CERTAIN INFORMATION IN THIS EXHIBIT IDENTIFIED BY [*****] IS CONFIDENTIAL AND HAS BEEN EXCLUDED BECAUSE IT (I) IS NOT MATERIAL AND (II) THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS THAT INFORMATION AS PRIVATE OR CONFIDENTIAL. SHARE PURCHASE AGREEMENT Between GOLAR MANAGEMENT (BERMUDA) LIMITED (as Seller) and COOL COMPANY LTD. (as Purchaser) and GOLAR LNG LIMITED (as guarantor)

i I N D E X 1 INTRODUCTORY TERMS ........................................................................................................................... 2 2 THE TRANSACTION .................................................................................................................................... 6 3 THE PURCHASE PRICE ............................................................................................................................... 7 4 THE COOLMAN GROUP'S ACTIVITIES AFTER THE RESTRUCTURING CLOSING DATE .............. 7 5 CONDITIONS PRECEDENT ........................................................................................................................ 7 6 COMPLETION ............................................................................................................................................... 8 7 WARRANTIES ............................................................................................................................................... 8 8 UNDERTAKING BY GOLAR ..................................................................................................................... 18 9 BREACH OF WARRANTIES...................................................................................................................... 18 10 INDEMNITIES ............................................................................................................................................. 19 11 POST COMPLETION OBLIGATIONS ....................................................................................................... 20 12 GUARANTEE BY GOLAR ......................................................................................................................... 20 13 TERMINATION ........................................................................................................................................... 20 14 PUT OPTION ................................................................................................................................................ 20 15 TRANSACTION COSTS ............................................................................................................................. 21 16 CONFIDENTIALITY ................................................................................................................................... 21 17 MISCELLANEOUS ...................................................................................................................................... 21 18 CHOICE OF LAW AND ARBITRATION .................................................................................................. 22 Schedule 1 - List of the CoolMan Companies Schedule 2 - List of the Management Agreements and the LNG Fleet

1 This share purchase agreement has been entered into on this 30th day of June, 2022 by and between: (1) GOLAR MANAGEMENT (BERMUDA) LIMITED, having its registered office at 2nd floor, S.E. Pearman Building, 9 Par-la-Ville Road, Hamilton HM11, Bermuda (the "Seller"); (2) COOL COMPANY LTD., having its registered office at 2nd floor, S.E. Pearman Building, 9 Par-la-Ville Road, Hamilton HM11, Bermuda (the "Purchaser"); and (3) GOLAR LNG LIMITED, having its registered office at 2nd floor, S.E. Pearman Building, 9 Par-la-Ville Road, Hamilton HM11, Bermuda ("Golar"). WHEREAS:- A. The Seller is a wholly owned subsidiary of Golar and the parent in a sub-group of management companies which organises the management functions in the Golar Group. B. The Purchaser is a public limited company incorporated and resident in Bermuda in which Golar holds approx. 31% of the issued shares. C. The Purchaser established its current business in Q1/2022 by, inter alia, acquiring 8 single purpose companies, each of which, at the date hereof, is the owner of an LNG tanker, and The Cool Pool Limited from Golar pursuant to the terms of a share purchase agreement dated 26 January 2022 (as subsequently amended by an amendment agreement dated 25 February 2022) (the "ShipCo SPA"). D. The LNG tankers acquired by the Purchaser pursuant to the ShipCo SPA were, on the date the ShipCo SPA was concluded, commercially and technically managed by Golar Management Ltd., a wholly owned subsidiary of the Seller. E. Golar Management Ltd. was furthermore, on the date of the ShipCo SPA, the commercial and technical manager of 17 other LNG tankers and FSRUs, 14 of which are owned or bareboat chartered by entities in the corporate group headed by New Fortress Energy Inc. and 3 of which are owned or operated by entities in the Golar Group. F. Golar and the Purchaser entered into an agreement dated 26 January 2022 whereby it was agreed, subject to the terms and conditions of such agreement, that the Purchaser should purchase such part of the Golar Group's management organisation as was responsible for the commercial and technical operation of LNG tankers and FSRUs after the same had been carved out of the Golar Group's overall management organisation as a stand alone sub-group with the Seller as parent. G. The Seller, its subsidiary Golar Management Ltd., the Purchaser, the companies acquired as per the ShipCo SPA and The Cool Pool Limited entered into a transitional services agreement on 26 January 2022 (the "TSA"). H. Cool Company Management Ltd. was incorporated by the Seller on 7 January 2022 and is, as of the date hereof, a wholly owned subsidiary of the Seller. I. The carve-out referred to in Recital (F) was completed with economical and accounting effect between the various parties in the Golar Group involved therein on 31 March 2022. J. The Golar Group's organisation responsible for the commercial and technical operation of LNG tankers and FSRUs together with the assets, liabilities and contractual rights and obligations related thereto is thus, as of today, organised in a sub-group of companies in which Cool Company Management Ltd. is the parent. K. The purpose of this agreement is to set out the complete terms upon which the Seller shall sell and the Purchaser shall purchase the sole share in issue in Cool Company Management Ltd.

2 NOW THEREFORE, it is hereby agreed as follows:- 1 INTRODUCTORY TERMS 1.1 Each of the terms set forth in the following shall, when used in the following, have the meaning set opposite it below. "Administrative Services Agreement" means an agreement dated 30 June, 2022 between GolarManUK (as service provider) and CoolManUK (as service recipient) setting forth the administrative services the former shall provide to the latter, subject to the terms and conditions set forth therein. "Affiliate" means, with respect to any person, a Subsidiary or a Holding Company of that person or any other Subsidiary of that Holding Company, and "Affiliated" shall have a correlating meaning. "Agreement" means this agreement together with the Schedules as the same may be amended and/or supplemented in writing between the Parties from time to time. "Banking Day" means a day on which banks are open for business in Oslo, London and, in respect of any day on which a payment in USD is to be made, New York. "Bermuda Services Agreement" means the agreement dated 30 June 2022 between among others the Seller and the Purchaser relating to the corporate secretarial services to be provided by the Seller to the Purchaser. "Claim" shall have the meaning attributed to the term in Clause 9.1. "Completion" means the completion of the Transaction in accordance with Clause 6. "Completion Date" means the date of this Agreement. "Conditions Precedent" means the conditions precedent that have to be met to effect Completion, such conditions being set out in Clause 5.1. "Control" means with respect to a person (a) direct or indirect ownership of more than 50% of the equity securities or votes of such person, (b) the right to appoint, or cause the appointment of, more than 50% of the members of the board of directors (or similar governing body) of such person or (c) the right to manage, or direct the management of, on a discretionary basis the business or assets of such person, and, for the purposes of this Agreement, a general partner is deemed to Control a limited partnership and a fund advised or managed directly or indirectly by a person shall also be deemed to be Controlled by such person (and the terms "Controlling" and "Controlled" shall have correlating meanings). "Cool Initiated Commitments" means the commitments undertaken by the CoolMan Companies at the request of the Purchaser as further described in Clause 4.2. "CoolMan Companies" means any and all member(s) of the CoolMan Group, the details of each of which are set out in Schedule 1. "CoolMan Group" means CoolManUK and its wholly owned subsidiaries CoolManNor, CoolManCro and CoolManMal. "CoolMan Group Balance Sheet" means the consolidated balance sheet of the CoolMan Group as of the Restructuring Closing Date, prepared in accordance with GAAP, consistently applied. "CoolManCro" means Cool Company Management d.o.o., a Croatian private limited company having Croatian organisation number 0759 5991 406 which, previously, traded under the name "Golar Management d.o.o." and which, at the date hereof, is a wholly owned subsidiary of CoolManUK.

3 "CoolManMal" means Coolco Management Bhd. Sdn., a Malaysian private limited company having Malaysian organisation number 202 201 008 184 (1453881-0) which, at the date hereof, is a wholly owned subsidiary of CoolManUK. "CoolManNor" means Cool Company Management AS, a Norwegian private limited company having Norwegian organisation number 995 435 705, which, previously, traded under the name "Golar Management Norway AS" and which, at the date hereof, is a wholly owned subsidiary of CoolManUK. "CoolManUK" means Cool Company Management Ltd., a private limited company incorporated in England and Wales with registration number 13835293 which, at the date hereof, is a wholly owned subsidiary of the Seller. "Croatia Transfer Agreement" means a transfer agreement between CoolManCro and GolarVikingMan dated 30 June 2022 documenting an exchange of a number of their respective employees between them with economical effect between these parties from the Restructuring Closing Date. "Data Room" means an electronic data room containing the Management Agreements and such other documents relating to the CoolMan Group's business as have been disclosed to the Purchaser up to the close of business GMT on 27 June 2022. "Disclosed" means fairly disclosed in the Data Room. "Encumbrance" any mortgage, charge, pledge, lien, option, right to acquire, right of pre-emption, assignment, trust arrangement, hypothecation, security interest, title retention and any other security interest or arrangement of any kind, or any agreement to create any of the foregoing. "GAAP" means the generally accepted accounting principles of the United States of America. "Golar" has the meaning assigned to the term at the beginning of this Agreement. "Golar Group" means Golar and its Subsidiaries. "GolarCos" means the subsidiaries of Golar parties to the Golar Management Agreements. "GolarManMal" means Golar Management Bhd. Sdn., a Malaysian private limited company, a wholly owned subsidiary of GolarManUK. "GolarManNor" means Golar Management AS, a Norwegian private limited company, a wholly owned subsidiary of GolarManUK. "GolarManUK" means Golar Management Ltd., a private limited company incorporated in England and Wales, a wholly owned subsidiary of the Seller. "Golar Management Agreements" means the agreements identified as such in Schedule 2. "GolarVikingMan" means Golar Viking Management d.o.o., a private limited company incorporated in Croatia and a wholly owned subsidiary of GolarManUK. "Governmental Body" means any local, municipal, regional, national or supranational entity exercising executive, legislative, judicial, regulatory or administrative functions of or relating to government, and any tribunal or arbitrators of a competent jurisdiction. "Holding Company" means, in relation to a company or corporation, any other company, corporation or partnership of which it is a Subsidiary.

4 "Intellectual Property Rights" means (i) copyright, patents, database rights and rights in trademarks, designs, know-how and confidential information (whether registered or unregistered), (ii) applications for registration, and rights to apply for registration, of any of the foregoing rights and (iii) all other intellectual property rights and equivalent or similar forms of protection existing anywhere in the world. "Leakage" means, during the Locked Box Period, any of the following in relation to a CoolMan Company: a. any dividend or other distribution (whether in cash or in specie) declared, paid or made whatsoever by such CoolMan Company to the Seller's Group; b. any payment made or liability incurred by such CoolMan Company for any fees, costs or expenses assumed in connection with this Agreement (including professional advisers' fees, consultancy fees, transaction bonuses, finder's fees, brokerage or other commission); c. any payment of any other nature by such CoolMan Company to or for the benefit of the Seller's Group (including royalty payments, management fees, monitoring fees, interest payments, loan payments, service or directors' fees, bonuses or other compensation of any kind); d. any transfer or surrender of assets, rights or other benefits by such CoolMan Company to or for the benefit of the Seller's Group; e. the assumption or incurrence by such CoolMan Company of any liability or obligation for the benefit of the Seller's Group; f. the provision of any guarantee or indemnity or the incurrence of any Encumbrance by such CoolMan Company in favour or for the benefit of the Seller's Group; g. any waiver, discount, deferral, release or discharge by such CoolMan Company of (i) any amount, obligation or liability owed to it by the Seller's Group; or (ii) any claim held by such CoolMan Company (howsoever arising) against the Seller's Group; and h. any agreement, arrangement or other commitment by such CoolMan Company or the Seller's Group to do or give effect to any of the matters referred to in paragraphs (a) to (g) (inclusive) above; provided that the term " Seller's Group" shall also include any employee and related party to such person. "LNG Fleet" means the LNG tankers and FSRUs listed in Schedule 2. "Locked Box Period" means the period from (and including) 1 April 2022 to (and including) the Completion Date. "Malaysia Transfer Agreement" means an agreement dated 30 June 2022 between GolarManMal and CoolManMal documenting the transfer of a number of employees from GolarManMal to CoolManMal with economical effect between them from the Restructuring Closing Date. "Management Agreements" means the Golar Management Agreements, the NFE Management Agreements and the ShipCo Management Agreements. "NFE" means New Fortress Energy Inc. "NFE Management Agreements" means the agreements identified as such in Schedule 2.

5 "Norwegian BTA" means a business transfer agreement dated 30 June 2022 between CoolManNor and GolarManNor documenting the transfer of such part of CoolManNor's business which is not related to the technical and commercial operation of the LNG Fleet to GolarManNor with economical and accounting effect between the parties thereto from the Restructuring Closing Date. "Parties" means the Seller, the Purchaser and Golar. "Permitted Leakage" means, in relation to each member of the CoolMan Company, any of the following payments during the Locked Box Period: a. any and all payments made by a CoolMan Company to persons or entities outside of the Seller's Group in the ordinary course of trading; b. any and all payments made by a CoolMan Company under the Golar Management Agreements made in the ordinary course of trading; c. any and all payments made by a CoolMan Company to members of the Seller's Group pursuant to the TSA; d. any and all payments against liabilities to members of the Golar Group which have been specifically accrued or provided for in the CoolMan Group Balance Sheet; and e. the assignment by CoolManNor of a patent for a system for controlling a flow of water from a process facility onboard a vessel (identified as Norwegian patent number 344865 and European patent application number 19801014.2) to GolarManNor on the terms of an assignment dated 29 June 2022. "Protocol" means a protocol of agreement between Golar, the Purchaser, GolarManUK, CoolManUK, GolarManNor, CoolManNor, GolarManMal and CoolManMal setting forth certain principles and further commitments from the Golar Group relevant to the establishment of Cool's management organisation. "Purchase Price" has the meaning attributed to the term in Clause 3.1. "Purchaser" has the meaning assigned to the term at the beginning of the Agreement. "Restructuring" means the restructuring of the Golar Group so that on the Restructuring Closing Date: (a) all personnel, assets, liabilities and contracts which are directly associated with the technical and commercial operation of the LNG Fleet are vested in the CoolMan Group; and (b) all other personnel, assets, liabilities and contracts are vested in the Seller's Group, it being understood that IT, treasury and accounting services shall remain vested in the Seller's Group. "Restructuring Closing Date" means 31 March 2022. "RSU/Option Agreement" means an agreement between Golar and the entities in the CoolMan Group other than CoolManMal dated 30 June 2022 documenting Golar's obligation to reimburse any tax expense incurred by these CoolMan Companies as a consequence of the exercise by former employees in the Golar Group who are in these CoolMan Group's employment of their rights under the Golar Group's long term incentive program after the Restructuring Closing Date. "Schedules" shall mean the schedules to this Agreement from time to time and any one of them. "Seller" has the meaning assigned to the term at the beginning of the Agreement. "Seller's Group" means the Seller and its Affiliates (excluding the CoolMan Companies), and references to a "member of the Seller's Group" shall be construed accordingly.

6 "Share" means the single share issued and allotted in CoolManUK. "ShipCo Management Agreements" means the agreements identified as such in Schedule 2. "ShipCo SPA" has the meaning assigned to the term in Recital (C) above. "Subsidiary" means an entity in which a person has direct or indirect Control. "Tax" means any taxes, levies, imposts, duties, charges and withholdings, however denominated, including without limitation any tax on gross or net income, profits or gains, taxes on sales, use, transfer, customs and other import or export duties, value added and personal property and social security and other payroll taxes and any interest, penalties or additional tax that may become payable by any CoolMan Company or for which any CoolMan Company will be held liable. "Tax Return" means any return, report, notice or other document or information submitted or required to be submitted to any Governmental Body in connection with the determination, assessment, collection or payment of any Tax or in connection with the enforcement of any law relating to Tax. "Transaction" means the sale and purchase of the Share. "Transaction Documents" means this Agreement, the Transfer Agreements, the Administrative Services Agreement, the RSU/Option Agreement, the Bermuda Services Agreement, the Protocol and any other agreements executed or to be executed by on the date of this Agreement. "Transfer Agreements" means the UK BTA, the Norwegian BTA, the Croatia Transfer Agreement and the Malaysia Transfer Agreement. "TSA" has the meaning assigned to the term in Recital (G). "UK BTA" means a business transfer agreement dated 30 June 2022 between GolarManUK and CoolManUK documenting the transfer of such part of GolarManUK's business as is related to the commercial and technical operation of the LNG Fleet to CoolManUK with economical and accounting effect between the parties thereto from the Restructuring Closing Date. "USD" means the lawful currency for the time being of the United States of America. "Warranties" means the warranties set forth in Clause 7 below. 1.2 In this Agreement: (i) references to a Party include the permitted successors or assigns (immediate or otherwise) of that Party; (ii) any reference to a document or agreement is to that document or agreement as amended, varied or novated from time to time (other than in breach of this Agreement or that document); and (iii) any reference to a person or an entity includes companies, corporations or other body corporates wheresoever incorporated. 2 THE TRANSACTION 2.1 The Seller hereby agrees to sell and the Purchaser hereby agrees to purchase the Share, free and clear of any and all Encumbrances and on the terms otherwise set forth herein.

7 3 THE PURCHASE PRICE 3.1 The consideration to be paid by the Purchaser to the Seller in exchange for the Share shall be the sum of USD 6,560,558 (the "Purchase Price"). 4 THE COOLMAN GROUP'S ACTIVITIES AFTER THE RESTRUCTURING CLOSING DATE 4.1 The Seller represents and warrants to the Buyer that the CoolMan Companies, in the period from the Restructuring Closing Date until the date hereof, have conducted their business in the ordinary course, consistent with past practice and used their best efforts to preserve intact their business and their business organisations, and otherwise as contemplated by this Agreement. 4.2 The Parties acknowledge that CoolManUK, at the request of the Purchaser, has concluded new ship management agreements with the following owners of the following LNG tankers: Pernli Marine Ltd. - "Kool Baltic" Persect Marine Ltd - "Kool Boreas" Felox Marine Ltd; and - "Kool Firn" Respent Marine Ltd. - "Kool Orca" covering technical and commercial management of these vessels. CoolManUK and CoolManNor have, at the same time, executed a "manager's undertaking" to the lenders to each of the above companies. The Seller has provided copies of these agreements and the manager's undertakings to the Purchaser. 4.3 The CoolMan Companies may, in the period from the date hereof until the Completion Date, undertake further commitments upon written instructions by the Purchaser to the Seller. 5 CONDITIONS PRECEDENT 5.1 Completion is subject to each of the following conditions being satisfied or, alternatively, waived by the Purchaser: (i) the Purchaser shall have completed its review of the documentation made available to the Purchaser in the Data Room and shall have received a memory stick from the Seller containing such documentation for future reference; (ii) the Purchaser shall have received satisfactory evidence of the corporate existence and status of each of the CoolMan Companies; (iii) the Purchaser shall have received copies of the executed Transaction Documents by all parties thereto, and shall be satisfied that the Restructuring has been completed and documented by the Seller in accordance with the Transfer Agreements; and (iv) the Warranties shall remain true and correct in all material respects.

8 6 COMPLETION 6.1 Completion is subject to the satisfaction or waiver of the Conditions Precedent and shall take place at 10:00 (Oslo time) on the Completion Date (or at such other place, at such other time and/or on such other date as the Parties may agree). 6.2 At Completion, the following steps shall be taken in sequence: (i) the Parties shall confirm that all of the Conditions Precedent have been met or waived; (ii) the Seller shall deliver a certified copy of the resolution adopted by the board of directors of the Seller authorising the execution and delivery by the officers specified in the resolution of this Agreement, any documents necessary to transfer the Share in accordance with this Agreement and any other documents referred to in this Agreement; (iii) the Seller shall document that title to the Share has been legally transferred to the Purchaser without Encumbrances; (iv) the Purchaser shall transfer the Purchase Price to a bank account nominated by the Seller for the purpose of receiving the same; and (v) all directors in the CoolMan Companies which are employed by Golar shall resign and all powers of attorneys and other authorities given by the CoolMan Companies to employees in the Golar Group shall be terminated. 6.3 As soon as possible after Completion, the Seller shall deliver all material hard copy corporate records, correspondence, documents, files, memoranda and other papers relating to the CoolMan Companies to the Purchaser and/or the relevant CoolMan Company. 7 WARRANTIES 7.1 The Purchaser enters into this Agreement on the basis of, and in reliance on, the Warranties set out in this Clause. 7.2 The Seller warrants and represents to the Purchaser that, each Warranty is true and not misleading as of the date hereof except (i) as provided by this Agreement, (ii) Disclosed or (iii) to the extent it relates to any Cool Initiated Commitment. 7.3 Each of the Warranties is separate and, unless specifically provided, is not limited by reference to any other Warranty or anything in this Agreement. 7.4 Warranties given so far as the Seller is aware are deemed to be given to the best of the knowledge, information and belief of the Seller after it has made all reasonable and careful enquiries. 7.4.1 Constitutional documents and corporate documents (i) the copy of the memorandum and articles of association (or the equivalent constitutional documents) of each CoolMan Company has been Disclosed and is accurate and complete and has annexed or incorporated copies of all resolutions or agreements required in relation to CoolManUK by the Companies Act 2006 and, for the other CoolMan Companies, applicable laws to be so annexed or incorporated. (ii) The register of members and other statutory books and registers of each CoolMan Company have been properly kept and no notice or allegation that any of them is incorrect or should be rectified has been received.

9 (iii) All returns, particulars, resolutions and other documents which a CoolMan Company is required by law to file with or deliver to the registrar of companies or his equivalent have been correctly made up and duly filed or delivered. 7.4.2 Capacity (i) Each of the Seller and Golar has the power to execute and deliver the Transaction Documents to which they are a party and to perform its obligations thereunder; (ii) each of the Seller and Golar has taken all corporate actions necessary to authorise the execution and delivery of the Transaction Documents to which they or members of their Group are a party and the performance of its obligations thereunder; (iii) this Agreement constitutes and the Transaction Documents to which they are a party will constitute legal, valid and binding obligations on each of the Seller and Golar and is enforceable against the Seller and Golar in accordance with their terms; and (iv) all authorisations from and notices or filings with Governmental Bodies which are necessary to enable the Seller and Golar or members of the Seller's Group to execute, deliver and perform its obligations under the Transaction Documents to which they are a party have been obtained or made (as the case may be) and are in full force and effect and all conditions of each such authorisation have been complied with. 7.4.3 Corporate Status - CoolMan Group (i) Each CoolMan Company is duly incorporated, validly existing and in good standing under the laws of its jurisdiction; (ii) the Share constitutes the whole of the allotted and issued share capital of CoolManUK and is fully paid; (iii) there are no unissued shares, debentures or other unissued securities in CoolManUK or any other CoolMan Company; (iv) the Seller is the sole legal and beneficial owner of the Share, and CoolMan UK is the sole legal and beneficial owner of the entire issued share capital in each of the other CoolMan Companies; (v) the Seller is entitled to transfer the legal and beneficial title to the Share, free from Encumbrances to the Purchaser; (vi) there are no rights of pre-emption or other restrictions on transfer in respect of the Share, whether conferred by the constitutional documents of CoolManUK or otherwise; (vii) the shares of the CoolMan Companies are free from all Encumbrances and no person has any right to require, at any time, the transfer, creation, issue or allotment of any further shares or other securities (or any rights or interest in them, including conversion rights and rights or pre-emption) in CoolManUK or any other CoolMan Company and the Seller confirms that it has not agreed to confer any such rights on any person and that no person has claimed any such rights; (viii) since the Restructuring Closing Date, none of the CoolMan Companies have made any distribution to its shareholders or any other person (including for the avoidance of doubt a purchase of own shares); (ix) none of the CoolMan Companies have made any distribution or payment to its shareholders or any other person in contravention of any law;

10 (x) none of the CoolMan Companies have any outstanding conditional shareholders' contributions or any equity or other capital contributions of any nature that may involve any payment obligations of any CoolMan Company to any person other than a CoolMan Company; (xi) none of the following applies to any of the CoolMan Companies: a. it is unable or has admitted its inability to pay its debts as they fall due; b. it has suspended making payments on any of its debts or started (or anticipates starting) negotiations with one of more of its creditors; c. the value of its assets is less than the amount of its liabilities, taking into account contingent and prospective liabilities; d. a moratorium has been declared in respect of any of its indebtedness; or e. a corporate action, legal proceedings or other procedure or step has been taken in relation to (a), (b) or (d) above; (xii) none of the CoolMan Companies holds or beneficially owns or has agreed to acquire, any shares, loan capital or any other securities; nor has it, at any time, had a. any subsidiary or subsidiary undertaking; b. held a membership in any limited liability partnership, partnership or other unincorporated association, joint venture or consortium; c. controlled or taken part in the management of any company or business organisation (other than the Golar Group) or agreed to do so; or d. established any branch or permanent establishment outside its country of incorporation; save for CoolManUK's ownership to all of the shares in issue in CoolManNor, CoolManCro and CoolManMal; (xiii) none of the CoolMan Companies have, at any time, purchased, redeemed, reduced, forfeited or repaid any of its own shares; given any financial assistance in contravention of any applicable laws or regulation or allotted or issued any securities that are convertible into its own shares; (xiv) Completion (and, indirectly, the transfer of ownership to the shares in CoolMan Cro, CoolMan Mal and CoolMan Nor) will not require the consent of any Governmental Body or any other third party; and (xv) the Transfer Agreements are in compliance with all applicable laws and completion thereunder has been or will be completed in accordance with all applicable laws. 7.4.4 Business and Contracts Since the Restructuring Closing Date: (i) each of the CoolMan Companies has conducted its business in the ordinary course and in accordance with past practise, contractual obligations (including but not limited to the obligations pursuant to the Management Agreements), laws, regulations and decisions of Governmental Bodies applicable to it;

11 (ii) all material agreements entered into by the CoolMan Companies that are in effect have been Disclosed; (iii) none of the CoolMan Companies have entered into any agreement outside the ordinary course of trading, any unusual contract or commitment or undertaken any acquisitions or disposals; (iv) none of the CoolMan Companies have entered into any loan agreement or undertaken any similar financial indebtedness; (v) none of the CoolMan Companies have entered into any transaction of any kind (including any loans, transfers, sales, gifts, supplies or intra-group trading) resulting in any payments made or to be made by it to the Golar Group or entered into any other agreements with the Golar Group; (vi) none of the CoolMan Companies have made any loans to, or investments in other entities; (vii) none of the CoolMan Companies have made any amendments to any agreement to which it is party as of the date of this Agreement, including, but not limited to, the Management Agreements; (viii) none of the CoolMan Companies have passed any resolution amending its articles of association or bye-laws or other corporate documents; (ix) none of the CoolMan Companies have made or proposed any issue of new shares, options, warrants or other similar rights to acquire shares or any other changes in their nominal share capital; (x) none of the CoolMan Companies have made or proposed to merge, de-merged, amalgamated or entered into any corporate restructuring, liquidation, dissolution or other business combination; (xi) none of the CoolMan Companies have taken any action, or refrained from taking any action, which would result in a breach of any of the Warranties; (xii) none of the CoolMan Companies have made any capital expenditure exceeding an amount of USD 50,000 in the individual case or any commitment thereto, other than in connection with the Transfer Agreements to which it is a party; (xiii) none of the CoolMan Companies have terminated, amended or waived any provision or right under any material agreement; (xiv) none of the CoolMan Companies are in default under any material agreement; (xv) none of the CoolMan Companies have received any notice of termination under any agreement; (xvi) none of the CoolMan Companies have entered into any material agreement outside the ordinary course of trading; (xvii) none of the CoolMan Companies have waived, released, assigned, settled or compromised any material claim or legal action; (xviii) none of the CoolMan Companies have established any Encumbrance over any of its assets; and (xix) none of the CoolMan Companies have entered into any agreement or commitment to do any of the above; (xx) there has been no Leakage (other than Permitted Leakage) in any of the CoolMan Companies or the CoolMan Group as a whole;

12 (xxi) the Management Agreements have been concluded in written form and no default has occurred under any of these; and (xxii) NFE has not terminated any NFE Management Agreement or withdrawn any vessel under any NFE Management Agreement as a result of the proposed acquisition of the Share by the Purchaser. 7.4.5 Financial Statements and Assets (i) The CoolMan Group Balance Sheet has been prepared in accordance with GAAP, consistently applied, and give a true and fair view of the financial position, assets and liabilities, liquidity and the results of the operations of the CoolMan Group for the relevant periods and as of the date of the CoolMan Group Balance Sheet; (ii) the CoolMan Group Balance Sheet contains either provision adequate to cover, or full particulars in notes of, all Tax (including deferred taxation) and other liabilities (whether quantified, contingent, disputed or otherwise) of the CoolMan Companies as at the Restructuring Closing Date; (iii) there were no material liabilities in the CoolMan Group at the Restructuring Closing Date not reflected in the CoolMan Group Balance Sheet; (iv) there are no material debts, liabilities or obligations of any type, description, kind and nature related to the CoolMan Group (fixed, contingent, direct or indirect, un-liquidated or otherwise), which, if known on the Restructuring Closing Date should, pursuant to GAAP, have been reflected or reserved against in the CoolMan Group Balance Sheet; (v) at the Restructuring Closing Date, the CoolMan Group did not have any obligations, commitments or liabilities, liquidated or non-liquidated, contingent or otherwise, whether for Taxes or otherwise, arising out of events which occurred prior to the Restructuring Closing Date and which are not clearly identified and described in the CoolMan Group Balance Sheet; (vi) all of the accounts receivable of the CoolMan Group have, with the exception of those arising pursuant to the Transfer Agreements, arisen in the ordinary course of business and all outstanding claims will be collected at full book value within 30 days from the respective invoice date or, if later, when due; (vii) the CoolMan Group has not pledged any assets and does not have any commitments or liabilities, whether contingent or not, whatsoever in excess of the commitments and liabilities included in the CoolMan Group Balance Sheet; (viii) the CoolMan Group has full ownership, free and clear from any Encumbrance, of all assets, tangible and intangible, that is reflected in the CoolMan Group Balance Sheet or which is used in its business, including any assets, tangible and intangible, acquired since the Restructuring Closing Date; (ix) the CoolMan Group has necessary legal rights to all assets (including Intellectual Property Rights) necessary for the continuation of the business of managing and operating the LNG Fleet, and no assets used or held for use in the conduct or operation of the business of the CoolMan Group are owned by the Seller or any member of the Golar Group; (x) at the Completion Date, the CoolMan Group (i) will not be using assets in its business which it neither owns nor has the right to use pursuant to written agreements with third parties and (ii) the assets of the CoolMan Group will comprise all the assets necessary for carrying on its business fully and effectively to the extent to which it is conducted at date of this Agreement; (xi) there is no agreement, option or other right or privilege outstanding in favour of any third party for the purchase of any of the assets used in the CoolMan Group;

13 (xii) there has been no transaction pursuant to or as a result of which (i) any of the shares of the CoolMan Companies or (ii) any asset owned, purportedly owned or otherwise held by any CoolMan Company is liable to be transferred or re-transferred to another person; and (xiii) all use of the assets by the CoolMan Group is in conformity with all laws, requirements and regulations applicable to ownership or use thereof. 7.4.6 Tax (i) Each of the CoolMan Companies has filed all Tax Returns which is or was required to be filed by it, and all Tax Returns filed by each CoolMan Company are materially true, correct and complete; (ii) each of the CoolMan Companies has paid all Taxes required to be paid under applicable laws when due; (iii) all Taxes that each of the CoolMan Companies is or was required by applicable laws to withhold or collect have been duly withheld or collected and, to the extent required, have been paid to the relevant Governmental Body; (iv) the Tax Returns of the CoolMan Group have been assessed and approved by the relevant Governmental Body through the Tax years up to and including the years for which such assessment and approval is required and no CoolMan Company is subject to any dispute with any such authority; (v) all Taxes: a. that have become due have been fully paid or fully provided for in the CoolMan Group Balance Sheet and no CoolMan Company will be liable for any additional Tax pertaining to the period before the Restructuring Closing Date; and b. for the period after the Restructuring Closing Date have been fully paid when due; (vi) there are no Tax audits, disputes or litigation currently pending with respect to any CoolMan Company, and there is no basis for assessment of any deficiency in any Taxes against any CoolMan Company which have not been provided for in the CoolMan Group Balance Sheet or which have not been paid; (vii) no CoolMan Company has been involved in any transactions which could be considered as Tax evasion; (viii) all transactions and agreements entered into between any CoolMan Company and the Seller and any other member of the Golar Group have been made on terms and conditions which do not in any way deviate from what would have been agreed between independent parties (i.e. on an arm's length basis); and (ix) no CoolMan Company is or has been subject to any taxation outside its fiscal residence. 7.4.7 Compliance (i) The CoolMan Companies have: a. complied with all applicable laws, regulations, judgements, decrees and orders, including (without limitation), trade sanctions, anti-money-laundering laws and financial record keeping and reporting requirements, rules, regulations and guidelines, issued or imposed by Governmental Bodies or courts with jurisdiction over the CoolMan Companies;

14 b. all licences, consents, permits and authorisations needed to operate the LNG Fleet, and has held, and complied with the terms of, all public and private permits, licences and approvals from all Governmental Bodies and other third parties necessary to carry out its business in its ordinary course, and have taken all actions required to prevent such permits, licences and approvals from lapsing; and c. not violated any applicable anti-bribery or anti-corruption law or regulation enacted in any jurisdiction; (ii) the CoolMan Companies hold all licenses, permits and authorisations required to carry on its business as presently conducted and none of them will expire or be revoked or suspended as a result of any transactions contemplated by the Transaction Documents; (iii) neither the Seller nor any CoolMan Company has received any formal or informal notice or other communication indicating that permits held by any CoolMan Company may be revoked, modified, expire prematurely or not be renewed; (iv) so far as the Seller is aware, there is no current governmental investigation or disciplinary proceeding relating to any alleged breach of any law or permit by any CoolMan Company and none is pending or threatened. 7.4.8 Environmental matters So far as the Seller is aware: (i) the CoolMan Companies comply and have, at all relevant times, complied with applicable environmental laws and environmental licenses granted to them; (ii) no claim in relation to environmental matters has been made or threatened to be made against any of the CoolMan Companies; (iii) each of the CoolMan Companies has all environmental permits and approvals that are required for its current operations and such permits and approvals are in full force and effect and none of them will expire or be revoked or suspended as a result of any transactions contemplated by the Transaction Documents; and (iv) no CoolMan Company has, other than as permitted under permits held or applicable laws or regulations, disposed of, discharged, released, placed, dumped or emitted any hazardous substances, such as pollutants, contaminants, hazardous or toxic materials, wastes or chemicals into the environment. 7.4.9 Litigation (i) None of the CoolMan Companies are engaged in any litigation (whether criminal, civil, administrative or tax), arbitration or alternative dispute resolution process; (ii) so far as the Seller is aware, no litigation, arbitration or dispute resolution process is currently threatened against any of the CoolMan Companies; (iii) no CoolMan Company has received any claims or complaints and, so far as the Seller is aware, no grounds exist for such claims; (iv) as far as the Seller is aware, no investigation or enquiry is being or has, during the last 3 years, been conducted by any Governmental Body in respect of the affairs of the CoolMan Group, and no such investigation is pending, threatened or expected; and

15 (v) the CoolMan Companies are not affected by any existing or pending judgments or rulings and have not given any undertakings arising from legal proceedings to a court, governmental agency, regulator or third party. 7.4.10 Employees (i) The names of each person who is a director of each CoolMan Company are set out in Schedule 1; (ii) all individuals employed by the CoolMan Companies and the particulars of the contract of employment of each individual have been Disclosed; (iii) all individuals who are providing services to the CoolMan Companies under an agreement which is not a contract of employment with a Coolman Company (including, in particular, where the individual acts as a consultant or is on secondment) and the particulars of the terms on which the individual provides services, have been Disclosed; (iv) as of the date hereof, no employee in the CoolMan Companies has served notice of termination of his or her current employment; (v) all information on pensions plans and all other benefit plans for employees and all relevant information for the assessment of the CoolMan Group's pension liabilities has been Disclosed; (vi) the CoolMan Group has complied, in all material respects, with all collective, workforce affecting its relations with, or the conditions of service of, its employees; (vii) no CoolMan Company has incurred any liability in connection with any termination of employment of its employees (including redundancy payments), or for failure to comply with any order for the reinstatement or re-engagement of any employee; (viii) no CoolMan Company has made or agreed to make a payment, or provided or agreed to provide a benefit to a present or former director, other officer or employee, or to the dependants of any of those people, in connection with the actual or proposed termination or suspension of employment or variation of an employment contract; (ix) each CoolMan Company has maintained in all material respects current, adequate and suitable records regarding the service of each of its employees; (x) in so far as they apply to its employees, each CoolMan Company has complied in all material respects with any legal obligations (collective agreements included); (xi) no claim in relation to any of the CoolMan Company employees or former employees has been made or, so far as the Seller is aware, threatened against any CoolMan Company or against any person whom any CoolMan Company is or may be liable to compensate or indemnify; (xii) no CoolMan Company is involved in any industrial or trade dispute or negotiation regarding a claim with any trade union or other group or organisation representing employees and, so far as the Seller is aware, there is nothing likely to give rise to such a dispute or claim; (xiii) particulars of all collective bargaining or procedural or other agreements or arrangements with any trade union, group or organisation representing employees that relate to any employees of the CoolMan Companies (including the crew on board the LNG Fleet) have been Disclosed; (xiv) no enquiry or investigation affecting any CoolMan Company has been made or, so far as the Seller is aware, threatened by any governmental, statutory or regulatory authority including any health and safety enforcement body in respect of any act, event, omission or other matter arising out of or in

16 connection with the employment (including terms of employment, working conditions, benefits and practices) or termination of employment of any person; (xv) no employee of any CoolMan Company is, or has been, involved in any criminal proceedings relating to the business of any CoolMan Company and, so far as the Seller is aware, there are no circumstances which are likely to give rise to any such proceedings; and (xvi) to the extent that any CoolMan Company has been a party to a relevant transfer for the purposes of the Transfer of Undertakings (Protection of Employment) Regulations or their equivalent in any jurisdiction in connection with the Restructuring, it has complied with all obligations under those regulations. 7.4.11 Relationship with the Seller (i) Neither the Seller nor any other member of the Seller's Group has any claims against any of the CoolMan Companies (other than those arising from the Transaction Documents and the TSA) and none of the CoolMan Companies is indebted in any way towards the Seller or any member of the Seller's Group (other than those arising from the Transaction Documents and the TSA); (ii) no payments of any kind, including but not limited to management charges, have been made by any CoolMan Company to the Seller or any member of the Seller's Group, save for payments under agreements or arrangements made on an arm's length basis. 7.4.12 Insurance (i) Each of the CoolMan Companies has adequate insurance coverage against business interruptions, loss of revenues, liability, injury and other risks normally insured against by persons operating in its field of business; (ii) so far as the Seller is aware there are no material outstanding claims under, or in respect of the validity of, any of those policies and so far as the Seller is aware, there are no circumstances likely to give rise to any claim under those policies; and (iii) all the insurance policies are in full force and effect, are not void or voidable, nothing has been done or not done which could make any of them void or voidable and Completion will not terminate or entitle any insurer to terminate any such policy. 7.4.13 Information (i) All information contained in the Data Room is complete, accurate and not misleading; (ii) the particulars relating to the CoolMan Companies in Schedule 1 to this agreement are accurate and not misleading; (iii) the information provided to the Purchaser concerning the CoolMan Group and its business (including such business as has or will be taken over under the Transfer Agreements) is true and accurate in all respects and not misleading in any way, and no document (irrespective of form) provided to the Purchaser by or on behalf of the Seller or the CoolMan Group, contains any untrue statement of a relevant fact or omits to state a relevant fact necessary not to make the statements contained in the document misleading; and (iv) there are no facts or circumstances concerning the CoolMan Group which have not been Disclosed to the Purchaser and which, if Disclosed, might reasonably have been expected to influence the decision of the Purchaser to purchase the Share on the terms set out in this Agreement.

17 7.4.14 Finance and Guarantees (i) Particulars of all money borrowed by any CoolMan Company have been Disclosed; (ii) no guarantee, mortgage, charge, pledge, lien assignment or other security agreement or arrangement has been given by or entered into by any CoolMan Company or any third party in respect of borrowings or other obligations of any CoolMan Company; (iii) no CoolMan Company has any outstanding loan capital or has lent any money that has not been repaid and there are no debts owing to any CoolMan Company; (iv) no financial indebtedness of any CoolMan Company is due and payable and no security over any of the assets of any CoolMan Company is now enforceable, whether by virtue of the stated maturity date of the indebtedness having been reached or otherwise; (v) no CoolMan Company is responsible for the indebtedness, or for the default in the performance of any obligation, of any other person; and (vi) a change of control of the CoolMan Companies will not result in: a. the termination of or material affect on any financial agreement or arrangement to which the CoolMan Companies is a party or subject; or b. any financial indebtedness of any CoolMan Company becoming due, or capable of being declared due and payable, prior to its stated maturity. 7.4.15 Pensions (i) All retirement pension, early retirement pension, disability pension and survivor pension plans and all other material benefit plans for the employees in the CoolMan Group or their dependants or beneficiaries have been Disclosed; (ii) the Seller has provided all relevant information to the Purchaser for the assessment of the CoolMan Group's pension liabilities. 7.4.16 Intellectual property (i) No claim has been made against any CoolMan Company (or of any licensee under any licence granted by a CoolMan Company) that they infringe or are likely to infringe any Intellectual Property Right of any third party and no claim has been made against any CoolMan Company or any such licensee in respect of such infringement; (ii) full and accurate particulars of all registered Intellectual Property Rights (including applications to register the same) and all commercially significant unregistered Intellectual Property Rights owned or used by the CoolMan Companies have been Disclosed. Each such Intellectual Property Right is legally and beneficially owned, free from any Encumbrance, solely by the CoolMan Companies; (iii) full and accurate particulars of or, in the case of a document, a copy of all licence and other agreements relating to any Intellectual Property Right to which any CoolMan Company is a party (whether as licensor or licensee) or which relate to any Intellectual Property Right owned by any CoolMan Company have been Disclosed. No CoolMan Company is in breach of any such agreement and, so far as the Seller aware, no third party is in breach of any such agreement; (iv) each CoolMan Company owns or has licensed to it all Intellectual Property Rights it requires to carry on its business of operating the LNG Fleet and none of such Intellectual Property Rights nor

18 any CoolMan Company ability to use any of such Intellectual Property Rights will be affected by the acquisition of the CoolMan Group by the Purchaser; and (v) so far as the Seller is aware there has been no unauthorised use by any person of any Intellectual Property Right or confidential information of any CoolMan Company. 7.4.17 Data and records (i) For the purposes of this paragraph, "Data Protection Legislation" means all statutes, enacting instruments, common law, regulations, directives, codes of practice, guidance notes, decisions, recommendations and the like (whether in the United Kingdom, the European Union or elsewhere) concerning the protection and/or processing of personal data; (ii) each CoolMan Company has complied with all relevant requirements of Data Protection Legislation, including: a. the data protection principles established in that legislation; b. requests from data subjects for access to data held by it; and c. the requirements relating to the notification by data controllers to the relevant data protection regulator of their processing of personal data. (iii) no CoolMan Company has received any notice or allegation from either the UK Information Commissioner or from any other data protection regulator in any other jurisdiction, a data controller or a data subject alleging non-compliance with any Data Protection Legislation (including data protection principles), requiring CoolMan Company to change or delete any data or prohibiting any transfer of data to a place outside the United Kingdom or Norway; and (iv) no individual has, so far as the Seller is aware, claimed or has the right to claim compensation from any CoolMan Company under any Data Protection Legislation, including for unauthorised or erroneous processing or loss or unauthorised disclosure of data. 7.4.18 Powers of attorney (i) No CoolMan Company has granted any power of attorney or similar authority which remains in force other than as Disclosed; and (ii) no person, as agent or otherwise, is entitled or authorised to bind or commit any CoolMan Company to any obligation not in the ordinary course of a CoolMan Company's business. 8 UNDERTAKING BY GOLAR 8.1 Golar procures that the GolarCos shall not, during the period from the date hereof until the Completion Date, do anything that will cause an adverse change to the CoolMan Companies and/or breach any term of this Agreement, including (without limitation) breaching any Warranty or cause any Warranty to be untrue, inaccurate or misleading in any material respect. 9 BREACH OF WARRANTIES 9.1 The Seller's liability 9.1.1 Subject to Clause 14, the Seller hereby agrees to indemnify and hold the Purchaser harmless against any and all losses incurred by the Purchaser as a consequence of a breach of any of the Warranties based on the following principles:

19 (i) a claim for compensation for breach of a Warranty (a "Claim") must be submitted by the Purchaser in writing together with reasonable supporting documentation, no later than the seventh anniversary of the Completion Date for any claim relating to Tax or the fourth anniversary of the Completion Date for any other Claim; (ii) the Seller shall not be liable to the Purchaser for any alleged loss incurred by the Purchaser due to a breach of Warranty unless the Claim, as a result of such breach, exceeds USD 10,000; and (iii) the Seller shall not be liable to the Purchaser for Claims (other than in relation to Tax) exceeding, in aggregate, USD 10,000,000. [*****]. The above indemnity obligation shall not apply to any breach of a Warranty caused by a Cool Initiated Commitment. 9.1.2 The limitations in the Seller's liability set forth in Clause 9.1 shall not apply to a breach of the Warranties caused by fraud, gross negligence or wilful misconduct by the Seller. 9.1.3 Without prejudice to the right of the Purchaser to claim on any other basis or take advantage of any other remedies available to it, if any Warranty is breached or proves to be untrue or misleading, the Seller undertakes to indemnify the Purchaser on demand: (i) the amount necessary to put the CoolMan Companies into the position they would have been in if the Warranty had not been breached and had been true and not misleading; and (ii) all costs and expenses (including, without limitation, damages, legal and other professional fees and costs, penalties, expenses and consequential losses whether directly or indirectly arising) incurred by the Purchaser or the CoolMan Companies as a result of the breach or of the Warranty not being true or being misleading (including a reasonable amount in respect of management time); and a payment made in accordance with the provisions of this Clause shall include any amount necessary to ensure that, after Tax of the payment, the Purchaser is left with the same amount it would have had if the payment was not subject to Tax. 9.1.4 If at any time before or at Completion the Seller becomes aware that a Warranty has been breached, is untrue or is misleading, or has a reasonable expectation that any of those things might occur, it must immediately: (i) notify the Purchaser in sufficient detail to enable the Purchaser to make an accurate assessment of the situation; and (ii) if requested by the Purchaser, use its best endeavours to prevent or remedy the notified occurrence. 9.1.5 The Purchaser shall, on receipt of a claim from a third party which may give raise to a Claim, notify the Seller and provide the Seller, at the Seller's cost and risk, with the opportunity to defend such claim on behalf of the relevant CoolMan Company. 10 INDEMNITIES 10.1 Leakage The Seller shall notify the Purchaser in writing promptly, but no later than five (5) Banking Days after becoming aware of any payments constituting a Leakage. In the event of a Leakage, the Seller shall repay to the Company on a USD for USD basis an amount equal to the Leakage plus any Taxes fee or expenses triggered or incurred by any CoolMan Companies in connection with the Leakage.

20 11 POST COMPLETION OBLIGATIONS 11.1 On or after Completion the Seller shall, at its own cost and expense, execute and do (or procure to be executed and done by any other necessary party) all such deeds, documents, acts and things as the Purchaser may from time to time require in order to vest the Share in the Purchaser or as otherwise may be necessary to give full effect to the Transaction Documents. 11.2 In relation to each CoolMan Company, the Seller shall procure the convening of all meetings, the giving of all waivers and consents and the passing of all resolutions as are necessary under statute, its constitutional documents or any agreement or obligation affecting it to give effect to the Transaction Documents. 11.3 For so long after Completion as the Seller or any nominee of remains the registered holder of the Share, it shall hold (or direct the relevant nominee to hold) that Share and any distributions, property and rights deriving from it in trust for the Purchaser and shall deal with that Share and any distributions, property and rights deriving from it as the Purchaser directs; in particular, the Seller shall exercise all voting rights as the Purchaser directs or shall execute an instrument of proxy or other document which enables the Purchaser or its representative to attend and vote at any meeting of the CoolMan Companies. 12 GUARANTEE BY GOLAR 12.1 Golar hereby unconditionally: (i) guarantees to the Purchaser the punctual performance by the Seller of the Seller's obligations under this Agreement; and (ii) undertakes that whenever the Seller does not pay any amount when due under or in connection with this Agreement, it shall immediately on demand pay that amount as if it was the principal debtor. 12.2 The Guarantee is a continuing guarantee and will extend to the ultimate balance of sums payable by the Seller under this Agreement, regardless of any intermediate payment or discharge in whole or in part and will remain in full force and effect until all such obligations have been discharged in full. 12.3 The maximum liability of Golar shall be limited to the maximum liability of the Seller, including any interest, costs and expenses. 13 TERMINATION 13.1 No Party shall be entitled to terminate this Agreement after Completion. 14 PUT OPTION 14.1 Notwithstanding Clause 13.1, if any Claim arises under this Agreement, the Purchaser shall have an option to require the Seller to purchase the Share from the Seller (the "Put Option") under this Clause. The consideration payable on exercise of the Put Option shall be satisfied in cash and shall be an aggregate amount of USD 5,000,000 plus the amount of any cash or receivables in the CoolMan Group at the date of completion of such purchase. 14.2 The Put Option may only be exercised: (i) before 31 March 2026, and if the Put Option is not exercised on or before such date, it shall lapse; and (ii) if there is no material adverse change to the business of the CoolMan Group since the Completion Date except if arising as a result of any action on the part of the Seller's Group.

21 14.3 The Put Option shall be exercised only by the Purchaser giving the Seller a notice (the "Exercise Notice") which includes: (i) the date on which the Put Option is exercised; (ii) a statement to the effect that the Purchaser is exercising the Put Option; (iii) a date, which is no less than five after the date of the Exercise Notice, on which Completion is to take place; and (iv) a signature by or on behalf of the Purchaser. 14.4 Upon completion of the transactions contemplated by the Put Option, the Purchaser shall have no further claims against the Seller under this Agreement. 15 TRANSACTION COSTS 15.1 Subject to Clause 15.2, all costs and expenses reasonably and properly incurred in connection with the negotiation and execution of the Transaction Documents shall be borne by the Purchaser. 15.2 Any costs and expenses relating to the Restructuring or any Tax, employment, transfer pricing and other professional advice obtained by the Golar Group in connection with the Transaction or the Restructuring shall be borne by the Golar. 16 CONFIDENTIALITY 16.1 Each Party agrees to treat all documents and other information which it may obtain in connection with this Agreement confidential and shall not make any broadcast, press release, advertisement, public disclosure or other public announcement or statement with respect to this Agreement, unless required by law or the rules of any stock exchange other than: (i) If agreed, press releases by the Purchaser and Golar announcing the completion of the Transaction; and (ii) such information as is required by law or relevant stock exchange regulations to be included in the Purchaser's and Golar's public reports; in both cases in form and substance acceptable to and consistent with such disclosure as the other Party makes. 16.2 The Parties acknowledge that the employees in the CoolMan Group on the one side and in the Golar Group on the other side will, during the period in which the Administrative Services Agreement is effective, have access to information relevant to the group in which they are not employed. In view of the fact that both the Purchaser and Golar are listed companies, the Parties undertakes to implement adequate information management routines to avoid the possibility for insider trading and other breaches of confidentiality. 17 MISCELLANEOUS 17.1 Neither Party shall be liable to the other Party for any indirect or consequential loss. 17.2 The invalidity, illegality or unenforceability of any provision of this Agreement shall not affect the continuation in force of or the remainder of this Agreement. The Parties agree to substitute, for any invalid, illegal or unenforceable provision, a valid or enforceable provision which achieves to the greatest extent possible the same effect as would have been achieved by the invalid, illegal or unenforceable provision.

22 17.3 Neither Party shall assign or transfer any of its rights and/or obligations under this Agreement except with the prior written consent of the other Party and then to such terms and conditions as the other Party may require. 17.4 This Agreement is made for the benefit of the Parties and their respective successors and permitted assigns and is not intended to benefit or be enforceable by anyone else. 17.5 No variation, amendment or addition to this Agreement shall be valid unless agreed in writing by both Parties. 17.6 A failure or delay by a Party to exercise any right or remedy provided under this Agreement or by law shall not constitute a waiver of that or any other right or remedy, nor shall it prevent or restrict any further exercise of that or any other right or remedy. 17.7 This Agreement is made for the benefit of the Parties and their respective permitted successors and assigns and is not intended to benefit or be enforceable by any other party. 17.8 No variation amendment or addition to this Agreement shall be valid unless agreed in writing by both Parties. 17.9 A failure or delay by a Party to exercises any right or remedy provided under this Agreement or by law shall not constitute a waiver of that or any other right or remedy, nor shall it prevent or restrict any further exercise of that or any other right or remedy. 18 CHOICE OF LAW AND ARBITRATION 18.1 This Agreement shall be governed by and construed in accordance with Norwegian law. 18.2 Any dispute arising out of or in connection with this Agreement shall be finally settled by arbitration under the rules of arbitration adopted by the Nordic Offshore and Maritime Arbitration Association in force at the time such arbitration proceedings are commenced by either of the Parties. The association's "Best Practice Guidelines" shall be taken into account.

The place of arbitration shall be Oslo, Norway. The language of the arbitration shall be English. For and on behalf of For and on behalf of Cool Company Ltd. Golar Management (Bermuda) Limited /s/ Neil J. Glass /s/ Mi Hong Yoon Mi Hong Yoon, Director For and on behalf of Golar LNG Limited /s/ Georgina E. Sousa Georgina E. Sousa, Director

SCHEDULE 1 COOLMAN COMPANIES CoolManUK Company name: Cool Company Management Ltd Registered number: 13835293 Registered / principal office: 6th floor the Zig Zag, 70 Victoria Street, London SW1E 6SQ Date and place of incorporation: 7 January 2022, England and Wales Directors: Malcolm Bulbeck and Eduardo Maranhao Secretary: N/A VAT number: VAT GB 405317723 Accounting reference date: 31 December Auditors: None appointed yet but expected to be EY UK Authorised capital: N/A Issued capital: 1 share of £1 CoolManNor Company name: Cool Company Management AS Registered number: 995 435 705 Registered / principal office: Fridtjof Nansens plass 4, 0160 OSLO Date and place of incorporation: 9 April 2010, Norway Directors: Trine Vossli and Erling David-Andersen Secretary: N/A VAT number: VAT NO 828 177 052 MVA Accounting reference date: 31 December Auditors: FGH Revisjon AS Authorised capital: NOK 500.000,00 Issued capital: 5000 shares at nominal value of 100 NOK CoolManCro Company name: Cool Company Management d.o.o. Registered number: OIB:07595991406 /MBS:060238051 Registered / principal office: Zrinsko Frankopanska 64, Split, Croatia Date and place of incorporation: 7 July 2016, Croatia Directors: Øistein Dahl, Lasse Roed and Erling David-Andersen Secretary: N/A VAT number: 07595991406 Accounting reference date: 31 December Auditors: N/A Authorised capital: HRK 20.000,00 Issued capital: 1 business share of nominal value of 20.000,00 kn, marked with number 1

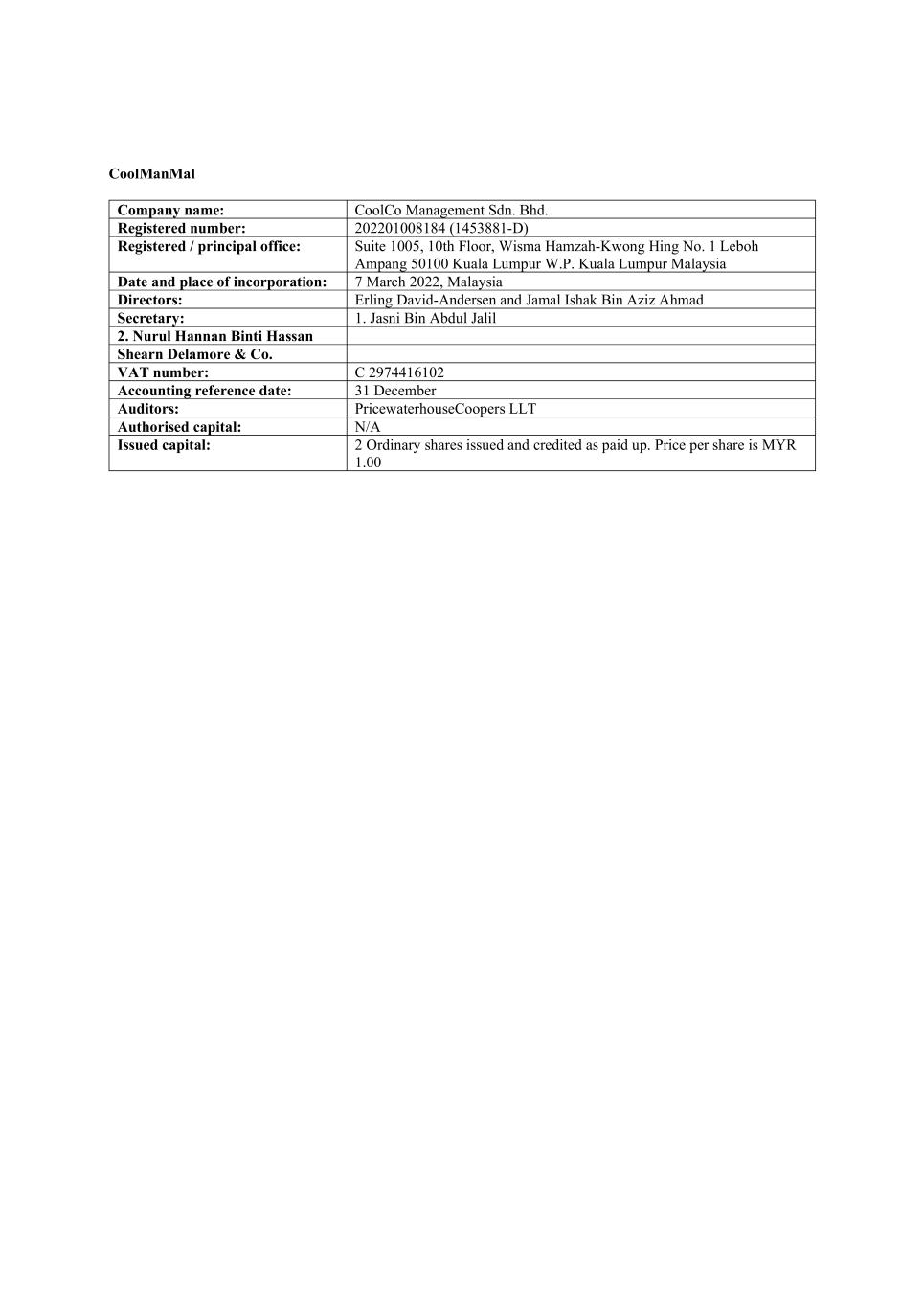

CoolManMal Company name: CoolCo Management Sdn. Bhd. Registered number: 202201008184 (1453881-D) Registered / principal office: Suite 1005, 10th Floor, Wisma Hamzah-Kwong Hing No. 1 Leboh Ampang 50100 Kuala Lumpur W.P. Kuala Lumpur Malaysia Date and place of incorporation: 7 March 2022, Malaysia Directors: Erling David-Andersen and Jamal Ishak Bin Aziz Ahmad Secretary: 1. Jasni Bin Abdul Jalil 2. Nurul Hannan Binti Hassan Shearn Delamore & Co. VAT number: C 2974416102 Accounting reference date: 31 December Auditors: PricewaterhouseCoopers LLT Authorised capital: N/A Issued capital: 2 Ordinary shares issued and credited as paid up. Price per share is MYR 1.00

SCHEDULE 2 LIST OF MANAGEMENT AGREEMENTS and VESSEL [*****]