UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 000-54007

Seaniemac International, Ltd.

(Exact name of registrant as specified in its charter)

| Nevada | 20-4292198 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 780 New York Avenue, Suite A, Huntington, New York | 11743 | |

| (Address of principal executive offices) | (Zip Code) |

(386) 409-0200

(Registrant’s telephone number, including area code)

N/A

(Former Name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] (Do not check if a smaller reporting company) | Smaller reporting company | [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of November 16, 2016, there were 2,533,452,820 shares of common stock, $0.001 par value, outstanding.

INDEX

| 2 |

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this report. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2015 as filed with the Securities and Exchange Commission on April 14, 2016 and in other reports that we file with the SEC. You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this quarterly report, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

| 3 |

Seaniemac International, Ltd. and Subsidiaries

Condensed Consolidated Balance Sheets

| September 30, 2016 | December 31, 2015 | |||||||

| (UNAUDITED) | ||||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 9,385 | $ | 959 | ||||

| Prepaid expenses and other current assets | 104,261 | 1,000 | ||||||

| Total Current Assets | 113,646 | 1,959 | ||||||

| Equipment, net | 2,018 | 696 | ||||||

| Goodwill | 996,894 | - | ||||||

| Intangible assets | 595,741 | - | ||||||

| Total Assets | $ | 1,708,299 | $ | 2,655 | ||||

| LIABILITIES AND DEFICIT | ||||||||

| Current Liabilities | ||||||||

| Convertible promissory notes, net - related party, net | $ | 197,957 | $ | - | ||||

| Convertible promissory notes, net | 1,105,571 | 566,624 | ||||||

| Notes payable | 1,872,548 | 30,000 | ||||||

| Accounts payable and accrued expenses | 2,853,461 | 1,701,474 | ||||||

| Stock payable | 71 | - | ||||||

| Due to related parties | 398,281 | 474,798 | ||||||

| Due to non related parties | 127,762 | 199,025 | ||||||

| Loans payable -related parties | 1,107,993 | 995,494 | ||||||

| Accrued officer’s compensation | - | 120,000 | ||||||

| Debt derivative liabilities | 3,424,839 | 2,310,067 | ||||||

| Warrant derivative liabilities | 875,871 | 1,616,758 | ||||||

| Total Current Liabilities | 11,964,354 | 8,014,240 | ||||||

| Commitments and Contingencies | ||||||||

| Deficit | ||||||||

| Convertible Preferred stock, $0.001 par value: 10,000,000 shares authorized, | ||||||||

| Series A:2,500,000 shares authorized, 2,293,750 shares issued and outstanding | 2,294 | 2,294 | ||||||

| Series B:1,500,000 shares authorized, 1,250,000 shares issued and outstanding | 1,250 | 1,250 | ||||||

| Series C:2,000,000 shares authorized, 1,828,569 shares issued and outstanding | 1,829 | 1,829 | ||||||

| Series D:100,000 shares authorized, 100,000 shares issued and outstanding | 100 | 100 | ||||||

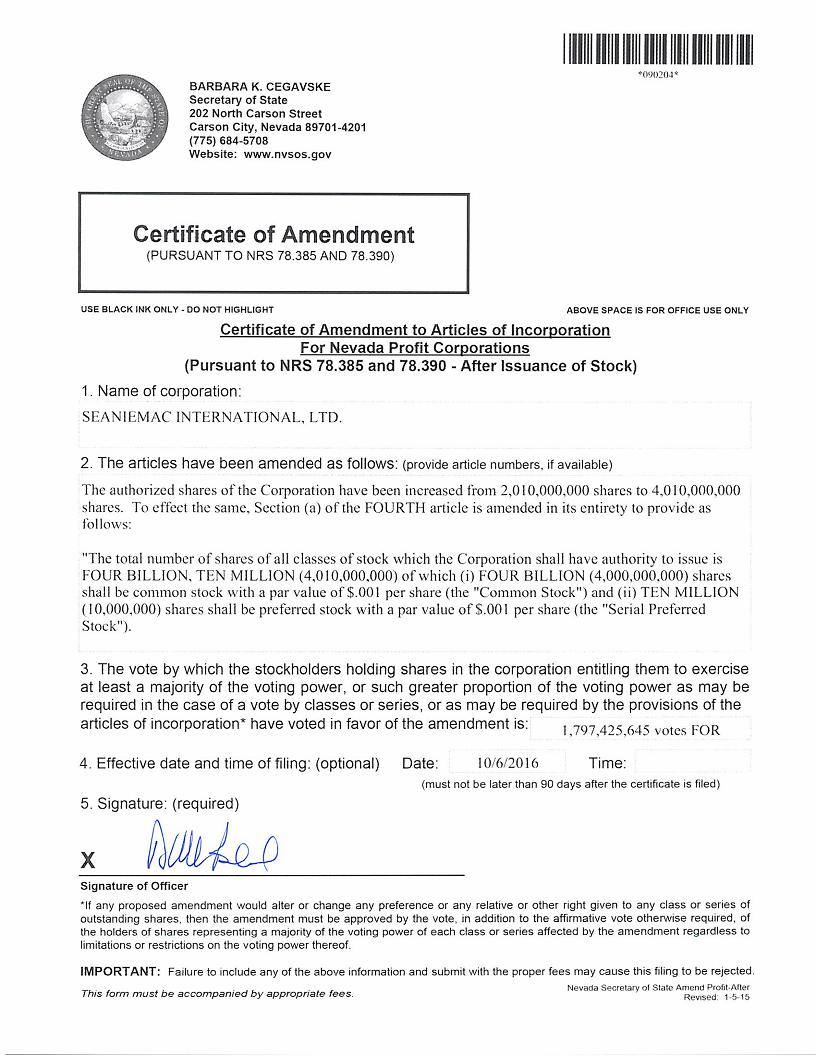

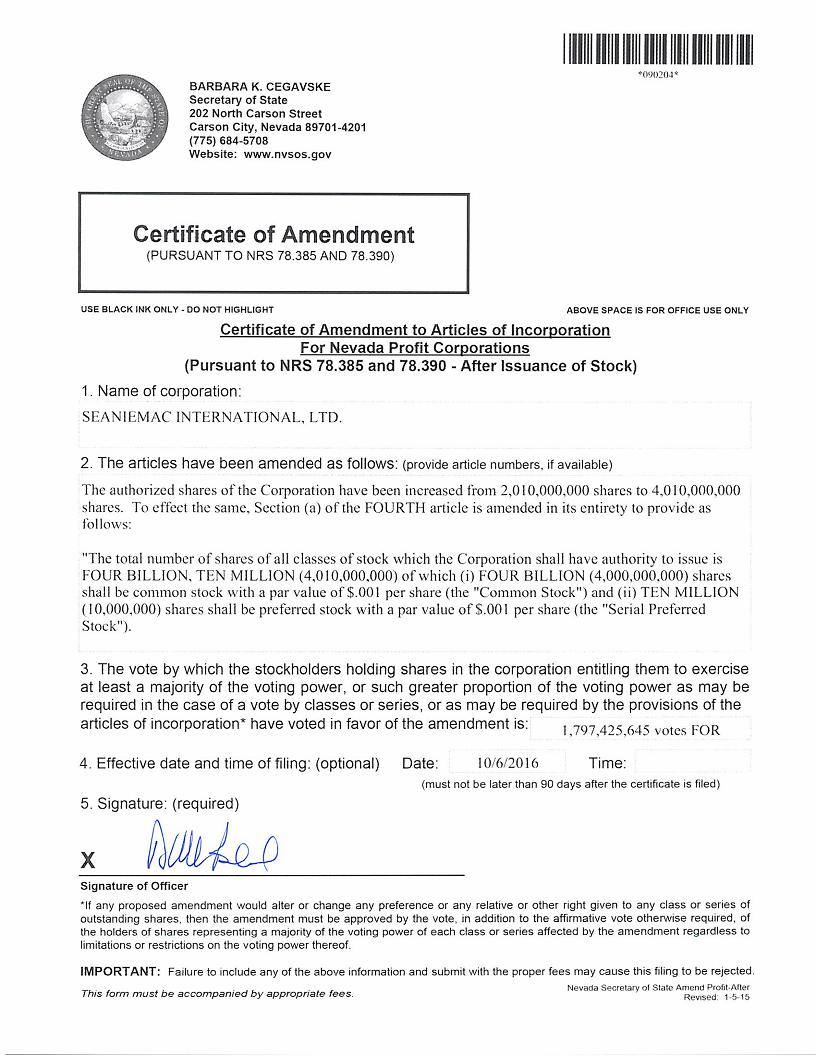

| Common stock, $0.001 par value; 4,000,000,000 shares authorized, 1,963,227,058 and 673,842,729 shares issued and outstanding, as of September 30, 2016 and December 31, 2015, respectively | 1,963,227 | 673,842 | ||||||

| Common stock issuable, $0.001 par value; 129,000,000 and 15,000,000 shares as of September 30, 2016 and December 31, 2015, respectively | 129,000 | 15,000 | ||||||

| Additional paid-in capital | 422,887 | 476,198 | ||||||

| Subscription receivable | (131 | ) | (131 | ) | ||||

| Accumulated other comprehensive income | 221,537 | 225,629 | ||||||

| Accumulated deficit | (12,307,348 | ) | (8,738,551 | ) | ||||

| Total Seaniemac International, Ltd. Stockholders’ Deficit | (9,565,355 | ) | (7,342,540 | ) | ||||

| Non-controlling interest | (690,700 | ) | (669,045 | ) | ||||

| Total Deficit | $ | (10,256,055 | ) | $ | (8,011,585 | ) | ||

| Total Liabilities and Deficit | $ | 1,708,299 | $ | 2,655 | ||||

| F-1 |

Seaniemac International, Ltd. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Gross gaming revenue | $ | 7,480 | $ | 10,621 | $ | 153,444 | $ | 163,650 | ||||||||

| Promotional allowances | 24,300 | 11,438 | 213,168 | 120,159 | ||||||||||||

| Net gaming Income (loss) | (16,820 | ) | (817 | ) | (59,724 | ) | 43,491 | |||||||||

| Operating Expenses | ||||||||||||||||

| Selling, general and administrative expenses | 541,737 | 131,449 | 1,419,784 | 548,106 | ||||||||||||

| Depreciation and amortization expense | 67,461 | - | 184,883 | - | ||||||||||||

| Total Operating Expenses | 609,198 | 131,449 | 1,604,667 | 548,106 | ||||||||||||

| Operating Loss | (626,018 | ) | (132,266 | ) | (1,664,391 | ) | (504,615 | ) | ||||||||

| Other Income / (Expense) | ||||||||||||||||

| Change in fair value of embedded derivative liability | (438,158 | ) | (549,568 | ) | 827,309 | (380,159 | ) | |||||||||

| Loss on debt modification | - | - | (134,614 | ) | (371,824 | ) | ||||||||||

| Loss on debt modification -related party | (444,339 | ) | - | (444,339 | ) | - | ||||||||||

| Interest expense (including amortization of loan costs, debt discount and penalty) | (1,347,693 | ) | (61,685 | ) | (2,174,417 | ) | (346,962 | ) | ||||||||

| Realized foreign exchange loss | - | (1,856 | ) | - | (2,000 | ) | ||||||||||

| Total Other Income / (Expense) | (2,230,190 | ) | (613,109 | ) | (1,926,061 | ) | (1,100,945 | ) | ||||||||

| Net Income (Loss) | $ | (2,856,208 | ) | $ | (745,375 | ) | $ | (3,590,452 | ) | $ | (1,605,560 | ) | ||||

| Income /(Loss) Attributable to Non-controlling Interest | $ | (1,953 | ) | $ | (31,744 | ) | $ | (21,655 | ) | $ | (85,952 | ) | ||||

| Net Income (Loss) Attributable to Common Shareholders | $ | (2,854,255 | ) | $ | (713,631 | ) | $ | (3,568,797 | ) | $ | (1,519,608 | ) | ||||

| Net Income /(Loss) Per Share - Basic | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Net Income /(Loss) Per Share - Diluted | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Weighted average number of shares outstanding during the period ended Basic | 1,628,112,178 | 673,842,729 | 1,148,066,775 | 547,032,100 | ||||||||||||

| Weighted average number of shares outstanding during the period ended Diluted | 1,628,112,178 | 673,842,729 | 1,148,066,775 | 547,032,100 | ||||||||||||

| F-2 |

Seaniemac International, Ltd. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Consolidated net Income (loss) | $ | (2,856,208 | ) | $ | (745,375 | ) | $ | (3,590,452 | ) | $ | (1,605,560 | ) | ||||

| Other comprehensive loss, net of tax: | ||||||||||||||||

| Foreign currency translation income | 32,295 | (3,321 | ) | (4,092 | ) | 96,295 | ||||||||||

| Comprehensive loss | (2,823,913 | ) | (748,696 | ) | (3,594,544 | ) | (1,509,265 | ) | ||||||||

| Comprehensive Income/(loss) attributable to non-controlling interest | (1,953 | ) | 31,744 | (21,655 | ) | 85,952 | ||||||||||

| Comprehensive loss attributable to common shareholders | $ | (2,821,960 | ) | $ | (780,440 | ) | $ | (3,572,889 | ) | $ | (1,595,217 | ) | ||||

| F-3 |

Seaniemac International, Ltd. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(UNAUDITED)

| For the Nine Months Ended September 30, | ||||||||

| 2016 | 2015 | |||||||

| Cash Flows From Operating Activities: | ||||||||

| Net Loss, including of non-controlling interest | $ | (3,590,452 | ) | $ | (1,605,560 | ) | ||

| Adjustments to reconcile net income/(loss) to net cash used in operations | ||||||||

| Depreciation and amortization | 184,882 | 576 | ||||||

| Share based payment | 93,600 | 43,500 | ||||||

| Non-cash interest | 979,134 | - | ||||||

| Change in fair value of debt derivative liability | - | 45,225 | ||||||

| Change in fair value of warrant derivative liability | (827,309 | ) | 334,934 | |||||

| Amortization of debt discount and OID attributable to convertible debt | 478,882 | 248,405 | ||||||

| Amortization of deferred loan costs | - | 13,368 | ||||||

| Imputed interest | 133,165 | 22,524 | ||||||

| Loss on debt modification | 134,614 | 371,824 | ||||||

| Loss on debt modification - related party | 444,339 | |||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and other current assets | 117,900 | 68,670 | ||||||

| Due to related parties | (198,286 | ) | - | |||||

| Due to non-related parties | (71,263 | ) | - | |||||

| Accounts payable and accrued expenses | 1,398,012 | 279,274 | ||||||

| Accrued officer’s compensation | - | 22,500 | ||||||

| Total adjustments | 2,867,670 | 1,450,800 | ||||||

| Net Cash Used In Operating Activities | (722,782 | ) | (154,760 | ) | ||||

| Cash Flows From Investing Activities: | ||||||||

| Initial payment made for acquisition | (80,000 | ) | - | |||||

| Net Cash Used In Investing Activities | (80,000 | ) | - | |||||

| Cash Flows From Financing Activities: | ||||||||

| Proceeds from issuance of convertible notes | 716,984 | - | ||||||

| Less: OID | (71,698 | ) | - | |||||

| Proceeds from loans - related parties | 140,014 | 58,404 | ||||||

| Proceeds from the loan | 30,000 | - | ||||||

| Net Cash Provided by Financing Activities | 815,300 | 58,404 | ||||||

| Effect of foreign exchange fluctuations on cash | (4,092 | ) | 96,295 | |||||

| Net Decrease in Cash | 8,426 | (61 | ) | |||||

| Cash at Beginning of Period | 959 | 446 | ||||||

| Cash at End of Period | $ | 9,385 | $ | 385 | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Cash paid for interest | $ | - | $ | - | ||||

| Cash paid for taxes | $ | - | $ | - | ||||

| Supplemental disclosure of non-cash investing and financing activities: | ||||||||

| Shares issued in conversion of convertible debt, including related party and accrued interest | $ | 345,431 | $ | 445,497 | ||||

| Derivative liability reclass to equity - on conversion of note | $ | 777,878 | $ | 513,143 | ||||

| Accounts payable reclassed into demand note | $ | 71,802 | $ | - | ||||

| Accounts payable reclassed into convertible loan | $ | - | $ | 35,814 | ||||

| Accounts payable reclassed into convertible loan - related party | $ | 197,958 | ||||||

| Short term demand notes payable reclassed into convertible loan | $ | - | $ | 36,530 | ||||

| Loans payable, reclassed into convertible loan - related party | $ | - | $ | 81,200 | ||||

| Loans payable, reclassed into convertible loan | $ | 85,000 | $ | - | ||||

| Accrued interest reclassed into convertible loan | $ | 4,000 | $ | - | ||||

| Debt discount and initial derivative liability at the issuance date of the notes | $ | 1,400,119 | $ | - | ||||

| Accounts payable balance paid directly by convertible promissory notes | $ | 27,500 | $ | - | ||||

| Convertible loan related party reclassified into convertibles notes | $ | - | $ | 176,200 | ||||

| Warrant derivative liability at inception | $ | - | $ | - | ||||

| Apollo Acquisition transaction | $ | 2,000,000 | $ | - | ||||

| Common stock to be issued now issued | $ | 15,000 | $ | - | ||||

| F-4 |

SEANIEMAC INTERNATIONAL, LTD. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

September 30, 2016

(Unaudited)

1. Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements of Seaniemac International, Ltd. and Subsidiaries (the “Company”) have been prepared by management in accordance with accounting principles generally accepted in the United States of America for interim financial information and pursuant to rules and regulations of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all information sand footnotes required by generally accepted accounting principles for annual financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included.

The results of operations for the three and nine months ended September 30, 2016 are not necessarily indicative of the results to be expected for the year ending December 31, 2016. The accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the Company’s audited condensed consolidated financial statements and notes thereto contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 filed with the SEC on April 14. 2016.

The Company’s Board of Directors approved a change of its name to Seaniemac International, Ltd. effective August 16, 2013 in connection with its current business focus in the operation and expansion of its on-line gaming website Seaniemac.com. The name change was effected through the Company’s acquisition of a 70% interest in Seaniemac Limited in which the Company was the surviving entity as discussed below. In accordance with the Nevada Revised Statutes, the Company changed its name effective August 16, 2013. This action was approved by the company’s Board of Directors on June 16, 2013 and no consent of Company’s stockholders was required under Nevada law.

Seaniemac Holdings Ltd. (“Holdings”) was incorporated in England and Wales on December 2, 2015. On February 10, 2016, SeanieMac International, Ltd. (the “Company”) and SeanieMac Holdings Ltd., a wholly owned subsidiary of the Company incorporated in England and Wales (“Holdings”), entered into an agreement (the “Agreement”) with Apollo Betting and Gaming Ltd (“Apollo”), pursuant to which Holdings purchased Apollo’s online gambling and betting business carried on by Apollo in the United Kingdom, via a purchase of Apollo’s assets related to that business. The purchase has an effective date of February 1, 2016.

On July 14, 2016, the Company entered into an agreement with Optima Information Services, S.L (“OIS”). OIS is the proprietor and/or license of software and is a supplier of software and information technology services. The Company was granted world-wide, non –exclusive, non-transferrable license to use the software in the betting and gaming business. The costs of platform setup and customization of platform is a onetime fee is $271,703 (GBP 195,000) and full support and maintenance monthly fee is $30,514 (GBP 21,900) per month. As of September 30, 2016 the Company paid $62,701 (GBP 45,000) in platform set up cost and the balance to be pay in 12 installments of $17,417 (GBP 12,500). The Company expensed full $271,703 as a direct costs during the nine months ended September 30, 2016.

On July 14, 2016, the Company entered into an agreement with SportsBetting and Gaming Services Malta, LTD (“SGS”). Under the agreement the Company will be using the technology which is licensed to SGS for sports betting and gaming. The agreement will remain in effect for twelve months, however, the agreement can be terminated due to non-payment. There is no upfront costs under the agreement. The SGS will pay the Company a commission comprised of a share of 100% of Net Gaming Revenue less 3% commission with a cap of (EU 6,000) and a minimum of (EU 1,800). Net Gaming Revenue is all revenues received by the business on sports betting and gaming after deducting:

| ● | Sums paid out to players as winnings | |

| ● | Betting and gaming ta and duties | |

| ● | Transaction charges to banks and payment processors | |

| ● | Cost of bonuses, promotions and commissions paid to players as a promotion or marketing activity | |

| ● | Commission paid to a third party in order to use any software, technology or other products s online or mobile |

| F-5 |

If negative revenue for the months is a negative figure that amount will be carried over to the future months. Any negative amount is required to be satisfies within days 10 and get gaming revenue minimum fee will EU 1,800 under the term of this contact. As of September 30, 2016, no revenue generation started from this arrangement.

2. Acquisition

On February 10, 2016, the Company, through its wholly owned subsidiary Seaniemac Holdings Ltd. (“Holdings”), entered into an agreement (the “Agreement”) with Apollo Betting and Gaming Ltd (“Apollo”), pursuant to which Holdings purchased Apollo’s online gambling and betting business carried on by Apollo in the United Kingdom, via a purchase of Apollo’s assets related to that business.

In exchange for the assets, the Company agreed to pay Apollo a total of $2,000,000, as follows: (i) $80,000 was paid at the closing; (ii) $10,000 to be paid to Apollo within 2 business days of the date on which Apollo delivers to Holdings audited accounts of Apollo for the year ended March 31, 2014; (iii) $10,000 to be paid to Apollo within 2 business days of the date on which Apollo delivers to Holdings audited accounts of Apollo for the year ended 31 March 2015; and (iv) $1,900,000 to be paid to Apollo upon the migration of the acquired business onto a new operating platform which is capable of delivering the online betting services provided by Apollo in substantially the same way as provided by Apollo as of the closing, and the successful use of the new platform in connection with a bet placed by any person who is included on Apollo’s database of customers as of the closing, with the amounts payable being paid from the combined net profits of Holdings and SeanieMac Ltd., which is also a wholly owned subsidiary of the Company.

In connection with the acquisition of the Apollo assets, a shareholder of the Company advanced $80,000 to the Company which represented the initial payment to the Apollo owners under the Agreement. The advance is informal and has no repayment terms.

The preliminary allocation of the purchase price to the assets acquired and liabilities assumed based on the estimated fair values is as follows:

| Assets | ||||

| Fixed Assets | $ | 1,779 | ||

| Intangible assets- Domain | 1,300 | |||

| Employee contracts | 52,200 | |||

| Intangible assets-Customer relationships | 845,172 | |||

| Goodwill | 1,099,549 | |||

| Liabilities | ||||

| Accounts Payable | - | |||

| Accrued Expenses | - | |||

| $ | 2,000,000 |

The Customer relationships and the employee contracts provisions will be amortized over their estimated useful lives of 3 years. During the three and nine months ended September 30, 2016, the Company charged to operations amortization expense of $184,575 and $117,422, respectively.

The purchase price allocated to the acquisition of the Apollo Transaction is made up as follows:

| Amount | ||||

| Cash payment made on agreement execution | $ | 80,000 | ||

| Cash payment to be made on Apollo Audit completion | 20,000 | |||

| Cash payment to be made on Closing date | 1,900,000 | |||

| Total | $ | 2,000,000 | ||

Unaudited supplemental pro forma financial information

The following unaudited supplemental pro forma financial information represents the consolidated results of operations of the Group as if the Acquisition had occurred as of the beginning of January 1, 2015. The unaudited supplemental pro forma financial information is not necessarily indicative of what the Group’s consolidated results of operations actually would have been had it completed the Acquisition at the beginning of the period. In addition, the unaudited supplemental pro forma financial information does not attempt to project the Group’s future results of operations after the Acquisition.

| F-6 |

Seaniemac International, Ltd. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

| Three Months Ended September 30, |

Nine Months Ended September 30, | |||||||||||||||

| 2016 | 2015 | 2016 | 2015 | |||||||||||||

| Gross gaming revenue | $ | 7,480 | $ | 163,784 | $ | 180,836 | $ | 264,741 | ||||||||

| Promotional allowances | 24,300 | 141,344 | 267,066 | 409,575 | ||||||||||||

| Net gaming Income (loss) | (16,820 | ) | 22,440 | (86,230 | ) | (144,834 | ) | |||||||||

| Operating Expenses | ||||||||||||||||

| Selling, general and administrative expenses | 541,737 | 190,363 | 1,452,166 | 715,148 | ||||||||||||

| Depreciation and amortization expense | 67,461 | 560 | 185,401 | 1,660 | ||||||||||||

| Total Operating Expenses | 609,198 | 190,923 | 1,637,567 | 716,808 | ||||||||||||

| Operating Loss | (626,018 | ) | (168,483 | ) | (1,723,797 | ) | (861,642 | ) | ||||||||

| Other Income / (Expense) | ||||||||||||||||

| Change in fair value of embedded derivative liability | (438,158 | ) | (549,568 | ) | 827,309 | (380,159 | ) | |||||||||

| Loss on debt modification | - | - | (134,614 | ) | (371,824 | ) | ||||||||||

| Loss on debt modification -related party | (444,339 | ) | - | (444,339 | ) | - | ||||||||||

| Interest expense (including amortization of loan costs, debt discount and penalty) | (1,347,693 | ) | (61,685 | ) | (2,174,417 | ) | (346,962 | ) | ||||||||

| Realized foreign exchange loss | - | (1,858 | ) | - | (2,401 | ) | ||||||||||

| Total Other Income / (Expense) | (2,230,190 | ) | (613,111 | ) | (1,926,061 | ) | (1,101,346 | ) | ||||||||

| Net Income (Loss) | $ | (2,856,208 | ) | $ | (781,594 | ) | $ | (3,649,858 | ) | $ | (1,962,988 | ) | ||||

| Income /(Loss) Attributable to Non-controlling Interest | $ | (1,953 | ) | $ | (31,744 | ) | $ | (21,655 | ) | $ | (85,952 | ) | ||||

| Net Income (Loss) Attributable to Common Shareholders | $ | (2,854,255 | ) | $ | (749,850 | ) | $ | (3,628,203 | ) | $ | (1,877,036 | ) | ||||

| Net Income /(Loss) Per Share - Basic | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Net Income /(Loss) Per Share - Diluted | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||

| Weighted average number of shares outstanding during the period ended Basic | 1,628,112,178 | 673,842,729 | 1,148,066,775 | 547,032,100 | ||||||||||||

| Weighted average number of shares outstanding during the period ended Diluted | 1,628,112,178 | 673,842,729 | 1,148,066,775 | 547,032,100 | ||||||||||||

(Unaudited)

| F-7 |

On June 7, 2012, the Company entered into a Securities Exchange Agreement (the “Exchange Agreement”) with RDRD II Holding LLC, a Delaware limited liability company (“RDRD”). The Exchange Agreement was amended on October 29, 2012. The Exchange Agreement contemplated the acquisition of RDRD’s 70% equity ownership interest (the “Seaniemac Equity Interest”) in Seaniemac Limited (“Seaniemac”), an Ireland corporation. Seaniemac is in the business of operating a sports gaming website. The Exchange Agreement further contemplated that, in exchange for the Seaniemac Equity Interest, the Company would issue to RDRD an amount of shares of its common stock (the “RDRD Exchange Shares”) which, following such issuance, would equal approximately 71% of the Company’s then outstanding shares of Common Stock (on a fully diluted basis), after taking into account the 10 million post-split shares the Company was ordered by a court in Florida to issue to certain of its creditors in exchange for $500,000 of debt owed to such creditors (the “RDRD Percentage”).

On October 30, 2012, the acquisition was consummated (the “Closing”). In addition, immediately following the Closing, the Company issued 10,000,000 post-split shares of its common stock in accordance with a court order, in exchange for the cancellation of $500,000 of our debt (“Debt Exchange Shares”). As a result of the acquisition and the issuance of our Debt Exchange Shares, RDRD holds approximately 71% of the Company’s common stock.

Prior to the acquisition, the Company was a shell company with no business operations. As a result of the acquisition, the Company is no longer considered a shell company. Its business and operations are now those of Seaniemac. Unless specifically set forth to the contrary, when used in this report the terms “we”, “our”, the “Company” and similar terms refer to Seaniemac International, Ltd., a Nevada corporation and its 70% owned subsidiary Seaniemac Limited, an Ireland corporation.

Seaniemac, is an Irish company that was incorporated on December 11, 2011. Its corporate charter authorizes 100,000 shares of one class of stock. Seaniemac has issued 100 of those shares, 70 of which we acquired from RDRD in the acquisition. Seaniemac began generating revenue from the second quarter of 2013 from its on-line gaming website that operates in the Irish market.

3. Liquidity and Going Concern

The accompanying condensed consolidated financial statements have been prepared assuming that the Company will continue as a going concern. The Company has suffered recurring losses from operations since its inception. At September 30, 2016, the Company had working capital deficiencies and accumulated deficit of $11,850,708 and $12,307,348, respectively.

Management believes the Company will continue to incur losses and negative cash flows from operating activities for the foreseeable future and will need additional equity or debt financing to sustain its operations until it can achieve profitability and positive cash flows, if ever. The Company launched its on-line gaming website that targets the Irish market which began to generate revenues during the quarter ended June 30, 2013. The Company’s continuation as a going concern is dependent upon its ability to ultimately attain profitable operations, generate sufficient cash flow to meet its obligations, and obtain additional financing as may be required. The outcome of this uncertainty cannot be assured.

Management intends to finance operating costs over the next 12 months with existing cash on hand, loans from stockholders and directors, and a possible private placement of our securities. No stockholder, director, or possible private placement participant has agreed to loan us any funds nor agreed to purchase any of our securities. The Company is currently in negotiations with a potential investor to purchase shares of our common stock. Although we can give no assurance that the transaction will close, the parties are working toward finalizing an agreement in the fiscal year ending December 31, 2016. If the transaction is consummated, we expect to use the proceeds from the sale of common stock to the investor to partially fund our operating costs. The Company continues to explore various financing alternatives, including debt and equity financings and strategic partnerships, as well as trying to generate additional revenue. However, at this time, the Company has no commitments to obtain any additional funds, and there can be no assurance such funds will be available on acceptable terms or at all. If the Company is unable to obtain additional funding and improve its operations, the Company’s financial condition and results of operations may be materially adversely affected and the Company may not be able to continue operations.

| F-8 |

The accompanying consolidated financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

4. Summary of Significant Accounting Policies

A. Principles of Consolidation

The consolidated financial statements include the accounts of the Company, its wholly owned subsidiaries including Call Compliance, Inc., Telephone Blocking Services Corporation, Call Compliance.com, Inc., Jasmine Communications, Inc., Call Center Tools, Inc., Execuserve Corp. which are inactive, its 70% owned subsidiary, Seaniemac and Seaniemac Holdings Ltd. All inter-company balances and transactions have been eliminated in consolidation.

The Company formed a subsidiary in Isle of Man called Pledge Limited in October 2012 that was intended to operate as a billing entity to utilize favorable tax treatment in the Isle of Man. The Company abandoned this plan and no transactions were transpired through this entity which remains dormant. There were no assets, liabilities or any transactions for Pledge Limited during its existence.

B. Foreign Currency

The assets and liabilities of Seaniemac, whose functional currency is the Euro, are translated into US dollars at period-end exchange rates prior to consolidation. Income and expense items are translated at the average rates of exchange prevailing during the period. The adjustments resulting from translating the Company’s financial statements are reflected as a component of other comprehensive (loss) income. Foreign currency transaction gains and losses are recognized in net earnings based on differences between foreign exchange rates on the transaction date and settlement date.

The assets and liabilities of Seaniemac Holding, Ltd, whose functional currency is the Sterling, are translated into US dollars at period-end exchange rates prior to consolidation. Income and expense items are translated at the average rates of exchange prevailing during the period. The adjustments resulting from translating the Company’s financial statements are reflected as a component of other comprehensive (loss) income. Foreign currency transaction gains and losses are recognized in net earnings based on differences between foreign exchange rates on the transaction date and settlement date.

C. Equipment Depreciation and Amortization

Equipment is stated at cost less accumulated depreciation. These assets are depreciated on a straight lines basis over their estimated useful lives, generally five years.

D. Identifiable Intangible Assets

ASC 350 prescribes a two-step process for impairment testing of goodwill and intangibles with indefinite lives, which is performed annually, as well as when an event triggering impairment may have occurred. ASC 350 also allows preparers to qualitatively assess goodwill impairment through a screening process which would permit companies to forgo Step 1 of their annual goodwill impairment process. This qualitative screening process will hereinafter be referred to as “Step 0”. Goodwill and intangible assets deemed to have an indefinite life are tested for impairment on an annual basis, or earlier when events or changes in circumstances suggest the carrying amount may not be fully recoverable. The Company has elected to perform its annual assessment on goodwill and intangible assets.

| F-9 |

| Useful Life | September 30, 2016 | December 31, 2015 | ||||||||

| Goodwill | Indefinite | 996,894 | - | |||||||

| Customer Lists and Intangible Assets | 3 Years | 767,445 | - | |||||||

| Accumulated amortization | (171,703 | ) | - | |||||||

| Net carrying value | $ | 1,592,636 | $ | - | ||||||

The company recorded above goodwill and intangible assets related to the acquisition of Apollo Betting and Gaming, LTD. It has been determined that the goodwill has an indefinite useful life and are not subject to amortization. However, the goodwill will be reviewed for impairment annually or more frequently if impairment indicators arise. For the nine months September 30, 2016 no impairment loss has been recorded.

E. Revenue Recognition

The Company recognized revenue on arrangements in accordance with FASB Codification Topic 605, “Revenue Recognition” (“ASC Topic 605”). Under ASC Topic 605, revenue is recognized only when the price is fixed and determinable, persuasive evidence of an arrangement exists, the service is performed and collectability of the resulting receivable is reasonably assured.

We had revenues of $7,480 and $10,621 for the three months ended September 30, 2016 and 2015; respectively. Promotional allowances and direct costs of $24,300 and $11,438 for the three months ended September 30, 2016 and 2015; respectively.

We had revenues of $153,444 and $163,650 for the nine months ended September 30, 2016 and 2015; respectively. Promotional allowances and direct costs of $213,168 and $120,159 for the nine months ended September 30, 2016 and 2015; respectively.

The Company recognized Gross gaming revenue is the gross gaming yield which is the difference between gaming wins and losses and includes promotional betting (“Free Bets”). Free Bets are included in promotional allowances and are deducted from gross gaming revenue to arrive at the net gaming revenue. All other costs are included in selling, general and administrative expenses.

Significant Customers

During the three months ended September 30, 2016, the Company had two customers which accounted for more than 10% of the Company’s revenues (29% and 10%).

During the three months ended September 30, 2015 the Company had no customer which accounted for more than 10% of the Company’s revenues.

During the nine months ended September 30, 2016, the Company had two customers which accounted for more than 10% of the Company’s revenues (15% and 11%).

During the nine months ended September 30, 2015 the Company had no customers which accounted for more than 10% of the Company’s revenues).

Significant Vendors

During the three months ending September 30, 2016, the Company had two vendors which accounted for more than 10% of the Company’s cost of revenue (77% and 22%).

During the nine months ending September 30, 2016, the Company had two vendors which accounted for more than 10% of the Company’s cost of revenue (44% and 29%).

During the three months ending September 30, 2015, the Company had two vendors which accounted for more than 10% of the Company’s cost of revenue (31%).

| F-10 |

During the nine months ending September 30, 2015, the Company had one vendor which accounted for more than 10% of the Company’s cost of revenue (14%).

F. Advertising

All advertising costs are expensed as incurred. Advertising costs incurred for the production of a commercial are considered prepaid expenses until the commercial airs, at which time such costs are expensed.

G. Stock Based Compensation Arrangements

The Company has accounted for stock-based compensation arrangements in accordance with Accounting Standards Codification subtopic 718-10, Compensation (“ASC 718”). This guidance addresses all forms of share-based payment awards including shares issued under employee stock purchase plans, stock options, restricted stock and stock appreciation rights, as well as share grants and other awards issued to employees and non-employees under free-standing arrangements. These awards are recorded at costs that are measured at fair value on the awards’ grant dates, based on the estimated number of awards that are expected to vest and will result in charges to operations.

From time to time, our shares of common stock and warrants have been issued as payment to employees and non-employees for services. These are non-cash transactions that require management to make judgments related to the fair value of the shares issued, which affects the amounts reported in our consolidated financial statements for certain of its assets and expenses.

H. Derivative Financial Instruments

We evaluate our financial instruments to determine if such instruments are derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported in the statements of operations. For stock-based derivative financial instruments, the Company uses the Black-Scholes-Merton pricing model to value the derivative instruments. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is evaluated at the end of each reporting period. Derivative instrument liabilities are classified in the balance sheet as current or non-current based on whether or not net-cash settlement of the derivative instrument could be required within 12 months of the balance sheet date.

We have determined that certain convertible debt instruments outstanding as of the date of these financial statements include an exercise price “reset” adjustment that qualifies as derivative financial instruments under the provisions of ASC 815-40, Derivatives and Hedging - Contracts in an Entity’s Own Stock (“ASC 815-40”). Certain of the convertible debentures have a variable exercise price, thus are convertible into an indeterminate number of shares for which we cannot determine if we have sufficient authorized shares to settle the transaction with. Accordingly, the embedded conversion option is a derivative liability and is marked to market through earnings at the end of each reporting period. Any change in fair value during the period recorded in earnings as “Other income (expense) - gain (loss) on change in derivative liabilities.”

Debt Derivative Liability:

| Carrying | Fair Value Measurements Using Fair Value Hierarchy | |||||||||||||||

| Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| Debt derivative liability – September 30, 2016 | $ | 3,424,839 | $ | — | $ | — | $ | 3,424,839 | ||||||||

| Debt derivative liability – December 31, 2015 | $ | 2,310,067 | $ | — | $ | — | $ | 2,310,067 | ||||||||

| F-11 |

The following table represents the Company’s derivative liability activity for the nine months ended September 30, 2016:

| Balance December 31, 2015 | $ | 2,310,067 | ||

| Initial measurement at issuance date of the notes | 1,400,119 | |||

| Loss on debt modification | 134,614 | |||

| Loss on debt modification- related party | 444,339 | |||

| Reclassification of derivative liability associated with convertible debt | (777,878 | ) | ||

| Change in derivative liability during the nine months ended September 30, 2016 | (86,422 | ) | ||

| Balance September 30, 2016 | $ | 3,424,839 |

Warrant derivative liability:

| Carrying | Fair Value Measurements Using Fair Value Hierarchy | |||||||||||||||

| Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| Warrant derivative liability – September 30, 2016 | $ | 875,871 | $ | — | $ | — | $ | 875,871 | ||||||||

| Warrant derivative liability – December 31, 2015 | $ | 1,616,758 | $ | — | $ | — | $ | 1,616,758 | ||||||||

The following table represents the Company’s warrant derivative liability activity for the nine months ended September 30, 2016

| Balance December 31, 2015 | $ | 1,616,758 | ||

| Change in derivative liability during the nine months ended September 30, 2016 | (740,887 | ) | ||

| Balance September 30, 2016 | $ | 875,871 |

I. Cash and Cash Equivalents

Cash primarily consists of cash on hand and bank deposits. The Company currently has no cash equivalents which would consist of money market accounts and other highly liquid investments with an original maturity of three months or less when purchased.

J. Allowance for Doubtful Accounts

The Company reserves for receivables that may not be collected. Methodologies for estimating the allowance for doubtful accounts range from specific reserves to various percentages applied to aged receivables. Historical collection rates are considered, as are customer relationships, in determining specific reserves. During the nine months ended September 30, 2016 and 2015, the Company did not record any accounts receivable and no associated allowance was recorded.

K. Use of Estimates in Preparation of Financial Statements

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results will differ from those estimates. Included in these estimates are assumptions about collection of accounts receivable, useful life of fixed assets, and assumptions used in Black-Scholes-Merton, or BSM, valuation methods, such as expected volatility, risk-free interest rate, and expected dividend rate.

| F-12 |

L. Earnings (loss) per common share

The Company utilizes the guidance per FASB Codification “ASC 260” “Earnings per Share”. Basic earnings (loss) per share are calculated by dividing income (loss) available to stockholders by the weighted-average number of common shares outstanding during each period. Diluted earnings per share are computed using the weighted average number of common shares and dilutive common share equivalents outstanding during the period. Dilutive common share equivalents consist of shares issuable upon the conversion of convertible notes and the exercise of stock options and warrants (calculated using the modified-treasury stock method).

The computation of basic and diluted loss per share for the nine months ended September 30, 2016 and 2015 excludes the common stock equivalents of the following potentially dilutive securities because their inclusion would be anti-dilutive:

| September 30, 2016 | September 30, 2015 | |||||||

| Stock Warrants (Exercise price - $0.000175-0.0042/share) | 2,307,692,571 | 1,488,822,973 | ||||||

| Convertible Debt (Exercise price - $0.000105 - $0.00030share) | 11,651,270,250 | 1,090,438,356 | ||||||

| Preferred Series – A (Exercise price – 1 Preferred shares is convertible into 100 Common Stock | 229,375,000 | 229,375,000 | ||||||

| Preferred Series – B (Exercise price – 1 Preferred shares is convertible into 100 Common Stock | 125,000,000 | 125,000,000 | ||||||

| Preferred Series – C (Exercise price – 1 Preferred shares is convertible into 100 Common Stock | 182,856,900 | 182,856,900 | ||||||

| Preferred Series – D (Exercise price – 1 Preferred shares is convertible into 1000 Common Stock | 100,000,000 | 100,000,000 | ||||||

| Total | 14,596,194,722 | 3,116,493,229 | ||||||

The Company’s obligations to issue shares upon conversion of its outstanding convertible notes, the exercise of stock options and warrants and conversion of its preferred stock (the “Convertible Instruments”) at current market prices for its common stock exceeds the 12,559,421,780 authorized but unissued shares of Common Stock as of the date of this report (the “Potentially Issuable Shares”). While it is uncertain whether the Company would receive requests to issue all of the Potentially Issuable Shares and the number of such shares fluctuates based on the market price of the Company’s common stock, the Company may increase the number of its authorized shares of common stock or effectuate a recapitalization, or a combination of both, in order to make available additional shares of its Common Stock for the Potentially Issuable Shares. Such action would require shareholder approval. Until such time as the Company has a sufficient number of shares of its Common Stock for available for issuance to cover the Potentially Issuable Shares, the Company could be subject to penalties and damages to the holders of the Convertible Instruments in the event it does not deliver the Potentially Issuable Shares upon request by a holder of the Convertible Instruments. Furthermore, the lack of available shares of common stock may be deemed a default under one or more of the Convertible Instruments.

Material Equity Instruments

The Company evaluates stock options, stock warrants and other contracts (convertible promissory note payable) to determine if those contracts or embedded components of those contracts qualify as derivative financial instruments to be separately accounted for under the relevant sections of ASC 815-40, Derivative Instruments and Hedging: Contracts in Entity’s Own Equity (“ASC 815”). The result of this accounting treatment could be that the fair value of a financial instrument is classified as a derivative financial instrument and is marked-to-market at each balance sheet date and recorded as a liability. In the event that the fair value is recorded as a liability, the change in fair value is recorded in the statement of operations as other income or other expense. Upon conversion or exercise of a derivative financial instrument, the instrument is marked to fair value at the conversion date and then that fair value is reclassified to equity. Financial instruments that are initially classified as equity that become subject to reclassification under ASC 815 are reclassified to a liability account at the fair value of the instrument on the reclassification date.

| F-13 |

Certain of the Company’s embedded conversion features on debt, convertible preferred stock and outstanding warrants are treated as derivative liabilities for accounting purposes under ASC 815-40 due to insufficient authorized shares to settle these outstanding contracts. Pursuant to SEC staff guidance that permits a sequencing approach based on the use of ASC 840-15-25 which provides guidance for contracts that permit partial net share settlement. The sequencing approach may be applied in one of two ways: contracts may be evaluated based on (1) earliest issuance date or (2) latest maturity date. In the case of insufficient authorized share capital available to fully settle outstanding contracts, the Company utilizes the earliest maturity date sequencing method to reclassify outstanding contracts as derivative instruments. These contracts are recognized currently in earnings until such time as the convertible notes or warrants are exercised, expire, the related rights have been waived and/or the authorized share capital has been amended to accommodate settlement of these contracts. These instruments do not trade in an active securities market.

As of September 30, 2016, the Company has already recorded a charge for the derivative liability resulting from the debt and warrants of $4,300,710. Accordingly, the insufficient of authorized capital had no additional impact on the Company’s financial statements.

M. Fair Value of Financial Instruments

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of September 30, 2016 and December 31, 2015. The respective carrying value of certain on-balance-sheet financial instruments, approximate their fair values. These financial instruments include cash, accounts payable, accrued expenses and notes payable. Fair values were assumed to approximate carrying values for these financial instruments because they are short term in nature and their carrying amounts approximate fair values or they are receivable or payable on demand.

The Company uses fair value measurements under the three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosure for fair value measures. The three levels are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. | |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. | |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

| Carrying | Fair Value Measurements Using Fair Value Hierarchy | |||||||||||||||

| Value | Level 1 | Level 2 | Level 3 | |||||||||||||

| Convertible notes (net of discount) –September 30, 2016 | $ | 1,105,571 | $ | - | $ | - | $ | 1,105,571 | ||||||||

| Convertible notes (net of discount) - | ||||||||||||||||

| September 30, 2016 – related party | $ | 197,957 | $ | - | $ | – | $ | 197,957 | ||||||||

| Convertible notes (net of discount) – December 31, 2015 | $ | 566,624 | $ | - | $ | - | $ | 566,624 | ||||||||

| Intangible Assets – September 30, 2016 | $ | 595,741 | $ | - | $ | 595,741 | $ | - | ||||||||

The following table provides a summary of the changes in fair value of the Company’s Convertible Promissory Notes, which are both Level 3 liabilities as of September 30, 2016:

| Balance at December 31, 2015 | $ | 566,624 | ||

| Issuance of notes | 716,984 | |||

| Unamortized debt discount | (716,984 | ) | ||

| Principal adjustment – per note assignment and penalty | 296,000 | |||

| Accounts payable and short term demand notes payable reclassified into convertible notes | 85,000 | |||

| Amortized debt discount | 478,882 | |||

| Conversion of notes | (320,935 | ) | ||

| Balance at September 30, 2016 | $ | 1,105,571 |

| F-14 |

The following table provides a summary of the changes in fair value of the Company’s Convertible Promissory Notes – related parties, which are both Level 3 liabilities as of September 30, 2016:

| Balance at December 31, 2015 | $ | - | ||

| Accounts payable and short term demand notes payable reclassified into convertible notes | 197,957 | |||

| Balance at September 30, 2016 | $ | 197,957 |

The Company determined the value of its convertible notes using a market interest rate and the value of the warrants and beneficial conversion feature issued at the time of the transaction less the accretion. There is no active market for the debt and the value was based on the delayed payment terms in addition to other facts and circumstances at the nine months ended September 30, 2016 and year ended December 31, 2015.

N. Deferred Financing Costs

Costs incurred with obtaining and executing debt arrangements are capitalized and amortized over the term of the related debt.

O. Reclassifications

Certain reclassifications have been made to conform the prior period data to the current presentations. These reclassifications had no effect on the reported results.

P. Income Taxes

The Company accounts for income taxes under the provisions of Financial Accounting Standards Board’s (“FASB”) Accounting Standard Codification (“ASC”) 740 “Income Taxes”. ASC 740 requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are determined based on the differences between the financial statement carrying amounts and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized.

The Company has adopted the provisions of FASB ASC 740. The ASC clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements. The ASC prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The ASC provides guidance on de-recognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. At September 30, 2016 and December 31, 2015, the Company had no material uncertain recognized tax positions.

The Company’s policy for recording interest and penalties is to record such items as a component of income before income taxes. Penalties are recorded in other expense and interest paid or received is recorded in interest expense or interest income, respectively, in the statement of operations. There were no amounts accrued for penalties or interest as of September 30, 2016 and December 31, 2015. The Company does not expect its unrecognized tax benefit position to change during the next twelve months. Management is currently unaware of any issues under review that could result in significant payments, accruals or material deviations from its position.

| F-15 |

Q. Recently Issued Accounting Pronouncements

ASU. 2016-16

In October 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-16 - Income Taxes: Intra-Entity Transfers of Assets Other Than Inventory. ASU 2016-16 will require the tax effects of intercompany transactions, other than sales of inventory, to be recognized currently, eliminating an exception under current GAAP in which the tax effects of intra-entity asset transfers are deferred until the transferred asset is sold to a third party or otherwise recovered through use. The guidance will be effective for the first interim period of our 2019 fiscal year, with early adoption permitted.

ASU.2016-15

In August 2016, the FASB issued ASU 2016-15, “Classification of Certain Cash Receipts and Cash Payments,” which aims to eliminate diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows under Topic 230, Statement of Cash Flows, and other Topics. ASU 2016-15 is effective for annual reporting periods, and interim periods therein, beginning after December 15, 2017 (fiscal year 2019 for the Company). The Company has not yet determined the potential effects of the adoption of ASU 2016-15 on its Consolidated Financial Statements.

ASU.2016-13

In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Statements,” which requires companies to measure credit losses utilizing a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. ASU 2016-13 is effective for annual reporting periods, and interim periods therein, beginning after December 15, 2019 (fiscal year 2021 for the Company). The Company has not yet determined the potential effects of the adoption of ASU 2016-13 on its Consolidated Financial Statements.

ASU.2016-08

In March 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net) that clarifies how to apply revenue recognition guidance related to whether an entity is a principal or an agent. ASU 2016-08 clarifies that the analysis must focus on whether the entity has control of the goods or services before they are transferred to the customer and provides additional guidance about how to apply the control principle when services are provided and when goods or services are combined with other goods or services. The effective date for ASU 2016-08 is the same as the effective date of ASU 2014-09 as amended by ASU 2015-14, for annual reporting periods beginning after December 15, 2017, including interim periods within those years. The Company has not yet determined the impact of ASU 2016-08 on its consolidated financial statements.

ASU.2016-09

In March 2016, the FASB issued ASU No. 2016-09, Compensation – Stock Compensation, or ASU No. 2016-09. The areas for simplification in this Update involve several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. For public entities, the amendments in this Update are effective for annual periods beginning after December 15, 2016, and interim periods within those annual periods. Early adoption is permitted in any interim or annual period. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. An entity that elects early adoption must adopt all of the amendments in the same period. Amendments related to the timing of when excess tax benefits are recognized, minimum statutory withholding requirements, forfeitures, and intrinsic value should be applied using a modified retrospective transition method by means of a cumulative-effect adjustment to equity as of the beginning of the period in which the guidance is adopted. Amendments related to the presentation of employee taxes paid on the statement of cash flows when an employer withholds shares to meet the minimum statutory withholding requirement should be applied retrospectively. Amendments requiring recognition of excess tax benefits and tax deficiencies in the income statement and the practical expedient for estimating expected term should be applied prospectively. An entity may elect to apply the amendments related to the presentation of excess tax benefits on the statement of cash flows using either a prospective transition method or a retrospective transition method. We are currently evaluating the impact of adopting ASU No. 2016-09 on our consolidated financial statements.

| F-16 |

ASU.2016-10

In April 2016, the FASB issued ASU 2016-10, Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing, which provides further guidance on identifying performance obligations and improves the operability and understandability of licensing implementation guidance. The effective date for ASU 2016-10 is the same as the effective date of ASU 2014-09 as amended by ASU 2015-14, for annual reporting periods beginning after December 15, 2017, including interim periods within those years. The Company has not yet determined the impact of ASU 2016-10 on its consolidated financial statements.

ASU.2016-02

In February 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842) to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and disclosing key information about leasing arrangements. Topic 842 affects any entity that enters into a lease, with some specified scope exemptions. The guidance in this Update supersedes Topic 840, Leases. The core principle of Topic 842 is that a lessee should recognize the assets and liabilities that arise from leases. A lessee should recognize in the statement of financial position a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term. For public companies, the amendments in this Update are effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. We are currently evaluating the impact of adopting ASU No. 2016-02 on our consolidated financial statements.

ASU 2016-01

In January 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (ASU) 2016-01, which amends the guidance in U.S. GAAP on the classification and measurement of financial instruments. Changes to the current guidance primarily affect the accounting for equity investments, financial liabilities under the fair value option, and the presentation and disclosure requirements for financial instruments. In addition, the ASU clarifies guidance related to the valuation allowance assessment when recognizing deferred tax assets resulting from unrealized losses on available-for-sale debt securities. The new standard is effective for fiscal years and interim periods beginning after December 15, 2017, and upon adoption, an entity should apply the amendments by means of a cumulative-effect adjustment to the balance sheet at the beginning of the first reporting period in which the guidance is effective. Early adoption is not permitted except for the provision to record fair value changes for financial liabilities under the fair value option resulting from instrument-specific credit risk in other comprehensive income. The Company is currently evaluating the impact of adopting this guidance.

ASU 2015-17

In November 2015, the FASB issued (ASU) 2015-17, Balance Sheet Classification of Deferred Taxes. Currently deferred taxes for each tax jurisdiction are presented as a net current asset or liability and net noncurrent asset or liability on the balance sheet. To simplify the presentation, the new guidance requires that deferred tax liabilities and assets for all jurisdictions along with any related valuation allowances be classified as noncurrent in a classified statement of financial position. This guidance is effective for interim and annual reporting periods beginning after December 15, 2016, and early adoption is permitted. The Company has adopted this guidance in the fourth quarter of the year ended December 31, 2015 on a retrospective basis. The adoption of this guidance did not have a material impact on the Company’s financial position, results of operations or cash flows, and did not have any effect on prior periods due to the full valuation allowance against the Company’s net deferred tax assets.

| F-17 |

ASU 2015-16

In September 2015, the FASB issued ASU 2015-16, simplifying the Accounting for Measurement –Period Adjustments. Changes to the accounting for measurement-period adjustments relate to business combinations. Currently, an acquiring entity is required to retrospectively adjust the balance sheet amounts of the acquiree recognized at the acquisition date with a corresponding adjustment to goodwill as a result of changes made to the balance sheet amounts of the acquiree. The measurement period is the period after the acquisition date during which the acquirer may adjust the balance sheet amounts recognized for a business combination (generally up to one year from the date of acquisition). The changes eliminate the requirement to make such retrospective adjustments, and, instead require the acquiring entity to record these adjustments in the reporting period they are determined. The new standard is effective for both public and private companies for periods beginning after December 15, 2015. Adoption of this new standard is not expected to have a material impact on the Company’s consolidated financial statements.

ASU 2015-15

In August 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-15, “Interest - Imputation of Interest (Subtopic 835-30).” ASU 2015-15 provides guidance as to the presentation and subsequent measurement of debt issuance costs associated with line of credit arrangements. We do not expect the adoption of ASU 2015-15 to have a material effect on our financial position, results of operations or cash flows.

ASU 2015-14

In August 2015, the FASB issued ASU No. 2015-14, Revenue From Contracts With Customers (Topic 606).” The amendments in this ASU defer the effective date of ASU 2014-09. Public business entities should apply the guidance in ASU 2014-09 to annual reporting periods beginning after December 15, 2017, including interim reporting periods within that reporting period. Earlier application is permitted only as of annual reporting periods beginning after December 15, 2016, including interim reporting periods within that reporting period. We are still evaluating the effect of the adoption of ASU 2014-09.

ASU 2015-11

In July 2015, the FASB issued ASU No. 2015-11, “Simplifying the Measurement of Inventory (Topic 330).” ASU 2015-11 simplifies the accounting for the valuation of all inventory not accounted for using the last-in, first-out (“LIFO”) method by prescribing that inventory be valued at the lower of cost and net realizable value. ASU 2015-11 is effective for financial statements issued for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016 on a prospective basis. We do not expect the adoption of ASU 2015-11 to have a material effect on our financial position, results of operations or cash flows.

ASU 2015-05

In April 2015, the FASB issued ASU 2015-05, “Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40).” ASU 2015-05 provides guidance regarding the accounting for a customer’s fees paid in a cloud computing arrangement; specifically about whether a cloud computing arrangement includes a software license, and if so, how to account for the software license. ASU 2015-05 is effective for public companies’ annual periods, including interim periods within those fiscal years, beginning after December 15, 2015 on either a prospective or retrospective basis. Early adoption is permitted. We do not expect the adoption of ASU 2015-05 to have a material effect on our financial position, results of operations or cash flows.

In May 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2015-07, “Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent)” (“ASU 2015-07”). This guidance eliminates the requirement to categorize investments within the fair value hierarchy if their fair value is measured using the net asset value (“NAV”) per share practical expedient in the FASB’s fair value measurement guidance. The new standard is effective for fiscal years and interim periods within those fiscal years, beginning after December 15, 2015 The Company does not expect the adoption of ASU 2015-07 to have a material effect on its consolidated financial statements.

| F-18 |

In April 2015, the FASB issued ASU 2015-03, “Imputation of Interest – Simplifying the Presentation of Debt Issuance Costs.” This guidance requires that the debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the debt liability, consistent with the presentation of a debt discount. This amendment is effective for fiscal years and interim periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted. The Company is currently evaluating the impact on its consolidated financial statements of adopting this new guidance but at this time does not expect it to have an impact on the Company’s consolidated financial statements.

In February 2015, the FASB issued new guidance to improve consolidation guidance for legal entities (Accounting Standards Update (“ASU”) 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis), effective for fiscal years beginning after December 15, 2015 and interim periods within those years and early adoption is permitted. The new standard is intended to improve targeted areas of the consolidation guidance for legal entities such as limited partnerships, limited liability corporations, and securitization structures. The amendments in the ASU affect the consolidation evaluation for reporting organizations. In addition, the amendments in this ASU simplify and improve current GAAP by reducing the number of consolidation models. The Company is currently evaluating the impact of this guidance on its consolidated financial statements.

ASU 2015-01

In January 2015, the FASB issued ASU No. 2015-01, “Income Statement - Extraordinary and Unusual Items (Subtopic 225-20): Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items.” This ASU eliminates from U.S. GAAP the concept of extraordinary items. ASU 2015-01 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. A reporting entity may apply the amendments prospectively. We do not expect the adoption of ASU 2015-01 to have a material effect on our financial position, results of operations or cash flows.

ASU 2014-17

In November 2014, the FASB issued ASU No. 2014-17, “Business Combinations (Topic 805): Pushdown Accounting.” This ASU provides an acquired entity with an option to apply pushdown accounting in its separate financial statements upon occurrence of an event in which an acquirer obtains control of the acquired entity. An acquired entity may elect the option to apply pushdown accounting in the reporting period in which the change-in-control event occurs. If pushdown accounting is applied to an individual change-in-control event, that election is irrevocable. ASU 2014-17 was effective on November 18, 2014. The adoption of ASU 2014-17 did not have any effect on our financial position, results of operations or cash flows.

ASU 2014-16

In November 2014, the FASB issued ASU 2014-16, “Derivatives and Hedging (Topic 815).” ASU 2014-16 addresses whether the host contract in a hybrid financial instrument issued in the form of a share should be accounted for as debt or equity. ASU 2014-16 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. We do not currently have issued, nor are we investors in, hybrid financial instruments. Accordingly, we do not expect the adoption of ASU 2014-16 to have any effect on our financial position, results of operations or cash flows.

ASU 2014-15

In August 2014, the FASB issued a new accounting standard which requires management to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern for each annual and interim reporting period. If substantial doubt exists, additional disclosure is required. This new standard will be effective for the Company for annual and interim periods beginning after December 15, 2016. Early adoption is permitted. The Company is evaluating the impact of adopting this accounting standard update on its consolidated financial statements and disclosures.

| F-19 |

ASU 2014-12

In June 2014, the FASB has issued ASU No. 2014-12, Compensation - Stock Compensation (Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period. This ASU requires that a performance target that affects vesting, and that could be achieved after the requisite service period, be treated as a performance condition. As such, the performance target should not be reflected in estimating the grant date fair value of the award. This update further clarifies that compensation cost should be recognized in the period in which it becomes probable that the performance target will be achieved and should represent the compensation cost attributable to the period(s) for which the requisite service has already been rendered. The amendments in this ASU are effective for annual periods and interim periods within those annual periods beginning after December 15, 2015. Earlier adoption is permitted. The Company has not yet determined the effect of the adoption of this standard and it is not expected to have a material impact on the Company’s consolidated financial position and results of operations.

ASU 2014-09

In May 2014, the FASB has issued ASU No. 2014-09, Revenue from Contracts with Customers. This ASU supersedes the revenue recognition requirements in Accounting Standards Codification 605 - Revenue Recognition and most industry-specific guidance throughout the Codification. The standard requires that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. This ASU is effective on January 1, 2017 and should be applied retrospectively to each prior reporting period presented or retrospectively with the cumulative effect of initially applying the ASU recognized at the date of initial application. The Company has not yet determined the effect of the adoption of this standard and it is not expected to have a material impact on the Company’s consolidated financial position and results of operations.

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not expect the future adoption of any such pronouncements to have a significant impact on the results of operations, financial condition or cash flow.

ASU 2014-08

In April 2014, the FASB issued ASU No. 2014-08, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360) and Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” ASU 2014-08 amends the definition for what types of asset disposals are to be considered discontinued operations, as well as amending the required disclosures for discontinued operations and assets held for sale. ASU 2014-08 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2014. The adoption of ASU 2014-08 did not have any effect on our financial position, results of operations or cash flows.

The Company has evaluated recent accounting pronouncements issued by the FASB (including its Emerging Issues Task Force), the AICPA and the SEC and we have not identified any that would have a material impact on the Company’s financial position, or statements.

5. Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consist of the following:

| September 30, 2016 | December 31, 2015 | |||||||

| (Unaudited) | ||||||||

| Prepaid consulting services | $ | 103,261 | $ | - | ||||

| Deposits | 1,000 | 1,000 | ||||||

| Total | $ | 104,261 | $ | 1,000 | ||||

| F-20 |

On January 10, 2016, the Company entered into a one-year Consulting and Representation Agreement with 626 Vanderbilt, LLC in exchange for 60,000,000 shares of the Company common stock. The shares were valued at $54,000 based upon the closing price of the Company’s stock on January 10, 2016 of $0.0009 per share. The total amount of $15,090 was included in prepaid consulting services and is being amortized over the one-year term. Amortization of $38,910 and $0 was recorded for the nine months ended September 30, 2016 and 2015.

On February 10, 2016, the Company, through its wholly owned subsidiary Seaniemac Holdings Ltd. (“Holdings”), entered into an agreement (the “Agreement”) with Apollo Betting and Gaming Ltd (“Apollo”), pursuant to which Holdings purchased Apollo’s online gambling and betting business carried on by Apollo in the United Kingdom, via a purchase of Apollo’s assets related to that business. Part of the assets acquired includes employment contracts with a fair value of $47,327 and recorded as prepaid consulting services for the nine months ended September 30, 2016 (See Note 2).