apei-2022123100012017922022FYFALSE5611233http://fasb.org/us-gaap/2022#GoodwillAndIntangibleAssetImpairmentP1Yhttp://www.americanpubliceducation.com/20221231#LeaseLiabilityCurrenthttp://www.americanpubliceducation.com/20221231#LeaseLiabilityCurrenthttp://www.americanpubliceducation.com/20221231#LeaseLiabilityNoncurrenthttp://www.americanpubliceducation.com/20221231#LeaseLiabilityNoncurrent00012017922022-01-012022-12-3100012017922022-06-30iso4217:USD00012017922023-03-10xbrli:shares00012017922021-12-3100012017922022-12-31iso4217:USDxbrli:shares0001201792us-gaap:SeriesAPreferredStockMember2021-12-310001201792us-gaap:SeriesAPreferredStockMember2022-12-3100012017922020-01-012020-12-3100012017922021-01-012021-12-310001201792us-gaap:PreferredStockMember2019-12-310001201792us-gaap:CommonStockMember2019-12-310001201792us-gaap:AdditionalPaidInCapitalMember2019-12-310001201792us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001201792us-gaap:RetainedEarningsMember2019-12-3100012017922019-12-310001201792us-gaap:CommonStockMember2020-01-012020-12-310001201792us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001201792us-gaap:RetainedEarningsMember2020-01-012020-12-310001201792us-gaap:PreferredStockMember2020-12-310001201792us-gaap:CommonStockMember2020-12-310001201792us-gaap:AdditionalPaidInCapitalMember2020-12-310001201792us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001201792us-gaap:RetainedEarningsMember2020-12-3100012017922020-12-310001201792us-gaap:CommonStockMember2021-01-012021-12-310001201792us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001201792us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001201792us-gaap:RetainedEarningsMember2021-01-012021-12-310001201792us-gaap:PreferredStockMember2021-12-310001201792us-gaap:CommonStockMember2021-12-310001201792us-gaap:AdditionalPaidInCapitalMember2021-12-310001201792us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001201792us-gaap:RetainedEarningsMember2021-12-310001201792us-gaap:PreferredStockMember2022-01-012022-12-310001201792us-gaap:RetainedEarningsMember2022-01-012022-12-310001201792us-gaap:CommonStockMember2022-01-012022-12-310001201792us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001201792us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001201792us-gaap:PreferredStockMember2022-12-310001201792us-gaap:CommonStockMember2022-12-310001201792us-gaap:AdditionalPaidInCapitalMember2022-12-310001201792us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001201792us-gaap:RetainedEarningsMember2022-12-310001201792apei:RasmussenUniversitySegmentMember2022-01-012022-12-31apei:campusapei:state0001201792apei:HondrosCollegeOfNursingSegmentMemberstpr:OH2022-01-012022-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberstpr:IN2022-01-012022-12-31apei:segment0001201792us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001201792srt:MaximumMemberapei:ProgramDevelopmentMember2022-01-012022-12-310001201792apei:FutureCoursesMember2021-12-310001201792apei:FutureCoursesMember2022-12-310001201792apei:RasmussenMember2021-09-012021-09-010001201792apei:RasmussenMember2021-09-010001201792apei:RasmussenMember2022-01-012022-03-310001201792apei:RasmussenUniversitySegmentMember2022-04-012022-06-300001201792us-gaap:TradeNamesMember2021-09-010001201792apei:AccreditationLicensingAndTitleFourMember2021-09-010001201792apei:StudentRosterMember2021-09-012021-09-010001201792apei:StudentRosterMember2021-09-010001201792apei:CurriculaMember2021-09-012021-09-010001201792apei:CurriculaMember2021-09-010001201792apei:LeadConversionsMember2021-09-012021-09-010001201792apei:LeadConversionsMember2021-09-0100012017922021-09-010001201792apei:AccreditationLicensingAndTitleFourMemberapei:RasmussenUniversitySegmentMember2022-04-012022-06-300001201792apei:AccreditationLicensingAndTitleFourMemberapei:RasmussenUniversitySegmentMember2022-10-012022-12-310001201792apei:RasmussenMember2020-01-012020-12-310001201792apei:RasmussenMember2021-01-012021-12-310001201792apei:GraduateSchoolUSAMember2021-08-102021-08-100001201792apei:GraduateSchoolUSAMember2021-08-100001201792apei:GraduateSchoolUSAMember2022-01-012022-12-310001201792apei:GraduateSchoolUSAMember2022-04-012022-06-300001201792apei:GraduateSchoolUSAMember2022-01-012022-01-010001201792apei:GraduateSchoolUSAMember2022-01-010001201792apei:CustomerContractsAndRelationshipsMember2022-01-012022-01-010001201792apei:CustomerContractsAndRelationshipsMember2022-01-010001201792apei:CurriculaMember2022-01-012022-01-010001201792apei:CurriculaMember2022-01-010001201792us-gaap:TradeNamesMember2022-01-012022-01-010001201792us-gaap:TradeNamesMember2022-01-010001201792apei:AccreditationLicensingAndTitleFourMember2022-01-012022-01-010001201792apei:AccreditationLicensingAndTitleFourMember2022-01-0100012017922022-01-010001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMember2022-01-012022-12-310001201792apei:GraduationFeesMemberapei:AmericanPublicEducationIncSegmentMember2022-01-012022-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberapei:TextbookAndOtherCourseMaterialsMember2022-01-012022-12-310001201792apei:AmericanPublicEducationIncSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2020-01-012020-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMember2020-01-012020-12-310001201792apei:GraduationFeesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792apei:GraduationFeesMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2020-01-012020-12-310001201792apei:GraduationFeesMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792apei:GraduationFeesMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001201792apei:GraduationFeesMember2020-01-012020-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMemberapei:TextbookAndOtherCourseMaterialsMember2020-01-012020-12-310001201792us-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMemberapei:TextbookAndOtherCourseMaterialsMember2020-01-012020-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMemberapei:TextbookAndOtherCourseMaterialsMember2020-01-012020-12-310001201792us-gaap:IntersegmentEliminationMemberapei:TextbookAndOtherCourseMaterialsMember2020-01-012020-12-310001201792apei:TextbookAndOtherCourseMaterialsMember2020-01-012020-12-310001201792apei:OtherFeesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792apei:OtherFeesMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2020-01-012020-12-310001201792apei:OtherFeesMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792apei:OtherFeesMemberus-gaap:IntersegmentEliminationMember2020-01-012020-12-310001201792apei:OtherFeesMember2020-01-012020-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792us-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2020-01-012020-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001201792apei:AmericanPublicEducationIncSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2021-01-012021-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMember2021-01-012021-12-310001201792apei:GraduationFeesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792apei:GraduationFeesMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2021-01-012021-12-310001201792apei:GraduationFeesMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792apei:GraduationFeesMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001201792apei:GraduationFeesMember2021-01-012021-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMemberapei:TextbookAndOtherCourseMaterialsMember2021-01-012021-12-310001201792us-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMemberapei:TextbookAndOtherCourseMaterialsMember2021-01-012021-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMemberapei:TextbookAndOtherCourseMaterialsMember2021-01-012021-12-310001201792us-gaap:IntersegmentEliminationMemberapei:TextbookAndOtherCourseMaterialsMember2021-01-012021-12-310001201792apei:TextbookAndOtherCourseMaterialsMember2021-01-012021-12-310001201792apei:OtherFeesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792apei:OtherFeesMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2021-01-012021-12-310001201792apei:OtherFeesMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792apei:OtherFeesMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001201792apei:OtherFeesMember2021-01-012021-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792us-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2021-01-012021-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001201792apei:AmericanPublicEducationIncSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2022-01-012022-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001201792apei:GraduationFeesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792apei:GraduationFeesMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2022-01-012022-12-310001201792apei:GraduationFeesMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792apei:GraduationFeesMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001201792apei:GraduationFeesMember2022-01-012022-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMemberapei:TextbookAndOtherCourseMaterialsMember2022-01-012022-12-310001201792us-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMemberapei:TextbookAndOtherCourseMaterialsMember2022-01-012022-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMemberapei:TextbookAndOtherCourseMaterialsMember2022-01-012022-12-310001201792us-gaap:IntersegmentEliminationMemberapei:TextbookAndOtherCourseMaterialsMember2022-01-012022-12-310001201792apei:TextbookAndOtherCourseMaterialsMember2022-01-012022-12-310001201792apei:OtherFeesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792apei:OtherFeesMemberus-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2022-01-012022-12-310001201792apei:OtherFeesMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792apei:OtherFeesMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001201792apei:OtherFeesMember2022-01-012022-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792us-gaap:OperatingSegmentsMemberapei:RasmussenUniversityMemberMember2022-01-012022-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792us-gaap:IntersegmentEliminationMember2022-01-012022-12-310001201792apei:CoursesInProgressMember2021-12-310001201792apei:CoursesInProgressMember2022-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2022-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2021-12-310001201792apei:AmericanPublicEducationIncSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMembersrt:MinimumMember2022-01-012022-12-310001201792srt:MaximumMemberapei:AmericanPublicEducationIncSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMember2022-01-012022-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberapei:InstructionalServicesNetOfGrantsAndScholarshipsMember2022-01-012022-12-310001201792apei:InstructionalServicesNetOfGrantsAndScholarshipsMemberapei:RasmussenUniversityMemberMember2022-01-012022-12-310001201792us-gaap:LandMember2021-12-310001201792us-gaap:LandMember2022-12-310001201792us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2022-01-012022-12-310001201792srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001201792us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001201792us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001201792us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2022-01-012022-12-310001201792us-gaap:LeaseholdImprovementsMember2021-12-310001201792us-gaap:LeaseholdImprovementsMember2022-12-310001201792us-gaap:OfficeEquipmentMember2022-01-012022-12-310001201792us-gaap:OfficeEquipmentMember2021-12-310001201792us-gaap:OfficeEquipmentMember2022-12-310001201792us-gaap:ComputerEquipmentMembersrt:MinimumMember2022-01-012022-12-310001201792srt:MaximumMemberus-gaap:ComputerEquipmentMember2022-01-012022-12-310001201792us-gaap:ComputerEquipmentMember2021-12-310001201792us-gaap:ComputerEquipmentMember2022-12-310001201792us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-01-012022-12-310001201792srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001201792us-gaap:FurnitureAndFixturesMember2021-12-310001201792us-gaap:FurnitureAndFixturesMember2022-12-310001201792us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-01-012022-12-310001201792us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-12-310001201792us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310001201792us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2022-01-012022-12-310001201792srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001201792us-gaap:SoftwareDevelopmentMember2021-12-310001201792us-gaap:SoftwareDevelopmentMember2022-12-310001201792apei:ProgramDevelopmentMember2022-01-012022-12-310001201792apei:ProgramDevelopmentMember2021-12-310001201792apei:ProgramDevelopmentMember2022-12-310001201792apei:AmericanPublicEducationIncSegmentMember2020-01-012020-12-310001201792apei:AmericanPublicEducationIncSegmentMember2021-01-012021-12-310001201792apei:AmericanPublicEducationIncSegmentMember2022-01-012022-12-310001201792apei:RasmussenMember2021-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2020-12-310001201792apei:RasmussenMember2022-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2022-12-310001201792apei:RasmussenUniversitySegmentMember2022-12-31xbrli:pure0001201792apei:AmericanPublicUniversitySystemSegmentMember2020-12-310001201792apei:RasmussenUniversitySegmentMember2020-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2020-12-310001201792apei:RasmussenUniversitySegmentMember2021-01-012021-12-310001201792apei:AmericanPublicUniversitySystemSegmentMember2021-01-012021-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2021-01-012021-12-310001201792apei:AmericanPublicUniversitySystemSegmentMember2021-12-310001201792apei:RasmussenUniversitySegmentMember2021-12-310001201792apei:AmericanPublicUniversitySystemSegmentMember2022-01-012022-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2022-01-012022-12-310001201792apei:AmericanPublicUniversitySystemSegmentMember2022-12-310001201792apei:RasmussenUniversitySegmentMember2022-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2021-12-310001201792apei:GraduateSchoolUSAMember2022-12-310001201792srt:MinimumMemberapei:StudentRelationshipsMember2022-01-012022-12-310001201792srt:MaximumMemberapei:StudentRelationshipsMember2022-01-012022-12-310001201792us-gaap:NoncompeteAgreementsMember2022-01-012022-12-310001201792apei:CurriculaMember2022-01-012022-12-310001201792apei:AccreditationAndLicensesMember2022-01-012022-12-310001201792apei:LeadConversionsMember2022-01-012022-12-310001201792apei:StudentRosterMember2022-01-012022-12-310001201792apei:TradenameMember2022-01-012022-12-310001201792apei:AccreditationLicensingAndTitleFourMemberapei:RasmussenMember2022-06-300001201792apei:AccreditationLicensingAndTitleFourMemberapei:RasmussenMember2022-12-310001201792apei:AccreditationLicensingAndTitleFourMemberapei:RasmussenMember2022-04-012022-06-300001201792apei:AccreditationLicensingAndTitleFourMemberapei:RasmussenMember2022-10-012022-12-310001201792apei:AccreditationLicensingAndTitleFourMemberapei:RasmussenUniversitySegmentMember2022-01-012022-12-310001201792apei:StudentRosterMember2021-12-310001201792apei:CurriculaMember2021-12-310001201792apei:StudentRelationshipsMember2021-12-310001201792apei:LeadConversionsMember2021-12-310001201792us-gaap:NoncompeteAgreementsMember2021-12-310001201792us-gaap:TrademarksMember2021-12-310001201792apei:AccreditationLicensingAndTitleFourMember2021-12-310001201792apei:AffiliatesMember2021-12-310001201792apei:StudentRosterMember2022-12-310001201792apei:CurriculaMember2022-12-310001201792apei:StudentRelationshipsMember2022-12-310001201792apei:LeadConversionsMember2022-12-310001201792us-gaap:NoncompeteAgreementsMember2022-12-310001201792apei:TradenameMember2022-12-310001201792apei:AccreditationAndLicensesMember2022-12-310001201792us-gaap:TrademarksMember2022-12-310001201792apei:AccreditationLicensingAndTitleFourMember2022-12-310001201792apei:AccreditationLicensingAndTitleFourMember2022-01-012022-12-310001201792apei:AffiliatesMember2022-12-310001201792us-gaap:SecuredDebtMemberapei:SeniorSecuredTermLoanFacilityMember2022-12-310001201792us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001201792us-gaap:LineOfCreditMemberapei:SubfacilityForSwingLineLoansMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001201792us-gaap:SecuredDebtMemberapei:SeniorSecuredTermLoanFacilityMember2021-12-310001201792us-gaap:LineOfCreditMember2022-12-310001201792us-gaap:SecuredDebtMember2022-12-310001201792us-gaap:SecuredDebtMemberapei:SeniorSecuredTermLoanFacilityMember2022-01-012022-12-310001201792us-gaap:SecuredDebtMember2022-01-012022-12-310001201792us-gaap:SecuredDebtMemberapei:SeniorSecuredTermLoanFacilityMember2021-01-012021-12-310001201792us-gaap:SecuredDebtMemberapei:SeniorSecuredTermLoanFacilityMember2022-12-012022-12-310001201792us-gaap:InterestRateCapMember2021-09-300001201792us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:InterestRateCapMember2021-09-300001201792us-gaap:InterestRateCapMember2022-12-310001201792us-gaap:InterestRateCapMember2022-01-012022-12-310001201792us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001201792us-gaap:StateAndLocalJurisdictionMember2022-12-310001201792us-gaap:DomesticCountryMember2022-12-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2022-01-012022-12-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2022-12-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2020-03-312020-03-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2020-06-302020-06-300001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2020-09-302020-09-300001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2020-12-312020-12-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2020-01-012020-12-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2021-03-312021-03-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2021-06-302021-06-300001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2021-09-302021-09-300001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2021-12-312021-12-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2021-01-012021-12-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2022-03-312022-03-310001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2022-06-302022-06-300001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2022-09-302022-09-300001201792apei:AmericanPublicEducationIncEmployeeStockPurchasePlanMember2022-12-312022-12-310001201792apei:TwentySeventeenIncentivePlanMember2022-12-310001201792apei:AmendedAmericanPublicEducationInc2017OmnibusPlanMember2020-05-152020-05-150001201792apei:AmendedAmericanPublicEducationInc2017OmnibusPlanMember2020-05-202020-05-200001201792apei:TwentySeventeenIncentivePlanMember2022-01-012022-12-310001201792apei:RestrictedStockandRestrictedStockUnitsMember2019-12-310001201792apei:RestrictedStockandRestrictedStockUnitsMember2020-01-012020-12-310001201792apei:RestrictedStockandRestrictedStockUnitsMember2020-12-310001201792apei:RestrictedStockandRestrictedStockUnitsMember2021-01-012021-12-310001201792apei:RestrictedStockandRestrictedStockUnitsMember2021-12-310001201792apei:RestrictedStockandRestrictedStockUnitsMember2022-01-012022-12-310001201792apei:RestrictedStockandRestrictedStockUnitsMember2022-12-310001201792us-gaap:EmployeeStockOptionMember2022-01-012022-12-3100012017922019-01-012019-12-310001201792us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001201792us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001201792us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001201792us-gaap:EmployeeStockOptionMember2022-12-310001201792apei:InstructionalCostsAndExpensesMember2020-01-012020-12-310001201792apei:InstructionalCostsAndExpensesMember2021-01-012021-12-310001201792apei:InstructionalCostsAndExpensesMember2022-01-012022-12-310001201792us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001201792us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001201792us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001201792us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001201792us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001201792us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-3100012017922019-05-0200012017922019-12-050001201792apei:ProgramRestrictedByConsentOfShareholdersMember2022-12-310001201792us-gaap:SeriesAPreferredStockMember2022-12-282022-12-280001201792us-gaap:SeriesAPreferredStockMember2022-12-280001201792us-gaap:EquipmentTrustCertificateMemberus-gaap:SeriesAPreferredStockMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-12-282022-12-280001201792us-gaap:EquipmentTrustCertificateMemberus-gaap:SeriesAPreferredStockMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMember2022-12-282022-12-280001201792us-gaap:EquipmentTrustCertificateMembersrt:MaximumMemberus-gaap:SeriesAPreferredStockMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-12-282022-12-280001201792apei:DepartmentOfDefenseTuitionAssistanceProgramsMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2020-01-012020-12-310001201792apei:DepartmentOfDefenseTuitionAssistanceProgramsMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001201792apei:DepartmentOfDefenseTuitionAssistanceProgramsMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001201792apei:VeteranEducationBenefitsMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2020-01-012020-12-310001201792apei:VeteranEducationBenefitsMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001201792apei:VeteranEducationBenefitsMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2020-01-012020-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2021-01-012021-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2022-01-012022-12-310001201792apei:CashAndOtherSourcesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2020-01-012020-12-310001201792apei:CashAndOtherSourcesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001201792apei:CashAndOtherSourcesMemberapei:AmericanPublicEducationIncSegmentMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001201792us-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2020-01-012020-12-310001201792us-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2021-01-012021-12-310001201792us-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2022-01-012022-12-310001201792apei:CashAndOtherSourcesMemberus-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMember2020-01-012020-12-310001201792apei:CashAndOtherSourcesMemberus-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001201792apei:CashAndOtherSourcesMemberus-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001201792apei:VeteranEducationBenefitsMemberus-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMember2020-01-012020-12-310001201792apei:VeteranEducationBenefitsMemberus-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001201792apei:VeteranEducationBenefitsMemberus-gaap:CustomerConcentrationRiskMemberapei:RasmussenUniversitySegmentMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001201792us-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2020-01-012020-12-310001201792us-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2021-01-012021-12-310001201792us-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMemberapei:TitleIVProgramsMember2022-01-012022-12-310001201792apei:CashAndOtherSourcesMemberus-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2020-01-012020-12-310001201792apei:CashAndOtherSourcesMemberus-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001201792apei:CashAndOtherSourcesMemberus-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310001201792apei:VeteranEducationBenefitsMemberus-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2020-01-012020-12-310001201792apei:VeteranEducationBenefitsMemberus-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2021-01-012021-12-310001201792apei:VeteranEducationBenefitsMemberus-gaap:CustomerConcentrationRiskMemberapei:HondrosCollegeOfNursingSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-3100012017922021-01-012021-06-300001201792apei:RasmussenUniversitySegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001201792apei:RasmussenUniversitySegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001201792apei:RasmussenUniversitySegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001201792us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001201792us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001201792us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001201792apei:AmericanPublicEducationIncSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001201792apei:RasmussenUniversitySegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001201792apei:RasmussenUniversitySegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001201792apei:HondrosCollegeOfNursingSegmentMemberus-gaap:OperatingSegmentsMember2022-12-310001201792us-gaap:CorporateNonSegmentMember2021-12-310001201792us-gaap:CorporateNonSegmentMember2022-12-3100012017922021-01-012021-03-3100012017922021-04-012021-06-3000012017922021-07-012021-09-3000012017922021-10-012021-12-3100012017922022-01-012022-03-3100012017922022-04-012022-06-3000012017922022-07-012022-09-3000012017922022-10-012022-12-310001201792apei:AmericanPublicEducationIncSegmentMember2021-12-310001201792apei:AmericanPublicEducationIncSegmentMember2022-12-310001201792us-gaap:CorporateAndOtherMember2021-12-310001201792us-gaap:CorporateAndOtherMember2022-01-012022-12-310001201792us-gaap:CorporateAndOtherMember2022-12-310001201792us-gaap:AllowanceForCreditLossMember2021-12-310001201792us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001201792us-gaap:AllowanceForCreditLossMember2022-12-310001201792apei:AmericanPublicEducationIncSegmentMember2020-12-310001201792us-gaap:AllowanceForCreditLossMember2020-12-310001201792us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001201792apei:AmericanPublicEducationIncSegmentMember2019-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2019-12-310001201792apei:HondrosCollegeOfNursingSegmentMember2020-01-012020-12-310001201792us-gaap:AllowanceForCreditLossMember2019-12-310001201792us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310001201792apei:RasmussenUniversitySegmentMember2021-09-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☒ Annual Report Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2022

or

☐ Transition report pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

For the transition period from ______ to ______

Commission file number: 001-33810

American Public Education, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware | 01-0724376 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

111 West Congress Street, Charles Town, West Virginia | 25414 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (304) 724-3700

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | APEI | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | þ | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, computed by reference to the price at which the common stock was last sold on the Nasdaq Global Select Market on that date, was approximately $302 million.

The total number of shares of common stock outstanding as of March 10, 2023, was 19,030,770.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s Definitive Proxy Statement for its 2023 Annual Meeting of Stockholders (which is expected to be filed with the Commission within 120 days after the end of the registrant’s 2022 fiscal year) are incorporated by reference into Part III of this Annual Report.

AMERICAN PUBLIC EDUCATION, INC.

FORM 10-K

INDEX

| | | | | | | | |

| | | Page |

|

| | |

| | |

| | |

| | |

| | |

| | |

| |

|

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

|

| | |

| | |

| | |

| | |

| | |

| |

|

| | |

Item 16 | Form 10-K Summary | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, or this Annual Report, including the sections entitled “Business”, “Risk Factors”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, contains forward-looking statements. We may, in some cases, use words such as “project,” “believe,” “anticipate,” “plan,” “expect,” “estimate,” “intend,” “should,” “would,” “could,” “potentially,” “will,” or “may,” or other words or expressions that convey future events, conditions, circumstances, or outcomes to identify these forward-looking statements. Forward-looking statements in this Annual Report include statements about:

•changes in and our ability to comply with the extensive regulatory framework applicable to our industry, as well as state law and regulations and accrediting agency requirements, and the expected impacts of any non-compliance;

•our ability to manage, grow, and diversify our business and execute our business initiatives and strategy;

•our cash needs and expectations regarding cash flow from operations, including the impacts of our debt service and the dividend payments that are required to be paid on our Series A Senior Preferred Stock;

•our ability to undertake initiatives to improve the learning experience, attract students who are likely to persist, and improve student outcomes;

•changes to and expectations regarding our student enrollment, net course registrations, and the composition of our student body, including the pace of such changes;

•our ability to maintain, develop, and grow our technology infrastructure to support our student body;

•our conversion of prospective students to enrolled students and our retention of active students;

•our ability to update and expand the content of existing programs and develop new programs to meet emerging student needs and marketplace demands, and our ability to do so in a cost-effective manner or on a timely basis;

•our plans for, marketing of, and initiatives at, our institutions;

•our ability to leverage our investments in support of our initiatives, students, and institutions;

•our maintenance and expansion of our relationships and partnerships and the development of new relationships and partnerships;

•actions by the Department of Defense, or DoD, or branches of the United States Armed Forces, including actions related to the disruption and suspension of DoD tuition assistance programs and ArmyIgnitED, and expectations regarding the effects of those actions;

•federal appropriations and other budgetary matters, including government shutdowns;

•changes in enrollment in postsecondary degree-granting institutions and workforce needs;

•the competitive environment in which we operate;

•our ability to recognize the benefits of our cost savings efforts;

•our ability to manage and influence our bad debt expense;

•future impacts of the COVID-19 pandemic; and

•our financial performance generally.

Forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance, taking into account information currently available to us, and are not guarantees of future results. There are a number of important factors that could cause actual results to differ materially from the results anticipated by these forward-looking statements. Risks and uncertainties involved in the forward-looking statements include, among others, the factors set forth below in “Summary of Risk Factors”.

Forward-looking statements should be considered in light of these factors and the factors described elsewhere in this Annual Report, including in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. You should read these factors and the other cautionary statements made in this Annual Report as being applicable to all related forward-looking statements wherever they appear in this Annual Report. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance, or achievements may vary materially from any future results, performance, or achievements expressed or implied by these forward-looking statements.

We caution readers not to place undue reliance on any forward-looking statements made by us, which speak only as of the date of this Annual Report. We undertake no obligation to publicly update any forward-looking statements after the date of this Annual Report, whether as a result of new information, future events, or otherwise, except as required by law.

Summary of Risk Factors

We are subject to a variety of risks and uncertainties, including risks that could have a material adverse effect on our business, financial condition, results of operations, and cash flows. The following summary of the principal factors that make an investment in our securities speculative or risky should not be relied upon as an exhaustive summary of the material risks facing us. You should read the following summary together with the more detailed description of risks that we deem material described under “Risk Factors” in Item 1A of this Annual Report and the other information contained in this Annual Report before investing in our securities.

Risks Related to Attracting and Retaining Students

•Our success and financial performance depend on the effectiveness of our ability to attract students who persist in our institutions’ programs. If we are unable to effectively market our programs or expand into new markets, our results of operations would be negatively affected.

•Our student registrations, revenue, and cash flow have been adversely impacted and we could continue to experience adverse impacts as a result of the Army’s transition to new systems for soldiers to request DoD tuition assistance, or TA.

•Enrollments and course registrations by active-duty service members may be adversely affected by factors not directly related to education programs, including changes in military activity and budgets.

•DoD’s Memoranda of Understanding, or MOUs, impose extensive regulatory requirements with respect to participation in DoD TA programs, and our revenue and number of students would decrease if we are no longer able to receive funds under DoD TA programs or if TA changes.

•Changes our institutions may make to improve the student experience and enhance their ability to identify and enroll students who are likely to succeed may adversely affect enrollment and profitability.

•If our institutions are unable to successfully adjust to future market demands, our performance may be impaired.

•Continued strong competition in the postsecondary education market, including the military and nursing education markets and from non-traditional offerings, could decrease our market share and increase our cost of acquiring students.

Risks Related to the Regulation of Our Industry

•If we or our institutions fail to comply with the regulatory requirements for the operation of postsecondary education institutions or to maintain institutional accreditation, we could face a decline in student enrollment, penalties, and significant restrictions on operations, including loss of the ability to participate in DoD TA programs, Title IV programs, Department of Veterans Affairs benefits, and of access to federal student loans and grants.

•Recent Department of Education negotiated rulemakings could result in regulations that materially and adversely affect our business.

•The failure to meet applicable NCLEX pass rates and other NCLEX standards could reduce our enrollments, revenue, and cash flow, lead to adverse actions by state boards of nursing, and limit our ability to offer or force us to close educational programs.

•The inability of our institutions’ graduates to obtain outcomes in their chosen fields of study could reduce our enrollments and revenue, limit our ability to offer educational programs, and potentially lead to litigation that could be costly to us.

•A failure of Hondros College of Nursing, or HCN, to satisfy accreditation standards could have a material adverse impact on HCN’s student enrollment and our and HCN’s revenue, results of operations, and cash flows.

•If one of our institutions does not comply with the “90/10 Rule”, it will lose eligibility to participate in federal student financial aid programs.

Risks Related to Our Business

•Economic and market conditions in the United States and abroad and changes in interest rates could affect our enrollments, success with placement and persistence and cohort default rates.

•Our business could be harmed if we experience a disruption in the ability to process Title IV financial aid.

•Business combinations and acquisitions may be difficult to integrate, disrupt our business, dilute stockholder value, or divert management attention, and we may not realize the expected benefits of any consummated combinations or acquisitions.

•Efforts to diversify our business model may provide strategic and operational challenges that we are not prepared or able to address.

•We have implemented a shared services model for services to our institutions, and challenges encountered due to the ongoing operation and expansion of this model could cause strategic or operational challenges.

•We have incurred substantial indebtedness, the cost of servicing that debt could adversely affect our business and financial results, and we may not be able in the future to service that debt.

•Our Series A Senior Preferred Stock provides rights, preferences, and privileges that are not held by our common stockholders, and is senior to our common stock.

•We may not be able to successfully manage and limit our exposure to bad debt.

•If we are unable to attract, retain, and develop skilled personnel, our business and growth prospects could be severely harmed, and changes in management could cause disruption and uncertainty.

•We may need additional capital in the future, but there is no assurance that funds will be available on acceptable terms.

Risks Related to Our Technology Infrastructure

•Our ongoing transition away from Collegis, LLC for outsourced Rasmussen University information technology and marketing functions may not be timely, efficient, or cost-effective, or may pose other operational challenges.

•We need to continue to expend time, money, and resources into our institutions’ information technology, which could adversely affect our systems, controls, and operating efficiency, and those of our institutions.

•Significant information technology system disruptions could negatively impact our ability to generate revenue and could damage our reputation, limiting our ability to attract and retain students.

•Data security breaches and cyber-attacks could compromise sensitive information and cause system disruptions and significant damage to our business and reputation.

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

American Public Education, or APEI, provides online and campus-based postsecondary education and career learning to approximately 107,100 students through four subsidiary institutions. Our institutions offer purpose-built education programs and career learning designed to prepare individuals for productive contributions to their professions and society and to offer opportunities to advance students in their current professions or to help them prepare for their next career.

Our Vision and Mission

Our vision is for education that transforms lives, advances careers, and improves communities. Our mission is to provide inclusive, high-quality and relevant education that empowers learners to achieve their ambitions and be of service to their communities while realizing return on their education investment. Our institutions of advanced learning are purpose-built to prepare service-minded students for employment, careers, and leadership in a diverse and changing world. We are the number one educator of active-duty military and of veterans, operate the nation’s largest pre-licensure nursing platform focused on a Diploma in Practical Nursing, or PN degree, and an Associate Degree in Nursing, or ADN degree, and operate one of the largest providers of training to the federal government and public workforce.

Our Institutions

We have four subsidiary institutions: American Public University System, or APUS, Rasmussen University, or RU, Hondros College of Nursing, or HCN, and Graduate School USA, or GSUSA.

American Public University System

APUS provides online postsecondary education to approximately 88,900 adult learners. APUS traces its roots to American Military University, or AMU, which was founded in 1991 as a distance-learning, graduate-level institution for military officers seeking an advanced degree in military studies. APUS has broadened its focus to include other military communities, veterans, and public service and public service-minded communities, with a focus on educating those who serve, and has two components: AMU, which is focused on educating students from the military, national security, military-affiliated and service communities, like police, firefighters, emergency personnel, and government employees, and American Public University, or APU, which is focused on educating career-focused working adults with an emphasis on educating professionals working in service-related communities, including nursing, public health, public administration, and business administration. Today, a majority of APUS students are undergraduate-level students in addition to its graduate and certificate students.

APUS is exclusively an online institution of higher learning, designed to meet the needs of the military, military-affiliated, public service, and working adult students. Many of these students serve in positions requiring extended and irregular work schedules, are on call for rapid response missions, participate in extended deployments and exercises, travel or relocate frequently, and often must balance family and work demands. Although APUS’s focus has broadened since its founding, it continues to have an emphasis on its relationship with the military community. As of December 31, 2022, approximately 65% of APUS’s students self-reported that they served in the military on active-duty at the time of initial enrollment, and approximately 11% of APUS’s students self-reported that they are a military veteran. The remainder of APUS’s students are other military or military-affiliated professionals (such as reservists or National Guard members), public service professionals (such as law enforcement personnel or other first responders), and other non-military students (such as working adult students and military spouses).

APUS is institutionally accredited by The Higher Learning Commission, or HLC, a regional accrediting agency recognized by the U.S. Department of Education, or ED, with an Open Pathway designation, which affords institutions greater opportunity to pursue institutional improvement projects than the alternative Standard Pathway designation. Most other higher education institutions accept APUS’s courses for transfer credit as a result of this accreditation.

Rasmussen University

RU provides nursing- and health sciences-focused postsecondary education to over 15,600 students at its 22 campuses in six states and online. At the beginning of its 123-year history, RU focused on educating business students to prepare them for practical careers in bookkeeping, secretarial services, and accounting. RU’s foundation of education that transforms lives created an inclusive institution built to serve those not typically served by traditional higher education. While RU continues to

offer programs across a broad range of study including business, technology, and education, it launched its focus on healthcare education in 2006, and today offers a comprehensive “ladder” of nursing degrees, including pre-licensure PN and ADN degrees, post-licensure Bachelor of Science in Nursing, or BSN and RN to BSN degrees, Master of Science degrees in Nursing, Specialties and Nurse Practitioner, and a Doctorate of Nurse Practice.

RU is committed to innovation in program delivery. For example, RU offers competency-based education, or CBE, helping to advance this learning approach where students learn by doing, manage their pace, and stay connected with faculty and peers. Additionally, virtually every nursing program at RU incorporates online content alongside lab and clinical or classroom components. As of December 31, 2022, approximately 7,600 students are pursuing nursing degrees at RU, over 90% of whom are enrolled in RU’s pre-licensure nursing degree programs, and approximately 8,000 students are enrolled in non-nursing programs.

RU is institutionally accredited by HLC with an Open Pathway designation and all of RU’s Nursing programs are programmatically accredited by specialty nursing accrediting bodies. As with APUS, most other higher education institutions accept RU’s courses for transfer credit as a result of RU’s HLC accreditation.

APEI acquired RU on September 1, 2021, which we refer to as the Rasmussen Acquisition, adding what we believe is an attractive portfolio of programs to APEI, with a strong alignment around mission and culture.

Hondros College of Nursing

HCN provides nursing education to approximately 2,600 students across eight campuses in three contiguous Midwestern states with six campuses in Ohio, one campus in Indianapolis, Indiana, and one campus in suburban Detroit, Michigan, that opened in October 2022. HCN offers pre-licensure nursing programs that are designed to prepare individuals for productive careers through both a PN Degree and an ADN Degree, and two Direct Entry ADN Degree options that offer an accelerated graduation pathway for students who meet certain transfer, academic, and entrance exam requirements.

HCN’s students principally receive on-campus instruction at one of HCN’s campuses and offer certain courses in a virtual setting for those that prefer remote course learning. For the fiscal year ended December 31, 2022, approximately 60% of HCN students were enrolled in the PN program, while 40% were enrolled in the ADN program.

HCN is institutionally accredited by the Accrediting Bureau for Health Education Schools, or ABHES, a national accrediting agency recognized by ED. HCN’s PN program is accredited by the National League for Nursing Commission for Nursing Education Accreditation, or NLN CNEA.

Graduate School USA

GSUSA, based in Washington, DC, is one of the largest providers of career learning to the federal government and public employee workforce. We acquired substantially all of the assets of GSUSA on January 1, 2022, advancing our focus on delivering training that provides students with pathways to employment and career advancement. GSUSA provides contract training to more than 100 federal government agency customers and through direct enrollment by federal, state, and municipal government employees, contractors, and non-government employees.

GSUSA provides career learning both in-person at its headquarters facility in Washington, D.C. and at customer sites, as well as online. GSUSA offers a catalog of more than 300 courses specializing in foundational and continuing professional development, as well as leadership training and practice management through its Center for Leadership and Management and Government Audit Training Institute. GSUSA trained over 25,000 individuals in 2022.

GSUSA is accredited by the Accrediting Council for Continuing Education and Training, or ACCET.

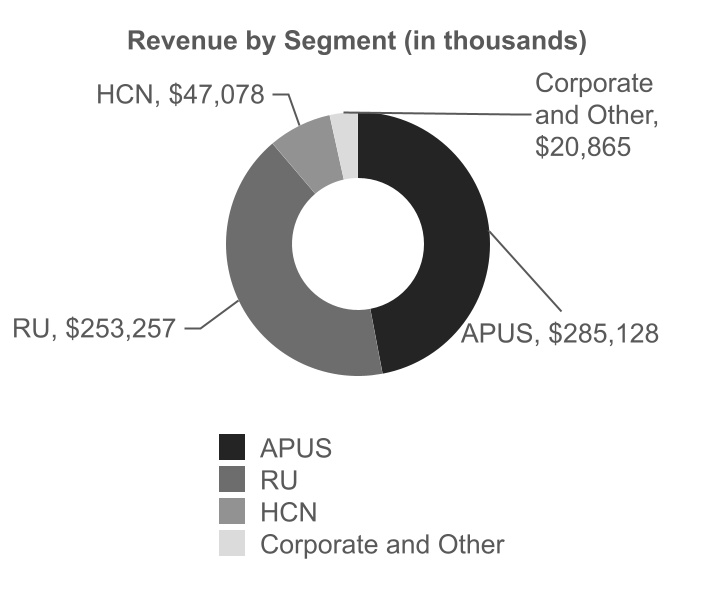

Our Segments

We have three reportable segments: the APUS Segment; the RU Segment; and the HCN Segment. Unallocated corporate activity, eliminations, and GSUSA’s results are included in “Corporate and Other” in the Consolidated Financial Statements. Financial information regarding each of our reportable segments is reported and discussed in this Annual Report in the sections entitled “Financial Statements and Supplementary Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”.

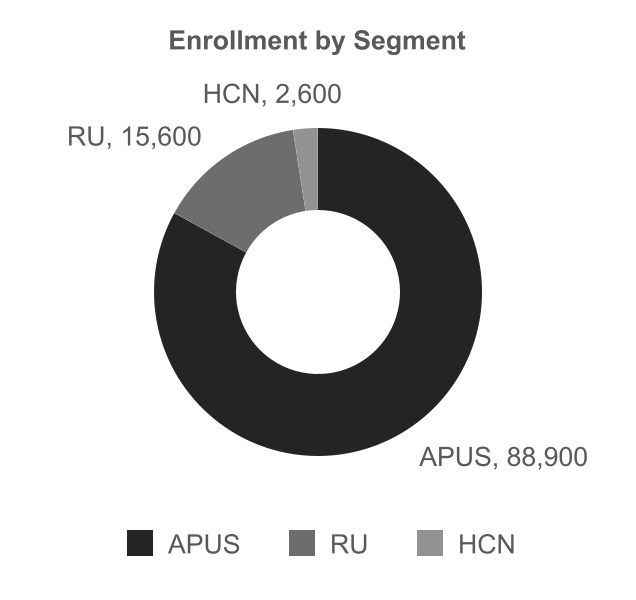

The following information for our segments is as of December 31, 2022.

2022 Developments and Future Financial Objectives

Acquisition Activity

We acquired GSUSA on January 1, 2022, advancing our focus on career learning that provides pathways to employment and career advancement, and began repositioning GSUSA and focusing it on a return to growth. During 2022, we also continued work to integrate RU, which we acquired on September 1, 2021, including through certain restructuring activities.

Campus Expansions and Relocations

In October 2022, HCN opened a new campus in suburban Detroit. The campus is now enrolling PN students from the Detroit area. Additionally, effective in 2022, the Indiana State Board of Nursing approved an increase in the maximum enrollment at its Indianapolis campus to 200 students per calendar year as compared to 30 in 2021. In July 2022, RU opened a consolidated RU Hennepin/Anoka campus in Minnesota by merging two existing campuses and relocating to a new space. The campus offers over 55 career-focused programs across seven areas of study.

Insourcing of Marketing and Information Technology

RU has historically outsourced the vast majority of its information technology functions and marketing services through two contracts, one for each of marketing and information technology, with Collegis, LLC, or Collegis. In October 2022, RU and Collegis mutually agreed to the termination of the marketing services contract effective January 31, 2023. Outsourced information technology services under the Collegis information technology contract will continue through September 2024, when we intend to allow the contract to expire. We have completed the transition of RU marketing in-house to our centralized marketing team and plan to transition all of the information technology services currently outsourced to Collegis back to our operations or to one or more other third-party vendors.

Executive Leadership Changes

We made several changes and additions to our executive leadership team in 2022 with strategic hires aimed at bolstering our ability to deliver improved student experience and outcomes, accelerating growth and transformation, building human capital capabilities, and moving both APUS and RU into the future. New members of executive leadership team include a new Executive Vice President and Chief Experience Officer, a new Executive Vice President and Chief Information Officer, a new Senior Vice President and Chief Human Resources Officer, a new President of APUS, a new Acting President of RU, and a new Acting President for GSUSA. In addition, in January 2023, we announced a new President of GSUSA. Please refer to “Our Institutions and Our Operations – Information About our Executive Officers” below for additional information about our executive officers serving as of the date of this Annual Report.

Financial Highlights

On December 28, 2022, we issued $40.0 million of Series A Senior Preferred Stock, $0.01 par value per share, to affiliates of existing holders of our common stock.

In December 2022, we made prepayments totaling $65.0 million on our senior secured term loan facility, or the Term Loan. As a result of this prepayment, we will not be required to make any quarterly principal payments until payment of the outstanding principal amount at maturity in September 2027.

Financial Objectives

We strive to build on the momentum created by our actions and achievements in fiscal 2022 and to continue to execute on our strategic plan. Specifically, we are focused broadly on (i) achieving public market scale by growing the revenue of our enterprise organically and inorganically and (ii) delivering improved enterprise-wide operating margins.

Our Market and Competition

Market Characteristics

The overall U.S. postsecondary education market is large, with approximately 4,500 institutions of higher learning, diverse in its business models, and fragmented such that no one institution has a significant market share. Most postsecondary institutions, including for-profit postsecondary institutions, regardless of where they are located, how they are organized, or who they serve, face challenges, including:

•demand for relevance and return on investment, as they must prepare students with relevant skills to work in new and rapidly changing industries, respond to technological change, and support employers in efforts to optimize and advance their workforce;

•focus on quality and affordability, including via questions from potential students, lawmakers, the media, and others about the quality and cost of postsecondary education and the impact of poor quality and high costs;

•changes in consumer demands as prospective students look to unbundle their education and pursue credentials outside of degrees;

•a continually changing regulatory environment;

•the prospect of enrollment declines, with overall fall 2022 enrollment down 0.7 percent as compared to fall 2021 and significantly below 2019 levels; and

•rapid technological transformation, including through increasing demand for online offerings and the utilization of technology to enhance student learning.

Competition

In addition to the characteristics outlined above, the U.S. postsecondary education market is characterized by intense competition. Competitive factors include, among other things:

•the quality of the academic program and alignment to high growth jobs;

•affordability;

•breadth of degree offerings;

•flexibility in delivery models;

•frequency of course or program starts;

•faculty experience;

•level of support for student success;

•career counseling and placement services;

•reputation;

•effectiveness in attracting college-ready students; and

•compliance track record.

Institutions Serving Military Students

APUS has focused on serving the military community since its founding, and the community continues to be a primary source of APUS students. Approximately 2,500 institutions serve military students through participation in Department of Defense, or DoD, tuition assistance programs, or TA, including APUS. APUS’s primary competitors for military students are other institutions offering online instruction and colleges and universities offering on-campus instruction near military installations.

We believe that APUS will continue to see competition in the military community from both not-for-profit and for-profit schools, as well as from the Armed Forces themselves, including through distance learning programs. For example, the Navy recently launched the U.S. Naval Community College, a community college supporting naval education for enlisted service members. As of November 2022, the U.S. Naval Community College had enrolled approximately 1,700 service members since March 2020 in two pilot programs, and it plans to eventually achieve the capability to accommodate up to 5,000 students. While a number of schools with which APUS competes are participating partners with the U.S. Naval Community College, as a for-profit institution, APUS is not an eligible partner. As traditional not-for-profit public and private schools advance online capabilities, we believe that they will also present increasing competition for APUS.

Nursing Programs

RU and HCN’s nursing programs are offered as campus-based programs in the geographic areas surrounding their campuses. In the approximately 20 market areas where RU and HCN’s combined 30 on-ground nursing campuses are located, we compete with a mix of community colleges, public and private postsecondary institutions, and other career-focused nursing colleges offering similar pre-licensure nursing programs. Because of the relatively local focus of these pre-licensure programs, our competitive environment is moderately fragmented and affected by various factors specific to the states and particular areas where campuses are located, including local supply and demand for nurses and nursing schools. We are also continuing to focus on growing our post-licensure programs, for which the competitive environment is less fragmented and has larger competitors, including because RN to BSN and other post-licensure degrees are available online, as well as in traditional campus-based environments.

Other Public and Postsecondary Institutions

Within the broader postsecondary education market, our institutions compete primarily with not-for-profit, public, and private two-year and four-year colleges, as well as other for-profit schools, particularly those that offer online learning programs. Due to an increase in online postsecondary offerings, we could face increased competition as students pursue degree and credential-based postsecondary education from a wider selection of online offerings. For example, we anticipate increased competition from campus-based postsecondary institutions as they continue to increase online degree programs and develop more non-traditional programs.

Most public institutions are aided by substantial government subsidies. Public and private not-for-profit institutions benefit from grants, tax-exemptions, contributions, and other financial resources not widely available to for-profit institutions. Many public competitors also benefit from longstanding name recognition and are able to directly recruit students in a more cost-effective manner, especially in their local markets. Many private institutions are able to make larger investments in marketing, including because they charge higher tuition.

Non-Traditional Competition

We also face competition from competing schools and others providing non-traditional education programs, often without charge or at low costs, including:

•institutions offering competency-based education, or CBE, programs and single course or course packages aimed at credentialing outcomes rather than degree outcomes;

•corporate training and other companies partnering with universities or the federal government to offer alternative educational paths for students and the federal government workforce, respectively;

•entities providing coding bootcamps or micro-credentials; and

•non-degree granting institutions such as massive online course, or MOOC, providers.

We believe that our institutions will continue to face new competition from non-traditional programs.

For more information on competition within the postsecondary education market in which we compete, refer to “Risk Factors – Risks Related to Attracting and Retaining Students”.

Our Opportunities and Strengths

Our Opportunities

Active-Duty Military and Veterans

The U.S. military community will continue to be an important market segment for online education. We believe service members will continue to seek respected universities that provide military-focused support services coupled with an online curriculum and flexible scheduling. We believe service members are particularly interested in postsecondary credentials that offer both career advancement within the military and preparation for employment outside of the military.

The U.S. military is demonstrating increased levels of support for credentials other than degrees. For example, Credentialing Opportunities On-Line, or COOL, is a program for each of the military branches and DoD civilians that links military occupations and experiences to civilian credentials (e.g., occupational certifications, licenses, and apprenticeships). The Army also offers an expanded credentialing program called the Army Credentialing Assistance Program, or Army CA, which is designed to support soldiers who wish to pursue civilian credentials, licenses, and certifications that may lead directly to a specific job. APUS is an approved training provider for Army CA. Service members using these programs may be eligible for assistance in paying for credentials, licenses, and certifications. Although utilization of our CA programs to date has been limited, we believe other service branches may follow the Army’s example or pursue other approaches to enhancing support for credentialing, including, for example, the Coast Guard’s CA Program, which has an annual combined cap on benefits higher than that of the Army. There are currently approximately 400 approved Army CA providers, none of which we believe have material market share.

We believe that military veterans represent another important addressable market for online education. The U.S. Census Bureau estimates that in 2022 there were approximately 1.7 million veterans aged 18 to 34 and 4.6 million veterans aged 35 to 54. We believe that our military heritage, affordability, and online offerings are attractive to veterans. New policies and campaigns to facilitate the hiring of veterans may lower barriers to non-military jobs and facilitate veteran-owned businesses. As these policies and campaigns lower barriers to non-military jobs and facilitate veteran-owned businesses, we believe online universities offer valuable educational opportunities for veterans regardless of where they live, work, or learn.

Nursing

The expanding need for healthcare coupled with a nursing shortage is driving significant demand for nursing education. Projected employment for both registered nurses and licensed practical nurses is expected to grow by approximately 6% annually from 2021 to 2031, according to the U.S. Bureau of Labor Statistics’ Occupational Outlook Handbook. When factoring in the need to replace workers who transfer to different occupations or exit the labor force, such as to retire, the U.S. Bureau of Labor Statistics projects more than 260,000 openings each year for registered nurses (203,200) and practical nurses (58,800) through 2031.

There is significant unmet demand from qualified students for nursing educational programs. Despite anticipated job opportunity growth, qualified applicants are not always accepted by nursing programs, primarily due to program selectivity, a shortage of clinical sites, faculty, and resource constraints. However, given the state and regulatory approvals necessary, investment in campuses, specialized programmatic knowledge and related accreditations, clinical placement requirements, time to receive approval to grow enrollments, and various standards that nursing schools must meet, we believe there are challenges for new entrants to nursing education. We also believe we may distinguish ourselves from our competitors by developing direct partnerships with healthcare providers as they become more involved in educating and training their future workforces, of which nurses are the largest segment.

Career Learning

U.S. employers are increasingly reporting significant gaps between required skills and the capabilities of their workforce. Working adults also recognize the need to be lifelong learners. We believe employers and professional associations will seek partnerships with academic institutions to advance the skills and productivity of their workforce through higher education and career learning programs, which we see as an opportunity, particularly for APUS, RU, and GSUSA. We also believe that there is an opportunity to expand the APU brand more broadly to attract students beyond its historical constituency.

Our Competitive Strengths

Return on Educational Investment and Affordability

Our institutions are committed to continually assessing and enhancing our academic programs and student services to offer a high-quality education and facilitate successful outcomes for our students and graduates that align with employer needs. In addition, as described in “Our Institutions and Operations – Human Capital” below, our institutions focus on excellence by hiring experienced faculty and continuing to develop their capabilities.

Providing affordable degree and certificate programs is an important element of our competitive strategy. The combined tuition and fees at APUS are generally less than the average in-state cost at a public university. APUS’s low tuition and fees, in combination with APUS-funded tuition grants and book grants provided to all undergraduate students, and active-duty military students and their spouses and dependents at the master’s level, result in significant savings and mean that APUS students are not required to take on as much debt as they might at another institution. APUS’s generous transfer credit policy, and use of open educational resources, further reduce a student’s out-of-pocket costs.

Tuition and fees at RU and HCN are also designed to be affordable and competitive when compared with those of similar institutions offering the same level of flexibility, accessibility, and student experience. RU students may also lower their total cost of attendance through self-directed assessments, which provide savings by permitting students who demonstrate proficiency in a subject to test out of courses. Similarly, HCN students may apply performance-based grants and needs-based grants toward the balance of their tuition. Please refer to “Our Institutions and Operations – Our Institutions – Affordability and Cost of Attendance” below.

We believe that, given broad concerns about rising tuition and student loan debt in higher education, there are opportunities to create awareness and attract college-ready students with the primary message of affordability and value, in order to help achieve a Higher Education Return on Investment for our Customers, or HEROICTM.

Relevant Offerings Aligned with Demand

Our institutions offer programs aligned to jobs that U.S. Bureau of Labor Statistics data and non-governmental organizations have indicated as high growth areas. Our institutions are also committed to continually assessing and enhancing our academic programs and student services to offer a high-quality education and facilitate successful outcomes for our students and graduates that align with employer needs. The depth and breadth of APUS’s and RU’s non-nursing program offerings are designed to effectively address the diverse needs of students who enter into education programs with vastly different educational and career backgrounds and goals. APUS also utilizes Industry Advisory Councils to evaluate its current curriculum and determine the career relevance of programs and degrees, which facilitate efforts to connect APUS’s curriculum to the industries and the students it serves and to deliver a high-quality academic product. RU and HCN, meanwhile, create new nurses to meet the significant imbalance of supply and demand that exists for nurses by preparing and training nursing students to enter the nursing profession as licensed nurses.

Flexible Program Offerings

Our institutions offer flexible learning modalities to meet the needs of busy working adults. APUS offers online delivery with monthly starts and academic support offerings are individualized to students’ needs, while RU offers CBE programs, a blend of online and in person courses for their nursing and other healthcare-related programs, and flexible start dates and online courses for other programs. HCN offers programs that accommodate working adults by offering blended online and in-person courses for the PN and ADN programs, as well as daytime and evening/weekend options. GSUSA offers virtual and in-person instructor-led, blended, and on demand online courses to accommodate the need for immediate application-specific training.

Market Leadership

Our status as a market leader in key areas we serve means that we operate from a position of strength. APUS is the number one educator of active-duty military and of veterans. Since its founding, APUS has broadened its focus to include other military communities, veterans, and public service and service-minded communities, with a focus on a broad purpose of “educating those who serve.” As of December 31, 2022, approximately 65% of APUS’s students self-reported that they served in the military on active-duty at the time of initial enrollment, and approximately 11% of APUS’s students self-reported that they are a military veteran. We are also the largest educator of ADN and PN pre-licensure nurses in the United States. RU has more than 7,600 nursing students at its 22 campuses across six states and online with over 90% of those students pursuing a pre-licensure PN Degree, ADN Degree, or post-licensure BSN. RU enrolls the largest number of ADN students in the United States and, together with HCN’s nearly 2,600 nursing students, we have the largest population of PN and ADN students in the country. Finally, we are one of the largest providers of training to the federal and public employee workforces through GSUSA with its extensive portfolio of government agency customers and directly enrolled federal government employees.

Expansive Nursing Footprint