Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 1-31517

(Exact Name of Registrant as Specified in Its Charter)

China Telecom Corporation Limited

(Translation of Registrant’s Name into English)

People’s Republic of China

(Jurisdiction of Incorporation or Organization)

31 Jinrong Street, Xicheng District

Beijing, People’s Republic of China 100033

(Address of Principal Executive Offices)

Ms. Yi Chen

China Telecom Corporation Limited

31 Jinrong Street, Xicheng District

Beijing, People’s Republic of China 100033

Email: chenyi@chinatelecom.com.cn

Telephone: (+86-10) 5850 1508

Fax: (+86-10) 5850 1504

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange On Which Registered | |

| American depositary shares H shares, par value RMB1.00 per share |

New York Stock Exchange, Inc. New York Stock Exchange, Inc.* |

| * | Not for trading, but only in connection with the listing on the New York Stock Exchange, Inc. of American depositary shares, each representing 100 H shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2011, 67,054,958,321 domestic shares and 13,877,410,000 H shares, par value RMB1.00 per share, were issued and outstanding. H shares are ordinary shares of the Company listed on The Stock Exchange of Hong Kong Limited.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer x Accelerated Filer ¨ Non-Accelerated Filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ¨

International Financial Reporting Standards as issued by the International Accounting Standards Board x

Other ¨

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Table of Contents

CHINA TELECOM CORPORATION LIMITED

TABLE OF CONTENTS

| Page | ||||||||

| - 2 - | ||||||||

| Item 1. |

- 2 - | |||||||

| Item 2. |

- 2 - | |||||||

| Item 3. |

- 2 - | |||||||

| Item 4. |

- 14 - | |||||||

| Item 4A. |

- 34 - | |||||||

| Item 5. |

- 35 - | |||||||

| Item 6. |

- 47 - | |||||||

| Item 7. |

- 57 - | |||||||

| Item 8. |

- 65 - | |||||||

| Item 9. |

- 65 - | |||||||

| Item 10. |

- 66 - | |||||||

| Item 11. |

- 78 - | |||||||

| Item 12. |

- 81 - | |||||||

| - 82 - | ||||||||

| Item 13. |

- 82 - | |||||||

| Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds. |

- 82 - | ||||||

| Item 15. |

- 82 - | |||||||

| Item 16A. |

- 84 - | |||||||

| Item 16B. |

- 84 - | |||||||

| Item 16C. |

- 84 - | |||||||

| Item 16D. |

- 85 - | |||||||

| Item 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers. |

- 85 - | ||||||

| Item 16F. |

- 85 - | |||||||

| Item 16G. |

- 85 - | |||||||

| Item 16H. |

- 85 - | |||||||

| Item 17. |

- 85 - | |||||||

| Item 18. |

- 85 - | |||||||

| Item 19. |

- 86 - | |||||||

Table of Contents

FORWARD-LOOKING STATEMENTS

This annual report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements are, by their nature, subject to significant risks and uncertainties, and include, without limitation, statements relating to:

| • | our business and operating strategies; |

| • | our network expansion and capital expenditure plans; |

| • | our operations and business prospects; |

| • | the expected benefit of any acquisitions or other strategic transactions; |

| • | our financial condition and results of operations; |

| • | the expected impact of new services on our business, financial condition and results of operations; |

| • | the future prospects of and our ability to integrate acquired businesses; |

| • | the industry regulatory environment as well as the industry outlook generally; and |

| • | future developments in the telecommunications industry in the People’s Republic of China, or the PRC. |

The words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “seek,” “will,” “would” and similar expressions, as they relate to us, are intended to identify a number of these forward-looking statements.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. We are under no obligation to update these forward-looking statements and do not intend to do so. Actual results may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information—D. Risk Factors” and the following:

| • | any changes in the regulations or policies of the Ministry of Industry and Information Technology, or the MIIT, and other relevant government authorities relating to, among other matters: |

| • | the granting and approval of licenses; |

| • | tariff policies; |

| • | interconnection and settlement arrangements; |

| • | capital investment priorities; |

| • | the provision of telephone and other telecommunications services to rural areas in the PRC; |

| • | the convergence of television broadcast, telecommunications and Internet access networks, or three-network convergence ; and |

| • | spectrum and numbering resources allocation; |

Table of Contents

| • | the effects of competition on the demand for and price of our services; |

| • | effects of our restructuring and integration following the completion of our acquisition of the Code Division Multiple Access technology, or CDMA, telecommunications business, or the CDMA Business in 2008; |

| • | any potential further restructuring or consolidation of the PRC telecommunications industry; |

| • | changes in the PRC telecommunications industry as a result of the issuance of the third generation mobile telecommunications, or 3G, licenses by the MIIT; |

| • | the development of new technologies and applications or services affecting the PRC telecommunications industry and our current and future business; and |

| • | changes in political, economic, legal and social conditions in the PRC, including changes in the PRC government’s specific policies with respect to foreign investment in and entry by foreign companies into the PRC telecommunications industry, economic growth, inflation, foreign exchange and the availability of credit. |

CERTAIN DEFINITIONS AND CONVENTIONS

As used in this annual report, references to “us,” “we,” the “Company,” “our Company” and “China Telecom” are to China Telecom Corporation Limited and its consolidated subsidiaries except where we make clear that the term means China Telecom Corporation Limited or a particular subsidiary or business group only. References to matters relating to our H shares or American depositary shares, or ADSs, or matters of corporate governance are to the H shares, ADSs and corporate governance of China Telecom Corporation Limited. In respect of any time prior to our incorporation, references to “us,” “we” and “China Telecom” are to the telecommunications business in which our predecessors were engaged and which were subsequently assumed by us. All references to “China Telecom Group” are to China Telecommunications Corporation, our controlling shareholder. Unless the context otherwise requires, these references include all of its subsidiaries, including us and our subsidiaries. Unless otherwise indicated, references to and statements regarding China and the PRC in this annual report do not apply to Hong Kong Special Administrative Region, Macau Special Administrative Region or Taiwan.

| Item 1. | Identity of Directors, Senior Management and Advisers. |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable. |

Not applicable.

| Item 3. | Key Information. |

| A. | Selected Financial Data |

The following table presents our selected financial data. The selected consolidated statement of financial position data as of December 31, 2010 and 2011, and the selected consolidated statement of comprehensive income (except for earnings per ADS) and consolidated cash flow data for the years ended December 31, 2009, 2010 and 2011, are derived from our audited consolidated financial statements included elsewhere in this annual report, and should be read in conjunction with those consolidated financial statements. The selected consolidated statement of financial position data as of December 31, 2007, 2008 and 2009 and the selected consolidated statement of comprehensive income (except for earnings per ADS) and consolidated cash flow data for the years ended December 31, 2007 and 2008 are derived from our consolidated financial statements which are not included in this annual report. Our consolidated financial statements are prepared in accordance with International Financial Reporting Standards, or IFRS.

- 2 -

Table of Contents

The selected financial data reflect the acquisitions in 2007 and 2008 described under “Item 4. Information on the Company—A. History and Development of the Company—Our Acquisitions from China Telecom Group and Corporate Organization Restructuring” and “—Industry Restructuring and Our Acquisition of the CDMA Business in 2008.”

On June 30, 2007, we acquired the entire equity interests in each of China Telecom System Integration Co., Limited, China Telecom (Hong Kong) International Limited and China Telecom (Americas) Corporation (formerly known as “China Telecom (USA) Corporation”) from China Telecom Group. In 2008, we acquired the entire equity interests in China Telecom Group Beijing Corporation, or Beijing Telecom, from China Telecom Group. Because we and these acquired companies were under the common control of China Telecom Group, our acquisitions of these acquired companies are accounted for in a manner similar to a pooling-of-interests. Accordingly, the assets and liabilities of the acquired companies have been accounted for at historical amounts and our financial statements for periods prior to the respective acquisitions have been restated to include the financial position and results of operations of the acquired companies on a combined basis.

On October 1, 2008, we acquired from China Unicom (Hong Kong) Limited (formerly known as China Unicom Limited), or China Unicom, and China Unicom Corporation Limited, or CUCL, the entire CDMA Business and related assets and liabilities for a total consideration of RMB43,800 million. The related direct transaction cost for the acquisition was RMB84 million. The final cost of the acquisition was RMB40,413 million as a result of a RMB3,471 million reduction to the total consideration. The reduction represented a net settlement due from China Unicom in connection with our acquisition of certain customer-related assets and assumption of certain customer-related liabilities relating to the CDMA Business pursuant to the acquisition agreement. China Unicom is a company incorporated in Hong Kong whose shares are listed on the Hong Kong Stock Exchange and whose American depositary shares are listed on the New York Stock Exchange, or NYSE. Our acquisition of the CDMA Business and related assets and liabilities was accounted for using the purchase method.

| As of or for the year ended December 31, | ||||||||||||||||||||||||

| 2007 RMB | 2008 RMB | 2009 RMB | 2010 RMB | 2011 RMB | 2011 US$ | |||||||||||||||||||

| (restated)(1) | (restated)(1) | (restated)(1) | (restated)(1) | |||||||||||||||||||||

| (in millions, except share numbers and per share and per ADS data) | ||||||||||||||||||||||||

| Consolidated Statement of Comprehensive Income Data: |

||||||||||||||||||||||||

| Operating revenues |

180,804 | 186,529 | 209,370 | 219,864 | 245,041 | 38,933 | ||||||||||||||||||

| Operating expenses(2) |

(143,775 | ) | (182,162 | ) | (187,318 | ) | (196,412 | ) | (220,912 | ) | (35,099 | ) | ||||||||||||

| Operating income |

37,029 | 4,367 | 22,052 | 23,452 | 24,129 | 3,834 | ||||||||||||||||||

| Earnings/(losses) before income tax |

33,039 | (592 | ) | 18,569 | 20,311 | 22,014 | 3,498 | |||||||||||||||||

| Income tax |

(7,214 | ) | 983 | (4,382 | ) | (4,846 | ) | (5,416 | ) | (861 | ) | |||||||||||||

| Profit attributable to equity holders of the Company |

25,728 | 296 | 13,983 | 15,347 | 16,502 | 2,622 | ||||||||||||||||||

| Basic earnings per share(3) |

0.32 | 0.00 | 0.17 | 0.19 | 0.20 | 0.03 | ||||||||||||||||||

| Basic earnings per ADS(3) |

31.79 | 0.37 | 17.28 | 18.96 | 20.39 | 3.24 | ||||||||||||||||||

| Cash dividends declared per share |

0.08 | 0.08 | 0.08 | 0.07 | 0.07 | 0.01 | ||||||||||||||||||

| Consolidated Statement of Financial Position Data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

21,427 | 27,866 | 34,804 | 25,824 | 27,372 | 4,349 | ||||||||||||||||||

| Accounts receivable, net |

16,979 | 17,289 | 17,438 | 17,328 | 18,471 | 2,935 | ||||||||||||||||||

| Total current assets |

44,110 | 55,499 | 60,936 | 55,245 | 59,576 | 9,466 | ||||||||||||||||||

| Property, plant and equipment, net |

326,663 | 296,376 | 283,550 | 272,478 | 268,877 | 42,720 | ||||||||||||||||||

| Total assets |

427,541 | 454,086 | 439,956 | 420,529 | 419,115 | 66,591 | ||||||||||||||||||

| Short-term debt |

67,767 | 83,448 | 51,650 | 20,675 | 9,187 | 1,460 | ||||||||||||||||||

| Current portion of long-term debt |

3,811 | 565 | 1,487 | 10,352 | 11,766 | 1,869 | ||||||||||||||||||

- 3 -

Table of Contents

| As of or for the year ended December 31, | ||||||||||||||||||||||||

| 2007 RMB | 2008 RMB | 2009 RMB | 2010 RMB | 2011 RMB | 2011 US$ | |||||||||||||||||||

| (restated)(1) | (restated)(1) | (restated)(1) | (restated)(1) | |||||||||||||||||||||

| (in millions, except share numbers and per share and per ADS data) | ||||||||||||||||||||||||

| Accounts payable |

29,013 | 34,458 | 34,321 | 40,039 | 44,358 | 7,048 | ||||||||||||||||||

| Total current liabilities |

140,245 | 176,790 | 143,481 | 126,923 | 127,258 | 20,219 | ||||||||||||||||||

| Long-term debt |

34,148 | 39,226 | 52,768 | 42,549 | 31,150 | 4,949 | ||||||||||||||||||

| Deferred revenues (including current portion) |

15,486 | 11,444 | 8,462 | 6,203 | 4,805 | 763 | ||||||||||||||||||

| Total liabilities |

186,003 | 224,560 | 202,804 | 174,405 | 162,237 | 25,777 | ||||||||||||||||||

| Equity attributable to equity holders of the Company |

240,120 | 228,047 | 236,304 | 245,628 | 256,090 | 40,689 | ||||||||||||||||||

| Consolidated Cash Flow Data: |

||||||||||||||||||||||||

| Net cash from operating activities |

75,783 | 76,756 | 74,988 | 75,571 | 73,006 | 11,599 | ||||||||||||||||||

| Net cash used in investing activities(4) |

(46,618 | ) | (75,819 | ) | (43,255 | ) | (45,734 | ) | (43,637 | ) | (6,933 | ) | ||||||||||||

| Capital expenditures(4) |

(46,847 | ) | (46,652 | ) | (40,311 | ) | (41,597 | ) | (48,495 | ) | (7,705 | ) | ||||||||||||

| Net cash (used in) / generated from financing activities |

(30,747 | ) | 5,585 | (24,793 | ) | (38,771 | ) | (27,720 | ) | (4,404 | ) | |||||||||||||

| (1) | Certain comparative financial data prior to January 1, 2011 presented herein have been restated as a result of the amendments to IFRS 1, First-time Adoption of International Financial Reporting Standards (IFRSs). See Note 3 to our audited financial statements. |

| (2) | Includes an impairment loss in 2008 on property, plant and equipment of RMB24,167 million, which primarily represented an impairment loss on our Personal Handyphone System, or PHS, specific equipment of RMB23,954 million, an impairment loss in 2009 on property, plant and equipment of RMB753 million, which mainly represented impairment made in respect of our Digital Data Network, or DDN, specific equipment and an impairment loss in 2010 on property, plant and equipment of RMB139 million, which mainly represented impairment made in respect of certain of our obsolete telecommunications equipment. |

| (3) | The basic earnings per share have been calculated based on the respective net profit attributable to equity holders of the Company in 2007, 2008, 2009, 2010 and 2011 and the weighted average number of shares in issue during each of the relevant years of 80,932,368,321 shares. Basic earnings per ADS have been computed as if all of our issued and outstanding shares, including domestic shares and H shares, are represented by ADSs during each of the years presented. Each ADS represents 100 H shares. |

| (4) | Capital expenditures are part of and not an addition to net cash used in investing activities. |

Pursuant to the shareholders’ approval at the annual general meeting held on May 20, 2011, a final dividend of RMB5,763 million (RMB0.071208 equivalent to HK$0.085 per share) for the year ended December 31, 2010 was declared, all of which has been fully paid.

Pursuant to a resolution passed at the Directors’ meeting on March 20, 2012, a final dividend of approximately RMB5,583 million (RMB0.068984 equivalent to HK$0.085 per share) for the year ended December 31, 2011 was proposed for shareholders’ approval at the forthcoming annual general meeting.

Exchange Rate Information

Our business is primarily conducted in China and substantially all of our revenues are denominated in Renminbi. We present our historical consolidated financial statements in Renminbi. In addition, solely for the convenience of the reader, this annual report contains translations of certain Renminbi and Hong Kong dollar amounts into U.S. dollars at specific rates. For any date and period, the exchange rate refers to the exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board. Unless otherwise indicated, conversions of Renminbi or Hong Kong dollars into U.S. dollars in this annual report are based on the exchange rate on December 30, 2011 (RMB6.2939 to US$1.00 and HK$7.7663 to US$1.00). We make no representation that any Renminbi or Hong Kong dollar amounts could have been, or could be, converted into U.S. dollars or vice versa, as the case may be, at any particular rate, the rates stated below, or at all. For a detailed explanation of the risk of currency rate fluctuations, please see “Risk Factors—Risks Relating to the People’s Republic of China—Fluctuation of the Renminbi could materially affect our financial condition and results of operations.” The PRC government imposes controls over its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign exchange and through restrictions on foreign trade. Examples of such government regulations and restrictions are set forth in “Risk Factors—Risks Relating to the People’s Republic of China—Government control of currency conversion may adversely affect our financial condition.”

- 4 -

Table of Contents

On April 20, 2012, the daily exchange rates reported by the Federal Reserve Board was RMB6.3080 to US$1.00 and HK$7.7613 to US$1.00. The following table sets forth additional information concerning exchange rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates that we use in this annual report or will use in the preparation of our future periodic reports or any information to be provided to you.

| RMB per US$1.00 | HK$ per US$1.00 | |||||||||||||||||

| High | Low | High | Low | |||||||||||||||

| October 2011 |

6.3825 | 6.3534 | October 2011 |

7.7884 | 7.7634 | |||||||||||||

| November 2011 |

6.3839 | 6.3400 | November 2011 |

7.7957 | 7.7679 | |||||||||||||

| December 2011 |

6.3733 | 6.2939 | December 2011 |

7.7851 | 7.7663 | |||||||||||||

| January 2012 |

6.3330 | 6.2940 | January 2012 |

7.7674 | 7.7538 | |||||||||||||

| February 2012 |

6.3120 | 6.2935 | February 2012 |

7.7559 | 7.7532 | |||||||||||||

| March 2012 |

6.3315 | 6.2975 | March 2012 |

7.7678 | 7.7551 | |||||||||||||

| April 2012 (through April 20, 2012) |

6.3150 | 6.2975 | April 2012 (through April 20, 2012) |

7.7660 | 7.7580 | |||||||||||||

The following table sets forth the average exchange rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for each of 2007, 2008, 2009, 2010 and 2011 calculated by averaging the exchange rates on the last day of each month during each of the relevant years.

Average Exchange Rate

| RMB per US$ 1.00 | HK$ per US$1.00 | |||||||

| 2007 |

7.5806 | 7.8008 | ||||||

| 2008 |

6.9193 | 7.7814 | ||||||

| 2009 |

6.8295 | 7.7513 | ||||||

| 2010 |

6.7603 | 7.7692 | ||||||

| 2011 |

6.4475 | 7.7793 | ||||||

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Risks Relating to Our Business

We face increasing competition, which may materially and adversely affect our business, financial condition and results of operations.

The telecommunications industry in the PRC is rapidly evolving.

After the industry restructuring in 2008, China Unicom and our Company have full-service capabilities and compete with each other in both wireline and wireless telecommunications services. China Mobile Limited, or China Mobile, continues to be the leading provider of mobile telecommunications services in the PRC and competes with us in mobile telecommunications services and other telecommunications services.

- 5 -

Table of Contents

In particular, in January 2009, each of China Mobile Communications Corporation, or China Mobile Group, China Telecom Group and China United Network Communications Group Company Limited (formerly known as China United Telecommunications Corporation prior to its merger with China Network Communications Group Corporation), or Unicom Group, received a license from the MIIT to operate 3G businesses nationwide. The licenses permit China Mobile Group, China Telecom Group and Unicom Group to provide 3G services based on TD-SCDMA, CDMA2000 and WCDMA technologies, respectively. We have been authorized by China Telecom Group to operate 3G business nationwide based on CDMA2000 technology. China Mobile, China Unicom and our Company have all launched 3G services. However, we cannot assure you that: (i) our 3G services will deliver the quality and levels of services currently anticipated; (ii) we will be able to provide all planned 3G services or we will be able to provide such services on schedule; (iii) there will be sufficient demand for 3G services for us to deliver these services profitably; (iv) our competitors’ 3G, or newer technology based, services will not be more popular among potential subscribers; or (v) we will not encounter unexpected technological difficulties in implementing the CDMA2000 technology. The failure of any of these possible developments to occur could impede our growth, which could have a material adverse effect on our business, financial condition and results of operations.

In May 2010, the PRC State Council issued Several Opinions on Encouraging and Guiding the Healthy Development of Private Investment, encouraging private investment in industry sectors that are mainly state-controlled, such as basic telecommunications services. As a result, the competitive landscape in the PRC telecommunications industry may further diversify, causing more intensified competition.

Increasing competition from other existing telecommunications services providers, including China Mobile and China Unicom, as well as competition from new competitors, could materially and adversely affect our business and prospect by, among other factors, forcing us to lower our tariffs to the extent permitted under relevant laws and regulations, reducing or reversing the growth of our customer base and reducing usage of our services. Any of these developments could materially adversely affect our revenues and profitability. We cannot assure you that the increasingly competitive environment and any change in the competitive landscape of the telecommunications industry in the PRC would not have a material adverse effect on our business, financial condition or results of operations.

We may further lose wireline telephone subscribers and revenues derived from our wireline voice services may continue to decline, which may adversely affect our results of operations, financial condition and prospects.

We continued to lose wireline telephone subscribers and revenues derived from our wireline voice services continued to decline during the past several years mainly due to the increasing popularity of mobile voice services and other alternative means of communication, such as VoIP. Tariffs for mobile services have continued decreasing in recent years, which further accelerated substitution of the wireline voice services by the mobile services. The number of our fixed-line subscribers decreased by 7.2% at the end of 2010 compared to that at the end of 2009 and further decreased by 3.1% at the end of 2011. Revenues from our wireline voice services decreased by 20.3% in 2010 compared to that in 2009 and further decreased by 20.4% in 2011. The percentage of revenues derived from our wireline voice services out of our total operating revenues continued to decrease, from 37.5% in 2009 to 28.4% in 2010 and 20.3% in 2011.

We have been taking various measures in order to mitigate the impact of loss of our wireline telephone subscribers and stabilize our revenues from wireline voice services. See “Item 4. Information on the Company—B. Business Overview—Our Products and Services—Wireline Voice Services.” However, we cannot assure you that we will be successful in mitigating the adverse impact of the substitution of wireline voice services by mobile voice services and other alternative means of communication or in slowing down the decline of our revenues generated from wireline voice services. Migration from wireline voice services to mobile services and other alternative means of communication may further intensify in the future, which may affect the financial performance of our wireline voice services and thus adversely affect our results of operations, financial condition and prospects as a whole.

We will continue to be controlled by China Telecom Group, which could cause us to take actions that may conflict with the best interests of our other shareholders.

- 6 -

Table of Contents

China Telecom Group, a wholly state-owned enterprise, owned approximately 70.89% of our outstanding shares as of April 23, 2012. Accordingly, subject to our Articles of Association and applicable laws and regulations, China Telecom Group, as our controlling shareholder, will continue to be able to exercise significant influence over our management and policies by:

| • | controlling the election of our Directors and, in turn, indirectly controlling the selection of our senior management; |

| • | determining the timing and amount of our dividend payments; |

| • | approving our annual budgets; |

| • | deciding on increases or decreases in our share capital; |

| • | determining issuance of new securities; |

| • | approving mergers and acquisitions; and |

| • | amending our Articles of Association. |

The interests of China Telecom Group as our controlling shareholder could conflict with our interests or the interests of our other shareholders. As a result, China Telecom Group may take actions with respect to our business that may not be in our or our other shareholders’ best interests.

We depend on China Telecom Group and its other subsidiaries to provide certain services and facilities for which we currently have limited alternative sources of supply.

In addition to being our controlling shareholder, China Telecom Group, by itself and through its other subsidiaries, also provides us with services and facilities necessary for our business activities, including, but not limited to:

| • | use of international gateway facilities; |

| • | provision of services in areas outside our service regions necessary to enable us to provide end-to-end services to our customers; |

| • | use of certain inter-provincial optic fibers; and |

| • | lease of properties and assets, including lease of the capacity on the CDMA network. |

The interests of China Telecom Group and its other subsidiaries as providers of these services and facilities may conflict with our interests. We currently have limited alternative sources of supply for these services and facilities. Therefore, we have limited leverage in negotiating with China Telecom Group and its other subsidiaries over the terms for the provision of these services and facilities. Termination or adverse changes of the terms for the provisions of these services and facilities could materially and adversely affect our business, results of operations and financial condition. See “Item 4. Information on the Company—A. History and Development of the Company—Industry Restructuring and Our Acquisition of the CDMA Business in 2008” and “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions” for a description of the services and facilities provided by China Telecom Group and its other subsidiaries.

Since our services require interconnection with networks of other operators, disruption in interconnections with those networks could have a material adverse effect on our business and results of operations.

- 7 -

Table of Contents

Under the relevant telecommunications regulations, telecommunications operators are required to interconnect with networks of other operators. China Telecom Group entered into interconnection settlement agreements with other telecommunications operators, including Unicom Group and China Mobile Group. We entered into an interconnection settlement agreement, as amended, with China Telecom Group, which allows our networks to interconnect with China Telecom Group’s networks as well as networks of the other telecommunications operators, with whom China Telecom Group had interconnection arrangements. The effective provision of our wireline voice, mobile voice and other services requires interaction between our networks and those of China Telecom Group, Unicom Group, China Mobile Group and other telecommunications operators. Any interruption in our interconnection with the networks of those operators or other international telecommunications carriers with which we interconnect due to technical or competitive reasons may affect our operations, service quality and customer satisfaction, and, in turn, our business and results of operations. In addition, any obstacles in existing interconnection arrangements and leased line agreements or any change in their terms, as a result of natural events, accidents, or for regulatory, technological, competitive or other reasons, could lead to temporary service disruptions and increased costs that may seriously jeopardize our operations and adversely affect our profitability and growth.

We may be unable to obtain sufficient financing to fund our capital requirements, which could limit our growth potential and prospects.

We believe that cash from operations, together with any necessary borrowings, will provide sufficient financial resources to meet our projected capital and other expenditure requirements. However, we may require additional funds to the extent we have underestimated our capital requirements or overestimated our future cash from operations. In addition, a significant feature of our business strategy is to continue to transform our Company into a modern integrated information services provider, which may require additional capital resources. The cost of implementing new technologies, upgrading our networks, expanding capacity or acquisitions of businesses or assets may be significant. Furthermore, in order for us to effectively respond to technological changes and more intensive competition, we may need to make substantial investments in the future.

Financing may not be available to us on acceptable terms or at all. In addition, any future issuance of equity securities, including securities convertible or exchangeable into or that represent the right to receive equity securities, may require approval from the relevant government authorities. Our ability to obtain additional financing will depend on a number of factors, including:

| • | our future financial condition, results of operations and cash flows; |

| • | general market conditions for financing activities by telecommunications companies; and |

| • | economic, political and other conditions in the markets where we operate or plan to operate. |

We cannot assure you that we can obtain sufficient financing at commercially reasonable terms or at all. If adequate capital is not available on commercially reasonable terms, our growth potential and prospects could be materially and adversely affected. Furthermore, additional issuances of equity securities will result in dilution to our shareholders. Incurrence of debt would result in increased interest expense and could require us to agree to restrictive operating and financial covenants.

If we are not able to respond successfully and cost-efficiently to technological or industry developments, our business may be materially and adversely affected.

The telecommunications market is characterized by rapid advancements in technology, evolving industry standards and changes in customer needs. We cannot assure you that we will be successful in responding to these developments. In addition, new services or technologies, such as the three-network convergence, cloud computing and Internet of Things, may render our existing services or technologies less competitive. In the event we do take measures to respond to technological developments and changes in industry standards, the integration of new technology or industry standards or the upgrading of our networks may require substantial time, effort and capital investment. For example, we continue to make significant investment to improve our broadband network, including the upgrade of optic fiber coverage capacity. However, we may not be able to recover our investment as expected.

- 8 -

Table of Contents

Our ability to respond to technological developments may also be adversely affected by external factors, some of which are beyond our control. For example, we have started to prepare for the application of Internet Protocol version 6, or IPv6, the next-generation Internet Protocol version, to our networks. However, the deployment of IPv6 depends on a number of external factors, including, among others, PRC domestic industry policies. If the future transition to IPv6 is delayed due to factors beyond our control, we may face obstacles in further developing our Internet-related business in the future. We cannot assure you that we will succeed in integrating these new technologies and industry standards or adapting our network and systems in a timely and cost-effective manner, or at all. Our inability to respond successfully and cost-efficiently to technological or industry developments may materially and adversely affect our business, results of operations and competitiveness.

We face a number of risks relating to our Internet-related services.

We currently provide a range of Internet-related services, including dial-up and broadband Internet access, and Internet-related applications. We face a number of risks in providing these services.

Our network may be vulnerable to unauthorized access, computer viruses and other disruptive problems. We cannot assure you that the security measures we have implemented will not be circumvented or otherwise fail to protect the integrity of our network. Unauthorized access could jeopardize the security of confidential information stored in our customers’ computer systems. Eliminating computer viruses and other security problems may also require interruptions, delays or suspension of our services, reduce our customer satisfaction and cause us to incur costs.

In addition, because we provide connections to the Internet and host websites for customers and develop Internet content and applications, we may be perceived as being associated with the content carried over our network or displayed on websites that we host. We cannot and do not screen all of this content and may face litigation claims due to a perceived association with this content. These types of claims have been brought against other providers of online services in the past. Regardless of the merits of the lawsuits, these types of claims can be costly to defend, divert management resources and attention, and may damage our reputation.

We are subject to an anti-monopoly investigation by the PRC National Development and Reform Commission over our pricing practices for Internet dedicated leased line access services to Internet service providers.

In 2011, the PRC National Development and Reform Commission, or the NDRC, initiated an anti-monopoly investigation over our pricing practices with respect to our Internet dedicated leased line access services to Internet service providers. In response to this investigation, we have conducted a self-evaluation of the relevant pricing practices and submitted to the NDRC a proposal for enhancement initiatives as well as an application for suspension of investigation. We plan to carry out capacity expansion and reduce the price for direct interconnection with other backbone network operators, further standardize our tariff arrangement of Internet dedicated leased line access services, continue to upgrade our broadband access capacity and reduce the bandwidth unit price of Internet access for public customers. Our proposal of enhancement initiatives and application for suspension of investigation are being considered by the NDRC. In the event of any adverse determination by the NDRC investigation, we may be required to carry out additional remedial measures and/or subject to penalties being imposed on us.

Risks Relating to the Telecommunications Industry in the PRC

The current and future government regulations and policies that extensively govern the telecommunications industry may limit our flexibility in responding to market conditions, competition or changes in our cost structure.

Our business is subject to extensive government regulation. The MIIT, which is the primary telecommunications industry regulator under the PRC’s State Council, regulates, among other things:

| • | industry policies and regulations; |

- 9 -

Table of Contents

| • | licensing; |

| • | tariffs; |

| • | competition; |

| • | telecommunications resource allocation; |

| • | service standards; |

| • | technical standards; |

| • | interconnection and settlement arrangements; |

| • | enforcement of industry regulations; |

| • | universal service obligations; |

| • | network information security; |

| • | network access license approval for telecom equipment and terminals; and |

| • | network construction plans. |

Other PRC governmental authorities also take part in regulating tariff policies, capital investment and foreign investment in the telecommunications industry. The regulatory framework within which we operate may constrain our ability to implement our business strategies and limit our flexibility to respond to market conditions or to changes in our cost structure.

In addition, these regulations and policies that govern the telecommunications industry in the PRC have experienced continuous changes in the past several years. The interpretation and enforcement of the PRC’s World Trade Organization commitments regarding telecommunications services may also affect telecommunications regulations. Possible future changes to regulations and policies of the PRC government governing the telecommunications industry could adversely affect our business and operations. For example, to provide a uniform regulatory framework for the orderly development of the telecommunications industry, the PRC government is currently preparing a draft telecommunications law. If and when the telecommunications law is adopted by the National People’s Congress or its Standing Committee, it is expected to provide a new regulatory framework for telecommunications regulation in the PRC. We cannot be certain how this law will affect our business and operations and whether it will contain more stringent regulatory requirements than the current telecommunications regulations. Any significant future changes in regulations or policies that govern the telecommunications industry may have a material adverse effect on our business and operations.

The PRC government may require us, along with other providers in the PRC, to reduce our tariff or to provide universal services with specified obligations, and we may not be compensated adequately for reducing our tariff or providing such services.

Tariffs are the prices we charge our customers for our telecommunications services. We are subject to government regulations on tariffs, especially those relating to our basic telecommunications services. See “Item 4. Information on the Company—B. Business Overview—Regulatory and Related Matters—Tariff Setting.” We derive a substantial portion of our revenues from services that are subject to tariff regulations of the PRC government. Our revenues have been adversely affected by adjustments in tariffs and other changes in the past, and we may be adversely affected by any future tariff regulations mandated by the PRC government. We cannot predict the likelihood, timing or magnitude of tariff adjustments by the government or their potential impact on our business.

- 10 -

Table of Contents

In addition, under the Telecommunications Regulations promulgated by the State Council, telecommunications service providers in the PRC are required to fulfill universal service obligations in accordance with relevant regulations to be promulgated by the PRC government. The MIIT has the authority to delineate the scope of universal service obligations. The MIIT may also select universal service providers through a tendering process. The MIIT, together with other governmental authorities, is also responsible for formulating administrative rules relating to the establishment of a universal service fund and compensation schemes for universal services. The PRC government currently uses financial resources to compensate the expenses incurred in the “Village to Village” projects before the establishment of a universal service fund. In December 2006, the Ministry of Finance issued the Provisional Rules on Usage and Administration of Telecommunications Universal Service Fund, effective December 21, 2006, which provide a compensation scheme for certain expenses incurred by the telecommunications services providers in undertaking the “Village to Village” projects. However, the compensation from the PRC government may not be sufficient to cover all of our expenses for providing the telecommunications services under the “Village to Village” projects.

Under the Telecommunications Regulations, all PRC telecommunications operators shall provide universal services, and we expect to perform our duties thereunder accordingly. We may not be able to realize adequate return on investments for expanding networks to, and providing telecommunications services in, those economically less developed areas due to potentially higher capital expenditure requirements, lower usage by customers and lack of flexibility in setting our tariffs. If the government substantially lowers the tariffs for our services, or if we are required to provide universal services with specified obligations without proper compensation by the government, our business and profitability may be materially adversely affected.

Risks Relating to the People’s Republic of China

Substantially all of our assets are located in the PRC and substantially all of our revenues are derived from our operations in the PRC. Accordingly, our results of operations and prospects are subject, to a significant extent, to the economic, political and legal developments in the PRC.

The PRC’s economic, political and social conditions, as well as government policies, could affect our business.

Substantially all of our business, assets and operations are located in the PRC. The PRC’s economy differs from the economies of most developed countries in many respects, including without limitation:

| • | government involvement; |

| • | level of development; |

| • | growth rate; |

| • | control of foreign exchange; and |

| • | allocation of resources. |

While the PRC’s economy has experienced significant growth in the past 30 years, growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of the PRC, but may also have a negative effect on us.

During the economic recovery in the PRC that followed the 2008 global financial crisis, the PRC government implemented various policies to control inflation. For example, the PRC government introduced measures in 2011 in certain sectors to avoid overheating of the economy, including tighter bank lending policies and increases in bank interest rates. More recently, the PRC government has announced its intention to relax certain of these policies in response to slowing economic growth in the PRC in the second half of 2011 and the beginning of 2012. However, continued implementation of these or similar measures, or a variety of other factors, may cause a continued slowdown in the PRC economy, which, in turn, could significantly reduce business activities in the PRC, as well as the demand for our products and services, and thus materially and adversely affect our business, financial condition and results of operations.

- 11 -

Table of Contents

Government control of currency conversion may adversely affect our financial condition.

We receive substantially all of our revenues in Renminbi, which currently is not a freely convertible currency. A portion of these revenues must be converted into other currencies to meet our foreign currency obligations. These foreign currency-denominated obligations include:

| • | payment of interest and principal on foreign currency-denominated debt; |

| • | payment for equipment and materials purchased offshore; and |

| • | payment of dividends declared, if any, in respect of our H shares. |

Under the PRC’s existing foreign exchange regulations, we will be able to pay dividends in foreign currencies without prior approval from the State Administration of Foreign Exchange by complying with certain procedural requirements. However, the PRC government may take measures at its discretion in the future to restrict access to foreign currencies for both current account transactions and capital account transactions. We may not be able to pay dividends in foreign currencies to our shareholders, including holders of our ADSs, if the PRC government restricts access to foreign currencies for current account transactions.

Foreign exchange transactions under our capital account, including foreign currency-denominated borrowings from foreign banks, issuance of foreign currency-denominated debt securities, if any, and principal payments in respect of foreign currency- denominated obligations, continue to be subject to significant foreign exchange controls and require the approval of the State Administration of Foreign Exchange. These limitations could affect our ability to obtain foreign exchange through debt or equity financing, or to obtain foreign exchange to meet our payment obligations under the debt securities, if any, or to obtain foreign exchange for capital expenditures.

Fluctuation of the Renminbi could materially affect our financial condition and results of operations.

We receive substantially all of our revenues, and our financial statements are presented, in Renminbi. The value of the Renminbi against U.S. dollar and other currencies fluctuates and is affected by, among other things, changes in the PRC’s and international political and economic conditions. Since 1994, the conversion of Renminbi into foreign currencies, including Hong Kong and U.S. dollars, has been based on rates set by the People’s Bank of China, which are set daily based on the previous business day’s inter- bank foreign exchange market rates and current exchange rates on the world financial markets. On July 21, 2005, the PRC government introduced a managed floating exchange rate system to allow the value of the Renminbi to fluctuate within a regulated band based on market supply and demand and by reference to a basket of currencies. In April 2012, the PRC government expanded the floating band of Renminbi trading prices against the U.S. dollar in the inter-bank spot foreign currency exchange market from 0.5% to 1.0%. Fluctuations in exchange rates may adversely affect the value, translated or converted into U.S. dollars or Hong Kong dollars, of our net assets, earnings and any declared dividends payable on our H shares in foreign currency terms. Our financial condition and results of operations may also be affected by changes in the value of certain currencies other than the Renminbi, in which our obligations are denominated. For further information on our foreign exchange risks and certain exchange rates, see “Item 3. Key Information—A. Selected Financial Data—Exchange Rate Information” and “Item 11. Quantitative and Qualitative Disclosures about Market Risk—Foreign Exchange Rate Risk.” We cannot assure you that any future movements in the exchange rate of the Renminbi against the U.S. dollar or other foreign currencies will not adversely affect our results of operations and financial condition.

- 12 -

Table of Contents

The PRC legal system has inherent uncertainties that could limit the legal protections available to you.

We were incorporated under PRC laws and are governed by our Articles of Association. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have limited precedential value. Since 1979, the PRC government has promulgated laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited number of published cases and their non-binding nature, interpretation and enforcement of these laws and regulations involve uncertainties.

The ability of our shareholders to enforce their rights in respect of violations of corporate governance procedures may be limited. In this regard, our Articles of Association provide that most disputes between holders of H shares and our Company, directors, supervisors, officers or holders of domestic shares, arising out of our Articles of Association or the PRC Company Law and related regulations concerning the affairs of our Company, are to be resolved through arbitration by an arbitration tribunal in Hong Kong or the PRC, rather than by a court of law. Awards that are made by PRC arbitral authorities recognized under the Arbitration Ordinance of Hong Kong can be enforced in Hong Kong. Hong Kong arbitration awards are also enforceable in the PRC. However, to our knowledge, no action has been brought in the PRC by any holder of H shares to enforce an arbitral award, and we are uncertain as to the outcome of any action, if brought in the PRC to enforce an arbitral award made in favor of holders of H shares. See “Item 10. Additional Information—B. Memorandum and Articles of Association.”

To our knowledge, there has not been any published report of judicial enforcement in the PRC by holders of H shares of their rights under the Articles of Association of a PRC company or the PRC Company Law.

Unlike in the United States, the applicable PRC laws did not specifically allow shareholders to sue the directors, supervisors, senior management or other shareholders on behalf of the corporation to enforce a claim against such party or parties that the corporation has failed to enforce itself until January 1, 2006, when the amendments to the PRC Company Law passed on October 27, 2005 became effective. Although the amended PRC Company Law provides that shareholders, under certain circumstances, may sue the directors, supervisors and senior management on behalf of the company, no detailed implementation rules or judicial interpretations have been issued in this regard. In addition, our minority shareholders may not be able to enjoy protections to the same extent afforded to shareholders of companies incorporated under the state laws of the United States.

Although we will be subject to the Hong Kong Stock Exchange Listing Rules, or the Listing Rules, and the Hong Kong Codes on Takeovers and Mergers and Share Repurchases, or the Codes, the holders of H shares will not be able to bring actions on the basis of violations of the Listing Rules or the Codes, and must rely on the Hong Kong Stock Exchange and The Securities and Futures Commission of Hong Kong to enforce the Listing Rules or the Codes, as the case may be.

You may experience difficulties in effecting service of legal process and enforcing judgments against us and our management.

We are a company incorporated under PRC laws, and substantially all of our assets and our subsidiaries are located in the PRC. In addition, most of our directors and officers reside within the PRC, and substantially all of the assets of our directors and officers are located within the PRC. As a result, it may not be possible to effect service of process within the United States or elsewhere outside the PRC upon most of our directors or officers, including with respect to matters arising under applicable laws and regulations. Moreover, our PRC counsel has advised us that the PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States, the United Kingdom or most other Western countries. Our Hong Kong counsel has also advised us that Hong Kong has no arrangement for the reciprocal enforcement of judgments with the United States.

As a result, recognition and enforcement in the PRC of judgments of a court in the United States and any of the other jurisdictions mentioned above in relation to any matter not subject to a binding arbitration provision may be difficult or impossible.

- 13 -

Table of Contents

Holders of H shares may be subject to PRC taxation.

Under the Enterprise Income Tax Law of the PRC, or the EIT Law, and its implementing regulations, holders of our H shares or ADSs which are “non-resident enterprises” for the EIT Law’s purpose are subject to enterprise income tax at the rate of 10.0% with respect to dividends paid by us and income derived from sale of our H shares or ADSs, unless reduced under an applicable tax treaty. In addition, a resident enterprise, including a foreign enterprise whose “de facto management body” is located in the PRC, is not subject to any PRC income tax with respect to dividends paid to it by us. The capital gains realized by such resident enterprise are subject to the PRC enterprise income tax. Specifically, according to the Notice of the PRC State Administration of Taxation Concerning the Withholding Enterprise Income Tax on Dividend Distributed by PRC Resident Enterprises to Overseas Non-Resident Enterprise Holders of H shares issued in November 2008 and the Approval of the PRC State Administration of Taxation Concerning the Collection of Enterprise Income Tax on Dividend from B-shares Received by Non- Resident Enterprise issued in July 2009, when PRC resident enterprises distribute dividend to overseas non-resident enterprise holders of H shares for the year 2008 and the years thereafter, the 10.0% enterprise income tax will be withhold. The Company will withhold the 10.0% enterprise income tax when it pays dividend to holders of H shares or ADSs who are non-resident enterprises. See “Item 10. Additional Information—E. Taxation—People’s Republic of China.”

Furthermore, dividends paid by us to holders of our H shares or ADSs who are individuals outside the PRC are subject to a withholding tax of 20.0% unless reduced by an applicable tax treaty. In addition, gains realized by individuals upon the sale or other disposition of our H shares or ADSs are temporarily exempted from PRC capital gains tax. If the exemptions are withdrawn in the future, holders of our H shares or ADSs who are individuals may be required to pay PRC capital gains tax upon the sale or other disposition of our H shares. See “Item 10. Additional Information—E. Taxation— People’s Republic of China.”

Natural disasters and health hazards in the PRC may severely disrupt our business and operations and may have a material adverse effect on our financial condition and results of operations.

Several natural disasters and health hazards have struck mainland China in recent years. In 2010, another major earthquake registering 7.1 on the Richter scale struck Qinghai Province. Our network equipment and other assets in the affected areas sustained some damage in the earthquakes, leading to service stoppage and other disruptions in our operations in those areas. In March 2011, a major earthquake registering 9.0 on the Richter scale struck Japan, which affected our international communications services. We are unable to predict the effect, if any, that any future natural disasters and health hazards may have on our business. Any future natural disasters and health hazards may, among other things, significantly disrupt our ability to adequately staff our business, and may generally disrupt our operations. Furthermore, such natural disasters and health hazards may severely restrict the level of economic activity in affected areas, which may in turn materially and adversely affect our business and prospects. As a result, any natural disasters or health hazards in the PRC or other regions in the world may have a material adverse effect on our financial condition and results of operations.

| Item 4. | Information on the Company. |

| A. | History and Development of the Company |

Our Restructuring and Initial Public Offering in 2002

We were incorporated under PRC laws on September 10, 2002 as a joint stock company with limited liability under the name “China Telecom Corporation Limited.” As part of our initial restructuring, China Telecom Group’s telecommunications operations in Shanghai Municipality, Guangdong Province, Jiangsu Province and Zhejiang Province, together with the related assets and liabilities, were transferred to us in consideration of 68,317,270,803 of our shares.

Following our restructuring, China Telecom Group continues to be the holder of the licenses required for operating our telecommunications business. In accordance with the approval of the MIIT (and prior to March 2008, the Ministry of Information Industry, or the MII), we derive our exclusive rights to operate our business from our status as a subsidiary controlled by China Telecom Group, and China Telecom Group must hold and maintain all licenses received from the MIIT (and prior to March 2008, the MII) in connection with our business for our benefits. The government currently does not charge license fees for the telecommunications licenses held by China Telecom Group.

- 14 -

Table of Contents

In 2002, we successfully completed our initial public offering of H shares and raised approximately RMB10,659 million in aggregate net proceeds for us. Upon completion of our initial public offering, our H shares have been listed for trading on the Hong Kong Stock Exchange, and ADSs representing our H shares have been listed for trading on the NYSE.

Our Acquisitions from China Telecom Group and Corporate Organization Restructuring

We carried out a series of acquisitions between 2003 and 2011, through which we acquired from China Telecom Group telecommunications operations conducted by its subsidiaries. As a result, we significantly expanded the geographical coverage and services of our operations in Mainland China.

In June 2007, we acquired from China Telecom Group and its wholly owned subsidiary China Huaxin Post and Telecommunications Development Center 100.0% equity interest in each of China Telecom (Hong Kong) International Limited, China Telecom System Integration Co., Limited and China Telecom (Americas) Corporation (formerly known as “China Telecom (USA) Corporation”).

In 2008, for the purpose of improving our organization structure by managing our businesses through branches instead of subsidiaries, we merged with certain of our wholly owned subsidiaries, with these subsidiaries dissolved and all of their assets, businesses, liabilities, rights and obligations being assumed by us. Our provincial branches have taken over the responsibilities of managing and operating the business in these provinces formerly operated by these subsidiaries.

On August 1, 2011 and December 1, 2011, E-surfing Pay Co., Ltd. and E-surfing Media Co., Ltd., two of our subsidiaries, acquired the e-commerce business and video media business from China Telecom Group.

Industry Restructuring and Our Acquisition of the CDMA Business in 2008

Industry Restructuring in 2008

On May 24, 2008, the MIIT, the National Development and Reform Commission and the Ministry of Finance issued a joint announcement relating to the further reform of the telecommunications industry in the PRC. According to the joint announcement, the principal objectives of the reform include, among others: (i) supporting the formation of three telecommunications service providers, each with nationwide network resources, comparable scale and standing, full-service capabilities and competitive strength, in order to help optimize the allocation of telecommunications resources and foster market competition; (ii) promoting homegrown innovation by telecommunications service providers; and (iii) enhancing the service capabilities and quality of, and the regulatory framework governing, the telecommunications industry. To achieve these objectives, the three ministries encouraged the following restructuring transactions: (a) the acquisition by China Telecom Group of the CDMA network (including both assets and subscriber base) then owned by China Unicom; (b) the acquisition by China Telecom Group of the basic telecommunications service business operated by China Satellite Communications Corporation, or China Satellite; (c) the merger between China Unicom and China Netcom; and (d) the acquisition of China Railcom by China Mobile. The joint announcement required that detailed implementation plans relating to these restructuring transactions be formulated by the relevant parties involved, subject to, in each case, agreement on terms among the relevant parties and approvals by applicable PRC government authorities, and carried out, as applicable, in accordance with customary practices in the domestic and international capital markets.

Our Acquisition of the CDMA Business

On June 2, 2008, we, China Unicom and CUCL entered into a framework agreement, or the CDMA Business Framework Agreement, which sets forth certain key terms in respect of our acquisition from CUCL of the CDMA Business then owned and operated by CUCL and related assets and liabilities. On July 27, 2008, we, China Unicom and CUCL entered into an acquisition agreement, or the CDMA Acquisition Agreement, which sets forth the terms and conditions in respect of our acquisition of the CDMA Business and related assets and liabilities (including the entire equity interest in China Unicom (Macau) Company Limited and 99.5% of the equity interest in Unicom Huasheng Telecommunications Technology Co. Ltd., or Unicom Huasheng). The CDMA Acquisition Agreement superseded the CDMA Business Framework Agreement. The total consideration for our acquisition of the CDMA Business was RMB43,800 million. The related direct transaction cost for the acquisition was RMB84 million. The final cost of the acquisition was RMB40,413 million as a result of a RMB3,471 million reduction to the total consideration. The reduction represents a net settlement due from China Unicom in connection with our acquisition of certain customer-related assets and assumption of certain customer-related liabilities relating to the CDMA Business pursuant to the acquisition agreement. The cost of the acquisition had been fully paid by us by February, 2010.

- 15 -

Table of Contents

Related Transactions

Acquisition of the CDMA Network by China Telecom Group. On July 27, 2008, China Telecom Group, Unicom Group, and Unicom New Horizon Mobile Telecommunications Company Limited, or Unicom New Horizon, a wholly-owned subsidiary of Unicom Group, entered into a CDMA network disposal agreement, pursuant to which Unicom Group and Unicom New Horizon sold the CDMA cellular telecommunications network constructed by Unicom New Horizon, or the CDMA Network, to China Telecom Group for a consideration of RMB66,200 million, or the CDMA Network Acquisition. On October 1, 2008, China Telecom Group completed the acquisition of the CDMA Network.

Lease of capacity on the CDMA Network by our Company from China Telecom Group. On July 27, 2008, we entered into a CDMA network capacity lease agreement with China Telecom Group to lease the capacity on the CDMA Network from China Telecom Group. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions—Ongoing Related Party Transactions between Us and China Telecom Group—CDMA Network Capacity Lease Agreement” for details of this agreement.

Transfer of Certain Basic Telecommunications Business from China Satellite to China Telecom Group

Following the approval by the SASAC and the MIIT, the transfer of basic telecommunications business of China Satellite to China Telecom Group, our controlling shareholder, without consideration was fully completed in January 2009. The business transferred from China Satellite to China Telecom Group included voice over internet protocol, or VoIP, services, satellite international private line services, very small aperture terminal, or VSAT, services, digital trunking communications services and other services related to basic telecommunications services in 21 service regions. These service regions consist of Beijing Municipality, Anhui Province, Chongqing Municipality, Fujian Province, Gansu Province, Guangdong Province, Guangxi Zhuang Autonomous Region, Guizhou Province, Hainan Province, Hubei Province, Hunan Province, Jiangsu Province, Jiangxi Province, Ningxia Hui Autonomous Region, Qinghai Province, Shaanxi Province, Shanghai Municipality, Sichuan Province, Xinjiang Uygur Autonomous Region, Yunnan Province and Zhejiang Province.

In connection with our restructuring and acquisitions set forth above, we entered into various arrangements with China Telecom Group relating to the mutual provision of ongoing telecommunications and other services. These arrangements include agreements for trademark licensing, centralized services, interconnection arrangements, optic fiber leasing, property leasing, IT services, CDMA network capacity lease and other services. See “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions” for a more detailed description of these arrangements.

Our Proposed Sale of Besttone E-Commerce Co., Ltd.

On April 28, 2011, we entered into an asset restructuring agreement with China Satcom Guomai Communications Co., Ltd., or Satcom Guomai, which is a subsidiary of China Telecommunications Corporation and listed on the Shanghai Stock Exchange. We have agreed to sell to Satcom Guomai our 100.0% equity interest in Besttone E-Commerce Co., Ltd., a subsidiary of the Company primarily engaged in the provision of e-commerce and booking services, for an estimated consideration of RMB350 million, subject to adjustment. Satcom Guomai will pay the consideration by issuing to us a certain number of its shares with reference to the average trading price for the twenty trading days to April 1, 2011 (inclusive) of RMB14.92 per share, representing around 4.0% of its enlarged share capital. In March 2012, the relevant government approval for the transaction has been obtained, which approval will remain in effect for 12 months. We intend to complete the transaction within such period.

- 16 -

Table of Contents

Organizational Structure

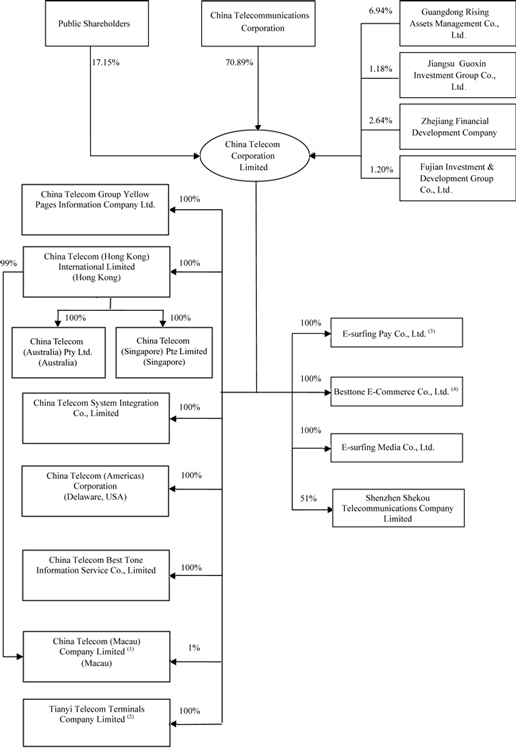

Set out below is a chart illustrating our corporate structure and significant subsidiaries as of April 23, 2012:

- 17 -

Table of Contents

| (1) | Formerly known as China Unicom (Macau) Company Limited. |

| (2) | Formerly known as Unicom Huasheng Telecommunications Technology Co., Ltd. |

| (3) | Formerly known as Bestpay Co., Ltd. |

| (4) | We have agreed to sell our 100.0% equity interest in this company to Satcom Guomai. See “Item 4-Information on the Company—A. History and Development of the Company – Our Proposed Sale of Besttone E-Commerce Co., Ltd.” |

In addition, our Company has a branch in each of 22 provinces, five autonomous regions and four centrally administered municipalities in the PRC. See “—Our Acquisition from China Telecom Group and Corporate Organization Restructuring” included elsewhere under this Item.

General Information

Our principal executive offices are located at 31 Jinrong Street, Xicheng District, Beijing, PRC 100033 and our telephone number is (+86-10) 6642-8166. Our website address is www.chinatelecom-h.com. The information on our website is not a part of this annual report. We have appointed CT Corporation System at 111 Eighth Avenue, New York, New York 10011 as our agent for service of process in the United States.

| B. | Business Overview |

We are an integrated information service provider in the PRC with full-service capabilities. Following our acquisition of the CDMA Business in 2008, we began to offer a comprehensive range of telecommunications services, including wireline voice services, mobile voice services, Internet access services, value-added services, integrated information application services, managed data and leased line services and other related services. See “—A. History and Development of the Company—Industry Restructuring and Our Acquisition of the CDMA Business in 2008.”

Since 2005, we have started to implement our business strategy of transformation from a traditional basic telecommunications service provider to a modern integrated information services provider. Specifically, we have enhanced our efforts in developing our non-voice services, such as Internet access services, value-added services and integrated information application services, while we continue to strengthen our traditional services such as the wireline voice services, in achieving a more structurally optimized business and enhanced competitive strength. We aim to provide differentiated and innovative services to create value for customers by leveraging on our integrated resources.

In January 2009, the MIIT issued to China Telecom Group, our controlling shareholder, a license to operate 3G business nationwide based on CDMA2000 technology. We have been authorized by China Telecom Group to operate CDMA2000 3G mobile business in the PRC. We launched our CDMA2000 3G mobile services in March 2009 and have extended our CDMA2000 3G mobile services nationwide in the PRC.

Our Operation Strategy

In 2011, facing a complex economic situation and increasing market competition, we continued to pursue the strategy of differentiation, integration and innovation to achieve the scale development of our full-service operations. By taking advantage of the opportunities created by the rapid development of 3G services, smartphones and wireless Internet access services in 2011, we have further developed our high-growth services such as mobile, wireline broadband, and wireline integrated information application services. We have maintained the high growth rate of our mobile services and further solidified the competitive advantage of our broadband services. While continuing to optimize our business structure, we have effectively managed the risks related to our declining wireline voice services. Focusing on 3G services, we continued to improve our wireless Internet access services in 2011. We will continue the scale development of our business through innovation and quality services.

- 18 -

Table of Contents

Subscribers and Service Usage

Our operating revenues depend largely on the size of our customer base, usage volume and the level and structure of our tariffs. The following table shows our selected operating data as of the dates and for the periods indicated.

| As of or for the year ended December 31, |

||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| Wireline Voice Services: |

||||||||||||

| Local wireline access lines in service (in millions) |

188.6 | 175.1 | 169.6 | |||||||||

| Residential |

112.2 | 110.2 | 108.0 | |||||||||

| Government and enterprises |

32.1 | 34.0 | 36.8 | |||||||||

| Public telephones |

15.1 | 14.5 | 13.9 | |||||||||

| Wireless local access |

29.2 | 16.4 | 10.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Wireline local voice usage (in billion pulses)(1) |

320.6 | 251.4 | 206.4 | |||||||||

| Domestic long distance wireline usage (in billion minutes) (2) |

83.9 | 68.5 | 52.9 | |||||||||

| International, Hong Kong, Macau and Taiwan long distance wireline usage (in billion minutes)(3) |

1.2 | 1.2 | 1.1 | |||||||||

| Mobile Voice Services: |

||||||||||||

| Mobile subscribers (in millions) |

56.1 | 90.5 | 126.5 | |||||||||

| Mobile voice usage (in billion minutes) |

155.4 | 295.9 | 407.8 | |||||||||

| Internet Access Services: |

||||||||||||

| Wireline broadband subscribers (in millions) |

53.5 | 63.5 | 76.8 | |||||||||

| Value-added Services |

||||||||||||

| Mobile SMS Usage (in billion messages) |

15.1 | 33.1 | 49.9 | |||||||||

| Mobile Color Ring Tone subscribers (in millions) |

32.6 | 54.2 | 75.4 | |||||||||

| Wireline caller ID service subscribers (in millions) |

128.5 | 119.0 | 115.6 | |||||||||

| Wireline Color Ring Tone subscribers (in millions) |

74.1 | 73.9 | 73.8 | |||||||||

| (1) | Pulses are the billing units for calculating local telephone usage fees. |

| (2) | Includes calls originated by mobile subscribers that are carried over our long distance networks. |