Exhibit 99.1

American

Public Education Reports Third Quarter 2011 Results

Third

Quarter 2011 Net Course Registrations Increased 32% Year-Over-Year

CHARLES TOWN, W.Va.--(BUSINESS WIRE)--November 7, 2011--American Public

Education, Inc. (NASDAQ: APEI) – parent company of online learning

provider American Public University System (APUS), which operates

through American Military University (AMU) and American Public

University (APU) – announced financial results for the quarter ended

September 30, 2011.

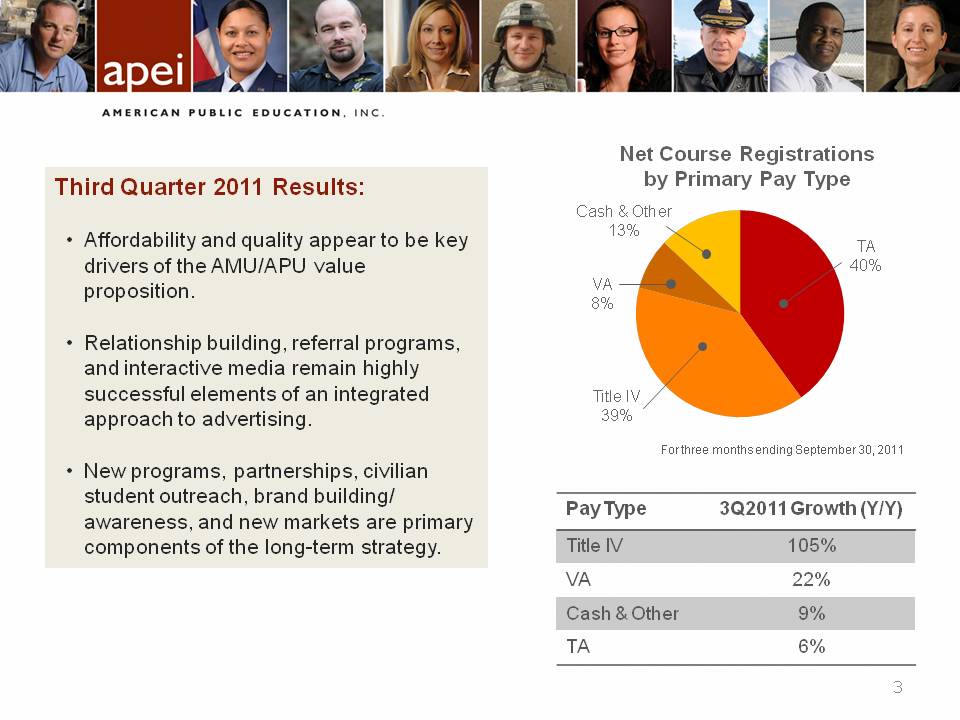

Recent Highlights:

-

Net course registrations1 increased to approximately 87,300

in the third quarter of 2011, a year-over-year increase of 32%.

-

Net course registrations from new students1 in the third

quarter of 2011 increased to approximately 23,900, an increase of

approximately 53% over the same period of 2010.

-

As of September 30, 2011, there were a total of 105,700 active

students at American Public University System, a year-over-year

increase of 36%.

-

Third quarter 2011 revenues increased 35% to $65.3 million, compared

to $48.3 million in the third quarter of 2010.

-

Income from operations before interest income and income taxes in the

third quarter of 2011 increased 61% to $15.0 million, compared to $9.3

million in the same period of 2010.

-

Net income for the third quarter of 2011 increased 95% to $10.9

million, or $0.60 per diluted share, compared to $5.6 million, or

$0.30 per diluted share, in the same period of 2010.

-

American Public Education anticipates fourth quarter 2011 net course

registrations from new students to increase approximately 29%1

year-over-year; net course registrations to increase approximately 28%1

year-over-year; revenues to increase approximately 29% over the prior

year period; and net income to be between $0.58 and $0.60 per diluted

share.

Financial and Other Results:

Total revenues for the third quarter of 2011 increased 35% to $65.3

million, compared to total revenues of $48.3 million in the third

quarter of 2010. Income from operations before interest income and

income taxes in the third quarter of 2011 increased 61% to $15.0

million, compared to $9.3 million in the same period of 2010.

Stock-based compensation expense reduced operating income by $812,000 in

the third quarter of 2011 and $704,000 in the third quarter of 2010.

Income tax expense for the third quarter of 2011 was reduced by

approximately $1.8 million, or $0.10 per diluted share, as a result of

recording an income tax expense adjustment for the full-year 2010 and an

adjustment to the projected effective tax rate for the nine months ended

September 31, 2011. The reduction in the effective tax rate in 2011 is

primarily due to the state tax, and research and development tax credit

studies that were completed during the third quarter of 2011. The state

tax study was undertaken to refine the allocation of income to various

states. The research and development tax credit study was completed to

claim the credit for increased software development activities

qualifying under the tax law. The company anticipates an effective tax

of 38% in the fourth quarter of 2011 and full-year 2012.

Net income for the third quarter of 2011 increased 95% to $10.9 million,

or $0.60 per diluted share, which includes $491,000, or $0.03 per

diluted share, in stock-based compensation expense, net of tax. This

compares to net income of $5.6 million, or $0.30 per diluted share for

the third quarter of 2010, including $434,000, or $0.02 per diluted

share in stock-based compensation expense, net of tax. The weighted

average diluted shares outstanding for the third quarter of 2011 and

2010 were approximately 18.3 million and 18.9 million, respectively.

For the nine months ended September 30, 2011, total revenues were $184.7

million, an increase of 30% compared to total revenues of $141.9 million

in the same period of 2010. Income from operations before interest

income and income tax for the nine months ended September 30, 2011

increased to $43.0 million, compared to $34.2 million in the same period

of 2010. Stock-based compensation expense reduced each period's

operating income by $2.4 million and $2.2 million, respectively.

Net income for the nine months ended September 30, 2011 increased to

$27.8 million, or $1.52 per diluted share, which includes $1.5 million,

or $0.08 per diluted share, in stock-based compensation expense, net of

tax. This compares to net income of $20.3 million, or $1.07 per diluted

share, in the same period of 2010, including $1.4 million, or $0.07 per

diluted share, in stock-based compensation expense, net of tax. The

weighted average diluted shares outstanding for the nine months ended

September 30, 2011 and 2010 were approximately 18.3 million and 19.0

million, respectively.

Total cash and cash equivalents as of September 30, 2011 were

approximately $107.3 million with no long-term debt. Cash from

operations for the nine months ended September 30, 2011 was

approximately $47.5 million, compared to $32.8 million in the same

period of 2010. Capital expenditures were approximately $13.8 million

for the nine months ended September 30, 2011, compared to $14.0 million

in the prior year period. Depreciation and amortization was $6.7 million

for the nine months ended September 30, 2011 and $4.7 million for the

same period of 2010.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Course Registrations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010

|

|

|

|

2011

|

|

|

|

% Change

|

|

Net Course Registrations from New Students1

|

|

|

|

15,600

|

|

|

|

23,900

|

|

|

|

53%

|

|

Net Course Registrations1

|

|

|

|

66,000

|

|

|

|

87,300

|

|

|

|

32%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010

|

|

|

|

2011

|

|

|

|

% Change

|

|

Net Course Registrations from New Students

|

|

|

|

42,300

|

|

|

|

60,600

|

|

|

|

43%

|

|

Net Course Registrations

|

|

|

|

189,000

|

|

|

|

246,300

|

|

|

|

30%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Net course registrations represent the aggregate number of classes

in which students remain enrolled after the date by which they may drop

the course without financial penalty.

1 On January 3, 2011, APUS combined each one-credit lab

course with its related three-credit class resulting in one four-credit

course. Net course registrations and net course registration growth

rates exclude other non-credit registrations and are presented

throughout this press release as if labs and classes were combined in

the prior year period.

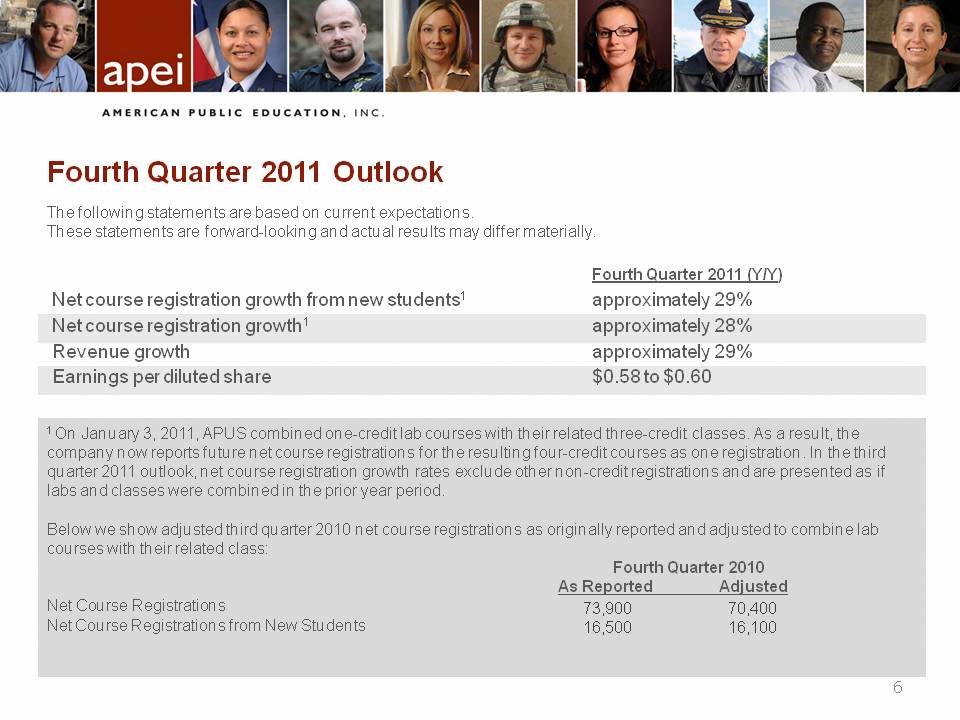

Fourth Quarter 2011 Outlook:

The following statements are based on current expectations. These

statements are forward-looking and actual results may differ materially.

The Company undertakes no obligation to update publicly any

forward-looking statements for any reason.

American Public Education anticipates fourth quarter 2011 net course

registrations from new students to increase approximately 29%1 year-over-year;

net course registrations to increase approximately 28%1

year-over-year; revenues to increase approximately 29% over the prior

year period; and net income to be between $0.58 and $0.60 per diluted

share.

1 As noted under Net Course Registrations above, net course

registration growth rates exclude other non-credit registrations and are

presented as if labs and classes were combined in the prior year period.

Webcast:

A live webcast of the Company’s third quarter earnings conference call

will be broadcast today at 5:30 p.m. Eastern time. This call will be

open to listeners who log in through the Company's investor relations

website, www.AmericanPublicEducation.com.

A replay of the live webcast will also be available starting

approximately one hour after the conclusion of the live conference call.

The replay will be archived and available to listeners for one year.

American Public Education, Inc.

American Public Education, Inc. (NASDAQ: APEI) is an online provider of

higher education focused primarily on serving the military and public

service communities. American Public University System (APUS),

wholly owned by APEI, operates through American Military University (AMU)

and American Public University (APU). APUS serves more than

100,000 adult learners worldwide and offers 87 degree programs in fields

ranging from homeland security, military studies, intelligence, and

criminal justice to technology, business administration, public health,

and liberal arts. Nationally recognized for its best practices in online

higher education, APUS provides an affordable education through classes

taught by experienced faculty who are leaders in their fields and

committed to the academic achievement of their students.

American Public University System is accredited by The Higher Learning

Commission and is a member of the North Central Association of Colleges

and Schools (www.ncahlc.org). For more information about APUS

graduation rates, median debt of students who completed programs, and

other important information, visit www.apus.edu/disclosure.

Forward Looking Statements

Statements made in this press release regarding American Public

Education, Inc., or its subsidiaries, that are not historical facts are

forward-looking statements based on current expectations, assumptions,

estimates and projections about American Public Education, Inc. and the

industry. These forward-looking statements are subject to risks and

uncertainties that could cause actual future events or results to differ

materially from such statements. Forward-looking statements can be

identified by words such as "anticipate", "believe", "could",

"estimate", "expect", "intend", "may", "should", "will" and "would".

These forward-looking statements include, without limitation, statements

regarding expected growth, expected revenues and expected earnings.

Actual results could differ materially from those expressed or implied

by these forward-looking statements as a result of various factors,

including the various risks described in the "Risk Factors" section and

elsewhere in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2010, Quarterly Report on Form 10-Q for the quarter ended

June 30, 2011 and other filings with the SEC. The Company undertakes no

obligation to update publicly any forward-looking statements for any

reason, even if new information becomes available or other events occur

in the future.

|

|

|

American Public Education, Inc.

|

|

Consolidated Statement of Income

|

|

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

September 30,

|

|

|

|

|

|

2011

|

|

|

|

2010

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

|

$

|

65,251

|

|

|

|

$

|

48,295

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

Instructional costs and services

|

|

|

|

|

23,948

|

|

|

|

|

19,483

|

|

Selling and promotional

|

|

|

|

|

11,705

|

|

|

|

|

9,621

|

|

General and administrative

|

|

|

|

|

12,160

|

|

|

|

|

8,194

|

|

Depreciation and amortization

|

|

|

|

|

2,404

|

|

|

|

|

1,682

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses

|

|

|

|

|

50,217

|

|

|

|

|

38,980

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations before interest income and income taxes

|

|

|

|

|

15,034

|

|

|

|

|

9,315

|

|

Interest income, net

|

|

|

|

|

35

|

|

|

|

|

28

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

|

15,069

|

|

|

|

|

9,343

|

|

Income tax expense

|

|

|

|

|

4,130

|

|

|

|

|

3,755

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

$

|

10,939

|

|

|

|

$

|

5,588

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

$

|

0.61

|

|

|

|

$

|

0.30

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

$

|

0.60

|

|

|

|

$

|

0.30

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares:

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

|

17,843,069

|

|

|

|

|

18,430,021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

|

18,253,426

|

|

|

|

|

18,931,197

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Public Education, Inc.

|

|

Consolidated Statement of Income

|

|

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

|

|

|

|

|

|

September 30,

|

|

|

|

|

|

2011

|

|

|

|

2010

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

|

|

$

|

184,710

|

|

|

|

$

|

141,860

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

Instructional costs and services

|

|

|

|

|

69,064

|

|

|

|

|

54,884

|

|

Selling and promotional

|

|

|

|

|

32,310

|

|

|

|

|

24,850

|

|

General and administrative

|

|

|

|

|

33,581

|

|

|

|

|

23,277

|

|

Depreciation and amortization

|

|

|

|

|

6,739

|

|

|

|

|

4,658

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses

|

|

|

|

|

141,694

|

|

|

|

|

107,669

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations before interest income and income taxes

|

|

|

|

|

43,016

|

|

|

|

|

34,191

|

|

Interest income, net

|

|

|

|

|

87

|

|

|

|

|

85

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

|

|

43,103

|

|

|

|

|

34,276

|

|

Income tax expense

|

|

|

|

|

15,331

|

|

|

|

|

14,015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

|

$

|

27,772

|

|

|

|

$

|

20,261

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income per common share:

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

$

|

1.55

|

|

|

|

$

|

1.10

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

$

|

1.52

|

|

|

|

$

|

1.07

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares:

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

|

|

17,887,624

|

|

|

|

|

18,380,178

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

|

18,321,204

|

|

|

|

|

18,970,381

|

|

|

|

|

|

|

|

|

|

|

|

|

CONTACT:

American Public Education, Inc.

Harry T. Wilkins, CPA

Executive

Vice President and Chief Financial Officer

304.724.3722

or

Christopher

L. Symanoskie

Associate Vice President, Investor Relations

703.334.3880