10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-50129

HUDSON GLOBAL, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 59-3547281 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

1325 Avenue of the Americas, New York, NY 10019

(Address of principal executive offices) (Zip Code)

(212) 351-7300

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: |

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $0.001 par value | | The NASDAQ Stock Market LLC |

Preferred Share Purchase Rights | | The NASDAQ Stock Market LLC |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 (d) of the Securities Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit to post such flies). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer | o | | Accelerated filer | x |

Non-accelerated filer | o | | Smaller reporting company | o |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant was approximately $72,242,000 based on the closing price of the Common Stock on the NASDAQ Global Select Market on June 30, 2015.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

Class | | Outstanding on January 31, 2016 |

Common Stock - $0.001 par value | | 35,475,048 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2016 Annual Meeting of Stockholders are incorporated by reference into Part III.

|

| | |

Table of Contents |

| | |

| | Page |

PART I |

ITEM 1. | | |

ITEM 1A. | | |

ITEM 1B. | | |

ITEM 2. | | |

ITEM 3. | | |

ITEM 4. | | |

PART II |

ITEM 5. | | |

ITEM 6. | | |

ITEM 7. | | |

ITEM 7A. | | |

ITEM 8. | | |

ITEM 9. | | |

ITEM 9A. | | |

PART III |

ITEM 10. | | |

ITEM 11. | | |

ITEM 12. | | |

ITEM 13. | | |

ITEM 14. | | |

PART IV |

ITEM 15. | | |

| | |

| | |

PART I

ITEM 1. BUSINESS

Hudson Global, Inc. (the “Company” or “Hudson”, “we”, “us” and “our”) provides highly specialized professional-level recruitment and related talent solutions worldwide. Core service offerings include Permanent Recruitment, Temporary Contracting, Recruitment Process Outsourcing (“RPO”) and Talent Management Solutions. Hudson has approximately 1,600 employees and operates in 12 countries with three reportable geographic business segments: Hudson Americas, Hudson Asia Pacific, and Hudson Europe.

For the year ended December 31, 2015, the amounts and percentage of the Company’s total gross margin from the three reportable segments were as follows:

|

| | | | | | | |

| | Gross Margin |

| | Amount | | Percentage |

Hudson Americas | | $ | 16,111 |

| | 8.6 | % |

Hudson Asia Pacific | | 89,682 |

| | 47.8 | % |

Hudson Europe | | 81,917 |

| | 43.6 | % |

Total | | $ | 187,710 |

| | 100.0 | % |

The Company's core service offerings include those services described below:

Permanent Recruitment: Offered on both a retained and contingent basis, Hudson's Permanent Recruitment services leverage the Company's 1,200 consultants, supported by the Company's specialists in the delivery of its proprietary methods to identify, select and engage the best-fit talent for critical client roles.

Temporary Contracting: In Temporary Contracting, Hudson provides a range of project management, interim management and professional contract staffing services. These services draw upon a combination of specialized recruiting and project management competencies to deliver a wide range of solutions. Hudson-employed professionals - either individually or as a team - are placed with client organizations for a defined period of time based on specific business need.

RPO: Hudson RPO delivers both permanent recruitment and temporary contracting outsourced recruitment solutions tailored to the individual needs of primarily mid-to-large-cap multinational companies. Hudson RPO's delivery teams utilize state-of-the-art recruitment process methodologies and project management expertise in their flexible, turnkey solutions to meet clients' ongoing business needs. Hudson RPO services include complete recruitment outsourcing, project-based outsourcing, contingent workforce solutions and recruitment consulting.

Talent Management Solutions: Featuring embedded proprietary talent assessment and selection methodologies, Hudson's Talent Management Solutions capability encompasses services such as talent assessment (utilizing a variety of competency, attitude and experiential testing), interview training, executive coaching, employee development and outplacement.

On June 15, 2015, the Company completed the sale of substantially all of the assets (excluding working capital) of its Hudson Information Technology (US) business (the "US IT business") to Mastech, Inc. As a result, the Company no longer has an Americas' Information Technology temporary contracting practice. The Company also completed the sale of its Netherlands business to InterBalanceGroup BV effective April 30, 2015. The results of both the US IT business and Netherlands were included in the Company's continuing operations as they did not meet the criteria for discontinued operations under the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") No. 205, "Presentation of Financial Statements."

On November 7, 2014, the Company completed the sale of substantially all of the assets and liabilities of its Legal eDiscovery business in the United States and United Kingdom. The Company no longer has operations in the Legal eDiscovery business. In addition, the Company ceased operations in Sweden, which was included within the Hudson Europe segment during the third quarter of 2014. The Company concluded that the divestiture of its Legal eDiscovery business and the cessation of operations in Sweden meet the criteria for discontinued operations set forth in ASC No. 205, "Presentation of Financial Statements." The Company reclassified its discontinued operations for all periods presented and has excluded the results from continuing operations and from segment results for all periods presented.

CLIENTS

The Company's clients include small to large-sized corporations and government agencies. For the year ended December 31, 2015, within revenue from continuing operations, there was approximately 130 Hudson Americas clients (as compared to approximately 150 in 2014), 2,600 Hudson Asia Pacific clients (as compared to 2,300 in 2014) and 3,500 Hudson Europe clients (as compared to 3,400 in 2014).

In 2015, the Company completed the sale of its US IT business and Netherlands operations, which consisted of approximately 90 clients and 150 clients, respectively and were included in continuing operations. In 2014, the Company exited its Legal eDiscovery business in the U.S. and U.K. markets as well as its operations in Sweden, which consisted of approximately 155 clients, 20 clients, and 70 clients, respectively and were included in discontinued operations.

For the year ended December 31, 2015, no single client accounted for more than 10% of the Company's total revenue. As of December 31, 2015, no single client accounted for more than 10% of the Company's total outstanding accounts receivable.

EMPLOYEES

The Company employs approximately 1,600 people worldwide. In most jurisdictions, the Company's employees are not represented by a labor union or covered by a collective bargaining agreement. The Company regards its relationships with its employees as satisfactory.

SALES AND MARKETING

The majority of Hudson's employees include approximately 1,200 client-facing consultants who sell its portfolio of services to its existing client base of approximately 6,300 companies and to prospective client organizations. The Company's consultant population has deep expertise in specific functional areas and industry sectors, and provides broad-based recruitment and solution services based on the needs of the client on a regional and global basis.

COMPETITION

The markets for the Company's services and products are highly competitive. There are few barriers to entry, so new entrants occur frequently, resulting in considerable market fragmentation. Companies in this industry compete on a number of parameters, including degree and quality of candidate and position knowledge, industry expertise, service quality, and efficiency in completing assignments. Typically, companies with greater strength in these parameters garner higher margins.

SEGMENT AND GEOGRAPHIC DATA

Financial information concerning the Company's reportable segments and geographic areas of operation is included in Note 19 of the Notes to Consolidated Financial Statements contained in Item 8 of this Form 10-K.

AVAILABLE INFORMATION

We maintain a website with the address www.hudson.com. We are not including the information contained on our website as part of, or incorporating it by reference into, this report. Through our website, we make available free of charge (other than an investor's own Internet access charges) our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to these reports in a timely manner after we provide them to the Securities and Exchange Commission.

ITEM 1A. RISK FACTORS

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, results of operations, and cash flows could be materially adversely affected.

Our operations will be affected by global economic fluctuations.

Clients' demand for our services may fluctuate widely with changes in economic conditions in the markets in which we operate. Those conditions include slower employment growth or reductions in employment, which directly impact our service offerings. We have limited flexibility to reduce expenses during economic downturns due to some overhead costs that are fixed in the short-term. Furthermore, we may face increased pricing pressures during these periods. For example, in prior economic downturns, many employers in our operating regions reduced their overall workforce to reflect the slowing demand for their products and services.

We may not be able to successfully execute our strategic initiatives or meet our long-term financial goals.

We have been engaged in strategic initiatives to refocus on our core business to maximize long-term stockholder value, to improve our cost structure and efficiency and to increase our selling efforts and developing new business. We cannot provide any assurance that we will be able to successfully execute these or other strategic initiatives or that we will be able to execute these initiatives on our expected timetable. We may not be successful in refocusing our core business and obtaining operational efficiencies or replacing revenues lost as a result of these strategic initiatives.

Our operating results fluctuate from quarter to quarter; no single quarter is predictive of future periods' results.

Our operating results fluctuate quarter to quarter primarily due to the vacation periods during the first quarter in the Asia Pacific region and the third quarter in the Americas and Europe regions. Demand for our services is typically lower during traditional national vacation periods when clients and candidates are on vacation.

Our revenue can vary because our clients can terminate their relationship with us at any time with limited or no penalty.

We focus on providing professional mid-level personnel on a temporary assignment-by-assignment basis, which clients can generally terminate at any time or reduce their level of use when compared to prior periods. Our professional recruitment business is also significantly affected by our clients' hiring needs and their views of their future prospects. These factors can also affect our RPO business. Clients may, on very short notice, terminate, reduce or postpone their recruiting assignments with us and, therefore, affect demand for our services. This could have a material adverse effect on our business, financial condition and results of operations.

Our markets are highly competitive.

The markets for our services are highly competitive. Our markets are characterized by pressures to provide high levels of service, incorporate new capabilities and technologies, accelerate job completion schedules and reduce prices. Furthermore, we face competition from a number of sources. These sources include other executive search firms and professional search, staffing and consulting firms. Several of our competitors have greater financial and marketing resources than we do. Due to competition, we may experience reduced margins on our services, loss of market share and our customers. If we are not able to compete effectively with current or future competitors as a result of these and other factors, our business, financial condition and results of operations could be materially adversely affected.

We have no significant proprietary technology that would preclude or inhibit competitors from entering the mid-level professional staffing markets. We cannot provide assurance that existing or future competitors will not develop or offer services that provide significant performance, price, creative or other advantages over our services. In addition, we believe that, with continuing development and increased availability of information technology, the industries in which we compete may attract new competitors. Specifically, the increased use of the Internet may attract technology-oriented companies to the professional staffing industry. We cannot provide assurance that we will be able to continue to compete effectively against existing or future competitors. Any of these events could have a material adverse effect on our business, financial condition and results of operations.

We have had periods of negative cash flows and operating losses that may recur in the future.

We have experienced negative cash flows and reported operating and net losses in the past. For example, we had operating and net losses for the years ended December 31, 2014 and 2013. We cannot provide any assurance that we will have positive cash flows or operating profitability in the future, particularly to the extent the global economy continues to recover slowly from the global economic downturn. If our revenue declines or if operating expenses exceed our expectations, we may not be profitable and may not generate positive operating cash flows.

Our credit facilities restrict our operating flexibility.

Our credit facilities contain various restrictions and covenants that restrict our operating flexibility including:

•borrowings limited to eligible receivables;

•lenders' ability to impose restrictions, such as payroll or other reserves;

| |

• | limitations on payments of dividends by our subsidiaries to us, which may restrict our ability to pay dividends to our shareholders; |

| |

• | restrictions on our ability to make additional borrowings, or to consolidate, merge or otherwise fundamentally change our ownership; |

| |

• | limitations on capital expenditures, investments, dispositions of assets, guarantees of indebtedness, permitted acquisitions and repurchases of stock; and |

| |

• | limitations on certain intercompany payments of expenses, interest and dividends. |

These restrictions and covenants could have adverse consequences for investors, including the consequences of our need to use a portion of our cash flow from operations for debt service, rather than for our operations, restrictions on our ability to incur additional debt financing for future working capital or capital expenditures, a lesser ability for us to take advantage of significant business opportunities, such as acquisition opportunities, the potential need for us to undertake equity transactions which may dilute the ownership of existing investors, and our inability to react to market conditions by selling lesser-performing assets.

In addition, a default, amendment or waiver to our credit facilities to avoid a default may result in higher rates of interest and could impact our ability to obtain additional borrowings. Finally, debt incurred under our credit facilities bears interest at variable rates. Any increase in interest expense could reduce the funds available for operations.

Extensions of credit under our existing agreements are permitted based on a borrowing base, which is an agreed percentage of eligible accounts receivable, less required reserves, applicable letters of credit and outstanding borrowings. If the amount or quality of our accounts receivable deteriorates, then our ability to borrow under these credit facilities will be directly affected. Furthermore, our receivables facilities with National Australia Bank Limited and Bank of New Zealand do not have a stated maturity date and can be terminated by National Australia Bank Limited and Bank of New Zealand upon 90 days' written notice. We cannot provide assurance that we will be able to borrow under these credit facilities if we need money to fund working capital or other needs.

If sources of liquidity are not available or if we cannot generate sufficient cash flows from operations, then we may be

required to obtain additional sources of funds through additional operating improvements, capital markets transactions, asset sales or financing from third parties, or a combination thereof and, under certain conditions, such transactions could substantially dilute the ownership of existing stockholders. We cannot provide assurance that the additional sources of funds will be available, or if available, would have reasonable terms.

Our investment strategy subjects us to risks.

From time to time, we make investments as part of our growth plans. Investments may not perform as expected because they are dependent on a variety of factors, including our ability to effectively integrate new personnel and operations, our ability to sell new services, and our ability to retain existing or gain new clients. Furthermore, we may need to borrow more money from lenders or sell equity or debt securities to the public to finance future investments and the terms of these financings may be adverse to us.

We face risks related to our international operations.

We conduct operations in 12 countries and face both translation and transaction risks related to foreign currency exchange. For the year ended December 31, 2015, approximately 91% of our gross margin was earned outside of the United States ("U.S."). Our financial results could be materially affected by a number of factors particular to international operations. These include, but are not limited to, difficulties in staffing and managing international operations, operational issues such as longer customer payment cycles and greater difficulties in collecting accounts receivable, changes in tax laws or other regulatory requirements, issues relating to uncertainties of laws and enforcement relating to the regulation and protection of intellectual property, and currency fluctuation. If we are forced to discontinue any of our international operations, we could incur material costs to close down such operations.

Regarding the foreign currency risk inherent in international operations, the results of our local operations are reported in the applicable foreign currencies and then translated into U.S. dollars at the applicable foreign currency exchange rates for inclusion in our financial statements. In addition, we generally pay operating expenses in the corresponding local currency. Because of devaluations and fluctuations in currency exchange rates or the imposition of limitations on conversion of foreign currencies into U.S. dollars, we are subject to currency translation exposure on the revenue and income of our operations in addition to economic exposure. Our consolidated U.S. dollar cash balance could be lower because a significant amount of cash is generated outside of the U.S. This risk could have a material adverse effect on our business, financial condition and results of operations.

We depend on our key management personnel.

Our success depends to a significant extent on our senior management team. The loss of the services of one or more key senior management team member could have a material adverse effect on our business, financial condition and results of operations. In addition, if one or more key employees join a competitor or form a competing company, the resulting loss of existing or potential clients could have a material adverse effect on our business, financial condition and results of operations.

Failure to attract and retain qualified personnel could negatively impact our business, financial condition and results of operations.

Our success also depends upon our ability to attract and retain highly-skilled professionals who possess the skills and experience necessary to meet the staffing requirements of our clients. We must continually evaluate and upgrade our base of available qualified personnel to keep pace with changing client needs and emerging technologies. Furthermore, a substantial number of our contractors during any given year may terminate their employment with us and accept regular staff employment with our clients. Competition for qualified professionals with proven skills is intense, and demand for these individuals is expected to remain strong for the foreseeable future. There can be no assurance that qualified personnel will continue to be available to us in sufficient numbers. If we are unable to attract the necessary qualified personnel for our clients, it may have a negative impact on our business, financial condition and results of operations.

We face risks in collecting our accounts receivable.

In virtually all of our businesses, we invoice customers after providing services, which creates accounts receivable. Delays or defaults in payments owed to us could have a significant adverse impact on our business, financial condition and results of operations. Factors that could cause a delay or default include, but are not limited to, global economic conditions, business failures, and turmoil in the financial and credit markets.

In certain situations, we provide our services to clients under a contractual relationship with a third-party vendor manager, rather than directly to the client. In those circumstances, the third-party vendor manager is typically responsible for aggregating billing information, collecting receivables from the client and paying staffing suppliers once funds are received from the client. In the event that the client has paid the vendor manager for our services and we are unable to collect from the vendor manager, we may be exposed to financial losses.

If we are unable to maintain costs at an acceptable level, our operations could be adversely impacted.

Our ability to reduce costs in line with our revenues is important for the improvement of our profitability. Efforts to improve our efficiency could be affected by several factors including turnover, client demands, market conditions, changes in laws, and availability of talent. If we fail to realize the expected benefits of these cost reduction initiatives, this could have an adverse effect on our financial condition and results of operations.

We rely on our information systems, and if we lose our information processing capabilities or fail to further develop our technology, our business could be adversely affected.

Our success depends in large part upon our ability to store, retrieve, process, and manage substantial amounts of information, including our client and candidate databases. To achieve our strategic objectives and to remain competitive, we must continue to develop and enhance our information systems. This may require the acquisition of equipment and software and the development, either internally or through independent consultants, of new proprietary software. If we are unable to design, develop, implement and utilize, in a cost-effective manner, information systems that provide the capabilities necessary for us to compete effectively, or if we experience any interruption or loss of our information processing capabilities, for any reason, this could adversely affect our business, financial condition and results of operations.

As we operate in an international environment, we are subject to greater cyber-security risks and incidents. We also use mobile devices, social networking and other online activities to connect with our candidates, clients and business partners. While we have implemented measures to prevent security breaches and cyber incidents, our measures may not be effective and any security breaches or cyber incidents could adversely affect our business, financial condition and results of operations.

Our business depends on uninterrupted service to clients.

Our operations depend on our ability to protect our facilities, computer and telecommunication equipment and software systems against damage or interruption from fire, power loss, cyber attacks, sabotage, telecommunications interruption, weather conditions, natural disasters and other similar events. Additionally, severe weather can cause our employees or contractors to miss work and interrupt delivery of our service, potentially resulting in a loss of revenue. While interruptions of these types that have occurred in the past have not caused material disruption, it is not possible to predict the type, severity or frequency of interruptions in the future or their impact on our business.

We may be exposed to employment-related claims, legal liability and costs from clients, employees and regulatory authorities that could adversely affect our business, financial condition or results of operations, and our insurance coverage may not cover all of our potential liability.

We are in the business of employing people and placing them in the workplaces of other businesses. Risks relating to these activities include:

| |

• | claims of misconduct or negligence on the part of our employees; |

| |

• | claims by our employees of discrimination or harassment directed at them, including claims relating to actions of our clients; |

| |

• | claims related to the employment of illegal aliens or unlicensed personnel; |

| |

• | claims for payment of workers' compensation and other similar claims; |

| |

• | claims for violations of wage and hour requirements; |

| |

• | claims for entitlement to employee benefits; |

| |

• | claims of errors and omissions of our temporary employees; |

| |

• | claims by taxing authorities related to our independent contractors and the risk that such contractors could be considered employees for tax purposes; |

| |

• | claims by candidates that we place for wrongful termination or denial of employment; |

| |

• | claims related to our non-compliance with data protection laws, which require the consent of a candidate to transfer resumes and other data; and |

| |

• | claims by our clients relating to our employees' misuse of client proprietary information, misappropriation of funds, other misconduct, criminal activity or similar claims. |

We are exposed to potential claims with respect to the recruitment process. A client could assert a claim for matters such as breach of a blocking arrangement or recommending a candidate who subsequently proves to be unsuitable for the position filled. Similarly, a client could assert a claim for deceptive trade practices on the grounds that we failed to disclose certain referral information about the candidate or misrepresented material information about the candidate. Further, the current employer of a candidate whom we place could file a claim against us alleging interference with an employment contract. In addition, a candidate could assert an action against us for failure to maintain the confidentiality of the candidate's employment search or for alleged discrimination or other violations of employment law by one of our clients.

We may incur fines and other losses or negative publicity with respect to these problems. In addition, some or all of these claims may give rise to litigation, which could be time-consuming to our management team, costly and could have a negative effect on our business. In some cases, we have agreed to indemnify our clients against some or all of these types of liabilities. We cannot assure that we will not experience these problems in the future, that our insurance will cover all claims, or that our insurance coverage will continue to be available at economically-feasible rates.

It is possible that we may still incur liabilities associated with certain pre-spin off activities with Monster Worldwide, Inc. ("Monster"). Under the terms of our Distribution Agreement with Monster, these liabilities generally will continue to be retained by us. If these liabilities are significant, the retained liabilities could have a material adverse effect on our business, financial condition and results of operations. However, in some circumstances, we may have claims against Monster, and we will make a determination on a case by case basis.

Our ability to utilize net operating loss carry-forwards may be limited.

The Company has U.S. net operating loss carry-forwards (“NOLs”) that expire through 2035. Section 382 of the U.S. Internal Revenue Code imposes an annual limitation on a corporation's ability to utilize NOLs if it experiences an “ownership change.” In general terms, an ownership change may result from transactions increasing the ownership of certain stockholders in the stock of a corporation by greater than 50% over a three-year period. The Company has experienced ownership changes in the past. Ownership changes in our stock, some of which are outside of our control, could result in a limitation in our ability to use our NOLs to offset future taxable income, could cause U.S. Federal income taxes to be paid earlier than otherwise would be paid if such limitation were not in effect and could cause such NOLs to expire unused, reducing or eliminating the benefit of such NOLs.

There may be volatility in our stock price.

The market price for our common stock has fluctuated in the past and could fluctuate substantially in the future. For example, during 2015, the market price of our common stock reported on the NASDAQ Global Select Market ranged from a high of $3.24 to a low of $1.98. Factors such as general macroeconomic conditions adverse to workforce expansion, the announcement of variations in our quarterly financial results or changes in our expected financial results could cause the market price of our common stock to fluctuate significantly. Further, due to the volatility of the stock market generally, the price of our common stock could fluctuate for reasons unrelated to our operating performance.

Our future earnings could be reduced as a result of the imposition of licensing or tax requirements or new regulations that prohibit, or restrict certain types of employment services we offer.

In many jurisdictions in which we operate, the provision of temporary staffing is heavily regulated. For example, governmental regulations can restrict the length of contracts of contract employees and the industries in which they may be used. In some countries, special taxes, fees or costs are imposed in connection with the use of contract workers.

The countries in which we operate may:

| |

• | create additional regulations that prohibit or restrict the types of employment services that we currently provide; |

| |

• | impose new or additional benefit requirements; |

| |

• | require us to obtain additional licensing to provide staffing services; |

| |

• | impose new or additional visa restrictions on movements between countries; |

| |

• | increase taxes, such as sales or value-added taxes, payable by the providers of staffing services; |

| |

• | increase the number of various tax and compliance audits relating to a variety of regulations, including wage and hour laws, unemployment taxes, workers' compensation, immigration, and income, value-added and sales taxes; or |

| |

• | revise transfer pricing laws or successfully challenge our transfer prices, which may result in higher foreign taxes or tax liabilities or double taxation of our foreign operations. |

Any future regulations that make it more difficult or expensive for us to continue to provide our staffing services may have a material adverse effect on our business, financial condition and results of operations.

Provisions in our organizational documents and Delaware law will make it more difficult for someone to acquire control of us.

Our certificate of incorporation and by-laws and the Delaware General Corporation Law contain several provisions that make it more difficult to acquire control of us in a transaction not approved by our Board of Directors, including transactions in which stockholders might otherwise receive a premium for their shares over then current prices, and that may limit the ability of stockholders to approve transactions that they may deem to be in their best interests. Our certificate of incorporation and by-laws currently include provisions:

| |

• | authorizing our Board of Directors to issue shares of our preferred stock in one or more series without further authorization of our stockholders; |

| |

• | requiring that stockholders provide advance notice of any stockholder nomination of directors or any new business to be considered at any meeting of stockholders; and |

| |

• | providing that vacancies on our Board of Directors will be filled by the remaining directors then in office. |

In addition, Section 203 of the Delaware General Corporation Law generally provides that a corporation may not engage in any business combination with any interested stockholder during the three-year period following the time that the stockholder becomes an interested stockholder, unless a majority of the directors then in office approve either the business combination or the transaction that results in the stockholder becoming an interested stockholder or specified stockholder approval requirements are met.

In February 2005, our Board of Directors adopted a Rights Agreement between the Company and a rights agent (the "2005 Rights Agreement") and declared a dividend of one preferred share purchase right (a “Right”) for each outstanding share of our common stock payable upon the close of business on February 28, 2005 to the stockholders of record on that date. On January 15, 2015, our Board of Directors approved an amendment and restatement of the 2005 Rights Agreement by adopting an Amended and Restated Rights Agreement (the "Rights Agreement") between the Company and a rights agent. The Board adopted the Rights Agreement in an effort to protect stockholder value by attempting to diminish the risk that the Company's ability to use its net operating losses ("NOLs") to reduce potential future Federal income tax obligations may become substantially limited. Each Right entitles the registered holder to purchase from us one one-hundredth (1/100th) of a share of our Series A Junior Participating Preferred Stock (“Preferred Shares”) at a price of $8.50 per one one-hundredth of a Preferred Share, subject to adjustment. If any person becomes a 4.99% or more stockholder of the Company, then each Right (subject to certain limitations) will entitle its holder to purchase, at the Right's then current exercise price, a number of shares of common stock of the Company or of the acquirer having a market value at the time of twice the Right's per share exercise price. The Company's Board of Directors may redeem the Rights for $0.001 per Right at any time prior to the time when the Rights become exercisable. The Rights will expire on the earliest of (i) January 15, 2018, (ii) the time at which the Rights are redeemed as described above, (iii) the time at which the Rights are exchanged pursuant to the terms of the Rights Agreement, (iv) the repeal of Section 382 of the Internal Revenue Code if the Board determines that the Rights Agreement is no longer necessary for the preservation of the Company’s NOLs, and (v) the beginning of a taxable year of the Company to which the Board determines that no NOLs may be carried forward. The Rights may have certain anti-takeover effects. The Rights may cause substantial dilution to any person or group that attempts to acquire the Company without the approval of the Board. As a result, the overall effect of the rights may be to render more difficult or discourage a merger, tender offer or other business combination involving the Company that is not supported by the Board.

Proxy contests and any other actions of activist stockholders could have a negative effect on our business.

The Company experienced a proxy contest from activist stockholders in connection with its 2014 annual meeting of stockholders. If further proxy contests or any other dissident stockholder activities ensue, then our business could be adversely affected because responding to proxy contests, litigation and other actions by dissident stockholders can be costly and time-consuming, disrupt our operations and divert the attention of management and our employees. In addition, perceived uncertainties as to our future direction may result in the loss of potential business opportunities and harm our ability to attract new investors and clients and to retain and attract experienced management and employees. Also, we may experience a significant increase in legal fees, administrative and associated costs incurred in connection with responding to a proxy contest or related action. These actions could also cause our stock price to experience periods of volatility or stagnation.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

All of the Company's operating offices are located in leased premises. Our principal executive office is located at 1325 Avenue of the Americas, New York, New York, 10019, where we occupy space under a lease expiring in December 2016 with approximately 8,000 aggregate square feet.

Hudson Americas shares our principal executive office and maintains no other leased locations. Hudson Asia Pacific maintains 14 leased locations with approximately 149,000 aggregate square feet. Hudson Europe maintains 18 leased locations with approximately 160,000 aggregate square feet. All leased space is considered to be adequate for the operation of its business, and no difficulties are foreseen in meeting any future space requirements.

ITEM 3. LEGAL PROCEEDINGS

The Company is involved in various legal proceedings that are incidental to the conduct of its business. The Company is not involved in any pending or threatened legal proceedings that it believes could reasonably be expected to have a material adverse effect on its financial condition or results of operations.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS OF THE REGISTRANT

The following table sets forth certain information, as of March 3, 2016, regarding the executive officers of Hudson Global, Inc.:

|

| | | | |

| | | | |

Name | | Age | | Title |

Stephen A. Nolan | | 55 | | Chief Executive Officer |

Patrick Lyons | | 52 | | Chief Financial Officer and Chief Accounting Officer |

David F. Kirby | | 41 | | Senior Vice President, Treasury and Investor Relations |

The following biographies describe the business experience of our executive officers:

Stephen A. Nolan has served as Chief Executive Officer since May 2015, with overall responsibility for the Company’s growth strategy, operational execution, and overall performance. Until August 2015, Mr. Nolan also served concurrently as Executive Vice President and Chief Financial Officer, a position he held since joining the Company in May 2013. Mr. Nolan also served as the Company’s Controller from March 2014 to March 2015. Mr. Nolan has more than 30 years of experience in accounting and finance, and has served as Chief Financial Officer for both Adecco Group North America and DHL Global Forwarding North America. From 2004 until 2012, Mr. Nolan served as Chief Financial Officer of Adecco Group North America, a staffing and human capital division of Adecco SA, one of the world’s leading human resources service providers. During his tenure at Adecco, he helped drive strong performance during a market downturn, spearheaded a major back office transformation and led the acquisition of MPS. Earlier in his career, he spent 15 years with Reckitt Benckiser, including two in the UK. Mr. Nolan is a Chartered Accountant and began his career as Audit Senior with PricewaterhouseCoopers in Ireland.

Patrick Lyons has served as Chief Financial Officer and Chief Accounting Officer since August 2015 with overall responsibility for the Company's global accounting and finance functions. Prior to that, Mr. Lyons served as Vice President, Planning since 2010 and prior to that as Chief Financial Officer, Americas, since joining the Company in 2006. Having served for more than 25 years in professional services financial management and leadership roles, Mr. Lyons combines analytical rigor with hands-on execution focus, driving accountability and accuracy in financial reporting, cost control and profitability. Before joining the Company, Mr. Lyons held Chief Financial Officer roles at two staffing companies, Strategic Legal Resources and Adecco Staffing USA. Previously, Mr. Lyons worked for the TNT Group and Arthur Andersen where he qualified as a Chartered Accountant.

David F. Kirby, has served as Senior Vice President, Treasury and Investor Relations since August 2015. Prior to that, Mr. Kirby served as Vice President, Finance since 2011 and as Assistant Treasurer since 2008. Prior to that, Mr. Kirby served in a variety of roles in finance, treasury and investor relations since joining the Company in 2001. Prior to joining the Company, Mr. Kirby held positions at TMP Worldwide, TransportEdge, and Merrill Lynch.

Executive officers are elected by and serve at the discretion of the Board of Directors. There are no family relationships between any of our directors or executive officers.

PART II

| |

ITEM 5. | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

MARKET FOR COMMON STOCK

The Company's common stock was listed for trading on the NASDAQ Global Select Market during 2015 under the symbol "HSON." On January 31, 2016, there were approximately 423 holders of record of the Company's common stock.

The following is a list by fiscal quarter of the market prices of the Company's common stock.

|

| | | | | | | | |

| | Market Price |

| | High | | Low |

2015 | | | | |

Fourth quarter | | $ | 2.98 |

| | $ | 2.10 |

|

Third quarter | | $ | 3.24 |

| | $ | 2.10 |

|

Second quarter | | $ | 3.10 |

| | $ | 2.11 |

|

First quarter | | $ | 3.23 |

| | $ | 1.98 |

|

2014 | | | | |

Fourth quarter | | $ | 3.84 |

| | $ | 2.69 |

|

Third quarter | | $ | 4.06 |

| | $ | 3.49 |

|

Second quarter | | $ | 4.33 |

| | $ | 3.33 |

|

First quarter | | $ | 4.17 |

| | $ | 3.31 |

|

DIVIDENDS

We historically have not declared or paid cash dividends on our common stock. In December 2015, our Board of Directors determined that we intend to pay a regular, quarterly cash dividend on our common stock. Our Board of Directors declared a dividend of $0.05 per share to be issued following the release of the Company’s fourth quarter 2015 earnings results. On March 2, 2016, our Board of Directors determined that the first cash dividend, set at $0.05 per share, will be paid on March 25, 2016 to shareholders of record as of March 15, 2016. However, the payment of any future cash dividends is at the discretion of the Board of Directors and will depend upon our financial condition, capital requirements, earnings and other factors deemed relevant by our Board of Directors. In addition, the terms of the credit agreements of our subsidiaries may restrict us from paying dividends and making other distributions to us that would provide us with cash to pay dividends to our shareholders.

ISSUER PURCHASES OF EQUITY SECURITIES

The Company's purchases of its common stock during the fourth quarter of fiscal 2015 were as follows:

|

| | | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased | | Average Price Paid per Share | | Total Number of

Shares Purchased as Part of Publicly

Announced Plans or Programs | | Approximate Dollar

Value of Shares

that May Yet Be

Purchased Under

the Plans or Programs (a) |

October 1, 2015 - October 31, 2015 | | 61,275 |

| | $ | 2.51 |

| | 61,275 |

| | $ | 9,134,000 |

|

November 1, 2015 - November 30, 2015 | | 64,249 |

| | $ | 2.49 |

| | 64,249 |

| | 8,974,000 |

|

December 1, 2015 - December 31, 2015 | | 139,850 |

| | $ | 2.58 |

| | 139,850 |

| | 8,614,000 |

|

Total | | 265,374 |

| | $ | 2.54 |

| | 265,374 |

| | $ | 8,614,000 |

|

| |

(a) | On July 30, 2015, the Company announced that its Board of Directors authorized the repurchase of up to $10 million of the Company's common stock. The authorization does not expire. As of December 31, 2015, the Company had |

repurchased 527,634 shares for a total cost of approximately $1.4 million under this authorization. From time to time, the Company may enter into a Rule 10b5-1 trading plan for purposes of repurchasing common stock under this authorization.

The following information in this Item 5 of this Annual Report on Form 10-K is not deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate it by reference into such a filing.

PERFORMANCE INFORMATION

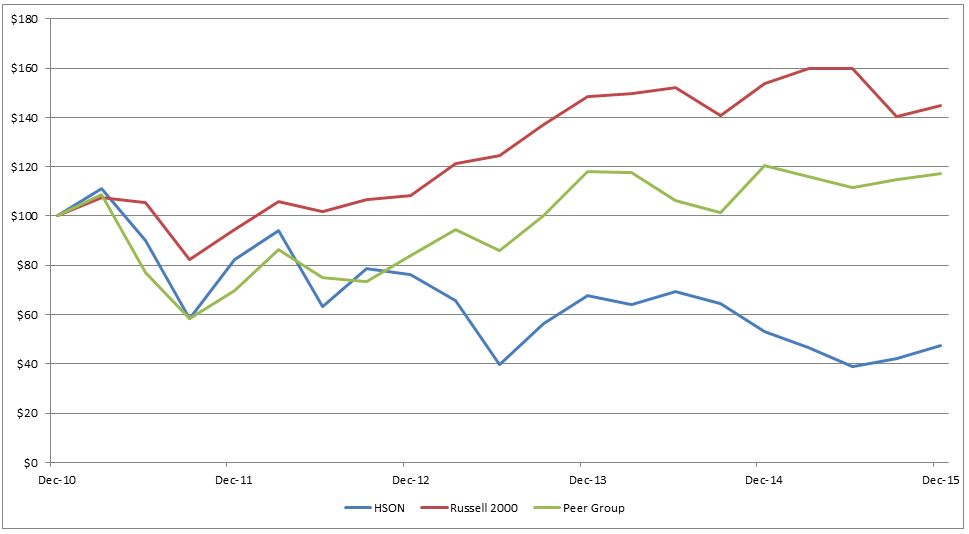

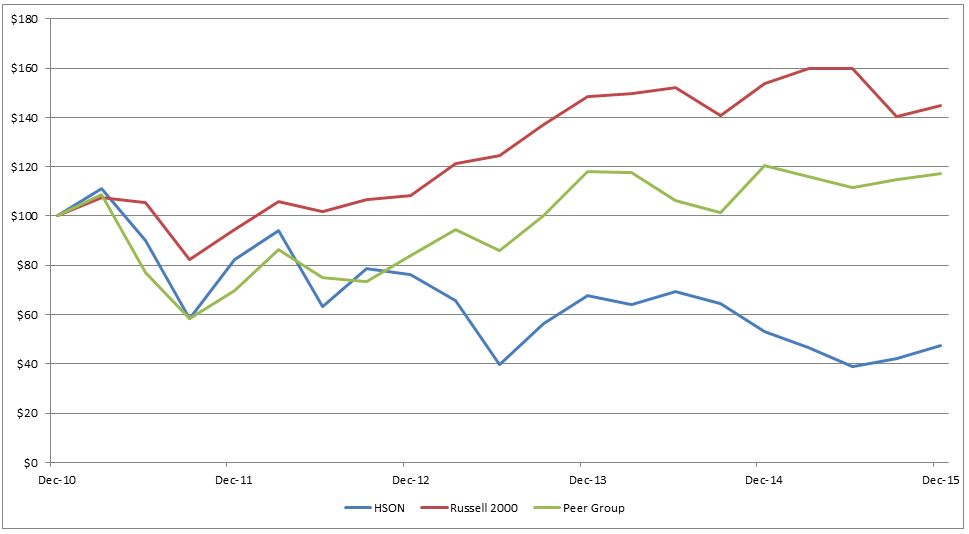

The following graph compares on a cumulative basis changes since December 31, 2010 in (a) the total stockholder return on the Company's common stock with (b) the total return on the Russell 2000 Index and (c) the total return on the companies in a peer group selected in good faith by the Company, in each case assuming reinvestment of dividends. Such changes have been measured by dividing (x) the difference between the price per share at the end of and the beginning of the measurement period by (y) the price per share at the beginning of the measurement period. The graph assumes $100 was invested on December 31, 2010 in the Company's common stock, the Russell 2000 Index and the peer group consisting of Resources Connection, Inc., Kelly Services, Inc., Kforce, Inc., and CDI Corporation. The returns of each component company in the peer group have been weighted based on each company's relative market capitalization on December 31, 2015.

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, |

| | 2010 | | 2011 | | 2012 | | 2013 | | 2014 | | 2015 |

HSON | | $ | 100.00 |

| | $ | 82.16 |

| | $ | 76.84 |

| | $ | 68.95 |

| | $ | 53.17 |

| | $ | 50.09 |

|

RUSSELL 2000 INDEX | | $ | 100.00 |

| | $ | 94.55 |

| | $ | 108.38 |

| | $ | 148.49 |

| | $ | 153.73 |

| | $ | 144.95 |

|

PEER GROUP | | $ | 100.00 |

| | $ | 69.76 |

| | $ | 84.08 |

| | $ | 117.93 |

| | $ | 120.72 |

| | $ | 117.51 |

|

ITEM 6. SELECTED FINANCIAL DATA

The following table shows selected financial data of the Company that has been adjusted to reflect the classification of certain businesses as discontinued operations. The data has been derived from, and should be read together with, “Management's Discussion and Analysis of Financial Condition and Results of Operations” and corresponding notes and the Consolidated Financial Statements included in Items 7 and 8 of this Form 10-K.

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

| | (dollars in thousands, except per share data) |

SUMMARY OF OPERATIONS (a): | | | | | | | | | | |

Revenue | | $ | 463,197 |

| | $ | 581,192 |

| | $ | 562,572 |

| | $ | 655,875 |

| | $ | 780,927 |

|

Gross margin | | $ | 187,710 |

| | $ | 222,845 |

| | $ | 209,429 |

| | $ | 257,793 |

| | $ | 314,253 |

|

Business reorganization and integration expense | | $ | 5,828 |

| | $ | 3,789 |

| | $ | 5,440 |

| | $ | 7,506 |

| | $ | 720 |

|

Operating income (loss) | | $ | 3,241 |

| | $ | (17,486 | ) | | $ | (27,152 | ) | | $ | (10,094 | ) | | $ | 5,928 |

|

| | | | | | | | | | |

Income (loss) from continuing operations | | $ | 1,607 |

| | $ | (15,786 | ) | | $ | (30,211 | ) | | $ | (7,222 | ) | | $ | 3,623 |

|

Income (loss) from discontinued operations, net of income taxes | | $ | 722 |

| | $ | 2,592 |

| | $ | (184 | ) | | $ | 1,887 |

| | $ | 7,286 |

|

Net income (loss) | | $ | 2,329 |

| | $ | (13,194 | ) | | $ | (30,395 | ) | | $ | (5,335 | ) | | $ | 10,909 |

|

Basic income (loss) per share from continuing operations | | $ | 0.05 |

| | $ | (0.48 | ) | | $ | (0.93 | ) | | $ | (0.22 | ) | | $ | 0.11 |

|

Basic net income (loss) per share | | $ | 0.07 |

| | $ | (0.40 | ) | | $ | (0.94 | ) | | $ | (0.17 | ) | | $ | 0.35 |

|

Diluted income (loss) per share from continuing operations | | $ | 0.05 |

| | $ | (0.48 | ) | | $ | (0.93 | ) | | $ | (0.22 | ) | | $ | 0.11 |

|

Diluted net income (loss) per share | | $ | 0.07 |

| | $ | (0.40 | ) | | $ | (0.94 | ) | | $ | (0.17 | ) | | $ | 0.34 |

|

OTHER FINANCIAL DATA: | | | | | | | | | | |

Net cash provided by (used in) operating activities | | $ | (17,351 | ) | | $ | (17,840 | ) | | $ | 2,513 |

| | $ | 13,159 |

| | $ | 13,396 |

|

Net cash provided by (used in) investing activities | | $ | 21,648 |

| | $ | 16,731 |

| | $ | (2,557 | ) | | $ | (8,272 | ) | | $ | (6,584 | ) |

Net cash provided by (used in) financing activities | | $ | 644 |

| | $ | (1,256 | ) | | $ | (497 | ) | | $ | (4,274 | ) | | $ | 1,639 |

|

BALANCE SHEET DATA: | | | | | | | | | | |

Current assets | | $ | 106,143 |

| | $ | 118,921 |

| | $ | 134,323 |

| | $ | 157,412 |

| | $ | 181,923 |

|

Total assets | | $ | 124,949 |

| | $ | 139,672 |

| | $ | 158,829 |

| | $ | 193,468 |

| | $ | 216,546 |

|

Current liabilities | | $ | 51,591 |

| | $ | 67,117 |

| | $ | 69,818 |

| | $ | 67,168 |

| | $ | 90,515 |

|

Total stockholders’ equity | | $ | 61,180 |

| | $ | 59,257 |

| | $ | 74,385 |

| | $ | 106,541 |

| | $ | 107,357 |

|

OTHER DATA: | | | | | | | | | | |

EBITDA (loss) (b) | | $ | 6,820 |

| | $ | (11,725 | ) | | $ | (20,471 | ) | | $ | (3,788 | ) | | $ | 11,885 |

|

| |

(a) | Effective June 14, 2015, the Company completed the sale of substantially all of the assets (excluding working capital) of its US IT business to Mastech, Inc. The Company also completed the sale of its Netherlands business to InterBalanceGroup BV effective April 30, 2015. In addition, during 2015, the Company’s Board of Directors and Management approved the exit of operations in certain countries within Central and Eastern Europe (Ukraine, Czech Republic, and Slovakia), Luxembourg and Ireland. As these actions did not meet the requirements for classification as discontinued operations, the operating results and gain (loss) on sale and exit of businesses are presented as components of income (loss) from continuing operations. See Note 3 included in Item 8 of this Form 10-K for additional information. |

Effective November 9, 2014, the Company completed the sale of substantially all of the assets and certain liabilities of its Legal eDiscovery business in the U.S and U.K. to Document Technologies, LLC and DTI of London Limited. In addition, the Company ceased its operations in Sweden within the Hudson Europe segment during the third quarter of 2014. The results of operations of the Legal eDiscovery business and the Company's operations in Sweden have been reclassified to discontinued operations for all periods presented and has been excluded from continuing operations in accordance with the provisions of ASC 205-20-45, “Reporting Discontinued Operations." See Note 4 included in Item 8 of this Form 10-K for additional information.

| |

(b) | SEC Regulation S-K 229.10(e)1(ii)(A) defines EBITDA as earnings before interest, taxes, depreciation and amortization. EBITDA is presented to provide additional information to investors about the Company's operations on a basis consistent with the measures that the Company uses to manage its operations and evaluate its performance. Management also uses this measurement to evaluate working capital requirements. EBITDA should not be considered in isolation or as a substitute for operating income and net income prepared in accordance with generally accepted accounting principles or as a measure of the Company's profitability. See Note 19 to the Consolidated Financial Statements for further EBITDA segment and reconciliation information. |

| |

1ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) should be read in conjunction with the Consolidated Financial Statements and the notes thereto, included in Item 8 of this Form 10-K. This MD&A contains forward-looking statements. Please see “FORWARD-LOOKING STATEMENTS” for a discussion of the uncertainties, risks and assumptions associated with these statements. This MD&A also uses the non-generally accepted accounting principle measure of earnings before interest, taxes, depreciation and amortization (“EBITDA”). See Note 19 to the Consolidated Financial Statements for EBITDA segment reconciliation information.

This MD&A includes the following sections:

| |

• | Liquidity and Capital Resources |

| |

• | Critical Accounting Policies |

| |

• | Recent Accounting Pronouncements |

| |

• | Forward-Looking Statements |

Executive Overview

The Company has expertise in recruiting mid-level professional talent across all management disciplines in a wide range of industries. The Company matches clients and candidates to address client needs on a part time, full time and interim basis. Part of that expertise is derived from research on hiring trends and the Company's clients’ current successes and challenges with their staff. This research has helped enhance the Company's understanding about the number of new hires that do not meet its clients’ long-term goals, the reasons why, and the resulting costs to the Company's clients. With operations in 12 countries and relationships with specialized professionals around the world, the Company brings a strong ability to match talent with opportunities by assessing, recruiting, developing and engaging the best and brightest people for the Company's clients. The Company combines broad geographic presence, world-class talent solutions and a tailored, consultative approach to help businesses and professionals achieve maximum performance. The Company's focus is to continually upgrade its service offerings, delivery capability and assessment tools to make candidates more successful in achieving its clients' business requirements.

The Company’s proprietary frameworks, assessment tools and leadership development programs, coupled with its broad geographic footprint, have allowed the Company to design and implement regional and global recruitment solutions that the Company believes greatly enhance the quality of its client's hiring.

To accelerate the implementation of the Company's strategy, the Company has engaged in the following initiatives:

| |

• | Investing in the core businesses and practices that present the greatest potential for profitable growth. |

| |

• | Improving further the Company’s cost structure and efficiency of its support functions and infrastructure. |

| |

• | Building and differentiating the Company's brand through its unique talent solutions offerings. |

Strategic Actions

During the year ended December 31, 2015, the Company continued to execute on strategic actions in its previously announced efforts to focus on its core business lines and growth opportunities. These actions included:

| |

• | In February 2015, the Company's management approved the exit of operations in certain countries within Central and Eastern Europe (Ukraine, Czech Republic and Slovakia). During the second quarter of 2015, the Company deemed the liquidation of those Central and Eastern Europe businesses to be substantially complete. As such, under ASC 830, "Foreign Currency Matters," the Company transferred $1.2 million of accumulated foreign |

currency translation gains from accumulated other comprehensive income to the statement of operations within gain on sale and exit of businesses. See Note 3 to the Condensed Consolidated Financial Statements for additional information.

| |

• | In March 2015, the Company's management approved the exit of operations in Luxembourg. During the third quarter of 2015, the Company deemed the liquidation of its Luxembourg business to be substantially complete. As such, under ASC 830, "Foreign Currency Matters," the Company transferred $0.1 million of accumulated foreign currency translation losses from accumulated other comprehensive income to the statement of operations within gain on sale and exit of businesses. See Note 3 to the Condensed Consolidated Financial Statements for additional information. |

| |

• | On May 7, 2015, the Company completed the sale of its Netherlands business to InterBalance Group B.V., effective April 30, 2015, in a management buyout for $9.0 million, including cash sold of $1.1 million. The Company recognized a gain on sale of $2.8 million, net of closing and other direct transaction costs, on the divestiture of the Netherlands business which included $2.8 million of non-cash accumulated foreign currency translation losses. See Note 3 to the Condensed Consolidated Financial Statements for additional information. |

| |

• | On June 15, 2015, the Company completed the sale of its Hudson Information Technology (US) business (the "US IT business") for $17.0 million in cash. The Company retained approximately $3.0 million in net working capital associated with the US IT business. The Company recognized a gain on sale of $15.9 million, net of closing and other direct transaction costs. See Note 3 to the Condensed Consolidated Financial Statements for additional information. |

| |

• | In August 2015, the Company exited its operations in Ireland. |

| |

• | In the fourth quarter of 2015, the Company substantially completed the migration of the remaining Americas business to a new, lower-cost, IT platform and shared service center and decommissioned the legacy support infrastructures. |

Discontinued Operations

Effective November 9, 2014, the Company completed the sale of substantially all of the assets and certain liabilities of its Legal eDiscovery business in the U.S. and U.K. to Document Technologies, LLC and DTI of London Limited for $23.0 million in cash, and recorded a gain of $11.3 million in connection with the sale. The divestiture is a significant component of the Company’s previously announced efforts to focus on its core business lines and growth opportunities. In addition, the Company ceased its operations in Sweden within the Hudson Europe segment during the third quarter of 2014.

The Company's divestiture of its Legal eDiscovery business and exit of operations in Sweden accounted for $0.7 million and $0.0 million of operating losses for the year ended December 31, 2015, respectively, which have been reclassified to discontinued operations for all periods presented and have been excluded from continuing operations and from segment results for all periods presented in accordance with the provisions of ASC 205-20-45 “Reporting Discontinued Operations”. See Note 4 included in Item 8 of this Form 10-K for additional information.

Current Market Conditions

Economic conditions in most of the world's major markets remain mixed. Conditions in Europe have shown improvement with GDP growth in most of the major markets, as well as forecasted GDP growth for 2016. Australia faces a slow growth outlook for 2016, while the outlook for Asia is uncertain given China's slowing growth outlook. The Company closely monitors the economic environment and business climate in its markets and responds accordingly. At this time, the Company is unable to accurately predict the outcome of these events or changes in general economic conditions and their effect on the demand for the Company's services.

Financial Performance

For the year ended December 31, 2015, the Company grew its underlying and retained business in most markets. On a constant currency basis, for the year ended December 31, 2015, revenue and gross margin declined by $50.0 million and $9.8 million, or 9.7% and 5.0%, respectively, compared to the same period in 2014. A primary driver of the decrease was attributable to the current year divestitures of the Netherlands, US IT business, Luxembourg and Central and Eastern Europe businesses. The following table reconciles the change in reported revenue and gross margin for the year ended December 31, 2015:

|

| | | | | | | |

| Year Ended December 31, 2015 |

$ in millions | Change in Revenue on a Constant Currency Basis | | Change in Gross Margin on a Constant Currency Basis |

Netherlands divestiture | $ | (26.3 | ) | | $ | (5.7 | ) |

US IT business divestiture | (22.5 | ) | | (5.9 | ) |

Luxembourg divestiture | (1.0 | ) | | (0.9 | ) |

Central and Eastern Europe divestitures | (0.8 | ) | | (0.7 | ) |

Retained businesses increase | 0.6 |

| | 3.4 |

|

Reported change | $ | (50.0 | ) | | $ | (9.8 | ) |

In addition to the impact of the divested businesses detailed above, on a constant currency basis, the Company's retained businesses experienced an overall increase in revenue and gross margin for the year ended 2015, as compared to 2014. This was driven by increases in retained revenue and gross margin in the Americas, Australia, China, Hong Kong, Belgium and Spain. The increases were partially offset by declines in retained revenue and gross margin in the U.K., France and New Zealand due to continued softness in recruitment activities.

The following is a summary of the highlights for the years ended December 31, 2015, 2014 and 2013. These should be considered in the context of the additional disclosures in this MD&A.

| |

• | Revenue was $463.2 million for the year ended December 31, 2015, compared to $581.2 million for 2014, a decrease of $118.0 million, or 20.3%. |

| |

◦ | On a constant currency basis, the Company's revenue decreased $50.0 million, or 9.7%. Contracting revenue decreased $55.4 million (down 15.4% compared to the same period in 2014). The decrease in contracting revenue was partially offset by increases in permanent recruitment revenue of $5.2 million (up 4.6% compared to 2014) and talent management revenue of $0.8 million (up 2.1% compared to 2014). |

| |

• | Revenue was $581.2 million for the year ended December 31, 2014, compared to $562.6 million for 2013, an increase of $18.6 million, or 3.3%. |

| |

◦ | On a constant currency basis, the Company's revenue increased $15.8 million, or 3.2%. Permanent recruitment revenue increased $12.8 million (up 12.7% compared to the same period in 2013) and talent management revenue increased $4.4 million (up 13.7% compared to the same period in 2013). The increases were partially offset by a decline in contracting revenue of $1.0 million (down 0.3% compared to 2013). |

| |

• | Gross margin was $187.7 million for the year ended December 31, 2015, compared to $222.8 million for 2014, a decrease of $35.1 million, or 15.8%. |

| |

◦ | On a constant currency basis, gross margin decreased $9.8 million, or 5.0%. Contracting gross margin decreased $12.9 million (down 23.2% compared to 2014) and talent management gross margin decreased $1.1 million (down 3.7% compared to 2014). The decrease was partially offset by an increase in permanent recruitment gross margin of $4.6 million (up 4.1% compared to 2014). |

Gross margin was $222.8 million for the year ended December 31, 2014, compared to $209.4 million for 2013, an increase of $13.4 million, or 6.4%.

| |

◦ | On a constant currency basis, gross margin increased $13.2 million, or 7.1%. Permanent recruitment gross margin increased $12.7 million (up 12.8% compared to 2013) and talent management gross margin increased $3.1 million (up 11.5% compared to 2013). The increase was partially offset by a decrease in contracting gross margin of $2.4 million (down 4.2% compared to 2013). |

| |

• | Selling, general and administrative expenses and other non-operating income (expense) (“SG&A and Non-Op”) was $194.9 million for the year ended December 31, 2015, compared to $230.1 million for 2014, a decrease of $35.2 million, or 15.3%. |

| |

◦ | On a constant currency basis, SG&A and Non-Op decreased $10.3 million, or 5.0%. SG&A and Non-Op, as a percentage of revenue, was 42.1% for the year ended December 31, 2015, compared to 40.0% for 2014. |

SG&A and Non-Op were $230.1 million for the year ended December 31, 2014, compared to $223.1 million for 2013, an increase of $7.0 million, or 3.1%.

| |

◦ | On a constant currency basis, SG&A and Non-Op increased $8.1 million, or 4.1%. SG&A and Non-Op, as a percentage of revenue, was 40.0% for the year ended December 31, 2014, compared to 39.6% for 2013. |

| |

• | Business reorganization expenses were $5.8 million for the year ended December 31, 2015, compared to $3.8 million for 2014, an increase of $2.0 million, or $2.4 million on a constant currency basis. |

Business reorganization expenses were $3.8 million for the year ended December 31, 2014, compared to $5.4 million for 2013, a decrease of $1.7 million, or $1.3 million on a constant currency basis.

| |

• | For the year ended December 31, 2015, the Company recorded $0.0 million of charges for impairment of long-lived assets as compared to $0.7 million in 2014. See "Long-lived Assets and Goodwill" below for further detail. |

| |

• | EBITDA was $6.8 million for the year ended December 31, 2015, compared to EBITDA loss of $11.7 million for 2014. On a constant currency basis, EBITDA increased $18.6 million in 2015 compared to 2014. |

EBITDA loss was $11.7 million for the year ended December 31, 2014, compared to EBITDA loss of $20.5 million for 2013. On a constant currency basis, EBITDA loss decreased $6.9 million in 2014 compared to 2013.

| |

• | Net income was $2.3 million for the year ended December 31, 2015, compared to a net loss of $13.2 million for 2014. On a constant currency basis, net income increased $14.8 million in 2015 compared to 2014. |

Net loss was $13.2 million for the year ended December 31, 2014, compared to a net loss of $30.4 million for 2013. On a constant currency basis, net loss decreased $14.2 million in 2014 compared to 2013.

Long-lived Assets and Goodwill

Under Financial Accounting Standards Board ("FASB") Accounting Standard Codification (“ASC”) 360, “Property, Plant, and Equipment," the Company is required to test a long-lived asset for impairment if circumstances indicate that its carrying value might exceed its current fair value.

During the fourth quarter of 2015, the Company experienced continued declines in the operating results within certain markets. These events were deemed to be triggering events that required the Company to perform an impairment assessment with respect to long-lived assets, primarily property and equipment. The Company's internal projections as of the fourth quarter of 2015 anticipate improvement in its operating performance in 2016. The impairment assessment indicated the Company's long-lived assets were not impaired.

In addition to the Company's long-lived assets impairment testing, the Company's management also tested its goodwill for potential impairment. At the conclusion of its goodwill impairment testing, the Company estimated the fair value of its China reporting unit substantially exceeded its carrying value. As such, the Company determined that no impairment of goodwill had taken place.

Although the Company currently anticipates improvement in its operating results for 2016, if general economic conditions in certain markets in which the Company operates remain weak, or if the Company’s performance does not improve, the Company may record impairment charges related to goodwill and other long-lived assets in the future.

Constant Currency

The Company operates on a global basis, with the majority of its gross margin generated outside of the U.S. Accordingly, fluctuations in foreign currency exchange rates can affect our results of operations. For the discussion of reportable segment results of operations, the Company uses constant currency information. Constant currency compares financial results between periods as if exchange rates had remained constant period-over-period. The Company defines the term “constant currency” to mean that financial data for previously reported periods are translated into U.S. dollars using the same foreign currency exchange rates that were used to translate financial data for the current period. The Company’s management reviews and analyzes business results in constant currency and believes these results better represent the Company’s underlying business trends.

Changes in revenue, gross margin, SG&A and Non-Op, business reorganization expenses, operating income (loss), net income (loss) and EBITDA (loss) include the effect of changes in foreign currency exchange rates. The tables below summarize

the impact of foreign currency exchange rate adjustments on the Company’s operating results for the years ended December 31, 2015, 2014 and 2013.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2015 | | 2014 | | 2013 |

| | As | | As | | Currency | | Constant | | As | | Currency | | Constant |

$ in thousands | | reported | | reported | | translation | | currency | | reported | | translation | | currency |

Revenue: | | |

| | |

| | |

| | |

| | | | | | |

Hudson Americas | | $ | 28,627 |

| | $ | 50,146 |

| | $ | (104 | ) | | $ | 50,042 |

| | $ | 51,857 |

| | $ | (195 | ) | | $ | 51,662 |

|

Hudson Asia Pacific | | 219,391 |

| | 246,873 |

| | (37,354 | ) | | 209,519 |

| | 232,748 |

| | (43,931 | ) | | 188,817 |

|

Hudson Europe | | 215,179 |

| | 284,173 |

| | (30,548 | ) | | 253,625 |

| | 277,967 |

| | (21,096 | ) | | 256,871 |

|

Total | | $ | 463,197 |

| | $ | 581,192 |

| | $ | (68,006 | ) | | $ | 513,186 |

| | $ | 562,572 |

| | $ | (65,222 | ) | | $ | 497,350 |

|

Gross margin: | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Hudson Americas | | $ | 16,111 |

| | $ | 20,757 |

| | $ | (101 | ) | | $ | 20,656 |

| | $ | 18,692 |

| | $ | (184 | ) | | $ | 18,508 |

|

Hudson Asia Pacific | | 89,682 |

| | 93,014 |

| | (11,717 | ) | | 81,297 |

| | 87,162 |

| | (14,094 | ) | | 73,068 |

|

Hudson Europe | | 81,917 |

| | 109,074 |

| | (13,532 | ) | | 95,542 |

| | 103,575 |

| | (10,825 | ) | | 92,750 |

|

Total | | $ | 187,710 |

| | $ | 222,845 |

| | $ | (25,350 | ) | | $ | 197,495 |

| | $ | 209,429 |

| | $ | (25,103 | ) | | $ | 184,326 |

|

SG&A and Non-Op (a): | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Hudson Americas | | $ | 17,590 |

| | $ | 20,582 |

| | $ | (136 | ) | | $ | 20,446 |

| | $ | 18,957 |

| | $ | (212 | ) | | $ | 18,745 |

|

Hudson Asia Pacific | | 85,684 |

| | 92,127 |

| | (11,216 | ) | | 80,911 |

| | 89,073 |

| | (14,077 | ) | | 74,996 |

|

Hudson Europe | | 83,617 |

| | 108,613 |

| | (13,563 | ) | | 95,050 |

| | 108,564 |

| | (11,751 | ) | | 96,813 |

|

Corporate | | 8,008 |

| | 8,797 |

| | (1 | ) | | 8,796 |

| | 6,530 |

| | (2 | ) | | 6,528 |

|

Total | | $ | 194,899 |

| | $ | 230,119 |

| | $ | (24,916 | ) | | $ | 205,203 |

| | $ | 223,124 |

| | $ | (26,042 | ) | | $ | 197,082 |

|

Business reorganization expenses: | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Hudson Americas | | $ | 1,108 |

| | $ | 94 |

| | $ | 1 |

| | $ | 95 |

| | $ | 448 |

| | $ | — |

| | $ | 448 |

|

Hudson Asia Pacific | | 669 |

| | 1,322 |

| | (181 | ) | | 1,141 |

| | 989 |

| | (184 | ) | | 805 |

|

Hudson Europe | | 2,883 |

| | 1,407 |

| | (158 | ) | | 1,249 |

| | 3,214 |

| | (527 | ) | | 2,687 |

|

Corporate | | 1,168 |

| | 966 |

| | — |

| | 966 |

| | 789 |

| | — |

| | 789 |

|

Total | | $ | 5,828 |

| | $ | 3,789 |

| | $ | (338 | ) | | $ | 3,451 |

| | $ | 5,440 |

| | $ | (711 | ) | | $ | 4,729 |

|

Operating income (loss): | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Hudson Americas | | $ | 12,931 |

| | $ | 870 |

| | $ | 3 |

| | $ | 873 |

| | $ | 1,367 |

| | $ | (25 | ) | | $ | 1,342 |

|

Hudson Asia Pacific | | 3,548 |

| | (3,013 | ) | | 169 |

| | (2,844 | ) | | (5,883 | ) | | 840 |

| | (5,043 | ) |

Hudson Europe | | 1,743 |

| | 3,112 |

| | (456 | ) | | 2,656 |

| | (5,251 | ) | | 1,035 |

| | (4,216 | ) |

Corporate | | (14,981 | ) | | (18,455 | ) | | — |

| | (18,455 | ) | | (17,385 | ) | | (3 | ) | | (17,388 | ) |

Total | | $ | 3,241 |

| | $ | (17,486 | ) | | $ | (284 | ) | | $ | (17,770 | ) | | $ | (27,152 | ) | | $ | 1,847 |

| | $ | (25,305 | ) |

Net income (loss), consolidated | | $ | 2,329 |

| | $ | (13,194 | ) | | $ | 704 |

| | $ | (12,490 | ) | | $ | (30,395 | ) | | $ | 803 |

| | $ | (29,592 | ) |

EBITDA (loss) from continuing operations(b): | | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Hudson Americas | | $ | 13,354 |

| | $ | 117 |

| | $ | 33 |

| | $ | 150 |

| | $ | (717 | ) | | $ | 29 |

| | $ | (688 | ) |