|

ALPINE EQUITY TRUST

Alpine Cyclical Advantage Property Fund

Alpine Realty Income & Growth Fund

Alpine International Real Estate Equity Fund

Alpine Emerging Markets Real Estate Fund

Alpine Global Infrastructure Fund

Alpine Global Consumer Growth Fund

|

ALPINE SERIES TRUST

Alpine Foundation Fund

Alpine Dynamic Dividend Fund

Alpine Financial Services Fund

Alpine Innovators Fund

Alpine Transformations Fund

Alpine Accelerating Dividend Fund

|

|

ALPINE INCOME TRUST

Alpine Municipal Money Market Fund

Alpine Ultra Short Tax Optimized Income Fund

|

c/o Boston Financial Data Services, Inc.

PO Box 8061

Boston, MA 02266

1-888-785-5578

May 11, 2012

Dear Shareholder:

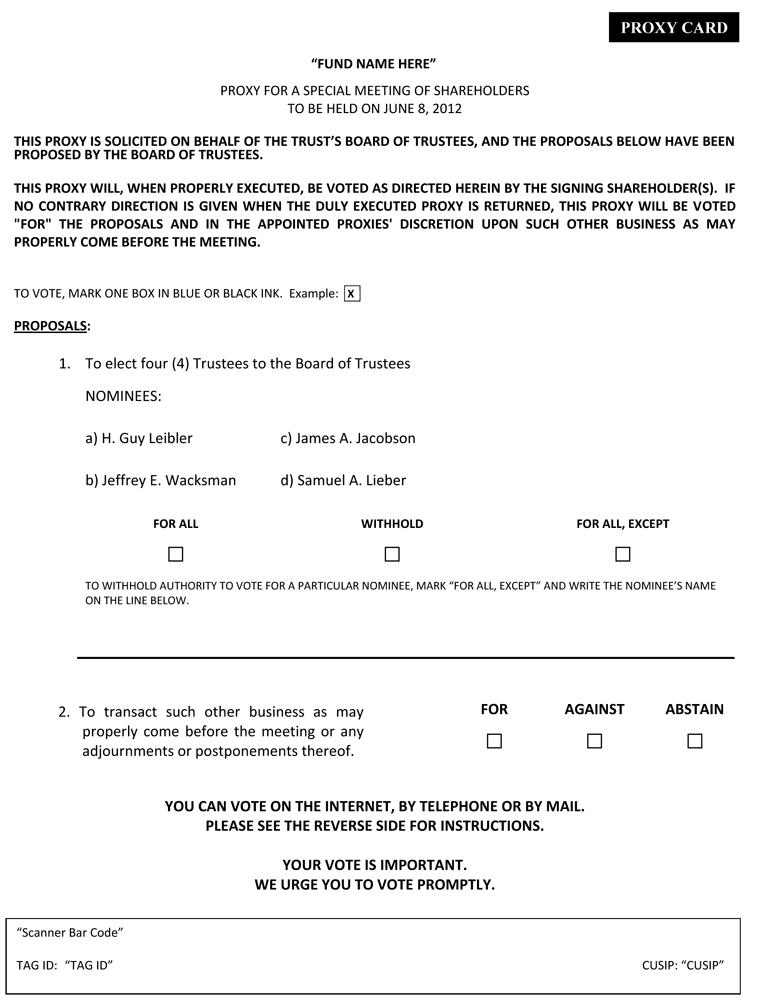

The Special Meeting of Shareholders (the “Meeting”) of the Alpine Equity Trust, Alpine Series Trust, and Alpine Income Trust (the “Alpine Open-End Trusts”) will be held on June 8, 2012 at 10:00 am Eastern Time, at 711 Westchester Avenue, White Plains, New York 10604. A Notice of the Special Meeting of Shareholders, Proxy Statement regarding the Meeting, proxy card for your vote, and postage prepaid envelope in which to return your proxy card are enclosed.

The matter on which you, as a shareholder in one or more of the funds of the Alpine Open-End Trusts, are being asked to vote is the election of four (4) Trustees to your Fund’s Board of Trustees (the “Board”). The Board of each Trust believes that this proposal is in the best interests of the Trust and its shareholders, and unanimously recommends that you vote “FOR” the election of each nominee standing for election to the Board.

Detailed information about the proposal is contained in the enclosed materials. Please exercise your right to vote by completing, dating and signing the enclosed proxy card. A self-addressed, postage-paid envelope has been enclosed for your convenience. It is very important that you vote and that your voting instructions be received as soon as possible.

If you have any questions after considering the enclosed materials, please call 1-866-745-0264.

| |

Alpine Open-End Trusts

|

| |

|

| |

Respectfully,

|

| |

|

| |

|

| |

|

| |

Samuel A. Lieber

|

| |

President

|

|

ALPINE EQUITY TRUST

Alpine Cyclical Advantage Property Fund

Alpine Realty Income & Growth Fund

Alpine International Real Estate Equity Fund

Alpine Emerging Markets Real Estate Fund

Alpine Global Infrastructure Fund

Alpine Global Consumer Growth Fund

|

ALPINE SERIES TRUST

Alpine Foundation Fund

Alpine Dynamic Dividend Fund

Alpine Financial Services Fund

Alpine Innovators Fund

Alpine Transformations Fund

Alpine Accelerating Dividend Fund

|

|

ALPINE INCOME TRUST

Alpine Municipal Money Market Fund

Alpine Ultra Short Tax Optimized Income Fund

|

(“ALPINE OPEN-END TRUSTS”)

NOTICE OF THE SPECIAL MEETING OF SHAREHOLDERS

June 8, 2012

To the Shareholders of the Alpine Open-End Trusts:

NOTICE IS HEREBY GIVEN that the Special Meeting of Shareholders (the “Meeting”) of each of the Alpine Open-End Trusts will be held on June 8, 2012, at 711 Westchester Avenue, White Plains, New York 10604, beginning at 10:00 am Eastern Time, for the following purposes:

|

|

1.

|

To elect four (4) Trustees to the Boards of Trustees; and

|

|

|

2.

|

To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

|

The Board of Trustees of each of the Alpine Open-End Trusts (the “Boards”) has fixed the close of business on March 5, 2012 as the record date for the determination of Shareholders entitled to notice of and to vote at the Meeting or any adjournments or postponements thereof.

You are cordially invited to attend the Meeting. Shareholders who do not expect to attend the Meeting in person are requested to vote by telephone, by Internet or by completing, dating and signing the enclosed proxy card and returning it promptly in the envelope provided for that purpose. You may nevertheless vote in person at the Meeting if you choose to attend. The enclosed proxy is being solicited by the Boards.

| |

By order of the Boards,

|

| |

|

| |

|

| |

|

| |

Samuel A. Lieber

|

| |

President

|

|

ALPINE EQUITY TRUST

Alpine Cyclical Advantage Property Fund

Alpine Realty Income & Growth Fund

Alpine International Real Estate Equity Fund

Alpine Emerging Markets Real Estate Fund

Alpine Global Infrastructure Fund

Alpine Global Consumer Growth Fund

|

ALPINE SERIES TRUST

Alpine Foundation Fund

Alpine Dynamic Dividend Fund

Alpine Financial Services Fund

Alpine Innovators Fund

Alpine Transformations Fund

Alpine Accelerating Dividend Fund

|

|

ALPINE INCOME TRUST

Alpine Municipal Money Market Fund

Alpine Ultra Short Tax Optimized Income Fund

|

(“ALPINE OPEN-END TRUSTS”)

c/o Boston Financial Data Services, Inc.

PO Box 8061

Boston, MA 02266

1-877-785-5578

_______________

PROXY STATEMENT

_______________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Boards of Trustees (the “Boards”) of the Alpine Open-End Trusts for use at the Special Meeting of Shareholders (the “Meeting”), to be held on June 8, 2012, at 711 Westchester Avenue, White Plains, New York 10604, at 10:00 am Eastern Time, and at any adjournments or postponements thereof. For purposes of this Proxy Statement, each series of the Trusts listed above may be referred to as a “Fund” or collectively as the “Funds.”

This Proxy Statement and proxy card are being mailed to shareholders on or about May 11, 2012. Any shareholder giving a proxy has the power to revoke it prior to its exercise by submitting a superseding proxy by phone, Internet or mail following the process described on the proxy card or by submitting a notice of revocation to the Alpine Open-End Trusts or in person at the Meeting. A proxy purporting to be executed by or on behalf of a shareholder shall be deemed valid unless challenged at or prior to its exercise, with the burden of proving invalidity resting on the challenger.

In order to transact business at the Meeting, a “quorum” must be present. Under each Trust’s Declaration of Trust, a quorum is constituted by the presence in person or by proxy of shareholders representing 40% of the shares of the Trust entitled to vote on a matter, in the case of Alpine Series Trust and Alpine Income Trust, and a majority of the outstanding shares of the Trust on the record date entitled to vote on a matter in the case of Alpine Equity Trust.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter. Abstentions and broker non-votes will not, however, be treated as votes cast at the Meeting. Abstentions and broker non-votes, therefore, will have no effect on proposals which require a plurality or majority of votes cast for approval. Accordingly, abstentions and broker non-votes will have no effect on the proposal to elect four trustees to the Board of Trustees.

The chairman of the Meeting shall have the power to adjourn the Meeting without further notice other than announcement at the Meeting. The Board of Trustees also has the power to postpone the Meeting to a later date and/or time in advance of the Meeting. Abstentions and broker non-votes will have the same effect at any adjourned or postponed meeting as noted above. Any business that might have been transacted at the Meeting may be transacted at any such adjourned or postponed session(s) at which a quorum is present.

Written notice of an adjournment of the Meeting, stating the place, date and hour thereof, shall be given to each shareholder entitled to vote thereat, at least ten (10) days prior to the Meeting, if the Meeting is adjourned to a date more than one hundred twenty (120) days after the original Record Date set for the Meeting.

The following proposal will be considered and acted upon at the Meeting:

| |

Proposal

|

Series Effected

|

Classes Effected

|

|

1.

|

For each Trust, to elect four (4) Trustees.

|

All Funds

|

All Classes

|

The Boards of Trustees have fixed the close of business on March 5, 2012 as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof. Shareholders on the record date will be entitled to one vote for each share held, with no shares having cumulative voting rights. As of the record date, the Alpine Open-End Trusts had the following shares outstanding and entitled to vote at the Meeting:

|

Name of Fund

|

Number of Shares Outstanding and Entitled to Vote

|

|

Alpine Equity Trust

|

Class A Shares

|

Institutional Class Shares

|

|

Alpine Cyclical Advantage Property Fund

|

N/A

|

2,637,624.426

|

|

Alpine Realty Income & Growth Fund

|

6,410.256

|

6,275,943.666

|

|

Alpine International Real Estate Equity Fund

|

5,580.357

|

15,433,833.865

|

|

Alpine Emerging Markets Real Estate Fund

|

7,434.944

|

257,800.103

|

|

Alpine Global Infrastructure Fund

|

7,189.073

|

2,692,182.872

|

|

Alpine Global Consumer Growth Fund

|

11,173.184

|

203,737.18

|

| |

|

|

|

Alpine Series Trust

|

|

|

|

Alpine Foundation Fund

|

9,425.071

|

5,728,874.563

|

|

Alpine Dynamic Dividend Fund

|

28,300.057

|

109,347,482.783

|

|

Alpine Financial Services Fund

|

14,492.754

|

889,496.49

|

|

Alpine Innovators Fund

|

9,832.842

|

991,406.744

|

|

Alpine Transformations Fund

|

8,912.656

|

551,468.703

|

|

Alpine Accelerating Dividend Fund

|

8,367.035

|

199,710.042

|

| |

|

|

|

Alpine Income Trust

|

|

|

|

Alpine Municipal Money Market Fund

|

N/A

|

282,864,329.589

|

|

Alpine Ultra Short Tax Optimized Income Fund

|

43,868,195.486

|

141,723,741.367

|

Management of the Alpine Open-End Trusts knows of no item of business other than that mentioned in Proposal 1 of the Notice of Meeting that will be presented for consideration at the Meeting.

The Alpine Open-End Trusts will furnish, without charge, copies of its annual reports for the fiscal year ended October 31, 2011 and the most recent semi-annual reports succeeding such annual reports, if any, to any shareholder requesting such a report. Requests for an annual or semi-annual report should be made by contacting Alpine Funds c/o Boston Financial Data Services, Inc., PO Box 8061, Boston, MA 02266, by accessing the Alpine Open-End Trusts’ website at www.alpinefunds.com or by calling 1-888-785-5578.

IMPORTANT INFORMATION

The Proxy Statement discusses important matters affecting the Alpine Open-End Trusts. Please take the time to read the Proxy Statement, and then cast your vote. There are multiple ways to vote. Choose the method that is most convenient for you. To vote by telephone or Internet, follow the instructions provided on the proxy card. To vote by mail simply fill out the proxy card and return it in the enclosed postage-paid reply envelope. Please do not return your proxy card if you vote by telephone or Internet. To vote in person, attend the Meeting and cast your vote. The Meeting will be held at 711 Westchester Avenue, White Plains, New York 10604. To obtain directions to the Meeting, please call 1-888-785-5578. Properly executed proxies will be voted as instructed on the proxy card. In the absence of such direction, executed proxies received prior to the Meeting or any adjournment thereof will be voted “FOR” the Nominees. Proxy holders may vote in their discretion with respect to any other matters properly coming before the Meeting.

PROPOSAL 1

ELECTION OF TRUSTEES

Section 16 of the Investment Company Act of 1940, as amended (the “1940 Act”), generally requires that at least two-thirds of the Boards be elected by the Alpine Open-End Trusts’ shareholders.

The Declaration of Trust for the Alpine Equity Trust dated October 26, 1988, as amended, for the Alpine Income Trust dated September 23, 2002, as amended and restated as of March 27, 2012, and for the Alpine Series Trust dated June 5, 2001, as amended and restated as of March 27, 2012, (collectively, the “Declarations of Trust”) each provides that the number of Trustees of the Trust may be fixed from time to time by written instrument signed (or by resolution approved at a duly constituted meeting for Alpine Income Trust and Alpine Series Trust) by a majority of the Trustees; provided, however, that the number of Trustees shall in no event be less than one (1) nor more than fifteen (15), in the case of the Alpine Income Trust and the Alpine Series Trust, and no less than two (2) nor more than fifteen (15), in the case of the Alpine Equity Trust.

The purpose of this proposal is to elect each nominee to serve on the Boards (each, a “Nominee” and collectively, the “Nominees”). The Boards currently have four serving Trustees, three of whom are not “interested persons” of the Alpine Open-End Trusts, as that term is defined in the 1940 Act, and are referred to herein as the “Independent Trustees.” Each Trustee of a Trust will hold office during the lifetime of the Trust and until its termination unless he earlier dies, resigns, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed, or, if sooner, until the next meeting of shareholders called for the purpose of electing Trustees and until the election and qualification of his successor, each as provided in each Declaration of Trust.

The election of a Nominee will require the affirmative vote of a plurality of shares voted in the case of each of the Alpine Open-End Trusts, in each case so long as a quorum is present. With respect to Proposal 1, shareholders of each Fund vote together with shareholders of all the Funds of an Alpine Open-End Trust.

Information Concerning the Nominees

Information about the Nominees, including their ages and principal occupations during the past five years, and other current directorships, are set forth in the table below. The address of each Nominee is 2500 Westchester Avenue, Suite 215, Purchase, New York 10577. A Nominee is deemed to be “independent” to the extent the Trustee is not an “interested person” of the Alpine Open-End Trusts, as that term is defined in Section 2(a)(19) of the 1940 Act.

All Nominees have consented to be named in this Proxy Statement and have agreed to serve if elected. Mr. Wacksman and Mr. Jacobson were appointed as Trustees by the Boards and have not previously been elected by shareholders.

Independent Trustees

|

Name and Year of Birth

|

Position(s) Held with the Trusts

|

Term of

Office and Length of

Time Served

|

Principal Occupation

During Past Five Years

|

# of

Portfolios in Fund Complex**

|

Other Directorships Held by

Trustee in the Past Five Years

|

|

H. Guy Leibler (1954)

|

Independent Trustee

|

Indefinite, since the Trust’s inception

|

Private investor (since 2007); Vice Chair and Chief Operating Officer, L&L Acquisitions, LLC (office properties management) (2004 to 2007).

|

17

|

Chairman Emeritus, White Plains Hospital Center (1988 to Present); Trustee of each of the Alpine Trusts (1996 to Present).****

|

|

Jeffrey E. Wacksman (1960)

|

Independent Trustee

|

Indefinite, since 2004

|

Partner, Loeb, Block & Partners LLP (law firm) (since 1994).

|

17

|

Director, International Succession Planning Association (since 2008); Director, Bondi Icebergs Inc. (women’s sportswear) (since 1994); Director, MH Properties, Inc. (land development) (since 1996); Trustee of each of the Alpine Trusts.****

|

|

James A. Jacobson (1945)

|

Independent Trustee

|

Indefinite, since July 2009

|

Retired (since 2008); Vice Chairman and Managing Director, Spear Leeds & Kellogg Specialists, LLC (sales and trading firm) (2003 to 2008).

|

17

|

Trustee of each of the Alpine Trusts;**** Trustee of Allianz Global Investors Multi-Funds (since 2009).

|

Interested Trustees

|

Name and Year of Birth

|

Position(s) Held with the Trusts

|

Term of

Office and Length of

Time Served

|

Principal Occupation

During Past Five Years

|

# of

Portfolios in Fund Complex**

|

Other Directorships Held by Trustee

|

|

Samuel A. Lieber* (1956)

|

Interested Trustee, President and Portfolio Manager

|

Indefinite, since the Trust’s inception

|

Chief Executive Officer, Alpine Woods Capital Investors, LLC (since 1997); President of Alpine Trusts (since 1998).

|

17

|

Trustee of each of the Alpine Trusts.****

|

|

*

|

Denotes Trustees who are “interested persons” of the Trusts or Funds under the 1940 Act. Mr. Lieber is the CEO of the Investment Adviser and is also the son of Stephen A. Lieber.

|

|

**

|

The Fund Complex includes each series of the Alpine Equity Trust (Alpine Global Consumer Growth Fund, Alpine Cyclical Advantage Property Fund, Alpine International Real Estate Equity Fund, Alpine Realty Income & Growth Fund, Alpine Emerging Markets Real Estate Fund, and Alpine Global Infrastructure Fund), each series of the Alpine Series Trust (Alpine Foundation Fund, Alpine Dynamic Dividend Fund, Alpine Financial Services Fund, Alpine Innovators Fund, Alpine Transformations Fund, and Alpine Accelerating Dividend Fund), each series of Alpine Income Trust (Alpine Municipal Money Market Fund and Alpine Ultra Short Tax Optimized Income Fund), the Alpine Global Dynamic Dividend Fund, the Alpine Total Dynamic Dividend Fund and the Alpine Global Premier Properties Fund.

The Alpine Equity Trust, Alpine Series Trust and Alpine Income Trust are each registered as open-end management investment companies. The Alpine Global Dynamic Dividend Fund, Alpine Total Dynamic Dividend Fund and Alpine Global Premier Properties Fund are each registered as a closed-end management investment company.

|

|

****

|

The Trustees identified in this proxy are members of the Board of Trustees for each of the Alpine Equity Trust, Alpine Income Trust, Alpine Series Trust, Alpine Global Dynamic Dividend Fund, Alpine Total Dynamic Dividend Fund and Alpine Global Premier Properties Fund (the “Alpine Trusts”). The Trustees currently oversee seventeen portfolios within the six Alpine Trusts.

|

Leadership Structure and the Boards of Trustees

The Boards believe that each Trustee's experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Trustees lead to the conclusion that the Boards possess the requisite attributes and skills. The Boards also believe that the Trustees' ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Investment Adviser, other service providers, counsel and the independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties support this conclusion.

In addition, the following specific experience, qualifications, attributes and/or skills apply to the respective Trustee. Mr. Leibler has substantial experience as a senior executive of an operating company. Mr. Wacksman has substantial experience practicing law and advising clients with respect to various business transactions. Mr. Jacobson has substantial experience as a senior executive of a specialist broker. Mr. Lieber has been the Chief Executive Officer of the Investment Adviser since its inception and has substantial experience as an executive and portfolio manager and in leadership roles with the Alpine Funds and the Investment Adviser. References to the experience, qualifications, attributes and skills of Trustees are pursuant to requirements of the SEC, do not constitute representations that the Boards or any Trustee have any special expertise, and shall not impose any greater responsibility or liability on any such person or on the Boards as a whole.

The Boards held four regular meetings for each Alpine Open-End Trust during the fiscal year ended October 31, 2011.

The Boards have three standing Committees: (1) the Audit Committee, (2) the Valuation Committee and (3) the Nominating and Corporate Governance Committee (the “Nominating Committee”). Each Committee consists of all three of the Independent Trustees. Where deemed appropriate, the Boards may constitute ad hoc committees.

Mr. Lieber serves as Chairman of the Boards and Mr. Leibler serves as Lead Independent Trustee. The Lead Independent Trustee works with the Chairman of the Boards to set the agendas for the Board meetings. The Lead Independent Trustee also serves as a key point person for interaction between management and the Independent Trustees. The Boards have determined that its leadership structure is appropriate. Each Board also believes that its leadership structure facilitates the orderly and efficient flow of information between the Independent Trustees and management.

The Audit Committee oversees the scope of the Alpine Open-End Trusts’ audit, the Alpine Open-End Trusts’ accounting and financial reporting policies and practices and internal controls. The Audit Committee assists the Boards in fulfilling its responsibility for oversight of the integrity of the Alpine Open-End Trusts’ accounting, auditing and financial reporting practices, the qualifications and independence of the Alpine Open-End Trusts’ independent registered public accounting firm and the Alpine Open-End Trusts’ compliance with legal and regulatory requirements. The Audit Committee approves, and recommends to the Boards for ratification, the selection, appointment, retention or termination of the Alpine Open-End Trusts’ independent registered public accounting firm and approves the compensation of the independent registered public accounting firm. The Audit Committee also approves all audit and permissible non-audit services provided to the Alpine Open-End Trusts by the independent registered public accounting firm and all permissible non-audit services provided by the Alpine Open-End Trusts’ independent registered public accounting firm to the Investment Adviser and service providers if the engagement relates directly to the Alpine Open-End Trusts’ operations and financial reporting. The Audit Committee also assists each Board in fulfilling its responsibility for the review and negotiation of the Alpine Open-End Trusts’ investment advisory arrangements. The Audit Committee met four times for each Alpine Open-End Trust during the fiscal year ended October 31, 2011.

The Valuation Committee is responsible for (1) monitoring the valuation each Fund’s securities and other investments; and (2) as required, when the Boards of Trustees are not in session, reviewing and approving the fair value of illiquid and other holdings after consideration of all relevant factors, which determinations are reported to the Boards of Trustees. The Valuation Committee met four times for each Alpine Open-End Trust during the fiscal year ended October 31, 2011.

The Nominating Committee is responsible for overseeing Board governance and related Trustee practices, including selecting and recommending candidates to fill vacancies on the Boards. The Nominating Committee may consider nominees recommended by a shareholder. In evaluating potential nominees, including any nominees recommended by shareholders, the Nominating Committee takes into consideration various factors, including, among any others it may deem relevant, character and integrity, business and professional experience, and whether the committee believes the person has the ability to apply sound and independent business judgment and would act in the interest of each Alpine Open-End Trust and its shareholders. Shareholders who wish to recommend a nominee should send recommendations to the Alpine Open-End Trusts’ Secretary that include all information relating to such person that is required to be disclosed in solicitations of proxies for the election of Trustees as well as any additional information required by each Alpine Open-End Trust’s By-Laws. A recommendation must be accompanied by a written consent of the individual to stand for election if nominated by the Boards and to serve if elected by the shareholders. The Nominating Committee met two times for each Alpine Open-End Trust during the fiscal year ended October 31, 2011.

Service providers to the Alpine Open-End Trusts, primarily the Investment Adviser, have responsibility for the day-to-day management of the Alpine Open-End Trusts, which includes responsibility for risk management. As an integral part of its responsibility for oversight of the Alpine Open-End Trusts, the Boards oversee risk management of the Alpine Open-End Trusts’ investment program and business affairs. Oversight of the risk management process is part of the Boards’ general oversight of the Funds and their service providers.

The Alpine Open-End Trusts are subject to a number of risks, including investment risk, counterparty risk, valuation risk, reputational risk, risk of operational failure or lack of business continuity, and legal, compliance and regulatory risk. Risk management seeks to identify and address risks, i.e., events or circumstances that could have material adverse effects on the business, operations, shareholder services, investment performance or reputation of the Alpine Open-End Trusts. The Investment Adviser or various service providers to the Alpine Open-End Trusts employ a variety of processes, procedures and controls to identify various of those possible events or circumstances, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Different processes, procedures and controls are employed with respect to different types of risks. Various personnel, including the Alpine Open-End Trusts’ and the Investment Adviser’s Chief Compliance Officer as well as personnel of other service providers, such as the Alpine Open-End Trusts’ independent registered public accounting firm, make periodic reports to the Audit Committee or to the Boards with respect to various aspects of risk management, as well as events and

circumstances that have arisen and responses thereto. The Boards recognize that not all risks that may affect the Alpine Open-End Trusts can be identified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve each Fund’s goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. As a result of the foregoing and other factors, the Boards’ risk management oversight is subject to inherent limitations.

Shareholder Communications

Shareholders who want to communicate with the Board or any individual Trustee should write to Alpine Open-End Trusts, Attention: Boards of Trustees, Alpine Woods Capital Investors, LLC, 2500 Westchester Avenue, Suite 215, Purchase, New York 10577. The letter should indicate that you are a Fund shareholder. The Alpine Open-End Trusts will ensure that this communication (assuming it is properly marked care of the Boards or care of a specific Trustee) is delivered to the Boards or the specified Trustee, as the case may be.

Executive Officers of the Trust

The following table provides information concerning the executive officers of the Alpine Open-End Trusts. The executive officers of the Alpine Open-End Trusts are elected annually by the Boards. Each of these executive officers are is also an officer and/or employee of the Investment Adviser.

|

Name, Address

and Age

|

Position

|

Term of Office

and Length of

Time Served

|

Principal Occupation During

the Past Five Years

|

|

Stephen A. Lieber*

(1925)

2500 Westchester Ave, Suite 215

Purchase, NY 10577

|

Executive Vice President

|

Indefinite, since June 23, 2006

|

Chief Investment Officer, Alpine Woods Capital Investors, LLC (since 2003); Chairman and Senior Portfolio Manager, Saxon Woods Advisors, LLC (since 1999).

|

|

John Megyesi

(1960)

2500 Westchester Ave, Suite 215

Purchase, NY 10577

|

Chief Compliance Officer

|

Indefinite, since March 30, 2009

|

Chief Compliance Officer, Alpine Woods Capital Investors, LLC (since 2009); Vice President and Manager, Trade Surveillance, Credit Suisse Asset Management, LLC (2006 to 2009); Manager, Trading and Surveillance, Allianz Global Investors (2004 to 2006).

|

|

Ronald G. Palmer, Jr.

(1968)

2500 Westchester Ave, Suite 215

Purchase, NY 10577

|

Chief Financial Officer and Treasurer

|

Indefinite, CFO since January 5, 2010, Treasurer since February 2, 2012

|

Chief Financial Officer, Alpine Woods Capital Investors, LLC (since 2010); Independent Consultant (2008 to 2009); Vice President, Macquarie Capital Investment Management LLC (2007 to 2008); Chief Operating Officer, Macquarie Fund Adviser, LLC (2004 to 2007).

|

|

Andrew Pappert

(1980)

2500 Westchester Ave, Suite 215

Purchase, NY 10577

|

Secretary

|

Indefinite, since March 30, 2009

|

Director of Fund Operations, Alpine Woods Capital Investors, LLC (since 2008); Assistant Vice President, Mutual Fund Operations, Credit Suisse Asset Management, LLC (2003 to 2008).

|

* Stephen A. Lieber is the father of Samuel A. Lieber.

The following table sets forth information regarding the ownership of securities in the Funds by the Trustees and Nominees as of December 31, 2011:

Amount Invested Key

| |

Independent Trustees

|

Interested Trustee

|

|

Dollar Range of Fund Shares Owned

|

H. Guy Leibler

|

Jeffrey E. Wacksman

|

James A. Jacobson

|

Samuel A. Lieber

|

|

Alpine Equity Trust

|

|

|

|

|

|

Alpine Cyclical Advantage Property Fund

|

A

|

A

|

A

|

E

|

|

Alpine Realty Income & Growth Fund

|

A

|

A

|

A

|

E

|

|

Alpine International Real Estate Equity Fund

|

A

|

A

|

A

|

E

|

|

Alpine Emerging Markets Real Estate Fund

|

A

|

A

|

A

|

E

|

|

Alpine Global Infrastructure Fund

|

A

|

D

|

A

|

E

|

|

Alpine Global Consumer Growth Fund

|

A

|

A

|

A

|

E

|

|

Alpine Series Trust

|

|

|

|

|

|

Alpine Foundation Fund

|

A

|

A

|

A

|

E

|

|

Alpine Dynamic Dividend Fund

|

A

|

A

|

A

|

E

|

|

Alpine Financial Services Fund

|

A

|

D

|

A

|

E

|

|

Alpine Innovators Fund

|

B

|

D

|

A

|

A

|

|

Alpine Transformations Fund

|

A

|

C

|

A

|

A

|

|

Alpine Accelerating Dividend Fund

|

A

|

A

|

A

|

A

|

| |

|

|

|

|

|

Alpine Income Trust

|

|

|

|

|

|

Alpine Municipal Money Market Fund

|

B

|

C

|

A

|

E

|

|

Alpine Ultra Short Tax Optimized Income Fund

|

A

|

A

|

A

|

E

|

| |

|

|

|

|

|

Total Value of Securities Owned in the Fund Complex*

|

C

|

E

|

A

|

E

|

|

*

|

The Fund Complex includes each series of the Alpine Equity Trust, each series of the Alpine Series Trust, each series of Alpine Income Trust, the Alpine Global Dynamic Dividend Fund, the Alpine Total Dynamic Dividend Fund and the Alpine Global Premier Properties Fund.

|

As of December 31, 2011, Samuel A. Lieber owned 49.29% of the Alpine Global Consumer Growth Fund’s shares, 28.08% of the Alpine Emerging Markets Real Estate Fund’s shares, 5.44% of the Alpine Global Infrastructure Fund’s shares, 1.67% of the Alpine Realty Income & Growth Fund’s shares, 4.25% of the Alpine Cyclical Advantage Property Fund’s shares, 1.95% of the Alpine International Real Estate Equity Fund’s shares, 3.63% of the Alpine Foundation Fund’s shares, 3.23% of the Alpine Financial Services Fund’s shares and 8.25% of the Alpine Municipal Money Market Fund’s shares. Stephen A. Lieber owned 49.29% of the Alpine Global Consumer Growth Fund’s shares, 1.69% of the Alpine Realty Income & Growth Fund’s shares, 19.51% of the Alpine Cyclical Advantage Property Fund’s shares, 9.92% of the Alpine International Real Estate Equity Fund’s shares, 42.52% of the Alpine Foundation Fund’s shares, 1.47% of the Alpine Dynamic Dividend Fund’s shares, 3.70% of the Alpine Financial Services Fund’s shares, 22.21% of the Alpine Innovators Fund’s shares, 42.31% of the Alpine

Transformations Fund’s shares, 45.98% of the Alpine Accelerating Dividend Fund’s shares, 1.61% of the Alpine Municipal Money Market Fund’s shares and 2.64% of the Alpine Ultra Short Tax Optimized Fund’s shares. All other officers and Trustees of the Alpine Open-End Trusts owned less than 1% of the outstanding shares of the Alpine Global Consumer Growth Fund, the Alpine Emerging Markets Real Estate Fund, the Alpine Global Infrastructure Fund, the Alpine Realty Income & Growth Fund, the Alpine Cyclical Advantage Property Fund, the Alpine International Real Estate Fund, the Alpine Foundation Fund, the Alpine Dynamic Dividend Fund, the Alpine Financial Services Fund, the Alpine Innovators Fund, the Alpine Transformations Fund, the Alpine Accelerating Dividend Fund, the Alpine Municipal Money Market Fund and the Alpine Ultra Short Tax Optimized Fund.

Compensation

Under the federal securities laws, the Alpine Open-End Trusts are required to provide to their shareholders in connection with the Meeting information regarding compensation paid to Trustees by the Alpine Open-End Trusts as well as by the various other U.S. registered investment companies advised by the Investment Adviser during its prior fiscal year.

The table below sets forth the amount of compensation the Trustees received from the Funds during the fiscal year ended October 31, 2011. Currently, the Funds do not have a bonus, profit sharing, pension or retirement plan.

|

Name of Trustee

|

Aggregate Compensation

|

Total Compensation from the Funds

and Fund Complex** Paid to Trustee

|

|

Alpine Equity

Trust

|

Alpine Series

Trust

|

Alpine Income

Trust

|

|

Independent Trustees*

|

|

|

|

|

|

Jeffrey E. Wacksman

|

$4,000

|

$4,000

|

$4,000

|

$60,000

|

|

H. Guy Leibler

|

$5,000

|

$5,000

|

$5,000

|

$75,000

|

|

James A. Jacobson

|

$4,000

|

$4,000

|

$4,000

|

$60,000

|

|

Interested Trustee

|

|

|

|

|

|

Samuel A. Lieber

|

$0

|

$0

|

$0

|

$0

|

|

*

|

Laurence B. Ashkin retired as an Independent Trustee of the Funds subsequent to the fiscal year ended October 31, 2011. Mr. Ashkin received Total Compensation from the Funds and the Fund Complex of $45,000 including $3,000 Aggregate Compensation from each of the Alpine Open-End Trusts.

|

|

**

|

The Fund Complex includes each series of the Alpine Equity Trust, each series of the Alpine Series Trust, each series of Alpine Income Trust, the Alpine Global Dynamic Dividend Fund, the Alpine Total Dynamic Dividend Fund and the Alpine Global Premier Properties Fund. |

Trustee Transactions with Fund Affiliates. As of March 5, 2012, neither the Independent Trustees or Nominees (except for Samuel A. Lieber) nor members of their immediate family owned securities beneficially or of record in the Investment Adviser or the Distributor, or an affiliate of or any person directly or indirectly controlling, controlled by or under common control with the Investment Adviser or the Distributor. Furthermore, over the past five years, neither the Independent Trustees or Nominees (except for Samuel A. Lieber) nor members of their immediate families had any direct or indirect interest, the value of which exceeds $120,000, in the Investment Adviser or the Distributor or any of their affiliates. In addition, since the beginning of the last two fiscal years, neither the Independent Trustees or Nominees (except for Samuel A. Lieber) nor members of their immediate families have conducted any transactions (or series of transactions) or maintained any direct or indirect relationship in which the amount involved exceeds $120,000 and to which the following persons were or are a party: the Alpine Open-End Trusts, an officer of the Trusts, any investment company sharing the same investment adviser or underwriter as the Alpine Open-End Trusts or any officer of such a company, the Investment Adviser or Distributor or any officer of either a party, any person directly or indirectly controlling, controlled by or under common control with the Investment Adviser or Distributor, or any officer of such a person.

Required Vote. With respect to each Trust, the election of the listed Nominees to the Board of Trustees of the Trust requires the affirmative vote of a plurality of shares of the Trust voted so long as a quorum is present. For purposes of this proposal, shareholders of all the Funds vote together as a single class. THE BOARDS OF TRUSTEES OF THE ALPINE OPEN-END TRUSTS RECOMMEND THAT THE SHAREHOLDERS VOTE “FOR” THE NOMINEES. Abstentions and broker non-votes will have no effect on the election of a Nominee as Trustee.

GENERAL INFORMATION

MANAGEMENT AND OTHER SERVICE PROVIDERS

Investment Adviser

The Alpine Open-End Trusts’ Investment Adviser is Alpine Woods Capital Investors, LLC, located at 2500 Westchester Avenue, Suite 215, Purchase, New York 10577.

Administrator and Transfer Agent

State Street Bank and Trust Company ("State Street"), located at One Lincoln Street, Boston, Massachusetts 02111, serves as the administrator for the Alpine Open-End Trusts pursuant to an administration agreement. State Street also serves as the Alpine Open-End Trusts’ Custodian for each Fund’s securities and cash.

The Alpine Open End Trusts’ transfer and dividend disbursing agent is Boston Financial Data Services, Inc. (“BFDS”), PO Box 8061, Boston, Massachusetts 02266.

Quasar Distributors, LLC, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the distributor of each Fund’s shares pursuant a Distribution Agreement with the Alpine Open-End Trusts.

Independent Registered Public Accounting Firm

Deloitte & Touche LLP (“Deloitte”), located at 555 East Wells Street, Milwaukee, Wisconsin 53202, currently serves as the independent registered public accountant for the Alpine Open-End Trusts. Representatives of Deloitte are not expected to attend the Meeting but have been given the opportunity to make a statement if they so desire and will be available should any matter arise requiring their presence.

The Alpine Open-End Trusts have engaged Deloitte to perform audit services, audit-related services, tax services and other services for the current fiscal year. “Audit services” refer to performing an audit of each Alpine Open-End Trust’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed for the fiscal year ended October 31, 2011 for audit fees, audit-related fees, tax fees and other fees by Deloitte:

|

Alpine Equity Trust

|

| |

Aggregate total for fiscal year

ended 10/31/10

|

Aggregate total for fiscal year

ended 10/31/11

|

|

Audit Fees

|

$73,031

|

$124,468

|

|

Audit-Related Fees

|

$0

|

$0

|

|

Tax Fees

|

$18,184

|

$22,794

|

|

All Other Fees

|

$0

|

$0

|

|

Alpine Series Trust

|

| |

Aggregate total for fiscal year

ended 10/31/10

|

Aggregate total for fiscal year

ended 10/31/11

|

|

Audit Fees

|

$77,781

|

$108,480

|

|

Audit-Related Fees

|

$0

|

$0

|

|

Tax Fees

|

$19,367

|

|

|

All Other Fees

|

$0

|

$0

|

|

Alpine Income Trust

|

| |

Aggregate total for fiscal year

ended 10/31/10

|

Aggregate total for fiscal year

ended 10/31/11

|

|

Audit Fees

|

$34,438

|

$43,928

|

|

Audit-Related Fees

|

$0

|

$0

|

|

Tax Fees

|

$8,575

|

$10,919

|

The Alpine Open-End Trusts’ Audit Committees adopted pre-approval policies and procedures that require the Audit Committee to pre-approve all audit and non-audit services of the Alpine Open-End Trusts, including services provided to any entity affiliated with the Alpine Open-End Trusts. All of Deloitte’s hours spent on auditing the Alpine Open-End Trusts’ financial statements were attributed to work performed by full-time permanent employees of Deloitte.

Since inception, and for the past two fiscal years, Deloitte has not billed the Alpine Open End Trusts or the Investment Adviser (or any entity controlling, controlled by or under common control with the Investment Adviser) for, nor accrued for on behalf of the Alpine Open-End Trusts or the Investment Adviser, any non-audit fees other than certain tax fees. The Audit Committee of the Boards of Trustees have considered whether the provision of non-audit services that were rendered to the Investment Adviser or any entity controlling, controlled by or under common control with the Investment Adviser is compatible with maintaining Deloitte’s independence, and has concluded that the provision of such non-audit services by Deloitte has not compromised its independence.

OTHER BUSINESS

The Boards do not intend to present any other business at the Meeting. If, however, any other matters are properly brought before the Meeting, the persons named in the accompanying form of proxy will vote thereon in accordance with their judgment.

SUBMISSION OF SHAREHOLDER PROPOSALS

The Alpine Open-End Trusts do not hold annual shareholder meetings.

Any shareholder intending to submit a proposal to be presented at a meeting of shareholders may transmit such proposal to the Trusts (addressed to Alpine Open-End Trusts, c/o Andrew Pappert, Secretary of the Funds, Alpine Woods Capital Investors, LLC, 2500 Westchester Avenue, Suite 215, Purchase, New York 10577) to be received within a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in that proxy statement relating to such meeting. Whether a proposal is included in a proxy statement will be determined in accordance with applicable federal and state law. The timely submission of a proposal does not guarantee its inclusion.

DELIVERY OF PROXY MATERIALS AND ANNUAL REPORTS

To avoid sending duplicate copies of materials to households, please note that only one annual or semi-annual report or proxy statement, as applicable, may be delivered to two or more shareholders of the Alpine Open-End Trusts who share an address, unless the Alpine Open-End Trusts have received instructions to the contrary. A shareholder may provide such instructions by contacting the Alpine Open-End Trusts at the address or phone number listed below. A shareholder may obtain additional copies of the Notice of the Special Meeting, Proxy Statement and proxy card by accessing www.proxyonline.com/docs/AlpineFundsproxy.pdf or by calling 1-866-745-0264. Requests for an annual or semi-annual report should be made by contacting

Alpine Funds c/o Boston Financial Data Services, Inc., PO Box 8061, Boston, MA 02266, by accessing the Alpine Open-End Trusts’ website at www.alpinefunds.com or by calling 1-888-785-5578.

PROXY SOLICITATION

Proxies will be solicited by the Alpine Open-End Trusts primarily via the internet or in some cases by mail. In addition, the Alpine Open-End Trusts have retained AST Fund Solutions, LLC to assist in the solicitation of proxies for a fee of $5,500 plus reimbursement of expenses. The Alpine Open-End Trusts will pay the costs of the proxy solicitation and the expenses incurred in connection with preparing, printing and mailing the Proxy Statement and its enclosures. Although it is not anticipated, the solicitation may also include telephone, facsimile, electronic or oral communications by certain officers of the Alpine Open-End Trusts or employees of the Investment Adviser, or State Street, the Alpine Open-End Trusts’ administrator, who will not be paid for these services. The Alpine Open-End Trusts, the Investment Adviser or State Street may also request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Alpine Open-End Trusts held of record by such persons. If requested, the Alpine Open-End Trusts shall reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of the Alpine Open-End Trusts.

ADJOURNMENTS/POSTPONEMENTS

In order to transact business at the Meeting, a “quorum” must be present. Under each Trust’s Declaration of Trust, a quorum is constituted by the presence in person or by proxy of shareholders representing 40% of the shares of the Trust entitled to vote on a matter, in the case of Alpine Series Trust and Alpine Income Trust, and a majority of the outstanding shares of the Trust on the record date entitled to vote on a matter in the case of Alpine Equity Trust.

In the event a quorum is not present at the Meeting or in the event that that sufficient votes in favor of the proposal set forth in the Notice of this Meeting are not received by June 7, 2012, the persons named as proxies in the enclosed proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. The Boards of Trustees may also postpone the Meeting in advance of such Meeting to a later date and/or time.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Set forth in Appendix A is information with respect to persons who are registered as beneficial owners of more than 5% of any class of a Fund’s voting securities as of March 5, 2012.

| |

By order of the Boards,

|

| |

|

| |

|

| |

|

| |

Samuel A. Lieber

|

| |

President

|

May 11, 2012

APPENDIX A

To the knowledge of the each Fund’s management, before the close of business on March 5, 2012, the following table sets forth each person (including any “group” as that term is used in Section 13(d) of the Securities Exchange Act of 1934, as amended), known to a Fund to be deemed the beneficial owner of more than five percent (5%) of the outstanding shares of each Fund:

5% or Greater Shareholders*

| |

Name and Address

|

Number of Shares

|

Percentage Ownership

|

|

Alpine Equity Trust

|

|

|

|

|

Alpine Cyclical Advantage Property Fund-Institutional Class

|

|

|

|

| |

Essel Foundation

Mamaroneck, NY 10543-4613

|

549,345.3670

|

20.83%

|

| |

RBC Capital Markets Corp FBO Stephen A. Lieber

Mamaroneck, NY

|

354,931.8630

|

13.46%

|

| |

Constance E. Lieber

Mamaroneck, NY 10543-4613

|

166,196.4190

|

6.30%

|

|

Alpine Realty Income & Growth Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

6,410.2560

|

100.00%

|

|

Alpine International Real Estate Equity Fund-Institutional Class

|

|

|

|

| |

RBC Capital Markets Corp

FBO Stephen A. Lieber

Mamaroneck, NY 10543-4693

|

1,334,811.4150

|

8.65%

|

|

Alpine International Real Estate Equity Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

5,580.3570

|

100.00%

|

|

Alpine Emerging Markets Real Estate Fund-Institutional Class

|

|

|

|

| |

Borrego Foundation

PO Box 301

Larchmont, NY 10538-0301

|

103,940.9510

|

40.32%

|

| |

Samuel A. Lieber

Larchmont, NY 10538-4005

|

73,403.2480

|

28.47%

|

|

Alpine Emerging Markets Real Estate Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

7,434.9440

|

100.00%

|

| Alpine Global Infrastructure Fund-Institutional Class |

|

|

|

| |

NFS LLC FEBO

Candace P Hunphreys

W. Michael Humphreys

San Antonio, TX 78209-5710

|

336,371.9540

|

12.50%

|

| |

Independence Trust

325 Bridge Street

PO Box 682188

Franklin, TN 37068-2188

|

199,739.6180

|

7.43%

|

| |

NFS LLC FEBO

Alan Sagner

Newark, NJ 07102-5528

|

161,961.4420

|

6.02%

|

| |

NFS LLC FEBO

Ronald Greene

Hobe Sound, FL 33455-2802

|

153,572.6650

|

5.71%

|

|

Alpine Global Infrastructure Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

7,189.0730

|

100.00%

|

|

Alpine Global Consumer Growth Fund-Institutional Class

|

|

|

|

| |

Samuel A. Lieber

Larchmont, NY 10538-4005

|

100,434.0890

|

49.30%

|

| |

Constance E. Lieber

Mamaroneck, NY 10543-4613

|

50,217.5460

|

24.65%

|

| |

Stephen A. Lieber

Mamaroneck, NY 10543-4613

|

50,217.5460

|

24.65%

|

|

Alpine Global Consumer Growth Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

11,173.1840

|

100.00%

|

|

Alpine Series Trust

|

|

|

|

|

Alpine Foundation Fund-Institutional Class

|

|

|

|

| |

Stephen A. Lieber

Mamaroneck, NY 10543-4613

|

2,156,833.0370

|

37.65%

|

| |

Essel Foundation

Mamaroneck, NY 10543-4613

|

1,145,750.9720

|

20.00%

|

| |

Janice Ruth Lieber Trust

Samuel A. Lieber Tr

Mamaroneck, NY 10543-4613

|

389,058.4050

|

6.79%

|

| |

Constance E. Lieber Trust

Mamaroneck, NY 10543-4613

|

318,257.6050

|

5.56%

|

|

Alpine Foundation Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

9,425.0710

|

100.00%

|

|

Alpine Dynamic Dividend Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

28,300.0570

|

100.00%

|

|

Alpine Financial Services Fund-Institutional Class

|

|

|

|

| |

Daniel P. Tully

Hobe Sound, FL 33475-0688

|

137,736.6490

|

15.48%

|

| |

NFS LLC FEBO

State Street Bank Trust Co.

Attn Dan Dinardo

1200 Crown Colony Drive

Quincy, MA 02169-0938

|

46,265.3870

|

5.20%

|

|

Alpine Financial Services Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

14,492.7540

|

100.00%

|

|

Alpine Innovators Fund-Institutional Class

|

|

|

|

| |

Stephen A. Lieber

Mamaroneck, NY 10543-4613

|

112,338.2540

|

11.36%

|

| |

Daniel P. Tully

Hobe Sound, FL 33475-0688

|

11,667.9600

|

11.29

|

| |

Essel Foundation

Mamaroneck, NY 10543-4613

|

105,376.2580

|

10.65%

|

| |

Constance E. Lieber

Mamaroneck, NY 10543-4613

|

105,376.2580

|

10.65%

|

| |

Janice Ruth Lieber Trust

Samuel A Lieber Tr

Mamaroneck, NY 10543-4613

|

52,688.1290

|

5.33%

|

|

Alpine Innovators Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

9,832.8420

|

100.00%

|

|

Alpine Transformations Fund-Institutional Class

|

|

|

|

| |

Stephen A. Lieber

Mamaroneck, NY 10543-4613

|

201,460.6580

|

36.53%

|

| |

Essel Foundation

Mamaroneck, NY 10543-4613

|

100,770.7010

|

18.27%

|

| |

Constance E. Lieber

Mamaroneck, NY 10543-4613

|

30,219.1000

|

5.48%

|

|

Alpine Transformations Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

8,912.6560

|

100.00%

|

|

Alpine Accelerating Dividend Fund-Institutional Class

|

|

|

|

| |

Stephen A. Lieber

Mamaroneck, NY 10543-4613

|

119,529.6290

|

59.85%

|

| |

NFS LLC FEBO

Frank O. Bogedain

Albany, NY 12205-4922

|

35,075.1310

|

17.56%

|

|

Alpine Accelerating Dividend Fund-Class A

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

8,367.0350

|

100.00%

|

|

Alpine Income Trust

|

|

|

|

|

Alpine Municipal Money Market Fund-Institutional Class

|

|

|

|

| |

Alpine Woods Capital Investors LLC

2500 Westchester Ave., Suite 215

Purchase, NY 10577-2515

|

25,018,818.68

|

8.83%

|

| |

Samuel A. Lieber

Larchmont, NY 10538-4005

|

17,024,651.4300

|

6.01%

|

|

*

|

To the knowledge of the Funds’ management, before the close of business on March 5, 2012, the officers and Trustees of the Funds owned (except for Samuel A. Lieber and Stephen A. Lieber), as a group, less than 1% of the outstanding shares of each Fund.

|