right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund

dividends and statements from your

financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund

dividends and statements directly from

Nuveen.

NOT FDIC INSURED MAY LOSE

VALUE NO BANK GUARANTEE

|

Chair’s Letter to Shareholders

|

4

|

|

Portfolio Manager’s Comments

|

5

|

|

Fund Leverage

|

7

|

|

Common Share Information

|

9

|

|

Risk Considerations

|

11

|

|

Performance Overview and Holding Summaries

|

12

|

|

Portfolios of Investments

|

20

|

|

Statement of Assets and Liabilities

|

58

|

|

Statement of Operations

|

59

|

|

Statement of Changes in Net Assets

|

60

|

|

Statement of Cash Flows

|

62

|

|

Financial Highlights

|

64

|

|

Notes to Financial Statements

|

69

|

|

Additional Fund Information

|

82

|

|

Glossary of Terms Used in this Report

|

83

|

|

Reinvest Automatically, Easily and Conveniently

|

85

|

|

Annual Investment Management Agreement Approval Process

|

86

|

to Shareholders

Chair of the Board

October 25, 2019

Nuveen California Municipal Value Fund, Inc (NCA)

Nuveen California Municipal Value Fund 2 (NCB)

Nuveen California AMT-Free Quality Municipal Income Fund (NKX)

Nuveen California Quality Municipal Income Fund (NAC)

|

|

NCA

|

NCB

|

NKX

|

NAC

|

|

Effective Leverage*

|

0.00%

|

0.00%

|

36.93%

|

36.08%

|

|

Regulatory Leverage*

|

0.00%

|

0.00%

|

35.27%

|

35.09%

|

|

* Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio

that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists

of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in

connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment

Company Act of 1940.

|

|

|

Variable Rate

|

Variable Rate

|

||||||||||

|

|

Preferred*

|

Remarketed Preferred**

|

||||||||||

|

|

Shares

|

Shares

|

||||||||||

|

|

Issued at

|

Issued at

|

||||||||||

|

|

Liquidation

|

Liquidation

|

||||||||||

|

|

Preference

|

Preference

|

Total

|

|||||||||

|

NKX

|

$

|

—

|

$

|

432,600,000

|

$

|

432,600,000

|

||||||

|

NAC

|

$

|

638,900,000

|

$

|

638,700,000

|

$

|

1,277,600,000

|

||||||

|

*

|

Preferred shares of the Fund featuring a floating rate dividend based on a predetermined formula or spread to an index rate. Includes the following preferred shares AMTP, iMTP, VMTP, MFP- VRM and VRDP in Special Rate Mode, where

applicable. See Notes to Financial Statements, Note 5 – Fund Shares, Preferred Shares for further details.

|

|

**

|

Preferred shares of the Fund featuring floating rate dividends set by a remarketing agent via a regular remarketing. Includes the following preferred shares VRDP not in Special Rate Mode, MFP- VRRM and MFP-VRDM, where applicable. See Notes

to Financial Statements, Note 5 – Fund Shares, Preferred Shares for further details.

|

|

|

Per Common Share Amounts

|

|||||||||||||||

|

Monthly Distributions (Ex-Dividend Date)

|

NCA

|

NCB

|

NKX

|

NAC

|

||||||||||||

|

March 2019

|

$

|

0.0285

|

$

|

0.0540

|

$

|

0.0515

|

$

|

0.0555

|

||||||||

|

April

|

0.0285

|

0.0540

|

0.0515

|

0.0555

|

||||||||||||

|

May

|

0.0285

|

0.0540

|

0.0515

|

0.0555

|

||||||||||||

|

June

|

0.0285

|

0.0470

|

0.0515

|

0.0555

|

||||||||||||

|

July

|

0.0285

|

0.0470

|

0.0515

|

0.0555

|

||||||||||||

|

August 2019

|

0.0285

|

0.0470

|

0.0515

|

0.0555

|

||||||||||||

|

Total Distributions from Net Investment Income

|

$

|

0.1710

|

$

|

0.3030

|

$

|

0.3090

|

$

|

0.3330

|

||||||||

|

Yields

|

||||||||||||||||

|

Market Yield*

|

3.23

|

%

|

3.29

|

%

|

4.00

|

%

|

4.32

|

%

|

||||||||

|

Taxable-Equivalent Yield*

|

6.61

|

%

|

6.74

|

%

|

8.18

|

%

|

8.87

|

%

|

||||||||

|

* Market Yield is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield

represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 54.1%. Your actual combined federal and state

income tax rate may differ from the assumed rate. The Taxable-Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on payments made during the previous calendar year) that was

either exempt from federal income tax but not from state income tax (e.g., income from an out-of-state municipal bond), or was exempt from neither federal nor state income tax. Separately, if the comparison were instead to investments that

generate qualified dividend income, which is taxable at a rate lower than an individual’s ordinary graduated tax rate, the fund’s Taxable-Equivalent Yield would be lower.

|

|

|

NCA

|

NCB

|

NKX

|

NAC

|

|

Common shares cumulatively repurchased and retired

|

–

|

–

|

230,000

|

370,000

|

|

Common shares authorized for repurchase

|

2,810,000

|

330,000

|

4,750,000

|

14,475,000

|

|

|

NCA

|

NCB

|

NKX

|

NAC

|

||||||||||||

|

Common share NAV

|

$

|

10.81

|

$

|

16.64

|

$

|

16.70

|

$

|

16.33

|

||||||||

|

Common share price

|

$

|

10.60

|

$

|

17.15

|

$

|

15.44

|

$

|

15.40

|

||||||||

|

Premium/(Discount) to NAV

|

(1.94

|

)%

|

3.06

|

%

|

(7.54

|

)%

|

(5.70

|

)%

|

||||||||

|

6-month average premium/(discount) to NAV

|

(4.69

|

)%

|

(0.07

|

)%

|

(9.31

|

)%

|

(8.79

|

)%

|

||||||||

|

NCA

|

Nuveen California Municipal Value Fund, Inc.

|

|

|

Performance Overview and Holding Summaries as of August 31, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

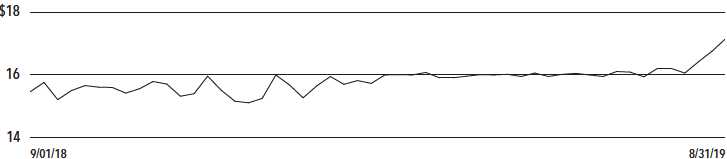

Average Annual Total Returns as of August 31, 2019

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NCA at Common Share NAV

|

8.46%

|

9.45%

|

4.76%

|

6.05%

|

|

NCA at Common Share Price

|

14.45%

|

13.33%

|

4.97%

|

6.18%

|

|

S&P Municipal Bond California Index

|

6.28%

|

8.19%

|

4.02%

|

5.27%

|

|

S&P Municipal Bond Index

|

5.92%

|

8.26%

|

3.79%

|

4.72%

|

12

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

94.5%

|

|

Short-Term Municipal Bonds

|

4.6%

|

|

Other Assets Less Liabilities

|

0.9%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

California

|

97.6%

|

|

Puerto Rico

|

2.0%

|

|

Virgin Islands

|

0.4%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Tax Obligation/General

|

24.7%

|

|

Transportation

|

19.4%

|

|

Water and Sewer

|

13.3%

|

|

Health Care

|

11.9%

|

|

Tax Obligation/Limited

|

11.7%

|

|

U.S. Guaranteed

|

6.1%

|

|

Other

|

12.9%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

6.1%

|

|

AAA

|

17.2%

|

|

AA

|

45.8%

|

|

A

|

15.6%

|

|

BBB

|

3.8%

|

|

BB or Lower

|

6.7%

|

|

N/R (not rated)

|

4.8%

|

|

Total

|

100%

|

|

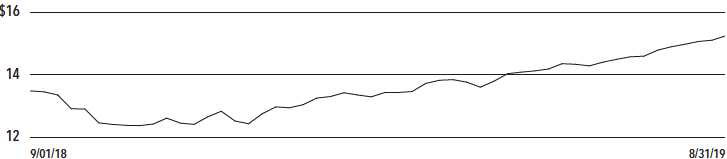

NCB

|

Nuveen California Municipal Value Fund 2

|

|

|

Performance Overview and Holding Summaries as of August 31, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

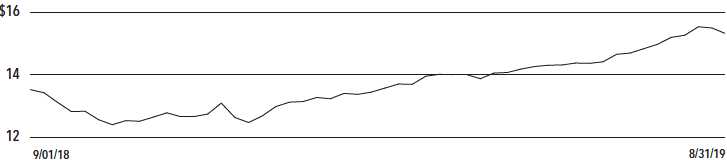

Average Annual Total Returns as of August 31, 2019

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NCB at Common Share NAV

|

8.40%

|

9.27%

|

4.55%

|

6.22%

|

|

NCB at Common Share Price

|

9.20%

|

15.10%

|

6.25%

|

7.05%

|

|

S&P Municipal Bond California Index

|

6.28%

|

8.19%

|

4.02%

|

5.27%

|

|

S&P Municipal Bond Index

|

5.92%

|

8.26%

|

3.79%

|

4.72%

|

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

88.6%

|

|

Short-Term Municipal Bonds

|

10.6%

|

|

Other Assets Less Liabilities

|

0.8%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

California

|

98.1%

|

|

Puerto Rico

|

1.9%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Tax Obligation/General

|

17.5%

|

|

Health Care

|

16.5%

|

|

Transportation

|

15.0%

|

|

Tax Obligation/Limited

|

11.9%

|

|

Utilities

|

11.8%

|

|

Water and Sewer

|

11.7%

|

|

Other

|

15.6%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

4.9%

|

|

AAA

|

20.1%

|

|

AA

|

36.8%

|

|

A

|

20.3%

|

|

BBB

|

6.6%

|

|

BB or Lower

|

4.9%

|

|

N/R (not rated)

|

6.4%

|

|

Total

|

100%

|

|

NKX

|

Nuveen California AMT-Free Quality

|

|

|

Municipal Income Fund

|

|

|

Performance Overview and Holding Summaries as of August 31, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

Average Annual Total Returns as of August 31, 2019

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NKX at Common Share NAV

|

12.22%

|

13.66%

|

6.46%

|

7.70%

|

|

NKX at Common Share Price

|

16.81%

|

20.35%

|

7.67%

|

7.95%

|

|

S&P Municipal Bond California Index

|

6.28%

|

8.19%

|

4.02%

|

5.27%

|

|

S&P Municipal Bond Index

|

5.92%

|

8.26%

|

3.79%

|

4.72%

|

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

154.3%

|

|

Short-Term Municipal Bonds

|

1.1%

|

|

Other Assets Less Liabilities

|

1.4%

|

|

Net Assets Plus Floating Rate

|

|

|

Obligations, MFP Shares, net of

|

|

|

deferred offering costs & VRDP Shares,

|

|

|

net of deferred offering costs

|

156.8%

|

|

Floating Rate Obligations

|

(2.6)%

|

|

MFP Shares, net of deferred offering costs

|

(17.6)%

|

|

VRDP Shares, net of deferred offering costs

|

(36.6)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

California

|

96.1%

|

|

Puerto Rico

|

2.3%

|

|

Guam

|

1.1%

|

|

Virgin Islands

|

0.4%

|

|

New York

|

0.1%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Tax Obligation/Limited

|

21.8%

|

|

Tax Obligation/General

|

20.8%

|

|

Water and Sewer

|

13.0%

|

|

Health Care

|

11.1%

|

|

Transportation

|

10.2%

|

|

U.S. Guaranteed

|

7.6%

|

|

Utilities

|

5.3%

|

|

Other

|

10.2%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

7.6%

|

|

AAA

|

6.4%

|

|

AA

|

59.0%

|

|

A

|

9.0%

|

|

BBB

|

3.5%

|

|

BB or Lower

|

5.8%

|

|

N/R (not rated)

|

8.7%

|

|

Total

|

100%

|

|

NAC

|

Nuveen California Quality Municipal

|

|

|

Income Fund

|

|

|

Performance Overview and Holding Summaries as of August 31, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

Average Annual Total Returns as of August 31, 2019

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NAC at Common Share NAV

|

11.56%

|

12.36%

|

6.27%

|

8.13%

|

|

NAC at Common Share Price

|

18.49%

|

19.79%

|

7.31%

|

8.66%

|

|

S&P Municipal Bond California Index

|

6.28%

|

8.19%

|

4.02%

|

5.27%

|

|

S&P Municipal Bond Index

|

5.92%

|

8.26%

|

3.79%

|

4.72%

|

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

153.8%

|

|

Other Assets Less Liabilities

|

1.3%

|

|

Net Assets Plus Floating Rate

|

|

|

Obligations, MFP Shares, net of

|

|

|

deferred offering costs & VRDP

|

|

|

Shares, net of deferred offering costs

|

155.1%

|

|

Floating Rate Obligations

|

(1.2)%

|

|

MFP Shares, net of deferred offering costs

|

(13.5)%

|

|

VRDP Shares, net of deferred offering costs

|

(40.4)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

California

|

97.0%

|

|

Puerto Rico

|

2.3%

|

|

Guam

|

0.6%

|

|

Virgin Islands

|

0.1%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Tax Obligation/General

|

23.2%

|

|

Tax Obligation/Limited

|

16.4%

|

|

Transportation

|

14.6%

|

|

U.S. Guaranteed

|

11.3%

|

|

Health Care

|

10.0%

|

|

Water and Sewer

|

8.4%

|

|

Utilities

|

6.9%

|

|

Other

|

9.2%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

10.9%

|

|

AAA

|

5.6%

|

|

AA

|

51.3%

|

|

A

|

12.4%

|

|

BBB

|

6.2%

|

|

BB or Lower

|

6.7%

|

|

N/R (not rated)

|

6.9%

|

|

Total

|

100%

|

|

NCA

|

Nuveen California Municipal Value Fund, Inc.

|

|

|

Portfolio of Investments

|

|

|

August 31, 2019 (Unaudited)

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

LONG-TERM INVESTMENTS – 94.5% (95.4% of Total Investments)

|

|

|

|

|

|

|

MUNICIPAL BONDS – 94.5% (95.4% of Total Investments)

|

|

|

|

|

|

|

Consumer Staples – 4.3% (4.3% of Total Investments)

|

|

|

|

|

|

$ 2,000

|

California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds,

|

9/19 at 100.00

|

B2

|

$ 2,012,860

|

|

|

|

Los Angeles County Securitization Corporation, Series 2006A, 5.650%, 6/01/41

|

|

|

|

|

|

3,570

|

Golden State Tobacco Securitization Corporation, California, Tobacco Settlement

|

6/22 at 100.00

|

B+

|

3,713,264

|

|

|

|

Asset-Backed Bonds, Senior Convertible Series 2007A-2, 5.300%, 6/01/37

|

|

|

|

|

|

2,450

|

Golden State Tobacco Securitization Corporation, California, Tobacco Settlement

|

6/22 at 100.00

|

N/R

|

2,529,258

|

|

|

|

Asset-Backed Bonds, Series 2018A-1, 5.250%, 6/01/47

|

|

|

|

|

|

3,895

|

Silicon Valley Tobacco Securitization Authority, California, Tobacco Settlement

|

9/19 at 29.71

|

N/R

|

1,152,608

|

|

|

|

Asset-Backed Bonds, Santa Clara County Tobacco Securitization Corporation, Series 2007A,

|

|

|

|

|

|

|

0.000%, 6/01/41

|

|

|

|

|

|

3,500

|

Tobacco Securitization Authority of Northern California, Tobacco Settlement Asset-Backed

|

9/19 at 100.00

|

B–

|

3,512,530

|

|

|

|

Bonds, Series 2005A-1, 5.500%, 6/01/45

|

|

|

|

|

|

15,415

|

Total Consumer Staples

|

|

|

12,920,520

|

|

|

|

Education and Civic Organizations – 1.2% (1.2% of Total Investments)

|

|

|

|

|

|

450

|

California Municipal Finance Authority, Charter School Revenue Bonds, Rocketship

|

6/22 at 102.00

|

N/R

|

505,440

|

|

|

|

Education Multiple Projects, Series 2014A, 7.250%, 6/01/43

|

|

|

|

|

|

185

|

California School Finance Authority, School Facility Revenue Bonds, Alliance for

|

7/25 at 100.00

|

BBB

|

208,821

|

|

|

|

College-Ready Public Schools Project, Series 2016A, 5.000%, 7/01/46, 144A

|

|

|

|

|

|

1,165

|

California School Finance Authority, School Facility Revenue Bonds, Alliance for

|

7/25 at 101.00

|

BBB

|

1,332,317

|

|

|

|

College-Ready Public Schools Project, Series 2016C, 5.250%, 7/01/52

|

|

|

|

|

|

690

|

California State University, Systemwide Revenue Bonds, Series 2016A, 4.000%, 11/01/38

|

5/26 at 100.00

|

Aa2

|

778,292

|

|

|

700

|

California Statewide Communities Development Authority, School Facility Revenue Bonds,

|

7/21 at 100.00

|

B+

|

746,746

|

|

|

|

Alliance College-Ready Public Schools, Series 2011A, 7.000%, 7/01/46

|

|

|

|

|

|

3,190

|

Total Education and Civic Organizations

|

|

|

3,571,616

|

|

|

|

Financials – 0.7% (0.7% of Total Investments)

|

|

|

|

|

|

|

Puerto Rico Urgent Interest Fund Corp (COFINA), National Custodial Taxable Trust Unit,

|

|

|

|

|

|

|

Series 2007A Sr. Bond:

|

|

|

|

|

|

569

|

0.000%, 8/01/40 (4)

|

No Opt. Call

|

N/R

|

413,837

|

|

|

2,500

|

0.000%, 8/01/44 (4)

|

No Opt. Call

|

N/R

|

1,818,750

|

|

|

3,069

|

Total Financials

|

|

|

2,232,587

|

|

|

|

Health Care – 8.2% (8.3% of Total Investments)

|

|

|

|

|

|

285

|

California Health Facilities Financing Authority, California, Revenue Bonds, Sutter

|

8/25 at 100.00

|

AA–

|

337,443

|

|

|

|

Health, Refunding Series 2015A, 5.000%, 8/15/43

|

|

|

|

|

|

1,950

|

California Health Facilities Financing Authority, California, Revenue Bonds, Sutter

|

11/26 at 100.00

|

AA–

|

2,356,341

|

|

|

|

Health, Refunding Series 2016B, 5.000%, 11/15/46

|

|

|

|

|

|

|

California Health Facilities Financing Authority, California, Revenue Bonds, Sutter

|

|

|

|

|

|

|

Health, Series 2018A:

|

|

|

|

|

|

1,200

|

5.000%, 11/15/34

|

11/27 at 100.00

|

AA–

|

1,523,844

|

|

|

2,950

|

5.000%, 11/15/48

|

11/27 at 100.00

|

AA–

|

3,615,196

|

|

|

555

|

California Health Facilities Financing Authority, Revenue Bonds, Lucile Salter Packard

|

8/24 at 100.00

|

AA–

|

635,009

|

|

|

|

Children’s Hospital, Series 2014A, 5.000%, 8/15/43

|

|

|

|

|

|

350

|

California Health Facilities Financing Authority, Revenue Bonds, Providence Health &

|

10/24 at 100.00

|

AA–

|

407,799

|

|

|

|

Services, Refunding Series 2014A, 5.000%, 10/01/38

|

|

|

|

|

|

690

|

California Health Facilities Financing Authority, Revenue Bonds, Providence Health &

|

10/24 at 100.00

|

AA–

|

793,058

|

|

|

|

Services, Series 2014B, 5.000%, 10/01/44

|

|

|

|

|

|

|

California Health Facilities Financing Authority, Revenue Bonds, Rady Children’s

|

|

|

|

|

|

|

Hospital – San Diego, Series 2011:

|

|

|

|

|

|

560

|

5.000%, 8/15/31

|

8/21 at 100.00

|

AA

|

599,922

|

|

|

670

|

5.250%, 8/15/41

|

8/21 at 100.00

|

AA

|

718,823

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Health Care (continued)

|

|

|

|

|

|

$ 100

|

California Municipal Finance Authority, Revenue Bonds, Eisenhower Medical Center,

|

7/27 at 100.00

|

Baa2

|

$ 118,186

|

|

|

|

Refunding Series 2017A, 5.000%, 7/01/42

|

|

|

|

|

|

400

|

California Municipal Finance Authority, Revenue Bonds, NorthBay Healthcare Group, Series

|

11/26 at 100.00

|

BBB–

|

466,144

|

|

|

|

2017A, 5.250%, 11/01/47

|

|

|

|

|

|

|

California Statewide Communities Development Authority, California, Revenue Bonds, Loma

|

|

|

|

|

|

|

Linda University Medical Center, Series 2016A:

|

|

|

|

|

|

2,390

|

5.000%, 12/01/46, 144A

|

6/26 at 100.00

|

BB

|

2,699,935

|

|

|

2,625

|

5.250%, 12/01/56, 144A

|

6/26 at 100.00

|

BB

|

3,001,950

|

|

|

1,000

|

California Statewide Communities Development Authority, California, Revenue Bonds, Loma

|

6/28 at 100.00

|

BB

|

1,179,090

|

|

|

|

Linda University Medical Center, Series 2018A, 5.250%, 12/01/48, 144A

|

|

|

|

|

|

2,625

|

California Statewide Communities Development Authority, Revenue Bonds, Kaiser

|

4/22 at 100.00

|

AA–

|

2,862,090

|

|

|

|

Permanente, Series 2012A, 5.000%, 4/01/42

|

|

|

|

|

|

1,510

|

California Statewide Community Development Authority, Revenue Bonds, Sherman Oaks Health

|

No Opt. Call

|

AA–

|

1,578,282

|

|

|

|

System, Series 1998A, 5.000%, 8/01/22 – AMBAC Insured

|

|

|

|

|

|

1,750

|

San Buenaventura, California, Revenue Bonds, Community Memorial Health System, Series

|

12/21 at 100.00

|

BB

|

1,959,090

|

|

|

|

2011, 7.500%, 12/01/41

|

|

|

|

|

|

21,610

|

Total Health Care

|

|

|

24,852,202

|

|

|

|

Housing/Multifamily – 0.9% (0.9% of Total Investments)

|

|

|

|

|

|

115

|

California Community Housing Agency, Workforce Housing Revenue Bonds, Annadel

|

4/29 at 100.00

|

N/R

|

129,326

|

|

|

|

Apartments, Series 2019A, 5.000%, 4/01/49, 144A

|

|

|

|

|

|

290

|

California Housing Finance Agency, Multifamily Housing Revenue Bonds, Series2019-1,

|

No Opt. Call

|

BBB+

|

347,339

|

|

|

|

4.250%, 1/15/35

|

|

|

|

|

|

|

California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas

|

|

|

|

|

|

|

Affordable Housing Inc Projects, Senior Series 2014A:

|

|

|

|

|

|

65

|

5.250%, 8/15/39

|

8/24 at 100.00

|

BBB+

|

74,048

|

|

|

175

|

5.250%, 8/15/49

|

8/24 at 100.00

|

BBB+

|

196,915

|

|

|

1,060

|

California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects

|

8/22 at 100.00

|

BBB

|

1,143,231

|

|

|

|

Series 2012A, 5.500%, 8/15/47

|

|

|

|

|

|

845

|

San Dimas Housing Authority, California, Mobile Home Park Revenue Bonds, Charter Oak

|

9/19 at 100.00

|

N/R

|

846,656

|

|

|

|

Mobile Home Estates Acquisition Project, Series 1998A, 5.700%, 7/01/28

|

|

|

|

|

|

2,550

|

Total Housing/Multifamily

|

|

|

2,737,515

|

|

|

|

Tax Obligation/General – 24.5% (24.7% of Total Investments)

|

|

|

|

|

|

1,000

|

California State, General Obligation Bonds, Refunding Various Purpose Series 2013,

|

2/23 at 100.00

|

AA

|

1,130,120

|

|

|

|

5.000%, 2/01/29

|

|

|

|

|

|

1,000

|

California State, General Obligation Bonds, Various Purpose Refunding Series 2014,

|

8/24 at 100.00

|

AA

|

1,176,220

|

|

|

|

5.000%, 8/01/31

|

|

|

|

|

|

3,000

|

California State, General Obligation Bonds, Various Purpose Refunding Series 2015,

|

8/25 at 100.00

|

AA

|

3,618,630

|

|

|

|

5.000%, 8/01/34

|

|

|

|

|

|

1,000

|

California State, General Obligation Bonds, Various Purpose Series 2009,

|

11/19 at 100.00

|

AA

|

1,007,940

|

|

|

|

6.000%, 11/01/39

|

|

|

|

|

|

2,000

|

California State, General Obligation Bonds, Various Purpose Series 2010, 5.500%, 3/01/40

|

3/20 at 100.00

|

AA

|

2,043,620

|

|

|

|

California State, General Obligation Bonds, Various Purpose Series 2013:

|

|

|

|

|

|

2,500

|

5.000%, 4/01/37

|

4/23 at 100.00

|

AA

|

2,826,750

|

|

|

2,500

|

5.000%, 2/01/43

|

2/23 at 100.00

|

AA

|

2,802,300

|

|

|

2,240

|

5.000%, 11/01/43

|

11/23 at 100.00

|

AA

|

2,567,130

|

|

|

|

California State, General Obligation Bonds, Various Purpose Series 2014:

|

|

|

|

|

|

5,000

|

5.000%, 5/01/32

|

5/24 at 100.00

|

AA

|

5,830,250

|

|

|

1,970

|

5.000%, 10/01/39

|

10/24 at 100.00

|

AA

|

2,306,614

|

|

|

2,000

|

California State, General Obligation Bonds, Various Purpose Series 2018,

|

4/26 at 100.00

|

AA

|

2,398,920

|

|

|

|

5.000%, 10/01/47

|

|

|

|

|

|

4,000

|

Los Angeles Unified School District, Los Angeles County, California, General Obligation

|

1/28 at 100.00

|

AAA

|

5,006,200

|

|

|

|

Bonds, Election 2008 Series 2018B-1, 5.000%, 7/01/38

|

|

|

|

|

|

3,000

|

Mount San Jacinto Community College District, Riverside County, California, General

|

8/28 at 100.00

|

Aa1

|

3,455,730

|

|

|

|

Obligation Bonds, Election 2014, Series 2018B, 4.000%, 8/01/43

|

|

|

|

|

NCA

|

Nuveen California Municipal Value Fund, Inc.

|

|

|

Portfolio of Investments (continued)

August 31, 2019 (Unaudited) |

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Tax Obligation/General (continued)

|

|

|

|

|

|

$ 290

|

Oceanside Unified School District, San Diego County, California, General Obligation

|

8/20 at 13.60

|

AA

|

$ 38,819

|

|

|

|

Bonds, Election 2008 Series 2010B, 0.000%, 8/01/49 – AGM Insured

|

|

|

|

|

|

5,000

|

San Mateo County Community College District, California, General Obligation Bonds,

|

9/28 at 100.00

|

AAA

|

6,353,900

|

|

|

|

Election 2014 Series 2018B, 5.000%, 9/01/45

|

|

|

|

|

|

11,875

|

San Mateo Union High School District, San Mateo County, California, General Obligation

|

9/36 at 100.00

|

Aaa

|

12,616,356

|

|

|

|

Bonds, Election 2010 Series 2011A, 0.000%, 9/01/41 (5)

|

|

|

|

|

|

19,860

|

Yosemite Community College District, California, General Obligation Bonds, Capital

|

No Opt. Call

|

Aa2

|

19,300,544

|

|

|

|

Appreciation, Election 2004, Series 2010D, 0.000%, 8/01/42 (5)

|

|

|

|

|

|

68,235

|

Total Tax Obligation/General

|

|

|

74,480,043

|

|

|

|

Tax Obligation/Limited – 11.6% (11.7% of Total Investments)

|

|

|

|

|

|

1,000

|

Artesia Redevelopment Agency, California, Tax Allocation Revenue Bonds, Artesia

|

9/19 at 100.00

|

BBB+

|

1,001,140

|

|

|

|

Redevelopment Project Area, Series 2007, 5.375%, 6/01/27

|

|

|

|

|

|

|

Bell Community Redevelopment Agency, California, Tax Allocation Bonds, Bell Project

|

|

|

|

|

|

|

Area, Series 2003:

|

|

|

|

|

|

2,460

|

5.500%, 10/01/23 – RAAI Insured

|

9/19 at 100.00

|

AA

|

2,467,626

|

|

|

1,000

|

5.625%, 10/01/33 – RAAI Insured

|

9/19 at 100.00

|

AA

|

1,003,430

|

|

|

1,500

|

California State Public Works Board, Lease Revenue Bonds, Department of Corrections &

|

9/23 at 100.00

|

AA–

|

1,728,360

|

|

|

|

Rehabilitation, Various Correctional Facilities Series 2013F, 5.250%, 9/01/33

|

|

|

|

|

|

1,250

|

California State Public Works Board, Lease Revenue Bonds, Department of Corrections &

|

9/24 at 100.00

|

AA–

|

1,457,775

|

|

|

|

Rehabilitation, Various Correctional Facilities Series 2014A, 5.000%, 9/01/39

|

|

|

|

|

|

3,000

|

California State Public Works Board, Lease Revenue Bonds, Various Capital Projects,

|

11/22 at 100.00

|

AA–

|

3,334,590

|

|

|

|

Series 2012G, 5.000%, 11/01/37

|

|

|

|

|

|

3,000

|

Los Angeles County Metropolitan Transportation Authority, California, Measure R Sales

|

6/26 at 100.00

|

AAA

|

3,662,640

|

|

|

|

Tax Revenue Bonds, Senior Series 2016A, 5.000%, 6/01/38

|

|

|

|

|

|

1,150

|

Los Angeles County Metropolitan Transportation Authority, California, Proposition C

|

7/27 at 100.00

|

AAA

|

1,436,166

|

|

|

|

Sales Tax Revenue Bonds, Senior Lien Series 2017A, 5.000%, 7/01/39

|

|

|

|

|

|

3,520

|

Los Angeles County Public Works Financing Authority, California, Lease Revenue Bonds,

|

8/22 at 100.00

|

AA+

|

3,889,952

|

|

|

|

Multiple Capital Facilities Project II, Series 2012, 5.000%, 8/01/42

|

|

|

|

|

|

140

|

Novato Redevelopment Agency, California, Tax Allocation Bonds, Hamilton Field

|

9/21 at 100.00

|

A–

|

154,192

|

|

|

|

Redevelopment Project, Series 2011, 6.750%, 9/01/40

|

|

|

|

|

|

|

Patterson Public Finance Authority, California, Revenue Bonds, Community Facilities District

|

|

|

|

|

|

|

2001-1, Senior Series 2013A:

|

|

|

|

|

|

940

|

5.250%, 9/01/30

|

9/23 at 100.00

|

N/R

|

1,050,130

|

|

|

855

|

5.750%, 9/01/39

|

9/23 at 100.00

|

N/R

|

960,285

|

|

|

145

|

Patterson Public Finance Authority, California, Revenue Bonds, Community Facilities District

|

9/23 at 100.00

|

N/R

|

163,240

|

|

|

|

2001-1, Subordinate Lien Series 2013B, 5.875%, 9/01/39

|

|

|

|

|

|

|

Puerto Rico Sales Tax Financing Corporation, Sales Tax Revenue Bonds,

|

|

|

|

|

|

|

Restructured 2018A-1:

|

|

|

|

|

|

60

|

0.000%, 7/01/24

|

No Opt. Call

|

N/R

|

52,351

|

|

|

2,108

|

5.000%, 7/01/58

|

7/28 at 100.00

|

N/R

|

2,203,197

|

|

|

80

|

Riverside County Redevelopment Agency, California, Tax Allocation Bonds, Jurupa Valley

|

10/21 at 100.00

|

A

|

88,729

|

|

|

|

Project Area, Series 2011B, 6.500%, 10/01/25

|

|

|

|

|

|

50

|

San Clemente, California, Special Tax Revenue Bonds, Community Facilities District

|

9/25 at 100.00

|

N/R

|

56,975

|

|

|

|

2006-1 Marblehead Coastal, Series 2015, 5.000%, 9/01/40

|

|

|

|

|

|

1,000

|

San Diego County Regional Transportation Commission, California, Sales Tax Revenue

|

4/22 at 100.00

|

AAA

|

1,098,010

|

|

|

|

Bonds, Refunding Series 2012A, 5.000%, 4/01/42

|

|

|

|

|

|

165

|

San Francisco City and County Redevelopment Agency Successor Agency, California, Special

|

8/24 at 100.00

|

N/R

|

182,492

|

|

|

|

Tax Bonds, Community Facilities District 7, Hunters Point Shipyard Phase One Improvements,

|

|

|

|

|

|

|

Refunding Series 2014, 5.000%, 8/01/39

|

|

|

|

|

|

5,000

|

San Francisco City and County Redevelopment Agency Successor Agency, California, Tax

|

8/26 at 100.00

|

A

|

5,937,800

|

|

|

|

Allocation Bonds, Mission Bay North Redevelopment Project, Refunding Series 2016A, 5.000%,

|

|

|

|

|

|

|

8/01/41 – NPFG Insured

|

|

|

|

|

|

110

|

Signal Hill Redevelopment Agency, California, Project 1 Tax Allocation Bonds, Series

|

4/21 at 100.00

|

N/R

|

118,907

|

|

|

|

2011, 7.000%, 10/01/26

|

|

|

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Tax Obligation/Limited (continued)

|

|

|

|

|

|

|

Stockton Public Financing Authority, California, Revenue Bonds, Arch Road East Community

|

|

|

|

|

|

|

Facility District 99-02, Series 2018A:

|

|

|

|

|

|

$ 1,000

|

5.000%, 9/01/33

|

9/25 at 103.00

|

N/R

|

$ 1,183,310

|

|

|

765

|

5.000%, 9/01/43

|

9/25 at 103.00

|

N/R

|

888,264

|

|

|

100

|

Temecula Public Financing Authority, California, Special Tax Bonds, Community Facilities

|

9/27 at 100.00

|

N/R

|

107,272

|

|

|

|

District 16-01, Series 2017, 5.750%, 9/01/32, 144A

|

|

|

|

|

|

1,000

|

Virgin Islands Public Finance Authority, Matching Fund Loan Notes Revenue Bonds, Series

|

10/22 at 100.00

|

AA

|

1,095,950

|

|

|

|

2012A, 5.000%, 10/01/32 – AGM Insured

|

|

|

|

|

|

31,398

|

Total Tax Obligation/Limited

|

|

|

35,322,783

|

|

|

|

Transportation – 19.2% (19.4% of Total Investments)

|

|

|

|

|

|

1,820

|

Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds,

|

1/24 at 100.00

|

BBB+

|

2,179,414

|

|

|

|

Refunding Junior Lien Series 2013C, 6.500%, 1/15/43

|

|

|

|

|

|

|

Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds,

|

|

|

|

|

|

|

Refunding Series 2013A:

|

|

|

|

|

|

1,945

|

5.000%, 1/15/42 – AGM Insured

|

1/24 at 100.00

|

AA

|

2,209,209

|

|

|

4,010

|

5.750%, 1/15/46

|

1/24 at 100.00

|

A–

|

4,700,763

|

|

|

4,010

|

6.000%, 1/15/53

|

1/24 at 100.00

|

A–

|

4,754,296

|

|

|

5,665

|

Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International

|

5/25 at 100.00

|

AA

|

6,576,668

|

|

|

|

Airport, Senior Lien Series 2015D, 5.000%, 5/15/41 (AMT)

|

|

|

|

|

|

4,610

|

Los Angeles Department of Airports, California, Revenue Bonds, Los Angeles International

|

5/28 at 100.00

|

AA–

|

5,678,736

|

|

|

|

Airport, Subordinate Lien Series 2018A, 5.250%, 5/15/48 (AMT)

|

|

|

|

|

|

3,000

|

Los Angeles Harbors Department, California, Revenue Bonds, Series 2014C, 5.000%, 8/01/44

|

8/24 at 100.00

|

AA

|

3,477,150

|

|

|

1,210

|

Port of Oakland, California, Revenue Bonds, Refunding Series 2012P, 5.000%,

|

5/22 at 100.00

|

A+

|

1,324,732

|

|

|

|

5/01/29 (AMT)

|

|

|

|

|

|

2,000

|

San Francisco Airports Commission, California, Revenue Bonds, San Francisco

|

5/27 at 100.00

|

A+

|

2,427,820

|

|

|

|

International Airport, Governmental Purpose Second Series 2017B, 5.000%, 5/01/47

|

|

|

|

|

|

11,750

|

San Francisco Airports Commission, California, Revenue Bonds, San Francisco

|

5/26 at 100.00

|

A+

|

14,108,107

|

|

|

|

International Airport, Second Governmental Purpose Series 2016C, 5.000%, 5/01/46

|

|

|

|

|

|

4,535

|

San Francisco Airports Commission, California, Revenue Bonds, San Francisco

|

5/27 at 100.00

|

A+

|

5,416,105

|

|

|

|

International Airport, Second Series 2017A, 5.000%, 5/01/47 (AMT)

|

|

|

|

|

|

4,465

|

San Francisco Airports Commission, California, Revenue Bonds, San Francisco

|

5/28 at 100.00

|

A+

|

5,523,651

|

|

|

|

International Airport, Second Series 2018E, 5.000%, 5/01/48

|

|

|

|

|

|

49,020

|

Total Transportation

|

|

|

58,376,651

|

|

|

|

U.S. Guaranteed – 6.0% (6.1% of Total Investments) (6)

|

|

|

|

|

|

1,000

|

California Health Facilities Financing Authority, Revenue Bonds, Sutter Health, Series

|

8/20 at 100.00

|

AA–

|

1,047,700

|

|

|

|

2011B, 6.000%, 8/15/42 (Pre-refunded 8/15/20)

|

|

|

|

|

|

955

|

California Municipal Finance Authority, Mobile Home Park Revenue Bonds, Caritas Projects

|

8/20 at 100.00

|

BBB

|

1,003,676

|

|

|

|

Series 2010A, 6.400%, 8/15/45 (Pre-refunded 8/15/20)

|

|

|

|

|

|

1,000

|

California State Public Works Board, Lease Revenue Bonds, Various Capital Projects,

|

10/19 at 100.00

|

A+

|

1,003,650

|

|

|

|

Series 2009G-1, 5.750%, 10/01/30 (Pre-refunded 10/01/19)

|

|

|

|

|

|

2,000

|

California State Public Works Board, Lease Revenue Bonds, Various Capital Projects,

|

11/19 at 100.00

|

A+

|

2,017,380

|

|

|

|

Series 2009-I, 6.375%, 11/01/34 (Pre-refunded 11/01/19)

|

|

|

|

|

|

785

|

Contra Costa County, California, GNMA Mortgage-Backed Securities Program Home Mortgage

|

No Opt. Call

|

AA+

|

832,053

|

|

|

|

Revenue Bonds, Series 1988, 8.250%, 6/01/21 (AMT) (ETM)

|

|

|

|

|

|

370

|

National City Community Development Commission, California, Tax Allocation Bonds,

|

8/21 at 100.00

|

A

|

409,542

|

|

|

|

National City Redevelopment Project, Series 2011, 6.500%, 8/01/24 (Pre-refunded 8/01/21)

|

|

|

|

|

|

5,710

|

Oceanside Unified School District, San Diego County, California, General Obligation

|

8/20 at 13.60

|

AA

|

769,080

|

|

|

|

Bonds, Election 2008 Series 2010B, 0.000%, 8/01/49 (Pre-refunded 8/01/20) – AGM Insured

|

|

|

|

|

|

2,940

|

Palomar Pomerado Health Care District, California, Certificates of Participation, Series

|

11/19 at 100.00

|

N/R

|

2,966,519

|

|

|

|

2009, 6.750%, 11/01/39 (Pre-refunded 11/01/19)

|

|

|

|

|

|

2,900

|

Palomar Pomerado Health Care District, California, Certificates of Participation, Series

|

11/20 at 100.00

|

Ba1

|

3,067,214

|

|

|

|

2010, 6.000%, 11/01/41 (Pre-refunded 11/01/20)

|

|

|

|

|

NCA

|

Nuveen California Municipal Value Fund, Inc.

|

|

|

Portfolio of Investments (continued)

August 31, 2019 (Unaudited) |

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

U.S. Guaranteed (6) (continued)

|

|

|

|

|

|

$ 440

|

Rancho Santa Fe CSD Financing Authority, California, Revenue Bonds, Superior Lien Series

|

9/21 at 100.00

|

A–

|

$ 482,121

|

|

|

|

2011A, 5.750%, 9/01/30 (Pre-refunded 9/01/21)

|

|

|

|

|

|

4,650

|

San Bernardino County, California, GNMA Mortgage-Backed Securities Program Single Family

|

No Opt. Call

|

AA+

|

4,182,536

|

|

|

|

Home Mortgage Revenue Bonds, Series 1988A, 0.000%, 9/01/21 (AMT) (ETM)

|

|

|

|

|

|

65

|

San Francisco Redevelopment Finance Authority, California, Tax Allocation Revenue Bonds,

|

2/21 at 100.00

|

A–

|

70,357

|

|

|

|

Mission Bay North Redevelopment Project, Series 2011C, 6.750%, 8/01/41 (Pre-refunded 2/01/21)

|

|

|

|

|

|

|

San Francisco Redevelopment Financing Authority, California, Tax Allocation Revenue

|

|

|

|

|

|

|

Bonds, Mission Bay South Redevelopment Project, Series 2011D:

|

|

|

|

|

|

65

|

7.000%, 8/01/33 (Pre-refunded 2/01/21)

|

2/21 at 100.00

|

BBB+

|

70,545

|

|

|

80

|

7.000%, 8/01/41 (Pre-refunded 2/01/21)

|

2/21 at 100.00

|

BBB+

|

86,825

|

|

|

190

|

Yorba Linda Redevelopment Agency, Orange County, California, Tax Allocation Revenue

|

9/21 at 100.00

|

N/R

|

210,955

|

|

|

|

Bonds, Yorba Linda Redevelopment Project, Subordinate Lien Series 2011A, 6.500%, 9/01/32

|

|

|

|

|

|

|

(Pre-refunded 9/01/21)

|

|

|

|

|

|

23,150

|

Total U.S. Guaranteed

|

|

|

18,220,153

|

|

|

|

Utilities – 4.8% (4.8% of Total Investments)

|

|

|

|

|

|

1,800

|

Long Beach Bond Finance Authority, California, Natural Gas Purchase Revenue Bonds,

|

No Opt. Call

|

A+

|

2,608,740

|

|

|

|

Series 2007A, 5.500%, 11/15/37

|

|

|

|

|

|

1,000

|

Los Angeles Department of Water and Power, California, Power System Revenue Bonds,

|

1/26 at 100.00

|

AA

|

1,202,690

|

|

|

|

Series 2016A, 5.000%, 7/01/40

|

|

|

|

|

|

420

|

Los Angeles Department of Water and Power, California, Power System Revenue Bonds,

|

1/26 at 100.00

|

AA

|

509,347

|

|

|

|

Series 2016B, 5.000%, 7/01/37

|

|

|

|

|

|

3,605

|

Los Angeles Department of Water and Power, California, Power System Revenue Bonds,

|

1/27 at 100.00

|

AA

|

4,422,902

|

|

|

|

Series 2017A, 5.000%, 7/01/42

|

|

|

|

|

|

2,630

|

Los Angeles Department of Water and Power, California, Power System Revenue Bonds,

|

7/27 at 100.00

|

AA

|

3,264,803

|

|

|

|

Series 2017C, 5.000%, 7/01/42

|

|

|

|

|

|

1,890

|

Los Angeles Department of Water and Power, California, Power System Revenue Bonds,

|

1/28 at 100.00

|

AA

|

2,383,800

|

|

|

|

Series 2018A, 5.000%, 7/01/38

|

|

|

|

|

|

11,345

|

Total Utilities

|

|

|

14,392,282

|

|

|

|

Water and Sewer – 13.1% (13.3% of Total Investments)

|

|

|

|

|

|

|

California Pollution Control Financing Authority, Water Furnishing Revenue Bonds,

|

|

|

|

|

|

|

Poseidon Resources Channelside LP Desalination Project, Series 2012:

|

|

|

|

|

|

1,375

|

5.000%, 7/01/37, 144A (AMT)

|

7/22 at 100.00

|

Baa3

|

1,483,831

|

|

|

2,675

|

5.000%, 11/21/45, 144A (AMT)

|

7/22 at 100.00

|

Baa3

|

2,870,703

|

|

|

4,240

|

East Bay Municipal Utility District, Alameda and Contra Costa Counties, California,

|

6/27 at 100.00

|

AAA

|

5,226,563

|

|

|

|

Water System Revenue Bonds, Green Series 2017A, 5.000%, 6/01/45

|

|

|

|

|

|

2,000

|

Irvine Ranch Water District, California, Certificates of Participation, Irvine Ranch

|

9/26 at 100.00

|

AAA

|

2,428,600

|

|

|

|

Water District Series 2016, 5.000%, 3/01/41

|

|

|

|

|

|

6,000

|

Los Angeles Department of Water and Power, California, Waterworks Revenue Bonds, Series

|

1/27 at 100.00

|

AA+

|

7,395,360

|

|

|

|

2017A, 5.000%, 7/01/41

|

|

|

|

|

|

4,475

|

Los Angeles Department of Water and Power, California, Waterworks Revenue Bonds, Series

|

1/28 at 100.00

|

AA+

|

5,528,191

|

|

|

|

2018A, 5.000%, 7/01/48

|

|

|

|

|

|

4,000

|

Los Angeles Department of Water and Power, California, Waterworks Revenue Bonds, Series

|

7/28 at 100.00

|

AA+

|

5,122,400

|

|

|

|

2018B, 5.000%, 7/01/38

|

|

|

|

|

|

1,400

|

Los Angeles, California, Wastewater System Revenue Bonds, Green Subordinate Series

|

6/28 at 100.00

|

AA

|

1,779,260

|

|

|

|

2018A, 5.000%, 6/01/38

|

|

|

|

|

|

270

|

Puerto Rico Aqueduct and Sewerage Authority, Revenue Bonds, Senior Lien Series 2008A,

|

9/19 at 100.00

|

Ca

|

274,050

|

|

|

|

6.000%, 7/01/44

|

|

|

|

|

|

|

Puerto Rico Aqueduct and Sewerage Authority, Revenue Bonds, Senior Lien Series 2012A:

|

|

|

|

|

|

145

|

5.500%, 7/01/28

|

7/22 at 100.00

|

Ca

|

153,700

|

|

|

535

|

5.750%, 7/01/37

|

7/22 at 100.00

|

Ca

|

568,438

|

|

|

435

|

6.000%, 7/01/47

|

7/22 at 100.00

|

Ca

|

463,275

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Water and Sewer (continued)

|

|

|

|

|

|

|

San Diego Public Facilities Financing Authority, California, Water Utility Revenue

|

|

|

|

|

|

|

Bonds, Refunding Subordinate Lien Series 2016B:

|

|

|

|

|

|

$ 2,335

|

5.000%, 8/01/32

|

8/26 at 100.00

|

Aa3

|

$ 2,919,147

|

|

|

3,000

|

5.000%, 8/01/37

|

8/26 at 100.00

|

Aa3

|

3,682,290

|

|

|

32,885

|

Total Water and Sewer

|

|

|

39,895,808

|

|

|

$ 261,867

|

Total Long-Term Investments (cost $246,440,370)

|

|

|

287,002,160

|

|

|

|||||

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

SHORT-TERM INVESTMENTS – 4.6% (4.6% of Total Investments)

|

|

|

|

|

|

|

MUNICIPAL BONDS – 4.6% (4.6% of Total Investments)

|

|

|

|

|

|

|

Education and Civic Organizations – 1.0% (1.0% of Total Investments)

|

|

|

|

|

|

$ 3,000

|

University of California, General Revenue Bonds, Variable Rate Demand Obligations, Refunding

|

|

|

|

|

|

|

Series 2013AL, 1.250%, 5/15/48 (7)

|

11/19 at 100.00

|

A-1+

|

$ 3,000,000

|

|

|

|

Health Care – 3.6% (3.6% of Total Investments)

|

|

|

|

|

|

750

|

California Health Facilities Financing Authority, Revenue Bonds, Catholic Healthcare West,

|

|

|

|

|

|

|

Variable Rate Demand Obligations, Series 2011C, 1.210%, 3/01/47 (7)

|

10/19 at 100.00

|

A-1

|

750,000

|

|

|

8,050

|

California Statewide Communities Development Authority, Revenue Bonds, Kaiser Permanente,

|

|

|

|

|

|

|

Variable Rate Demand Obligations, Series 2008A, 1.280%, 4/01/32 (7)

|

10/19 at 100.00

|

A-1+

|

8,050,000

|

|

|

2,100

|

California Statewide Communities Development Authority, Revenue Bonds, SWEEP Loan Program,

|

|

|

|

|

|

|

Variable Rate Demand Obligations, Variable Rate Demand Series 2007A, 1.190%, 8/01/35 (7)

|

11/19 at 100.00

|

A-1+

|

2,100,000

|

|

|

10,900

|

Total Health Care

|

|

|

10,900,000

|

|

|

$ 13,900

|

Total Short-Term Investments (cost $13,900,000)

|

|

|

13,900,000

|

|

|

|

Total Investments (cost $260,340,370) – 99.1%

|

|

|

300,902,160

|

|

|

|

Other Assets Less Liabilities – 0.9%

|

|

|

2,878,955

|

|

|

|

Net Asset Applicable to Common Shares – 100%

|

|

|

$ 303,781,115

|

|

|

(1)

|

All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted.

|

|

(2)

|

Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic

principal paydowns.

|

|

(3)

|

For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Inc. (“Fitch”) rating. This treatment of split-rated

securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not

rated by any of these national rating agencies.

|

|

(4)

|

Effective February 12, 2019, the par value of the original bonds was replaced with taxable and tax exempt Puerto Rico Sales Tax Financing Corporation (commonly known as (COFINA) bond units that are collateralized by a bundle of zero and

coupon paying bonds. The quantity shown represents units in a trust, which were assigned according to the original bond’s accreted value. These securities do not have a stated coupon interest rate and income will be recognized through

accretion of the discount associated with the trust units. The factor at which these units accrete can also decrease, primarily for principal payments generated from coupon payments received or dispositions of the underlying bond collateral.

The quantity of units will not change as a result of these principal payments.

|

|

(5)

|

Step-up coupon bond, a bond with a coupon that increases ("steps up"), usually at regular intervals, while the bond is outstanding. The rate shown is the coupon as of the end of the reporting period.

|

|

(6)

|

Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest.

|

|

(7)

|

Investment has a maturity of greater than one year, but has variable rate and/or demand features which qualify it as a short-term investment. The rate disclosed, as well as the reference rate and spread, where applicable, is that in effect

as of the end of the reporting period. This rate changes periodically based on market conditions or a specified market index.

|

|

144A

|

Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified

institutional buyers.

|

|

AMT

|

Alternative Minimum Tax.

|

|

ETM

|

Escrowed to maturity.

|

|

|

See accompanying notes to financial statements.

|

|

NCB

|

Nuveen California Municipal Value Fund 2

|

|

|

Portfolio of Investments

|

|

|

August 31, 2019 (Unaudited)

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

LONG-TERM INVESTMENTS – 88.6% (89.3% of Total Investments)

|

|

|

|

|

|

|

MUNICIPAL BONDS – 88.6% (89.4% of Total Investments)

|

|

|

|

|

|

|

Consumer Staples – 4.4% (4.5% of Total Investments)

|

|

|

|

|

|

$ 1,100

|

Golden State Tobacco Securitization Corporation, California, Tobacco Settlement

|

6/22 at 100.00

|

N/R

|

$ 1,135,585

|

|

|

|

Asset-Backed Bonds, Series 2018A-1, 5.250%, 6/01/47

|

|

|

|

|

|

1,000

|

Silicon Valley Tobacco Securitization Authority, California, Tobacco Settlement

|

9/19 at 29.71

|

N/R

|

295,920

|

|

|

|

Asset-Backed Bonds, Santa Clara County Tobacco Securitization Corporation, Series 2007A,

|

|

|

|

|

|

|

0.000%, 6/01/41

|

|

|

|

|

|

1,000

|

Tobacco Securitization Authority of Northern California, Tobacco Settlement Asset-Backed

|

9/19 at 100.00

|

B–

|

1,003,580

|

|

|

|

Bonds, Series 2005A-1, 5.500%, 6/01/45

|

|

|

|

|

|

3,100

|

Total Consumer Staples

|

|

|

2,435,085

|

|

|

|

Education and Civic Organizations – 2.7% (2.7% of Total Investments)

|

|

|

|

|

|

865

|

California Educational Facilities Authority, Revenue Bonds, University of the Pacific,

|

11/19 at 100.00

|

A2

|

871,003

|

|

|

|

Series 2009, 5.500%, 11/01/39

|

|

|

|

|

|

100

|

California Municipal Finance Authority, Charter School Revenue Bonds, Rocketship

|

6/22 at 102.00

|

N/R

|

112,320

|

|

|

|

Education Multiple Projects, Series 2014A, 7.250%, 6/01/43

|

|

|

|

|

|

35

|

California School Finance Authority, School Facility Revenue Bonds, Alliance for

|

7/25 at 100.00

|

BBB

|

39,507

|

|

|

|

College-Ready Public Schools Project, Series 2016A, 5.000%, 7/01/46, 144A

|

|

|

|

|

|

260

|

California School Finance Authority, School Facility Revenue Bonds, Alliance for

|

7/25 at 101.00

|

BBB

|

297,341

|

|

|

|

College-Ready Public Schools Project, Series 2016C, 5.250%, 7/01/52

|

|

|

|

|

|

150

|

California Statewide Communities Development Authority, School Facility Revenue Bonds,

|

7/21 at 100.00

|

B+

|

160,017

|

|

|

|

Alliance College-Ready Public Schools, Series 2011A, 7.000%, 7/01/46

|

|

|

|

|

|

1,410

|

Total Education and Civic Organizations

|

|

|

1,480,188

|

|

|

|

Financials – 0.7% (0.7% of Total Investments)

|

|

|

|

|

|

500

|

Puerto Rico Urgent Interest Fund Corp (COFINA), National Custodial Taxable Trust Unit,

|

No Opt. Call

|

N/R

|

363,750

|

|

|

|

Series 2007A Sr. Bond, 0.000%, 8/01/44 (4)

|

|

|

|

|

|

|

Health Care – 9.9% (10.0% of Total Investments)

|

|

|

|

|

|

1,090

|

California Health Facilities Financing Authority, Revenue Bonds, Children’s Hospital Los

|

8/27 at 100.00

|

BBB+

|

1,305,220

|

|

|

|

Angeles, Series 2017A, 5.000%, 8/15/47

|

|

|

|

|

|

1,000

|

California Health Facilities Financing Authority, Revenue Bonds, Childrens Hospital of

|

11/19 at 100.00

|

AA–

|

1,008,790

|

|

|

|

Orange County, Series 2009A, 6.500%, 11/01/38

|

|

|

|

|

|

70

|

California Health Facilities Financing Authority, Revenue Bonds, Lucile Salter Packard

|

8/24 at 100.00

|

AA–

|

80,091

|

|

|

|

Children’s Hospital, Series 2014A, 5.000%, 8/15/43

|

|

|

|

|

|

75

|

California Health Facilities Financing Authority, Revenue Bonds, Providence Health &

|

10/24 at 100.00

|

AA–

|

87,385

|

|

|

|

Services, Refunding Series 2014A, 5.000%, 10/01/38

|

|

|

|

|

|

150

|

California Health Facilities Financing Authority, Revenue Bonds, Providence Health &

|

10/24 at 100.00

|

AA–

|

172,404

|

|

|

|

Services, Series 2014B, 5.000%, 10/01/44

|

|

|

|

|

|

20

|

California Municipal Finance Authority, Revenue Bonds, Eisenhower Medical Center,

|

7/27 at 100.00

|

Baa2

|

23,637

|

|

|

|

Refunding Series 2017A, 5.000%, 7/01/42

|

|

|

|

|

|

100

|

California Municipal Finance Authority, Revenue Bonds, NorthBay Healthcare Group, Series

|

11/26 at 100.00

|

BBB–

|

117,364

|