As filed with the Securities and Exchange Commission on June 18, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Bionomics Limited

(Exact name of Registrant as specified in its charter)

| Australia | 2834 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

200 Greenhill Road

Eastwood, SA 5063

Australia

+61 8 8150 7400

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Bionomics Inc.

Spyridon “Spyros” Papapetropoulos, M.D.

Chief Executive Officer

spyros@bionomics.com.au

2710 Gateway Oaks Drive, Suite 150N

Sacramento, CA 95833

+1 (786) 201 8066

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Theodore Ghorra | Andrew Reilly |

| Rimon PC | Rimon Law Pty Ltd |

| 100 Park Avenue, 16th Floor | Level 2, 50 Bridge Street |

| New York, NY 10017 | Sydney, NSW 2000, Australia |

| +1 212 515 9979 | +61 2 9055 6965 |

| theodore.ghorra@rimonlaw.com | andrew.reilly@rimonlaw.com |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Preliminary Prospectus

Subject to completion, dated June 18, 2024

Bionomics Limited

3,641,213,340 Ordinary Shares

represented by 20,228,963 American Depositary Shares

This prospectus relates to the offer and resale from time to time by the selling shareholder identified in this prospectus (the “Selling Shareholder”) of up to 3,641,213,340 ordinary shares of Bionomics Limited as represented by 20,228,963 American Depositary Shares (“ADS”), all of which were initially issued by us pursuant to the Securities Purchase Agreement dated as of May 31, 2024 by and between us and the Selling Shareholder. Each ADS represents 180 ordinary shares.

The Selling Shareholder will receive all the proceeds from any sales of ADSs offered pursuant to this prospectus. We will, however, receive proceeds from any exercise of warrants by the Selling Shareholder. We will pay the expenses associated with registering the sales of ADSs by the Selling Shareholder.

The Selling Shareholder will bear the commissions and discounts, if any, attributable to any sale of the ADSs by Selling Shareholder. The Selling Shareholder may sell the ADSs at various times and in various types of transactions, including sales in the open market, sales in negotiated transactions and sales by a combination of these methods. ADSs may be sold at the market price at the time of a sale, at prices relating to the market price over a period of time or at prices negotiated with the buyers of ADSs. See “Plan of Distribution” for more information.

The ADSs are listed on The Nasdaq Global Market under the symbol “BNOX”.

Investing in the ADSs involves risks. See “Risk Factors” beginning on page 6 of this prospectus.

Neither the Securities and Exchange Commission, nor any state securities commission, has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated ___, 2024

TABLE OF CONTENTS

i

This prospectus only provides you with a general description of the securities being offered. This prospectus is part of a registration statement on Form F-1 that we filed with the Securities and Exchange Commission (“SEC”). You should rely only on the information contained in or incorporated by reference into this prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you.

This prospectus and the information incorporated herein by reference contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section entitled “Incorporation of Documents by Reference.” You should read this prospectus, together with additional information described below under the heading “Where You Can Find Additional Information,” and “Incorporation of Documents by Reference” before deciding whether to invest in any of the ADSs being offered by the Selling Shareholder. For a more complete understanding of the offering of the ADSs, you should refer to the registration statement, including the exhibits. You may access the registration statement, exhibits and other reports we file with the SEC on the SEC’s website.

The information in this prospectus is accurate as of the date on the front cover of this prospectus, and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Neither the delivery of this prospectus nor the sale of any securities means that information contained in this prospectus is correct after the date of this prospectus or as of any other date. Any information incorporated by reference is only accurate as of the date of the document incorporated by reference.

Unless otherwise indicated or the context implies otherwise:

| ● | “we,” “us,” or “our” refers to Bionomics Limited, an Australian corporation, and its consolidated subsidiaries; |

| ● | “shares” or “ordinary shares” refers to our ordinary shares; |

| ● | “ADSs” refers to American Depositary Shares, each of which represents 180 ordinary shares; and |

| ● | “ADRs” refers to American Depositary Receipts, which evidence the ADSs. |

We use our registered and unregistered trademarks, including Bionomics™, in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Our reporting and functional currency is the Australian dollar. Solely for the convenience of the reader, this prospectus contains translations of some Australian dollar amounts into U.S. dollars at specified rates. Except as otherwise stated in this prospectus, all translations from Australian dollars to U.S. dollars are based on the rate published by the Reserve Bank of Australia on the date indicated. No representation is made that the Australian dollar amounts referred to in this prospectus could have been or could be converted into U.S. dollars at such rate.

All references to “$” in this prospectus refer to Australian dollars or U.S. dollars, as the context requires based on the foregoing. All references to “A$” in this prospectus mean Australian dollars. All references to “US$” in this prospectus mean U.S. dollars.

Our fiscal year end is June 30. References to a particular “fiscal year” are to our fiscal year ended June 30 of that calendar year.

Unless otherwise indicated, the consolidated financial statements and related notes incorporated by reference in this prospectus have been prepared in accordance with International Accounting Standards and also comply with International Financial Reporting Standards, or IFRS, and interpretations issued by the International Accounting Standards Board.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, that are based on our management’s beliefs and assumptions and on information currently available to our management. These forward-looking statements are contained principally in “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” In some cases, you can identify forward-looking statements by the following words: “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “seek,” “believe,” “estimate,” “predict,” “potential,” “continue,” “contemplate,” “possible” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Statements regarding our future results of operations and financial position, growth strategy and plans and objectives of management for future operations are forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates of future events and trends which affect or may affect our business, operations and industry. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to numerous risks and uncertainties.

Many important factors could adversely impact our business and financial performance, including but not limited to those discussed in “Risk Factors” of this prospectus and the following:

| ● | the ability of our clinical trials to demonstrate safety and efficacy of our product candidates and other positive results; |

| ● | the timing and focus of our clinical trials and preclinical studies, and the reporting of data from those trials and studies; |

| ● | our plans relating to commercializing any product candidates, including the geographic areas of focus and sales strategy; |

| ● | the market opportunity and competitive landscape for our product candidates, including our estimates of the number of patients who suffer from the conditions we are targeting; |

| ● | the success of competing therapies that are or may become available; |

| ● | our estimates of the number of patients that we will enroll in our clinical trials; |

| ● | the beneficial characteristics, safety, efficacy and therapeutic effects of our product candidates; |

| ● | the timing of initiation and completion, and the progress of our drug discovery and research programs; |

| ● | the timing or likelihood of regulatory filings and approvals for our product candidates for various diseases; |

| ● | our ability to obtain and maintain regulatory approval of our product candidates; |

| ● | our plans relating to the development of our product candidates, including additional indications we may pursue; |

| ● | existing regulations and regulatory developments in the United States, Australia, Europe and other jurisdictions; |

| ● | risks associated with any pandemic that could adversely impact our preclinical studies and clinical trials; |

| ● | our plans and ability to obtain, maintain, protect and enforce our intellectual property rights and our proprietary technologies, including extensions of existing patent terms where available; |

| ● | our continued reliance on third parties to conduct additional clinical trials of our product candidates, and for the manufacture of our product candidates for preclinical studies and clinical trials; |

| ● | our plans regarding any collaboration, licensing or other arrangements that may be necessary or desirable to develop, manufacture or commercialize our product candidates; |

| ● | the need to hire additional personnel and our ability to attract and retain such personnel; |

| ● | our estimates regarding expenses, future revenue, capital requirements, needs for additional financing and the impact of a fluctuating currency exchange on these estimates; |

| ● | our financial performance; |

| ● | the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements; |

| ● | our anticipated use of our existing resources; |

| ● | cyber security risks and any failure to maintain the confidentiality, integrity and availability of our computer hardware, software and internet applications and related tools and functions; |

| ● | our expectations regarding our ceasing to be exempt as a “foreign private issuer” from a number of rules under the U.S. securities laws and Nasdaq corporate governance rules; and |

| ● | other risks and uncertainties, including those listed under “Risk Factors.” |

iii

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate and financial trends that we believe may affect our business, financial condition, results of operations and prospects, and these forward-looking statements are not guarantees of future performance or development. These forward-looking statements speak only as of the date of this prospectus and are subject to a number of risks, uncertainties and assumptions described under the sections in this prospectus entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this prospectus. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. The forward-looking statements contained in this prospectus are excluded from the safe harbor protection provided by the Private Securities Litigation Reform Act of 1995 and Section 27A of the Securities Act.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than US$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These advantages include:

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002; |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports (if any), proxy statements (if any) and registration statements; and |

| ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of our initial public offering. However, if certain events occur prior to the end of such five-year period, our annual gross revenues exceed US$1.235 billion or we issue more than US$1.0 billion of non-convertible debt in any three-year period, then we will cease to be an emerging growth company prior to the end of such five-year period.

We may elect to take advantage of reduced reporting requirements in future filings. As a result, the information in this prospectus and that we provide to our shareholders in the future may be different than what you might receive from other public reporting companies in which you hold equity interests.

iv

This summary highlights information contained in other parts of this prospectus and in the documents incorporated by reference herein and does not contain all the information that may be important to you in making your investment decision. In addition to this summary, before investing in our securities, you should carefully read the entire prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors”. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements and related notes and the exhibits to the registration statement of which this prospectus is a part.

Overview

We are a clinical-stage biopharmaceutical company developing novel, allosteric ion channel modulators designed to transform the lives of patients suffering from serious central nervous system (“CNS”) disorders with high unmet medical need. Ion channels serve as important mediators of physiological function in the CNS and the modulation of ion channels influences neurotransmission that leads to downstream signaling in the brain. The α7 nicotinic acetylcholine (“ACh”) receptor (“α7 receptor”) is an ion channel that plays an important role in driving emotional responses and cognitive performance. Utilizing our expertise in ion channel biology and translational medicine, we are developing orally active small molecule negative allosteric modulators (“NAMs”) to treat anxiety and stressor-related disorders. In addition, through a long-standing strategic partnership with Merck & Co., Inc., in the United States and Canada (“MSD”), we are also developing positive allosteric modulators (“PAMs”) of the α7 receptor to treat cognitive dysfunction. Bionomics’ pipeline also includes preclinical assets that target Kv3.1/3.2 and Nav1.7/1.8 ion channels being developed for CNS conditions of high unmet need.

You should carefully consider the information on our business activities and strategies disclosed in Item 4 of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024), and the Half-Year Report for the six months ending December 31, 2023, disclosed in Form 6-K filed on March 15, 2024, each of which are herein incorporated by reference.

Private Placement

On May 31, 2024, we entered into a Securities Purchase Agreement with the Selling Shareholder to sell the following securities in a private placement (the “Private Placement”):

| ● | 233,367,480 ordinary shares as represented by 1,296,486 restricted ADSs (ie, not registered under the Securities Act) at a price of US$0.99 per ADS; |

| ● | a pre-funded warrant to purchase up to 6,279,905 ADSs at an exercise price of US$0.0001 per ADS (the “Pre-Funded Warrant”); and |

| ● | an accompanying 5-year warrant to purchase up to 12,652,572 ADSs at an exercise price of US$0.99 per ADS (the “Accompanying Warrant” and, together with the Pre-Funded Warrant, the “Warrants”). |

Upon the closing of the Private Placement on June 4, 2024, we received proceeds of US$7.5 million, before deducting offering expenses payable by us. We intend to use the net proceeds to fund the advancement of BNC210’s registrational programs in both social anxiety disorder and post-traumatic stress disorder, business development activities, working capital and general corporate purposes.

Under the terms of the Securities Purchase Agreement and the Warrants, the Selling Shareholder may not beneficially own more than 9.9% of the Company’s outstanding ordinary shares at any time. Otherwise, the Pre-Funded Warrant is immediately exercisable and remains exercisable until exercised in full. The Accompanying Warrant is immediately exercisable and remains exercisable until June 2, 2029 except to the extent such exercise would cause the Selling Shareholder, together with its affiliates and attribution parties, to beneficially own a number of ordinary shares that would exceed 4.99% of our then outstanding ordinary shares following such exercise.

This prospectus relates to the offer and potential sale by the Selling Shareholder of those ordinary shares (including the ordinary shares issuable upon exercise of the Warrants) represented by ADSs sold in the Private Placement.

For further details of the Private Placement, see “Private Placement” and “Material Contracts – Securities Purchase Agreement for Private Placement” as well as the information disclosed in our Form 6-K filed on June 3, 2024, which Form 6-K and the exhibits filed therewith are incorporated by reference herein.

1

The Offering

| Securities offered by the Selling Shareholders | 20,228,963 ADSs, representing 3,641,213,340 ordinary shares (including 3,407,845,860 ordinary shares issuable upon the exercise of Warrants). | |

| The ADSs | Each ADS represents 180 ordinary shares. The depositary (as identified below) is the holder of the ordinary shares underlying the ADSs and ADS holders have the rights provided in the deposit agreement among us, the depositary and holders and beneficial owners of ADSs from time to time. To better understand the terms of the ADSs, please see the section in the accompanying prospectus entitled “Description of American Depositary Shares.” | |

| Depositary | Citibank, N.A. | |

| Ordinary shares outstanding after the Offering, including shares underlying ADSs offered by the Selling Shareholder | 2,384,539,964 ordinary shares. | |

| Use of proceeds | We will not receive any proceeds from the sale of the ADSs representing the ordinary shares offered hereby except that we may receive up to US$12.7 million upon exercise of the Warrants. | |

| Nasdaq Global Market | “BNOX”. | |

| Risk Factors |

This investment involves a high degree of risk. See “Risk Factors” beginning on page 6 of this prospectus, as well as the information and documents incorporated by reference herein, for a discussion of risks you should consider carefully before making an investment decision. |

Summary of Risk Factors

Investing in our securities involves a high degree of risk. Below is a summary of certain factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all the risks that we face. Additional discussion of the risks summarized below, as well as other risks that we face, can be found under the heading “Risk Factors” contained or incorporated by reference in this prospectus.

| ● | Sales of a substantial amount of the ADSs in the public markets, as a result of the exercise of the Warrants or otherwise, could cause the market price of the ADSs to decline. |

| ● | We face competition from entities that have developed or may develop product candidates for our target disease indications, including companies developing novel treatments and technology platforms based on modalities and technology similar to ours. |

| ● | We are a clinical-stage biopharmaceutical company with no approved products. We have incurred significant operating losses since our inception and expect to incur significant losses for the foreseeable future. We have never generated any revenue from product sales and may never generate any revenue or become profitable or, if we achieve profitability, we may not be able to sustain it. |

| ● | We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our product development programs, commercialization efforts or other operations. |

| ● | Preclinical and clinical drug development is a lengthy and expensive process, with an uncertain outcome. Our preclinical and clinical programs may experience delays or may never advance, which would adversely affect our ability to obtain regulatory approvals or commercialize our product candidates on a timely basis or at all, which could have an adverse effect on our business. |

2

| ● | If we experience delays or difficulties in the initiation, enrollment and/or retention of patients in clinical trials, our regulatory submissions or receipt of necessary regulatory approvals could be delayed or prevented. |

| ● | The trading price of our ordinary shares has been volatile, and that of our ADSs may be volatile, and you may not be able to resell the ADSs at or above the price you paid. |

| ● | An active trading market for the ADSs may not be maintained or be liquid enough for you to sell your ADSs quickly or at market price. |

| ● | Your right as a holder of ADSs to participate in any future preferential subscription rights offering or to elect to receive dividends in ordinary shares may be limited, which may cause dilution to your holdings. |

| ● | Our current or future product candidates may cause adverse or other undesirable side effects that could delay or prevent their regulatory approval, limit the commercial profile of an approved label or result in significant negative consequences following marketing approval, if any. |

| ● | We may have difficulties in attracting and retaining key personnel, and if we fail to do so our business may suffer. |

| ● | We depend on collaboration partners to develop and commercialize our collaboration product candidates, including Merck and Carina Biotech. If our collaboration partners fail to perform as expected, fail to advance our collaboration product candidates or are unable to obtain the required regulatory approvals for our collaboration product candidates, the potential for us to generate future revenue from such product candidates would be significantly reduced and our business would be significantly harmed. |

| ● | We currently rely, and expect to continue to rely, on third parties to conduct some or all aspects of our product manufacturing, research and preclinical and clinical testing, and these third parties may not perform satisfactorily. |

| ● | We may not be able to protect our intellectual property rights throughout the world. |

Corporate Information

Bionomics Limited is an Australian company incorporated in 1996. Our registered office is located at 200 Greenhill Road Eastwood, South Australia 5063 Australia, and our telephone number is +61 8 8150 7400. Our agent for service of process in the United States is CSC-Lawyers Incorporating Service, 2710 Gateway Oaks Drive, Suite 150N, Sacramento, CA 95833. Our website address is www.bionomics.com.au. The information contained in, or accessible through, our website does not constitute part of this prospectus.

Implications of being a Foreign Private Issuer

We are currently a “foreign private issuer” (as defined in Rule 405 under the Securities Act). As a foreign private issuer, we have taken advantage of certain reduced disclosure and other requirements in this prospectus. Accordingly, the information contained this prospectus may be different than the information you receive from U.S. public companies in which you hold equity securities.

A company would cease to be a “foreign private issuer” if more than 50% of its outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of its executive officers or directors are U.S. citizens or residents, (ii) more than 50% of its assets are located in the United States or (iii) its business is administered principally in the United States. This assessment is made as of the end of the second fiscal quarter of each fiscal year and any loss of status as a foreign private issuer takes effect on the first day of the next fiscal year.

Bionomics will cease to qualify as a “foreign private issuer” on July 1, 2024 and will begin reporting as a domestic issuer under the Securities Exchange Act of 1934 from that date. See “Risk Factors - A loss of our status as a foreign private issuer could result in additional cost.”

3

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our cash and cash equivalents and capitalization as of December 31, 2023, as derived from our financial statements, which are prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board. The information in this table should be read in conjunction with the financial statements and notes thereto and other financial information incorporated by reference into this prospectus.

The table below presents our capitalization on an actual basis, and on an as-adjusted basis as to give effect to the gross proceeds of US$7,499,999 received from the first tranche of the Private Placement of (i) 233,367,480 ordinary shares as represented by 1,296,486 restricted ADSs and (ii) pre-funded warrants to purchase 6,279,905 ADSs.

The table below, however, does not present our capitalization on an as-adjusted basis to give effect to the issuance and sale of 3,407,845,860 ordinary shares represented by ADSs issuable upon exercise of the Warrants issued to the Selling Shareholder in the Private Placement. The holders of the Warrants are not obligated to exercise them and, as a result, there can be no assurance that the holders will do so.

| As of December 31, 2023 | ||||||||

| Actual | As Adjusted* | |||||||

| A$ | A$ | |||||||

| Cash and cash equivalents | 14,866,263 | 25,831,174 | ||||||

| Non-current borrowings | - | - | ||||||

| Lease liabilities | 176,669 | 176,669 | ||||||

| Equity: | ||||||||

| Issued capital (1,924,808,444 ordinary shares outstanding as of December 31, 2023; 2,384,539,964 ordinary shares, as adjusted) | 233,823,665 | 244,788,576 | ||||||

| Reserves | 13,835,261 | 13,835,261 | ||||||

| Accumulated losses | (218,625,845 | ) | (218,625,845 | ) | ||||

| Total equity | 29,033,081 | 39,997,992 | ||||||

| Total capitalization | 29,033,081 | 39,997,992 | ||||||

| * | The proceeds from the Private Placement were converted from U.S. dollars to Australian dollars based on the rate published by the Reserve Bank of Australia on December 29, 2023, which was A$1.00 = US$0.6840. |

4

On May 31, 2024, we sold to the Selling Shareholder in the Private Placement: (i) 233,367,480 ordinary shares as represented by 1,296,486 restricted ADSs at a price of US$0.99 per ADS; (ii) the Pre-Funded Warrant to purchase up to 6,279,905 ADSs at an exercise price of US$0.0001 per ADS and (iii) the Accompanying Warrant to purchase up to 12,652,572 ADSs at an exercise price of US$0.99 per ADS.

Upon the closing of the Private Placement on June 4, 2024, we received proceeds of approximately US$7.5 million, before deducting offering expenses payable by us. We intend to use the net proceeds to fund the advancement of BNC210’s registrational programs in both social anxiety disorder and post-traumatic stress disorder, business development activities, working capital and general corporate purposes.

Under the terms of the Securities Purchase Agreement and the Warrants, the Selling Shareholder may not beneficially own more than 9.9% of the Company’s outstanding ordinary shares at any time.

The Pre-Funded Warrant is immediately exercisable and remains exercisable until exercised in full. The Accompanying Warrant is immediately exercisable and remains exercisable until June 2, 2029. However, the Selling Shareholder may not exercise the Accompanying Warrant to the extent such exercise would cause the Selling Shareholder, together with its affiliates and attribution parties, to beneficially own a number of ordinary shares that would exceed 4.99% of our then outstanding ordinary shares following such exercise.

This prospectus relates to the offer and sale by the Selling Shareholder of those ordinary shares (including the ordinary shares issuable upon exercise of the Warrants) represented by ADSs sold in the Private Placement.

You should carefully consider the information on the Private Placement disclosed in Form 6-K filed on June 3, 2024, which is herein incorporated by reference.

We will not receive any proceeds from the resale of the ADSs by the Selling Shareholders except that we may receive up to US$12.7 million upon exercise in full of the Accompanying Warrants to the Selling Shareholder.

We cannot predict when or if the Warrants will be exercised. It is possible that the Warrants may expire and never be exercised. Any proceeds received by us from the exercise of the Warrants will be used for funding our research and development, pre-commercialization activities and for general corporate purposes.

We have not declared or paid any dividends on our ordinary shares, and we do not anticipate paying any dividends in the foreseeable future. Our board of directors presently intends to reinvest all earnings in the continued development and operation of our business.

Payment of dividends in the future, if any, will be at the discretion of our board of directors. If our board of directors elects to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial conditions, contractual restrictions and other factors that our board of directors may deem relevant.

5

Investment in any securities offered pursuant to this prospectus involves risks. You should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 20-F for the fiscal year ended June 30, 2023, as amended, which is incorporated herein by reference, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Securities Act of 1934, as amended, and the risk factors and other information contained therein. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

You should consider carefully the risks described below and the risks described in Items 3D and 11 of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024), each of which are herein incorporated by reference.

Risks relating to this Offering

Sales of ADSs issuable upon exercise of the Warrants and other derivative securities could cause the market price of our ADSs to decline.

The Warrants entitle the Selling Shareholder to purchase up to 19,124,355 ADSs, representing 3,442,383,900 ordinary shares, at a purchase price per ADS of $0.99 per Accompanying Warrant, and $0.9899 per Pre-Funded Warrant, respectively. The sale of these additional ordinary shares, or the perception that such sales could occur, could cause the market price of our ADSs to decline or become more volatile.

Our failure to meet the $1.00 minimum bid price or other continued listing requirements of Nasdaq could result in a delisting of our ADSs, which could negatively impact the market price and liquidity of our ADSs and our ability to access the capital markets.

Any failure by Bionomics to comply with Nasdaq’s continued listing standards could result in a deficiency notice and, if not cured within the applicable period, could result in delisting. In particular, a company must meet a $1.00 minimum bid price for continued listing on Nasdaq. While the price of our ADSs has recently been under $1.00 we have not yet received a deficiency notice and, if we do, we expect to take action to satisfy the minimum bid price. Such action could include increasing the ratio of the number of our ordinary shares per ADS.

Any Nasdaq action relating to a delisting could have a negative effect on the price of our ADSs, impair the ability to sell or purchase our ADSs when persons wish to do so, and any such delisting action may materially adversely affect our ability to raise capital or pursue strategic restructuring, refinancing or other transactions on acceptable terms, or at all. Delisting from the Nasdaq Global Market could also have other negative results, including the potential loss of institutional investor interest, reduced research coverage, and fewer business development opportunities.

In the event of any delisting or potential delisting, we may attempt to take actions to restore our compliance with Nasdaq’s listing requirements, but we can provide no assurance that any such action taken by us would allow our ADSs to remain listed or be re-listed, stabilize the market price or improve the liquidity of our ADSs, maintain a minimum closing bid price of $1.00 per ADS for 10 consecutive trading days as required for continued listing on the Nasdaq Global Market or prevent future non-compliance with Nasdaq’s listing requirements.

6

A loss of our status as a “foreign private issuer” could result in additional cost.

We currently qualify as a “foreign private issuer” (as defined in Rule 405 under the Securities Act). As a foreign private issuer, we are exempt from certain rules under the Securities Act of 1934, as amended (the “Exchange Act”) that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and the rules under the Exchange Act with respect to their purchases and sales of our ordinary shares. Moreover, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

As a foreign private issuer, we have taken advantage of certain reduced disclosure and other requirements in this prospectus. Accordingly, the information contained this prospectus may be different than the information you receive from U.S. public companies in which you hold equity securities.

A company would cease to be a “foreign private issuer” if more than 50% of its outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of its executive officers or directors are U.S. citizens or residents, (ii) more than 50% of its assets are located in the United States or (iii) its business is administered principally in the United States. This assessment is made as of the end of the second fiscal quarter of each fiscal year of a foreign private issuer and any loss of status as a foreign private issuer takes effect on the first day of the following fiscal year.

Bionomics will cease to qualify as a “foreign private issuer” effective July 1, 2024 and will begin reporting as a domestic issuer under the Exchange Act from that date.

The regulatory and compliance costs to us under U.S. securities laws as a domestic issuer could be significantly more than costs that we incur as a foreign private issuer. We will be required to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC, which forms are more detailed and extensive in certain respects than the forms available to a foreign private issuer. We will be required to prepare our financial statements in accordance with U.S. GAAP rather than IFRS. Such conversion of our financial statements to U.S. GAAP has involved significant time and cost. In addition, we will lose our ability to rely upon exemptions from certain corporate governance requirements on U.S. stock exchanges that are available to foreign private issuers and exemptions from procedural requirements related to the solicitation of proxies. In addition, as long as long as Bionomics remains an Australian corporation, we will remain subject to certain Australian law reporting requirements, including continuing to prepare financial statements in accordance with Australian Accounting Standards, which are consistent with IFRS.

We will not receive any of the proceeds from the resale of ADSs in this offering, so your purchase of ADSs will not directly benefit the Company.

The Selling Shareholder will receive all the net proceeds from the resale of ADSs under this registration statement, so we will not directly benefit from your purchase. We will, however, bear the costs and expenses incurred in connection with the registration of these ADSs.

7

We are a clinical-stage biopharmaceutical company developing novel, allosteric ion channel modulators designed to transform the lives of patients suffering from serious central nervous system (“CNS”) disorders with high unmet medical need. Ion channels serve as important mediators of physiological function in the CNS and the modulation of ion channels influences neurotransmission that leads to downstream signaling in the brain. The α7 nicotinic acetylcholine (“ACh”) receptor (“α7 receptor”) is an ion channel that plays an important role in driving emotional responses and cognitive performance. Utilizing our expertise in ion channel biology and translational medicine, we are developing orally active small molecule negative allosteric modulators (“NAMs”) to treat anxiety and stressor-related disorders. In addition, through a long-standing strategic partnership with Merck & Co., Inc., in the United States and Canada (“MSD”), we are also developing positive allosteric modulators (“PAMs”) of the α7 receptor to treat cognitive dysfunction. Bionomics’ pipeline also includes preclinical assets that target Kv3.1/3.2 and Nav1.7/1.8 ion channels being developed for CNS conditions of high unmet need.

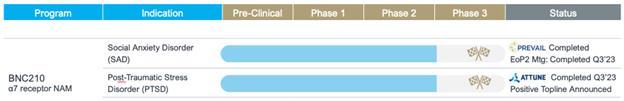

We are advancing our lead product candidate, BNC210, an oral, proprietary, selective NAM of the α7 receptor, for the chronic treatment of Post-Traumatic Stress Disorder (“PTSD”) and the acute treatment of Social Anxiety Disorder (“SAD”). There remains a significant unmet medical need for the over 27 million patients in the United States alone suffering from SAD and PTSD.

There remains a significant unmet medical need for patients suffering from SAD and PTSD. Current pharmacological treatments include certain antidepressants and benzodiazepines, and there have been no new FDA approved therapies in these indications in nearly two decades. These existing treatments have multiple shortcomings, such as a slow onset of action of antidepressants, and significant side effects of both classes of drugs, including abuse liability, addiction potential and withdrawal symptoms. BNC210 has been observed in our clinical trials to have a fast onset of action and clinical activity without the limiting side effects seen with the current standard of care.

In September 2023, we announced the results of the Phase 2b ATTUNE study, which was a double-blind, placebo-controlled trial conducted in a total of 34 sites in the United States and the United Kingdom, with 212 enrolled patients, randomized 1:1 to receive either twice daily 900 mg BNC210 as a monotherapy (n=106) or placebo (n=106) for 12 weeks. The trial met its primary endpoint of change in Clinician-Administered PTSD Scale for DSM-5 (“CAPS-5”) total symptom severity score from baseline to Week 12 (p=0.048). A statistically significant change in CAPS-5 score was also observed at Week 4 (p=0.016) and at Week 8 (p=0.015). Treatment with BNC210 also showed statistically significant improvement both in clinician-administered and patient self-reporting in two of the secondary endpoints of the trial. Specifically, BNC210 led to significant improvements at Week 12 in depressive symptoms (p=0.041) and sleep (p=0.039) as measured by Montgomery-Åsberg Depression Rating Scale (“MADRS”) and Insomnia Severity Index (ISI), respectively. BNC210 also showed signals and trends across visits in the other secondary endpoints including the clinician and patient global impression - symptom severity (“CGI-S”, “PGI-S”, respectively) and the Sheehan Disability Scale (“SDS”). Contingent upon successful capital raise, and successful End-of-Phase 2 meeting interactions with the FDA, we are planning to initiate Phase 3 study in PTSD in the second half of 2024.

We have completed our Phase 2 PREVAIL trial for BNC210 for the acute treatment of SAD. While PREVAIL did not meet its primary endpoint, as measured by the change from baseline to the average of the Subjective Units of Distress Scale (“SUDS”) scores during a 5-minute Public Speaking Challenge in the BNC210-treated patients when compared to placebo, the December 2022 topline data readout revealed encouraging trends in the prespecified endpoints. The findings did indicate a consistent trend toward improvements across primary and secondary endpoints and a favorable safety and tolerability profile consistent with previously reported results. These results supported a post-hoc in-depth analysis of the full dataset to better understand the potential of the drug and guide late-stage trial design. In October 2023, we announced a positive outcome of an End-of-Phase 2 meeting with FDA that enables advancement of BNC210 into Phase 3 studies in SAD. Start-up activities for a planned Phase 3 trial of BNC210 in SAD are underway. We plan to initiate dosing in the Phase 3 study in SAD in the third quarter of 2024.

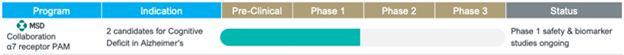

The Company's expertise in ion channels and approach to developing allosteric modulators have been validated through its strategic partnership with MSD for our α7 receptor PAM program, which targets a receptor that has garnered significant attention for treating cognitive deficits. This partnership enables Bionomics to maximize the value of its ion channel and chemistry platforms and develop transformative medicines for patients suffering from cognitive disorders such as Alzheimer's disease.

8

Below is a summary of our non-partnered pipeline, which shows the current status and expected topline data:

Below is a summary of the status of the programs under our collaboration relationships:

BNC210

We are initially focused on developing BNC210 for two distinct indications with high unmet medical need: (i) chronic treatment of PTSD and (ii) acute treatment of SAD. In our clinical trials to-date, BNC210 has been observed to have a fast onset of action, and demonstrated clinical anti-anxiety and anti-depressive activity, but without many of the limiting side effects observed with the current standards of care for SAD and PTSD, including benzodiazepines, selective serotonin reuptake inhibitors (“SSRIs”) and serotonin and norepinephrine reuptake inhibitors (“SNRIs”). Based on extensive preclinical data and clinical trials, we believe BNC210 may have a number of advantages over drugs currently used to treat anxiety, depression and PTSD, including:

| ● | fast acting anxiolytic with the potential to be used in both acute and chronic settings; |

| ● | non-sedating; |

| ● | no addictive effect and a lack of discontinuation/withdrawal syndrome; |

| ● | no memory impairment; |

| ● | no impairment of motor coordination; and |

| ● | no suicidality liability. |

We have administered BNC210 in approximately 600 subjects across 14 completed clinical trials, including healthy volunteers, elderly patients with agitation and patients with Generalized Anxiety Disorder (“GAD”), SAD and PTSD. We have observed BNC210 to be generally well tolerated in the trials to date following both acute and chronic dosing.

Further, in our clinical trials in GAD patients and in panic-induced healthy subjects, we have observed three key results:

| ● | statistically significant reductions in hyperactivity in the amygdala, the region of the brain responsible for emotional control, when exposed to fear-inducing triggers; |

| ● | in a head-to-head study, showed a statistically significant reduction in the intensity of defensive behavior, while lorazepam, a widely prescribed benzodiazepine did not; and |

| ● | a statistically significant reduction in the intensity and total number of panic symptoms as well as more rapid recovery from the panic state relative to placebo. |

We have designed and developed a novel, proprietary tablet formulation of BNC210 which has shown differentiated pharmacokinetic properties in clinical trials. BNC210 tablet has demonstrated rapid oral absorption characteristics in clinical trials making it ideal for acute, or on demand, treatment of SAD. Furthermore, the tablet formulation is intended to provide patients the convenience of taking BNC210 with or without food in the outpatient setting and enhance the BNC210 IP portfolio.

In September 2023, we announced the results of the Phase 2b ATTUNE study, which was a double-blind, placebo-controlled trial conducted in a total of 34 sites in the United States and the United Kingdom, with 212 enrolled patients, randomized 1:1 to receive either twice daily 900 mg BNC210 as a monotherapy (n=106) or placebo (n=106) for 12 weeks. The trial met its primary endpoint of change in CAPS-5 total symptom severity score from baseline to Week 12 (p=0.048). A statistically significant change in CAPS-5 score was also observed at Week 4 (p=0.016) and at Week 8 (p=0.015). Treatment with BNC210 also showed statistically significant improvement both in clinician-administered and patient self-reporting in two of the secondary endpoints of the trial. Specifically, BNC210 led to significant improvements at Week 12 in depressive symptoms (p=0.041) and sleep (p=0.039) as measured by MADRS and ISI, respectively. BNC210 also showed signals and trends across visits in the other secondary endpoints including the CGI-S, PGI-S and the SDS. Contingent upon successful capital raise and FDA interactions, we are planning to initiate Phase 3 study in PTSD in the fourth quarter of 2024.

9

While PREVAIL did not meet its primary endpoint, as measured by the change from baseline to the average of the SUDS scores during a 5-minute Public Speaking Challenge in the BNC210-treated patients when compared to placebo, the December 2022 topline data readout revealed encouraging trends in the prespecified endpoints that focused on individual phases of the public speaking task. The findings did indicate a consistent trend toward improvements across primary and secondary endpoints and a favorable safety and tolerability profile consistent with previously reported results; however, this cannot be relied upon as a predictor of future results. We also completed an FDA End-of-Phase 2 meeting to discuss the registrational program for BNC210 in SAD.

In October 2023, Bionomics received the official meeting minutes from the End-of-Phase 2 meeting with the FDA held on September 13, 2023 reflecting that Bionomics has reached an agreement with the FDA on the following:

| ● | the plan to conduct two single dose randomized, placebo-controlled studies; |

| ● | the use of the SUDS measured during a public speaking challenge as the primary efficacy endpoint; |

| ● | the doses of BNC210 to be studied in Phase 3; |

| ● | the sample size assumptions for the Phase 3 controlled studies based on PREVAIL findings; |

| ● | the design elements of the open label safety study; |

| ● | the size of the safety database to support the NDA; and |

| ● | the nonclinical toxicology studies needed to support the NDA. |

Start-up activities for a planned Phase 3 trial of BNC210 in SAD are underway. We have initiated dosing in the Phase 3 study in SAD in the third quarter of 2024.

We have received Fast Track designation from the FDA for our PTSD and SAD programs.

Additional Programs

α7 Receptor PAM Program with MSD

In June 2014, we entered into a License Agreement with MSD (known as Merck & Co., Inc., Rahway NJ, USA in the US and Canada) to develop α7 receptor PAMs targeting cognitive dysfunction associated with Alzheimer’s disease and other central nervous system conditions. Under the 2014 License Agreement, MSD funded certain research and development activities on a full-time equivalent (“FTE”) basis pursuant to a research plan. MSD funds current and future research and development activities, including clinical development and worldwide commercialization of any products developed from the collaboration. We received upfront payments totaling $20 million, which included funding for FTEs for the first twelve months, and another $10 million in February 2017 when the first compound from the collaboration-initiated Phase 1 clinical trials, and we are eligible to receive up to an additional $465 million in milestone payments for achievement of certain development, regulatory and commercial milestones. The MSD collaboration currently includes two candidates which are PAMs of the α7 receptor that are in early-stage Phase 1 safety and biomarker clinical trials for treating cognitive impairment. The first compound has completed Phase 1 safety clinical trials in healthy subjects and there are ongoing biomarker studies. In 2020, a second molecule that showed an improved potency profile in preclinical animal models was advanced by MSD into Phase 1 clinical trials. MSD controls the clinical development and worldwide commercialization of any products developed from the collaboration and therefore we cannot predict whether or when we might achieve any milestone payments under the collaboration or estimate the full amount of such payments, and we may never receive any such payments. Further, we are subject to limited information rights under the 2014 MSD License Agreement. As such, we are dependent on MSD to provide us with any updates related to clinical trial results, serious adverse events and ongoing communications with FDA or other regulatory agencies related to these programs, which MSD may provide or withhold in its sole discretion, and as a result we may not be able to provide material updates on a timely basis or at all with respect to these programs. On September 14, 2023, we provided an update on the α7 nAChR PAM collaboration with MSD The original lead molecule BNC375, a Type I α7 nAChR PAM, showed a robust and sustained dose-dependent efficacy over a broad dose range and across multiple cognitive animal models. MSD has subsequently developed MK-4334, a novel clinical candidate, which in early preclinical studies has shown improved drug like and pharmacological properties relative to BNC375. In addition to Phase 1 safety, tolerability and clinical pharmacokinetics studies, clinical biomarker studies are ongoing to further evaluate the pharmacological response of α7 nAChR PAMs in humans.

Our Early-Stage CNS Assets

Our CNS pipeline includes two earlier stage small molecule discovery programs targeting ion channels and represents additional opportunities for future clinical programs and partnering. These programs are at a similar stage to the stage at which the α7 receptor PAM program was licensed under the 2014 MSD License Agreement, although there is no assurance that we will be able to enter into a license or collaboration agreement with respect to these programs. The first of these programs has developed two patented series of small molecule Kv3.1/3.2 potassium channel activators for the potential treatment of cognitive deficits and negative symptoms/social withdrawal in schizophrenia and autism spectrum disorders. The second program has developed three patented series of small molecule inhibitors with functional selectivity for Nav1.7 and Nav1.8 voltage gated sodium ion channels for the potential treatment of chronic pain without the liability of addiction associated with opioid treatment. We plan to advance our early-stage programs either internally or through potentially new partnerships.

10

Legacy Oncology Programs

We have a portfolio of legacy clinical-stage oncology programs targeting cancer stem cells (BNC101) and tumor vasculature (BNC105) that we have progressed through external funding for clinical trials and out-licensing to capture future value for our shareholders. Our first legacy oncology program is BNC101, a novel humanized monoclonal antibody that targets LGR5, a cancer stem cell receptor highly overexpressed in most solid tumors. In November 2020, we exclusively licensed BNC101 to Carina Biotech for the development of chimeric receptor antigen T-cell (“CAR-T”) therapeutics in return for milestones and royalties. On 24 January 2023, Carina announced that it had received an FDA “Safe to Proceed” Letter for a Phase 1/2a clinical trial of BNC101 CAR-T therapy for the treatment of advanced colorectal cancer and plans to commence patient enrolment during the first half of 2023. On 25 August 2023, Carina announced that patient screening for their Phase 1/2a study had commenced.

Our second legacy oncology program, BNC105, is a novel vascular tubulin polymerization inhibitor agent for treatment of cancer, which disrupts the blood vessels that nourish tumors. We plan to advance these oncology programs only through existing and potentially new partnerships.

For additional information on our business strategy, clinical data and approach, our team, competition, intellectual property and more, please read the business overview section in its entirety as disclosed in Item 4 of our Annual Report on Form 20-F for the year ended June 30, 2023 (as filed with the SEC on October 18, 2023 and amended on January 17, 2024), the entirety of which is incorporated by reference into this prospectus. In addition, you should carefully consider the information on our business disclosed in the Half-Year Report for the six months ending December 31, 2023 (as disclosed in our Form 6-K filed on March 15, 2024, which is herein incorporated by reference).

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should carefully consider the discussion and analysis of our financial condition and results of operations disclosed in Items 5 and 11 of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024), and the Half-Year Financial Report for the six months ending December 31, 2023, disclosed in Form 6-K filed on March 15, 2024, each of which are herein incorporated by reference.

You should carefully consider the financial information disclosed in Items 8 and 18 of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024), and the Half-Year Report for the six months ending December 31, 2023, disclosed in Form 6-K filed on March 15, 2024, each of which are herein incorporated by reference.

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

You should carefully consider the information disclosed in Item 11 of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024), which is herein incorporated by reference.

You should carefully consider the information disclosed in Item 6 of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024), the Half-Year Financial Report for the six months ending December 31, 2023, disclosed in Form 6-K filed on March 15, 2024, and the Form 6-K filed on November 28, 2023, each of which are herein incorporated by reference.

11

The following table sets forth information regarding shares of our ordinary shares beneficially owned as of May 31, 2024 by: (i) each of our directors; (ii) all the executive officers and directors as a group; and (iii) each person known by us to beneficially own five percent or more of the outstanding ordinary shares.

The number of shares beneficially owned by each shareholder in the below table is determined under rules issued by the SEC. Under these rules, beneficial ownership includes any shares as to which a person has sole or shared voting power or investment power. Applicable percentage ownership is based on 2,151,172,484 ordinary shares outstanding on May 31, 2024. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, ordinary shares subject to options, warrants or other rights held by such person that are currently exercisable or will become exercisable within 60 days of May 31, 2024, are considered outstanding, although these shares are not considered outstanding for purposes of computing the percentage ownership of any other person.

| Shares Beneficially Owned | ||||||||

| Name of Beneficial Owner | Number | Percentage | ||||||

| 5% or Greater Shareholders | ||||||||

| Lynx1 Capital Management LP(1) | 146,604,060 | 6.15 | % | |||||

| Apeiron Investment Group Ltd(2) | 325,463,021 | 13.65 | % | |||||

| Named Executive Officers and Directors | ||||||||

| Liz Doolin(3) | 2,127,629 | * | ||||||

| Spyridon “Spyros” Papapetropoulos, M.D. (4) | 16,150,070 | * | ||||||

| Tim Cunningham | - | * | ||||||

| Miles Davies | 269,984 | * | ||||||

| Alan Fisher(5) | 400,000 | * | ||||||

| Jane Ryan, Ph.D.(6) | 300,000 | * | ||||||

| Aaron Weaver | - | * | ||||||

| David Wilson(7) | 551,939 | * | ||||||

| All executive officers and directors as a group | 19,799,622 | * | ||||||

| * | Less than 1%. |

| (1) | Includes 814,467 ADSs (representing 146,604,060 shares) held by Lynx1 Capital Advisors LLP. |

| (2) | Includes (i) 100,241 ordinary shares and 1,016,784 ADSs (representing 183,021,120 shares) held by Apeiron Investment Group Ltd and (ii) 790,787 ADSs (representing 142,341,660 shares) held by Apeiron Presight Capital Fund II, L.P. |

| (3) | Includes (i) 127,629 shares and (ii) 2,000,000 shares that Ms. Doolin has the right to acquire pursuant to options that are exercisable as of May 31, 2024, or will become exercisable within 60 days of such date. |

| (4) | Includes (i) 5,999,940 shares and (ii) 10,150,130 shares that Mr. Papapetropoulos has the right to acquire pursuant to options that are exercisable as of May 31, 2024 or will become exercisable within 60 days of such date. |

| (5) | Includes (i) 100,000 shares and (ii) 300,000 shares that Mr. Fisher has the right to acquire pursuant to options that are exercisable as of May 31, 2024 or will become exercisable within 60 days of such date. |

| (6) | Includes 300,000 shares that Dr. Ryan has the right to acquire pursuant to options that are exercisable as of May 31, 2024, or will become exercisable within 60 days of such date. |

| (7) | Includes (i) 251,939 shares and (ii) 300,000 shares that Mr. Wilson has the right to acquire pursuant to options that are exercisable as of May 31, 2024, or will become exercisable within 60 days of such date. |

As at May 31, 2024, there were 3,499 holders on record of our ordinary shares, of which 21 holders, holding approximately 0.15% of our ordinary shares, had registered addresses in the United States. These numbers are not representative of the number of beneficial holders of our shares or ADRs nor are they representative of where such beneficial holders reside, as many of these ordinary shares and ADRs were held of record by brokers or other nominees. The estimated percentage of beneficial ADR holders based in the United States is 84.20% based on the last broker search conducted on January 22, 2024.

12

You should carefully consider the information on our related-party transactions disclosed in Item 7B of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024), and the Half-Year Financial Report for the six months ending December 31, 2023, disclosed in Form 6-K filed on March 15, 2024, each of which are herein incorporated by reference.

In December 2023, we entered into an engagement letter with WG Partners LLP to provide financial advisory services to Bionomics. David Wilson, a director of Bionomics, is the Chief Executive Officer of WG Partners. Under the agreement, Bionomics must pay to WG Partners a monthly fee of US$15,000 and any applicable commission. The agreement will continue until such time as a party gives 30 days prior written notice of termination to the other party. From December 1, 2023 through June 14, 2024, Bionomics paid WG Partners US$89,112 in monthly fees and a commission of US$100,000 in connection with the Private Placement. We believe that this agreement is on an arms-length basis.

You should carefully consider the information disclosed in Item 10C of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023, filed on October 18, 2023 (as amended on January 17, 2024).

The following is a summary of material contracts that Bionomics entered into since the filing of our Annual Report on Form 20-F for the fiscal year ended June 30, 2023.

Securities Purchase Agreement for Private Placement

In May 2024, we entered into a Securities Purchase Agreement with Armistice Capital Master Fund Ltd. (“Armistice”) pursuant to which Bionomics agreed to issue and sell in a three-tranche private placement a certain number of restricted ADSs, a pre-funded warrant to purchase ADSs and an accompanying 5-year cash purchase warrant.

The first tranche of the Private Placement involved the issuance of 1,296,486 restricted ADSs and a Pre-Funded Warrant to purchase up to 6,279,905 ADSs, at a combined purchase price of US$0.99 per ADS, as well as the Accompanying Warrant to purchase up to 12,652,572 ADSs at an exercise price of US$0.99 per ADS (or pre-funded warrants in lieu thereof). Under the terms of the Securities Purchase Agreement and the Warrants, the Selling Shareholder may not beneficially own more than 9.9% of our outstanding ordinary shares at any one time.

The second tranche of the Private Placement is subject to the satisfaction of regulatory milestones that, if achieved, would involve the purchase by Armistice of up to an additional US$25.0 million of ADSs (or pre-funded warrants in lieu thereof) from Bionomics at US$0.99 per ADS. The second tranche milestones are the earlier of (i) receipt of formal written correspondence by Bionomics from the Food and Drug Administration (“FDA”) following planned interactions with the FDA regarding the outcomes of the end-of-phase meeting 2 and breakthrough designation status for BNC210 for PTSD or (ii) December 31, 2024.

The second tranche purchase option will, however, become a mandatory maximum purchase by Armistice during the thirty days following receipt by Armistice of a second tranche closing notice by Bionomics if its 10-day volume-weighted average price per ADS is at least US$8.00 with an aggregate of at least US$100 million in trading volume (or such lesser amount as may be approved by Armistice).

The third tranche of the Private Placement is subject to the satisfaction of regulatory milestones that, if achieved, would involve the purchase by Armistice of up to an additional US$25.0 million of ADSs (or pre-funded warrants in lieu thereof) from Bionomics at US$0.99 per ADS. The third tranche milestones are the latter of (i) completion of an interim blinded safety review of the planned BNC210 Phase-3 PTSD study or (ii) December 31, 2025.

The third tranche purchase option will, however, become a mandatory maximum purchase by Armistice during the thirty days following receipt by Armistice of a third tranche closing notice by Bionomics if its 10-day volume-weighted average price per ADS is at least US$8.00 with an aggregate of at least US$100 million in trading volume (or such lesser amount as may be approved by Armistice).

The Pre-Funded Warrant is immediately exercisable and remains exercisable until exercised in full. The Accompanying Warrant is immediately exercisable and remains exercisable until June 2, 2029. However, the Selling Shareholder may not exercise the Accompanying Warrant to the extent such exercise would cause the Selling Shareholder, together with its affiliates and attribution parties, to beneficially own a number of ordinary shares that would exceed 4.99% of our then outstanding ordinary shares following such exercise. The Securities Purchase Agreement is filed as Exhibit 99.1 to our Form 6-K filed on June 3, 2024, and is incorporated by reference herein.

Registration Rights Agreement

Concurrent with the entry into the Securities Purchase Agreement, we entered into a registration rights agreement with the Selling Shareholder for the registration of ordinary shares underlying the unregistered ADSs, as well as the ordinary shares underlying ADSs that would be issuable upon exercise of the Pre-Funded Warrant and the Accompanying Warrant pursuant to a registration statement on Form F-1 within 30 calendar days from entry into the Securities Purchase Agreement. We filed the registration statement of which this prospectus forms a part pursuant to the terms of the Registration Rights Agreement. The Registration Rights Agreement is filed as Exhibit 99.2 to our Form 6-K filed on June 3, 2024, and is incorporated by reference herein.

13

The table below lists the Selling Shareholder and other information regarding its beneficial ownership of our ordinary shares as of June 4, 2024.

Ordinary Shares Beneficially Owned prior to the Offering(1) | Maximum Number of Ordinary Shares to Be Sold pursuant to this | Ordinary Shares Beneficially Owned after the Offering(1)(3) | ||||||||||||||||||

| Name of Selling Shareholder and address | Number(2) | Percentage (4) | Prospectus(2) | Number | Percentage | |||||||||||||||

| Armistice

Capital, LLC 510 Madison Avenue, 7th Floor New York, NY 10022 | 233,367,480 | 9.8 | % | 233,367,480 | - | - | % | |||||||||||||

| (1) | Beneficial ownership is determined in accordance with Section 13(d) of the Exchange Act and generally includes voting and investment power with respect to securities and including any securities that grant the Selling Shareholder the right to acquire our ordinary shares within 60 days of the date of this prospectus. |

| (2) | Includes 233,367,480 ordinary shares (as represented by ADSs) issued to the Selling Shareholder on June 4, 2024 and excludes ordinary shares (as represented by ADSs) that are issuable upon exercise of the Warrants because they may not be exercised to the extent the number of the Company’s ordinary shares beneficially owned by the Selling Shareholder would exceed 9.99%. The aggregate additional number of ordinary shares excluded in the column titled “Maximum Number of Ordinary Shares to Be Sold pursuant to this Prospectus”, which are registered for resale under this Prospectus is an additional 3,407,845,860 Ordinary Shares (represented by18,932,477 ADSs), and which may be sold hereunder when the Selling Shareholder is able to exercise its issued warrants under its 9.99% beneficial ownership limitation set forth in its securities purchase agreement with us, dated May 31, 2024. Note, however, that the “accompanying warrants” are subject to a beneficial ownership limitation of 4.99%, which limitation restricts the Selling Shareholder from exercising that portion of the warrants that would result in the Selling Shareholder and its affiliates owning, after exercise, a number of ADSs in excess of the beneficial ownership limitation set forth in the accompanying warrant. The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| (3) | Assumes that the Selling Shareholder disposes of all the ordinary shares it beneficially owned as of June 4, 2024 and covered by this prospectus. |

| (4) | Applicable percentage of ownership is based on 2,384,539,964 ordinary shares outstanding as of June 4, 2024. |

14

The Selling Shareholder and any of its assignees and successors-in-interest may, from time to time, sell any or all of its ordinary shares covered by this prospectus on the Nasdaq Global Market or any other stock exchange or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices.

The Selling Shareholder may use any one or more of the following methods when selling securities:

| ● | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| ● | block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| ● | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| ● | an exchange distribution in accordance with the rules of the applicable exchange; | |

| ● | privately negotiated transactions; | |

| ● | settlement of short sales; | |

| ● | in transactions through broker-dealers that agree with the Selling Shareholder to sell a specified number of such securities at a stipulated price per security; | |

| ● | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

| ● | a combination of any such methods of sale; or | |

| ● | any other method permitted pursuant to applicable law. |

The Selling Shareholder may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Shareholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Shareholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.