Exhibit 99.1

American Public Education Reports Second Quarter 2020 Results

Enrollment Momentum Continues as Net Course Registrations at American Public University System Increased 18% and Student Enrollment at Hondros College of Nursing Increased 14%

Continued Focus on Providing Adult Learners with Quality, Affordable, Flexible and Inclusive Educational Opportunities

CHARLES TOWN, W.V., Aug. 10, 2020 /PRNewswire/ -- American Public Education, Inc. (Nasdaq: APEI) (the "Company") – parent company of online learning provider American Public University System (APUS) and on-ground pre-licensure Hondros College of Nursing (HCN) – announced financial results for the second quarter ended June 30, 2020 that reflected continued momentum in enrollment growth across both institutions and the ongoing turnaround at Hondros.

Second Quarter Highlights:

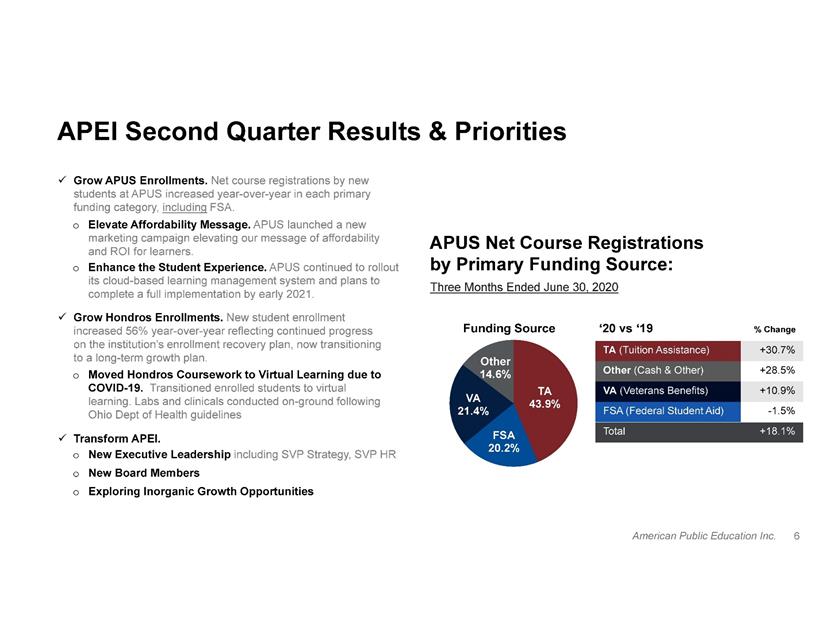

- Net course registrations by new students at APUS increased 30% year-over-year.

- Total net course registrations increased 18% year-over-year to 89,600.

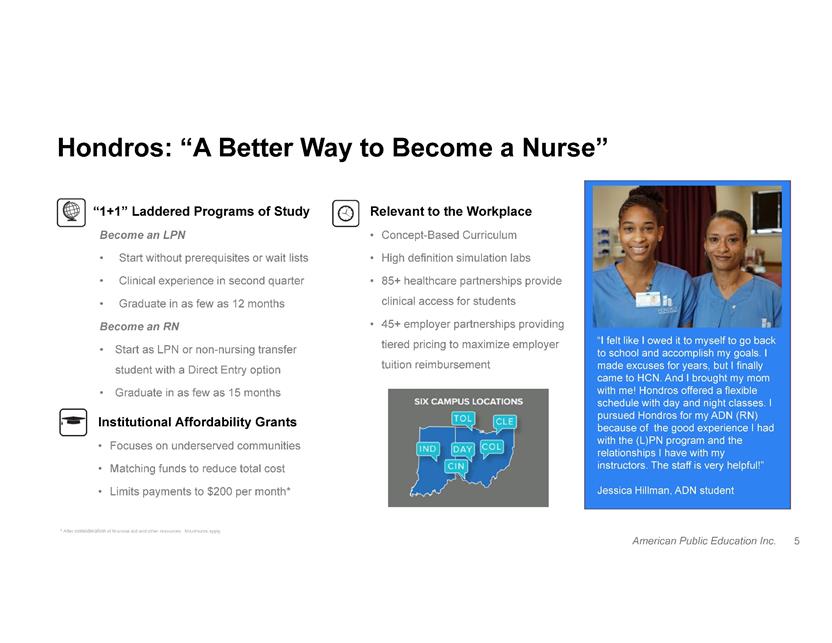

- New student enrollment at HCN increased 56% year-over-year and total student enrollment increased 14% year-over-year to 1,750.

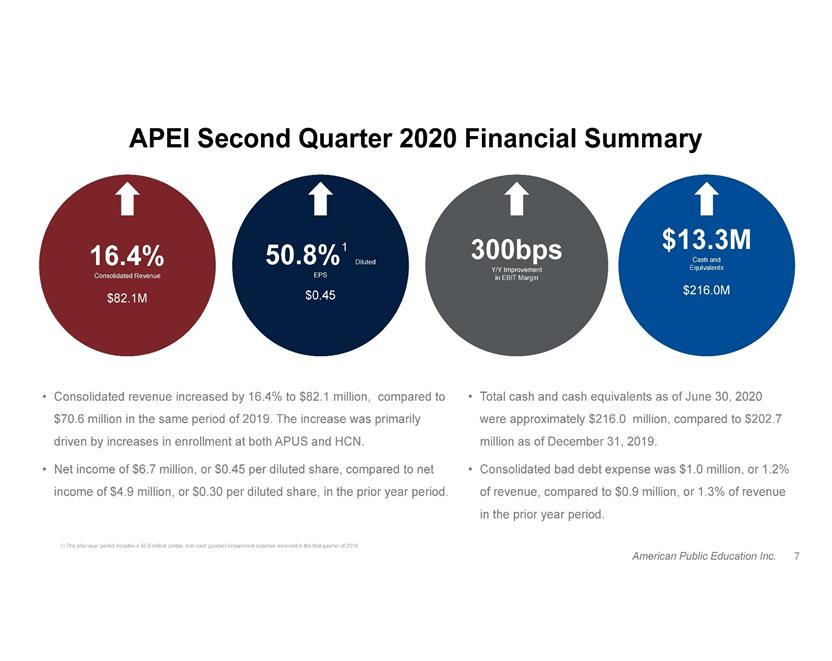

- Consolidated revenue increased 16.4% year-over-year to $82.1 million, compared to the prior year period.

- Net income increased 35.9% year-over-year to $6.7 million, or $0.45 per share.

"We are incredibly grateful that a growing number of adult learners seeking affordable, safe and uninterrupted access to high-quality higher-education experiences recognize the value of our learning platforms," said Angela Selden, Chief Executive Officer of APEI. "Our institutions were built on the belief that quality education should be accessible to all, not reserved for the few, and this is especially true during this period of great disruption in our economy and in higher education."

"The growth in enrollments in the second quarter as compared to a year ago reflects the ongoing transformation that has been taking place at APEI over the past year. At HCN, we have improved curriculum and made pre-licensure degrees more readily available to individuals interested in the nursing field. At APUS, students looking to improve their future career prospects chose APUS for its affordability and high-quality academic programs."

"Moving forward, we will continue to emphasize helping more adult learners maximize their higher education return on investment (HEROI) with highly relevant programs of study at affordable prices," added Selden. "We believe this approach, combined with the investments we are making in our business operations and in our ongoing technology transformation, will further strengthen our ability to serve learners of all backgrounds with great distinction."

Financial Results:

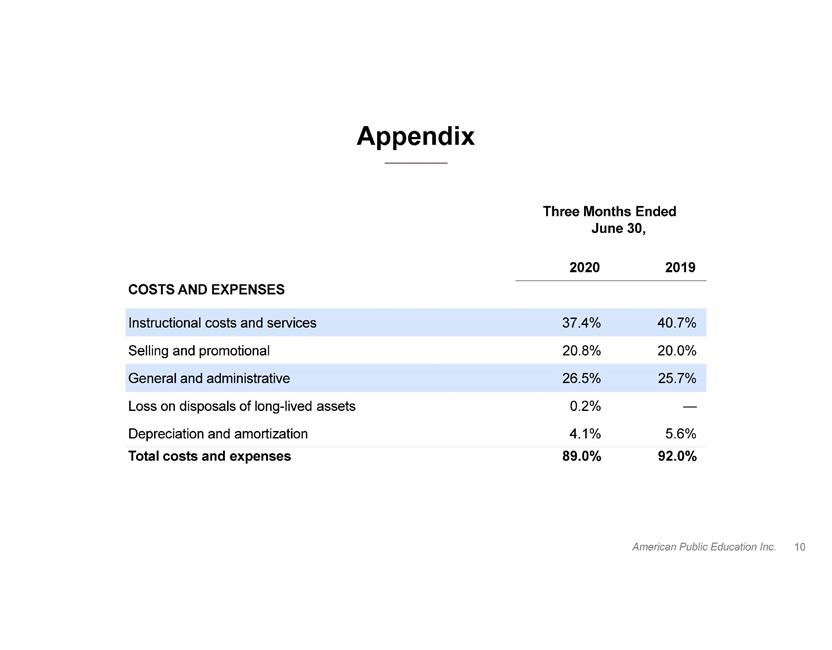

Total consolidated revenue for the second quarter of 2020 increased by 16.4% to $82.1 million, compared to total revenue of $70.6 million in the second quarter of 2019. The increase was driven by a $10.1 million, or 15.9%, increase in APEI Segment revenue and a $1.4 million, or 20.5%, increase in HCN Segment revenue resulting from increases in student enrollment.

Consolidated income from operations before interest income and income taxes in the second quarter of 2020 increased by 59.2% to $9.0 million, compared to $5.7 million in the prior year period. APEI Segment income from operations before interest income and income taxes increased by $2.5 million, compared to the prior year period. APEI Segment income includes a $1.9 million increase in pretax advertising costs as compared to the prior year period, as well as $1.3 million in professional fees associated with inorganic growth opportunities, and $1.0 million in pretax costs related to APEI's information technology transformation project. The HCN Segment reduced its loss from operations before interest income and income taxes to $0.04 million, from a loss of $0.9 million in the prior year period.

Net income for the three months ended June 30, 2020 was $6.7 million, or $0.45 per diluted share, compared to net income of $4.9 million, or $0.30 per diluted share, in the same period of 2019. The weighted average diluted shares outstanding for the second quarter of 2020 and 2019 were approximately 14.9 million and 16.7 million, respectively.

For the six months ended June 30, 2020, total consolidated revenue increased by 8.8% to $156.7 million, compared to total revenue of $144.0 million in the prior year period. The increase was driven by an $11.5 million, or 8.9%, increase in APEI Segment revenue and a $1.3 million, or 8.4%, increase in HCN Segment revenue, both resulting from increases in student enrollment.

Consolidated income from operations before interest income and income taxes for the six months ended June 30, 2020 was $11.7 million, compared to $7.1 million in the prior year period. This increase was driven by a $6.1 million decrease in HCN Segment loss from operations before interest income and income taxes. The HCN Segment loss for the prior year period includes a $5.9 million pretax, non-cash goodwill impairment expense recorded in the first quarter of 2019. APEI Segment income from operations before interest income and income taxes decreased $1.5 million, or 10.3%, compared to the prior year.

Net income for the six months ended June 30, 2020 was $9.1 million, or $0.61 per diluted share, compared to net income of $5.9 million, or $0.36 per diluted share, in the prior year period. The weighted average diluted shares outstanding for the six months ended June 30, 2020 and 2019 were approximately 15.0 million and 16.7 million, respectively.

Total cash and cash equivalents as of June 30, 2020 were approximately $216.0 million, compared to $202.7 million as of December 31, 2019. Capital expenditures were approximately $1.0 million for the three months ended June 30, 2020, compared to $1.4 million in the prior year period. Depreciation and amortization expense was $3.4 million for the three months ended June 30, 2020, compared to $3.9 million in the prior year period.

Registrations and Enrollment:

American Public University System1 |

|

|

|

For the three months ended June 30, | 2020 | 2019 | % Change |

Net Course Registrations by New Students | 12,100 | 9,300 | 30% |

Net Course Registrations | 89,600 | 75,900 | 18% |

|

|

|

|

|

For the six months ended June 30, |

|

|

|

Net Course Registrations by New Students | 22,300 | 19,500 | 14% |

Net Course Registrations | 174,400 | 160,200 | 9% |

|

|

|

|

|

As of June 30, |

|

|

|

APUS Student Enrollment2 | 83,700 | 80,300 | 4% |

|

|

|

|

|

Hondros College of Nursing3 |

|

|

|

For the three months ended June 30, | 2020 | 2019 | % Change |

New Student Enrollment | 490 | 315 | 56% |

Total Student Enrollment | 1,750 | 1,540 | 14% |

|

|

1APUS Net Course Registrations represent the approximate aggregate number of courses for which students remain enrolled after the date by which they may drop a course without financial penalty. |

2APUS Student Enrollment represents the number of unique active students, including those who are currently on an approved leave of absence, who are currently in class or have completed a course within the past 12 months. Excludes students in doctoral programs. |

3HCN Student Enrollment represents the approximate number of students enrolled in a course after the date by which students may drop a course without financial penalty. |

Third Quarter 2020 Outlook:

The following statements are based on APEI's current expectations. These statements are forward-looking and actual results may differ materially. The Company undertakes no obligation to update publicly any forward-looking statements for any reason unless required by law.

American Public Education anticipates third quarter 2020 consolidated revenue to increase between 10% and 14%, compared to the prior year period. The Company expects diluted earnings per share to be between $0.05 and $0.10 in the third quarter of 2020.

American Public Education expects the following results from its subsidiaries in the third quarter of 2020:

- At APUS, net course registrations by new students are expected to increase between 10% and 14% year-over-year and net course registrations are expected to increase between 8% and 12% year-over-year.

- At HCN, new student enrollment increased approximately 88% and total student enrollment increased approximately 38% year-over-year for the three months ended September 30, 2020.

Webcast:

A live webcast of the Company's second quarter 2020 earnings conference call will be broadcast today at 5:00 p.m. Eastern time. This call will be open to listeners who log in through the Company's investor relations website, www.apei.com.

A replay of the live webcast will also be available starting approximately one hour after the conclusion of the live conference call. The replay will be archived and available to listeners for one year.

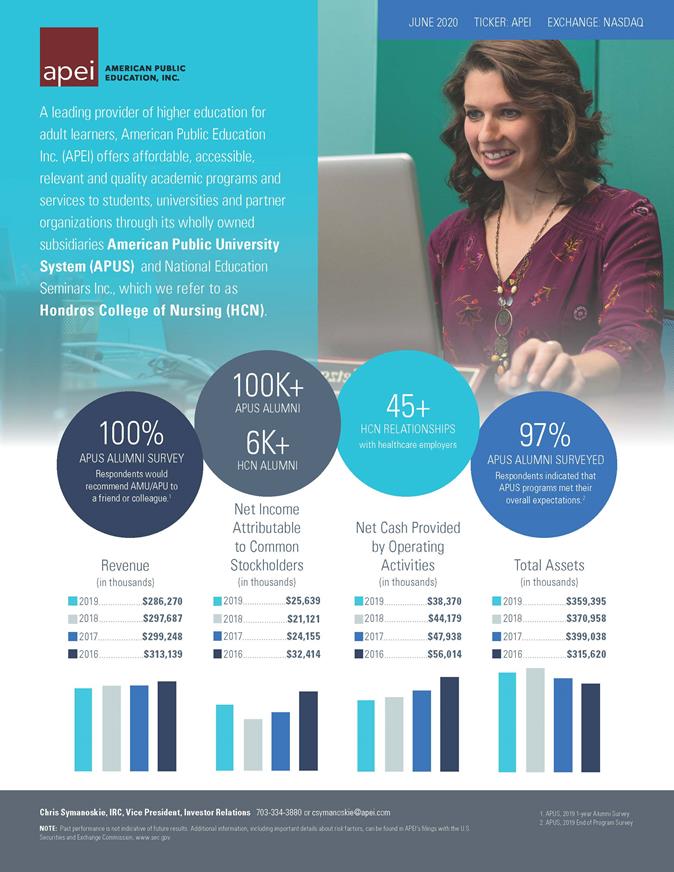

About American Public Education

American Public Education, Inc. (Nasdaq: APEI) is a leading provider of higher learning dedicated to preparing students all over the world for excellence in service, leadership and achievement. The Company offers respected, innovative and affordable academic programs and services to students, universities and partner organizations through wholly owned subsidiaries: American Public University System and National Education Seminars Inc., which we refer to in this press release as Hondros College of Nursing. Together, these institutions serve more than 80,000 adult learners worldwide and offer more than 200 degree and certificate programs in fields ranging from homeland security, military studies, intelligence, and criminal justice to technology, business administration, public health, nursing and liberal arts. For additional information, please visit

www.apei.com.

Forward Looking Statements

Statements made in this press release regarding American Public Education, Inc., or its subsidiaries, that are not historical facts are forward-looking statements based on current expectations, assumptions, estimates and projections about American Public Education, Inc. and the industry. Forward-looking statements can be identified by words such as "anticipate," "believe," "seek," "could," "estimate," "expect," "intend," "may," "plan," "should," "will" and "would." These forward-looking statements include, without limitation, statements regarding expected growth, expected registration and enrollments, expected revenues, earnings and expenses, plans with respect to recent, current and future initiatives, and future impacts of and the Company's response to the COVID-19 pandemic.

Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, among others, risks related to: the Company's dependence on the effectiveness of its ability to attract students who persist in its institutions' programs; impacts of the COVID-19 pandemic; the Company's ability to effectively market its institutions' programs; adverse effects of changes the Company makes to improve the student experience and enhance the ability to identify and enroll students who are likely to succeed; the Company's ability to maintain strong relationships with the military and maintain enrollments from military students; the Company's ability to comply with regulatory and accrediting agency requirements and to maintain institutional accreditation; the Company's reliance on Department of Defense tuition assistance, Title IV programs, and other sources of financial aid; the Company's dependence on its technology infrastructure; strong competition in the postsecondary education market and from non-traditional offerings; and the various risks described in the "Risk Factors" section and elsewhere in the Company's Annual Report on Form 10-K for the year ended December 31, 2019, Quarterly Report on Form 10-Q for the period ended June 30, 2020, and other filings with the SEC. You should not place undue reliance on any forward-looking statements. The Company undertakes no obligation to update publicly any forward-looking statements for any reason, unless required by law, even if new information becomes available or other events occur in the future.

Contacts:

Richard W. Sunderland, Jr., CPA

Executive Vice President and Chief Financial Officer

304.885.5371

Christopher L. Symanoskie, IRC

Vice President, Investor Relations

703.334.3880

American Public Education, Inc. | |||||||

Consolidated Statement of Income | |||||||

(In thousands, except per share data) | |||||||

|

|

|

|

|

|

|

|

|

|

| Three Months Ended |

| |||||

|

| June 30, |

| |||||

|

| 2020 |

|

| 2019 |

| ||

|

| (unaudited) |

| |||||

|

|

|

|

|

|

|

|

|

Revenues | $ | 82,127 |

|

| $ | 70,560 |

|

Costs and expenses: |

|

|

|

|

|

|

|

Instructional costs and services |

| 30,744 |

|

|

| 28,725 |

|

Selling and promotional |

| 17,056 |

|

|

| 14,087 |

|

General and administrative |

| 21,737 |

|

|

| 18,123 |

|

Loss on disposals of long-lived assets |

| 158 |

|

|

| 4 |

|

Depreciation and amortization |

| 3,391 |

|

|

| 3,943 |

|

Total costs and expenses |

| 73,086 |

|

|

| 64,882 |

|

|

|

|

|

|

|

|

|

|

Income from operations before interest income and income taxes |

| 9,041 |

|

|

| 5,678 |

|

Interest income, net |

| 179 |

|

|

| 1,135 |

|

Income before income taxes |

| 9,220 |

|

|

| 6,813 |

|

|

|

|

|

|

|

|

|

|

Income tax expense |

| 2,532 |

|

|

| 1,898 |

|

Equity investment income |

| 1 |

|

|

| 6 |

|

Net income | $ | 6,689 |

|

| $ | 4,921 |

|

|

|

|

|

|

|

| ||

Net income per common share: |

|

|

|

|

| ||

Basic | $ | 0.45 |

|

| $ | 0.30 |

|

Diluted | $ | 0.45 |

|

| $ | 0.30 |

|

|

|

|

|

|

|

| ||

Weighted average number of common shares: |

|

|

|

|

|

|

|

Basic |

| 14,789 |

|

|

| 16,512 |

|

Diluted |

| 14,948 |

|

|

| 16,653 |

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| Three Months Ended |

| |||||

Segment Information: | June 30, |

| |||||

|

| 2020 |

|

| 2019 |

| ||

Revenues: |

|

|

|

|

|

|

|

American Public Education, Inc. | $ | 73,547 |

|

| $ | 63,448 |

|

Hondros College of Nursing | $ | 8,602 |

|

| $ | 7,141 |

|

Intersegment Elimination1 | $ | (22) |

|

| $ | (29) |

|

Income (loss) from operations before interest income and income taxes: |

|

|

|

|

|

|

|

American Public Education, Inc. | $ | 9,077 |

|

| $ | 6,589 |

|

Hondros College of Nursing | $ | (35) |

|

| $ | (910) |

|

Intersegment Elimination1 | $ | (1) |

|

| $ | (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six Months Ended |

| |||||

|

| June 30, |

| |||||

|

| 2020 |

|

| 2019 |

| ||

|

| (unaudited) |

| |||||

|

|

|

|

|

|

|

|

|

Revenues | $ | 156,743 |

|

| $ | 144,001 |

|

Costs and expenses: |

|

|

|

|

|

|

|

Instructional costs and services |

| 59,974 |

|

|

| 56,640 |

|

Selling and promotional |

| 35,242 |

|

|

| 29,134 |

|

General and administrative |

| 42,740 |

|

|

| 37,188 |

|

Loss on disposals of long-lived assets |

| 324 |

|

|

| 130 |

|

Impairment of Goodwill |

| — |

|

|

| 5,855 |

|

Depreciation and amortization |

| 6,729 |

|

|

| 7,994 |

|

Total costs and expenses |

| 145,009 |

|

|

| 136,941 |

|

|

|

|

|

|

|

|

|

|

Income from operations before interest income and income taxes |

| 11,734 |

|

|

| 7,060 |

|

Interest income, net |

| 881 |

|

|

| 2,188 |

|

Income before income taxes |

| 12,615 |

|

|

| 9,248 |

|

|

|

|

|

|

|

|

|

|

Income tax expense |

| 3,506 |

|

|

| 1,835 |

|

Equity investment income (loss) |

| — |

|

|

| (1,481) |

|

Net income | $ | 9,109 |

|

| $ | 5,932 |

|

|

|

|

|

|

|

| ||

Net income per common share: |

|

|

|

|

| ||

Basic | $ | 0.61 |

|

| $ | 0.36 |

|

Diluted | $ | 0.61 |

|

| $ | 0.36 |

|

|

|

|

|

|

|

| ||

Weighted average number of common shares: |

|

|

|

|

|

|

|

Basic |

| 14,907 |

|

|

| 16,522 |

|

Diluted |

| 15,026 |

|

|

| 16,671 |

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

| Six Months Ended |

| |||||

Segment Information: | June 30, |

| |||||

|

| 2020 |

|

| 2019 |

| ||

Revenues: |

|

|

|

|

|

|

|

American Public Education, Inc. | $ | 140,641 |

|

| $ | 129,169 |

|

Hondros College of Nursing | $ | 16,141 |

|

| $ | 14,888 |

|

Intersegment Elimination1 | $ | (39) |

|

| $ | (56) |

|

Income (loss) from operations before interest income and income taxes: |

|

|

|

|

|

|

|

American Public Education, Inc. | $ | 12,655 |

|

| $ | 14,111 |

|

Hondros College of Nursing | $ | (921) |

|

| $ | (7,056) |

|

Intersegment Elimination1 | $ | — |

|

| $ | 5 |

|

|

|

|

|

|

|

|

|

|

1.The APEI Segment charges the HCN Segment for the value of courses taken by HCN Segment employees at APUS. The intersegment elimination represents the elimination of this intersegment revenue in consolidation. | |||||||