UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21233

PARADIGM FUNDS

(Exact name of registrant as specified in charter)

Nine Elk Street, Albany, NY 12207-1002

(Address of principal executive offices) (Zip code)

Robert A. Benton

Nine Elk Street, Albany, NY 12207-1002

(Name and address of agent for service)

Registrant's telephone number, including area code: (518) 431-3500

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e -1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number.

Item 1. Reports to Stockholders.

Paradigm Funds

Paradigm Value Fund

Paradigm Select Fund

Paradigm Opportunity Fund

Paradigm Micro-Cap Fund

For Investors Seeking Long-Term Capital Appreciation

A

December 31, 2016

| Table of Contents | |

| PARADIGM FUNDS | |

| Letter to Shareholders | 2 |

| Sector Allocation | 5 |

| Performance Information | 7 |

| Schedules of Investments | 11 |

| Statements of Assets and Liabilities | 21 |

| Statements of Operations | 21 |

| Statements of Changes in Net Assets | 23 |

| Financial Highlights | 25 |

| NOTES TO FINANCIAL STATEMENTS | 27 |

| DISCLOSURE OF EXPENSES | 33 |

| ADDITIONAL INFORMATION | 35 |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 37 |

| TRUSTEES & OFFICERS | 38 |

2016 Annual Report 1

Letter to Shareholders

Dear Fellow Shareholders:

In our prior year-end letter, we expressed optimism that small-cap outperformance was likely to rebound after two previous years of underperformance. We are happy to report that in 2016 we finally saw a reversal of the equity market trends from 2014 and 2015, when large-cap outperformed small-cap, and Growth outperformed Value. In 2016, however, small-cap finally outperformed large-cap and Value outperformed Growth across all market-cap buckets. In a clear illustration of this trend, the Russell 2000 Index returned 21.31%, with the Russell 2000 Growth Index returning 11.32% versus 31.74% for the Russell 2000 Value Index—a massive 20-point differential. This small-cap value resurgence is consistent with our investment strategy, and a welcome contrast to the anomalous 2014-2015 period.

While we were gratified to see a reversal of the market trends that had been challenging in prior years, we would also be the first to acknowledge that the US equity market—small-cap in particular—has come very far very fast. When considering that 20-point spread between Value and Growth, and the more than 30-point spread between the Russell 2000’s low and high within 2016, this by definition gives us pause for thought. Clearly such a rapid ascent in the markets causes investors—ourselves included—to question if fundamentals have truly changed as quickly as the market has repriced them.

The US economy as a whole remains on solid footing, with sustained improvements in all of the key areas, such as GDP growth, employment data, housing and construction growth, and ISM data. Clearly the outcome of the US election drove strength in small-cap stocks as the presumed beneficiary of a Trump presidency. In our conversations with our portfolio holdings’ CFOs, there is a general assessment of a less onerous (and thus less costly) regulatory environment, potential lower corporate tax rates, as well as the possibility of a more favorable offshore cash repatriation policy. These factors all bode well for corporate America. Moreover, recent headlines have highlighted large corporations such as Ford and Amazon bringing more jobs back to the US from lower-cost geographies.

Despite all of these positives, there are still several headwinds from our view. The US consumer environment remains challenging, as retailers navigate what it means to provide an omnichannel shopping experience. The consumer may enjoy the convenience, but the costs of fulfilling this demand can be prohibitive for a traditional specialty retailer. Healthcare was the only negative sector in the Russell 2000 in 2016 and remains under pressure in 2017. Concerns around pharmaceutical pricing and the repeal of the Affordable Care Act have thrown the share prices of many healthcare companies into a tailspin. The energy and commodity price landscape remains an unknown to us, confirming our typical underweight exposure to these areas. The Technology sector, as our top contributor for 2016, has performed exceptionally well, but we would question how much further near-term upside there is from here, as the sector appears well priced at present.

It is clearly still a thematic market, in which industries that are well loved (optical components to name one) seem to have a self-propelling momentum. Small-cap equities appear to also have momentum in light of a more US-centric presidential administration, as well as the perception that they should be more immune to global turmoil and trade issues.

Given the above cross-currents, while we are constructive for 2017, we do not see it as a cakewalk. The new presidential administration remains a total unknown, and we do view that as a risk for equity markets. This wild-card aspect means that global markets could be roiled by any number of one-off comments, geopolitical tensions, or saber-rattling. We see

2016 Annual Report 2

this new risk element as one that we must overweight in the near-term transition. The silver lining to this unknown is that volatility does create opportunities, particularly in the more inefficient pockets of the market, such as small-cap. For example, the recent broad-based sell-off in healthcare should provide investment opportunities for those with a long-term outlook.

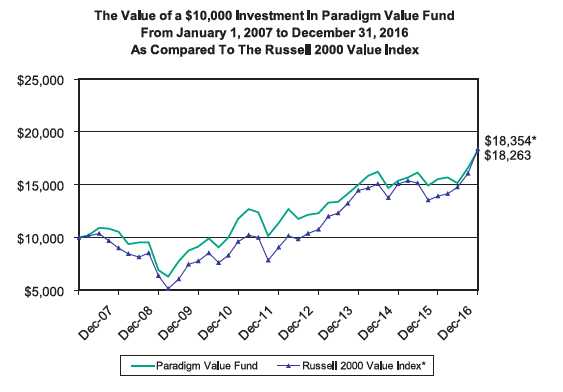

Paradigm Value Fund

The Paradigm Value Fund (PVFAX) appreciated 17.29% in 2016, compared to a gain of 31.74% for the benchmark Russell 2000 Value.

The soaring benchmark Financials sector appreciated 34.82% but the portfolio sector surpassed with a return of 39.17%, making that sector the portfolio’s biggest contributor for the year. This was offset by an underweight to the sector.

Stock selection also drove the Industrials sector, with portfolio holdings’ 40.50% return ahead of the benchmark sector’s 31.44% gain.

Consumer Discretionary and Health Care proved more challenging, however, and portfolio holdings lagged benchmark peers materially in both sectors.

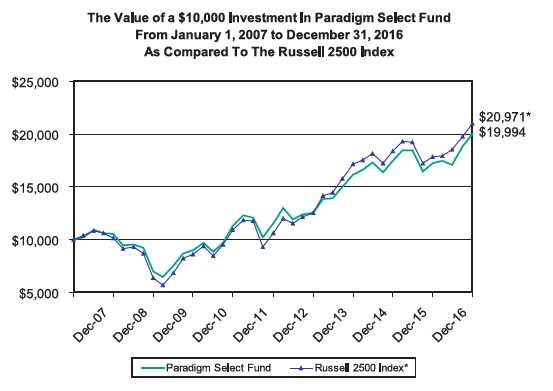

Paradigm Select Fund

The Paradigm Select Fund (PFSLX) gained 15.98% in 2016, compared to a gain of 17.59% for the benchmark Russell 2500.

Strong stock selection in the Information Technology sector was the top contributor to relative and absolute performance in 2016 by a large margin. Portfolio holdings gained 30.28%, compared to a gain of 17.83% for the benchmark sector.

Industrials holdings proved more challenging, with modest stock selection underperfor-mance compounded by an underweight to a high-performing sector.

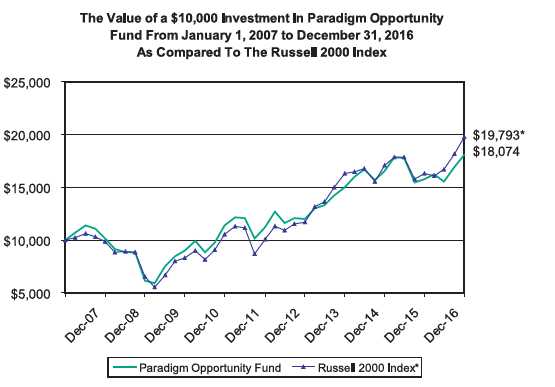

Paradigm Opportunity Fund

The Paradigm Opportunity Fund (PFOPX) gained 14.58% in 2016, compared to a gain of 21.31% for the benchmark Russell 2000.

The Fund’s concentration in the Information Technology sector made that sector the top absolute contributor in 2016.

Health Care was the top performer on a relative basis. Portfolio holdings slipped 0.86% over the course of the year, compared to a drop of 7.84% for the benchmark sector.

While the Financials sector was 2016’s top-performing benchmark sector, Financials were a detractor to the Fund’s performance relative to the Russell 2000, primarily due to the Fund’s significant underweight to the sector.

2016 Annual Report 3

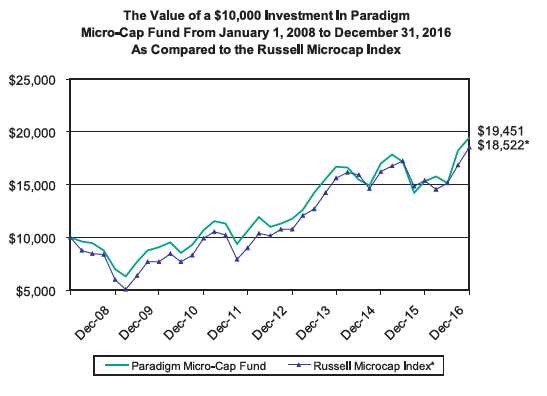

Paradigm Micro-Cap Fund

The Paradigm Micro-Cap Fund (PVIVX) gained 27.33% in 2016, compared to a gain of 20.37% for the benchmark Russell Microcap.

The portfolio outperformed in three of the four sectors where it has traditionally focused: Information Technology, Health Care, and Industrials. The Information Technology sector was the major driver of returns in 2016. Portfolio holdings in the Information Technology sector appreciated 43.33%, more than double the benchmark sector’s 18.52% gain.

Ongoing upheaval in retail made the Consumer Discretionary sector a detractor for the year, with that sector’s portfolio holdings’ 16.29% gain lagging the benchmark sector’s 20.52% increase. The portfolio’s Specialty Retail industry holdings did outperform their peers in the benchmark industry, however.

Sincerely,

|

Candace King Weir |

Amelia F. Weir |

2016 Annual Report 4

Paradigm Funds (Unaudited)

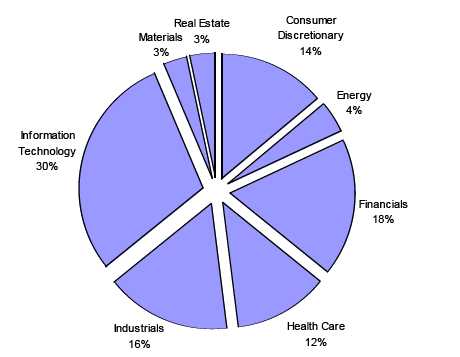

PARADIGM VALUE FUND

Sector Allocation as of December 31, 2016

(As a Percentage of Equity Securities Held)

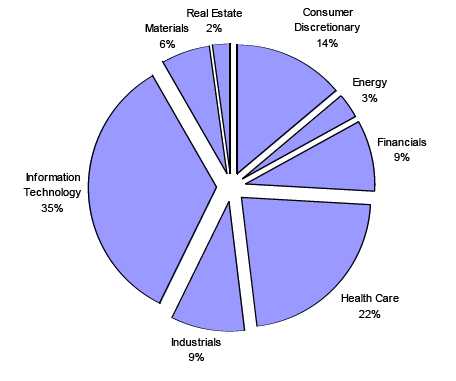

PARADIGM SELECT FUND

Sector Allocation as of December 31, 2016

(As a Percentage of Equity Securities Held)

2016 Annual Report 5

Paradigm Funds (Unaudited)

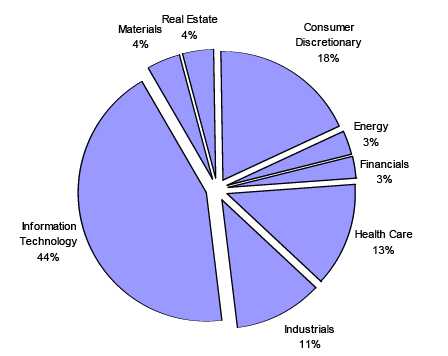

PARADIGM OPPORTUNITY FUND

Sector Allocation as of December 31, 2016

(As a Percentage of Equity Securities Held)

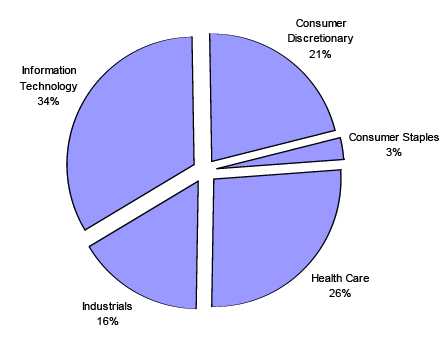

PARADIGM MICRO-CAP FUND

Sector Allocation as of December 31, 2016

(As a Percentage of Equity Securities Held)

2016 Annual Report 6

Paradigm Value Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Periods Ended December 31, 2016.

December 31, 2016 NAV $48.10

| 1 Year(A) | 3 Year(A) | 5 Year(A) | 10 Year(A) | |||||

| Paradigm Value Fund | 17.29% | 6.79% | 9.87% | 6.21% | ||||

| Russell 2000® Value Index(B) | 31.74% | 8.31% | 15.07% | 6.26% |

(A) 1 Year, 3 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Paradigm Value Fund was January 1, 2003.

(B) The Russell 2000® Value Index (whose composition is different from the Fund) is an unmanaged index of small-capitalization stocks with lower price-to-book ratios and lower forecasted growth values than the total population of small-capitalization stocks.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio (before any fee waiver) is 2.00%, and 1.50% post waiver. The Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees and commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in Acquired Funds) at 1.50% of its average daily net assets through April 30, 2017.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2016 Annual Report 7

Paradigm Select Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Periods Ended December 31, 2016.

December 31, 2016 NAV $33.49

| 1 Year(A) | 3 Year(A) | 5 Year(A) | 10 Year(A) | |||||

| Paradigm Select Fund | 15.98% | 7.29% | 11.66% | 7.17% | ||||

| Russell 2500® Index(B) | 17.59% | 6.93% | 14.54% | 7.69% |

(A) 1 Year, 3 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Paradigm Select Fund was January 1, 2005.

(B) The Russell 2500® Index (whose composition is different from the Fund) measures the performance of the small to mid-cap segment of the U.S. equity universe, commonly referred to as “mid” cap. The Russell 2500 Index is a subset of the Russell 3000® Index. It includes approximately 2,500 of the smallest securities based on a combination of their market cap and current index membership.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio (before any fee waiver) is 1.50%, and 1.15% post waiver. The Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees and commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in Acquired Funds) at 1.15% of its average daily net assets through April 30, 2017.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2016 Annual Report 8

Paradigm Opportunity Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Periods Ended December 31, 2016.

December 31, 2016 NAV $35.68

| 1 Year(A) | 3 Year(A) | 5 Year(A) | 10 Year(A) | |||||

| Paradigm Opportunity Fund | 14.58% | 6.37% | 10.02% | 6.10% | ||||

| Russell 2000® Index(B) | 21.31% | 6.74% | 14.46% | 7.07% |

(A) 1 Year, 3 Year, 5 Year and 10 Year returns include change in share prices and in each case includes reinvestment of any dividends, capital gain distributions and return of capital. The inception date of the Paradigm Opportunity Fund was January 1, 2005.

(B) The Russell 2000® Index (whose composition is different from the Fund) consists of the smallest 2,000 companies in the Russell 3000 Index (which represents approximately 98% of the investable U.S. equity market). The Index is an unmanaged index generally considered as the premier of small capitalization stocks.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio (before any fee waiver) is 2.00%, and 1.25% post waiver. The Advisor has contractually agreed to waive management fees and reimburse expenses to the extent necessary to maintain total annual operating expenses of the Fund (excluding brokerage fees and commissions, interest and other borrowing expenses, taxes, extraordinary expenses and the indirect costs of investing in Acquired Funds) at 1.25% of its average daily net assets through April 30, 2017.

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2016 Annual Report 9

Paradigm Micro-Cap Fund (Unaudited)

PERFORMANCE INFORMATION

Average Annual Rate of Return (%) for The Period Ended December 31, 2016.

December 31, 2016 NAV $29.89

| Since | ||||||||

| 1 Year(A) | 3 Year(A) | 5 Year(A) | Inception(A) | |||||

| Paradigm Micro-Cap Fund | 27.33% | 5.26% | 12.87% | 7.67% | ||||

| Russell Microcap® Index(B) | 20.37% | 5.77% | 15.59% | 7.09% |

(A) 1 Year, 3 Year, 5 Year and Since Inception returns include change in share prices and in each case includes reinvestment of any dividends and capital gain distributions. The inception date of the Paradigm Micro-Cap Fund was January 1, 2008. Effective December 27, 2011, the name of the Paradigm Intrinsic Value Fund was changed to the Paradigm Micro-Cap Fund.

(B) The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. Microcap stocks make up less than 3% of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small-cap Russell 2000® Index, plus the next smallest eligible securities by market cap. The Russell Microcap is completely reconstituted annually to ensure larger stocks do not distort performance and characteristics of the true microcap opportunity set. Effective December 27, 2011 the Fund changed its investment strategy. Under normal circumstances, the Micro-Cap Fund invests at least 80% of its net assets in common stocks of U.S. micro-cap companies. Therefore, the primary comparative index was changed from the S&P 500® Index to the Russell Microcap® Index.

For purposes of the graph and the accompanying table, it is assumed that all dividends and distributions were reinvested.

Per the Fund’s most recent prospectus, the Fund’s total annual operating expense ratio is 1.25% .

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. INVESTMENT RETURN AND PRINCIPAL VALUE WILL FLUCTUATE SO THAT SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. RETURNS DO NOT REFLECT THE DEDUCTION OF TAXES THAT A SHAREHOLDER WOULD PAY ON FUND DISTRIBUTIONS OR THE REDEMPTION OF FUND SHARES. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAT THE PERFORMANCE DATA QUOTED. TO OBTAIN PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END, PLEASE CALL 1-800-239-0732 OR VISIT OUR WEBSITE AT www.paradigm-funds.com.

2016 Annual Report 10

| Paradigm Value Fund | |||||

| Schedule of Investments | |||||

| December 31, 2016 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Air Courier Services | |||||

| 90,000 | Air Transport Services Group, Inc. * | $ | 1,436,400 | 2.31 | % |

| Aircraft Parts & Auxiliary Equipment, NEC | |||||

| 40,000 | Ducommun Incorporated * | 1,022,400 | 1.65 | % | |

| Cable & Other Pay Television Services | |||||

| 33,700 | TiVo Solutions Inc. * | 704,330 | 1.13 | % | |

| Communications Equipment, NEC | |||||

| 20,000 | Vocera Communications, Inc. * | 369,800 | 0.60 | % | |

| Computer Communications Equipment | |||||

| 66,200 | A10 Networks, Inc. * | 550,122 | |||

| 400,000 | Extreme Networks, Inc. * | 2,012,000 | |||

| 2,562,122 | 4.13 | % | |||

| Construction - Special Trade Contractors | |||||

| 74,800 | Matrix Service Co. * | 1,697,960 | 2.73 | % | |

| Deep Sea Foreign Transportation of Freight | |||||

| 122,100 | Ardmore Shipping Corporation (Ireland) | 903,540 | 1.46 | % | |

| Electrical Work | |||||

| 26,400 | EMCOR Group Inc. | 1,868,064 | 3.01 | % | |

| Electronic Computers | |||||

| 10,000 | Omnicell, Inc. * | 339,000 | 0.55 | % | |

| Heavy Construction Other Than Building Construction - Contractors | |||||

| 25,000 | Granite Construction Incorporated | 1,375,000 | 2.21 | % | |

| Industrial Organic Chemicals | |||||

| 21,100 | Sensient Technologies Corp. | 1,658,038 | 2.67 | % | |

| Laboratory Analytical Instruments | |||||

| 29,600 | PerkinElmer Inc. | 1,543,640 | 2.49 | % | |

| Motor Vehicle Parts & Accessories | |||||

| 63,100 | Tower International, Inc. | 1,788,885 | 2.88 | % | |

| Motor Vehicles & Passenger Car Bodies | |||||

| 40,000 | Federal Signal Corporation | 624,400 | 1.01 | % | |

| National Commercial Banks | |||||

| 48,700 | First Merchants Corporation | 1,833,555 | |||

| 29,436 | National Bank Holdings Corporation - Class A | 938,714 | |||

| 2,772,269 | 4.46 | % | |||

| Orthopedic, Prosthetic & Surgical Appliances & Supplies | |||||

| 113,200 | RTI Surgical, Inc. * | 367,900 | 0.59 | % | |

| Paper Mills | |||||

| 10,000 | KapStone Paper and Packaging Corporation | 220,500 | 0.36 | % | |

| Printed Circuit Boards | |||||

| 10,000 | Jabil Circuit, Inc. | 236,700 | 0.38 | % | |

| Radio & TV Broadcasting & Communications Equipment | |||||

| 10,000 | ARRIS International plc * | 301,300 | |||

| 120,000 | Mitel Networks Corporation * (Canada) | 816,000 | |||

| 1,117,300 | 1.80 | % | |||

| Retail - Apparel & Accessory Stores | |||||

| 30,000 | Citi Trends, Inc. | 565,200 | |||

| 85,400 | Express Inc. * | 918,904 | |||

| 33,400 | Tailored Brands, Inc. | 853,370 | |||

| 2,337,474 | 3.76 | % | |||

| Retail - Family Clothing Stores | |||||

| 80,400 | American Eagle Outfitters, Inc. | 1,219,668 | 1.96 | % | |

| Retail - Retail Stores, NEC | |||||

| 24,500 | IAC/InterActiveCorp. * | 1,587,355 | 2.56 | % | |

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 11

| Paradigm Value Fund | ||||||

| Schedule of Investments | ||||||

| December 31, 2016 | ||||||

| Shares | Fair Value | % of Net Assets | ||||

| COMMON STOCKS | ||||||

| Retail - Shoe Stores | ||||||

| 24,400 | Foot Locker, Inc. | $ | 1,729,716 | 2.79 | % | |

| Retail - Women's Clothing Stores | ||||||

| 60,000 | New York & Company, Inc. * | 136,200 | 0.22 | % | ||

| Savings Institution, Federally Chartered | ||||||

| 40,300 | LegacyTexas Financial Group, Inc. | 1,735,318 | 2.79 | % | ||

| Semiconductors & Related Devices | ||||||

| 3,488 | Cavium, Inc. * | 217,791 | ||||

| 73,700 | EMCORE Corporation * | 641,190 | ||||

| 12,000 | Finisar Corporation * | 363,240 | ||||

| 51,400 | Kulicke & Soffa Industries Inc. * (Singapore) | 819,830 | ||||

| 50,000 | Lattice Semiconductor Corporation * | 368,000 | ||||

| 33,700 | Microsemi Corporation * | 1,818,789 | ||||

| 30,000 | NeoPhotonics Corporation | 324,300 | ||||

| 40,000 | Oclaro, Inc. * | 358,000 | ||||

| 29,900 | Qorvo, Inc. * | 1,576,627 | ||||

| 6,487,767 | 10.44 | % | ||||

| Services - Business Services, NEC | ||||||

| 33,500 | Rightside Group, Ltd. * | 277,045 | 0.45 | % | ||

| Services - Computer Integrated Systems Design | ||||||

| 52,600 | Convergys Corp. | 1,291,856 | ||||

| 44,300 | Quality Systems, Inc. * | 582,545 | ||||

| 1,874,401 | 3.02 | % | ||||

| Services - Equipment Rental & Leasing, NEC | ||||||

| 30,000 | Neff Corporation - Class A * | 423,000 | 0.68 | % | ||

| Services - Help Supply Services | ||||||

| 66,100 | Kforce Inc. | 1,526,910 | 2.46 | % | ||

| Services - Hospitals | ||||||

| 22,900 | Magellan Health Services Inc. * | 1,723,225 | ||||

| 23,100 | MEDNAX, Inc. * | 1,539,846 | ||||

| 3,263,071 | 5.25 | % | ||||

| Services - Management Services | ||||||

| 100,000 | Accretive Health, Inc. * | 225,000 | 0.36 | % | ||

| Services - Motion Picture Theaters | ||||||

| 65,300 | Regal Entertainment Group Class A | 1,345,180 | 2.17 | % | ||

| Special Industry Machinery, NEC | ||||||

| 107,000 | Brooks Automation, Inc. | 1,826,490 | 2.94 | % | ||

| State Commercial Banks | ||||||

| 30,000 | Banner Corporation | 1,674,300 | ||||

| 34,000 | Renasant Corporation | 1,435,480 | ||||

| 3,109,780 | 5.01 | % | ||||

| Surgical & Medical Instruments & Apparatus | ||||||

| 60,000 | MiMedx Group, Inc. * | 531,600 | 0.86 | % | ||

| Telegraph & Other Message Communications | ||||||

| 22,500 | j2 Global, Inc. | 1,840,500 | 2.96 | % | ||

| Transportation Services | ||||||

| 19,500 | GATX Corp. | 1,200,810 | 1.93 | % | ||

| Total for Common Stocks (Cost $32,527,001) | $ | 55,285,533 | 89.03 | % | ||

| REAL ESTATE INVESTMENT TRUSTS | ||||||

| 58,000 | Blackstone Mortgage Trust, Inc. - Class A | $ | 1,744,060 | |||

| 120,928 | Gramercy Property Trust Inc. | 1,110,119 | ||||

| 15,550 | Mid-America Apartment Communities Inc. | 1,522,656 | ||||

| Total for Real Estate Investment Trusts (Cost $2,885,995) | 4,376,835 | 7.05 | % | |||

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 12

| Paradigm Value Fund | ||||||

| Schedule of Investments | ||||||

| December 31, 2016 | ||||||

| Shares | Fair Value | % of Net Assets | ||||

| MONEY MARKET FUNDS | ||||||

| 2,521,016 SEI Daily Income Trust Government Fund CL A 0.32% ** | 2,521,016 | 4.06 | % | |||

| (Cost $2,521,016) | ||||||

| Total Investment Securities | 62,183,384 | 100.14 | % | |||

| (Cost $37,934,012) *** | ||||||

| Liabilities in Excess of Other Assets | (87,355 | ) | -0.14 | % | ||

| Net Assets | $ | 62,096,029 | 100.00 | % | ||

| ** The Yield Rate shown represents the 7-day yield at December 31, 2016. *** At December 31, 2016, tax basis cost of the Fund’s investments was $38,071,347 and the unrealized appreciation and depreciation were $25,871,389 and ($1,759,352), respectively, with a net unrealized appreciation of $24,112,037. |

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 13

| Paradigm Select Fund | |||||

| Schedule of Investments | |||||

| December 31, 2016 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Air Transportation, Nonscheduled | |||||

| 3,400 | Air Methods Corporation * | $ | 108,290 | 0.47 | % |

| Aircraft & Parts | |||||

| 6,000 | Triumph Group, Inc. | 159,000 | 0.70 | % | |

| Cable & Other Pay Television Services | |||||

| 31,000 | TiVo Solutions Inc. * | 647,900 | 2.83 | % | |

| Chemical & Allied Products | |||||

| 575 | Innospec Inc. | 39,388 | |||

| 1,625 | Olin Corp. | 41,616 | |||

| 81,004 | 0.35 | % | |||

| Construction - Special Trade Contractors | |||||

| 23,800 | Matrix Service Co. * | 540,260 | 2.36 | % | |

| Electrical Work | |||||

| 5,700 | EMCOR Group Inc. | 403,332 | 1.76 | % | |

| Electromedical & Electrotherapeutic Apparatus | |||||

| 13,700 | Masimo Corporation * | 923,380 | 4.04 | % | |

| Electronic Computers | |||||

| 6,000 | Omnicell, Inc. * | 203,400 | 0.89 | % | |

| Fire, Marine & Casualty Insurance | |||||

| 300 | Alleghany Corporation * | 182,436 | |||

| 2,850 | American Financial Group Inc. | 251,142 | |||

| 4,350 | Aspen Insurance Holdings Limited (Bermuda) | 239,250 | |||

| 733 | Endurance Specialty Holdings Ltd. (Bermuda) | 67,729 | |||

| 740,557 | 3.24 | % | |||

| Footwear (No Rubber) | |||||

| 4,700 | Caleres, Inc. | 154,254 | 0.67 | % | |

| Household Furniture | |||||

| 4,000 | La-Z-Boy Incorporated | 124,200 | 0.54 | % | |

| Industrial Instruments for Measurement, Display, and Control | |||||

| 3,400 | MKS Instruments, Inc. | 201,960 | 0.88 | % | |

| Industrial Organic Chemicals | |||||

| 4,100 | Sensient Technologies Corporation | 322,178 | |||

| 3,850 | Westlake Chemical Corp. | 215,562 | |||

| 537,740 | 2.35 | % | |||

| Instruments For Measurement & Testing of Electricity & Electric Signals | |||||

| 17,875 | Teradyne, Inc. | 454,025 | 1.99 | % | |

| Laboratory Analytical Instruments | |||||

| 9,600 | PerkinElmer Inc. | 500,640 | 2.19 | % | |

| Millwood, Veneer, Plywood, & Structural Wood Members | |||||

| 5,400 | Ply Gem Holdings, Inc. * | 87,750 | 0.38 | % | |

| Miscellaneous Manufacturing Industries | |||||

| 5,400 | Hillenbrand, Inc. | 207,090 | 0.91 | % | |

| Motor Vehicle Parts & Accessories | |||||

| 1,500 | Visteon Corporation * | 120,510 | 0.53 | % | |

| National Commercial Banks | |||||

| 3,600 | KeyCorp | 65,772 | 0.29 | % | |

| Paper Mills | |||||

| 10,000 | KapStone Paper and Packaging Corporation | 220,500 | 0.96 | % | |

| Plastics Products | |||||

| 1,900 | AptarGroup Inc. | 139,555 | |||

| 10,000 | Entegris, Inc. * | 179,000 | |||

| 318,555 | 1.39 | % | |||

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 14

| Paradigm Select Fund | |||||

| Schedule of Investments | |||||

| December 31, 2016 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Printed Circuit Boards | |||||

| 19,200 | Jabil Circuit, Inc. | $ | 454,464 | ||

| 14,600 | TTM Technologies, Inc. * | 198,998 | |||

| 653,462 | 2.86 | % | |||

| Radio & TV Broadcasting & Communications Equipment | |||||

| 7,400 | ARRIS International plc * | 222,962 | |||

| 30,000 | Mitel Networks Corporation * (Canada) | 204,000 | |||

| 426,962 | 1.87 | % | |||

| Retail - Apparel & Accessory Stores | |||||

| 17,300 | Express Inc. * | 186,148 | |||

| 8,950 | Tailored Brands, Inc. | 228,672 | |||

| 414,820 | 1.81 | % | |||

| Retail - Family Clothing Stores | |||||

| 22,800 | American Eagle Outfitters, Inc. | 345,876 | 1.51 | % | |

| Retail - Lumber & Other Building Materials Dealers | |||||

| 16,100 | BMC Stock Holdings, Inc. * | 313,950 | 1.37 | % | |

| Retail - Radio, TV & Consumer Electronics Stores | |||||

| 11,600 | Best Buy Co., Inc. | 494,972 | 2.16 | % | |

| Retail - Retail Stores, NEC | |||||

| 7,300 | IAC/InterActiveCorp. | 472,967 | 2.07 | % | |

| Retail - Shoe Stores | |||||

| 8,400 | Foot Locker, Inc. | 595,476 | 2.60 | % | |

| Savings Institution, Federally Chartered | |||||

| 7,800 | Capitol Federal Financial, Inc. | 128,388 | 0.56 | % | |

| Savings Institution, Not Federally Chartered | |||||

| 4,000 | Berkshire Hills Bancorp, Inc. | 147,400 | 0.64 | % | |

| Search, Detection, Navigation, Guidance, Aeronautical Systems | |||||

| 6,000 | Garmin Ltd. (Switzerland) | 290,940 | 1.27 | % | |

| Semiconductors & Related Devices | |||||

| 7,300 | Finisar Corporation * | 220,971 | |||

| 13,500 | Kulicke & Soffa Industries Inc. * (Singapore) | 215,325 | |||

| 17,725 | Marvell Technology Group Ltd. (Bermuda) | 245,846 | |||

| 15,500 | Microsemi Corporation * | 836,535 | |||

| 26,200 | Oclaro, Inc. * | 234,490 | |||

| 11,000 | Qorvo, Inc. * | 580,030 | |||

| 5,800 | Skyworks Solutions, Inc. | 433,028 | |||

| 2,766,225 | 12.10 | % | |||

| Services - Auto Rental & Leasing | |||||

| 1,200 | Ryder System, Inc. | 89,328 | 0.39 | % | |

| Services - Computer Integrated Systems Design | |||||

| 20,600 | Allscripts Healthcare Solutions, Inc. * | 210,326 | |||

| 18,800 | Convergys Corp. | 461,728 | |||

| 14,000 | Quality Systems, Inc. * | 184,100 | |||

| 856,154 | 3.74 | % | |||

| Services - Help Supply Services | |||||

| 12,525 | Kelly Services, Inc. - Class A | 287,073 | |||

| 9,750 | Kforce Inc. | 225,225 | |||

| 512,298 | 2.24 | % | |||

| Services - Hospitals | |||||

| 8,200 | Magellan Health Services Inc. * | 617,050 | |||

| 13,400 | MEDNAX, Inc. * | 893,244 | |||

| 1,510,294 | 6.60 | % | |||

| Services - Motion Picture Theaters | |||||

| 17,000 | Regal Entertainment Group Class A | 350,200 | 1.53 | % | |

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 15

| Paradigm Select Fund | |||||||

| Schedule of Investments | |||||||

| December 31, 2016 | |||||||

| Shares | Fair Value | % of Net Assets | |||||

| COMMON STOCKS | |||||||

| Services - Prepackaged Software | |||||||

| 2,625 | Progress Software Corporation | $ | 83,816 | 0.37 | % | ||

| Steel Pipe & Tubes | |||||||

| 6,800 | Allegheny Technologies Incorporated | 108,324 | 0.47 | % | |||

| Steel Works, Blast Furnaces & Rolling Mills (Coke Ovens) | |||||||

| 2,100 | Carpenter Technology Corporation | 75,957 | 0.33 | % | |||

| Surety Insurance | |||||||

| 10,500 | MGIC Investment Corporation * | 106,995 | |||||

| 8,200 | Radian Group Inc. | 147,436 | |||||

| 254,431 | 1.11 | % | |||||

| Surgical & Medical Instruments & Apparatus | |||||||

| 26,800 | Globus Medical, Inc. - Class A * | 664,908 | |||||

| 15,000 | MiMedx Group, Inc. * | 132,900 | |||||

| 3,600 | NuVasive, Inc. * | 242,496 | |||||

| 1,040,304 | 4.56 | % | |||||

| Telegraph & Other Message Communications | |||||||

| 6,700 | j2 Global, Inc. | 548,060 | 2.41 | % | |||

| Telephone & Telegraph Apparatus | |||||||

| 9,100 | Ciena Corporation * | 222,131 | |||||

| 5,500 | Fabrinet * (Thailand) | 221,650 | |||||

| 443,781 | 1.95 | % | |||||

| Title Insurance | |||||||

| 5,900 | Fidelity National Financial, Inc. | 200,364 | |||||

| 6,700 | Fidelity National Financial Ventures * | 91,790 | |||||

| 292,154 | 1.28 | % | |||||

| Transportation Services | |||||||

| 2,400 | GATX Corporation | 147,792 | 0.65 | % | |||

| Wholesale - Computers & Peripheral Equipment & Software | |||||||

| 900 | SYNNEX Corporation | 108,918 | 0.48 | % | |||

| Wholesale - Electrical Apparatus & Equipment, Wiring Supplies | |||||||

| 2,200 | EnerSys | 171,820 | 0.75 | % | |||

| Wholesale - Lumber & Other Construction Materials | |||||||

| 8,400 | Boise Cascade Company * | 189,000 | 0.83 | % | |||

| Total for Common Stocks (Cost $17,681,878) | $ | 20,634,188 | 90.23 | % | |||

| REAL ESTATE INVESTMENT TRUSTS | |||||||

| 5,200 | Mid-America Apartment Communities Inc. | 509,184 | 2.23 | % | |||

| Total for Real Estate Investment Trusts (Cost $433,746) | |||||||

| MONEY MARKET FUNDS | |||||||

| 2,255,932 | SEI Daily Income Trust Government Fund CL A 0.32% ** | 2,255,932 | 9.86 | % | |||

| (Cost $2,255,932) | |||||||

| Total Investment Securities | 23,399,304 | 102.32 | % | ||||

| (Cost $20,371,556) *** | |||||||

| Liabilities in Excess of Other Assets | (530,227 | ) | -2.32 | % | |||

| Net Assets | $ | 22,869,077 | 100.00 | % | |||

| * Non-Income Producing Securities. ** The Yield Rate shown represents the 7-day yield at December 31, 2016. *** At December 31, 2016, tax basis cost of the Fund’s investments was $20,422,484 and the unrealized appreciation and depreciation were $3,343,962 and ($367,142), respectively, with a net unrealized appreciation of $2,976,820. |

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 16

| Paradigm Opportunity Fund | |||||

| Schedule of Investments | |||||

| December 31, 2016 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Cable & Other Pay Television Services | |||||

| 13,700 | TiVo Solutions Inc. * | $ | 286,330 | 4.27 | % |

| Computer Communications Equipment | |||||

| 13,400 | A10 Networks, Inc. * | 111,354 | 1.66 | % | |

| Construction - Special Trade Contractors | |||||

| 8,600 | Matrix Service Co. * | 195,220 | 2.91 | % | |

| Electrical Work | |||||

| 2,825 | EMCOR Group Inc. | 199,897 | 2.98 | % | |

| Industrial Organic Chemicals | |||||

| 2,550 | Sensient Technologies Corporation | 200,379 | 2.99 | % | |

| Instruments For Measurement & Testing of Electricity & Electric Signals | |||||

| 7,075 | Teradyne, Inc. | 179,705 | 2.68 | % | |

| Laboratory Analytical Instruments | |||||

| 2,850 | PerkinElmer Inc. | 148,628 | 2.22 | % | |

| Miscellaneous Manufacturing Industries | |||||

| 5,500 | Hillenbrand, Inc. | 210,925 | 3.15 | % | |

| Retail - Apparel & Accessory Stores | |||||

| 9,475 | Express Inc. * | 101,951 | |||

| 4,900 | Tailored Brands, Inc. | 125,195 | |||

| 227,146 | 3.39 | % | |||

| Retail - Department Stores | |||||

| 1,400 | Dillard's, Inc. - Class A | 87,766 | 1.31 | % | |

| Retail - Family Clothing Stores | |||||

| 12,200 | American Eagle Outfitters, Inc. | 185,074 | 2.76 | % | |

| Retail - Lumber & Other Building Materials Dealers | |||||

| 8,700 | BMC Stock Holdings, Inc. * | 169,650 | 2.53 | % | |

| Retail - Retail Stores, NEC | |||||

| 3,250 | IAC/InterActiveCorp. * | 210,568 | 3.14 | % | |

| Retail - Shoe Stores | |||||

| 2,200 | DSW Inc. - Class A | 49,830 | |||

| 4,500 | Foot Locker, Inc. | 319,005 | |||

| 368,835 | 5.51 | % | |||

| Rolling Drawing & Extruding of Nonferrous Metals | |||||

| 2,131 | Alcoa, Inc. | 59,838 | 0.89 | % | |

| Semiconductors & Related Devices | |||||

| 8,300 | Kulicke & Soffa Industries Inc. * (Singapore) | 132,385 | |||

| 6,500 | Microsemi Corporation * | 350,805 | |||

| 4,900 | Qorvo, Inc. * | 258,377 | |||

| 3,400 | Skyworks Solutions, Inc. | 253,844 | |||

| 995,411 | 14.86 | % | |||

| Services - Computer Integrated Systems Design | |||||

| 8,350 | Convergys Corp. | 205,076 | 3.06 | % | |

| Services - Help Supply Services | |||||

| 7,600 | Kelly Services, Inc. - Class A | 174,192 | 2.60 | % | |

| Services - Hospitals | |||||

| 3,150 | Magellan Health Services Inc. * | 237,037 | |||

| 2,600 | MEDNAX, Inc. * | 173,316 | |||

| 410,353 | 6.13 | % | |||

| Services - Motion Picture Theaters | |||||

| 11,475 | Regal Entertainment Group Class A | 236,385 | 3.53 | % | |

| Services - Prepackaged Software | |||||

| 6,700 | Progress Software Corporation | 213,931 | 3.19 | % | |

| Special Industry Machinery (No Metalworking Machinery) | |||||

| 2,000 | Kadant Inc. | 122,400 | 1.83 | % | |

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 17

| Paradigm Opportunity Fund | |||||||

| Schedule of Investments | |||||||

| December 31, 2016 | |||||||

| Shares | Fair Value | % of Net Assets | |||||

| COMMON STOCKS | |||||||

| Special Industry Machinery, NEC | |||||||

| 17,625 | Brooks Automation, Inc. | $ | 300,859 | 4.49 | % | ||

| Surgical & Medical Instruments & Apparatus | |||||||

| 10,125 | AtriCure, Inc. * | 198,146 | |||||

| 16,800 | Avinger, Inc. * | 62,160 | |||||

| 260,306 | 3.90 | % | |||||

| Telegraph & Other Message Communications | |||||||

| 3,775 | j2 Global, Inc. | 308,795 | 4.61 | % | |||

| Total for Common Stocks (Cost $3,478,574) | $ | 6,069,023 | 90.59 | % | |||

| REAL ESTATE INVESTMENT TRUSTS | |||||||

| 2,825 | Mid-America Apartment Communities Inc. | 276,624 | |||||

| Total for Real Estate Investment Trusts (Cost $121,247) | 276,624 | 4.13 | % | ||||

| MONEY MARKET FUNDS | |||||||

| 366,086 | SEI Daily Income Trust Government Fund CL A 0.32% ** | 366,086 | 5.47 | % | |||

| (Cost $366,086) | |||||||

| Total Investment Securities | 6,711,733 | 100.19 | % | ||||

| (Cost $3,965,907) *** | |||||||

| Liabilities in Excess of Other Assets | (13,003 | ) | -0.19 | % | |||

| Net Assets | $ | 6,698,730 | 100.00 | % | |||

| * Non-Income Producing Securities. ** The Yield Rate shown represents the 7-day yield at December 31, 2016. *** At December 31, 2016, tax basis cost of the Fund’s investments was $3,988,010 and the unrealized appreciation and depreciation were $2,856,646 and ($132,923), respectively, with a net unrealized appreciation of $2,723,723. |

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 18

| Paradigm Micro-Cap Fund | |||||

| Schedule of Investments | |||||

| December 31, 2016 | |||||

| Shares | Fair Value | % of Net Assets | |||

| COMMON STOCKS | |||||

| Aircraft Parts & Auxiliary Equipment, NEC | |||||

| 40,000 | Ducommun Incorporated * | $ | 1,022,400 | ||

| 140,500 | LMI Aerospace, Inc. * | 1,211,110 | |||

| 2,233,510 | 4.32 | % | |||

| Communications Equipment, NEC | |||||

| 100,000 | Vocera Communications, Inc. * | 1,849,000 | 3.58 | % | |

| Computer Communications Equipment | |||||

| 467,800 | Extreme Networks, Inc. * | 2,353,034 | 4.55 | % | |

| Computer Peripheral Equipment, NEC | |||||

| 250,000 | RadiSys Corporation * | 1,107,500 | 2.14 | % | |

| Electromedical & Electrotherapeutic Apparatus | |||||

| 1,300 | Cutera, Inc. * | 22,555 | 0.04 | % | |

| Electronic Computers | |||||

| 30,000 | Omnicell, Inc. * | 1,017,000 | 1.97 | % | |

| Footwear (No Rubber) | |||||

| 50,000 | Caleres, Inc. | 1,641,000 | 3.18 | % | |

| Guided Missiles & Space Vehicles & Parts | |||||

| 150,000 | Kratos Defense & Security Solutions, Inc. * | 1,110,000 | 2.15 | % | |

| Household Furniture | |||||

| 20,000 | Hooker Furniture Corporation | 759,000 | 1.47 | % | |

| Millwood, Veneer, Plywood, & Structural Wood Members | |||||

| 80,000 | Ply Gem Holdings, Inc. * | 1,300,000 | 2.52 | % | |

| Miscellaneous Manufacturing Industries | |||||

| 146,542 | Summer Infant, Inc. * | 293,084 | 0.57 | % | |

| Motor Vehicles & Passenger Car Bodies | |||||

| 100,000 | Federal Signal Corporation | 1,561,000 | 3.02 | % | |

| Orthopedic, Prosthetic & Surgical Appliances & Supplies | |||||

| 400,000 | RTI Surgical, Inc. * | 1,300,000 | 2.52 | % | |

| Pharmaceutical Preparations | |||||

| 100,000 | Nature's Sunshine Products | 1,500,000 | 2.90 | % | |

| Printed Circuit Boards | |||||

| 100,000 | TTM Technologies, Inc. * | 1,363,000 | 2.64 | % | |

| Radio & TV Broadcasting & Communications Equipment | |||||

| 200,000 | Mitel Networks Corporation * (Canada) | 1,360,000 | 2.63 | % | |

| Retail - Apparel & Accessory Stores | |||||

| 120,000 | Citi Trends, Inc. | 2,260,800 | |||

| 80,000 | Francesca’s Holdings Corporation * | 1,442,400 | |||

| 135,800 | Vince Holding Corp. * | 549,990 | |||

| 4,253,190 | 8.23 | % | |||

| Retail - Catalog & Mail-Order Houses | |||||

| 43,567 | PC Connection, Inc. | 1,223,797 | |||

| 10,000 | PCM, Inc. * | 225,000 | |||

| 1,448,797 | 2.80 | % | |||

| Retail - Furniture Stores | |||||

| 40,000 | Haverty Furniture Companies, Inc. | 948,000 | 1.83 | % | |

| Retail - Retail Stores, NEC | |||||

| 88,000 | Kirkland's, Inc. | 1,364,880 | 2.64 | % | |

| Retail - Women's Clothing Stores | |||||

| 550,000 | New York & Company, Inc. * | 1,248,500 | 2.42 | % | |

| * Non-Income Producing Securities. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 19

| Paradigm Micro-Cap Fund | |||||||

| Schedule of Investments | |||||||

| December 31, 2016 | |||||||

| Shares | Fair Value | % of Net Assets | |||||

| COMMON STOCKS | |||||||

| Semiconductors & Related Devices | |||||||

| 340,000 | EMCORE Corporation * | $ | 2,958,000 | ||||

| 40,000 | Finisar Corporation * | 1,210,800 | |||||

| 100,000 | Lattice Semiconductors Corporation * | 736,000 | |||||

| 60,000 | MaxLinear, Inc. - Class A * | 1,308,000 | |||||

| 200,000 | Oclaro, Inc. * | 1,790,000 | |||||

| 8,002,800 | 15.49 | % | |||||

| Services - Computer Integrated Systems Design | |||||||

| 160,000 | Allscripts Healthcare Solutions, Inc. * | 1,633,600 | |||||

| 120,000 | Quality Systems, Inc. * | 1,578,000 | |||||

| 3,211,600 | 6.22 | % | |||||

| Services - Equipment Rental & Leasing, NEC | |||||||

| 40,000 | Neff Corporation * | 564,000 | 1.09 | % | |||

| Services - Management Services | |||||||

| 600,000 | Accretive Health, Inc. * | 1,350,000 | 2.61 | % | |||

| Special Industry Machinery (No Metalworking Machinery) | |||||||

| 15,000 | Kadant Inc. | 918,000 | 1.78 | % | |||

| Surgical & Medical Instruments & Apparatus | |||||||

| 20,000 | AtriCure, Inc. * | 391,400 | |||||

| 200,000 | Avinger, Inc. * | 740,000 | |||||

| 60,000 | Globus Medical, Inc. - Class A * | 1,488,600 | |||||

| 180,000 | MiMedx Group, Inc. * | 1,594,800 | |||||

| 4,214,800 | 8.16 | % | |||||

| Telephone & Telegraph Apparatus | |||||||

| 160,000 | Shoretel, Inc. * | 1,144,000 | 2.21 | % | |||

| Wholesale - Lumber & Other Construction Materials | |||||||

| 50,000 | Huttig Building Products, Inc. * | 330,500 | 0.64 | % | |||

| Total for Common Stocks (Cost $41,220,392) | $ | 49,768,750 | 96.32 | % | |||

| CONTINGENT VALUE RIGHTS | |||||||

| 50,000 | Synergetics USA, Inc. * + | - | 0.00 | % | |||

| (Cost $0) | |||||||

| MONEY MARKET FUNDS | |||||||

| 2,111,879 | SEI Daily Income Trust Government Fund CL A 0.32% ** | 2,111,879 | 4.09 | % | |||

| (Cost $2,111,879) | |||||||

| Total Investment Securities | 51,880,629 | 100.41 | % | ||||

| (Cost $43,332,271) **** | |||||||

| Liabilities in Excess of Other Assets | (210,730 | ) | -0.41 | % | |||

| Net Assets | $ | 51,669,899 | 100.00 | % | |||

| * Non-Income Producing Securities. ** The Yield Rate shown represents the 7-day yield at December 31, 2016. *** At December 31, 2016, tax basis cost of the Fund’s investments was $43,332,271 and the unrealized appreciation and depreciation were $10,462,632 and ($1,914,274), respectively, with a net unrealized appreciation of $8,548,358. + Under the terms of the Contingent Value Rights (“CVR”), the holder has the right to receive cash pay- ments of between $0.50 and $1.00 if Synergetic’s ophthalmology business achieves certain revenue per- formance milestones. |

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 20

| Paradigm Funds | ||||||||

| Statements of Assets and Liabilities | Value | Select | ||||||

| December 31, 2016 | Fund | Fund | ||||||

| Assets: | ||||||||

| Investment Securities at Fair Value* | $ | 62,183,384 | $ | 23,399,304 | ||||

| Cash | - | 279 | ||||||

| Receivable for Fund Shares Sold | 1,022 | - | ||||||

| Dividends Receivable | 73,980 | 3,981 | ||||||

| Interest Receivable | 215 | 269 | ||||||

| Total Assets | 62,258,601 | 23,403,833 | ||||||

| Liabilities: | ||||||||

| Payable for Fund Shares Redeemed | 47,960 | - | ||||||

| Payable for Securities Purchased | 34,563 | 512,379 | ||||||

| Payable to Advisor | 80,049 | 22,377 | ||||||

| Total Liabilities | 162,572 | 534,756 | ||||||

| Net Assets | $ | 62,096,029 | $ | 22,869,077 | ||||

| Net Assets Consist of: | ||||||||

| Paid In Capital | $ | 37,893,571 | $ | 19,888,146 | ||||

| Accumulated Realized Loss on Investments - Net | (46,914 | ) | (46,817 | ) | ||||

| Unrealized Appreciation in Value of Investment Securities - Net | 24,249,372 | 3,027,748 | ||||||

| Net Assets | $ | 62,096,029 | $ | 22,869,077 | ||||

| Net Asset Value, Offering and Redemption Price (Note 2) | $ | 48.10 | $ | 33.49 | ||||

| * Investments at Identified Cost | $ | 37,934,012 | $ | 20,371,556 | ||||

| Shares Outstanding (Unlimited number of shares | 1,290,929 | 682,951 | ||||||

| authorized without par value) | ||||||||

| Statements of Operations | ||||||||

| For the fiscal year ended December 31, 2016 | ||||||||

| Investment Income: | ||||||||

| Dividends (Net of foreign withholding taxes** of $0 and $0, respectively) | $ | 865,214 | $ | 83,265 | ||||

| Interest | 2,098 | 2,258 | ||||||

| Total Investment Income | 867,312 | 85,523 | ||||||

| Expenses: | ||||||||

| Investment Advisor Fees | 1,202,039 | 126,540 | ||||||

| Total Expenses | 1,202,039 | 126,540 | ||||||

| Less: Expenses Waived | (300,510 | ) | (29,526 | ) | ||||

| Net Expenses | 901,529 | 97,014 | ||||||

| Net Investment Loss | (34,217 | ) | (11,491 | ) | ||||

| Realized and Unrealized Gain on Investments: | ||||||||

| Net Realized Gain on Investments | 3,302,080 | 167,631 | ||||||

| Net Change in Unrealized Appreciation on Investments | 5,946,334 | 1,605,144 | ||||||

| Net Realized and Unrealized Gain on Investments | 9,248,414 | 1,772,775 | ||||||

| Net Increase in Net Assets from Operations | $ | 9,214,197 | $ | 1,761,284 | ||||

| ** Foreign withholding taxes on foreign dividends have been provid- ed for in accordance with the Funds’ understanding of the applica- ble country’s tax rules and rates. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 21

| Paradigm Funds | ||||||||

| Statements of Assets and Liabilities | Opportunity | Micro-Cap | ||||||

| December 31, 2016 | Fund | Fund | ||||||

| Assets: | ||||||||

| Investment Securities at Fair Value* | $ | 6,711,733 | $ | 51,880,629 | ||||

| Dividends Receivable | 849 | 18,313 | ||||||

| Interest Receivable | 34 | 110 | ||||||

| Total Assets | 6,712,616 | 51,899,052 | ||||||

| Liabilities: | ||||||||

| Payable for Fund Shares Redeemed | - | 30,435 | ||||||

| Payable for Securities Purchased | 6,744 | 143,100 | ||||||

| Payable to Advisor | 7,142 | 55,618 | ||||||

| Total Liabilities | 13,886 | 229,153 | ||||||

| Net Assets | $ | 6,698,730 | $ | 51,669,899 | ||||

| Net Assets Consist of: | ||||||||

| Paid In Capital | $ | 4,141,375 | $ | 43,120,699 | ||||

| Accumulated Undistributed Realized Gain (Loss) on Investments - Net | (188,471 | ) | 842 | |||||

| Unrealized Appreciation in Value of Investment Securities - Net | 2,745,826 | 8,548,358 | ||||||

| Net Assets | $ | 6,698,730 | $ | 51,669,899 | ||||

| Net Asset Value, Offering and Redemption Price (Note 2) | $ | 35.68 | $ | 29.89 | ||||

| * Investments at Identified Cost | $ | 3,965,907 | $ | 43,332,271 | ||||

| Shares Outstanding (Unlimited number of shares | 187,737 | 1,728,738 | ||||||

| authorized without par value) | ||||||||

| Statements of Operations | ||||||||

| For the fiscal year ended December 31, 2016 | ||||||||

| Investment Income: | ||||||||

| Dividends (Net of foreign withholding taxes** of $0 and $0, respectively) | $ | 71,101 | $ | 255,352 | ||||

| Interest | 357 | 2,466 | ||||||

| Total Investment Income | 71,458 | 257,818 | ||||||

| Expenses: | ||||||||

| Investment Advisor Fees | 121,796 | 558,064 | ||||||

| Total Expenses | 121,796 | 558,064 | ||||||

| Less: Expenses Waived | (45,674 | ) | - | |||||

| Net Expenses | 76,122 | 558,064 | ||||||

| Net Investment Loss | (4,664 | ) | (300,246 | ) | ||||

| Realized and Unrealized Gain on Investments: | ||||||||

| Net Realized Gain on Investments | 53,024 | 2,286,331 | ||||||

| Net Change in Unrealized Appreciation on Investments | 807,613 | 9,440,597 | ||||||

| Net Realized and Unrealized Gain on Investments | 860,637 | 11,726,928 | ||||||

| Net Increase in Net Assets from Operations | $ | 855,973 | $ | 11,426,682 | ||||

| ** Foreign withholding taxes on foreign dividends have been provid- ed for in accordance with the Funds’ understanding of the applica- ble country’s tax rules and rates. The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 22

| Paradigm Funds | ||||||||||||||||

| Statements of Changes in Net Assets | Value Fund | Select Fund | ||||||||||||||

| 1/1/2016 | 1/1/2015 | 1/1/2016 | 1/1/2015 | |||||||||||||

| to | to | to | to | |||||||||||||

| 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | |||||||||||||

| From Operations: | ||||||||||||||||

| Net Investment Income (Loss) | $ | (34,217 | ) | $ | (36,184 | ) | $ | (11,491 | ) | $ | 12,404 | |||||

| Net Realized Gain on Investments | 3,302,080 | 10,102,364 | 167,631 | 455,515 | ||||||||||||

| Change in Net Unrealized Appreciation | 5,946,334 | (8,943,339 | ) | 1,605,144 | (502,967 | ) | ||||||||||

| Increase (Decrease) in Net Assets from Operations | 9,214,197 | 1,122,841 | 1,761,284 | (35,048 | ) | |||||||||||

| From Distributions to Shareholders: | ||||||||||||||||

| Net Investment Income | - | - | (3,424 | ) | (9,124 | ) | ||||||||||

| Net Realized Gain from Security Transactions | (2,927,866 | ) | (8,355,645 | ) | (165,344 | ) | (456,985 | ) | ||||||||

| Total Distributions to Shareholders | (2,927,866 | ) | (8,355,645 | ) | (168,768 | ) | (466,109 | ) | ||||||||

| From Capital Share Transactions: | ||||||||||||||||

| Proceeds From Sale of Shares | 3,997,611 | 3,224,508 | 16,625,834 | 485,080 | ||||||||||||

| Proceeds from Redemption Fees (Note 2) | 212 | 2,584 | 211 | 500 | ||||||||||||

| Shares Issued on Reinvestment of Dividends | 2,812,610 | 8,044,376 | 166,931 | 446,727 | ||||||||||||

| Cost of Shares Redeemed | (17,931,904 | ) | (33,269,143 | ) | (915,039 | ) | (1,569,443 | ) | ||||||||

| Net Increase (Decrease) from Shareholder Activity | (11,121,471 | ) | (21,997,675 | ) | 15,877,937 | (637,136 | ) | |||||||||

| Net Increase (Decrease) in Net Assets | (4,835,140 | ) | (29,230,479 | ) | 17,470,453 | (1,138,293 | ) | |||||||||

| Net Assets at Beginning of Period | 66,931,169 | 96,161,648 | 5,398,624 | 6,536,917 | ||||||||||||

| Net Assets at End of Period | $ | 62,096,029 | $ | 66,931,169 | $ | 22,869,077 | $ | 5,398,624 | ||||||||

| Accumulated Undistributed Net Investment Income | $ | - | $ | 3,078 | $ | - | $ | 3,421 | ||||||||

| Share Transactions: | ||||||||||||||||

| Issued | 90,447 | 65,850 | 523,164 | 14,617 | ||||||||||||

| Reinvested | 58,293 | 184,886 | 4,958 | 15,195 | ||||||||||||

| Redeemed | (413,801 | ) | (684,272 | ) | (30,738 | ) | (47,255 | ) | ||||||||

| Net Increase (Decrease) in Shares | (265,061 | ) | (433,536 | ) | 497,384 | (17,443 | ) | |||||||||

| Shares Outstanding Beginning of Period | 1,555,990 | 1,989,526 | 185,567 | 203,010 | ||||||||||||

| Shares Outstanding End of Period | 1,290,929 | 1,555,990 | 682,951 | 185,567 | ||||||||||||

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 23

| Paradigm Funds | ||||||||||||||||

| Statements of Changes in Net Assets | Opportunity Fund | Micro-Cap Fund | ||||||||||||||

| 1/1/2016 | 1/1/2015 | 1/1/2016 | 1/1/2015 | |||||||||||||

| to | to | to | to | |||||||||||||

| 12/31/2016 | 12/31/2015 | 12/31/2016 | 12/31/2015 | |||||||||||||

| From Operations: | ||||||||||||||||

| Net Investment Loss | $ | (4,664 | ) | $ | (12,427 | ) | $ | (300,246 | ) | $ | (148,705 | ) | ||||

| Net Realized Gain (Loss) on Investments | 53,024 | (201,820 | ) | 2,286,331 | 395,501 | |||||||||||

| Change in Net Unrealized Appreciation (Depreciation) | 807,613 | (86,400 | ) | 9,440,597 | (5,063,818 | ) | ||||||||||

| Increase (Decrease) in Net Assets from Operations | 855,973 | (300,647 | ) | 11,426,682 | (4,817,022 | ) | ||||||||||

| From Distributions to Shareholders: | ||||||||||||||||

| Net Investment Income | - | - | - | - | ||||||||||||

| Net Realized Gain from Security Transactions | - | (872 | ) | (1,798,512 | ) | (543,398 | ) | |||||||||

| Total Distributions to Shareholders | - | (872 | ) | (1,798,512 | ) | (543,398 | ) | |||||||||

| From Capital Share Transactions: | ||||||||||||||||

| Proceeds From Sale of Shares | 5,171 | 394,205 | 3,577,443 | 23,904,401 | ||||||||||||

| Proceeds from Redemption Fees (Note 2) | - | 556 | 253 | - | ||||||||||||

| Shares Issued on Reinvestment of Dividends | - | 870 | 1,796,975 | 543,357 | ||||||||||||

| Cost of Shares Redeemed | (181,798 | ) | (768,997 | ) | (5,727,837 | ) | (2,792,347 | ) | ||||||||

| Net Increase (Decrease) from Shareholder Activity | (176,627 | ) | (373,366 | ) | (353,166 | ) | 21,655,411 | |||||||||

| Net Increase (Decrease) in Net Assets | 679,346 | (674,885 | ) | 9,275,004 | 16,294,991 | |||||||||||

| Net Assets at Beginning of Period | 6,019,384 | 6,694,269 | 42,394,895 | 26,099,904 | ||||||||||||

| Net Assets at End of Period | $ | 6,698,730 | $ | 6,019,384 | $ | 51,669,899 | $ | 42,394,895 | ||||||||

| Accumulated Undistributed Net Investment Income | $ | - | $ | - | $ | - | $ | - | ||||||||

| Share Transactions: | ||||||||||||||||

| Issued | 170 | 11,226 | 135,485 | 881,559 | ||||||||||||

| Reinvested | - | 28 | 60,059 | 22,115 | ||||||||||||

| Redeemed | (5,747 | ) | (22,648 | ) | (209,844 | ) | (113,529 | ) | ||||||||

| Net Increase (Decrease) in Shares | (5,577 | ) | (11,394 | ) | (14,300 | ) | 790,145 | |||||||||

| Shares Outstanding Beginning of Period | 193,314 | 204,708 | 1,743,038 | 952,893 | ||||||||||||

| Shares Outstanding End of Period | 187,737 | 193,314 | 1,728,738 | 1,743,038 | ||||||||||||

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 24

| Paradigm Value Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Value Fund | ||||||||||||||||||||

| Selected data for a share outstanding | 1/1/2016 | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | |||||||||||||||

| throughout the period: | to | to | to | to | to | |||||||||||||||

| 12/31/2016 | 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 43.02 | $ | 48.33 | $ | 56.37 | $ | 56.47 | $ | 52.54 | ||||||||||

| Net Investment Income (Loss) (a) | (0.02 | ) | (0.02 | ) | (0.05 | ) | (0.19 | ) | 0.15 | |||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | 7.46 | 0.74 | 1.50 | 12.45 | 4.01 | |||||||||||||||

| Total from Investment Operations | 7.44 | 0.72 | 1.45 | 12.26 | 4.16 | |||||||||||||||

| Distributions (From Net Investment Income) | - | - | - | - | (0.16 | ) | ||||||||||||||

| Distributions (From Capital Gains) | (2.36 | ) | (6.03 | ) | (9.49 | ) | (12.37 | ) | - | |||||||||||

| Distributions (From Return of Capital) | - | - | - | - | (0.07 | ) | ||||||||||||||

| Total Distributions | (2.36 | ) | (6.03 | ) | (9.49 | ) | (12.37 | ) | (0.23 | ) | ||||||||||

| Proceeds from Redemption Fee (Note 2) | - | + | - | + | - | + | 0.01 | - | + | |||||||||||

| Net Asset Value - End of Period | $ | 48.10 | $ | 43.02 | $ | 48.33 | $ | 56.37 | $ | 56.47 | ||||||||||

| Total Return (b) | 17.29% | 1.35% | 2.44% | 21.82% | 7.93% | |||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 62,096 | $ | 66,931 | $ | 96,162 | $ | 133,113 | $ | 244,606 | ||||||||||

| Before Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 2.00% | 2.00% | 1.97% | 1.91% | 1.84% | |||||||||||||||

| After Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets (c) | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | |||||||||||||||

| Ratio of Net Investment Income (Loss) to Average | ||||||||||||||||||||

| Net Assets (c) | (0.06)% | (0.05)% | (0.09)% | (0.31)% | 0.26% | |||||||||||||||

| Portfolio Turnover Rate | 12.68% | 14.35% | 31.47% | 48.01% | 62.22% | |||||||||||||||

| Paradigm Select Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Select Fund | ||||||||||||||||||||

| Selected data for a share outstanding throughout the period: | 1/1/2016 | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | |||||||||||||||

| to | to | to | to | to | ||||||||||||||||

| 12/31/2016 | 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 29.09 | $ | 32.20 | $ | 37.05 | $ | 32.50 | $ | 30.24 | ||||||||||

| Net Investment Income (a) | (0.04 | ) | 0.07 | - | + | 0.06 | 0.24 | |||||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | 4.69 | (0.45 | ) | 2.98 | 9.29 | 2.49 | ||||||||||||||

| Total from Investment Operations | 4.65 | (0.38 | ) | 2.98 | 9.35 | 2.73 | ||||||||||||||

| Distributions (From Net Investment Income) | (0.01 | ) | (0.05 | ) | - | (0.05 | ) | (0.28 | ) | |||||||||||

| Distributions (From Capital Gains) | (0.24 | ) | (2.68 | ) | (7.83 | ) | (4.75 | ) | (0.19 | ) | ||||||||||

| Total Distributions | (0.25 | ) | (2.73 | ) | (7.83 | ) | (4.80 | ) | (0.47 | ) | ||||||||||

| Proceeds from Redemption Fee (Note 2) | - | + | - | + | - | - | + | - | + | |||||||||||

| Net Asset Value - End of Period | $ | 33.49 | $ | 29.09 | $ | 32.20 | $ | 37.05 | $ | 32.50 | ||||||||||

| Total Return (b) | 15.98% | (1.26)% | 7.86% | 28.83% | 9.07% | |||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 22,869 | $ | 5,399 | $ | 6,537 | $ | 8,181 | $ | 9,462 | ||||||||||

| Before Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 1.50% | 1.50% | 1.50% | 1.50% | 1.50% | |||||||||||||||

| After Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets (c) | 1.15% | 1.15% | 1.15% | 1.15% | 1.15% | |||||||||||||||

| Ratio of Net Investment Income (Loss) to Average | ||||||||||||||||||||

| Net Assets (c) | (0.14)% | 0.21% | 0.00% | + | 0.16% | 0.73% | ||||||||||||||

| Portfolio Turnover Rate | 31.47% | 19.57% | 36.25% | 46.80% | 86.71% | |||||||||||||||

| (a) Per share amount calculated using the average shares method. (b) Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares. (c) Such percentages reflect an expense waiver by the Advisor. See Note 4. + Amount calculated is less than $0.005/0.005% . |

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 25

| Paradigm Opportunity Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Opportunity Fund | ||||||||||||||||||||

| Selected data for a share outstanding throughout the period: | 1/1/2016 | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | |||||||||||||||

| to | to | to | to | to | ||||||||||||||||

| 12/31/2016 | 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 31.14 | $ | 32.70 | $ | 31.25 | $ | 26.44 | $ | 25.04 | ||||||||||

| Net Investment Loss (a) | (0.02 | ) | (0.06 | ) | (0.05 | ) | (0.08 | ) | (0.03 | ) | ||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | 4.56 | (1.50 | ) | 3.27 | 6.82 | 1.71 | ||||||||||||||

| Total from Investment Operations | 4.54 | (1.56 | ) | 3.22 | 6.74 | 1.68 | ||||||||||||||

| Distributions (From Net Investment Income) | - | - | - | - | - | |||||||||||||||

| Distributions (From Capital Gains) | - | - | + | (1.77 | ) | (1.93 | ) | (0.28 | ) | |||||||||||

| Distributions (From Return of Capital) | - | - | - | - | - | + | ||||||||||||||

| Total Distributions | - | - | (1.77 | ) | (1.93 | ) | (0.28 | ) | ||||||||||||

| Proceeds from Redemption Fee (Note 2) | - | - | + | - | + | - | - | |||||||||||||

| Net Asset Value - End of Period | $ | 35.68 | $ | 31.14 | $ | 32.70 | $ | 31.25 | $ | 26.44 | ||||||||||

| Total Return (b) | 14.58% | (4.76)% | 10.28% | 25.54% | 6.72% | |||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 6,699 | $ | 6,019 | $ | 6,694 | $ | 6,036 | $ | 4,807 | ||||||||||

| Before Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | |||||||||||||||

| After Reimbursement | ||||||||||||||||||||

| Ratio of Expenses to Average Net Assets (c) | 1.25% | 1.25% | 1.25% | 1.25% | 1.33% | |||||||||||||||

| Ratio of Net Investment Loss to Average | ||||||||||||||||||||

| Net Assets (c) | (0.08)% | (0.19)% | (0.15)% | (0.28)% | (0.10)% | |||||||||||||||

| Portfolio Turnover Rate | 10.65% | 16.21% | 7.59% | 44.00% | 61.11% | |||||||||||||||

| Paradigm Micro-Cap Fund | ||||||||||||||||||||

| Financial Highlights - Paradigm Micro-Cap Fund | ||||||||||||||||||||

| Selected data for a share outstanding throughout the period: | 1/1/2016 | 1/1/2015 | 1/1/2014 | 1/1/2013 | 1/1/2012 | |||||||||||||||

| to | to | to | to | to | ||||||||||||||||

| 12/31/2016 | 12/31/2015 | 12/31/2014 | 12/31/2013 | 12/31/2012 | ||||||||||||||||

| Net Asset Value - Beginning of Period | $ | 24.32 | $ | 27.39 | $ | 30.35 | $ | 23.24 | $ | 21.01 | ||||||||||

| Net Investment Income (Loss) (a) | (0.18 | ) | (0.11 | ) | (0.17 | ) | (0.06 | ) | 0.09 | |||||||||||

| Net Gain (Loss) on Securities (Realized and Unrealized) | 6.83 | (2.64 | ) | 0.74 | 9.69 | 2.23 | ||||||||||||||

| Total from Investment Operations | 6.65 | (2.75 | ) | 0.57 | 9.63 | 2.32 | ||||||||||||||

| Distributions (From Net Investment Income) | - | - | - | - | (0.09 | ) | ||||||||||||||

| Distributions (From Capital Gains) | (1.08 | ) | (0.32 | ) | (3.53 | ) | (2.52 | ) | - | |||||||||||

| Total Distributions | (1.08 | ) | (0.32 | ) | (3.53 | ) | (2.52 | ) | (0.09 | ) | ||||||||||

| Proceeds from Redemption Fee (Note 2) | - | + | - | - | - | - | + | |||||||||||||

| Net Asset Value - End of Period | $ | 29.89 | $ | 24.32 | $ | 27.39 | $ | 30.35 | $ | 23.24 | ||||||||||

| Total Return (b) | 27.33% | (10.05)% | 1.81% | 41.41% | 11.06% | |||||||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

| Net Assets - End of Period (Thousands) | $ | 51,670 | $ | 42,395 | $ | 26,100 | $ | 27,210 | $ | 17,598 | ||||||||||

| Ratio of Expenses to Average Net Assets | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% | |||||||||||||||

| Ratio of Net Investment Income (Loss) to Average | ||||||||||||||||||||

| Net Assets | (0.67)% | (0.41)% | (0.58)% | (0.21)% | 0.38% | |||||||||||||||

| Portfolio Turnover Rate | 88.88% | 70.95% | 101.19% | 70.07% | 60.47% | |||||||||||||||

| (a) Per share amount calculated using the average shares method. (b) Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares. (c) Such percentages reflect an expense waiver by the Advisor. See Note 4. + Amount calculated is less than $0.005. |

| The accompanying notes are an integral part of these financial statements. |

2016 Annual Report 26

NOTES TO FINANCIAL STATEMENTS

PARADIGM FUNDS

December 31, 2016

1.) ORGANIZATION

Paradigm Funds (the “Trust”) is an open-end management investment company that was organized in Ohio as a business trust on September 13, 2002 that may offer shares of beneficial interest in a number of separate series, each series representing a distinct fund with its own investment objectives and policies. The Paradigm Value Fund (“Value”) commenced operations on January 1, 2003. Value’s investment objective is long-term capital appreciation. The Paradigm Select Fund (“Select”) and Paradigm Opportunity Fund (“Opportunity”) both commenced operations on January 1, 2005 with long-term capital appreciation as their objective. The Paradigm Micro-Cap Fund (“Micro-Cap”) commenced operations on January 1, 2008. Micro-Cap’s investment objective is long-term capital appreciation. Under normal circumstances, Micro-Cap invests at least 80% of its net assets in the common stocks of U.S. micro-cap companies. Prior to December 27, 2011, the principal investment strategy of the Fund was to invest primarily in the common stocks of small, mid or large capitalization companies that the Advisor (defined below) believed had the potential for capital appreciation. Value, Select, Opportunity and Micro-Cap are all diversified funds. The advisor to Value, Select, Opportunity and Micro-Cap (each a “Fund” and collectively the “Funds”) is Paradigm Funds Advisor LLC (the “Advisor”).

2.) SIGNIFICANT ACCOUNTING POLICIES

SECURITY VALUATION: The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services - Investment Companies. All investments in securities are recorded at their estimated fair value, as described in Note 3.

SECURITY TRANSACTIONS AND OTHER: Security transactions are recorded based on a trade date for financial statement reporting purposes. Dividend income is recognized on the ex-dividend date. Interest income is recognized on an accrual basis. The Funds use the highest cost basis in computing gain or loss on sale of investment securities. Discounts and premiums on fixed income securities purchased are amortized over the lives of the respective securities. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates. The Funds may invest in real estate investment trusts (“REITs”) that pay distributions to their shareholders based on available funds from operations. It is common for these distributions to exceed the REITs taxable earnings and profits resulting in the excess portion of such distribution to be designated as return of capital. Distributions received from REITs are generally recorded as dividend income and, if necessary, are reclassified annually in accordance with tax information provided by the underlying REITs.

The Funds may hold investments in master limited partnerships (“MLPs”). It is common for distributions from MLPs to exceed taxable earnings and profits resulting in the excess portion of such dividend to be designated as return of capital. Annually, income or loss from MLPs is reclassified upon receipt of the MLPs K-1. For financial reporting purpose management does not estimate the tax character of MLP distributions for which actual information has not been reported.

SHARE VALUATION: The net asset value (the “NAV”) is calculated as of the close of trading on the New York Stock Exchange (normally 4:00 p.m. Eastern time) every day the Exchange is open. The NAV for each Fund is calculated by taking the total value of the Fund’s assets, subtracting its liabilities, and then dividing by the total number of shares outstanding, rounded to the nearest cent. The offering price and redemption price per share is equal to the net asset value per share, except that shares of each Fund are subject to a redemption fee of 2% if redeemed within 90 days of purchase. During the fiscal year ended December 31, 2016 proceeds from redemption fees were $212, $211, $0 and $253 for Value, Select, Opportunity and Micro-Cap, respectively.

INCOME TAXES: The Funds’ policy is to continue to comply with the requirements of the Internal Revenue Code that are applicable to regulated investment companies and to distribute all of their taxable income to shareholders. Therefore, no federal income tax provision is required. It is the Funds’ policy to distribute annually, prior to the end of the calendar year, dividends sufficient to satisfy excise tax requirements of the Internal Revenue Code. This Internal Revenue Code requirement may cause an excess of distributions over the book year-end accumulated income. In addition, it is the Funds’ policy to distribute annually, after the end of the fiscal year, any remaining net investment income and net realized capital gains.

The Funds recognize the tax benefits of certain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Funds’ tax posi-

2016 Annual Report 27

Notes to Financial Statements - continued

tions, and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years. The Funds identify their major tax jurisdictions as U.S. Federal and New York State tax authorities; the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statements of Operations. During the fiscal year ended December 31, 2016, the Funds did not incur any interest or penalties.

ESTIMATES: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

DISTRIBUTIONS TO SHAREHOLDERS: Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The Funds may utilize earnings and profits distributed to shareholders on redemptions of shares as part of the dividends paid deduction. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassification will have no effect on net assets, results of operations or net asset values per share of any Fund. At December 31, 2016, the following permanent adjustments were recorded. Such adjustments were attributed to the reclassification of net investment loss, distribution adjustments and the usage of equalization for tax purposes.

| Value | |||

| Paid In Capital | $365,515 | ||

| Accumulated Undistributed Net Investment Income | $31,139 | ||

| Accumulated Realized Loss on Investments - Net | ($396,654 | ) | |

| Select | |||

| Accumulated Undistributed Net Investment Income | $11,494 | ||

| Accumulated Realized Loss on Investments - Net | ($11,494 | ) | |

| Opportunity | |||

| Paid In Capital | ($4,664 | ) | |

| Accumulated Undistributed Net Investment Income | $4,664 | ||

| Micro-Cap | |||

| Accumulated Undistributed Net Investment Income | $300,246 | ||

| Accumulated Undistributed Realized Gain on Investments - Net | ($300,246 | ) | |

3.) SECURITIES VALUATIONS

The Funds utilize various methods to measure the fair value of their investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 - Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2 - Observable inputs other than quoted prices included in level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 - Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Funds’ best information about the assumptions a market participant would use in valuing the assets or liabilities.

The availability of inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in level 3.

2016 Annual Report 28

Notes to Financial Statements - continued