior Stock, in each case solely to the extent required pursuant

to binding agreements entered into prior to September 27, 2011 or any subsequent agreement for the accelerated exercise, settlement or exchange of these types of securities for our common stock, (v) redemptions of securities held by us or

by any of our wholly owned subsidiaries or (vi) redemptions, purchases or other acquisitions of capital stock or other equity securities of any kind of any of our subsidiaries required pursuant to binding agreements entered into prior to

September 27, 2011.

“Share Dilution Amount” means the increase in the number of diluted shares outstanding

(determined in accordance with accounting principles generally accepted in the United States, or GAAP, applied on a consistent basis, and as measured from December 31, 2010) resulting from the grant, vesting or exercise of equity-based

compensation to employees and equitably adjusted for any stock split, stock dividend, reverse stock split, reclassification or similar transaction.

Liquidation Rights

In the event of any voluntary or involuntary

liquidation, dissolution or winding up of the affairs of Western Alliance, holders of the Series B Preferred Stock will be entitled to receive for each share of Series B Preferred Stock, out of the assets of Western Alliance or proceeds available

for distribution to our stockholders, subject to any rights of our creditors, before any distribution of assets or proceeds is made to or set aside for the holders of our common stock and any other class or series of our stock ranking junior to the

Series B Preferred Stock, payment of an amount equal to the sum of (i) the $1,000 liquidation preference amount per share and (ii) the amount of any accrued and unpaid dividends on the Series B Preferred Stock. To the extent the

assets or proceeds available for distribution to stockholders are not sufficient to fully pay the liquidation payments owing to the holders of the Series B Preferred Stock and the holders of any other class or series of our stock ranking equally

with the Series B Preferred Stock, the holders of the Series B Preferred Stock and such other stock will share ratably in the distribution.

For purposes of the liquidation rights of the Series B Preferred Stock, neither a merger nor consolidation of Western Alliance with another entity nor a sale, lease or exchange of all or substantially all

of Western Alliance’s assets will constitute a liquidation, dissolution or winding up of the affairs of Western Alliance.

Redemption

and Repurchases

Subject to the approval of the Federal Reserve Board, the Series B Preferred Stock is redeemable at our

option in whole or in part at any time and from time to time. In addition, if there is a change in the law that modifies the terms of Treasury’s investment in the Series B Preferred Stock or the terms of Treasury’s SBLF program in a

materially adverse respect for us, we may, after consultation with the Federal Reserve Board, redeem all of the shares of Series B Preferred Stock. The per share redemption price will be equal to the sum of the liquidation preference amount per

share of $1,000 plus the per share amount of any unpaid dividends for the then current dividend period to, but excluding, the date of redemption (regardless of whether any dividends are actually declared for that dividend period).

To exercise the redemption right described above, we must give notice of the redemption to the holders of record of the Series B

Preferred Stock by first class mail, not less than 30 days and not more than 60 days before the date of redemption. The notice of redemption given to a holder of Series B Preferred Stock must state: (i) the redemption date; (ii) the

number of shares of Series B Preferred Stock to be redeemed and, if less than all the shares held by such holder are to be redeemed, the number of such shares to be redeemed from such holder; (iii) the

11

redemption price; and (iv) the place or places where certificates for such shares are to be surrendered for payment of the redemption price. In the case of a partial redemption of the

Series B Preferred Stock, the shares to be redeemed will be selected either pro rata or in such other manner as our Board of Directors or a committee of the Board determines to be fair and equitable, provided that shares representing at least 25% of

the aggregate liquidation amount of the Series B Preferred Stock are redeemed.

Shares of Series B Preferred Stock that we

redeem, repurchase or otherwise acquire will revert to authorized but unissued shares of preferred stock, which may then be reissued by us as any series of preferred stock other than the Series B Preferred Stock.

No Conversion Rights

Holders of the Series B Preferred Stock have no right to exchange or convert their shares into common stock or any other securities.

Voting Rights

The holders of the Series B Preferred Stock do not have voting rights other than those described below, except to the extent from time to

time required by law.

If dividends on the Series B Preferred Stock have not been declared and paid in full within five

business days after each dividend payment date for an aggregate of five or more dividend periods, whether or not consecutive, we must invite a representative selected by the holders of a majority of the outstanding shares of Series B Preferred

Stock, voting as a single class, to attend all meetings of our Board of Directors in a nonvoting observer capacity and give such representative copies of all notices, minutes, consents, and other materials that we provide to our directors in

connection with such meetings. The holders of the Series B Preferred Stock are not obligated to select such a representative, and such a representative, if selected, is not obligated to attend any meeting to which he or she is

invited. This right of the holders of the Series B Preferred Stock will terminate when full dividends have been timely paid for at least four consecutive dividend periods, subject to re-vesting in the event we again fail to declare and pay

dividends in full on the Series B Preferred Stock for five or more dividend periods.

If dividends on the Series B Preferred

Stock have not been declared and paid in full within five business days after each dividend payment date for an aggregate of six or more dividend periods, whether or not consecutive, and (ii) the aggregate liquidation preference of the

then-outstanding shares of Series B Preferred Stock is at least $25,000,000, the authorized number of directors of Western Alliance will automatically be increased by two and the holders of the Series B Preferred Stock, voting as a single class,

will have the right, but not the obligation, to elect two directors, or the Preferred Directors, to fill such newly created directorships at the next annual meeting of stockholders of Western Alliance (or, if the next annual meeting is not yet

scheduled or is scheduled to occur more than 30 days later, the President of Western Alliance must promptly call a special meeting for that purpose) and at each subsequent annual meeting of stockholders until full dividends have been timely paid on

the Series B Preferred Stock for at least four consecutive dividend periods, at which time this right will terminate, subject to re-vesting in the event we again fail to declare and pay dividends in full on the Series B Preferred Stock for six or

more dividend periods. It will be a qualification for election of any Preferred Director that the election of such individual will not cause us to violate any corporate governance requirements of any securities exchange or other trading

facility on which our securities may then be listed or traded that listed or traded companies must have a majority of independent directors. Upon any termination of the right of the holders of Series B Preferred Stock to vote for directors as

described above, the Preferred Directors will cease to be qualified as directors, the term of office of all Preferred Directors then in office will terminate immediately and the authorized number of directors will be reduced by the number of

Preferred Directors previously elected. Any Preferred Director may be removed at any time, with or without cause, and any vacancy created thereby may be filled, only by the affirmative vote of the holders of a majority of the then-outstanding

shares of Series B Preferred Stock, voting separately as a class. If the office of any Preferred Director becomes vacant for any reason other than removal from office, the holders of a majority of the outstanding shares of Series B Preferred

Stock, voting as a single class, may choose a successor to serve for the remainder of the unexpired term of the vacant directorship.

12

In addition to any other vote or consent required by law or by our charter, the written

consent of (x) Treasury, if Treasury holds any shares of Series B Preferred Stock, or (y) the holders of a majority of the outstanding shares of Series B Preferred Stock, voting as a single class, if Treasury does not hold any shares of

Series B Preferred Stock, is required in order to do the following:

| |

• |

|

amend our certificate of incorporation or the Certificate of Designation for the Series B Preferred Stock to authorize or create or increase the

authorized amount of, or any issuance of, any shares of, or any securities convertible into or exchangeable or exercisable for shares of, any class or series of stock ranking senior to the Series B Preferred Stock with respect to the payment of

dividends and/or the distribution of assets on any liquidation, dissolution or winding up of Western Alliance; |

| |

• |

|

amend our certificate of incorporation or Certificate of Designation for the Series B Preferred Stock in a way that materially and adversely affect the

rights, preferences, privileges or voting powers of the Series B Preferred Stock; |

| |

• |

|

consummate a binding share exchange or reclassification involving the Series B Preferred Stock or a merger or consolidation of Western Alliance with

another entity, unless (i) the shares of Series B Preferred Stock remain outstanding or, in the case of a merger or consolidation in which Western Alliance is not the surviving or resulting entity, are converted into or exchanged for preference

securities of the surviving or resulting entity or its ultimate parent, and (ii) the shares of Series B Preferred Stock remaining outstanding or such preference securities, as the case may be, have such rights, preferences, privileges and

voting powers, and limitations and restrictions, that are the same as the rights, preferences, privileges and voting powers, and limitations and restrictions of the Series B Preferred Stock immediately prior to consummation of the transaction, taken

as a whole; |

| |

• |

|

sell all, substantially all or any material portion of, the assets of Western Alliance, if the Series B Preferred Stock will not be redeemed in full

contemporaneously with the consummation of such sale; or |

| |

• |

|

consummate a Holding Company Transaction (as defined below), unless as a result of the Holding Company Transaction each share of Series B Preferred

Stock will be converted into or exchanged for one share with an equal liquidation preference of preference securities of Western Alliance or the acquiror, or the Holding Company Preferred Stock. Any such Holding Company Preferred Stock must

entitle its holders to dividends from the date of issuance of such stock on terms that are equivalent to the terms of the Series B Preferred Stock, and must have such other rights, preferences, privileges and voting powers, and limitations and

restrictions that are the same as the rights, preferences, privileges and voting powers, and limitations and restrictions of the Series B Preferred Stock immediately prior to such conversion or exchange, taken as a whole;

|

provided, however, that (1) any increase in the amount of our authorized shares of preferred stock, and

(2) the creation and issuance, or an increase in the authorized or issued amount, of any other series of preferred stock, or any securities convertible into or exchangeable or exercisable for any other series of preferred stock, ranking equally

with and/or junior to the Series B Preferred Stock with respect to the payment of dividends, whether such dividends are cumulative or non-cumulative, and the distribution of assets upon the liquidation, dissolution or winding up of Western Alliance,

will not be deemed to adversely affect the rights, preferences, privileges or voting powers of the Series B Preferred Stock and will not require the vote or consent of the holders of the Series B Preferred Stock.

A “Holding Company Transaction” means the occurrence of (a) any transaction that results in a person or group (i)

becoming the direct or indirect ultimate beneficial owner of common equity of Western Alliance representing more than 50% of the voting power of the outstanding shares of our common stock or (ii) being otherwise required to consolidate Western

Alliance for GAAP purposes, or (b) any consolidation or merger of Western Alliance or similar transaction or any sale, lease or other transfer in one transaction or a series of related transactions of all or substantially all of our

consolidated assets to any person other than one of our subsidiaries; provided that, in the case of either clause (a) or (b), Western Alliance or the acquiror is or becomes a bank holding company or savings and loan holding company.

13

To the extent holders of the Series B Preferred Stock are entitled to vote, holders of

shares of the Series B Preferred Stock will be entitled to one for each share then held.

The voting provisions described

above will not apply if, at or prior to the time when the vote or consent of the holders of the Series B Preferred Stock would otherwise be required, all outstanding shares of the Series B Preferred Stock have been redeemed by us or called for

redemption upon proper notice and sufficient funds have been deposited by us in trust for the redemption.

DESCRIPTION OF DEPOSITARY SHARES

Pursuant to a securities purchase agreement between us and Treasury, we have agreed,

if requested by Treasury, to enter into a depositary arrangement pursuant to which the shares of Series B Preferred Stock may be deposited and depositary shares, each representing a fraction of a share of Series B Preferred Stock as specified by

Treasury, may be issued. The Shares of Series B Preferred Stock would be held by a depositary (expected to be a bank or trust company) reasonably acceptable to Treasury. If we enter into such a depositary arrangement, the selling

securityholders would be offering depositary shares, each representing a fraction of a share of Series B Preferred Stock, instead of actual whole shares of Series B Preferred Stock. The actual terms of any such depositary arrangement would be

set forth in a deposit agreement to which we would be a party, which would be attached as an exhibit to a filing by us that would be incorporated by reference into this prospectus. See “Where You Can Find More Information.”

SELLING SECURITYHOLDERS

The selling securityholders may include (i) Treasury, which acquired all of the shares of Series B Preferred Stock from us on

September 27, 2011 in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended, and (ii) any other person or persons holding shares of Series B Preferred Stock or depositary shares evidencing

fractional interests in shares of Series B Preferred Stock to whom Treasury has transferred its registration rights under the terms of the securities purchase agreement between us and Treasury. Treasury is required to notify us in writing of

any such transfer of its registration rights within ten days after the transfer, including the name and address of the transferee and the number and type of securities with respect to which the registration rights have been assigned. As of the date

of this prospectus, Treasury has not notified us of any such transfer. Accordingly, we believe that Treasury currently holds record and beneficial ownership of 100% of the outstanding shares of the Series B Preferred Stock.

The securities to be offered under this prospectus for the account of the selling securityholders are 141,000 shares of Series B

Preferred Stock, representing 100% of the shares of Series B Preferred Stock outstanding on the date of this prospectus, or, in the event Treasury requests that we deposit the shares of Series B Preferred Stock with a depositary in accordance with

the securities purchase agreement between us and Treasury, depositary shares evidencing fractional share interests in such shares of Series B Preferred Stock.

For purposes of this prospectus, we have assumed that, after completion of the offering, none of the securities covered by this prospectus will be held by the selling securityholders.

We do not know when or in what amounts the selling securityholders may offer the securities for sale. The selling securityholders might

not sell any or all of the securities offered by this prospectus. Because the selling securityholders may offer all or some of the securities pursuant to this offering, and because, to our knowledge, no sale of any of the securities is

currently subject to any agreements, arrangements or understandings, we cannot estimate the number of the securities that will be held by the selling securityholders after completion of the offering.

The only potential selling securityholder whose identity we are currently aware of is Treasury. Other than with respect to

Treasury’s acquisition of the Series B Preferred Stock from us pursuant to the SBLF program and our prior participation in Treasury’s TARP Capital Purchase Program, Treasury has not had a material relationship with us.

14

Information about the selling securityholders may change over time and changed information

will be set forth in supplements to this prospectus if and when necessary.

PLAN OF DISTRIBUTION

The selling securityholders and their successors, including their transferees, may sell the securities directly to

purchasers or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling securityholders or the purchasers of the securities. These discounts, concessions or

commissions as to any particular underwriter, broker-dealer or agent may be in excess of those customary in the types of transactions involved.

The securities may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of sale, at varying prices determined at the time of sale or at negotiated prices. These

sales may be effected in transactions, which may involve crosses or block transactions:

| |

• |

|

on any national securities exchange or quotation service on which the Series B Preferred Stock may be listed or quoted at the time of sale;

|

| |

• |

|

in the over-the-counter market; |

| |

• |

|

in transactions otherwise than on these exchanges or services or in the over-the-counter market; or |

| |

• |

|

through the writing of options, whether the options are listed on an options exchange or otherwise. |

In addition, any securities that qualify for sale pursuant to Rule 144 under the Securities Act may be sold under Rule 144 rather than

pursuant to this prospectus supplement.

In connection with sales of securities, the selling securityholders may enter into

hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging in positions they assume. The selling securityholders may also sell securities short and if

such short sale shall take place after the date that the registration statement of which this prospectus is a part is declared effective by the SEC, the selling securityholders may deliver securities covered by this prospectus to close out short

positions and to return borrowed shares in connection with such short sales. The selling securityholders may also loan or pledge securities to broker-dealers that in turn may sell such shares. The selling securityholders may also enter into option

or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus,

which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling securityholders may pledge or grant a security interest in some or all of the securities owned by them and, if they default in the performance of their secured obligations, the pledgees or

secured parties may offer and sell the securities from time to time pursuant to this prospectus or any amendment or supplement to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act, amending, if necessary, the

identification of selling securityholders to include the pledgee, transferee or other successors in interest as selling securityholders under this prospectus. The selling securityholders also may transfer and donate the securities in other

circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The aggregate proceeds to the selling securityholders from the sale of the securities will be the purchase price of the securities less discounts and commissions, if any.

In effecting sales, broker-dealers or agents engaged by the selling securityholders may arrange for other broker-dealers to participate.

Broker-dealers or agents may receive commissions, discounts or concessions from the selling securityholders in amounts to be negotiated immediately prior to the sale.

15

In offering the securities covered by this prospectus supplement, the selling

securityholders and any broker-dealers who execute sales for the selling securityholders may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act in connection with such sales. Any profits

realized by the selling securityholders and the compensation of any broker-dealer may be deemed to be underwriting discounts and commissions. Selling securityholders who are “underwriters” within the meaning of Section 2(a)(11) of the

Securities Act will be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory and regulatory liabilities, including liabilities imposed pursuant to Sections 11, 12 and 17 of the Securities Act

and Rule 10b-5 under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

In order to comply with the

securities laws of certain states, if applicable, the securities must be sold in such jurisdictions only through registered or licensed brokers or dealers. In addition, in certain states the securities may not be sold unless they have been

registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

The anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of securities pursuant to this prospectus and to the activities of the selling securityholders. In addition, we will

make copies of this prospectus supplement available to the selling securityholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act, which may include delivery through the facilities of the New York Stock

Exchange pursuant to Rule 153 under the Securities Act.