EXHIBIT 3

IMAGING3,

INC.

AGREEMENT

TO REPLACE MEDLEY EMPLOYMENT AGREEMENT

This

AGREEMENT TO REPLACE MEDLEY EMPLOYMENT AGREEMENT is entered into as of __________, 20 between Imaging3, Inc., a California corporation

(the “Company”), and Dane Medley (“Medley”), a resident of Toluca Lake, California, and current

Chief Executive Officer and President of the Company (this “Agreement”).

The

parties hereby agree as follows:

SECTION

1

INTENT

OF THE PARTIES

The

Company hired Medley, effective ___________, 20__, as its Chief Executive Officer and President, and the two parties made effective

an Employment Agreement dated May 15, 2014 (the “Current Employment Agreement”). Employee and Company now desire,

contingent on various lenders to the Company amending their current notes and warrants for new notes and warrants (see SECTION

2), to: (i) make void the Current Employment Agreement, shown as Exhibit A, and (ii) replace it with a Restated Employment

Agreement, shown as Exhibit B.

SECTION

2

AMENDMENT

OF NOTES AND WARRANTS

(a)

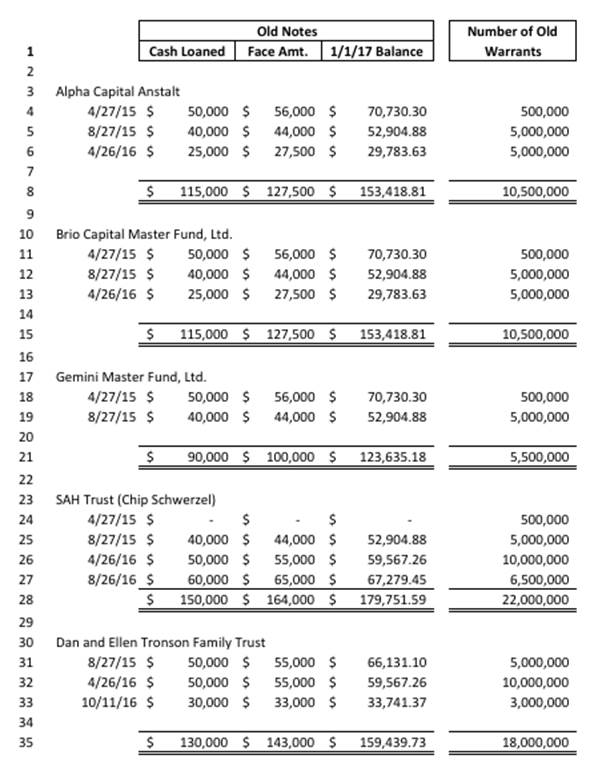

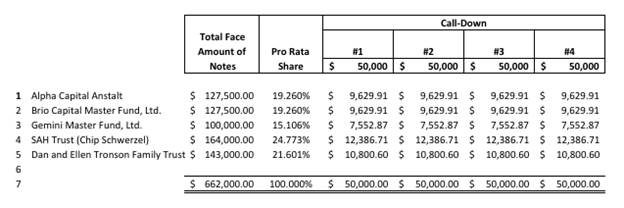

The Company has borrowed $662,000 (face amount) from five lenders for which the Company issued Convertible Secured Notes and related

Warrants (“the “Original Notes” and the “Original Warrants,” respectively).

(b)

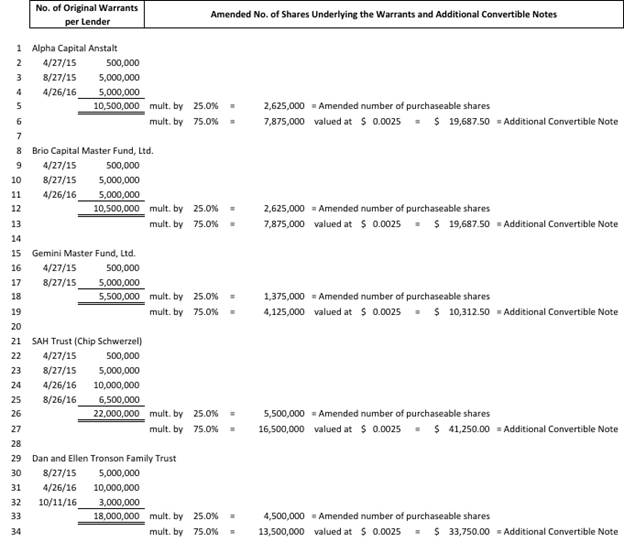

The Company and the lenders intend to effect an amendment of these Original Notes and Original Warrants as part of that certain

CONVERTIBLE NOTE AMENDMENT AGREEMENT, substantially in the form attached as Exhibit C (the “Amendment Agreement”).

SECTION

3

REPLACEMENT OF CURRENT EMPLOYMENT

AGREEMENT WITH RESTATED EMPLOYMENT AGREEMENT

(a)

Medley hereby agrees that, within three business days following the date that the Amendment Agreement is effective (duly signed

by all parties), Medley shall execute the Restated Employment Agreement and thereby forfeit all his rights, privileges, and obligations

associated with the Current Employment Agreement

(b)

The Company agrees that, within three business days following the date that the Amendment Agreement is effective (duly signed

by all parties), it shall execute the Restated Employment Agreement and accept all the terms and conditions therein.

(c)

The Company warrants that all corporate action on the part of the Company, its directors, and shareholders necessary for the authorization,

execution, delivery and performance of this Agreement by the Company for the execution of the Restated Employment Agreement hereunder

has been taken. This Agreement, when executed and delivered by the Company, will constitute a valid and binding obligation of

the Company enforceable in accordance with its terms, subject to (i) laws of general application relating to specific performance,

injunctive relief or other equitable remedies, and (ii) applicable bankruptcy, insolvency, reorganization or other laws of general

application relating to or affecting the enforcement of creditors’ rights generally.

SECTION

4

MISCELLANEOUS

4.1

Governing Law. This Agreement shall be governed in all respects by the internal laws of the State of California,

without reference to principles of conflict of laws or choice of law.

4.2

Survival. The representations, warranties, covenants and agreements made herein shall survive the execution and

delivery of this Agreement and the Closing.

4.3

Successors and Assigns. Except as otherwise provided herein, the provisions hereof shall inure to the benefit of,

and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto.

4.4

Entire Agreement; Amendment. This Agreement, together with the exhibits to this Agreement, constitute the full and

entire understanding and agreement between the parties with regard to the subjects hereof and thereof. Any term of this Agreement

and the Security Agreement may be amended and the observance of any term of this Agreement and the Security Agreement may be waived

(either generally or in a particular instance and either retroactively or prospectively), only with the written consent of the

Company and the Lenders who have loaned more than half of the aggregate Principal Amounts loaned by all of the Lenders under this

Agreement. Any amendment or waiver effected in accordance with this Section 8.4 shall be binding upon the Company, the Lender

and each future holder of the Securities.

4.5

Expenses. The Company and Medley shall each bear its own fees and expenses relating to this Agreement, including

any and all legal fees.

4.6

Notices, Etc. All notices and other communications required or permitted hereunder shall be in writing and shall

be mailed by U.S. mail, postage prepaid, or otherwise delivered by hand, messenger, telecopier or a nationally recognized overnight

courier service, addressed to the Lender and the Company at the addresses set forth on the signature page.

All

such notices, requests and other communications will (i) if delivered personally or by express courier to the address as provided

in this Section 8.6, be deemed given upon delivery, or (ii) if delivered by facsimile transmission to the facsimile number as

provided in this Section 8.6, be deemed given upon receipt. Any party from time to time may change its address, facsimile number

or other information for the purpose of notices to that party by giving ten (10) days’ prior written notice specifying such

change to the other party hereto.

4.7

Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be enforceable against

the parties actually executing such counterparts, and all of which together shall constitute one instrument. Signatures may be

delivered and transmitted by facsimile transmission.

4.8

Headings. The headings and captions used in this Agreement are used for convenience only and are not to be considered

in construing or interpreting this Agreement. All references in this Agreement to sections, paragraphs, exhibits and schedules

shall, unless otherwise provided, refer to sections and paragraphs hereof and exhibits and schedules attached hereto, all of which

exhibits and schedules are incorporated herein by this reference.

4.9

Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, such

provision(s) shall be excluded from this Agreement and the balance of the Agreement shall be interpreted as if such provision(s)

were so excluded and shall be enforceable in accordance with its terms.

4.10

Cooperation. With respect to performance of the terms of this Agreement, each party shall use its good faith efforts

to cooperate and to take such actions as may be appropriate to carry out the terms and intentions of this Agreement. Whenever

a party’s approval is required with respect to the terms of this Agreement, such approval will not be unreasonably withheld.

4.11

Arbitration. If a dispute arises between or among the parties relating to the interpretation or performance of this

Agreement, the Notes, the Warrants or the Security Agreement, and with the exception of any claim for a temporary restraining

order or preliminary or permanent injunctive relief to enjoin any breach or threatened breach, such dispute shall be settled by

a single neutral arbitrator, who is mutually agreeable to the parties, with such arbitration to be held in Los Angeles, California,

in accordance with the then effective California rules of arbitration (CCP § 1282, et seq.). If the parties do not promptly

select the neutral arbitrator, then the Los Angeles Superior Court shall select the neutral arbitrator. Judgment upon the award

rendered by the arbitrator may be entered in any court having jurisdiction thereof. The arbitrator shall make his or her decision

in accordance with the terms of this Agreement and applicable law. Each party shall initially bear its own costs and legal fees

associated with such arbitration; and the parties shall initially split the cost of the arbitrator, but the prevailing party in

any such arbitration shall be entitled to recover from the other party the reasonable attorneys’ fees, costs and expenses

incurred by such prevailing party in connection with such arbitration. The decision of the arbitrator shall be final and may be

sued on or enforced by the party in whose favor it runs in any court of competent jurisdiction at the option of the prevailing

party. The rights and obligations of the parties to arbitrate any dispute relating to the interpretation or performance of this

Agreement shall survive the Closing. The arbitrator shall be empowered to award specific performance, injunctive relief and other

equitable remedies as well as damages, but shall not be empowered to award punitive or exemplary damages.

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement as of the date first set forth above.

| |

COMPANY: |

| |

IMAGING3, INC. |

| |

3022 North Hollywood Way |

| |

Burbank,

California 91505 |

| |

Attention: Xavier Aguilera |

| |

|

|

| |

|

|

| |

By:

|

|

| |

|

|

| |

Date: |

___________________________________,

20___ |

| |

|

|

| |

DANE MEDLEY: |

| |

___________________ |

| |

___________________ |

| |

|

|

| |

Signature: |

|

| |

|

|

| |

Date: |

___________________________________,

20___ |

Exhibit

A

to

the Agreement to Restate Medley Employment Agreement

[CURRENT

EMPLOYMENT AGREEMENT]

EMPLOYMENT

AGREEMENT

This

EMPLOYMENT AGREEMENT (this “Agreement”) is made as of the 15th day of May 2014, by and between Imaging 3, Inc., a

California corporation (the “Company”), and Dane Medley, an individual (“Employee”), and is made with

respect to the following facts:

R

E C I T A L S

A.

The Company and the Employee wish to ensure that the Company will receive the benefit of Employee’s loyalty and service.

B.

In order to help ensure that the Company receives the benefit of Employee’s loyalty and service, the parties desire to enter

into this formal Employment Agreement to provide Employee with appropriate compensation arrangements and to assure Employee of

employment stability.

C.

The parties have entered into this Agreement for the purpose of setting forth the terms of employment of the Employee by the Company.

NOW,

THEREFORE, in consideration of the premises and mutual covenants herein contained, THE PARTIES HERETO AGREE AS FOLLOWS:

1.

Employment of Employee and Duties. The Company hereby hires Employee and Employee hereby accepts employment upon

the terms and conditions described in this Agreement. The Employee shall be the Chief Executive Officer of the Company with all

of the duties, privileges and authorities usually attendant upon such office, including but not limited to overall supervision

of the management of the Company’s operations. Subject to (a) the general supervision of the (Board of Directors) of the

Company, and (b) the Employee’s duty to report to the Board of Directors periodically, as specified by it from time-to-time,

Employee shall have all of the authority and discretion in the conduct of the Company’s operations that can lawfully be

delegated by the Board of Directors.

2.

Time and Effort. Employee agrees to devote his full working time and attention to the management of the Company’s

business affairs, the implementation of its strategic plan, as determined by the Board of Directors, and the fulfillment of his

duties and responsibilities as the Company’s Chief Executive Officer; provided that the expenditure of a reasonable amount

of time by the Employee for personal matters and charitable activities shall not be deemed to be a breach of this Agreement.

3. The

Company’s Authority. Employee agrees to comply with the Company’s rules and regulations as adopted by the

Company’s Board of Directors regarding performance of his duties, and to carry out and perform those orders,

directions and policies established by the Company with respect to his engagement. Employee shall promptly notify the Board

of Directors of any objection he has to the Board’s directives and the reasons for such objection.

4.

Noncompetition by Employee. Employee agrees that during the term of his employment with the Company or during any

time that the Employee serves as a director of the Company, or while he is receiving any severance payments from the Company,

Employee will not directly or indirectly, whether (a) as employee, agent, consultant, employer, principal, partner, officer or

director; (b) holder of ten percent or more of any class of equity securities or ten percent or more of the aggregate principal

amount of any class of debt, notes or bonds of a company with publicly traded equity securities; or (c) in any other individual

or representative capacity whatsoever, in each case for his own account or the account of any other person or entity, engage in

any business or trade competing with the then business or trade of the Company anywhere in the world in which the Company is carrying

on such trade or business as of the effective date of such termination.

5.

Confidential Information: Nondisclosure Covenant.

5.1.

Confidential Information. As used herein the term “Confidential Information” shall mean all customer

and contract lists, supplier lists, records, financial data, trade secrets, proprietary technology and intellectual property,

business and marketing plans and studies, manuals for employee and personnel policies, manufacturing and/or production manuals,

computer programs and software, strategic plans, formulas, manufacturing and production processes and techniques (including without

limitation types of machinery and equipment used together with improvements and modifications thereon), tools, applications for

patents, designs, models, patterns, drawings, tracings, sketches, blueprints, and all other similar information developed and/or

used by Company in the course of its business and which is not known by or readily available to the general public.

5.2

Nondisclosure Covenant. Employee acknowledges that, in the course of performing services for and on behalf of Company,

Employee has had and will continue to have access to Confidential Information. Employee hereby covenants and agrees to maintain

in strictest confidence all Confidential Information in trust for Company, its successors and assigns. During the period of Employee’s

employment with Company and at all times following Employee’s termination of employment for any reason, including without

limitation Employee’s voluntary resignation or involuntary termination with or without cause, Employee agrees to not misappropriate,

utilize for any purpose other than for the direct benefit of the Company, or disclose or make available to anyone outside Company’s

organization, any Confidential Information or anything relating thereof without the prior written consent of Company, which consent

may be withheld by Company for any reason or no reason at all.

5.3

Return of Property. Upon Employee’s termination of his employment with Company for any reason, including without

limitation Employee’s voluntary resignation or involuntary termination with or without cause, Employee hereby agrees to

promptly return to Company’s possession all copies of any writings, computer discs or equipment, drawings or any other information

relating to Confidential Information which are in Employee’s possession or control, as well as all keys, passwords, credit

cards and similar Company items. Employee further agrees that, upon the request of Company at any time during Employee’s

period of employment with Company, Employee shall promptly return to Company all such copies of writings, computer discs or equipment,

drawings or any other information relating to Confidential Information which are in Employee’s possession or control.

5.4

Rights to Inventions and Trade Secrets. Employee hereby assigns to Company all right, title and interest in and

to any ideas, inventions, original works or authorship, developments, improvements or trade secrets which Employee solely or jointly

has conceived or reduced to practice, or will conceive or reduce to practice, or cause to be conceived or reduced to practice

during his employment with Company. All original works of authorship which are made by Employee (solely or jointly with others)

within the scope of Employee’s services hereunder and which are protectable by copyright are “works made for hire,”

as that term is defined in the United States Copyright Act.

6.

Noninterference and Nonsolicitation Covenants. In further reflection of the Company’s important interests

in its proprietary information and its trade, customer, vendor and employee relationships, Employee agrees that, during the 24

month period following the termination of Employee’s employment with Company for any reason, including without limitation

Employee’s voluntary resignation or involuntary termination with or without cause, Employee will not directly or indirectly,

for or on behalf of any person, firm, corporation or other entity, (a) interfere with any contractual or other business relationships

that Company has with any of its customers, clients, service providers or materials suppliers as of the date of Employee’s

termination of employment, or (b) solicit or induce any employee of Company to terminate his/her employment relationship with

Company.

7.

Term of Agreement. This Agreement shall commence to be effective on the date first above written (the “Commencement

Date”), and shall continue until May 15, 2019, unless terminated sooner as provided in Section 15 hereof, or unless extended

by a resolution duly adopted by the Company’s Board of Directors and agreed upon by the Employee.

8.

Compensation. During the term of this Agreement, the Company shall pay the following compensation to Employee:

8.1

Annual Compensation. Employee shall be paid a base salary of $192,000 per year during the first year of the term

of this Agreement. The base salary in subsequent years during the term of this Agreement will be no less than $192,000 per year,

but may be adjusted to be higher by a resolution duly adopted by the Company’s Board of Directors. The Employee’s

salary will be payable in two installments per month, each installment equaling one-twenty-fourth of the annual base salary, and

each payable on the 1st and the 16th day of each month covering, respectively, the first 15 days of the current month

and the 16th day through the last day of the previous month.

8.2

Bonus Payments. In addition to the base salary provided for in Section 8.1 of this Agreement and the potential for

discretionary additional bonuses in Section 8.4 of this Agreement, the Employee will be entitled to the following fixed performance-based

annual bonuses, payable on or before January 30th of each year for performance during the prior calendar year, equal

to (a) 20% of the Employee’s base annual salary for the prior calendar year if the Company’s annual gross revenue

for the prior calendar year, calculated in accordance with generally accepted accounting principles (“GAAP”), equals

or exceeds $_500,000 in calendar year 2014, $3,000,000 in calendar year 2015, $7,000,000 in calendar year 2016, $15,000,000 in

calendar year 2017 and $_30,000,000 in calendar year 2018, and (b) 40% of the Employee’s base annual salary for the prior

calendar year if the Company’s annual gross revenue for the prior calendar year, calculated in accordance with GAAP, equals

or exceeds $1,000,000 in calendar year 2014, $5,000,000 in calendar year 2015, $15,000,000 in calendar year 2016, $40,000,000

in calendar year 2017 and $70,000,000 in calendar year 2018. In the event of a change to the calculation of the Company’s

annual gross revenue for a particular calendar year after January 30th of the next year, then the bonus payment will

be adjusted accordingly.

8.3

Stock Incentives. Upon commencement of this Agreement, Employee shall be issued 18,000,000 shares of the Company’s

common stock (the “Incentive Shares”); provided, however, if Employee is terminated by the Company pursuant to Section

15.3(i) of this Agreement during the first year of its term, the Employee will tender back to the Company for cancellation 3,000,000

Incentive Shares. On May 15, 2014, the Company will grant to the Employee stock options to purchase up to 5,000,000 shares of

the Company’s common stock pursuant to the Company’s Stock Incentive Plan for Directors, Officers, Employees and Key

Consultants of Imaging 3, Inc. (the “Plan”), having an exercise price of $0.001 per share and an exercise period of

ten years, with a vesting schedule as follows: (i) up to 1,000,000 stock options will vest and be exercisable on December 31,

2014 if the 2014 Goals set forth in Exhibit A to this Agreement are satisfied by December 31, 2014 and the Employee is still engaged

on the scheduled vesting date as either an officer, director, employee or key consultant of the Company, (ii) up to 1,000,000

stock options will vest and be exercisable on December 31, 2015 if the 2015 Goals set forth in Exhibit A to this Agreement are

satisfied by December 31, 2015 and the Employee is still engaged on the scheduled vesting date as either an officer, director,

employee or key consultant of the Company, (iii) up to 1,000,000 stock options will vest and be exercisable on December 31, 2016

if the 2016 Goals set forth in Exhibit A to this Agreement are satisfied by December 31, 2016 and Employee is still engaged on

the scheduled vesting date as either an officer, director, employee or key consultant of the Company, (iv) up to 1,000,000 stock

options will vest and be exercisable on December 31, 2017 if the 2017 Goals set forth in Exhibit A to this Agreement are satisfied

by December 31, 2017 and the Employee is still engaged on the scheduled vesting date as either an officer, director, employee

or key consultant of the Company, and (v) up to 1,000,000 stock options will vest and be exercisable on December 31, 2018 if the

2018 Goals set forth in Exhibit A to this Agreement are satisfied by December 31, 2018 and the Employee is still engaged on the

scheduled vesting date as either an officer, director, employee or key consultant of the Company. The stock options granted to

Employee pursuant to this Agreement will be governed by the terms and conditions of the Plan and the stock option agreement executed

by the Company and the Employee which applies to the options. Said stock options will be Incentive Stock Options (ISOs) under

the Plan to the maximum extent permitted by the Plan and applicable law. Upon approval of the Company’s full Board of Directors,

the Employee may be granted additional stock options to purchase additional stock of the Company during the second, third, fourth,

and fifth years of the term of this Agreement, depending on the achievement of Company operating milestones such as annual gross

revenue and EBIDTA, to be established by the Board of Directors of the Company. In the event Mr. Aguilera is asked to resigned

(or leave, vacate, step-down or be removed from the Board of Directors) his position, he will further be compensated eighty percent

(80%) of the outstanding Imaging3 Inc. common shares, along with any Imaging3 Inc. stock options he owns at the time of departure.

8.4

Discretionary Additional Compensation. In addition to the compensation set forth in Sections 8.1, 8.2 and 8.3 of

this Agreement, upon approval of the Company’s full Board of Directors, Employee may be paid an additional bonus or bonuses

during each year, and may have his annual compensation raised, based on the CEO’s Board’s evaluation of the Employee’s

definable efforts, accomplishments and similar contributions. In this regard, the Company expects that the Employee will earn

an annual bonus equal to between 60% and 120% of his base fixed salary, including the fixed performance-based bonuses provided

for in Section 8.2 of this Agreement, if the Company achieves certain additional operating milestones to be agreed upon by the

Company and the Employee in a separate addendum to this Agreement; provided, that if the Company and the Employee do not agree

on a separate written addendum to this Agreement setting forth said additional milestones, then discretionary bonuses will be

determined in good faith in the discretion of the Company’s Board of Directors.

9.

Fringe Benefits. The Company shall provide Employee with medical and dental group insurance coverage or equivalent

coverage for Employee, including his dependents. The medical and dental insurance coverage shall begin on the Commencement Date

and shall continue throughout the term of this Agreement. All compensation provided in Sections 8 and 9 of this Agreement shall

be subject to customary withholding tax and other employment taxes, to the extent required by law.

10.

Office and Staff. In order to enable Employee to discharge his obligations and duties pursuant to this Agreement,

the Company agrees that it shall provide suitable office space for Employee, together with all necessary and appropriate supporting

staff and secretarial assistance, equipment, stationery, books and supplies. Employee agrees that the supporting staff presently

in place is suitable for the purposes of this Agreement. The Company agrees to provide at its expense parking for one vehicle

by the Employee at the Company’s executive offices.

11.

Reimbursement of Expenses. The Company shall reimburse Employee for all reasonable travel, mobile telephone, promotional

and entertainment expenses incurred in connection with the performance of Employee’s duties hereunder, subject to Section

12 of this Agreement with respect to automobile expenses. Employee’s reimbursable expenses shall be paid promptly by the

Company upon presentment by Employee of an itemized verifiable list of invoices describing such expenses. In the event Mr. Aguilera

is asked to resigned (or leave, vacate, step-down or be removed from the Board of Directors) his position, he will further be

compensated eighty percent (80%) of the outstanding Imaging3 Inc. common shares, along with any Imaging3 Inc. stock options he

owns at the time of departure.

12.

Automobile Expenses. Notwithstanding anything else herein to the contrary, the Company shall pay to the Employee

a fixed amount equal to $1,000 per month on the last day of each month during the term of this Agreement as reimbursement to the

Employee for all expenses incurred by the Employee for the use of his automobile for Company business purposes, including but

not limited to depreciation, repairs, insurance, reasonable maintenance, and gasoline expenses. Employee shall not be entitled

to any other reimbursement for the use of his automobile for business purposes.

13.

Vacation. Employee shall be entitled to four weeks of paid vacation per year or pro rata portion of each year of

service by Employee under this Agreement. The Employee shall be entitled to the holidays provided in the Company’s established

corporate policy for employees with comparable duties and responsibilities. If asked to resigned or leave, employee will be entitled

to liquidate all existing vacations days owed for cash.

14.

Definition of “Cause.” For the purposes of this Agreement, “termination for cause”

means termination of Employee’s employment by Employer due to (a) Employee’s conviction of, or the entry of a pleading

of guilty or nolo contender by Employee to, a felony or crime involving moral turpitude, or (b) Employee’s failure to comply

with any material provision of this Agreement that results in material damage to the Company, or (c) an act of fraud committed

by Employee against the Company, or (d) a willful act by Employee as a result of which he receives a material improper personal

benefit at the expense of the Company, or (e) Employee’s demonstration of gross negligence or willful misconduct in the

execution of his material assigned duties, or (f) Employee’s intentionally imparting confidential information relating to

the Company to a third party, other than in the course of carrying out the Employee’s duties, which has resulted in material

damage to the Company, in each case other than as a result of Employee’s death, disability or retirement, and the Employee

has been given the written notice specified in this Section and has failed to cure any defect in performance as specified in such

notice. The Company shall give Employee written notice specifying the conduct alleged to have constituted such cause and provide

Employee the opportunity to cure such conduct, if curable, within 15 days following receipt of such notice.

15.

Termination. This Agreement may be terminated in the following manner and not otherwise:

15.1

Mutual Agreement. This Agreement may be terminated by the mutual written agreement of the Company and Employee to

terminate.

15.2

Termination by Employee. Employee may at his option and in his sole discretion terminate this Agreement for (i)

the material breach by the Company of the terms of this Agreement (other than where Employee has first materially breached this

Agreement causing material damage to the Company), or (ii) any “Change of Control” (as defined in Section 15.6) in

which the Employee is unable to come to an agreement with the surviving company regarding an employment agreement as specified

further in Section 15.6 of this Agreement.

15.3

Termination by the Company. The Company may at its option terminate this Agreement upon fifteen (15) days prior

written notice (“Termination Notice”) to the Employee of the Company’s election to terminate this Agreement

(i) for cause as defined in and in accordance with Section 14 of this Agreement, or (ii) in the event of any “Change of

Control”, as defined in Section 15.6 of this Agreement. In the event of termination by the Company pursuant to Section 15.3(i)

herein, the Company shall pay the Employee any remaining base salary, at the rate then in effect under Section 8.1, 8.2, 8.3,

11, 13 through the effective date of such termination, plus any benefits under other plans or programs in which the Employee is

vested at the time of his termination. In the event of termination by the Company pursuant to Section 15.3(ii) (and inability

of the Employee, negotiating in good faith, to come to an agreement with the surviving Company or new controlling parties of the

Company regarding an employment agreement), then the Employee will be entitled to the following severance payments and benefits,

in addition to accrued salary and bonuses, if any, for past service, provided that the Employee enters into a severance agreement

with the Company waiving and releasing the Company from all claims Employee may have against the Company and agreeing not to disparage

the Company or its employees: (a) the Employee’s then salary and accrued but unpaid bonus (if any, with respect to bonus)

payable for the twelve month period immediately following the Termination Notice, payable in semi-monthly installments in accordance

with Section 8.1 of this Agreement, if the Termination Notice is issued during the first year of the term of this Agreement, with

the severance payment period being nine months if the Termination Notice is issued during the second year of the term of this

Agreement and six months if the Termination Notice is issued during the third, fourth, or fifth year of the term of this Agreement,

and (b) Employee shall also be entitled to all the benefits during the severance payment period under Sections 9 and 12 of this

Agreement, and (c) Employee shall be entitled to exercise all vested stock options which he owns for the entire remaining exercise

period of the stock options as set forth in Section 8.3 of this Agreement, no such stock options shall terminate prior to said

expiration dates, and no “severance” shall be deemed to have occurred under the Company’s Plan or under existing

stock option agreements covering said stock options.

15.4

Termination Upon Death. This Agreement shall terminate upon the death of the Employee.

15.5

Termination Upon the Disability of the Employee. This Agreement shall terminate upon the disability of the Employee.

As used in the previous sentence, the term “disability” shall mean the complete physical and/or mental disability

to discharge Employee’s duties and responsibilities for a continuous period of not less than six months during any consecutive

twelve (12) month period. Any physical or mental disability which does not prevent Employee from discharging his duties and responsibilities

in accordance with usual standards of conduct as determined by the Company in its reasonable opinion shall not constitute a disability

under this Agreement.

15.6

Termination As A Result of A Change in Control of the Company. “Change of Control” is defined as a sale

of all or substantially all of the Company’s assets or more than fifty percent (50%) of the Company’s outstanding

stock, to a purchaser which is unaffiliated with the Company, in a single transaction or a series of related transactions, or

a merger, of which the Company is not the surviving corporation, with any entity which is unaffiliated with the Company. In the

event of a Change in Control of the Company and termination of this Agreement as a result of said Change of Control, if the Employee,

negotiating in good faith, is unable to come to an agreement with the surviving company or new controlling parties of the Company

regarding an employment agreement, then the Employee may terminate this Agreement pursuant to Section 15.2 (ii) of this Agreement.

15.7

Survival of Covenants. Notwithstanding anything contained in this Agreement to the contrary, the covenants of Employee

contained in Section 4, Section 5 and Section 6 of this Agreement shall survive the term of this Agreement (as specified in Section

7 hereof) or Employee’s termination of his employment relationship with the Company, in each case as specified further in

such covenants.

16.

Indemnification of Employee. Pursuant to the provisions and subject to the limitations of the California Corporations

Code, the Company shall indemnify and hold Employee harmless as provided in Sections 16.1, 16.2 and 16.3 of this Agreement. The

Company shall, upon the request of Employee, assume the defense and directly bear reasonable expenses of any action or proceedings

which may arise for which Employee is entitled to indemnification pursuant to this Section.

16.1

Indemnification of Employee for Actions by Third Parties. The Company hereby agrees to indemnify and hold Employee

harmless from any liability, claims, fines, damages, losses, expenses, judgments or settlements actually incurred by him, including

but not limited to reasonable attorneys’ fees and costs actually incurred by him as they are incurred, as a result of Employee

being made at any time a party to, or being threatened to be made a party to, any proceeding (other than an action by or in the

right of the Company, which is addressed in Section 16.2 of this Agreement), relating to actions Employee takes within the scope

of his employment as the President of the Company or in his role as a director of the Company, provided that Employee acted in

good faith and in a manner he reasonably believed to be in the best interest of the Company and, in the case of a criminal proceeding,

had no reasonable cause to believe his conduct was unlawful.

16.2

Indemnification of Employee for Actions in the Right of the Company. The Company hereby agrees to indemnify and

hold Employee harmless from any liability, claims, damages, losses, expenses, judgments or settlements actually incurred by him,

including but not limited to reasonable attorneys’ fees and costs actually incurred by him as they are incurred, as a result

of Employee being made a party to, or being threatened to be made a party to, any proceeding by or in the right of the Company

to procure a judgment in its favor by reason of any action taken by Employee as an officer, director or agent of the Company,

provided that Employee acted in good faith in a manner he reasonably believed to be in the best interests of the Company and its

shareholders, and provided further, that no indemnification by the Company shall be required pursuant to this Section 16.2 (i)

for acts or omissions that involve intentional misconduct or a knowing and culpable violation of law, (ii) for acts or omissions

that Employee believed to be contrary to the best interests of the Company or its shareholders or that involve the absence of

good faith on the part of Employee, (iii) for any transaction from which Employee derived an improper personal benefit, (iv) for

acts or omissions that show a reckless disregard by Employee of his duties to the Company or its shareholders in circumstances

in which Employee was aware, or should have been aware, in the ordinary course of performing his duties, of a risk of serious

injury to the Company or its shareholders, (v) for acts or omissions that constitute an unexcused pattern of inattention that

amounts to an abdication of Employee’s duties to the Company or its shareholders, or (vi) for any other act by Employee

for which Employee is not permitted to be indemnified under the California Corporations Code. Furthermore, the Company has no

obligation to indemnify Employee pursuant to this Section 16.2 in any of the following circumstances:

A.

In respect of any claim, issue, or matter as to which Employee is adjudged to be liable to the Company in the performance

of his duties to the Company and its shareholders, unless and only to the extent that the court in which such action was brought

determines upon application that, in view of all the circumstances of the case, he is fairly and reasonably entitled to indemnity

for the expenses and then only in the amount that the court shall determine.

B.

For amounts paid in settling or otherwise disposing of a threatened or pending action without court approval.

C.

For expenses incurred in defending a threatened or pending action which is settled or otherwise disposed of without court

approval.

16.3

Reimbursement. In the event that it is determined that Employee is not entitled to indemnification by the Company

pursuant to Sections 16.1 or 16.2 of this Agreement, then Employee is obligated to reimburse the Company for all amounts paid

by the Company on behalf of Employee pursuant to the indemnification provisions of this Agreement. In the event that Employee

is successful on the merits in the defense of any proceeding referred to in Sections 16.1 or 16.2 of this Agreement, or any related

claim, issue or matter, then the Company will indemnify and hold Employee harmless from all fees, costs and expenses actually

incurred by him in connection with the defense of any such proceeding, claim, issue or matter.

17.

Assignability of Benefits. Except to the extent that this provision may be contrary to law, no assignment, pledge,

collateralization or attachment of any of the benefits under this Agreement shall be valid or recognized by the Company. Payment

provided for by this Agreement shall not be subject to seizure for payment of any debts or judgments against the Employee, nor

shall the Employee have any right to transfer, modify, anticipate or encumber any rights or benefits hereunder; provided that

any stock issued by the Company to the Employee pursuant to this Agreement shall not be subject to Section 17 of this Agreement.

18.

Directors’ and Officers’ Liability Insurance. The Company may purchase directors’ and officers’

liability insurance for the officers and directors of the Company, which would include the same coverage for Employee.

19.

Notice. All notices and other communications required or permitted hereunder shall be in writing or in the form

of a email or facsimile (confirmed in writing) to be given only during the recipient’s normal business hours unless arrangements

have otherwise been made to receive such notice by email or facsimile outside of normal business hours, and shall be mailed by

registered or certified mail, postage prepaid, or otherwise delivered by hand, messenger, or email or facsimile (as provided above)

addressed (a) if to the Employee, at the address for such Employee set forth on the signature page hereto or at such other address

as such Employee shall have furnished to the Company in writing or (b) if to the Company, to its principal executive offices and

addressed to the attention of the Chairman of the Board, or at such other address as the Company shall have furnished in writing

to the Employee.

In

case of the Company:

Imaging

3, Inc.

3022

North Hollywood Way

Burbank,

California 91505

Telephone

No.: (818) 260-0930

Facsimile

No.: (818) 260-0445

In

case of the Employee:

Dane

Medley

____________

____________

Each

such notice or other communication shall for all purposes of this Agreement be treated as effective or having been given when

delivered if delivered personally, or, if sent by mail, at the earlier of its receipt or seventy-two (72) hours after the same

has been deposited in a regularly maintained receptacle for the deposit of the United States mail, addressed and mailed as aforesaid,

or, if by telex or telecopy pursuant to the above, when received.

20.

Attorneys’ Fees. In the event that any of the parties must resort to legal action in order to enforce the

provisions of this Agreement or to defend such suit, the prevailing party shall be entitled to receive reimbursement from the

non-prevailing party for all reasonable attorneys’ fees and all other costs incurred in commencing or defending such suit,

including post judgment costs.

21.

Entire Agreement. This Agreement embodies the entire understanding among the parties and merges all prior discussions

or communications among them, and no party shall be bound by any definitions, conditions, warranties, or representations other

than as expressly stated in this Agreement or as subsequently set forth in a writing signed by the duly authorized representatives

of all of the parties hereto.

22.

No Oral Change; Amendment. This Agreement may only be changed or modified and any provision hereof may only be waived

by a writing signed by the party against whom enforcement of any waiver, change or modification is sought. This Agreement may

be amended only in writing by mutual consent of the parties.

23.

Severability. In the event that any provision of this Agreement shall be void or unenforceable for any reason whatsoever,

then such provision shall be stricken and of no force and effect. The remaining provisions of this Agreement shall, however, continue

in full force and effect, and to the extent required, shall be modified to preserve their validity.

24.

Applicable Law. This Agreement shall be construed as a whole and in accordance with its fair meaning. This Agreement

shall be interpreted in accordance with the laws of the State of Los Angeles, and venue for any action or proceedings brought

with respect to this Agreement shall be in the County of Los Angeles in the State of California.

25.

Successors and Assigns. Each covenant and condition of this Agreement shall inure to the benefit of and be binding

upon the parties hereto, their respective heirs, personal representatives, assigns and successors in interest. Without limiting

the generality of the foregoing sentence, this Agreement shall be binding upon any successor to the Company whether by merger,

reorganization or otherwise.

26.

Injunctive Remedy. In the case of any breach or threatened breach by Employee of any of his covenants or obligations

under Sections 4, 5 and/or 6 of this Agreement, the parties hereto agree that damages may not be an adequate remedy for the Company

and that, in the event of any such breach or threatened breach, the Company may, either with or without pursuing any potential

damage remedies, immediately obtain and enforce an injunction prohibiting Employee from committing or continuing to commit such

breach or threatened breach.

27.

Counterparts. This Agreement may be executed in two counterparts, each of which may be deemed an original, but both

of which together shall constitute one and the same agreement.

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement on the date first above written.

| COMPANY: |

IMAGING 3, INC., a California corporation |

| |

|

|

| |

By:

|

|

| |

|

BOD (Board of Directors) |

| |

|

|

| |

By |

|

| |

|

BOD

(Board of Director) |

| |

|

|

| |

By |

|

| |

|

BOD

(Board of Director |

| EMPLOYEE: |

|

| |

Dane

Medley |

| |

|

| |

|

| |

Street

Address |

| |

|

| |

|

| |

City,

State and Zip Code |

| |

|

| |

|

| |

Telephone

Number |

| |

|

| |

|

| |

Facsimile

Number |

EXHIBIT

A

to

the Current Employment Agreement

BENCHMARKS

FOR VESTING OF UP TO 5,000,000 STOCK OPTIONS PURSUANT TO SECTION 8.3 OF THE EMPLOYMENT AGREEMENT

| Year | |

Goal | |

Percentage Vested | | |

Number of

Options to Vest | |

| 2016 Goals | |

Submit the Dominion for FDA approval.

| |

| 50 | % | |

| 2,200,000 | |

| | |

| |

| | | |

| | |

| | |

Obtain a symbol from FINRA and begin trading. | |

| 50 | % | |

| 2,250,000 | |

| | |

| |

| | | |

| | |

| 2017 Goals | |

To be established by the BOD

(Board of Directors)

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| 2018 Goals | |

To be established by the BOD

(Board of Directors)

| |

| | | |

| | |

| | |

| |

| | | |

| | |

| 2019 Goals | |

To be established by the BOD

(Board of Directors)

| |

| | | |

| | |

Exhibit

B

to

the Agreement to Restate Medley Employment Agreement

RESTATED

EMPLOYMENT AGREEMENT

THIS

RESTATED EMPLOYMENT AGREEMENT is made as of _________ __, 20__, at Los Angeles, California among Imaging3, Inc., a

California corporation (the “Company”), and Dane Medley (the “Employee”) with reference to the

following facts:

In

consideration of their respective promises contained herein, the parties hereto agree as follows:

1.

EMPLOYMENT

Company

hired Employee, effective ___________, 20__, as its Chief Executive Officer and President, and the two parties made effective

an Employment Agreement dated May 15, 2014 (the “Current Employment Agreement”). Employee and Company now desire:

(i) to make void the Current Employment Agreement, together with all the obligations, duties, and restrictions therein (including

any payments and share grants that have yet to be made), and (ii) to replace it with this Restated Employment Agreement, which

shall serve to define all the terms and conditions associated with Employee’s employment with the Company going forward.

2.

EMPLOYEE’S DUTIES

The

Employee shall, while contributing his services hereunder:

(a)

Serve the Company as President, with all of the duties, privileges and authorities usually attendant upon such office.

(b)

Report initially to the Board of Directors; should (the “Board) or to whomever the Board designates, as long as the reporting

relationship is consistent with the Employee’s position of President.

(c)

Comply with and conform to any lawful instructions or directions given or made by his supervisor and/or the Board, and faithfully,

industriously, diligently, and to the best of the Employee’s ability, experience, and talents, serve the Company and perform

all of the duties that may be required by the terms and conditions of this Agreement to the reasonable satisfaction of his supervisor

and the Board, so as to promote the Company’s business interests; and

(d)

Devote approximately three-quarters of his working time and attention to the fulfillment of his duties and responsibilities as

the Company’s President, provided that the expenditure of a reasonable amount of time by the Employee for personal matters

and charitable activities shall not be deemed to be a breach of this Agreement.

3A.

COMPENSATION

In

consideration of the performance by the Employee of his duties hereunder, the remuneration of the Employee shall be (and the Company

shall pay to the Employee):

| (a) |

|

A base salary (“Salary”) of $48,000 per year until the closing of an equity offering of at least $2.5 million in gross proceeds (a “Qualified Financing”), at which point the base salary will increase to $96,000 per year. The base salary in subsequent years during the term of this Agreement will be no less than $96,000 per year, but may be adjusted to be higher by a resolution duly adopted by the Company’s Board of Directors. The Employee’s salary will be payable in two installments per month, each installment equaling one-twenty-fourth of the annual base salary, and each payable on the 1st and the 16th day of each month covering, respectively, the first 15 days of the current month and the 16th day through the last day of the previous month, |

| (b) |

|

Bonus compensation of up to 50% of the Consultant’s base compensation for the prior calendar year, to be based generally on the Board’s good-faith evaluation of (i) achievements by the Employee of the objectives provided him by the Board and/or (ii) the Employee’s definable efforts, accomplishments, and contributions. The bonus decision is at the Board’s sole discretion, but it is agreed hereby that reasonably strong performance by the Consultant would result in a 30%-35% bonus level, on average, over many years. It agreed that for the stub year of 2016, Employee will have earned, and will accrue, a bonus of $16,000, to be paid only if at least $2,500,000 of new equity is raised by the Company between January 1, 2017 and August 31, 2017. |

| |

|

|

| (c) |

|

Equity compensation of 4,000,000 Restricted Stock Units (“RSUs”) (the “Incentive Shares”), which shall be issued as soon as practical after the Company approves a stock option plan (or equivalent). The Company’s Board hereby agrees to approve such a plan no later than 30 days after the closing of a Qualified Financing, with underlying shares of at least 12%, but no greater than 15%, of the fully diluted number of shares outstanding at the time, and to then hold a shareholder vote for approval of the plan within 60 days after that. The Incentive Shares shall be issued to Employee regardless of his employment status and shall be immediately 100% vested. |

| |

|

|

| (d) |

|

Paid vacation, which shall accrue at the rate of four weeks per year, |

| |

|

|

| (e) |

|

Other benefits and perquisites normally available to executives of the Company, as may be changed from time to time, and |

| |

|

|

| (f) |

|

Such additional remuneration as Employee and the Company shall negotiate after January 1, 2018. |

3B.

AGREEMENT TO SELL CLASS A PREFERRED VOTING SHARES

As

part of this agreement, Employee shall agree to sell, and the Company shall agree to purchase, the 2,000 Class A Preferred Voting

Shares (the “Voting Shares”) currently owned by Employee for a purchase price of $60,000, to be paid as follows: $5,000

per month for twelve successive months beginning the fourth month after Employee is terminated. Employee warrants that, other

than the Voting Shares to be sold in this transaction, no other voting shares of any type exist, nor are than any plans to issue

additional voting shares.

4.

EXPENSES

The

Company shall pay on behalf of the Employee or reimburse the Employee (against the Employee’s submission to the Company

of proper receipts therefore) for all expenses properly incurred by him in the course of his employment hereunder or otherwise

in connection with the business of the Company in accordance with Company policies, as such policies may be established and revised

by the Board from time to time.

5.

AT-WILL EMPLOYMENT

Employee

and the Company understand and expressly agree that Employee’s employment with the Company is at-will, is not for a specified

term, and may be terminated by the Company or by Employee at any time, with or without notice and with or without cause. While

not required, as a courtesy, the parties shall attempt if possible to give thirty (30) days’ notice of termination. This

clause shall not be interpreted to conflict with Employee’s at-will employment status. Employee and the Company further

understand and agree that no representation contrary to this section is valid, and that this section may not be augmented, contradicted,

or modified in any way, by any representative or agent of the Company or any other person, except by a writing signed by the Employee

and by the Board.

6.

TERMINATION

6.1

Upon termination for any reason, including voluntary resignation, Employee shall:

| |

(a) |

Be entitled to the compensation set forth in Section 3(a) hereof, prorated to the effective date of such termination; |

| |

(b) |

Be entitled to the equity compensation set forth in Section 3 (c) hereof, if not already issued |

| |

(c) |

Remain subject to the provisions of the Proprietary Information and Inventions Agreement, in the form attached hereto as Exhibit A, signed concurrently herewith; |

| |

(d) |

Be entitled to receive a termination payment for any accrued, unused vacation. |

| |

(e) |

Not be entitled to severance, unless as provided in Section 6.2. |

6.2

If Company terminates the employment of Employee without Cause (to be defined later in this section), the Company will, in addition

to the provisions of Section 6.1, and in exchange for Employee’s execution of a full and complete release of all claims

as described herein:

(i)

Pay Employee three months’ base compensation. Such payments are to be made in accordance with Company’s normal payroll

procedures with normal payroll deductions.

(ii)

The term “Cause” is defined to mean conduct that in the good faith judgment of the Board constitutes a material breach

of duty and is to include one or more of the following that results in a material adverse impact to the Company: falsification

of company documents, fraud, moral turpitude, theft, embezzlement, criminal conduct, indictment on felony criminal charges, serious

violations of Company policies, material breach of Employee’s employment agreement, extended or repeated absence from work

that in the reasonable judgment of the Board is unjustified, inability to perform duties for a period of thirty (30) or more days

without reasonable excuse and notice, or insubordination (e.g., refusal to carry out the reasonable instructions of the

Board). If the material breach of duty is reasonably curable, Company shall provide notice to Employee of such breach of duty

and shall give Employee a 30-day cure period. Refusal to relocate to a facility more than 50 miles from the current facility is

NOT considered Cause.

(vi)

Employee will be eligible for no other severance compensation, benefits, or vesting other than that which is provided for in this

Section 6.2 when he is terminated. A condition precedent to the Company’s obligation to fulfill the severance terms in this

Section 6.2 shall be Employee’s execution of a full and complete release of all claims against the Company, its Board, officers,

agents, and affiliates in reasonable form as provided by the Company. Nothing in this severance provision supersedes or in any

way alters the at-will provisions of Section 5 above.

(vii)

Employee agrees that he will surrender to the Company, at its request, or at the conclusion of his employment, all accounts, notes,

data, sketches, drawings and reproductions, and copies thereof, any of which (a) relate in any way to the business, products,

practices, or techniques of the Company, (b) contain Confidential Information, whether or not created by him, or (c) come into

his possession by reason of his employment with the Company; and Employee agrees further that all of the foregoing are the property

of the Company.

7.

LOYAL PERFORMANCE

7.1

Employee shall not, during the period of his employment by the Company, engage in any employment or activity in any business competitive

with the Company. Employee agrees to notify the Company in writing of any outside employment or business activity, including the

name of the business and the general nature of employee’s involvement, during the period of Employee’s employment

with the Company.

7.2

If, at any time during the period ending two years after Employee has ceased to be an employee of the Company (or of any subsidiary

or affiliate of the Company), whether or not pursuant to this agreement, Employee:

(a)

directly or indirectly engages with...

(b)

assists or has an active interest in, whether as owner, partner, shareholder, joint venturer, corporate officer, director, employee,

consultant, principal, agent, trustee or licensor, or in any other similar capacity whatsoever (provided that ownership of not

more than two percent of the outstanding stock of a corporation traded on a National securities exchange or quoted on NASDAQ OTC

shall not of itself be viewed as assisting or having an active interest)...

or

(c)

enters the employment of or acts as an agent for or advisor or consultant to...

...

any person, firm, partnership, association, corporation, business organization, entity, or enterprise (the Business”) that

is, or is about to become, directly or indirectly, engaged in any business or program that competes directly with or is substantially

similar to any business or program that the Company (or any subsidiary or affiliate of the Company) was involved in (or was in

the planning or development stage) during the 120-day period immediately prior to Employee’s ceasing to provide services

to the Company (or any subsidiary or affiliate of the Company) [such business or program shall include, but not be limited to,

those that involve: (a) any composition of matter or method that is protected by (i) any Company trade secret or (ii) any Company

intellectual property that is either issued, pending, or filed at the time of termination or (b) the use, research or development,

for any therapeutic or diagnostic purpose, of (i) any sphingolipid, (ii) any lysophosphatidic acid, or (iii) any component of

their respective pathways], then Employee shall immediately notify Company in writing of such involvement, including the name

of the Business and the nature of Employee’s involvement, and Employee agrees to fully respond to reasonable questions by

the Company regarding such involvement and to provide such further assurances reasonably requested by Company that Employee is

not and will not be in breach of the Proprietary Information and Inventions Agreement attached hereto as Exhibit A.

7.3

Employee will not, at any time, without prior written consent of the Company:

(a)

Directly or indirectly take any action or make or cause to be made any statements which would disparage the reputation of the

Company or any subsidiary or affiliate of the Company, or

(b)

Induce or attempt to influence any employee or consultant of the Company or any of its or their subsidiaries or affiliates to

terminate his or her employment.

7.4

Nothing contained in this Section 7 is intended to supersede or alter in any way the provisions of the Proprietary Information

and Inventions Agreement attached hereto as Exhibit A.

8.

CONFIDENTIALITY MATTERS

8.1

It is an express condition to the employment of Employee by Company that Employee sign and deliver a Proprietary Information and

Inventions Agreement in the form attached hereto as Exhibit A concurrently with the execution of this Agreement.

4.12

8.2 The covenants contained in the Proprietary Information and Inventions Agreement constitute separate covenants. If in

any judicial proceeding, a court shall hold that any of the covenants set forth in the Proprietary Information and Inventions

Agreement is not permitted by applicable laws, Employee and Company agree that such provision shall and is hereby reformed to

the maximum time, geographic, or occupational limitations permitted by such laws. Further, in the event a court shall hold unenforceable

any of the separate covenants deemed included herein, then such unenforceable covenant or covenants shall be deemed eliminated

from the provisions of this Agreement for the purpose of such proceeding to the extent necessary to permit the remaining separate

covenants to be enforced in such proceeding. Employee and Company further agree that the covenants in the Proprietary Information

and Inventions Agreement shall each be construed as a separate agreement independent of any other provisions of this Agreement,

and the existence of any claim or cause of action by Employee against the Company whether predicated on this Agreement or otherwise,

shall not constitute a defense to the enforcement by the Company of any of the covenants set forth in the Proprietary Information

and Inventions Agreement.

9.

ACKNOWLEDGMENT

Employee

acknowledges that he has been advised by Company to consult with independent counsel of his own choice, at his expense, as to

the entering into this Agreement, that he has had the opportunity to do so, and that he has taken advantage of the opportunity

to the extent that he desires. The Employee further acknowledges that he has read and that he understands this Agreement, is fully

aware of its legal effect, and has entered into it freely based on his own judgment and such professional advice as he has seen

fit to obtain.

10.

ARBITRATION

Employee

and the Company agree that in the event of any dispute concerning, arising out of, or related in any way to this Agreement, such

dispute shall be submitted to arbitration. Except as otherwise provided for herein, the disputes subject to this agreement to

arbitrate include, to the fullest extent allowable by law, all potential claims between Employee and Company including, but not

limited to, breach of contract, tort, discrimination, harassment, wrongful termination, compensation and benefits claims, constitutional

claims and claims for the violation of any local, state or federal statute, ordinance or regulation. Arbitration proceedings may

be commenced by either party by giving the other party written notice thereof and proceeding thereafter in accordance with the

rules and procedures of the American Arbitration Association and California law. Any such arbitration shall take place before

a single arbitrator only in Los Angeles, California. Any such arbitration shall be governed by and be subject to the applicable

laws of the State of California and the then-prevailing rules of the American Arbitration Association (the “AAA”).

If the parties are unable to agree on a single neutral arbitrator, the arbitrator shall be selected pursuant to the AAA rules.

The arbitrator’s award in any such arbitration shall be final and binding, and a judgment upon such award may be entered

and enforced by any court of competent jurisdiction. Each party to this Agreement understands that by agreeing to arbitrate

their disputes, they are giving up their right to have their disputes heard in a court of law and, if applicable, by a jury.

Company shall bear the costs of the arbitrator, the forum, and filing fees. Each party shall bear its own respective attorney’s

fees and all other costs, unless otherwise required or allowed by law and awarded by the arbitrator.

11.

VIOLATION OF THE PROPRIETARY INFORMATION AND INVENTIONS AGREEMENT

The

Employee agrees and acknowledges that the violation of any of the provisions contained in the Proprietary Information and Inventions

Agreement attached hereto as Exhibit A would cause irreparable injury to the Company, the remedy at law for any violation or threatened

violation thereof would be inadequate, and that the Company shall be entitled to temporary and permanent injunctive or other equitable

relief without the necessity of proving actual damages. The Employee agrees that such relief shall be available in a court of

law in Los Angeles, California, regardless of the arbitration provisions contained in Section 10 of this Agreement.

12.

MISCELLANEOUS

12.1

Amendment. This Agreement may not be modified or amended without the express prior written consent of the Company and the Employee.

12.2

Notices. All notices required or permitted under this Agreement shall be in writing, shall be sent either certified mail, return

receipt requested, or by facsimile transmission and mailed or sent to the relevant party at its address or facsimile number set

out below (or such other address or facsimile number as the addressee has given to the other parties in accordance with the terms

of this Section):

To

the Company:

Imaging3

Therapeutics, Inc.

3022

North Hollywood Way

Burbank,

California 91505

(818)

260-0930

To

the Employee:

Dane

Medley

_______________

_______________

_______________

Any

notice, demand or other communication so addressed to the relevant party shall be deemed to have been delivered (a) if given or

made by certified letter, return receipt requested, when actually delivered to the relevant party; and (b) if given or made by

facsimile, upon receipt of a transmission report confirming receipt.

12.3

Entire Agreement. This Agreement and the Exhibits attached hereto contain the entire agreement of the parties regarding the employment

of the Employee, and there are no other promises or conditions regarding the Employee’s employment in any other agreement,

whether oral or written. This Agreement shall terminate and supersede any previous employment agreements or arrangements between

Employee and Company.

12.4

Assignment. The rights and obligations of the Company under this Agreement shall inure to the benefit of and shall be binding

upon the successors and assigns of the respective corporation. Employee shall not be entitled to assign any of his rights or obligations

under this Agreement.

12.5

Sections. References herein to Sections are to the sections in this Agreement, unless the context requires otherwise.

12.6

Headings. The section headings are inserted for convenience only and shall not affect the construction of this Agreement.

12.7

Rules of Construction. Unless the context requires otherwise, words importing the singular include the plural and vice versa,

and words importing a gender include every gender.

4.13

12.8 Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective

and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any

respect under applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect any

other provision or any other jurisdiction, but this Agreement will be reformed, construed and enforced in such jurisdiction as

if such invalid, illegal or unenforceable provision had never been contained therein.

12.9

Survival. Any variation in salary or conditions mutually agreed upon after the effective date of this Agreement shall not constitute

a new agreement; instead, the terms and conditions of this Agreement, except as to such variation, shall continue in force.

12.10

Waiver. The failure of either party to enforce any provision of this Agreement shall not be construed as a waiver or limitation

of that party’s right to subsequently enforce and compel strict compliance with every provision of this Agreement.

12.11

Interpretation. This Agreement shall not be construed against any party on the grounds that such party drafted the Agreement or

caused it to be drafted.

12.12

Governing Law. This Agreement shall be governed by the laws of the State of California. Any controversy or claim arising out of

or relating to this Agreement or the breach thereof, whether involving remedies at law or equity, shall be adjudicated in Los

Angeles, California.

12.13

No Conflicting Agreements. Employee represents and warrants to the Company that he is not a party to or bound by any confidentiality,

noncompetition, nonsolicitation or other agreement or restriction which could conflict with or be violated by the performance

of Employee’s duties to the Company under this Agreement or otherwise. Employee agrees that he will not disclose to the

Company, use, or induce the Company to use, any invention or confidential information belonging to any third party.

IN

WITNESS WHEREOF, the parties hereto have executed this Agreement on the day and year first written above.

| IMAGING3, INC. |

|

EMPLOYEE |

| |

|

|

|

| By: |

|

|

|

| |

|

|

Signature |

| Its: |

|

|

|

| |

|

|

Print

Name |

EXHIBIT

A

TO

THE RESTATED EMPLOYMENT AGREEMENT

IMAGING3,

INC.

PROPRIETARY

INFORMATION & INVENTIONS AGREEMENT

4.1

This Agreement is entered into this 25th day of July 2006, by and between Imaging3, Inc., a California corporation having an

office at 3022 North Hollywood Way, Burbank CA 91505 (the “Company”), and _________________________________ (hereinafter

referred to as “Employee”), having a principal residence at ______________________________________________________________.

In

consideration of the compensation paid to Employee by the Company for Employee’s service as a member of the Company’s

Board of Employees during such time as may be mutually agreeable to the Company and Employee, the Company and Employee hereby

agree as follows:

1.

Confidentiality, Non-disclosure.

(a)

During the period of service, Employee will learn of and acquire Company and/or customer confidential, proprietary or other privileged

information whether or not developed by Employee, relating to the products, processes, genes, promoters, plasmids, biological

materials, microorganisms, computer programs, know-how, trade secrets, customers, suppliers, developments, patent rights and applications,

equipment, and business information made, used, developed or practiced by the Company in its business. Employee recognizes that

the success of the Company depends, in part, upon maintaining confidentiality of such information, which includes, without limitation,

all non-public results of research or experiments, unannounced projects or plans, and all materials and information labeled as

proprietary or confidential.

(b)

Employee agrees to hold in strict confidence and not to disclose, during the term of service to the Company or thereafter, to

anyone outside the Company or make use of such confidential, proprietary or privileged information except in the course of the

performance of Employee’s duties to the Company or otherwise upon the prior written consent of the company in each instance.

Disclosure of proprietary information through publications, seminars, posters and other media shall require the express written

consent of the Company. The Company recognizes that Employee may from time to time desire to communicate with members of the professional

community on matters of general interest. This paragraph is not intended to prohibit Employee’s interaction and communication

with members of the professional community regarding issues of a general nature and not involving the disclosure of any Company

confidences.

2.

Disclosure and Assignment of Inventions.

(a)

Employee will disclose promptly in writing to the Company every invention, discovery, improvement, process, technique, microorganism,

gene, promoter, plasmid, vector, biological material, copyrightable material or know-how (herein “Invention”), whether

patentable or not, made, conceived or developed, in whole or in part solely by Employee or jointly with others during the entire

period of service to the Company which relate to the Company’s existing or contemplated business or which result from or

are suggested by any work Employee has performed or may perform for the Company.

(b)

Employee hereby agrees to assign to the Company the entire right, title, and interest, domestic and foreign, to such Inventions.

Employee further agrees, during and after the period of service to the Company, to sign all papers, execute all oaths and do everything

necessary and proper to assign to the Company the domestic and foreign rights to said Inventions and to enable the Company to

apply for, obtain, maintain and enforce United States and foreign patents and copyrights therein. This obligation is limited by

the terms of Section 3 hereof.

(c)

The Company agrees to bear all expense which it causes to be incurred by Employee in assigning, obtaining, maintaining and enforcing

said patents and copyrights and further to pay Employee at a fair and reasonable rate for the time which it may require subsequent

to the termination of Employee’s service and to reimburse Employee for any reasonable expenses incurred in connection therewith.

(d)

With respect to such Inventions, whether patentable or not, conceived or made by Employee during the period of service, the obligations

of this Section I shall continue beyond the term of such employment and shall be binding upon the heirs, legatees, assigns, executors,

administrators and other legal representatives of Employee.

3.

Unrelated Inventions. In signing this Agreement, I understand that California Labor Code Section 2870, of which notification

is given below, applies to me regarding inventions, and that I am still required to disclose all my inventions to the Company.

NOTICE:

This Agreement does not apply to an invention that qualifies fully under the provisions of Labor Code Section 2870 of

the State of California, which states that:

(a)

Any employment-agreement provision stating that an employee shall assign, or offer to assign, any of his or her rights in an invention

to his or her employer shall not apply to an invention that the employee developed entirely on his or her own time without using

the employer’s equipment, supplies, facilities, or trade secret information, except for those inventions that either:

(1)

relate at the time of conception or reduction to practice of the invention to the employer’s business or actual demonstrably

anticipated research or development of the employer, or

(2)

result from any work performed by the employee for the employer.

(b)